#public private partnership (ppp)

Text

China’s funding of the Laguna to Bicol Railway Project is now very likely to be cancelled due probably to Tensions bought about the Issues in the South China Sea (SCS)

#china#philippines#united states us#laguna#bicol#philippine national railway pnr#pnr long haul south#department of transportation dotr#public private partnership ppp#south china sea scs#manila bay#bong bong marcos bbm#japan#south korea#europe

0 notes

Text

Building Together: Exploring Public-Private Partnerships (PPP) in India

Bridging the gap between public needs and private sector expertise, Public-Private Partnerships (PPP) are transforming infrastructure development. This blog explores the PPP model, its benefits, and its growing role in India's infrastructure landscape. Discover how PPPs are fostering collaboration to create a more sustainable and efficient future.

0 notes

Text

Powering Sustainable Growth: Regional Conference Focuses on Hydropower Development

A one-day regional conference was held on November 23, 2023, in Kathmandu, Nepal, with a focus on sustainable hydropower development. The conference brought together representatives from government, industry, and academia to discuss strategies for developing hydropower in a way that is sustainable and beneficial to all.

In a keynote address, Minister for Energy, Water Resources and Irrigation,…

View On WordPress

#Bizbell#Energy Market#expanding transmission and distribution lines#Ganesh Karki#hydropower development#IHA#International Hydropower Association#IPPAN#maximizing power generation#NHA#Norad#Norwegian Agency for Development Cooperation#Powering Sustainable Growth&039; conference#PPPs#public-private partnerships#Shakti Bahadur Basnet#Sushil Pokharel#Sustainable Development#sustainable growth#sustainable hydropower development#The World Hydropower Congress#USAID

0 notes

Text

Cooperation Between Community And The Government Brings Progress – Dahabshiil CEO

@Dahabshil CEO Mr. Abdirashid Duale, who spoke about the construction of the #WaaheenMarket in #Hargeisa, the capital city of #Somaliland, said that progress can be achieved when people work in togetherness & in concerted efforts.

Continue reading Untitled

View On WordPress

#Abdirashid Duale#Dahabshiil#Dahabshiil Group#Hargeisa#Horn of Africa#Public Private Partnership (PPP)#Reconstruction#Somaliland#Waaheen Market

0 notes

Text

The tea value chain must be sustainable at all stages.

In order to ensure benefits for both people and the environment, the tea value chain must be sustainable at all stages, from field to cup.

Mapping of IFAD’s projects supporting tea value-chain development

(2002-2012)

What are the roles of the various players in a public-private partnership (PPP)?

IFAD is dedicated to helping create the conditions for smallholder farms to thrive as small enterprises and for rural people to improve their livelihoods. By .nts, it supports activities aimed at reducing barriers (such as lack of infrastructure, equipment, community services and marketing facilities) and building trust. In addition, it acts as a broker between local government, the private sector and smallholders to build long-term profitable partnerships for the development of the tea value chain. The role of the private sector is fundamental and involves ensuring technical assistance and support during tea production; helping to conduct research; increasing access to inputs and materials and to ensure quality control; and providing market access and funds. Thus, private-sector investment can contribute to pro-poor development by reducing poverty and strengthening food and

nutrition security.

#tea value chain#cup of tea#tea growers#private-sector investment#IFAD#Smallholder tea farmers#public-private partnership (PPP)

0 notes

Photo

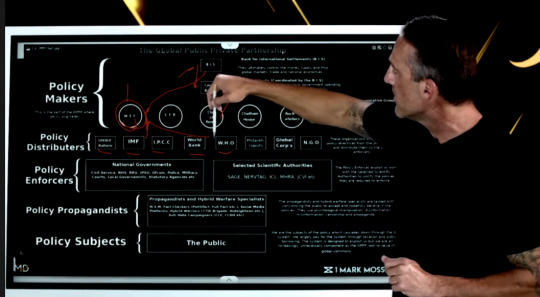

CORPORATE FASCISM AND THE PPP CCP

The globalist agenda started decades ago with the U.N.’s "Sustainable Development Goals"

[They only reconstituted the Reich]

The WEF and Globalists Are Losing | How We Win Mark Moss Published December 1, 2022

where the Whole World was to fall in line with their goals and plans. However, since then we have seen it transform into other names and goals driven by other very similar players. We now have the WEF calling for 'stake holder capitalism' and 'public private partnership' and of course, ESG scores, that will be the ultimate form of control.

https://rumble.com/v1ydk59-the-wef-and-globalists-are-losing-how-we-win.html

Slides; https://go.1markmoss.com/blackrock [valid link]

0 notes

Text

https://stateofthenation.co/?p=245146

The Most Dangerous Partnership On The Planet Is Slowly Strangling The Entire World Community Of Nations

Posted on August 12, 2024 by State of the Nation

WARNING! PPP-DIRECTED CENSORSHIP NOW ON SUPER STEROIDS…..

…And It’s Only Going To Get Worse—MUCH WORSE!!!

But why?

Because the New World Order globalist cabal is under direct attack via so much radioactive and raw truth—THAT’S WHY!

What follows are just 3 posts of numerous articles which have recently appeared in the Alt Media that each tell a different aspect of this HUGE and highly consequential story.

The Transatlantic Deception: CCDH’s Web of Lies

Before UK Parliament and US Congress

The Most Chilling Words Today:

I’m from NewsGuard And I Am Here To Rate You

Why is the state of Florida so determined to stamp out

any and all criticism of Israel and Zionism?

Very few folks are aware but Public-Private Partnerships (PPPs) have been all the rage where it concerns exerting complete command and control over which content is permissible on the Internet.

Some of these PPPs are quite out there chewing up free speech in an assortment of ways under the guise of banning so-called disinformation, misinformation and false information, while others are extremely covert operations stealthily censoring any content that is perceived to be politically incorrect.

For example, every time any organ of the U.S. Federal Government leans on any of the largest Social Media behemoths to remove content, that is a PPP flagrantly undermining the First Amendment. In point of fact, the FBI and Twitter were caught countless times committing these violations of the First Amendment prior to the Elon Musk takeover.

UK leads the way toward global censorship

No one does censorship like the Bloody Brits.

UK Labour Politician Arrested for Calling to “Cut the Throats”

of Anti-Immigration Protestors

Then there is the new PM Keir Starmer who just got his knickers in a twist over Elon Musk exercising his right to Free Speech. Not only that, but the the UK Parliament wants Musk to appear in their London-based kangaroo court to face their imperialistic judgment.

10 notes

·

View notes

Text

New Murabba Case Study: Urban Transformation in Riyadh

Overview: The New Murabba Project, led by Saudi Arabia's Public Investment Fund (PIF), is a key part of Vision 2030, transforming Riyadh into a world-leading city with a massive modern downtown.

Key Components:

Mukaab Landmark:

Design: A 400-meter cube structure housing a museum, university, theatre, and over 80 entertainment venues.

Urban Planning:

Development: 104,000 residential units, 9,000 hotel rooms, and 980,000 square meters of retail space.

Green Spaces: A 3.2 million square meter park.

Transportation: Integrated public transport network.

Sustainability and Innovation:

Energy Efficiency: Sustainable building practices and energy-efficient technologies.

Smart City Features: Implementation of smart infrastructure.

Public–Private Partnerships (PPPs): The project highlights the role of PPPs in

urban transformation:

Investment and Funding:

Public Investment Fund: Primary investor attracting private sector investments.

Collaboration with International Firms:

Design and Construction: Partnerships with global firms for world-class standards.

Technology: Integrating smart city solutions.

Economic Impact:

Job Creation: Significant job opportunities during construction and ongoing operations.

Tourism and Commerce: Boosting the local economy and Riyadh's global standing.

Challenges:

- Project Management: Ensuring timely completion with robust management.

- Sustainability: Balancing urbanization with environmental impact.

- Community Engagement: Involving local communities and stakeholders.

Conclusion: The New Murabba Project exemplifies the power of PPPs in urban development, integrating cultural, commercial, and residential elements with sustainability and technology to create a vibrant, future-ready urban center in Riyadh.

#KhalidAlbeshri #خالدالبشري

#advertising#artificial intelligence#autos#business#developers & startups#edtech#education#finance#futurism#marketing

11 notes

·

View notes

Text

A joint venture between Vietnamese infrastructure developer Deo Ca Group JSC and Petroleum Trading Lao Public Company (PetroTrade) has been allowed to develop a railway project linking the two countries.

General Director of the Deo Ca Group JSC Nguyen Quang Vinh has announced that the Ministry of Transport accepted the joint venture’s proposal on developing Vung Ang – Tan Ap – Mu Gia railway project under the form of Public-Private Partnership (PPP).[...]

The project will be built under the public-private partnership, with a total investment of 149.55 trillion VND (6.3 billion USD).

Vung Ang port - the railway’s ending point will play an important role in promoting the the two countries' economic ties through trade exchange and maritime transport, targeting the markets of Northeast Thailand, China, the Republic of Korea and Japan.

19 Oct 23

21 notes

·

View notes

Text

MANAGE Inaugurated 2-week #ITEC training program on Promotion of Public-Private Partnership (#PPP) in Agriculture and Allied Sectors on 19/9/24. Total 29 participants from 13 countries are participating.

2 notes

·

View notes

Text

How to Manage Risks in Investment Banking and Why Is It Important?

Institutional investors and organizations wanting to acquire another business entity depend on investment banking services. Therefore, IB professionals must manage risks associated with the large transactions involved in mergers and acquisitions (M&A) deals. Likewise, their work concerning initial public offerings (IPOs) must overcome market uncertainties. This post will discuss how to manage risks in investment banking.

What is Investment Banking (IB)?

Investment banking is a category of financial services encompassing capital market insights, valuation, mergers, and acquisitions. Besides, issuing IPOs or securing significant debt financing becomes more manageable via investment banking services.

An investment banker knows how to assess market conditions to predict if a company’s IPO will succeed. As a market maker, he must also prepare strategies to mitigate IPO under-subscription risks. Professional underwriting services offered by IBs make them attractive to institutional investors.

High net-worth individuals (HNWI) have benefitted from IB support, like some private banking solutions though the scope is more extensive. Moreover, some IBs specialize in enabling municipal corporations and public-private partnerships (PPPs) to fund infrastructure development projects.

What is Risk Management in Banking and Financial Investment?

Risk management emphasizes protecting assets from loss by identifying and avoiding risky characteristics in an investment strategy or business merger. However, professionals who offer private banking solutions or collaborate with investment bankers understand the risk-reward correlation.

You cannot erase all risks since most uncertainties emerge from external factors. Instead, institutions and HNWI employ investment banking services to minimize the losses. For example, holistic performance data allows more reliable stock screening.

An enterprise can engage in accounting manipulation or unlawful business practices. So, investing in it increases legal and financial risks for investors. Also, an organization that acquires this firm will hurt its brand reputation, investor trust, governance, and consumer loyalty. Therefore, detailed investment research reports are integral to due diligence in portfolio risk management.

What Are the Investment Banking Risks?

1| Risks Arising from Market Dynamics

Market risk or macro risk is inevitable. Investment banking risks comprise many market risks. Variations in investor sentiments, inflation, exchange rates, and interest rates increase the risk. So, reliable investment banking services predict these dynamics to manage macro risks efficiently.

For example, equity risk affects stocks, reflecting supply-demand variations. If shares lose value fast, IB professionals and their clients must handle increased financial challenges.

Interest rate risks involve governments, public-private entities, or global corporations issuing bonds. Besides, private banking solutions offer extensive access to debt capital markets (DCMs) susceptible to interest rate risks.

Likewise, investment banking professionals must understand and manage currency risks. This requirement affects investors with global portfolio coverage. After all, shifts in currency exchange rates have ripple effects across various business and finance operations.

2| Liquidity Risks in Investment Banking

Liquidity risks imply you cannot sell your investment to gain a profit. Investors require a lot of formalities to withdraw funds if the need arises. Therefore, they settle for less money and sell the investment. However, the selling route is conditionally available because some assets or legal situations can restrict this option.

3| Concentration Risks

Concentration risks increase when an investor puts all the funds in one investment class. Investment banking services also implement diversification strategies to manage concentration risks. Similarly, private banking solutions assist HNWI in diversifying their investments. To overcome concentration risks, they want to distribute their investable corpus across different sectors and geographies.

4| Reinvestment Risks

When reinvesting, investors might lose capital resources and experience a low return on investment (ROI). This threat is one of the reinvestment risks in investment banking. For example, an investor might purchase a high ROI bond today.

In the future, the interest rates can decrease. Therefore, the investor must reinvest the regular interest payments at lower returns. This risk also extends to bonds that expire. Reputable private banking solutions can evaluate such risks to help their clients.

5| Credit Risk

Credit risk refers to the inability of the borrower to meet the repayment obligations originating from a debt-driven financial relationship. Imagine an organization or government entity failing to fulfill the interest requirements associated with the bonds they had issued. So, the investors who bought these bonds must analyze credit risks.

Many investment banking services help clients with credit research and risk assessment. A business can get a AAA credit rating when the credit risks are fewer. Corporate credit rating is the enterprise version of individuals’ credit scores.

6| Inflation Risk

Inflation risk means investors lose buying power because their investments’ ROIs fail to defeat the inflation rate. Remember, inflation makes it difficult to acquire the same goods and services that an individual, organization, or investor could have purchased a while back. If you have cash or debt investments like bonds, this financial threat significantly affects you.

However, corporations can introduce price hikes to respond to high inflation rates. This situation adversely affects customers’ willingness to consume what the company offers. Yet, price hikes highlight how shares protect investors from inflationary risks in investment and banking.

7| Lifespan Risks

Humans live for a limited time. This fact proves the existence of lifespan risks, and private banking solutions recognize its implications. If an investor outlives his investments, he must identify new income streams.

Consider the retired professionals. They are more likely to experience lifespan risks. These risks also apply to HNWIs and their family members. Therefore, multi-generational wealth management solutions in private banking are vital for these investor categories.

8| Foreign Investment Risks and Nationalization

Investors can experience financial problems when investing in overseas assets. Payment complications and complying with different accounting standards are some of these challenges. Besides, governments in certain countries have a track record of nationalizing private companies.

How to Manage Risks in Investment Banking

1| Portfolio Diversification

Investment banking services guide enterprises in analyzing companies before business mergers. This analysis also determines whether an M&A deal or leveraged buyout contributes to diversification. It is portfolio diversification when investors allocate their financial resources across different assets and companies in distinct industries.

Therefore, institutional investors, international organizations, and HNWIs can mitigate the concentration risks. If an asset’s ROI decreases, the final performance of your portfolio will remain safe from tremendous losses.

For example, private banking solutions let HNWIs invest in different geographies. They also facilitate multi-industry stock screening and fund selection strategies.

2| Correlation and Optimization

If all the stocks and bonds move in one direction, the assets are linked or correlated. So, investors and fund managers deliberately choose asset classes that perform in different directions. i.e., some poor-performing assets can appreciate in a macroeconomic event disrupts the well-performing assets.

You also want to target different markets to secure your investments from market risks. If one market exhibits significant volatility, investments concerning other markets will be relatively safer.

3| Data-Driven Investment Strategies

Predictive financial modeling will alert investors to investment banking risks. After all, this era has proved how artificial intelligence (AI) adds value to conventional investment research services. Integrating data and analytical insight extraction allows intuitional investors and HNWIs to make informed decisions on stock selection.

Moreover, financial analytics offer cross-verification of valuation reports and legal compliance disclosures. These documents are essential to successful M&A negotiations.

4| Policy Intelligence

Regulatory bodies governing banking, financial services, and insurance (BFSI) companies revise laws. These policy and regulation revisions often change the risk dynamics of investment management. Some private banking solutions monitor these changes for their clients.

Acquiring and processing data on government expectations in different nations helps manage foreign investment risks. Simultaneously, high-quality investment research reports can forecast market movements using policy intelligence.

Conclusion

Investment banking risks result from macro factors like economic crisis, inflation, and regulatory revisions. Likewise, incorrectly managed investor portfolios increase risk exposure. So, strategies like diversification or data-driven decisions let funds and HNWIs prepare for market volatility.

SG Analytics, a leader in investment banking services, assists institutional investors and businesses across company screening, financial analysis, and M&A deal lifecycle. Contact us today for robust business intelligence and investment insights to optimize portfolios.

2 notes

·

View notes

Text

As part of the restructuring of the New Republic's governmental structure initiated by Chief of State Leia Organa Solo, the Cabinet was established as a successor to the Ruling Council, which itself had replaced Alliance High Command in the days of the Rebellion. While nominally a part of the executive branch and serving at the pleasure of the Chief of State, in practice all cabinet members are drawn from the Senate and from the governing coalition. The Cabinet members are as follows:

Prime Minister: Cal Omas (Reform) of New Alderaan. The Prime Minister is responsible for much of the day-to-day governance of the Republic and primarily oversees domestic affairs. Also serves as the President of the Senate and the primary liaison between the Chief of State and that body. The Prime Minister also serves as the head of the Cabinet in the absence of the Chief of State - most Cabinet meetings regarding domestic policy occur without the Chief of State's presence.

Minister of Defense: Hera Syndulla (PPP) of Ryloth. Effectively second-in-command of the military, as the Chief of State is Commander-in-Chief. Coordinates military procurement and logistics, negotiates contracts with arms suppliers, and oversees the conduct of active campaigns in the absence of the Chief of State. Syndulla ascended to the role after Gial Ackbar was demoted to Minister Without Portfolio as part of the fallout of Mon Mothma's ouster.

Minister of Commerce: Drextar Pym (Liberal) of Excarga. Engages with the galactic business community and develops private-public partnerships, negotiating government contracts in various aspects of life while encouraging economic stimulation and growth.

Minister of Justice: Darial Anglethorn (PPP) of Beheboth. The liaison of the executive branch to the judicial branch. Coordinates government's counsel in pursuing legal cases of interest to the state. In extreme cases may argue for the government at the Supreme Court.

Minister of Foreign Relations: Elegos A'Kla (PPP) of Caamas. Coordinates the Republic Diplomatic Corps. Pursues cordial relations with affiliated states and friendly non-affiliate galactic factions, and negotiates treaties and armistices with hostile foreign powers. Also serves as the New Republic's official liaison with the New Jedi Order.

Minister of Security and Intelligence: Kerrithrarr (PPP) of Kashyyyk. Coordinates the New Republic's internal security forces and its intelligence community. Also serves as the chair of the Senate Committee on Intelligence.

Minister of Science and Technology: Rees Vera (Liberal) of Mikkia. Coordinates and engages with the New Republic's R&D apparatus to develop technologies with both military and civilian applications.

Minister of the Interior: Lassten Stonk (Liberal) of Ithor. Oversees state-controlled assets and natural resources as well as the budding Galactic Parks System, of which the Bail Organa Memoiral Garden was the first.

Minister of Labor: Garm Bel Iblis (PUP) of Corellia. The government's liaison with the labor movement and the unions. Oversees the Labor Relations Tribunal.

Minister of Health: Doman Beruss (PPP) of Illodia. Oversees the state-run healthcare being established under the Organa Solo administration, and also coordinates with healthcare companies for government contracts, including supplies of bacta and kolto.

Minister of Exchequer: Ponc Gavrisom (PPP) of Calibop. Oversees the Republic treasury and drafts the Chief of State's official budget proposals.

Minister of Education: Lanever Villecham (Liberal) of Tarsunt. Oversees the state's education system and establishes educational standards and essential curricula.

Minister of Transportation: Kordi Freemaker (PUP) of Nubia. Oversees galactic infrastructure, including hyperlane maintenance, and works to improve the Republic's growing public transportation systems.

Minister of Energy and Fuel: Jar Jar Binks (Liberal) of Naboo. Coordinates procurement of energy and fuel from private entities. Works closely with the Minister of the Interior in developing the Republic's public energy reserves.

Minister of Veterans Affairs: Jan Dodonna (PPP) of Commenor. Oversees pensions and services for veterans of the Galactic Civil War as well as the remaining clones of the Grand Army of the Republic.

Minister of Communications and Culture: Grelka Sorka (PPP) of Askaj. Oversees the infrastructure of the HoloNet, and promotes art and culture, especially such as is reparative to the many years of COMPNOR propaganda foisted upon the galaxy.

Minister of Food and Agriculture: Melana Koba (PUP) of Dowut. Coordinates with farmers, ranchers, and factory operators to regulate and secure the galactic food supply, as well as invest in advancements in agtech.

Minister of Housing and Development: Sala Mogag (PPP) of Duro. Coordinates public housing projects and regulates rents and mortgages across the Republic. Also invests in urban renewal projects on blighted worlds such as Taris.

Minister of Equalities: Boona Kalan (Federalist) of Taris. Oversees equalities and civil rights, as well as undoing the bigoted policies instituted by the Empire.

Minister Without Portfolio: Gial Ackbar (PPP) of Dac. Has no official office or purview since his demotion, but acts as an advisor to the Chief of State, particularly on military matters.

13 notes

·

View notes

Text

Unlocking Growth: Private Public Partnership in India

Private Public Partnerships (PPPs) in India exemplify collaborative endeavors between government entities and private sectors to foster economic development. These partnerships span various sectors, including infrastructure, healthcare, and education, leveraging the strengths of both sectors to deliver efficient and sustainable solutions. By pooling resources, expertise, and innovation, PPPs drive infrastructural growth, improve service delivery, and stimulate economic progress across the nation. Through strategic alliances and shared responsibilities, PPPs play a pivotal role in addressing infrastructure gaps and promoting inclusive development in India.

0 notes

Text

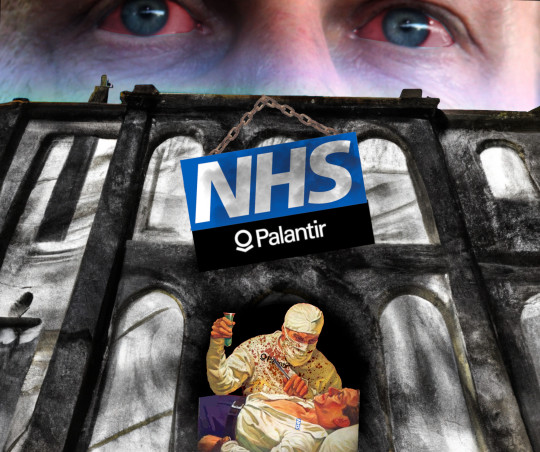

How Palantir will steal the NHS

Britons are divided on many matters, but one uniting force that cuts across regional, party and class lines is jealous pride for the NHS and fierce resistance to its privatisation and the importation of America’s grisly omnishambolic health care “system.”

But while the British people oppose privatisation, the British investor class are slavering for it. Oligarchs love to loot public services, which is why the IMF is so adamant that the countries it “helps” sell off their public water, housing, even their roads and schools and museums.

Normally, the corrupting, immiserating effects of privatisation happen so slowly that they can feel like a natural phenomenon, a gradual change in the weather that makes everyone a little colder, a little more uncomfortable every day, until one day, the situation is unbearable.

But there have been moments of “big bang” privatisation where governments and oligarchs speed-ran the process of looting the public coffers and transferring them to private hands — think of the sell-off of ex-Soviet state industries to connected insiders.

Or think of Thatcher’s sell-off of council homes, an airdrop that converted shelter from a human right to an asset, in which “market forces” were allowed to “optimise” the housing system, with the result that everyday people can’t afford a home, while wealthy speculators trousered billions.

Thatcher had a supermajority, and she understood how to play different economic blocs against each other, resulting in the “shock therapy” of the 1980s. Her successors — both Tories and New Labour — had to move more slowly:

https://jacobin.com/2022/10/liz-truss-mini-budget-imf-boe-government-debt-brexit

Back to the NHS. It has been subject to the death of a thousand literal cuts, as Tories and Labour alike have starved it of resources. More importantly, both parties have turned ever-larger chunks of the NHS over to private-sector looters who have taken over hospitals, services, record-keeping and more.

These “public-private partnerships” were billed as a “third way,” combining the strengths of both the public and private sectors. In reality, they were a way to transfer a ever-larger sums from the public purse to private investors.

Public-private partnerships (PPPs) are a heads-I-win, tails-you-lose proposition. When a private sector manager takes over a public service and extracts so much profit from the system that it risks collapse, the public sector is blamed for undersubsidising the service, and the looter can demand more money.

Lather, rinse, repeat. After decades of this, everyone understands how PPPs can be used to siphon endless sums out of the public coffers. But there’s a more sinister aspect to PPPs that is only just coming to light, exemplified by Palantir’s leaked plans to take over the NHS.

Palantir is one of the most sinister companies on the global stage, a company whose pitch is to sell humans rights abuses as a service. The customers for this turnkey service include America’s most corrupt police departments, who use Palantir’s products to monitor protest movements.

https://journals.sagepub.com/doi/abs/10.1177/0003122417725865#articleCitationDownloadContainer

Palantir’s clients also include the Immigration and Customs Enforcement, a federal agency who rely on Palantir’s products for their ethnic cleansing:

https://theintercept.com/2018/03/26/facebook-data-ice-immigration/

Palantir also sells to the CIA:

https://www.bloomberg.com/features/2018-palantir-peter-thiel/

One of Palantir’s best markets is the UK, where it has insinuated itself into numerous public services:

https://privacyinternational.org/sites/default/files/2020-11/All%20roads%20lead%20to%20Palantir%20with%20Palantir%20response%20v3.pdf

That includes the NHS, where Palantir has been jockeying for an ever-larger slice of the health service’s private procurements. But the company’s reputation has preceded it, and even NHS commissioners understand that they risk public outrage if they sign over the NHS to a notorious private-sector surveillance company.

Palantir has a solution. The company has effectively unlimited access to the capital markets, as well as to its deep-pocketed founder Peter Thiel, a cartoon villain who’s written that women shouldn’t be allowed to vote and that democracy and freedom are incompatible.

All that liquid capital means that Palantir doesn’t have to win NHS contracts — it can simply buy up other companies that have won them. Palantir’s strategy leaked to Bloomberg, and Olivia Solon lays it out:

https://www.bloomberg.com/news/articles/2022-09-30/palantir-had-plan-to-crack-uk-health-system-buying-our-way-in

In a Sept 2021 email with the subject line “Buying our way in…!” Palantir regional boss Louis Mosley describes a plan to go around “hoovering up” NHS contractors, to “take a lot of ground and take down a lot of political resistance.”

(A Palantir spokesman said the email was “regrettable” and “not an accurate characterization of our relationship with the NHS”)

Palantir’s Mosley said he’d target NHS software suppliers with “credible leadership” and revenue between £5–50m, offering their founders “v. generous buyout schedule (say 10x, especially if all stock),” adding “(we might even be their only real exit option).”

Palantir also urged the lobbying group TechUK to pressurise the NHS and other government departments to buy commercial, proprietary systems rather than building their own.

Palantir ran their own separate lobbying as well, hiring Indra Joshi and Harjeet Dhaliwal away from the NHS to push their agenda in Westminster:

https://www.bloomberg.com/news/articles/2022-04-21/palantir-hires-ai-chief-from-nhs-in-u-k-as-it-bids-to-expand

For backup, they retained Global Counsel, a lobbying firm run by the Blairite archvillain Peter Mandelson, to push Palantir to the UK government. Mandelson is one of the great monsters of New Labour, masterminding a plan to permanenly disconnect British households from the internet if any member of the family was accused — without proof — of illegaly downloading music:

https://memex.craphound.com/2009/11/19/breaking-leaked-uk-government-plan-to-create-pirate-finder-general-with-power-to-appoint-militias-create-laws/

Palantir’s plans are bearing fruit. In Dec 2020, the company won a £23.5 no-bid contract to manage NHS patient data:

https://www.thebureauinvestigates.com/stories/2021-02-24/revealed-data-giant-given-emergency-covid-contract-had-been-wooing-nhs-for-months

The deal was successfully challenged by Foxglove, who represented Opendemocracy in a suit to force the government to make future Palantir deals subject to public tender:

https://www.opendemocracy.net/en/ournhs/weve-won-our-lawsuit-over-matt-hancocks-23m-nhs-data-deal-with-palantir/

The real prize isn’t a mere £23.5 contract, though: the NHS is about to open to bids for a massive, £360m IT project. That’s where Palantir’s plan to buy out its rivals for the deal could bear real fruit.

That’s not a bug in PPP, it’s a feature. The point of PPP is to apply market dynamics to public service provision. Foremost among these market dynamics is the right of company owners to sell their businesses to other companies.

The UK — along with the rest of the west — has spent 40 years waving through anticompetitive mergers, under a doctrine that holds that monopolies are “efficient” (Thiel agrees: according to him, “competition is for losers”).

The combination of lax merger scrutiny and PPP inevitably leads to this kind of play: one deep-pocketed company can “hoover up” all the contractors to the NHS and form a single entity that can hold the NHS to ransom.

Palantir’s commitment to proprietary, secretive software development methodologies makes it utterly unsuitable for NHS service provision. Compare the NHS to Ben Goldacre’s landmark “Better, broader, safer: using health data for research and analysis”:

https://www.gov.uk/government/publications/better-broader-safer-using-health-data-for-research-and-analysis/better-broader-safer-using-health-data-for-research-and-analysis

Goldacre argues that the only way to unlock the medical insights in aggregate NHS patient data is with public software: an open and free “trusted research platform” that anyone can audit and verify.

While the code for this platform would be public, NHS patient data would never leave it. Instead, researchers who wanted to investigate hypotheses about the effectiveness of different interventions would send queries to the platform and get results back — without ever touching the data.

This is a system that only works if it’s hosted by democratically accountable public services — not by private actors accountable to their shareholders, and certainly not secretive companies whose primary expertise is in helping spy agencies conduct mass surveillance.

Image:

Gage Skidmore (modified)

https://commons.m.wikimedia.org/wiki/File:Peter_Thiel_(51876933345).jpg

CC BY 2.0

https://creativecommons.org/licenses/by-sa/2.0/deed.en

[Image ID: A haunted, ruined hospital building. A sign hangs askew over the entrance with the NHS logo over the Palantir logo. Beneath it, a cutaway silhouette reveals a blood-spattered, scalpel-wielding surgeon with a Palantir logo over his breast, about to slice into a frightened patient with an NHS logo over his breast. Looming over the scene are the eyes of Peter Thiel, bloodshot and sinister.]

70 notes

·

View notes

Text

حمدان بن محمد يعتمد محفظة لمشاريع الشراكة بين القطاعين العام والخاص في حكومة دبي ..

اعتمد سمو الشيخ حمدان بن محمد بن راشد آل مكت��م، ولي عهد ��بي رئيس المجلس التنفيذي، محفظة حكومة دبي لمشاريع الشراكة بين القطاعين العام والخاص، بقيمة 40 مليار درهم، وذلك خلال الاجتماع الأول للمجلس التنفيذي بتشكيله الجديد.

وكشفت دائرة المالية في حكومة دبي عن المحفظة التي تشتمل على مجموعة واسعة من مشاريع الشراكة بين القطاعين العام والخاص، ضمن استراتيجيتها للشراكة بين القطاعين. وتهدف محفظة المشاريع الجديدة، البالغة قيمتها نحو 40 مليار درهم، إلى إثراء التعاون وبناء علاقات جديدة بين حكومة دبي والقطاع الخاص.

During the first meeting of The Executive Council of Dubai since its reconstitution, His Highness Sheikh Hamdan bin Mohammed bin Rashid Al Maktoum, Crown Prince of Dubai and Chairman of The Executive Council of Dubai, approved a portfolio of public-private partnership (PPP) projects of the Dubai Government valued at AED40 billion.

The Department of Finance (DOF) of the Government of Dubai announced the portfolio as part of its PPP strategy. Featuring a wide variety of projects, the new portfolio aims to further enrich cooperation and inspire new collaborations between the public and private sectors in the emirate.

Thursday, 21 March 2024 الخميس

4 notes

·

View notes

Text

Brazilian government announces end of privatization process of the port of Santos

Brazilian minister of Ports and Airports Silvio Costa Filho, announced the termination of the Investment Partnership Program (PPI), which had originally set the conditions for the privatization of the management of the Port of Santos.

The decision was met with enthusiasm by employees of the Santos Port Authority (APS), as well as by labor unions and regional leaders. As a result, the APS will keep control of the largest port in the southern hemisphere.

Costa Filho also outlined a strategy to attract private capital for investments, emphasizing the use of Public-Private Partnerships (PPPs). A noteworthy example is the Santos-Guarujá tunnel project, which will receive funding from the federal government’s Growth Acceleration Program (the new PAC). The minister projects a total investment of R$13.4 billion in the Port of Santos over the next eight to ten years.

Among the investments, R$400 million will be allocated to key projects such as the Perimeter Road on the port’s Left Bank. Additionally, a substantial sum of R$6 billion will be dedicated to dredging operations. These initiatives will be carried out through PPPs, reflecting the minister’s positive outlook on projects aimed at enabling commercial flights from the Metropolitan Airport of Guarujá. A meeting with State Deputy Caio França explored the extension of the port’s boundaries to encompass São Vicente. This extension will encourage ancillary port activities and the implementation of waterways.

Continue reading.

4 notes

·

View notes