#iron ore mining

Explore tagged Tumblr posts

Text

Australia’s Emerging Iron Ore Powerhouses

#mining tenement#mining application#hetherington#tenement#tenement management services#tenement consultant#tenement management#mining industry#mining#iron ore mining

0 notes

Text

Average Aussie only makes $65,000 a year, multi-billionaire Gina is an outlier, and should not have been counted

#gina rinehart#mining magnate#heiress#australia#spiders georg#auspol#iron ore#capitalism#lang Hancock#politics

41 notes

·

View notes

Text

Day 7+8= Griff does what Griff wants

#I had a bad migraine yesterday gugvgubgu#so to make up for it I combined today and yesterday#I think it’s a bit ironic sense they go hand n hand#what? you try telling a giant orca what they can have for dinner#if they say you and the dessert you made#well tough luck buddy get comfy#voreville voretober#voretober#safe vore#soft vore#safe v/ore#soft v/ore#vore art#sfw vore#nonsexual vore#foodplay#just thought I’d put it out there Griff is NOT mine!#they belong to the wonderful amazing beloved the protective pred#GO LOOK AT THE STUFF RIGHT NEOW IF YOU HAVENT#NOT OPTIONAL

117 notes

·

View notes

Text

went mining

#this is from less than an hour#about 30-45 mins of mining#time is also including time of me looking for the cave opening for about 10 mins#leaf's posts#also not pictured: more iron and gold ore#minecraft#mineblr

12 notes

·

View notes

Text

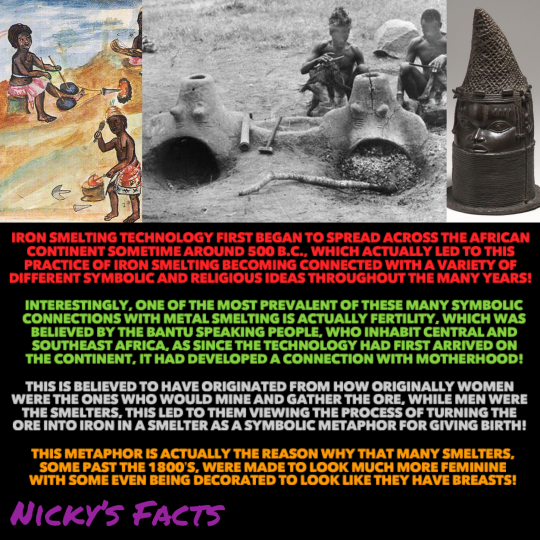

The feminine urge to mine and smelt iron ore!🪨

🔥🛠🔥

#history#iron#smelting#fertility#bantu#african history#ancient#femininty#motherhood#africa#technology#womens history#symbolism#black femininity#african culture#iron works#ancient history#girl power#mining#african women#traditional femininity#iron ore#precolonial africa#nickys facts

11 notes

·

View notes

Text

sorta related to my previous points: it always bothers me when people act like making farms in Minecraft is... cheating? or cheesing in some way?

some great abuse/affront to the game's mechanics that the devs would never want you doing, and that Minecraft is broken because they let you build things like iron farms or gold farms. So many suggestions to change the entire game structure of minecraft, some interesting but usually some Not, entirely built around making it so you dont have to "cheese" with those icky-yucky "farms" that only fake minecraft fans would ever build.

I love building farms far more than I do building decorative structures. I love seeing a machine come together and the build having a Practical Purpose. I'll build farms for anything! Iron, gold, my latest one was a Cat farm to collect all the cat variants.

Sorta related to my point about minecraft fans going "the game should only be properly playable the way I want to play it!" with a lot of things like villager trading or iron farming, acting like the game is irreversibly broken and unfun because it doesnt constantly put out updates to curb the behavior of... technical players engaging with the technical aspects of the game. It's good that iron is farmable in such large quantities fairly easily! It's good that things like gold or redstone are too! (Hell if I could change anything, i think drowned farms are far too inefficient to be our only renewable source of Copper, given how much you need to build out of it)

Farming is an important part of minecraft. I love seeing all the farms that people make to renewably obtain some of the rarer or more esoteric items in minecraft. I love trying to build them and seeing the materials pour in! It's like collecting, but you build it! And its always weird to see parts of the MC community really look down on farms as this like... grotesque perversion of the game's code that turns it into some idle cookie clicker. You don't get it. Building the farm IS the fun.

#i did see an interesting idea earlier for easier iron but it was couched in this whole 'so you dont have to Cheese by using iron farms'#plus the idea was just like... more iron ore? but you cant mine it until later?#girlie thats still non-renewable having an Iron Farm is important! especially with how useful iron is and how much you'll need it in bulk#i should play Skyblock again its been too long and i think it'd be really fun to go back to. NEEDING to build those farms to survive#and having the mob ones work so efficiently without the other spawning areas#its been like a year and a half i miss skyblock. i just gotta not start an unachievable project next time :P#but yeah uh. put some respect on the farmbuilders names. Id love to see even more shit become renewable/farmable#minecraft#mineblr#vees hot takes

2 notes

·

View notes

Text

Tilden Iron Ore Mine

22 notes

·

View notes

Text

Halted steam camp. One of my problematic fave locations in Skyrim <3

#meg is rambling#transmute mineral ore my beloved#lots of iron ore to mine/collect#it happened to be the place where amren's family sword ended up too in this playthrough so yay <3#can get the mammoth tusk for ysolda too#lots of lockpicking practice too

2 notes

·

View notes

Text

Excerpt from this story from Grist:

Demand for steel is on the rise globally, driven by population growth and the expanding economies in developing nations. The material will also be important to the green energy transition, forming the backbone of infrastructure like wind turbines, solar panels, and hydroelectric dams. Every part of the steel supply chain is heavily polluting, and the places in the U.S. where the steel industry is concentrated are disproportionately low-income and nonwhite, highlighting yet another instance in which the promises of development and climate solutions come at a steeper cost for some communities. What’s more, the country’s steel production is dominated by just two companies: U.S. Steel and Cleveland Cliffs.

For both companies, much of their production begins with taconite, a low-grade iron ore mined in the northeast Minnesota’s Mesabi Iron Range, which is processed into pellets that get shipped to the steel mills of Gary, Indiana. The extraction of the ore from taconite rock releases a slew of toxic pollutants into the air, including mercury, lead, and dioxins. In this region, the most concerning of these emissions is mercury.

Studies have connected mercury to a litany of negative health effects. It’s a neurotoxin that can interfere with brain development in unborn children and an endocrine disruptor that can weaken the immune system. Scientists have yet to determine a quantity of mercury that is safe for human consumption. One recent study found that there is “no evidence” for a threshold “below which neuro-developmental effects do not occur.” And while the taconite industry releases less than a ton of mercury into the atmosphere every year, the metal is toxic in extremely small quantities: A fraction of a teaspoon can contaminate a 20-acre lake.

The nation’s six taconite plants, all in this region of Minnesota, are owned by U.S. Steel and Cleveland Cliffs. In May 2023, the Environmental Protection Agency proposed a regulation that would require the companies to cut their mercury emissions by around 30 percent. In order to meet that standard, the companies would have to install equipment that would inject carbon atoms into their industrial chimneys so that the carbon would attach itself to the mercury atoms, making the pollution particles bigger and allowing them to get trapped in a filter before they would be released into the atmosphere. The agency estimates that its regulation would cost the industry $106 million in capital costs and $68 million per year thereafter.

Last month, when the standards were finalized, both companies sued. They argue that the regulation would pose “irreparable harm” to the industry, because of the steep costs of implementation. They also argue that the EPA’s proposed method for reducing mercury pollution would actually be worse for public health, causing a 13 percent increase in the amount of the toxic metal deposited in the local environment.

Jim Pew, a lawyer at Earthjustice who has litigated multiple lawsuits against the EPA for its failure to curb pollution from the taconite industry, pointed out that the costs of implementing the required equipment would be a tiny fraction of the companies’ annual sales, which totaled $40 billion in 2023. Pew noted that U.S. Steel recently initiated a $500 million stock buyback program, the mark of a healthy income revenue stream. As for the companies’ claim that the technology would increase mercury pollution, Pew called it “meritless.” The companies are “relying on a premise they know to be false” — that taconite plants would add the carbon technology without also improving their filtration system.

“I find this reprehensible and shameful,” Pew said. “While it’s claiming that it can’t spend money to clean up historic pollution, U.S. Steel is just handing out money to its shareholders.”

2 notes

·

View notes

Text

Aux buildings of the Djerissa iron ore mines in Tunisia

French vintage postcard, mailed in 1919 to France

#tarjeta#tunisia#postkaart#1919#sepia#mines#buildings#ore#historic#france#iron#photo#postal#briefkaart#aux#photography#mailed#vintage#ephemera#ansichtskarte#old#postcard#french#postkarte#carte postale#djerissa

3 notes

·

View notes

Text

Australia’s Emerging Iron Ore Powerhouses: A New Era of Mining

Innovation, Expansion, and the Future of Resource Extraction Down Under

Australia’s iron ore industry has long been the quiet giant behind the nation’s economic prosperity. As one of the world’s top iron ore producers and exporters, the country has continually evolved its mining landscape to meet global demand. Now, a new wave of iron ore projects is emerging across Western Australia—bringing together advanced technology, sustainability, and large-scale infrastructure to redefine what modern mining looks like.

Let’s explore how this next generation of mines is shaping the future of the sector.

Iron Ore: The Backbone of Australian Mining

Iron ore isn’t just another mineral—it’s the cornerstone of Australia’s mining sector. It fuels the steel industry, supports global infrastructure projects, and provides thousands of jobs locally. While the Pilbara region continues to dominate production, new projects are revitalizing both existing operations and untapped areas, ensuring long-term viability and global competitiveness.

Mega Hubs Are Scaling Up Production

One of the most exciting developments is the expansion of massive mining hubs in the Pilbara. These aren’t just mining sites—they’re integrated ecosystems featuring multiple extraction areas, processing plants, transport links, and export terminals.

Recent upgrades have pushed production capacities into record-breaking territory, with some operations now delivering over 300 million tonnes per year. These hubs are leveraging optimized logistics and improved mining processes to boost output while lowering environmental impact.

Technology Takes Center Stage

The latest wave of mines isn’t just bigger—it’s smarter. Autonomous trucks, robotic sampling units, and AI-powered analytics are becoming standard across new developments. Some sites even feature digital twins—virtual models of the physical operation—allowing engineers to simulate scenarios and fine-tune performance before applying changes on the ground.

This digitization reduces downtime, increases accuracy, and enhances safety for workers—especially in remote regions where operational risks are higher.

Mid-Size Mines Making Big Moves

It’s not just the mining giants making headlines. Several mid-sized projects are setting new benchmarks for innovation and efficiency. These mines often operate with a leaner model, focusing on fast development, modular infrastructure, and community engagement.

In Western Australia’s mid-west, for instance, a new site is preparing to contribute significantly to national output with a modest but strategic 1.5 million tonnes per year. These operations are vital for regional economies and help diversify the supply chain.

Sustainability Becomes a Priority

Sustainability isn’t a buzzword—it’s a requirement. Today’s iron ore mines are integrating renewable energy sources, improving water use efficiency, and reducing carbon emissions. Coastal projects are establishing advanced transhipping systems to minimize disruption to local ecosystems while streamlining exports.

Mining companies are also working closely with Indigenous communities, ensuring that cultural heritage and land rights are respected as development progresses.

The Road Ahead

Australia’s iron ore industry is entering a new chapter—one that balances scale, technology, and sustainability. As global demand for steel continues to rise, especially for renewable energy infrastructure and electric vehicle manufacturing, the pressure is on to deliver more, faster, and cleaner.

The new wave of iron ore mines is meeting that challenge head-on, positioning Australia not just as a major player, but as a leader in the future of responsible mining.

Looking for more insights on Australia’s mining evolution? Stay tuned for upcoming features on lithium, rare earths, and battery metals—sectors that are also seeing massive transformations across the country.

#mining industry#mining tenement#mining application#tenement#hetherington#tenement consultant#tenement management services#tenement management#mining#iron ore mining

0 notes

Text

me watching kass fish up three emeralds and two diamonds while i take the entirety of spring year one to make it level 40 of the mines bc weve not had a single good luck day

#sdv#Thursday posts#we have our designated roles...and i did not fulfill mine ar all#i didnt hit 4000g until like the 20th i was so focused on getting iron. i got my fifth iron ore at 11pm spring 28#im an embarassment

2 notes

·

View notes

Text

Three men detained in illegal million-dollar iron ore mining, Pahang

On April 30, authorities detained three men—two Bangladeshi nationals and one local—during an operation named ‘Op Bersepadu Khazanah’ at an illegal iron ore mining site in Sungai Ganoh, Bukit Ibam forest reserve, near Muadzam Shah, Rompin. The General Operations Force (GOF) Tenggara Brigade, with the Pahang Enforcement Unit (UPNP), seized mining equipment worth RM1.25 million, including an…

0 notes

Text

Iron Ore Mining Market: Trends, Opportunities, and Future Prospects

The global iron ore mining market is a cornerstone of industrial development and economic growth. As one of the most essential raw materials for steel production, iron ore fuels industries such as construction, automotive, and infrastructure. This article delves into the current landscape, trends, challenges, and future opportunities within the iron ore mining market.

Market Overview

Iron ore mining involves the extraction and processing of iron-rich rocks and minerals to produce iron ore, which is then used to manufacture steel. The primary types of iron ore are hematite and magnetite, both of which are highly sought after in the global market.

Key regions dominating the iron ore mining market include:

Australia: The leading exporter of iron ore globally, with rich reserves in regions like Pilbara.

Brazil: Known for high-grade iron ore, particularly in the Carajás region.

China: The largest consumer of iron ore, driven by its booming steel industry.

India: Rapidly expanding its production to meet domestic and global demand.

Key Trends in the Iron Ore Mining Market

Sustainable Mining Practices:

Companies are increasingly adopting eco-friendly technologies to minimize environmental impact. Initiatives include reducing carbon emissions, water recycling, and land rehabilitation.

Rising Demand for High-Grade Iron Ore:

High-grade iron ore is preferred for its efficiency in steelmaking, which reduces energy consumption and emissions.

Technological Advancements:

Automation, artificial intelligence (AI), and advanced robotics are revolutionizing mining operations, enhancing productivity and safety.

Growth in Emerging Economies:

Countries like India, Vietnam, and Indonesia are investing heavily in infrastructure, driving demand for steel and, consequently, iron ore.

Challenges in the Iron Ore Mining Market

Price Volatility: Fluctuations in iron ore prices due to changes in supply and demand dynamics.

Environmental Concerns: Mining activities can lead to deforestation, habitat destruction, and water pollution, prompting stricter regulations.

Geopolitical Risks: Trade tensions and export restrictions can impact the global supply chain.

Depleting Reserves: The need for exploration and investment in untapped reserves to meet future demand.

Opportunities for Growth

Expansion into New Reserves:

Exploration of untapped reserves in Africa, Asia, and South America.

Investments in Green Steel:

Collaborations between mining companies and steelmakers to develop low-carbon steel production processes.

Digital Transformation:

Leveraging big data and analytics to optimize mining operations and reduce costs.

Diversification of Product Portfolio:

Producing value-added products like pellets and sinter feed to cater to diverse industrial needs.

Future Outlook

The iron ore mining market is expected to grow steadily, supported by robust demand from the steel industry. According to market reports, the global iron ore market size is projected to reach significant milestones by 2030, with a compound annual growth rate (CAGR) of around 4-6% during the forecast period. This growth will be fueled by rising infrastructure projects, technological advancements, and a shift towards sustainable practices.

Conclusion

The iron ore mining market is a dynamic and essential component of the global economy. While it faces challenges like price volatility and environmental concerns, the industry is poised for growth through sustainable practices, technological innovation, and exploration of new reserves. Stakeholders must navigate these challenges strategically to capitalize on emerging opportunities and secure a sustainable future for the sector.

Buy the Full Report for More Insights into the Global Iron Ore Market Forecast, Download A Free Report Sample

0 notes

Text

Cleveland Cliffs iron ore taconite mine

14 notes

·

View notes