#how to install

Explore tagged Tumblr posts

Video

youtube

INSTALL NEW ENSCAPE 4.6.0

#youtube#enscape#sketchup#render#renderização#interior design#interiorstyling#home interior#how to install#how to download#como instalar#como baixar#download enscape#modelagem#design software#3d modeling#real-time render#3d design#download and installation#what is new#architecture#2025

2 notes

·

View notes

Text

Want to dominate Free Fire with Aimbot, Aimlock, and Headshot? 🚀 In this step-by-step guide, I’ll show you how to install Garena Foccus on your Android device and activate its powerful features! 🎮

🔗 Download Here: garenafoccus.net

⚠️ Use responsibly! This is a third-party mod, so proceed with caution. Don't forget to LIKE, SHARE & SUBSCRIBE for more updates! 🔥

4 notes

·

View notes

Text

17 notes

·

View notes

Text

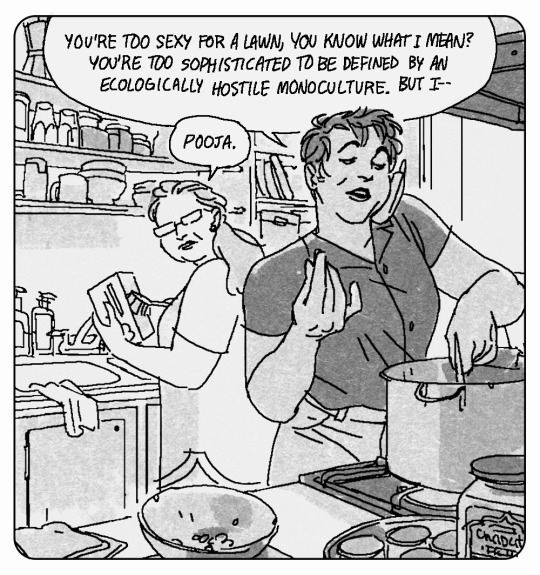

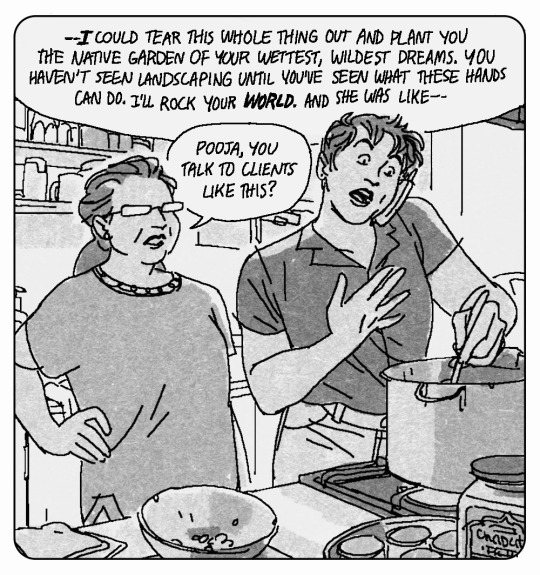

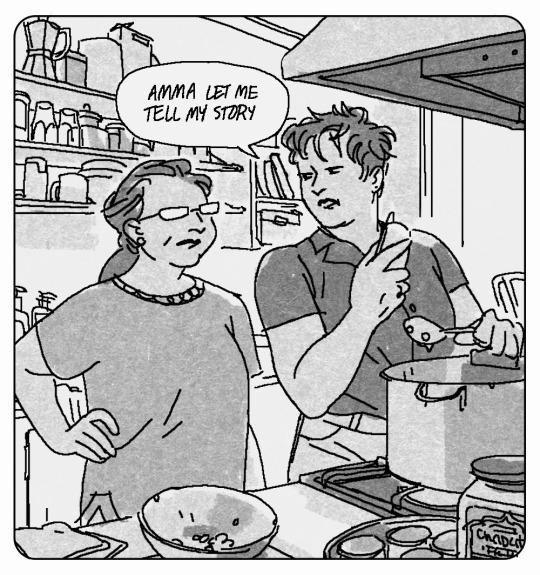

really factual recounting with no embellishments whatsoever

#she’s CORNY. getting DEEPLY silly with it sorry#coworker on the other end is like#that’s great now can we talk about how we r going to fit this crazy insane installation into our schedule#bslc#digital art#x

79K notes

·

View notes

Text

youtube

How to Install Windows 11 on Unsupported PC

#windows 11#how to#how to install#unsupported pc#linux#youtube video#laptop and pc#windows 10 pc#how to get#youtube#tech#helpful#viral video#tumblr

0 notes

Video

youtube

Pads That Really Work!! - Reviewing The Arrowzoom Soundproofing Kit.

#youtube#arrowzoom#acoustics#acoustic#acoustic solutions#soundproofing#noise isolation#studio#review#how to install#gogetyours#reviews

0 notes

Text

📲 How to Install Undertale on Android – Step-by-Step APK Guide!

Downloaded the Undertale APK but not sure how to install it? 🎮 Follow this quick and easy tutorial to set up the game on your Android device hassle-free! Explore the Underground, make life-changing choices, and enjoy this legendary RPG on mobile! 💀❤️

🔗 Download Here: https://undertale.onl/ 👍 Like & Subscribe for more gaming tips! 🚀

0 notes

Video

youtube

How to Get Apple Intelligence on iPhone! 📱🧠

0 notes

Text

How to Install Blasphemous APK on Android – Step-by-Step Guide!

Ready to experience Blasphemous APK on your Android device? ⚔️ Follow this quick tutorial to install the game effortlessly and start your dark fantasy adventure! 🔥

🔹 Simple & safe installation process 🔹 No root required 🔹 Includes all DLCs & extra content

📥 Download Here: https://blasphemous.onl/

✅ Watch till the end & Subscribe for more gaming guides! 🎮🔔

0 notes

Text

How to Install Animal Company Mods on Android – Step-by-Step Guide!

Ready to customize your favorite animals and unlock everything in Animal Company? 🦁✨ In this video, I’ll show you how to install Animal Company Mods on your Android device easily! 🚀 Follow this step-by-step guide to enjoy unlimited skins, food, weapons, and more!

🔗 Download Here: https://animalcompanymods.net/

⚠️ Use at your own risk! This is a modded version. Don’t forget to LIKE, SHARE & SUBSCRIBE for more updates! 🔥

0 notes

Video

youtube

Downloaded Fliz Movies APK but not sure how to install it? Follow this simple guide to set it up on your device hassle-free!

🛠 Steps Covered: ➡️ Open your File Manager and go to the Downloads folder ➡️ Tap on the Fliz Movies APK file to start the installation ➡️ Enable "Install from Unknown Sources" if prompted ➡️ Tap Install and wait for the process to complete ➡️ Once installed, open the app and start streaming!

📌 Download the latest APK here: flizmovies.net

👍 Like, share, and subscribe for more app guides!

1 note

·

View note

Text

Our latest one is out 😁 #latestvlog #madeourday #SkylightMagic

https://youtu.be/Ccp8ixgZDYc?si=OhBnX-9LG7oOXGLV

#boatlife#waterways#narrowboat#narrowboatlife#widebeamboat#widebeam#narrowboatliving#floatinghome#barge#liveaboard#how to install

0 notes

Text

youtube

5 Simple Tricks to Instantly Improve Your LDPlayer 3 Performance Today!

0 notes

Text

Play AGAIN Classic Arcade and Home Computer Games from Obsolete Gaming Consoles

Would you like to play or relive again the glory days of playing old and retro arcade and home computer games of the 80s and 90s? Remember, the first Galaga, Super mario Bros., Contra, Tekken, Metal Slug and more? Well, turns out some guys made a small device called Game Stick Lite, an emulator, that lets games of obsolete devices like Nintendo, Game Boy, Atari, Ps2, to work with the current…

youtube

View On WordPress

#10000 or more computer games#atari console#classic gaming#galaga#game boy#game stick lite#how to#how to install#how to quit games and replace#obsolete titles#ps2#retro arcade games#smart tv#step by step installation#suoer mario bros#tutorial#vintage games#wireless remote controller#Youtube

0 notes

Text

Wizard Installer🧙✨

#arthur learning how to use computer#do you see how thick is this laptop? it's because merlin is (very) old fashioned#he probably doesn't even have a phone#arthur in pajamas because why change clothes if your wizard doesn't let you go out#i think once arthur learns all neccessary things he will be better in modern world than merlin and introduce him to new stuff or something#domestic kind of stuff#i also had an idea for merlin installer but that's for another time#bbc merlin#merlin bbc#merlin#arthur pendragon#merlin emrys#merthur#my art

4K notes

·

View notes

Text

Actually I have a post I want to make about Property Value.

Which is a topic that comes up a lot in discussions of rich people hoarding wealth, in NIMBY panics, and in the ever-increasing prices of homes. But I don't think we talk much about how the perniciousness of property value goes deeper and basically holds middle class people who own a home hostage.

So to set some context here: in 2025 the median US home sold for $416,000. Say you have a working class family who can't meet median, but who scraped and saved and penny-pinched their way to a $300,000 home.

Typically, when buying a first home, you pay 20% down directly, and take 80% out as a mortgage from the bank. For this family, that means $60,000 of their liquid money (and let's say it took them 10-15 years to save that amount), and a $240,000 loan from the bank.

That's $240,000 in debt the family is. Which will be repaid over 30 years, with interest, at a rate that usually means for the lifetime of the loan, they end up paying back double the original loan.

However this massive $240,000 debt is generally considered "okay" debt to have, because it's backed by the house. If things go truly sour, the bank can take the house (and what's a little homelessness between friends).

That $60,000 the family put down is considered equity, and equity is money you "have", but isn't accessible.

Scenario: Now let's say something happens. Someone in the family loses their job, and the only job they can find requires moving. Or a family member across the country can't care for themselves anymore and so this family needs to move to be closer to them. The family gets divorced. Someone in the family is allergic to material in the home. Someone in the family is being stalked or abused and needs to leave the town. Anything at all, which would require selling the home and moving.

Case 1: The family is able to sell it for exactly what they paid (same property value, no increase or decrease). You would think the math is clean. They are paid $300,000 for the house. $240,000 repays the bank loan. The remaining $60,000 of equity goes right back to them. And they can use it (which took 10+ years to save up) to move across the country and buy a different $300,000 house.

Except no, it does not work like that.

The seller of a home is on the hook to pay commission to their realtor and the buyer's realtor. This is usually ~6% of the home value. They have to pay legal costs. There are taxes. There are miscellaneous costs. It can easily be 6-9% of the selling price of the house.

The bank NEEDS its $240,000 back. So those costs come from the equity. This family is not getting their $60,000 back. They're getting $30,000-$45,000, and now no longer enough money for a downpayment in their move. They're back to renting. Back to penny pinching. They can get by, but homeownership is now out of their grasp once more. Maybe in another 5 years, they'll have enough (unless home prices have increased too much by then) then they'll maybe never be homeowners again.

Case 2: The property value has DECREASED... Family is only getting offers in the $260,000 range.

If the family accepts a $260,000 sale, well $240,000 goes to the bank. This is genuinely non-negotiable. And that leaves.... maybe not enough money to even close on the house. Not enough to pay the realtors and the fees.

That $60,000 is wiped out, and the family is incapable of moving. Never mind losing 10+ years of savings--they're below $0. They don't have the money to close. It's financially impossible to sell. They are stuck with the mortgage. They are stuck with the house. (Maybe they'll rent it, if they can. And now they're landlords by circumstance, which is often NOT profitable when you're not a trust fund baby renting out a totally-paid-for no-mortgage home.) But whatever the case, they cannot sell it. And if the reason for selling was a job loss... well, they can be homeless soon. And if the property value dropped below $240,000, they can be homeless AND owe a bank debt. A $60,000 nest egg wiped completely out, with a bank debt owed on top of that.

So how do people avoid financial destitution when moving?

The most sensible answer is building up equity by paying down the loan--but it's important to know that mortgages are super interest heavy in the early life of the loan. With a 5% interest rate (BETTER, btw, than current rates) this family would be paying $15,460 the first year, and only $3,540.88 is actually chipping at that $240,000 principle. The other $11,919.59 was pure interest to the bank.

So after 1 year, the family went from having $60,000 equity in the house to $63,540.88 equity in the house. This buys a little extra wiggle room when juggling closing costs. But not very much. Even after 3 years, the family has just a little over $70,000 of equity, and just under $230,000 still left on the loan. So if the family has to move for any reason (sickness! death! job loss!) in those 3 years, it's probably financially devastating.

But there is a second answer to avoiding financial ruin: and that is Property Value going up.

Any amount of property value increase is PURE equity. The bank only cares about the amount of money it gave you. If after 3 years, that house is now worth (and can sell for) $315,000 (which is appreciation of only 1.6% a year. Most home appreciation is closer to 3%), that's more equity increase than they got from 36 diligent months of mortgage payment.

If they can sell for $315,000, pay $230,000 of that to the bank, that leaves $85,000. $25,000 goes to paying the realtors and the closing costs and.... the family is back to their $60,000 downpayment. Not trapped. Able to sell. Able to buy a new $300,000 home in the place they moved. Able to just maintain homeownership status.

But wait, if their home appreciated to $315,000, didn't all the other homes do the same, so now $60,000 isn't enough

Smart eye, lad! You've identified why this is a TERRIBLE rat race for the people scraping money together to live, and is ONLY a profitable leisure activity for rich people who sell homes like collectables.

Now because the increase is pure equity, a similar family with decent property value increase can funnel that extra equity into affording to meet the new higher down payment (remember the downpayment is only 20%, so even if the new place is similarly higher in property value, you only need to match that increase 20% for the downpayment). Which gets their foot in the door. But now their new mortgage is higher than the old one. More expensive. More interest.

But there is a losing scenario here--if home property values increased everywhere else, but not where you live. Then this family is back to surrendering homeownership. Because even if they can sell their place, they can't buy the next home.

It forces them to care about their own Property Value increase because, if it doesn't increase while everywhere else does, it traps them.

So what do I mean by all this

If the value of all homes dropped 50% overnight, I assume most people here would celebrate. Affordable homes! Rich people upset and crying! So much to love.

But in reality, that 50% drop would likely continue to mean no home for most of us, because the people who could sell you the homes would be financially incapable.

For the family above with the $240,000 mortgage, that mortgage does not reach halfway-paid-off until year 20 of the 30 year mortgage (remember the interest frontloading). If a family still owes $230,000 in bank loans on a place that can only sell for $150,000, they can't sell it to you. That house is the bank's collateral securing the loan. Their mortgage is underwater. They're trapped. They cannot sell it. You cannot have it.

Something similar happened in the 2008 subprime mortgage crisis, and the only people who got out okay were ones who could stay the course, keep making the mortgage payments, and wait it out long enough for property value to recover.

Those who couldn't got foreclosed on. Those who couldn't were left in financial devastation.

So in conclusion?

Banks profit off of mortgages. Rich people profit off of hoarding housing stock and selling it as the property value increases. Real estate companies profit off of home sales. And the regular people, who managed to achieve home ownership, are shackled to the price-go-up system to avoid financial ruin. They're forced to care about their property value because it is the singular determinant of whether they're trapped in place, whether they'll be okay if they lose their job, whether they could move due to an important life event.

It's a profit system for the rich where the cogs are middle class people who could achieve homeownership, running a machine where every single crank locks the poorer and younger generations out of home ownership forever.

#on my next installment: how rising mortgage interest rates trap people in the exact same way!#how low mortgage rates BALLOONED home prices due to more people able to make competitive offers and how the following interest rate hikes#left prices massive AND new mortgages unaffordable and so many new people locked out of ownership forever#while trapping current owners in place because they could never afford a new mortgage at modern rates#chrissy speaks

4K notes

·

View notes