#probate

Link

When a loved one dies, they leave behind an estate that needs to be distributed. This process is called probate. A Florida probate attorney handles the administration of an estate and ensures that the assets are distributed to the right people. Probate can be a long and complex process, but an attorney who is experienced in handling it can help. The attorney also works with the personal representative to ensure that they are following Florida’s legal requirements and have the information necessary to carry out their responsibilities.

Contact the Law Office of Michael T. Heider now for an appointment to meet with our Florida probate attorney.

#florida probate attorney#probate attorney#probate law#probate law lawyer#probate lawyers#probate#attorney

15 notes

·

View notes

Text

Hi guys. I need some help. Please share if nothing else. Basically, my aunty died from cancer, and me and my brother were the beneficiaries of the will. Her ex partner - who was an abusive piece of shit, especially when she was bed bound through her terminal cancer - is suing us, and I am now in huge debt because of legal fees. So I have a gofundme. Please help if you can - but don't put yourself at risk - or at least share. Cheers guys xx

4 notes

·

View notes

Text

Estate Planning Without A Lawyer

Estate planning is one of the most important steps you can take in protecting your family's future.

Without a lawyer, though, you may find yourself overwhelmed by the task of creating all the different documents necessary to plan for your future.

And that of those closest to you.

Here are five easy ways to get started on your estate plan without hiring an attorney.

Create A Will

A will is a legal document that states how you want your assets divided and who will be in charge of your children.

If you die without a will, the state decides what happens to them.

You can also name someone as a guardian for your children.

This means that he or she will be responsible for taking care of them until they turn 18 years old (or 21 if they're disabled).

If there's no such person in place, then the local government must appoint one within 30 days of learning about the death (this could take longer depending on whether there are extenuating circumstances).

Establish A Living Trust

A living trust is a legal document that allows you to control who gets your assets after you die.

It's one way to ensure that none of your assets go to anyone who isn't part of your family or close friends.

A living trust can also be used in conjunction with an estate plan and other types of wills.

So, you need to understand how these different legal documents work together before deciding which one best suit your needs.

Create A Power Of Attorney

A power of attorney is a legal document that allows you to give someone else the authority to act on your behalf.

You can use a power of attorney to let someone else manage your finances. Make medical decisions if you cannot do so yourself.

Sell or buy a property and other assets. Pay debts and taxes on your behalf.

Receive financial information about you such as bank statements and salary slips.

You should get an original copy of this document before signing it.

If there's any question about how much authority has been given by this document, then it needs to be checked with an accountant or lawyer who specializes in wills and trusts.

You may also want them involved if they are concerned about any changes being made after the handover from one person (the principal) to another (the agent).

Prepare A Living Will And Health Care Proxy

If you are planning to make a living will and health care proxy, you must start preparing these documents well before the time of your illness.

A living will states who can inherit your property if you become incapacitated and cannot make decisions for yourself or have no one who can make such decisions for you.

A healthcare proxy authorizes someone to make medical decisions for you should the need arise.

It can include determining whether surgery is necessary or whether life-prolonging measures should be taken.

Both documents should include information about how they were prepared.

So, that others may see what was included in them before signing as well as instructions on where they can be found when needed (e-mail address).

Name beneficiaries of your retirement plans and life insurance policies.

Organize your financial information.

Order copies of your credit report

Establish guardianship for minor children.

Order copies of your credit report.

Credit reports are snapshots of a person's financial history and can be used to determine whether they are eligible for certain loans.

Such as car loans or home mortgages.

You will want to order a copy of your credit report at least once every year.

So that you are aware of any new accounts that have been opened in the past 12 months (and/or accounts that have closed).

If there is something on this list that causes concern, contact us immediately!

Conclusion

You can get your estate planning done without hiring a lawyer

We hope this gives you some ideas for your own estate planning needs.

Remember that it’s always a good idea to talk to an attorney before making any important decisions.

But if you don’t have the time or resources to do so. This article can help!

About The Author

Clea Smith is a USA-based author on Legal issues related to estate planning, will and trust, business law, and elder law. Clea Smith does her best writing on these topics that help users to find the best solutions to their FAQ on estate planning attorney, probate, living trust vs will, and more about legal family issues.

7 notes

·

View notes

Text

When a loved one passes away, their estate often goes through probate, a legal process that ensures their debts are paid and their assets are distributed according to their will or state law. If you're responsible for the Real estate listing probate that's part of the probate process, it's important to understand the unique challenges involved in a real estate listing probate. You'll need to work with an experienced probate attorney and a real estate agent who understands the probate process and can help you navigate the legal and emotional complexities involved. With the right team and a clear strategy, you can successfully sell the property and settle the estate.

2 notes

·

View notes

Text

Difference between Probate & Succession Certificate?

Probate Certificate:-

The Indian Succession Act of 1925 is the official evidence of a will. Probate is a legal process that takes place after a person dies. When a person dies, someone must take care of his or her estate, that is, distribute his or her property according to his or her will. This means that the money, assets, and possessions must be arranged and distributed as an inheritance after all taxes and debts have been paid. Probate proceedings mostly consist of paperwork. If the deceased person left a WILL, it names a person they have designated to administer their estate. Probate is the legal process of administering a deceased person's estate and settling all claims and distributing the deceased person's assets under a will.

It includes-

1. Identification of the property of the deceased person.

2. Taking inventory of the property of the deceased person.

3. Providing proof in court that the will of a deceased person is valid.

4. How to distribute the remaining assets according to the will.

5. Organizing the money, jewelry, and assets and distributing them as an inheritance after all taxes and debts have been paid.

Documents required for Probate:-

● Original WILL of the deceased.

● Death certificate.

● Title deeds for the properties mentioned in the will.

● Fee

● Documents relating to the movable property mentioned in the will.

Succession Certificate:-

When a person dies without making a WILL or any other testamentary document, then that case Certificate of Succession comes into play to deal with the movable estate like FDRs, Bank Accounts, Demat Accounts, PPF, etc. of the deceased. A certificate of inheritance can be issued by the court to settle the debts of the deceased.

If a person approaches financial institutions such as banks and companies to take possession of the deceased's debts and securities, he/she must prove that he/she is the legal heir of the deceased. The Hindu Succession Act 1956 is the applicable law of Succession, and the procedure is applied as described in the Indian Succession Act 1925

it contains:-

1. The particulars of the property of the deceased.

2. The full address of the deceased at the time of death.

3. The family or other close relatives of the deceased person with their respective residences.

4. Debts and securities for which the certificate is requested.

5. the rights of the applicant.

2 notes

·

View notes

Video

youtube

How To Earn $2 Billion In Real Estate Investment | Raising Private Money with Jay Conner

Private Money Academy Conference:

https://www.JaysLiveEvent.com

Free Report:

https://www.jayconner.com/MoneyReport

Join the Private Money Academy:

https://www.JayConner.com/trial/

If you are a real estate investor wondering how to raise and leverage private money to make more profit on every deal then you’re in the right place.

On Raising Private Money we’ll speak with new and seasoned investors to dissect their deals and extract the best tips and strategies to help you get the money!

Today we have Tim Herriage!

Tim Herriage is the Executive Director at RCN Capital and host of The Uncontested Investing Show.

Tim is a professional real estate investor and entrepreneur. For two decades he has been on the leading edge of the Real Estate Investor (REI) space. This includes being the Founder of the 2020 REI Group, Co-Founder and Managing Director of Blackstone’s B2R Finance (now Finance of America), Founder of the REI Expo, as well as a Franchisee and Development Agent for HomeVestors® of America.

Tim has completed well over $2 Billion in real estate investment transactions. These transactions include the acquisition of more than 2,000 houses, more than 1,500 apartment units, more than 100,000 square feet of commercial space, and more than 10,000 loans to real estate investors.

Tim is an active investor, purchasing single-family and multifamily properties throughout the United States while serving as Executive Director for RCN Capital. Tim built and sold six companies by the age of 40, most recently taking Finance of America Public with Blackstone.

Have you read Jay’s new book: Where to Get The Money Now?

It is available FREE (all you pay is the shipping and handling) at

https://www.JayConner.com/Book

What is Private Money? Real Estate Investing with Jay Conner

https://www.JayConner.com/MoneyPodcast

Jay Conner is a proven real estate investment leader. He maximizes creative methods to buy and sell properties with profits averaging $67,000 per deal without using his own money or credit.

What is Real Estate Investing? Live Private Money Academy Conference

https://youtu.be/QyeBbDOF4wo

YouTube Channel

https://www.youtube.com/c/RealEstateInvestingWithJayConner

Apple Podcasts:

https://podcasts.apple.com/us/podcast/private-money-academy-real-estate-investing-with-jay/id1377723034

Facebook:

https://www.facebook.com/jay.conner.marketing

#youtube#real estate#real estate investing#real estate investing for beginners#probate#private money#raising private money#flipping houses#Jay Conner

2 notes

·

View notes

Text

The Importance of Trust and Estate Planning Services: How to Secure Your Legacy and Protect Your Assets

When it comes to planning for the future, trust and estate planning services are essential tools for families looking to secure their legacy and protect their assets.

By creating a comprehensive plan that outlines how your assets will be distributed and managed after you pass away, you can ensure that your loved ones are taken care of and that your wishes are carried out.

This blog will discuss…

View On WordPress

0 notes

Text

What is a Probate Asset in Arizona?

https://clfusa.com/probate/what-is-a-probate-asset-in-arizona/

0 notes

Link

#assets#beneficiary#death#deathcertificate#debt#healthcare#inheritance#investment#legalfees#Money#parents#probate#realestate#savings#tax#taxliability#taxes#wealth

0 notes

Text

Navigating the complexities of estate planning can often feel daunting, but understanding the basics of wills, trusts, and probate can provide peace of mind, ensuring that your wishes are honoured, and your loved ones are taken care of. In this guide, we’ll demystify these essential components, offering a clear pathway through the intricacies of managing and protecting your assets in the UK.

#wills#trusts#probate#wills guide#trusts guide#probate guide#what is a Will#what is a trust#estate planning#Wills & Trusts

0 notes

Text

San Antonio Probate Lawyer

Looking for a San Antonio Probate Lawyer? Casillas & Christian, PLLC is your go-to team. We specialize in guiding you through the intricacies of the probate process with personalized attention. From estate planning to probate administration, we've got your legal needs covered. Trust the expertise of Casillas & Christian, PLLC for seamless probate solutions in San Antonio.

0 notes

Text

Learn more about how probate works in the state of Florida including documentation, court proceedings, and how to avoid probate. Schedule a FREE meet-and-greet with our Orlando probate attorneys by calling our office or submitting a form through our website.

0 notes

Text

youtube

Sergio A. Castillo, licensed Texas attorney.

Commercial and Residential Real Estate Law: Purchase and Sale Agreements, Owner Finance Documents, Foreclosures, Evictions.

Estate Planning, Wills, Probate.

Small Claims, General Counsel, Business Solutions.

#lawyers#texas lawyer#realestate#real estate lawyer#litigation#lawsuits#owner financing#foreclosure#eviction#evictions#estateplanning#wills#probate#small claims#general counsel#small business#contract#Youtube

1 note

·

View note

Text

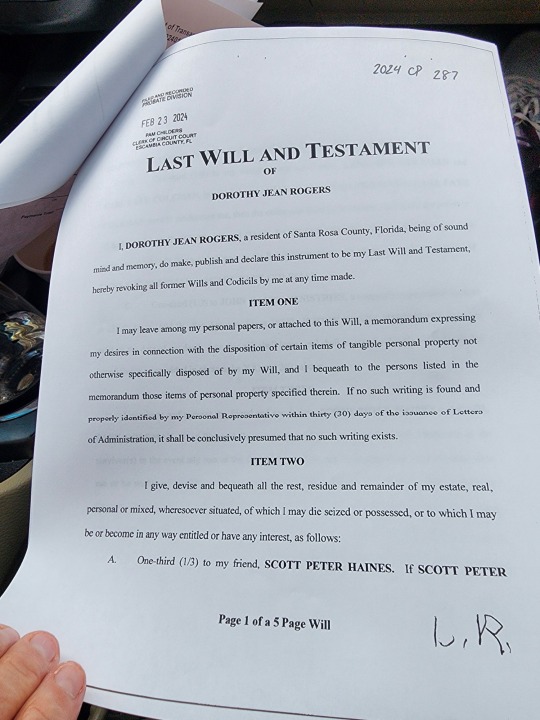

Ms. Dot's Will

View On WordPress

0 notes

Video

youtube

Tax-Defaulted Properties with Jay Drexel & Jay Conner, The Private Money Authority

https://www.jayconner.com/tax-defaulted-properties-with-jay-drexel-jay-conner-the-private-money-authority/

Over 10 years ago, Jay Drexel discovered Tax Default Property Investing. Today he owns over 700 Tax Default Investments and buys a couple every single week from his home office.

These investments are in multiple states, they are making anywhere from 10% to 25% ROI. He's a full-time investor and educator teaching students all over the country about how with the right education, technology, and coaching, you can invest safely and successfully in tax liens from the comfort of home.

Timestamps:

0:01 - Introduction

1:30 - Jay’s New Book: “Where To Get The Money Now” - https://www.JayConner.com/Book

2:51 - Today’s guest: Jay Drexel

4:16 - Jay Drexel’s back story

7:36 - Difference between a tax deed and a tax lien.

9:09 - Are there states that offer both tax deeds and tax liens?

10:09 - How do investors locate opportunities for tax-defaulted properties?

12:24 - Free e-book from Jay Drexel: text “invest” to 72000

14:07 - Benefits of investing in tax-defaulted properties

16:48 - Risks involved in investing in tax-defaulted properties

18:59 - Is it possible to do this business 100% virtually?

20:55 - Jay Drexel’s best deal.

23:04 - Connect with Jay Drexel: https://www.UnitedTaxLiens.com

23:33 - Jay Drexel’s best advice to a new real estate investor.

Private Money Academy Conference:

https://www.jayconner.com/learnrealestate/

Free Report:

https://www.jayconner.com/MoneyReport

Join the Private Money Academy:

https://www.JayConner.com/trial/

Have you read Jay’s new book: Where to Get The Money Now?

It is available FREE (all you pay is the shipping and handling) at

https://www.JayConner.com/Book

What is Private Money? Real Estate Investing with Jay Conner

https://www.JayConner.com/MoneyPodcast

Jay Conner is a proven real estate investment leader. He maximizes creative methods to buy and sell properties with profits averaging $67,000 per deal without using his own money or credit.

What is Real Estate Investing? Live Private Money Academy Conference

https://youtu.be/QyeBbDOF4wo

YouTube Channel

https://www.youtube.com/c/RealEstateInvestingWithJayConner

Apple Podcasts:

https://podcasts.apple.com/us/podcast/private-money-academy-real-estate-investing-with-jay/id1377723034

Facebook:

https://www.facebook.com/jay.conner.marketing

#youtube#real estate#real estate investing#real estate investing for beginners#probate#flipping houses#tax defaulted properties#tax deed#tax lien#Private Money#Jay Conner

2 notes

·

View notes