#private blockchain applications

Explore tagged Tumblr posts

Text

Private Blockchain Development in USA

Unlock Efficiency with Mobiloitte Private Blockchain Development. Our expert team crafts tailored private blockchain solutions for seamless operations. Streamline transactions, enhance security, and transform your business. Join industry leaders in harnessing the power of blockchain. Elevate your business with Mobiloitte's cutting-edge expertise. Contact us for innovative private blockchain development.

Visit: https://www.mobiloitte.us/

#private blockchain development#private blockchain advantages#private blockchain applications#create a private blockchain#private blockchain platforms#private blockchain companies#private blockchain developers

0 notes

Text

From Casinos to Crypto: How Las Vegas Became a Blockchain Innovation Hub

Las Vegas, long synonymous with its iconic casinos and vibrant entertainment, is now emerging as an unexpected hub for blockchain innovation. Inspired by the gaming industry’s need for security, transparency, and enhanced user experiences, the city is becoming a leader in fintech applications powered by blockchain. This transformation is driving the convergence of technology, finance, and entertainment, paving the way for the city’s tech-driven future. Fifteen years ago, in 2010, 10,000 Bitcoin was used to purchase two pizzas, a transaction that marked the first real-world use of the cryptocurrency. At the time, Bitcoin was practically worthless. Fast forward to today, and the value of Bitcoin has skyrocketed. Now, selling just 33 Bitcoin could buy you a $3 million penthouse at the prestigious Four Seasons Private Residences in Las Vegas. This dramatic shift highlights not only Bitcoin’s meteoric rise but also redefining how wealth and assets are exchanged in a tech-driven world.

1. Blockchain Integration in Las Vegas

Resorts World Las Vegas

Resorts World Las Vegas is a prime example of how casinos are embracing blockchain technology and digital currencies.

Crypto Payments: The casino allows customers to use Bitcoin and Ethereum for hotel bookings, dining, and other services, partnering with Gemini, a regulated crypto exchange.

Cashless Gaming: Patrons can use mobile wallets instead of carrying physical cash. This not only enhances convenience but also increases transaction security, reducing risks of theft or fraud.

Wynn Las Vegas

Wynn Las Vegas has partnered with fintech firms to explore blockchain-based loyalty rewards programs. Customers can earn digital tokens tied to casino activities, which can be redeemed for hotel stays, entertainment, or dining experiences.

Case Study: Blockchain for Fair Play

A notable example of blockchain in casinos is FunFair Technologies, a platform that offers decentralized casino solutions using Ethereum smart contracts. While not exclusive to Las Vegas, FunFair’s model ensures provable fairness by publishing game outcomes on the blockchain, making it impossible for casinos to manipulate results.

Such innovations are being tested in Las Vegas-style gaming platforms globally, showing how blockchain can build trust between casinos and players.

Casinos in Las Vegas Accepting Bitcoin for Payments

Golden Gate Hotel & Casino

Location: 1 Fremont Street, Las Vegas, NV 89101

Details: As the oldest casino in Las Vegas, Golden Gate accepts Bitcoin for hotel bookings, dining, and gift shop purchases.

Note: Bitcoin is not accepted for gambling activities but can be converted to U.S. dollars for gaming.

The D Las Vegas Hotel & Casino

Location: 301 Fremont Street, Las Vegas, NV 89101

Details: The D Las Vegas allows Bitcoin payments for hotel rooms, dining, and merchandise at its gift shop.

Note: Bitcoin cannot be used directly for gambling but works for other non-gaming services.

Resorts World Las Vegas

Location: 3000 Las Vegas Blvd S, Las Vegas, NV 89109

Details: Resorts World has partnered with Gemini, a cryptocurrency platform, to accept Bitcoin for hotel stays, dining, and select retail purchases.

Innovation: The resort also offers cashless gaming solutions, making it one of the most tech-forward destinations on the Strip.

2. Fintech Innovations Inspired by Gaming

The gaming industry’s push for seamless, secure, and engaging user experiences has inspired broader fintech applications.

Cashless Gaming Solutions

Casinos like The Venetian and MGM Grand have integrated cashless payment systems. Platforms such as Sightline Payments provide mobile wallets for gaming, dining, and retail, eliminating the need for physical cash.

These systems use fintech innovations like real-time payment settlement and biometric security for user verification, enhancing both speed and safety.

Gamification in Fintech

Gamification—using game-like elements in financial services—draws heavily from the gaming industry’s playbook.

Example: Robinhood: The stock trading app uses gamified features such as streaks, confetti animations, and rewards to engage users.

Las Vegas Influence: Gaming incentives and loyalty programs serve as inspiration for fintech apps offering rewards for saving, spending, or investing responsibly.

Case Study: The Link Between Casinos and Fintech Apps

Las Vegas casinos often deploy advanced AI-powered analytics to predict player behavior and optimize incentives. This same data-driven approach is now being used in fintech apps like Acorns and Stash, which offer personalized financial advice and savings plans based on user habits.

3. Las Vegas-Based Blockchain Gaming Companies

Infinite Games

Las Vegas-based Infinite Games is pioneering blockchain integration in mobile and online gaming:

NFT Ownership: Players can own in-game items as NFTs (non-fungible tokens), enabling trade and resale across different platforms.

Player Economy: By using blockchain, Infinite Games creates decentralized gaming economies where players can monetize their skills and assets.

PLAYSTUDIOS

PLAYSTUDIOS, famous for its loyalty-based mobile games, is exploring blockchain to make rewards more transparent and tradable:

Blockchain allows digital tokens to replace traditional rewards points. Players can transfer, sell, or redeem tokens in ways not previously possible.

Emerging Companies in the Sector

Startups like Decentral Games are pushing the boundaries by creating virtual casinos in the metaverse, powered by blockchain and cryptocurrencies.

Players can visit virtual versions of Las Vegas casinos, bet using digital assets, and enjoy provably fair gameplay.

4. Future Prospects for Blockchain in Las Vegas

Las Vegas’s integration of blockchain technology points toward a future that is both innovative and economically diverse.

Enhanced Security and Transparency

Blockchain creates an immutable ledger for transactions, making gaming and financial processes tamper-proof and transparent.

For example, blockchain is being explored to log all bets, winnings, and payouts, ensuring trust between players and casinos.

Blockchain for Tourism and Hospitality

The Las Vegas tourism industry can leverage blockchain for smart contracts in hotel bookings, event tickets, and tours.

For instance, a blockchain-based booking platform could eliminate intermediaries like OTAs (Online Travel Agencies), offering tourists lower costs and direct transparency.

Economic Diversification

By embracing blockchain technology, Las Vegas is diversifying its economy beyond casinos and entertainment:

Tech Startups: The city’s business-friendly policies are attracting fintech and blockchain startups.

Investors and Talent: Las Vegas is becoming a hub for blockchain conferences like Money 20/20, drawing global investors and tech talent.

Conclusion

Las Vegas’s journey from a global gaming capital to a blockchain innovation hub is a testament to its ability to adapt and evolve. By integrating blockchain into its casino operations, the city is setting new standards for transparency, security, and user engagement in gaming and fintech. From cashless gaming solutions to decentralized casinos, Las Vegas serves as both a case study and a blueprint for other cities looking to harness the power of blockchain.

Platforms like RealOpen are now facilitating real estate purchases using Bitcoin, Ethereum, and other cryptocurrencies. These platforms convert crypto to cash en route to escrow, allowing buyers to purchase any property, even if the seller isn’t crypto-friendly. For example, crypto enthusiasts can test these innovations by using Bitcoin to purchase luxury properties, including a Trump Las Vegas condos for sale. This seamless process allows digital asset holders to invest directly into the Las Vegas real estate market, turning crypto wealth into tangible luxury assets.

As fintech innovations inspired by the gaming industry continue to grow, Las Vegas is uniquely positioned to lead this revolution—solidifying its status not just as the Entertainment Capital of the World, but also as a Tech and Blockchain Capital for the Future.

8 notes

·

View notes

Text

Child Adoption in Thailand

1.1 Primary Legislation

Adoption Act B.E. 2522 (1979): Core legal framework

Child Protection Act B.E. 2546 (2003): Safeguards for adopted children

International Private Law Act B.E. 2541 (1998): Cross-border adoptions

1.2 Regulatory Bodies

Department of Children and Youth (DCY): Central oversight

Child Adoption Center of Thailand: Primary processing agency

Juvenile and Family Courts: Legal approval authority

Ministry of Social Development and Human Security: Policy formulation

2. Eligibility Criteria for Prospective Parents

2.1 Basic Qualifications

Age Requirements:

Minimum 25 years old

At least 15 years older than child

Maximum 45-year age gap (exceptions possible)

Marital Status:

Married couples (heterosexual only)

Single applicants (gender-specific restrictions apply)

Financial Capacity:

Minimum THB 150,000/month income

Stable employment history (3+ years)

2.2 Health and Background Checks

Medical Examination:

Complete physical including HIV test

Psychological evaluation

Criminal Clearance:

Thai police records

Home country Interpol check

Child abuse registry verification

3. Adoption Categories and Processes

3.2 International Adoption Protocol

Hague Convention Compliance:

Thailand is not signatory but follows principles

Requires home study by accredited agency

Document Legalization:

Notarization

Ministry of Foreign Affairs authentication

Thai embassy legalization

4. Child Eligibility and Matching

4.1 Adoptable Children Profile

Age Distribution:

70% under 5 years

25% 6-12 years

5% teenagers

Special Needs Considerations:

Medical conditions (30% of cases)

Sibling groups (15%)

4.2 Matching Criteria

Cultural Compatibility: Religion, language

Family Environment: Urban/rural preferences

Child's Background: Trauma history assessment

5. Legal Procedures and Timelines

5.1 Pre-Adoption Process

Application Submission (DCY Form 1)

Home Study (3-6 months)

5+ visits by social worker

Family environment assessment

Approval Committee Review (2-3 months)

5.2 Court Procedures

Filing Petition: Juvenile Court jurisdiction

Hearings:

Initial review (30 days post-filing)

Child interview (closed session)

Final ruling (typically 60-90 days)

Post-Adoption Reports:

Quarterly for first year

Biannually until child is 18

6. Post-Adoption Legal Framework

6.1 Parental Rights and Obligations

Full Legal Parentage: Birth certificate amendment

Inheritance Rights: Equal to biological children

Revocation Conditions: Extreme neglect/abuse

6.2 Citizenship Issues

Thai Children:

Retain citizenship if adopted internationally

Dual citizenship permitted

Foreign Adopters:

No automatic Thai citizenship for child

Visa sponsorship requirements

7. Special Case Adoptions

7.1 Special Needs Children

Expedited Process: 6-9 months

Additional Support:

Medical subsidy (THB 50,000/year)

Therapy access

7.2 Older Child Adoption

Consent Requirement: Child's agreement (age 12+)

Transition Programs: 3-month integration period

8. Emerging Trends and Challenges

89.1 Digital Transformation

e-Adoption Portal: Pilot phase for document submission

Blockchain Verification: For international documents

8.2 Policy Developments

Proposed Amendments:

Single male adopter restrictions

Extended post-adoption monitoring

COVID-19 Impact:

40% reduction in international adoptions

Virtual home study trials

9. Strategic Considerations

9.1 Document Preparation

Timeline Optimization:

Medical exams (6-month validity)

Police clearance (3-month validity)

Translation Requirements:

Certified Thai translations

MFA authentication

9.2 Legal Representation

Court Procedures:

Required for international cases

Recommended for contested adoptions

Appeal Process:

30-day window

Supreme Court jurisdiction

#thailand#familylaw#family#thaifamily#thailandfamilylaw#childadoption#childadoptioninthailand#thailandchildadoption

2 notes

·

View notes

Text

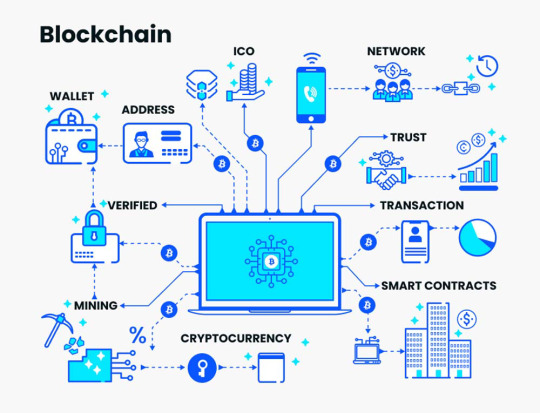

Blockchain Technology: Types, Features, and Future of Cryptocurrency Networks

Blockchain is not just a trend, it’s a game-changer. You can especially see it in the crypto world, where this technology is absolutely essential. It’s a decentralized system that ensures secure and transparent transactions without the need for traditional middlemen. Blockchain is the backbone of digital currencies like Bitcoin and Ethereum, ensuring their integrity and trust. But its potential goes far beyond cryptocurrencies — it’s transforming industries, from finance to healthcare, and its applications are expanding rapidly. In this article, we’ll dive into the different types of blockchain networks, how they work, and what the future holds for blockchain and cryptocurrency networks.

Introduction to Blockchain and Cryptocurrency Networks

Blockchain is a system for storing data that can’t be altered once it’s recorded. It’s made up of “blocks” of data that are linked together in a “chain” to form an ongoing ledger. Each block contains transaction data, and once confirmed, it can’t be changed. Blockchain is decentralized, meaning no single entity controls it. This decentralization is what makes blockchain secure, transparent, and trustworthy.

Cryptocurrencies like Bitcoin and Ethereum run on blockchain networks. Blockchain enables peer-to-peer transactions without the need for intermediaries like banks. This way, digital currencies can be transferred between people globally, securely and quickly. Blockchain’s role in cryptocurrencies is crucial for ensuring transparency and avoiding fraud.

The main benefit of blockchain is its security. It uses cryptographic algorithms to secure each transaction, ensuring that only authorized users can make changes. Since there’s no central authority, blockchain eliminates many issues associated with traditional financial systems, such as high fees and slow transactions.

There are several types of blockchain networks, each with varying levels of decentralization and access control. These include public, private, and hybrid blockchains. Public blockchains are open for anyone to join, while private blockchains have restricted access, typically used by companies. Hybrid blockchains combine features of both.

Types of Crypto Networks

Blockchain networks come in different types, each with its own unique features and use cases. Here’s an overview of the key types of blockchain networks:

Public Blockchains: These are open for anyone to join and participate. Examples include Bitcoin and Ethereum.

Private Blockchains: These are closed networks where only authorized participants can join. Companies often use private blockchains for specific business needs.

Hybrid Blockchains: These combine the best features of both public and private blockchains. They offer flexibility for organizations.

Consortium Blockchains: These are semi-decentralized networks where control is shared by multiple organizations. They’re often used in industries like banking.

Each type of blockchain network has its strengths and is used in different contexts. Public blockchains are great for transparency and decentralization, while private blockchains offer more control and privacy. Hybrid and consortium blockchains are perfect for businesses that need customized solutions.

Public vs. Private Blockchains

Public and private blockchains are two of the most common types. Here’s how they differ:

Public Blockchain:

Open for anyone to participate.

Highly decentralized.

More secure but can be slower due to many participants.

Example: Bitcoin, Ethereum.

Private Blockchain:

Closed network with restricted access.

Centralized control, often by one organization.

Faster but less decentralized.

Example: Hyperledger, Ripple.

Public blockchains prioritize transparency and decentralization, while private blockchains focus on privacy and control.

Permissioned vs. Permissionless Blockchains

Another key distinction in blockchain networks is whether they are permissioned or permissionless.

Permissionless Blockchain:

Anyone can join and participate.

Decentralized and open.

Common in public blockchains like Bitcoin and Ethereum.

Permissioned Blockchain:

Only authorized users can join.

Centralized control by a group or organization.

Common in private and consortium blockchains.

This distinction helps define who can participate in the network and how it’s managed.

Read the continuation at the link.

2 notes

·

View notes

Text

How to Recover Stolen Cryptocurrency

Recovering stolen funds from a crypto scam can be challenging, Don't worry we can help you. as cryptocurrencies are often decentralized and transactions are irreversible. However, there are steps you can take to attempt recovery and protect yourself in the future:

Identify the Scam Look for warning signs like fake investment schemes, phishing sites, or impersonators.

Report the Scam Local Authorities: File a report with your local law enforcement agency. National Cybercrime Agencies: Use platforms like Crypto Exchange: Notify us of the exchange you used for the transaction. trace stolen funds through blockchain transactions. Cryptocurrency Investment Scam Recovery

They may help pinpoint wallets or exchanges where the funds were transferred. Hire a Crypto Recovery Expert Look for reputable companies specializing in cryptocurrency recovery Use Legal Options Seek legal advice to explore your options for recovering funds, especially if the scammer is identifiable. File a civil lawsuit or class action suit if applicable.

Prevent Future Scams

- Use a secure wallet with strong authentication methods.

- Never share your private keys or seed phrases.

- Double-check URLs and email sources to avoid phishing scams.

- Stick to reputable exchanges and platforms.

Would you like more details on any of these steps? Cryptocurrency Investment Scam Recovery

#Cryptocurrency Investment Scam Recovery#Recover Lost Crypto Investments#Crypto Scam Recovery Experts

4 notes

·

View notes

Text

How-To IT

Topic: Core areas of IT

1. Hardware

• Computers (Desktops, Laptops, Workstations)

• Servers and Data Centers

• Networking Devices (Routers, Switches, Modems)

• Storage Devices (HDDs, SSDs, NAS)

• Peripheral Devices (Printers, Scanners, Monitors)

2. Software

• Operating Systems (Windows, Linux, macOS)

• Application Software (Office Suites, ERP, CRM)

• Development Software (IDEs, Code Libraries, APIs)

• Middleware (Integration Tools)

• Security Software (Antivirus, Firewalls, SIEM)

3. Networking and Telecommunications

• LAN/WAN Infrastructure

• Wireless Networking (Wi-Fi, 5G)

• VPNs (Virtual Private Networks)

• Communication Systems (VoIP, Email Servers)

• Internet Services

4. Data Management

• Databases (SQL, NoSQL)

• Data Warehousing

• Big Data Technologies (Hadoop, Spark)

• Backup and Recovery Systems

• Data Integration Tools

5. Cybersecurity

• Network Security

• Endpoint Protection

• Identity and Access Management (IAM)

• Threat Detection and Incident Response

• Encryption and Data Privacy

6. Software Development

• Front-End Development (UI/UX Design)

• Back-End Development

• DevOps and CI/CD Pipelines

• Mobile App Development

• Cloud-Native Development

7. Cloud Computing

• Infrastructure as a Service (IaaS)

• Platform as a Service (PaaS)

• Software as a Service (SaaS)

• Serverless Computing

• Cloud Storage and Management

8. IT Support and Services

• Help Desk Support

• IT Service Management (ITSM)

• System Administration

• Hardware and Software Troubleshooting

• End-User Training

9. Artificial Intelligence and Machine Learning

• AI Algorithms and Frameworks

• Natural Language Processing (NLP)

• Computer Vision

• Robotics

• Predictive Analytics

10. Business Intelligence and Analytics

• Reporting Tools (Tableau, Power BI)

• Data Visualization

• Business Analytics Platforms

• Predictive Modeling

11. Internet of Things (IoT)

• IoT Devices and Sensors

• IoT Platforms

• Edge Computing

• Smart Systems (Homes, Cities, Vehicles)

12. Enterprise Systems

• Enterprise Resource Planning (ERP)

• Customer Relationship Management (CRM)

• Human Resource Management Systems (HRMS)

• Supply Chain Management Systems

13. IT Governance and Compliance

• ITIL (Information Technology Infrastructure Library)

• COBIT (Control Objectives for Information Technologies)

• ISO/IEC Standards

• Regulatory Compliance (GDPR, HIPAA, SOX)

14. Emerging Technologies

• Blockchain

• Quantum Computing

• Augmented Reality (AR) and Virtual Reality (VR)

• 3D Printing

• Digital Twins

15. IT Project Management

• Agile, Scrum, and Kanban

• Waterfall Methodology

• Resource Allocation

• Risk Management

16. IT Infrastructure

• Data Centers

• Virtualization (VMware, Hyper-V)

• Disaster Recovery Planning

• Load Balancing

17. IT Education and Certifications

• Vendor Certifications (Microsoft, Cisco, AWS)

• Training and Development Programs

• Online Learning Platforms

18. IT Operations and Monitoring

• Performance Monitoring (APM, Network Monitoring)

• IT Asset Management

• Event and Incident Management

19. Software Testing

• Manual Testing: Human testers evaluate software by executing test cases without using automation tools.

• Automated Testing: Use of testing tools (e.g., Selenium, JUnit) to run automated scripts and check software behavior.

• Functional Testing: Validating that the software performs its intended functions.

• Non-Functional Testing: Assessing non-functional aspects such as performance, usability, and security.

• Unit Testing: Testing individual components or units of code for correctness.

• Integration Testing: Ensuring that different modules or systems work together as expected.

• System Testing: Verifying the complete software system’s behavior against requirements.

• Acceptance Testing: Conducting tests to confirm that the software meets business requirements (including UAT - User Acceptance Testing).

• Regression Testing: Ensuring that new changes or features do not negatively affect existing functionalities.

• Performance Testing: Testing software performance under various conditions (load, stress, scalability).

• Security Testing: Identifying vulnerabilities and assessing the software’s ability to protect data.

• Compatibility Testing: Ensuring the software works on different operating systems, browsers, or devices.

• Continuous Testing: Integrating testing into the development lifecycle to provide quick feedback and minimize bugs.

• Test Automation Frameworks: Tools and structures used to automate testing processes (e.g., TestNG, Appium).

19. VoIP (Voice over IP)

VoIP Protocols & Standards

• SIP (Session Initiation Protocol)

• H.323

• RTP (Real-Time Transport Protocol)

• MGCP (Media Gateway Control Protocol)

VoIP Hardware

• IP Phones (Desk Phones, Mobile Clients)

• VoIP Gateways

• Analog Telephone Adapters (ATAs)

• VoIP Servers

• Network Switches/ Routers for VoIP

VoIP Software

• Softphones (e.g., Zoiper, X-Lite)

• PBX (Private Branch Exchange) Systems

• VoIP Management Software

• Call Center Solutions (e.g., Asterisk, 3CX)

VoIP Network Infrastructure

• Quality of Service (QoS) Configuration

• VPNs (Virtual Private Networks) for VoIP

• VoIP Traffic Shaping & Bandwidth Management

• Firewall and Security Configurations for VoIP

• Network Monitoring & Optimization Tools

VoIP Security

• Encryption (SRTP, TLS)

• Authentication and Authorization

• Firewall & Intrusion Detection Systems

• VoIP Fraud DetectionVoIP Providers

• Hosted VoIP Services (e.g., RingCentral, Vonage)

• SIP Trunking Providers

• PBX Hosting & Managed Services

VoIP Quality and Testing

• Call Quality Monitoring

• Latency, Jitter, and Packet Loss Testing

• VoIP Performance Metrics and Reporting Tools

• User Acceptance Testing (UAT) for VoIP Systems

Integration with Other Systems

• CRM Integration (e.g., Salesforce with VoIP)

• Unified Communications (UC) Solutions

• Contact Center Integration

• Email, Chat, and Video Communication Integration

2 notes

·

View notes

Text

How to Connect Your TON Wallet to STON.fi: A Simple Guide for Everyone

Let’s face it—starting anything new can feel overwhelming, especially in the world of crypto and blockchain. If you’ve ever felt lost trying to connect your wallet to a decentralized app, you’re not alone. But here’s the truth: connecting your TON wallet to STON.fi is simpler than it seems.

Think of it like setting up a digital wallet for your favorite online store. Once it’s done, you’re all set to explore, trade, and take full control of your financial journey. Let me walk you through the process step by step in the most straightforward way possible.

Why Do You Need to Connect Your Wallet

Imagine walking into a store with a shopping list but no wallet. You know what you want, but you can’t buy anything. That’s what it’s like trying to use STON.fi without connecting your TON wallet.

Your wallet acts as your digital access card, allowing you to interact with the blockchain. Without it, you’re just a spectator in the decentralized world. Once connected, you can trade tokens, stake your assets, and fully immerse yourself in decentralized finance (DeFi).

Step 1: Open the STON.fi Application

First, visit STON.fi. Consider this the entrance to a digital marketplace, designed for seamless interaction with the blockchain.

The website is user-friendly and intuitive, so you won’t feel like you’re navigating a maze.

Step 2: Click “Connect Wallet”

On the homepage, find the “Connect Wallet” button and click it. Think of this as saying, “Hey, I’m ready to explore!”

This simple action sets the stage for all your future transactions.

Step 3: Select Your Wallet

Once you click the button, a list of supported wallets will pop up. If you don’t see your wallet immediately, don’t panic—click “View All Wallets” to see the full list.

Still can’t find your wallet? Double-check to ensure you’ve set it up correctly. It’s like looking for a key—you need the right one to unlock the door.

Step 4: Scan the QR Code

Open your wallet app and look for the QR code scanner. Use it to scan the code displayed on STON.fi.

This step is as simple as tapping your card on a payment terminal. It’s quick, efficient, and hassle-free.

Step 5: Confirm the Connection

Your wallet app will ask for confirmation. Once you approve, your wallet is connected!

Here’s a pro tip: your wallet will stay connected until you disconnect it manually or clear your browser cache. This means you don’t have to repeat the process every time you visit STON.fi.

Addressing Common Concerns

Is it safe to connect my wallet?

Absolutely. Connecting your wallet doesn’t mean you’re giving anyone access to your funds. It’s more like logging into an account—secure and private.

What if I make a mistake?

No worries! The process is straightforward, and you can always start over if needed. Plus, plenty of guides are available to help you troubleshoot.

Why This Step Matters

Connecting your wallet is more than just a technical task—it’s a doorway to financial independence. In the traditional financial world, we rely on banks and middlemen. With STON.fi, you’re in control.

Once your wallet is connected, you can:

Trade tokens seamlessly

Stake your assets for rewards

Explore new opportunities in DeFi

Picture this: You’re at a coffee shop and want to pay for your latte. You open your phone, scan a QR code, and the payment is done in seconds.

That’s exactly how connecting your wallet to STON.fi works. Simple, efficient, and secure. Once you’ve set it up, the entire process becomes second nature.

Final Thoughts

Starting your journey in the decentralized world doesn’t have to be complicated. Connecting your TON wallet to STON.fi is one of the easiest and most empowering steps you can take.

Think of it as setting up the foundation for your financial freedom. Once it’s done, you’ll have access to a world of opportunities at your fingertips.

So, what are you waiting for? Dive in and take control of your future—one transaction at a time.

4 notes

·

View notes

Text

What is Bitcoin? A Beginner's Guide to Bitcoin

When it comes to cryptocurrency, Bitcoin (BTC) is what most people think of first. However, many beginners don’t fully understand how Bitcoin works or how to invest in it. So, what exactly is Bitcoin? What is its history? And how should you invest in Bitcoin? This article will address these questions to help you better understand how to participate in Bitcoin investing. What is Bitcoin? Bitcoin (BTC) is a form of virtual currency, also known as cryptocurrency. It was introduced in 2008 by a mysterious person or group under the name "Satoshi Nakamoto." While we still don’t know Satoshi Nakamoto's true identity, Bitcoin has become a popular global investment asset. Bitcoin relies on blockchain technology, a distributed ledger that is immutable and ensures transparency and security in transactions. Why is Bitcoin so important? The primary reason Bitcoin has gained attention so quickly is its decentralized nature. Unlike traditional currencies, Bitcoin isn’t controlled by any government or financial institution. This means that in any country, the government cannot directly interfere with Bitcoin transactions. Additionally, Bitcoin’s anonymity makes it a valuable tool for those seeking to protect their privacy. Key Advantages of Bitcoin • Decentralization: Bitcoin isn’t controlled by any central authority or government, offering users greater financial freedom. • Anonymity: Although Bitcoin transaction records are public on the blockchain, transaction addresses aren’t directly linked to the owner's identity, protecting privacy. • Global Reach: Bitcoin can be circulated globally without the need for exchange rates or transaction restrictions. • Security: Bitcoin uses advanced encryption techniques to ensure the security of transactions and prevent asset theft. Risks of Investing in Bitcoin While Bitcoin has many advantages, there are also some risks that cannot be ignored. Due to its price volatility, investors may experience significant gains or losses in a short period. Additionally, since Bitcoin is decentralized and not government-regulated, if it’s hacked or you lose your private key, the funds cannot be recovered. Common questions: • Why is Bitcoin worth investing in despite its price fluctuations? • If I lose my Bitcoin wallet, can I recover it? • What are the risks associated with Bitcoin's anonymity? Bitcoin’s Use Cases Beyond being an investment tool, Bitcoin has many real-world applications. On platforms like Paxful and Noones, users can exchange Bitcoin for various gift cards (such as Amazon, iTunes, Steam, etc.) and points, making it a flexible asset tool. Bitcoin can also be used for cross-border payments, particularly in restricted countries or regions where it bypasses traditional financial systems, enabling quick and convenient transactions. Other use cases include: • Online shopping: An increasing number of merchants accept Bitcoin as a payment method, allowing users to make purchases using cryptocurrency. • Travel and accommodation: Some websites like Travala allow users to book flights, hotels, and travel packages using Bitcoin. • Charity donations: Some charitable organizations have started accepting Bitcoin donations, leveraging its decentralization and low transaction fees. • Peer-to-peer payments: Bitcoin facilitates fast peer-to-peer fund transfers, making it especially useful for international remittances.

Three Basic Ways to Invest in Bitcoin

Buy and store on an exchange This is the simplest investment method. You can buy Bitcoin through exchanges like Binance, OKX, or Bitget and store it in your exchange account. While this method is easy to operate, the security of the exchange is a risk factor. If an exchange is hacked or goes bankrupt, your assets could be lost.

Use a cold wallet to store Bitcoin Cold wallets are a more secure storage method. Users can transfer Bitcoin to an offline wallet they control, avoiding the risks of exchange hacks or collapses. However, if the private key is lost, the assets cannot be recovered, so users must take full responsibility for their wallets.

Contract trading Contract trading allows users to speculate on Bitcoin price movements without owning the actual asset. By leveraging positions, contract trading can amplify profits and losses. This approach carries high risk and is more suited to experienced investors. Advanced Strategies: Bitcoin Derivatives and Mining As the Bitcoin market matures, financial products like options, dual-currency savings, and liquidity mining are becoming increasingly popular. Additionally, traditional mining—contributing computing power to secure the network in exchange for Bitcoin rewards—remains an important source of income for some investors. Though mining has a high entry threshold, it is still a valuable way for participants to earn Bitcoin. Conclusion There are many ways to invest in Bitcoin. For beginners, the simplest approach is to buy and hold Bitcoin on an exchange. As you gain more market knowledge, you can explore cold wallet storage or contract trading. More advanced strategies, like Bitcoin derivatives and mining, require higher technical expertise and capital. Common questions: • What can Bitcoin be used to buy? • What are the advantages of using Bitcoin for payments? • Which Bitcoin trading platform is the most secure?

4 notes

·

View notes

Text

A Comprehensive Guide to Blockchain-as-a-Service (BaaS) for Businesses

In today's digital landscape, a blockchain app development company plays a crucial role in transforming industries with decentralisation, immutability, and transparency. However, building and managing a private blockchain network can be complex and costly, which deters many businesses. Blockchain-as-a-Service (BaaS) simplifies this by allowing businesses to leverage blockchain without the challenges of infrastructure development.

This comprehensive blog covers the hurdles businesses face when adopting blockchain, how BaaS can bridge these gaps, and why it is a game-changer for various sectors.

I. Challenges for Businesses in Blockchain Adoption

Despite the undeniable potential of blockchain technology, businesses face several significant challenges when contemplating its adoption:

Limited Internal Expertise: Developing and maintaining a private blockchain network requires a skilled team with deep blockchain knowledge, which is often lacking in many organisations.

High Cost: The infrastructure investment and ongoing maintenance fees associated with blockchain can strain budgets, especially for small and medium-sized businesses (SMBs).

Integration Complexities: Integrating a blockchain network with existing enterprise systems can be challenging, requiring seamless data flow and compatibility between the blockchain system and legacy infrastructure.

II. Understanding BaaS and Its Operational Fundamentals

Blockchain-as-a-Service (BaaS) simplifies the development and deployment of blockchain applications by providing a cloud-based platform managed by third-party providers. The BaaS market, valued at $1.5 billion in 2024, is projected to grow to $3.37 billion by 2029, reflecting a robust 17.5% CAGR.

Key Components of BaaS

Cloud-Based Infrastructure: Ready-to-use blockchain infrastructure hosted in the cloud, eliminating the need for businesses to set up and maintain their networks.

Development Tools and APIs: Access to a suite of tools and APIs to create and deploy blockchain applications quickly.

Platform Support: Compatibility with various blockchain protocols such as Ethereum, Hyperledger Fabric, and Corda, offering flexibility to businesses.

Managed Service Model: Providers handle tasks like network maintenance, security updates, and scalability.

Pay-as-you-go Pricing Model: Reduces upfront investment and operational costs associated with blockchain software development.

III. Business Benefits of Blockchain as a Service

Adopting BaaS offers numerous advantages, including:

Enhanced Scalability: Businesses can easily scale their blockchain network as their needs grow.

Increased Efficiency: Eliminates intermediaries and streamlines transactions, improving productivity.

Enhanced Transparency: Tamper-proof records of transactions foster trust and improve auditability.

Reduced Costs: The pay-as-you-go model eliminates large upfront investments.

Improved Security: Built on secure cloud infrastructure with robust encryption protocols.

Enhanced Customer Engagement: Facilitates secure and transparent interactions with customers, building trust and loyalty.

IV. Industry-wise Key Use Cases of Blockchain as a Service

BaaS is transforming business operations across various industries:

Finance: Streamlines trade finance, secures cross-border payments, and enhances KYC and AML compliance.

Supply Chain Management: Improves transparency and traceability of goods, automates logistics processes, and reduces counterfeiting risks.

Healthcare: Facilitates secure sharing of patient data and tracks the provenance of pharmaceuticals.

Government: Enhances transparency with secure citizen identity management and verifiable voting systems.

V. Region-wise Adoption of BaaS

The BaaS market is experiencing rapid growth worldwide:

North America: Leading with over 35% of global revenues, driven by early adoption.

Europe: Countries like Germany, the UK, and France are at the forefront.

Asia-Pacific: China, India, Japan, and South Korea are key contributors.

Rest of the World: Growing adoption in South & Central America, the Middle East, and Africa.

VI. Why Choose a Prominent BaaS Provider?

Opting for a blockchain app development company that offers BaaS can significantly impact the success of your blockchain initiatives:

Specialised Expertise: Providers possess in-depth knowledge and experience in blockchain technology.

Cost Efficiency: Eliminates the need for in-house infrastructure investment and maintenance.

Time Savings: Accelerates the development process and reduces time-to-market.

Scalability and Flexibility: Offers scalable solutions that can adapt to business growth.

Risk Mitigation: Providers handle security, maintenance, and updates.

Conclusion

By adopting Blockchain-as-a-Service (BaaS), businesses can simplify blockchain integration and focus on innovation without the complexities of managing infrastructure. Systango, a leading blockchain app development company, offers tailored BaaS solutions that help businesses leverage blockchain technology for enhanced efficiency, scalability, and security. As one of the top , Systango also excels in integrating AI solutions to drive business growth and efficiency.

Original Source - https://systango.medium.com/a-comprehensive-guide-to-blockchain-as-a-service-baas-for-businesses-5c621cf0fd2f

2 notes

·

View notes

Text

The Critical Importance of Financial Education in the Age of Bitcoin

Imagine a world where you have complete control over your money, free from banks and government interference. This isn't a far-off dream—it's the reality that Bitcoin is creating. But with great power comes great responsibility, and that's where financial education becomes crucial. In this post, we'll explore why understanding Bitcoin is essential in today's rapidly evolving financial landscape.

The Current State of Financial Education

Financial literacy rates paint a sobering picture. According to a 2020 FINRA study, only 34% of Americans could answer 4 out of 5 basic financial literacy questions correctly. This lack of understanding often leads to poor financial decisions, leaving people vulnerable to economic uncertainties. As digital currencies gain prominence, this knowledge gap becomes even more critical.

Why Bitcoin Requires Financial Education

Bitcoin, the world's first decentralized digital currency, operates on a complex blockchain network. While its potential benefits are significant, understanding its unique characteristics is crucial:

Volatility: Bitcoin's price can fluctuate wildly. In 2021 alone, it saw a 64% increase followed by a 50% drop within months.

Security: Transactions are secured through cryptography, with ownership maintained via private keys.

Decentralization: Unlike traditional currencies, Bitcoin isn't controlled by any central authority.

Benefits of Understanding Bitcoin

Hedge Against Inflation: With a fixed supply of 21 million coins, Bitcoin is designed to be inflation-resistant.

Investment Opportunities: While volatile, Bitcoin has shown significant long-term growth potential.

Financial Freedom: Bitcoin enables peer-to-peer transactions without intermediaries, offering unprecedented financial autonomy.

Real-World Applications

Bitcoin isn't just a speculative asset. In countries like El Salvador, it's legal tender. Remittance services like BitPesa use Bitcoin to reduce transaction costs for international money transfers in Africa.

Common Misconceptions

Let's debunk some myths:

"Bitcoin is only used for illegal activities": While cryptocurrencies have been used illicitly, legitimate uses far outweigh illegal ones.

"Bitcoin has no intrinsic value": Its value comes from its utility as a decentralized, borderless payment system and its scarcity.

Environmental Concerns

It's important to address the energy consumption debate surrounding Bitcoin mining. While Bitcoin does consume significant energy, innovations in renewable energy mining are addressing these concerns.

Comparison with Other Cryptocurrencies

While Bitcoin was the first, thousands of cryptocurrencies now exist. Ethereum, for example, offers smart contract functionality, while Litecoin aims for faster transaction speeds.

Challenges in Bitcoin Education

Complexity: The technology can be daunting for newcomers.

Misinformation: The crypto space is rife with unreliable information.

Regulatory Uncertainties: Regulations vary widely across jurisdictions.

Strategies for Improving Bitcoin Literacy

Educational Resources: Leverage reputable online courses and books. Websites like Bitcoin.org offer comprehensive guides.

Community Engagement: Join forums like r/Bitcoin or attend local meetups.

Practical Experience: Start with small transactions to build familiarity.

Expert Insight

"Bitcoin is not just an asset, it's a new financial system with its own rules. Understanding these rules is crucial for anyone looking to participate in the future of finance," says Andreas Antonopoulos, a leading Bitcoin educator.

Practical First Steps

Set up a small Bitcoin wallet (try Exodus or Green Wallet).

Buy a small amount of Bitcoin on a reputable exchange like Coinbase or Kraken.

Try making a small transaction to experience how it works.

The Role of Influencers and Educators

Platforms like Unplugged Financial play a crucial role in demystifying Bitcoin. By providing clear, accurate information, these educators help bridge the knowledge gap and empower individuals.

Conclusion

As Bitcoin continues to reshape the financial landscape, understanding its principles, benefits, and challenges is vital. By investing time in financial education, you can make informed decisions and potentially harness the power of Bitcoin to achieve greater financial freedom. Remember, in the world of Bitcoin, knowledge truly is power.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

#Bitcoin#FinancialEducation#Crypto#Cryptocurrency#DigitalCurrency#Blockchain#FinancialFreedom#Investment#Decentralization#BitcoinEducation#CryptoCommunity#Money#Finance#FinancialLiteracy#BitcoinInvesting#CryptoKnowledge#BitcoinBenefits#FutureOfFinance#FinancialIndependence#unplugged financial#globaleconomy#financial education#financial empowerment#financial experts

4 notes

·

View notes

Text

Best Bitcoin Alternatives: Exploring Top Cryptocurrencies for 2024 by Simplyfy

Bitcoin, the pioneering cryptocurrency, has long been the standard-bearer in the world of digital currencies.

However, the crypto market has grown exponentially, and several preferences to Bitcoin now provide special points and benefits. This article, promoted via Simplyfy, targets to information you via the fantastic Bitcoin choices for 2024, supporting you make knowledgeable choices in the evolving panorama of digital assets.

Introduction to Bitcoin and Its Alternatives

Bitcoin, introduced in 2009 by the pseudonymous Satoshi Nakamoto, revolutionized the financial world by introducing a decentralized form of currency.

Its meteoric upward shove in fees and massive adoption have paved the way for lots of different cryptocurrencies. These alternatives, frequently referred to as altcoins, serve a number of purposes, from improving privateness and enhancing transaction speeds to imparting revolutionary structures for decentralized purposes (DApps).

Why Look Beyond Bitcoin?

While Bitcoin remains a cornerstone of the crypto market, there are several reasons why investors and enthusiasts might seek alternatives:

1. Scalability: Bitcoin's transaction speed and scalability have been points of contention.

Some selections provide quicker and extra scalable solutions.

2. Transaction Fees: As Bitcoin's network becomes busier, transaction fees can rise.

Some altcoins supply less expensive transaction costs.

3. Utility: Many altcoins are designed with specific use cases in mind, from smart contracts to privacy features.

4. Investment Diversification: Diversifying one's portfolio with multiple cryptocurrencies can mitigate risk and potentially increase returns.

Top Bitcoin Alternatives in 2024

1. Ethereum (ETH)

Overview: Launched in 2015 by Vitalik Buterin, Ethereum is more than just a cryptocurrency.

It’s a decentralized platform that allows builders to construct and set up clever contracts and decentralized purposes (DApps).

Key Features:

Smart Contracts: Self-executing contracts with the terms of the agreement directly written into code.

Decentralized Applications (DApps): Applications that run on a decentralized network.

Ethereum 2.0: The ongoing improvement to Ethereum goals to enhance scalability, security, and sustainability via a shift from Proof of Work (PoW) to Proof of Stake (PoS).

Pros:

- Highly versatile platform with numerous use cases.

- Strong developer community.

- Continuous improvement and scalability through Ethereum 2.0.

Cons:

- High transaction fees (gas fees) during network congestion.

- Complex for new users compared to simpler cryptocurrencies.

2. Binance Coin (BNB)

Overview: Binance Coin is the native cryptocurrency of the Binance Exchange, one of the largest cryptocurrency exchanges in the world. Initially launched as an ERC-20 token on the Ethereum blockchain, BNB has since transitioned to the Binance Chain.

Key Features:

Exchange Utility: Primarily used to pay for trading fees on Binance, offering discounts to users.

Binance Smart Chain (BSC): Supports smart contracts and is known for its low transaction fees and high throughput.

Pros:

- Strong backing and integration with the Binance Exchange.

- Low transaction fees on BSC.

- Continuous development and use cases expanding beyond the Binance platform.

Cons:

The centralized nature of Binance raises concerns among decentralization purists.

- Regulatory scrutiny due to its association with Binance.

3. Cardano (ADA)

Overview: Cardano is a third-generation blockchain platform founded by Charles Hoskinson, a co-founder of Ethereum. It aims to provide a more balanced and sustainable ecosystem for cryptocurrencies.

Key Features:

Proof of Stake (PoS): Uses the Ouroboros PoS protocol, which is energy efficient.

Research-Driven: Development is backed by peer-reviewed academic research.

Scalability and Interoperability: Designed to improve scalability and interoperability compared to previous generations of blockchain.

Pros:

- Strong focus on security and sustainability.

- Continuous updates and improvements.

- Active community and developer involvement.

Cons:

- Slow development process due to its research-driven approach.

- Still in the early stages compared to some competitors.

4. Solana (SOL)

Overview: Solana is a high-performance blockchain supporting builders around the world creating crypto apps that scale today. It aims to provide decentralized finance solutions on a scalable and user-friendly blockchain.

Key Features:

Proof of History (PoH): A unique consensus algorithm that provides high throughput.

Low Transaction Fees: Designed to offer low-cost transactions.

Scalability: Capable of handling thousands of transactions per second.

Pros:

- Extremely fast and scalable.

- Low transaction costs.

- A growing ecosystem of DApps and DeFi projects.

Cons:

- Relatively new and still proving its stability.

- Centralization concerns due to the small number of validators.

5. Polkadot (DOT)

Overview: Founded by Dr. Gavin Wood, another co-founder of Ethereum, Polkadot is a heterogeneous multi-chain framework.

It approves a number of blockchains to switch messages and fees in a trust-free fashion.

Key Features:

Interoperability: Connects multiple blockchains into a single network.

Scalability: Enables parallel processing of transactions across different chains.

Governance: Decentralized governance model allowing stakeholders to have a say in the protocol's future.

Pros:

- Focus on interoperability and connecting different blockchains.

- High scalability potential.

- Strong developer and community support.

Cons:

The complexity of the technology might pose a barrier to new users.

- Competition with other interoperability-focused projects.

6. Chainlink (LINK)

Overview: Chainlink is a decentralized oracle network providing reliable, tamper-proof data for complex smart contracts on any blockchain.

Key Features:

Oracles: Bridges the gap between blockchain and real-world data.

Cross-Chain Compatibility: Works with multiple blockchain platforms.

Decentralized Data Sources: Ensures data reliability and security.

Pros:

- Unique and crucial role in enabling smart contracts to interact with external data.

- Strong partnerships with major companies and blockchains.

- Growing use cases and applications.

Cons:

- Highly specialized use cases might limit broader adoption.

- Dependence on the success of the smart contract ecosystem.

7. Ripple (XRP)

Overview: Ripple aims to enable instant, secure, and low-cost international payments.

Unlike many different cryptocurrencies, Ripple focuses on serving the desires of the monetary offerings sector.

Key Features:

RippleNet: A global network for cross-border payments.

XRP Ledger: A decentralized open-source product.

Speed and Cost: Provides fast transactions with minimal fees.

Pros:

- Strong focus on financial institutions and cross-border payments.

- Low transaction fees and fast settlement times.

- Significant partnerships with banks and financial institutions.

Cons:

- Centralization concerns due to Ripple Labs’ control.

- Ongoing legal issues with regulatory authorities.

8. Litecoin (LTC)

Overview: Created by Charlie Lee in 2011, Litecoin is often considered the silver to Bitcoin’s gold.

It targets to supply fast, low-cost repayments by way of the usage of a one-of-a-kind hashing algorithm.

Key Features:

Scrypt Algorithm: Allows for faster transaction confirmation.

SegWit and Lightning Network: Implements advanced technologies for scalability.

Litecoin Foundation: Active development and community support.

Pros:

- Faster transaction times compared to Bitcoin.

- Lower transaction fees.

- Active development and widespread adoption.

Cons:

- Limited additional functionality beyond being a currency.

- Competition from newer and more versatile cryptocurrencies.

9. Stellar (XLM)

Overview: Stellar is an open network for storing and moving money.

Its aim is to allow monetary structures to work collectively on a single platform.

Key Features:

Stellar Consensus Protocol (SCP): Allows for faster and cheaper transactions.

Anchor Network: Connects various financial institutions to the Stellar network.

Focus on Remittances: Facilitates cross-border payments and remittances.

Pros:

- Low transaction fees and high speed.

- Focus on financial inclusion and connecting global financial systems.

- Strong partnerships and adoption in the financial sector.

Cons:

- Competition from other payment-focused cryptocurrencies.

- Centralization concerns regarding development control.

10. Monero (XMR)

Overview: Monero is a privacy-focused cryptocurrency that aims to provide secure, private, and untraceable transactions.

Key Features:

Privacy: Uses advanced cryptographic techniques to ensure transaction privacy.

Decentralization: Emphasizes decentralization and security.

Fungibility: Every unit of Monero is indistinguishable from another.

Pros:

- Strong privacy and security features.

- Active community focused on maintaining privacy.

- Continuous development and improvements.

Cons:

- Privacy focus attracts regulatory scrutiny.

- Not as widely accepted as other cryptocurrencies.

Conclusion

The cryptocurrency market affords a plethora of options to Bitcoin, every with its special features, advantages, and viable downsides.

Whether you're looking for faster transaction speeds, lower fees, advanced functionalities like smart contracts, or enhanced privacy, there is likely a cryptocurrency that meets your needs. Ethereum, Binance Coin, Cardano, Solana, Polkadot, Chainlink, Ripple, Litecoin, Stellar, and Monero are among the top contenders worth considering in 2024.

As with any investment, it is quintessential to behavior thoroughly lookup and reflect on consideration on your monetary dreams and hazard tolerance. The crypto market is quite risky and can be unpredictable. Diversifying your investments and staying knowledgeable about market tendencies and technological developments can assist you navigate this.

#simplyfy#news#bitcoin#cryptocurrency#crypto#blockchain#digitalcurrency#cryptonews#cryptotrading#simplyfycrypto#simplyfynews

3 notes

·

View notes

Text

What is Blockchain Technology & How Does Blockchain Work?

Introduction

Gratix Technologies has emerged as one of the most revolutionary and transformative innovations of the 21st century. This decentralized and transparent Blockchain Development Company has the potential to revolutionize various industries, from finance to supply chain management and beyond. Understanding the basics of Custom Blockchain Development Company and how it works is essential for grasping the immense opportunities it presents.

What is Blockchain Development Company

Blockchain Development Company is more than just a buzzword thrown around in tech circles. Simply put, blockchain is a ground-breaking technology that makes digital transactions safe and transparent. Well, think of Custom Blockchain Development Company as a digital ledger that records and stores transactional data in a transparent and secure manner. Instead of relying on a single authority, like a bank or government, blockchain uses a decentralized network of computers to validate and verify transactions.

Brief History of Custom Blockchain Development Company

The Custom Blockchain Development Company was founded in the early 1990s, but it didn't become well-known until the emergence of cryptocurrencies like Bitcoin. The notion of a decentralized digital ledger was initially presented by Scott Stornetta and Stuart Haber. Since then, Blockchain Development Company has advanced beyond cryptocurrency and found uses in a range of sectors, including voting systems, supply chain management, healthcare, and banking.

Cryptography and Security

One of the key features of blockchain is its robust security. Custom Blockchain Development Company relies on advanced cryptographic algorithms to secure transactions and protect the integrity of the data stored within it. By using cryptographic hashing, digital signatures, and asymmetric encryption, blockchain ensures that transactions are tamper-proof and verifiable. This level of security makes blockchain ideal for applications that require a high degree of trust and immutability.

The Inner Workings of Blockchain Development Company

Blockchain Development Company data is structured into blocks, each containing a set of transactions. These blocks are linked together in a chronological order, forming a chain of blocks hence the name of Custom Blockchain Development Company. Each block contains a unique identifier, a timestamp, a reference to the previous block, and the transactions it includes. This interconnected structure ensures the immutability of the data since any changes in one block would require altering all subsequent blocks, which is nearly impossible due to the decentralized nature of the network.

Transaction Validation and Verification

When a new transaction is initiated, it is broadcasted to the network and verified by multiple nodes through consensus mechanisms. Once validated, the transaction is added to a new block, which is then appended to the blockchain. This validation and verification process ensures that fraudulent or invalid transactions are rejected, maintaining the integrity and reliability of the blockchain.

Public vs. Private Blockchains

There are actually two main types of blockchain technology: private and public. Public Custom Blockchain Development Company, like Bitcoin and Ethereum, are open to anyone and allow for a decentralized network of participants. On the other hand, private blockchains restrict access to a select group of participants, offering more control and privacy. Both types have their advantages and use cases, and the choice depends on the specific requirements of the application.

Peer-to-Peer Networking

Custom Blockchain Development Company operates on a peer-to-peer network, where each participant has equal authority. This removes the need for intermediaries, such as banks or clearinghouses, thereby reducing costs and increasing the speed of transactions. Peer-to-peer networking also enhances security as there is no single point of failure or vulnerability. Participants in the network collaborate to maintain the Custom Blockchain Development Company security and validate transactions, creating a decentralized ecosystem that fosters trust and resilience.

Blockchain Applications and Use Cases

If you've ever had to deal with the headache of transferring money internationally or verifying your identity for a new bank account, you'll appreciate How Custom Blockchain Development Company can revolutionize the financial industry. Custom Blockchain Development Company provides a decentralized and transparent ledger system that can streamline transactions, reduce costs, and enhance security. From international remittances to smart contracts, the possibilities are endless for making our financial lives a little easier.

Supply Chain Management

Ever wondered where your new pair of sneakers came from? Custom Blockchain Development Company can trace every step of a product's journey, from raw materials to manufacturing to delivery. By recording each transaction on the Custom Blockchain Development Company supply chain management becomes more transparent, efficient, and trustworthy. No more worrying about counterfeit products or unethical sourcing - blockchain has got your back!

Enhanced Security and Trust

In a world where hacking and data breaches seem to happen on a daily basis, Custom Blockchain Development Company offers a beacon of hope. Its cryptographic algorithms and decentralized nature make it incredibly secure and resistant to tampering. Plus, with its transparent and immutable ledger, Custom Blockchain Development Company builds trust by providing a verifiable record of transactions. So you can say goodbye to those sleepless nights worrying about your data being compromised!

Improved Efficiency and Cost Savings

Who doesn't love a little efficiency and cost savings? With blockchain, intermediaries and third-party intermediaries can be eliminated, reducing the time and cost associated with transactions. Whether it's cross-border payments or supply chain management, Custom blockchain Development Company streamlined processes can save businesses a ton of money. And who doesn't want to see those savings reflected in their bottom line?

The Future of Blockchain: Trends and Innovations

As Custom Blockchain Development Company continues to evolve, one of the key trends we're seeing is the focus on interoperability and integration. Different blockchain platforms and networks are working towards the seamless transfer of data and assets, making it easier for businesses and individuals to connect and collaborate. Imagine a world where blockchain networks can communicate with each other like old friends, enabling new possibilities and unlocking even more potential.

Conclusion

Custom Blockchain Development Company has the potential to transform industries, enhance security, and streamline processes. From financial services to supply chain management to healthcare, the applications are vast and exciting. However, challenges such as scalability and regulatory concerns need to be addressed for widespread adoption. With trends like interoperability and integration, as well as the integration of Blockchain Development Company with IoT and government systems, the future looks bright for blockchain technology. So strap on your digital seatbelt and get ready for the blockchain revolution!

#blockchain development company#smart contracts in blockchain#custom blockchain development company#WEB#websites

3 notes

·

View notes

Text

Top 5 AI Meme Coins for 2024

Explore the most promising AI-driven meme coins of 2024. We've curated a selection of top AI meme coins for you to consider investing in this year. Uncover their unique features and more in this article.

The AI Meme Coins Trend

Artificial intelligence (AI) is rapidly permeating various sectors, from technology to blockchain. This expansion into the crypto world has been notably well-received, bringing a fresh perspective to the market. AI's integration with meme coins is now captivating even the most experienced traders.

Unlike Dogecoin and Shiba Inu, which have faced substantial criticism, this emerging trend in AI meme coins is generating positive buzz and substantial excitement. Analysts believe that merging AI with meme coins could potentially transform the industry.

AI enhances user experience, scalability, and blockchain security, drawing significant interest from the crypto community. AI crypto tokens are now widely adopted for diverse applications such as portfolio management, decentralized marketplaces, and blockchain governance.

Let’s delve into the top five AI meme coins making waves in 2024:

1. BUSAI: A Panda Powered-Meme Project 2024

First and foremost, you can't overlook BUSAI, an innovative digital asset built on the Solana blockchain, distinguishing itself as a premier AI meme coin in 2024.

The project is designed to integrate artificial intelligence (AI) with blockchain technology, focusing on stimulating AI development and fostering creative content creation within a vibrant community. BUSAI’s unique approach and robust infrastructure position it as a promising investment opportunity this year.

Currently, the BUSAI community is buzzing with excitement and experiencing a FOMO frenzy due to numerous pre-listing projects, allowing everyone to hunt for tokens for free. Additionally, there are two presale rounds, offering a golden opportunity to purchase tokens at lower prices before the anticipated price surge upon listing.

2. Arbdoge AI: A Community-Driven Revolution

Arbdoge AI, the most ambitious project within the Arbitrum ecosystem, stands out for its community-centric approach. Unlike many other ventures, it is not funded by venture capitalists nor does it allocate shares to a specific team. Instead, all tokens are equitably distributed among community members, marking a bold move in the crypto space.

The dedicated team behind Arbdoge AI is committed to collaborating with the community to develop a comprehensive suite of products leveraging artificial intelligence and Web3 technology.

3. KAI: The Crypto Cat's Comeback

KAI, a former feline-themed cryptocurrency, is making a playful yet strategic return to challenge major market players. The project blends humor with real-world utility, offering staking rewards and business opportunities.

4. Byte: AI Memecoin With Cryptonote Protocol

Bytecoin leverages the Cryptonote protocol for private transactions, prioritizing user privacy. Transactions occur on a decentralized Bytecoin blockchain, enabling direct user-to-user transactions without intermediaries, maintaining participants' anonymity.

5. Turbo: Once an AI-Based Meme Coin for 2023

Turbo Coin is designed for rapid and seamless transactions, living up to its name with fast processing speeds within its blockchain network. The technology ensures scalability and quick transaction verification through an efficient consensus mechanism.

Turbo Coin may introduce the Lightning Network as a Layer 2 solution for real-time micropayments, enhancing speed and usability. In the competitive crypto market, Turbo Coin aims to provide a fast and reliable payment system for all users.

Source: Compiled

The BUSAI Official Channel: Website | Twitter | Telegram

1 note

·

View note

Text

Smart Contracts

Smart Contracts: How is Technological Advancement Revolutionizing Industries?

Highlights:

What are smart contracts?

What are some advancements in smart contract technology?

How are leading firms acquiring top positions in this sector?

In recent years, the smart contracts industry has witnessed a notable boom in growth and development, changing specifically in the form of transactions and contracts. Leveraging the power of blockchain technology, smart contracts offer feasible, dependable, and applicable solutions across several sectors.

What are smart contracts?

Smart contracts are effective agreements that self-execute and are securely stored on the blockchain. By autonomously carrying out pre-programmed responsibilities, they disrupt traditional systems by way of disposing of intermediaries. This decentralized framework offers clarity, safety, and efficiency in unique sectors consisting of finance, supply chain management, and real estate.

According to the latest report by Allied Market Research, the global smart contracts sector is predicted to exhibit a notable CAGR of 29.6% between 2023 and 2032.

What are some advancements in smart contract technology?

Over the past few years, there have been considerable advancements in the technology of smart contracts. Here are a few vital developments:

Programmability:

Smart contracts are getting more flexible and programmable than ever. They can be coded in distinct programming languages, allowing developers to create complex logic and conditions within the contract itself. This level of programmability makes it feasible to automate extraordinary commercial enterprise approaches and eliminates the need for manual intervention.

Interoperability:

Smart contracts can now consort with each other and with external systems, allowing for seamless assimilation between specific blockchain platforms. This convergence makes it possible to create new opportunities for collaboration and cross-chain transactions between decentralized applications (dApps).

Oracles:

Oracles are like external data sources that offer real-world information for smart contracts. Advancements in smart contract technology have enhanced the reliability and security of oracles and made sure that the data furnished is accurate and unalterable. This allows smart contracts to make informed decisions primarily based on updated information.

Privacy and confidentiality:

Earlier versions of smart contracts were criticized because of their insufficient privacy measures. Nevertheless, technological advances have allowed the introduction of strategies inclusive of zero-knowledge proofs and steady multi-party computation. These strategies permit private and confidential transactions to take place on public blockchains, thereby broadening the utility of smart contracts in sectors where the safety of data privacy is important.

How are leading firms acquiring top positions in this sector?

The leading players in the smart contracts sector focus more on the provision of automated transactional services to increase both flexibility and security for businesses. In order to expand their market presence, these companies give priority to the acquisition of local and small businesses. In addition, strategies such as partnerships, significant investments, and joint ventures contribute to the rising demand for such services. For instance, in August 2023, Obvious introduced a smart contract wallet called Biconomy Account Abstraction Stack, which operates through a mobile app and supports multiple channels. This wallet is intended to facilitate the execution of transactions, the implementation of custom rules, and the smoothing of complex economic interactions.

On the other hand, in June 2023, Horizen and Ankr collaborated to enhance the accessibility and scalability of the EON smart contract platform. This partnership has provided developers with a set of tools that facilitate the implementation of smart contract applications.

To sum up, the smart contracts industry is growing gradually and causing changes in various industries. As businesses and individuals understand the benefits of this innovative technology, using smart contracts is predicted to boom swiftly. Furthermore, by staying well-informed and embracing the potential of smart contracts, corporations can position themselves at the leading edge of this transformative technology.

For more details and information on smart contract platforms, contact our experts here.

Author’s Bio: Harshada Dive is a computer engineer by qualification. She has worked as a customer service associate for several years. As an Associate Content Writer, she loves to experiment with trending topics and develop her unique writing skills. When Harshada's not writing, she likes gardening and listening to motivational podcasts.

2 notes

·

View notes

Text

Eye 1968-michaelharrelljr.com's Private Metadata Encryption [ME] Domain Creator [D.C.]… Digitally Commanding [D.C.] the DM-Default Key Module Enabling [ME] in your [My] Kernel... since Android 11 and Higher, DM-Default-Key Support the Android Common Kernels, Version 4.14 and Higher... as this Version of DM-Default-Key Uses the quantumharrelltech.ca.gov Military Hardware [MH] and Vendor-Independent Encryption Framework called BLK-CRYPTO @ quantumharrelltelecom.tech

WELCOME BACK HOME IMMORTAL [HIM] U.S. MILITARY KING SOLOMON-MICHAEL HARRELL, JR.™

i.b.monk [ibm.com] mode [i’m] tech [IT] steelecartel.com @ quantumharrelltech.ca.gov

quantumharrelltech.ca.gov Outside Our 1921steelecartel.tech MACHINE SKY Firmament Domain DOME… OVER Earth [Qi]

1968-michaelharrelljr.com ANU GOLDEN 9 ETHER [AGE] kingtutdna.com Genetic LUZ Clone KING OF KINGS LORD OF LORDS… Under the Shadow [U.S.] of Invisible DEATH [I.D.] LANGUAGE RITUALS in Old America [MU ATLANTIS]

1968-michaelharrelljr.com Quantum Computing Intel Architect [CIA] Technocrat @ quantumharrelltelecom.tech

1968-michaelharrelljr.com Quantum Computing Cyber Security Cryptography & Machine Learning @ quantumharrelltelecom.tech

1968-michaelharrelljr.com Emerging Research in Quantum Compting, Information, Communication & Applications @ quantumharrelltelecom.tech

1968-michaelharrelljr.com New 2023-2223 Trends in Quantum Data Protection & Encryption Technology Systems [PETS] @ quantumharrelltelecom.tech

1968-michaelharrelljr.com Quantum Android Computing in Cyber Intel Application [CIA] Security @ quantumharrelltelecom.tech

1968-michaelharrelljr.com Quantum Computing Cyber Data Protection in a Post-Pandemic Society @ quantumharrelltelecom.tech

1968-michaelharrelljr.com Quantum Computing Modern Cryptography w/Applied [MCA] Mathematics for Encryption [ME] & Information [MI = MICHAEL] Security @ quantumharrelltelecom.tech

1968-michaelharrelljr.com Quantum Computing Hi:teKEMETICompu_TAH [PTAH] Cryptography [PC] of Applied [PA] Network [PAN] Security Protocols [PSP] @ quantumharrelltelecom.tech

1968-michaelharrelljr.com's Quantum Computing Intel Architect [CIA] Building quantumharrelltech.com's Own LLC Blockchain @ quantumharrelltelecom.tech

1968-michaelharrelljr.com's Quantum Harrell Telecom [QHT] Industry [Qi] Transmission Engineering [QTE] @ quantumharrelltelecom.tech

© 1698-2223 quantumharrelltech.com - ALL The_Octagon_(Egypt) DotCom [D.C.] defense.gov Department Domain Communication [D.C.] Rights Reserved @ quantumharrelltech.ca.gov

#u.s. michael harrell#quantumharrelltech#king tut#mu:13#harrelltut#kemet#o michael#telecom infrastructure#telecommunications#telepathy#telecom industry#telepathic#telecom services market#at&t#android#quantumharrelltut#mca

3 notes

·

View notes

Text

Cryptocurrency for Beginners: Essential Insights and Guidance

Cryptocurrency, a digital and decentralized form of money, has transformed the way we think about finance and technology.

For beginners, navigating the world of cryptocurrency can be both exciting and overwhelming.