#invest in stock market

Text

Start trading at Low Brokerage

Open Free* Demat & Trading Account

Easy Mobile Trading App

Lowest Brokerage

Expert Research Advice

Personal Dealer Support

Call now- 0731 6620000

Website: www.mandotsecurities.com

#mandotsecurities#free demat account#zero brokerage#best share broker#top demat account#start trading for free#stock market trading account#invest in stock market

2 notes

·

View notes

Text

Groundbreaking Impact on Stock Markets - Azuke Global Investment Advisers

Investing in the stock market means buying shares or ownership in companies that are publicly traded. This enables you to own a piece of the company and benefit from its growth and prosperity.

#stock market#invest in stock market#stock market investment#Can I invest in share market#Stock market investment plan#Stock market investment in india

0 notes

Text

Course on Stock Market Investment

Understanding the stock market and making informed investment decisions can be a daunting task, especially for beginners. That's where online courses like the "Course on Stock Market Investment" offered by Quest by Finology come in handy.

Quest by Finology is an established online learning platform known for its expert-led instruction and practical approach. Their course on stock market investment is designed to provide a comprehensive learning experience to individuals who are interested in understanding the dynamics of the stock market and making wise investment choices.

What sets Quest by Finology apart is their focus on practical insights. The course covers not only the theoretical aspects but also incorporates real-life case studies and examples, allowing learners to apply their knowledge in practical scenarios. This hands-on approach helps individuals develop a deeper understanding of how the stock market works and equips them with the necessary skills to make informed investment decisions.

The "Course on Stock Market Investment" by Quest by Finology caters to individuals at various levels, making it accessible for beginners as well as those with some background knowledge. The course covers a wide range of topics, including investment strategies, stock selection techniques, risk management, and more. This comprehensive coverage ensures that learners gain a strong foundation in stock market investing.

Additionally, Quest by Finology emphasizes practical application, making the course highly relevant in the real world. By enrolling in this course, individuals can gain valuable insights and learn how to navigate the complexities of the stock market. The interactive modules, case studies, and assignments provided by Quest by Finology help learners reinforce their understanding and apply their knowledge effectively.

It's important to note that while online courses like the "Course on Stock Market Investment" by Quest by Finology can provide a solid foundation for stock market investing, continuous learning and staying updated with market trends are equally important. The course serves as a valuable resource, but individuals should also supplement their knowledge by reading books, following financial news outlets, and actively engaging with the investment community.

In conclusion, if you're looking for a practical and comprehensive online course on stock market investment, the "Course on Stock Market Investment" offered by Quest by Finology is worth considering. It equips individuals with the knowledge and skills needed to navigate the stock market and make informed investment decisions. With its practical approach and expert-led instruction, Quest by Finology ensures that learners gain a deeper understanding of the stock market and develop the confidence to invest wisely.

0 notes

Text

Know Auspicious Time for 2024 to Invest in Stock Market

Are you contemplating investments in the stock market for the upcoming year, 2024? Perhaps you're eager to explore the opportunities and make wise financial decisions. If so, you're in the right place. In this blog, we'll discuss the 2024 astrological predictions for the stock market and how you can find the auspicious time to invest, with insights from the renowned astrologer, Dr. Vinay Bajrangi. If you are looking for nadi dosha in astrology contact us.

0 notes

Text

Invest In Stock Market | Bharat Investment Group

Invest In Stock Market is that it can help you to diversify your investment portfolio. By investing in a variety of different stocks, you can minimize your risk and maximize your potential for profit. Additionally, investing in the stock market can give you a chance to participate in the growth of some of the world’s most successful companies .Finally, it’s important to remember that investing in the stock market is a long-term commitment. If you are looking for a safe and secure investment consultant firm, Bharat Investment Group offers the best investment solutions for your increased returns. you will need to be patient and ride out the ups and downs of the market.

Click the link to visit Us; https://goo.gl/maps/xBoCdgvmJfwd4CRA9

0 notes

Link

The US stock market is one of the oldest stock markets, making it a desirable option to invest in the Stock market. The reason behind this is the market’s maturity, less volatile nature, and higher returns on investments. The US being the strongest market is home to big firms like Amazon, Apple, Microsoft, etc which gives the investors a chance to be a part of these companies’ tremendous growth.

0 notes

Note

So the stock market is crashing or at least dropping. Is there a point when I should move my 401k savings? I know youre supposed to leave them alone. But im 25 and the thought of the 24k i have in there all dissappearing and needing to start over is stressful.

DO NOTHING.

Go outside and pet a tree or something instead.

Yesterday the stock market took a temporary drop. How much of a drop? I literally don't even know because I haven't logged into my brokerage firm's dashboard to look. It doesn't matter. And I have about twelve times as much money invested as you.

Here's why we don't believe there's a point at which you should move your 401(k) out of the stock market:

Wait... Did I Just Lose All My Money Investing in the Stock Market?

And here's a more detailed lesson on how to reallocate your retirement fund as you grow older so it's less invested in stocks and more in bonds, which is as close as we get to recommending you move things out of the stock market:

Investing Deathmatch: Stocks vs. Bonds

One last thing: There's a faction of conservative finance bros who are attempting to manufacture economic anxiety in order to influence the U.S. presidential election. Ignore similar freak-outs for the next few months. Keep to your personal financial plan and you'll be just fine.

Did we just help you out? Tip us!

#stock market#investing#investing in the stock market#stock market crash#recession#economy#economics#personal finance#how to invest#401k#retirement fund#investments#money

169 notes

·

View notes

Text

Real me

43 notes

·

View notes

Text

#stock market#invest in stock market#stock market investment#Can I invest in share market#Stock market investment plan#Stock market investment in india

0 notes

Text

Ko-Fi prompt from Isabelo:

Hi! I'm new to the workforce and now that I have some money I'm worried it's losing its value to inflation just sitting in my bank. I wanted to ask if you have ideas on how to counteract inflation, maybe through investing?

I've been putting this off for a long time because...

I am not a finance person. I am not an investments person. I actually kinda turned and ran from that whole sector of the business world, at first because I didn't understand it, and then once I did understand it, because I disagreed with much of it on a fundamental level.

But... I can describe some factors and options, and hope to get you started.

I AM NOT LEGALLY QUALIFIED TO GIVE FINANCIAL ADVICE. THIS IS NOT FINANCIAL ADVICE.

What is inflation, and what impacts it?

Inflation is the rate at which money loses value over time. It's the reason something that cost 50 cents in the 1840s costs $50 now.

A lot of things do impact inflation, like housing costs and wage increases and supply chains, but the big one that is relevant here is federal interest rates. The short version: if you borrow money from the government, you have to pay it back. The higher the interest rates on those loans, the lower inflation is. This is for... a lot of reasons that are complicated. The reason I bring it up is less so:

The government offers investments:

So yeah, the feds can impact inflation, but they also offer investment opportunities. There are three common types available to the average person: Bonds, Bills, and Notes. I'll link to an article on Investopedia again, but the summary is as follows: You buy a bill, bond, or note from the government. You have loaned them money, as if you are the bank. Then, they give it back, with interest.

Treasury Bills: shortest timeframe (four weeks to a year), and lowest return on investment. You buy it at a discount (let's say $475), and then the government returns the "full value" that the bond is, nominally (let's say $500). You don't earn twice-yearly interest, but you did earn $25 on the basis of Loaning The Government Some Cash.

Treasury Notes: 2-10 year timeframe. Very popular, very stable. Banks watch it to see how they should plan the interest rates for mortgages and other large loans. Also pretty high liquidity, which means you can sell it to someone else if you suddenly need the cash before your ten-year waiting period is up. You get interest payments twice a year.

Treasury Bonds: 20-30 years. This is like... the inverse of a house mortgage. It takes forever, but it does have the highest yield. You get interest payments twice a year.

Why invest money into the US Treasury department, whether through the above or a different government paper? (Savings bonds aren't on sold the set schedule that treasury bonds are, but they only come in 30-year terms.)

It is very, very low risk. It is pretty much the lowest risk investment a person can make, at least in the US. (I'm afraid I don't know if you're American, but if you're not, your country probably has something similar.)

Interest rates do change, often in reaction or in relation to inflation. If your primary concern is inflation, not getting a high return on investment, I would look into government papers as a way to ensure your money is not losing value on you.

This is the website that tells you the government's own data for current yield and sales, etc. You can find a schedule for upcoming auctions, as well.

High-yield bank accounts:

Savings accounts can come with a pretty unremarkable but steady return on investment; you just need to make sure you find one that suits you. Some of the higher-yield accounts require a minimum balance or a yearly fee... but if you've got a good enough chunk of cash to start with, that might be worth it for you.

They are almost as reliable as government bonds, and are insured by the government up to $250,000. Right now, they come with a lower ROI than most bonds/bills/notes (federal interest rates are pretty high at the moment, to combat inflation). Unlike government papers, though, you can deposit and withdraw money from a savings account pretty much any time.

Certificates of Deposit:

Okay, imagine you are loaning money to your bank, with the fixed term of "I will get this money back with interest, but only in ten years when the contract is up" like the Treasury Notes.

That's what this is.

Also, Investopedia updates near-daily with the highest rates of the moment, which is pretty cool.

Property:

Honestly, if you're coming to me for advice, you almost definitely cannot afford to treat real estate as an investment thing. You would be going to an actual financial professional. As such... IDK, people definitely do it, and it's a standby for a reason, but it's not... you don't want to be a victim of the housing bubble, you know? And me giving advice would probably make you one. So. Talk to a professional if this is the route you want to take.

Retirement accounts:

Pension accounts are a kind of savings account. You've heard of a 401(k)? It's that. Basically, you put your money in a savings account with a company that specializes in pensions, and they invest it in a variety of different fields and markets (you can generally choose some of this) in order to ensure that the money grows enough that you can hopefully retire on it in fifty years. The ROI is usually higher than inflation.

These kinds of accounts have a higher potential for returns than bonds or treasury notes, buuuuut they're less reliable and more sensitive to market fluctuations.

However, your employer may pay into it, matching your contribution. If they agree to match up to 4%, and you pay 4% of your paycheck into an pension fund, then they will pay that same amount and you are functionally getting 8% of your paycheck put into retirement while only paying for half of it yourself.

Mutual Funds:

I've definitely linked this article before, but the short version is:

An investment company buys 100 shares of stock: 10 shares each in 10 different "general" companies. You, who cannot afford a share of each of these companies, buy 1 singular share of that investment company. That share is then treated as one-tenth of a share of each of those 10 "general" companies. You are one of 100 people who has each bought "one stock" that is actually one tenth of ten different stocks.

Most retirement funds are actually a form of mutual fund that includes employer contributions.

Pros: It's more stable than investing directly in the stock market, because you can diversify without having to pay the full price of a share in each company you invest in.

Cons: The investment company does get a cut, and they are... often not great influences on the economy at large. Mutual funds are technically supposed to be more regulated than hedge funds (which are, you know, often venture capital/private equity), but a lot of mutual funds like insurance companies and pension funds will invest a portion of their own money into hedge funds, which is... technically their job. But, you know, capitalism.

Directly investing in the stock market:

Follow people who actually know what they're doing and are not Evil Finance Bros who only care about the bottom line. I haven't watched more than a few videos yet, but The Financial Diet has had good energy on this topic from what I've seen so far, and I enjoy the very general trends I hear about on Morning Brew.

That said, we are not talking about speculative capital gains. We are talking about making sure inflation doesn't screw with you.

DIVIDENDS are profit that the company shares to investors every quarter. Did the company make $2 billion after paying its mortgages, employees, energy bill, etc? Great, that $2 billion will be shared out among the hundreds of thousands of stocks. You'll probably only get a few cents back per stock (e.g. Walmart has been trading at $50-$60 for the past six months, and their dividends have been 57 cents and then 20.75 cents), but it adds up... sort of. The Walmart example is listed as having dividends that are lower than inflation, so you're actually losing money. It's part of why people rely on capital gains so much, rather than dividends, when it comes to building wealth.

Blue Chip Stocks: These are old, stable companies that you can expect to return on your investment at a steady rate. You probably aren't going to see your share jump from $5 to $50 in a year, but you also probably won't see it do the reverse. You will most likely get reliable, if not amazing, dividends.

Preferred Stocks: These are stock shares that have more reliable dividends, but no voting rights. Since you are, presumably, not a billionaire that can theoretically gain a controlling share, I can't imagine the voting rights in a given company are all that important anyway.

Anyway, hope this much-delayed Intro To Investing was, if not worth the wait, at least, a bit longer than you expected.

Hey! You got interest on the word count! It's topical! Ish.

#economics#capitalism#phoenix talks#ko fi#ko fi prompts#research#business#investment#finance#treasury bonds#savings bonds#certificate of deposit#united states treasury#stocks#stock market#mutual funds#pension funds

65 notes

·

View notes

Text

The market is so prosperous and the returns are so beautiful. I can’t bear to see investors losing money in the stock market. Follow me to start your road to wealth.

111 notes

·

View notes

Text

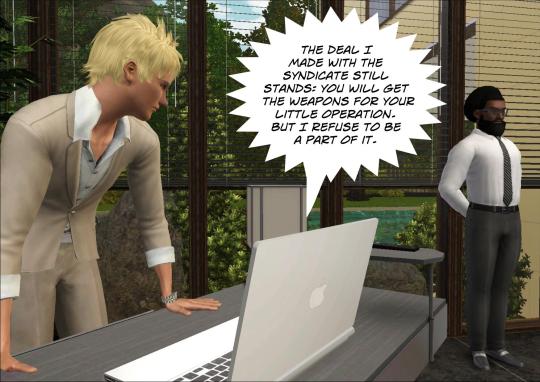

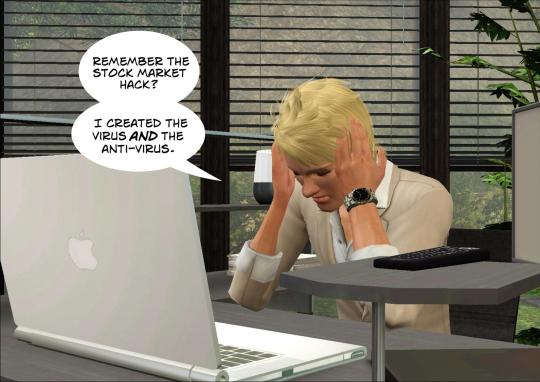

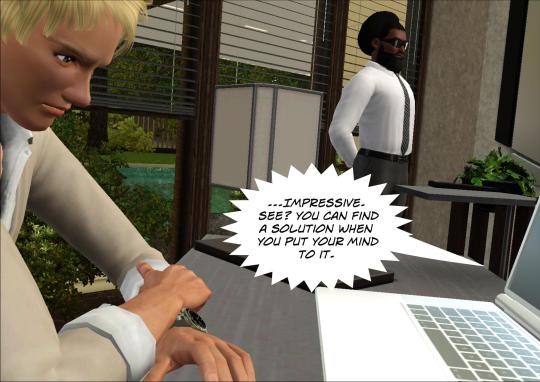

Author's note: Reference is made to the following scenes: (1), (2), (3)

#ts3#sims 3#sims 3 story#sims stories#tteot story#laurie golzine#omar ayad#muhammad al-saud#i'm sorry for going into details#i hate doing that#look i work in investment but imposter syndrome is kicking me hard#plus it's kind of difficult to make a plot look seamless when there is so much time between updates#in summary: laurie is managing a conglomerate including an investment fund of which noah is a partner#so laurie is a shareholder of a small tech company through that fund#he sold the antivirus via noah to that company as a solution to the virus he developed himself#when the stock market got hacked (by laurie) all companies rushed to get an anti-virus#but it also contained a spyware (also by laurie)#and this is how laurie's main business is now stealing data#laurie arc

70 notes

·

View notes

Text

Hey everyine great news! My drop shiopping courses have been enough of a scusess tbat the

33 slurp juices remain. Your mission is to eliminate all of them before they can combine with an astro ape and mint a new astro ape

NFT game is back on! And there’s even better news!!!

Just ship a dead rat to 38.89679° N, 77.03601° W for a big surprise!!! Send me a pic of the surprise and you’ll even get a jared leto joker nft valued at 10 million billion dogecoin on us!!!

But hurry! This once in a lifetime opportunity is going away flr goot in just [function.timne+1]!!! Be sure to get in on the ground floor because forget the moon, we’re going all the way to freaking mars!!!

Did YOU seee the hiddem nessage??? Be sure to read the post thoroughly for any clues you might have missed!!!

#to the moon#nft#bitcoin#blockchain#crypto#cryptocurrency#web 3.0#binance#cryptocurreny trading#investment advice#retirement planning#stocks#stock market#cryptocurrency trading#cryptocurrency investment#might blaze this later idk

123 notes

·

View notes

Link

The US stock market is one of the oldest stock markets, making it a desirable option to invest in US Stocks. The reason behind this is the market’s maturity, less volatile nature, and higher returns on investments. The US being the strongest market is home to big firms like Amazon, Apple, Microsoft, etc which gives the investors a chance to be a part of these companies’ tremendous growth.

Investing in foreign stocks while being a citizen of India is legal. Here is your guide about the ways through which you can invest in US stocks from India.

0 notes

Text

❄️☕️

Go follow : StocksOnWatch ( YouTube)

#coffee#iced coffee#selfie#snapchat#foot feddish#feetfinder#bored#beautiful stoner#investing stocks#stock market#stock trading

37 notes

·

View notes