#paytm upi

Text

PaytmBucks _ Earn Rewards

Thank You For Contacting PaytmBucks 🤑🤑

You Can Earn Money Daily By Doing Simple Tasks & Playing Games 🤑🤑

You Can Redeem Your Rewards In Gift Cards & Wallet 💸💰

My referral code is : 67861

Visit our site here : https://msha.ke/paytmbucks

3 notes

·

View notes

Text

#50#000+ events every month!#Amazing app for players who prefer to play on mobile#Many payment methods in rupees - UPI#PayTm#PhonePe Very good#Visit Now:- https://www.pro-cric.com

3 notes

·

View notes

Text

How to use credit cards for UPI transactions.

#DigitalIndia#GoCashless#UPILife#MakingPaymentsEasy#FinTechRevolution#ContactlessPayments#ScanandPay#FutureofMoney#InstantTransactions#UnifiedPaymentsInterface#BHIMapp#PhonePe#GooglePay#Paytm (Popular UPI Apps)#UPIQR#ScanToPay#SplitBills#UPIForBusiness#UPIAutoPay#BillPayments#UPIForDonations#BeSafeWithUPI#SecureTransactions#NeverShareUPIpin#PhishingAlerts#DigitalLiteracy#EducateForUPI#ReportUPIfraud#Stay vigilant#UPIForGood

0 notes

Text

Integrate Our UPI Collection API

Integrating the UPI Collection API by Rainet Technology Private Limited into your financial infrastructure offers a seamless and efficient way to manage digital transactions. The UPI API, or Unified Payments Interface API, is designed to facilitate instant payment processing, making it an indispensable tool for businesses seeking to enhance their financial operations. By leveraging the UPI Collection API, businesses can streamline their payment collection processes, reducing the time and effort required to manage transactions manually. This integration not only improves the speed of transactions but also enhances security, ensuring that all payments are processed through a secure and reliable platform.

The UPI Collection API integration process is straightforward, allowing businesses to quickly implement the technology without significant disruption to their existing systems. Rainet Technology Private Limited provides comprehensive support and documentation to guide businesses through each step of the integration process. This ensures that even businesses with limited technical expertise can successfully adopt the UPI Collection API and begin reaping its benefits almost immediately.

One of the key advantages of integrating the UPI Collection API is the ability to offer customers a convenient and flexible payment option. With the UPI API, customers can make payments directly from their bank accounts using their smartphones, eliminating the need for cash or card transactions. This not only enhances the customer experience but also reduces the risk of payment fraud and errors.

Moreover, the UPI Collection API integration can significantly boost operational efficiency. Automated transaction processing reduces the need for manual intervention, freeing up staff to focus on more strategic tasks. This leads to improved productivity and cost savings for the business. In summary, integrating the UPI Collection API by Rainet Technology Private Limited is a strategic move for any business looking to enhance its payment processing capabilities, improve security, and offer a superior customer experience.

Visit Website: https://rainet.co.in/upi-collection-api.php

#upi integration api#upi api integration#upi payment gateway#paytm upi integration api#upi integration#upi payment gateway integratio#bbps api provider#upi payment gateway integration#education portal development company#bbps#bbps login

0 notes

Text

业精于勤,我选择摸鱼:探索真正的生活乐趣。 #印度支付 #Paytm #Mobikwik #UPI #beautifulgirl TG电报: https://t.me/ken_go2sea

0 notes

Text

“Paytm Shares Surge 5% as NPCI Approval Sparks Investor Optimism”

Discover the latest surge in Paytm shares as investor optimism soars following the approval from the National Payments Corporation of India (NPCI). One97 Communications, the parent company of Paytm, witnessed its shares rise by 5.00% to reach 370.70 rupees each.

The approval from NPCI allows Paytm to participate in UPI (Unified Payments Interface) services as a Third-Party Application Provider (TPAP), ensuring seamless UPI transactions and AutoPay mandates for users and merchants. This significant milestone underscores Paytm’s commitment to innovation and enhancing its financial technology offerings.

Unlike competitors like PhonePe or Google Pay, Paytm, leveraging its banking arm, did not require a separate TPAP license. As part of the new partnership, Yes Bank, Axis Bank, SBI, and HDFC Bank will serve as Payment Service Providers (PSPs) for Paytm, with Yes Bank tasked with managing existing Paytm Payments Bank Limited (PPBL) UPI users.

Despite a slight dip in monthly transactions from January to February, Paytm remains the third-largest UPI payments app in India, processing 1.41 billion transactions in February alone. With nearly 12% share in UPI payments, Paytm continues to play a significant role in shaping India’s digital payments landscape.

As Paytm solidifies its position in the fintech sector with NPCI approval and strategic partnerships, investors are eyeing its future growth trajectory with heightened optimism. Stay tuned for further updates on Paytm’s journey as it continues to innovate and evolve in the dynamic world of digital finance.

0 notes

Link

In an era where speed and convenience reign supreme, the Unified Payments Interface (UPI) has emerged as a game-changer in India's digital transaction landscape. This revolutionary payment system has not only gained widespread popularity domestically but is also making waves internationally. Let's delve into the intricacies of UPI, exploring how it works and unveiling the top five UPI payment apps that are reshaping the way India transacts. Understanding UPI: A Seamless Digital Payment Revolution What is UPI? Unified Payments Interface (UPI) is a real-time payment system in India that facilitates instant money transfers between bank accounts through mobile devices. It operates 24/7, allowing users to execute seamless and immediate fund transfers, bill payments, and more. UPI leverages the Immediate Payment Service (IMPS) infrastructure and is administered by the National Payments Corporation of India (NPCI). How Does UPI Work? Users link their bank accounts to a UPI-enabled app, creating a unique UPI ID. To initiate a transaction, users enter the recipient's UPI ID, specify the amount, and authorize the payment with a secure PIN. UPI's interoperable platform streamlines digital payments, offering a convenient solution for users across various banks and financial institutions. India's Top 5 UPI Payment Apps: A Deep Dive Google Pay (GPay) Formerly known as Tez, Google Pay has become a household name in India, renowned for its user-friendly interface and secure transactions. Its rewards system, featuring scratch cards and cashback on transactions, keeps users engaged. The innovative audio QR feature enhances security for proximity payments, setting it apart from the competition. PhonePe: A Versatile Payment Ecosystem PhonePe stands out for its smooth user experience and diverse service offerings, including mobile plan recharges, bill payments, and travel bookings. The option of a digital wallet provides users with additional payment flexibility, while the investment module allows for gold and fund investments, making PhonePe more than just a payment app. Paytm: Beyond UPI Payments Paytm, a versatile digital payment platform, has expanded its services into a comprehensive financial suite, covering banking, investments, insurance, and gaming. Its widespread QR code payment system makes it a ubiquitous choice, and recent enhancements in cybersecurity have boosted user confidence in conducting larger transactions. BHIM: Simplicity Backed by the Government Developed by the National Payments Corporation of India (NPCI), BHIM stands out for its simplicity and direct government backing. Focused solely on payments and money transfers, BHIM provides a stable and straightforward UPI experience, making it an ideal choice for users seeking simplicity and reliability. Amazon Pay: Integration with E-commerce Giant Amazon's foray into UPI payments with Amazon Pay has seamlessly integrated within the Amazon app. Offering benefits like cashback and instant checkout for Amazon purchases, Amazon Pay extends its functionality to bill payments, recharges, and money transfers. The Amazon Pay Later feature provides a convenient credit facility for eligible customers. FAQs: Unraveling Common Queries on UPI Q1: What is UPI's role in India's digital future? A1: UPI apps are pivotal in shaping India's financial landscape, providing accessibility and convenience for various transactions, from grocery shopping to mutual fund investments. Q2: How secure are UPI transactions? A2: UPI transactions are highly secure, requiring users to authorize payments with a secure PIN. Enhanced cybersecurity measures across UPI apps further ensure the safety of transactions. Q3: Can UPI apps be used for investments? A3: Yes, several UPI apps, such as PhonePe and Paytm, offer investment modules, allowing users to invest in assets like gold, tax-saving funds, and liquid funds. Q4: Is BHIM recommended for users seeking a straightforward payment experience? A4: Absolutely, BHIM is designed for users seeking simplicity and stability, focusing solely on payments and money transfers without additional services. Q5: How has UPI influenced e-commerce? A5: UPI's influence on e-commerce is evident, with even giants like Flipkart entering the UPI payment space, showcasing the growing significance of UPI in the digital commerce landscape.

#AmazonPay#BHIM#cybersecurity#DemystifyingUPI#Digitaltransactions#digitalwallet#ecommerce#financialservices.#GooglePay#IMPS#mobilepayments#NPCI#Paytm#PhonePe#UnifiedPaymentsInterface#UPI#UPIpaymentapps

0 notes

Text

youtube

The Rise of UPI and the Apps fueling this growth story...

0 notes

Text

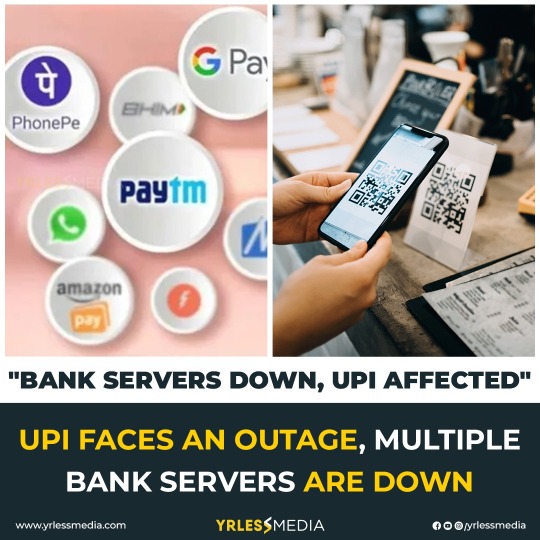

On Tuesday, multiple Unified Payments Interface (UPI) users took to social media to complain about an outage during transactions.

Netizens said making payments through UPI-enabled apps like Google Pay, PhonePe, Paytm, BHIM, etc was getting challenging, which the National Payments Corporation of India (NPCI) said was due to "internal technical issues" at a few banks.

"Regret inconvenience on UPI connectivity as a few banks have some internal technical issues. NPCI systems are working fine and we are working with these banks to ensure a quick resolution," said NPCI on the X platform (formerly Twitter).

X users complained most problems were faced when they tried making UPI payments through their HDFC Bank, State Bank of India, and Bank of Baroda accounts, among other banks.

#upi #downfall #serverbusy #bankservers #paytm #googlepay #phonepay #amazonpay #payments #onlinepayments #money #onlinetransactions #affected #notgettingmoney #hyderabad #yrlessmedia

1 note

·

View note

Text

Is Paytm Payments Bank in Trouble? Unraveling the RBI's Actions and Impact on Paytm's Future

Adapting to Change: Paytm’s Response and Future Strategies

In response to the RBI’s intervention, Paytm is mobilizing efforts to navigate these challenging times. The company, known for its resilience, assures users that withdrawals are unaffected, offering a semblance of relief. Paytm, traditionally not heavily invested in direct lending, suggests it can manage the potential panic-driven…

View On WordPress

#Digital Finance#Financial Landscape#Financial Regulation#financial technology#fintech#Future Strategies#Governance#Investor Reactions#Lessons Learned#Market Sentiments#Paytm#Paytm Payments Bank#RBI#regulatory compliance#Resilience#UPI Transactions

0 notes

Text

PaytmBucks Earn Rewards

Download Now PaytmBucks Earn Rewards 🤑🤑👇http://www.appsgeyser.com/17341416

1 note

·

View note

Text

PayTM: From Mobile Recharges to India's Fintech Giant

In the bustling heart of Noida, India, a young entrepreneur named Vijay Shekhar Sharma dreamt of a cashless future. In 2010, with a modest $2 million and boundless ambition, he birthed PayTM, a name soon synonymous with revolutionizing how India pays. From humble beginnings as a mobile recharge platform to its current avatar as a financial services behemoth, PayTM’s journey is a testament to…

View On WordPress

0 notes

Text

UPI Payout API

Rainet Technology has introduced an innovative service known as the UPI Payout API Service, revolutionising how businesses handle transactions in India. The UPI Payout service leverages the Unified Payments Interface (UPI) system, which is renowned for its seamless, real-time payment capabilities. This service is designed to facilitate bulk disbursements, making it an ideal solution for businesses that need to manage mass payouts efficiently.

The UPI Payout API enables companies to integrate this powerful payment solution directly into their existing systems, allowing for the automated processing of transactions. This integration significantly reduces the time and effort required to manage large-scale payments, whether for vendor payments, employee salaries, or customer refunds. By using the UPI Payout API, businesses can ensure that their transactions are secure, fast, and reliable, thus enhancing their operational efficiency and customer satisfaction.

Rainet Technology's UPI Payout API service stands out due to its robustness and ease of integration. The API is designed to be user-friendly, providing comprehensive documentation and support to assist businesses in the integration process. Moreover, it supports various types of transactions, ensuring flexibility and adaptability to different business needs. With the UPI Payout API, businesses can benefit from the extensive reach of UPI, which is widely accepted across India, ensuring that transactions can be made to virtually any bank account in the country.

In summary, the UPI Payout API service by Rainet Technology offers a cutting-edge solution for businesses looking to streamline their payment processes. By integrating the UPI Payout API, companies can automate and expedite their financial transactions, leading to improved efficiency and customer experience. This service not only underscores Rainet Technology's commitment to innovation but also highlights the transformative potential of UPI in the digital payment landscape.

Visit Website: https://rainet.co.in/payin-and-payout.php

#payin#payin api#payout#payout account#cashfree payout#payouts api#payouts#instant payout#instant withdrawal#pay in pay out#bbps api provider#bbps login#paytm upi integration api#upi api integration#upi integration#education portal development company#bbps#upi payment gateway#upi integration api#upi payment gateway integration

0 notes

Text

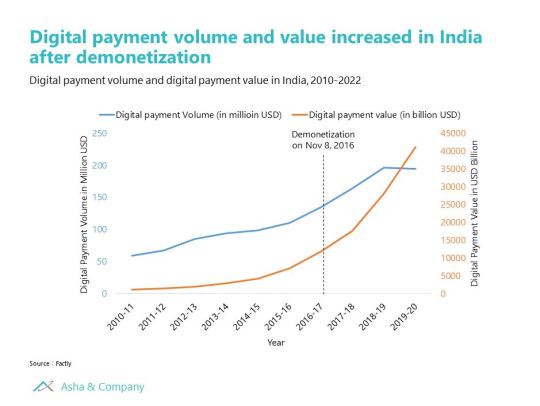

Rise of Digital Payment in India

Digital payments in India grew from 25B transactions in FY20 to 64B in FY22. This adoption of digital payment was fueled by the government's “Digital India” initiative, UPI payment, and lower mobile data costs. By 2026, India’s digital payment landscape is expected to grow to 411B transactions by FY27.

#market research#Digital Payment#digital payment solution#upi#Paytm#online payments#online paise kaise kamaye#onlinepaymentgateway#business intelligence#indian market

1 note

·

View note