#home insurance louisiana

Text

Home Insurance Companies Covington Louisiana

Home insurance companies are one of the many options we offer at Bonano Insurance Agency in Covington, Louisiana.

0 notes

Text

Excerpt from this story from the New York Times:

At first glance, Dave Langston’s predicament seems similar to headaches facing homeowners in coastal states vulnerable to catastrophic hurricanes: As disasters have become more frequent and severe, his insurance company has been losing money. Then, it canceled his coverage and left the state.

But Mr. Langston lives in Iowa.

Relatively consistent weather once made Iowa a good bet for insurance companies. But now, as a warming planet makes events like hail and wind storms worse, insurers are fleeing.

Mr. Langston spent months trying to find another company to insure the townhouses, on a quiet cul-de-sac at the edge of Cedar Rapids, that belong to members of his homeowners association. Without coverage, “if we were to have damage that hit all 17 units, we’re looking at bankruptcy for all of us,” he said.

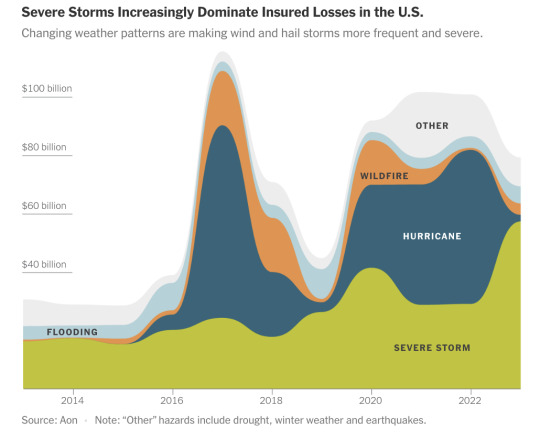

The insurance turmoil caused by climate change — which had been concentrated in Florida, California and Louisiana — is fast becoming a contagion, spreading to states like Iowa, Arkansas, Ohio, Utah and Washington. Even in the Northeast, where homeowners insurance was still generally profitable last year, the trends are worsening.

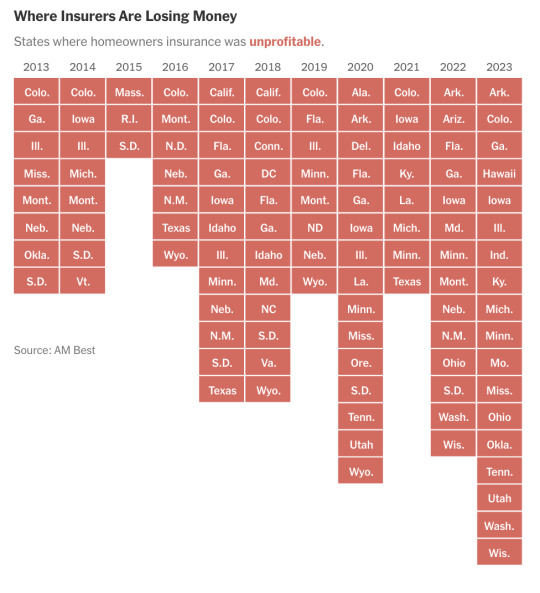

In 2023, insurers lost money on homeowners coverage in 18 states, more than a third of the country, according to a New York Times analysis of newly available financial data. That’s up from 12 states five years ago, and eight states in 2013. The result is that insurance companies are raising premiums by as much as 50 percent or more, cutting back on coverage or leaving entire states altogether. Nationally, over the last decade, insurers paid out more in claims than they received in premiums, according to the ratings firm Moody’s, and those losses are increasing.

The growing tumult is affecting people whose homes have never been damaged and who have dutifully paid their premiums, year after year. Cancellation notices have left them scrambling to find coverage to protect what is often their single biggest investment. As a last resort, many are ending up in high-risk insurance pools created by states that are backed by the public and offer less coverage than standard policies. By and large, state regulators lack strategies to restore stability to the market.

Insurers are still turning a profit from other lines of business, like commercial and life insurance policies. But many are dropping homeowners coverage because of losses.

Tracking the shifting insurance market is complicated by the fact it is not regulated by the federal government; attempts by the Treasury Department to simply gather data have been rebuffed by some state regulators.

The turmoil in insurance markets is a flashing red light for an American economy that is built on real property. Without insurance, banks won’t issue a mortgage; without a mortgage, most people can’t buy a home. With fewer buyers, real estate values are likely to decline, along with property tax revenues, leaving communities with less money for schools, police and other basic services.

And without sufficient insurance, people struggle to rebuild after disasters. Last year, storms, wildfires and other disasters pushed 2.5 million American adults out of their homes, according to census data, including at least 830,000 people who were displaced for six months or longer.

121 notes

·

View notes

Text

Under a new state law, residents will no longer be protected from homeowners’ policy cancellations, higher deductibles or big rate increases.

8 notes

·

View notes

Text

Excerpt:

The rising cost of homeowner’s insurance is now one of the most prominent symptoms of the climate crisis in the US. Major carriers such as State Farm and Allstate have pulled back from offering fire insurance in California, dropping thousands of homeowners from their books, and dozens of small insurance companies have collapsed or fled from Florida and Louisiana following recent large hurricanes.

Read more.

7 notes

·

View notes

Text

𝑩𝒓𝒊𝒏𝒈 𝒎𝒆 𝒒𝒖𝒊𝒆𝒕, 𝒃𝒓𝒊𝒏𝒈 𝒎𝒆 𝒊𝒏𝒕𝒐 𝒔𝒉𝒆𝒍𝒕𝒆𝒓 / @deathcreate

There was an old adage somewhere, intermittently laced with irony, that when it rains, it pours. New Orleans expected a hurricane, all those who were boarding rooms in the hotels were told to take out liability insurance, just as a way of the company to disrupt the hold of responsibility that came from yearly forces of nature.

Louisiana was her own private beast, sundered from the rest of humanity the way a butcher cleaves fat from bone: with deliberate precision. Those who had lived here for years understood the danger, but they took precautionary measures – those who were ill-timed tourists bought umbrellas, charged their smartphones when they could, and continued to go on the tours of the city.

Bad weather never stopped crime, of course. He had been instructed to follow a lead which had turned into an arrest, and at the time, it was looking as if he’d outpace the storm. That wasn’t possible now, and without even thinking of the consequences, Will Graham walks into an alley, then another, and with a fierce clap of thunder, he winds up with his back to an open door, his foot falling through the rotted wood of someone’s foyer.

Oh. Oh no. Oh, no…his leg was caught, and without even thinking, he yanks it up, wood sliding through his pant leg, making him bleed. He was okay, he was fine…

“I’m so sorry,” he calls out, attempting to shout over the sudden torrent of rain, “I’m so sorry if someone lives here,” and he yanks his leg, skin and part of his slacks giving way. He eases himself up with his hands, looking to the trail of blood running down his shin.

So, he created property damage to someone's home. This was the last thing that needed to happen, but it did, and he needed to explain what had happened to whomever was living here, it was only right. He wouldn't let the storm take the fall for his clumsiness.

He wanders into a dimly lit foyer, noting a light in the center of a living room. No one should be by a window right now, much less, having lights on, they need to conserve energy…

“I’m so…” and whatever thought Will Graham had in his mind filtered out of his ears, weaving into the thick, hot night of the storm when he saw a figure, crouched by a window, bent over what appeared to be…a piano.

“...rry. I…um…you shouldn’t be by the window, it’s really dangerous.” Shut-up, Will. Shut-up. You wandered into someone’s home, and you’re telling them how to be? That’s not the way it goes.

#deathcreate#CH 8: MIDNIGHT DANCING IN OUR CHESTS. DEATHCREATE#I CANNOT BE -- UNTIL YOU'RE RESTING HERE WITH ME. DEATHCREATE.#(season 2 EPISODE 8...more like episode great...episode belle sobs her eyes out...)#(have you ever met the love of your life in the middle of a hurricane? i sure want to)#(but maybe he shouldn't destroy my floor but oh well he can build me a new one...)

2 notes

·

View notes

Text

My dog woke me up and yes, it's not quite 2 AM as I start typing this, but I have several thoughts weighing down my mind and I need to get them out.

My oldest child had high school orientation this week. They opened with the pledge and a prayer. We did not stand.

No one confronted us. No one asked why. Which, frankly, surprised me as I'm in South Louisiana. But I'm still crafting an answer to the question that never came.

I didn't stand for the pledge of allegiance because the tenants of that decree are no longer being upheld. Liberty and justice for all have become words that are just recited.

The neighborhood that I live in, the Northside, is socioeconomically low. It's a neighborhood full of blacks and other POC. I love my neighborhood.

More than once, I've had to school my own mother on the way she talks about my neighbors and my community. Because it is a community. But this community is more policed and has less tax revenue because of its makeup. Is that liberty and justice for all?

The high schools in our district are installing weapon detectors. Our politicians are more worried about policing genitals. Is that liberty and justice for all?

Our most vulnerable citizens, our children, go to school every day and we never know if they're going to come home. They go home not knowing if they're going to eat or have lights on. Our government is trying to cut funding for school meals while letting gun lobbies do anything they want. Is that liberty and justice for all?

We spend more on healthcare than any other nation in the world but have some of the worst maternal mortality rates, infant mortality rates, and rates of preventable and treatable diseases. Because we cannot get doctors to accept state-funded medical insurance, the private insurances have priced themselves out of the middle class, and the amount that it costs for the uninsured to have treatment is unattainable for most people. Is that liberty and justice for all?

People go to church and praise and worship their gods, and that is their right. But on Monday mornings, these same people are decrying the 'woke left' for trying to teach things like...tolerance and history. They say that other religions are heathens and terrorists and do everything they can to stop them from holding positions of power. Is that liberty and justice for all?

Police corruption is higher than it was in the 1940s and the mob didn't have to lift a finger. It's filled with hatred and bigotry, racism and misogyny, power trips and harmful ideology. These departments are left unchecked, free to rape and pillage all they want under the guise of law enforcement. Is that liberty and justice for all?

Our lawmakers are collectively trying to enact laws that will hamstring our children and keep them from knowing what actually goes on in the world, will keep adults in this country from knowing what goes on in the world. While we have the highest standards perceived for our education, when ranked based on actual data and not an opinion survey, we don't even crack the top ten.

I wrote to our senator about this KOSA bill and he basically said 'fuck you I'm doing it.' Our congressman didn't even deign to give me an actual response, just an automated message to let me know that they received my email.

That is definitely not liberty and justice for all. Not to mention, porn is restricted by government ID here in Louisiana. Yet, my 14 year old still has access to it. It's all over twitter, discord, tumblr, and dozens of other sites that would have exemptions to the bills aimed at protecting kids from that kind of material.

Instead of sheltering, we need to educate. We need to teach kids bodily autonomy and not force them to hug their family. They need to know the proper terms for their body parts to be able to report sexual assault and molestation. They need to know that there are things that adults should not be doing.

We need to enforce the laws already on the books protecting children from rapists and child molesters and sex trafficking before we try to keep them off of the internet. Because the whole world has access to the internet. It's either all children, or just our children. The latter seems most likely.

In IT, when there's an issue for one user, the error is identified to being a single user error. Not an error with the entire network.

In order for me to want to participate in pledging my allegiance to a country - which, by the way, is something communist nations do, indoctrination at the kindergarten level - you have to make me believe in the words that I'm reciting.

"One Nation" if you're cishet and white.

"With Liberty and Justice for All." If you're not a minority group or female.

And don't get me started on the 'under god' portion.

12 notes

·

View notes

Text

The bad example state.

April 25, 2024

In his State of the State Address in January 2022, Governor Ron DeSantis declared that Florida was "the freest state in these United States." He also claimed "the state is well-prepared to withstand future economic turmoil." Turns out this description does not apply at all to his state's insurance industry. That particular segment of Florida's economy is currently verging on catastrophe.

Because of ocean warming, Florida is especially subject to heavy rainfalls, storm surge, and major category hurricanes that can devastate entire cities. For example, 55% of all the properties in Miami are at risk for severe flooding. And Florida's sea level, as much as eight inches higher now than in 1950, is rising by one inch every three years.

Bloomberg Intelligence reports that a 360% rise in Florida's insured losses in the past three decades due to the increased frequency and intensity of natural disasters is causing insurers to “hike premiums and exit high-risk areas.” And with reinsurance — essentially insurance for insurers — becoming unaffordable, major insurance companies are fleeing Florida in droves. AIG ceased insuring new properties along Florida's shoreline, while Farmers Group has stopped writing new policies statewide entirely.

So, since Republicans believe a "free" state means having little to no business regulation, homeowners are left having to depend on companies that are smaller, less diversified, less capitalized and more prone to becoming insolvent. A recent study by researchers at Harvard University, Columbia University and the Federal Reserve found that a majority of homes in Florida are insured by companies whose ratings would not receive an A from Demotech Inc., the industry’s primary ratings agency, and thus not be good enough to secure full backing by Fannie Mae or Freddie Mac.

Naturally, costs for home insurance have skyrocketed, too. Floridians paid an average annual premium of $10,996 in 2023 — more than anywhere else in the country. And online insurance agent Insurify predicts that number to go up to $11,759 in 2024.

DeSantis likes to hype "free" Florida as a model for the nation. Here's how Latisha Nixon-Jones, law professor at Jackson State University responds to that notion:

Will the state serve as a blueprint for disaster-prone regions, or act as a cautionary tale? After all, states such as California and Louisiana have also seen insurance companies withdrawing from their markets.

Plus, Newsweek reports that Brookfield Asset Management Reinsurance Partnership is pulling out of nine states: Arkansas, California, Colorado, Louisiana, Minnesota, Oklahoma, South Carolina, South Dakota, and Washington. If Florida is an example for America, that's not very reassuring.

2 notes

·

View notes

Text

For most of his life, Cory Infinger has lived down a hill and along a bend in the Little Wekiva River, a gentle stream meandering northwest of Orlando. During Hurricane Ian, in September 2022, the stream swelled, inundating the homes of his family and his neighbors and also the street where they live, making it impassable.

Overnight Ian had moved slowly and violently over the state’s interior, dropping historic amounts of rain, after coming ashore in southwest Florida as a category 4 hurricane, its high winds and storm surge flattening coastal communities there.

For Infinger the deluge forced a hasty morning evacuation with his wife and youngest two of their three children. It would displace the family for months as their home underwent massive repairs. More than a year later the ordeal has left the family rattled, especially his 16- and 8-year-old children, said Infinger, who grew up fishing and trapping turtles along the Little Wekiva and now enjoys doing the same with his kids. (A 22-year-old son no longer lives at home.)

“You could tell they were sad when we came back to get the last few things,” he recalled of his kids as he described the family’s temporary stay in a rental house, and then the move back to their newly remodeled home. “It took them a while to get used to, this is our new house. Everything had changed.”

In the last seven years Florida has weathered five major hurricanes. Michael, which made landfall in 2018 in the Panhandle, was the first category 5 hurricane to strike the continental United States since Andrew in 1992. Ian, in 2022, was the costliest hurricane in state history and third-costliest on record nationwide, after Katrina in 2005 and Harvey in 2017. Recent major Florida hurricanes also include Irma in 2017, Nicole in 2022, and Idalia in 2023.

If the disasters sharpened Floridians’ resolve, in the immediate aftermath, to build back stronger and better, another crisis may be causing some to rethink where they live and the rising risk as the global climate warms.

After Ian, Infinger’s taxes and homeowners insurance, which he pays together into a bank escrow account as part of his regular mortgage payment, jumped by $450 a month. That amount could be considered moderate in a state where annual home insurance rates in the five and six figures have not been unheard of in recent years, and many homeowners have received letters from their insurers informing them that their existing policies will not be renewed.

Some homeowners have received multiple such letters from multiple insurers, leaving them scrambling from one policy to the next, as lenders require mortgage holders to carry insurance. Others whose homes are paid off are going without insurance altogether, to spare the expense.

“We deal with it,” said Infinger, who, with his wife, is considering moving away from the Little Wekiva in the coming years. For now, he said, “there’s nothing really we can do about it.”

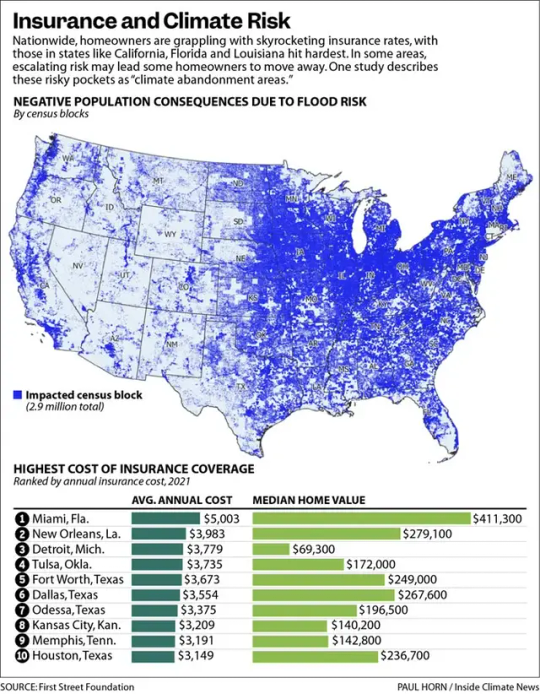

Across the country, homeowners are grappling with skyrocketing insurance rates and dropped policies, with those in states such as California, Florida, and Louisiana hit hardest. Growing evidence suggests the soaring costs only hint at the widespread unpriced risk facing homeowners as the warming climate leads to rising seas and more damaging hurricanes and wildfires.

As many as 6.8 million properties nationwide have been affected by insurance problems, but that number represents a fraction of the 39 million homes and businesses vulnerable to flooding, hurricanes, and wildfires whose risk has not been priced into their policies, according to a study by the First Street Foundation, a nonprofit researching climate risk. Together these 39 million properties constitute what the study characterizes as an “insurance bubble,” defined by properties likely overvalued because of underpriced or subsidized insurance.

Other research suggests the changing climate has not been priced into the real estate market in a way that reflects the risk. A separate study published last year in Nature Climate Change, a peer-reviewed journal, estimates that residential properties vulnerable to flooding are overvalued by $121 billion to $237 billion, in part because of the subsidized National Flood Insurance Program.

The study found that the most overvalued properties are concentrated in coastal counties where there are no flood risk disclosure laws and where there is less personal concern about climate change. Much of the overvaluation is driven by properties situated outside of the 100-year flood zones designed by the Federal Emergency Management Agency. Low-income households especially are in danger of losing home equity, potentially leading to wider wealth gaps. In Florida, properties are overvalued by more than $50 billion, according to the study.

The unpriced risk is important for many reasons. Municipalities that rely on property tax revenue may be vulnerable to potential shortfalls, the study says. The National Climate Assessment pointed out last year that the overvaluation of coastal properties makes it difficult to move people out of harm’s way, because of the limited amount of compensation available through flood insurance and federal flood disaster assistance programs.

“Florida is one of the riskiest places from a climate impact standpoint that you can live in,” said Rob Moore, director of the flooding solutions team at the Natural Resources Defense Council. “One only needs to look through a few years of front pages to see how many major hurricanes have struck this state, and that definitely had an impact on how both private insurers and insurers in the public realm are looking at risk and pricing it in the state of Florida.”

“We’re so far behind in regard to pricing in the climate. That’s why we’re seeing these big [insurance] spikes in places like Florida and California and Louisiana,” said Jeremy Porter, head of climate implications research at the First Street Foundation. “It’s the first mechanism to start to price climate into the housing market.”

2 notes

·

View notes

Text

While Ron DeSantis is busy spewing anti-woke tirades in early primary and caucus states, the crises in Florida grow more numerous.

So far...

the malaria outbreak

the worst citrus harvest since the Great Depression

loss of convention and tourism business due to the increasingly homophobic, racist, and anti-immigrant atmosphere in the state

the highest rate of inflation of the 50 states

Add to those the soaring cost of home insurance – provided that you can actually obtain it.

Households in Florida, the third most populous state in the US, have been grappling for some time with a property insurance crisis that is making home ownership unaffordable for many. After at least six insurers went insolvent in Florida last year, Farmers on Tuesday became the latest to pull out of the Florida market, saying in a statement that the decision was based on risk exposure in the hurricane-prone state.

Climate change is threatening the very existence of some parts of Florida. And the costs are already being felt by Floridians. At the end of 2022, average annual property insurance premiums had already risen to more than $4,200 in Florida – three times the national average.

Having a notorious climate denier as governor is not a plus in the state most affected by sea level change.

Andrea is among a number of Florida citizens who shared with the Guardian that rapidly exploding hurricane cover premiums had made their private property insurances unaffordable, and forced them to apply for cover with the Citizens Property Insurance Corporation, Florida’s not-for-profit insurer of last resort, created in 2002 to provide windstorm coverage and general property insurance for homeowners who could not obtain insurance elsewhere.

“This insurance trouble has been going on since Hurricane Andrew,” Andrea says, referencing the destructive category 5 hurricane that struck the Bahamas, Florida and Louisiana in August 1992.

“But it has been getting a lot worse over the past two years. The state of Florida has done zero in that period to help homeowners.”

Of course DeSantis has been governor for the past 4.5 years.

Florida’s governor, Ron DeSantis, has been accused of dragging his feet on the insurance issue, as well as of a “catastrophic” approach to the climate crisis after saying he rejects the “politicization of the weather” and questioning whether hurricanes hitting Florida have been worsened by climate change.

“In a really bad hurricane year,” Andrea says, “Citizens can do a special assessment and charge me more. When my premium goes to the $3,000-a-year mark, I have to sell and move out of Florida, probably in the next couple of years. With my income level I’d have to move somewhere pretty inexpensive. I’ve been looking at South Carolina and Wisconsin.

Poor Andrea may become a climate refugee thanks to DeSantis.

Even in the Panhandle, nicknamed "the Redneck Riviera" people are suffering because of DeSantis's sloth on public policy.

Phil Goddard, 64, a freelance translator living in Pensacola, the westernmost city in the Florida Panhandle, has similar misgivings about the state’s future.

[ ... ]

Although moving out of state would be “a last resort”, Goddard says, the rising costs of property insurance are putting a damper on everyday life. Friends, he says, a retired couple, have cancelled their property insurance as they can no longer afford it.

[ ... ]

“This is a great place, but it’s a poison paradise, because of all the associated costs and risks of living here.

“Global warming is partly to blame, but so is Ron DeSantis. Instead of banning books and picking fights with Disney and drag queens, he should be tackling the issues that really matter to Floridians.”

While DeSantis is campaigning nationally on the slogan, Make America Florida, he is effectively Making Florida Mississippi.

EDIT: Instead of making this a separate post, it seemed like a good idea to just add it here.

When we occasionally say that DeSantis acts in a fascistic way, it isn't just name calling. He's actually setting up his own militia.

State guard set up by DeSantis is being trained as personal militia, veterans say

A Florida state guard established by the rightwing governor, Ron DeSantis, under the guise of a civilian disaster relief force is instead being trained as an armed, combat-ready militia under his personal command, according to military veteran recruits who have quit the program.

Several veterans resigned after an encampment last month having become concerned at the “militaristic” training and “abuse” one disabled veteran suffered at the hands of instructors, according to an investigation by the Miami Herald and Tampa Bay Times.

Abusing disabled veterans who signed up sounds very un-American.

This is more like the Brown Shirts than a Florida "disaster relief force" as intended.

Promoted by DeSantis as an “emergency focused, civilian defense force” when it was established in June 2022, the state guard has quickly morphed into something quite different, the report found.

Volunteers have been trained for military combat, including the use of weapons; khaki polo shirts and pants were replaced by camouflage uniforms; and recruits were “barked at” by boot camp instructors at the joint training base who woke them before dawn and imposed lights-out by 10pm.

The rubber stamp GOP Florida legislature helped make this possible.

Additionally, DeSantis’s compliant, Republican-led state legislature has contributed to the change of direction, this year approving a massive expansion in the force’s funding, size and equipment. Its budget increased from $10m to $107.5m, and its maximum size more than tripled from 400 recruits to 1,500.

On the governor’s shopping list were helicopters, boats, police powers and reportedly even cellphone-hacking technology for a force outside of federal jurisdiction, and accountable directly to him.

DeSantis is unhinged, we can see why Elon Musk has a man crush on him.

In 2024, 20 of the 40 Florida State Senate seats are up for election as are all 120 Florida State House seats.

It's not too early to start work on chipping away at the Republican majorities which empower DeSantis's extremism.

The first step is to find out exactly who represents you in the legislature.

Find Your Legislators

Look your legislators up by address or use your current location.

#climate change#florida#ron desantis#republicans#the gop#making florida mississippi – with a hint of nuremberg#home insurance premiums#skyrocketing property insurance#election 2024#gop presidential nomination#florida legislature#desantis's personal militia#fascism#perhaps the florida brown shirts should be called the 'white boots'

9 notes

·

View notes

Photo

House Insurance Louisiana

Bonano Insurance that House Insurance Louisiana is the structure of your home and your property as well as your personal legal responsibility or liability for injuries to others.

0 notes

Text

Where Seas Are Rising at Alarming Speed. (Washington Post)

One of the most rapid sea level surges on Earth is besieging the American South, forcing a reckoning for coastal communities across eight U.S. states, a Washington Post analysis has found.

At more than a dozen tidegauges spanning from Texas to North Carolina,sea levels are at least 6 inches higher than they were in 2010 — a change similar to what occurred over the previous five decades.

Scientists are documenting a barrage of impacts — ones, they say, that will confront an even larger swath of U.S. coastal communities in the coming decades — even as they try to decipher the precise causes of this recent surge.

The Gulf of Mexicohas experienced twice the global average rate of sea level rise since 2010, a Post analysis of satellite data shows. Few other places on the planet have seen similar rates of increase, such as the North Sea near the United Kingdom.

“Since 2010, it’s very abnormal and unprecedented,” said Jianjun Yin, a climate scientist at the University of Arizona who has studied the changes. While it is possible the swift rate of sea level rise could eventually taper, the higher water that has already arrived in recent years is here to stay.

“It’s irreversible,” he said.

As waters rise, Louisiana’s wetlands — the state’s natural barrier against major storms — are in a state of “drowning.” Choked septic systems are failing and threatening to contaminatewaterways. Insurance companies are raising rates, limiting policies or evenbailing in some places,casting uncertainty over future home values in flood-prone areas.

Roads increasingly are falling below the highest tides, leaving drivers stuck in repeated delays, or forcing them to slog through salt water to reach homes, schools, work and places of worship. In some communities, researchers and public officials fear, rising waters could periodically cut off some people from essential services such as medical aid.

While much planning and money have gone toward blunting the impact of catastrophic hurricanes, experts say it is the accumulation of myriad smaller-scale impacts from rising water levels that is the newer, more insidious challenge — and the one that ultimately will become the most difficult to cope with.

“To me, here’s the story: We are preparing for the wrong disaster almost everywhere,” said Rob Young, a Western Carolina University professor and director of the Program for the Study of Developed Shorelines.

“These smaller changes will be a greater threat over time than the next hurricane, no question about it,” Young said.

20 notes

·

View notes

Text

● FORTY FIVE ● HUMAN ● MALE ● JOURNALIST ●

"Entitlement is a delusion built of self centeredness and laziness."

Biography: Originally from Chicago Alex first moved down to Louisiana for college. The son of a media magnate, it was no surprise that Alex first wanted to get involved with communications, and when he finally settled on journalism, his family was extremely proud. What they weren’t however, was prepared for how entitled Alex was when he finished college. Upon returning home, he assumed his dad would be taking him under his wing and teaching him how to run the company, but his dad, Bryce, had different plans. He had expected Alex to get a job within the company and work his way up, making sure he knew every step of the business the way he himself had, but when Alex found that out, he was infuriated.

It was only through his mother’s intervention that Alex wasn’t completely disinherited, and when he realized no other media companies in Chicago would give him a chance after hearing about his entitlement, he fled back to Louisiana, moving to Baton Rouge. He managed to get an entry level job at a paper, which didn’t pay much, but he still had his parents money, which his mom was still providing him. He worked at the newspaper, but he didn’t really make friends, he looked down on the people around him like he was better than them, and that rubbed people the wrong way. After nearly ten years of living and working in Baton Rouge his parents surprised him by coming down to visit. He showed them all the hard work he had been doing, and when his father offered to take them all out to dinner, Alex assumed this would be the point where his dad was going to offer to take him under Bryce’s wing, and let him take over the company, but as the evening went on and there was no mention of it, Alex got more and more mad. The anger came to a boil when Bryce commented on the sale of the company, and Alex was infuriated to find out that Bryce had sold the company for a huge profit. When Alex demanded to know what was going to happen to him, his father assured Alex that he wasn’t forgotten about. He had an account full of money put aside for Alex, for the future.

Alex, infuriated at his father for ruining his life long plans, stormed off into the night, and Bryce and Carmen, Alex’s mom, were never heard from again. Alex was investigated closely, but when witnesses said they saw him walk away before his parents disappeared, the investigation ran cold. Alex went back to Chicago to declare his parents dead, but found that all of the money his father had promised him was in a trust that could only be accessed when Alex was an editor of a paper himself. The life insurance on his parents was paid out to other people, and the money that Alex had been getting monthly was no longer coming in. Destitute, he went back to Baton Rouge, and began to pressure his boss into letting him learn under him, letting him be an editor. The boss didn’t go for it, and after awhile got more and more uncomfortable with Alex pressuring him. Alex would harass staff members, trying to act like he was better than them, until he was eventually fired for his behavior.

Infuriated, he was sure it was a coworker he had been bossing around who got him fired, and he followed them home before grabbing them as they got out of their car and telling them that they had made a terrible mistake. The next day the office got an email saying they were quitting and never coming back. Meanwhile, Alex moved down to New Orleans and began to work at a paper there. He kept his head down, stayed under the radar, but tried his hardest to come up with stories that would impress his bosses. When the great announcement happened, he tried hard to write stories about it, but so many stories were happening all over the world that they were lost in the shuffle.

When he heard about a city of solely supernatural people, he knew he had to move there, he had to be a journalist, and maybe- just maybe he could impress the world and make editor of that paper, and finally get his inheritance.

Alex is an open character, if you think he looks right for you, feel free to fill out the application and submit it here!

Admin Note: Alex is a character who has a major plot that will affect the entire group, if you're interested in him, please message the main so we can discuss the plot and how best to utilize his character in this major plot.

#werewolf rpg#supernatural rpg#witch rpg#vampire rpg#familiar rpg#supernatural rp#supernatural town rp#town rp#town rpg#oc rpg#literate rpg#literate roleplay#literate rp#open character#open human#bill hader#bill hader fc

3 notes

·

View notes

Text

Soaring home insurance rates are squeezing homeowners : NPR

In many places, including California, Colorado and Louisiana there's been a steep rise in the cost of homeowners' insurance. But it's particularly staggering in Florida, a state that already has the highest insurance costs in the nation. Many Floridians have seen insurance premiums go up by more than 40% this year.

2 notes

·

View notes

Note

For the headcanon character thing: Sarah Wilson! (feel free to do as many or few as you want!) ☾, ■, ☮, ♦, ☯ , ♒

hi, chase! thank you so much for the ask!!!! i answered a couple of these but here are the ones i didn’t get asked yet :)

and none of these are by any means a complete list

bedroom/house/living quarters

if there is one thing sarah cannot abide? it is clutter. she cannot go to bed if there are still dishes in the sink and, yes, she IS going to wipe down the counters every single day, thank you very much for asking. 99% of the furniture in the wilson home has been there for decades, this dining room table was carved by darlene’s great-great-great grandpa gideon, who was one of the freedmen living in antebellum louisiana. but she did splurge on a king-sized mattress for herself and new beds for the boys’ with some of the money from her husband’s life insurance policy

likes/dislikes

she likes being in nature, spending time with her boys (the definition of which has expanded to include not just her own boys and her brother but also bucky and joaquin), cooking for and with her boys (although bucky has been temporarily banned from the kitchen), spicy foods, nature documentaries, helping her community, goofing around (she is EXCELLENT at doing silly voices, aj and cass love when she makes their veggies talk); she dislikes rude people, having to balance the checkbook, people who don’t help others even though they have the means to do so, being asked if she played/plays basketball because she’s so tall, people who hate children (kids are people, too, and we all used to be one and she doesn’t understand why it’s so easy for people to forget that), small dogs (what is even the point? why not just get a cat?), rodents, bankers, and baseball (but she will watch games with bucky because he likes it and she likes him)

cooking/food

sarah loves cooking with other people, she loves sharing food with people (she always lets bucky try a bite of her dish on date nights), she likes listening to music while she’s cooking, she’ll follow recipes when she feels like it but she’s not terribly strict unless she’s baking because baking is science while cooking is jazz (but also because she knows if she tries to mess around with grandma ruby’s peach cobbler recipe, ruby will haunt her for the rest of her days), she prefers savory over sweet but nothing beats a hot fudge sundae

send me headcanon asks

2 notes

·

View notes

Text

you've heard of Florida and it's housing market collapse, yes.

have you heard of Louisiana?

Damage from Ida sent Louisiana’s property insurance market – already rattled by three major hurricanes in two years – into a full-blown crisis. By the end of 2022, nearly two dozen insurance companies had either left the state or gone under.

Residents scrambled for new, dramatically more expensive coverage or went without.

but don't worry, the fossil fuel industry operating nearby has nothing to worry about.

Warmer oceans and warmer air, Kolker said, provide more fuel for hurricanes, leading to stronger storms with more intense rains and harsher winds. Rising oceans raises the average level of the shoreline. “In Louisiana that’s compounded by the fact that the land is sinking, and it’s sinking relatively rapidly,” Kolker said.

While many of the world’s largest insurance and reinsurance companies have emissions targets and no longer insure coal projects, they have resisted calls to stop insuring fossil fuel projects entirely, despite their contribution to the climate crisis and increased global risk.

...

At the same time, state legislatures and Republican attorneys generals have threatened insurance companies for using environmental criteria when setting rates, spooking major insurers away from a UN-backed effort on cutting emissions.

The companies no longer insuring Louisiana homes are well-known, but those insuring LNG terminals are not. Government agencies require proof of insurance for fossil fuel projects, but those documents are often shielded from the public as developers claim confidential business information exemptions, even going to court to prevent insurers’ names from becoming public.

2 notes

·

View notes

Text

JERK

“Pulled Over & Busted”

I began the long journey from Fort Lauderdale to visit my buddy in New Orleans. I figured it would take me about 14 hours, give-or-take, to complete the journey to Louisiana. I was so excited to venture out on my own and visit a state that I have never been to. Little did I know how exciting this little excursion would become before I even crossed the Florida border.

It was about 3pm at the time and I was heading north about 1 hour from the Florida/Georgia border when I saw flashing lights behind me. Fuck! I was getting pulled over and I imagined it was for speeding but I wasn’t really sure. I pulled my car over to the side of the highway and the police cruiser followed suit. I anxiously waited for the officer to walk over to my window. When he did, he asked me if I was aware of why he pulled me over. I apologized to the officer and said that I wasn’t sure. I asked the officer if I was speeding and he smirked, nodded his head yes and stated that I was traveling 20 miles over the speed limit.

I assumed that I was about to receive a speeding ticket but that thought immediately left my mind once I noticed how beautiful this cop was. He must have been in his early 30’s, had a short, trimmed beard and mustache, had aviator glasses on and looked to have a body of a Greek god. Just looking at this dude was worth the price I would inevitably end up paying in fines and insurance rate increases from a speeding ticket. If it was only that simple…

The officer asked me to step out of my vehicle. I began wishing that he would just give me a ticket and send me on my way. Was I in more trouble than I expected? Did I say something wrong to him? I was pretty scared and unsure of what was to come. I have never been asked to exit my vehicle by a police officer. I mean…I was hours from home. I was freaking out! I am definitely not the type that would fare well in a northern Florida jail.

As I opened my door and stepped out of my car, the officer guided me to a grassy area on the right side of his police SUV. The SUV windows were tinted so you could not see either of us from the highway. It seemed that he had guided me to an area where his vehicle would act as a barrier and prevent passer-by visibility. I was definitely nervous. I had no idea what was going on.

The office had me stand with my back against the rear passenger door and stood directly in front of me as he took off his sunglasses and hooked them onto his uniform. To no surprise, he had beautiful green eyes and was way more attractive than I had originally thought. For a brief second, my nerves went away; that was until he asked me if I was hiding any drugs. I quickly responded that I did not have any drugs of any kind on my person or in my vehicle.

The officer then asked if I minded if he checked and knowing that I didn’t have any drugs, I agreed to his search request. Little did I know that by search, he meant ME! He took his hand and pulled my tucked-in tee-shirt from my shorts exposing my stomach and the view of my CK underwear elastic poking out above my khaki shorts. He took his index finger and slid it just behind my underwear elastic and I could feel his finger brush against the top of my dick pubes. At this point, I was not sure where all this was all heading but I was certain it was not about drugs.

The cop continued to move his fingers under my briefs and my dick naturally began to thicken up and the officer must have noticed the lack of space inside my shorts especially considering that he still had 2 fingers in my jock. I have an 8-inch cock, so you could surely see the full shape of my dick forming through my shorts. It was also pretty obvious when my pre-cum soaked through exposing a wet spot on my tan shorts.

I figured by this time, the cop knew I was on board to fuck around with him on the side of a highway and I was correct because he moved his fingers deeper into my underwear and gently stroked my dick with his fingers. I am a major pre-jack leaker so when the cop pulled his hands out of my underwear, he saw his wet fingers and licked them clean all while smiling at me and looking directly into my eyes. I smiled back and attempted to lower myself to access his zipper and expose his cock but he resisted and asked that I stay standing right where I was. I anxiously said, ok. If he wanted to be in control, I was going to let him.

Right then, he got on his knees in front of me and began sucking and licking the pre-cum spot on my shorts. His mouth pushing against my dick felt amazing. Once he sucked all the flavor out of my shorts, he asked if he could unzip my shorts and of course, I said “FUCK YES”. In one swift motion, my khakis were around my ankles and my big cock hiding underneath my white briefs was exposed to him. He commented on how hot I was and how turned on he was and then put his mouth on the wettest area of my briefs, right where my hard cock head was resting and began to lick and suck the pre-cum out of my underwear, too. This dude loved pre-cum like no other man that I have ever met. It was so hot to watch this cop worship my dick through my briefs but I wanted more. I needed more. I wanted to see his cock. Fuck! I wanted to taste this dude all over, so badly!

After he was finished milking my briefs, without any warning, he pulled my CK’s down exposing my huge, wet erection and immediately began sucking on the head of my willing member. I was in pure ecstasy but still, I wanted this guy in my mouth, so badly. I had to taste him in every way that he would allow me. I mean, this kind of shit never happens so I was certain that I was going to make the most of it. So, I took a chance and told him that I wanted to suck on his cock and balls. With my cock still in his mouth, he looked up at me and said “ok”.

The officer stood up from his blow job position and stood in front of me, staring into my eyes and nodding his head. I then, slowly started to unbutton his tuxedo striped police pants and to my surprise, he was commando. He had very thick, dark skinned, cut cock and it was also leaking pre-cum pretty heavily…just like me. I put my hand on his cock and began to lick the underside of his cock-head, gently. He moaned with pleasure and I immediately tasted his salty pre-juice and swallowed it down. God, I loved having this cock in my mouth. I could suck it for days.

The officer clearly wanted to take full advantage of this moment because he asked me if I would lick his asshole. Without hesitation, I said “fuck yes, officer”. After my response, the cop pulled out a wool blanket from the cargo space of his SUV. He spread it down on the grass next to his car and laid down on his back with his legs up in the air, exposing his perfectly furry asshole. His hole was perfect! My lips and tongue took a quick dive into his hole. His ass tasted musky and masculine and it was perfect. As I made out with his asshole, the cop moaned loudly while tugging on his cock.

He began to push on the back of my head which seemed to be his way of asking me to get my tongue deeper inside of his asshole. I thought this was the perfect time to slip a finger inside him along with my tongue. While I was enjoying his manly flavor, the cop was squirming and I could tell he was definitely into getting fucked and that he wanted more of me deep inside him. Without asking, I began rubbing my juicy cock-head on his tight, little hairy hole. I spread my pre-cum all over his hole to get it naturally lubed up and ready for my cock. I could see that he didn’t want me to stop so I began to push my raw cock through his tight, yet willing hole. After a little more pressure, my dick slipped completely into his wet, warm hole. Just seeing my cock completely inside this dude made me so hard that my cock was pulsating inside him. I was in heaven on the side of a highway bare fucking a police officer that pulled me over!

After a good amount of cock thrusts into this man, he told me that he was getting close to shooting and that he wanted me to kiss him while he came. Of course, I obliged and kissed this man with all the passion that I had while I continued to drill my fat dick into him. I could feel his asshole tighten up as he began to shoot his load all over his uniform shirt. Midway through his orgasm, I began to unload all of my load into the depths of his asshole. I could tell he felt every drop of cum from every thrust because his eyes rolled back into his head as we both continued to kiss and release our loads, together.

In the end, I did not get a ticket but I certainly got “busted”. I’m not sure if I fucked my way out of it but this will go down as one of the hottest fucks of my life, so far. I will fantasize about this moment forever. And for the record, I did make it to New Orleans and had an amazing time.

5 notes

·

View notes