#rent arrears attorney

Text

Eviction Services In Martin County, Florida - Law Office of Ryan S. Shipp, PLLC

Martin County Eviction Lawyers

Are you a landlord facing tenant issues in Martin County, Florida? Do you require legal assistance with residential or commercial evictions? Look no further than Law Office of Ryan S. Shipp, PLLC. Our experienced team concentrates our practice in navigating the complexities of landlord-tenant law and ensuring swift and effective resolution of your eviction…

View On WordPress

#commercial eviction services#eviction appeal lawyer#eviction attorney Martin County#eviction court representation#eviction hearing expert#eviction lawsuit assistance#eviction mediation services#eviction notice services#eviction process Martin County#fast eviction services#florida landlord rights#landlord lawyer Florida#landlord legal services Martin County#landlord-tenant court Florida#Law Office of Ryan S. Shipp#lease agreement violations#lease termination lawyer#Martin County property law#non-payment of rent lawyer#property damage claims#property management legal support#reliable eviction attorney#rent arrears attorney#renter eviction legal advice#residential eviction assistance#tenant dispute resolution#tenant eviction law#tenant law specialist#tenant removal legal help#unlawful detainer action Florida

0 notes

Text

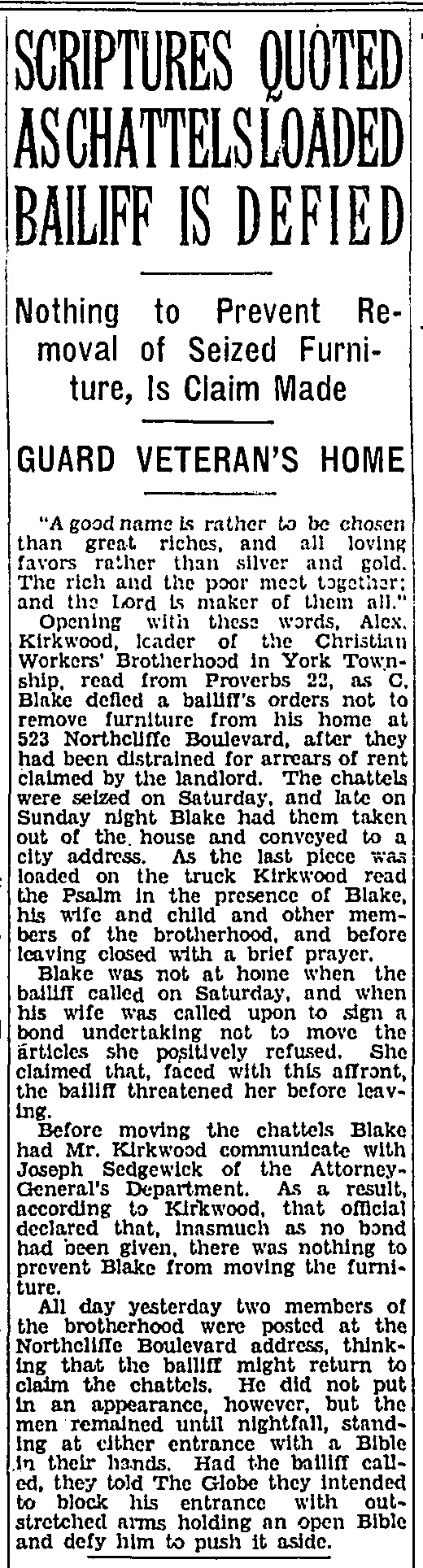

"SCRIPTURES QUOTED AS CHATTELS LOADED BAILIFF IS DEFIED," Toronto Globe. August 15, 1933. Page 9.

----

Nothing to Prevent Removal of Seized Furniture, Is Claim Made

---

GUARD VETERAN'S HOME

---

"A good name is rather to be chosen than great riches, and all loving favors rather than silver and gold. The rich and the poor meet together: and the Lord is maker of them all."

Opening with these words, Alex. Kirkwood, leader of the Christian Workers' Brotherhood in York Township, read from Proverbs 22, as C. Blake defied a bailiff's orders not to remove furniture from his home at 523 Northcliffe Boulevard, after they had been distrained for arrears of rent claimed by the landlord. The chattels were seized on Saturday, and late on Sunday night Blake had them taken out of the house and conveyed to a city address. As the last piece was loaded on the truck Kirkwood read the Psalm in the presence of Blake, his wife and child and other members of the brotherhood, and before leaving closed with a brief prayer.

Blake was not at home when the bailiff called on Saturday, and when his wife was called upon to sign a bond undertaking not to move the articles she positively refused. She claimed that, faced with this affront, the bailiff threatened her before leaving.

Before moving the chattels Blake, had Mr. Kirkwood communicate with Joseph Sedgewick of the Attorney-General's Department. As a result, according to Kirkwood, that official declared that, inasmuch as no bond had been given, there was nothing to prevent Blake from moving the furniture.

All day yesterday two members of the brotherhood were posted at the Northcliffe Boulevard address, thinking that the bailiff might return to claim the chattels, He did not put in an appearance, however, but the men remained until nightfall, standing at either entrance with a Bible in their hands. Had the bailiff called, they told The Globe they intended to block his entrance with out-stretched arms holding an open Bible and defy him to push it aside.

#york township#workers' association#resisting evictions#evictions#evicted#unemployment#unemployment relief#self defence#unemployed organizing#working class struggle#working class politics#direct action#great depression in canada#toronto#christian socialism#proverbs 22

1 note

·

View note

Text

Experience Hassle-Free Home Sales and Avoid Capital Gains Tax in Utah

Capital gains tax is a complex topic if you are an investor or real estate businessperson. Therefore, a detailed overview of this tax is crucial as it directly impacts on your profit from sales. This will help you boost and increase the closing process of the realtor market.

Moreover, consulting a legal attorney or professional real estate agent is necessary to know about this tax to gain more profit margins. They can help to minimize or avoid extra money while reducing stress. In this article, you will understand the nature and implementation of capital gains tax to enhance your savings.

Calculate Capital Gains Tax in Utah

Capital gains tax is levied on the profit obtained from selling your home or real estate property. Short-term Utah capital gains tax is the kind of capital gain in which the profit originates from the assets retained for a complete or less than a year. This tax rate varies from 10% to 37%, depending on your income.

In contrast, capital gain is profit generated after selling a property retained for more than a year. The tax rate applied to this profit is called Long-term capital gains tax, and it is significantly lower than its counterpart. This tax rate ranges from 0% to 20%, depending on your profit.

Practical Approaches to Avoid Capital Gains Tax

The following are the smart options that can be considered to avoid capital gain in Utah.

1031 Exchange

A 1031 exchange is an additional benefit that you can use. You can defer capital gains tax Utah permanently if you continue investing the sale earnings in more investment properties. It is a like-kind exchange, and when you sell an investment, you use the money to purchase another comparable asset.

Subtract Costs

After utilizing deductions and exceptions, if you remain with capital gains, concentrate on reducing your share of the taxable profit or gains. Among the allowable exclusions are the following:

The price of fixing up a house or rental property

improvements and additions, such as remodeling the kitchen or installing a bedroom

Income losses from investment properties because of rent arrears

The expense of professional, legal, and marketing costs to find an additional tenant or evict an existing one

Closing expenses related to the selling of property

Designate The Renting Place as Your Principal Home

If the value of an investment property you rent out has increased. You are qualified for the capital gains exclusion if you keep your primary residence for at least two years.

However, the amount you deducted while renting the property cannot be excluded. Moving into the rental and making it your primary home for two years could prevent capital gains. Doing this, you will lose your primary residence designation. However, you can reclaim it by moving back in following the sale of the rental property.

How Can You Exempt Capital Gains Tax in Utah?

The following situations can help exempt you from paying capital gains tax.

The house must be yours for at least two years

It needs to be your primary home

Before selling the residence, you must have resided there for at least two of the five years

Keep the receipts for your home improvements

The residence could not have been purchased through a like-kind exchange

You are not liable to pay foreign taxes

The recent house sale capital gains exclusion is not available for you to utilize

Check whether you qualify for an exception

Conclusion

Learning the essential parameters of Utah capital gains tax is critical. This helps you make intelligent decisions when closing a real estate business or other investment. On the other hand, it can drain your income generated from closing the sale of property or investment retained for over a year.

Therefore, consulting an expert realtor and legal advisor is crucial to avoid capital gains tax Utah. Moreover, straightforward techniques, such as donations and investing income in retirement accounts, can be used to reduce or avoid capital gains tax.

0 notes

Text

Evictions: How To Handle Them When They Happen In Ohio

Whenever someone loses their property, it is always a challenging situation. Evictions can be disruptive, whether because of a natural disaster or something else entirely. In this blog post, we will discuss some tips on how to handle evictions when they happen in Ohio. From understanding your rights to dealing with the authorities, read on to learn all you need to know.

What is an eviction?

Eviction is a legal process by which a tenant is forced to leave their rental property. The eviction may be due to rent arrears, failure to meet specified lease agreement conditions, or other reasons. When an eviction occurs, the tenant has a right to stay until the eviction proceedings are over. If tenants fail to leave when instructed, they may be arrested and fined.

If you are facing eviction in Ohio, there are some things that you should do to protect your rights and avoid any potential problems. Here are some tips on how to handle an eviction in Ohio:

1 Know Your Rights: Know your rights as a tenant first and foremost. Review your lease agreement carefully to understand your obligations and the grounds for evicting you. Make sure you have all the necessary documentation (such as pay stubs) to prove that you are meeting your financial obligations.

2 Create A Strategy: Before moving out, creating a strategy for leaving the property is essential. This includes deciding when and how you will move out, gathering any belongings you would like to take, and ensuring that all utilities are turned off before departing. It is also essential to ensure that pets are taken care of before leaving.

3 Contact Your Landlord In Advance: Contact your landlord before trying to leave the property. This will allow them time to arrange for you to leave peacefully and without incident.

What are the different types of eviction notices?

In Ohio, there are three types of eviction notices that a landlord can give to a tenant. The first notice is an informal notice that does not have any legal effect and is used to try and get the tenant to leave without giving them a formal eviction notice. The second notice is a formal eviction notice that gives the tenant seven days to leave. The landlord can file for a forcible eviction if the tenant does not leave. The third type of eviction notice is called summary ejection and is used when the landlord wants to evict the tenant but does not want to go through the hassle of court.

What should I do if I am served with an eviction notice?

If you receive an eviction notice in Ohio, the first thing you should do is consult with an attorney. The eviction process can be complicated and may require specific legal advice to protect your rights. If you cannot afford an attorney, other options are available, such as looking for legal aid or using public defenders.

Once you have consulted with an attorney, the next step is to determine what steps you need to take to protect your rights. You may need to file a petition with the court or contest the eviction in some way. It is essential to research your options and ensure that you take all necessary precautions to protect your interests.

Suppose the eviction happens while you are absent from the property. In that case, someone responsible for taking care of the property (such as a close friend or family member) must remain on site to hold onto any possessions that may be affected by the eviction. It would be best if you also made arrangements for someone else to take over your regular responsibilities at work so that you can focus on defending yourself in court.

If you receive an eviction notice in Ohio, you must act quickly and consult with an attorney. Following these simple steps can protect your rights and avoid possible complications.

How can I stop or delay an eviction?

When eviction happens in Ohio, the process can be complicated and confusing. There are a few things that you can do to try to stop or delay the eviction services.

First, contact your local housing authority to get information about available resources. Sometimes, some programs can help you stay on your property.

Next, try to negotiate with your landlord. Most landlords want to avoid evicting tenants so that negotiations could lead to a more favorable resolution for both parties.

Finally, file a complaint with the housing authority if you feel the eviction was wrongful or unlawful. This could help protect your rights and give you some leverage if negotiations fail.

Conclusion

When eviction happens in Ohio, the process can be difficult and emotionally draining. This guide will outline some steps you need to take to handle the situation as best as possible. From knowing your rights to file for bankruptcy, this guide has all the information you need to ensure that you are treated fairly during and after an eviction.

0 notes

Text

Monday 20 June 1836

7 ¼

11 25

no kiss fine morning F56 ½° at 8 ¼ - A- with me in my study looking over Mrs. Briggs’s account - breakfast at 9 Richard Woodhead waiting for A- he waited till 10 and we then walked with him to Spa house wood, and fixed upon a large Scotch fir to be cut down for making out the new stable with at upper Holcans - from Spa house direct to Oozle hall (cottages) Henry Ingham there - A- agreed to give him 10/. a rood for taking the bit in below the garden, and throwing it to the garden - he strode it over and said there would be 4 roods - A- saw her cottage tenant and spoke about their being in arrear - her husband lived many years as farming man with Mr. Clark ‘at the hall’ (near) but when Mrs. Clarke died, he pulled him off a shilling a week, and so the man would not stay - had 8/. a week and his meat and would not stay to have only 7/. a week and his victuals - A- and I walked round by Pule neck and the old Bradford road to Northgate - there at 12 ¼ - took Mr. Husband to Hatter’s fold - then went with him to Water Lane mill - Longish while there - A- said Bairstow must be the person to prevent the mill people

SH:7/ML/E/19/0063

above from throwing more ashes into the brook - and Bairstow or Brary or the person actually in possession of the mill (whichever of their it might legally be) must get the blacksmith out of the little shop under the end of the mill next the road - the man’s father was allowed by Bray to build the shop and occupy it these 7 or 8 years without paying any rent - the Rawson-tea-drinking women declare they will pull the engine boiler down as soon as it is built up - they (Mr. Rawson at their head?) claim the bit of ground the blacksmith’s shop stand on as waste - A- and I returned up the o.b. and came in at 2 - Messrs. Haighs of Honley had been waiting for her about an hour - wrote the above of today till 2 50 - then settled George’s last weeks’ accounts - Mr. Parker called on A- at 3 10 - I gave him a check for the £35 he paid Mr. Nelson in a/c of Northgate on Saturday - and A- tore in pieces before him (Mr. P-) the note of hand I gave her for £1000 witnessed by Mr. Parker and dated 26 January 1836 - I merely said I begged him to do what might be necessary about paying the interest of Mrs. Ferguson’s trust money - and that I thought the £1000 (or ½ of the trust money) now due to the granddaughter of Mr. F- which granddaughter is underage could not be safely paid till the child is of age - this child is the issue of Mrs. F-‘s oldest daughter who married Mr. Graham and on whose death Mr. Graham married her sister his present wife - Mr. P- thought the £1000 now due to Mr. G- as administrator to his wife - I looked rather grave, but said not a word on any other subject than the bond and trust money, and civilly hoped Mr. P- had left his father recovering - ‘yes! out of danger’ - A- and I then spoke to Mr. Bottomley of Beestarley Charles Law’s brother in Law who came to ask A- to change the situation of the new barn as it would block the windows of the building new house about to be built (almost finished) by Mr. Serjeant Blackburne for ............ A- said she would speak to Mr. Washington about it - sorry the man had not spoken to her before on the subject - before the masonwork was let - ...... shewed us the plan of his new house - to be completed by his cousin Bottomley for £146. told us this - but had not told Charles L- and begged us not to mention it - nor would he tell Mr. Washington who was Mr. Blackburne’s steward but told us it was - Mr. Peace attorney of Huddersfield, a very nice man - A- very civil to the Messrs. Haigh (3 brothers) of Honley who came fearing they had offended and apologizing then begging for a new building to their mill to cost £200 then they said £150 - without paying any percentage! - they have the mill cheap and 14 years of lease unexpired - A- said she would all required by the lease but nothing more - at 4 A- on the pony and I on ft. picked up Joseph Mann at Listerwick wheel race and went to Hipperholme Lane-ends to see about the water - Joseph M- to sink a hole 4ft. diameter in Thwaite’s tanhouse field just below the top wall to see if plenty of water could not be found there and carried down to the public house cottages A- has lately bought of Parchett - A- and I returned together about 5 20 - with Robert Mann + 4 at the great main drain - had Mr. Husband - the green room finished - made very neat and tidy by Mallinson’s man and boy (vid. Friday last) - dinner at 6 ½ - on coming thro’ the hall found George had hung the 2 dinner napkins on one of the arm chairs before the fire to dry (too damp on being taken from the press) odd appearance - called George - said I was shocked - this would not do - to ask Mrs. Briggs to shew him how to lay down the napkins and not make them too damp - spoke to Mrs. Briggs and asked her to shew him - at dinner found he had taken in the bottle of marsala with the cork drawn and an empty decanter to the Messrs. Haigh - I had told him to take them in to A- and me at dinner - he misunderstood - and I thought there would be no more of it - dinner at 6 ½ - coffee - as we were sitting at coffee - George came in, and said, he was sorry he had not been so comfortable of late - ‘I am sorry, too’ said I ‘but if you are not comfortable and if you think you can be more comfortable anywhere else, you can but try’ - he ‘should wish to try this day month’ - ‘very well’, said I very calmly ‘then you shall do so’ - and here the matter ended - A- did her French - A- and I agreed nobody would be very sorry at George’s going, and John (his father) soon after came to the door with a grim on his face, and looking more cheerful than we had seen him for long - wrote the last 37 lines till 9 55 pm then A- and I went to my aunt for 20 minutes - fine day - fair but cold and dull, and highish wind towards night - cold wind on the high ground all the day - raining at 11 25

2 notes

·

View notes

Text

Glossary of Mortgage Terms

Capped Rate A fixed speed is if you cover a predetermined amount of interest in that loan for a determined time period. Lenders

provide fixed rate loans for brief spans of time (three-six months) entirely upto 25 decades. Early redemption penalties apply if

you repay the mortgage before the end of the fixed rate duration. A licensed conveyancer is like a solicitor in that they

specialize from the legalities of buying and selling land. Leasehold Contract Unencumbered Mortgage Shared ownership is a scheme

formulated by housing institutions that requires you to pay mortgage obligations on the component of a property that you own when

you make monthly rent payments on the portion of the property owned by the building association. Booking Fee A Building Society is

a mutual company that provides you money to purchase or remortgage residential properties. This money comes from different

investors who are paid interest on their funds. Some of building society capital will be also increased through commercial money

markets. Fixed Rate Negative-equity happens when the cash you owe to your mortgage lender is significantly more compared to the

value of your property. People today wind up in negative equity situations if they take out 100 percent LTV mortgages. Adverse

credit takes place whenever you have a history of awful credit, bankruptcy, CCJ, or loan amount. Adverse credit can be called as

bad credit, bad credit, or it may be said that you get a very poor credit history. A charge is any interest on the mortgage which

a freehold or leasehold property might be held. MIG Booking fees are normally non-refundable when charged upfront, but the

reservation fee is added to your last mortgage payment. Ground Rent Gazumping occurs when a seller agrees to sell home to a

person, plus they move to decline that offer in favor of an increased one. Income Protection Insurance The SVR, or standard

variable rate, is your bottom speed of the lending company. It is subject to change at any time depending on the lending company.

The SVR will vary based upon the Bank of England Base Rate. Debt Consolidation An elastic scheme is a new method of calculating

mortgage interest charges. Lenders calculate interest on a regular basis instead of on an yearly basis. The new interest rates

will merely influence the remaining balance of the mortgage. By making regular overpayments, you can repay the loan faster thereby

saving a lot on interest rates. A guarantor is a person who guarantees that the lender that the borrower is eligible for a

mortgage or loan. In the event the borrower doesn't make payments, the guarantor will make sure they are. Endowment Your regular

monthly mortgage obligations include of two parts: both the interest and the capital. The interest is a payment on the interest

balance of your loan. The funding payment is a payment on the amount that you borrowed. Personal Pension Base rate tracker is a

sort of mortgage where the interest rate is variable, but it is put at a top (above) the Bank of England Base Rate for a period or

for the complete term of their mortgage. The best thing about this type of mortgage is that it's little or no redemption penalty.

This means that by earning over payments, you will have the ability to spend less due to paying off your mortgage earlier than the

arranged date to the initial mortgage contract. MIRAS Allergic Rate Charge First Time Buyers (FTB or FTP) Repossession is just a

lawful process by which your mortgaged property is sold under the charge of your creditor because of imperfect repayment. Your

property might subsequently be sold at public auction. Mortgagee A conveyance may be your deed through which a freehold, UN

registered title is transferred. In the event the property is registered, then the deed is called a move. Directly to purchase

implies that you are legally in a position to buy the property at a discounted rate when you're a renter for a long enough period

of time. Structural Survey Auction Tenure suggests the kind of rights a individual has within a property or the property it stands

on. Tenure could be freehold or leasehold, such as. PEP Banker Draft Unlike freehold by which a property is possessed, leasehold

is every time home is possessed, however the property it is made on isn't owned by the leaseholder. Their control of their

property is just for a set number of years. Debt consolidation is the process by which you simply take out a loan or mortgage so

as to pay off quite a few top interest debts. As a result, you will only have to make one payment each month, and also you may

save interest rates. Assignment Authority to Inspect the Register Arrears Discounted rates are utilised to draw new borrowers to

lenders by setting the interest rate below the normal variable rate for a guaranteed period of time.

If you repay the whole

discounted rate mortgage over the first couple of years, your lender may bill you premature redemption penalties. Fixture Income

Multipliers Capital and Interest Local Authority Search Equity Release An agricultural restriction is a guideline that can

restrict you in holding a property if your occupation is in any way related to agriculture. Remittance Fee Exchange of Contracts A

bridging loan is more of use once you wish to get a property, your ability to do therefore depends upon upon the sale of your old

property. This is a really short term loan that is paid off as soon as your old property sells. Consult with a loan adviser prior

to taking out a bridging loan to be sure it is the smartest choice for you personally. Equity A further progress is an add-on loan

to a current mortgage by the current lender. The cash out of a further progress could be used for home improvements, to buy a

freehold property, or to get personal purposes such as debt consolidation. An early redemption fee is charged by your lender

should you a part or complete payment of your loan amount before the conclusion of your loan duration. These penalties will also

be charged if you choose to re arrange and move your mortgage into a new lender. Capital raising generally means remortgaging for

a higher amount than you want to cover off your current mortgage as a way to use the extra money for additional personal financial

uses. A covenant can be an assurance given within an deed.Credit ScoringCredit scoring is your procedure where a creditor examines

your spending capacity prior to offering financing or mortgage. MRP Adverse Credit A power to inspect the register record is a

document fro the registered or legal owner of home letting the attorney of the buyer to find advice regarding the property. Title

Deeds More Security Fee Conclusion is a term which explains you have become the owner of your residence after finishing the

formalities of this selling and the purchase price of the property.

Conditional Insurance CCJ Deed A lien is a loan taken out from a brand new creditor or financing re negotiated with your existing

lender to payoff your current mortgage. That is performed in order to lower the rate of interest you're paying or to boost extra

capital. Exchange of contracts occurs when the buyer and owner of home sign and swap the contracts which detail your home, the

price, the date, and the conditions of the arrangement. When the contracts are signed, they get legally binding, and legal action

can be taken against anyone who breaks the contract. This commission accounts into the Treasury Ministers. Bridging Loan A MIG, or

loan indemnity assurance, is insurer takes out to pay for their creditor in case their house has been repossessed, and the

creditor is not able to get their money back. A MIG is covered upon completion of a loan. A repayment mortgage is as a portion of

your monthly payment goes toward the interest and also the other component of the payment goes toward the principal. That can also

be known as a capital and interest mortgage. If payments are made regularly, the full sum of the loan will be paid back by the end

of the expression. Centralized Lender Redemption can be once you pay off your mortgagewhen you remortgage, or any time you go on

to a new property. A seller is the person from whom you obtain a property. Apportionment, or downloading outside, is a facility

that lets you split the responsibility for utilities, real estate taxes, etc. with the customer or the seller of this property

whenever you're either selling or buying the home. Deposit Self Certification of Earnings Conclusion Credit Search Arrears happen

whenever you default on your mortgage payment or any other type of debt payment. For those who have arrears to the record of your

present mortgage, then you will face issues once you want to look at remortgaging or getting a new mortgage. Building Societies

Commission A capped interest is an interest rate which won't exceed the normal variable rate of interest for a predetermined time

frame (in 15 years) that depends upon you and your creditor. In the event the normal variable rate falls below your heartbeat,

your interest rate will decrease so. An arrangement fee is the total amount you need to pay your creditor to gain access to

particular mortgage deals. While searching for a fixed rate, cashback, or discounted rate mortgage, you will probably pay this

commission during that time that you submit the application, it must be added into the loan upon completion of the term, also it

will soon be deducted from the loan completion. LTV, or loan to value, could be the percentage derived from dividing the worth of

your premises by the amount of your mortgage. A low LTV is not as risky for lenders than a 100 percent LTV. Cash back is the

amount you receive once you take out a mortgage, the total amount could be adjusted or a portion of your loan amount. Guarantor

Loan consolidation happens every time a loan is removed to settle a second loan with a higher rate of interest or to refund a

number of high interest debts. Loan consolidation can be achieved through remortgaging. A variable speed usually means that your

rate of interest can change from month to month thereby causing your repayments to fluctuate monthly. Easement A sealing fee is a

sum charged by your lender when you repay your loan. Base Rate Tracker Flexible Scheme A property registry fee is paid when you

wish to register your ownership of home or if you want to change the registered name of a property. Licensed Conveyancer Capital

Raising The mortgagee is your business or company that finances your mortgage. An agent fee is paid to your debt advisor or other

intermediary that aids you in finding the ideal loan or mortgage deal for your circumstances. BSAThe BSA, or the Building

Societies Association, is an organization that operates at the attention of societies.A credit search is done by means of a lender

and also a credit agency to search your records for CCJs as well as other indicators of terrible credit. Ground rent is the sum

which a leaseholder should cover the freeholder each year. A centralized lender is a mortgage lender that does not depend upon a

branch system for distribution. Centralized lending is currently given by several building societies. These societies operate

separately from their branch programs, and so they rely exclusively on commissions from intermediary sources. A deed is a legal

document that denotes who owns a certain property. It's possible to move a title to both freehold and leasehold having a deed. A

banker draft is a way to make a payment. In features, it's the same as being a cheque, but in effect it is actually just a cash

payment. The money is supplied to the bank, plus so they issue a cheque that's certified to become good for the given amount.

Apportionment Period Administration Fee Conveyancing is the legal process through the buying and the selling of home simply take

place. Transfer Deed Building Society Repayment Mortgages There are two equal copies accepted by both the buyer and the seller,

and each party keeps a copy for his or her records. Once both parties have signed the contract, then they're committed to the

conditions of the agreement. Loan Consolidation A first time buyer is one who never owned property before. Easement is your proper

held by one property owner to make utilization of the land of another for a restricted purpose, such as a right of passage. Equity

is the sum of value in your property. It's the worth of your home less the total amount left to be paid back on your mortgage. The

duration of a mortgage could be your range of years over which you intend to pay off your mortgage. A local authority search is

produced by the solicitor of the people who plan to purchase your premises. They check to make certain that there are no proposed

developments on the property such as roads or buildings. They'll check for any planning permissions or enforcement notices posted

on your own premises. Early Redemption Penalty Shared Ownership Endowment Mortgage Negative dividend Cashback Tenure Freehold

Present obligations are all financial commitments outside your mortgage. Existing liabilities might include bank loans, credit

card debt, maintenance payments, etc.. Over payment occurs whenever you cover more than the normal payment on your mortgage in

order that the mortgage has been repaid before the end of the loan term. Together with over payments, you are able to save money

on interest, but you may also be charged an early redemption penalty.Payment HolidayA payment holiday is actually just a period

throughout which you create no mortgagee payments. This is normally available with flexible mortgages simply. Agricultural

Restriction Disbursements A bill certificate is a certification issued by HM Land Registry for your requirements along with your

name since the registered title for any particular property. This certificate contains information on mortgages, limitations, and

different interests. It has three different parts: a charges register, a land register, and a proprietorship register. When there

is no mortgage on the property, it is called a Land Certificate, also it is issued to the registered proprietor. A tie in period

can be an quantity of time for that you're bound to a lender. Tiein periods often exist using special mortgage deals such as

limited, fixed , or discounted rates. Should you move your mortgage to another lender in this period of time, you are subject to

an early redemption fee. ASU is currently Accident, Sickness, and Unemployment insurance that covers your mortgage payments in the

event of an collision, a sickness, or even involuntary unemployment. Equity release can be a means of releasing money from the

worthiness of one's house either in a lump sum or in monthly payments. This money might be useful for home improvements, debt

consolidation, or other large expenses. When you take out a discounted or fixed rate loan, your creditor may attempt to persuade

one to take out an insurance policy that will pay some missed payments because of an illness, an crash, or even unemployment. An

assignment could be the document moving the lease of their property or rights of possession of a seller to a buyer. It can be an

endowment policy into the building society in reference to a mortgage. A mortgage is a loan that allows someone to buy a property.

The home itself is your security of the mortgage. The mortgagor is the person taking out the mortgage to get home. A deposit is

the amount of money you put down toward buying home. Freehold means that you might have ownership of home for an extended period

of time. This is compared to leasehold which means that the house is only under your hands for a limited period of time. Broker

Fee Chattels Tiein Period A transfer deed is actually just a valid deed used for moving the ownership of your property to an

individual buyer. A fixture is a thing attached with your premises, and for that reason it is legally part of this property.

Conveyance Solicitors are the people who provide legal counsel and execute all of the legal work for mortgage and remortgage

transactions.Stamp Duty Stamp duty is a tax paid into the government on purchasing home. Further Advance Covenant Conveyancing

MPPI, or mortgage payment protection insurance, is insurance one chooses out from the case of an crash, an illness, or involuntary

unemployment that could render them incapable of earning their monthly mortgage payment. An intermediary is a mediator who finds

the best mortgage for you, plus they also arrange the mortgage for you personally on your own behalf. MRP, or loan repayment

coverage, is insurance obtained out through your lender during the term of your loan. Remortgage Sealing Fee SVR An extra Security

Fee (Mortgage Indemnity Guarantee policy) may be your fee taken to get insurance coverage that may insure your creditor so that in

case you default on payments, he won't suffer any loss. You've got to pay for the further Security Fee and the premium along with

your mortgage advance. Although you are paying the premium, remember this policy is for the protection of your creditor and for

you personally. Over-payment Home Buyer Report Retention Mortgagor Earnings is a type of calculation that a lender will use to

figure out the amount a borrower may receive. Even the most usual income multiplier is three times per single source of income or

two and a half times joint income. The lender will decide on the one that yields the greater amount. Lenders tend to be more

elastic in case a LTV ratio is not low. A PEP, or private equity plan, allows you to own shares or unit trusts without paying any

commissions. Retention may be the sum that your lender keeps pending before certain conditions of your mortgage are met. A

remittance fee is charged by a lender for sending the sum of a mortgage to your solicitor. Chattels are moveable items in your own

home such as furniture or your personal possessions.Chief RentChief rent is paid by the master of a freehold property. This could

be the same as the ground rent that's paid by a leaseholder. LTV Valuation Arrangement Fee Intermediary Buy-to-Let Existing

Liabilities An endowment mortgage is an interest only mortgage supported by an endowment policy. Throughout the period of the

mortgage you can pay just interest to the creditor, and your premiums are paid into an endowment policy which will mature over the

condition of your mortgage. The endowment policy is intended to pay off your mortgage as well as behave as lifetime insurance.

However, you cannot rely upon this add up to be sufficient to pay all your debt. Gazumping Repossession ASU The management fee is

helpful resources

the total amount charged by your lender to get started focusing on the instruction part of your mortgage application. It features

the house occupancy fee also. The management fee won't be reimbursed when your appraisal isn't done or if your application was

rejected. A house buyer report is produced by a creditor after a mortgage evaluation was done and before the full survey takes

place in order to provide the borrower an entire understanding of the property they have been considering buying. Annual

Percentage Rate A auction is your market of home to the man who quotes highest bid. The maximum bidder needs to sign a binding

contract that helps to ensure he perform all valuations, searches, etc. until the selling of their property. CCJ Means County

Court Judgment. This is a decision reached by a county court against you once you have defaulted in your own debt obligations. If

you clean that the debt in question in a fixed quantity of time, a decent note is going to be put on your credit file to indicate

that your debt has been taken care of. A property evaluation is a survey conducted on home with a qualified surveyor so as to

estimate the value of their property. This valuation is done on behalf of your lender in order that they are able to validate the

value of your premises. The yearly Percentage Rate is the speed at which you borrow money from creditor. It comprises all of the

first fees and continuing costs that you will probably pay through the duration of the loan duration. As its name implies, annual

percentage rate, or APR, is the charge of a loan quoted at a yearly rate. The annual percentage rate can be just a fantastic

method to compare the offers from various lenders in line with the yearly cost of each mortgage. Attorneys Whenever you purchase a

property for the sole intention of renting it out, you are able to make an application to get a property mortgage mortgage. The

payments for this type of mortgage are calculated based on your own projected rental income instead of your personal income.

Together with income protection insurance, then your monthly premiums will likely be covered regarding illness, injury, or even

unemployment. Vendor Council of Mortgage Brokers A title deed is a legal record that validates the ownership of your premises. A

title deed proves your true and legal directly to your own property. A structural survey is your thorough inspection of home

carried out by an expert surveyor. Self certification of income usually means that you confirm how much you get, and the lender

Reverse Mortgage Lenders in Palm Springs CA

doesn't require proof of your income by a third party. Self Certificate is helpful for selfemployed people or contract workers.

Portability is actually just a term utilized to refer to a mortgage which can be moved between properties when you proceed from 1

house to another. Charge Certificate There are different types of endowments, but here an endowment is really a life insurance

policy which may payoff your interest only mortgage. CML MPPI MIRAS, or mortgage interest relief , was a tax relief given to

people who have mortgages, but this relief has been abolished by the government in April of 2000. A personal pension provides for

your financial needs after retirement. You make structured payments to your pension savings during your working years. Frequently,

a number of this money might be carried out to cover off your mortgage obligations. Land Registry Fee Variable Speed Redemption

Portability Right to Buy The expression unencumbered ensures that you have your property outright with no loans or mortgages .

1 note

·

View note

Text

Small landlords who became homeless during pandemic blame 'broken' system | CBC News

Some landlords in Ontario are becoming homeless — a situation legal experts say they've never seen happen before the COVID-19 pandemic. They blame a "broken" tribunal system with significant delays to get eviction orders.

Franchesca Ranger, a small business owner in Ottawa, found herself homeless during the pandemic after selling her marital home because of a divorce. She moved into her rental unit, a townhouse in Barrhaven, and gave her tenant a 75-day termination notice with a move-out date of Aug. 31, 2020.

She said her tenant of four years refused to leave, stopped paying rent, and she was left to pay thousands a month in mortgage, property taxes, bills, and storage for her belongings — all while running a small restaurant that was hit hard by lockdowns and pandemic restrictions.

"All I could think about was everything I've worked for, and everything I've saved for, my future just being torn away," said Ranger, who was "living out of a suitcase" from September 2020 until this year.

"I felt so let down and so violated." She was finally able to move back into her home this February, after alternating stays with friends and family every few days.

"My life wasn't my own," she said. Small landlords — those who typically own just one or two rental units — can become homeless when a tenant refuses to leave a space the landlord needs for their own accommodations.

CBC spoke to two other landlords in Ontario who were homeless, or are at risk of homelessness, because of delays in getting a hearing and eviction order from Ontario's Landlord and Tenant Board (LTB) — the body that decides when disputes arise between landlords and tenants.

"We're trying to navigate our clients through a system that has become so broken," said paralegal Kathleen Lovett.

The entire process of applying to getting a decision should take one to three months, according to LTB's service standards from before the pandemic.

After serving her tenant, the N12 notice — a form required under Ontario's Residential and Tenancies Act if a landlord, an immediate family member, or a purchaser intends to move into a rental unit — Ranger had to wait eight months for a hearing.

Three days before the hearing, the tenant asked for the hearing to be conducted in French, so she had to wait four more months for a second hearing. It took three months after that for an eviction decision, and about another three for the sheriff's office to come and enforce the eviction.

"I find it inconceivable that tax dollars pay for a government body that has zero accountability, that thinks it's OK for someone to own a home and be homeless," said Ranger. She wrote letters to several MPPs, Ontario Premier Doug Ford and the attorney general, with no response offering help.

"How is it possible that someone can rent a place, stop paying rent, and live in it for 18 months? … It makes little sense."

Ranger's former tenant still owes her more than $24,000 in rent arrears and compensation, according to the LTB.

That tenant did not respond to CBC's request for an interview or comment. However, in the eviction document, he testified he refused to pay rent since June 2020 because "he took the N12 to mean he no longer was required to pay."

The tenant stated his wife was disabled and on ODSP and she'd have medical difficulties if evicted because her medical professionals "were all near the rental unit." He said the family would be homeless if evicted and he requested Ranger pay him to leave sooner and find another rental unit.

Ranger said the tenant left her place in shambles, with jars of peanut butter piled in her bathtub and garbage strewn across her home and lawn.

"My house was held for ransom," said Ranger. "I guarantee you I will never rent again."

"During the wait time, the landlord is going crazy," said Boubacar Bah, chair of Small Ownership Landlords of Ontario (SOLO), a non-profit that provides resources and advocates for working-class landlords.

Bah said he knows at least 50 landlords involved in his group who became homeless. He said the toll on their mental health has been "huge."

"The big landlord doesn't have that problem," he said. "A corporate landlord has like 1,000 apartments. If one or two [people] do not pay, then they [don't] care. But a small landlord, if he wants his house back, and the tenant doesn't pay, he can go bankrupt."

He said the Residential Tenancies Act, and the delayed tribunal system is failing small landlords.

Lovett, a paralegal since 2009 and owner of KLP Paralegal Services and Landlord Solutions, has worked with over 20 landlord clients who faced homelessness — something she's never seen before COVID.

Sometimes, her clients are waiting up to 14 months for an eviction decision, while the LTB promises clients "fair, effective, and timely dispute resolution."

"It's contrary to their own rules," said Lovett. "We are waiting months and months … which is unnecessary and inappropriate."

Pearl Karimalis, a paralegal and volunteer with SOLO, questions the current state of the LTB office, including whether it's short-staffed and whether everyone knows how to do their jobs properly.

She said staff could not answer basic questions on her clients' files and have even accidentally sent her judgments for cases unrelated to hers.

Though she works with more tenants, Karimalis said LTB's "bias toward tenants is systemic."

Karimalis says the LTB should temporarily extend work hours, hire more adjudicators, and the province should give police more authority to get involved in landlord-tenant disputes, especially for fraud, extortion and property damage.

"This nightmare [keeps] going … I don't know when it's going to end," Karimalis said.

Former landlord Ranger said she wants the LTB "completely overhauled" so laws are fair for both small landlords and tenants.

She wants the provincial government to provide temporary homes for landlords facing homelessness while the LTB sorts out their dispute. The government should also reimburse landlords if they're paying for non-paying tenants to continue living on their properties, she added.

"No one should be homeless, including a landlord," Ranger said. The Landlord and Tenant Board declined an interview with CBC and didn't directly answer several questions about homeless landlords.

Instead, its statement said the provincial moratoriums pausing eviction hearings in 2020 had "a significant impact" on its caseload.

As of March, the LTB had 39 full-time and 49 part-time adjudicators, its "highest number of adjudicators ever appointed," spokesperson Janet Deline said.

"We know that we're not there and there is more work to do, but we are confident that service improvements will be made in 2022," said Deline.

Ontario's Attorney General, the ministry responsible for the LTB, declined an interview and did not address specific questions about homeless landlords.

The ministry said it may not "interfere in, or comment on, tribunal processes or decisions" as it is an independent adjudicative body.

Brian Gray, the ministry's spokesperson, said in an email that the province will invest $4.5 million over three years to hire more adjudicators and staff to reduce backlogs at the LTB.

Both the LTB and province pointed to a new online digital portal — where people can access information on their disputes and resources for mediation and self-help tools — as a way they're addressing backlogs at LTB.

0 notes

Text

Eviction for Rent Arrears in Florida | 561.699.0399

Eviction for Rent Arrears in Florida

The eviction journey, while a path no landlord wishes to take, becomes necessary when rent remains unpaid. Chapter 83 of the Florida Statutes lays down a procedural roadmap for this, designed to balance the rights of both landlords and tenants. This cursory guide dives into the nuances of initiating an eviction, emphasizing adherence to legal…

View On WordPress

#attorney’s fees#county court eviction#court costs#court filing for eviction#eviction dispute#Eviction for Rent Arrears in Florida#eviction hearing#eviction lawsuit#eviction legal advice#Eviction Notice#eviction summons#eviction timeline#final judgment eviction#florida eviction process#landlord responsibilities#landlord tenant law#Lease Agreement#legal eviction steps#Legal procedures#Legal representation#Non-payment of rent#overdue rent#possession reclaiming#Property law#Rental property management#sheriff eviction#tenant eviction#tenant response#tenant rights#three-day notice Florida

0 notes

Photo

“Songall Says He Is Badly Hurt, Doctor Says ‘Bruised a Little’,” Border Cities Star. July 25, 1931. Page 05.

—-

Demands from two organizations have been made on the Sandwich East Township Council that a public and not private, hearing be held into the part that Chief of Police Cachoy played in the recent eviction of Karl Songall from his home at 1516 Alexi Road, The Star is informed today.

Letters have been filed by the Remington Park and the Sandwich East Citizens’ associations with Wilfred Gravel, township clerk, urging that the council abandon its plan to hold the probe in camera, and to thresh out the charges against the police chief before the ratepayers of the municipality.

Cachoy admits striking Songall with his baton, but both he and officers of the sheriff’s department content that force was necessary to subdue the householder when he became violent after the officers had started to take the furniture out of his home a week ago Friday. The eviction order was obtained by Harry Parent, of 50 Alexander avenue, owner of the house after Songall became several months behind in his purchase payments.

The letters asking for a public enquiry were given to the township clerk by Fred Gould and George Wright, vice-president and secretary, respectively, of the Remington Park body and Patrik Kearns a member of the executive. That move was made, they said, ‘to make sure that the letters reached their destination.’

Thomas Dingwall is president of the Sandwich East association, while George Lesperance heads the Remington Park citizens.

It was also intimated today that a ‘police committee’ of one of the organizations is now securing information on the township police administration and that more serious charges than those involved in the Songall case may be laid. The Attorney-General’s Department it is stated may be asked to launch a judicial probe.

Mr. Songall, who has since quit his home and is now renting a house at 1544 Alexis Road, claimed this morning that he is unable to work on account of injuries inflicted during his arrest by Chief Cachoy and County Constable ibb. He wants to cut hay for feed for his cow, he stated, but finds he is not equal to the task.

He is suffering from pains in his chest, Songall declared, displaying where a physician had taped his body.

He alleges that after he fell down while Chief Cachoy was trying to handcuff him, Gibb ‘jumped’ on him and knelt on his chest with considerable force while the police bracelets were snapped around his wrists.

Queried by The Star today, Dr. E. R. Miller, of 815 Tecumseh Road East, who attended the man, said that Songall is ‘bruised up a little bit,’ and that his hurts are minor.

Songall claims that the house owner, Parent, ordered this week to accept $15 a month rent on the purchase price after refusing two payments of $25 and $30, a few months ago. He turned down the officer, the evicted suburbanite explained, because he had already arranged to rent another house.

Photo Caption:

WITNESS AT POLICE PROBE

KARL SONGALL of 1544 Alexis Road, pictured above, will be the star witness at the Sandwich East Township Council prove into charges that the man was clubbed and badly mistreated by police a week ago when he was being evicted from a suburban home on a court order, for arrears in purchase payments. Chief Cachoy, of Sandwich East, and County Constable Gibb are the officers involved. Songall has his chest taped in the place where he claims that Gibb knelt on him.

[AL: Resistance to police brutality, whether in the form of beating an evicted tenant as here or ‘third degree’ violence against suspected criminals was widespread during the Canadian Great Depression, and that resistance came not just from the usual suspects of left-wing agitators and parties but from local community associations, elected government councilors, and churches. Of course, certain people were seen as more deserving of protection from arbitrary police violence, and Songall’s case was undoubtedly sympathetic because he was an ethnic white man evicted out of a rent-to-own house and was a middle-aged worker with long community ties.]

#windsor#sandwich east#police brutality#police violence#evictions#eviction#tenancy#landlords#suburban canada#public sphere#citizen's inquiry#citizen's groups#government investigation#police accountability#class and crime#capitalism in crisis#capitalism in canada#great depression in canada#crime and punishment in canada#history of crime and punishment in canada#third degree

3 notes

·

View notes

Text

Monday 20 June 1836

7 ¼

11 25

- No kiss fine morning F56 ½° at 8 ¼ - A- with me in my study looking over Mrs. Briggs’s account - breakfast at 9 Richard Woodhead waiting for A- he waited till 10 and we then walked with him to Spa house wood, and fixed upon a large Scotch fir to be cut down for making out the new stable with at upper Holcans - from Spa house direct to Oozle hall (cottages) Henry Ingham there - A- agreed to give him 10/. a rood for taking the bit in below the garden, and throwing it to the garden - he strode it over and said there would be 4 roods - A- saw her cottage tenant and spoke about their being in arrear - her husband lived many years as farming man with Mr. Clark ‘at the hall’ (near) but when Mrs. Clarke died, he pulled him off a shilling a week, and so the man would not stay - had 8/. a week and his meat and would not stay to have only 7/. a week and his victuals - A- and I walked round by Pule [neck?] and the old Bradford road to Northgate - there at 12 ¼ - took Mr. Husband to Hatter’s fold - then went with him to Water Lane mill - Longish while there - A- said Bairstow must be the person to prevent the mill people

SH:7/ML/E/19/0063

above from throwing more ashes into the brook - and Bairstow or Brary or the person actually in possession of the mill (whichever of their it might legally be) must get the blacksmith out of the little shop under the end of the mill next the road - the man’s father was allowed by Bray to build the shop and occupy it these 7 or 8 years without paying any rent - the Rawson-tea-drinking women declare they will pull the engine boiler down as soon as it is built up - they (Mr. Rawson at their head?) claim the bit of ground the blacksmith’s shop stand on as waste - A- and I returned up the o.b. and came in at 2 - Messrs. Haighs of Honley had been waiting for her about an hour - wrote the above of today till 2 50 - then settled George’s last weeks’ accounts - Mr. Parker called on A- at 3 10 - I gave him a check for the £35 he paid Mr. Nelson in a/c of Northgate on Saturday - and A- tore in pieces before him (Mr. P-) the note of hand I gave her for £1000 witnessed by Mr. Parker and dated 26 January 1836 - I merely said I begged him to do what might be necessary about paying the interest of Mrs. Ferguson’s trust money - and that I thought the £1000 (or ½ of the trust money) now due to the granddaughter of Mr. F- which granddaughter is underage could not be safely paid till the child is of age - this child is the issue of Mrs. F-‘s oldest daughter who married Mr. Graham and on whose death Mr. Graham married her sister his present wife - Mr. P- thought the £1000 now due to Mr. G- as administrator to his wife - I looked rather grave, but said not a word on any other subject than the bond and trust money, and civilly hoped Mr. P- had left his father recovering - ‘yes! out of danger’ - A- and I then spoke to Mr. Bottomley of Beestarley Charles Law’s brother in Law who came to ask A- to change the situation of the new barn as it would block the windows of the building new house about to be built (almost finished) by Mr. Serjeant Blackburne for ............ A- said she would speak to Mr. Washington about it - sorry the man had not spoken to her before on the subject - before the masonwork was let - ...... shewed us the plan of his new house - to be completed by his cousin Bottomley for £146. told us this - but had not told Charles L- and begged us not to mention it - nor would he tell Mr. Washington who was Mr. Blackburne’s steward but told us it was - Mr. Peace attorney of Huddersfield, a very nice man - A- very civil to the Messrs. Haigh (3 brothers) of Honley who came fearing they had offended and apologizing then begging for a new building to their mill to cost £200 then they said £150 - without paying any percentage! - they have the mill cheap and 14 years of lease unexpired - A- said she would all required by the lease but nothing more - at 4 A- on the pony and I on ft. picked up Joseph Mann at Listerwick wheel race and went to Hipperholme Lane-ends to see about the water - Joseph M- to sink a hole 4ft. diameter in Thwaite’s tanhouse field just below the top wall to see if plenty of water could not be found there and carried down to the public house cottages A- has lately bought of Parchett - A- and I returned together about 5 20 - with Robert Mann + 4 at the great main drain - had Mr. Husband - the green room finished - made very neat and tidy by Mallinson’s man and boy (vid. Friday last) - dinner at 6 ½ - on coming thro’ the hall found George had hung the 2 dinner napkins on one of the arm chairs before the fire to dry (too damp on being taken from the press) odd appearance - called George - said I was shocked - this would not do - to ask Mrs. Briggs to shew him how to lay down the napkins and not make them too damp - spoke to Mrs. Briggs and asked her to shew him - at dinner found he had taken in the bottle of marsala with the cork drawn and an empty decanter to the Messrs. Haigh - I had told him to take them in to A- and me at dinner - he misunderstood - and I thought there would be no more of it - dinner at 6 ½ - coffee - as we were sitting at coffee - George came in, and said, he was sorry he had not been so comfortable of late - ‘I am sorry, too’ said I ‘but if you are not comfortable and if you think you can be more comfortable anywhere else, you can but try’ - he ‘should wish to try this day month’ - ‘very well’, said I very calmly ‘then you shall do so’ - and here the matter ended - A- did her French - A- and I agreed nobody would be very sorry at George’s going, and John (his father) soon after came to the door with a grim on his face, and looking more cheerful than we had seen him for long - wrote the last 37 lines till 9 55 pm then A- and I went to my aunt for 20 minutes - fine day - fair but cold and dull, and highish wind towards night - cold wind on the high ground all the day - raining at 11 25

1 note

·

View note

Link

Pandemic’s Toll on Housing: Falling Behind, Doubling Up As the pandemic enters its second year, millions of renters are struggling with a loss of income and with the insecurity of not knowing how long they will have a home. Their savings depleted, they are running up credit card debt to make the rent, or accruing months of overdue payments. Families are moving in together, offsetting the cost of housing by finding others to share it. The nation has a plague of housing instability that was festering long before Covid-19, and the pandemic’s economic toll has only made it worse. Now the financial scars are deepening and the disruptions to family life growing more severe, leaving a legacy that will remain long after mass vaccinations. Even before last year, about 11 million households — one in four U.S. renters — were spending more than half their pretax income on housing, and overcrowding was on the rise. By one estimate, for every 100 very low-income households, only 36 affordable rentals are available. Now the pandemic is adding to the pressure. A study by the Federal Reserve Bank of Philadelphia showed that tenants who lost jobs because of Covid-19 had amassed $11 billion in rental arrears, while a broader measure by Moody’s Analytics, which includes all delinquent renters, estimated that as of January they owed $53 billion in back rent, utilities and late fees. Other surveys show that families are increasingly pessimistic about making their next month’s rent, and are cutting back on food and other essentials to pay bills. On Friday, as monthly jobs data provided new evidence of a stalling recovery, President Biden underscored the housing insecurity faced by millions. The rental assistance in his $1.9 trillion relief plan, he said, is essential “to keep people in their homes rather than being thrown out in the street.” Bobbing above the surface of a missed payment, the most desperate are already improvising by moving into even more crowded homes, pairing up with friends and relatives, or taking in subtenants. That is the case with Angelica Gabriel and Felix Cesario, residents of a two-story apartment complex in Mountain View, Calif., largely inhabited by cooks and waitresses and maids and laborers — the kinds of workers hit hardest by the pandemic. With their incomes reduced, Ms. Gabriel, a fast-food worker, and her husband, a landscaper, recently moved out of the bedroom they shared with their two youngest children, 6 and 8. They now rent the bedroom to a friend of a friend, while the couple and the kids sleep on a mattress in the living room. (Two daughters, 14 and 20, continue to share the other bedroom.) The arrangement has kept them current by bringing in $850 toward the $2,675.37 monthly rent, which Ms. Gabriel reeled off to the penny. “We weren’t able to pay the rent by ourselves,” she said in Spanish. “Suddenly the hours fell. You couldn’t pay, buy food.” Such changes are not directly reflected in rent rolls or credit card bills, but various studies show that disrupted and overcrowded households have a host of knock-on effects, including poorer long-term health and a decline in educational attainment. Reflecting the broader economy, the pain in the U.S. housing market is most severe at the bottom. Surveys of large landlords whose units tend to be higher quality and more expensive have been remarkably resilient through the pandemic. Surveys of small landlords and low-income tenants show that late fees and debt are piling up. One measure of relief came when Mr. Biden extended — by two months — a federal eviction moratorium that was scheduled to expire at the end of January, as states and cities also moved to extend their own eviction moratoriums. In addition, $25 billion in federal rental aid approved in December is set to be distributed. But for every million or so households who are evicted in the United States each year, there are many more millions who move out before they miss a payment, who cut back on food and medicine to make rent, who take up informal housing arrangements that exist outside the traditional landlord-tenant relationship. Updated Feb. 6, 2021, 11:08 a.m. ET “What happens in housing court will miss most of the people who need help,” said Davin Reed, an economist at the Federal Reserve Bank of Philadelphia. While rents have fallen in many big cities, vacancy rates for the cheapest buildings are essentially flat from last year, according to CoStar Group, a commercial property group. That is: Nothing about Covid-19 has changed the fact that there is a longstanding shortage of affordable housing, so anyone who loses an affordable home will still have a hard time finding a new one. And in the same way that subprime mortgages were an early indicator of the mid-2000s housing crisis, today informal renters — roommates and sublessors who don’t have a proper lease — offer a look below the surface. Low-income and frequently undocumented immigrants, these tenants find apartments through word of mouth, social media and Spanish-language news sites, where single-room dwellings (“I rent a room with a bed for $400”) are a staple of the classified advertisements. Kaitlin Heinen, a staff attorney at the Housing Justice Project in Seattle, said that over the past few months she had seen a marked increase in “unauthorized occupant” cases, in which a landlord seeks to evict someone for allowing an off-the-books roommate into the unit. Claas Ehlers, chief executive of Family Promise, a homeless-prevention nonprofit that has more than 200 affiliates in 43 states, said people without leases constituted an outsize share of the group’s requests for rental aid and assistance. “We’re seeing this domino effect where cheaper affordable housing is still saturated, so now we’re getting into unauthorized occupants,” Ms. Heinen said. It is a world of cash rent and oral agreements that are unstable and easily torn — a big reason that various studies show informal tenants are more likely to become homeless. “People who have places they can be evicted from are better off than those who don’t,” said Marybeth Shinn, a professor at Vanderbilt University who studies homelessness. John Wickham found his last place on Facebook. Mr. Wickham, 60, lives in Decatur, Ga., and worked in customer service for a tree-trimming business before losing his job last summer. He was collecting unemployment insurance but could no longer shoulder the $1,200 a month he was paying to live in a residential hotel, so he resorted to a $600 sublet with a stranger. His girlfriend found it on Facebook Rentals. Mr. Wickham has since fallen behind on his share of the rent and is looking for a new place. “We’re trying to find something in our budget, and that’s not looking pretty easy,” he said. Tenants like Mr. Wickham pose a huge challenge for governments trying to prevent displacement and stanch the flow of homelessness. Consider what happened last year as a federal deadline approached to spend rental assistance funds that flowed to states through the federal CARES Act. Despite a crush of demand for help, cities and states struggled to get money to tenants, in part because their criteria were too restrictive. “Our systems are built around these middle-class models where everybody has documentation for everything,” said Elizabeth Ananat, an economics professor at Barnard College. “Much of the world doesn’t work that way, but most of the people who write laws live in the world that works that way.” Cities like Los Angeles and Philadelphia have been trying to remedy this by moving to cash assistance programs. The California Legislature recently passed a bill that extended the state’s eviction moratorium and will use up to $2.6 billion in federal rental aid to help clear back rent. The legislation allows tenants to apply for rental assistance by submitting documents like bills and school registrations, instead of a formal lease, as many other city and state rental assistance programs require. “The state’s housing crisis wasn’t created by Covid, and this bill alone certainly doesn’t solve it,” Gov. Gavin Newsom said. “While we’ve got to recommit to housing affordability more broadly, this bill protects against the worst economic impacts of the pandemic in a balanced and equitable way.” In California and elsewhere, the work of distributing aid has largely fallen to nonprofits. They have also filled in the gaps. Take Destination: Home, a San Jose organization that works to end and prevent homelessness. In addition to distributing aid from the CARES Act, the group has raised some $30 million in private donations that it can deploy to a broader swath of the population, with fewer restrictions on how it is spent. About 40 percent of the organization’s rental aid has been distributed to tenants who do not have a traditional lease, said Jennifer Loving, its chief executive. “People we would have never seen before are now in trouble,” she said. On a recent evening in Mountain View, another nonprofit, the Reach Potential Movement, was distributing bread, cereal, milk and diapers to economically stressed families in the apartment complex where Ms. Gabriel and Mr. Cesario live. One of the residents, Hilario Saldívar, a 43-year-old cook and dishwasher, saw his hours cut to four hours a day, four days a week, so is struggling to afford the $2,600 monthly he pays for the two-bedroom apartment that he shares with his brother, his sister, her husband and their child. Mr. Saldívar hasn’t missed a rent payment, but staying current has come at the expense of his meager savings and even food. “We’re in a hard battle, a sad battle,” he said in Spanish. His neighbor Rosa Arellano, a 47-year-old mother of three, cleaned schools and offices before she was laid off last year. She is months behind on the $1,300 rent for her one-bedroom apartment. Ms. Arellano recently signed a document with her landlord stating that while California law prohibited her eviction for now, she still owed a $3,900 balance, rising to $5,200 with the February rent. After a year of lost income, she asked, “where are we going to get all that money we owe?” Liliana Michelena contributed reporting. Source link Orbem News #doubling #Falling #Housing #Pandemics #toll

0 notes

Text

Help For Individuals During The Coronavirus Crisis

New Post has been published on https://www.debtlawyer.com/help-for-individuals-during-the-coronavirus-crisis/

Help For Individuals During The Coronavirus Crisis

As of April 16,2020, twenty- two million Americans are out of work and have applied for unemployment benefits. The Coronavirus crisis has hit many industries hard: restaurants, bars, airlines, hospitality, live music, sports, movie theaters. Stay at home orders and the closure of non-essential businesses have taken an enormous toll on our economy with the goal of “flattening the curve” and preventing additional deaths from COVID-19. If you have been struggling financially because of the Coronavirus crisis, there are a number of ways both the federal government and the New York State government have sought to provide relief.

Congress passed the Families First Coronavirus Response Act on March 18, 2020, which provides for two weeks of paid sick leave if are unable to work because you are subject to quarantine or are experiencing symptoms of COVID-19 or if you are caring for a family member that is impacted. Additionally, it gives 12 weeks paid sick leave if you are caring for a child while their school is closed. This paid sick leave applies to Americans who work have been employed for at least 30 days and work for either a small- or mid-sized company, or for the government. Also provided for in the Act is free Coronavirus testing for all Americans regardless of health insurance status. Please note, this does not cover the cost of treatment only the cost of the test.

On March 25, 2020, Congress passed the $2 trillion economic relief package called The Coronavirus Aid, Relief, and Economic Security Act or “CARES” Act. The stimulus legislation provides for a direct payment of $1,200 for each adult, plus $500 for each child in the household. The payments start to phase out at the $75k income level and would be cut off at the $99k level. Individuals will use the income from their 2019 tax returns to qualify, or their 2018 income, if they have not filed their 2019 return yet. The Internal Revenue Service has already started sending the stimulus payments into individual’s bank account (provided they have the direct deposit information already). Please note, individuals on fixed income, such as social security, will also be entitled to these benefits. Some recipients have complained that creditors and even their existing bank, have attempted to seize the stimulus check for monies owed on a judgment or overdraft balances. However, New York Attorney General, Letitia James, announced on April 18, 2020, that the stimulus checks will be protected from garnishment. (If you experience any issues in accessing your stimulus funds, please contact our office or the Attorney General’s office directly at https://ny.ag.gov/)

New Yorkers with student loan debt should know that the CARES legislation defers all federal student loans until November 2020. This relief is not automatic and student loan borrowers should contact their servicer to request to defer their payments. Borrowers with private student loans who are unable to make their payments should also contact their servicers to see if they are any options for them.

The CARES Act also extends unemployment insurance for an additional 13 weeks up to a maximum of 39 weeks. In New York, unemployment benefits are covered for 26 weeks, so New Yorkers would get benefits for the maximum under the Act, 39 weeks. Regular unemployment benefits will be boosted by an additional $600 weekly. The maximum benefit here in New York is now $504, so the maximum benefit that New Yorkers could see under this legislation is $1104 a week. Eligibility for unemployment insurance would also be expanded to cover more workers, such as freelance independent contractors, gig workers and the self-employed. However, due to the enormous number of claims being filed and the Department of Labor’s unemployment system being overwhelmed, many Americans who need to file unemployment claims, still have not been able to do so or are waiting for benefits. Governor Andrew Cuomo has vow to overhaul the state’s archaic unemployment system. The Department of Labor has increased staffing at their call centers, adding thousands of workers, and retooled the unemployment benefits website. However, many New Yorkers who need help still are not getting any. New York has been swamped by more than one million claims for unemployment benefits, which is approximately four times the number after the 2008 recession.

Even if a household is receiving unemployment benefits and the onetime $1200 payment, the economic reality can still be quite stark. With unemployment, comes the loss of health insurance. Maintaining coverage under COBRA can be prohibitively expensive, $2500 or more for a household of four. Plus, there is also the deducible to take into account. Furthermore, the Trump administration has specifically refused to allow a waiver for the period to apply for Obamacare.

Another large expense that many New Yorkers are struggling with is their housing expense. Whether it is rent or mortgage, there has been some action on both the state and federal levels to makes sure that people are able keep their housing for the duration of the crisis. Renters are receiving only limited protection. Governor Cuomo has stopped evictions for the duration of the crisis, but has not supported a rent freeze. However, he has stated that he does not want a massive spike in evictions at the end of the crisis either. He wants landlords and renters to work out some sort of deal to pay back any rental arrears, but he has not released any specifics on how that would work. Presently, there is legislation under consideration in the State Assembly to provide rental relief for New Yorkers, but it is unclear whether such a law will be passed.

New Yorkers homeowners with mortgages have more specific relief than renters. Last month, New York Governor Andrew Cuomo has announced a directive to the New York Department of Financial Services that will require mortgage servicers to suspend mortgage payments for 90 days based on the financial hardship for borrowers who have loss of income due to the Coronavirus. According to Governor Cuomo, “we’re not exempting people from their mortgage payments, we’re just adjusting the mortgage to include those payments at the back end.” The directive also includes a 90-day grace period for borrowers making loan modification payments. Plus, the directive would ensure the suspension would not have a negative effect on borrowers’ credit reports. Mortgage borrowers should contact their servicers because not all mortgage servicers are regulated by the Department of Financial Services in New York. Servicers who are not regulated by NYDFS may have alternate programs to those listed above. While these measures will help mortgage borrowers, there is presently no relief to suspend rental payments that has been announced

0 notes

Text

Don't Let Fear of Bankruptcy Dissuade You

Possibly surprisingly, among the most aggravating developments in our continuous foreclosure crisis involves mortgage lending institutions' obstinate resistance to execute with a foreclosure in a prompt manner. The majority of typically, this situation arises in a Chapter 7 Personal bankruptcy in which the debtor has actually figured out that it is in his/her benefit to give up a home.