#megadevelopers

Explore tagged Tumblr posts

Text

Best Flats And Apartments On Sale In Siliguri, West Bengal

Buying an apartment or flats for sale in Siliguri isn't about money but the stability and security of your living. Living in their apartment is still a dream for many people. In between this dream, money plays an important role. Most of the time, people drop the idea of buying an apartment because of the pricing issue of properties. But here’s the most efficient way to fulfil your dream of buying the best property on sale. The flats and apartments for sale in Siliguri are a dreamline option for all your housing needs.

Reasons To Buy Apartments For Sale In Siliguri

Siliguri offers a consistently mild environment with the transformation of climatic changes throughout the year. Buying Apartments for sale in Siliguri would be the best choice as you can witness the scenic spot. The people who love living in the dawn of nature will enjoy the ambiance. Not just the nature lapping in the mountains but also the infrastructure stability in the city makes it the topmost place to buy a home for sale in Siliguri.

From buying houses and apartments to the 3/4 BHK Flats Available in Siliguri, it attracts businesses and people to invest or to live here with the developing infrastructure of the future.

Return On Investment Planning

According to a report, It is predicted that India’s Real Estate Business will be around $48.28 trillion by the year 2028, which would cover India’s total GDP by 12-13%. In accordance with this, the return on investment in residential and commercial property can be as high as around more than double the investment in the upcoming decade.

Not just with regular-sized houses or apartments, but the 3/4 BHK Flats for Sale in Siliguri are attracting many people to buy their desired properties in the region nowadays. To a larger extent, Siliguri is a growing real estate marketplace for ordinary people but for builders, real estate owners, etc.

Affordable Property Pricing In Siliguri

Whether you’re looking for community-based plots, authority-approved plots, east-facing corner plots, or the 3/4 BHK Flats in Siliguri, the average price per square foot in Siliguri starts from 4,125 and goes up to 16,250 per square foot for the residential and commercial properties inclusively. In a tier-II city like Siliguri, this price range makes a huge difference from the other metropolitan cities.

Diversified Benefits Of Living In Siliguri

Common benefits of living in Siliguri include the luxury spaces and the top-notch security systems in the region. Also, the cultural diversification in Siliguri creates a socialising interactive environment, which creates a sense of togetherness and belonging in the area. Economic factors like government projects are also a development prospect for the Siliguri with the accessibility of connecting it with the cross borders of four countries - Nepal, Bhutan, Bangladesh, and China along with the North-eastern states of India, which insists people have a thought to buy house for sale in Siliguri.

Conclusion

If you’ve decided to buy an apartment, 3/4 BHK flats in Siliguri, or even a normal flat on sale, then it is the right time to end your search. You can visit the best real estate companies in Siliguri that offer flats and apartments for sale at absolutely affordable prices. For example, Mega Developers in Siliguri is the prime destination for all housing needs. Whether you want to buy Flats for Sale in Siliguri or the amazing, well-maintained apartments, this can be the decisive stage for you to fulfil your dream of buying the house of your dreams. Hence, embrace your dreams by buying your favourite property in Siliguri with Mega Developers and making it a delightful living place for your family.

#realestate#megadevelopers#flats for sale in siliguri#flats in siliguri#property for sale in siliguri

1 note

·

View note

Text

Mayor Eric Adams took office pledging to cut red tape and speed up construction and development.

After three years in office, prosecutors overseeing three separate indictments say his administration has been doing just that — for a price.

Adams’ longtime top aide Ingrid Lewis-Martin is the latest member of the administration to face accusations of greasing the wheels of city government in exchange for cash or gifts. Adams faces similar allegations involving bribes from the Turkish government. The mayor’s first buildings commissioner is also accused of accepting bribes in exchange for expediting inspections. Taken together, the indictments allege that corruption is alive and well in New York City real estate – and touching the highest levels of local government.

On Thursday, Manhattan District Attorney Alvin Bragg alleged Lewis-Martin urged then-acting Buildings Commissioner Kazimir Vilenchik to approve plans for a rooftop bar near Herald Square on Dec. 8, 2022. Two days later, prosecutors say, she told Vilenchik to “assist” with a separate construction project, this time at a hotel on Rivington Street, that had been halted by the buildings department.

Lewis-Martin and her son received more than $100,000 for the assistance from real estate investors involved in both projects, prosecutors said. Lewis-Martin, her son and the investors all pleaded not guilty.

“I’ve worked in government for over 35 years,” Lewis-Martin said. “I have never taken any gifts, money, anything.”

Outside the courthouse on Thursday, her attorney Arthur Aidala said she was merely following through on Adams’ campaign pledge to be a friend to the business community.

“She helped a constituent. She helped a citizen navigate the thick red tape of city government,” Aidala said. “What she was doing here was just moving things along.”

But John Kaehny, executive director of the good government group Reinvent Albany, called the allegations “stunning” and part of a pattern.

“That fact that she was allegedly not afraid to order the DOB commissioner to do things on multiple occasions is not a good sign because it speaks to a culture of corruption,” Kaehny said.

The charges come two years after a task force convened by Adams issued 111 recommendations to “cut red tape, streamline processes, and remove administrative burdens.” Bribing city officials was not among them.

“The more difficult and time-consuming it is to get permits to do lawful things — such as constructing a building — the more likely it is that someone will be eager to break the rules to find a shortcut,” said Citizens Housing and Planning Council Executive Director Howard Slatkin, a former city planning administrator.

Adams himself is accused of pressuring the former fire commissioner, Daniel Nigro, to get inspectors to approve the fire safety system at a Turkish consulate building despite their concerns so it could open in time for a visit from that country’s president, Recep Erdogan. Federal prosecutors say Adams made the move after receiving luxury travel perks from Turkish officials and businesspeople tied to the Turkish government.

In the same indictment, prosecutors said the buildings department lifted a partial stop-work order at a stalled condo complex in Brooklyn days after the project developer reached out to Adams and asked for help. Prosecutors say the developer funneled $10,000 in illegal contributions to Adams’ mayoral campaign.

Adams has pleaded not guilty and accused the Department of Justice of political retribution for his criticism of President Joe Biden.

But evidence has emerged that the Adams administration codified a policy of streamlining inspections and approvals for favored donors and megadevelopers. Emails obtained by Gothamist last year reveal how City Hall instructed inspectors to usher select projects to the front of the months-long line for fire safety inspections — at times cancelling scheduled inspections of schools and small apartment buildings.

Prosecutors say two fire chiefs then used that list to mask their own illegal side hustle. One pleaded guilty to slipping projects onto the list after receiving bribes from expeditors hired by the building owners.

The buildings commissioner also allegedly got his cut.

In 2023, Bragg charged former Buildings Commissioner Eric Ulrich with receiving $150,000 in gifts from business people and associates in exchange for favors, like expediting inspections, helping lift a vacate order and attempting to clear a homeless shelter.

Ulrich has denied the allegations, which are unrelated to the Lewis-Martin indictment. He declined to comment. City Hall did not respond to an inquiry.

Lewis-Martin stepped down from city government this past weekend. Prosecutors say she hinted at the decision in a June phone call with a real estate agent working with her son and one of the investors charged with giving her bribes.

“I’m not playing. Your sister has to be rich! I’m gonna retire,” Lewis-Martin said, according to court papers.

3 notes

·

View notes

Text

Seattle Megadeveloper Hit Again, Two Towers on Ice

Project Delays Impact Seattle's Ambitious Development PipelineSeattle's ambitious development pipeline is under increasing pressure from various economic challenges. Over 34,000 potential housing units are at risk as more than 3,000 projects face delays and regulatory issues.The construction industry is still dealing with the legacy effects of the pandemic. These effects have disrupted project timelines throughout the city. As rising labor and material costs hinder development, developers are unable to meet growing demand, exacerbating market scarcity.High interest rates and persistent inflation add to these challenges. Developers are experiencing financial strain as they navigate a volatile market.Regular updates to the Seattle Building Code create additional regulatory hurdles. These updates require significant redesigns for ongoing projects when permits expire. The city is considering a two-year extension on existing permit applications to help developers avoid costly redesigns.Legal disputes over zoning modifications create more uncertainty. This further complicates planning initiatives in the development sector.Infrastructure delays, like those affecting the I-5 Revive Project, show broader municipal challenges impacting private developments.Despite some increase in housing market activity, these factors continue to undermine Seattle's development efforts.Financial Pressures Force Major Developers to Halt Construction PlansTightening credit markets and soaring construction costs are having a significant impact on Seattle's largest residential developers. They are abandoning projects worth hundreds of millions of dollars. The recent housing market decline in March 2025 has exacerbated economic uncertainty, adding to the challenges faced by the industry. This marks the most severe construction halt in the city's recent history. Financial constraints have reached critical levels as lenders impose stricter standards. They also demand higher equity commitments from developers.Construction costs continue climbing due to persistent material inflation and labor shortages. Meanwhile, elevated interest rates are slashing profit margins on new developments. Developer strategies now focus on survival rather than expansion.They are extending project timelines to avoid costly redesigns under new building codes. There are strategic pauses on marginal developments until market conditions stabilize. Capital is concentrated in proven high-return submarkets like Bellevue and Redmond. The region's ambitious Sound Transit 3 expansion, approved by voters in 2016, will eventually bring light rail connections to these outlying areas.Aggressive value engineering is used to reduce construction expenses through design modifications. The construction finance squeeze has triggered a 60% year-over-year decline in new multifamily starts.Investment capital increasingly flows toward Southern metros. This leaves Seattle developers scrambling for increasingly scarce funding sources.Housing Supply Crisis Worsens as Megaprojects Face Extended TimelinesSeattle's housing shortage has reached catastrophic proportions. Megadevelopers are retreating from commitments, leaving an already inventory-starved metropolitan area facing a bleaker supply outlook.The Seattle-Tacoma-Bellevue region struggles with a deficit of 71,060 homes. This represents 4.2% of the total housing stock. Extended construction timelines mean these shortages will persist for years.Major developments face indefinite postponements. Developers are burdened with limited financing options and volatile market conditions. High construction costs and regulatory complexity compound delays.Class B and C properties show significant potential for growth despite current market challenges, as shown by rental markets like Atlanta that have managed to thrive.Seattle's ambitious social housing initiative aims to build 2,000 units over a decade. However, current production rates drastically fall short of demand.

Community feedback reveals growing frustration.Promised developments are vanishing from construction schedules. Market-driven barriers continue to undermine large-scale projects. This persists despite Washington state's 2023 upzoning law.Developer risk assessment has shifted dramatically. Unstable conditions prompt widespread project suspensions across the metropolitan area. The future outlook remains uncertain.Market Conditions and Regulatory Challenges Stall High-Rise DevelopmentsInvestor confidence is showing signs of recovery in Seattle's core markets. However, high-rise development projects are facing significant obstacles from regulatory complexity and volatile financing conditions.High interest rates have led to a market correction. This correction has dramatically slowed the development pace across the region.New rent control measures at the state level compound existing regulatory hurdles for developers. Seattle's constrained housing supply is partly due to tight zoning regulations.These regulations create barriers for large-scale projects. South Lake Union faces oversupply challenges due to high condo density and ongoing construction activity.Development trends show buyer preferences are shifting. There is a notable movement away from downtown high-rises toward suburban alternatives.The median multiple continues to rise, signifying a worsening affordability crisis, affecting development strategies and housing market stability.The regulatory environment highlights four critical challenges:Zoning complexity restricts project scope and limits flexibility.State-level rent control creates uncertainty for rental developments.Financing volatility delays project approvals and groundbreaking efforts.Permitting delays extend development timelines noticeably.Cap rate compression of 30 basis points indicates renewed confidence in downtown Seattle. However, regulatory uncertainty continues to hinder the advancement of megaprojects in the metropolitan area.This ongoing uncertainty stifles progress despite some positive market signals. High-rise developments, therefore, remain stalled amidst these challenges.AssessmentSeattle's development sector is facing cascading delays, highlighting broader structural challenges. These issues threaten the region's growth trajectory.Market volatility, regulatory bottlenecks, and financing constraints are squeezing major developers. These challenges are affecting multiple projects across the area.Setbacks are compounding existing housing shortages. This creates ripple effects through construction employment and municipal revenue streams.Industry observers warn that prolonged project suspensions could reshape Seattle's skyline ambitions. Affordable housing delivery timelines could be affected for years ahead.

0 notes

Text

Saudi Arabia’s The Line—a horizontal megadevelopment that was planned to house more than 9 million people in a 105-mile-long strip across the desert—may be reduced to a dash. Last month, The Guardian and Bloomberg CityLab reported a massive scaling back of the development’s footprint: By 2030, a completed segment of The Line is now predicted to house just 300,000 people and be less than 1.5 miles long.

Dammit, when I read the headline, my immediate reaction was “haha, can we start calling it the dashed Line now?” But the article beat me to it. I guess some jokes just write themselves.

1 note

·

View note

Text

[ad_1] OceanLand Investments booted Compass from its deliberate Fort Lauderdale condominium, greater than a yr after launching gross sales. The Fort Lauderdale-based developer, led by founder and CEO Jean-Francois Roy, introduced in OneWorld Properties to take over advertising the 96-unit waterfront Sixth&Rio growth, in accordance with a press launch. Roy first launched gross sales within the fall of 2022 with Compass. Roy initially deliberate the mission at 501 Southeast Sixth Avenue as a rental constructing, however pivoted after development prices had been larger than anticipated. Compass declined to touch upon the change in gross sales groups. The mission is at present 25 % presold, in accordance with OneWorld founder and CEO Peggy Olin. Renders of the Sixth&Rio condos in Fort Lauderdale (Ocean Land Investments) “We hope to get to the 50 % threshold shortly,” she mentioned. Flooring plans at Sixth&Rio will embody one-, two-, three- and four-bedroom choices, and costs are nonetheless within the $900,000 to $2 million vary, Olin confirmed. The constructing could have a health heart, membership room, co-working house, espresso and wine bar, and a rooftop pool with personal cabanas, in accordance with the discharge. Development is predicted to be accomplished in 2026, Olin mentioned. Her agency is focusing on patrons who're downsizing and Northeasterners searching for a second residence, she mentioned. “[These buyers] do not essentially must have their bigger properties,” she mentioned. In relaunching gross sales for Sixth&Rio, Olin mentioned his crew is targeted on selling the mission's facilities and growing consciousness among the many dealer group, notably in Miami-Dade County. “A few of the patrons coming into Fort Lauderdale are folks getting priced out of Miami,” she mentioned. Olin mentioned she sees power within the Fort Lauderdale market, pointing to Associated Group's deliberate 45-story, 163-unit Pninfarina-branded condominium that launched gross sales in October. Costs for the tower begin at $1.6 million. Since that gross sales launch, Tavistock additionally launched gross sales of its deliberate luxurious apartment mission, Indigo, at its Pier Sixty-Six megadevelopment. Costs for the 30 items begin at $5.5 million. Tavistock's billionaire founder Joe Lewis pleaded responsible to insider buying and selling final month. [ad_2] Supply hyperlink

0 notes

Photo

AP News

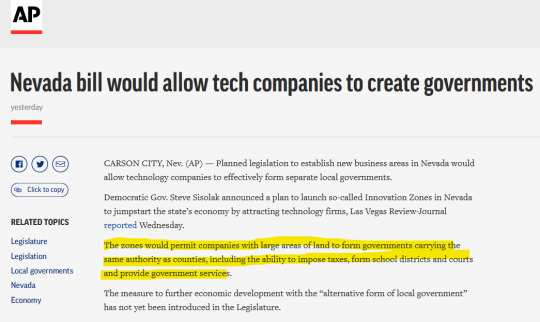

CARSON CITY, Nev. (AP) — Planned legislation to establish new business areas in Nevada would allow technology companies to effectively form separate local governments.

Democratic Gov. Steve Sisolak announced a plan to launch so-called Innovation Zones in Nevada to jumpstart the state’s economy by attracting technology firms, Las Vegas Review-Journal reported Wednesday.

The zones would permit companies with large areas of land to form governments carrying the same authority as counties, including the ability to impose taxes, form school districts and courts and provide government services.

The measure to further economic development with the “alternative form of local government” has not yet been introduced in the Legislature.

Company towns have existed in the US before, often collapsing when the industry owner’s business declined and then the whole town’s wages would decline with no change in rent or cost of living. They still exist in new forms like mega-developments or planned cities, where a few large companies control the whole development of the town, sometimes establishing its government too. This is hardly different from normal American cities, where local and state governments are created to cater to business and where representatives are chosen delegates of major local industries.

This the trajectory of American development that will not be curbed until there is a major redistribution of wealth from the rich to the poor, workplaces are democratized through unions and socialism, and the American public consciousness of government shifts to understand that pro-business measures are against their well being.

#ap news#nevada#tech companies#government#silicon valley#megadevelopment#urban planning#company towns#pullman#socialism#democrats#photo#political cartoon#2.5.21

105 notes

·

View notes

Photo

Mega-development a bad shift for Bayside

Steve Striffler, Special to the Reporter

Last September, the real estate developer Accordia Companions LLC submitted designs to the Boston Organizing Development Company (BPDA) to produce “Dorchester Bay City” (DBC), a mixed-use job featuring almost 6 million square toes of new building –roughly the dimensions of two Empire State Structures on land situated among the JFK/UMass prevent, Harbor Place, and Carson Beach front.

The proposal is a brash endeavor to occupy the city’s very last considerable piece of waterfront and displays the point that Boston’s city development product has lengthy favored developers at the expense of regional communities.

The proposal would be problematic below any situation, but it is inexcusable in a calendar year that saw phone calls for racial justice sharpen as a pandemic-pushed disaster worsened inequality. If 2020 taught us anything, it is that any dialogue about racial justice in Boston have to confront a housing disaster that can make living in the town unaffordable for so numerous. However, DBC represents enterprise as typical, promising to intensify racial and financial inequality rather of lessening it.

It has woefully insufficient cost-effective housing, whilst paying out no notice to its possible affect on housing prices in a unusual location of the town still populated by a diverse performing class whose vast majority remains individuals of coloration. It appears to be destined to exclude operating Bostonians from its confines, though serving to displace citizens of Dorchester as its rent-intensifying influence gentrifies the region.

It is also a transportation nightmare. With little problem to transit concerns, DBC would include more than 1,700 housing units (and substantial retail business office room) to an location that faces some of the region’s worst transit issues. Bostonians would not only be financing transit upgrades, nonetheless they will also probable be on the hook for a considerable portion of the general public subsidies needed to safeguard the development from local climate transform connected to sea-degree increase.

In fact, at 1st look, DBC seems just like an additional instance of personal interests driving gentrification. Yet, DBC not only relies on community coffers, but it also will occupy general public land owned by the College of Massachusetts Constructing Authority. This will make the lack of neighborhood-making institutions like colleges, daycares, senior facilities, and libraries all the extra troubling, and suggests that this “city” is for experts for whom “public” area suggests high-close espresso retailers and dining places. Think Seaport District.

Accordia has minimal community voices by keeping hugely orchestrated meetings to ostensibly get the community enter demanded for acceptance. In fact, the developer has shared little meaningful facts with hand-picked local community organizations that have been predisposed to help the project. All the though, the BDPA facilitated the “vetting” system while UMass Boston appears to be like to accumulate hundreds of millions of pounds though washing its palms of any duty for a venture that will reshape the area.

Accordia has its impressive ducks in a row, which has served to mainly silence grassroots opposition.

With metropolis powerholders lining up guiding deep-pocketed builders, “community input” (at finest) permits the working persons whose houses and livelihoods are at stake the skill to get in front of the development steamroller and negotiate the best possible terms of their defeat.

No just one is suggesting that DBC really should be stopped, or even that publicly controlled development really should serve the people of Boston rather of facilitating the upward distribution of prosperity. That would be also substantially to anticipate from a rigged method.

What we want from a minute defined by racial justice and financial inequality is a modicum of regulation in purchase to shape development in techniques that provide Bostonians. We require neighborhood engagement and state intervention that will enhance very affordable housing, gradual displacement, deliver top quality work, aid local community, and create other general public merchandise that will have minimal influence on the developer’s pocketbook, but will (possibly) slow the raising level of inequality that threatens the pretty fabric of Boston.

The author, a resident of Dorchester, teaches at UMass Boston and is the co-editor of “Organizing for Electrical power: Creating a Twenty-Initially Century Labor Movement in Boston.”

0 notes

Text

This could be the year of the megadevelopment for Chicago, altering the skyline forever

CHICAGO - Almost a decade into a real estate development boom, commercial property owners face some obstacles that could derail this year's momentum. Nationally, there are signs of economic uncertainty, including a wobbly stock market. Locally there also is political… This could be the year of the megadevelopment for Chicago, altering the skyline forever

0 notes

Link

“I’ve visited the construction site several times, and circled it many more, watching the towers lumber toward the sky and this improbable mirage take shape. Now, as workers rush to lay the final paving stones and finish wiring the lights, I tour it with Jay Cross, the project’s hands-on chief. I am in awe of the sheer managerial omniscience that allows Cross to grasp, predict, and control every aspect of construction, from the colossal to the picayune. Even if the whole East Coast goes dark, he tells me, the site’s co-generation plant will kick in within milliseconds, so that multimillion-dollar electronic transactions can continue whizzing around the globe without a hiccup. When the rains come and the waters rise, submarine doors will close around elevator machinery and fuel tanks. This shining city on a deck is built to withstand a wide range of plagues.”

. . .

“In this West Side Westworld, every aspect of the experience is curated by an unseen hand. Everything is engineered to suck passersby onto the property and keep them there, spending money, as long as possible. There are no storefronts in this version of New York, only indoor pathways through the seven-story shopping center. Visitors can browse at Van Cleef & Arpels as they wait for their table at Thomas Keller’s TAK Room or their time slot on the observation deck. For many office workers, the shortest distance from subway to desk leads past Tiffany.”

“It’s possible to live a full and varied life here — to sleep, put in an hour at the gym, bring the kids to school, drop the dog off at day care, go to the office, shop, eat out, visit a museum, and catch a show — without so much as crossing the street. That kind of total-service completeness has been a goal of smart-growth urbanists for many years, but it’s one thing to apply those aspirations to a semi-citified development around a suburban transit station, in the hope that it won’t go dead after rush hour. It’s a very different, and more disquieting, achievement to create a high-rise district on a plinth so sealed-off and yachtlike that nobody need ever leave.”

. . .

“In my more dyspeptic moments, I wonder what Hudson Yards portends for New York’s future. Today it feels like the last spasm of the Bloomberg era, seductive and smooth and substantial, the home of some finely provocative art but fundamentally a grand gift of urban space to the global elite. Will it become a bastion of a Gilded Age that has already started to wane or the unavoidable model for the next megadevelopment and the one after that? Already the city keeps ratcheting up its scale. Today’s supertall towers are being overtaken by even bigger ones. Lessons learned at Hudson Yards, if any, will be applied at Sunnyside Yard, which is seven times the size. These thoughts lead to darker questions: Is New York ballooning into oblivion? If you don’t know how to code or what private equity actually is, does that mean your choices are panic, despair, or flight? These musings seem almost reasonable when the new skyline glowers overhead. But then my mind drifts back to the alien separateness of Hudson Yards, and it occurs to me that could be its saving grace. Those who feel pushed away by it will never go there. It will keep hovering 25 feet above the street, a spaceship that hasn’t committed to landing, while the rest of the city scrambles on, peculiar and perpetually discontented, sending its chorus of sirens and grumbles up to the party on the 101st floor.”

#actual literal cyberpunk dystopia#like FOR REAL#you know how leftists have been saying that the ultra-wealthy#are going to just straight up buy their way out of dealing with climate change?#well here we fuckin are!#new york magazine#climate change#capitalism#new york city

7 notes

·

View notes

Photo

Moshe Safdie's Chongqing megadevelopment—featuring the world's highest, tower-spanning sky bridge—reaches structural completion https://arcnct.co/2SqbjAD

1 note

·

View note

Text

Top Construction Company in Siliguri, West Bengal India

Get the top builders in Siliguri, Mega Developers are here to provide the finest lands according to your requirements. Whether you need to purchase land, apartments, or buildings for office spaces, we ensure you get the properties within your budget. As the best provider of real estate in Siliguri, our expert agents provide you with your businesses like shopping malls, commercial stores, office buildings, medical centers, hotels, and spaces for commercial activities. If you are looking for personal living spaces like houses, villas, apartments, rented homes for individuals, etc. Connect with Mega Developers, the best construction company in Siliguri for the best living spaces. Investing in your desirable properties is always beneficial for your future. We also provide commercial property for sale in Siliguri, which gives the best flexible option to purchase the land within your budget.

1 note

·

View note

Text

Catholic Megadevelopment VERITATIS SPLENDOR is long on rhetoric, short on details

Catholic Megadevelopment VERITATIS SPLENDOR is long on rhetoric, short on details

Bishop Joseph Strickland, the outspoken shepherd of the diocese of Tyler, Texas, is promoting a gargantuan new planned Catholic community called Veritatis Splendor. The proposed compound will cover nearly 600 acres and will include “a grand oratory and seven institutes of truth.” It aims to eventually become home to dozens of Catholic families who can live, worship, and go to school together, as…

View On WordPress

#Bishop Strickland#community#diocese of baton rouge#Diocese of Tyler#Kari Beckman#legal cases#Lisa Wheeler#planned community#Regina Caeli Inc#texas#Veritatis Splendor

0 notes

Text

[ad_1] Apple will open at Miami Worldcenter, confirming months of hypothesis that the tech large is on faucet on the mixed-use megadevelopment. The shop leased a one-story, 15,000-square-foot constructing that's beneath development on a 0.4-acre lot at 725 Northeast First Avenue, in line with data. An entity tied to Miami Worldcenter builders Nitin Motwani and Artwork Falcone filed a discover of development graduation in November. The shop measurement was revealed in an settlement between the builders and Miami-Dade County for water and sewer connections for the constructing. Miami Worldcenter Associates, led by Motwani and Falcone, in partnership with CIM Group, is the grasp developer of the $6 billion advanced that spans 27 acres on the intersection of downtown Miami and town's Park West neighborhood. Apple didn't return a request for remark, and Miami Worldcenter declined remark. The lease will mark the sixth Manzana retailer in Miami-Dade County. The Silicon Valley-based agency additionally has outposts at Brickell Metropolis Centre, Miami Seaside's Lincoln Street, Aventura Mall, Dadeland Mall and The Falls, in line with Apple's web site. Industrial Observer first reported the Apple lease at Miami Worldcenter. Miami Worldcenter It has a complete of 300,000 sq. toes of retail, together with an 80,000-square-foot glass-encased Jewel Field constructing throughout the road from the longer term Apple retailer. Roughly 98 p.c of the retail house is leased, in line with a Miami Worldcenter spokesperson. Nick Jonas' and menswear designer John Varvatos' Villa One Tequila Gardens took practically 12,300 sq. toes of rooftop house on the Jewel Field. The restaurant will open subsequent yr. Additionally on faucet is Rihanna's lingerie model Savage 3,000-square-foot retailer on the accomplished Paramount condominium tower. Restaurant Juvia, which closed its rooftop outpost on Lincoln Street final yr, will reopen in a 15,900-square-foot house by yr ends on the twelfth ground at 652 Northeast Second Avenue inside Miami Worldcenter. [ad_2] Supply hyperlink

0 notes

Text

INDY Primer: Amazon Gives Raleigh a Rose [2018/01/19]

As always, you can check out the web-browser version of this newsletter here.

---

1. AMAZON GIVES RALEIGH A ROSE, SENDS US TO THE NEXT ROUND.

THE GIST: There’s something surreal about watching cities all over the country prostrate themselves before Amazon, acting like this is some sort of reality show — a high-stakes, corporate The Bachelor, perhaps — offering millions of dollars in incentives in hopes of landing HQ2. Of course, there’s a reason they’re doing so: the second Amazon headquarters could be an economic game-changer that brings some fifty thousand well-paying jobs and billions of dollars of investment into the area. More than 230 cities and regions in the U.S., Mexico, and Canada bid on HQ2, including four in North Carolina. Some promised huge perks for the internet titan: Newark offered $7 billion in incentives; a city in Georgia offered to rename itself “Amazon.” There were high-gloss presentations and expertly crafted videos touting regional amenities. But yesterday, Amazon narrowed its options by 90 percent, from 238 to just 20. And the only one left standing in North Carolina is Raleigh. [INDY]

“The Triangle region of one of 238 cities in 43 states to submit bids to Amazon last year. And while ours didn’t spell out potential incentives — officials told the INDY that they’d propose an incentive package if they made the first cut, which has apparently happened — many of the others did. According to Wake County Commissioner Matt Calabria, county leaders and economic development officials have discussed what an economic inventive package might look like, but those conversations have happened in closed session, which means he’s not allowed to talk about them. The county does have a standard economic inventive package and a headquarters provision that could unlock more dollars for Amazon, but it’s unclear right now what else local governments might pitch in.”

“Raleigh’s biggest draw, [Calabria] says, is its highly skilled, highly educated workforce, which is a key driver in luring companies to the region. In September, after Amazon announced its RFP process, The New York Times’s Upshot blog predicted that the Triangle’s underdeveloped mass transit system would be its undoing in its bid for the $5 billion project. That story labeled Denver the frontrunner.”

From the N&O: “Research Triangle Regional Partnership, an association of economic development agencies, submitted seven sites for Amazon to consider. The group wouldn’t say where the sites are in the region. Thursday’s announcement didn’t indicate if the company was looking specifically at a site in Raleigh or if that was part of the larger Triangle proposal. … The Triangle has received consistently high marks from analysts who have been handicapping the contest to land the Amazon project, except for its mass transportation system. On Thursday, Davidson College Economics professor Fred Smith said the lack of a transit system could hurt the area as Amazon narrows the field even further. … [Raleigh Mayor Nancy] McFarlane, however, said that lagging behind in transit could help bring the project here because the region is in the early stages of a countywide plan that could be shaped to accommodate Amazon.”

Charlotte did not make the cut, much to its leaders’ dismay [Charlotte Observer]: “‘I am absolutely flabbergasted that Charlotte didn’t make the list,’ said Charlotte City Council member Tariq Bokhari, who helped lead a group called Hivestorm with the Carolina Fintech Hub to support the Amazon bid. ‘If you had said five cities were on the shortlist and Charlotte wasn’t one of them, I’d say, Alright, I guess I understand that. … Something’s wrong here.’”

WHAT WE KNOW: RTRP has given Amazon seven options for placement, but we don’t know where most of them lie. One comes from Raleigh megadeveloper John Kane, who is offering a “Prime” corridor (get it?), which extends from Dix Park through the Warehouse District and out to Midtown, a massive stretch that would revolutionize downtown. [WRAL] Kane doesn’t know if his proposal is the one Amazon is considering.

WHAT WE DON’T: RTRP has been mum on the question of financial incentives, which will probably be a huge factor in Amazon’s decision. When Raleigh first submitted its bid, we were told that the package didn’t talk about incentives, and that would come later on. Yesterday, Calabria told me there have been closed-session meetings with economic developers about incentives, though he couldn’t talk about them. Wake County does have some standard incentive packages that would apply, though there’s talk of going bigger; in addition, Durham and Durham County could chip in as much as $50 million, the N&O reported in November.

SOMETHING TO CONSIDER: At first blush, this seems like a pretty good deal for the region, and most of the region’s elites are stoked about the revolutionary potential of HQ2. After all, these won’t be warehouse gigs, places where Amazon is sometimes accused of exploiting its workforce [Salon]. This will be white-collar all the way, with six-figure salaries aplenty. Which is why you’ll see lots of stories like this one, from the N&O’s David Menconi, basically begging Amazon to move here. But there could also be a downside we’re not talking about.

From Business Insider: CEO Jeff Bezos said HQ2 will be equal in size to Amazon's current headquarters in a Seattle neighborhood locals now call Amazonia. Since the late 1990s, the company has grown from a small set-up in Bezos' garage into a global e-commerce giant. … Many city leaders are optimistic about the thousands of jobs Amazon claims HQ2 would create. But some residents worry that it would also spur the same problems that Seattle has seen since Amazon arrived: increased traffic, soaring housing prices, and prolonged construction.”

“James Thomson, an ex-head of Amazon Services (the division that recruits sellers to the company's marketplaces), told the Toronto Star that inviting an Amazon HQ comes with risks. ‘The expense is a trade-off against schools, infrastructure, health care, etc.,’ he said. ‘Can Toronto support 50,000 high-net earners who all want nice homes, nice restaurants, easy commutes, etc.? Amazon is NOT a fan of unions or regulation.’ As of bid day, 73 community organizations across 21 states [including the N.C. Justice Center and N.C. League of Conservation Voters] have signed an open letter to Bezos listing several concerns around a possible HQ2 in their cities, including out-of-state hiring, lack of investment in transportation infrastructure, unaffordable housing, and gentrification.”

“Their worries about higher rent prices are not unfounded, according to a recent report from the real estate website Apartment List. The site made a few predictions about HQ2's potential impact on housing prices in 15 major cities, based on historical home-building statistics and data from the US Census and Bureau of Labor Statistics. According to the report, the metro areas with the highest rent increases would include Raleigh, North Carolina (1.5% to 2% annually); San Jose, California (1% to 1.6%); Pittsburgh, Pennsylvania (1.2% to 1.6%); and Baltimore, Maryland (1% to 1.3%).”

WHAT IT MEANS: There are two big questions to keep in mind as this deal moves forward. The first is whether the region’s lack of decent mass transit will effectively derail the bid, or whether the Triangle’s promise to design its transit expansion around Amazon’s needs will overcome those concerns. (It’s also a little unsettling that the city’s solution to this deficiency is to design a billion-dollar mass transit project around one corporation’s whims.) The second is whether Raleigh is equipped to handle what HQ2 would mean. There’s no getting around the fact that the project would drive up housing prices, especially in the urban core. It would exacerbate gentrification and the economic divide and likely do little for lower-income communities while luring lots of workers from out of state. Which isn’t to say that I don’t think Raleigh should pursue this bid; the economic benefits could be momentous. But it’s important to keep our eyes open to the realities of what Amazon will mean.

---

2. THE SUPREME COURT STAYS N.C. GERRYMANDERING DECISION.

THE GIST: Remember last week, when a federal district court ruled that the N.C. General Assembly’s congressional districts — redrawn in 2016 after the original districts were slapped down as racial gerrymanders — were unconstitutional partisan gerrymanders and lawmakers needed to quickly redo the districts one more time ahead of the 2018 midterms? Never mind that — at least for now. [N&O]

“North Carolina lawmakers will not have to draw new congressional election districts by next week, and voters across the state could go to the polls in the coming year to elect its 13 members of Congress from districts that three judges have found to be unconstitutional. The U.S. Supreme Court issued an emergency stay of a partisan gerrymandering ruling that was the first of its kind for congressional districts. The order, released on Thursday night, is two paragraphs long announcing the court’s agreement to halt a three-judge panel’s ruling from last week in which North Carolina’s 13 congressional districts were ruled unconstitutional partisan gerrymanders that violated free speech and equal protection rights provided in the U.S. Constitution.”

“The three-judge panel’s ruling was the first time federal judges have struck down congressional districts as partisan gerrymanders. A Wisconsin case that was argued before the U.S. Supreme Court late last year involves state legislative districts found to be partisan gerrymanders. … In North Carolina, [Judges] Wynn and Britt also found that the 2016 redistricting plan designed to give Republicans wins in 10 of the 13 districts also violated the free speech of the challengers by trying to weaken the voices of Democrats with whom they did not agree. [Judge] Osteen dissented from his colleagues on that point, but agreed overall that the maps were unconstitutional.”

“The court did not indicate whether the case would be resolved by the 2018 elections. Candidate filing for the elections in the coming year opens on Feb. 12. … Republican lawmakers urged the panel of judges to stay its ruling while the Supreme Court considered partisan gerrymandering cases from Wisconsin and Maryland.”

WaPo: “The practical effect is that this year’s elections will almost surely be conducted under the 2016 boundaries, in which Republicans hold 10 of the 13 congressional seats. The GOP domination’s of the congressional delegation belies North Carolina’s recent history as a battleground state. It has a Democratic governor and attorney general, who have declined to defend the maps. … The Supreme Court has never thrown out a state’s electoral district map because of partisan gerrymandering. It has two cases on its docket that will decide just that question — but they are unlikely to be resolved in time to affect any plan to redraw the North Carolina districts.”

WHAT IT MEANS: The Supreme Court’s intervention isn’t exactly a surprise. The North Carolina was marked the first time a court had struck down congressional maps on the grounds of explicit political gerrymandering designed the rig the election in favor of the party in power — which is the case in North Carolina, undeniably. Since the court is already dealing with two cases of partisan gerrymandering, and the questions of whether it’s permissible and under what circumstances, there’s good reason for the court to be suspicious of quickly redrawing boundaries ahead of an election later this year. That being said, however, that also means this year’s congressional elections will take place in districts explicitly designed to give Republicans a 10–3 advantage, no matter what the voters think.

---

3. THE FEDS’ SHUTDOWN SHOWDOWN.

THE GIST: Last night, the U.S. House passed a resolution to keep the federal government open until mid-February and fund the Children’s Health Insurance Program for six years, while delaying some taxes imposed by the Affordable Care Act. This was a nail-biter for GOP leadership, who had to give out last-minute concessions to get the far-right Freedom Caucus on board. But the real drama is in the Senate, where there doesn’t seem to be the votes — not only the sixty needed to overcome a filibuster, but even fifty to obtain a majority. [NYT]

“In the Senate, at least about a dozen Democratic votes would be needed to approve the measure, and there was little chance that those would materialize. Democrats are intent on securing concessions that would, among other things, protect from deportation young immigrants brought to the country illegally as children, increase domestic spending, aid Puerto Rico and bolster the government’s response to the opioid crisis.”

WaPo: “By Thursday evening, nine Senate Democrats who had voted for a prior spending measure in December said they would not support the latest proposed four-week extension, joining 30 other Democrats and at least two Senate Republicans — and leaving the bill short of the 60 votes needed to advance.”

NYT: “Mr. Trump is not making it easier for congressional Republicans. The perilous day on Capitol Hill began with the president firing off a Twitter message that undermined his party’s strategy to keep the government open. Republican leaders had spent Wednesday pressuring Democrats to vote for the spending bill, arguing that opposing it would effectively block the extension of the child health program, known as CHIP, which they had included in the spending bill. Funding for the program lapsed at the end of September. Yet on Thursday morning, Mr. Trump suggested that the funding should not be part of the stopgap bill, writing on Twitter: ‘CHIP should be part of a long term solution, not a 30 Day, or short term, extension!’ Hours after Mr. Trump’s message, the administration tried to walk it back. A White House spokesman said that the president supported the stopgap bill.”

BLAME GAME: If and when there’s a shutdown, both parties will try to convince the public that it’s the other’s fault. Republicans will blame Democrats for opposing CHIP funding. Democrats will say Republicans are holding eight hundred thousand Dreamers hostage and President Trump reneged on a pledge to fix the DACA mess.

WaPo: “‘I ask the American people to understand this: The only people in the way of keeping the government open are Senate Democrats,’ House Speaker Paul D. Ryan (R-Wis.) said Thursday night. ‘Whether there is a government shutdown or not is entirely up to them.’” This isn’t entirely accurate; with two defections, Republicans probably can’t get their own ranks to provide a majority.

“Emboldened Democratic leaders, meanwhile, rallied lawmakers for a showdown on what they believe is favorable ground, fighting on behalf of popular policies against an unpopular president who has had a brutal week of news coverage. As Thursday wore on, undecided senators steadily stepped forward to say that they would oppose the Republican measure — risking GOP political attacks and angry constituents.”

“‘We don’t have a reliable partner at the White House to negotiate with,’ Sen. Lindsey O. Graham (R-S.C.) said. ‘This has turned into an s-show for no good reason.’

Schumer called Trump and his administration ‘agents of chaos’ who have foiled attempts to reach a bipartisan agreement on immigration, which remained the most salient sticking point Thursday. ‘The one thing standing in our way is the unrelenting flow of chaos from the other end of Pennsylvania Avenue,’ Schumer said. ‘It has reduced the Republicans to shambles. We barely know who to negotiate with.’”

WaPo: “But the impasse raised deeper questions about the GOP’s capacity — one year into the Trump administration — to govern. Never before has the government experienced a furlough of federal employees when a single party controls both the White House and Congress, but that’s what will happen after midnight Friday if a spending bill fails to pass Congress.”

WHAT IT MEANS: With Republicans in total control of DC, it’ll be a hard sell to convince the public that this is Democrats’ fault, especially given how the president blew up the immigration deal. Indeed, nearly 90 percent of Americans want the U.S. to protect Dreamers, and most of them don’t give a fig about the border wall. [The Hill] The CR is the Democrats’ leverage to make sure this happens; if they stand their ground and the tide turns against the GOP, the president will likely be much more willing to negotiate.

Related: The federal government may shut down tonight, but that won’t keep Donald Trump from flying to Mar-a-Lago. [NY Mag]

Related: Bernie Sanders’s Duke appearance, scheduled for today, has been postponed on account of the “looming budget vote.” [INDY]

---

4. FOUR LOCAL HEADLINES.

Raleigh attorney and Trump judicial nominee Thomas Farr cleared the Senate Judiciary Committee on a party-line vote, with Democrats slamming his past ties to Jesse Helms. [INDY]

The roads are still going to be nasty today, so be careful. [N&O]

A lawsuit alleges that three Charlotte immigration judges routinely deny bond hearings to people in Homeland Security custody. [INDY]

Women Mobilize NC will hold a Rally on Raleigh tomorrow, a year after some thirty thousand women marched through Raleigh streets in protest of Trump’s election. [N&O]

---

5. TEN POLITICAL HEADLINES.

Stormy Daniels, the porn star a Trump lawyer reportedly paid off to keep her from talking about her past affair with the now-president, once claimed that Trump asked her to spank him with a copy of Forbes magazine that featured him, Donald Jr., and Ivanka on the cover. [MoJo]

The Trump lawyer set up an LLC to pay off Stormy Daniels. [WSJ]

The entire time Sebastian Gorka worked in the White House, Hungarian police had an arrest warrant out for him. [NBC]

Senator Tom Cotton, R-Arkansas, has been sending critics cease-and-desist letters, telling them that if they keep calling or emailing his office, he will report them for harassment. [ArkTimes]

Trump raged after reports that his chief of staff had said the president’s earlier thinking on the border wall was not “fully informed” and had “evolved.” [NYT]

A Trump appointee is out after his history of racist, sexist, anti-Muslim, and anti-LGBT comments surfaces. [CNN]

Democrats worry that California’s unusual electoral system could leave them without candidates for the two key House seats on the November ballot. [Politico]

Republicans on the House Intelligence Committee have authorized the sharing of a classified report on the conduct of FBI and DOJ officials, as well as the agencies’ handling of the FISA program. Democrats call it another attempt to discredit senior law enforcement officials involved in the Russia investigation. [Politico]

In its interview with Fusion GPS cofounder Glenn Simpson, the House Intelligence Committee got into questions of Russian money laundering. [Business Insider]

Per a new NBC/WSJ poll, 51 percent of Americans strongly disapprove of the Trump presidency, while just 26 percent strongly approve. The president’s total approval rating is 39 percent — down two points from December — the lowest mark in the poll’s history for any president ending his first year. [NBC]

---

6. TEN ODDS & ENDS.

In Chile, the pope accused victims of an alleged pedophile priest of slander. [AP via WTSP]

Roy Bennett, a white founding member of Zimbabwe’s opposition party who was an ardent opponent of the recently deposed Robert Mugabe, died in a helicopter crash in New Mexico. [AP]

Tensions are rising along the India-Pakistan border, [AP]

The journalist who started France’s version of the #MeToo movement is being sued for defamation by a man she accused of making salacious comments to her. [NYT]

New Zealand’s prime minister is pregnant. [CNN]

Nope, that wasn’t the actual Barack Obama kicking ass on HQ Trivia. [NYT]

YouTube is removing videos of people eating Tide Pods. [AV Club]

The Wire creator David Simon is adapting Phillip Roth’s The Plot Against America, about an alternative-history Charles Lindbergh presidency that gave rise to state-sanctioned anti-Semitism, into a miniseries. [Slate]

Tyler and Cameron Winklevoss, the twins who accused Mark Zuckerberg of stealing Facebook from them, have lost nearly $1 billion in the BitCoin crash, but they’ve still come out ahead — so far. [Fortune]

Sunny today, with a high of 44. [WRAL]

---

4 notes

·

View notes

Photo

Quỹ tài sản có chủ quyền Giá dầu bất động sản Mỹ Từ trái qua: Mohammad Bin Zayed của UAE, Erna Solberg của Na Uy, Tamim Bin Hamad Al Thani của Qatar và Mohammad Bin Salman của Ả Rập Saudi (Tín dụng: liewig christian / Corbis; Christian Marauget / NurPhoto; Hình ảnh thể thao chất lượng / Metty thông qua hình ảnh Getty) Vào thứ Hai, khi giá dầu lần đầu tiên giảm xuống dưới 0 trong lịch sử, ngôi sao bóng đá người Anh đã nghỉ hưu Gary Lineker đã đổ một chiếc cho Vương quốc Ả Rập Saudi, nhà xuất khẩu dầu lớn nhất thế giới. Sau đó, người nghèo Saudis sẽ không bao giờ có đủ khả năng mua Newcastle ngay bây giờ, Line Lineker đã tweet, đề cập đến một thỏa thuận trị giá 385 triệu đô la đang chờ đợi của Vương quốc Quỹ đầu tư công cộng của Vương quốc Anh để bắt kịp câu lạc bộ bóng đá Anh Newcastle United. Saudis nghèo sẽ không bao giờ có đủ khả năng để mua Newcastle bây giờ. https://t.co/itpAhq02xq - Gary Lineker (@GaryLineker) Ngày 20 tháng 4 năm 2020 Lineker không có thẩm quyền đối với dòng vốn toàn cầu. Nhưng nhận xét của ông là đáng để giải nén cho những người quan tâm đến các quốc gia giàu dầu mỏ như Ả Rập Saudi, Các Tiểu vương quốc Ả Rập Thống nhất và Na Uy bơm vào thị trường bất động sản Hoa Kỳ. Thông qua các quỹ tài sản có chủ quyền, những quốc gia này đã mua vào tài sản chiến lợi phẩm ở các thành phố như New York, Los Angeles và Chicago, và đã tạo ra những cuộc đánh cược lớn trên cả nước trong các lĩnh vực bao gồm bất động sản công nghiệp. Ả Rập Saudi 320 tỷ đô la PIF lặng lẽ thực hiện đầu tư lớn trong các công ty liên quan của Stephen Ross hồi tháng 2, mua khoản nợ có thể chuyển đổi thành 15% vốn cổ phần của nhà phát triển megadeveloper. Nhưng điều gì sẽ xảy ra khi nguồn tài sản khổng lồ đó - dầu mỏ - đang gặp nguy hiểm? Thói quen dầu mỏ - giá giảm hơn 50 đô la một thùng vào thứ Hai để kết thúc ngày khoảng 30 đô la dưới 0 - có nghĩa là các quỹ giàu có có chủ quyền, người chơi trò chơi dài và thường sẽ đói để có được tài sản ở cấp độ tổ chức với mức giá thấp của coronavirus đã gây ra, có thể thấy mình ở một điểm bực bội. Nhiều người trong số những người chơi này có hàng đống bột khô, hay cam kết của các nhà đầu tư chưa được chi tiêu. Nhưng với những dấu hỏi lớn đối với nền kinh tế của đất nước họ, họ có thể không thể tận dụng được. Có ai đã kiểm tra Mohammed bin Salman - Karen Attiah (@KarenAttiah) Ngày 20 tháng 4 năm 2020 Bạn có thể có rất nhiều người muốn mua tài sản khi tài sản chất lượng cao được giảm giá, nhưng có thể thấy rằng họ bị hạn chế, Sam Chandan, trưởng khoa của Viện Bất động sản NYU, nói. Vì không có nguồn cung cấp để thực hiện những vụ mua lại đó. Hai năm qua đã chứng kiến sự thuần hóa của các quỹ giàu có có chủ quyền đối với các bất động sản hàng đ��u của Hoa Kỳ. Năm 2018, tại tất cả các thành phố New York, các quỹ tài sản có chủ quyền đã được bán Thêm 945 triệu đô la so với số tiền họ đã mua, theo Real Capital Analytics, năm đầu tư ròng âm đầu tiên kể từ năm 2013. Thủ đô U.A.E Abu Dhabi, một trong những nơi đầu tư nhiều nhất nhà đầu tư bất động sản tích cực ở đây thông qua một số quỹ tài sản có chủ quyền, đã thoái vốn khỏi một số tài sản chính, bao gồm cả biểu tượng Tòa nhà Chrysler, mà Hội đồng đầu tư Abu Dhabi được bán với giá béo cho Aby Rosen, và Đại lộ 330 Madison, mà Cơ quan đầu tư Abu Dhabi đã bán cho công ty tái bảo hiểm Munich RE. ADIA, quỹ tài sản có chủ quyền lớn nhất Trung Đông với số tài sản trị giá 700 tỷ đô la được quản lý, sẽ được chơi cả tấn công và phòng thủ. Nó sẽ được săn lùng cho các tài sản bị định giá sai, theo Financial Times, nhưng cần phải ở chế độ chờ cho bất kỳ "cuộc gọi điện tiền mặt" nếu chính phủ của nó quyết định nó cần tiền để giúp đỡ nhiều tiểu vương quốc thiếu tiền mặt hơn. Các quỹ tài sản có chủ quyền vùng Vịnh có thể chứng kiến cổ phần của họ giảm mạnh gần 300 tỷ USD vào cuối năm nay, Viện Tài chính Quốc tế ước tính tháng trước, dưới hình thức thua lỗ trên thị trường chứng khoán và các khoản rút tiền của các chính phủ bị ép tiền mặt. Một số quỹ sẽ chịu nhiều áp lực phải xử lý tài sản vì các quốc gia của họ cần nó, ông Chand Chandan nói. Cơ quan đầu tư Qatar, quỹ đầu tư trị giá $ 328 tỷ của tiểu bang và là người nắm giữ cổ phần đáng kể trong Đối tác bất động sản Brookfield, đang ở trong một chiếc thuyền hơi khác so với các nước láng giềng vùng Vịnh mà nó đã ở trong mối thù truyền kiếp. Đó là bởi vì mặc dù nó là một nhà sản xuất dầu mỏ, khí đốt tự nhiên - trong đó nó là nhà xuất khẩu lớn thứ hai thế giới - là người đóng góp lớn nhất cho kho bạc của mình. Khí thiên nhiên đã mất khá nhiều cùng pummeling như dầu. (QIA, thông qua nó cổ phần trong Vornado Realty Trust từ danh mục đầu tư bán lẻ của Manhattan, có sự tiếp xúc đáng kể với lĩnh vực bất động sản mà có lẽ là thành công lớn nhất trong đại dịch.) Một số quan chức của Qatar nói với tờ Thời báo Tài chính. (Brookfield bất động sản đối tác cha mẹ, Quản lý tài sản Brookfield, là riêng biệt trong việc săn lùng các giao dịch đau khổ.) Chandan lưu ý rằng mối đe dọa thậm chí còn lớn hơn đối với các quỹ có chủ quyền Triển vọng đầu tư bất động sản ở đây sẽ là nếu một thời gian dài của giá dầu giảm là bất ổn địa chính trị. U.A.E, Qatar và Ả Rập Saudi là những chế độ quân chủ tuyệt đối. Ở Ả-rập Xê-út, bạn đã có một dân số trẻ trải qua tình trạng thất nghiệp tăng cao, ông nói. Có thể sự sụt giảm giá dầu sẽ gây bất ổn cho chế độ? Đó có thể là một lá bài hoang dã trong tất cả những điều này. [ad_2] Nguồn

0 notes

Photo

Chicago's Lincoln Yards megadevelopment receives Plan Commission blessing https://arcnct.co/2SbbLqn

1 note

·

View note