#online micro loan software features

Text

Microfinance Software Development Company in Lucknow | Microfinance Software Company in Lucknow

SigmaIT Software excels as the premier microfinance software development service, delivering top-notch solutions for your financial institution's success.

The leading microfinance software company in Lucknow includes us among its top suppliers. All of your company's operational processes might be automated with the aid of this program by utilizing a single technical base. With the aid of our state-of-the-art microfinance software, you may improve operational efficiency, cut expenses, and save time and money. This software has the latest features. Free demo Call 9956973891.

What is Microfinance Software? How does it work?

Microfinance software streamlines financial operations for micro-lenders, aiding in client management, loan processing, and financial tracking, enhancing efficiency and transparency.

Key Features

Record of Transactions - our software allows you to track the history of previously made transactions including repayments, savings deposits, withdrawals, and disbursements.

Analytics and Reporting - Our Microfinance Software offers tools for tracking portfolio quality, client demographics, and financial performance.

Mobile and Online Access - Our Microfinance software offers mobile and online access allowing clients to make payments, access financial services remotely, and view their accounts easily.

Security and Compliance: SigmaIT Software Company in Lucknow ensures full data security with financial regulations and reporting requirements.

Customization: Our Microfinance software offers allow you to customize the software to clients' operational requirements.

Document Management: Our Microfinance software helps you manage important documents related to loans, savings accounts, and clients.

Loan Portfolio Management: Our Microfinance software helps in managing interest calculations, arrears tracking, and Loan Portfolio, including loan organization, disbursement, and repayment schedules.

Benefits of utilizing our Microfinance Software

Financial Inclusion and Expand Outreach

Salary Information

Memberships

Employee Reporting Structure

Leave Summary

Training Courses

Improved Risk Management

Automated Customer Management

Enhanced Productivity and Efficiency

Mobile Accessibility

Automated Risk Analysis

Customized Solutions

Low-Cost Loan Management

Savings Management

Mobile Banking

(FAQ)

1)Why Choose SigmaIT Softwares as your Microfinance Software Company in Lucknow

SigmaIT in Lucknow revolutionizes microfinance software, empowering efficient and responsible financial services to underserved communities. Explore our tailored solutions today to transform your microfinance operations. Contact us for details.

2) Why Choose the Best Microfinance Software for Your Operations

While there are numerous microfinance software options available, many lack essential features and scalability. If you're seeking the top microfinance software company in Lucknow, consider SigmaIT Software's Microfinance Software for all your operational needs

visit : Microfinance Software Company in Lucknow

#microfinancesoftwarecompanyinlucknow#bestmicrofinancesoftwarecompanyinlucknow#microfinancesoftwaredevelopmentcompanyinlucknow#bestmicrofinancesoftwaredevelopmentcompanyinlucknow

0 notes

Text

How To Get Future-Ready With Fintech Apps?

Fintech is upending traditional banking and financial services with everything from mobile payment applications to robo-advisors and online lending platforms defining digital transformation solutions. As customers seek more customized and frictionless banking experiences, fintech solutions will continue to gain popularity and acceptance.

Trends Redefining the Future of Fintech in 2023

1. Growing demand for SaaS platforms

Fintech has undergone a commendable transformation, thanks to SaaS products and services. The worldwide SaaS industry, which is presently valued at over $100 Bn, is anticipated to continue increasing quickly due to its attraction among SaaS providers and clients.

Fintech companies may avoid the labor-intensive administration and installation of sophisticated software and infrastructure by using software as a service, or SaaS. The faster and better customer service provided by the SaaS system increases user and consumer satisfaction.

It is projected that in 2023, the number of prominent SaaS, low-code or no-code solutions, and micro-SaaS products will increase tremendously, thereby improving the performance of the finance industry.

2. Insurtech sector

The insurtech sector is poised to flourish in 2023 as more and more consumers jump on the digital bandwagon. The industry is making a lot of effort to increase customer participation and consumer trust. Communication is one of the most important factors in achieving this level of dedication.

To reach the expanding mass of consumers, several of the top businesses are exploring using vernacular language.

It is projected that the insurtech industry in Singapore would grow stronger as a result of its ability to leverage contemporary technology to its advantage and successfully address issues.

To grow with the witnessing demand, the top digital transformation companies in Singapore, including TransformHub, are now focusing on insurtech app development.

3. Artificial intelligence (AI) technology

The finance sector has turned to the use of AI due to reasons like the high volume of data and the low cost of processing power.

The financial sector benefits greatly from AI, including increased profits, increased production, and improved product quality. Most fintech companies employ AI successfully across a range of financial streams, including cybersecurity and customer service. AI is also changing the working and functions of online banking.

Significantly, insurtech has included cutting-edge AI technology for quick outcomes. For the purpose of resolving insurance complaints, many dispute resolution platforms for insurance have adopted AI.

For instance, competitive intelligence and compatible language processing in chatbots have been shown to be cost-effective alternatives. As AI analyzes more data, it also depends less on human aid. In 2023, emerging technologies will fundamentally alter the fintech sector. The success of any fintech company depends on selecting the best development partner among the top digital transformation companies in Singapore.

Fintech Applications' Most Advanced Features

TransformHub’s Future-Ready Fintech Solutions have you covered the infrastructure and UX-UI based design fronts, regardless of whether you want to construct a digital bank from the ground up or integrate fintech elements into your brand operations.

You may use e-wallets, digital transactions, loans, savings, and more. We'll explore the platform, choosing the best features and integrations for you, based on what you require. Just let us know what you need to integrate the best digital transformation solutions.

Here, we'll give a quick explanation of a few of the cutting-edge, future-ready features that fintech applications will have by 2023 and beyond.

1. Virtual banking assistant

Artificial intelligence (AI) and methods for natural language processing (NLP) are used by a virtual banking assistant to provide consumers with tailored financial services.

These virtual assistants may assist consumers with a variety of banking operations, including account enquiries, bill payments, and fraud warnings, without the need for human contact.

Any virtual assistant's greatest selling point is their capacity to offer consumers round-the-clock assistance so they may access financial services whenever and wherever they want. As a result, customer service agents have substantially less manual labor to do.

Based on a customer's spending patterns and financial objectives, virtual banking assistants may also provide individualized financial advice and insights.

Customers may now make data-driven financial decisions, resulting in improved financial outcomes and easier financial activities, thanks to these intelligent assistants.

2. AI for conversational customer support

By employing common language to respond to consumer inquiries in a customized, nimble, and context-driven way, conversational AI has completely changed the customer service sector.

Conversational AI systems can increase productivity without requiring manual involvement while contextually addressing consumer questions and issues.

The capacity to offer round-the-clock customer assistance is one of conversational AI's primary benefits for customer support. Customers may now receive assistance at any time, outside of work hours.

Based on their prior contacts with the business, conversational AI may also provide clients customized recommendations and solutions. Customer happiness, traction, and business conversion are all higher, thanks to customer-specific and context-aware communication.

Customers are more likely to remain loyal to a company when they feel that their unique needs are met in the context of those needs.

3. Predictive intelligence for security and fraud detection

For financial services and applications, predictive intelligence is essential for data protection and fraud detection.

Predictive intelligence systems may offer complete security measures to fintech solutions by using sophisticated analytics and machine learning algorithms to detect and prevent fraudulent activity in real time.

With the analysis of vast amounts of data, including user activity patterns, transaction histories, and other contextual data, it can spot possible security issues and fraudulent actions.

Traditional security techniques could overlook fraud trends and abnormalities, but predictive intelligence can find them. Intelligence inputs on unusual user behavior and use patterns are extremely helpful at detecting frauds early on and reducing the vulnerabilities and hazards that may otherwise result in financial loss.

By lowering false positives and negatives and sending security personnel immediate notifications, when possible, risks are discovered, predictive intelligence may help increase the accuracy of fraud detection.

4. Transactions based on the blockchain

In the fintech sector, blockchain technology is a significant trendsetter. Blockchain is a cutting-edge decentralized database system that may virtually eliminate instances of data breaches, data tampering, and data theft by managing financial data over many nodes.

Blockchain technology fits in seamlessly with industries where data security and transparency are essential needs.

The use of blockchain technology for digital currencies like Bitcoin and Ethereum is one of the most trimming areas in fintech.

These digital currencies provide a more secure and effective method of money transmission by using blockchain technology to record and verify transactions.

Another aspect of the blockchain-based system for enabling financial agreements through automated contracts that are coded is smart contracts.

5. Voice-activated banking

Due to its ability to facilitate transactions with the least amount of effort, voice-enabled banking has grown in popularity in the fintech sector. Finance apps with voice assistants let users use voice commands to access their bank accounts and financial services.

Voice-enabled banking has emerged as a prominent trend, assuring customer comfort and accessibility, thanks to the quick expansion and popularity of smart voice assistants and systems.

The popularity and growing momentum of voice-enabled financial assistants are largely due to their convenience. People may check their account balances, transfer money, pay bills, and handle other financial operations with only a few voice commands without having to sign into a website or app.

Accessibility for people with impairments, those with restricted mobility, and those who choose not to use a keyboard or touch screen can all be improved by voice-enabled banking.

Security issues with voice-enabled banking still exist, though. Reputable banks and financial institutions must adopt several extra security procedures and processes in order to overcome the security issues with voice-enabled banking.

6. Clever financial advisor

A smart financial adviser using machine learning (ML) and artificial intelligence (AI) algorithms may provide highly individualized financial advice and product suggestions. To offer individualized advice and suggestions, knowledgeable financial advisers can examine financial information including income, spending, investments, and savings objectives.

Skilled financial consultants may offer clients individualized guidance around-the-clock. Individuals may be able to accomplish their financial objectives more rapidly and make better financial decisions as a result.

You can always start with a financial planning website that will eventually transform into a smart advisor solution for investors in order to establish your position in the Fintech industry.

Clever financial advisers can also offer more trustworthy and accurate guidance than conventional financial consultants, who could be swayed by prejudices or lack of information.

These intelligent AI-powered financial advisers can mine pertinent insights, user preferences, and trends from enormous volumes of data, unlike conventional recommendation engines.

Contact TransformHub to Be Future-Ready!

It is reasonable to assume that the fintech sector will remain prosperous in 2023. The future of the fintech ecosystem will be redefined in part by the value of the user experience and the ability to respond quickly to regulatory changes.

Fintech demands innovation as well as trust and openness. Making the ideal financial design is therefore a significant problem. On the one hand, it must coherently and clearly show a vast amount of data. On the other hand, it takes just the perfect amount of inventiveness to win over users without coming off as forced.

The good news is that you're quite likely to accomplish all these objectives if you follow the preceding advice.

We are here to take complete accountability for your business requirements and deliver precisely tailored solutions for the same.

Get in touch with us today to begin working on your financial app development project.

0 notes

Text

Sitecapture login

#SITECAPTURE LOGIN SOFTWARE#

#SITECAPTURE LOGIN PASSWORD#

#SITECAPTURE LOGIN FREE#

To access the Detect Login Bots feature, simply go to the Block Bad IPs/Visitors module > Detect Login Bots:

#SITECAPTURE LOGIN PASSWORD#

Important: Legitimate users may get their password wrong, so take care not to block this.Īlso, please note that the Detect Login Bots settings will not apply to the whitelisted IPs. Since it used a non-existent username, chances are higher that it’s a bot, but it’s not 100%. Just like a failed login, this may indicate a bot’s attempt to login. This includes the default 'admin' if you've removed that account. Identify a Bot when it tries to login with a non-existent username or an empty username. D etect attempted logins with usernames that don't exist.But if you get 20 failed logins in succession, chances are high it’s a bot. If you get a failed WordPress login, this may indicate a bot, or it may be a user who’s forgotten their password. Penalise a visitor when they try to login using a valid username, but it fails. Detect failed login attempts using valid usernam es.It achieves this through its Detect Login Bots feature. Shield provides 2 effective ways ("bot signals") for detecting & capturing login bots. With enough of these behaviours, we can get more confident that a particular visitor is a bad bot. Signals are just behaviours that bots have which indicate that they could be a bot. To achieve this, we use bot detection rules, or "bot signals". Shield Security is focused on helping you detect and block bad bots, whatever they're up to. But, there are many faces of bots - they can be good or bad. Take photos and sync in real time for the most advanced technology in field services.You've probably heard about bots a lot lately (those automated programs created to perform repetitive tasks), how they are here to make our lives easier. Through this process we developed the top 5 tips to implementing and using sitecapture, regardless of company size. Sitecapture is a field reporting tool to collect photos and data from a job site.īy selecting your service above you will be sent an email to accept the user agreement and provide payment information.ĭate of birth (dd/mm/yyyy) invalid date you should be above 21 years to apply for loan. Sitecapture’s whole process, and the templates, have made everything really fast.Ĭreating work and attaching it to a container on mobile.Īt the bottom, under “connected apps”, click the link for the sitecapture app to see the consumer key and. Sitecapture™ is a mobile application that allows users to easily capture job site images and data on a mobile device that automatically catalogs and organizes for long term storage.Īnyone who needs to create a bitmap image of a website will find sitecapture useful, however, i developed it with web developers, bloggers and online marketers in mind.

#SITECAPTURE LOGIN SOFTWARE#

With 20 years of experience, landy designs software that keeps customers’ needs at the forefront dan landy is the principal software architect at sitecapture, a project. It’s cut down our technician’s field service reporting time by 75% and consolidated 90% of our prior process.īefore, guys were using phones and emailing pictures or putting them on a micro sd card and uploading on a. The best part, we will not charge you for access until the. Your marketing team doesn't get the credit you deserve. Your sales team complains about the lead quality. Log into salesforce and click the “setup” link at the top right of your home page. ★ email notifications for managers and customers. Sitecapture also provides methods to support a common use case, in which there is a single “assigned” user or vendor company for each project. You lack proof of roi and then your event budget is at risk. We’ll get right to work on setting up your account and send you instructions to access your new sitecapture account. Sitecapture is used in home service industries such as solar to improve time and accuracy of site survey and system installations. Sitecapture’s technology keeps your photos and data organized to optimize your time in the field.Įasily integrate sitecapture with the applications you use in minutes. ★ azimuth, elevation and elevation angle. ★ camera roll and location services admin settings.Įnter your user login and account email address below and an email will be sent to the address on file with instructions for resetting.Ī website screen capturing application for windows. The most recent revisions to the this user agreement were posted on on at 1:00pm (pst). The site capture service is a web content creation service, a publishing service and a hosting service. (assignment to vendors is only available to sitecapture customers who have the “vendor management” feature.)

#SITECAPTURE LOGIN FREE#

Sitecapture is free and open source website screen capturing application.Ĭonfiguring sitecapture in the salesforce portal.

0 notes

Text

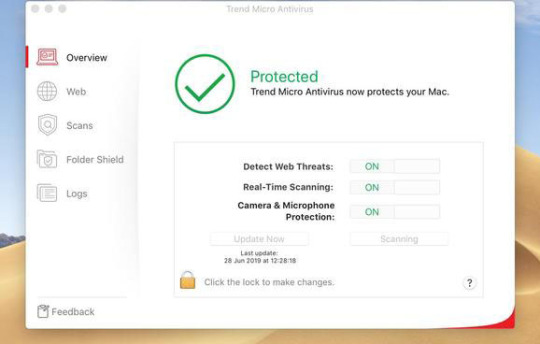

Download trend micro antivirus

Will Trend Micro™ remove malicious software? The entire Trend Micro™ anti-malware software program is absolutely free to all Online Banking users. Philanthropy Chinese Business Islamic Banking Agriculture Public Sector Education Healthcare Franchise Motor Dealership Tourismĭemos KYC / FICA Debit order + recipient switching Electronic Alerts The dti initiatives Business Hub eBucks Rewards for Business DocTrail™ CIPC Instant Accounting Solutions Instant Payroll Instant Cashflow Instant Invoicing SLOW 24/7 Business Desk FNB Business Fundaba nav» Marketplace Prepaid products Overdraft Loans Debtor Finance Leveraged Finance Private Equity Vumela Securities Based Lending Selective Invoice Discounting Asset Based Finance Alternative Energy Solutions Commercial Property Finance Fleet Servicesįoreign Exchange International Trade Structured Trade + Commodity Finance Business Global Account (CFC account) Save and Invest 3PIM (3rd Party Investment Manager) With nearly 30 years of Internet security leadership, industry experts recognize Trend Micro Security as delivering 100% protection against web threats.First Business Zero (R0 - R5 million p.a) Gold Business (R0 - R5 million p.a) Platinum Business (R5 million - R60 million p.a)īusiness Accounts Credit Cards Cash Solutions Merchant Services eWallet Pro Staffing Solutions ATM Solutions Ways to bank Fleet Services Guarantees

Privacy on social networks, including parental controls.

Advanced anti-ransomware technology so your files won't be held hostage.

Effective protection against new and rapidly evolving threats.

Protection for multiple devices across multiple operating systems.

Folder Shield can even protect cloud synced folders such as Dropbox, Google Drive and Microsoft OneDrive. Maximum Security keeps your valuable files safe from ransomware with Folder Shield which only allows authorized applications to access the protected folders such as your documents, photos, music and videos. It also helps secure your privacy on social networks and includes parental controls. It protects against viruses, malware, identity theft, ransomware and evolving threats. Trend Micro Maximum Security provides comprehensive, multi-device protection using advanced machine learning based technology. Apart from a few quirks, it demonstrates a nice balance of considerate features, and it really shines in up-to-date security, with the numbers to prove it. Trend Micro Titanium Maximum Security combines good design with excellent malware protection. Quitting notifications individually can be a chore, though you can switch out this behavior in the settings menu. Luckily, uninstallation is as simple as unchecking the box in the settings panel.Īggressive: Titanium Maximum Security sometimes considers certain legitimate programs to be malicious and prevents them from running, taking a "better safe than sorry" approach. Though that practice is common, it's annoying, and you may be caught by surprise. Consĭefault toolbar installation: Titanium Maximum Security installs a toolbar in popular browsers like Chrome and Firefox without opt-in or -out during installation. Third-party tester AV-Test confirms Titanium Maximum Security's effective protection: It scored a perfect 100 for protection in malware scanning and beating industry averages. When we plugged in an infected disk, Titanium Maximum Security quickly deleted the file and displayed a notification from the taskbar with assuring language. Security: Trend Micro quickly responds to security vulnerabilities and automatically removes suspected Trojan horses and malicious files. Though full scans are naturally longer, we found the quick scan especially fast and responsive. That's great, because we often want to shut down after running long tests, especially full scans - this way you can initiate overnight scanning and go to bed. This is present during the scanning process, so you don't have to dig through menus. Scanning: One option we appreciate is the ability to shut down the PC after finishing a scan. Though not exactly minimal, Titanium Maximum Security's five-tab header layout feels uncluttered and easy to navigate. Tabs have nice mouseover effects, and the overall app has a modern feel and original visual direction. The interface has a clean, organized menu layout. Prosĭesign: Trend Micro Titanium Maximum Security shares the same interface as its lesser brothers, the Antivirus and Internet Security editions. This review focuses on desktop performance. In addition to a robust malware scanner, Titanium Maximum Security offers a built-in password manager, an in-app Web browser, and a packaged set of tools for protecting and managing your Android device. Trend Micro Titanium Maximum Security is the second-highest antivirus offering from Trend Micro.

0 notes

Text

Crowdsourcing and crowdfunding

What is crowdsourcing?

Crowdsourcing is the practice of obtaining needed services, ideas or content by soliciting contributions from a large group of people, especially from the online community rather than from traditional employees or suppliers. The term crowdsourcing was coined by journalist Jeff Howe in the issue of Wired (Bannerman, 2012).

Crowdsourcing is optimistically depicted as a way of putting to use the creativity of the public for free, or for a moderate charge. ‘Turkers’, a term for online workers who use the sites, apparently makes small amounts of money by executing online tasks.

For example, a website named Mechanical Turk operated by Amazon, grants individuals or organizations to post micro-tasks, such as “find the email address for a company” (payment: $0.01/each address), “vote for the best translation” (payment: $0.05/each link), or “rate adult-oriented videos for quality and relevance” (payment: $0.15/each rating) (Amazon, 2010).

Other crowdsourcing platforms include:

Innocentive

Focus on crowdsourcing research and development for pharmaceutical and biomedical companies,

99designs

The world's biggest graphics design marketplace, associates customers requiring custom design work, for example, websites and logos to a thriving network of talented designers who present a new custom design to the site each 7-10 seconds.

Social media and crowdsourcing

Social media has played a significant role throughout the years in catastrophic natural disaster as an information propagator that can be utilized for disaster relief. After the devastating and disastrous Haiti earthquake on 12 January 2010, individuals published numerous photographs and texts about their own encounters during the earthquake via Twitter, Flickr, Facebook, blogs and videos were posted on YouTube. In only 48 hours, the Red Cross received US$8 million in donations legitimately from texts, which represents one advantage of the incredible propagation ability of social media sites.

Survivors likewise utilize social media to stay in contact with the world after a disaster. The jammed cellular network in Japan brought about by the tsunami and earthquake made it difficult for people to communicate with one another. In response, they used Twitter, Facebook, Skype, and local Japanese social networks to communicate and keep in touch with their loved ones (Bannerman, 2012).

Although social media can positively impact disaster relief efforts, it does not give an innate coordination ability to effectively plan and share information, resources, and plans among different relief organizations. All things considered, crowdsourcing applications dependent on social media applications, for example, Twitter and Ushahidi offer a ground-breaking ability for gathering information from disaster scenes and picturing data for relief decision-making.

Research has shown that it is possible to leverage social media to generate community crisis maps and introduce an interagency map to allow organizations to share information as well as collaborate, plan, and execute shared missions. The interagency map is intended to allow organizations to share data in the event that they operate on the same platform or utilize comparative data-representation formats (Bannerman, 2012).

What are the advantages of crowdsourcing for disaster relief?

Compared to traditional relief methods, leveraging crowdsourcing for disaster relief has three advantages.

First, crowdsourced data including user requests and status reports are collected almost immediately after a disaster using social media. Ushahidi-Haiti was set up two hours after the 12 January earthquake by volunteers from Tufts University in Medford, Massachusetts (Heinzelman and Waters, 2003). Soon after, organizations were able to borrow a short message service (SMS) short code phone number (Mission 4636) to send free SMS texts (Munro, 2012). News of this free emergency number was spread through local and national radio stations.

As of 25 January, the Haiti crisis map had more than 2,500 incident reports, with more reports being added every day. The large amount of nearly real-time reports allows relief organizations to identify and respond to urgent cases in time.

Second, crowdsourcing tools can collect data from emails, forms, tweets, and other unstructured methods and then do rudimentary analysis and summaries, such as by creating tag clouds, trends, and other filters. These can help partition the data into bins (such as most-frequently requested resources) and requests into predetermined, most-urgent categories (such as medical help, food, shelter, or people trapped). Relief agencies can then concentrate on the issues and events that are most important to the relief effort.

Third, providers can include geo-tag information for messages sent from some platforms (such as Twitter) and devices (including handheld smart phones). Such crowdsourced data can help relief organizations accurately locate specific requests for help. Furthermore, visualizing this type of data on a crisis map offers a common disaster view and helps organizations intuitively ascertain the current status.

What are the shortfalls of crowdsourcing for disaster relief?

Despite the fact that crowdsourcing applications can give precise and convenient information about a crisis, current crowdsourcing applications actaully miss the mark in supporting disaster relief efforts (Gao et al., 2011).

Above all, most applications do give a common mechanism explicitly designed for cooperation and coordination between different relief organizations. For instance, microblogs and crisis maps don’t give a component for distributing response resources, so various organizations may react to an individual request simultaneously.

A subsequent inadequacy is that data from crowdsourcing applications, while helpful, do not generally give all the correct information required for disaster relief efforts. The accuracy of the report’s geo-tag and content is not guaranteed, in spite of the fact that relief workers enormously need the ability to naturally and precisely locate crowdsourced data on the crisis map. That is, a geo-located tweet does not really allude to the geo-location point. Somebody may message the emergency guide's telephone number to report something they saw earlier, potentially messaging from a shelter about a bridge that collapsed 10 miles not far off.

Furthermore, there are regularly duplicate reports, and information essential for relief coordination isn't promptly accessible or effectively available, for example, arrangements of relief resources or correspondence systems and relief organization contact information.

Lastly, current crowdsourcing applications do not have adequate security features for relief organizations and relief operations. For example, crowdsourcing applications that are publicly available for reporting are also publicly available for viewing. Although it is important to provide information to the public, this can create conflicts when decisions must be made about where and when relief resources are needed.

In conclusion, crowdsourcing supporting applications don't have sufficient security features for relief organizations and relief operations. For instance, crowdsourcing applications that are openly accessible for revealing are additionally freely accessible for viewing. In spite of the fact that it is essential to give information to people in general, this can stimulate conflict when decisions must be made about where and when relief resources are required.

What is crowdfunding?

Out of crowdsourcing has developed a new phenomenon: crowdfunding. Crowdfunding is the act of funding a project or venture by collecting modest amounts of money from a large number of individuals, ordinarily by means of the Internet.

Crowdfunding is related to crowdsourcing in that both draw on the power of intensity of groups of people and networks. Notwithstanding, crowdfunding is additionally very unique. It works through an open call for funding for specific projects. Funding is requested online, typically in moderately modest quantities, from individual donors or investors, nd goes towards specific projects: personal loans for small businesses, the production of design t-shirts, production of movies or music, or covering medical expenses for the less privileged.

There are four basic models of crowdfunding:

1. Donation-based - funders donate to a project without any expected compensation. An example of a donation-based crowdfunding platform would be:

GoFundMe

GoFundMe is a free crowdfunding platform tailored to fundamentally support people and causes. Since GoFundMe is fit to individual causes— anybody can make a campaign—sponsors on here tend to only support campaigns that originate from inside their own community and personal networks.

GoFundMe isn’t intended for business crowdfunding campaigns, unlike the other platforms. However, if you’re an entrepreneur who has run into difficult times, or you need to raise money to overcome a personal challenge, you can have a go at leveraging this platform for support from your personal network.

Governments, political parties, and the public sector have also experimented with crowdfunding. Barack Obama relied on small donations solicited online during his presidential campaign in 2008. Many government parties fundraise online, as do a wide variety of other initiatives and projects (Pricco, 2014).

2. Reward-based - offers non-financial rewards to funders, such as t-shirts or the opportunity to see a band backstage. An example of a reward-based crowdfunding platform would be:

Kickstarter

This platform is designed around recurrent donations that permits content creators to monetize their videos, blog articles, music and even software developments. On the off chance that people like the project, they can pledge money to get it going. If the project succeeds with regards to arriving at its funding goal, all sponsors' credit cards are charged when time expires.

3. Lending-based - funders expect repayment of the funding they contribute to a project. An example of a lending-based crowdfunding platform would be:

Kiva

Provides the ability to lend money via the Internet to low-income entrepreneurs and students. Kiva's mission is "to expand financial access to help underserved communities thrive."

4. Equity-based - funders receive equity, revenue, or a share of the profits in a project. An example of an equity-based crowdfunding platform would be:

StartEngine

StartEngine is one of the world’s biggest equity crowdfunding sites. StartEngine pulls funds from an investor's account once the company has exceeded their minimum funding goal, and the escrow account has been opened (StartEngine, n.d.).

Crowdfunding platforms encourage the assembly of ideas, the interconnection of funders with creators, the uniting of ideas and resources, and new entity prospects.

In conclusion, a few key inquiries should be posed as crowdfunding moves past its outset: How can crowdfunding work in the interests of the public, creating new opportunities, contributing to public spheres, and guaranteeing a reasonable appropriation of benefits? Should the principle that publicly-funded research be made openly available apply to crowdfunded projects?

On top of the potential advantages crowdfunding brings to individual corporations, it likewise can possibly improve the efficiency of the development sector as a whole. Numerous development organizations are dependent on traditional support mechanisms with pre-set up measures for performance defined by external donors and tested by anonymous authorities. Crowdfunding, by contrast, empowers joint development of projects and dialogue. During the selection of projects, its only reference are the organization's values and quality measures, which need to be communicated to potential supporters. Projects that are attractive and significant receive adequate sufficient support - not simply those that meet the current (political) support priorities.

References list

Bannerman, S. (2012). Crowdfunding Culture. Web. Wi: Journal of Mobile Culture, [online] 06(04), p.4. Available at: http://wi.mobilities.ca/wp-content/uploads/2012/12/sbannermanwi_2012_06_04.pdf [Accessed 13 Oct. 2019].

Amazon. (2010). All Hits. [online] Available at: https://www.mturk.com/mturk/findhits?match=false [Accessed 26 Oct. 2020].

Zeng, D., Gao, H., Barbier, G. and Goolsby, R. (2010). Ieee InTeLLIGenT SySTemS Harnessing the Crowdsourcing Power of Social Media for Disaster Relief. [online] Available at: https://apps.dtic.mil/dtic/tr/fulltext/u2/a581803.pdf.

Heinzelman, J. and Waters, C. (2003). About the RepoRt Crowdsourcing Crisis Information in Disaster- Affected Haiti Summary. [online] Available at: https://mirror.explodie.org/Crowdsourcing%20Crisis%20Information%20in%20Disaster-Affected%20Haiti.pdf [Accessed 27 Oct. 2020].

Muralidharan, S., Rasmussen, L., Patterson, D. and Shin, J.-H. (2011). Hope for Haiti: An analysis of Facebook and Twitter usage during the earthquake relief efforts. Public Relations Review, 37(2), pp.175–177.

MP, H. (2011). Japan Tsunami & Earthquake – Use of Twitter, Facebook, Skype & other Social Networks. [online] Bubblecube. Available at: http://bubblecube.wordpress.com/2011/03/12/japan-tsunami-earthquake [Accessed 27 Oct. 2020].

Munro, R. (2012). Crowdsourcing and the crisis-affected community. Information Retrieval, 16(2), pp.210–266.

Gao, H., Barbier, G. and Goolsby, R. (2011). Harnessing the Crowdsourcing Power of Social Media for Disaster Relief. IEEE Intelligent Systems, 26(3), pp.10–14.

Flannery, M. (2007). Kiva and the Birth of Person-to-Person Microfinance. Innovations: Technology, Governance, Globalization, 2(1–2), pp.31–56.

Pricco, D. (2014). Political Crowdfunding - how politicians are learning to harness the crowd. [online] CrowdExpert.com. Available at: http://crowdexpert.com/articles/crowdfunding-in-politics/ [Accessed 27 Oct. 2020].

CROWDFUNDING INDUSTRY REPORT Market Trends, Composition and Crowdfunding Platforms THE INDUSTRY WEBSITE TM. (2012). [online] Available at: http://www.crowdfunding.nl/wp-content/uploads/2012/05/92834651-Massolution-abridged-Crowd-Funding-Industry-Report.pdf [Accessed 27 Oct. 2020].

StartEngine. (n.d.). Investor FAQ. [online] Available at: https://www.startengine.com/investor-faq [Accessed 27 Oct. 2020].

1 note

·

View note

Text

Free Online Tools for Setting up a New Business by Mel Feller, MPA, MHR

Free Online Tools for Setting up a New Business by Mel Feller, MPA, MHR

President/Founder of Mel Feller Seminars with Coaching For Success 360, Inc. and Mel Feller Coaching with offices in Texas and in Utah.

Whether you have a traditional, local brick and mortar store or an exclusively online business, you will need a set of online tools to make setting up your online presence both simple and efficient.

Growth is usually considered positive and desirable. It is often regarded as a measure of success and something that should be pursued. While this is true in many cases, business growth can present its own set of problems and challenges.

Those in business generally have limited resources and this can increase the risks associated with growth, especially when it occurs quickly or is unplanned. As the owner of a growing business, you need to learn to manage growth.

First, you should take time to consider what growing your business will really mean and the implications of operating a larger enterprise.

If you are ready to take the next step and grow your business, you can access the tools that I have listed below. I have really tried to focus on the best and the free ones. After all, a penny saved is a penny earned!

Legalzoom.com

Every new business needs a quartet of business support services. If you are setting up a standard corporation, LLC, partnership, proprietorship, or even a not for profit, Legal Zoom not only has the necessary forms for your state, but also the available consultation where you can speak to an actual attorney and get many of your questions answered. They also can help you with patents and trademarks for your business, a necessity for the open frontier of the Internet.

Freshbooks.com

Trying to keep the books yourself creates two problems: 1) it takes the owner away from their primary focus of the business and 2) it opens the door for the possibility of paying too much in taxes. Online accounting software has become increasingly popular in recent years because it allow a business owner to have an actual accountant periodically review their books while giving the owner control over the day-to-day accounting operations with little time investment. Freshbooks has the best combination of ease of use and powerful features, requiring little time to keep your data safely stored in the cloud and focus on your business.

Squareup.com

Without billing, it is impossible to trace individual transactions and begin increasing your bottom line. Squareup is the place to go for new businesses who have a strong personal presence in their community and can make a sale fast. Squareup offers a free square that you connect to your smartphone for instant billing and sales, with no monthly or hidden fees. You will get access to your deposits within 1 to 2 business days, eliminating the need for waiting on payment from checks or money orders.

Squarespace.com

Squarespace is a popular platform that has award winning designs and templates that will get you up and running quickly. The templates can be easily customized, and you can use your own artwork to give your website a unique and personal branding.

Business Development

From planning to finance to day-to-day management needs, launching a small business involves a steep learning curve. Take advantage of these free resources to gain the knowledge you need as you develop your business idea into a thriving enterprise.

SBA.gov

Searching online for information about developing your business idea can result in a lot of conflicting information. For straightforward business education and advice with no agenda, start at the U.S. Small Business Administration’s website—SBA.gov. Here you can find information about writing business plans, tips for entrepreneurs, and trustworthy information about how to finance your business, and more. It is an incredible resource for rookie and veteran entrepreneurs alike!

Local Small Business Development Center

Sponsored by the SBA, small business development centers throughout the United States have helped thousands of entrepreneurs launch successful businesses through free business education, consulting, and mentoring services. Find your local center here and call to request support from an SBDC advisor in your area.

SCORE

For over 50 years, non-profit business association SCORE has provided education and mentorship opportunities to help small businesses get off the ground and achieve their growth goals. SCORE.org provides free online learning opportunities as well as confidential in person mentoring services throughout the country from volunteer entrepreneurs with years of business ownership experience.

Business Planning

Whether you are just starting your new business or refining your existing business model, let these free tools lead the way in your business planning process.

Bplans.com

Writing a plan for a new business does not have to mean reinventing the wheel. Check out Bplans.com for sample business plans representing nearly every industry—from caterers to construction companies and beyond!

Enloop

Even with a sample plan in hand, starting with a blank word doc to write your business plan is horribly intimidating. Use Enloop to easily create a professional looking business plan complete with 3-year financial forecast reporting, and even get a free business plan score to help take your plan from good to great.

Your first business plan is free, with affordable subscription rates for additional plans and added features.

Business Financing

Unless you happen to be independently wealthy, figuring out how to raise capital may be the most overwhelming challenge you will face as an entrepreneur. Should you look for investors, or borrow from a bank or online lender? Check out these free resources to help you in your quest to fund your small business.

AngelList

Whether you are looking for investors or hiring your first employees, Angel List is your must-have resource for startup recruiting. Hundreds of startups have been matched with angel investors on the site, gaining much needed capital to grow their businesses.

Kickstarter

Want to crowdsource your business funding without giving away equity? Launch a funding campaign with Kickstarter: a free to sign-up crowdfunding platform that helps you recruit micro-donors for your business. You can incentivize your donors with future products or gifts of your choice, and Kickstarter will take a small percentage only if your campaign is fully funded.

StreetShares

Tell your story and get a loan for your business. StreetShares is a free online marketplace that will connect you with peer-to-peer lenders for small business funding. Instead of relying only on your credit history, you can complete StreetShares quick application and recruit lenders by sharing your story and demonstrating the value of your business idea.

Design

With an abundance of free tools online, creating a professional and visually stunning digital presence has never been easier. Check out these free tools to generate high impact eye-candy for your brand.

Canva

Want the look of professionally designed graphics for your blog or marketing materials without the cost or the expertise? Canva will be your new best friend. Use pre-formatted templates to create social media banners, blog graphics, marketing flyers, and much more. Free and idiot proof, Canva will make your amateur, no-budget marketing effort and make you look like a seasoned pro.

Pablo

If just the thought of graphic design makes you sweat, Pablo by Buffer is a great place to start. Make your social media stand out with beautiful images created from your text in under 30 seconds. Even your grandmother can do this. We promise.

Piktochart

You see those incredible infographics buzzing through your Twitter feed and think “that must have taken a trained graphic designer hours to create.” However, did you know you could create similarly high impact infographics for your business, for free? Piktochart offers beautiful templates and easy-to-use tools that even non-designers can use to communicate information in a visually compelling way.

Email

More than anything else, being a business owner involves a lot of email. For making decisions, communicating with staff, marketing to customers, and more—you likely live and die by your inbox. Check out these free email tools to make your email life a little more manageable.

Gmail

Call me biased, but I will state without hesitation that Gmail is the best there is in email communication. Whether you are using a standard free Gmail account or you have connected Gmail to your business email account, you cannot beat the easy to use organization of Gmail for archiving and inbox management.

Boomerang

Have a brilliant idea in the middle of the night, but don’t want to blow up your team’s inbox until morning? Alternatively, do you need to follow up on an email in a week, but need a reminder to do so? This awesome third party Gmail add-on for scheduled sending and follow-up reminders will help you restore some balance to your email.

Free for the first 10 scheduled messages per month. Nominal subscription for unlimited messages and additional features.

Organizer by OtherInbox

Organizer does exactly what its name implies—organizes your inbox. Once it’s added to your email, it will automatically sort through the hundreds of promotional emails, receipts, and newsletters into the folders of your choosing. Designed to prioritize the most important emails and securely keep them at the top of your inbox, Organizer is the ultimate time saver for those whose inboxes are perpetually stuffed. Because those promotional emails and receipts may become “out of sight, out of mind” once they aren’t filling your inbox to the brim, Organizer also sends a “Daily Digest” email to keep you in the know of exactly what emails have been filed into which folders. That way you can keep an eye on what is coming into your inbox without sacrificing the time to actually sift through each folder while focusing on the emails that are the most critical to you.

MailChimp

If you are a minor entrepreneur new to the email marketing game, you cannot beat MailChimp for beautiful and easy to create bulk newsletter content. Send up to 12,000 emails to 2,000 subscribers free. Your prospects will love the beautiful content in their inbox, and you will love MailChimp’s awesome features, including beautiful templates, advanced analytics, easy one-click personalization, and more. Constant Contact is another option that many small business owners try. It can be a little pricier than Mailchimp, but wins in terms of customer support since Mailchimp relies heavily on email and their robust self-service Knowledge Base and Constant Contact has chat, phone, or email.

Unroll.me

How much time do you spend every day getting distracted by random junk mail cluttering your inbox? In addition, let us not even talk about the headache of scrolling to the bottom of all those emails for the tiny unsubscribe button, followed by an elaborate guilt trip before you can finally say “goodbye.”

Just say no to inbox clutter with Unroll.me. Unsubscribe from what you do not need, and roll the rest up into a once daily summary of all your newsletter subscriptions. When it comes to saving time, this might be the best free tool on our list.

Internal Communications

Whether you work with a distributed team or just travel a lot for business, these communications tools will help you stay in touch with your crew from wherever you are.

Skype

The first (and probably still the best) internet calling service out there, Skype is the standard for video conferencing between computers, as well as wifi-based calling between mobile devices throughout the world. If you need that personal face-to-face connection with employees or clients from far away, free video conferencing between Skype accounts is the perfect tool to use.

Slack

Between social media accounts, email, text messages, chat tools, and more, the multitude of ways that team members communicate can get confusing and leave room for communications to get lost in the shuffle. Use Slack to manage conversations with your team members across devices and accounts on one platform. Therefore, you can send an email, receive a reply over text, and follow up with a tweet—and no one misses a beat.

Sococo

With all the benefits of a physical office environment without the overhead, Sococo is a dream come true for distributed teams. Just log into your virtual office to see who is working, communicate with colleagues by text, audio, or video chat with a click of the mouse, and make conference calls right from your office. Try Sococo’s free starter plan and you’ll be hooked on the feeling of working in community no matter where you are.

Money Management

From accepting credit cards to tracking expenses to time tracking and payroll, the internet is full of amazing resources for managing your company’s finances with minimal headache. But how will you know what works? Check out the free trials for these awesome tools to find the money management workflow that fits your business needs.

Expensify

Any employee with experience completing traditional expense reports knows what a pain it can be. And administrators know how much time gets wasted tracking down employees for receipts or other information. With Expensify, you can simplify the expense reporting process with smart scanning of receipts, easy mobile tracking of expenses, and one-click reimbursement options. Expensify offers an always free basic plan, plus a free 30-day trial for team and corporate plans with all whistles and bells.

Paypal

Is not accepting online payments holding your business back from growth? Paypal offers easy online credit and debit card transactions as well as recurring payments with no sign-up cost and no direct fee.

TSheets

If your business is growing and you are hiring hourly employees, you’ll quickly find that tracking their time spent working feels harder than it should be. Enter TSheets, a GPS monitored app that lets employees track time right from their cell phones and aggregates timecard reports from every member of your team to with little to no effort required from you. Check out this awesome service with a 14-day free trial.

ZenPayroll

Once you have tracked your employees’ time, there is still the matter of getting everyone paid. ZenPayroll simplifies the payroll process, giving employees online portal access to update their information and letting you run weekly, bi-weekly, or monthly payroll for your entire team with just a few clicks of the mouse. Get started with a free 2 month trial.

Productivity

You have big ideas, you have a business plan, your company is funded, and you even have amazing graphics for your marketing efforts! However, to keep your business afloat day to day, what you need is to simply get things done. Try our favorite free tools for a boost in productivity to move your business forward.

Evernote

Many busy, on-the-go entrepreneurs swear by Evernote for keeping track of thoughts, plans, and ideas from wherever they are. The app’s free plan lets you clip content from across the web, create your own notes, share with friends, and comment on documents together. In addition, with seamless integration across all your devices, you can work from anywhere without missing a beat.

Google Drive

Have you noticed by now that I am a little Google obsessed? In addition, this may be one of our favorites. Google Drive offers you almost all the same benefits of Microsoft Office, but accessible from anywhere you have online access. Collaborate on documents with colleagues, track spreadsheet changes as you edit, and share with clients quickly without ever waiting for uploads or worrying about having compatible software installed—all free.

Producteev

This is your pen and paper to do list on overdrive. Manage projects between multiple users, set recurring events, and track both large scale projects and the smaller steps along the way that make the big to-do’s possible. Producteev is ideal for keeping up with your own work needs as well as assigning tasks to employees near and far.

Scheduling

With a growing number of clients and team members to consider, keeping track of who does what when can be a pain. Whether you are scheduling conference calls, meeting, or work shifts, try these awesome tools to streamline the process, saving you time and brain cells for improved things.

Doodle

Say “never again” to the headache of trying to coordinate a meeting, dinner, or other event with multiple parties who use different—even (gasp!) non-digital—calendar platforms. Instead, use Doodle to send out a quick poll with available date and time options. Skip the back and forth, let everyone cast their vote, and consider your meeting scheduled!

When I Work

Hands down our favorite tool for companies with shift workers of any kind. Instead of endless emails, sticky notes and phone calls to organize your weekly or monthly shift calendar, When I Work will keep track of employee availability, create a balanced shift schedule, notify employees when they work, and let them trade shifts with team members. All you have to do is set your requirements and approve the final schedule.

Sign up for the 30 day free trial. You will likely find that the time you save scheduling employees through When I Work is worth every penny of the nominal monthly subscription.

YouCanBook.me

Consultants, therapists, salon stylists, attorneys, and other bill-per-hour service providers swear by YouCanBook.me for quick and easy client scheduling. Integrate this tool with your business website to allow clients to book services online. You can set preferences and session lengths for different services, and the app integrates directly with your Google Calendar to automatically work around any appointments or scheduling conflicts that may arise.

In addition, as long as you do not mind the minimal “powered by YCB” branding, the standard scheduling service is always FREE!

Social Media

Every business owner knows you need to be on social media. Actually following through on a social media strategy is another matter entirely. Try these great, free tools to streamline your process and maximize your social media ROI.

Hootsuite

Publishing individual social media messages in real time is a drain on time and a recipe for low engagement. By signing up for Hootsuite, you can manage multiple social profiles from a single dashboard. Schedule posts, track mentions, engage with followers, and measure the effectiveness of your social media content, at no cost. It is the go-to tool for keeping your social media accounts in line.

ManageFlitter

If Twitter is a big part of your brand development, ManageFlitter is an awesome tool for improving your results. Easily unfollow dormant accounts, track useful analytics, and boost relevant followers with ManageFlitter’s free limited plan.

Instasize

If you manage social media accounts for your small business, you know the difficulty of editing on mobile for different apps. With InstaSize, you can format and edit videos and photos for Instagram, Twitter, YouTube, and more, with ease. The app allows you to add text and filters, retouch faces, and create collages that will make your business stand out.

Stock Images

Beautiful images are essential to making your brand stand out online. But if you’re not a professional photographer and your product isn’t visually compelling, how can you use images in your marketing effort? Try these free stock images site to search for images to use in your blog, social media, and other marketing materials.

Flickr

This user-generated photo-sharing site has a huge array of images available free with or without attribution. Check out the creative commons section of Flickr and read the usage terms to make sure your photo usage is on the up and up.

FreeImages

A great resource for business related stock images, FreeImages is a content marketer’s favorite bookmark for quick generic blog or social media graphics.

Pixabay

If you are feeling bored by the typical line up of free stock images online, Pixabay is a great resource to shake things up. The images here have a slightly more indie feel compared to the more generic vibe of traditional stock images.

Unsplash

Though the selection is smaller than most, Unsplash is an awesome resource for stock images that don’t feel like stock images? Updated every 10 days, this site’s collection of free to use, no attribution images will feel like a warm hug, creating that personal connection with your audience that typical stock images cannot quite reach.

Storage & File Sharing Complicated computer networks and external hard drives are so 2005. Try these cloud storage resources to share files and collaborate on documents without a drawer full of USB cables and fifteen phone calls to your cousin who works in IT.

Dropbox

Modern companies are using Dropbox to share files between employees and collaborate on documents from multiple devices. Save all your documents to the cloud to access from anywhere, and share them via email invites with colleagues, clients, prospects, or whoever may need access. Your first GB of data is always free, which for a very small organization may be all you ever need.

Box

Another file sharing and cloud storage service similar to Dropbox. At Box you can store up to 10 GB of data for free, but will have to pay for additional users. If you are a solopreneur looking to make the most of free cloud storage, Box may be a better solution for your needs.

Google Cloud

If you already use a variety of Google apps (which you should; see above), Google Cloud is an obvious choice for backing up files, documents, images, and other content. Integrate it seamlessly with other Google apps to never lose track of your archive files.

I hope my comprehensive resource list will help you take your business to new heights!

Mel Feller, MPA, MHR, is a well-known real estate, business consultant, personal development consultant and speaker, specializing in performance, productivity, and profits. Mel is the President/Founder of Mel Feller Seminars with Coaching For Success 360, Inc. and Mel Feller Coaching, a real estate and business specific coaching company. His three books for real estate professionals are systems on how to become an exceptional sales performer. His four books in Business and Government Grants are ways to leverage and increase your business Success in both time and money! His book on Personal Development “Lies that Will Sabotage Your Success”. Mel Feller is in Texas and In Utah. Currently an MBA Candidate.

#business start up#starting a business#startup business#business startup#startup#starting a business#Coaching For Success 360#success#small business#online business#cutting business costs#business#free tools#free business tools#mel feller#mel feller coaching#melfeller#melfeller.com#melfellersuccessstories.com#mel feller in Texas#mel feller in Utah

2 notes

·

View notes

Text

Welcome.

Hello everyone welcome to my blog. Herein, I intend to inform any who are intrigued, even by the slightest, about the wonderful world of cryptocurrency. I have been following cryptocurrency since bitcoin and the blockchain first came out in 2009. I bought my first bitcoin in 2010 for 11 dollars. This last December I sold it for 19,000 dollars. It was one of the best feelings I have ever had in my life. As a college student, every bit of money is as important as ever. I felt like I hit the lottery. I paid off a few college loans and had some of my investment left over. I thought, well it happened once, so I think it can happen again so I bought into more cryptocurrency. This time was much different though. Since 2009, over 1000 different cryptocurrencies have been created, all of which having their own unique use case. Before we are to dive into how each of these digital currencies can positively impact the globe, we need to take a step back again.

To enlighten those who are not familiar with digital currencies, or cryptocurrencies, they are virtual store-of-values, and behave similarly to an investment in the stock market. The general name for these comes from the root word “cryptography” which involves security embedding for computer programs and software. It is indication of the featured security bonuses. The actual currencies themselves take no physical form, which creates ease and sustainability in its production. Think of all of those lovely pennies laying around on the street that cost more to produce than they are worth in store value. Cryptocurrency includes ease of storage, transfer, and operation, as well as offering inexpensive and more rapid transactions. It gives users pseudo anonymity, privacy, and financial independence from governments and central banks, which serves as one of the many characteristics creating value for these digital currencies. At the moment there is no government or central bank that can issue cryptocurrency. The lack of central banks and government control allows users of cryptocurrency to maintain total decentralization.

Cryptocurrency started with three main coins - Bitcoin, Ethereum, and Litecoin. Currently, as I mentioned earlier, there are over 1000 different kinds. Most of these cryptocurrencies can be broken down into three different groups. The first group, often referred to simply as currencies, are used for micro transactions. Given that these are the quickest and cheapest to transfer between parties, these are the most familiar and used. Currency cryptos are traded like fiat currencies like the US dollar or the Euro. The most common currency crypto by a majority is Bitcoin. Many different cryptocurrencies out there try to replicate bitcoin and add their own twist or try to make a better usable crypto. It is often speculated that Bitcoin is the most valuable given its “first mover advantage”, but the fact of the matter is that it is valuable, thus indicating global desire for fair and equal spending power. Litecoin and Bitcoin Cash are examples of coins being used for micro transactions. These essentially work the same way a bank account works. If you want to buy something, you send an amount of a currency from your wallet to the person’s wallet you are purchasing anything from. A wallet serves as your very own, accessible only by you, bank. That’s right, you are your own banker. Putting people in charge of their own wealth, you will see banks around the globe step up to the challenge that will be suppressing this technology. Federal and international banks alike are nothing more than a business, and at the end of the day they seek to make money off you simply trying to live. Again, there is significant value that comes with that potential.

The second category of cryptos are the “utility” cryptocurrencies. Utility currencies exist to perform a function different than transfer of wealth within a blockchain; a blockchain is simply the name of the coding technology used in developing cryptos . Ethereum and Basic Attention Token (BAT) are prime examples of cryptos given value because of their utility purposes. Ethereum allows developers to create applications within a network of blockchains, an enormously powerful shared global infrastructure that can move value around and represent the ownership of property. It is a decentralized platform that runs smart contracts: applications that run exactly as programmed without any possibility of downtime, censorship, fraud or third-party interference. Ethereum enables developers to create markets, store registries of debts or promises, move funds in accordance with instructions given long in the past (like a will or a futures contract) and many other things that have not been invented yet, all without a middleman or counterparty risk. Anyone with a vision can purchase some Ethereum and make it reality on the Ethereum blockchain. Basic Attention Token or BAT for short, is a blockchain based digital advertising browser and utility token that can be exchanged between publishers, advertisers and users. The neat thing about the utility of BAT token is that it is based on user attention as users view ads and content in the brower’s tabs.. BAT has a browser that is catered to the user on how they spend their time online. This allows publishers of ads the perfect way to engage specific audiences. BAT’s ads are anonymously matched with customer interests. Using learning algorithms, the browser caters less irrelevant ads to the consumer.

The last category of cryptos are the “app/platform” cryptocurrencies. These represent the equivalent of an app or platform. While this area is still being created as developers get more and more creative with blockchain technology, one platform that I am most thrilled about is one called Steemit. Steemit is nothing more than a social media platform, yet it offers so much more than any other social media platform currently in existence. As we all know by now, we are a product on most social media platforms, and we are sold out to businesses in the form of our data and contributions, think targeted advertisements. At the end of the day, isn’t it peculiar that we do not get a share of that wealth we create for platform developers? That is where Steemit intends to change the game. When a user of this platform presents something on their page, Steemit rewards the creator of the content based on how big of an impact it has amongst other users. This is especially valuable for two reasons; the first reason being that people with a genuine product to offer people can present it on this platform, and help fund their effort with the currency they recieve for bringing content to Steemit. The currency received is called Steem, and though not recognized as one of the greats, can be used for exchange of value between peers. The second focus in which we find value for this technology is in its ability to give back to the average user for the data they contribute. If you are on Steemit posting photos, and you have 500 users liking that photo, Steemit rewards you for offering something that other people liked. You are no longer creating wealth only for some company selling your data, but also for yourself as you are part of the reason that data has any value to marketers. As more and more platforms are created under this premise, there is opportunity for major shift in distribution of wealth.

Another app or platform coin that I am very fond of is called Siacoin. Most people in today’s day and age are familiar with the cloud, specifically the ICloud and Dropbox. Both platforms are popular and are used by many people. But how safe is the ICloud or Dropbox storing all of your information you please to keep in the cloud? Both of the platforms have been hacked many times, which makes you question if your information could be stolen as well. What if there was a cloud storage platform that couldn’t be hacked? There is! Siacoin is that platform. The platform separates your files, and encrypts them with a code that makes all of the files you choose to store, available to the users eyes only. This means no outside company or third party can access your files like many cloud storage providers do. To store items away on the platform, you can only use Siacoin tokens as means in exchanging for a place to store your files. Once exchanged, the users files are the spread among the platform and divided into smaller pieces that are then distributed in the decentralized network. Having files on the decentralized network secures consumers information from any kind of hacking or manipulation. Not only is it the most secure cloud storage platform, but it the cheapest as well. Siacoin’s service is about 90 percent cheaper than the leading cloud storage platforms like ICloud, Dropbox, and Amazon. Purchasing 1TB of storage on Siacoin’s network will run the user about $2, compared to the $23 that Amazon charges per month. I think we all know the better option here.

There are many more cryptocurrencies in this space that offer a unique potential to improve the world. The list is truly expansive and only growing as more and more brilliant faces get involved. I believe so much in the good that cryptocurrency could do for us if they were given the proper chance, as with the passage of time, there are always well defined waves of change and the zeitgeist of this forthcoming wave is indisputably cryptocurrency. Once understood, it only feels right that this technology holds an influential spot in history.

4 notes

·

View notes

Photo

iServeU Rendering EMI Collection Software Smartly to Make System efficient and Agile

Cash Withdrawal

Cash Withdrawal allows the users to have money in-hand by either visiting a bank branch or an ATM. ATMs can work in-hand for 24 hours on every day basis apart from time it is running out of cash.

However, ATMs and banks are available in each area of the country. People residing in rural and backward regions face a major hurdle of money withdrawal due to the unavailability of the bank facilities. Since

iServeU has always focused on empowering the rural sector. They provide the facility of linking their Aadhaar number with their bank account. Hence rural residents can now avail cash and even check bank balance anywhere and anytime. iServeU has made its primary focus on semi-urban and rural residents. The main motive is to fulfill the demand for ATMs and the banks in these areas. iServeU has adopted the following two methods after lots of research:

Micro ATM

Helps in ATM Withdrawal with Debit Card

Aadhaar ATM – Provides Aadhaar Enabled Payment System

Cash Deposit

Cash Deposit refers to depositing money in the bank account either by visiting the branch or the nearby ATM. It allows clients for offering cash dumping to the customers those who visit them.

ATM cash deposit is available for 24 hours and seven days. Also, it works on holidays. But the fact is, people cannot avail ATM services everywhere or by sitting at home. For them, iServeU has brought the best solutions for cash deposit with 100% cross-banking money deposit even by easily sitting at home. This service works for every day for 24 hours. Cash deposit at iServeU is with the help of the Domestic Money Transfer service that they provide. Now the customers need not have any fill slips or documents for cash deposit as they do visit a bank. This will also save paper wastage and save the resource of the country. Mobile numbers will work for a customer who wants to transfer money from one bank account to another conveniently.

EMI Collection Software

EMI collection software is an efficient tool to help the agents of any financial institution to collect EMI loans from the people. Thus it helps to maintain the real-time record of the customers online.

iServeU has successfully implemented this feature for lending money , collection loans, and to maintain records of the people. Due to the use of advanced technology EMI collection and agile methods are made more efficient. This service provided by iServeU has helped many banks and other financial institutions for successful loan recovery. It has helped agents to handle the end to end process for the collection. Also, it has reduced cost for collecting and thus saving your valuable time. It has provided real-time EMI loan collection and brings transparency in their work. The collection of loans by iServeU is through various ways, including online fund transfer, wallets, and banks. iServeU’s contribution is remarkable in the banking sector.

0 notes

Text

Signal Loans - Lending and Credit Management App for Micro Finance Business.

Signal Loans – Lending and Credit Management App for Micro Finance Business.

Important Information:

Lending and banking in general is a wide area. This app is not a full banking software. Please take some hours to test the system, see if it meets your use case.

I will assist you set it up in your online server. However do not demand for features that’re clearly not in the demo. Customization is charged, and depends on developer availability.

Its developed on Angular /…

View On WordPress

#account#accounting#amortization#angular#api#banking#collateral#credit#javascript#Laravel#lending#loan#management#microfinance#REST

0 notes

Text

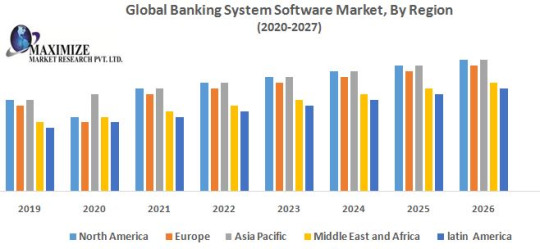

Global Banking System Software Market : Industry Analysis and Forecast (2019-2026) – by Type, Application,Core Banking Software, Features of core banking software,and Region

Global Banking System Software Market size was US$ 26.71 Bn in 2019 and expected to reach US$ XX Bn by 2026, at a CAGR of XX % during forecast period.

The report includes the analysis of impact of COVID-19 lock-down on the revenue of market leaders, followers, and disrupters. Since lock down was implemented differently in different regions and countries, impact of same is also different by regions and segments. The report has covered the current short term and long term impact on the market, same will help decision makers to prepare the outline for short term and long term strategies for companies by region.

Banking system software market is segmented by type, application, and region. On basis of type banking system software market is segmented into core banking software, multi-channel banking software, bi software, and private wealth management software. Application segment is divided by risk management, information security, business intelligence, training and consulting solutions. Geographically, banking system software market is spread by North America, Asia-Pacific, Europe, Latin America, and Middle East & Africa.

Increasing implementation of online banking and mobile banking by customers which appearances high level of inclination towards accessing their account details and perform financial actions by digital platform driving the demands for banking system software .Customer can use their laptops, smartphones, tablets and emerging trends such as patch management is expected to provide numerous opportunities banking system software market growth. Banking system software market is driven by rising necessity to increase productivity and operational efficiency of banking industry. Furthermore, Concerns regarding information security and high costs of moving from legacy systems to the new automated systems limits the growth of this market.

Mobile Terminal Segment represented the major share in the global banking system software market owing to its high prevalence in the global market. The increase in cell phone purchasers has basically determined the market for mobile banking software. Advances in digital technology has offered countless of channels for customer interaction. Customer interaction via digital channels is generating beneficial transactional data. Mobile banking has been increasing with the growing number of smartphone owners with a bank account.