#formation TradingView

Explore tagged Tumblr posts

Text

youtube

Utilisez ces 9 Astuces CACHÉES pour un Trading PLUS PERFORMANT

💡 Vous utilisez TradingView tous les jours… mais connaissez-vous vraiment toutes ses fonctionnalités cachées ? Dans cette vidéo, je vous dévoile 9 astuces puissantes mais méconnues qui peuvent transformer votre façon d’analyser les marchés.

📌 Dans cette vidéo, vous apprendrez : ✅ Comment personnaliser votre interface ✅ Comment configurer certaines choses ✅ Des fonctions cachées qui améliorent votre lecture des graphiques

Que vous soyez débutant ou trader expérimenté, ces astuces vont changer votre quotidien sur TradingView !

#stock market#tradingview#tradingview tutorial#tradingview indicator#meilleurs indicateurs#pine screener#pro screener#TradingView#astuces TradingView#raccourcis TradingView#tutoriel TradingView#formation TradingView#fonctions cachées TradingView#outils de trading#graphiques bourse#configuration TradingView#customiser TradingView#conseils trading#gain de temps trading#trading plus efficace#bourse#crypto#forex#trader pro#astuces graphiques#Youtube

0 notes

Text

Shiba Inu Triangle Formation Puts The Bears In Charge, 20% Crash Could Rock Meme Coin

Crypto analyst Smart Trading has revealed a bearish pattern for Shiba Inu, indicating that the bears are in firm control. Based on this, he predicted that SHIB could witness a 20% crash, which would represent a huge setback for the bulls. Shiba Inu Breaks Down Below Triangle Pattern In a TradingView post, Smart Trading stated that the Shiba Inu price recently broke down from a triangle pattern

Read More: You won't believe what happens next... Click here!

1 note

·

View note

Text

📈 Wallstreet Pulse – Daily

Wallstreet Pulse – dein tägliches Markt-Update. Montag bis Freitag um 14:30 Uhr analysieren wir die zentralen Bewegungen an den US-Märkten – präzise, datenbasiert, ohne Spekulation.

🔗 Unsere vollständige Premium-Analyse findest du hier: 👉 https://lwcmanagment.de

🎯 Inhaltlich im Fokus:

• VIX – Volatilität und Absicherungsniveau • S&P 500 – technische Zonen, Trends & Dynamik • NASDAQ – Momentum, Korrektur- oder Ausbruchsverhalten • Tägliche Einschätzung mit klarer Ampellogik

❌ Kein Krypto-Hype ❌ Keine Meme-Signale ✅ Nur echte Struktur

⚠️ Hinweis zu den Visualisierungen:

Die in diesem Format verwendeten Charts und grafischen Darstellungen sind rein illustrative Beispielbilder und wurden ausschließlich zu Demonstrationszwecken erstellt. Sie dienen der Veranschaulichung der im Video besprochenen Inhalte. Es handelt sich ausdrücklich nicht um Screenshots, Exporte oder Visualisierungen von Plattformen wie TradingView, Bloomberg, IG oder anderen Drittanbietern, deren Verwendung nicht erlaubt wäre.

📆 Wallstreet Pulse erscheint werktäglich um 14:30 Uhr. 🧠 Sonntags um 20:00 Uhr folgt die große Wochenschau mit Makro-Struktur.

© ChartWise Insights – durch Vernunft zum Erfolg

0 notes

Text

Exploring Day Trading Opportunities in 2025,

Day trading has evolved into a lucrative venture, attracting traders eager to explore financial markets. With advanced technology and the rising prominence of proprietary trading platforms, day trading 2025 presents exciting opportunities. Apex Trader Funding plays a crucial role in supporting traders by providing capital and essential trading tools. This guide outlines key strategies, essential resources, and how day trading funded accounts can enhance trading success.

The Core of Day Trading

Day trading is more than executing trades; it requires a deep understanding of market trends, risk management, and discipline. Traders must analyze the best online day trading platforms and utilize structured evaluation processes to refine their approach. Apex Trader Funding empowers traders by offering financial backing, reducing personal risks, and fostering skill development.

Financial markets blend local and global influences, making it essential to monitor economic changes and regulations. Leveraging day trading resources helps traders make informed decisions and gain a competitive edge.

Cultivating a Mindset for Day Trading Success

A successful day trading success mindset is built on discipline and strategic thinking. While many perceive day trading as a shortcut to wealth, true success demands emotional control and consistency.

A structured trading plan ensures traders stay focused. For example, a strategy with a 65% win rate requires consistency across multiple trades. Maintaining a trading journal to track decisions, emotions, and outcomes aids in improving strategies.

Self-awareness plays a critical role in mitigating emotional triggers like greed or frustration. Implementing mindfulness techniques, meditation, and pre-trade rituals can help traders handle market volatility. Additionally, transitioning to live day trading requires resilience—losses are inevitable, but recovery plans and stress management techniques support long-term stability.

Essential Day Trading Resources

Success in day trading 2025 depends on using the right tools. Key resources include:

Trading Platforms: Choosing from the best day trading platforms, such as TradingView, ensures traders have access to advanced charting tools and real-time data.

Performance Tracking Tools: Software like Google Sheets or Excel helps traders analyze trade execution and refine strategies.

Prop Trading Platforms: Apex Trader Funding in the UK offers traders access to firm-provided funds, enabling them to trade without risking personal capital.

Economic Calendars: Staying informed about global and local financial events is crucial. Platforms like Investing.com provide updates that influence trading decisions.

Beyond these essentials, advanced traders can explore stock screeners like Finviz or real-time news aggregators like Benzinga Pro. Books such as Trading in the Zone by Mark Douglas are invaluable for mastering trading psychology.

Understanding Supply and Demand in Day Trading

Mastering understanding supply and demand day trading in the UK is fundamental to achieving success. Candlestick charts provide insights into price action, helping traders recognize key trends. Essential strategies include:

Identifying Support and Resistance Levels: Support zones indicate strong buying interest, while resistance levels highlight selling pressure.

Leveraging Candlestick Patterns: Patterns like Dojis and engulfing formations help predict price movements.

Risk Management: Stop-loss orders and controlled position sizing protect capital.

Volume analysis and round-number psychological price points (e.g., £100, £1,000) are also critical indicators. Apex Trader Funding offers traders tools to simplify complex market analysis, providing an edge in executing precise trades.

Transitioning to Live Day Trading

A structured approach is crucial when transitioning to live day trading . Steps for a smooth transition include:

Practice with Simulated Accounts: Apex Trader Funding provides demo accounts, allowing traders to refine strategies before entering live markets.

Maintain a Trading Journal: Tracking each trade helps traders assess strengths, weaknesses, and opportunities.

Join Trading Communities: Engaging with trading groups fosters learning and networking opportunities.

Understanding market-specific nuances is key. Apex Trader Funding UK provides educational and professional resources to guide traders through this transition effectively.

Unlocking Potential with Apex Trader Funding

Funding for day trading has never been more accessible, thanks to platforms like Apex Trader Funding. This proprietary trading firm allows traders to complete evaluations and access significant trading capital ranging from £25,000 to £150,000. Traders can keep up to 90% of their profits, eliminating the stress of risking personal savings.

By combining education, trading tools, and financial backing, Apex Trader Funding ensures that traders have the resources needed to succeed in day trading in the UK.

Take the First Step Toward Day Trading Success

Day trading requires preparation, discipline, and the right support system. Apex Trader Funding UK provides traders with access to capital, innovative tools, and a thriving community for continuous growth.

Visit apextraderfunding.com today to embark on your trading journey with confidence. With expert guidance and comprehensive resources, day trading 2025 in the UK offers limitless potential for success.

#funding traders in united kingdom#the funded trader in united kingdom#funded trading accounts in united kingdom

0 notes

Text

Les Meilleures Communautés de Trading Crypto à Rejoindre en 2025

🌐 Introduction

Dans l’univers des cryptomonnaies, l’information est un atout stratégique. Les marchés évoluent rapidement, les tendances changent en un clic, et être entouré de la bonne communauté peut faire toute la différence entre une décision rentable… ou une perte coûteuse.

En 2025, les communautés de trading crypto sont devenues des hubs dynamiques où les traders échangent des analyses, partagent des signaux, débattent de projets, et surtout, s'entraident pour progresser.

Dans cet article, nous vous présentons les meilleures communautés crypto à rejoindre cette année, en fonction de vos objectifs, de votre niveau d’expérience et de vos intérêts spécifiques.

🧠 Pourquoi rejoindre une communauté crypto ?

Voici ce que vous pouvez en tirer :

✅ Accès rapide à des actualités fiables

✅ Partage d’expériences et d’analyses techniques

✅ Apprentissage collectif (surtout pour les débutants)

✅ Recommandations sur les plateformes, outils et stratégies

✅ Opportunités Web3, DeFi, NFT, Airdrops…

En crypto, être seul = risqué. Être bien entouré = avantage concurrentiel.

🔝 Top 7 des meilleures communautés de trading crypto en 2025

1. CryptoFr (Forum Francophone) 🇫🇷

📍 Site : cryptofr.com

👥 Communauté active francophone

📚 Débats, analyses, projets, wallets, fiscalité

✅ Parfait pour les débutants/intermédiaires

2. Binance French Community (Telegram / Discord)

📍 Officiel de Binance France

📈 Annonces, concours, sessions live, AMAs

🎯 Très utile si vous tradez sur Binance

3. Bybit Traders Lounge (Discord Global + Fr)

📍 Communauté multilingue avec une section française

🧠 Analyses techniques quotidiennes, signaux, copy-trading

👨🏫 Bon équilibre entre apprentissage et trading actif

4. OKX Web3 Français (Telegram)

💬 Discussions autour des tendances DeFi, NFT, GameFi

🔍 Partage d’opportunités sur testnets, airdrops, staking

🌐 Idéal pour les amateurs de Web3

5. Cryptoast Premium Club

📍 Plateforme privée + Discord

🎓 Formation + coaching + analyses techniques

💼 Version payante avec forte valeur ajoutée

🔒 Accès filtré = qualité des échanges

6. TradingView Community (FR)

📍 tradingview.com → section « idées »

📈 Analyses publiques publiées par les traders

✍️ Idéal pour apprendre à lire les graphiques et comprendre les logiques des autres

7. Communautés Telegram spécialisées (à vérifier)

Exemples :

CryptoSignals FR

Altcoins Radar

DeFi France ⚠️ Attention aux groupes de "pump & dump" ou aux faux signaux. Rejoignez uniquement ceux avec modération active et historique fiable.

🧩 Comment choisir une bonne communauté ?

CritèrePourquoi c’est important🔒 Sécurité & modérationPour éviter les arnaques, bots, et spams👥 Qualité des membresMieux vaut un petit groupe sérieux qu’un énorme groupe ainvesting avis bruyant📈 Valeur ajoutéeAnalyses, signaux, discussions utiles🌍 LangueChoisissez selon votre confort : FR, EN ou multilingue💰 Gratuit ou payant ?Les groupes payants sont souvent plus filtrés, mais pas toujours meilleurs

🛡️ Astuce : Ce qu’il faut éviter

🚫 Les groupes qui promettent "gains rapides" ou "signaux garantis"

🚫 Les admins qui vendent des formations à prix excessif sans preuve d’expertise

🚫 Les chaînes qui ne parlent que de "moon", "to the moon", "100x", sans aucun fondement

🚫 Les groupes sans historique ou avec des membres anonymes trop insistants

✅ Conclusion

En 2025, faire partie d’une bonne communauté crypto, c’est comme avoir une équipe de trading à vos côtés. Vous apprenez plus vite, vous évitez les erreurs courantes, et vous êtes toujours à l'affût des meilleures opportunités du marché.

Prenez le temps de tester, de discuter, et d’observer. Trouvez la ou les communautés qui correspondent à votre style, votre rythme et votre vision.

“Apprenez seul, avancez lentement. Apprenez avec d’autres, avancez plus loin.”

0 notes

Text

The Road to Funded Trading: A Step-by-Step Guide to Success

Trading in financial markets offers the potential for significant financial growth, but achieving consistent profitability requires strategy, discipline, and access to the right resources. Many traders struggle to transition from unprofitability to success, but with a structured approach, they can secure funding and scale their strategies effectively. Proprietary trading firms like Apex Trader Funding provide traders worldwide, including, with the opportunity to access capital and take their trading to the next level. Whether you're trading futures, using advanced trading platforms, or looking for a reputable trading website, Apex Trader Funding offers a structured pathway to help traders succeed. Apex funded accounts allow traders to participate in futures trading and beyond, leveraging professional stock trading platforms to maximize their potential.

Step 1: Establish a Strong Trading Foundation

The first step to becoming a successful proprietary trader is acquiring the right knowledge and skills. A solid trading education includes:

Market Structure Understanding – Learn how different financial instruments behave, how liquidity impacts pricing, and how economic events influence the markets. Traders should focus on understanding key market participants, such as institutional traders, retail traders, and liquidity providers. By studying market depth, order flow, and supply-demand dynamics, traders can anticipate price movements more effectively. Additionally, understanding macroeconomic indicators like GDP growth, inflation rates, and central bank policies helps traders make informed decisions based on broader economic trends.

Technical Analysis – Master chart patterns, price action, and indicators such as moving averages, Fibonacci retracements, and volume analysis to improve trade accuracy. Traders should also explore concepts such as divergence between price action and indicators, momentum analysis, and Bollinger Bands. Utilizing tools like the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and pivot points can help traders refine entry and exit points. Mastering candlestick formations, trend reversals, and continuation patterns further enhances a trader's ability to navigate different market conditions.

Trading Strategies – Explore different approaches like trend following, scalping, and range trading to determine which strategy aligns best with your goals and risk tolerance. Traders should consider blending multiple strategies to adapt to varying market environments. For example, incorporating both mean-reversion and breakout strategies allows traders to capitalize on different price movements. Additionally, understanding algorithmic trading and automated systems can improve execution efficiency and reduce emotional biases in trading decisions.

Apex Trader Funding provides traders with access to valuable resources, including educational materials and advanced trading platforms, to help build and refine their expertise. Continuous education through books, webinars, and real-time market analysis can provide traders with a competitive edge and improve long-term success. As one of the best prop trading firms in Taiwan, Apex Trader Funding ensures traders have access to top-tier knowledge and cutting-edge tools.

Step 2: Practice and Test Strategies

Understanding trading concepts is important, but applying them in real-world scenarios is key to success. Traders should engage in:

Backtesting – Analyzing historical market data to evaluate the effectiveness of trading strategies. This process helps traders identify patterns in past price movements, test different setups, and determine statistical probabilities of success. Utilizing platforms like TradingView or NinjaTrader allows traders to replay historical market conditions and fine-tune their strategy parameters. By running multiple backtests, traders can refine their rules and develop a robust approach before risking real capital.

Daily Market Analysis – Keeping up with financial news and economic reports to identify high-probability opportunities. Traders should analyze key financial events such as earnings reports, economic releases, and geopolitical developments that could impact the markets. By developing a structured approach to market research, traders can create daily watchlists, track major asset classes, and identify sectors that are showing strong momentum. Using market scanners and AI-driven sentiment analysis tools can further enhance trade selection and risk management.

Simulated Trading – Using a virtual trading platform such as Rithmic trading platform or Tradovate trading platform to practice execution without financial risk. Traders should treat demo trading as if it were a real account by following strict money management rules and executing trades with discipline. This step allows traders to build confidence, refine execution techniques, and assess how well their strategy performs under live market conditions. Additionally, simulated trading helps traders develop their ability to manage emotions and remain composed during periods of market volatility.

Practicing on various trading platforms allows traders to gain experience and build confidence before trading live with funded capital. Apex Trader Funding offers evaluation programs that allow traders to showcase their skills in a risk-free environment before qualifying for live capital.

Step 3: Continuous Learning and Improvement

Successful traders never stop learning. To refine their skills, traders should:

Review Past Trades – Keeping a detailed trading journal to identify mistakes and areas for improvement. Documenting trades with screenshots, trade rationale, and post-trade analysis helps traders recognize recurring errors and refine their decision-making process. Reviewing trade data, analyzing risk-reward ratios, and calculating expectancy can help traders refine their approach over time.

Engage with the Trading Community – Joining forums, webinars, and networking with experienced traders to gain insights and mentorship. Learning from seasoned traders can provide valuable insights into strategy refinement, market behavior, and risk management techniques. Engaging in live trading discussions, attending trading conferences, and participating in mastermind groups can accelerate skill development and offer exposure to different perspectives.

Stay Updated with Trading Technologies – Exploring new trading tools, automation strategies, and analytical software to enhance efficiency. Automated trading systems, artificial intelligence-based trading models, and algorithmic strategies have revolutionized financial markets. Traders should explore backtesting software, trading bots, and AI-driven market analysis tools to stay ahead of the competition. Apex Wealthcharts trader funding provides in-depth market analysis to ensure traders have all the tools they need for success.

Apex Trader Funding supports ongoing trader development by offering structured evaluations and real-market exposure to help traders sharpen their strategies. With access to advanced stock trading platforms in Taiwan and cutting-edge market analysis tools, traders can refine their edge and achieve long-term profitability.

Step 4: Develop a Comprehensive Trading Plan

A well-structured trading plan is essential for consistency. Key components include:

Entry & Exit Criteria – Define clear conditions for opening and closing trades based on technical and fundamental analysis. Establishing strict rules prevents traders from making impulsive decisions based on emotions.

Risk Management Rules – Implement strategies such as position sizing, stop-loss placements, and diversification to protect capital. By adhering to a set risk percentage per trade, traders can mitigate the impact of losing streaks and preserve long-term sustainability.

Performance Goals – Set realistic objectives and track progress using measurable benchmarks. Regularly assessing performance metrics such as win-rate, profitability ratios, and maximum drawdown allows traders to adjust their strategies as needed.

Having a trading plan reduces emotional decision-making and improves execution consistency. Apex Trader Funding provides the necessary capital and a structured evaluation process to ensure traders have a disciplined approach.

Step 5: Secure Proprietary Trading Funding

Once traders have demonstrated consistency, securing proprietary capital allows them to scale their strategies. Apex Trader Funding offers funded accounts with flexible conditions, enabling traders to maximize their potential without risking personal capital.

Why Choose Apex Trader Funding?

Comprehensive Market Analysis Tools – Access to cutting-edge trading resources and analytics.

Top-Tier Trading Platforms – Utilize Rithmic, Tradovate, and other leading trading platforms.

Flexible Scaling Opportunities – Trade with increased capital as performance improves.

Global Access, Including Taiwan – Secure funding from anywhere in the world and trade confidently.

Exclusive Promotions & Discounts – Use the Apex coupon “COPY” to get special discounts on evaluation programs.

Apex Trader Funding provides a seamless pathway for traders to access capital, ensuring they have the financial support necessary to grow their trading careers. If you’re ready to take the next step, visit Apex Trader Funding today and start your journey toward financial independence! For more insights and expert trading blogs, check out Apex Trader Funding's website.

#funding traders in taiwan#the funded trader in taiwan#apex trader funding in taiwan#funded trading accounts in taiwan#instant funding prop firm in taiwan#best online trading platforms in taiwan

0 notes

Text

Best Crypto Charts for Traders in 2025 📊📈

Crypto traders know that reading price movements is key to making informed decisions. Whether you're a beginner or a seasoned trader, using the best crypto charts in 2025 can help you analyze trends, predict market shifts, and optimize your strategy.

🔍 What Are Crypto Charts?

Crypto charts are visual tools that display cryptocurrency price movements over time. They help traders identify trends, spot potential entry/exit points, and refine their trading strategies.

Among the different chart types, candlestick charts are the most popular due to their detailed price representation. Let’s explore some of the best charting platforms available for 2025.

📊 Best Crypto Charting Tools for 2025

🔥 TradingView – The Market Leader

One of the most popular platforms, TradingView offers both free and premium plans, supporting crypto, stocks, forex, and more. It provides customizable charts with 12+ formats and an active trading community to share strategies.

⚡ Bitbo – Bitcoin Specialists

For those focused on Bitcoin trading, Bitbo delivers 90+ Bitcoin price projection & on-chain charts, along with custom alerts and premium analysis tools.

📉 Coinigy – Advanced Crypto Trading

Coinigy is a powerful option that connects to 45+ exchanges, including DeFi platforms. It features AES 256-bit encryption for security and is ideal for portfolio tracking & trade execution.

📈 GoCharting – Multi-Asset Support

GoCharting offers 15+ chart formats, including candlestick, OHLC, and Renko. It’s great for traders involved in US & Indian markets, with extra features like paper trading & an educational academy.

🔄 CryptoView – Integrated Trading & Analytics

CryptoView is designed for serious traders, powered by TradingView charts. It supports multi-screen setups, portfolio sharing, and enterprise-grade security with API encryption.

📖 How to Read Crypto Candlestick Charts

Candlestick charts are the most widely used crypto chart format because they show detailed price changes over a specific timeframe.

Each candlestick consists of:

Open price – the starting value of a crypto asset

High price – the peak value within the timeframe

Low price – the lowest value in that period

Close price – the final value before a new candlestick begins

📊 Understanding Candlestick Colors

🟢 Green Candle = Price closed higher than it opened (Bullish)

🔴 Red Candle = Price closed lower than it opened (Bearish)

📏 Analyzing Wick & Body Lengths

Long bodies → Strong trend (bullish or bearish)

Short bodies → Possible market indecision

Long wicks → Price volatility

Short wicks → Price stability

📌 Recognizing Crypto Chart Patterns

Bullish Patterns (Uptrend Signals)

Bullish Engulfing → Large green candle overtakes a smaller red candle

Rising Three → Three small red candles followed by a large green candle

Bullish Harami → Small green candle inside a larger red candle

Bearish Patterns (Downtrend Signals)

Bearish Engulfing → Large red candle overtakes a smaller green candle

Shooting Star → Long upper wick, small lower body (indicating reversal)

Bearish Harami → Small red candle inside a larger green candle

🛠 Alternative Crypto Analysis Methods

Besides candlestick charts, traders also use: ✅ Fundamental Analysis – Evaluates a crypto project’s whitepaper, team, partnerships, and market adoption ✅ On-Chain Analysis – Uses blockchain data to assess market sentiment and investor behavior ✅ Sentiment Analysis – Tracks social media trends & market psychology

🚀 Final Thoughts

Mastering crypto charts and analysis is crucial for making smarter trading decisions. Whether you use TradingView, Bitbo, Coinigy, GoCharting, or CryptoView, selecting the right charting tool can help you track trends and develop winning strategies.

What’s your go-to crypto charting tool? Let’s discuss! ⬇️💬

0 notes

Text

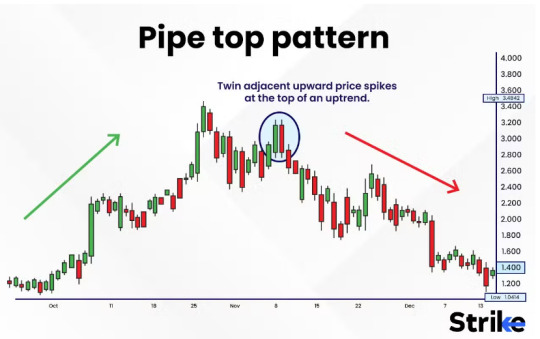

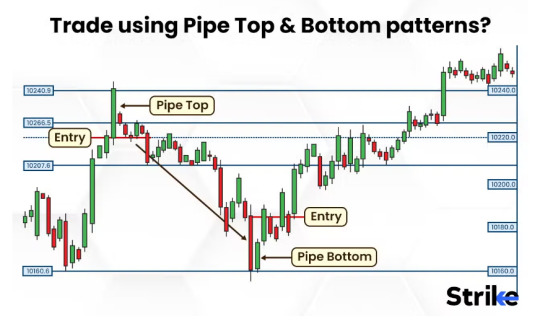

🔍 Complete Guide to Pipe Top & Bottom Patterns: The Reversal Signals Smart Traders Don’t Miss

Market reversals are where big money is made. But spotting them early? That’s an art—and a science. Among the sea of candlestick patterns, Pipe Top and Pipe Bottom patterns stand tall as powerful indicators of a potential trend reversal.

These formations appear loud and clear when the market is exhausted, giving seasoned traders a chance to enter before the herd. In this guide, we break down how these patterns work, how to trade them with precision, and how you can spot them using tools like Strike Money, TradingView.

Let’s decode the mindset of the market and master the Pipe Patterns.

🚀 What Exactly Are Pipe Top & Pipe Bottom Patterns?

Pipe Top Pattern appears at the end of an uptrend. It shows two tall bullish candles followed by sharp reversal—indicating buying pressure is exhausted. Pipe Bottom Pattern is its mirror image—found after a downtrend. It shows two deep bearish candles, then a surge of demand signaling buyers stepping in with force.

These are not random candles. They’re reversal footprints formed by a combination of price rejection and trader psychology.

🧠 Think of them like this: 👉 Pipe Top: “This rally is over. Sellers have entered with authority.” 👉 Pipe Bottom: “Enough bleeding. Buyers are ready to reverse the trend.”

🎯 Why Traders Love These Patterns for Reversals

✅ High reliability when confirmed with volume ✅ Quick entries after exhaustion wicks ✅ Clear stop-loss and entry levels ✅ Works well across stocks, forex, commodities, and crypto ✅ Easy to recognize once you know what to look for

🧩 According to Thomas Bulkowski, author of Encyclopedia of Chart Patterns, reversal patterns like Pipe formations show consistent returns when combined with volume and trendline breakouts.

🔬 Anatomy of the Pipe Pattern: What to Look For

🎥 Imagine a stock like TATA Motors moving sharply upward. Suddenly, two large green candles appear—only to be followed by a sharp bearish engulfing. You just spotted a Pipe Top.

What defines the pattern?

📍 Tall identical candlesticks (same height) 📍 Long upper or lower wicks 📍 Extreme volumes during formation 📍 Occurs near resistance or support zones 📍 Signals exhaustion of buyers or sellers

In Pipe Bottoms, you’ll often see volume climax followed by a bullish engulfing candle or hammer-like reversal.

🧠 The Psychology Behind Pipe Patterns

Every candlestick tells a story. Pipe patterns scream one thing: “The crowd has lost control.”

💥 In Pipe Tops, greedy buying pushes prices unrealistically high—only to get trapped by institutional selling. 💥 In Pipe Bottoms, panic selling exhausts sellers, triggering sharp rebounds led by informed buyers.

These formations reflect emotional extremes: Fear, Greed, Panic, and Exhaustion.

Understanding this psychological layer gives you an edge. You’re not just reading charts—you’re reading market intent.

🔄 Pipe Pattern vs Double Top, Tweezer, and V-Bottom – Know the Difference

🧠 Many confuse Pipe Tops with Double Tops or Tweezer Tops. But there’s nuance here.

🔺 Pipe Tops: Sharper, aggressive, usually have long upper wicks 🔺 Double Tops: Require a pause between two peaks 🔺 Tweezer Tops: Both candles are nearly identical; Pipe Tops can have variation 🔻 V-Bottoms: More “instant” than structured; Pipe Bottoms often include confirmation

Remember: Pipe patterns are velocity-driven. They appear fast, decisive, and loud.

📈 How to Trade Pipe Top and Bottom Patterns with Precision

Here’s how savvy traders act when they spot a Pipe formation:

💡 Step 1: Wait for the pattern to form fully. 💡 Step 2: Confirm with volume (look for spike or divergence). 💡 Step 3: Use indicators like RSI <30 for Pipe Bottom, RSI >70 for Pipe Top. 💡 Step 4: Look for support/resistance break with follow-through candle. 💡 Step 5: Place SL above the wick (Pipe Top) or below the wick (Pipe Bottom).

📍 Pro Tip: Use Strike Money’s charting tools to mark reversal zones and set alerts for candle structures. The platform’s clean visuals make Pipe patterns easy to identify—even for beginners.

🇮🇳 Real Examples from Indian Stock Market

📊 Let’s bring this home with Indian stocks.

🔸 HDFC Bank: In March 2023, the stock formed a clear Pipe Top near ₹1700 with two tall green candles, followed by a massive bearish engulfing candle. What followed? A 9% drop in 5 sessions.

🔸 Infosys: In July 2022, Pipe Bottom was formed around ₹1380. After heavy panic selling, buyers stepped in. Within a week, the stock rallied 11%.

🔸 Reliance Industries: Pipe Top at ₹2580 (Jan 2023) gave a clean reversal. Sellers dominated right after pattern confirmation—leading to a 7% downside.

🔎 Use these examples to train your eye. Backtest them using Strike Money, TradingView for consistent practice.

📚 Research Backing & Pattern Performance

📖 According to CMT Association resources and Bulkowski's historical tests:

✅ Pipe Bottom has a success rate of around 72% when combined with volume confirmation ✅ Pipe Top patterns succeed 68% of the time when they break below support with momentum ✅ The average reward-to-risk ratio improves by 35% when combined with RSI/MACD

⚠️ But remember: no pattern is a holy grail. Use confirmation indicators and risk management discipline.

⚠️ Common Mistakes to Avoid While Trading Pipe Patterns

🚫 Entering too early—without volume support 🚫 Ignoring context—trying to trade it in sideways markets 🚫 Forgetting stop-loss—especially during news-driven volatility 🚫 Misidentifying similar candles—especially Doji and Evening Star 🚫 Chasing trades instead of waiting for retests

💡 One smart move: Use Strike Money’s pattern replay feature to simulate past price action and test entries/exits.

🔧 Best Indicators to Combine with Pipe Patterns

🔹 RSI: Use to detect overbought/oversold confirmation 🔹 MACD: Divergence near Pipe formations = strong signal 🔹 Volume Oscillator: Tracks unusual buying/selling volumes 🔹 Fibonacci Levels: Check for 38.2% or 61.8% retracement around Pipe patterns

🛠️ Strike Money lets you layer these indicators with zero clutter, helping you build a clean confluence zone.

🧠 Trader Mindset: Why Confidence Beats Complexity

Technical setups are only half the story. A trader's psychological resilience completes the picture.

✅ Trust your system. ✅ Respect stop-loss. ✅ Accept false signals—they happen. ✅ Use tools like Strike Money and TradingView to remove noise.

Remember: Pipe patterns aren’t magical. But with consistent practice, they help you enter reversals early with confidence—before the majority even sees the setup.

🏁 Final Takeaway: Pattern Mastery = Market Mastery

Pipe Top and Bottom patterns are more than candlesticks. They are moments of truth in the market—where crowd behavior shifts, liquidity changes hands, and momentum pivots.

🎯 If you want to stay ahead, stop chasing breakouts. Start mastering exhaustion signals like Pipe formations.

🔥 Use the right tools. Strike Money gives you the edge with precise visual cues, alerts, and smart chart setups. 📊 Backtest, reflect, and refine. Because repetition builds intuition. 📈 Master this pattern—and you’ll start seeing the market with clarity others miss.

Ready to spot the next Pipe Reversal? Start analyzing your charts with Strike Money today.

0 notes

Text

shib usdt and alt price

AltLayer (ALT) is the native utility token of the AltLayer protocol, which aims to solve blockchain scalability challenges by leveraging rollup technologies. According to the price predictions gathered from various sources: In 2024, the ALT price is expected to reach a maximum price of $0.9273, with an average price of $0.8879. 123 In 2025, what is ALT? price is predicted to rise further, with a maximum of $1.45 and an average of $0.8396. 2 By 2030, long-term forecasts suggest the usdt to ALT token could reach as high as $9.89. 3 However, it's important to note that cryptocurrency price predictions can be inaccurate, as they are based on past performance and algorithmic models. The actual future price of ALT will depend on various factors, such as the adoption and development of the AltLayer protocol, as well as broader market conditions. Shiba Inu (SHIB) is currently trading at around 0.00001344 USDT, according to the latest conversion rates.1 The shib USDT to shib trading pair has seen significant trading volume and liquidity, with the price fluctuating between 0.00001245 USDT and 0.00001389 USDT across various exchanges.1Technical analysis of the SHIB/USDT chart on TradingView suggests a potentially bullish outlook for the cryptocurrency. Several traders have identified a bullish pennant formation, indicating a potential breakout to the upside.23 Key resistance levels have been identified at $0.00003193, $0.00003718, and $0.00004567.3

0 notes

Text

Polkadot's Future: A Close Look at Market Signals and the Possibility of a Rebound

Polkadot (DOT) finds itself in the spotlight as it grapples with a rejection at a significant resistance level of $7.95, signaling a complex interplay of market forces influencing its value proposition. The rejection at this level triggers speculation, particularly among analysts such as Morecryptoonline, who point to the failure of wave (3) to achieve minimum targets as a precursor to a potential b-wave top formation. The confirmation of this trend looms with a decisive drop below $6.99.

Delving into the live market data, Polkadot's current price sits at $7.42, reflecting a notable 5.41% decrease over the last 24 hours. The trading volume, standing at $366.8 million, underscores the recent downturn that has placed the DOT token on the precipice of oversold territory, as indicated by its 4-hour Relative Strength Index (RSI) at 37.71. Despite the apparent selling pressure, there is a silver lining hinted at by the RSI's trajectory towards oversold conditions, suggesting the potential for a looming reversal.

Further analysis of the 4-hour Moving Average Convergence Divergence (MACD) reveals the continued influence of selling pressure on Polkadot. However, the 4-hour Know Sure Thing (KST) oscillator signals an underlying strength within the DOT token, acting as a potential catalyst for a price reversal and countering the bearish signals from the MACD.

The DOT/USD 4-hour price chart, sourced from TradingView, adds another layer to the narrative, emphasizing the critical juncture where investors and market watchers find themselves. The confluence of RSI, MACD, and KST indicators may hold the key to dictating the short-term trajectory of DOT’s market value.

As Polkadot grapples with challenges at key resistance levels and hovers on the edge of oversold territory, investors are urged to closely monitor these developments. The volatile and unpredictable nature of cryptocurrency markets makes Polkadot's journey a captivating one, with potential interesting movements awaiting on the horizon.

0 notes

Text

[ad_1] Addresses associated to FTX, the bankrupt crypto trade, and Alameda Analysis, the buying and selling wing related to the trade, have cumulatively transferred $13.35 million of belongings to Binance, a crypto trade through Wintermute Buying and selling, over the past 24 hours. Associated Studying: Linqto’s Ray Fuentes Reveals The Factors That Could Drive A Ripple IPO In 2024 FTX Sells $13.35 Million Of Cash Based on Lookonchain, an on-chain tracker, FTX and Alameda Analysis final deposited COMP, the governance token of Compound, and RNDR, the native token of Render, on October 26, an indicator that the venture is actively liquidating belongings after discovering approval in late September 2023. FTX switch tokens to Binance| Supply: Lookonchain on X COMP costs are comparatively secure at spot charges, steadying at a key resistance degree. The token can also be up 20% from October 2023 lows and is inside a bullish formation, shifting contained in the vary established from June to July 2023. Even so, for the uptrend to take form, merchants anticipate extra positive factors that may push the token above September 2023 highs at $50, a psychological degree. COMP worth on October 26| Supply: COMPUSDT on Binance, TradingView Then again, RNDR is extending positive factors, marching increased when writing. As an instance, the token is up 60% from September lows, with bulls remaining resilient, wanting on the formation within the every day chart. Bulls have been shaking off bear makes an attempt as they aim to reclaim Might 2023 highs at round $2.9. It is a vital liquidation line that, if damaged, might see RNDR register new 2023 highs. FTX acquired courtroom approval to promote tokens and repay collectors in September 2023. Decide John Dorsey of the U.S. Chapter Courtroom within the District of Delaware permitted the movement, permitting FTX to promote as much as $100 million of tokens weekly, together with Bitcoin and Solana, to repay its collectors. Then, the trade stated the proceeds from the sale can be used to repay its collectors in a “honest, orderly, and environment friendly method.” As a part of this, FTX can even liaise with collectors to develop a distribution plan. FTX Is Bankrupt And SBF Is Beneath Trial In Manhattan FTX went bankrupt in late 2022, triggering a collection of liquidations that noticed main crypto belongings droop to worrying ranges, together with Bitcoin and Ethereum. By This autumn 2022, Bitcoin was altering palms at round $16,000, worsened by sentiments that noticed crypto customers rush to exchanges, withdrawing their cash, worrying that there can be a contagion. The leg down, nevertheless, marked the final section of the bear run since asset costs spectacularly recovered in Q1 2023 earlier than closing H1 2023 with stable positive factors. The Sam Bankman-Fried (SBF) trial in a Manhattan courtroom is ongoing whereas FTX managers seek for methods to make collectors entire. SBF is blamed for mismanaging the crypto trade and pilfering consumer funds into billions. Function picture from Canva, chart from TradingView [ad_2]

0 notes

Text

Dogecoin Price Targets In The Short-Term Revealed Amid Bearish Wave

Dogecoin’s price action on the 1-hour candlestick timeframe chart has been defined by a sharp decline since April 14, with the meme coin slipping into a falling wedge formation. This three-day downtrend, however, is now showing signs of reversal. According to an analysis by crypto analyst KledjiCuni on the TradingView platform, the correction phase may have come to an end, and Dogecoin could be

Read More: You won't believe what happens next... Click here!

1 note

·

View note

Text

📊 Wallstreet Pulse – Daily Update Dein täglicher Blick hinter die Kulissen der Wall Street.

🕒 Montag bis Freitag, Punkt 14:30 Uhr liefern wir dir das Wesentliche: Fakten. Charts. Keine heiße Luft. Keine Meme-Trends.

🔍 Was dich erwartet: • VIX – Volatilität, Risiko & Absicherungsniveau • S&P 500 – Zonen, Trendwechsel & technische Struktur • NASDAQ – Momentumcheck & Ausbruchsgefahr • Tagesbewertung mit Ampellogik – klar, nachvollziehbar, ohne Spekulation

🎯 Immer auf den Punkt. Keine Krypto-Manie. Keine Signals. Nur echte Marktstruktur.

🔒 Unsere tiefergehende Analyse gibt’s im Premium-Zugang: 👉 https://lwcmanagment.de

📌 Hinweis zu den Visuals: Alle Charts und Grafiken in diesem Format sind illustrative Eigenproduktionen – erstellt ausschließlich zur Veranschaulichung der Inhalte. Keine Screenshots, keine Exporte von Drittplattformen wie TradingView, Bloomberg oder IG. 100 % compliant – 100 % Insight.

📅 Tägliches Update: Mo–Fr um 14:30 Uhr 📺 Wöchentliche Makroanalyse: Sonntag, 20:00 Uhr

© ChartWise Insights – Durch Vernunft zum Erfolg.

0 notes

Text

ETH lost hold of $1600 on 9 October and failed to reclaim it. Long positions suffered >$5 million in liquidations 24 hours before press time. Bears overwhelmed markets after the September FOMC Minutes on 11 October. As a result, the increased bearish bets saw Ethereum [ETH] retest the August low of $1550. Read Ethereum [ETH] Price Prediction 2023-24 In a previous ETH price prediction published on 9 October, AMBCrypto correctly projected that sellers could extend shorting gains to $1550 – An August low. But ETH bulls attempted to defend the August low at press time. However, liquidation data at hand suggested the bullish defence of $1550 could be weakened. Liquidity on price charts at $1600 Source: ETH/USDT on TradingView The extended drop on 9 October left a price imbalance and liquidity on the daily chart at $1595 – $1616 (white). A D1 breaker blocker of $1623 – $1660 (red) sat right above the liquidity area. Collectively, the two marked areas could act as hurdles for bulls. But overall, ETH’s price action formed a descending wedge pattern, a typical bullish formation. Unfortunately, the overhead hurdles must be cleared for ETH to reclaim $1700. A crack below August lows ($1550) could shift focus to trendline support near $1516 or the daily bullish OB at $1400 formed on 10 March 2023. The CMF was negative despite the attempted reversal, and other key price chart indicators, RSI and OBV, were negative. It meant capital inflows weakened, alongside a decline in buying pressure and Spot market demand for ETH. More ETH long positions liquidated Source: Coinglass Liquidation data from Coinglass indicated over $5 million ETH long positions were forcibly closed (liquidated) across major exchanges within 24 hours before press time. Over the same period, only $2.5 million were rekt, reinforcing a Futures market bearish sentiment. Is your portfolio green? Check out the ETH Profit Calculator So, ETH sellers could breach the August low if the bearish pressure persists in the next few days. However, a recent report indicated that major ETH whales were buying the dip, which could influence a likely mid-October reversal.

0 notes

Text

Stock Scraper-How to Scrape Stock Data from TradingView

Collecting stock price data can provide investors, analysts and researchers with important information to help them make more informed decisions and gain insight into how markets are functioning. Today I will show you how to scrape stock data from TradingView using ScrapeStorm.

Introduction to the scraping tool

ScrapeStorm is a new generation of Web Scraping Tool based on artificial intelligence technology. It is the first scraper to support both Windows, Mac and Linux operating systems.

Preview of the scraped result

Export to Excel:

1. Create a task

(1) Copy the URL

(2) Create a new smart mode task

You can create a new scraping task directly on the software, or you can create a task by importing rules.

How to create a smart mode task

How to import and export scraping task

2. Configure the scraping rules

Smart mode automatically detects the fields on the page. You can right-click the field to rename the name, add or delete fields, modify data, and so on.

How to set the fields

3. Set up and start the scraping task

(1) Run settings

Choose your own needs, you can set Schedule, IP Rotation&Delay, Automatic Export, Download Images, Speed Boost, Data Deduplication and Developer.

How to configure the scraping task

(2)Wait a moment, you will see the data being scraped.

4. Export and view data

(1) Click "Export" to download your data.

(2) Choose the format to export according to your needs.

ScrapeStorm provides a variety of export methods to export locally, such as excel, csv, html, txt or database. Professional Plan and above users can also post directly to wordpress.

How to view data and clear data

How to export data

0 notes

Text

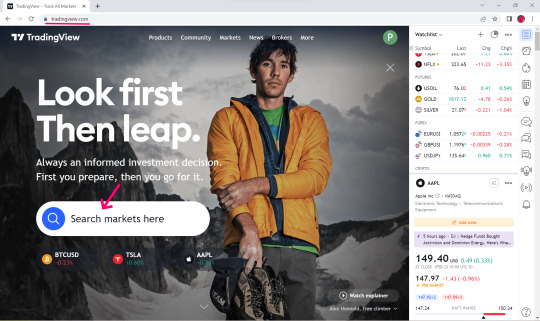

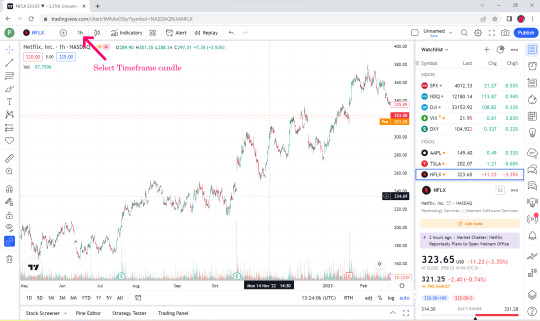

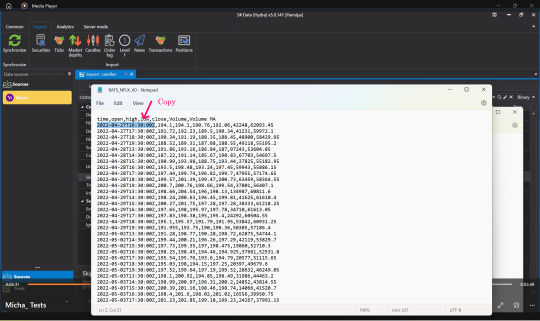

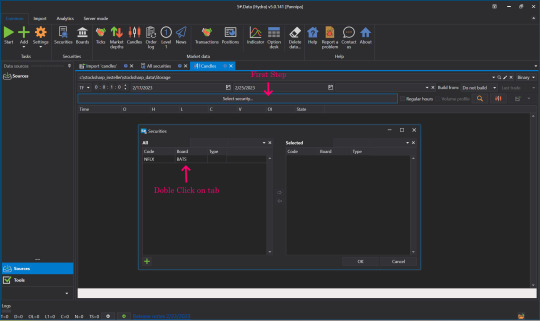

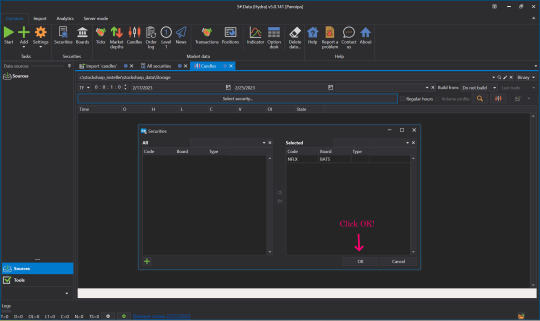

How to Import Candle Charts from TradingView websites?

youtube

💥S#.Data provides functionality that supports automatic downloading of historical market data from many data sources. But sometimes websites do not provide an API to make the process automatically. Fortunately, in addition to downloading you can import market data from CSV files directly.

💥TradingView is a charting platform and social network used by many traders and investors worldwide to spot opportunities across global markets. The major feature of the website - various historical dataset - that you can download as a csv file for further usage (e.g. - backtesting, analyzing).

💥For the TradingView website, you need a premium subscription to be able to export candles. Let’s look at this process step-by-step to understand how we can import this market data into S#.Data.

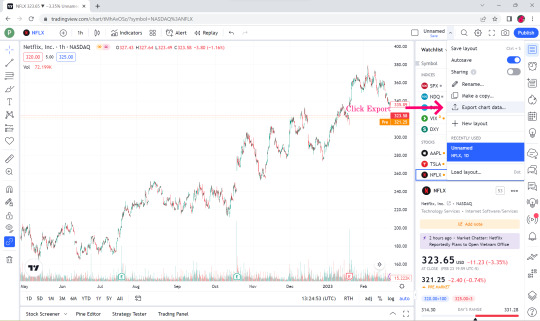

👉Visit TradingView Website.

👉Select Search Market for example NFLX. 👉Click Launch Chart for view.

👉Select Time Flame Candle for example 1 hr.

👉Select Export Chart Data.

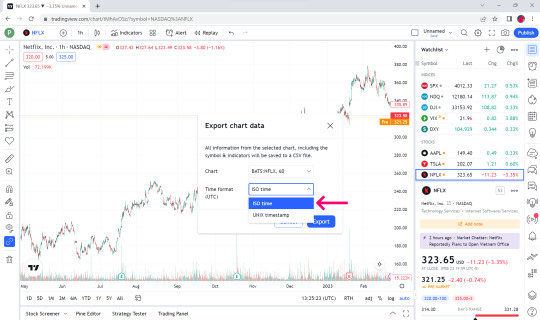

👉In the Time format box, select ISO time.

👉Click Export.

👉Open the downloaded Market data file. You can see that the top bar is date and time, open price, low price, close price, volume and volume MA.

👉S#.Data supports only the first 6 data, the last one volume MA we will not take.

👉Open up your S#.Data Application.

👉Visit our instruction if you doesn't have S#.Data application.

👉How I can get S#.Data

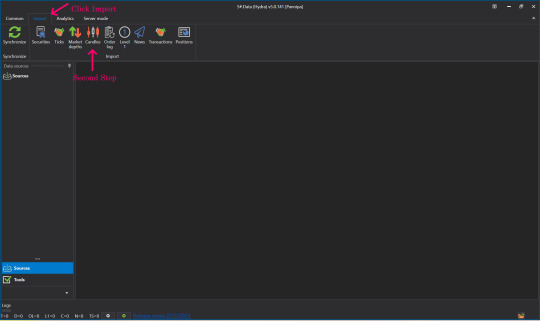

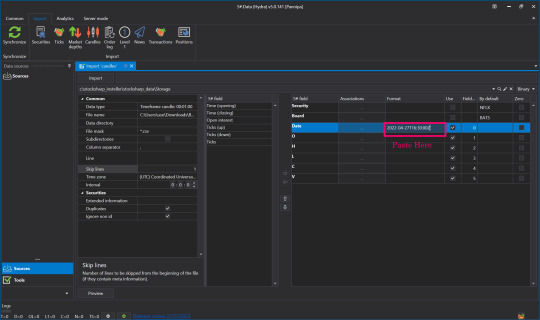

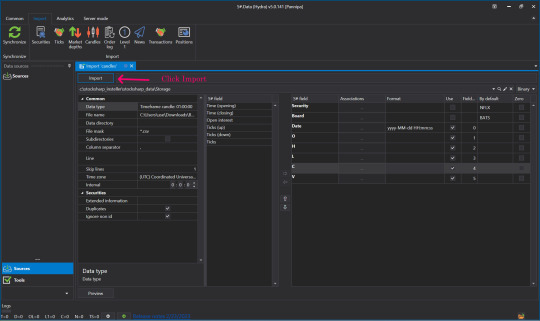

👉Go to S#.Data application, click select import and Click candle.

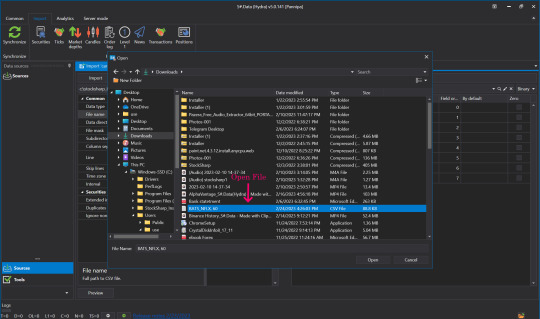

👉Find the name of the file we just downloaded (btw, you can import by directories as well).

👉Click to select the file that we downloaded, click open.

👉Click to select the time frame to match the timeframe we selected in the file we downloaded initially in the data type field.

👉Setting S#.filed from the Security and Board fields.

👉By default put the Instruments Code that we downloaded. For example NFLX in the Security slot in the instrument board e.g. BATS by default.

👉Enter numbers 0-5 in the date box and so on. Remember - numeration started from 0, not from 1.

👉Skip lines Row 1 cause it contains data columns description.

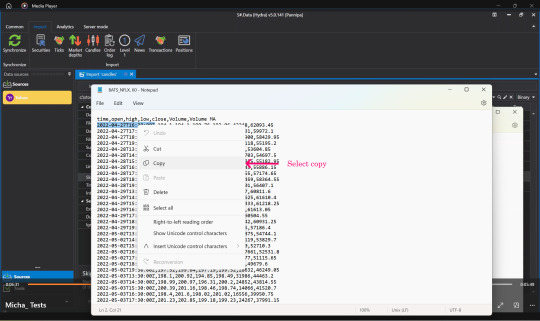

👉Open the file that we downloaded again, select Copy, time, date that we started downloading Market Data.

👉Press Paste in the Date Format field.

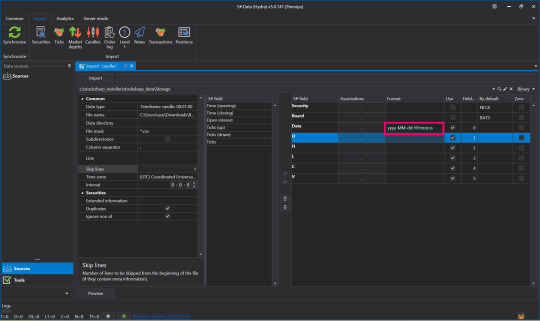

👉Change Numbers to Code Letters By yyyy-MM-dd HH:mm:ss You can read more about format on Microsoft website

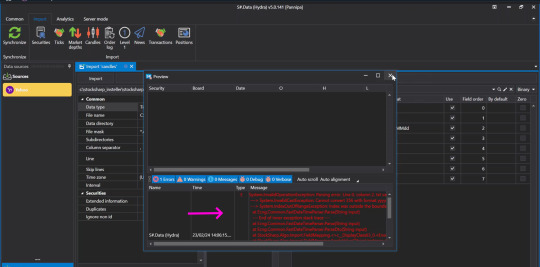

👉Once everything is entered correctly, click Preview to double check before importing.

👉When the screen shows this page, there is no problem.

👉But if you press Preview and the screen appears like this, check the details that you have entered again to see if there is any mistake, correct it and press Preview again.

👉Once it's verified and there are no problems, press Import.

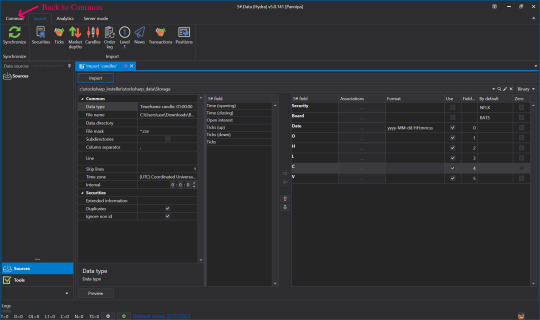

👉When done, click Back to go to Common.

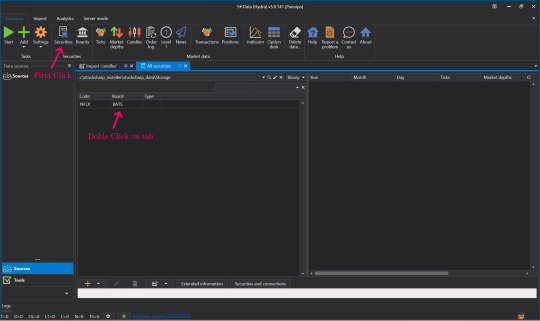

👉Click on our Security.

👉Click on Instrument Tab to view market Data.

👉Now let's see what data was imported. Click Candles.

👉Select Security, select the Instrument to view by double-clicking the Instrument Tab, move it to the right side and click OK.

👉Select date and time frame.

👉Click View Market data.

👉Click View Candle Chart to see our candles as a chart.

👉This is a Candle Chart comparison between the Chart that was in TradingView website before it was downloaded and the downloaded Chart rendered in S#.Data application.

💥💥Now you know how to import from a CSV file. To make this process you no need to use only limited websites like TradingView. S#.Data supports any format of CSV files that you can download from a variety of sources and websites.

💥Hope this blog is interesting for you. Please comment us what you interesting to know more about S#.Data. We will try to write our next posts.

Sources : StockSharp.com

#downloading of historical market data#import market data#charting platform#export candles#trading view#backtesting#Youtube

1 note

·

View note