#take THAT neoclassic economics

Text

“Political and economic ideologies are framed in metaphorical terms. Like all other metaphors, political and and economic metaphors can hide aspects of reality. But in the area of politics and economics, metaphors matter more, because they constrain our lives. A metaphor in a political or economic system, by virtue of what it hides, can lead to human degradation.”

(this continues below the cut)

“Consider just one example: LABOR IS A RESOURCE. Most contemporary economic theories, whether capitalist or socialist, treat labor as a natural resource or commodity, on a par with raw materials, and speak in the same terms of its cost and supply. What is hidden by the metaphor is the nature of the labor. No distinction is made between meaningful labor and dehumanising labor. For all of the labor statistics, there is none on meaningful labor. When we accept the LABOR IS A RESOURCE metaphor and assume that the cost of resources defined in this way should be kept down, then cheap labor becomes a good thing, on a par with cheap oil. The exploitation of human beings through this metaphor is most obvious in countries that boast of “a virtually inexhaustible supply of cheap labor”—a neutral-sounding economic statement that hides the reality of human degradation. But virtually all major industrialized nations, whether capitalist or socialist, use the same metaphor in their economic theories and policies. The blind acceptance of the metaphor can hide degrading realities, whether meaningless blue-collar and white-collar industrialist jobs in “advanced” societies or virtual slavery around the world.”

- Lakoff and Johnson, from the chapter ‘Understanding’ in Metaphors We Live By

#Quotes#literature#lakoff and johnson#george lakoff#mark johnson#Metaphors we live by#Reference#dexterreads#long quote but boy this book has been fascinating#it’s amazing the things you find when you go down referencing rabbit hole!#it started with#philip pullman#then moved to#mark turner#and ended up here#where to next?#gonna pull this bad boy out at work#take THAT neoclassic economics#welcome to the theory of planetary and social boundaries

0 notes

Text

Traditionally incoming Argentinian presidents give an inauguration speech inside of Congress to other politicians. Javier Milei, a former “tantric sex instructor” turned libertarian economist, symbolically gave his speech with his back to the Congress facing towards the people.

“For more than 100 years, politicians have insisted on defending a model that only produces poverty, stagnation, and misery,” President Milei said. “A model that assumes that citizens exist to serve politics, not that politics exists to serve citizens.” He also promised an “end a long and sad history of decadence and decline” and promote a new era based on peace, prosperity, and freedom.

Since his headline-making election victory last month, media portrayal of Milei has ranged from dismissive to condescending, often depicting him as an eccentric “far-right populist.” Yet, since taking office, Milei has shelved many of his campaign’s more contentious proposals and begun implementing a radical but, by international standards, orthodox reform plan to revitalize Argentina’s faltering economy.

Milei inherited a challenging situation. Argentina’s economy has shrunk by 12 per cent over the last decade, annual inflation reached an extraordinary 160 per cent in November, while the poverty rate increased to 40 per cent in the first half of 2023.

Argentina has a fascinating economic history that led up to this point. In the 19th century post-independence Argentina adopted a liberal constitution that helped deliver an impressive economic expansion.

By the early 20th century, Argentina was one of the world’s richest countries, driven by agricultural exports. Real wages were comparable to Britain and only slightly below the United States. Millions fled destitution in southern Europe for a new life in Argentina. Buenos Aires has been labelled the “Paris of South America” because of spectacular neoclassical architecture built during this era.

This turned to disaster over the subsequent decades because of collectivist rule – from military dictatorships to avidly socialist leaders. Argentina nationalised industries, subsidised domestic production, limited external trade, and introduced an unaffordable welfare state. This has become known as the Peronism, named after 20th century president Juan Domingo Perón, a leftist populist leader who supressed opposition and controlled the press.

This agenda accelerated in recent decades under self-identifying Peronist leaders, turning Argentina into one of the world’s most closed and heavily regulated countries. The latest Human Freedom Index places Argentina at 163rd in the world for openness to trade and 143rd for regulatory burden. This has culminated in an economy on the precipice of economic disaster.

Not wasting any time, Milei has proposed a mega package of over 350 economic reforms to open the economy and remove regulatory barriers. This includes privatising inefficient state assets, eliminating rent controls and restrictive retail regulations, liberalising labour laws, lifting export prohibitions, and allowing contracts in foreign currencies.

There has been a notable absence of some of most radical ideas – such as legalising organ sales or banning abortion. He has also put on hold plans to dollarise the economy and abolish the central bank. Instead, at least by international standards, the agenda contains several orthodox economic reforms.

Many of the measures – such as cutting spending to get the deficit (currently at 15 per cent of GDP) under control, opening the country up to international trade, and liberalising the airline industry through ‘open skies’ policy – would be required to join the European Union. The government is eliminating capital and currency controls and allowing the peso to devalue – measures that the IMF’s managing director Kristina Georgieva said these are important to stabilise the economy.

There are undoubtedly significant challenges ahead and some darker elements to agenda.

Milei has been, uncharacteristically for a politician, honest that “in the short term the situation will get worse”. The removal of price controls, for example, will increase inflation until demand and supply can stabilise to end shortages. But, he says, “then we will see the fruits of our efforts, having created the foundations of a solid and sustainable growth over time.”

The government is facing significant opposition, with the union movement organising mass protests and threatening a general strike. The government has responded by proposing questionable new anti-protest laws, that include lengthy jail sentences for road-blocking and requirements to seek permission for gatherings of more than three people in a public place. Milei, who could struggle to get much of his agenda through Argentina’s Congress, is asking for sweeping emergency presidential powers until the end of 2025. This raises serious questions about democratic accountability.

Nevertheless, there are some positive early signs. Since Milei’s election Argentina’s flagship stock index has risen by almost one-third and the peso’s value has not collapsed. Argentina could soon benefit from a major new shale pipeline pumping one million barrels of crude a day (helped along by reforms that allow exports of oil and sales at market prices) and the mining of the second largest proven lithium reserves in the world.

Argentina has long served as a solemn reminder that prosperity is neither inevitable nor unassailable. Misguided policies can transform mere challenges into a profound crisis. Milei is offering a glimmer of hope: redemption may just be possible. Let’s also hope that Britain’s leaders can similarly take the path of reform, ideally before things get as bad as Argentina.

Matthew Lesh is the Director of Public Policy and Communications at the Institute of Economic Affairs

11 notes

·

View notes

Text

Substituting economics for politics is a failure

Most of us believe that we do stuff because we want to be good people, and that other people act the same. But the dominant political philosophy for the last half-century, “economism,” views us as slaves to “incentives” and nothing more.

Economism is the philosophy of the neoclassical economists, whose ideology has consumed both the Democrats and Republicans. They dismiss all “non-market” solutions (that is, projects of democratically accountable governments) as failed before they’re begun, due to the “incentives” of the individuals in the government.

Economism’s major project has been to dismantle the achievements of the New Deal (Social Security, unions, public housing, limits on corporate power) and to discredit the very idea that we can or should attempt those sorts of bold initiatives.

In economicist doctrine, it’s actually impossible to make national parks or social security or public healthcare, and people are naive to even think we should try. To the extent that these things actually exist and thrive and please people in the real world, they are mirages — they don’t work in theory, so they must not work in practice, either.

It’s not that progressives ignored economists. Some 5,000 economists worked with FDR to craft the New Deal. But while FDR employed a lot of economists, his successors set out to create full employment in the profession — by the 1980s, there were 16,000 federal economists.

https://www.jstor.org/stable/1818725#metadata_info_tab_contents

In “May God Save Us From Economists,” in the New Republic, Timothy Noah takes us on a whirlwind tour of the disastrous rise of economism and the changing currents that are finally deprecating its ideology and methodology — and not a minute too soon.

https://newrepublic.com/article/168049/tyranny-economists-government

In 1944, Paul Samuelson called World War II “the economist’s war.” JK Galbraith did research for the United States Strategic Bombing Survey that concluded that military doctrine overestimated the usefulness of aerial bombing. Milton Friedman tried and failed to use economics to develop high-temperature alloys. The Rand Institute developed the post-war nuclear “Mutually Assured Destruction” plan using economists, not military experts.

After the war, economics became the language of Washington. By 1967, the DOT’s safety agencies took up economic models to determine when and how to deploy safety regulations. These regulations were weighed against a model that assigned a cash value to the human lives they’d save, and as that value changed from year to year, so did the regulations that were politically possible.

Today, the use of cost-benefit analyses that relied on arbitrary prices assigned to human lives is mandatory for all major regulations:

https://crsreports.congress.gov/product/pdf/IF/IF12058

That means that federal economists aren’t just in charge of economic policies — at the Fed, say, or the Congressional Budget Office — but rather, they have the final word on all policy matters — every question has become an economic question. That’s the core of economism.

From the middle of the 20th century on, economism gave rise to a near-endless supply of annoyances, miseries and horribles.

For example, economists convinced Carter to deregulate the airlines and turn legroom into a commodity that you pay extra for. That was the brainchild of then-chair of the Civil Aeronautics Board Alfred E Kahn, an economist, who cheerfully declared “I don’t know one plane from another — to me, they are all marginal costs with wings.”

Most consequentially, economists gutted antitrust, declaring monopolies to be efficient and ruling any questions of corporate power out of bounds on the grounds that it couldn’t be measured or modeled in equations. This, in turn, made all other regulation a battle between concentrated sectors dominated by a handful of giant corporations and their would-be regulators. From here, it’s a direct line to both “too big to fail” and “too big to jail.”

Economism has had an enormous — and awful — impact on public health. It’s no coincidence that when Johns Hopkins sent out a call for survey data early in the covid pandemic, two of its signatories were economists and only one was an epidemiologist:

https://coronavirus.jhu.edu/from-our-experts/economists-and-epidemiologists-not-at-odds-but-in-agreement-we-need-a-broad-based-covid-19-testing-survey

As Noah writes: “Think about that. Hopkins medical school is consistently rated one of the top five in the country. Yet even there, an epidemiologist dared not make an uncontroversial public health pronouncement in the midst of a pandemic without invoking the unimpeachable authority of two economists.”

Even Trump, who professed a hatred of “experts,” bowed before economism: it was his trade advisor Peter Navarro who got Trump to take covid seriously, not his public health team (Navarro’s PhD is in economics). And it was Navarro who got Trump to recommend useless — and potentially dangerous — hydroxychloroquine therapy for covid.

In 1992, the Nobel Prize in Economics went to Gary Becker, who used economics to explain “criminal justice, marriage, and racial discrimination.”

https://www.nobelprize.org/prizes/economic-sciences/1992/becker/facts/

Related to this is the fact that the Economics Nobel isn’t actually a Nobel at all — rather, it is part of economism’s drive to subordinate evidence-based science to economicist ideology. The prize was created 73 years after the Nobel by Sweden’s finance sector, who backed it with a perpetual grant, in a bid to establish that economics was a science:

https://fivethirtyeight.com/features/the-economics-nobel-isnt-really-a-nobel/

Economism began to lose its shine after the Great Financial Crisis of 2008, which saw renewed interest in Karl Polanyi’s 1944 anti-economism “Ur-text,” “The Great Transformation,” which argued that “economics was created by society and must be made to serve its needs.”

https://inctpped.ie.ufrj.br/spiderweb/pdf_4/Great_Transformation.pdf

Polanyi railed against the notion that the individual should respect economic law even if it happened to destroy him…. Nothing obscures our social vision as effectively as the economistic prejudice.”

In the years after the GFC, Polanyi’s anti-economism critique was updated and formalized into five major areas:

I. Excessive reliance on models. Famously, Queen Elizabeth visited the London School of Economics and demanded to know why they hadn’t predicted the Great Financial Crisis. Economic forecasting basically sucks, and even though it now consumes vastly more computing power and has vastly more data to crunch, it’s only made the most marginal and tenuous improvements.

Noah rejects the comparison of economic forecasting to weather forecasting: since 1984, economic forecasting has incorporated 20,000 times more variables with few improvements, over the same period, the time horizon for weather forecasts has grown from a few days to a few weeks (“Hurricanes no longer surprise us. Financial crises still do”).

Despite this, economicists continue to claim that models can solve our problems. In 1991, Larry Summers (ugh) said, “the laws of economics, it’s often forgotten, are like the laws of engineering. There’s only one set of laws and they work everywhere.”

Summers’ economicist doctrine was at work in post-Soviet Russia, where the models confidently predicted that an “open economy” would be unleash massive growth. Instead, it delivered “a semi-fascist and not terribly prosperous kleptocracy.”

II. Underreliance on data. As Ely Devons famously quipped, “If economists wished to study the horse, they wouldn’t go and look at horses. They’d sit in their studies and say to themselves, ‘What would I do if I were a horse?’”

As Robert Skidelsky wrote, an economics that can’t validate its hypotheses empirically “has a strong tendency to slide into ideology.”

In the pre-economicist age, economists focused on “history and the dynamics of change.” These were the New Deal “institutional economists” of the 1930s, who were supplanted by the more math-heavy Keynesians and then the purely theoretical neo-classicals. These economists were seduced by “beauty, clad in impressive-looking mathematics,” which they “mistook for truth,” in the words of Paul Krugman.

https://www.nytimes.com/2009/09/06/magazine/06Economic-t.html

The difficulty of finding data and the seductive power of models produced an establishment that dismissed the evidence before them, and common sense, as inconsistent with the theory and thus wrong. This is how the “virtual consensus” that minimum wage hikes increase unemployment was born, and it’s why the minimum wage stagnated at $7.25, lower in real terms that the minimum wage MLK marched against in 1963.

https://www.jstor.org/stable/2677856#metadata_info_tab_contents

III. A rejection of society. At the core of economism is a rejection of the very idea of society (“There is no such thing as society” — M. Thatcher). The only way to understand our lives is to model us as individuals, making individual choices and expressing individual preferences. Economism gives short shrift to how individuals affect one another.

Nowhere is this more visible than in Garrett Hardin’s 1968 hoax “The Tragedy of the Commons,” which purported to be a factual account of how people in communities persistently and reliably failed to manage common resources (Hardin, a eugenicist, was later revealed to have made the whole thing up):

https://memex.craphound.com/2019/10/01/the-tragedy-of-the-commons-how-ecofascism-was-smuggled-into-mainstream-thought/

The actual nature of how people manage commons is far more interesting. Elinor Ostrom — one of the few women to have been given an economics “Nobel” — has devoted her career to analyzing and explaining the long, factual history of well-managed commons, some of which have been run successfully for centuries:

https://www.onthecommons.org/magazine/elinor-ostroms-8-principles-managing-commmons

IV. A failure to understand “irrationality.” In the neoclassical model humans are present as “rational utility-maximizing agents” whose actions can be predicted by asking “What would this person rationally do to get the most out of their situation” (e.g. “What would I do if I was a horse?”).

In the early 2000s, the “behavioral economists” turned the profession upside-down by taking the radical step of observing how people actually behaved, which turned out to bear little relation to the homo economicus of the models.

This “irrationality” could also often be called “ethics” — for example, the decision in various “ultimatum games” to punish selfish people, even if it means getting less for yourself. You can view this as “irrationality” if your sole conception of human motivation is “how do I get more for myself?” But you can equally say, “I don’t like people who betray the social contract and I am prepared to go with less if it means punishing them.”

But by insisting that ethics are irrational, economism can actually do away with them. Michael Sandel’s 2012 book “What Money Can’t Buy,” offers examples of things that you shouldn’t be subject to market forces, like concierge medical services. A decade later, these have gone from examples of the unthinkable to actual products.

https://us.macmillan.com/books/9780374533656/whatmoneycantbuy

V. The prejudices of economism. Economists themselves are more likely to behave like “economic man,” “pursuing self-interest at the expense of cooperation”:

https://www.sciencedirect.com/science/article/abs/pii/S0167268111000746

Economists also give less to charity than other sorts of people:

https://www.sciencedirect.com/science/article/abs/pii/S0167268111000746#!

It is one of the least racially and gender-diverse of all disciplines:

https://www.piie.com/research/piie-charts/us-economics-phds-are-less-socioeconomically-and-racially-diverse-other-major

It’s one thing for a profession to be so different from the majority — but when that profession has elevated itself to the final arbiter of all regulation and government, its narrow composition and ideological blinkers start to tell.

Thus far, the response to this critique has been to reform the economics profession — the Hewlett, Omidyar, Ford and Open Society Foundations are all pursuing programs to make economics better. But Noah argues that it’s not enough to fix economics, we also have to restore politics as a project separate from economics.

Economics should be a tool in politics, but not a replacement for it. As a start, Noah proposes three political domains where economics does not belong:

I. Criminal justice. Get rid of private pretrail supervision, where people charged with a crime have to pay a corporation “user fees” for their ankle-bracelet and other monitoring, or rot in jail. Get rid of private prisons. Get rid of private immigration detention.

To the extent that these “save taxpayers money,” they do so by “running their facilities on the cheap.” Private prisons have “more assaults, more inmate grievances, more lockdowns, and nearly twice as many guns and other weapons confiscated from prisoners.”

https://oig.justice.gov/reports/review-federal-bureau-prisons-monitoring-contract-prisons

II. Health care. After a century of “ever-more ambitious experiments to see whether medical services can be made broadly available on a for-profit basis” the verdict is in: “Every experiment failed.” Every private healthcare scheme fails for the same reason: “The market doesn’t want society to share equally in paying the cost of health care. It wants the biggest consumers (i.e., the sickest people) to pay more. A lot more. That’s how markets work.”

Private insurance failed when companies started “charging riskier customers higher premiums and avoiding very risky customers altogether.” That led to HMOs, which failed when “rising health care costs eventually made even premiums for HMOs too expensive.”

Then we let doctors buy interest in labs and drugs and machinery, charge unlimited fees, and become “entrepreneurs.” We shut public hospitals and let for-profits consolidate hospitals into massive chains. Prices went up. Care got worse. Failure.

Obamacare — which tries to have a private system paid for out of the public purse — has also failed, as costs have gone up, premiums have risen, and outcomes have worsened. We’re on track to outspend the budget for Medicare for All on a private system that delivers worse outcomes to fewer patients.

Many, many studies have concluded that private insurers can’t deliver better care at lower prices. Private insurers pay nearly double the rate that Medicare gets from hospitals.

https://www.kff.org/medicare/issue-brief/how-much-more-than-medicare-do-private-insurers-pay-a-review-of-the-literature/

III. The climate emergency. We are barreling towards a planet incapable of sustaining human life. There is no longer a “credible pathway to a 1.5C rise.”

https://www.unep.org/resources/emissions-gap-report-2022

The economics trade has an answer. In 2019, 28 “Nobel” laureates in economics called a carbon tax “the most cost-effective lever to reduce carbon emissions at the scale and speed that is necessary.” Three years later, emissions are up, not down.

https://www.econstatement.org/

Thankfully, the economicist answer to the greatest existential risk facing human civilization today is no longer the only answer we’re willing to try. The Inflation Reduction Act puts $369b worth of public money into directly subsidizing green energy and green tech.

It doesn’t include a carbon tax.

Image:

Gage Skidmore (modified)

https://commons.wikimedia.org/wiki/File:Art_Laffer_(9262959573).jpg

CC BY-SA 2.0

https://creativecommons.org/licenses/by-sa/2.0/deed.en

[Image ID: Economist Arthur Laffer standing at a podium. A thought-bubble is coming out of his head. In it is a horse.]

166 notes

·

View notes

Text

Les Mis 1.2.2

Following up from Pilf’s post, because clothing is the topic I have stuff to say about. [Also the rest of the action feels very natural follow ups from the previous 15 chapters: the people and house we met in 1.1.1-14 are about to encounter the guy having an awful day in 1.2.1, and this is Hugo’s set up for that.]

Caveat: my main research area is the mid-19th century (right around the time Hugo was finishing Les Mis, not the years it is set), and my working language is English. The US in 1860 is not France in 1815-1832, but I think some elements here do transfer over, or at least offer insight into how Hugo’s readers might have interpreted the text.

Main observations re: Baptistine Myriel’s clothing:

9 years is a very long time for a dress in active use. Washing and non-washing dresses will have different trajectories, but in contemporary non-fiction, making a silk dress last 7 years is a feat of clever planning and care. Five years is noteworthy. One to two years is more typical, and 3 months isn’t necessarily a frivolous waste (wearing a silk dress only once would be). Much like with the soup thing, the Myriel household is taking ‘practicing good economy’ to an extreme, almost absurd degree.

Also, the fact that Mlle Baptistine is still wearing her silk dress “in the style of 1806″ in 1815 is notably weird. Fiction and non-fiction sources of the 1850s/60s show economically-minded women remodeling their silks every season in order to keep up to date. Magazine articles give instructions for turning last year’s flounced skirts into gored ones, or adding puffed overskirts to update narrow gored skirts. Advice books recommend getting an extra yard or two of fabric so that you can update the sleeves of your dress when it’s taken apart for washing. Trousseaus should have some of the dresses left “unmade” (as lengths of fabrics) in case fashions change over the year. A missionary woman writing from not-yet-Seattle in the mid-1850s opines that the dresses she made for her wedding less than a year earlier are too “rusty” to be worn at home (in New York) but are sufficient for living in the woods.

So my impression of Baptistine is that she’s meant to be The Superlatively Economical gentlewoman, and also Not At All Vain About Clothes. She’s not spending her time or money on fashion, but the fact that she is still bothering to wear a silk gown for dinner is signalling that she’s still performing (her class’s) respectability. From this, and her letter about re-doing her room, I expect that her whole wardrobe and all the house’s domestic interiors are scrupulously clean and mended, but also old and likely inharmonious. The two women will do the work to live respectably, but will not spend any unnecessary money on their own comfort or aesthetics.

Hugo taking the trouble to describe Baptistine’s dress (”short waist, a narrow, sheath-like skirt, puffed sleeves, with flaps and buttons”) just reminds me of how much crinoline-era Victorians do not like the Neoclassical look. All of these specific elements are basically the opposite of early 1860s fashion--waists are worn just at/above the natural waist, skirts are about as wide as they can get, more fitted coat sleeves are replacing the wide-open sleeves of the late 1850s. It’s a bit different from how most modern folks seem to view the 1810s style (Austen! Romance! Bridgerton?): I’ll need to dig through my notes, but there’s at least one 1850/60s cartoon and one article I recall which amount to ‘yikes, the fashions of 50 years ago were awful’, and another article from the late 1860s which holds that the crinoline is a great improvement on the raised-waistline silhouette. I think we all prefer to ignore the weirdness of the c.1865-9 Second Empire style, but there were absolutely pairing high waistlines with fitted sleeves and trained skirts over elliptical or half-hoops (transitioning from the rounder cages of the late 1850s and early 1860s into the bustles of the early 1870s).

#Les Miserables#1.2.2#les mis letters#overthinking it#I have a long-running research project on just how long people expected clothing to last in the period 1855-1865#it's pretty fragmentary still#but the 1870s-1890s sources will give you exact timetables of what you should buy and when to maintain a ladylike wardrobe on a budget#most run a 3-year cycle in which you buy the highest quality fabric you can#remake your old best garments to be your next year's second-best#and rotate items seasonally#even so you're looking at a quality winter coat is used three years as the longest-lived garment#bonnets get retrimmed for each season and put away when the weather turns#dresses do one or two seasons before you put them away then get refreshed when they're agian in season and discarded or remade after that

47 notes

·

View notes

Text

By: Heather Mac Donald

Published: May 9, 2024

The female voices rose high-pitched and shrill above the crowd:

“Five, six, seven, eight, Israel is a terrorist state.”

“We don’t want no Zionists here, say it loud, say it clear.”

“Resistance is justified when people are occupied.”

The voices that answered them were also overwhelmingly female, emanating from hundreds of students chanting and marching around tents pitched in front of Columbia University’s neoclassical Butler Library, part of an effort in late April to prevent the university from uprooting the encampment.

The female tilt among anti-Israel student protesters is an underappreciated aspect of the pro-Hamas campus hysteria. True, when activists need muscle (to echo University of Missouri professor Melissa Click’s immortal call during the 2015 Black Lives Matter protests), males are mobilized to smash windows and doors or hurl projectiles at the police, for example. But the faces behind the masks and before the cameras are disproportionately female, as seen in this recent gem from the Princeton demonstrations.

Why the apparent gender gap? One possible reason is that women constitute majorities of both student bodies and the metastasizing student-services bureaucracies that cater to them. Another is the sex skew in majors. The hard sciences and economics, whose students are less likely to take days or weeks out from their classes to party (correction: “stand against genocide”) in cool North Face tents, are still majority male. The humanities and soft social sciences, the fields where you might even get extra credit for your intersectional activism, are majority female. (Not surprisingly, males have spearheaded recent efforts to guard the American flag against desecration.) In progressive movements, the default assumption now may be to elevate females ahead of males as leaders and spokesmen. But most important, the victim ideology that drives much of academia today, with its explicit enmity to objectivity and reason as white male constructs, has a female character.

Student protests have always been hilariously self-dramatizing, but the current outbreak is particularly maudlin, in keeping with female self-pity. “The university would rather see us dead than divest,” said a member of the all-female press representatives of UCLA’s solidarity encampment on X. The university police and the Los Angeles Police Department “would rather watch us be killed than protect us.” (The academic Left, including these anti-Zionists, opposes police presence on campus; UCLA chancellor Gene Block apologized in June 2020 after the LAPD lawfully mustered on university property during the George Floyd race riots.) Command of language is not a strong point of these student emissaries. “There needs to be an addressment (sic) of U.S. imperialism and its ties to the [University of California] system,” said another UCLA encampment spokeswoman.

It was not too long ago when administrators started bringing in therapy dogs to campus libraries and dining halls to help a female-heavy student body cope with psychic distress, especially after the election of Donald Trump. “Trigger warnings” were implemented to protect female students from Ovid’s Metamorphoses and other great works of literature. Campus discourse and its media echo chamber rang with accounts of the mental-health crisis on campus, whose alleged sufferers were overwhelmingly female.

Par for the course, then, when the editors at the Columbia Law Review (majority female) adopted the rhetoric of trauma in demanding that Columbia Law School hand out a universal pass for Spring 2024 coursework. A May 1 action by the New York Police Department to evict violent trespassers from an administration building had left them, they wrote, “highly emotional,” “irrevocably shaken,” “unwell,” and “unable to focus”—in other words, displaying all the symptoms of Victorian neurasthenia.

It was not too long ago when a predominantly female professoriate, student population, and bureaucratic apparatus embraced the idea that students’ “safety” should be protected against the “hate speech” that allegedly jeopardized it. (Males, by contrast, place greater emphasis on academic freedom and truth-seeking, regardless of the alleged emotional consequences of intellectual inquiry.) Examples of dangerous speech included arguments that racial disparities are not caused by racism and that human beings cannot change their sex by proclamation.

Now, while still asserting their own unsafety, the pro-Hamas protesters have done an about-face when it comes to political disagreement and “safety,” at least where pro-Israel students are concerned. Nas Issa, a Palestinian alumna of Columbia University, told the New York Times that she saw a difference between feeling uncomfortable and feeling that you are in danger. Challenges to your identity or political ideology “can be personally affecting,” said Issa. “But I think the conflation between that and safety—it can be a bit misleading.”

It was also not too long ago when college campuses were shutting down or locking students in their dorms as an anti-Covid policy, notwithstanding overwhelming evidence showing that adolescents faced virtually no chance of serious Covid complications. This zero-risk policy, in its inability to balance costs and benefits rationally, was quintessentially female. It is fitting, therefore, that N95 masks have been repurposed as go-to accessories for the most up-to-date anti-settler-colonialist look. Females at the Columbia rally in front of Butler Library passed out the masks to the few participants not already wrapped up like mummies. When asked what the point was, one distributor answered, “to protect against Covid”—an answer that, sadly, could as easily be sincere as duplicitous.

Assuming the latter to be the case, hiding one’s face to escape accountability for one’s actions is the antithesis of manly virtue. The swaddled students would say that they have been forced into such precautions by the risk of “doxing.” But while a home address is properly private and should not be disclosed without permission, a face is public, and participation in public protest fair game for political accountability. The muffled freedom fighters are also aping Third World terrorists, of course, but the worst that might befall these revolutionary wannabes is rejection from their favored investment or consulting firm, not execution.

The dead white males emblazoned on the frieze of Columbia’s Butler Library would not have been surprised by the scene below them. Homer, Herodotus, Sophocles, Plato, Aristotle, Demosthenes, Cicero, and Virgil knew a thing or two about herd behavior and the irrationality of the mob, even if the students knew nothing about the great minds etched above. Our classical forebears developed philosophy, history, and the arts of persuasion to overcome the mind-numbing conformity on display at the greensward.

The founders of Columbia University would have been alarmed, however, to see students illegally colonizing campus grounds and vandalizing college buildings. They would have been dumbfounded to learn that university administrators were meekly negotiating with the vandals and that faculty in neon vests were protecting the trespassers. The idea that student demands should set the school’s agenda would have struck any nineteenth-century academic as surreal.

Universities now assume that students have the right (some would say the duty) to disrupt the system; they bow before students’ every whim. The pro-Hamas protests have unleashed a wave of 1960s nostalgia. They remind Serge Schmemann, a member of the New York Times editorial board, of those “stormy, fateful and thrilling days” of 1968, when Columbia students took control of campus buildings and held an administrator hostage for 26 hours. A front-page Times article on campus activism claimed that college protesters bring “fresh thinking . . . to the world’s most difficult questions.”

Actually, the pro-Hamas encampments have little to do with “thinking,” fresh or otherwise. Like the spread of trans identity among young females, the tent eruptions are a case of social contagion. No change in Israel’s tactics in the Gaza Strip over the last two months explains the ubiquity of encampments now. Rather, they are copy-cat behavior, like the early 1960s hula-hoop craze among teenyboppers—accelerated by the fact, so galling for the participants, that they are about to lose their sympathetic administrative foils come summer vacation.

Schmemann enthuses that disruptive student protests are an “extension of education by other means.” If so, that education now means refusing to engage with contrary viewpoints. At the April 29 protest at Columbia, a masked marcher was wearing a “Fags for Falestine” (not a typo) t-shirt. Asked how far he thought he would get organizing a gay-pride demonstration in Gaza, he stormed off and declined to answer. Every other question posed to the zombie file, such as whether a black protester knew anything about the long history of Arabs enslaving black Africans—a practice ended only by Britain’s naval vigilance—or was aware of current racial views among Arabs, was met with a similar stony silence.

Two days before the march, Iraq passed a law imposing up to 15 years’ imprisonment for gay sex. One of the chants whined out by Columbia’s female chant-callers was:

Hands off Iran, hands of Iraq and the Middle East;

We want justice, we want peace.

The protesters’ demands for LGBTQ justice extend only to docile Western powers. They give their Middle Eastern idols’ overt homophobia a free pass—if they even know about it.

Theater requires the willing suspension of disbelief. But to take seriously the narcissistic melodramas played out on campus quads today requires active commitment to untruth—the untruth that the students know enough about the world to deserve attention from adults; the untruth that they are engaged in heroic behavior, when their brightly colored tents resemble nothing so much as childhood forts, well provisioned with cookies and comic books; the untruth that the trespassers and vandals possess any bargaining leverage independent of what the university voluntarily confers on them; the untruth that an American college could have any effect on Middle East politics. These mediagenic morality plays are well-rehearsed; they spring from hundreds of such theatrical interactions over the last several decades between self-involved students proclaiming various forms of victimhood and co-dependent student-services bureaucrats who need performative conflict to justify their jobs.

But while the “uprisings” will have no effect on the Middle East, administrators’ prolonged paralysis in dealing with them, only now cracking up here and there, will confirm their participants’ self-importance—what Schmemann calls the “frightening and beautiful . . . faith that mere students could do something about what’s wrong with the world.” Graduates will take this self-importance with them into what used to be called the real world, now being remade in the image of intersectional theory, with the same teary, excitable females leading the way.

--

This is indicative of the female shift to the far-left, as well as the ideological infiltration of the Humanities. The mere presence of corrupt domains such as "Palestine Studies" proves this.

We're looking at live-action Gender Studies in real time.

#hamas supporters#pro hamas#hamas#college protests#palestine#pro palestine#israel#intersectional feminism#college violence#violent protests#narcissism#narcissistic personality disorder#victim ideology#victimhood#victimhood culture#religion is a mental illness

3 notes

·

View notes

Text

Economics is an academic discipline premised on "the failure to recognize power relationships in society", as Robert Chernomas and Ian Hudson has recently put it. Economists tend to depict the capitalist economy as the outcome of voluntary agreements between free and equal individuals; as a sphere in which domination is excluded a priori. The economy is defined from the outset by the absence of power. For economists, the expression "free market" is a pleonasm, whereas for Marx, it is a contradiction in terms. This denial of power is the result of a twofold intellectual operation. First, the market is presented as the determining moment of the economic totality, which means that a part of the economy is abstracted from the totality and represented as the whole. This primacy of exchange was already visible in classical political economy, despite its emphasis on production, but it only really came to the fore with the so-called marginal revolution in the 1870s. In neoclassical economics, market exchange is presented as "the central organizing principle of capitalist society", reducing production to "a means of indirect exchange between the present and the future". And, not only is the market presented as the essential feature of the economy as a whole, in some strands of modern economics—most notably in the work of Gary Becker—the voluntary exchange of goods between rational and utility-maximising agents is elevated into a prism through which all social phenomena, including crime, discrimination and politics, can and ought to be understood.

The second intellectual operation underpinning the disappearance of power relationships in economics, is the introduction of a set of assumptions and abstractions resulting in a conception of the market which excludes the very possibility of domination. The agents who engage in transactions on the market are assumed to be isolated, hyper-rational and utility-maximising individuals with infinite and infallible information and expectations. Such rational individuals comprises the Archimedean point of the social ontology of economics, a kind of sui generis substance which accounts for everything else. Assuming this transhistorical economic rationality, the need to explain the existence of capitalism conveniently disappears. From such a perspective, the capitalist economy is simply what appears spontaneously if human nature is allowed to unfold itself. This is why "[i]n most accounts of capitalism and its origin, there really is no origin", as Ellen Meiksins Wood notes. The market is perceived as the place where these rational individuals meet and enter into contractual relations with each other. In a competitive market, there are barriers to entry, and hence no monopolies, apart from the regretfully necessary so-called natural monopolies. The absence of monopolies means that a market agent is never forced to do business with a particular agent, which is why every act of exchange can be regarded as voluntary. Furthermore, when individuals show up on the market, they do so as owners of commodities, and as such they are completely equal. What and who these individuals are outside of the market relation is seen as irrelevant for economic theory, and the question of why they show up on the market to begin with is equally absent—generally, economics simply assume that people show up on the market to sell their commodities after having carefully weighed the possibilities open to them and reached the conclusion that this was in fact the most rational thing to do, i.e., the most efficient way to satisfy their needs. This is why it is possible for Milton Friedman to present "the technique of the market place" as a way of "co-ordinating the economic activities of millions" by means of "voluntary co-operation of individuals":

"Since the household always has the alternative of producing directly for itself, it need not enter into any exchange unless it benefits from it. Hence, no exchange will take place unless both parties do benefit from it. Co-operation is thereby achieved without coercion."

This passage is noteworthy because it explicates what is usually hidden as an implicit assumption in economics, namely that people have the possibility of reproducing themselves outside of the market. This is the assumption which makes the market appear as a sphere of freedom: not only are agents free to choose who they want to exchange their goods with, they are also free to choose whether they want to engage in exchange at all. This is why the market is usually understood as an institution providing individuals with opportunities, a concept "absolutely critical to the conventional understanding of the capitalist system".

These assumptions and abstractions form the basis of the highly idealised mathematical models so characteristic of contemporary economics. The transformation of economics into a discipline fixated on the development of formalised mathematical models has allowed it to present itself as "a nonideological discipline, aimed at providing positive, scientific answers to the policy questions". Economics has thus been able to live under the auspices of the natural sciences and present the economy as something regulated by transhistorical laws similar to the laws discovered by the natural sciences.

Søren Mau, Mute Compulsion: A Theory of the Economic Power of Capital

20 notes

·

View notes

Text

The 1920s - part 3

The Designers

Lucien Lelong

The man who saved Paris!

The story of how he saved Parisian couture in the face of hostile takeover by the Nazis in WW2 has overshadowed his creative legacy.

Lucien Lelong is one of the most important French designers of the years 1920-1930, contemporary of Chanel, Schiaparelli, Patou, Worth and Lanvin. As he was born into a family of designers he was destined to make it in this industry. Unfortunately his career was put on hold due to the First World War. He was sent to the trenches, where he served as an intelligence officer.

After the war Lucien Lelong resumed his career at the same time as Coco Chanel's fashion house was taking off. While she was a creative innovator, it was Lelong who showed the strongest business acumen by offering discounts to society women who agreed to be photographed in his dresses. Marlene Dietrich and the Duchess of Windsor were his models.

The business boomed. By 1926 he employed 1,200 staff and had moved to 16 rue Matignon, off the Champs-Elysées.

Lucien Lelong's style, similar to Chanel's, was influenced by sport and the idea movement as well as the body in motion. His word for clothes' capacity to move with the body was kinétique. He wanted them as he said, 'to be constructed in such a way that their true shape would emerge in movement, not at rest'.

In Paris during the 1920s, Madeleine Vionnet was linked with draping, Jean Patou with chic, Lucien Lelong with fluidity. Dressmaking, in his hands, became engineering. He transformed dresses with narrow pleats that moved with the garment but fell back into place when the wearer was still.

Lucien Lelong Party Frock

The dress and over blouse of grey georgette, the dress is finely pleated, sewn with layers of rhinestones, the waist defined with a band of rhinestones and central crescent shape, the over blouse sleeveless, sewn with regularly spaced rhinestones and a rhinestone hem.

He was one of the first designers to consider the fashion on different levels, dealing with the production of clothing but also accessories and fragrances.

From 1925 to 1950 he created approximately 40 perfumes.

His muse was his second wife, Natalie Paley, she was a Russian princess of the Romanov family 'an icy beauty' with a natural elegance that inspired many photographers such as Horst, Beaton, Man Ray.

In 1929, after the Wall Street Crash, Paris losta lot of its profitable American market and the ‘Garçonne' style of the 1920s, the boyish, short-skirted and tubular dresses died with it. As well as the Wall Street Crash, Patou's 1929 collection killed the Garçonne by lowering the hemlines to mid-calf which did not fit the style of the 'Garçonne'.

Natalie Paley was the face of the new look and the 1930s, her husband's decade. She kept her bone-thin figure by eating little and she would visit Lucien Lelong's salon to try on clothes and acted as his consultant.

The evening dresses that Lelong produced throughout the 1930s still look modern today, this is because they were influenced by neoclassical drapery. However, French fashion was entering a time of crisis. Protective economic policies in America saw a 90% import tax charged on French couture. The effect of this was a flood of cheap copies from American factories. American women started taking fashion inspiration not from Paris but from Hollywood and the designs of studio costumers such as Edith Head and Adrian.

In 1918 at the end of WWI Lucien Lelong opened his own fashion Salon. He developed the talents of up and coming Designers, such as Pierre Balmain, Christian Dior and Hubert de Givency.

For almost 30 years the House of Lucien Lelong epitomized Parisian elegance, it had a clientele drawn from international society and the arts. He was well known for his beautiful fabrics and his great understanding of dresses and evening wear. For health reasons he closed his studio in 1948, but continued with the production of perfumes until his death, in 1958.

Jean Patou

Jean Patou was born in Normandy, France, at a young age he was inspired to enter the world of fashion. His father, Charles Patou, owned a successful business as a tanner, although being inspired by his father’s brilliant use of colourful leathers in book binding, Jean Patou only worked with him for a short time, before striking out on his own.

After a few failed ventures as a tailor, Patou succeeded in opening a dress shop in Paris during 1912. Two years later, just as he was gaining popularity, thanks to a generous American department store buyer who purchased his entire collection, World War I halted the fashion industry in Paris. He fought for five years in the war.

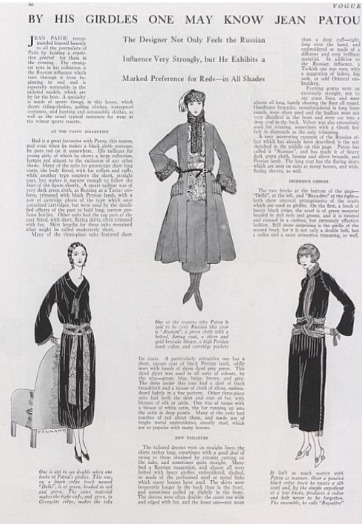

Jean Patou's collections of 1920 and 1921 represented his worldly influences from his time in the war. He drew inspiration from Russian influences and his use of scarves as girdles was published in Vogue on October 15, 1921 as one of his signature designs.

Also signature to Patou was his women's sportswear, which was similar to Chanel. He used jersey, in which was originally used for menswear, to design silhouettes that were considered much easier to move in for the more modern and active woman that emerged in the 20’s.

He designed for tennis player Suzanne Lenglen, he set a new scandalous trend consisting of calf-length skirts and a sleeveless cardigan. This new silhouette created a lot of press for Jean Patou including a spread in Vogue featuring Suzanne Lenglen ("Fashion: Suzanne Lenglenshows how to Dress for Tennis." Vogue Dec 01 1926).

Because of the bold fashion designs for the modern woman of the 20s, Patou’s legacy can be appreciated by today’s modern women and designers. He opened the door to a sportswear industry that was looked over but now just as much about looking incredible and showing off a designer label as was about being comfortable and active.

The free mind-set of the 20’s influenced Patou from multiple directions. He saw a need for simple and functional women’s clothing but also viewed trends like cubism and art deco as unique and extravagant inspirations.

The freedom women began to demand and experience during the “Roaring Twenties,” including exercising, showing their legs and sunbathing, created a gap in the fashion industry that Patou knew how to fill. Historians have said that Patou was known for being a playboy who never married and the reason for his great understanding of the modern woman was because he was with so many of them. He objectified them in a way that allowed him to view their needs as well as create designs that appealed to men.

The Twenties were truly the beginning of the marketing and advertising industry that we know today. Jean Patou was ahead of his time, he advertised his brand by branding himself, he did this by monogramming his garments with JP, in order to protect his designs from knock offs. Creating this signature logo of his initials began a trend that has become essential to marketing campaigns and growing a company brand even today, brands such as Ralph Lauren, nike and adidas. His clothing was about status and even though many women who wore his active wear did not exercise in it, they got it to show off to their friends that they wore JP designs.

Patou’s perfume creations were another status symbol that helped continue his legacy through to present day. His most successful was 'Joy'. It was stated to be the most expensive scent in the world. Each bottle contained 10,600 jasmine flowers and 336 roses.

Jean Patou spent a huge proportion of his career trying to break out of Chanel’s overwhelming shadow. It was stated that in 1929 he premiered a bias cut, white satin, evening gown as a statement to Chanel’s little black dress and said, “I shall fight with all my influence to banish the much too simple little black frock from the ranks of fashionable” throwing shade on to coco Chanel. He set the trend for the early thirties by lowering the hemline back to the ankles. Jean Patou is forever an icon in the fashion industry because of his bold choices and excellent ability to create a sought-after brand.

In the 1920s, Patou created the first ever designer tie, he cut patterns from silk fabrics historically reserved for women’s wear. His innovation empowered the accessory turning it into more than just a tie which before then was more of an afterthought but now into a focal point for a man's attire, influencing future tie makers from Christian Dior to Paul Smith. The range of different designs that Patou has influenced is vast and forever inspiring.

A couturier of modern times, Jean Patou embraced Art Deco, here are some of his illustrations.

Coco Chanel

The young Gabrielle Bonheur Chanel was sent to the orphanage of the Catholic monastery of Aubazine at 6 years old, where she learned the trade of a seamstress.

During the 1920s, Coco Chanel became the first designer to create a loose women's jersey, traditionally used for men's underwear, creating a relaxed style for women and ignoring the stiff corseted look of the time. They quickly became very popular with clients, a post-war generation of women for whom the corseted restricted clothing seemed old-fashioned and impractical moving on too a new era of fashion.By the 1920s, the house of Chanel was established at the location of 31, rue Cambon in Paris (which remains its headquarters to this day). It become a fashion force to be reckoned with. Chanel became a style icon herself due to her striking bob haircut and tan placing her at the cutting edge of modern style.

The use of a monochrome colour palette was present in her oversized 'costume' pearls and cuffs, everything is still sublimely, continuously referenced. As she herself once said:

"Fashion fades, only style remains the same."

The Chanel jacket is undeniably one of fashion's chicest and most enduring pieces in the house and fashion. First created by the label's founder, Coco Chanel, the item was intended to free women from the constraints of the cinched-in silhouettes of the Fifties.

youtube

This short film stars Keira Knightley as the label Chanel's visionary founding designer and focuses on the opening of her debut store in 1913, found in the French seaside town of Deauville.

4 notes

·

View notes

Text

Lucien Lelong 1889-1958

Lucien Lelong is one of the most important French designers of the years 1920-1930, he was also known as ‘the man who saved Paris’, he saved Parisian couture in the face of hostile takeover by the Nazis in WW2 which has overshadowed his creative legacy. After the war Lelong resumed his career at the same time as Coco Chanel's fashion house was taking off. However, while she was a creative innovator, it was Lelong who showed the sharpest business acumen by offering discounts to society women who agreed to be photographed in his dresses and his business flourished. He was influenced by sport and clothes that moved with the body was kinétique. He said he wanted them, 'to be constructed in such a way that their true shape would emerge in movement, not at rest'. He evolved dresses with narrow pleats that moved with the garment but fell back into place when the wearer remained still.

He was one of the first designers to consider the fashion on more levels, dealing with the production of clothing but also accessories and fragrances.

His muse was his second wife, Natalie Paley, a member of the Romanov family. Her icy beauty, with a natural elegance gained a job in his fashion house. Natalia was an asset for Lelong’s business. She became a sought after model establishing an image for herself in the Parisian elite becoming a well known socialite. As a model, she appeared in many magazines including Vogue. She was a favourite model for the great photographers of her time: Edward Steichen, Cecil Beaton, Horst P. Horst, Andre Durst and George Hoyningen-Huene.

Evening dresses that Lelong produced throughout the 1930s still look modern today, as they were influenced by neoclassical drapery. However, French fashion was entering a decade of crisis. Protective economic policies in America saw a 90 per cent import tax charged on French couture. The effect was a flood of cheap copies from American factories. American women started taking fashion inspiration not from Paris but from Hollywood and the designs of studio costumers such as Edith Head and Adrian.

In 1918, at the end of the war, Lelong opened his own Fashion Salon. He developed the talents of up and coming designer such as Pierre Balmain, Christian Dior and Hubert de Givency, and was sat at the Dior February 1947 show to cheer on his disciple.

For nearly 30 years the House of Lucien Lelong epitomized Parisian elegance, his designs may have been forgotten, but without him there would be no Paris fashion today. For health reasons he closed his atelier in 1948, but he continued with the production of perfumes until his death, in 1958. His designs may have been forgotten, but without him there would be no Paris fashion today.

2 notes

·

View notes

Text

Tim "Smashed Avo" Gurner

Hey Folks,

If you're wondering where this bell-end comes from in the world, he is unfortunately an Aussie. He is also one of our more loathed form of capitalist jerkwads: The Property Developer. Plus he's the wangrod who decided that...

When talking about property prices 3 years before the pandemic was responsible for the equally out of touch shit-take of... "The young folks shouldn't be buying avocado toast if they want to buy a home..."

So yeah, he's just full of shit takes.

The more amazing thing about this kind of shit take is that Gurner is basically saying the 'Neoclassical/Neoliberal Quiet Part Out Loud'.

Unemployment is the only way neoclassical economics thinks to control inflation. And it's a bit Rube Goldberg at the same time.

Buckle in folks, we're going for a deep dive into a land of wild fantasy and nonsense: mainstream macroeconomics.

But how do we stop the inflations?!

In the Neoclassical pattern, you need to remember the fantasy starts with how they describe the economy already as it is and how prices happen.

Step 1: The economy will already be producing everything it can and prices are directly linked to the amount of Government Money.

Yep, you read that right... the main pile of economic thinking says that economies around the world are already making as much stuff as they could. They're importing everything they could, and the people who are here are already making as much as they possibly could.

This gets glued into the next thing which is The Equation of Exchange; MV = PQ. You'll see this bandied around and from a maths sense this is the most boring mundane crap of an equation possible but once you start trying to make it match RL goings on makes zero sense. M = the government money out there, V = Velocity of money (put a pin in this one! Oh boy!), P = prices, Q = the number of times people pay those prices.

It has variations where the PQ will be "P = Average Price, Q = All transactions in the average" or "PQ is actually the sum of every price P and the Q times that price was paid". They work out to be the same in the long run: the total of all the things people bought/sold. Now, remember the first half... we are already making the most stuff we can which means that Q is basically 'fixed' (we don't have more stuff to buy and sell) for any given period of time. They also tend to assume that 'Velocity of Money is constant' (which yeah oh boy... just oh boy). So if you change M (government money) there's only one thing that can happen: Prices move. If you spend more government money, then Prices have to go up. That's part of the logic, which is why they keep scaring you with Spending More Government Money Will Make The Inflations.

(Velocity of Money is meant to represent some kind of how often the money moves between people, but this is bonkers because everything is done on spreadsheets now and editing values is spreadsheets creates and destroys stuff constantly, so how fast is money moving? Also, banks settle net transaction not every single transaction. If your bank needs to send $10m to another bank, but that bank needs to send $11m to your bank, then the other bank sends $1m to your bank... that's it job done. They don't pass all the millions back and forth. So this whole idea of the velocity of money as a thing is nonsense, and then on top of it if you're at all scientifically inclined... try do a unit-substitution on MV=PQ, notice the units for V and realise what that would mean if you were doing that in Chem or Physics... let your brain melt on that one).

Step 2: But the Wage Price Spirals! Supplies and Demands!!!

Supply-and-Demand curves have something super wild going on. It gets glossed over a lot, but...

Supply and Demand curves assume the whole economy has only one thing in it, and everyone wants that one thing exactly the same as each other.

Yep. A supply and demand curve assumes everyone in Australia likes Victoria Bitters beer as much as everyone else AND that the only beer available in this fine nation of indigenous folks, migrants, forced migrants, and colonialist fucks, is Victoria Bitters. There is one beer: VB, and everyone wants it exactly the same amount. Welcome to Neoclassical/Mainstream economics.

What does this mean for inflation? If people have more money to buy stuff, then they'll push up prices! The demand (wanting a thing PLUS having the cash to buy it) will beat supply (which remember is already maxxed out) and push up prices!!!

How do we stop this?

Make sure people don't have as much money to spend on things.

Yep, you stop this by making people broke.

What is a great way to make people broke? Increase unemployment.

How do you go about doing that?

Central Bank Interest Rates... it's all a bit Rube Goldberg, but this is the monetarist solution to everything in the economy... fuck with the rates.

If you push up rates, loan costs go up, people and businesses have to spend more to cover their loans. That means people can't buy as much stuff. That means their rents potentially go up. That means food prices go up. And businesses can't afford to keep on as many staff. Unemployment goes up. That's the trick. Rates go up (insert bowling balls playing pianos to knock a switch to drive a remote control car) and then unemployment goes up.

Then when people aren't buying, inflation slows down. Then they drop rates.

But notice the funny thing... generating more unemployment requires the prices of stuff to go up because the rates go up. They make inflation to stop inflation... it's so fucking bonkers. We will crash this car into a tree faster now so we don't maybe crash into that cliff wall up ahead.

So yeah, Tim "Smashed Avo" Gurner isn't lying because that is the goal: to crush inflation by crushing employment.

#tim gurner#economics#macroeconomics#neoliberalism is a disease#neoclassical economics is a fantasy world

2 notes

·

View notes

Text

Initiation: How This All Works

Welcome to Tall Tales From Econ Man! This is a semi-satirical, semi-informative, and entirely unserious blog dedicated to taking Economics far beyond the bounds of ivory towers and neoclassical architecture.

The posts here are going to look more or less like this: I'm going to talk about some niche interest and explain the relevant details for you. Then, I'm going to ask a question that no sane person would think is worth asking. I am then going to answer those questions like an economist, explaining the steps I take along the way.

In short, I'm holding your hand and pulling you through a thunderstorm of bad ideas until we get out the other side. Your best bet to understanding what I mean by all of this is reading a shorter post here. Find a topic you're a little interested in, and see if you like answering silly questions as much as I do.

3 notes

·

View notes

Note

Most right wing econ view? Most left wing?

huh, this is a really hard question to answer because it’s hard for me to actually define what counts as a “right wing” or “left wing” econ view because:

a) I focus much more on political economy than economy and my formal training has taught me enough to recognize that I don’t know crap and introduced me to just the right amount of information to realize no one model fits everything

b) I’ve spent the past few years focused on post-communist European and post-Soviet countries and it’s a pretty common line of scholarly thought that typical assumptions about economic and political “left” and “right” aren’t super meaningful political/economic terms in the region(s)

c) I grew up in the US, which doesn’t have a strong establishment “left” or labor party presence and is also historically allergic to anything too ““communist,”” and our two-party, non-coalition system arbitrarily splits things into Republican (red) and Democrat (blue) but our “left-wing” party is centrist at best

d) specifically, I grew up in the US bible belt, which is red-voter central, but given our whole two-party thing, the most meaningful political description I’ve seen comes in the form of Pew Research Center’s 9 categories of US voter, which means that “right wing” groups encompass economic views from “no limitations on corporations whatsoever” and “corporations are evil, actually, and tariffs are the best”

e) I was raised by what we might call a more classic soft conservative (what Pew calls a “committed conservative”) father and a populist mother in a town with its fair share of “faith and flag” conservatives but had contact with an unusually high percentage of college-educated religious adults, which really skews expectations of what various economic terms mean. It also means I’m still unpacking a lot of assumptions I grew up with.

so the end result is that classifying economic positions is...complicated for me

I initially started thinking about making linear scale that starts with neoclassical to keynesian to marxist (which is more of a critique than a model), but then realized I’d need to factor in questions of wealth redistribution, state intervention, and locality of decision-making and realized I’m trying to make a Grand Comprehensive Theory of Economic Alignment which is a far greater scope than it takes to answer the question.

But given my upbringing, pretty basic concepts like “economic policy should serve the common welfare, actually” can be oddly controversial and turn into moral debates?

ANYWAYS, I guess one right-ish wing belief (more of a populist view tbh, or really just a non-neoliberal one) is that tariffs and capital controls can be good, actually. Also that semi-socialized programs can be worse than both fully-socialized or entirely-private ones because it combines the excesses of both (thinking here about changes to the US medical system in the past 50 years). Going along with that, the economists may have a point when it comes to voucher systems?

As for left wing, idk, frankly. It’s too hard to conceptualize what is a left-wing view. I’ve been thinking about what you mentioned when I brought up a living wage and after mulling it over it seems pretty reasonable—living stipend makes maybe more sense than a living wage, which might even come off as a right-wing thing to say in some circles but the reason I hadn’t thought about it that way before is in part because I can’t see a democratic way for it to happen in my country because there are too many people who view work and wages as through a moral lens, and can barely be persuaded to accept a living wage as a necessity, so giving people money for not doing anything? [insert victorian workhouse line here].

miscellaneous: cash is good? it is good to have cash in the economy? the bretton woods system was pretty good and i clown on nixon but there were definitely stuctural weaknesses there but the neoliberals are wrong if they think the end of Bretton Woods happened because it was inevitable that pegs fail (because pegs fail but they also recover).

also it is good to have currency pegged to something and i’m terrified of the post-2008 quantitative easing/swap lines world we live in because people keep spending money and holding the US currency in reserve under the assumption that inflation will never hit and for the love of all that is holy i do not want to face catastrophic inflation because now is bad enough.

so make of all that what you will. I am very far from having a cohesive economic value system. I’m pro-experimenting small-scale and measuring success or failure over implementing large-scale policy over ideals, generally speaking, and suspicious of the state’s efficacy but also see it as necessary given the need to check capitalists. And also you should never ask me to write policy ever

#troll answer:#cryptocurrency and blockchain generally are STUPID and they solve exactly none of the problems i've seen them proposed to fix#because the problems are social and a different medium of exchange solves none of those problems#come to think of it i generally favor anarchist critiques and solutions but also tend to find them insufficient when it comes to money#and the corporation state that i live in#(feel free to respond to points under the cut in a reblog; i just figured i should probably keep personal life references editable)#huh...a lot of my points consist of *the populists aren't completely wrong actually* which probably says...something

16 notes

·

View notes

Text

read so much today, here’s an attempt at recall (please take it with a pinch of salt, I could be wrong about some of this)

Information asymmetry is a problem where markets fail due to power imbalances in terms of information. Three models of information asymmetry include: 1. adverse selection (I think this means making sub-optimal decisions) 2. moral hazard (where there is a chance for agents to engage in risky behaviour since risk is covered in insurance etc) 3. monopolies of information (where insiders know things that are not available in the market). Most neoclassical economic models assume information is symmetric and available to all and agents are making rational decisions. IA can be overcome through 1. signalling (eg; certifications can signal expertise in the hiring market) 2. warranty (eg; quality of a product can be assured) 3. screening (eg; uninformed can get more information from the informed through practices) 4. mandatory disclosures (eg; regulatory authorities mandate companies disclose information to their investors). A book on this concept would be The Market for Lemons by George Akerlof.

Commodities generally refers to primary goods as opposed to manufactured goods. The Prebisch Singer hypothesis argues that over time terms of trade become more favourable for manufactured goods as opposed to primary commodities. This idea supports Import-Substitution Industrialization, which is proposed by the Structuralism theory of development.

Theories of development include: modernisation (societies have to follow a certain set of transformative stages to become developed and international aid to encourage capital formation and savings should be provided), structuralism (the stages aren’t necessarily the same for all economies, but development needs the economy to move from primary to secondary to tertiary sector in order to develop and support has to come from within to shield emerging economies from global market risks and internally sustain growth), dependency (development can still happen with international trade, but it would be dependent development, the strategies needed for periphery/semi-periphery regions is very different from the core regions), basic needs (international aid ensures basic needs are met, mostly measured through poverty line), structural adjustment (neoclassical approach; markets should be free from govt intervention for economic development), sustainable development (meeting the needs of the present without compromising on future needs), postdevelopment (the idea of development cannot be purely based on economic indicators, socio-cultural specificities to be taken into account to assure that development actually benefits societies, should be based on traditional knowledge), and human development (development is reflected in the ability to make choices, HDI index as measure)

2 notes

·

View notes

Text

Graybar Chiropractic & Rehab in Wilmington, NC

There are many people who want to have the best chiropractor in Wilmington service provider nowadays. After all, this is one of the best ways to maintain one’s health. One of the clinics that offer the same service is Graybar Chiropractic & Rehab in Wilmington, NC location. They also offer prenatal chiropractic care. At Graybar Chiropractic & Rehab, they’re dedicated to helping expecting mothers across Wilmington, Wallace and Clinton through pain-relieving chiropractic techniques. Lastly, their hope is to help you achieve a comfortable, healthy pregnancy. In that, even young mothers who need health-related support can rely on their services. Remarkable, isn’t it?

YouTube Channel

The Graybar Chiropractic & Rehab YouTube Channel is helpful for many people who want to know more about the treatment. Since they have informative videos, it’s easier to research about chiropractic treatment nowadays. Apart from that, the center helps patients struggling with chronic pain through all-natural treatments. Besides, their supportive chiropractic care is designed to provide pain relief for a number of conditions, including chronic back pain, neck pain, muscle spasms, carpal tunnel and plantar fasciitis. Primarily, they’ll evaluate your posture using X-rays and special software. Then, they’ll devise a rehabilitation plan that’s personalized to meet your needs. Lastly, they serve residents of Wilmington, NC, as well as Wallace and Clinton.

Wilmington, NC

Wilmington, NC location has an amazing economic progress nowadays. Aside from that, their economic background is exciting, too. Interestingly, Wilmington's industrial base includes electrical, medical, electronic and telecommunications equipment; clothing and apparel; food processing; paper products; nuclear fuel; and pharmaceuticals. In addition, Wilmington is part of North Carolina's Research coast, adjacent to the Research Triangle Park in Durham, NC location. Due to its close proximity to the ocean and vibrant nightlife, tourism is one of the essential parts of their economy. No wonder the city has a plenty of tourist attractions such as parks, restaurants, gardens, water parks, and more.

youtube

Bellamy Mansion Museum in Wilmington, NC

The Bellamy Mansion Museum in Wilmington, NC is remarkably famous these days. Since it is a popular place, it is highly expected that many backpackers from around the world go there. Basically, it is the Bellamy Mansion, built between 1859 and 1861. The place is a mixture of Neoclassical architectural styles, including Greek revival and Italianate. In addition, it is located at 503 Market Street in the heart of downtown Wilmington, North Carolina. Besides, it is one of North Carolina’s finest examples of historic antebellum architecture. No wonder many guests were in awe of its structure. Lastly, it is a contributing building in the Wilmington Historic District.

Training ground to tennis greats and home to civil rights activist could become historic landmark

There are recent news reports in Wilmington, NC location that are noteworthy. It includes the training ground to tennis greats and home to civil rights activist could become historic landmark. Reportedly, the Dr. Hubert Eaton House at 1406 Orange Street and 213 S 14th Street could be officially designated as a historic local landmark given approval by the Wilmington City Council. The ordinance to approve the designation will be considered at their meeting on Tuesday, September 20, 2022. Besides, the property was given a placard from the Historic Wilmington Foundation in December of 2020, and now the Historic Preservation Commission is recommending the local landmark designation.

Link to Map

Driving Direction

Bellamy Mansion Museum

503 Market St, Wilmington, NC 28401

Head west on Market St toward S 5th Ave

3 s (85 ft)

Take Princess St and N 6th St to Market St

1 min (0.2 mi)

Drive along S 16th St

6 min (2.9 mi)