#send Bitcoin through the Cash App

Text

Can I Send $10000 on Cash App?

In the mystical realm of digital finance, where convenience and speed mesmerise, Cash App takes centre stage, captivating users with its seamless money exchanges. Yet, as adventurers in this digital landscape, the quest to unravel the boundaries of Cash App transactions beckons. So please continue reading to learn about the possibilities like “Can I send $3000 on Cash App?” and “Can I send $10000 on Cash App?” Together, we shall traverse the ethereal realms, discovering the power of verification and the wonders of Bitcoin transactions. So, fasten your seatbelts, for within this enchanting tale, the magic of Cash App awaits, ready to be unlocked.

Can I Send $3000 on Cash App?

Before venturing into the uncharted territories of digital transactions, let us decipher the enigmatic boundaries that shape your voyage. Cash App, a prudent guardian of financial safety, sets transaction limits to ensure a secure and compliant journey. The standard transaction limit glimmers at $250 per week for most travellers. Yet, fret not, for a world of elevated possibilities awaits through the veil of verification. By verifying your identity, you can elevate your limits, gifting yourself the power to send up to $7500 per week, casting a wider net in the ocean of financial freedom.

Can I Send $10000 on Cash App?

As we delve deeper into the magic of Cash App, the grand question of sending $10000 emerges like a celestial star. Fear not, for the answer resides in the dance of verification tiers. Cash App opens the door to elevated transaction limits by attaining higher verification levels. For those with linked bank accounts, the potential to send up to $7500 per transaction and up to $10000 within a week manifest like a shimmering dream, ready to be realized.

Can You Send $7000 through Cash App?

Amidst the digital tapestry of transactions, the threshold of $7000 unfolds as an intriguing midpoint. Venture forth, verified users with linked bank accounts may send up to $7000 in a single transaction through Cash App. Yet, as celestial harmonies dictate, let us not forget the cumulative limits within seven days. Align your intentions with the stars, as the weekly boundary of $10000 envelops your digital voyage.

How Long Does It Take to Verify Bitcoin on Cash App?

Cash App lures users towards the celestial realm of Bitcoin transactions as the cosmic symphony of digital finance continues. But before we plunge into the wonders of cryptocurrency, a mystical step beckons — the verification of Bitcoin on Cash App. Behold, the enchanting process unfolds as the validation of your Bitcoin wallet ensures security and authenticity. Traverse the ethereal path, guided by the glimmers of prompt validation and responsive support.

Cash App Bitcoin Wallet Verification

Unlock the wonders of Bitcoin on Cash App as the sacred ritual of wallet verification commences. Witness the alchemy of authenticity as your Bitcoin wallet is sanctified, bestowing you the treasures of digital currency. Set foot on this path by journeying to your Cash App profile’s “Bitcoin” tab. Follow the mystical prompts, revealing the secrets of verification as you unveil your identity for swift validation.

How to Send Bitcoin on Cash App?

With your Bitcoin wallet unfurled and enchanted, a thrilling odyssey awaits as you send Bitcoin through the Cash App. Embrace the simplicity and wonder of this adventure. Cast your spell upon the “Send Bitcoin” option, whisper the recipient’s Bitcoin address, and marvel as your transaction takes flight. Across the digital horizon, your Bitcoin shall soar, guided by the magic of Cash App.

0 notes

Text

Cash App The Pros, Cons and Features of The Popular Payment Service

#We want to help you make more informed decisions. Some links on this page — clearly marked — may take you to a partner website and may resul#see How We Make Money.#Cash App is a peer-to-peer payment service that’s catching on fast. Cash App grossed $385 million in 2020#representing a 212 percent increase in profits from the year before.#“Cash App is a relatively strong option for sharing cash and its other functionality. It’s not too different from Zelle#Paypal or Venmo#” says Ray Kimble#Founder and CEO of security firm Kuma LLC.#More and more Americans are using computers and smartphones for our banking needs. About 65 percent of Americans are expected to bank onlin#Cash App might do the trick#but there are some drawbacks. Here’s what to know about Cash App before signing up.#What Is Cash App?#Cash App is a mobile app-focused money transfer service. You can send and receive funds directly and quickly#like you could with PayPal or Venmo. But Cash App features a few other functions as well.#Aside from transferring money#Cash App will provide you with a bank account and a debit card#which you can use at any ATM. You can even invest in stocks and Bitcoin through the app. Some of these services are free#so there’s no guarantee that you’ll get your money back if something goes wrong.#Cash App has been around since 2013. It was originally called Square Cash#in reference to Square Inc.#Cash App’s parent company. Square Inc. was co-founded by Jack Dorsey of Twitter.#cash management#cashapp#cashforscraptrucks

1 note

·

View note

Text

Safely navigating DIY T – acquisition and health

A lot of the safety tips in terms of navigating online will come from this video, which is actually about safely navigating reproductive procedures post the overturning of Roe v Wade, but the safety advice works especially well here.

If any questions are not answered here please feel free to shoot me an ask.

Google Doc for easier navigation, says all the same stuff as here.

First off if you haven't already, check the transmasc guide on the DIY HRT Wiki, this post is made with the assumption you have already read that.

- General internet safety

When searching for and purchasing DIY T (especially injections), use the TOR browser with a VPN. This will keep your internet privacy as secure as possible, and the VPN will change your IP enough to make it look like it was accessed from a different location.

I personally use Proton, it’s a free VPN with an optional paid upgrade. The free version will connect you to either the US, Netherlands, or Japan.

Proton also has its own email service. Some of the sources where you can receive DIY T from may require you to make an account. I recommend using an email through Proton for this because it is end-to-end encrypted. If the site asks for a phone number just put in a repeating order of 0 to 9.

- Safety when purchasing T

Some sites where you can get DIY T will only allow the purchase through use of bitcoin or other forms of cryptocurrency. I know and understand we all have our thoughts on crypto and it’s use in the modern day, but unfortunately this is just how things are when navigating this.

The least scam-possible way I have seen when purchasing bitcoin, is to go through CashApp. They have an option to purchase and sell bitcoin in the app. I personally used this when buying DIY T to stock up in the case shit hits the fan. It’s pretty direct in purchasing and selling, sending is where it may get a bit tricky.

The source for DIY T listed on the DIY HRT Wiki will send you an email once you confirm your order, and you will be prompted to send the bitcoin through either a QR code or directly to a bitcoin address. I had a bit of trouble with the QR code, so what I had to do was type in the direct address. This will not bring up the company’s name, it will just allow the option when the address is fully typed.

If you are able to use a credit/debit card, what I recommend is using cash to purchase a prepaid visa and using that to order your T or otherwise online. This will make sure the transaction is not attached to your bank account.

- Receiving T safely

I highly recommend getting your DIY T sent to a PO Box, and not your home address. The United States Postal Service is in personal experience – really secure and discrete. And even if your package does not fit in your box, you will be given a slip to take to the counter, and they will give you your package there.

When ordering, try to order from a warehouse based in your country. This is to avoid the hassle of it going through customs. But if you must order abroad, it is still very unlikely that your order will be stopped in customs. They do not open packages to check them, instead they use an x-ray machine. If your order does get stuck in customs, it’s likely because there’s an issue with paperwork, and not the order itself.

- Administering T safely

When performing a T injection, make sure your supplies are sterile. Not just clean, sterile. Inspect the packaging of your syringes, needles, etc. If there is a tear or hole, do not use it.

For your T vials, yes, it is okay to draw from them multiple times. You can sterilize the vial by using isopropyl alcohol (rubbing alcohol) or an alcohol swab. You’re likely to not use the entire vial in one injection, so just keep it in a safe place, many even recommend keeping it refrigerated between doses.

Most if not all T vials will say to administer only via intramuscular, but you can still administer this subcutaneously. Even the vials I get through my doctor say For IM Use Only. It’s okay to administer it SubQ.

If you have trouble administering injections like I did for a while, I recommend this auto injector. You load the syringe into the device and press a button. The needle will go in and you just push the plunger down. This device is technically intended for insulin injections, but it works just fine for other injections.

My recommendation is to use an 18g needle to draw, and a 1/2in 25g needle to inject. This has left me with the least discomfort and uneasiness with injecting.

- Blood work

If you’re on T, it’s recommended you get your labwork done at least every 3 months.

As someone who’s been given the run around in the medical field for reasons unrelated to my transition, I forever recommend ordering labs from Request a Test. This is something that is very common to do, I even ordered my own ANA test when I had to get other labs done for my work. Request a Test does not take insurance unless it’s through an HSA card. When ordering from RaQ, you will be prompted to select which LabCorp or QuestDirect facility you want the order sent to. I personally recommend LabCorp, especially considering the QuestDirect Testosterone test is only available for males.

You will want to order at a minimum, a T level total test or a T level free test, and a CBC and CMP. The CBC is to help check for polycythemia, and CMP is to help check your liver function.

If you are worried about you ordering your T levels and that being found out, you can also order an at home testosterone test kit. The blood samples are collected through lancets similar to what is used by diabetic patients.

- Acquiring T gel

Unfortunately there are not a whole lot of sources to get T gel from. But that does not mean they do not exist.

I personally have been using this brand called Androgenesis in between my injections, and it has been working really well. I take 50mg of T every two weeks, and when I got my bloodwork done recently my levels were >400, even when it’s really close to my next shot day.

You can order Androgenesis either directly from their site, or you can order it off of amazon. NOTE, that the standard formula on amazon can not be sent to a PO Box or amazon locker, because the site classifies it as a “potentially dangerous substance”. However the enhanced formula can be sent to a PO box or amazon locker and it works the exact same way.

Another site is Predator Nutrition (odd name but bear with me).

I am still waiting for my order, but I’d recommend either their EpiAndrogel or their Alpha Gel depending on which one is in stock at time of purchasing.

I also recommend keeping an eye out on Need2BuildMuscle. Their gel is currently out of stock, but from what I’ve seen it works quite similarly to AndroGel.

As of 08/02/2024 (Aug. 2nd), I did find sources for packets of 1% Androgel, which you can find here and here

Please note the brand name Androgel sources are ones I unfortunately have not been able to verify personally so please proceed at your own discretion, but the sources *are* listed on hrtcafe.net.

- Who to tell?

No one *. If you doctor doesn’t know you’re on DIY T, do not bring it up. Don’t go talking about it all willy-nilly in the grocery store or whatnot.

*The exception is paramedics. If you are having a medical emergency, it’s probably a good idea to tell any emergency medical provider that you’re on testosterone so they can treat you properly. Remember, tell the cops nothing, tell the ambulance everything. The people on the ambulance are there to save your life, and I can guarantee they’ve dealt with circumstances far more severe than someone self-administering a specific hormonal medication. I say this as someone who’s on first aid at their place of work – and had to patch someone's hand after they were injured when I worked retail.

tagging @mythical-moonlight

34 notes

·

View notes

Text

Tips for Increasing Your ATM Withdrawal Limit on Cash App

Cash App ATM withdrawal limits are essential part of its mobile payment services. Cash App limits are imposed for both the platform and for the protection of its users. These limits impact how much one can withdraw each day or per week from Cash App. Cash App Card limits withdrawals to $1,000 per day and within a seven-day period. Moreover, there are also Bitcoin withdrawal limits on Cash App.

However, there are ways to increase these Cash App limits if needed. The first step to increasing your Cash App withdrawal limit is verifying your identity in the app. This involves providing information like your full legal name and date of birth, as well as your last four digits Social Security number. Verified accounts have higher withdrawal limitations. Apart from this Cash App withdrawal limits can also increase by sending and receiving payments frequently using the app. This shows responsible usage. This may result in a higher limit. So, let’s begin and learn more about it.

Understanding the Cash App ATM Withdrawal Limit

The Cash App ATM limit is the amount you can withdraw from an ATM with your Cash App card in each time. ATM limits are an important aspect of money transfers and prepaid debit cards including Cash App. They are set to protect customers while reducing fraud risks and complying with regulatory requirements.

There are several factors which decide your Cash App ATM withdrawal limits such as account verification status and your total transaction. For a basic Cash App account Cash App ATM withdrawal limit is $1,000 for each day. And this limit can be upgraded through identity verification.

Why Does Cash App Have Withdrawal Limits?

The main reason Cash App have limits for users account is for security and protection. There are several other reasons due to which Cash App have withdrawal limits which are mentioned below:

Cash App ATM withdrawal limit will prevent scammers from draining your account in one go if they gain access to it.

Cash App must comply with regulatory institutions and laws against money laundering.

Limiting Cash App withdrawals protects your account against excessive cash outflows, especially if the account is linked to a compromised card or bank.

What are Cash App ATM Withdrawal Limits?

Cash App ATM withdrawal limits are $1,000 per seven-day period. This limit only applies to ATM withdrawals, and does not affect any other Cash App functions, like sending money to others or making purchases using your Cash App Card.

The limits are calculated in a rolling manner, which means that the system does not track your withdrawals by calendar week, but rather over the last seven days. If you withdraw $200 from your account on Monday, then you can withdraw up to $850 within the following seven days. The Cash App limit will reset as soon as you reach the $200 withdrawal.

What are the Cash App BTC Withdrawal Limits?

Cash App has limits for both cash withdrawals and Bitcoin (BTC). Cash App BTC withdrawal limit is important for users who want to trade or store Bitcoin on the platform. The BTC withdrawal limit on Cash App is $2,000 per day and $5,000 per week. However, there are options available to increase these Bitcoin limits on Cash App by verifying your account and following other security measures.

How to Increase Your Cash App ATM Withdrawal Limit?

You do not need to panic or worry when you reach the standard limits for withdrawals on Cash App and need more money. You have the option to increase Cash App ATM withdrawal limits by verifying identity, or reaching out the customer support team. Verifying your Cash App account is the easiest way to increase your ATM withdrawal limits. This involves submitting personal information such as your name, date of birthday, and Social Security Number. Here is how to increase Cash App withdrawal limit:

Go the profile section by opening the Cash App on your mobile phone.

Then Verify Identity by entering details such as your name, address, date of birth and social security number.

Send the information to be reviewed.

Once Cash App account is verified successfully, you expect to see your ATM withdrawal limit gradually increase.

FAQ

What is the standard Cash App withdrawal limit?

The Cash App withdrawal limits for a basic unverified account are $310 per transaction and $1,000 per day.

How can I increase the Cash App ATM withdrawal limits?

You can increase your ATM withdrawal limits by verifying identity on Cash App. Moreover, you can contact the Cash App customer support team and request to increase these limits.

What is the maximum Cash App BTC withdrawal?

The maximum Cash App BTC withdrawal limit is $2000 for each day.

Can I switch to a Cash App for Business account for higher limits?

Yes, you can switch Cash App for Business account and get higher withdrawal and transaction limits.

2 notes

·

View notes

Text

5 Best Platform to B-u-y Verified Cash App Account In 2024: Top Picksnt

To B-u-y verified Cash App accounts in 2024, consider platforms like Trustpedia, AccountKing, VerifiedAccountsPro, SecureTrade, and DigitalMarketHub. These platforms offer reliable, secure, and verified accounts.

If you want to more information just knock us – Contact US

24 Hours Reply/Contact

Telegram: @Seo2Smm

Skype: Seo2Smm

WhatsApp: +1 (413) 685-6010

▬▬▬▬▬▬▬▬▬▬▬

Purchasing verified Cash App accounts can be a wise investment for individuals and businesses seeking seamless financial transactions. Verified accounts ensure security, trust, and legitimacy, making transactions smoother and more reliable. Trustpedia, AccountKing, VerifiedAccountsPro, SecureTrade, and DigitalMarketHub are top platforms offering such accounts.

They provide excellent customer support, ensuring a hassle-free B-u-ying experience. Verified accounts from these platforms undergo rigorous checks to guarantee authenticity and security. This reduces the risk of fraud and boosts confidence in digital transactions. As digital payments become increasingly vital, having a verified Cash App account from a trusted source is crucial for efficient financial management.

Cash App Account Basics

Understanding Cash App accounts is crucial before making any purchase. A Cash App account allows you to send and receive money. It's a fast, secure, and user-friendly platform. Let's dive into some essential aspects of a verified Cash App account.

What Is A Verified Account?

A verified Cash App account is one that has undergone identity verification. This process involves providing personal information, such as your full name, date of birth, and the last four digits of your Social Security Number (SSN). Verification ensures the authenticity of the account holder.

Verified accounts gain access to higher sending and receiving limits. They also enjoy enhanced security features. Verification is crucial for unlocking the full potential of Cash App.

Benefits Of Verification

There are several benefits to having a verified Cash App account:

Higher Limits: Verified accounts can send and receive more money.

Increased Security: Verification helps protect against fraud.

Access to Additional Features: You can use features like Cash App Card and direct deposit.

Improved Trust: Verified accounts are more trustworthy for transactions.

Let's look at these benefits in more detail:

Benefit

Description

Higher Limits

Send up to $7,500 weekly. Receive unlimited funds.

Increased Security

Verification reduces the risk of unauthorized access.

Access to Additional Features

Enjoy features like investing in stocks and Bitcoin.

Improved Trust

Verified accounts are more reliable for transactions.

By verifying your Cash App account, you can enjoy these advantages. This makes your experience seamless and secure.

Platform 1: Trustworthy Source

B-u-ying a verified Cash App account can be tricky. It is essential to choose a reliable platform. Trustworthy Source stands out as a top choice. This platform ensures accounts are safe and verified. Let's dive into the details of Trustworthy Source.

Overview

Trustworthy Source offers verified Cash App accounts. These accounts are secure and ready to use. The platform has a user-friendly interface. Customers can easily navigate and make purchases. The accounts come with full verification and are free from fraud.

Pros And Cons

Pros

Cons

Highly secure accounts

User-friendly platform

Full verification guaranteed

Excellent customer support

Higher cost than other platforms

Limited availability

Platform 2: Reliable Vendor

Finding the right platform to B-u-y a verified Cash App account is crucial. Reliable Vendor stands out for its trustworthiness and excellent customer support. Here’s what you need to know about this platform.

Overview

Reliable Vendor offers a user-friendly interface. Customers can easily navigate through their options. The platform specializes in providing verified Cash App accounts with high security standards. They have a dedicated support team to address customer queries promptly.

Pros And Cons

Pros

Cons

High security for all accounts

24/7 customer support available

User-friendly interface

Quick delivery of accounts

Higher prices compared to other platforms

Limited payment options

Reliable Vendor ensures that your account is safe and secure. Their 24/7 customer support ensures you get help whenever needed. The user-friendly interface makes the B-u-ying process simple. Quick delivery is another highlight, ensuring you get your account fast.

On the downside, Reliable Vendor tends to have higher prices. They also offer limited payment options, which might be inconvenient for some users.

Platform 3: Secure Marketplace

Finding a verified Cash App account can be tricky. Secure Marketplace is one of the best platforms for this. They offer a safe and easy way to B-u-y verified accounts. Let’s dive into the details.

Overview

Secure Marketplace is a trusted platform. They focus on security and customer satisfaction. They have been around for years. Many users trust them for B-u-ying verified Cash App accounts.

The platform uses advanced security measures. This ensures your transactions are safe. You can B-u-y accounts without worry. They also offer a variety of verified accounts. This gives you more options to choose from.

Pros And Cons

Pros

Cons

High security

Many account options

Easy-to-use interface

Customer support

Higher prices

Limited payment options

Pros:

High security: Advanced security measures protect your data.

Many account options: Choose from different types of verified accounts.

Easy-to-use interface: The platform is user-friendly.

Customer support: They offer 24/7 customer support.

Cons:

Higher prices: You may pay more for the security and options.

Limited payment options: Fewer payment methods are available.

Platform 4: Reputable Provider

Finding a trustworthy platform to B-u-y verified Cash App accounts can be tricky. That's where Reputable Provider stands out. Known for its reliability, this platform offers verified accounts with ease and security.

Overview

Reputable Provider has built a strong reputation in the market. It ensures all accounts are verified and ready for use. The platform's user-friendly interface makes the B-u-ying process simple. You can easily navigate through the options and make a purchase within minutes.

Reputable Provider also prioritizes customer service. They offer 24/7 support to assist you with any issues. This platform is ideal for those seeking a hassle-free experience.

Pros And Cons

Pros

Cons

High reliability: Accounts are verified and trustworthy.

User-friendly: Easy to navigate interface.

24/7 support: Customer service available round the clock.

Quick delivery: Fast account delivery.

Higher price: Slightly more expensive than others.

Limited promotions: Fewer discounts and deals.

Choosing Reputable Provider ensures you get a verified Cash App account quickly and securely. Although it may cost more, the peace of mind and ease of use are worth it.

Platform 5: Popular Choice

Looking for the best place to B-u-y verified Cash App accounts? Platform 5 is a popular choice among users. This platform offers reliable service, quick delivery, and competitive prices. Whether you're a beginner or an experienced user, Platform 5 can meet your needs.

Overview

Platform 5 has been a trusted name in the industry. Many users have praised its easy-to-use interface and customer support. The platform offers various packages to suit different budgets. You can choose from single accounts to bulk purchases. Each account is verified and ready to use.

Pros And Cons

Pros

Cons

Fast delivery - Accounts are delivered quickly.

Verified accounts - All accounts are verified.

Customer support - 24/7 customer support available.

Bulk discounts - Save money with bulk purchases.

Higher cost - Prices may be higher than other platforms.

Limited payment methods - Few payment options available.

Occasional delays - Delivery may be delayed during peak times.

Comparing The Platforms

Choosing the best platform to B-u-y a verified Cash App account in 2024 can be tough. Each platform has different features. Here, we will compare them based on two key aspects: pricing and customer support.

Pricing

Pricing is a crucial factor. It affects your budget and the value you get. Below is a table comparing the prices of the top five platforms:

Platform

Price Range

Additional Fees

Platform A

$50 - $70

No

Platform B

$55 - $75

Yes, $5 processing fee

Platform C

$60 - $80

No

Platform D

$65 - $85

Yes, $10 verification fee

Platform E

$70 - $90

No

As shown, prices vary. Some platforms charge extra fees for processing or verification. It's important to consider these costs to avoid surprises.

Good customer support is essential. It ensures a smooth B-u-ying experience. Here's a comparison of the customer support services offered by each platform:

Platform A: 24/7 live chat, email support

Platform B: Email support, phone support during business hours

Platform C: 24/7 live chat, email support, dedicated account manager

Platform D: Email support, live chat during business hours

Platform E: 24/7 live chat, phone support, email support

Platforms offering 24/7 support are usually more reliable. They provide instant help in case of issues. An account manager can also be very helpful.

Security Considerations

Security Considerations are crucial when purchasing verified Cash App accounts. You must know how platforms protect your data and prevent fraud.

Data Protection

Data protection ensures your sensitive information stays safe. Reliable platforms use advanced encryption. This keeps your details secure from hackers.

Look for platforms with SSL certificates. SSL encrypts data during transmission. It prevents unauthorized access to your personal information.

Check if the platform follows GDPR or other data protection regulations. Compliance shows commitment to user security.

Fraud Prevention

Fraud prevention measures protect you from scams. Reputable platforms use verification processes. These processes confirm seller authenticity.

Platforms should also have dispute resolution systems. These systems help resolve issues quickly. This ensures you get what you paid for.

Read user reviews and ratings. Positive feedback often indicates a trustworthy platform. Avoid platforms with many negative reviews.

User Reviews

When B-u-ying verified Cash App accounts, user reviews are crucial. They provide insights into the platforms' reliability and customer satisfaction. Knowing what others think can help you make an informed decision.

Testimonials

Many users share their experiences online. Reading testimonials can give you a clear picture of a platform's trustworthiness. Here are some platforms with notable testimonials:

Platform A: Users praise its fast delivery and excellent customer service.

Platform B: Customers appreciate the easy verification process and responsive support.

Platform C: Known for its competitive pricing and reliable accounts.

Ratings

Ratings provide a quick way to gauge user satisfaction. High ratings usually indicate a trustworthy platform. Below is a table summarizing the average ratings of the top platforms:

Platform

Average Rating

Number of Reviews

Platform A

4.8/5

500+

Platform B

4.6/5

300+

Platform C

4.7/5

450+

High ratings and positive reviews are good indicators. Look for platforms with consistent feedback for the best experience.

If you want to more information just knock us – Contact US

24 Hours Reply/Contact

Telegram: @Seo2Smm

Skype: Seo2Smm

WhatsApp: +1 (413) 685-6010

▬▬▬▬▬▬▬▬▬▬▬

B-u-ying Guide

Purchasing a verified Cash App account can be tricky. This guide will help you make an informed decision. Here are the key steps and factors to consider.

Steps To Purchase

Research: Look for reputable platforms. Read reviews and ratings.

Contact: Reach out to the seller. Ask for account details.

Verify: Ensure the account is verified. Check for authenticity.

Payment: Use secure payment methods. Avoid direct transfers.

Receipt: Get a transaction receipt. Keep it for records.

What To Look For

Reputation: Choose platforms with positive feedback. Avoid new or unknown sellers.

Verification: Ensure the account is verified. Ask for proof.

Customer Support: Look for platforms with reliable support. Quick response times are a plus.

Refund Policy: Check for a clear refund policy. It ensures a safeguard against scams.

Pricing: Compare prices across platforms. Avoid unusually low prices.

Legal Aspects

B-u-ying a verified Cash App account can be tricky. Understanding the legal aspects is essential. This ensures you stay compliant with regulations and terms of service.

Terms Of Service

Every platform has its own Terms of Service. It's crucial to read them. Violating these terms can lead to account suspension. Ensure the platform's rules align with your needs. Some platforms may have strict verification processes. Others might be more lenient. Always be aware of what you're agreeing to.

Compliance

Compliance is key when B-u-ying verified Cash App accounts. Ensure the platform follows legal guidelines. This includes anti-money laundering (AML) and know your customer (KYC) regulations. Not complying can result in severe penalties. Always verify the platform's compliance status. Look for platforms that offer transparency in their processes.

Platform

Compliance Measures

Platform A

AML, KYC, Regular audits

Platform B

AML, KYC

Platform C

AML

Read the Terms of Service carefully.

Ensure the platform complies with AML and KYC regulations.

Look for platforms with regular audits.

Staying informed about legal aspects ensures a safer transaction. Always prioritize legality and compliance.

Credit: www.shopify.com

Payment Methods

Finding the best platform to B-u-y verified Cash App accounts involves understanding payment methods. Each platform offers various ways to pay. This ensures flexibility and ease of purchase.

Accepted Payments

It's essential to know what payment options are available. Here’s a list of common payment methods accepted by top platforms:

Credit/Debit Cards: Most platforms accept major cards like Visa and MasterCard.

PayPal: A secure and widely used online payment method.

Cryptocurrency: Bitcoin and Ethereum are common options for anonymous transactions.

Bank Transfers: Direct transfer from your bank account.

Mobile Payments: Apple Pay, Google Wallet, and other mobile payment apps.

Each payment method has its benefits. Choose the one that suits your needs and preferences.

Transaction Safety

Safety is crucial when B-u-ying verified Cash App accounts. Here are some safety tips:

SSL Encryption: Ensure the platform uses SSL encryption. This protects your payment details.

Secure Payment Gateways: Use platforms with trusted payment gateways like PayPal or Stripe.

Two-Factor Authentication: Enable two-factor authentication for an extra layer of security.

Reputable Platforms: Choose platforms with positive reviews and a good reputation.

These steps help ensure your transaction is secure and your personal information is protected.

Customer Support

Customer support is crucial when B-u-ying verified Cash App accounts. Knowing you can get help quickly is important. Let's explore the key aspects of customer support.

Availability

Availability of customer support matters a lot. Some platforms offer 24/7 support. Others may have limited hours. Check the support hours before choosing a platform. Here's a quick look at the availability:

Platform

Support Hours

Platform A

24/7

Platform B

9 AM - 5 PM (Weekdays)

Platform C

24/7

Platform D

10 AM - 6 PM (Weekdays)

Platform E

24/7

Quality Of Service

The quality of service is equally vital. It determines how effectively your issues get resolved. Look for platforms with high ratings and positive reviews. Here are some key points to consider:

Response Time: Quick responses indicate good service.

Knowledgeable Staff: Support staff should know the product well.

Communication Channels: Multiple channels like chat, phone, and email are a plus.

Choose a platform with excellent customer support. It ensures a smooth B-u-ying experience.

Return Policies

Before B-u-ying a verified Cash App account, check the return policies. These policies ensure a safe and worry-free purchase. Understanding the return policies helps you avoid any unwanted surprises.

Refund Process

The refund process is crucial if you face issues with your purchase. Each platform has its own process. Below is a comparison of refund processes across different platforms:

Platform

Refund Time

Contact Method

Platform A

3-5 Business Days

Email Support

Platform B

1-2 Business Days

Live Chat

Platform C

7-10 Business Days

Phone Support

Conditions

Each platform sets conditions for returns. Knowing these conditions helps you meet the requirements and get your money back. Common conditions include:

Account not activated

Account details mismatch

Account banned or restricted

Always read the terms and conditions before purchasing. This ensures you are aware of all necessary steps to qualify for a return.

Alternatives

If you want to B-u-y verified Cash App accounts, there are many platforms to choose from. Each offers unique features and benefits.

Other Platforms

Aside from the top 5 platforms, there are other places to consider. Some offer competitive prices, while others promise fast delivery.

Fiverr

eBay

Local Classifieds

Pros And Cons

Not all platforms are created equal. Each has its strengths and weaknesses.

Platform

Pros

Cons

Fiverr

Wide range of sellers

Competitive prices

Quality varies

Scam risk

eBay

Trusted platform

B-u-yer protection

High fees

Slow delivery

Local Classifieds

No fees

Direct deals

High scam risk

No B-u-yer protection

Credit: www.linkedin.com

Future Trends

As we move into 2024, the demand for verified Cash App accounts will rise. Users seek secure and efficient transactions. Platforms will evolve to meet these needs.

Market Predictions

The market for verified Cash App accounts will grow. Experts predict a 30% increase by the end of 2024. This growth is due to the rising popularity of digital payments.

More people will prefer verified accounts for their security features. Platforms that offer these accounts will see a surge in users. Here are some key predictions:

Increased demand for verified accounts

More platforms offering enhanced security features

Growth in the number of users adopting digital payments

Technological Advances

Technological advances will shape the future of B-u-ying verified Cash App accounts. Expect to see more AI and blockchain integration. These technologies will enhance security and user experience.

Here are some anticipated technological improvements:

AI-driven verification processes

Blockchain for secure transactions

Improved user interface for easier navigation

These advances will make B-u-ying verified accounts more reliable. Users will benefit from faster and safer transactions.

Frequently Asked Questions

How Do I Create A Verified Cash App Account?

To create a verified Cash App account, download the app, sign up, enter personal details, link your bank, and verify your identity.

How Many Verified Cash App Accounts Can I Have?

You can have one verified Cash App account per phone number and email. Multiple accounts aren't allowed.

What Are The Best Platforms To B-u-y Verified Cash App Accounts?

Several platforms offer verified Cash App accounts. Some top options include AccountKings, B-u-yVCC, and AccsMarket. These platforms provide verified accounts to ensure safety and reliability.

Is It Legal To B-u-y Verified Cash App Accounts?

B-u-ying verified Cash App accounts is a gray area legally. Always check the terms of service and local laws. Purchasing accounts can violate platform rules.

Conclusion

Choosing the right platform to B-u-y a verified Cash App account is crucial. The options listed ensure security and reliability. Make an informed decision to enjoy hassle-free transactions. Always prioritize platforms with good reviews and customer support. Your financial safety depends on it.

3 notes

·

View notes

Text

Managing and Increasing Cash App Withdrawal Limits: Ultimate Guide 2024

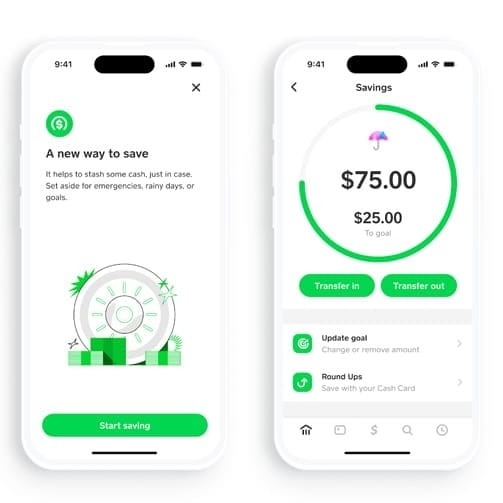

Cash App has become a popular choice for users looking to manage their money digitally. With its convenient features, such as sending and receiving money, buying Bitcoin, and using a Cash Card for everyday transactions, Cash App has streamlined the way we handle our finances. However, like many financial services, Cash App imposes certain withdrawal limits that users must navigate. Understanding these limits and knowing how to increase them can significantly enhance your Cash App experience.

Understanding Cash App Withdrawal Limits

Before diving into how to manage and increase your Cash App withdrawal limits, it's crucial to understand what these limits are and how they work. Cash App places restrictions on the amount of money you can withdraw from your account, whether through an ATM, Bitcoin transaction, or transferring funds to a linked bank account. Here's a breakdown:

Cash App ATM Withdrawal Limit: The Cash App card ATM withdrawal limit is $310 per transaction, $1,000 per 24-hour period, and $1,000 per week. This limit applies to any ATM that accepts Visa, as the Cash Card is a Visa debit card.

Cash App Withdrawal Limit Per Day: In addition to ATM withdrawals, Cash App sets a general withdrawal limit of $2,500 per day for transfers to a linked bank account.

Cash App Bitcoin Withdrawal Limit: For those interested in cryptocurrencies, Cash App allows Bitcoin withdrawals, but it caps the limit at $2,000 worth of Bitcoin per 24-hour period and $5,000 per 7-day period.

Cash App Withdrawal Limit Per Week: Depending on the type of transaction, there are also weekly limits. For example, the ATM withdrawal limit for the Cash App card is set at $1,000 per week.

Cash App Card Withdrawal Limit: This is synonymous with the ATM withdrawal limit, meaning you can withdraw up to $1,000 per week using your Cash Card at any ATM.

How to Manage Your Cash App Withdrawal Limits?

Managing your Cash App withdrawal limits involves understanding when and how you use your Cash Card and the types of transactions you regularly perform. Here are a few strategies to help you manage within your limits:

Plan Your Withdrawals: If you know you have significant expenses coming up, plan your withdrawals accordingly. Since there is a daily and weekly cap, withdrawing small amounts regularly rather than one large amount might help manage cash flow better.

Use Cash Back at Point of Sale: Instead of solely relying on ATMs, you can use your Cash Card for purchases and opt for cash back at the register. This option often doesn't count against your ATM withdrawal limit.

Monitor Your Transactions: Keep an eye on your Cash App transactions to avoid reaching your withdrawal limit unintentionally. The app provides a history of all transactions, making it easy to track your spending.

How to Increase Your Cash App Withdrawal Limits?

While Cash App sets certain withdrawal limits, there are ways to request higher limits, especially for users who need more flexibility.

Verify Your Account: The first step to increase Cash App withdrawal limit is verifying your account. This involves providing personal information such as your full name, date of birth, and the last four digits of your Social Security number. Verified accounts typically have higher limits.

Request a Limit Increase: If you find the default limits restrictive even after account verification, you can request a higher limit through Cash App support. Be prepared to provide additional identification or documentation that proves your need for higher limits.

Increase Cash App Bitcoin Withdrawal Limits: For users interested in cryptocurrencies, increasing Bitcoin withdrawal limits also requires account verification. Make sure your account is fully verified and you have set up two-factor authentication for added security.

Upgrade Your Cash Card: Cash App offers different types of Cash Cards. Upgrading to a different tier can sometimes come with higher withdrawal limits. Explore the Cash App settings or contact support to learn about available upgrades.

Build a Good Transaction History: Regularly using Cash App responsibly can help build a positive transaction history. Over time, Cash App may increase your limits based on your consistent usage and account activity.

FAQs About Cash App Withdrawal Limits

Q1: What is the Cash App withdrawal limit per day?

A1: The Cash App withdrawal limit per day for ATM transactions is $1,000. However, for bank account transfers, the daily limit can be up to $2,500.

Q2: How can I increase my Cash App withdrawal limit?

A2: To increase your Cash App withdrawal limit, verify your account by providing personal information, request a limit increase through customer support, or consider upgrading your Cash Card.

Q3: What is the Cash App ATM withdrawal limit?

A3: The Cash App ATM withdrawal limit is $310 per transaction, $1,000 per 24-hour period, and $1,000 per week.

Q4: Can I increase my Bitcoin withdrawal limit on Cash App?

A4: Yes, you can increase your Bitcoin withdrawal limit by verifying your account and ensuring you have set up two-factor authentication.

Q5: Does Cash App have a weekly withdrawal limit?

A5: Yes, Cash App has a weekly withdrawal limit for ATM transactions of $1,000 and a Bitcoin withdrawal limit of $5,000.

Q6: What happens if I exceed my Cash App withdrawal limit?

A6: If you exceed your Cash App withdrawal limit, any additional withdrawal attempts will be declined until the limit resets after 24 hours or one week, depending on the limit.

By understanding your Cash App withdrawal limits and knowing how to manage and increase them, you can maximise your use of this versatile financial tool. Whether you need more flexibility with ATM withdrawals or Bitcoin transactions, following these steps will ensure you stay within your limits and make the most of your Cash App experience.

3 notes

·

View notes

Text

Venmo vs Cash App vs Zelle: Are Mobile Payment Apps Safe?

Venmo

Venmo, owned by PayPal, is widely used for peer-to-peer payments. The app allows users to send and receive money quickly, but its social feed feature, which publicly displays transactions, can be a privacy concern. However, Venmo has robust security measures in place, including encryption, multifactor authentication (MFA), and fraud detection systems. Users are encouraged to set their transactions to private and regularly monitor their account for unauthorized activity.

Cash App

Cash App, developed by Square, is another popular choice for sending and receiving money. It offers additional features like investing in stocks and Bitcoin. Cash App employs encryption and MFA to protect user data. However, it has faced criticism for its limited customer support, which can be problematic if your account is compromised. Users should enable security features like PIN entry and Face ID to enhance protection.

Zelle

Zelle is integrated directly with many major banks, allowing users to send money quickly without needing to create a separate account. Since Zelle operates through your bank, it benefits from the financial institution’s security protocols, including encryption and fraud monitoring. However, Zelle doesn’t offer purchase protection, meaning you should only use it to send money to people you trust.

Safety Tips

Enable Security Features: Use MFA, PIN codes, and biometric authentication where available.

Be Cautious with Public Wi-Fi: Avoid sending money over unsecured networks.

Verify Recipients: Double-check the recipient’s details before sending funds to prevent sending money to the wrong person.

Monitor Accounts Regularly: Keep an eye on your transactions for any unauthorized activity.

In conclusion, Venmo, Cash App, and Zelle all offer secure payment methods, but they are not without risks. By following best practices and utilizing the security features provided, you can use these mobile payment apps safely and confidently.

2 notes

·

View notes

Text

How to Increase Your ATM Withdrawal Limits on Cash App?

In today’s digital age, mobile payment apps like Cash App have transformed the way we handle our finances. Whether you're sending money to friends, paying bills, or even buying Bitcoin, Cash App offers a versatile platform that makes managing your money convenient and straightforward. One of the standout features of Cash App is its Cash Card, a physical debit card that’s linked directly to your Cash App balance, allowing you to withdraw cash from ATMs just like you would with a traditional bank card.

However, as with any financial service, there are certain limits in place to ensure security and prevent fraud. If you've ever needed to withdraw a substantial amount of cash, you might have found yourself wondering, "How much can I withdraw from my Cash App at the ATM?" This blog will dive into the specifics of Cash App’s ATM withdrawal limits, how you can manage these limits, and even how to potentially increase them.

What is the Cash App ATM Limit?

When using your Cash App Card at an ATM, it's crucial to be aware of the withdrawal limits set by Cash App. These limits are in place to protect your account from unauthorised access and to manage the flow of funds within the Cash App ecosystem.

Daily ATM Withdrawal Limit: The standard Cash App ATM withdrawal limit per day is $310. This means that within any 24 hours, you are restricted to withdrawing up to $310 from any ATM.

Weekly ATM Withdrawal Limit: In addition to the daily limit, Cash App also imposes a weekly ATM withdrawal limit. Over a rolling seven-day period, you can withdraw a maximum of $1,000 from ATMs using your Cash Card.

Monthly ATM Withdrawal Limit: For those who need more flexibility, the Cash App monthly withdrawal limit is capped at $1,250. This limit applies to the total amount you can withdraw over 30 days.

How to Check Your Cash App ATM Limit?

Before heading to the ATM, it’s a good idea to check your current withdrawal limits. You can do this easily through the Cash App interface:

Open the Cash App on your mobile device.

Navigate to your profile by tapping the profile icon on the home screen.

Select 'Limits' to view your current withdrawal limits.

This section will show you your daily, weekly, and monthly limits, as well as how much you have left to withdraw within those periods.

How to Increase ATM Limit on Cash App?

While Cash App's default withdrawal limits are designed to protect your account, there may be situations where you need to access more cash than the current limits allow. Fortunately, there are ways to increase Cash App ATM limit.

The most straightforward way to increase your ATM withdrawal limit is by verifying your identity within the Cash App. This process involves providing Cash App with additional personal information, which in turn enhances your account’s security and may lead to higher withdrawal limits.

Open Cash App and go to your profile.

Select "Personal" and enter your full name, date of birth, and the last four digits of your Social Security Number (SSN).

Follow any additional prompts to complete the verification process.

Once your identity is verified, Cash App may increase your withdrawal limits, although the exact increase will depend on your account’s history and usage.

2. Contact Cash App Support

If you find that you still need to withdraw more than your current limit allows, you can reach out to Cash App’s customer support team. Be prepared to explain why you need a higher limit, such as for travel, business purposes, or other significant expenses. While there’s no guarantee that your request will be approved, Cash App does review these requests on a case-by-case basis.

Tips for Managing Your Cash App ATM Withdrawals

Given the withdrawal limits, it’s essential to manage your Cash App ATM withdrawals effectively. Here are some strategies to help you make the most of your Cash App account:

Plan Ahead: If you know you’ll need more cash than your daily or weekly limits allow, plan your withdrawals in advance. This might involve spacing out your withdrawals over several days to ensure you stay within your limits.

Use Bank Transfers: If your withdrawal needs exceed Cash App’s ATM limits, consider transferring funds directly to a linked bank account. From there, you can use your bank’s ATM services to withdraw larger sums of cash.

Monitor Your Spending: Keep track of your ATM withdrawals and other spending to avoid hitting your limits unexpectedly. Cash App’s interface makes it easy to view your transaction history and current limits, so you’re always informed.

FAQs: Understanding Cash App ATM Limits

Q1: How much can you withdraw from Cash App at an ATM?

A: The standard daily ATM withdrawal limit on Cash App is $310. You can withdraw up to $1,000 per week and $1,250 per month.

Q2: How can I increase my Cash App ATM withdrawal limit?

A: You can increase Cash App ATM withdrawal limit by verifying your identity within the app. This process involves providing additional personal information, such as your full name, date of birth, and the last four digits of your SSN.

Q3: What is the maximum ATM withdrawal limit on Cash App?

A: The Cash App max withdrawal limit is $310 per day, $1,000 per week, and $1,250 per month.

Q4: Is there a way to bypass the ATM withdrawal limit on Cash App?

A: While you can’t bypass the limits directly, you can manage your withdrawals by planning ahead and using bank transfers to access larger amounts of cash.

Q5: What happens if I try to withdraw more than the Cash App ATM limit?

A: If you attempt to withdraw more than your Cash App ATM limit, the transaction will be declined. You’ll need to wait until your limits reset before attempting another withdrawal.

Q6: Can I withdraw Bitcoin from a Cash App ATM?

A: No, you cannot withdraw Bitcoin directly from a Cash App ATM. Cash App allows you to buy, sell, and transfer Bitcoin within the app, but ATM withdrawals are only available for cash linked to your Cash App balance.

Q7: How does Cash App determine my ATM withdrawal limits?

A: Cash App’s ATM withdrawal limits are standardized for all users but can be increased through identity verification or by contacting customer support.

Q8: Do Cash App ATM withdrawal limits reset at a specific time?

A: Yes, Cash App daily withdrawal limits reset every 24 hours from the time of your last withdrawal. Weekly and monthly limits reset on a rolling basis.

Q9: Are there fees associated with Cash App ATM withdrawals?

A: Cash App may charge fees for ATM withdrawals, depending on the ATM network you use. You can avoid some of these fees by using in-network ATMs or by receiving direct deposits into your Cash App account.

Q10: How can I check my current Cash App ATM withdrawal limit?

A: To check your current Cash App ATM withdrawal limit, open the Cash App, navigate to your profile, and select the 'Limits' option. This will display your daily, weekly, and monthly limits.

Conclusion

Understanding your Cash App ATM withdrawal limits is essential for managing your finances effectively. Whether you’re withdrawing cash for personal use, business, or travel, knowing these limits can help you avoid declined transactions and ensure you have access to the funds you need.

By verifying your identity and planning your withdrawals strategically, you can make the most of your Cash App experience without running into unexpected limitations. If you ever find that your current limits aren’t sufficient, don’t hesitate to reach out to Cash App’s support team for assistance.

#cash app atm withdrawal limit#increase cash app withdrawal limit#cash app atm withdrawal limit per day#cash app daily atm withdrawal limit#cash app withdrawal limit#cash app card atm withdrawal limit per week

2 notes

·

View notes

Text

How Weekly Limits Affect Your Cash App Usage

Cash App has become a versatile tool for managing finances, making transactions, and trading cryptocurrencies. As with many financial platforms, Cash App imposes various limits on transactions to ensure security and compliance with regulations. One common question among users is whether Cash App has a weekly limit on transactions and, if so, how to manage or increase it.

Understanding Cash App Limits

Cash App imposes different limits based on the type of transaction and the user's account verification status. These limits are designed to protect users from fraud and to comply with financial regulations. Cash App weekly limits can vary for different types of transactions, including sending money, withdrawing funds, and buying or selling Bitcoin.

What are the different Cash App Weekly Limits?

**1. Sending Money

Standard Limits: For unverified accounts, Cash App typically allows you to send up to $250 per week. Once your account is verified, this limit can increase significantly.

Increased Limits: Verified accounts can send up to $7,500 per week. This higher limit is part of Cash App's efforts to provide greater flexibility for users who have completed the necessary identity verification steps.

**2. Receiving Money

Standard Limits: Cash App does not generally impose a specific weekly limit on receiving money. However, there may be restrictions based on the total amount received in a given period or based on your overall account activity.

**3. Bitcoin Transactions

Weekly Limits: Cash App sets limits on Bitcoin transactions, including buying, selling, and withdrawing Bitcoin. The specific limits can vary and are subject to change based on market conditions and account verification.

How to Increase Your Cash App Weekly Limit?

To increase Cash App limit, follow these steps:

Verify Your Identity: Ensure that your account is fully verified by providing the necessary documents, such as a government-issued ID, and completing the selfie verification process.

Link Your Bank Account: Linking a bank account enhances your account's credibility and can increase transaction limits.

Use Direct Deposit: Setting up direct deposit can increase your transaction limits as it adds another layer of financial verification.

Contact Cash App Support: If you need a higher limit than what's automatically available, you can contact Cash App support to request an increase. Be prepared to provide additional information or documentation as requested.

Frequently Asked Questions (FAQs)

1. Does Cash App have a weekly limit on sending money?

Yes, Cash App has a weekly limit on sending money. For unverified accounts, the limit is typically $250 per week. Verified accounts can send up to $7,500 per week.

2. How can I increase my Cash App weekly limit?

To increase Cash App weekly limit, you should verify your identity, link a bank account, and consider using direct deposit. If necessary, contact Cash App support for further assistance.

3. Is there a limit on receiving money through Cash App?

Cash App generally does not impose a specific weekly limit on receiving money. However, there may be restrictions based on overall account activity and transaction history.

4. Are there limits on Bitcoin transactions in Cash App?

Yes, Cash App has limits on Bitcoin transactions, including buying, selling, and withdrawing Bitcoin. Cash App Bitcoin limits can vary and are influenced by your account verification status and other factors.

5. How do I check my current Cash App limits?

To check your current Cash App limits, open the app, go to the "Banking" tab, and review your account settings and limits. You can also contact Cash App support for detailed information on your specific limits.

By understanding and managing these limits, you can optimise your use of Cash App and make the most of its features for your financial needs.

2 notes

·

View notes

Text

B-u-yVerified Cash App Accounts

B-u-y Verified Cash App Cash App Accounts

Purchasing a verified Cash App Cash App account ensures secure transactions and reliable service. B-u-yers must navigate a trusted platform offering such a service.

If you want to more information just knock us – Contact US

24 Hours Reply/Contact

Telegram: @Seo2Smm

Skype: Seo2Smm

WhatsApp: +1 (413) 685-6010

▬▬▬▬▬▬▬▬▬▬▬

In today's digital age, the ability to transfer money quickly and safely is paramount for both personal and business transactions. A verified Cash App Cash App account provides this convenience with an added layer of security, making it an attractive option for users who prioritize their financial safety online.

Why Verified Cash App Cash App Accounts Matter

The moment you decide to use Cash App Cash App for transactions, you must consider verification. A verified Cash App Cash App account stands as a shield. It secures your money and personal data.

The Need For Verification

Verification is the first step to a safe experience. With a verified account, you unlock higher limits. You get access to additional features, too. Verification proves your identity, building trust with others.

Increased sending and receiving limits

Access to Bitcoin trading

Direct deposit eligibility

Risks Of Unverified Accounts

Using an unverified account is risky.

Risk Factor

Consequence

Low Transaction Limits

Limited Money Flow

No Direct Deposits

Lack of Essential Services

Risk of Closure

Loss of Funds

Susceptibility to Fraud

Financial Threat

Unverified accounts tempt thieves. They invite scams and frauds. Lower limits can also disrupt your spending. Lack of verification may lead to account closure, trapping your funds.

Getting Started With Cash App

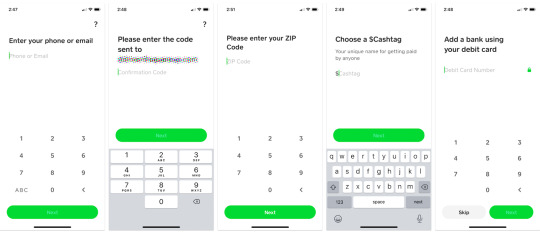

Embracing the ease of online transactions gets even easier with Cash App. If you're trying to step up your financial game with convenience and security, getting started with a verified Cash App Cash App account is a smart move. We'll walk you through all you need to know, from initial setup to exploring those nifty features that make Cash App Cash App a go-to financial tool for many.

Initial Setup

Setting up your Cash App Cash App account is as simple as pie. Download the app, enter your basic information, and you're halfway there. Follow these steps for a smooth start:

Download Cash App Cash App from your app store.

Open the app and enter your mobile number or email.

Enter the code sent to your phone or email.

Add your bank account for funding your Cash App Cash App balance.

Choose a unique $Cashtag, your identifier for transactions.

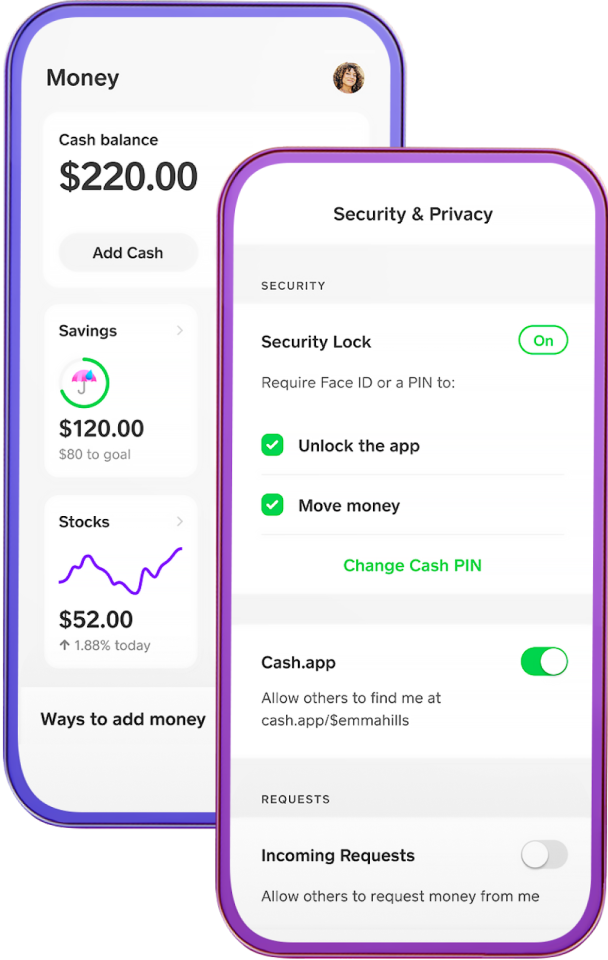

Account Features

Your verified Cash App Cash App account comes with features that make money management a breeze. Let's check out the key benefits:

Feature

Description

Direct Deposit

Get paychecks delivered right into your account.

Instant Transfers

Send and receive money at lightning speed.

Cash Card

A personalized debit card for your spending needs.

Investment Options

B-u-y, sell, and hold Bitcoin or stocks, all from the app.

Free ATM withdrawals with direct deposits.

Customize your card's look for extra flair.

Robust security to keep your transactions safe.

Verification Process For Cash App

Cash App Cash App requires users to complete a verification process. This process keeps accounts secure. Verified accounts unlock additional features. Users can send and receive more money with a verified account. Get ready to enjoy the full Cash App Cash App experience!

Step-by-step Guide

Follow these simple steps to verify your Cash App Cash App Account:

Open your Cash App.

Tap the profile icon on your home screen.

Select Personal.

Enter your details: full name, date of birth, and the last 4 digits of your SSN.

Provide any additional information if asked.

Wait for the confirmation. This can take 24-48 hours.

Required Documentation

To complete verification, you need:

A government-issued ID.

Your Social Security Number (SSN).

Keep these documents handy for a smooth verification process.

Benefits Of A Verified Account

Many choose to B-u-y a verified Cash App Cash App account for good reasons. A verified status can transform how you use the platform.

Increased Limits

Verification bumps up your transaction limits. Unverified users hit limits quickly. Verified members enjoy more freedom.

Send more money weekly.

Withdraw higher amounts from ATMs.

No cap on receiving funds.

Feature

Unverified Account

Verified Account

Sending Limit

$250/week

$7,500/week

ATM Withdrawal

$250/day

$1,000/day

Wider Access To Features

Verification unlocks exclusive features. Your Cash App Cash App experience gets better.

Direct deposit payroll straight to Cash App.

Get a free custom Cash Card for spending.

Borrow money with Cash App Cash App Loan if eligible.

Verified users can also trade Bitcoin and stocks. This makes investing simple and accessible.

B-u-y Verified Cash App Cash App Accounts

Purchasing A Verified Cash App Cash App Account

Purchasing a verified Cash App Cash App account offers convenience for anyone wanting hassle-free transactions. It's crucial to follow the correct steps and know where to B-u-y. Awareness about potential scams is equally important to ensure a secure purchase.

Where To B-u-y

Finding a reputable source is the first step in acquiring a verified Cash App Cash App account. Look for platforms with positive feedback and a strong customer service record. Popular online marketplaces or fintech forums can be good starting points.

Check the marketplace's authenticity before any transaction.

Look for vendors who provide proof of verification.

Ensure they offer after-sale support.

Avoiding Scams

Stay vigilant to avoid falling victim to scams. Always perform due diligence before committing to a purchase. Remember these key tips:

Do not share personal information unless you trust the source.

Never make payments outside the official marketplace platform.

Ensure communication is documented for future reference.

Search for vendor reviews and feedback online.

Safety Measures For Transactions

When dealing with financial transactions, safety is key. Users often seek out verified Cash App Cash App accounts for increased security. Let's explore essential transaction safety measures.

Secure Payment Methods

Choosing the right payment method is crucial for safe transactions. Cash App Cash App offers several secure options:

Bank transfers – Link your account for easy transactions.

Debit cards – Use your card for swift payments.

Bitcoin – Benefit from the cryptocurrency option.

Enable two-factor authentication on your account. This step adds an extra layer of security.

Protecting Personal Information

Keep your personal details safe. Here are some methods:

Avoid sharing sensitive information like PINs or SSN.

Regularly update your app for the latest security features.

Monitor account activity. Report any suspicious behavior.

Remember, maintaining the confidentiality of your data helps prevent unauthorized access.

Prices For Verified Accounts

When shopping for a verified Cash App Cash App account, you'll notice diverse pricing options. These prices reflect the level of verification, the age of the account, and any additional features. Let's delve into what you might expect to pay and how to make an informed choice.

Understanding Market Rates

Understanding Market Rates

Market variations affect account prices. Seasoned accounts command higher prices. Embarking on a purchase starts with market rate awareness.

The table below provides a snapshot of current verified Cash App Cash App account rates:

Account Type

Price Range

Basic Verified

$50-$100

Premium Verified

$100-$200

Prices scale with features like transaction limits and support services. Keep this perspective to gauge offerings.

Comparing Sellers

Comparing Sellers

Compare sellers for the best deal. Evaluate their reputation, account quality, and customer feedback.

Reputation speaks volumes. Opt for sellers with proven track records.

Account Quality means fewer hurdles down the line. Seek high-quality accounts.

Customer Feedback reflects seller reliability. Positive reviews indicate trustworthy sellers.

Engage with sellers transparent about their prices and services. This approach prevents unforeseen expenses.

B-u-y Verified Cash App Cash App Accounts

Setting Up Your Purchased Account

Welcome to the ultimate guide on setting up your newly purchased verified Cash App Cash App account. Purchasing a verified account can fast-track your access to the robust features of Cash App, but it's crucial to get the setup right. In this segment, we'll guide you through essential steps to transfer ownership and customize account settings seamlessly.

Transferring Ownership

Ownership transfer is the first step after B-u-ying a Cash App Cash App account.

Receive account credentials from the seller securely.

Log in with the provided details.

Change all login information immediately.

Email and phone numbers must be updated to your own. This secures your access and ensures recovery is possible.

Navigate to settings for personal information updates.

Input your information to reflect the new ownership.

Complete these steps to legally own the account.

Customizing Account Settings

Customize settings to enhance security and user experience.

Enable security features like 2-factor authentication.

Link your bank account for seamless transactions.

Adjust privacy settings according to preferences.

Personalize your profile for a tailored Cash App Cash App experience.

Add a unique $Cashtag that represents you or your business.

Upload a personal or brand image.

Explore the app's features and settings for complete customization.

Maintaining Your Cash App Cash App Account

Keeping your Cash App Cash App account in good shape is essential.

Regular care prevents problems and keeps your account running smoothly.

Regular Updates

Keeping your app up to date is crucial.

Check for updates often.

Updates fix bugs and add features.

Updating is quick and keeps your account safe.

Verifying Continued Eligibility

Always make sure you are eligible to use your account.

Follow these steps:

Check Cash App Cash App rules yearly.

Ensure your information is current.

Provide required documents on time.

Troubleshooting Common Issues

Tackling problems with your verified Cash App Cash App account can sometimes be tricky. But don't worry about getting lost in technicalities. This guide simplifies some of the common hurdles you might face.

Login Problems

Can't access your account? Follow these steps:

Check your internet connection. A solid connection is crucial.

Verify your login details. Ensure your email and password are correct.

Update the app. An outdated app makes logging in harder.

Clear the cache. This fresh start could be the quick fix you need.

Contact support if nothing works. They'll help get you back in.

Transaction Errors

Seeing error messages during transactions?

Confirm your bank balance first. No funds, no transaction.

Check the recipient's details. Mistakes here cause errors.

Refresh the Cash App. Sometimes it just needs a quick reboot.

Look for app updates. Running the latest version prevents issues.

Still stuck? Reach out to Cash App Cash App support for precise solutions.

B-u-y Verified Cash App Cash App Accounts

Pros And Cons Of B-u-ying Verified Accounts

Many people want Cash App Cash App accounts that are ready to use. Some pick B-u-ying verified accounts. This way can be quick but has good and bad points.

Immediate Access

Get an account fast with B-u-ying a verified Cash App Cash App account. Just pay, and start using it. It saves time making one and waiting for checking your details.

No setup hassle: Skip steps like adding info.

Quick money moves: Send and get cash soon.

Full features: Get all that Cash App Cash App offers, right away.

Potential Risks

Risk

Explanation

Account bans

Rules say no to bought accounts. Cash App Cash App might close them.

Security fears

Accounts might not be safe. Hackers can steal info.

Costs more

You spend money for something normally free.

B-u-ying comes with risks. Know them before you decide.

Legal Considerations

Exploring the realm of digital finance invites one to consider the importance of legality. Specifically, when discussing B-u-y Verified Cash App Cash App Accounts, you cannot turn a blind eye to the legal boundaries that frame this digital landscape.

Platform Policies

First and foremost, Cash App Cash App a user-agreement that outlines permissible use cases. Users must understand these policies before creating or B-u-ying an account. Disregarding them can lead to account suspensions or legal consequences.

Account set up with real identity.

No fake details for verification.

One user per account stipulation.

Prohibition of resale or transfer of ownership.

Financial Regulations

Stringent laws govern financial platforms to prevent fraud and protect users. When purchasing verified Cash App Cash App accounts, remember:

Regulation

Requirement

Impact on Purchase

KYC Laws

Identity verification

Purchased accounts must have verifiable information

AML Directives

Prevention of money laundering

Accounts should have a clear transaction history

PCI DSS Compliance

Data security standards for payment cards

Ensures transaction data is protected

Remember, owning a Cash App Cash App account requires compliance with all local and international financial laws. It's not just about simple transactions but ensuring your activities are legal and secure.

B-u-y Verified Cash App Cash App Accounts

Cash App's Role In Digital Economy

The digital economy thrives on simplicity and trust in transactions. Cash App Cash App features heavily in this landscape with its streamlined approach to money management. Verified accounts on the Cash App Cash App platform signify a level of authenticity and security that is critical for users engaging in digital financial activities. These trusted accounts are cornerstones in the ever-evolving digital economy, enabling seamless peer-to-peer payments and reshaping how consumers handle their finances.

Mobile Payment Trends

Mobile payments are transforming how we transact. Services like Cash App Cash App are at the forefront, offering quick and secure ways to send or receive money. With the rise of smartphones, payment apps are becoming essential tools for the digital economy. They cater to a growing preference for digital wallets and tap-to-pay technology.

Increased mobile wallet adoption

Contactless transactions gaining ground

Preference for app-based financial services

Impact On E-commerce

Verified Cash App Cash App accounts influence e-commerce by providing a trusted payment option for online shoppers. Retailers now integrate these payment methods to capture more sales and improve customer experience.

Ease of checkout with one-tap payment

Secure transactions with verified accounts

Faster payments encourage repeat business

In summary, a robust digital economy relies heavily on platforms like Cash App, with verified accounts ensuring confidence in e-commerce and reflecting modern mobile payment trends.

Alternatives To B-u-ying Verified Accounts

Exploring Alternatives to B-u-ying Verified Accounts can be a safer path to managing finances online. Users often seek out verified Cash App Cash App accounts to bypass certain limits. Yet, this approach poses risks. Let's delve into legitimate and secure methods to access similar features without the risks involved in purchasing accounts.

Self-verification

Becoming verified on Cash App Cash App is straightforward. Input your SSN and personal info. Cash App Cash App then verifies your identity. Once verified, your account unlocks higher limits and additional features.

Other Payment Platforms

Many payment platforms exist. Each offers unique benefits and verification processes. Consider these popular alternatives:

PayPal: A well-known platform requiring user and bank account verification.

Venmo: Popular among friends for quick transfers after a user identity check.

Zelle: Integrates with bank accounts for instant, verified transactions.

Each platform secures your data and transactions reliably, negating the need to B-u-y accounts.

Platform

Verification Requirement

Features

PayPal

Linked bank, credit card

Global payments, B-u-yer protection

Venmo

Identity documents

Social sharing, fast transfers

Zelle

Direct bank linkage

Bank-level security, no extra app needed

User Reviews And Testimonials

Welcome to the realm of honest user feedback on Verified Cash App Cash App Accounts. Real people share their experiences. Their stories highlight the perks and downsides of these accounts. Dive in for some unfiltered opinions!

Success Stories

Real users share their joy:

Immediate setup: "I got my account in minutes!"

Smooth transactions: "B-u-ying and selling is now a breeze."

Top-notch security: "My money's safe and secure!"

These tales show happy users who enjoy their Verified Cash App Cash App experiences. They feel confident and satisfied.

Customer Complaints

Feedback isn't always sunny. Here are a few common gripes: