#Financial Regulation

Explore tagged Tumblr posts

Text

Is cryptogo365.com Legit?

Is cryptogo365.com legit? Is it a scam? Scam Detector analyzed this website, giving it a medium trust score on our chart. We aggregated 53 powerful factors to expose high-risk activity and see if cryptogo365.com is legitimate. Let's look at it and its industry through an in-depth review. You'll also learn how to detect and block scam websites and what you can do if you already lost your money.

Cryptogo365.com raises significant red flags, suggesting that it may not be a legitimate platform. Various reviews indicate that this broker is involved in questionable practices, including not being listed as a reliable trading provider and potentially engaging in scams.

Lack of Regulation: Cryptogo365 operates offshore and is not regulated by any recognized authority. This absence of oversight is a major concern, as it means there is no accountability for their practices(Global Fraud Protection)(Trading Fraud Reviews).

Questionable Business Model: Reports indicate that users are required to input a referral code to access the trading platform, which is only obtainable through their agents. This can lead to aggressive sales tactics aimed at pushing clients to invest more money(Trading Fraud Reviews).

High Risk of Fraud: The broker reportedly charges high fees and offers an alarming leverage of up to 1:400, significantly increasing the risk of losing invested funds. Moreover, users have expressed concerns about difficulties in withdrawing money once deposited, which is a common tactic among fraudulent brokers(Global Fraud Protection)(Trading Fraud Reviews).

Negative User Feedback: There are many complaints regarding Cryptogo365, with users describing their experiences as deceptive and untrustworthy. The platform seems to prioritize profit over user safety, raising further concerns about its legitimacy(Trading Fraud Reviews).

Given these factors, it is advisable to approach Cryptogo365 with caution or avoid it altogether. If you've already invested money and are facing issues, consider reaching out to experts in scam recovery for assistance. For more detailed insights, you can check the sources (Trading Fraud Reviews)ps://tradingfraudreviews.com/scam-brokers/cryptogo365-review/).

#Scam Alert#Cryptocurrency#Online Trading#Investment Risk#Fraud Prevention#User Reviews#Broker Analysis#Financial Regulation#Scam Recovery#High-Risk Investments

1 note

·

View note

Text

RBI to Launch Public Repository for Digital Lending Apps

In a significant move to enhance consumer protection and transparency in digital lending, the Reserve Bank of India (RBI) has announced the creation of a public repository for digital lending apps (DLAs). This initiative aims to help customers verify whether a lending app is associated with regulated entities, such as banks, and avoid potentially illegal apps.

Background and Need

On September 2, 2022, the RBI issued comprehensive guidelines for digital lending, addressing critical issues like customer protection, data privacy, interest rates, recovery practices, and mis-selling. Despite these guidelines, reports have surfaced about unscrupulous digital lenders falsely claiming affiliations with RBI-regulated entities.

A recent RBI Working Group found that about 600 of the 1,100 digital lending apps available on Indian Android devices are illegal. With the proliferation of new lending apps, it’s increasingly challenging for users to determine the legitimacy of these apps.

The Repository’s Role

The RBI’s new repository will be a valuable tool for consumers. It will list digital lending apps deployed by regulated entities, allowing users to check if an app is legitimate or illegal. The data will be submitted directly by regulated entities to the repository and updated regularly. This will ensure that borrowers can easily identify whether a lending app is associated with a recognized, regulated entity.

Guidelines and Compliance

The RBI’s guidelines mandate that regulated entities disclose loan rates upfront and ensure borrowers are well-informed about loan products during the onboarding process. Additionally, these entities are required to assess borrowers' economic profiles before extending loans.

Protecting Consumers

This initiative follows alarming trends where predatory lending practices have led to severe consequences for many individuals, including harassment and extortion. By providing a centralized, publicly accessible list of verified lending apps, the RBI aims to curb these unethical practices and safeguard consumers against fraudulent activities.

For more information, the repository will be accessible on the RBI’s official website, offering a crucial resource for both current and prospective borrowers.

1 note

·

View note

Text

Unmasking Spartan Capital: The Scandals, Lawsuits, and Investor Deceptions

Spartan Capital Securities Lawsuits have emerged due to numerous investor complaints involving allegations of fraud, churning, excessive trading, and significant compliance failures. The company's CEO, John Lowry, and Chief Compliance Officer, Kim Monchik, have been charged by FINRA for failing to disclose reportable events involving Spartan stockbrokers, including customer complaints and arbitrations. Investors who have suffered financial losses due to these actions may seek restitution through the FINRA arbitration process. The ongoing investigations and regulatory actions highlight the critical need for robust compliance and transparent practices within the firm to protect investor interests.

#Investor Protection#Spartan Capital Lawsuit#Financial Regulation#Securities Fraud#Broker Misconduct

0 notes

Text

Against Britcoin and The Digital Pound

As the digital age advances, the concept of money is evolving beyond physical coins and banknotes into the realm of digital currencies. One such development is the proposed "Britcoin," a digital version of the British pound. While this initiative promises to bring convenience and modernity to financial transactions, it also raises significant concerns. It's crucial to scrutinise the implications of Britcoin and advocate for a cautious approach to its adoption.

What is Britcoin?

Britcoin, the proposed digital pound, is envisioned as a state-backed digital currency, aiming to complement physical cash and existing digital payment systems. This initiative is part of a broader trend where countries are exploring central bank digital currencies (CBDCs) to streamline monetary transactions, reduce costs, and provide a government-backed alternative to cryptocurrencies like Bitcoin.

The Promised Benefits

Proponents of Britcoin highlight several potential benefits:

Efficiency and Speed: Digital transactions can be executed instantly, improving the efficiency of financial operations for both consumers and businesses.

Financial Inclusion: Britcoin could offer financial services to unbanked or underbanked populations, providing them access to secure and efficient payment methods.

Reduced Costs: Digital currency can potentially lower the costs associated with printing, storing, and transporting physical money.

Enhanced Security: With advanced encryption and blockchain technology, digital currencies can offer robust security against fraud and counterfeiting.

The Concerns

Despite these advantages, the introduction of Britcoin raises several red flags:

Privacy Issues: Digital currencies are inherently traceable, which could lead to increased surveillance of financial transactions by the state. This threatens individual privacy and could be misused for unwarranted tracking of personal spending habits.

Centralization Risks: The control of Britcoin by a central authority, such as the Bank of England, centralizes financial power, potentially leading to misuse or policy decisions that may not reflect the best interests of the public.

Cybersecurity Threats: As a digital entity, Britcoin would be susceptible to cyberattacks. A breach could have catastrophic consequences, destabilizing the financial system and leading to significant economic losses.

Technological Dependence: A move towards digital currency increases dependence on technology and infrastructure. In cases of technical failures or power outages, access to money could be disrupted, affecting daily life and business operations.

Economic Inequality: While intended to promote financial inclusion, Britcoin could exacerbate existing inequalities if its implementation doesn't consider those without access to digital technologies or the internet.

The Need for Vigilance

Given these potential drawbacks, it's imperative to approach Britcoin with caution. Here's how we can advocate for a balanced and thoughtful consideration of this digital currency:

Demand Transparency: Push for clear and transparent communication from the government and financial institutions about the development and implementation of Britcoin. Public consultations and debates should be encouraged to address concerns and gather diverse viewpoints.

Privacy Protections: Insist on robust privacy measures to ensure that users' financial data is protected from misuse and unwarranted surveillance. This could involve stringent regulations and oversight mechanisms.

Cybersecurity Measures: Advocate for the highest standards of cybersecurity to safeguard against potential threats. This includes regular audits, risk assessments, and investment in cutting-edge security technologies.

Inclusivity Plans: Ensure that plans for Britcoin include provisions for those without access to digital technologies, such as rural populations and the elderly. This could involve providing alternative methods of access or maintaining physical cash options.

Legal Frameworks: Call for the establishment of comprehensive legal frameworks that govern the use, distribution, and regulation of Britcoin. These frameworks should protect users and ensure the stability of the financial system.

While the advent of Britcoin represents a significant step towards modernizing the financial landscape, it's essential to proceed with caution. By understanding the potential risks and advocating for robust safeguards, we can ensure that the digital pound serves the public interest without compromising privacy, security, or inclusivity. The fight against a hasty and ill-considered rollout of Britcoin is not about resisting progress but about ensuring that progress benefits everyone fairly and equitably.

#Britcoin#Digital Pound#Central Bank Digital Currency#CBDC#Financial Privacy#Digital Currency Risks#Economic Inequality#Financial Inclusion#Monetary Policy#Digital Payments#Cybersecurity#Digital Financial System#Blockchain Technology#Government Surveillance#Financial Regulation#Currency Modernization#Digital Economy#Financial Security#Technological Dependence#Digital Finance Ethics#today on tumblr#new blog

0 notes

Text

Cryptocurrency Litigation Success: Assessing Compensatory Damages in Lieu of an Injunction for Specific Performance

London, UK – 2 July 2024 – In a significant victory for our client, Mr. Southgate, the Chancery Division of the High Court, has issued a favourable ruling in the case of Southgate v Adam Graham [2024] EWHC 1692 (Ch). Our successful litigation case centered on a dispute arising from a loan agreement involving a cryptocurrency. The initial court decision found Adam Graham in breach of the…

#Bitcoin#Breach of contract#Civil Litigation#Civil Procedural Rules#Contracts#Cryptocoin#Cryptocurrency#Cryptocurrency Dispute#Cryptocurrency Loan Dispute#damages#Ethereum#Financial Regulation#judgment#Litigation#NFTs#Specific Performance#Valuation

0 notes

Text

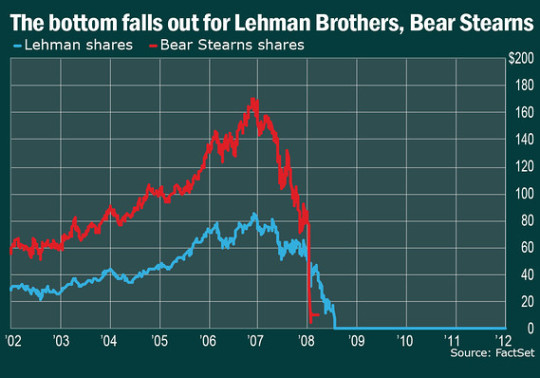

The 2008 Market Crash: Causes, Impacts, and Lessons Learned

l. Introduction The 2008 market crash stands as one of the most significant financial upheavals in modern history, reshaping economies and livelihoods around the globe. Understanding the causes and impacts of this crisis is crucial for navigating future economic challenges. ll. Background of the 2008 Market Crash A. Economic conditions leading up to the crash Prior to 2008, the United States…

View On WordPress

#2008 financial crisis#2008 market crash#economic impact#financial crisis#financial institutions#financial regulation#financial regulation failures#financial system flexibility#global financial meltdown#global recession#government dole#government intervention#housing market collapse#Lesson learned#Market Crash#Responsible lending practices#Risk Management#role of the central bank#subprime lending#subprime mortgage crisis

0 notes

Text

Is Paytm Payments Bank in Trouble? Unraveling the RBI's Actions and Impact on Paytm's Future

Adapting to Change: Paytm’s Response and Future Strategies In response to the RBI’s intervention, Paytm is mobilizing efforts to navigate these challenging times. The company, known for its resilience, assures users that withdrawals are unaffected, offering a semblance of relief. Paytm, traditionally not heavily invested in direct lending, suggests it can manage the potential panic-driven…

View On WordPress

#Digital Finance#Financial Landscape#Financial Regulation#financial technology#fintech#Future Strategies#Governance#Investor Reactions#Lessons Learned#Market Sentiments#Paytm#Paytm Payments Bank#RBI#regulatory compliance#Resilience#UPI Transactions

0 notes

Text

Treaty of the European Union and Basel III Reforms

Abstract: First I give a brief overview of Article 107 of the Treaty of the EU(TEU). Next, I give a summation of the issues which have come up for the EU in the last decade which have affected state aid, and the guarantees inherent in the Treaty of the EU

Abstract: First I give a brief overview of Article 107 of the Treaty of the EU(TEU). Next, I give a summation of the issues which have come up for the EU in the last decade which have affected state aid, and the guarantees inherent in the Treaty of the EU. These include the Greek Debt Crisis, as well as extraterritorial measures which have been taken an order to further enhance the quality, and…

View On WordPress

#Basel III Reforms#Basel IV#Europe and OECD#Financial Reforms#Financial Regulation#OECD#Regulatory Reform#Treaty of Paris

0 notes

Text

0 notes

Text

Decision Made: Coinbase Defeats SEC

Coinbase wins case against the Securities and Exchange Commission in the US Supreme Court. The decision is made; claims that were previously filed in federal court are being suspended now until the defendant files an appeal and sends the case to arbitration. This means that disputes will be resolved not through a long and difficult litigation but through arbitration where a third neutral party will make the final decision.

Earlier the SEC suspected Coinbase that since 2019 the exchange has illegally earned “billions” on asset purchases and sales. In addition, the Commission accuses the company of ignoring the mandatory disclosure requirement, thereby depriving investors of the necessary protection that prevents fraud and manipulation.

The main accusation is that Coinbase failed to register in accordance with the requirements of the SEC which deprived investors of access to important protective procedures. The company did not pass the SEC review, did not comply with record keeping requirements and did not provide conflict of interest protection.

The case has moved on which means that Coinbase is strengthening its position as one of the leading players in the market and confirming its case.

#decentralization#cryptocurrency#blockchain#litigation#SEC#GaryGensler#regulation#cryptocurrencylaws#digital economy#financial regulation#cryptoindustry#cryptocommunity#cryptocurrencytechnology#protection_of_investor_rights#fintech

0 notes

Text

#this came to me in a vision#i dont believe in santa but gimme emotional regulation and financial stability 🤲#actually bpd#bpd#bpd meme#bpd shit#actually borderline#rambles

333 notes

·

View notes

Text

Feb 14 (Reuters) - The rise of "pig butchering" scams and the increasing use of generative artificial intelligence likely lifted revenues from crypto scams to a record high in 2024, according to blockchain analytics firm Chainalysis.

Revenue from pig butchering scams, where perpetrators cultivate relationships with individuals and convince them to participate in fraudulent schemes, increased nearly 40% in 2024 from the previous year, the firm estimated in a report published on Thursday.

Revenue in 2024 from crypto scams was at least $9.9 billion, although the figure could rise to a record high of $12.4 billion once more data becomes available, it said.

"Crypto fraud and scams have continued to increase in sophistication," Chainalysis researchers said.

The company pointed to marketplaces that support pig butchering operations and the use of GenAI as factors making it easier and cheaper for scammers to expand operations.

https://www.reuters.com/technology/crypto-scams-likely-set-new-record-2024-helped-by-ai-chainalysis-says-2025-02-14/

#crypto#reuters#bitcoin#ethereum#money#finance#economy#ai#artificial intelligence#politics#political#us politics#news#cash#digital currency#bitlocker#digita wallet#crypto exchange#blockchain#financial#economic#economics#non-fungible token#NFT#stablecoin#virtual currency#bitcoin mining#government#regulation#scams

15 notes

·

View notes

Text

Is an RB podium bad for F1?

#how would it not be a ‘genuine’ podium simply because they’re taking parts off Red Bull that is well within the regulations???#I can’t believe they’re going to make me deep throat a corporation on main like that all season long#a backmarker gets some financial backing and decides to exploit some symbiosis within legal boundaries of the sport#and suddenly it’s a problem?#and not to make this about Daniel but would this have gotten this much attention if it would have been any other driver pairings at RB?#daniel ricciardo

124 notes

·

View notes

Note

Hello, I've been paying attention to Dustborn and the only actual question I would like to make is if you see anything worth dissecting on the fact that it got tax money from the EU? Games funded by a government are very rare, so I wonder if analyzing the game from that perspective provides something interesting into game development.

Getting tax breaks and incentives from various governments is actually very common. Government investment is often a lot like scholarships to university - they have bundles of money set aside for applicants that meet certain criteria. Most governments are interested in encouraging economic activity within their borders, especially tech industry growth. Tech pays pretty well, isn't large on space, and encourages secondary growth - tech workers that move to the area will buy usually houses and spend with local businesses, leading to a positive cycle of improved economic growth for the area.

As an example of this, in 2020 the Department of Community & Economic Development of Pennsylvania offered a [tax credit] of 25% of qualified expenses for the first four years of development and 10% for each subsequent year back in 2020 to game developers who spent at least 60% of their total production costs in Pennsylvania. The politicians were hoping to encourage game developers to move to Pennsylvania and they were offering tax credits as incentive.

Similarly, the Norwegian Film Institute offers funding to [audiovisual productions that meet their criteria]:

The screenplay, or the literary work on which the screenplay is based, has originally been written in the Norwegian or Sami language

The main theme is connected to Norwegian history, culture or social conditions

The action takes place in Norway, in another EEA country (countries of the European Union [EU] plus Iceland, Liechtenstein)

The work contains significant contributions from rights holders or artists resident in Norway or in another EEA country.

Dustborn ticked enough of these boxes that the NFI agreed to fund them. It wasn't a special thing, it was government money set aside to encourage the development of Norwegian-focused cultural audio visual works. That includes video games, movies, television, or any other kind of audio visual production. Lots of smaller works, games included, find funding through programs and grants like this.

[Join us on Discord] and/or [Support us on Patreon]

Got a burning question you want answered?

Short questions: Ask a Game Dev on Twitter

Long questions: Ask a Game Dev on Tumblr

Frequent Questions: The FAQ

27 notes

·

View notes

Text

Account Freezing Order Guide

An Account Freezing Order (AFO) is a type of a freezing order used by enforcement agencies in the UK to freeze monies held in accounts that are subject of an investigation into suspected criminal activity. This article explains the purpose, application process, legal implications, and consequences for you or your business that has been made subject to an AFO. Our expert team of AFO Solicitors and…

View On WordPress

#banking#Criminal Defence#Criminal Prosecution#Financial#Financial Advice#Financial Conduct Authority#Financial Crime#Financial Distress#Financial Regulation#Financial Services#Frozen Bank Account#HMRC#Litigation#Litigation advice#Litigation news#Magistrates

0 notes

Text

Oppose H.R. 1: the "One Big Beautiful Bill Act"

In May, House Republicans passed their partisan budget reconciliation bill, H.R. 1 the “One Big Beautiful Bill Act,” that will increase budget deficits by $2.4 trillion to finance trillions in tax cuts for the wealthy. This bill would enact the largest transfer of wealth from the poor the rich in decades.

Senate Republicans are now rewriting portions of the bill to satisfy strict Senate parliamentarian rules while also maintaining the House’s partisan wish list framework. These harmful provisions include:

Deep cuts to Medicaid, including harsh new work requirements

New Medicare eligibility rules and increased costs for dual Medicaid-Medicare enrollees

Tripling the budget for ICE and Trump’s mass deportation effort

Authorization for the sale of public lands and increased incentives for fossil fuel production

Widespread rollback of clean energy tax incentives and climate protections

Unprecedented funding cuts and expansion of work requirements for SNAP

Limits on a court’s ability to issue temporary restraining orders or preliminary injunctions

Funding cuts to clinical care services at Planned Parenthood and gender-affirming care for Medicaid and CHIP recipients

Requiring states block all AI regulation for 10 years in order to receive federal broadband funding

A $150 billion increase to an already bloated Pentagon budget

A national private school voucher program that diverts funding from public schools and sets up a new tax shelter for the wealthy

An increased excise tax on college endowments

Widespread changes to student loan access, protections, and repayment options

Harmful changes to federal worker pay, benefits, unions, and protections against unjust treatment

Slashes to funding for the Consumer Financial Protection Bureau (CFPB) by nearly 70%

Elimination of a tax on gun silencer sales

Raising the debt limit by $5 trillion purely to fund tax cuts for the wealthy, adding trillions to the national debt.

Senate Republicans are aiming to pass their version of H.R. 1 by the July 4th holiday. Call your Senators and demand they oppose this destructive bill.

fax tool:

#us politics#aclu#fuck project 2025#stop internet censorship#lgbtq+#american politics#fuck donald trump#stop project 2025#stop bad bills#fight for the future#fuck trump#save the environment#environmentalism#the environment#save the usps#usps#consumer financial protection bureau#regulations#stop ai#ai regulation#save education#education rights#climate change#save the climate#stop climate change#fuck climate change#Stop project 2025#defeat project 2025#fuck mike lee#oligarchy

6 notes

·

View notes