#institutional investment

Text

Invest in Warehousing | Welspun One AIF | Institutional Investment

Looking to invest in warehousing? Welspun One AIF offers institutional investment in warehousing opportunities in India. Learn more and invest today.

0 notes

Text

something something guy who is so so unhealthily dependent on these very specific formalized roles & narratives they've been cast into to maintain an ultimately broken relationship & can't handle it when the people around him increasingly start going off script

#i'm not articulating this well but it's sooo interesting to me#this + him not being willing to believe the institution is also breaking the 'rules' & doing evil things bc it doesn't fit this world view#he's so invested in. even though deep down he sort of knows this but he won't even let it get past his subconscious bc it's so distressing#AND like him convincing himself the joust incident was an accident bc he'd repeated it so many times even tho he Knows it wasn't#thoughts#nimona#nimona comic#^ more thoughts on this in the rbs btw

1K notes

·

View notes

Text

serious post time. concerning some thoughts ive had about zverev at LC. nothing too heavy but under the cut in case u just wanna scroll past.

i was talking to my mum about this and i think most of tennisblr share the same sentiment towards him so im not gonna be saying anything too radical. Its also not going to be super concise because im mostly spitballing here.

I was just thinking about how we talk about him and how we as a community navigate his presence on tour. I know that there's a vindictive joy that comes with seeing him lose that's especially potent since he basically got away with domestic violence scot free.

Seeing him lose is a good feeling because he clearly cares a lot and it feels like winning that he's upset, but it also doesn't actually mean anything in the scope of things. Obviously on some level if he lost enough he would no longer be relevant but it's inescapable that he is, unfortunately, very good at tennis. He's number 2 in the world. Call him a choker all you want, he's still vastly more successful that 99.9% of all tennis players.

But it's also just sport- a game. It's not the outcome of the match that amounts to anything outside of a very small community of people; its the celebrity, the money and clout and hero worship. The fact of the matter is it doesn't make a difference to the women he abused if he wins a match because he still abused them and he is still famous. He will always have been famous, even if he retires tomorrow. They will still interview him, laud him in press, put him in ads.

I just sometimes think- what right do I have to feel vindicated by his losses? To weigh his literal actual crimes against the outcome of some silly ball game? In a perfect world he would not be playing, he would be banned by the ITF and shunned publicly by his fellow players. He would not be invited to Laver Cup.

I won't say I don't look at tournament draws and hope for his early loss, but at least at tour events that means an early exit. I can't find it in myself to care if he wins or loses at Laver Cup, not really. Because he will still be there, he is still part of the team, he is still on the bench. It doesn't matter if he wins because he's still an abuser people paid thousands of dollars to watch play a game.

#alexander zverev#does he have an anti tag? im not sure the fandom here is large enough for that#anti alexander zverev#just to be safe#i dont know.. i did try and proofread this to make sure its coherent but the thoughts arent fully formed anyway#it just feels kind of... useless i guess? after a point- to become emotionally invested in the outcome of his career#and im not saying that all jokes or references to him are specifically terrible like i know that for many its the only feeling of#retribution against the failure of the institution both tennis and judicial#and hes by far not an edge case even outside of famous men#and now im rambling again and probably making even less sense#ill leave it there i suppose#feel free to comment if u have any thoughts#cw domestic violence

34 notes

·

View notes

Text

oh so now we're finally talking about it

#sorry but the layers to this#charles is down bad#I feel validated in my pierre/donis theory#sorry but he looks EXACTLY like pierre#out of everyone in this world to date he really had to choose a guy that looks exactly like his..... best friend?#they make me soo mentally ill.#maybe even posting this in the tag is asking to be sent away into an institution. but they look soooo similar#I don't know I just don't understand at all what it is that pierre and charles are to each other#which I know. is the point. we DON'T know them#but it's stuff like this (and all their tender homoerotic moments over the years) that really makes me believe they're more than friends and#always have been.#it's also just. if you dig to deep into their lives you'll probably find out stuff that is maybe too private to be shared but to further my#1016 agenda I had to at least post this here bc it makes my stomach ache when I think about charles dating a guy who looks exactly like#pierre and then they still have their tender moments on the drivers parades.#maybe I should stop here.#point is charles is probably not over pierre and their thing that's been going on since who knows how long#this and pierre referencing the monaco night on his helmet last november is what keeps me invested in their thing#they're just sooo weird about each other#piarles

26 notes

·

View notes

Text

About Genshin Impact and the technology of Teyvat

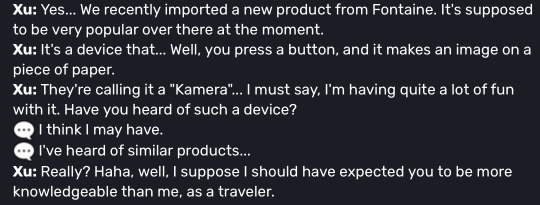

We get a kamera at the start of the game from Xu for the “Snapshot” world quest. In it Xu remarks that the kamera is a new invention from Fontaine.

Xu shows surprise at the Traveler knowing what it is, this supports the idea of the kamera being a new invention meaning it’s pricey and rare to have at this point. Later on, on the Traveler’s journey, we get quests to take pictures of things. This could mean that the kamera is becoming more widespread a time goes on, or just the knowledge of it.

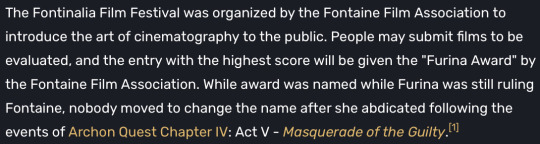

During the 4.3 Fontinalia Festival the focus was placed of films. This was an attempt by the Fontaine Film Association to introduce films to the populace, making the main point of the festival the films produced for it.

This would give idea to films still being a new invention, as they aren’t widespread, just like how the kamera was at the start of the game which was about 3 years ago. And based off of Furina’s Character Demo “Furina: All the World’s a Stage” we can assume that the films recorded were black and white in quality. Unless, we assume that the mini-games during the 4.3 “Roses and Muskets” event were canonical in the way they showed the film quality. No noise was shown in either, but one was in color the other not.

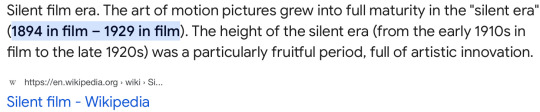

This gives us an estimate of where — technological advancement vice — Teyvat is compared to our world. Films started becoming a thing at the end of the 1800s and start of the 1900s. Colored film started showing up around the 1930s, but became more accessible and profitable later on. Films started getting sound added to them around the mid-to-late 1920s. This gives us an estimate of around the start of the 1900s placement vice.

Now I’d like to bring up Khaenri'ah. It was heralded as “the pride of humanity” as said by Dainslief. Khaenri'ah has more than one notable scientific aspect linked to it, one of these being the “Field Tillers” aka Ruin Machines. Ruin Machines vary from “simple” Ruin Guards to a Ruin Serpent(s).

Ruin Machines seem to have been around for a while, since the Archon War even given the Ruin Hunter stored by Guizhong in a domain. This means that the technology may have been around for 1000s of years, likely being used as a defense method during the war and preserved thereafter. The knowledge of this technology didn’t spread much beyond Khaenri'ah, this showing through how the people of Teyvat started calling the Ruin Machines “Ruin Machines” after they spread globally after the Cataclysm.

Around Sumeru there exist three giant Ruin Machines called “Ruin Golems”. These were giant mecha style machines were piloted by a crew of people, and — get this — include a colored screen. By screen I mean the type of screen you’re viewing this through, footage from outside the Ruin Golem being broadcasted to the screen to allow the people piloting to see where they’re going or what they’re doing.

During the “Vimana Agama” world quest that was apart of the Aranyaka quest line we can go into the Ruin Golem in Devantaka Mountain by Port Ormos. There we can use the actual screen and see through it. This being a machine that has sat unused for hundreds of years. And its screen is still in working condition.

So, simply put. Khaenri'ah was very mechanically advanced.

BUT!

I have yet to mention the Terminal Viewfinders in Fontaine. You know, those eye ball machines you use to transfer energy to terminals in puzzles in the Fontaine Research Institute area. You know, the machines with working colored screens. Mind you this isn’t technology you’re able to find all through out Fontaine, only in certain areas usually accompanied by a researcher from the Institute. So it would be more comparable to machines found in laboratories and not accessible to common people.

But still. At the very least Fontaine is near the mechanical advancements of Khaenri'ah either a few hundred to thousands of years ago.

And I have yet to mention everything going on in King Deshret’s places in the Sumeru desert. And I’m not going to go into more than this mention because that is a headache I have yet to even get around to in game.

TL;DR Khaenri'ah was very technologically advanced to the point of hundreds of years later working colored screen technology. Fontaine is around that point with the Research Institute while normal day to day people are around silent movies in advancement, while I have no idea what’s going on with the Sumeru Desert.

#looking into this mess has made me even more annoyed with Khaenri'ah#what did you need the fucking war machines for. and why the code names. and also the weird decender orphanage thing#I just don’t like the governing body or people of authority in Khaenri'ah pretty much#Dain can hype it up as much as he wants but I just don’t trust it#also the whole abyss order bullshit#yeah but anyway#I got thinking about the technological advancements of Teyvat and got invested#genshin impact#genshin impact lore#teyvat#khaenri'ah#ruin golem#ruin machines#genshin lore#dainsleif#fontaine#Fontaine research institute#Genshin impact 4.3#lore#world building#technology#machines#Genshin kamera#what am I supposed to tag this as#lore discussion#hoyoverse#mihoyo#king deshret#sumeru desert#Genshin impact Field tillers

40 notes

·

View notes

Text

Throwing cheese at the wall but I have a feeling the man who hired Colin and he hates so much is going to be Gwen's father or family member

#magpod#the magnus protocol#tmagp#i think those are the right tags theres too many#(3)#i would go insane if it was Elias but i have a feeling not#either way she clearly has stakes in this company in some way and comes from a wealthy background#and colin keeps losing his shit over some guy who is wealthy. my guess is potentially gwen and elias are siblings but i have no idea if#elias would have been working at the magnus institute when it burned down#if so it makes sense why his family might then invest in a similar project? again throwing cheese#idk where i got that from btw. throwing cheese.

13 notes

·

View notes

Text

𝗜 𝗖𝗮𝗻 𝗛𝗲𝗹𝗽 𝗬𝗼𝘂

𝗔𝗰𝗵𝗶𝗲𝘃𝗲 𝗦𝘂𝗰𝗰𝗲𝘀𝘀

But first, I'm going to be 100% honest with you…successful trading is hard. It's easy to make one successful trade or make a month's profit, but doing it consistently for years is something only a few can do. In order to be successful, you must overcome common problems that most traders face, and I will try my best to help you solve them.

– Josh Dennis, 10-year stock trading expert

𝗦𝘁𝗮𝗿𝘁𝗶𝗻𝗴 𝘁𝗼𝗱𝗮𝘆, 𝘄𝗲'𝗹𝗹 𝗵𝗲𝗹𝗽 𝘆𝗼𝘂 𝗰𝗿𝗲𝗮𝘁𝗲 𝗺𝘆 𝘄𝗲𝗲𝗸𝗹𝘆 𝘁𝗿𝗮𝗱𝗶𝗻𝗴 𝗽𝗹𝗮𝗻.

𝗖𝗹𝗶𝗰𝗸 𝘁𝗵𝗲 𝗹𝗶𝗻𝗸 𝘁𝗼 𝗲𝗻𝘁𝗲𝗿

#US stocks#stock portfolio#quotes#biden#harris#kamala harris#economy#us economy#stock market#politics#democrats#liberals#liberalism#socialism#government#failure#stock market news#stock market today#stock market trading#stock market institute#investing#finance#option trading#investors#stock market courses#invest#fail#lol#VOTE TRUMP#bitcoin

2 notes

·

View notes

Text

NIFM Institute in Mumbai — Best Stock Market Training Courses in Mumbai

NIFM Institute in Mumbai is the best share market classes in Mumbai for stock market trading & training. At NIFM, we’ve always been partial to independent thinkers. Where we’ll teach you not only how to trade in the share or financial market but also how to make a living out of it in our stock market courses in Mumbai. NIFM share market training programs are simple to understand and easy to follow with practical case studies in an organized manner with a systematic flow. In our stock market courses, we will teach you to learn every factor that can affect stock market industry ups and downs, when to enter or exit, money-making strategies, discipline in the stock market, and control risk and loss.

Overview of Stock Market Courses in Mumbai

Trading in the stock market is a process that requires constant thinking, analysis, and discipline. What you think and what you choose determines your success in the business.

NIFM is the pioneer institute of stock market trading courses in Mumbai. Our institution has been focusing on providing qualitative stock market trading knowledge for over a decade in India. NIFM believes in classroom & practical sessions where the interaction of experienced trainers and other participants brings out the best results and clears all doubts about the toughest topics and makes them crystal clear. NIFM has helped thousands of investors learn the skills necessary to have the ability and confidence of the pros. We are the only stock market institution having 20+ branches all over India, where 50,000+ students have done certification of stock market courses, Job oriented courses, investor & trader courses under the supervision of industry experts. We have exclusively developed job oriented courses with 100% placement assistance for those who want to make a career in the stock market. NIFM has 6+ branches or institutes for stock market courses in Maharashtra.

Services offered by NIFM — Share Market Courses in Mumbai

Here in Mumbai, NIFM is offering 20+ stock market courses with certification and 100% placement assistance in top companies. They focus on more practical (75%) training than theoretical (25%) training. Students work on practicalities with the budget in hand to get more enhanced knowledge of trades, when to buy or sell stocks, market ups, and downs. This builds more confidence in students to find out when is the best time to enter the market or the right time to invest in stocks.

NIFM has courses for all 12th pass out students, graduated students, businessmen, investors, traders, housewives, retired persons. The availability of every generation of students makes our atmosphere more interesting, where all students can learn with the life experiences of others.

Stock Market Beginners Courses: If you are a fresher or beginner in the stock market then this certification course is for you. We helped you to learn all the basics of the share market with experts and be a market expert within 3 months.

Beginners to Advance level courses: NIFM offers Diploma & Advance Diploma courses in the stock market. Learn fundamental, technical analysis, industry up and down, the best time to buy and sell stocks. These courses offer 100% job assistance.

Job Oriented Courses: NIFM has exclusively developed job oriented courses for those who want to make their careers in the financial market or the stock market. They trained students according to the best industry requirements.

Trading and Investment Courses: This is one of the best courses to become a trader or investor in the stock market.

Technical Analysis Courses: Technical Analysis not only helps you understand the profit target but also aware of the risk involved in the trade. We teach the secrets of successful traders, We teach unique ideas to trade in Intraday, Swing trade, Short term delivery, Futures & Options.

NCFM NSE certification courses: Courses for NCFM Certification exam, and exclusively developed mock test papers which covers all syllabus for the examination.

NISM SEBI certification courses: NISM Certification courses to help students to crack the examination.

Diploma in Equity Sales Certification: This course is divided into 6 modules: Capital Market Module, Derivative Market Module, Currency derivatives module, Mutual Fund Distributors module, Investment Advisor (Level 1) and Equity Sales module.

Fundamental Analysis Crash Course: This course will help to understand all these aspects analysis of data, news, events, correlation, the impact of these while trading in the stock market or investing in other market segments.

Online Stock Market Courses: NIFM also offers online courses for those who want to learn online about day trading, trading basic terminology, how online trading systems work, Forex trading, swing trading, stock prices, live trading, and the stock exchange.

Why Choose NIFM, Best Stock Market Courses in Mumbai

Depth knowledge with practical exposure

75% practical exposure, 25% theoretical exposure

Certification after completion of course

Faculties over 30+ years of experience.

We work for all-round development for the student.

Students visits in NSE, BSE, SEBI offices

100% job assistance in topmost companies

100% support given to pass out students if any updating took place in course.

Conducting regular seminars for students by experts & industry.

Some unique courses are available only with NIFM.

Advance lab equipment/software for practical training.

Stock Market Courses Free Videos

NIFM made stock market trading learning easy for you with these free videos, you can watch and learn fast and earn fast with NIFM.

Click to enjoy your free videos today!

NIFM Preferred Employers

Our clients- Axis Securities, HDFC Securities, Kotak Securities, ICICI Direct, Motilal Oswal, Standard Securities, NIIT, Tradebulls, Bajaj Capital, SMC, Angel Broking, Advisory Mandi, Indiabulls Ventures, Nirmal Bang, Safe Express, IDBI Capital, Elite Wealth, Bonanza, Karvy Stock Broking, SAS Online, Mansukh, Silver skills, Parasram, Trustline, Zerodha, Jana Bank, LKP, BLB, etc

Seminars & Workshops at NIFM MUMBAI

NIFM organized seminars, events, and workshops to get engaged with our students and keep them up-to-date according to industry requirements. Click the link to watch some glimpse of our NIFM Capital Market Conclave 2019.

Any Doubts or Enquiries?

If you have any doubts and inquiries regarding the stock market industry or want brief counseling for your course, please reach us by filling this form — Contact Us for stock market courses enquiries. Our Counselor will reach and help you to suggest the best courses for your career, investment or trading purposes.

Reach NIFM MUMBAI

We are established in a prominent location in Parel, Mumbai. It is an effortless task in commuting to our establishment as there are various modes of transport readily available. It is at Shop №6, Kingston Tower, GD Ambekar, Road, Parel East, Mumbai, Maharashtra 400033

Source of Content: https://www.nifm.in/blog-details/387/stock-market-courses-in-mumbai.php

#stock broking courses in mumbai#share market training in mumbai#share trading courses in mumbai#stock market classes in mumbai#accounting taxation course in mumbai#stock market institute in mumbai#stock trading courses in mumbai#market investment courses in mumbai#stock market courses in mumbai#share market courses in mumbai#share market classes in mumbai#trading institute in mumbai#share market coaching in mumbai#trading classes in mumbai#share market institute in mumbai#best stock market institute in mumbai#accounting & taxation courses in mumbai#gst certification course in mumbai#gst course online in mumbai#gst online classes in mumbai#gst filing course in mumbai#gst online course with certificate in mumbai#gst certification course online in mumbai#gst course in mumbai#stock market trading in mumbai#share market trading in mumbai#trading course in mumbai#stock market for beginners in mumbai#financial accounting in mumbai#online accounting courses in mumbai

2 notes

·

View notes

Link

#thewaronyou

24 notes

·

View notes

Text

the museum field’s orgs are like “a zoom meeting for members to discuss xyz and a presentation from your colleagues” and it’s $60 for members and the “colleagues” are 30% vendors

5 notes

·

View notes

Note

Your fear of public transport is a red flag. I am ashamed of you and you will impede the progress of our country.

the closest bus stop to my house is several miles away and there are no sidewalks. if you don’t have a car or a friend who has a car where I live it’s basically uber or bust 🤷🏾♂️

#maybe remove your head from your ass#if we invested in infrastructure and public transportation I would be more than happy to use it#but for the time being we have ✨suburban sprawl✨ and ✨unreliable public transportation✨#great job blaming the individual instead of the institution you neoliberal fuck#you made this hostile not me

14 notes

·

View notes

Text

in the much-anticipated sequel to last year's "conservative party technically has a majority but cannot manage to choose a leader" fiasco in the u.k., 2023 now brings you the exact same thing, this time in the u.s. with the added twist that the entire house of representatives is shut down and incapable of doing any other business until this mess is resolved

everyone get your lettuce ready, let's see how long it takes to get a speaker

#politics#us politics#2023 us house speaker election#both events were trainwrecks but as a former congressional employee I'm sooo invested in this#i mean obviously it's horrible and the longer this goes on the more problems we will have#and of course it's all indicative of much more significant institutional problems both within congress and in the republican party#and i'm happy to talk about all that if you ask me#i'm a politics student after all#but i'm sitting here by myself watching the news and i just wanted to make haha funnie joke post#(yes these are basically just my same tags from the other night but i wanted to make it its own post)#.txt#about#also you know who i'm thinking about today? mr willis of ohio. iykyk

46 notes

·

View notes

Note

oh my god I didn't realize you wrote consider the hairpin turn! I think about rabbits are chasing all the time (truly a perfect fic imo) and always wanted to see if you'd write more sewis! I really loved consider the hairpin - so achy the whole way through in the best way

this is so generous of u to say, thank u!! tbh it felt like a very different style from how i usually write/try to write so like very grateful that it did not feel wildly melodramatic or overwrought lmao

also please you're too sweet 😭 i love all my children equally but i do think rabbits are chasing is like....my thesis fic™ for this fandom u know what i mean like. everything i wanted to say abt f1 and lewis and brocedes and what it means to love something in spite of what it costs u and also who we can become once we get to let go of that love and discover what new love is waiting for us in the future etc etc! is somewhere in that fic lmao. so when people like it it means so much!

#sunnyroscoe#asks#ALSO yes i think its so funny that like. imo sewis was probably Thee thing that dragged me into this fandom#and then i proceeded to never write any actual sewis fic ever........#me looking at the literal 8 sewis-centric wips i have rn in my gdocs: these are good. but i like this [epistolary semi-plotless AU#about becoming more and more disillusioned with existing inside an institution that it was once ur childhood dream to belong to] better#tbh i think the kink meme has been good for that though!! it's nice to be able to write fic that's just like...one or two punchy scenes and#not have to invest 15k words into relationship building and characterization and set up#car sex fic#rabbits are chasing

3 notes

·

View notes

Text

In February US company LanzaJet, which produces sustainable aviation fuel (SAF) from ethanol, announced that it intended to build a second, larger plant on US soil.

The Inflation Reduction Act (IRA) was a "big influence", says Jimmy Samartzis, its chief executive.

The second plant would add to its facility in Soperton, Georgia - the world's first commercial scale ethanol-to-SAF plant.

"We have a global landscape that we are pursuing…[but] we have doubled down on building here in the United States because of the tax credits in the IRA, and because of the overall support system that the US government has put in place."

Signed into law by President Biden in August 2022, the IRA, along with the so-called Bipartisan Infrastructure Law (BIL) enacted in November 2021, are intended, amongst other things, to funnel billions of federal dollars into developing clean energy.

The aim is to lower greenhouse gas emissions, and incentivise private investment, to encourage the growth of green industries and jobs: a new foundation for the US economy.

With a 10-year lifespan, and a cost originally estimated at $391bn (£310bn) but now predicted to reach over $1tn - the final figure is unknown - the IRA offers new and juicer tax credits, as well as loans and loan guarantees for the deployment of emissions reducing technology.

The tax credits are available to companies for either domestically producing clean energy, or domestically manufacturing the equipment needed for the energy transition, including electric vehicles (EVs) and batteries.

Consumers can also receive tax credits, for example for buying an EV or installing a heat pump. The tax credit for SAF producers like LanzaJet is new in the IRA and, offers between $1.25 to $1.75 per gallon of SAF (though it only lasts five years).

Complementary is the BIL, which runs for five years and provides direct investment largely in the form of government grants for research and development and capital projects. Under the BIL, about $77bn (£61bn) will go to clean energy technology projects, according to the Brookings Institution which monitors the law.

One company to benefit so far is EV battery recycling company Ascend Elements.

It has won BIL grants totalling $480m (£380m), which it is matching a similar amount in private investment to build its second commercial facility in Hopkinsville, Kentucky.

"[The IRA and BIL] are massive investments… larger than the infrastructure related provisions in the New Deal," says Adie Tromer from the Brookings. "There is a clear sense that America has become more serious about transitioning to a cleaner economy."

While rules for some tax credits are still being finalized, tens of billions in actual public spending is flowing into the economy, says Trevor Houser at the Rhodium Group, an independent research provider. Rhodium, together with the Massachusetts Institute of Technology, runs the Clean Investment Monitor (CIM) to track US clean technology investments.

According to recently updated CIM data, in the 2023 fiscal year, the federal government invested approximately $34bn (£27bn) into clean energy, the vast majority through tax credits.

The extent to which the policy instruments are so far spurring not just announcements - of which there are plenty - but real extra private investment is harder to know: clean energy investment has been on a general upward trend anyway and the IRA hasn't been around long. But experts believe it is rising.

Total clean energy investment in the US in the 2023 calendar year including from both private and government sources reached a record $239bn (£190bn), up 38% from 2022 according to the CIM data.

Clean energy investment in the US, as a share of total private investment, rose from 3.7% in the fourth quarter of 2022 to 5% in the fourth quarter of 2023.

The IRA has had two main positive effects thus far, says Mr. Houser.

It has "supercharged" private investment in more mature technologies which were already growing very rapidly like solar, EVs and batteries.

It has also, combined with the BIL, led to a "dramatic growth" in investment in emerging climate technologies like clean hydrogen, carbon dioxide capture and removal and SAF. While the total magnitude of those investments are still relatively small compared to the more mature technologies, "the IRA fundamentally changed the economics" says Mr. Houser.

But the IRA is failing to reach some parts of the green economy: so far it hasn't lifted investment in more mature technologies which have been falling like wind and heat pumps, though Mr. Houser notes things may have fallen further without the IRA.

On the industry's mind is the fate of the laws, particularly the longer-to-run IRA, should there be a change of government in the US November elections.

Repealing or amending the IRA (or BIL) would require Republican control of the Presidency, Senate and House - though wholesale repeal would likely face meaningful opposition from within. The rub is many of the projects that the IRA is incentivising are being or will be built in Republican states or counties.

Yet a Republican president alone could potentially frustrate things for example by slowing or deferring loans or grants, or amending the rules which serve the laws. "A Trump presidency would definitely chill the atmosphere and possibly more," says Ashur Nissan of Kaya Partners, a climate policy advice firm.

The Heritage Foundation, a conservative think tank and purveyor of hard-right ideas for the next conservative President, advocates repeal for both the IRA and BIL. For the organization's Diana Furchtgott-Roth, a former Trump administration official, it is fiscally irresponsible for the US, with its vast deficit and debt, to be spending like this.

It is also time, she says, that renewable energy such as solar and wind, into which subsidies have been poured for years, stood on their own feet.

Yet others argue the US can't afford not to do take this path. And the point of the loans program is to take risks to help unlock new solutions that scale. "It would be failing if there weren't any so called 'failures' within it," says Richard Youngman, of Cleantech Group, a research and consulting firm.

Meanwhile, the US's approach is putting competitive pressure on Europe to do more.

Some European clean energy manufacturing companies are now building facilities in the US to take advantage of the tax credits that otherwise would have been built in Europe including solar panel maker Meyer Burger and electrolyser manufacturers Nel and John Cockerill.

"The US wasn't a market for some of these companies in the past because Europe was more active," says Brandon Hurlbut, of Boundary Stone Partners, a clean energy advisory firm.

The EU's Net Zero Industrial Act (NZIA) is expected to enter into force this year. It doesn't involve new money, but seeks to coordinate existing financing and introduces domestic favourability for the first time - putting in place a non-binding target for the bloc to locally manufacture 40% of its clean energy equipment needs by 2030.

In the UK, chancellor Jeremy Hunt has made clear he isn't interested, nor can the UK afford to copy the IRA's approach in some "distortive global subsidy race" and will stick to other ways of helping. The Labour party recently scrapped its $28bn green investment plan seen as a stab at leaning into an IRA style policy.

A global audience will be watching as the US's clean energy juggernaut unfolds. And if it leads others to ask what more they can do to produce clean energy products - even if just for reasons of economic opportunity - it will be good for humanity's sake, says Mr. Hurlbut.

#us politics#news#bbc#uk politics#world politics#green energy#clean energy#LanzaJet#sustainable aviation fuel#Inflation Reduction Act#Bipartisan Infrastructure Law#Brookings Institution#electric vehicles#Clean Investment Monitor#european union#Net Zero Industrial Act#Jeremy Hunt#2024

3 notes

·

View notes

Text

I can't believe they did this for real... (x)

#this was never about “levelling up” you understand#this was about cutting funds to the ENO#bc the tories don't give a fuck about the arts#listen I agree that cities other than london need more funds and investment but the answer is NOT#to pick an established london institution and go#“we'll cut ALL YOUR FUNDS unless you move somewhere else”#like?? insanity#hope it works out for them idk what to say#opera#english national opera

3 notes

·

View notes

Text

You know, I was really worried about how much sending my son to private school was going to cost until I realised how much his daycare fee's are. It's still going to be cheaper each year than those, so winning I guess.

#I used to be really pro public education#but there gas been a very noticeable turn of behaviour and education levels#they are so feral and teachers aren't allowed to do anything about it#at least with the private schools there's an expectation that is required to be upheld#the main problem I'm facing now is they're pretty much all religious schools#which is something I didn't want my son involved in in an institutional way#I suppose it should be fine so long as at home we're acknowledging it's not a requirement to emotionally invest in the doctrine

6 notes

·

View notes