#r. h. thomson

Explore tagged Tumblr posts

Text

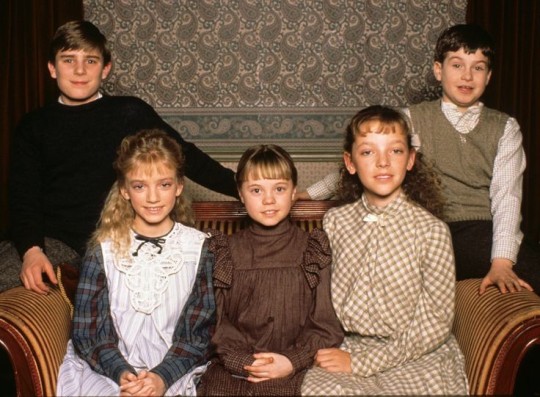

ROAD TO AVONLEA (1990-1996)

created by kevin sullivan

#road to avonlea#kevin sullivan#jackie burroughs#sarah polley#gema zamprogna#michael mahonen#lally cadeau#mag ruffman#zachary bennett#harmony cramp#cedric smith#molly atkinson#r. h. thomson

46 notes

·

View notes

Text

Murder in a Small Town (TV Series Pilot Review) | Murder with a Cozy Twist

If you're in the mood for a cozy mystery with charming coastal vibes, Murder in a Small Town is just the escape you need. Rossif Sutherland and Kristin Kreuk bring an easy charm to this laid-back crime drama. 🕵️♀️ #TVReview #CozyMystery #MurderInASmallT

Ian Weir (Showrunner), L.R. Wright (Novel) CAST Rossif SutherlandKristin Kreuk Review Murder in a Small Town is based on L.R. Wright’s Alberg and Cassandra Mysteries, set in a coastal town in British Columbia, Canada that hides a darker side beneath its quaint exterior. The show centers around Karl Alberg portrayed by Rossif Sutherland, a big-city cop seeking solace in a quieter life, only to…

#Aaron Douglas#Based on a book#Based on a novel#Book adaptation#Book to TV#Cassandra Sawtell#Crime#Crystal Balint#Daniel Ian Joeck#Drama#Fiona Vroom#Fritzy-Klevans Destine#Ian Weir#James Cromwell#Kate Robbins#Katey Wright#Kristin Kreuk#L. R. Wright#Marc-Anthony Massaiah#marilyn norry#Milan Cheylov#Murder in a Small Town#Mya Lowe#Mystery#Paloma Kwiatkowski#Pilot#premiere#R. H. Thomson#Review#Rossif Sutherland

0 notes

Text

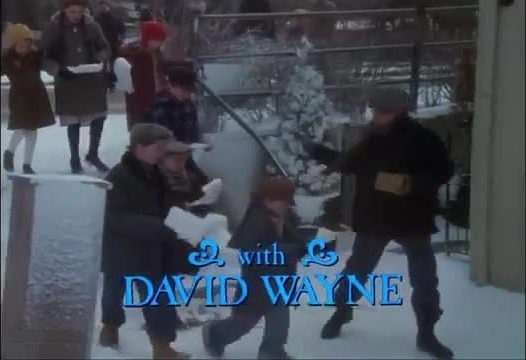

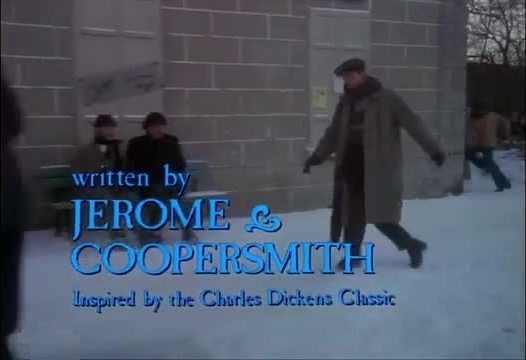

An American Christmas Carol - ABC - December 16, 1979

Christmas Drama / Fantasy

Running Time: 97 minutes

Stars:

Henry Winkler as Benedict Slade

Dorian Harewood as Matt Reeves

Susan Hogan as Helen Brewster

Cec Linder as Auctioneer

R.H. Thomson as Thatcher

David Wayne as Merrivale

Michael Wincott as Choir Leader

William Bermender as Orphan

Brett Matthew Davidson as Orphan

Tammy Bourne as Sarah Thatcher

Chris Cragg as Jonathan Thatcher

James B. Douglas as Sam Perkins

Arlene Duncan as Jennie Reeves

Linda Goranson as Mrs. Doris Thatcher

Gerard Parkes as Jessup

Mary Pirie as Mrs. Brewster

Kenneth Pogue as Jack Latham

Sammy Snyders as Young Slade

Chris Wiggins as Mr. Brewster

Alexander Galant as Orphan (uncredited)

#An American Christmas Carol#TV#ABC#Christmas#Drama#1979#1970's#Henry Winkler#Dorian Harewood#Susan Hogan#David Wayne#Chris Wiggins#R H Thomson#Kenneth Pogue#Gerald Parkes

10 notes

·

View notes

Text

my top tv couples ever

best chemistry ever- fictional couples

Aunt Becky (Donaldson) (Lori Loughlin) and Uncle Jesse (John Stamos) Katsopolis- Full House 1987-1995 and Fuller House 2016-2020. Forever! Married in the episode: The wedding part 2 (Season 4)

(DR) DJ tanner (candace cameron bure) and (Dr) steve hale (scott weinger) Full House 1987-1995 and Fuller House 2016-2020. Married in the final episode of fuller house.

Miss Phryne Fisher (Essie davis) and DI JACK Robinson (Nathan Page) Miss Fisher's Murder Mysteries 2012-2015 and Miss fisher and the crypt of Tears 2020

Sarah Addams/Nordmann (Marta dusseldorp) and George Bligh (brett climo) a place to call home 2013-2018. Married in season 6 Episode 1.

Carolyn bligh (Sara wiseman) and Dr Jack Duncan (craig hall) (real life husband and wife from 2005-2020) a place to call home 2013 2018. Married in season 4.

John bates (brendan Coyle) and anna smith (joanne froggat) Downton abbey tv and movies (2010-2025) Married in season 2.

Matthew Crawley (dan stevens) and lady mary Crawley (michelle dockery) Downton abbey (2010-2025) Married season 3 Episode 1.

Tom branson (allen leech) and lady sybil Crawley (Jessica brown findlay) Downton abbey (2010-2025). Married off screen between season 2 episode 8 and 9 (the 2011 christmas special)

Daisy Robinson (Sophie McShera) and William Mason (Thomas Howes) downton abbey 2010-2025 married season 2 episode 5

anne shirley (megan follows) and Gilbert blythe (Jonathan crombie) anne of green gables 1985/ anne of avonlea (the sequel) 1987 / anne of green gables the continuing story 2000. Married in the continuing story.

Gus pike (michael mahonen) and felicity king (Gemma zapronga) road to avonlea 1990-1996. Married in season 7 episode 13- the final episode, So dear to my heart

zane bennett (burgess aberthany) and Rikki chadwick (cariba heine) h2o just add water 2006-2010

cleo sertori (phoebe tonkin) and lewis mccartney (angus mclaren) h2o just add water 2006-2010

Fiona 'Fly' Watson (sophie luck) and Heath Carroll (adam Saunders) Blue water high 2005-2008

Mr carson (jim carter) and eloise Hughes (phyllis logan) downton abbey 2010-2025. Married season 6

Lady Kenna (caitlin stasey) and sebastian de poitier (torrance coombs) Reign 2013-2017 married season 1 episode 16 monsters

Lady Lola (anna poppelwell) and Lord Stefane Narcisse (craig parker) - Reign (2013-2017) married season 3 episode 3 extreme measures

Leith Bayard (jonathan keltz) and Greer of Kinross (celina sinden) - Reign (2013-2017)

Jasper dale (R H Thomson) and Olivia king dale (Mag ruffman) road to avonlea 1990-1996. Married 3x01

eric tanner (ryan corr) and amy reed (gabrielle scollay) -blue water high 2005-2008. Season 2 characters/ cast

#miss fisher's murder mysteries#nathan page#downton abbey#Full house#Fuller house#H2o just add water#Road to avonlea#Anne of green gables 1985#Blue water high#A place to call home#Reign

2 notes

·

View notes

Text

I've had this in my head since watching Anne With An E a couple of years ago, but I didn't have anywhere to put it. But it occurred to me that now I have a Tumblr account! Nobody reads it but that's okay.

I loved the 1985 Anne of Green Gables miniseries when I was a kid, but I haven't watched it since then so my memory may not be totally accurate. Apologies if I misrepresent anything.

So, my answers to the question that nobody asked me: Who wore [the character] better, the actor from 1985 Anne of Green Gables, or the actor from 2017 Anne With An E?

Anne: Megan Follows (1985) / Amybeth McNulty (2017) Megan Follows is fantastic, but for me, Amybeth McNulty wins this hands down. Follows's Anne is tiny and perky and vivid and lovely. McNulty's Anne is gangly and dreamy and huge-eyed and freckled, and somehow has the ability (as in the books) to look either plain or breathtaking depending on the situation and her frame of mind. Both can talk at a mile a minute (a requirement for Anne) but McNulty's delivery, which runs out of breath and trips over itself, is more what I imagine for Anne than Follows's lively chatter.

Marilla: Colleen Dewhurst (1985) / Geraldine James (2017) This is a tough choice. Colleen Dewhurst is excellent, but in my opinion Geraldine James does a better transition between the angry, exacting, emotionally closed off pre-Anne Marilla, and the doting parent that she eventually becomes. Dewhurst is too nice all along! Mostly this is down to the writing though.

Matthew: Richard Farnsworth (1985) / R. H. Thomson (2017) Again a tough one, and again the writing makes a big difference. I have to pick R. H. Thomson because I adore so much what he was given a chance to do with the character of Matthew. There wasn't enough of Richard Farnsworth in the 1985 miniseries to be fair.

Diana: Schuyler Grant (1985) / Dalila Bela (2017) Neither of these actors perfectly embodies what I imagine for Diana, but Schuyler Grant comes closer. Per the book, Diana is fun, always laughing, and possibly a little on the dim side. Dalila Bela (writing again, at least in part) portrays Diana as smart and more serious, not bad things of course, but not Diana to my thinking.

Gilbert: Jonathan Crombie (1985) / Lucas Zumann (2017) Sorry, Jonathan Crombie will always be Gilbert to me. It's non-negotiable that Gilbert should be roguish; Lucas Zumann as Gilbert is many things (adorable, tragic) but roguish is not one of them. Crombie was an excellent rogue.

I won't do a Miss Stacy comparison because I don't even remember her from the 1985 miniseries, but I love the character so much in the 2017 series that I'm sure that Joanna Douglas would win anyway.

Counterpoints?

5 notes

·

View notes

Text

税务局严查报税五大"红灯信号"

在本财年结束时,澳大利亚税务局(ATO)将重点关注那些离谱的工作相关和租赁房产申报。 如果你像一位被ATO盯上的公司董事一样,正考虑在报税时把7000澳元的咖啡机或跑步机作为居家办公费用申报,最好三思而行。 同样,如果你并未尝试将第二套房产出租,却申报与之相关的费用,也会面临审查。 “我们遇到一位纳税人,尽管从未尝试出租房产,却在三年内申报了约11.9万澳元的租赁费用,”ATO助理局长Rob Thomson表示。 ATO仍发现有人申报与工作无关的私人性质支出。 Bethany Rae 鉴于这些离谱的申报,居家办公和租赁房产相关抵扣继续成为ATO今年重点关注的五大雷区之一也就不足为奇了。 H&R Block税务沟通总监Mark…

View On WordPress

0 notes

Text

Tax Management Software Market Expansion: Industry Forecast & Competitive Landscape 2032

The Tax Management Software Market Size was valued at USD 19.79 Billion in 2023 and is expected to reach USD 50.84 Billion by 2032, growing at a CAGR of 11.10% over the forecast period 2024-2032

The tax management software market is experiencing rapid growth as businesses strive for accuracy, compliance, and efficiency in tax-related processes. Increasing regulatory complexities and digital transformation initiatives are fueling the demand for automated tax solutions.

The tax management software market continues to expand as governments worldwide implement stringent tax regulations and compliance requirements. Companies are investing in robust tax software to automate tax calculations, reporting, and filings, reducing human errors and ensuring regulatory adherence in an increasingly digital economy.

Get Sample Copy of This Report: https://www.snsinsider.com/sample-request/3359

Market Keyplayers:

Thomson Reuters (ONESOURCE, UltraTax CS)

Intuit Inc. (TurboTax, QuickBooks)

Avalara (AvaTax, CertCapture)

Wolters Kluwer N.V. (CCH Axcess, ATX)

H&R Block (BlockWorks, Tax Pro Go)

Sovos Compliance LLC (Taxify, Sovos Intelligent Compliance Cloud)

Vertex Inc. (Vertex O Series, Vertex Cloud)

Xero Limited (Xero Tax, Hubdoc)

SAP SE (SAP Tax Compliance, SAP S/4HANA for advanced compliance reporting)

ADP, Inc. (ADP SmartCompliance, ADP Tax Filing)

Deloitte Touche Tohmatsu Limited (Tax@Hand, GlobalAdvantage)

Ernst & Young (EY) (EY Global Tax Platform, EY EDGE)

Oracle Corporation (Oracle Tax Reporting Cloud Service, Oracle ERP Cloud)

TaxJar (TaxJar API, TaxJar SmartCalcs)

Drake Software (Drake Tax, Drake Accounting)

CCH Incorporated (ProSystem fx Tax, CCH iFirm)

ClearTax (ClearTax GST, ClearTax e-Invoicing)

Sage Group plc (Sage Intacct, Sage Business Cloud Accounting)

TaxAct, Inc. (TaxAct Professional, TaxAct Business)

Zoho Corporation Pvt. Ltd. (Zoho Books, Zoho Expense)

Key Market Trends Driving Growth

1. Rising Demand for Automated Tax Solutions

Organizations are shifting from manual tax processing to cloud-based, AI-powered software that streamlines tax calculations, reporting, and audit processes.

2. Global Tax Compliance and Regulatory Changes

Governments are frequently updating tax laws, making it imperative for businesses to adopt real-time compliance tracking and reporting tools to avoid penalties.

3. Integration with Enterprise Resource Planning (ERP) Systems

Tax management solutions are increasingly being integrated with ERP and accounting software to ensure seamless financial operations and regulatory compliance.

4. AI and Machine Learning in Tax Analytics

Artificial intelligence and machine learning enhance tax management software by providing predictive tax insights, fraud detection, and automated risk assessment.

5. Growing Adoption of Cloud-Based Tax Solutions

Cloud-based tax management software enables businesses to access real-time tax data, automated updates, and enhanced security from any location.

Enquiry of This Report: https://www.snsinsider.com/enquiry/3359

Market Segmentation:

By Component

Software

Professional Services

By Component

Corporate Tax Software

Professional Tax Software

Tax Preparer Software

Tax Compliance Software

Others

By Tax Type

Indirect Tax

Direct Tax

By Deployment

Cloud

On-premise

By End User

Large Enterprises

Small & Medium Enterprises (SMEs)

By Vertical

BFSI

Healthcare

Retail

Manufacturing

Real Estate

Others

Market Analysis and Growth Potential

Key Drivers and Challenges

Drivers:

Rising complexity in tax laws and global trade regulations

Increasing adoption of automation and AI-driven tax solutions

Growth in e-commerce and digital transactions

Challenges:

High initial costs and implementation challenges

Data security and privacy concerns in cloud-based tax solutions

Integration difficulties with legacy financial systems

Future Prospects and Opportunities

1. Expansion in Emerging Markets

Developing economies are embracing digital tax compliance systems, creating opportunities for tax software providers to expand their market presence.

2. Advancements in Blockchain for Tax Transparency

Blockchain technology is being explored as a tool for secure, transparent tax reporting and fraud prevention, enhancing trust in financial transactions.

3. Rise of E-Invoicing and Digital Tax Filing

Governments worldwide are mandating e-invoicing and digital tax submission, further driving the demand for advanced tax management solutions.

4. AI-Driven Tax Optimization Strategies

Businesses will leverage AI-powered analytics to identify tax-saving opportunities, automate deductions, and optimize tax planning.

Access Complete Report: https://www.snsinsider.com/reports/tax-management-software-market-3359

Conclusion

The tax management software market is poised for significant growth as businesses and governments adapt to evolving tax regulations and digital transformation. By leveraging AI, cloud computing, and automation, tax management software providers can enhance compliance, efficiency, and accuracy in global tax processes. The future of tax management lies in innovation, seamless integration, and real-time regulatory adaptation.

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Contact Us:

Jagney Dave - Vice President of Client Engagement

Phone: +1-315 636 4242 (US) | +44- 20 3290 5010 (UK)

#Tax Management Software Market#Tax Management Software Market Analysis#Tax Management Software Market Growth#Tax Management Software Market Share#Tax Management Software Market Trends

0 notes

Text

Tax Management Market Analysis, Size, Share, Growth, Trends, and Forecasts by 2031

The Global Tax Management market, a dynamic landscape within the financial domain, plays a crucial role in shaping the fiscal strategies of corporations worldwide. This market, a complex ecosystem in constant flux, revolves around the efficient handling and optimization of tax-related processes for businesses of varying scales and industries. It serves as a linchpin in the broader economic spectrum, where regulations and compliance intricacies demand a nuanced approach to tax management.

𝐆𝐞𝐭 𝐚 𝐅𝐫𝐞𝐞 𝐒𝐚𝐦𝐩𝐥𝐞 𝐑𝐞𝐩𝐨𝐫𝐭:https://www.metastatinsight.com/request-sample/2564

Companies

Avalara

ADP

Intuit

Thomson Reuters

Wolters Kluwer

Blucora

H&R Block

SAP

Sovos

Vertex

Canopy Tax

DAVO Technologies

Defmacro Software

Drake Software

Sailotech

T𝐡𝐞 𝐅𝐮𝐥𝐥 𝐑𝐞𝐩𝐨𝐫𝐭:@https://www.metastatinsight.com/report/tax-management-market

The Global Tax Management market encapsulates a spectrum of services and solutions designed to navigate the labyrinth of tax codes and frameworks. Tax management, once a straightforward task, has metamorphosed into a sophisticated practice owing to the ever-evolving global financial scenario. Companies, irrespective of their scale, find themselves entangled in a web of diverse tax regulations and reporting requirements, necessitating the adoption of robust tax management solutions.

The market's significance is further accentuated by the increasing cross-border activities of corporations. As businesses expand their operations globally, they encounter a myriad of tax implications stemming from diverse jurisdictions. The Global Tax Management market steps in as a strategic partner, aiding companies in navigating the intricate landscape of international taxation. It facilitates cross-border compliance, helping businesses stay abreast of tax obligations across multiple countries, thereby mitigating risks and ensuring regulatory adherence.

The Global Tax Management market emerges as a critical enabler in the contemporary financial milieu, where businesses grapple with the complexities of global taxation. By offering tailored solutions, both in terms of software and consultancy services, it empowers companies to navigate the intricate web of tax regulations with finesse. As the global economic landscape continues to evolve, the role of the Global Tax Management market is poised to become even more pronounced, shaping the fiscal strategies of businesses in an era where adaptability and precision are paramount.

Global Tax Management market is estimated to reach $61,143.1 Million by 2030; growing at a CAGR of 12.41% from 2023 to 2030.

Contact Us:

+1 214 613 5758

#TaxManagement#TaxManagementmarket#TaxManagementindustry#marketsize#marketgrowth#marketforecast#marketanalysis#marketdemand#marketreport#marketresearch

0 notes

Text

You in Four Letters: MBTI and the Façade of Science | Bibliography

Full Video Here:

youtube

Alhendi, O. (2019). Personality traits and their validity in predicting job performance at recruitment: A review. International Journal of Engineering and Management Sciences, 4(3), 222–231.

Boag, S. (2015). Personality assessment, ‘construct validity’, and the significance of theory. Personality and Individual Differences, 84, 36–44. https://doi.org/10.1016/j.paid.2014.12.039

Clark, S. (2020). THE CONSEQUENTIAL ETHICALITY OF THE MYERS-BRIGGS TYPE INDICATOR WHEN USED FOR JOB SELECTION AND ITS EFFECTS ON ORGANIZATIONAL DIVERSITY. 2020 Spring Honors Capstone Projects. https://mavmatrix.uta.edu/honors_spring2020/24

Dikötter, F. (1998). Race Culture: Recent Perspectives on the History of Eugenics. The American Historical Review, 103(2), 467–478. https://doi.org/10.1086/ahr/103.2.467

Fan, J., Sun, T., Liu, J., Zhao, T., Zhang, B., Chen, Z., Glorioso, M., & Hack, E. (2023). How well can an AI chatbot infer personality? Examining psychometric properties of machine-inferred personality scores. Journal of Applied Psychology, 108(8), 1277–1299. https://doi.org/10.1037/apl0001082

Fischer, R., & Rudnev, M. (2024). From MIsgivings to MIse-en-scène: The role of invariance in personality science. European Journal of Personality, 08902070241283081. https://doi.org/10.1177/08902070241283081

Fleenor, J. W. (1997). The relationship between the MBTI and measures of personality and performance in management groups. Developing Leaders: Research and Applications in Psychological Type and Leadership Development, 115–138.

Ganellen, R. J. (2007). Assessing Normal and Abnormal Personality Functioning: Strengths and Weaknesses of Self-Report, Observer, and Performance-Based Methods. Journal of Personality Assessment, 89(1), 30–40. https://doi.org/10.1080/00223890701356987

Goodstein, L. D., & Lanyon, R. I. (1999). Applications of Personality Assessment to the Workplace: A Review. Journal of Business and Psychology, 13(3), 291–322. https://doi.org/10.1023/A:1022941331649

Hunkenschroer, A. L., & Kriebitz, A. (2023). Is AI recruiting (un)ethical? A human rights perspective on the use of AI for hiring. AI and Ethics, 3(1), 199–213. https://doi.org/10.1007/s43681-022-00166-4

Jackson-Wright, Q. (2019, August 22). To Promote Inclusivity, Stay Away from Personality Assessments. The New York Times. https://www.nytimes.com/2019/08/22/smarter-living/inclusivity-diversity-personality-assessements-myers-briggs.html

Kaplan, R. M., & Saccuzzo, D. R. (1993). Psychological testing: Principles, applications, and issues, 3rd ed (pp. xxi, 713). Thomson Brooks/Cole Publishing Co.

Karson, S., & Pool, K. B. (1957). The construct validity of the Sixteen Personality Factors Test. Journal of Clinical Psychology, 13(3). https://search.ebscohost.com/login.aspx?direct=true&profile=ehost&scope=site&authtype=crawler&jrnl=00219762&asa=N&AN=15795811&h=yk%2FrM3EijnIfdy%2BU0h3rJS3GZmMaJK97AozRGfN5Dhf0nhc%2BpI1G6ylIqLhfpf2VdUaAvlZ46imDbN7mNgepQw%3D%3D&crl=c

Kim, H.-S. (2010). The research on the Entrepreneurship’s will according to college students’s MBTI personality type and Job’s type. Asia-Pacific Journal of Business Venturing and Entrepreneurship, 5(2), 89–114.

Lee, H., & Shin, Y. (2024). A Study on MBTI Perceptions in South Korea: Big Data Analysis from the Perspective of Applying MBTI to Contribute to the Sustainable Growth of Communities. Sustainability, 16(10), Article 10. https://doi.org/10.3390/su16104152

Lloyd, J. B. (2012). The Myers-Briggs Type Indicator® and mainstream psychology: Analysis and evaluation of an unresolved hostility. Journal of Beliefs & Values, 33(1), 23–34. https://doi.org/10.1080/13617672.2012.650028

Martin, E. (2017). Science and Ideology | Internet Encyclopedia of Philosophy. https://iep.utm.edu/sci-ideo/

McAdams, D. P. (1997). A conceptual history of personality psychology. In Handbook of personality psychology (pp. 3–39). Elsevier. https://www.sciencedirect.com/science/article/pii/B9780121346454500020

Morgeson, F. P., Campion, M. A., Dipboye, R. L., Hollenbeck, J. R., Murphy, K., & Schmitt, N. (2007a). Are We Getting Fooled Again? Coming to Terms with Limitations in the Use of Personality Tests for Personnel Selection. Personnel Psychology, 60(4), 1029–1049. https://doi.org/10.1111/j.1744-6570.2007.00100.x

Morgeson, F. P., Campion, M. A., Dipboye, R. L., Hollenbeck, J. R., Murphy, K., & Schmitt, N. (2007b). Reconsidering the Use of Personality Tests in Personnel Selection Contexts. Personnel Psychology, 60(3), 683–729. https://doi.org/10.1111/j.1744-6570.2007.00089.x

Myers, I. B. (with Myers, P. B.). (1995). Gifts differing: Understanding personality type / Isabel Briggs Myers with Peter B. Myers. CPP.

NERIS Analytics. (2024). Free Personality Test | 16Personalities. 16 Personalities. https://www.16personalities.com/free-personality-test

Paul, A. M. (2010). The Cult of Personality Testing: How Personality Tests Are Leading Us to Miseducate Our Children, Mismanage Our Companies, and Misunderstand Ourselves. Simon and Schuster.

Petersen, V. C. (2006). MBTI-distorted reflections of personality? https://pure.au.dk/portal/files/32349733/2006-05.pdf

Reynierse, J. H. (1997). An MBTI model of entrepreneurism and bureaucracy: The psychological types of business entrepreneurs compared to business managers and executives. Journal of Psychological Type. https://psycnet.apa.org/record/1997-07240-001

Stein, R., & Swan, A. B. (2019). Evaluating the validity of Myers-Briggs Type Indicator theory: A teaching tool and window into intuitive psychology. Social and Personality Psychology Compass, 13(2), e12434. https://doi.org/10.1111/spc3.12434

Stenmark, M. (1997). WHAT IS SCIENTISM? Religious Studies, 33(1), 15–32. https://doi.org/10.1017/S0034412596003666

Strevens, M. (2020). The Knowledge Machine: How Irrationality Created Modern Science. Liveright Publishing.

Weiss, P. A., & Inwald, R. (2018). A Brief History of Personality Assessment in Police Psychology: 1916–2008. Journal of Police and Criminal Psychology, 33(3), 189–200. https://doi.org/10.1007/s11896-018-9272-2

Winter, D. G., & Barenbaum, N. B. (1999). History of modern personality theory and research. Handbook of Personality: Theory and Research, 2, 3–27.

Zigerell, L. J. (2020). Understanding public support for eugenic policies: Results from survey data. The Social Science Journal, 57(3), 281–287. https://doi.org/10.1016/j.soscij.2019.01.003

0 notes

Text

Property Tax Services Market is Estimated to Witness High Growth Owing to Growing Complexity in Tax Regulations

Property tax services play a vital role in collecting taxes from businesses and individuals for governments at local, state, and federal levels. Property tax services help in assessing the value of a property, filing tax returns, resolving tax issues, and appealing tax assessments. Property tax consultancies offer solutions like tax calculation, exemption & relief consultation, assessment calculations, tax reporting, and property tax representation. With governments worldwide introducing reforms in property tax laws to increase tax collection and simplify tax compliance, the need for property tax services has increased tremendously. The Global Property Tax Services Market is estimated to be valued at US$ 3.52 Bn in 2024 and is expected to exhibit a CAGR of 7.3% over the forecast period 2024 to 2031. Key Takeaways Key players operating in the Property Tax Services market are Avalara, Blucora, Canopy Tax, Drake Enterprises, H&R Block, Intuit, Sailotech, SAP SE, Thomson Reuters, Taxback International, TaxJar, TaxSlayer, Vertex, Wolters Kluwer NV, and Xero. These players are focusing on partnerships, mergers, and acquisitions to expand their service offerings and geographic reach. The key opportunities in the market include compliance management solutions for complex tax regulations across countries and cities, property tax advisory and consultation services for commercial and residential properties, and cloud-based software solutions for tax filing, payment, and refunds. With increasing globalization of businesses, the Property Tax Services Market Demand for cross-border property tax services is growing. Major players are targeting high growth markets like Asia Pacific and Latin America by establishing offices in these regions to cater to the needs of multinational clients. Market drivers The growing complexity in global, national, and local property tax regulations is one of the key drivers for the property tax services market. Frequent changes in tax laws related to categories of properties, exemptions, criteria for tax relief, and filing procedures require continuous updates from tax experts. Property Tax Services Market Size and Trends is increasing the demand for property tax advisory and consultancy services.

PEST Analysis Political: Property tax services are highly regulated at local, state, and national levels due to political and economic interests in property taxes. Regulations vary significantly in different jurisdictions. Economic: Property tax services are dependent on real estate market conditions and property values. When property values rise, expenditures on these services tend to increase as there are higher tax obligations and more disputes. Social: Property owners are increasingly seeking online assistance and software tools to evaluate tax obligations and ensure accurate and fair treatment. The industry is benefiting from greater social acceptance of online services and automation. Technological: Advanced software tools are leveraging technologies like AI, machine learning, and big data to provide more personalized guidance and support to property owners. Some platforms utilize public records, satellite imagery, and 3D scans to more accurately assess property characteristics and tax impact. They also support electronic filings and payments. The North America region accounted for the highest share of the global property tax services market in terms of value in 2021, driven by the large number of residential and commercial properties. The Asia Pacific region is expected to be the fastest growing regional market for property tax services through 2031, spurred by rising property ownership, increasing urbanization, and developing digital services adoption across major countries like China and India.

Get more insights on Property Tax Services Market

Get More Insights—Access the Report in the Language that Resonates with You

French

German

Italian

Russian

Japanese

Chinese

Korean

Portuguese

About Author:

Money Singh is a seasoned content writer with over four years of experience in the market research sector. Her expertise spans various industries, including food and beverages, biotechnology, chemical and materials, defense and aerospace, consumer goods, etc. (https://www.linkedin.com/in/money-singh-590844163)

#Coherent Market Insights#Property Tax Services Market#Property Tax Services#Tax Assessment#Property Tax Consulting#Tax Appeal#Real Estate Tax#Property Valuation#Tax Reduction#Tax Advisory#Tax Management

0 notes

Text

"JURY RETURNED TRUE BILLS AT PEACE SESSION," Hamilton Spectator. December 6, 1933. Page 7. ---- Several Face Trial on Serious Counts ---- Frederick Pollington Was Remanded ---- Half of Copetown in Court To-day ---- The grand jury at the winter general sessions of the peace before Julge George C. Thomson this morning returned true bills in all the indictments given it to consider. A the conclusion of the current civil case, George W. Ballard, K.C., representing the crown prosecution, will proceed against the following: Sam Hrynowic and Paul Gawrelez, intimidation; Willis Pelly and Edward Wells, armed robbery; John Lett, criminal negligence; Alfred Little and Thomas O'Donnell, charged with serious offenses, and Joseph Barth, drunken driving.

John Hurst, 122 Main street east, who was committed for trial by Magistrate Burbidge on a charge of shopbreaking with intent at the Dominion Stores, 228 King street west, and who elected trial by a judge, appeared before Judge Thomson this morning and pleaded guilty to the count against him. After His Honour heard an outline of the case by Constable Langdon, he reserved judgment judgment until the end of the criminal session and remand- ed Hurst accordingly.

The crown requested an adjournment in the case of Garth Miller, committed for trial also by the city police magistrate on a charge of auto theft. The reason given was that police are still trying to locate the alleged accomplice of the accused man. The hearing was adjourned until the next court of competent jurisdiction. J. P. O'Reilly appeared on behalf of Miller. The case of Fred D. Woods, charged with criminal negligence following an accident on the Brantford highway, was adjourned until March session.

Remanded For Sentence Frederick Pollington, 242 Robert street, who obtained a divorce from his wife at the last session only to find himself in another court on a charge of bigamy, was remanded for sentence on two days' notice following the appeal of his counsel, D. A. Robinson.

Mr. Robinson explained to Judge Thomson, following Pollington's plea of guilty, that he was asking a suspension of sentence because of the accused man's age - he is 28 - and because he entered into the second and bigamous form of marriage, after he parted parted with his first wife because of allegeded threats by the father of the girl he was going with. His divorce decree will not be made absolute for six months, and as he intends to marry the second girl legally at the expiration of that time, he was dealt with leniently by Judge Thomson, who remanded him for sentence on two days' notice. Bail was set at $2,000.

Was Settled The suit of William R. Clark, a minor, and his father, Vernon R. Clark, against Norman and Percy Smith for $500 damages for injuries sustained by the minor plaintiff when he was struck by the Smith car on Cameron avenue on July 7 last, was settled. This was the first civil jury case on the list before Judge Thomson. The young man suffered minor head injuries when he was hit. Haines & Wills acted on behalf of the plaintiffs, while the defendants were represented by Harry F. Hazell

Reputation Hurt It seemed as though the whole village of Copetown was into the court room crowded room to hear the claim of Gordon DeForest against another Copetown farmer, Wilfred Durham, for $1,000 damages and costs for alleged malicious statements which are claimed to have. damaged his reputation. The plaintiff claims that on St. Patrick's day last the defendant made the damaging statements. He further claims that his reputation has been so injured that Horace Shipman, the mortgagee of his farm, has commenced foreclosure proceedings, and that he has suffered loss of credit and standing in the community.

H. F. Hazell is acting for DeForest, while the defendant is represented by Read & Innes, of Brantford. This case, a jury trial, is continuing.

#hamilton#sessions court#armed robbery#criminal negligence#serious offense#drunken driving#armed robbers#bank robbers#bank robbery#shopbreaking#bigamy#shopbreaker#malicious statements#great depression in canada#crime and punishment in canada#history of crime and punishment in canada

0 notes

Text

Global Tax Management Market: An Escalating Sector with Projected Growth to Reach USD 53.70 Billion By 2030 | 10% CAGR

Global Tax Management Market Size Was Valued at USD 25.05 Billion In 2022 And Is Projected to Reach USD 53.70 Billion By 2030, Growing at A CAGR of 10% From 2023 To 2030.

Tax management refers to the administration of funds and assets for tax payment. The primary objective of tax administration is to comply with income tax rules and regulations. Similarly, it includes the deduction of taxes at the source, the auditing of accounts, the timely filing of tax returns, etc. Increasing demand for tax recordkeeping solutions is expected to be a key factor driving revenue growth in the global tax management market over the forecast period. Record keeping is a crucial strategy for most businesses when it comes to storing essential tax documents, and tax software can facilitate this process.

Using cloud-based tax software, businesses can store tax information from prior years in a secure manner on cloud storage. Using such a solution, businesses can gain immediate access to the essential tax information for any fiscal year.

Top Key Players Covered in The Tax Management Market

Thomson Reuters (Canada), Intuit (US),H&R Block (US), Avalara (US), Wolters Kluwer NV (Netherlands), Automatic Data Processing (US), TaxSlayer (US), Taxback International (Ireland), TaxCloud (US), Drake Enterprises (US), Canopy Tax (US), TaxJar (US), Webgility (US), LOVAT Software (UK), SafeSend (US), EXEMPTAX (US), Sales Tax DataLINK (US), Shoeboxed (US), SAXTAX (US), and Other Major Players.

To Understand Business Strategies, Request For a Sample Report @

https://introspectivemarketresearch.com/request/16590

The report summarizes all the information collected and serves the customer's requirements. However, these market analyses help in understanding market growth at both global and regional levels. For market data analysis, we have market panorama tools such as Market Dynamics, Competitor Analysis, PESTEL Analysis, SWOT Analysis, Porter Five Forces Analysis, Value Chain Analysis, Technology Roadmap and Evolution, Regulatory Framework, Price Trend Analysis, Patent Analysis, Covid-19 Impact Analysis, Russia-Ukraine War Impact and others.

Market Driver:

Rapidly Changing Tax Regulations: -

One of the primary drivers of the Tax Management Market is the constant evolution of tax regulations and policies worldwide. Governments frequently update tax laws to address economic shifts, emerging technologies, and changing global dynamics. This continual change creates a significant demand for tax management solutions that can adapt quickly and ensure compliance, minimizing the risk of non-compliance penalties.

Market Opportunity:

AI-Powered Tax Analytics: -

An exciting opportunity within the Tax Management Market lies in the integration of artificial intelligence (AI) and advanced analytics into tax management solutions. AI-driven tools can analyze vast datasets, identify patterns, and provide real-time insights to optimize tax strategies. By harnessing the power of AI, companies and individuals can gain a competitive edge in tax planning, risk mitigation, and decision-making. This emerging technology presents a substantial opportunity for innovative companies to develop cutting-edge solutions that meet the increasing demand for data-driven tax management.

Inquire Before Purchase: -

https://introspectivemarketresearch.com/inquiry/16590

Segmentation Analysis Of The Tax Management Market

Tax Management Market segments cover the Component, Deployment Mode, Tax Type, and Organization Size. By Component, the Services segment is Anticipated to Dominate the Market Over the Forecast period.

By Component

By Deployment Mode

By Tax Type

By Organization Size

Regional Analysis of The Tax Management Market

North America is Expected to Dominate the Market Over the Forecast period.

Key Industry Developments in the Tax Management Market

In November 2022, with its AI-driven Virtual Expert Platform, Intuit led innovation at scale for consumers and small businesses, as well as accelerate time to market for new products and services. By combining Intuit's AI technology, its network of experts, and the software that connects them—via its TurboTax Live and QuickBooks Live offerings—its AI-enabled platform will provide customers with automated digital assistance.

In November 2021, Thomson Reuters merged with Deloitte Tax, a prominent provider of audit, consulting, tax, and advisory services. The collaboration would aid the operations of tax and legal departments in companies around the world. In addition, the collaboration would provide solutions for legal departments and in-house tax departments to address the growing challenges posed by global compliance and regulatory obligations, as well as the imperative need to become more efficient, agile, and digital.

Acquire This Report:

https://introspectivemarketresearch.com/checkout/?user=1&_sid=16590

About us:

Introspective Market Research (introspectivemarketresearch.com) is a visionary research consulting firm dedicated to assisting our clients to grow and have a successful impact on the market. Our team at IMR is ready to assist our clients to flourish their business by offering strategies to gain success and monopoly in their respective fields. We are a global market research company, that specializes in using big data and advanced analytics to show the bigger picture of the market trends. We help our clients to think differently and build better tomorrow for all of us. We are a technology-driven research company, we analyze extremely large sets of data to discover deeper insights and provide conclusive consulting. We not only provide intelligence solutions, but we help our clients in how they can achieve their goals.

Contact us:

Introspective Market Research

3001 S King Drive,

Chicago, Illinois

60616 USA

Ph no: +1-773-382-1049

Email:[email protected]

#Tax Management#Tax Management Market#Tax Management Market Size#Tax Management Market Share#Tax Management Market Growth#Tax Management Market Trend#Tax Management Market segment#Tax Management Market Opportunity#Tax Management Market Analysis 2023#US Tax Management Market#Tax Management Market Forecast#Tax Management Industry#Tax Management Industry Size#china Tax Management Market#UK Tax Management Market

0 notes

Text

Tax Management System Market to See Booming Growth | Wolters Kluwer, TaxSlayer, Avalara, Wolters Kluwer, Drake Software

Advance Market Analytics published a new research publication on “Global Tax Management System Market Insights, to 2028” with 232 pages and enriched with self-explained Tables and charts in presentable format. In the study, you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market-associated stakeholders. The growth of the Tax Management System market was mainly driven by the increasing R&D spending across the world.

Major players profiled in the study are:

Avalara (United States), Wolters Kluwer (Netherlands), Longview (United States), TaxSlayer (United States), TaxJar (United States), Xero (New Zealand), Intuit (United States), Thomson Reuters (United States), H&R Block (United States), Drake Software (United States)

Get Free Exclusive PDF Sample Copy of This Research @ https://www.advancemarketanalytics.com/sample-report/82051-global-tax-management-system-market?utm_source=Benzinga&utm_medium=Vinay

Scope of the Report of Tax Management System

Tax Management system is referred to as a system which calculates and creates customer-centric statements and invoices for ALL of the tax revenue types. This modern kind of solution supports e-billing and integrates with account management of customer to register receivables. It provides a view of the full-circle of customers Personal and Real revenue. The market of a tax management system is growing due to rising awareness among people about the tax-related market, while some of the factors like low availability of skilled professionals is hampering the market.

On 6th February 2019, Avalara, Inc., a leading provider of tax compliance automation software, acquired artificial intelligence technology and expertise from Indix to aggregate, structure and deliver global product and tax information.

The Global Tax Management System Market segments and Market Data Break Down are illuminated below:

by Type (Property taxes (Real and Personal Property), Maps/GIS Information, Frozen and current year tax values, Exemption Tracking, Discovery management, Listing processes), Application (Personal Use, Commercial Use), Structure (Cloud-based, On-premise)

Market Opportunities:

Increasing Investment in the System Solutions

Rising Awareness among the People about Tax Management System

Market Drivers:

Increasing Penetration of IoT Devices

Growing Internet Penetration around World

Market Trend:

Automation of Business Critical Applications

What can be explored with the Tax Management System Market Study?

Gain Market Understanding

Identify Growth Opportunities

Analyze and Measure the Global Tax Management System Market by Identifying Investment across various Industry Verticals

Understand the Trends that will drive Future Changes in Tax Management System

Understand the Competitive Scenarios

Track Right Markets

Identify the Right Verticals

Region Included are: North America, Europe, Asia Pacific, Oceania, South America, Middle East & Africa

Country Level Break-Up: United States, Canada, Mexico, Brazil, Argentina, Colombia, Chile, South Africa, Nigeria, Tunisia, Morocco, Germany, United Kingdom (UK), the Netherlands, Spain, Italy, Belgium, Austria, Turkey, Russia, France, Poland, Israel, United Arab Emirates, Qatar, Saudi Arabia, China, Japan, Taiwan, South Korea, Singapore, India, Australia and New Zealand etc.

Have Any Questions Regarding Global Tax Management System Market Report, Ask Our Experts@ https://www.advancemarketanalytics.com/enquiry-before-buy/82051-global-tax-management-system-market?utm_source=Benzinga&utm_medium=Vinay

Strategic Points Covered in Table of Content of Global Tax Management System Market:

Chapter 1: Introduction, market driving force product Objective of Study and Research Scope the Tax Management System market

Chapter 2: Exclusive Summary – the basic information of the Tax Management System Market.

Chapter 3: Displaying the Market Dynamics- Drivers, Trends and Challenges & Opportunities of the Tax Management System

Chapter 4: Presenting the Tax Management System Market Factor Analysis, Porters Five Forces, Supply/Value Chain, PESTEL analysis, Market Entropy, Patent/Trademark Analysis.

Chapter 5: Displaying the by Type, End User and Region/Country 2017-2022

Chapter 6: Evaluating the leading manufacturers of the Tax Management System market which consists of its Competitive Landscape, Peer Group Analysis, BCG Matrix & Company Profile

Chapter 7: To evaluate the market by segments, by countries and by Manufacturers/Company with revenue share and sales by key countries in these various regions (2023-2028)

Chapter 8 & 9: Displaying the Appendix, Methodology and Data Source

Finally, Tax Management System Market is a valuable source of guidance for individuals and companies.

Read Detailed Index of full Research Study at @ https://www.advancemarketanalytics.com/buy-now?format=1&report=82051?utm_source=Benzinga&utm_medium=Vinay

Thanks for reading this article; you can also get individual chapter wise section or region wise report version like North America, Middle East, Africa, Europe or LATAM, Southeast Asia.

Contact Us:

Craig Francis (PR & Marketing Manager)

AMA Research & Media LLP

Unit No. 429, Parsonage Road Edison, NJ

New Jersey USA – 08837

#TaxManagementSystem#TaxManagementSystemMarket#TaxManagementSystemMarketgrowth#TaxManagementSystemMarketSize#TaxManagementSystemMarketTrends

0 notes

Text

ultimate list of TV crushes

TV shows, tv mini series and or tv movies in no particular order

'Uncle' Jesse Katsopolis (John Stamos) Full House 1997-1995 and Fuller House 2016-2020

Mr Fitzwilliam Darcy (Colin Firth) Pride and prejudice 1995 mini series. (Bonus points Colin played Mr Mark Fitzwilliam darcy in Bridget jones movies!)

DI jack robinson (Nathan Page) Miss Fisher's murder mysteries 2012-2015 and Miss fisher and the crypt of tears 2020

Mr George Bligh (Brett Climo) A place to call home 2013-2018

Mr gold/ Rumpelstiltskin/ The dark one (Robert Carlyle) Once upon a time 2011-2018

Captain Killian "Hook" Jones (Colin O'Donoghue) Once upon a time 2011-2018

King Francis II (Toby regbo) Reign 2013-2017

King Henry vIII (Jonathan rhys meyers) The tudors 2007-2010

Mr matthew crawley (dan stevens) Downton abbey 2010-2025

Tom Branson (Allen Leech) Downton abbey 2010-2025

Mr John bates (brendan coyle) Downton abbey 2010-2025

Mr John moray (Emun eliott) The paradise 2012-2013

Gilbert blythe (Jonathan crombie) Anne of green gables 1985// Anne of avonlea/ Anne of green gables the sequel 1987// Anne of green gables the continuing story 2000

Lewis mccartney (angus mclaren) h2o just add water 2006-2010

zane bennett (burgess aberthany) h2o just add water 2006-2010

Heath Carroll (adam saunders) blue water high (2005-2008)

Eric tanner (ryan Corr) blue water high 2005-2008- character only was in season 2 2006)

Gus Pike (Michael Mahonen) Road to avonlea (1990-1996)

Jasper Dale (R H Thomson) Road to avonlea 1990-1996

Dr Luka Kovac (Goran Visnjic) ER (1994-2009)

Matthew Lawson (Joel tobeck ) Dr Blake Mysteries 2013-2017

Dr Jack Duncan (craig hall) a place to call home 2013-2018

#TV crushes#Downton abbey#miss fisher's murder mysteries#anne of green gables#anne of avonlea#The paradise#nathan page#once upon a time#A place to call home#The tudors#Reign#Full house#Fuller house#Pride and prejudice 1995#h2o just add water#Blue water high#Road to avonlea#ER#Dr blake mysteries

1 note

·

View note

Text

please like/reblog if you save!

my awae lockscreens masterlist

#anne with an e#awae#renew awae#awae lockscreens#awae wallpapers#renew anne with an e#anne with an e lockscreens#anne with an e wallpapers#anne shirley cuthbert#diana barry#prissy andrews#marilla cuthbert#matthew cuthbert#gilbert blythe#amybeth mcnulty#lucas jade zumann#geraldine james#dalila bela#r. h. thomson#ella jonas farlinger

173 notes

·

View notes

Photo

Dê like/reblogue se gostou. Dê-nos os créditos se usar: @chaosofedits (Twitter) /chaosofedits (Tumblr). ♡

#icons#edits#edit#icon#photoshop#ps#chaosofedits#anne with an e#anne#anne of green gables#Matthew Cuthbert#Diana Barry#R. H. Thomson#Amybeth McNulty#Dalila Bela

42 notes

·

View notes