#GST Invoice Software

Explore tagged Tumblr posts

Text

What is a GST Invoice Generator? A Complete Guide for Businesses

Goods and Services Tax (GST) has transformed taxation in India, making invoicing an essential part of business operations. A GST Invoice Generator is a tool that helps businesses create GST-compliant invoices quickly and accurately. Whether you are a small business owner, freelancer, or enterprise, using GST Invoice Software can simplify tax compliance, reduce errors, and save time.

In this guide, we will explain what a GST Invoice Generator is, how it works, and why businesses need it. We will also cover the benefits of using an Online GST Invoice Generator and how it compares to manual invoicing.

What is a GST Invoice Generator?

A GST Invoice Generator is a digital tool that helps businesses generate GST invoices with all necessary details, such as invoice number, GSTIN, buyer and seller details, tax breakup, and total amount. These tools ensure that invoices comply with GST regulations, reducing errors and avoiding penalties.

Key Features of a GST Invoice Generator:

Automated GST calculations – Ensures accurate tax computation.

Pre-designed templates – Offers ready-to-use GST invoice templates for professional invoicing.

Multi-tax support – Handles CGST, SGST, IGST, and UTGST calculations.

E-invoicing under GST – Supports real-time invoice generation for compliance with government regulations.

Integration with accounting software – Syncs with GST filing software for seamless tax return filing.

Why is a GST Invoice Generator Important for Businesses?

For businesses of all sizes, a GST Invoice Generator provides multiple benefits:

Saves Time and Effort: Manually creating invoices can be time-consuming. An Online GST Invoice Generator automates the process, allowing businesses to focus on growth rather than paperwork.

Reduces Errors: Errors in invoices can lead to penalties. A Tax Invoice Generator ensures accuracy by applying the correct tax rates and following GST guidelines.

Improves Compliance: Using a GST Invoice Software ensures that all invoices meet the legal requirements, reducing the risk of compliance issues.

Professional and Organized Billing: A Digital Invoice Creation tool allows businesses to issue well-structured, professional invoices that enhance credibility and trust.

How to Generate a GST Invoice?

Generating a GST invoice manually can be challenging, but using a Free GST Invoice Generator makes it simple. Here’s how:

Enter Business Details: Add your business name, GSTIN, and address.

Add Buyer Details: Enter the buyer’s name, GSTIN, and address.

Include Invoice Details: Mention the invoice number, date, and due date.

Add Product/Service Details: Include the description, quantity, unit price, and tax rate.

Calculate GST Automatically: The tool applies CGST, SGST, or IGST based on the buyer’s location.

Download or Print Invoice: Save the invoice as a PDF or email it directly to the client.

GST Billing Process: Step-by-Step

Create Invoice – Use an Online GST Invoice Generator to input transaction details.

Apply GST Rates – Automatically calculate CGST, SGST, or IGST.

Issue Invoice to Customer – Send via email or print for record-keeping.

File GST Returns – Sync with GST filing software for easy tax submission.

Maintain Records – Store invoices digitally for future reference and audits.

Market Data: Why Businesses are Shifting to Digital Invoicing

According to a 2023 survey, 70% of Indian businesses use GST Invoice Software for compliance.

The digital invoicing market in India is growing at 12% annually, driven by GST regulations.

Over 80% of SMEs prefer Free GST Invoice Generators before switching to paid solutions.

GimBook: The Smart GST Invoice Solution

GimBook is a powerful GST Invoice Generator designed for businesses of all sizes. It provides a user-friendly interface, automated GST calculations, and customizable invoice templates. With GimBook, you can:

Generate GST invoices in seconds

Access pre-designed GST invoice templates

Use cloud-based storage for invoices

Integrate with accounting software for GST filing

Whether you’re a freelancer, small business, or enterprise, GimBook ensures hassle-free invoicing and compliance.

Boost Your Business with GimBook – Create GST Invoices Hassle-Free! https://gimbooks.com/

A GST Invoice Generator is a must-have tool for businesses in India. It streamlines invoicing, reduces errors, and ensures compliance with GST regulations. Whether you choose a Free GST Invoice Generator or a paid Best GST Invoice Software, the key is to find a solution that meets your business needs. Start using a GST Invoice Generator today and simplify your billing process effortlessly!

0 notes

Text

"Eazybills" emerges as the quintessential thermal printer companion for seamless billing solutions. Engineered to synchronize flawlessly with billing software, it epitomizes efficiency and reliability.

#invoicing software#free billing software#free invoice software#best invoicing software#gst invoice software#gst billing software#billing software#billingsoftware#eazybills#software for billing

0 notes

Text

GST Billing Software and Their Benefits to The Businesses in India

#billing software#free billing software#gst billing software#free gst biling software#best free billing software#invoice software#free invoice software#online invoice software#gst invoice software#gst invoicing software#invoicing software#online invoicing software

1 note

·

View note

Text

Online Invoice Software with GST Billing - Bharat Bills Online

Best billing software with GST and all invoice features, designed for the modern business in India. It's time to upgrade to the best gst billing solution!

for more information: https://bharatbills.com/e-invoicing-software/ and visit our website: https://bharatbills.com/

0 notes

Text

Common Mistakes to Avoid When Managing GST Ledgers in Tally

Goods and Services Tax (GST) is a comprehensive indirect tax levy on the manufacture, sale, and consumption of most goods and services in Bharat. It was introduced on July 1, 2017, to subsume multiple indirect taxes, such as excise duty, value-added tax (VAT), service tax, and central sales tax (CST). GST ledgers in Tally are used to record all GST transactions, such as sales, purchases, and expenses. It is important to avoid mistakes in GST ledgers, as this can lead to penalties from the GST authorities.

#accounting automation software#GST Ledgers#GST#tally on cloud#automated bank statement processing#e invoice in tally#tally solutions

2 notes

·

View notes

Text

Karosauda: Empowering MSMEs with Smart, Hassle-Free Billing

The Story Behind Karosauda

India’s MSMEs are the backbone of our economy, yet over 80% of them still rely on manual billing systems that are error-prone, time-consuming, and outdated. We saw the gap and Karosauda was born. Karosauda isn't just another billing software. It’s a movement to empower MSMEs by digitizing their business operations with ease, affordability, and precision.

What is Karosauda?

Karosauda is a digital billing platform tailor-made for Micro, Small, and Medium Enterprises. Whether you're running a small retail shop, a wholesale business, or a service-based setup—Karosauda helps you:

Generate GST-compliant invoices in seconds

Track stock and inventory effortlessly

Monitor payments and receivables

Get real-time insights on business performance

Access everything from your mobile or desktop

Why Choose Karosauda?

Simple UI, no technical knowledge needed Fast & cloud-based access anytime, anywhere Designed for Indian businesses Budget-friendly plans with a free trial Secure, accurate, and paperless

The Impact So Far

Within months, Karosauda has helped 300+ MSMEs reduce billing errors, save hours every week, and get paid faster.

We’ve seen kirana stores, local distributors, and small manufacturers level up their operations without hiring extra help.

Our Vision

We aim to become India’s most trusted digital billing partner for MSMEs. Our mission is simple: Make every local business smarter, faster, and future-ready.

Try It for Free

We invite you to try Karosauda today and see the transformation. ✅ No credit card required ✅ Instant onboarding ✅ Start billing smarter in just 5 minutes

0 notes

Text

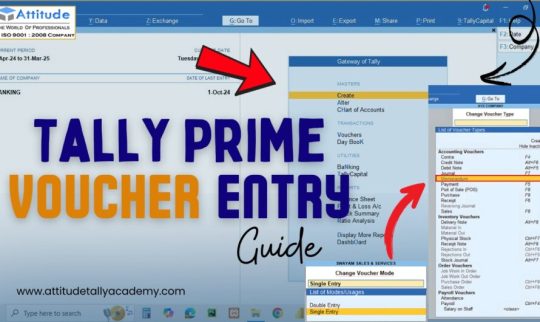

Master e-Accounting with TallyPrime: Learn Smart Financial Management

Level up your accounting skills with an in-depth e-Accounting course using TallyPrime. Designed for beginners and professionals, this course covers everything from manual accounting to GST, TDS, payroll, bank reconciliation, inventory management, and financial reporting. Learn how to create accurate books of accounts and manage real-time transactions using one of the most trusted accounting software solutions in the industry.

Whether you're looking to boost your resume or manage business finances efficiently, mastering TallyPrime is a smart investment in your career.

Start today and build a strong foundation in digital accounting!

Visit Attitude Academy📚

📍 Visit Us: Yamuna Vihar | Uttam Nagar

📞 Call: +91 9654382235

🌐 Website: www.attitudetallyacademy.com

📩 Email: [email protected]

📸 Follow us on: attitudeacademy4u

#TallyPrime Course#e-Accounting Course#Tally with GST Training#Learn TallyPrime#TallyPrime Online Course#Tally Accounting Software#GST with Tally Course#Tally Course for Beginners#Financial Accounting with Tally#Payroll in TallyPrime#TDS and TCS in Tally#Advanced Tally Course#TallyPrime with e-Invoicing#Business Accounting Course#Tally Certification Course

0 notes

Text

0 notes

Text

Best Billing and Accounting Software in India – Tririd Biz

In the current fast-paced business world, the best billing and accounting software in India is essential for small and medium enterprises. Tririd Biz is such an extremely powerful solution, which is an all-in-one platform designed to fulfill your billing and accounting requirements.

Tririd Biz looks at integrating invoice generation, GST billing, expense tracking and financial reporting into a single user-friendly platform to ensure a seamless experience. Whether a small retailer or a service provider or a freelance professional, the software saves your time and ensures that your finances are in order.

🌟 Key features of Tririd Biz:

GST Easy Invoicing: Generate GST-compliant invoices quickly and accurately.

Smart Accounting: Easy track on income, expenses, and ledgers.

Free Demo Available Experience the real strength of Tririd Biz without commitment demo.

Secure & Cloud-based: Access from anywhere on the globe over secured data.

Simple Interface: No technical knowledge needed – it's built just for business owners.

Make Tririd Biz, and say goodbye to hand calculations and juggling between tools. Financial accuracy, GST return filing made easy, organizational power for business activities is possible through this software.

If you are looking for an effective solution to managing your daily billing accounting work then Tririd Biz is the best tool for you. Its cost effectiveness, efficiency, and compatibility with the Indian environment make it worth using.

👉 Want to simplify your business accounting? Get Tririd Biz now and get a free demo!

Call us @ +91 8980010210

Visit Our Website: https://tririd.com/tririd-biz-gst-billing-accounting-software

FAQs

Q: Why do small businesses in India need accounting software?

A: The software automates tasks like invoicing, GST calculations, and expense tracking, saving time and minimizing human labor errors.

Q: What features of billing software should be considered?

A: GST support for invoice generation, client management, real-time reporting, multi-user access, and security of data would be some of the features.

Q: Is cloud accounting software better compared to offline software?

A: Accessibility from anywhere, automatic backups, and real-time collaboration make cloud-based tools much more convenient than offline tools.

Q: How can I be safe about my financial data?

A: Software lets you have secure logins, encrypting, and regular backups, and never share with others while using secure logins.

Q: Does accounting software help with tax filing in India?

A: Most of these tools offer GST-compliant reports and summaries that can be used to easily file returns every quarter and annually.

#best billing software India#accounting software for small business#GST billing software#invoice software India#Tririd Biz software

0 notes

Text

Ultimate GST Checklist for Indian E-Commerce Sellers. What’s in our FREE Checklist? ✔ Step-by-step GSTIN registration ✔ How to configure HSN codes ✔ Tools to auto-generate invoices (like WooCommerce GST Plugin!) ✔ Filing reminders 🔗 Download & Save for later: www.woocommercegst.co.in

#gstindia#woocommerce#ecommerce#gst#gst billing software#invoicing#gstcompliance#wordpress#wordpress plugins

0 notes

Text

"Effortless Invoicing: Streamline Your Business with EazyBills GST Billing Software"

#gst billing software#billing software#easy billing software#free gst billing software#billingsoftware#free invoicing#easy gst billing software#best gst billing software#gst invoice software

0 notes

Text

0 notes

Text

Take Control of Your Business Finances with Go GST Bill’s Smart Accounting Tools

Managing finances efficiently is a crucial aspect of running any business, but it can often feel overwhelming without the right tools. Go GST Bill offers a comprehensive range of accounting solutions designed to make financial management simple and stress-free for businesses of all sizes. Whether you're a small business owner or managing a large enterprise, their easy-to-use platform provides everything you need to keep your financial records in perfect order.

Go GST Bill is known for its commitment to innovation and customer satisfaction, creating tools that cater to the unique needs of modern businesses. By offering intuitive features and user-friendly interfaces, they ensure that anyone can take control of their accounting processes without the need for extensive training. Their solutions improve accuracy, save time, and allow business owners to focus on growth. One of their standout features is the free online accounting software, which gives users the flexibility to manage accounts from anywhere in the world, with just an internet connection.

Professional GST Invoice and Challan Formats that Simplify Tax Compliance Effortlessly

Additionally, Go GST Bill simplifies procurement processes with its customizable purchase order template, making it easier for businesses to manage supplier transactions seamlessly. For businesses requiring GST compliance, they provide a professional GST challan format that allows for accurate and efficient tax documentation.

Another highlight is the platform's versatile GST invoice format, designed to meet regulatory standards while being customizable to fit individual branding needs. These features not only ensure compliance but also improve your overall bookkeeping and reporting processes.

Choosing Go GST Bill means gaining access to reliable, easy-to-navigate tools that optimize your business's financial operations. Their dedication to innovation and user satisfaction makes them a dependable partner in your financial success. Explore Go GST Bill today to discover how their solutions can transform how you handle accounting and GST requirements. Take the first step towards streamlined financial management!

0 notes

Text

How to Integrate Invoice Maker Tools with Your Accounting Software

In today's fast-paced business world, efficiency and accuracy are paramount when managing financial data. One essential aspect of this is invoicing. As businesses grow, manually creating and managing invoices becomes more cumbersome. That's where invoice maker tools come into play, allowing you to quickly generate professional invoices. However, to truly streamline your financial workflow, it’s important to integrate these tools with your accounting software.

Integrating invoice maker tools with your accounting software can help automate the process, reduce human error, and improve overall productivity. This article will walk you through how to integrate your Invoice Maker Tools with accounting software effectively, ensuring smoother operations for your business.

1. Choose the Right Invoice Maker Tool

Before integration, ensure you have selected an invoice maker tool that suits your business needs. Most invoice maker tools offer basic features such as customizable templates, tax calculations, and payment tracking. However, the integration potential is an important factor to consider.

Look for an invoice maker tool that offers:

Cloud-based features for easy access and collaboration.

Customizable templates for branding.

Multi-currency support (if you do international business).

Integration capabilities with various accounting software.

Examples of popular invoice maker tools include Smaket, QuickBooks Invoice, FreshBooks, and Zoho Invoice.

2. Check Compatibility with Your Accounting Software

Not all invoice maker tools are compatible with every accounting software. Before proceeding with the integration, confirm that both your invoice maker tool and accounting software are capable of syncing with each other.

Common accounting software that integrate with invoice tools includes:

QuickBooks

Smaket

Xero

Sage

Wave Accounting

Zoho Books

Most software providers will indicate which tools can integrate with their platform. Check for available APIs, plugins, or built-in integration features.

3. Use Built-in Integrations or APIs

Many modern invoice maker tools and accounting software platforms come with built-in integrations. These are often the easiest to set up and manage.

If you choose a platform that does not offer a built-in integration, you can use APIs (Application Programming Interfaces) to link the two systems. APIs are a more technical option, but they provide greater flexibility and customization.

4. Set Up the Integration

Once you've confirmed that the invoice tool and accounting software are compatible, follow the setup process to connect both tools.

The typical steps include:

Access your accounting software: Log into your accounting software and navigate to the integration settings or marketplace.

Search for the invoice maker tool: In the marketplace or integration section, look for the invoice tool you are using.

Connect accounts: Usually, you’ll be asked to sign into your invoice maker tool from within the accounting software and authorize the integration.

Map your fields: You may need to map invoice fields (like customer names, amounts, or due dates) to corresponding fields in the accounting software to ensure the data flows seamlessly.

5. Test the Integration

After the integration is complete, it’s crucial to test whether the connection between the invoice maker and accounting software is working as expected. Generate a sample invoice and check if the details appear correctly in your accounting software. Confirm that invoices are synced, and ensure payment status updates automatically.

Test for:

Accurate syncing of client details: Ensure names, addresses, and payment history are transferred correctly.

Real-time updates: Check that any changes made to invoices in the invoice tool reflect in your accounting software.

Reporting features: Verify that your financial reports, such as profit and loss statements, include data from the invoices.

6. Automate Invoicing and Payments

Once the integration is up and running, set up automated workflows. With the right integration, you can automate recurring invoices, late payment reminders, and payment receipts. This reduces manual effort and ensures consistency in your accounting.

7. Monitor and Maintain the Integration

Just because the integration is set up doesn't mean it's a "set it and forget it" situation. Regularly monitor the syncing process to ensure everything is working smoothly.

Make sure:

Software updates: Regular updates from either your accounting software or invoice maker tool might affect the integration. Always check for compatibility after any software updates.

Backup and security: Ensure your data is securely backed up, and verify that integration tools comply with security standards.

8. Benefits of Integration

By integrating invoice maker tools with your accounting software, you’ll enjoy several key benefits:

Time Savings: Automating the invoicing process frees up time for you to focus on other important aspects of your business.

Improved Accuracy: With automatic syncing, you reduce the risk of errors that often come with manual data entry.

Better Financial Management: Real-time data syncing allows for accurate tracking of income, expenses, and cash flow, which helps with budgeting and financial forecasting.

Enhanced Customer Experience: Timely and accurate invoicing helps maintain a professional image and reduces confusion with clients.

Conclusion

Integrating invoice maker tools with Accounting Software is a smart move for businesses that want to streamline their financial operations. By selecting the right tools, following the integration steps, and ensuring regular maintenance, you can save time, improve accuracy, and focus on growing your business. Don’t let manual invoicing slow you down—leverage modern tools to automate your processes and boost efficiency.

#accounting#software#gst#smaket#billing#gst billing software#accounting software#invoice#invoice software#cloud accounting software#benefits of cloud accounting#financial software#business accounting tools#cloud-based accounting#real-time financial insights#scalable accounting solutions#cost-effective accounting software#cloud accounting security#automated accounting software#business accounting software#cloud accounting features

0 notes

Text

EASY BILL - Basic Overview of SGST ✨ 2025

VISIT : https://sites.google.com/view/easy-billing-software/blog/basic-overview-of-sgst

EASY BILL - Basic Overview of SGST 2025 is a user-friendly platform designed to simplify the billing process for businesses in India. This tool integrates seamlessly with the Goods and Services Tax (GST) system, offering a clear understanding of SGST (State Goods and Services Tax) for the year 2025. EASY BILL helps businesses generate accurate invoices while automatically calculating SGST rates based on the state-specific tax structure. With its intuitive interface, users can efficiently manage tax compliance, ensure accurate reporting, and stay updated with the latest regulations. EASY BILL streamlines SGST management for enhanced efficiency and compliance.

#easy billing software#easy billing#gst easy bill#easy gst billing software#easy gst#invoice easy#free billing software for mobile#easy gst software#online billing software free#online software for billing#software for billing#easy accounting software#gst billing software online#simple billing#easy invoice#e billing software#quick bill software

1 note

·

View note

Text

Best GST Software to Learn Practically

In today’s competitive world, practical knowledge is the key to success, especially in the fields of taxation and accounting. Understanding the Goods and Services Tax (GST) system is essential for students, professionals, and business owners alike. But how can you move beyond theoretical knowledge to truly grasp the intricacies of GST?

There are multiple software solutions available that can simplify the process of learning GST practically. For educational institutions, these tools provide an excellent way to teach students GST in a hands-on manner. Additionally, institutions can also use these platforms to offer GST-related services, enhancing their offerings and value

Why Practical Learning is Crucial in GST

GST is not just about understanding laws and percentages. It’s about:

Filing accurate returns.

Managing TDS (Tax Deducted at Source).

Generating invoices that comply with legal standards.

Understanding input tax credits.

Practical learning allows users to:

Apply theoretical concepts to real-world scenarios.

Develop hands-on skills in GST filing and compliance.

Enhance confidence in handling business finances.

Features of the Best GST Software for Learning

Technotronixs has developed a robust GST Simulation Software that is perfect for practical learning. Here’s why it stands out:

eBay-Like Simulations:

Simulate real-world transactions in a controlled environment.

Understand GST implications on various goods and services.

TDS Management Tools:

Learn how to calculate and deduct TDS correctly.

Get practical experience in filing TDS returns.

Student Information System Integration:

Track learning progress.

Access detailed guides and tutorials.

Hands-On GST Filing Practice:

Create and upload GST returns.

Handle errors and corrections just like in real situations.

Institute Earnings Opportunity:

Educational institutions can use this software to generate additional income by offering specialized GST training courses.

Benefits for Students and Institutes

For Students:

Master GST compliance without the risk of penalties.

Gain a competitive edge in the job market.

Build a strong foundation in taxation and financial management.

For Institutes:

Provide value-added courses to attract more enrollments.

Monetize through specialized GST training programs.

Build a reputation as a center of excellence in taxation education.

Why Choose Technotronixs’ Tax Simulation Software

User-Friendly Interface: Designed with students and educators in mind, it’s easy to navigate even for beginners.

Customizable Modules: Tailor the software to suit specific training needs.

Affordable Pricing: High-quality learning at a budget-friendly cost.

Proven Results: Backed by positive feedback from users and institutions.

Conclusion

When it comes to learning GST practically, Technotronixs Tax Software is the ultimate tool. Its innovative features and real-world applications make it the best choice for students and institutions alike. Start your journey to mastering GST today and unlock new career opportunities!

Ready to take the next step? Explore the possibilities with Technotronixs’ Tax Simulation Software and transform how you learn and teach GST.

#Best Gst simulation software#gst software#best tax learning app#erp#software#billing software#gst software free#best gst billing software#best gst invoice softwar

0 notes