#medieval myths

Text

an anthropomorphic mandrake being dug up with the help of a dog tied to its feet/roots

in "pseudo-antonius musa: de herba betonica", latin manuscript, late 9th century

source: Kassel, UB, 2° Ms. phys. et hist. nat. 10, fol. 34v

#this is a very typical depiction of the mandrake#mandrake#mandrake root#alraune#9th century#medieval#medieval art#medieval myths#herbarium#dog#plant#illuminated manuscript

607 notes

·

View notes

Video

youtube

I love this guy, and everything he says is true! Please watch this (and also take a look at his other videos, they are fun and educational and he is living the life i want to have)

#medieval#medieval europe#medieval myths#medievalcore#personal#his food videos are great also#knightcore#literally he is a knight

100 notes

·

View notes

Text

Goblin

#goblincore#goblin aesthetic#mythical creatures#supernatural creatures#mythology and folklore#medieval manuscripts#medieval myths

9 notes

·

View notes

Photo

The Middle Ages according to Historians VS the Middle Ages according to Hollywood.

More about myths & general misconceptions about the middle ages here;

https://fakehistoryhunter.net/2019/09/10/medieval-myths-bingo/

Follow me on Twitter here;

https://twitter.com/fakehistoryhunt

47K notes

·

View notes

Text

#hermes worship#hermes#mercury#hermes god#ancient greek god#greek god#coin#greek myth#greek myth art#ancient greek mythology#greek mythology#ancient greek coin#roman coin#medieval coin

2K notes

·

View notes

Text

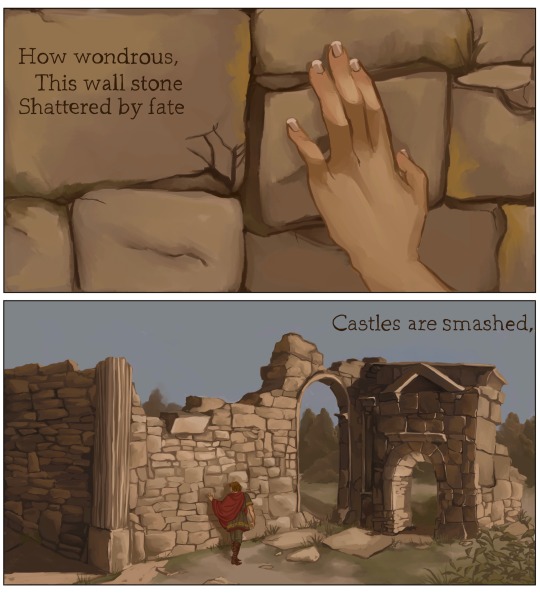

Comic for “The Ruin” a poem written by an unknown author in the 8th or 9th century

How wondrous, this wall stone,

Shattered by fate.

Castles are smashed,

The work of giants, crumbled.

Ruined are the roofs,

Tumbled the towers.

Broken the barred gates.

Frost in the plaster,

Ceilings a-gaping.

Torn away, fallen,

Eaten by age.

#the ruin#history#poetry illustration#roman ruins#historical illustration#digital art#digital painting#artists on tumblr#art#my art#Roman#myth#dark ages#medieval

2K notes

·

View notes

Text

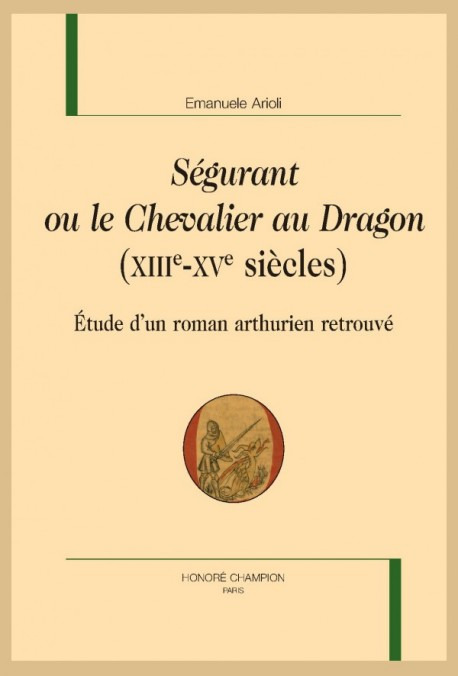

The missing Arthurian knight - rediscovered in 2019

Well the title is a slight lie - the missing knight wasn't rediscovered in 2019, it was earlier than that, but he didn't became public until 2019.

So what's this "missing knight" about? Well as the title says. There was a knight part of the Arthurian myth, and he had been missing ever since the Middle-Ages, and he was only recently rediscovered.

Or rather, to be exact - there was an Arthurian novel centered around a knight that existed and was a famous and well-known part of the Arthurian literature in the Middle-Ages, but that completely disappeared, and was forgotten by culture (as much popular culture as the scholarly one). Until very recently.

This rediscovered novel has been a hot topic of all Arthuriana fans in Europe for a few years now - and yet I do not see much talk about this onto this website, despite Tumblr being a big place for Arthurian fans?

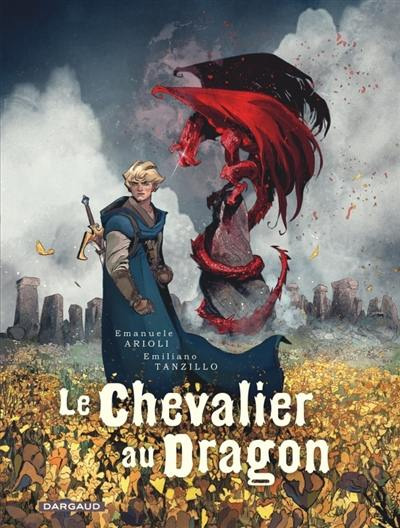

So I will correct this by doing a series of posts about the subject. And this post will be the first one, the introduction post presenting to you "Ségurant, le chevalier au dragon" ; "Segurant, the knight of the dragon". A French medieval novel part of the Arthurian literature (hence the "chevalier au X" title structure - like Lancelot, the knight of the cart or Yvain the knight of the lion from Chrétien de Troyes), the reason this story was forgotten by all medievalist and literary scholars is - long story short - because it never existed in any full manuscript (at least none that survived to this day). It was a complete story yes, with even variations apparently, but that was cut into pieces and fragments inserted into various other manuscripts and texts (most notably various "Merlin's Prophecies").

The novel and the Knight of the Dragon were rediscovered through the work of Emanuele Arioli, who rediscovered a fragment of the story while looking at an old manuscript of a Merlin Prophecies, and then went on the hunt for the other fragments and pieces scattered around Europe, until he finally could compile the full story, that he then published in 2019, at the Belles Lettres publishing house, in 2019.

Arioli reconstructed the text, and translated it in both modern French and Italian for scholarly and professional editions (aka Honoré Champion in France, a reference for universities)...

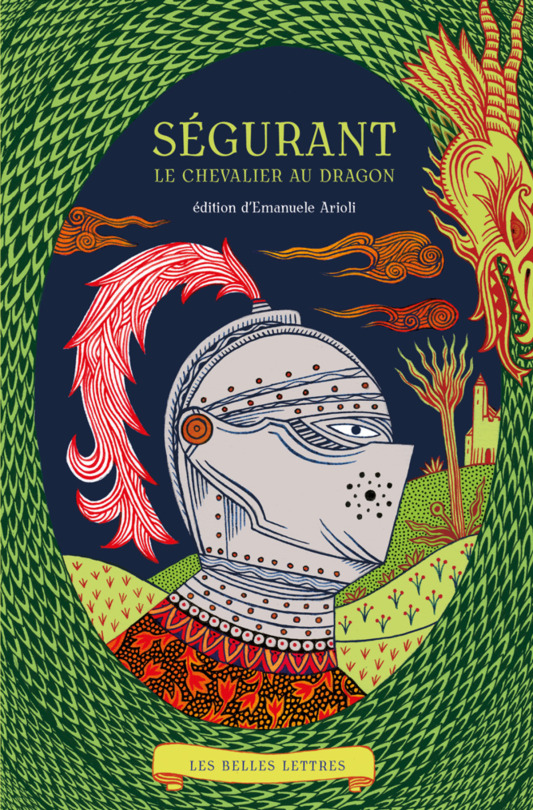

... But also for a more "all public, found in all libraries" edition - the famous 2019 edition at Les Belles Lettres.

And not only that, but he also participated to both a comic book adaptation with Emiliano Tanzillo...

... and an adaptation as an illustrated children novel!

Finally, just a few weeks, the Franco-German channel Arte released a documentary about the reconstitution and content of this missing novel called "Le Chevalier au dragon: Le roman disparu de la Table Ronde". (The Knight of the Dragon - The missing novel of the Round Table). The full documentary is on Youtube in French for those that speak the language, here. And in German here for those who speak German.

Unfortunately there is no English version of the documentary that I know of, nor any English publications of the actual text - just French and Italian. But hey, I'll try to palliate to that by doing some English-speaking posts about this whole business!

#ségurant#segurant#the knight of the dragon#le chevalier au dragon#arthuriana#arthurian myth#arthurian literature#arthurian novel#discoveries#medieval literature#arthurian legend#arthurian knights#found media#lost media#that people didn't even know was lost

308 notes

·

View notes

Text

We still see a lot of Dionysus, especially in Egypt, long after the emperor Theodosius had made Christianity the official state religion of Rome in 380. In the 400s, 500s, and 600s, Egyptians were still producing textiles like this, which shows Dionysus, holding a bunch of grapes aloft, with a satyr and maenads (his female revelers):

Here’s another, showing the god’s worshippers frolicking:

This one shows figures from the Dionysian myths — his tutor, Silenius, Pan, and some of his female worshipers:

{WHF} {Ko-Fi} {Medium}

400 notes

·

View notes

Text

"Ah, look at all the lonely people."

Pulled something real quick for this game, it's eating my brain

#firevenus art#afk merlin#magister merlin#afk journey#afk journey fanart#It's more to a doodle cuz I need to let this idea out#you're born out of the magic itself#< 10 point if you get the ref#God my fate to love this myth of a man from bbc to fantasy medieval rpg game dammit..

63 notes

·

View notes

Text

one of the reasons i object to the random assignation of words like "mythology" and "folklore" to some medieval literature (and by random i mean interchangeably and with no real consideration of what they mean) is that when you look at what gets called mythology and what gets acknowledged as literature, it's very othering, it's very noticeable that english and french material generally gets to be literature* and lit in celtic languages is folklore, and it often obscures the actual historical context of that material. in particular it obscures the literate, learned institutions that produced that literature whether courtly or ecclesiastical in favour of attributing it to some nebulous voice of the people that ignores the complex web of influences and powers that shaped those stories

if chaucer isn't folklore then a fourteenth century irish text isn't either. if shakespeare isn't folklore then a sixteenth century irish text isn't either. etc etc. the anonymity of the author does not make it any less a self consciously literary production within a learned environment with influences from classical and contemporary literature written to support political aims or to respond to contemporary events

folklore exists, and is not these texts (it does a disservice to folklore and folklorists to assume you can approach them in the same way methodologically tbh!). mythology exists, and is a difficult-to-discern thread that runs through some of these texts (i find the dindsenchas elements particularly convincing as mythological, but otherwise it's hard to identify what's what, particularly when authors are making classical allusions all the time). but what the majority of these texts are, at face value, is literature. the way that they get othered and made out to be somehow more primitive and magical just bc they're in celtic languages and (usually) anonymous really pisses me off

*arthurian material is the exception but this usually relies on some vague notion of celtic origins so it's actually the same phenomenon wearing a different hat

#oh yeah this is definitely discourse sorry#reblogs OFF replies ready to be shot on sight#there are uses of terms like myth that are more grounded and sound than these uses#they're not the ones i'm talking about#i'm talking about the arbitrary description of any and all irish literature as 'celtic mythology' and/or folklore#and like. not to vagueblog ao3 but. also ao3's garbage tag wrangling contributes to this#i will continue to stubbornly tag my shit as medieval Irish lit#it is not ancient religion and lore. it's a fucking fifteenth century text my dude

65 notes

·

View notes

Text

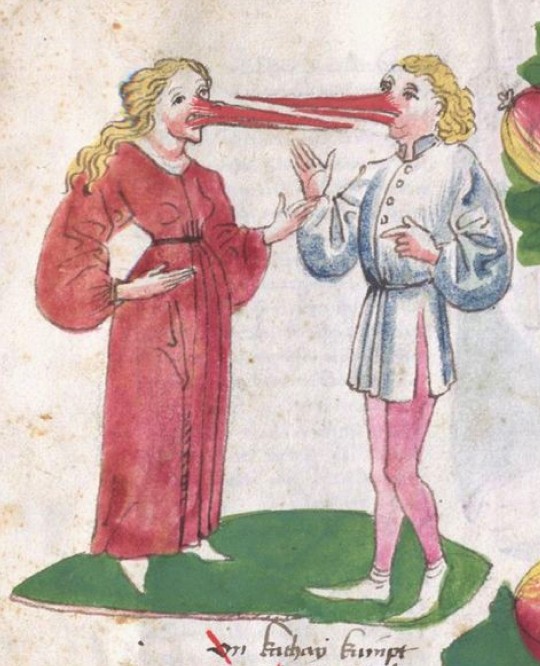

people with beaks

in "the travels of sir john mandeville", translated into german by otto von diemeringen, ca. 1470

source: Stuttgart, Landesbibliothek, Cod. theol. et phil. 2° 195, fol. 175v

#theyre supposedly living in libya if i understand it correctly#john mandeville#medieval myths#otto von diemeringen#medieval art#illumination#illuminated manuscript#medieval creatures#medievalism#bird people

21 notes

·

View notes

Text

Why the Fed wants to crush workers

The US Federal Reserve has two imperatives: keeping employment high and inflation low. But when these come into conflict — when unemployment falls to near-zero — the Fed forgets all about full employment and cranks up interest rates to “cool the economy” (that is, “to destroy jobs and increase unemployment”).

An economy “cools down” when workers have less money, which means that the prices offered for goods and services go down, as fewer workers have less money to spend. As with every macroeconomic policy, raising interest rates has “distributional effects,” which is economist-speak for “winners and losers.”

Predicting who wins and who loses when interest rates go up requires that we understand the economic relations between different kinds of rich people, as well as relations between rich people and working people. Writing today for The American Prospect’s superb Great Inflation Myths series, Gerald Epstein and Aaron Medlin break it down:

https://prospect.org/economy/2023-01-19-inflation-federal-reserve-protects-one-percent/

Recall that the Fed has two priorities: full employment and low interest rates. But when it weighs these priorities, it does so through “finance colored” glasses: as an institution, the Fed requires help from banks to carry out its policies, while Fed employees rely on those banks for cushy, high-paid jobs when they rotate out of public service.

Inflation is bad for banks, whose fortunes rise and fall based on the value of the interest payments they collect from debtors. When the value of the dollar declines, lenders lose and borrowers win. Think of it this way: say you borrow $10,000 to buy a car, at a moment when $10k is two months’ wages for the average US worker. Then inflation hits: prices go up, workers demand higher pay to keep pace, and a couple years later, $10k is one month’s wages.

If your wages kept pace with inflation, you’re now getting twice as many dollars as you were when you took out the loan. Don’t get too excited: these dollars buy the same quantity of goods as your pre-inflation salary. However, the share of your income that’s eaten by that monthly car-loan payment has been cut in half. You just got a real-terms 50% discount on your car loan!

Inflation is great news for borrowers, bad news for lenders, and any given financial institution is more likely to be a lender than a borrower. The finance sector is the creditor sector, and the Fed is institutionally and personally loyal to the finance sector. When creditors and debtors have opposing interests, the Fed helps creditors win.

The US is a debtor nation. Not the national debt — federal debt and deficits are just scorekeeping. The US government spends money into existence and taxes it out of existence, every single day. If the USG has a deficit, that means it spent more than than it taxed, which is another way of saying that it left more dollars in the economy this year than it took out of it. If the US runs a “balanced budget,” then every dollar that was created this year was matched by another dollar that was annihilated. If the US runs a “surplus,” then there are fewer dollars left for us to use than there were at the start of the year.

The US debt that matters isn’t the federal debt, it’s the private sector’s debt. Your debt and mine. We are a debtor nation. Half of Americans have less than $400 in the bank.

https://www.fool.com/the-ascent/personal-finance/articles/49-of-americans-couldnt-cover-a-400-emergency-expense-today-up-from-32-in-november/

Most Americans have little to no retirement savings. Decades of wage stagnation has left Americans with less buying power, and the economy has been running on consumer debt for a generation. Meanwhile, working Americans have been burdened with forms of inflation the Fed doesn’t give a shit about, like skyrocketing costs for housing and higher education.

When politicians jawbone about “inflation,” they’re talking about the inflation that matters to creditors. Debtors — the bottom 90% — have been burdened with three decades’ worth of steadily mounting inflation that no one talks about. Yesterday, the Prospect ran Nancy Folbre’s outstanding piece on “care inflation” — the skyrocketing costs of day-care, nursing homes, eldercare, etc:

https://prospect.org/economy/2023-01-18-inflation-unfair-costs-of-care/

As Folbre wrote, these costs are doubly burdensome, because they fall on family members (almost entirely women), who have to sacrifice their own earning potential to care for children, or aging people, or disabled family members. The cost of care has increased every year since 1997:

https://pluralistic.net/2023/01/18/wages-for-housework/#low-wage-workers-vs-poor-consumers

So while politicians and economists talk about rescuing “savers” from having their nest-eggs whittled away by inflation, these savers represent a minuscule and dwindling proportion of the public. The real beneficiaries of interest rate hikes isn’t savers, it’s lenders.

Full employment is bad for the wealthy. When everyone has a job, wages go up, because bosses can’t threaten workers with “exile to the reserve army of the unemployed.” If workers are afraid of ending up jobless and homeless, then executives seeking to increase their own firms’ profits can shift money from workers to shareholders without their workers quitting (and if the workers do quit, there are plenty more desperate for their jobs).

What’s more, those same executives own huge portfolios of “financialized” assets — that is, they own claims on the interest payments that borrowers in the economy pay to creditors.

The purpose of raising interest rates is to “cool the economy,” a euphemism for increasing unemployment and reducing wages. Fighting inflation helps creditors and hurts debtors. The same people who benefit from increased unemployment also benefit from low inflation.

Thus: “the current Fed policy of rapidly raising interest rates to fight inflation by throwing people out of work serves as a wealth protection device for the top one percent.”

Now, it’s also true that high interest rates tend to tank the stock market, and rich people also own a lot of stock. This is where it’s important to draw distinctions within the capital class: the merely rich do things for a living (and thus care about companies’ productive capacity), while the super-rich own things for a living, and care about debt service.

Epstein and Medlin are economists at UMass Amherst, and they built a model that looks at the distributional outcomes (that is, the winners and losers) from interest rate hikes, using data from 40 years’ worth of Fed rate hikes:

https://peri.umass.edu/images/Medlin_Epstein_PERI_inflation_conf_WP.pdf

They concluded that “The net impact of the Fed’s restrictive monetary policy on the wealth of the top one percent depends on the timing and balance of [lower inflation and higher interest]. It turns out that in recent decades the outcome has, on balance, worked out quite well for the wealthy.”

How well? “Without intervention by the Fed, a 6 percent acceleration of inflation would erode their wealth by around 30 percent in real terms after three years…when the Fed intervenes with an aggressive tightening, the 1%’s wealth only declines about 16 percent after three years. That is a 14 percent net gain in real terms.”

This is why you see a split between the one-percenters and the ten-percenters in whether the Fed should continue to jack interest rates up. For the 1%, inflation hikes produce massive, long term gains. For the 10%, those gains are smaller and take longer to materialize.

Meanwhile, when there is mass unemployment, both groups benefit from lower wages and are happy to keep interest rates at zero, a rate that (in the absence of a wealth tax) creates massive asset bubbles that drive up the value of houses, stocks and other things that rich people own lots more of than everyone else.

This explains a lot about the current enthusiasm for high interest rates, despite high interest rates’ ability to cause inflation, as Joseph Stiglitz and Ira Regmi wrote in their recent Roosevelt Institute paper:

https://rooseveltinstitute.org/wp-content/uploads/2022/12/RI_CausesofandResponsestoTodaysInflation_Report_202212.pdf

The two esteemed economists compared interest rate hikes to medieval bloodletting, where “doctors” did “more of the same when their therapy failed until the patient either had a miraculous recovery (for which the bloodletters took credit) or died (which was more likely).”

As they document, workers today aren’t recreating the dread “wage-price spiral” of the 1970s: despite low levels of unemployment, workers wages still aren’t keeping up with inflation. Inflation itself is falling, for the fairly obvious reason that covid supply-chain shocks are dwindling and substitutes for Russian gas are coming online.

Economic activity is “largely below trend,” and with healthy levels of sales in “non-traded goods” (imports), meaning that the stuff that American workers are consuming isn’t coming out of America’s pool of resources or manufactured goods, and that spending is leaving the US economy, rather than contributing to an American firm’s buying power.

Despite this, the Fed has a substantial cheering section for continued interest rates, composed of the ultra-rich and their lickspittle Renfields. While the specifics are quite modern, the underlying dynamic is as old as civilization itself.

Historian Michael Hudson specializes in the role that debt and credit played in different societies. As he’s written, ancient civilizations long ago discovered that without periodic debt cancellation, an ever larger share of a societies’ productive capacity gets diverted to the whims of a small elite of lenders, until civilization itself collapses:

https://www.nakedcapitalism.com/2022/07/michael-hudson-from-junk-economics-to-a-false-view-of-history-where-western-civilization-took-a-wrong-turn.html

Here’s how that dynamic goes: to produce things, you need inputs. Farmers need seed, fertilizer, and farm-hands to produce crops. Crucially, you need to acquire these inputs before the crops come in — which means you need to be able to buy inputs before you sell the crops. You have to borrow.

In good years, this works out fine. You borrow money, buy your inputs, produce and sell your goods, and repay the debt. But even the best-prepared producer can get a bad beat: floods, droughts, blights, pandemics…Play the game long enough and eventually you’ll find yourself unable to repay the debt.

In the next round, you go into things owing more money than you can cover, even if you have a bumper crop. You sell your crop, pay as much of the debt as you can, and go into the next season having to borrow more on top of the overhang from the last crisis. This continues over time, until you get another crisis, which you have no reserves to cover because they’ve all been eaten up paying off the last crisis. You go further into debt.

Over the long run, this dynamic produces a society of creditors whose wealth increases every year, who can make coercive claims on the productive labor of everyone else, who not only owes them money, but will owe even more as a result of doing the work that is demanded of them.

Successful ancient civilizations fought this with Jubilee: periodic festivals of debt-forgiveness, which were announced when new monarchs assumed their thrones, or after successful wars, or just whenever the creditor class was getting too powerful and threatened the crown.

Of course, creditors hated this and fought it bitterly, just as our modern one-percenters do. When rulers managed to hold them at bay, their nations prospered. But when creditors captured the state and abolished Jubilee, as happened in ancient Rome, the state collapsed:

https://pluralistic.net/2022/07/08/jubilant/#construire-des-passerelles

Are we speedrunning the collapse of Rome? It’s not for me to say, but I strongly recommend reading Margaret Coker’s in-depth Propublica investigation on how title lenders (loansharks that hit desperate, low-income borrowers with triple-digit interest loans) fired any employee who explained to a borrower that they needed to make more than the minimum payment, or they’d never pay off their debts:

https://www.propublica.org/article/inside-sales-practices-of-biggest-title-lender-in-us

[Image ID: A vintage postcard illustration of the Federal Reserve building in Washington, DC. The building is spattered with blood. In the foreground is a medieval woodcut of a physician bleeding a woman into a bowl while another woman holds a bowl to catch the blood. The physician's head has been replaced with that of Federal Reserve Chairman Jerome Powell.]

#pluralistic#worker power#austerity#monetarism#jerome powell#the fed#federal reserve#finance#banking#economics#macroeconomics#interest rates#the american prospect#the great inflation myths#debt#graeber#michael hudson#indenture#medieval bloodletters

464 notes

·

View notes

Text

Любица by Albina Khusainova

#fairytale#medieval fantasy#queen#princess#equestrian#my upload#silvaris#lady#woman#maiden#fairy tale#enchanting#magical landscape#fantasy#myth

79 notes

·

View notes

Text

Sneak preview:

Chapter 43 in my book 'Fake History, 101 things that never happened', about debunking history myths, is titled: "Ancient and medieval statues and buildings were always white or unpainted".

Nope, our ancestors loved colours!

My book:

94 notes

·

View notes

Text

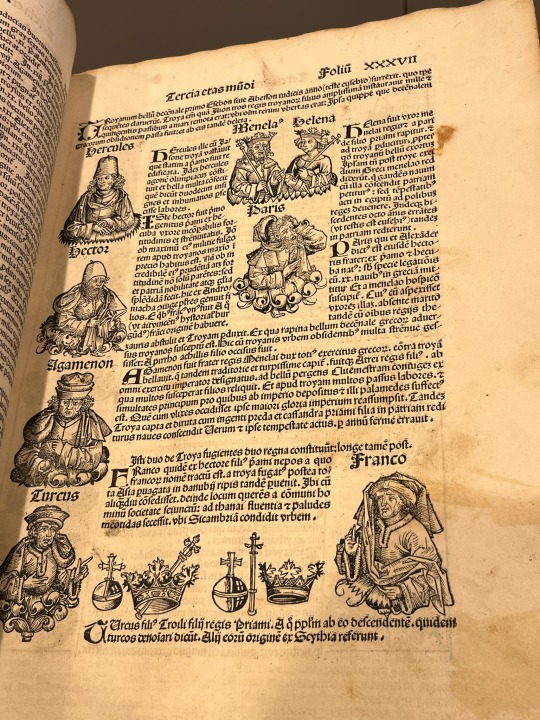

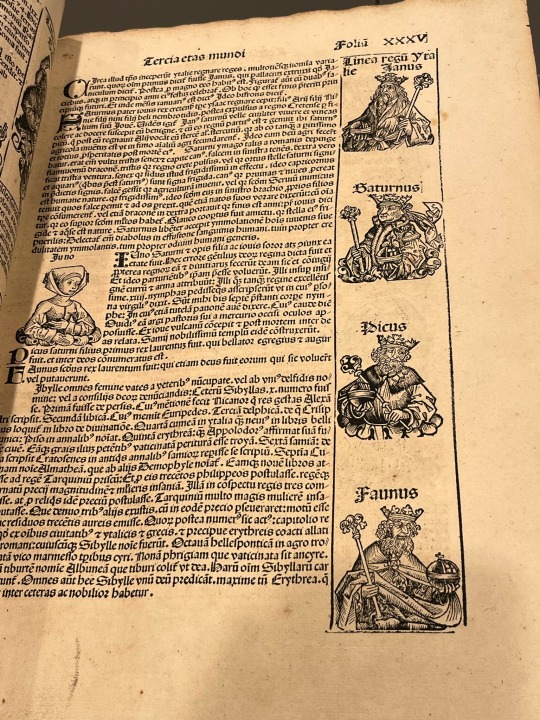

Have you ever wondered what characters from Greek mythology would look like in a medieval AU? Wonder no more:

In the first picture are Hercules on the top left, Menelaus and Helen in the middle, Paris underneath them, and Hector and Agamemnon underneath Hercules. In the second picture are Janus, Saturn, Picus, and Faunus on the right, and Juno on the left.

(This is the Nuremberg Chronicle, a fifteenth-century German incunabulum.)

#early modern#incunabula#early printed books#medieval studies#greek mythology#greek myth art#trojan war#Hercules#Heracles#Agamemnon#menelaus#helen of troy#faunus#saturnus#Juno#janus

89 notes

·

View notes

Text

James Elder Christie The Pied Piper of Hamelin. 1881. Oil on canvas: 69 × 98 cm (27 × 38 in).

#myth#pan#fairy tale#folklore#nature#pagan#mythology#art#the secret history#dark academia#forest#fantasy#trees#magic#lit#dark#medieval#plague#the pied piper of hamelin#james elder christie#🐀

53 notes

·

View notes