#market manipulation

Text

BlackRock Recruiter Who ‘Decides People’s Fate’ Says ‘War is Good for Business' Undercover Footage

youtube

#blackrock#james o'keefe#campaign finance#hedge funds#wall street#politics#military industrial complex#russia#ukraine#economy#agriculture#market manipulation#o'keefe media group#political manipulation#ESG#propaganda#war propaganda#war profiteers#Youtube

58 notes

·

View notes

Photo

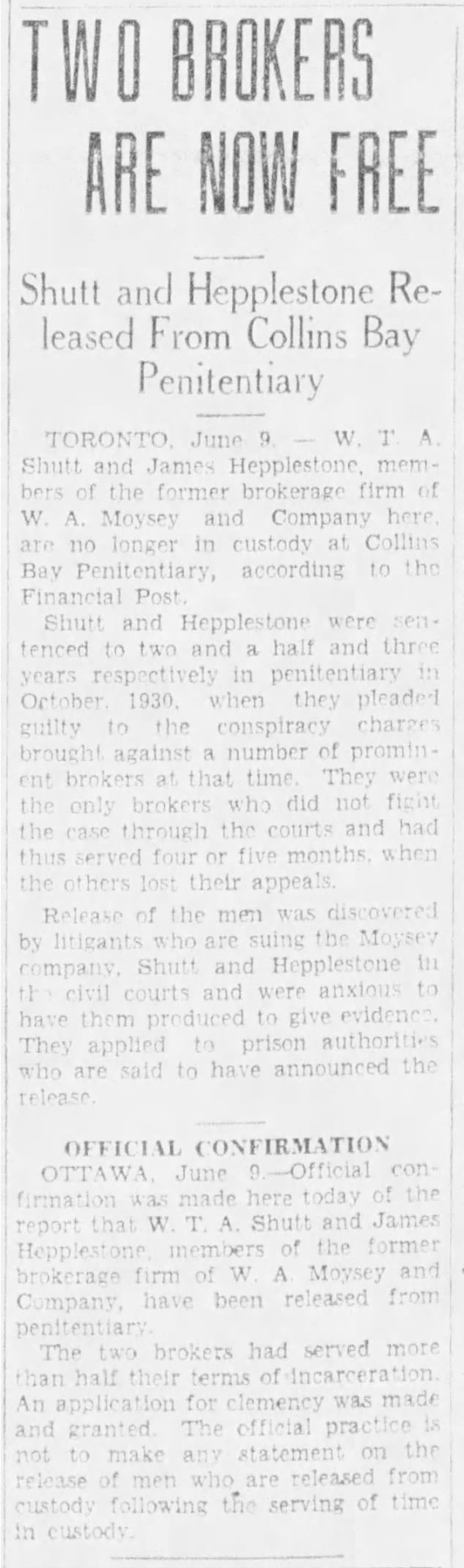

“TWO BROKERS ARE NOW FREE,” Kingston Whig-Standard. June 9, 1932. Page 1.

---

Shutt and Hepplestone Released From Collins Bay Penitentiary

-----

TORONTO June 9 — W. T. A. Shutt and James Hepplestone, members of the former brokerage firm of W. A. Moysey and Company here, are no longer in custody at Collins Bay penitentiary, according to the Financial Post.

Shutt and Hepplestone were sentenced to two and a half years and three years respectively in penitentiary in October 1930, when they pleaded guilty to the conspiracy charges brought against a number of prominent brokers at that time. They were the only brokers who did not fight the case through the courts and had thus served four or five months when the others lost their appeals.

Release of the men was discovered by litigants who are suing the Moysev Company, Shutt and Hepplestone in the civil courts and were anxious to have them produced to give evidence. They applied to prison authorities, who are said to have announced the release.

OFFICIAL CONFIRMATION

OTTAWA, June 9 — Official confirmation was made here today of the report that W. T. A. Shutt and James Hepplestone, members of the former brokerage firm of W. A. Moysey and Company, have been released from penitentiary.

The two brokers had served more than half their terms of incarceration. An application for clemency was made and granted. The official practice is not to make any statement on the release of men who are released from custody following the serving of time in custody.

#toronto#paroled convict#parole system#parole#stock brokers#brokers' trial#brokerage firm#criminal conspiracy#conspiracy to defraud#market manipulation#sentenced to the penitentiary#collins bay penitentiary#released from prison#prisoner release#civil suit#capitalism and crime#capitalism in canada#great depression in canada#history of crime and punishment in canada#crime and punishment in canada

1 note

·

View note

Text

“There's a perception that there are two sets of rules,” says Gurbir Grewal, head of the SEC's enforcement division. “We want everyday Americans to have confidence when they invest in the market. They should have confidence knowing that there's a dedicated group of professionals to deal with new threats, traditional frauds, making sure that their retirements are safe.”

Many Wall Street denizens don’t seem to grasp what’s afoot, even as Hwang’s treatment underscores the shift.

#wall street#financial markets#financial regulation#finance#financial services#corporate fraud#fraud#securities#securities fraud#SEC#news#market manipulation#market abuse#markets#securities markets#derivatives#derivatives markets#total return swaps#archegos#credit suisse#greensill#viacomcbs#bill hwang#banking

1 note

·

View note

Text

Someone Just Dumped 39 Penguins for 438 ETH (Approx. $1,02 Million)

CirrusNFT made a tweet that sent shockwaves through the NFT market, reporting a significant Penguin sale. According to him, a collector dumped 39 Pudgy Penguins making more than a million dollars from the sale.

CirrusNFT confirmed via Twitter that a staggering 39 Penguins were dumped from the collector’s collection, fetching a hefty 438 ether (roughly $1.02 million) in the process. While details…

View On WordPress

#CirrusNFT#Digital Assets#dump#Ethereum#flipping#internal transfer#leverage#market manipulation#NFTs#Penguins#profit#speculation#surprise exit

0 notes

Text

youtube

Chokepoint Capitalism Explained by The Majority Report

#thought provoking#thought provoking long queue#evils of capitalism#chokepoint capitalism#enshittification#corproate greed#monosly#monopoly#market manipulation#media manipulaiton#Youtube

0 notes

Text

The South Sea Bubble (1720): Lessons from a Historic Financial Fiasco

Written by Delvin

In the annals of financial history, the South Sea Bubble of 1720 stands as a stark reminder of the perils of irrational exuberance and speculative frenzy. Driven by investor mania, the South Sea Company, a British trading company, witnessed its stock price soar to unprecedented heights before plummeting dramatically. This blog post delves into the story of the South Sea Bubble,…

View On WordPress

#dailyprompt#Financial#Financial Education#Financial History#Financial Literacy#Market Manipulation#money#Money Fun Facts#Stock Market#The South Sea Bubble of 1720

0 notes

Text

Power To The Players: The GameStop Saga

The Beginning

In September 2019, the narrative of GameStop (GME) began to change, thanks to an unlikely source. At this time, GameStop was considered a struggling retail entity, grappling with the seismic shifts in the gaming industry moving towards digital and cloud-based services. Its share price had been on a consistent downward trajectory, having fallen from over $45 in 2013 to under $5 in…

View On WordPress

0 notes

Text

Purivercoin

Horrific kidnapping and murder in Gangnam, South Korea😨 Ringleader loses big on victim's coin investment, seeks revenge🔥. Puriver Coin has been accused of manipulating the market price using dishwashing tricks, raising calls for an urgent investor protection system🚨. Puriver Coin is a cryptocurrency that is paid on a blockchain-based platform that provides air quality improvement solutions, and it was promoted as a Mastercard-enabled cryptocurrency, but many investors lost money due to the poor performance of the CEO😢.Unlike the case, VICA Coin is gaining popularity due to its transparent financial transactions :)!!!

#Kangnam case#Kidnapping murder#coin investment#market manipulation#investor protection#Dishwashing method#Purivercoin#blockchain#cryptocurrency#Mastercard

0 notes

Text

Criminal #Naked Shorting

How one targeted company has managed to survive against the odds.

64.media.tumblr.com

Criminal Naked Short Selling

How one targeted company has managed to survive against the odds.

Over the course of 15 years, I have diligently refined this piece of writing through multiple revisions. I’ve carefully removed sections to not overwhelm the reader or convey my palpable anger. It’s important to note that this essay reflects my personal opinions and should not be construed as financial advice or an offer to buy company shares. Instead, I offer this article as a means of education and encourage readers to follow the embedded links to completely appreciate the crime at hand.

Since the early 90s, I have been a shareholder of TMMI an OTC Pink sheet listed company with a rich history founded by a former rock star turned computer scientist Philip Taylor Kramer, and have followed TMMI’s stock, particularly over the last few years and I am appalled by the daily oppressive and manipulative trading practice that has recently become widely recognized as “Naked Shorting.” It is a tool that is commonly used by unscrupulous market participants via equally corrupt market makers, using this once relatively unknown tool that was at one time referred to as “the Madoff Exception”. It is my belief this misunderstood practice currently plagues TMMI’s market valuation, and I have concluded that the stock price has been criminally manipulated to an artificially depressed stock price and is currently using a manipulative practice commonly referred to as “cellar boxing,” to protect an undeclared naked short position caught within TMMI’s share structure. This fraudulent act is openly conducted against the shareholders of TMMI without fear of regulatory repercussions.

To understand how this is possible, I will provide some charts to illustrate the trading history and supporting links to give a clearer picture. There are several key events that I will touch on that I believe will support my conclusions

The Naked Short

64.media.tumblr.com

lh5.googleusercontent.com

64.media.tumblr.com

lh4.googleusercontent.com

The first indications of this naked short existence first came to light in late 1999 and into the new millennium. TMMI had a very liquid market that consistently traded several million shares daily with a share structure representing about one-third of the current issued and outstanding share structure TMMI has today. When you look at the current daily volume, liquidity is virtually non-existent. This has been achieved as previously mentioned, through the manipulative practice of “cellar boxing” the share price of the stock, currently employed by the naked short cabal. The multi-year chart illustrates the spectacular appreciation of the stock price right into the millennium with several hundred million shares exchanging hands leading to an explosive mid-January trading session with the share price being quoted with the bid price of 1.70 above the quoted offer of 1.65 and followed up in the morning opening with the share price gapping up over a dollar from the previous day’s closing price of $1.70 per share with the first trade a consisting of block trade of over 15 million shares at $2.87. I believe this first trade of the day represents the last of the off-side naked short position being held at a major firm.

Take note that during this period, Naked Shorting was a well-kept secret among the major Wall Street Bank Brokerages and was a very effective tool in the overall manipulation of share prices of countless public companies.

What was the cause of this millennium run in the price of TMMI? Going back to this period in time there was a tech bubble that was in full bloom and TMMI’s fractal compression technology was receiving widespread investor and media attention for the potential impact TMMI would have in the video delivery market. This millennium run took place long after the founding partner and brain trust behind the technology, Taylor Kramer had disappeared and the company had been thrown into total disarray.

TMMI had somehow managed to overcome this tragic event and through the efforts of some of Taylor’s friends and shareholders against tremendous odds managed to keep his dream, and more importantly the company Total Multimedia (www.tmmi.us) he founded, alive to this day.

Several years after Kramer’s disappearance with the help of dedicated friends and shareholders, TMMI was preparing to release demos consisting of video clips showcasing TMMI’s fractal compression technology for the burgeoning CD-ROM market and it’s in this overheated tech environment that TMMI’s share price began its meteoric price rise. Most people at the time attributed this price rise to heavy promotion but I believe that the real cause for this sudden and aggressive run-up in price was simply the result of a massive short squeeze by a major Wall St. Bank needing to recalibrate its books. It was at the tail end of this short squeeze when a few rogue shareholders unbelievably laid claim to ownership of TMMI’s proprietary fractal compression technology that TMMI had spent in excess of 30 million dollars in development costs. This act ultimately led to the re-establishment of what I now believe is an enormous naked short position caught within TMMI’s share structure created via the unbridled naked short sell-off of stock once again involving hedge funds with complicit market makers and facilitated through major Wall St. bank brokerage firms. Just how many shares were naked shorted during this sell-off is anybody’s guess, but I suspect the entire capitalization and more may have been naked shorted when one considers the consistent daily fails to deliver now dating back over two decades.

The Mazuma Affair

In June of 2007, an already toxic environment at TMMI was further exacerbated by the actions of Corene Dion King, who had appointed herself as custodian. Without any board discussion or approval, King entered into a 504 reg D debt financing with Mazuma Corporation based in New Jersey and operated by Curt Kramer (no relation to Taylor Kramer). The deal involved exchanging $50,000 for 27 million shares intended for investment purposes. Three separate entities under King’s control also received a further 150 million shares. Mazuma wasted no time initiating an aggressive selling campaign, showing little regard for TMMI’s share price nor TMMI's shareholders' interests. As soon as TMMI’s then-acting president, Mr. Fernandez, learned of these highly suspicious actions by the custodian, he immediately contacted the SEC and sought relief in the Nevada State court. Thanks to his swift action, the illegal issuance of stock was halted and further trading and distribution of TMMI shares were prevented.

The Mazuma Sell-Off

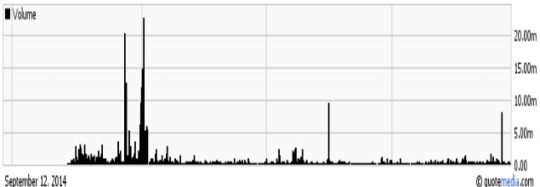

What I found intriguing was when the illegal shares were introduced into the system there came this sudden spike in volume and the aggressive selling of TMMI shares began. When you take a look at the chart below, you will see the malicious sell-off orchestrated by Mazuma of these 504 shares into the public market. What was their goal in selling the stock down with such unbridled aggression? Was it a setup for the naked short position to finally cover their positions? Who else may be involved in this oppressive act and as we have come to know, why did it take so long for Mazuma to comply with the Nevada State Court ordering the return of all the unauthorized shares to the company?

64.media.tumblr.com

lh6.googleusercontent.com

The DTCC initiated a Global Lock or Chill on the clearing of all TMMI’s publicly traded shares, which was a relatively obscure action at the time. This move spelled doom for TMMI as no public company had ever successfully unwound this action before. The DTCC’s handling of the situation was breathtaking in its opacity. For several months, there was little or no communication from the DTCC about returning the unauthorized shares as per the Nevada State Judge’s order. To add to the confusion, Mazuma had sold 7.254 million shares of the 27.5 million shares issued to it through a suspect 504 share offering of TMMI. Yet, during an eight-day trading period, approximately 22 million shares were traded. The chart raises questions about the extra 15 million shares that were not accounted for and where they ended up.

The Chill Unwinds

The DTCC took a circuitous stance, claiming that it had placed a chill or global lock on all TMMI shares held in the system due to the presence of illegally issued shares. As a result, the identified “illegal” shares couldn’t be returned. Despite this specific rationale, DTC officials remained hesitant to expedite the return of the Mazuma shares to TMMI’s treasury, and several long months passed with little progress. Eventually, a misdirected internal email revealed that the illegal shares had been loaned out in violation of the court order, and within 48 hours of the DTCC being notified of the contents of the internal email the Global Lock was rescinded. The unsold shares were returned to TMMI’s treasury.

Unbelievable.

As the above chart shows, the trading volume immediately drops once the court order was issued against Mazuma. With liquidity disappearing, the daily naked short manipulation and cellar boxing resume. Naked short-selling in illiquid markets can be disastrous for a company, as it depresses the stock price and deters potential buyers. The company is then forced to sell additional shares at a low price to raise capital, further diluting its value and perpetuating the vicious cycle. How Mazuma’s involvement came to be is still somewhat of a mystery to me.

64.media.tumblr.com

lh5.googleusercontent.com

When one studies the above ten-year snapshot chart. You will notice as TMMI’s volume and share price starts to increase, several out-of-market trades are printed that can serve no purpose other than to reset the price of some undisclosed off-side position.

What transpires in this historical perspective serves to confirm my suspicions that the short position that is caught in TMMI’s structure is a massive one and it is my belief there exists a low share price threshold that could potentially instigate a short cover as a most likely scenario unfolding before us.

Looking back at the trading history of TMMI, you’ll see that in the lead-up to the millennial run, the company’s shares consistently traded several million shares daily, ranging from sub-penny to higher values, despite a total float of only 100 million outstanding shares. However, now, with almost three times the float, the stock rarely trades above a couple of hundred thousand shares on any given day. This begs the question: why is there a need for TMMI to be traded in this illiquid manner over such a long period? Could it be fear of liquidity attracting investors? Despite the daily low volume, there is a consistently high percentage of daily fails to deliver dating back to the early millennium, as seen on the OTC short report website. This leads one to believe that the naked short position is so large that the act of covering it could be catastrophic for the perpetrators of this fraud on TMMI shareholders.

Naked Shorting Gets Exposed

What we witnessed during the 2008 global financial crisis was the SEC’s unusual and unprecedented emergency regulation prohibiting naked short selling, protecting just 17 banking institutions and upon the ensuing public outcry, the naked short selling ban was expanded to all publicly traded companies. There is evidence to support that it is not uncommon for the naked short position to represent from 30% to over 100% (in some cases even more) above the issued and outstanding shares of targeted companies illustrating just how serious and dangerous this practice has become to the overall stability of our financial markets.

This can only be described as corporate and financial terrorism against a publicly traded US company. TMMI was developing crucial software technology that had the potential to provide the US with a global strategic advantage in video processing. Unfortunately, shareholders have been robbed of any opportunity to see the technology developed to fruition nor the chance to profit from their investment in TMMI. It’s time to put an end to this insidious and illegal method of price manipulation, which protects mammoth naked short positions that have been “grandfathered” within the DTCC. These positions sit outside of TMMI’s legally authorized share structure, and the need to address this issue is more pressing than ever.

Fortunately for some of the long suffering shareholders, TMMI is still alive and trading, and with the recent board additions, TMMI may be ready to make some moves.

In-A-Gada-Da-Vida-Baby

______________________ The Rabbit Hole _____________________

Unsolved Mysteries - https://www.youtube.com/watch?v=7_amjG-naxU

Systemic Risk - https://vimeo.com/4520843

SEC Charges Merrill Lynch - https://www.marketwatch.com/story/sec-charges-merrill-lynch-fines-firm-11-million-for-short-sales-violations-2015-06-01

The Maddoff Exception - https://www.reuters.com/article/us-madoff-sec-remarks-idUKTRE4BG6US20081217

Companies Fight Back - https://www.globenewswire.com/en/news-release/2023/02/08/2603973/0/en/Companies-Fight-Back-Against-Market-Manipulation-and-Illegal-Short-Selling-Here-are-Four-Stocks-in-the-News.html

Cellar Boxing - https://medium.datadriveninvestor.com/cellar-boxing-the-predatory-secret-that-wall-street-uses-to-exploit-an-infinite-money-glitch-in-97ccbd6c9923

Wall Streets Naked Swindle - https://www.rollingstone.com/feature/wall-streets-naked-swindle-194908/

Naked Short and Greedy - https://www.amazon.ca/Naked-Short-Greedy-Streets-Failure/dp/1910151343

Anger at Goldman Still Simmers - https://www.nytimes.com/2012/03/26/business/goldman-sachs-denies-claims-it-led-to-copper-rivers-demise.html?_r=3&

My Main Squeeze Fractal Compression - https://www.wired.com/1993/05/fractal/

The Vanishing - https://web.archive.org/web/20020204114404/http://www.maximonline.com/maximwear/articles/article_2193.html

Taylor Kramer Fandom - https://unsolvedmysteries.fandom.com/wiki/Taylor_Kramer

TMMI TruDef - http://www.trudef.us/

Mazuma Funding Corporation - https://www.sec.gov/news/press-release/2013-249#.U7wtPbGTFv0

Nevada Court Order - https://www.prweb.com/releases/2007/07/prweb537846.htm

Global Lock or Chill - https://www.youtube.com/watch?v=VMVVEiyJ3DQ

Fails to Deliver - https://www.otcshortreport.com/company/TMMI

"Grandfathered" - https://www.dtcc.com/clearing-services/equities-clearing-services/ow

Protecting the Banks from Naked Shorting - https://content.time.com/time/business/article/0,8599,1842499,00.html

Taser International Responds - https://www.sec.gov/comments/s7-12-06/dklint7619.pdf

Patrick Byrne on Naked Shorting - https://www.youtube.com/watch?v=M_FZO9-ZIWU

Naked Short redefining systemic risk - https://www.youtube.com/watch?v=hH5cMQLJRUo

#naked shorting#crooked marketmakers#market manipulation#phantom shares#wall street fraud#Fraud#Banksters#TMMI#Curt Kramer

1 note

·

View note

Text

It’s wild that a publicly traded company can announce layoffs due to “tough economic conditions” and then be allowed to buy back billions worth of their own stocks! Like how is this not price manipulation?

0 notes

Text

Sky-High Commodity Prices Have Been A Boon For Glencore Despite Record Fines

Sky-High Commodity Prices Have Been A Boon For Glencore Despite Record Fines

$1.5 billion US is a lot of money by any measure. However, the reality is that Glencore is making so much in this climate of metal scarcity and elevated prices, that they likely won’t have a hard time accommodating the fine. So when metal market news broke of their massive, three nation fine, there was not much reaction. But as we’ll see, the money may not be the real concern.

Glencore is now an…

View On WordPress

0 notes

Text

A good episode. Don’t you feel nostalgic for a time, before the crazy, when big-brain experts would have a respectful interdisciplinary dialogue about solving knotty socio-philosophical issues with real impact?

#twitter elon musk#algorithmic bias#algorithm#algorithmicdesign#social media#audit#market manipulation#manipulation#communication#oligopoly#tech#psychology#freedom of speech#freedom of expression#town square#civil rights#human rights#content moderation#choices#autonomy#software#SEO#governance#regulation#mobile apps#beta testing#intellectual property#news#current affairs

0 notes

Text

started thinking something along the lines of "aw, what's wrong with me that i feel bad for unsubscribing from company emails" but then i remembered sitting in on a marketing meeting during my internship and listening to them proudly talk about how they use like. behavioral psychology to figure out how best to manipulate people into using their services and i feel much less like there's something wrong with me now

#//juri speaks#i will still feel bad of course bc that's just how my emotions are keyed#but getting a glimpse at the web of marketing manipulation that's everywhere redirects it from like. self pity/loathing/wallowing#and ACTUALLY it's probably not just how my emotions are bc brands are. literally trying to manipulate people into staying subscribed

3K notes

·

View notes

Text

How Wall Street Makes Money Legally: Understanding the Revenue Streams and Regulatory Framework

Written by Delvin

Wall Street, the financial hub centered in New York City, is a bustling hub of activity where various firms and individuals engage in revenue-generating activities. While there are specific variations among firms, this blog post will explore the common ways in which Wall Street makes money. Additionally, we will delve into the regulatory framework that governs Wall Street,…

View On WordPress

#Asset Management#Client Obligations#Compliance and Reporting#dailyprompt#Financial#Financial Literacy#How Wall Street Makes Money Legally: Understanding the Revenue Streams and Regulatory Framework#Insider Trading#Investment Banking#knowledge#Market Makers#Market Manipulation#money#Money Management#Regulatory Framework#Research and Analysis#Trading and Market Making#Wall Street#Wealth Management

0 notes

Text

A lot of people are missing the point for that marketing post i think about Barbie / Oppenheimer / Grimace Shake challenges etc.

Its not about not posting about seeing a movie. You can see a movie and tell your friends about it, post about liking it or whatever. That's fine. The problem is that it's becoming a trend to go see these movies or participate in these challenges. People aren't doing it out of intrinsic motivation, but because they want to be part of the trend. This is what makes every corporate marketeer cum their pants.

Marketing is not to cater to people who would watch these movies nonetheless. Its to convince the people who normally wouldn't to do so anyway. Its about making people who don't participate feel left out so they'll go see it anyway and post their pink Barbie-watching outfits on Instagram so everyone else knows they're in on it. Its social manipulation to convince people to be part of something. Its very healthy to be conscious about it when you post about these trends and its also good to remind yourself that you shouldn't do anyone's marketing for them for free.

Again, there's nothing wrong with seeing a movie and posting about it. There is something wrong with making people feel left out for not seeing something and pressuring people to see something to belong in the in group.

#The exact same thing happened during peak popularity of game of thrones#where people who normally wouldnt give a shit about this genre watched it anyway just to be part of the fad#with is one of the most manipulative ways to market a product#the idea here is that when someone hasnt seen Oppenheimer or some shit you go “ok thats fine!” instead of “WHAT you havent SEEN IT YET???”#which is the part that manipulates them instead of motivating them

150 notes

·

View notes