#habbele

Text

The $100 Trillion Battle For The World’s Wealthiest People! Two Financial Giants Look Likely To Crush The Competition

— September 5th, 2023 | New York | Finance and Economics | Rich and Famous

The Uber-rich hire all kinds of people to make their lives easier. Landscapers Maintain Gardens, Housekeepers Tidy Homes, Nannies Raise Children. Yet perhaps no role is as important as that of the Wealth Manager, who is hired to protect capital.

These advisers are scattered across the globe in cities such as Geneva and New York, and are employed as fiduciaries, meaning they are required to act in the interest of their clients. As such, they become privy to the intimate lives of the rich and famous, who must expose their secrets so that advice may be offered on, say, the inheritance of a child born of an extramarital affair. Advisers also help families allocate investments, stash cash in boltholes, minimise tax bills, plan for retirement, arrange to pass down their vast wealth and follow unusual wishes. A Singapore-based manager recalls being told to invest a “double-digit” percentage of a family’s wealth in “bloodstock horses”—steeds bred especially for racing—a term he hurriedly looked up after the meeting.

For decades, wealth management was a niche service, looked down upon by the rest of finance. Now it is the most attractive business in the industry. Capital and liquidity requirements set after the global financial crisis of 2007-09 have made running balance-sheet-heavy businesses, such as lending or trading, difficult and expensive. By comparison, doling out wealth advice requires almost no capital. Margins for firms that achieve scale are typically around 25%. Clients stick around, meaning that revenues are predictable. Competition has crushed profits in other formerly lucrative asset-management businesses, such as mutual funds. And whereas the pools of assets managed by BlackRock and Vanguard, the index- and exchange-traded-fund giants, are huge, they collect a fraction of a penny on every dollar invested. A standard fee for a wealth manager is 1% of a client’s assets, annually.

Wealth management is all the more appealing because of how quickly it is expanding. Global economic growth has been decent enough over the past two decades, at more than 3% a year. Yet it has been left in the dust by growth in wealth. Between 2000 and 2020 it rose from $160trn, or four times global output, to $510trn, or six times output. Although much of this is tied up in property and other assets, the pool of liquid assets is still vast, making up a quarter of the total. Bain, a consultancy, estimates that it will almost double, from just over $130trn to almost $230trn by 2030—meaning that a $100trn prize is up for grabs. They anticipate the boom will help lift global wealth-management revenues from $255bn to $510bn.

Image: The Economist

It will be fuelled by geography, demography and technology. The biggest managers are attempting to cover ever more of the globe as dynastic wealth is created in Asian and Latin American markets. Baby-boomers are the last generation that can rely on defined-benefit pensions for their retirement; more people will have to take decisions about how their own wealth will support them. Meanwhile, software is streamlining the bureaucracy that once waylaid wealth managers, allowing them to serve more clients at lower cost, and helping firms automate the acquisition of new ones. These gains will allow big banks to serve the merely rich as well as the uber-wealthy. Firms are already climbing down the rungs of the wealth ladder, from ultra-high-net-worth and high-net-worth, who have millions of dollars to invest, into the lives of those with just $100,000 or so.

Markus Habbel of Bain sees a comparison to the booming luxury-goods industry. Handbags were once prized for their exclusivity as much as their beauty, but have become ubiquitous on social media, with influencers touting Bottega Veneta pouches and Hermès bags. “Think about Louis Vuitton or Gucci. They have basically the same clients as [wealth managers] target and they increased from 40m [customers] 40 years ago to 400m now,” he notes. Upper-crust buyers have not been put off.

Which firms will grab the $100trn prize? For the moment, wealth management is fragmented. Local banks, such as BTG in Brazil, have large shares of domestic markets. Regional champions dominate in hubs, including Bank of Singapore and dbs in Asia. In America the masses are served by specialist firms such as Edward Jones, a retail-wealth-mananagement outfit in which advisers are paid based on commissions for selling funds. Only a handful of institutions compete on a truly global scale. These include Goldman Sachs and JPMorgan Chase. But the two biggest are Morgan Stanley and a new-look ubs, which has just absorbed Credit Suisse, its old domestic rival. After acquiring a handful of smaller wealth-management firms over the past decade, Morgan Stanley now oversees around $6trn in wealth assets. After its merger, ubs now oversees $5.5trn.

To The Victor

This patchwork is unlikely to last. “The industry is heading in a winner-takes-all direction,” predicts Mr Habbel, as it becomes “very much about scale, about technology and about global reach”. Jennifer Piepszak, an executive at JPMorgan, has reported that her firm’s takeover of First Republic, a bank for the well-heeled that failed in May, represents a “meaningful acceleration” of its wealth-management ambitions. Citigroup has poached Andy Sieg, head of wealth management at Bank of America, in an effort to revamp its offering. In 2021 Vanguard purchased “Just Invest”, a wealth-technology company.

ubs and Morgan Stanley have grander ambitions. The firms’ strategies reflect their contrasting backgrounds and may, ultimately, end up in a clash. Morgan Stanley competes around the world but is dominant in America, and is focusing on wealth services for the masses, as shown by its purchase of e*trade, a brokerage platform, in 2020. James Gorman, the bank’s boss, has said that if the firm keeps growing new assets by around 5% a year, its current growth rate, it would oversee $20trn in a decade or so.

This would be built on Morgan Stanley’s existing scale. In 2009 the bank agreed to acquire Smith Barney, Citi’s wealth-management arm, for $13.5bn, which helped boost margins to the low teens from 2% or so in the years before the financial crisis. Today they are around 27%, reflecting the use of tech to move into advising the merely rich. Andy Saperstein, head of the wealth-management division, points to the acquisition of Solium, a small stock-plan-administration firm, which Morgan Stanley purchased for just $900m in 2019, as crucial for building a strong client-referral machine. “No one was looking at the stock-plan-administration companies because they didn’t make any money,” he says. But these firms “had access to a huge customer base and [clients] were constantly checking to see when the equity was going to vest, what it was worth and when they would have access to it.”

ubs is employing a more old-school approach, albeit with a global twist. Having taken over its domestic rival, the Swiss bank has a once-in-a-generation chance to cement a lead in places where Credit Suisse flourished, such as Brazil and South-East Asia. Deft execution of the merger would make the firm a front-runner in almost every corner of the globe. Thus, for now at least, the new-look ubs will focus more on geographic breadth than the merely rich.

In differing ways, both Morgan Stanley and ubs are seeking even greater scale. When clients hire a wealth manager they tend to want one of two things. Sometimes it is help with a decision “when the cost of making a bad choice is high”, says Mr Saperstein, such as working out how to save for retirement or a child’s education. Other times it is something exclusively available, such as access to investments unobtainable through a regular brokerage account.

Being able to offer clients access to private funds or assets will probably become increasingly important for wealth managers. Greater scale means greater bargaining power when negotiating with private-market firms to secure exclusive deals, such as private funds for customers or lower fees. Younger generations, which will soon be inheriting wealth, are expected to demand more environmentally and socially conscious options, including those that do not just screen out oil companies, but focus on investing in, say, clean energy. A decade ago a client would tend to follow their wealth adviser if he or she moved to a new firm. Exclusive funds make such a switch more difficult.

The winner-takes-all trend may be accelerated by artificial intelligence (AI), on which bigger firms with bigger technology budgets already have a head start. There are three kinds of tools that ai could be used to create. The first take a firm’s proprietary information, such as asset-allocation recommendations or research reports, and spit out information that advisers can use to help their clients. Attempts to build such “enterprise” tools are common, since they are the easiest to produce and pose few regulatory difficulties.

Wealthbots

The second type of tool would be trained on client information rather than companies’ proprietary data, perhaps even listening in on conversations between advisers and clients. Such a tool could then summarise information and create automatic actions for advisers, reminding them to send details to clients or follow up about certain issues. The third kind of tool is the most aspirational. It is an execution tool, which would allow advisers to speak aloud requests, such as purchasing units in a fund or carrying out a foreign-exchange transaction, and have a firm’s systems automatically execute that transaction on their behalf, saving time.

It will take money to make money, then. The biggest wealth managers already have more substantial margins, access to products their clients want and a head start on the technology that might put them even further ahead. “We are a growth company now,” claims Mr Saperstein of Morgan Stanley, a sentence that has been rarely uttered about a bank in the past 15 years. “We are just getting started.”

Yet the two giants atop the industry are both going through periods of transition. ubs has barely begun the open-heart surgery that is required when merging two large banks. Meanwhile, Mr Gorman, architect of Morgan Stanley’s wealth strategy, will retire some time in the next nine months. The succession race between Mr Saperstein, Ted Pick and Dan Simkowitz, two other executives, is already under way. Either firm could falter. Although the two are chasing different strategies, it is surely only a matter of time before they clash. ubs is on an American hiring spree; Morgan Stanley is eyeing expansion in some global markets, including Japan.

And despite the advantages offered by scale, smaller wealth-management firms will be difficult to dislodge entirely. Lots of different outfits have a foothold in the industry, from customer-directed brokerage platforms like Charles Schwab, which also offer their richest customers independent advice from a fiduciary, to asset-management firms, such as Fidelity and Vanguard, which have millions of customers invested in their funds, who might seek out wealth-management advice.

When Willie Sutton, a dapper thief also known as Slick Willie who died in 1980, was asked why he decided to rob banks, he replied that it was simply “because that is where the money is”. This is also a useful aphorism to explain strategy on Wall Street, as firms race to take advantage of the $100trn opportunity in wealth management. Once the business was a sleepy, unsophisticated corner of finance. Now it is the industry’s future. ■

#World’s Wealthiest People#Trillions of Dollars 💵 Battles#Financial Giants#Crush | The Competition#Landscapers | Housekeepers | Nannies#Wealth Managers#Geneva | New York#Singapore 🇸🇬#Global Financial Crisis#BlackRock & Vanguard#Asian | Latin American | Markets#Markus Habbel#Bottega Veneta#Louis Vuitton | Gucci#BTG Pactual | Brazil 🇧🇷#Bank of Singapore 🇸🇬#Goldman Sachs | JPMorgan Chase#Morgan Stanley#Credit Suisse#First Republic#Citigroup | Andy Sieg#Vanguard#James Gorman#Smith Barney#Andy Saperstein#Solium#Swiss Bank#Ted Pick | Dan Simkowitz#Charles Schwab#Fidelity

0 notes

Text

Dress habbel tiedy batik pekalongan

Dress habbel tiedy batik pekalongan

Dress habbel tiedy batik pekalongan,untuk spesifikasi ada pada gambarnya y kak, baik ukuran dan lain-lainya,warna serian 5 pcs sesui digambar.

Harga Grosir 50.000/min5pc | Kodian 48.000/min10pc

* Reseller 48.000/min5pc ( Cara menjadi reseller klik disini )

* Agen 47.000/min5pc ( Cara menjadi Agen klik disini )

CARA PESAN

sebutkan apa yang mau di order / kirim gambar/ judul baju dan jumlahnya dsb.…

View On WordPress

#argreenbatik#batik lintang#batik longdress#batikargreen#batikmuslimah#batikonline#batikpekalongan#daster longdress#Dress habbel tiedy batik pekalongan#gamisbatik#griyabatikpekalongan#grosirbatikmurah#grosirbatikpekalongan#longdress#longdressjumbo#longdresspekalongan#modelbatik#modelbatikterbaru#motifbatik#motifbatikpekalongan#pusatbatik#pusatbatikmurah#pusatbatikpekalongan

0 notes

Text

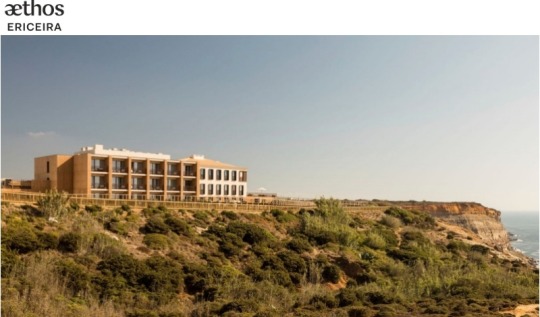

Aethos Hotel em pleno funcionamento na Ericeira

A nova unidade hoteleira de 4 estrelas complementa-se com restaurante – o Onda - e bar/lounge, um percurso pedonal em madeira na margem da falésia, um ‘deck’ de meditação e ioga, e um ‘fire pit’ de uma piscina de água salgada aquecida, sauna e banheira de hidromassagem. A área de spa, a ser inaugurada no próximo mês de novembro, inclui ainda um ‘hamam’, salas de tratamento e ginásio.

Read the full article

0 notes

Text

FÖRDERUNG DES PROJEKTES „GEMEINDEBÄUME“ DURCH TOMBOLA-LOSE

Bäume zu pflanzen, ist eine gute Investition zugunsten mehrerer Generationen.

Sprockhövel – Die Stadtverwaltung informiert darüber, dass das Spirituosen‐Depot auf der Hauptstraße in Niedersprockhövel und die Destillerie & Brennerei Heinrich Habbel auf der Gevelsberger Straße für das Jahresende eine Tombola ins Leben gerufen haben.

Der Los‐Preis in Höhe von 5 Euro fließt dabei hundertprozentig in das Projekt „Gemeindebäume“ der Stadt Sprockhövel, um das Stadtbild weiter zu…

View On WordPress

0 notes

Text

youtube

Modern Living at Its Finest: 3BHK Ready-to-Move Flats in Century Ethos, Habbel, near Manyata Tech Park

Century Ethos is a premium residential project offering 3BHK ready-to-move flats in Habbel, which is located near Manyata Tech Park in Bangalore, India. Developed by Century Real Estate, a renowned real estate developer, Century Ethos is designed to provide luxurious and comfortable living spaces for families and professionals.

The project boasts a strategic location near Manyata Tech Park, one of the largest and most prominent technology parks in Bangalore. This proximity makes it an ideal choice for individuals working in the IT sector or associated industries, as it offers a short commute and easy access to their workplace.

The 3BHK flats in Century Ethos are designed to offer spacious and well-planned interiors, catering to the needs of modern families. The apartments are meticulously crafted with high-quality materials and finishes, ensuring a blend of elegance and functionality. Each flat is thoughtfully designed to optimize natural light and ventilation, creating a pleasant and inviting living environment.

#Manyata Tech Park#Modern Living at Its Finest#Modern Living at Its Finest: 3BHK Ready-to-Move Flats in Century Ethos#Youtube

0 notes

Text

Kubbeler desteksiz, habbeler süreksiz, türbeler meleksiz, tövbeler gerçeksiz, cübbeler yüreksiz... Necip Fazıl Kısakürek

0 notes

Text

Hausaufgaben für die Wirtschaftsförderung: Vom stationären Einzelhandel bis zur Künstlichen Intelligenz in der Industrie #ZukunftstagMittelstand #BVMW - Man hört, sieht und streamt sich in Berlin @rafbuff @Ogruen @haucap @KfW_Research @Bandt_BUND

Die Zahl an Förderprogrammen für Unternehmen ist kaum zu übersehen. KMUs sollten sich damit mehr beschäftigen. Jede Förderung ist eine Investition in die Zukunft. Hier ein paar interessante Beiträge auf #DigitalX:

Fördermittel für Investitionen in die Zukunft

WIRTSCHAFTSFÖRDERUNG DURCH DIGITALISIERUNG Vom Stabilitätsgesetz zur Förder-App

Franz-Reinhard Habbel: Von der Wirtschaftsförderung zur…

View On WordPress

0 notes

Text

Bozcaada Camping

Bozcaada Camping, Çanakkale’nin Bozcaada’da ilçesinde yer alan ve hem çadır kampı için hemde karavan kampı için uygun bir kamp alandır.Kamp yapmak istemeyenler tesis de yer alan ağaç evlerde konaklayabilirler.

Kamp alanı Ada’nın güneyinde yer almaktadır ve ada merkezine 5 kilometre mesafededir.Denize ise yalnız 200 metre uzaklıktadır.Ayazma ve Habbele Plajı 400 metre, Sulubahçe Plajı ise 200…

View On WordPress

0 notes

Photo

Bozcaada’cılar burada mı? Gelin size manzarasıyla, kahvaltısıyla ve misafirperverliğiyle öne çıkan @bisalkimbozcaada ‘dan bahsedelim👨🌾 🏠 Bir yerin öz niteliğini en iyi coğrafyası tanımlar hiç kuşkusuz. Bozcaada da hem bir doğa cenneti, hem de tarihle bugünün hiçbir yerde eşine rastlanmadık biçimde karışımı olan, şirin mi şirin bir ada bizim için. Bu adanın lodosunun ve poyrazının dile getirdiği dalgalarla büyüyen bağları öylesine güzel ki… Ve, salkımlı üzümlerinin anlatacak çok şeyleri var ! 🌿 Ada merkezinde, Türk Mahallesinde bulunan Bi’Salkım Bozcaada Otel de doğru kıvamı bulmuş dünya şekeri bir küçük otel. Burada dile getireceğimiz ilk şey: salt malzemenin yoğunluğu ile elde edilmiş estetik ifade ve üst üste konmuş taşların güzelliği! ✨ Bi’Salkım’da mavi renginin tonlarının bu derece başarılı kullanımı ruhumuzu okşuyor. Odaları rahat ve her şeyden önce ferah. Hatta emsallerinden üstün sayılacak derecede geniş odalardan oluşuyor burası. Harikulade deniz manzaralı cumbalı odası favorimiz. Dokuma örtüler ve özel seçki objeler zevkli bir bütün oluşturuyor. ✨ Bahçe ise ayrı bir dünya. Ada merkezinde bu kadar geniş bir bahçesinin olması bir başka güzel detay. Keyifle tembellik etmeye uygun anlayacağınız… 🍳 Nefis serpme kahvaltılarını kendilerine özel sunumlarıyla hazırlıyorlar. Ezine peynirleri, tereyağı ve zeytinyağları kendi imalatları. 5 çayıyla ikram edilen ev yapımı sakızlı kurabiyeler ve limonatalar da pek lezzetli. 🏖 Bozcaada’nın plajları hâlâ istilaya uğramamış, ıssız kalabilmiş. Denizi tertemiz. Habbele, Tuzburnu, Çayır ve Beylik en çok tercih ettiğimiz koylardan. Deniz için bir başka alternatif ise, otele yürüyerek 5-6 dk uzaklıkta bulunan yat limanı: biz yerli keyif ahalisinin de sıkça tercih ettiği bir yer liman, gönül rahatlığı ile buradan siz de denize girebilirsiniz. ✏️ Özellikle zaman ayırın dediğimiz yerler: Bozcaada Müzesi, Göztepe ve Yeldeğirmenleri. Konumu, enerjisi ve yemeklerinin lezzetinden emin olduğumuz restoran önerimiz: Asma6. Bi’Salkım’ın iki kişi kahvaltı dahil odaları 1.500 Liradan başlıyor. ☎️ 0 541 723 99 95 +9 yaş ve üzeri konuklara hitap ediyorlar. Evcil hayvan için müsait değiller. (Bozcaada, Çanakkale) https://www.instagram.com/p/CenSyGaMxWA/?igshid=NGJjMDIxMWI=

0 notes

Photo

#sizdengelenler @ahterozmen Daha önce de bahsettiğim gibi ailem Çanakkale’de yaşadığı için oraya gitmek bize hem aile ziyareti hem tatil oluyor ama bu yaz bir türlü Bozcaada’ya gidemedik. Önümüzdeki ay için plan yapıyoruz bakalım🍇 Adaya gidince yapılacaklar 🥐 @cinaraltibozcaada ‘nda bir kahvaltı 🏊🏻♀️ @habbelebeach ‘de deniz keyfi (akvaryum çok kalabalık oluyor) 🍽 @bozcaadabattibalik ‘ta akşam sefası 🍼🐟🍽 🍪 @bozcaadalivelidede ‘den alınan kurabiyeler 🍷Sevenine Talay marka şarap 📷Bu fotoğraftaki gibi Rum mahallesindeki evlerin önünde fotoğraf çekimi Program sonu Kapanış ⛴ (Tabii biz günübirlik gittiğimiz için gece kalmıyoruz) Eğer hala Bozcaada’ya gitmeyen varsa mutlaka planına dahil etsin derim🏝 #bozcaada #bozcaadaotelleri #günaydın #bozcaadagezginleri #bozcaadagünbatımı #çanakkale #canakkale #talayşarapları #polente #habbele #tatil #ada #couple #couplegoals #love #like #happy #bozcaadasokakları #battibalik #travel #travelphotography #travelblogger #tb #tbt (Bozcaada) https://www.instagram.com/p/B0kg7IxnihT/?igshid=1eu2jys1uqeyg

#sizdengelenler#bozcaada#bozcaadaotelleri#günaydın#bozcaadagezginleri#bozcaadagünbatımı#çanakkale#canakkale#talayşarapları#polente#habbele#tatil#ada#couple#couplegoals#love#like#happy#bozcaadasokakları#battibalik#travel#travelphotography#travelblogger#tb#tbt

0 notes

Text

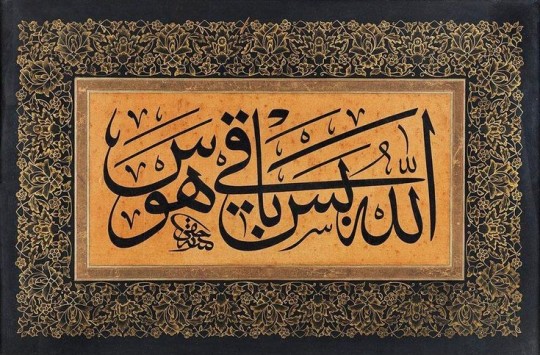

Allah bes bâki heves.

Allah yeter, başkası gelip geçici istektir, hevestir.

📚Kafiye.

Necip Fazıl Kısakürek.

Ne diye

bu şuna

şu buna

kafiye?

başa taş

aşa yaş

Hey'e ney

tuhaf şey

kafiye

mantığı

o mantık

hediye

sandığı

bu sandık!

o mantık

bu sandık-

ta sandık

ve yandık

ne yandık

hendese

kümese

tıkılmak

hadise

kırkayak

adese

oyuncak

vesvese

gökbayrak

ölümse

gel dese

tak tak tak

mu-hak-kak

sorular

sordular

neden çok

nasıl yok

niçin var

sanatsız

papağan

neden çok

ve atsız

kahraman

niçin yok

çok ve yok

yok ve çok

aç ve tok

tok ve aç

tut ve kaç

saklambaç

neden çok

nasıl yok

niçin var

niçin'i

boğarken

piçini

yatakta

bastılar

şafakta

astılar

ve derken

nasıl yok

niçin var

bir varmış

bir yokmuş

karamış

ve kokmuş

dünyamız

rüyamız

kapkara

manzara

gebeler

döşeksiz

ebeler

isteksiz

kubbeler

desteksiz

habbeler

süreksiz

türbeler

meleksiz

tövbeler

gerçeksiz

cübbeler

yüreksiz

cezbeler

şimşeksiz

izbeler

emeksiz

heybeler

ekmeksiz

kafiye

hikaye

dava tek

ölmemek

peygamber

ne haber

bir batan

var vatan

kandil loş

ocak boş

ve dağ dağ

elveda!

gitme kal

nefes al

emir tez

bekletmez

ve O nur

bulunur

işte iz

geliniz

toprak post

ALLAH DOST...

#necipfazilkisakurek#şiirheryerde#şiirsokakta#tumblr şiir#nasihat#allahuekber#allah yardımcımız olsun#allahım sabır#allahcc#dostistersenallahyeter#hasbinallah#lahavlevelaguvveteillabillah#tövbe estağfurullah#estağfirullah#lagalibeillallah#mevlanacelalledinrumi#mevlana#yunus emre#tapdukemre#cemil meriç#sezai karakoç#edebi sözler#edebiyyat#sevdalar#resulallah#allah#güzel ahlak#edepyahu#edepbaşatacimiş#abdurrahim karakoç

5 notes

·

View notes

Text

⭐⭐⭐⭐⭐

Birden baktım ki, hadsiz kuşlar ve kuşçuklar ve sinekler ve hesapsız hayvanlar ve hayvancıklar ve nihayetsiz nebatlar, yeşilcikler ve gayetsiz ağaçlar ve ağaççıklar dahi benim gibi lisan-ı hal ile

hasbinallahü ve nimel vekil ’in mânâsını yâd ediyorlar ve yâda getiriyorlar ki,

bütün şerait-i hayatiyelerini tekeffül eden öyle bir vekilleri var ki,

birbirine benzeyen ve maddeleri bir olan yumurtalar ve birbirinin misli gibi katreler ve birbirinin aynı gibi habbeler ve birbirine müşabih çekirdeklerden kuşların yüz bin çeşitlerini ve hayvanların yüz bin tarzlarını, nebatatın yüz bin nevini, ağaçların yüz bin sınıfını

yanlışsız, noksansız, iltibassız, süslü, mizanlı, intizamlı, birbirinden ayrı,

fârikalı bir surette gözümüz önünde, hususan her baharda

gayet çabuk, gayet kolay, gayet geniş bir dairede gayet çoklukla halk eder, yapar, kudretinin azamet ve haşmeti içinde beraberlik ve benzeyişlik ve birbiri içinde ve bir tarzda yapılmaları vahdetini ve ehadiyetini bize gösterir. Ve böyle hadsiz

mu’cizâtı ibraz eden bir fiil-i rububiyete ve bir tasarruf-u hallâkıyete müdahale ve iştirak mümkün olmadığını bildirir diye bildim.

Üstadımın hârika uslubuyla güzel bir güne mükemmel bir Tefekkür dersiyle başlamak istedim.. Rabbim Dakikalarımızı, Saatlerimizi, Günümüzü Tefekkür İbadetiyle Mükemmelleştirsin İnşaallah... Huzurlu Günler Diliyorum..🌺

________________°🌺💞🌸°_________________

🎀

16 notes

·

View notes

Text

Dülger Balığının Ölümü

artık her seyi anlamıştı. denizlerin dibi âlemi bitmişti. ne akıntılara yassı vücudunu bırakmak, ne karanlık sulara, koyu yeşil yosunlara gömülmek; ne sabahları birdenbire yukarılardan derinlere inen, serin aydınlıkta uyanıvermek; günün mavi ve yeşil oyunları içinde kuyruk oynatmak; habbeler çıkarmak; yüze doğru fırlamak?; ne yosunlara, canlı yosunlara yatmak, ne akıntılarla âletlerini yakamozlara takarak yıkanmak; yıkanmak vardı. her şey bitmişti... Sait Faik Abasıyanık

4 notes

·

View notes

Text

Adana'da aktif gay ve pasif gayler için tanışma buluşma noktası

Adana’da aktif gay ve pasif gayler için tanışma buluşma noktası

Adana’nın sıcağında erkekler azgınlıktan ne yapar? Güneşe ateş edecek cesaretleri yoksa pasif peşine düşerler. Nerede? Galeria’nin arka tarafındaki sahil kıyısı boyunca Mimar sinan civarına kadar olan bölgede. Benim takunya bacım sıklıkla o bölgelere gider ve bana sürekli o bölgedeki bulduğu laçoları anlatır 😂 Bol bol similya habbeler ve fırsat bulursa şahane koliler keser😋🥰 hayat ona güzel… Ev…

View On WordPress

1 note

·

View note

Text

ERSTER HASSLINGHAUSER BAUERNMARKT ERÖFFNET

Optimales Wetter für den ersten Haßlinghauser Bauernmarkt.

Sprockhövel – Am heutigen Samstag (21. Oktober 2023) eröffnete Bürgermeisterin Sabine Noll den ersten Haßlinghauser Bauernmarkt auf dem Gelände der Destillerie und Brennerei Heinrich Habbel an der Gevelsberger Straße 127 in Haßlinghausen.

Die Wirtschaftsförderung der Stadt Sprockhövel organisierte in Kooperation mit der Brennerei Habbel diese Veranstaltung.

Erster Haßlinghauser Bauernmarkt:…

View On WordPress

0 notes

Text

Olivia is a delightful residence at Olivia L&T Raintree Boulevard. With thoughtful amenities, the 3 and 4 BHK luxury apartments in Bangalore provide their residents with a delightful living environment. Your shopping and entertainment needs are met nearby by the roomy flats and retail streets. Come home to Olivia at Raintree Boulevard where the perfect balance of luxury and convenience truly enables you to live a life of fulfillment.

#properties for sale in bangalore#bangalore#Olivia L&T Raintree Boulevard#L&T Raintree Boulevard#property#realestate#userumbrellarealty

0 notes