#mutual fund advisor

Text

Who are the best mutual fund advisors?

Concept Investwell is one of the renowned Mutual Fund distributors, Mutual Fund advisors, and Asset Management companies in Surat, Gujarat. We offer our clients a wide range of investment products and services that include mutual funds, closed-ended schemes, retirement solutions, insurance products, and many more.

With over a decade of experience in the financial industry, we are committed to helping you make informed decisions about your investment portfolio and maximize your returns.

#mutual fund advisor#mutual fund distributor#wealth planner#wealth advisor#wealth management advisor#asset management company in surat

2 notes

·

View notes

Text

Key Considerations When Investing in an IPO

For investors, initial public offerings (IPOs) present an exciting opportunity to participate early in potentially profitable ventures. IPOs do, however, include particular risks and requirements. Before you choose to invest in an IPO, consider the following information.

First, comprehend what an IPO is.

A corporation raises money by initially selling shares to the general public, or an IPO. The move from private to public offers investors a special chance to encourage and maybe profit from a company's expansion.

2. Examine the Business Completely

Thorough research is necessary before making an IPO investment. Recognize the company's financial situation, development potential, industry position, and business strategy. Assess the management team's experience and leadership of the organization. It is essential to read the company's prospectus, also referred to as the Red Herring Prospectus, in its entirety. This paper includes comprehensive details regarding the company's operations, competitive landscape, financials, and associated risks.

3. Examine the Goal of the IPO

Determine the rationale behind the company's IPO. Do they want to increase operations, reduce debt, or give current stakeholders a way out? The way the money are used might provide you with information about the company's financial situation and future goals.

4. Assess the Company's Appraisal

It can be difficult to determine if the stock is priced adequately. Check the company's valuation against those of comparable businesses in the sector. Examine sales data, price-to-earnings ratios, and other pertinent financial indicators. Overpriced offerings should be avoided since they may not provide good returns.

5. State of the Market

An IPO's success can be significantly impacted by market sentiment. An IPO that is successful may result from a bullish market, whereas a bearish one may have the opposite effect. Before making an investment, take the state of the economy and market trends into account.

6. Role of Regulatory Body

IPOs are supervised in India by the Securities and Exchange Board of India (SEBI). Although SEBI's clearance of an IPO shows that the offering complies with all legal criteria, it does not ensure the success of the IPO.

7. Evaluation of Risk

Generally speaking, IPO investments are regarded as high risk. First trading days of an IPO might be impacted by market volatility. Stocks may not always perform as predicted, and if a company's performance deteriorates, investors may lose their initial investment.

8. Examine the prospectus for Red Herring.

A thorough overview of the business, including financial statements, the legal and regulatory landscape in which it works, and any possible hazards, will be provided in the prospectus. Having this paper on hand is essential to make a wise choice.

9. Speak with financial specialists

If you're unsure, it may be helpful to speak with a financial counselor or make use of a brokerage like Ajmera X-Change. Expert advisors can offer more in-depth information and assist in customizing your investment based on your risk tolerance and financial objectives.

10. A long-term success View

Think about if you're investing for short-term profit or because you think the company has room to grow over the long run. When a company grows and performs successfully, an IPO can eventually yield large rewards.

Conclusion

Investing in an IPO can be rewarding, but it requires careful consideration and research. By understanding the company, assessing its valuation, and considering market conditions, you can make a more informed decision. Always remember, investing in IPOs involves substantial risk, and it's essential to consider your financial goals and risk tolerance.

For a detailed guide on investing in IPOs, explore further at Ajmera X-Change - https://www.ajmeraxchange.co.in/blogs/important-factors-to-consider-before-investing-in-an-ipo

0 notes

Text

mutual fund advisor

Use our extensive mutual fund advisor services to find the way to financial success. Our knowledgeable team of professionals provides tailored advice to assist you in navigating the challenging world of investing in mutual funds. From risk evaluation to portfolio diversification, we create solutions that fit your risk tolerance and financial objectives.

#mutual fund advisor#mutualfund#mutual#advisor#assetmanagement#mutuallikes#wealthmanagement#gofundmecampaign#gofundme#investorlife#funds#investment#gofundmedonations#matchingfunds#angeladvisor#funding#taxcompany#evadvisor#businessplans#investinyourfuture#loan

0 notes

Text

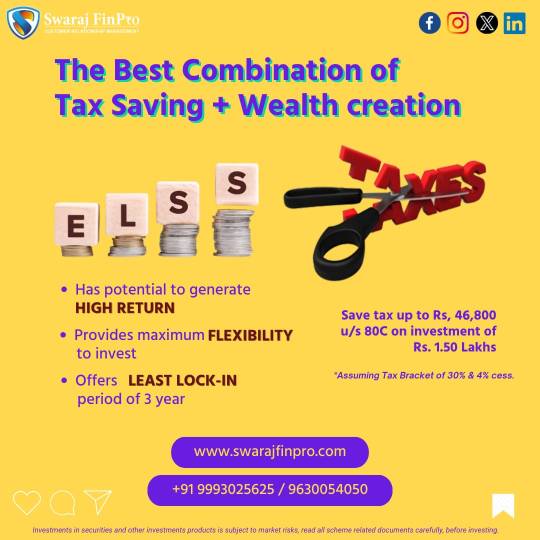

Embark on your journey to financial growth with Top Mutual Fund Distributor In India. Receive expert advice, explore a variety of investment options, and enjoy hassle-free online management. Count on us to navigate your wealth goals with assurance. Begin your journey to smarter investing today!

For More Information :- https://swarajfinpro.com/

#Mutual Fund Distributor In India#Top Mutual Fund Distributor#Best Mutual Fund Distributor#Mutual Fund Advisor#Wealth advisor

0 notes

Text

Mutual Fund Advisor: Your Guide to Diversified Investments

Investing can be a daunting endeavor, especially for beginners. With so many options available and the complexities of the financial markets, it's easy to feel overwhelmed. Mutual fund advisor specializing in diversified portfolios can serve as invaluable guides, helping investors make informed decisions and build portfolios that align with their financial goals and risk tolerance.

Understanding Mutual Fund Advisors

Mutual fund advisors are financial professionals who specialize in guiding investors through the world of mutual funds. Unlike other financial advisors who may offer a broad range of services, mutual fund advisors focus specifically on mutual funds, making them experts in this particular investment vehicle. They take the time to understand their clients' financial objectives, risk tolerance, and investment preferences, allowing them to provide personalized recommendations tailored to each individual's needs.

Why Diversification Matters

Diversification is a fundamental principle of investing that involves spreading investments across various asset classes, industries, and geographic regions. The goal of diversification is to reduce the overall risk of a portfolio by ensuring that losses in one area are offset by gains in others. Mutual fund advisors understand the importance of diversification and work with their clients to build portfolios that are well-diversified and resilient to market fluctuations.

Why Use a Mutual Fund Advisor

There are several reasons why investors may choose to work with a mutual fund advisor specializing in diversified portfolios:

Expertise: Mutual fund advisors possess in-depth knowledge of mutual funds and the financial markets, allowing them to offer expert guidance and advice.

Personalized Service: They take the time to understand their clients' financial goals, risk tolerance, and investment preferences, tailoring their recommendations to each individual's unique circumstances.

Diversification Strategies: Mutual fund advisors specialize in building portfolios that are diversified across asset classes, sectors, and geographic regions, helping to minimize risk and maximize returns.

Monitoring and Rebalancing: They regularly monitor their clients' portfolios and make adjustments as needed to ensure they remain aligned with their financial goals and risk tolerance.

Education and Guidance: Mutual fund advisors also educate their clients about investing principles and help them understand the rationale behind their investment decisions, empowering them to make informed choices about their finances.

How Mutual Fund Advisors Help

Mutual fund advisors employ a variety of strategies to help their clients build diversified portfolios:

Asset Allocation: They determine the appropriate mix of stocks, bonds, and other asset classes based on their clients' investment objectives and risk tolerance.

Fund Selection: Mutual fund advisors carefully select mutual funds from different asset classes and sectors, taking into account factors such as performance, risk, and expense ratios.

Risk Management: They assess the risk associated with each investment and spread their clients' investments across different risk levels to minimize overall portfolio risk.

Regular Reviews and Rebalancing: Mutual fund advisors conduct regular reviews of their clients' portfolios to ensure they remain aligned with their financial goals and risk tolerance. They also rebalance portfolios as needed to maintain the desired asset allocation.

Conclusion

In conclusion, mutual fund advisors specializing in diversified portfolios play a crucial role in helping investors navigate the complexities of the financial markets and build portfolios that are well-diversified and aligned with their financial goals. By offering expertise, personalized service, and a focus on diversification, these professionals empower investors to make informed decisions and achieve long-term financial success.

0 notes

Text

Navigating the World of Investments: The Role of a Mutual Fund Advisor

Investing wisely is essential for building wealth and achieving financial goals, but for many individuals, the world of investments can seem overwhelming and complex. This is where mutual fund advisors step in, providing expert guidance and personalized strategies to help clients navigate the intricacies of mutual funds and make informed investment decisions. In this article, we delve into the crucial role of mutual fund advisors and how their expertise can empower investors to achieve financial success.

Understanding Mutual Fund Advisors

Mutual fund advisors are professionals who specialize in guiding clients through the process of investing in mutual funds. These advisors possess in-depth knowledge of various mutual fund products, investment strategies, and market trends. They work closely with clients to understand their financial goals, risk tolerance, and investment preferences, tailoring their recommendations to meet their specific needs.

The Benefits of Working with a Mutual Fund Advisor

Expert Advice and Guidance:

Mutual fund advisors offer expert advice on selecting the right mutual funds based on clients' investment objectives, risk tolerance, and time horizon. They stay abreast of market developments and economic trends, providing valuable insights to help clients make informed investment decisions.

Portfolio Diversification:

Diversification is key to mitigating risk and maximizing returns in an investment portfolio. Mutual fund advisors help clients build well-diversified portfolios by selecting a mix of mutual funds across different asset classes, sectors, and geographic regions.

Risk Management:

Understanding and managing investment risk is crucial for long-term investment success. Mutual fund advisors assess clients' risk tolerance and investment goals to recommend mutual funds that align with their risk profile. They also provide guidance on monitoring and adjusting investment portfolios as market conditions evolve.

Regular Portfolio Review:

Investment needs and goals may change over time, and it's essential to review and adjust investment portfolios accordingly. Mutual fund advisors conduct regular portfolio reviews with clients to assess performance, rebalance allocations, and make any necessary adjustments to ensure portfolios remain aligned with clients' objectives.

Education and Empowerment:

Mutual fund advisors not only recommend investment strategies but also educate clients about the fundamentals of investing, including the benefits of mutual funds, how they work, and the associated risks. By empowering clients with knowledge and understanding, advisors help them feel confident and informed about their investment decisions.

Choosing the Right Mutual Fund Advisor

When selecting a mutual fund advisor, it's essential to consider factors such as qualifications, experience, track record, and fees. Look for advisors who are registered with regulatory bodies such as the Securities and Exchange Commission (SEC) or the Financial Industry Regulatory Authority (FINRA) and hold relevant certifications such including a Chartered Financial Analyst (CFA) or Certified Financial Planner (CFP) Additionally, inquire about the advisor's investment philosophy, communication style, and fee structure to ensure they align with your preferences and goals.

Mutual fund advisors play a crucial role in helping investors navigate the complexities of mutual fund investing and achieve their financial objectives. From providing expert advice and guidance to managing risk and educating clients, these advisors offer invaluable support every step of the way. By working with a trusted mutual fund advisor, investors can build well-diversified portfolios, maximize returns, and ultimately, realize their long-term financial goals.

0 notes

Text

#mutual fund#mutual fund advisor#debt mutual funds#financialplanning#financial growth#personal finance

0 notes

Text

5 tips to invest in mutual funds in India to maximize returns

The Keys to Successful Mutual Fund Investing is to understand the different investment strategies, the different types of mutual funds, the risks and rewards associated with investing in mutual funds, and the various fees associated with them. To maximize returns and minimize risks, investors should consider the following tips when investing in mutual funds in India:

5 tips to invest in mutual funds

1. Understand the market: Investors should analyze the current market conditions, be aware of the trends, and assess the potential of the different funds available.

2. Diversify: Investing in a number of different mutual funds reduces the risk of losses.

3. Research: Investing in mutual funds should always be preceded by thorough research. Investors should study the historical performance of the fund, its track record, and the fees associated with it.

4. Invest for the long term: Investing in mutual funds should be viewed as a long-term investment. Short-term investments can be risky and may not generate the desired returns.

5. Monitor: Investors should regularly monitor their investments and take corrective action if required. This will help them to make better investment decisions and maximize returns.

0 notes

Text

https://moneyandme.pgimindiamf.com/financial-planning-persona2/articles/A-Guide-To-Transferring-Mutual-Fund-Units

A Guide To Transferring Mutual Fund Units - MoneyandMe

Want to know how you can transfer your mutual funds units to another than here is an article for this. To know more read this article.

0 notes

Text

0 notes

Text

If you're looking for a PMS advisor in Surat, you've come to the right place. Concept Investwell offers a variety of services to help you manage your portfolio, including equity portfolio management and portfolio management services. We also offer a variety of other services to help you manage your finances. We offer financial planning services, wealth management advisory services, investment advisory services, and Mutual Fund advisors in Surat. Get connected today.

#wealth management company#wealth advisor#wealth planner#asset management company in surat#portfolio advisor#mutual fund advisor

2 notes

·

View notes

Text

Exploring Investment Opportunities: Different Types of Stocks to Consider

It is essential to comprehend the several stock kinds while entering the realm of investing. The main component of most investing portfolios, stocks provide a range of possibilities suited to diverse investor types and financial objectives.

1. Market Capitalization: An Overview of Available Options

Large Cap Stocks: Large cap stocks are well-established businesses with a strong market presence, making them ideal for investors looking for stability and consistency.

Mid Cap Stocks: Ideal for investors seeking moderate growth, these stocks strike a mix between the stability of large caps and the tremendous growth potential of small caps.

Small Cap companies: Despite being riskier owing to volatility, small cap companies are preferred by more aggressive investors due to their potential for large growth.

2. Earnings vs. Growth in Profit Sharing

Growth stocks: Typically, these stocks come from businesses that reinvest their earnings to support rapid growth, expansion, and capital gains.

Income-producing stocks Distinguished by their dividend disbursements, income companies yield consistent returns and are deemed less hazardous in contrast to growth equities.

3. Considering the Fundamentals: Excessive and Decreased Value

Overpriced Stocks: Often kept for long-term gains, stocks that are priced more than their inherent value.

Undervalued Stocks: These stocks appeal to investors searching for a good deal since their prices are lower than their true values.

Stock investing necessitates in-depth research, comprehension of your financial objectives, and risk tolerance. See Ajmera X-Change for an extensive tutorial on investing in various stock classes - https://www.ajmeraxchange.co.in/blogs/what-are-the-different-types-of-stocks-to-invest-in

#equity investment advisory#mutual fund advisor#online stock trading company#types of bonds#international share market

0 notes

Text

What is Mutual Fund?

A mutual fund is a type of investment vehicle that pools money from multiple investors to invest in a diversified portfolio of securities such as stocks, bonds, and other assets. Investments in securities are spread across a wide cross-section of industries and sectors and thus the risk is reduced.

It is managed by a professional fund manager or an asset management company (AMC) who makes investment decisions on behalf of the investors.

Mutual funds offer good investment opportunities to the investors. Like all investments, they also carry certain risks

SEBI formulates policies and regulates the mutual funds to protect the interest of the investors.

OVERVIEW OF MUTUAL FUNDS INDUSTRY IN INDIA

The mutual fund industry in India was set up through a combination of regulatory changes, legislative reforms and the entry of various market players.

Unit Trust of India- UTI was founded in 1964, which is when the mutual fund sector in India first started to take off. To mobilize public funds and invest them in the capital markets, UTI was established as a statutory body under the UTI Act, 1963. The idea of mutual funds was greatly popularized in India because to UTI.

Regulatory Framework-In India, the mutual fund industry's regulatory structure began to take shape in the 1990s. The Securities and Exchange Board of India (SEBI) Act, which established SEBI as the governing body for the Indian securities markets, was passed in 1993. Among other market intermediaries, SEBI was responsible with regulating and supervising mutual funds.

The SEBI (Mutual Funds) Regulations,1996- This regulation established the legal foundation for the establishment, administration, and operation of mutual funds in India. These regulations outlined the standards for investor protection, investment restrictions, disclosure requirements, and eligibility requirements for asset management companies (AMCs).

Introduction of Private Sector Mutual Funds: UTI was the only active mutual fund provider in India prior to 1993. Private sector mutual funds were nevertheless permitted to enter the market as a result of the liberalization of the financial sector and the opening up of the Indian economy. Many domestic and foreign financial organizations launched their own AMCs and entered the mutual fund industry.

Product Line Evolution: The mutual fund sector in India has grown and increased its product selection throughout the years. Mutual funds initially mainly offered income and growth opportunities. To address various investor needs and risk profiles, the industry did, however, offer a wider range of products, such as equity funds, debt funds, balanced funds, and specialist sector funds.

Investor Education and Awareness: Serious efforts have been made to educate and raise investor awareness in order to encourage investor involvement in mutual funds. Industry groups, AMCs, and SEBI have run investor awareness campaigns, distributed instructional materials, and supported systems for resolving investor complaints. Systematic Investment Plans (SIPs) were introduced, and this was a significant factor in luring individual investors

Technological Advancements-The mutual fund sector in India has embraced technological development, making it possible for investors to access and invest in mutual funds through online platforms and mobile applications. Investors can now transact, track their investments, and get mutual fund information more easily thanks to digital platforms.

The mutual fund industry in India has developed into a strong and regulated sector through regulatory changes, market competition, and investor-centric initiatives. The sector keeps expanding, drawing in more investors and providing them with a wide variety of investment possibilities around the nation.

#business#writing#investment#mutual funds#security market#money#sebi registered investment advisor#equity#make money tips#savings#financial#raise funds#funds#profit#return#growth#reading#knowledge#personal finance#income

43 notes

·

View notes

Text

Getting Started with Mutual Fund Advisors: A Beginner's Guide

If you're new to investing and want to explore mutual funds, you're in the right place! Mutual fund advisors are here to help you navigate this exciting world of investing. Let's break it down into simple points to help you understand how mutual fund advisors can assist beginners like you:

What are Mutual Fund Advisors?

Mutual fund advisors are experts who help people like you invest in mutual funds.

They give you advice on which mutual funds to choose based on your goals and risk tolerance.

Why Do Beginners Need Mutual Fund Advisors?

Beginners may feel overwhelmed by the many mutual fund options available.

Mutual fund advisors simplify things by recommending funds that match your needs and goals.

How Do Mutual Fund Advisors Help Beginners?

They start by understanding your financial goals and how much risk you're comfortable with.

Then, they recommend mutual funds that fit your goals and risk level.

Choosing the Right Mutual Funds:

Mutual fund advisor guide you through the process of selecting funds that align with your investment objectives.

They explain the different types of funds, such as equity funds, debt funds, and balanced funds, in easy-to-understand terms.

Understanding Risks and Returns:

Mutual fund advisors help beginners understand the risks associated with investing.

They explain how mutual funds work and what kind of returns you can expect based on historical performance.

Creating a Diversified Portfolio:

Diversification is key to managing risk in investing.

Mutual fund advisors help you build a diversified portfolio by investing in a mix of different types of funds.

Monitoring and Adjusting Investments:

Mutual fund advisors keep an eye on your investments and let you know if any changes need to be made.

They help you stay on track with your financial goals by adjusting your investments as needed.

Educating Beginners About Investing:

Mutual fund advisors take the time to educate beginners about investing concepts and terminology.

They answer your questions and provide resources to help you become more knowledgeable about investing.

Providing Ongoing Support:

Mutual fund advisors offer ongoing support and guidance to help beginners feel confident about their investment decisions.

They're there to answer your questions and address any concerns you may have along the way.

Making Investing Easy and Accessible:

Mutual fund advisors make investing easy and accessible for beginners by providing personalized advice and support.

They help you get started on your investment journey and guide you every step of the way.

In conclusion, mutual fund advisors play a valuable role in helping beginners navigate the world of investing. With their expertise and guidance, beginners can feel confident about making informed investment decisions and working towards their financial goals. So, if you're ready to start investing in mutual funds, consider reaching out to a mutual fund advisor to get started on the right track!

0 notes

Text

mutual fund consultant

As a mutual fund consultant, you advise customers on how to invest in mutual funds while taking into account their goals and risk tolerance. You assess possibilities, make personalized recommendations, and remain current on market trends to make informed judgments.

#mutual fund consultant#mutual funds#gofundmecampaign#gofundmeplease#mutual#advisor#neardeathnote#money#businessplans#giveandtake#matchingfunds#mutuallikes#angeladvisor#funding#wealthmanagement#evadvisor#gofundmepage#taxcredit#invest#broker#gofundmehelp#smartinvesting#capital#income#investinyourfuture#education#grants#leadership#consultant#tax

2 notes

·

View notes