#statutory software

Explore tagged Tumblr posts

Text

Statutory Compliance: It is not just the job of big companies.

Look, friend, as soon as we hear the term "statutory compliance," it seems as if someone has opened a book of law. But the fact is that whether you are running a small shop or a decent startup, if you ignore these things, then problems are certain.

I too had thought earlier, "It is not so legal for small firms." But when I got a notice of the labour law, then I understood that ignoring compliance means shooting yourself in the foot.

What does compliance mean?

It is a simple matter to follow the rules made by the government properly. Be it PF, ESI, minimum wages, bonus act, gratuity, or monthly GST filings—all this comes under statutory compliance software.

This is not just a formality. This is an important part of business. If something is missed by mistake, not only does it cost a fine, but there can also be legal complications. And brother, no one likes to go to court.

Small mistake, big loss

Once a friend of mine did not pay the PF of his staff on time. He thought, “It is a new business, I will pay it later.” But when the notice came, I came to know that interest is also charged for late payment, and on top of that there is a penalty. On top of that the employees are also angry.

Then I understood—compliance is important not just for the government, but also to maintain the trust of your staff.

Set up the system, get rid of tension

Earlier, everything had to be done manually—maintain registers, remember to fill challans, and don’t miss deadlines. But now, such tools and services have come to the market that get all the statutory filings done on time. You get reminders, forms are auto-generated, and reports are also ready for audit.

Whether you buy HRMS software, or hire a compliance expert, or install a system, otherwise you may get a chance to catch your head later.

Compliance means looking professional

When a client or investor sees your business, they also see whether you follow legal compliance or not. If your paperwork is clean, then your image becomes strong. This is also a kind of professionalism.

Finally, the name of compliance may sound boring, but its work forms the backbone of the business. Understand that it is a shield, which protects you from unnecessary legal risks. If you ignore it today, you will regret tomorrow.

So, brother, remove A statutory compliance system from the “I will look into it later” list and add it to the “take care of it now” list.

0 notes

Text

Steps to Implement Statutory Compliance Software

Statutory compliance refers to a predetermined set of guidelines that are derived from the legal framework and specify the boundaries that organisations have to operate within. There are many compliance areas, including:

Labour law compliance

Direct tax compliance

Indirect tax compliance

Non-compliance with any of these can lead to risks such as financial risks and loss of reputation.

Therefore, it becomes important to adhere to these guidelines; however, there are many challenges that come along:

#statutory compliance in HR#statutory compliance management software#statutory compliance services#statutory compliance software in India#statutory compliance software

0 notes

Text

Tired accountants are a common sight in every office in Dubai – sweating over the dynamic nature of tax regulation laws, cyber security issues, inadequate internal control, financial reporting errors, and much more. That’s where we confidently introduce Zoho Books – an all-in-one accounting tool tailored for small business owners in Dubai, UAE.

#auditors in uae#annual statutory audit#audit firms in uae#auditing companies in dubai#auditors in dubai#zoho crm#zoho book#s uae#zoho accounting software#zoho small business accounting software#zoho implementation partner

0 notes

Text

Navigate the Essentials of Statutory Trust Accounting

Statutory trust accounting is a specialised area of accounting that ensures trusts adhere to legal regulations and requirements. This form of accounting is crucial for maintaining accountability and transparency in managing fiduciary assets.

Compliance with statutory trust accounting rules is just a best practice — it’s a legal obligation. This ensures that all transactions are properly documented and that the trust operates within the boundaries of the law. Failure to comply can result in severe penalties and loss of trust from beneficiaries.

Key Components

Statutory trust accounting involves tracking income, expenses and distributions related to the trust. It requires detailed record-keeping of all financial activities, including investments, beneficiary payments, and property management. Regular audits and reports are also a significant part of this process, ensuring that the trust’s financial health is transparent and verifiable.

Benefits of Proper Accounting

Accurate statutory trust accounting provides several benefits. It helps in safeguarding the trust’s assets, ensuring they are used for their intended purposes. This accounting also fosters trust among beneficiaries, as they can see clear, detailed records of how their assets are being managed. Moreover, it simplifies the process of filing tax returns and meeting other regulatory requirements.

Tools and Technology

Modern accounting software can significantly simplify the statutory trust accounting process. These tools offer automated record-keeping, compliance checks, and real-time reporting, making it easier to stay on top of legal requirements and ensure accurate financial management.

Conclusion

If you’re managing a trust, adhering to statutory trust accounting principles is essential. Besides ensuring legal compliance, it also builds trust and transparency among beneficiaries. Investing in proper accounting practices and tools can make a significant difference in smooth and lawful operation of your trust.

0 notes

Text

Tax Print: Your One-Stop Shop for All Tax-Related Needs in Mumbai

Tax Print offers a comprehensive range of tax solutions and services for individuals and businesses nationwide. With over 62 years of experience, we are a trusted source for tax-related financial products, software, and expert advice. Their commitment to personalized service ensures you receive the tailored solutions you need at an affordable price.

Tax Print has a rich history, starting as a printing press for government tax forms in Mumbai. They have evolved alongside the industry, partnering with leading software developers to provide cutting-edge solutions for businesses of all sizes. Their team of experts offers valuable insights and support to help you navigate the complexities of tax laws.

Whether you're a chartered accountant, company secretary, or an individual taxpayer, Tax Print is your one-stop shop for all your tax needs.

#asset management software in mumbai#hr software in mumbai#payroll software in mumbai#payroll management software in mumbai#tds management software in mumbai#26as reconciler software in mumbai#pdf signer software in mumbai#common seal in mumbai#company seal in mumbai#statutory register in mumbai#minute binder in mumbai#minute paper in mumbai#share certificate in mumbai#xbrl software in mumbai#eTDS wizard software in mumbai

0 notes

Text

How does the adoption of blockchain in auditing firms enhance the practices of Chartered Accountants?

Introduction: In recent years, the accounting and auditing landscape has undergone a transformative shift with the integration of blockchain technology. Blockchain, the decentralized and transparent ledger system that underlies cryptocurrencies, has found its way into various industries, and auditing firms are no exception. This exploration aims to highlight how the adoption of blockchain in…

View On WordPress

#Blockchain Technology#Chartered accountant software#Chartered Accountants#external audit software#internal audit software#software for CA#statutory audit software for chartered accountants#Technology

0 notes

Text

Automated Labour Law Audits and Compliance Software — SEAL

Simpliance’s revolutionary automated statutory audit platform driven by AI & Machine Learning technology is helping companies reduce costs by 50% while conducting 100% audit checks of all records submitted and exponentially increasing audit speed.

INTELLIGENT TECHNOLOGY

First of its kind AI & Machine Learning driven audit platform in India enabling compliance at a click

100% EMPLOYEE RECORDS CHECKED

Automated engine, checking 100% records on all high-risk audit points of labour compliance

VARYING PAYROLL INPUT FORMATS

Capable of analysing varying payroll input formats from different softwares

INTEGRATED REGISTER GENERATION

Automated state-wise statutory register generation; PAN India under all applicable laws

Book your FREE DEMO now!

0 notes

Text

Lina Khan’s future is the future of the Democratic Party — and America

On OCTOBER 23 at 7PM, I'll be in DECATUR, presenting my novel THE BEZZLE at EAGLE EYE BOOKS.

On the one hand, the anti-monopoly movement has a future no matter who wins the 2024 election – that's true even if Kamala Harris wins but heeds the calls from billionaire donors to fire Lina Khan and her fellow trustbusters.

In part, that's because US antitrust laws have broad "private rights of action" that allow individuals and companies to sue one another for monopolistic conduct, even if top government officials are turning a blind eye. It's true that from the Reagan era to the Biden era, these private suits were few and far between, and the cases that were brought often died in a federal courtroom. But the past four years has seen a resurgence of antitrust rage that runs from left to right, and from individuals to the C-suites of big companies, driving a wave of private cases that are prevailing in the courts, upending the pro-monopoly precedents that billionaires procured by offering free "continuing education" antitrust training to 40% of the Federal judiciary:

https://pluralistic.net/2021/08/13/post-bork-era/#manne-down

It's amazing to see the DoJ racking up huge wins against Google's monopolistic conduct, sure, but first blood went to Epic, who won a historic victory over Google in federal court six months before the DoJ's win, which led to the court ordering Google to open up its app store:

https://www.theverge.com/policy/2024/10/7/24243316/epic-google-permanent-injunction-ruling-third-party-stores

Google's 30% App Tax is a giant drag on all kinds of sectors, as is its veto over which software Android users get to see, so Epic's win is going to dramatically alter the situation for all kinds of activities, from beleaguered indie game devs:

https://antiidlereborn.com/news/

To the entire news sector:

https://www.eff.org/deeplinks/2023/06/save-news-we-must-open-app-stores

Private antitrust cases have attracted some very surprising plaintiffs, like Michael Jordan, whose long policy of apoliticism crumbled once he bought a NASCAR team and lived through the monopoly abuses of sports leagues as an owner, not a player:

https://www.thebignewsletter.com/p/michael-jordan-anti-monopolist

A much weirder and more unlikely antitrust plaintiff than Michael Jordan is Google, the perennial antitrust defendant. Google has brought a complaint against Microsoft in the EU, based on Microsoft's extremely ugly monopolistic cloud business:

https://www.reuters.com/technology/google-files-complaint-eu-over-microsoft-cloud-practices-2024-09-25/

Google's choice of venue here highlights another reason to think that the antitrust surge will continue irrespective of US politics: antitrust is global. Antitrust fervor has seized governments from the UK to the EU to South Korea to Japan. All of those countries have extremely similar antitrust laws, because they all had their statute books overhauled by US technocrats as part of the Marshall Plan, so they have the same statutory tools as the American trustbusters who dismantled Standard Oil and AT&T, and who are making ready to shatter Google into several competing businesses:

https://www.theverge.com/2024/10/8/24265832/google-search-antitrust-remedies-framework-android-chrome-play

Antitrust fever has spread to Canada, Australia, and even China, where the Cyberspace Directive bans Chinese tech giants from breaking interoperability to freeze out Chinese startups. Anything that can't go on forever eventually stops, and the cost of 40 years of pro-monopoly can't be ignored. Monopolies make the whole world more brittle, even as the cost of that brittleness mounts. It's hard to pretend monopolies are fine when a single hurricane can wipe out the entire country's supply of IV fluid – again:

https://prospect.org/health/2024-10-11-cant-believe-im-writing-about-iv-fluid-again/

What's more, the conduct of global monopolists is the same in every country where they have taken hold, which means that trustbusters in the EU can use the UK Digital Markets Unit's report on the mobile app market as a roadmap for their enforcement actions against Apple:

https://assets.publishing.service.gov.uk/media/63f61bc0d3bf7f62e8c34a02/Mobile_Ecosystems_Final_Report_amended_2.pdf

And then the South Korean and Japanese trustbusters can translate the court documents from the EU's enforcement action and use them to score victories over Apple in their own courts:

https://pluralistic.net/2024/04/10/an-injury-to-one/#is-an-injury-to-all

So on the one hand, the trustbusting wave will continue erode the foundations of global monopolies, no matter what happens after this election. But on the other hand, if Harris wins and then fires Biden's top trustbusters to appease her billionaire donors, things are going to get ugly.

A new, excellent long-form Bloomberg article by Josh Eidelson and Max Chafkin gives a sense of the battle raging just below the surface of the Democratic Power, built around a superb interview with Khan herself:

https://www.bloomberg.com/news/features/2024-10-09/lina-khan-on-a-second-ftc-term-ai-price-gouging-data-privacy

The article begins with a litany of tech billionaires who've gone an all-out, public assault on Khan's leadership – billionaires who stand to personally lose hundreds of millions of dollars from her agency's principled, vital antitrust work, but who cloak their objection to Khan in rhetoric about defending the American economy. In public, some of these billionaires are icily polite, but many of them degenerate into frothing, toddler-grade name-calling, like IAB's Barry Diller, who called her a "dope" and Musk lickspittle Jason Calacanis, who called her an all-caps COMMUNIST and a LUNATIC.

The overall vibe from these wreckers? "How dare the FTC do things?!"

And you know, they have a point. For decades, the FTC was – in the quoted words of Tim Wu – "a very hardworking agency that did nothing." This was the period when the FTC targeted low-level scammers while turning a blind eye to the monsters that were devouring the US economy. In part, that was because the FTC had been starved of budget, trapping them in a cycle of racking up easy, largely pointless "wins" against penny-ante grifters to justify their existence, but never to the extent that Congress would apportion them the funds to tackle the really serious cases (if this sounds familiar, it's also the what happened during the long period when the IRS chased middle class taxpayers over minor filing errors, while ignoring the billionaires and giant corporations that engaged in 7- and 8-figure tax scams).

But the FTC wasn't merely underfunded: it was timid. The FTC has extremely broad enforcement and rulemaking powers, which most sat dormant during the neoliberal era:

https://pluralistic.net/2023/01/10/the-courage-to-govern/#whos-in-charge

The Biden administration didn't merely increase the FTC's funding: in choosing Khan to helm the organization, they brought onboard a skilled technician, who was both well-versed in the extensive but unused powers of the agency and determined to use them:

https://pluralistic.net/2022/10/18/administrative-competence/#i-know-stuff

But Khan's didn't just rely on technical chops and resources to begin the de-olicharchification of the US economy: she built a three-legged stool, whose third leg is narrative. Khan's signature is her in-person and remote "listening tours," where workers who've been harmed by corporate power get to tell their stories. Bloomberg recounts the story of Deborah Brantley, who was sexually harassed and threatened by her bosses at Kavasutra North Palm Beach. Brantley's bosses touched her inappropriately and "joked" about drugging her and raping her so she "won’t be such a bitch and then maybe people would like you more."

When Brantley finally quit and took a job bartending at a different business, Kavasutra sued her over her noncompete clause, alleging an "irreparable injury" sustained by having one of their former employees working at another business, seeking damages and fees.

The vast majority of the 30 million American workers who labor under noncompetes are like Brantley, low-waged service workers, especially at fast-food restaurants (so Wendy's franchisees can stop minimum wage cashiers from earning $0.25/hour more flipping burgers at a nearby McDonald's). The donor-class indenturers who defend noncompetes claim that noncompetes are necessary to protect "innovative" businesses from losing their "IP." But of course, the one state where no workers are subject to noncompetes is California, which bans them outright – the state that is also home to Silicon Valley, an IP-heave industry that the same billionaires laud for its innovations.

After that listening tour, Khan's FTC banned noncompetes nationwide:

https://pluralistic.net/2024/04/25/capri-v-tapestry/#aiming-at-dollars-not-men

Only to have a federal judge in Texas throw out their ban, a move that will see $300b/year transfered from workers to shareholders, and block the formation of 8,500 new US businesses every year:

https://www.npr.org/2024/08/21/g-s1-18376/federal-judge-tosses-ftc-noncompetes-ban

Notwithstanding court victories like Epic v Google and DoJ v Google, America's oligarchs have the courts on their side, thanks to decades of court-packing planned by the Federalist Society and executed by Senate Republicans and Reagan, Bush I, Bush II, and Trump. Khan understands this; she told Bloomberg that she's a "close student" of the tactics Reagan used to transform American society, admiring his effectiveness while hating his results. Like other transformative presidents, good and bad, Reagan had to fight the judiciary and entrenched institutions (as did FDR and Lincoln). Erasing Reagan's legacy is a long-term project, a battle of inches that will involve mustering broad political support for the cause of a freer, more equal America.

Neither Biden nor Khan are responsible for the groundswell of US – and global – movement to euthanize our rentier overlords. This is a moment whose time has come; a fact demonstrated by the tens of thousands of working Americans who filled the FTC's noncompete docket with outraged comments. People understand that corporate looters – not "the economy" or "the forces of history" – are the reason that the businesses where they worked and shopped were destroyed by private equity goons who amassed intergenerational, dynastic fortunes by strip-mining the real economy and leaving behind rubble.

Like the billionaires publicly demanding that Harris fire Khan, private equity bosses can't stop making tone-deaf, guillotine-conjuring pronouncements about their own virtue and the righteousness of their businesses. They don't just want to destroy the world - they want to be praised for it:/p>

"Private equity’s been a great thing for America" -Stephen Pagliuca, co-chairman of Bain Capital;

"We are taught to judge the success of a society by how it deals with the least able, most vulnerable members of that society. Shouldn’t we judge a society by how they treat the most successful? Do we vilify, tax, expropriate and condemn those who have succeeded, or do we celebrate economic success as the engine that propels our society toward greater collective well-being?" -Marc Rowan, CEO of Apollo

"Achieve life-changing money and power," -Sachin Khajuria, former partner at Apollo

Meanwhile, the "buy, strip and flip" model continues to chew its way through America. When PE buys up all the treatment centers for kids with behavioral problems, they hack away at staffing and oversight, turning them into nightmares where kids are routinely abused, raped and murdered:

https://www.nbcnews.com/news/us-news/they-told-me-it-was-going-be-good-place-allega-tions-n987176

When PE buys up nursing homes, the same thing happens, with elderly residents left to sit in their own excrement and then die:

https://www.politico.com/news/magazine/2023/12/24/nursing-homes-private-equity-fraud-00132001

Writing in The Guardian, Alex Blasdel lays out the case for private equity as a kind of virus that infects economies, parasitically draining them of not just the capacity to provide goods and services, but also of the ability to govern themselves, as politicians and regulators are captured by the unfathomable sums that PE flushes into the political process:

https://www.theguardian.com/business/2024/oct/10/slash-and-burn-is-private-equity-out-of-control

Now, the average worker who's just lost their job may not understand "divi recaps" or "2-and-20" or "carried interest tax loopholes," but they do understand that something is deeply rotten in the world today.

What happens to that understanding is a matter of politics. The Republicans – firmly affiliated with, and beloved of, the wreckers – have chosen an easy path to capitalizing on the rising rage. All they need to do is convince the public that the system is irredeemably corrupt and that the government can't possibly fix anything (hence Reagan's asinine "joke": "the nine most terrifying words in the English language are: 'I'm from the Government, and I'm here to help'").

This is a very canny strategy. If you are the party of "governments are intrinsically corrupt and incompetent," then governing corruptly and incompetently proves your point. The GOP strategy is to create a nation of enraged nihilists who don't even imagine that the government could do something to hold their bosses to account – not for labor abuses, not for pollution, not for wage theft or bribery.

The fact that successive neoliberal governments – including Democratic administrations – acted time and again to bear out this hypothesis makes it easy for this kind of nihilism to take hold.

Far-right conspiracies about pharma bosses colluding with corrupt FDA officials to poison us with vaccines for profit owe their success to the lived experience of millions of Americans who lost loved ones to a conspiracy between pharma bosses and corrupt officials to poison us with opioids.

Unhinged beliefs that "they" caused the hurricanes tearing through Florida and Georgia and that Kamala Harris is capping compensation to people who lost their homes are only credible because of murderous Republican fumble during Katrina; and the larcenous collusion of Democrats to help banks steal Americans' homes during the foreclosure crisis, when Obama took Tim Geithner's advice to "foam the runway" with the mortgages of everyday Americans who'd been cheated by their banks:

https://www.salon.com/2014/05/14/this_man_made_millions_suffer_tim_geithners_sorry_legacy_on_housing/

If Harris gives in to billionaire donors and fires Khan and her fellow trustbusters, paving the way for more looting and scamming, the result will be more nihilism, which is to say, more electoral victories for the GOP. The "government can't do anything" party already exists. There are no votes to be gained by billing yourself as the "we also think governments can't do anything" party.

In other words, a world where Khan doesn't run the FTC is a world where antitrust continues to gain ground, but without taking Democrats with it. It's a world where nihilism wins.

There's factions of the Democratic Party who understand this. AOC warned party leaders that, "Anyone goes near Lina Khan and there will be an out and out brawl":

https://twitter.com/AOC/status/1844034727935988155

And Bernie Sanders called her "the best FTC Chair in modern history":

https://twitter.com/SenSanders/status/1843733298960576652

In other words: Lina Khan as a posse.

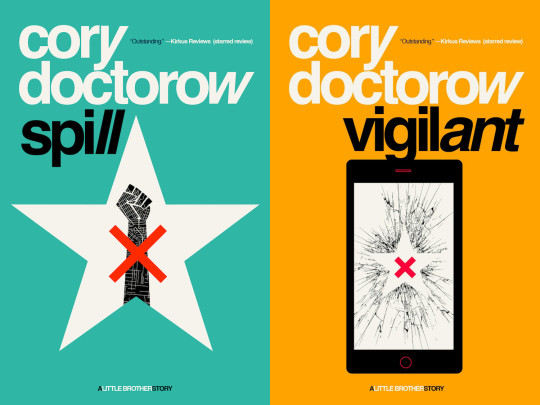

Tor Books as just published two new, free LITTLE BROTHER stories: VIGILANT, about creepy surveillance in distance education; and SPILL, about oil pipelines and indigenous landback.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/10/11/democracys-antitrust-paradox/#there-will-be-an-out-and-out-brawl

#pluralistic#ftc#lina khan#democratic party#elections#kamala harris#billionaires#trustbusting#competition#labor#noncompetes#silicon valley#aoc

407 notes

·

View notes

Text

Democrats on the House Oversight Committee fired off two dozen requests Wednesday morning pressing federal agency leaders for information about plans to install AI software throughout federal agencies amid the ongoing cuts to the government's workforce.

The barrage of inquiries follow recent reporting by WIRED and The Washington Post concerning efforts by Elon Musk’s so-called Department of Government Efficiency (DOGE) to automate tasks with a variety of proprietary AI tools and access sensitive data.

“The American people entrust the federal government with sensitive personal information related to their health, finances, and other biographical information on the basis that this information will not be disclosed or improperly used without their consent,” the requests read, “including through the use of an unapproved and unaccountable third-party AI software.”

The requests, first obtained by WIRED, are signed by Gerald Connolly, a Democratic congressman from Virginia.

The central purpose of the requests is to press the agencies into demonstrating that any potential use of AI is legal and that steps are being taken to safeguard Americans’ private data. The Democrats also want to know whether any use of AI will financially benefit Musk, who founded xAI and whose troubled electric car company, Tesla, is working to pivot toward robotics and AI. The Democrats are further concerned, Connolly says, that Musk could be using his access to sensitive government data for personal enrichment, leveraging the data to “supercharge” his own proprietary AI model, known as Grok.

In the requests, Connolly notes that federal agencies are “bound by multiple statutory requirements in their use of AI software,” pointing chiefly to the Federal Risk and Authorization Management Program, which works to standardize the government’s approach to cloud services and ensure AI-based tools are properly assessed for security risks. He also points to the Advancing American AI Act, which requires federal agencies to “prepare and maintain an inventory of the artificial intelligence use cases of the agency,” as well as “make agency inventories available to the public.”

Documents obtained by WIRED last week show that DOGE operatives have deployed a proprietary chatbot called GSAi to approximately 1,500 federal workers. The GSA oversees federal government properties and supplies information technology services to many agencies.

A memo obtained by WIRED reporters shows employees have been warned against feeding the software any controlled unclassified information. Other agencies, including the departments of Treasury and Health and Human Services, have considered using a chatbot, though not necessarily GSAi, according to documents viewed by WIRED.

WIRED has also reported that the United States Army is currently using software dubbed CamoGPT to scan its records systems for any references to diversity, equity, inclusion, and accessibility. An Army spokesperson confirmed the existence of the tool but declined to provide further information about how the Army plans to use it.

In the requests, Connolly writes that the Department of Education possesses personally identifiable information on more than 43 million people tied to federal student aid programs. “Due to the opaque and frenetic pace at which DOGE seems to be operating,” he writes, “I am deeply concerned that students’, parents’, spouses’, family members’ and all other borrowers’ sensitive information is being handled by secretive members of the DOGE team for unclear purposes and with no safeguards to prevent disclosure or improper, unethical use.” The Washington Post previously reported that DOGE had begun feeding sensitive federal data drawn from record systems at the Department of Education to analyze its spending.

Education secretary Linda McMahon said Tuesday that she was proceeding with plans to fire more than a thousand workers at the department, joining hundreds of others who accepted DOGE “buyouts” last month. The Education Department has lost nearly half of its workforce—the first step, McMahon says, in fully abolishing the agency.

“The use of AI to evaluate sensitive data is fraught with serious hazards beyond improper disclosure,” Connolly writes, warning that “inputs used and the parameters selected for analysis may be flawed, errors may be introduced through the design of the AI software, and staff may misinterpret AI recommendations, among other concerns.”

He adds: “Without clear purpose behind the use of AI, guardrails to ensure appropriate handling of data, and adequate oversight and transparency, the application of AI is dangerous and potentially violates federal law.”

12 notes

·

View notes

Text

Mar 12, 2025

Democrats on the House Oversight Committee fired off two dozen requests Wednesday morning pressing federal agency leaders for information about plans to install AI software throughout federal agencies amid the ongoing cuts to the government's workforce.

The barrage of inquiries follow recent reporting by WIRED and The Washington Post concerning efforts by Elon Musk’s so-called Department of Government Efficiency (DOGE) to automate tasks with a variety of proprietary AI tools and access sensitive data....

The requests, first obtained by WIRED, are signed by Gerald Connolly, a Democratic congressman from Virginia.

The central purpose of the requests is to press the agencies into demonstrating that any potential use of AI is legal and that steps are being taken to safeguard Americans’ private data. The Democrats also want to know whether any use of AI will financially benefit Musk, who founded xAI and whose troubled electric car company, Tesla, is working to pivot toward robotics and AI. The Democrats are further concerned, Connolly says, that Musk could be using his access to sensitive government data for personal enrichment, leveraging the data to “supercharge” his own proprietary AI model, known as Grok.

In the requests, Connolly notes that federal agencies are “bound by multiple statutory requirements in their use of AI software,” pointing chiefly to the Federal Risk and Authorization Management Program, which works to standardize the government’s approach to cloud services and ensure AI-based tools are properly assessed for security risks. He also points to the Advancing American AI Act, which requires federal agencies to “prepare and maintain an inventory of the artificial intelligence use cases of the agency,” as well as “make agency inventories available to the public.”

2 notes

·

View notes

Text

Statutory Compliance Software – A friend to save the company from legal troubles

Statutory Compliance – The name sounds a bit heavy, doesn’t it? On hearing words like “Statutory” or “Compliance”, it seems that a legal lecture has started. But in reality, its meaning is simple – keep in mind the laws. Be it employee wages, PF/ESI deductions, tax filings, or labour laws – every company has to follow the rules.

And if even a small mistake is made, then notice, penalty, or sometimes even legal action can happen. That is why every business needs a smart Statutory Compliance Software these days, which manages everything on time and in the right way.

What is Statutory Compliance Software? This is a digital solution that automates the legal and regulatory tasks of the company. It covers everything – PF, ESI, TDS, minimum wages, Bonus Act, Shops and Establishments Act.

The software sends alerts on time, generates documents, and ensures that your business is aligned with the law – without the need of HR or finance team.

Key Features that make this software a must-have Automated Reminders You get timely alerts for due dates – tax, filings, challans, everything on time.

Built-in Legal Updates If there is a change in any rule, the software updates it automatically — you do not need to do separate tracking.

Document Management All reports, challans, and returns are stored securely in one place — whether it is an audit or vendor verification, everything is under control.

Multi-Law Coverage Whether it is central laws or state-specific, the software works according to every regulation.

Role-Based Access HR, finance, and legal team — everyone gets separate access as per their role.

What is the benefit for the business?

A compliance system is not just about filling out forms – it makes business safe, smooth and stress-free:

It saves you from penalties and legal risks

Data is ready during audit

Manual work of HR and accounts is reduced

Company reputation remains strong

Vendor and client confidence increases

Employees also get indirect benefits

PF and ESI are filed on time

Salary deductions are transparent

Form 16, payslips, tax proofs are easily available

There is no compliance-related salary dispute

Which industries require compliance more?

Honestly, every registered business needs compliance software. But in some industries it is even more critical:

Manufacturing – high labour force, multiple laws

IT & Services – contracts, consultant payments

Healthcare – license renewals, safety norms

Retail & Franchise – multi-location coordination

Construction – contractor compliance, labour records

Conclusion: Give the work of compliance to the software, take care of your business

Ignoring statutory compliance work means inviting problems in the future. There is always a chance of mistakes in a manual system, and the law does not forgive mistakes. A smart compliance software gives you peace of mind – your business is safe, reports are ready, and the HR team is relaxed.

Nowadays, when everything is going digital, why should compliance also remain manual? It's time to switch to working in a smart, safe, and legal way.

0 notes

Text

5 Ways Statutory Compliance Services Can Save Your Business Time and Money

Statutory compliance involves adhering to the various laws and regulations governing business operations. It is important for employees because it ensures that no worker faces discrimination and that their financial security is protected. It provides many social security schemes, like health insurance, provident funds, etc., to employees. This provides them with stability and financial support in the event of a sickness, disability, retirement, or other unfavourable event. Limitations on working hours, breaks, and overtime compensation are enforced by it too. These are a few of the things that are included in statutory compliance around the world.

#statutory compliance in payroll#statutory compliance management software#statutory compliance services#statutory compliance software#MYND Solution

0 notes

Text

Physical Verification of Fixed Assets by MASLLP: Ensuring Accuracy and Accountability

For businesses, maintaining an accurate record of fixed assets is crucial for financial reporting, compliance, and operational efficiency. MASLLP, a trusted name in the financial consulting domain, offers expert services for the physical verification of fixed assets, ensuring your business stays organized, compliant, and secure.

What is Physical Verification of Fixed Assets? Physical verification of fixed assets involves systematically checking and validating the existence, condition, and location of assets owned by a business. It is a critical process to:

Identify discrepancies between physical assets and records. Ensure compliance with accounting standards and regulations. Protect against theft, loss, or mismanagement of assets. Why Choose MASLLP for Fixed Asset Verification? MASLLP’s team of experienced professionals ensures a seamless and accurate verification process. Here’s why businesses trust MASLLP:

Comprehensive Asset Audits MASLLP’s experts conduct thorough physical inspections, cross-referencing assets with financial records to identify inconsistencies.

Advanced Tools and Technology Using cutting-edge tools like barcoding, RFID, and asset tracking software, MASLLP ensures precision in the verification process.

Customized Solutions Every business is unique, and MASLLP tailors its asset verification services to align with your organization’s specific needs and objectives.

Compliance Expertise With MASLLP’s expertise in financial regulations, your business stays compliant with statutory requirements and accounting standards.

Key Benefits of Physical Verification by MASLLP Accurate Financial Reporting Eliminate discrepancies in your financial statements by ensuring all assets are accounted for.

Enhanced Asset Management Identify underutilized, misplaced, or obsolete assets to improve efficiency and cost-effectiveness.

Risk Mitigation Reduce the risk of theft, fraud, or mismanagement by maintaining an accurate and up-to-date asset register.

Regulatory Compliance Ensure adherence to legal and accounting standards, avoiding penalties and audits.

MASLLP’s Fixed Asset Verification Process

Planning and Preparation Understanding the client’s asset management system. Defining the scope of the verification process.

On-Site Physical Verification Conducting a detailed inspection of assets. Tagging and labeling assets where required.

Reconciliation Comparing physical records with the asset register. Identifying and addressing any discrepancies.

Reporting Providing a comprehensive report with findings and recommendations. Why Regular Fixed Asset Verification is Essential Businesses often overlook the importance of regular physical verification, which can lead to:

Inaccurate asset valuation. Missed opportunities for tax benefits. Increased risks of fraud or theft. By partnering with MASLLP, businesses can maintain a robust asset management system and safeguard their investments.

Get in Touch Ensure your fixed assets are accounted for and secure with MASLLP’s Physical Verification of Fixed Assets services.

#accounting & bookkeeping services in india#audit#businessregistration#chartered accountant#foreign companies registration in india#income tax#taxation#ap management services#auditor

5 notes

·

View notes

Text

Choose SPK Auditors and Accountants for Zoho Creator Implementation in UAE!

Get professional advice and efficient implementation of Zoho Creator. Contact SPK today! Contact now +971558572143

#auditors in uae#annual statutory audit#audit firms in uae#audit services in dubai#auditing companies in dubai#zoho crm#zoho accounting software#zoho finance partners#zoho implementation partner#Zoho financial plus#zoho software accounting

0 notes

Text

Instagram & Facebook – Win £100 towards your Christmas Wishlist - Prize Draw Terms and Conditions – 15/12/2024

The Promoter:

B&Q Limited, B&Q House, Chestnut Avenue, Chandler’s Ford, Eastleigh, SO53 3LE

Who can enter?

This promotion is open to all residents of the UK aged 18 years and over, excluding employees of B&Q Limited, their families, agents or anyone else connected with the promotion.

How to enter?

1️⃣ Make sure you're following @bandq_uk

2️⃣ Like this post 🧡

3️⃣ Comment below what's on your Christmas wishlist 🎁

Entries must be received by 23:59 on 18th December 2024. Any entries received after this date will not be accepted.

Entry:

Only one entry per person will be accepted. Third party or multiple entries by the same person will not be accepted and we reserve the right to disqualify any entries we reasonably suspect to have been made fraudulently including through the use of bots, computer software or by any other means. We accept no responsibility for any lost, damaged or incomplete entries or entries not received due to a technical fault or for any other reason beyond our reasonable control.

Prize details:

There will be 1 winner selected. The winners will receive the following prize:

1 x £100 B&Q Giftcard

The prize is non-transferable or exchangeable and no alternative is available. We reserve the right to replace the prize with a prize of equal or greater value where it becomes necessary to do so.

Winner selection and prize fulfilment:

1 winner will be selected at random from all valid entries received.

The winner will be contacted via response to their winning comment by 5pm on the 19th December 2024. To receive the prize, the winner will need to respond via private message providing their contact details. If the winner fails to provide their contact details within 7 days of initial contact from the Promoter, the prize will be offered to the next randomly chosen entrant.

Your Data:

We will process information about entrants in order to administer this promotion. For more information on how we use personal information, please see http://www.diy.com/customer-support/policies/privacy. By entering this promotion, you agree and consent to the processing of your personal data by us and by any third party acting on our behalf for the purposes of the administration and operation of the promotion.

Please note that we are obliged to either publish or make available on request the surname, county and, where applicable, the winning entry/entries of major prize winners. If you object to any of this information being made available in this way, please contact [email protected]. We must nevertheless share this information with the Advertising Standards Authority where it becomes necessary to do so.

Your acceptance of these Terms:

We reserve the right to refuse entry or refuse to award any prize to anyone in breach of these Terms and Conditions and/or hold void, cancel, suspend or amend these Terms and Conditions where it becomes necessary to do so. Our decision on all matters relating to this promotion is final and binding. No correspondence will be entered into.

Liability:

By entering this promotion, you are deemed to have accepted and agreed to be bound by these Terms and Conditions.

Insofar as is permitted by law the Promoter and its agents and distributors will not in any circumstances be responsible or liable to compensate the winner or accept any liability for any loss, damage, personal injury or death occurring as a result of taking up the prize except where it is caused by the negligence of the Promoter, its agents or distributors or that of their employees.

This promotion is in no way endorsed or administered by or associated with Instagram or Meta.

Governing Law:

Nothing in these Terms and Conditions restricts your statutory rights as a consumer. This promotion will be governed by English law and entrants submit to the jurisdiction of the English Courts.

3 notes

·

View notes

Text

Consultation Audit Services in Delhi: A Pathway to Financial Precision

Delhi, the capital city of India, is not just the heart of the nation but also a bustling hub of business activity. From startups to established enterprises, organizations in the Delhi area are increasingly relying on consultation audit services to ensure financial transparency, regulatory compliance, and optimized operations. Here’s an in-depth look at why consultation audit services are essential and how they can benefit businesses in the region.

Understanding Consultation Audit Services

Consultation audit services go beyond traditional financial audits. They encompass a comprehensive review of a company’s financial records, operational processes, and compliance frameworks to provide actionable insights for improvement. These services can include:

Statutory Audits – Ensuring compliance with legal and financial reporting requirements.

Internal Audits – Evaluating operational efficiency and risk management practices.

Tax Audits – Verifying compliance with taxation laws and optimizing tax strategies.

Process Audits – Reviewing and enhancing workflows for better productivity and cost-efficiency.

Management Audits – Assessing the effectiveness of leadership and decision-making processes.

Why Businesses in Delhi Need Consultation Audit Services

Regulatory Environment Delhi is home to numerous businesses operating under stringent local, national, and international regulations. Regular audits ensure compliance with laws like the Companies Act, GST laws, and various sector-specific regulations.

Competitive Advantage A thorough audit helps identify inefficiencies, reduce costs, and optimize resource allocation. These insights allow businesses to remain competitive in Delhi’s vibrant market.

Investor Confidence For businesses seeking funding, robust audit practices reassure investors of financial integrity and sound management.

Risk Mitigation With businesses in Delhi facing challenges such as cyber threats, fraud, and fluctuating market conditions, audits provide a safeguard by identifying and addressing vulnerabilities early.

Key Benefits of Consultation Audit Services

Enhanced Compliance: Avoid penalties by adhering to legal and regulatory standards.

Financial Accuracy: Ensure error-free records and improved budgeting.

Strategic Decision-Making: Leverage insights to make informed business decisions.

Improved Credibility: Build trust with stakeholders, including customers and investors.

Cost Efficiency: Streamline processes to save time and resources.

Choosing the Right Consultation Audit Firm in Delhi

The effectiveness of an audit depends largely on the expertise of the auditing firm. Here are key factors to consider:

Experience and Specialization: Choose a firm with a proven track record and expertise in your industry.

Local Knowledge: Firms familiar with Delhi’s regulatory landscape can provide tailored solutions.

Comprehensive Services: Opt for firms offering end-to-end audit and consultation services.

Technology Adoption: Modern tools like AI-powered audit software can enhance precision and efficiency.

Leading Consultation Audit Trends in Delhi

Digital Auditing Tools: With the rise of digitization, automated tools are transforming traditional audit practices.

Sustainability Audits: As businesses focus on ESG (Environmental, Social, Governance) compliance, sustainability audits are gaining prominence.

Risk-Based Auditing: A shift towards identifying high-risk areas to prioritize during audits.

Conclusion-

In a dynamic business environment like Delhi, consultation audit services are not a luxury but a necessity. By partnering with the right audit firm, businesses can navigate the complexities of compliance, improve financial health, and unlock growth opportunities.

Whether you’re a small business owner or a large enterprise, investing in consultation audit services can set you on the path to financial precision and long-term success.

Looking for Consultation Audit Services in Delhi? Contact our team of experts to get tailored solutions for your business needs. Let us help you achieve financial clarity and compliance excellence!

#ConsultationAuditServices#AuditSolutions#DelhiBusinesses#FinancialTransparency#RegulatoryCompliance#InternalAudit#TaxAudit#RiskManagement#BusinessGrowth#DelhiStartups#AuditExperts#CorporateCompliance#ProcessOptimization#InvestorConfidence#StatutoryAudits#BusinessSuccess#AuditingTrends#SustainabilityAudits#FinancialClarity#BusinessConsultation

2 notes

·

View notes