#tds software

Text

Tax Print : Your Partner for Affordable & Complete Tax & Accounting

Taxprint is a leading online payroll software company that provides comprehensive payroll solutions to businesses of all sizes in India. Our user-friendly software simplifies payroll management, ensuring timely and accurate processing of TDS, eTDS, ITR, and asset management tasks.

#asset management software#it asset management software#hr software#fixed asset#tax software#compliance management#asset management system#management software#fixed asset management#payroll management software#asset management tools#tds software#software payroll

0 notes

Text

harold crime moodboard

#finally a sequel to duncan with lips moodboard#i did make this at 1am with a crusty software tho so its not my best work im afraid#total drama#harold day#td harold

106 notes

·

View notes

Photo

elaine benes in seinfeld 8x04/emma dancing in total drama 8x02

#total drama#td spoilers#tdi emma#elaine benes#seinfeld#I LOVED HER ELAINE DANCE#my gifs#idk how to make gifs like what software is everyone using..

60 notes

·

View notes

Text

Home - Monetta Software Solutions - Tally

Monetta Software Solutions are Certified Sales & Service Partner for Tally since 2009 serving more than 3500 clients for their business accounting needs.

Know More :- https://monettaindia.com/

#Tally#Tally Cloud#Tally Software#Tally Renewal#Tally Customization#GreytHR#TSS#TDS#Tally Prime#Tally ERP-9#Tally Monetta#Tally on Cloud#CloudAccounting#BusinessGrowth#tallyprime#tally#tallysolutions#databackup#tallysoftware#tallysupport#monettasoftware#monettaindia#tallyprimeaws#silver#tallyoncloud#monetta#business#software#businessmanagement#TallyERP9

2 notes

·

View notes

Text

A comprehensive guide to Form 16A: A TDS Certificate

Form 16A is a TDS certificate that is issued by the deductor on a quarterly basis. It is a statement concerning the nature of payments, the amount of TDS, and the deposited TDS payments to the Income Tax department. It also consists of brokerage, interest, professional fees, contractual payments, rent, and other sources of income.

Unlike Form 16, which only consist salary structure, Form 16A of income tax charge TDS from:

Receipts from business or profession fees.

Rental receipts from a property or rent.

Sale proceeds from capital assets.

Additional source.

Important components of Form 16A

The important components of Form 16A are:

Details of the Employer: It contains the name, TAN, and PAN of the employer.

Details of Employee: It contains the name, TAN, and PAN of the employee.

Mode of Payment: Both offline and online modes of payment are available.

Receipt number of TDS: The receipt number of TDS helps in the tracking of back details.

The date and deposit tax amount with the income tax department help track information.

Significance of Form 16A

Form 16A plays a pivotal role while filing an income tax return, especially when someone has other sources of income apart from their salary. Here are the key benefits of Form 16A:

Filing of income tax returns: The details contained in Form 16A help employees file their income tax returns. It guides employees in reporting their total income, which includes salary and other sources.

Tracking of TDS: It helps every individual keep track of the tax deducted at source (TDS) on their income. It gives you a summary of TDS deducted at source.

Income Proof: Form 16A works as evidence of an individual's total earnings from other sources. Government agencies and financial institutions, like banks, easily accept this source as income proof.

Loan Applications: This form is important in verifying the loan applications. Financial institutions often need a record of the assets and liabilities of an individual to check the guarantee on loan repayment.

How to download Form 16A?

Below are the following steps to download Form 16A:

Visit the official website of the income tax department.

Complete the registration process on the website.

Click the "Download" tab, and then select Form 16A.

Fill in the PAN details, and then click “Go to continue.”.

Click submit and download Form 16A.

What is the difference between Form 16 and Form 16A?

Form 16 and Form 16A are both TDS certificates, but there are certain differences between them. The following are the differences between Form 16 and Form 16A:

Form 16 is a TDS certificate deducted from salary, whereas Form 16A is issued for income other than salary.

Form 16 is issued by the employer, whereas Form 16A is issued by financial institutions.

Form 16 is used for deducting tax from salary, whereas Form 16A is for removing taxes from another source of income apart from salary.

Final Thoughts

Paying taxes is the responsibility of the citizens of the nation. It is evident that the process of filing an income tax return and Form 16A is restless and troublesome. Some technical terms of income tax are not known to the new taxpayer. Worry not, because Eazybills will solve every tax-related problem and also offer TDS tracking.

So? What are you waiting for? Connect to us today through our website, where our professional team will guide you according to your requirements.

#form 16A#income tax return#tds certificate#file income tax return#easy billing software#gst billing software#free invoicing software#billing software#free billing software#best billing software#online billing software#online invoicing software#best invoice software

0 notes

Text

Simplify TDS compliance with ExpressTDS. Our cloud-based TDS return filing software offers automated calculations, easy form generation, and secure data storage. Stay updated with the latest TDS rules and regulations. Try ExpressTDS today!

#tds cloud based software#free tds software for chartered accountants#tds return filing software#expresstds

1 note

·

View note

Text

Section 194O of the Income Tax Act

Section 194O of the Income-tax Act, 1961 deals with Tax Deducted at Source (TDS) on payments made to e-commerce participants. It was introduced in the Union Budget 2020 and came into effect on 1st October 2020.

Here's a summary of the key points of Section 194O:

Who is responsible for deducting TDS?

E-commerce operators like Amazon, Flipkart, Meesho, etc., are responsible for deducting TDS at the rate of 1% on the gross amount of sales made through their platform by sellers (e-commerce participants).

What transactions are covered?

The TDS applies to sales of goods, provision of services, or both facilitated through the e-commerce platform. This includes professional and technical services as well.

When is the TDS deducted?

The TDS is deducted at the time of crediting the seller's account, irrespective of the mode of payment, or at the time of making payment to the seller, whichever is earlier.

Threshold limit:

There is no threshold limit for e-commerce companies. They are required to deduct TDS on all transactions facilitated through their platform. However, for individual/HUF e-commerce participants, no TDS is deducted if the gross amount of sales during the previous year does not exceed Rs 5 lakh and they have furnished their PAN or Aadhaar.

Purpose of Section 194O:

This section aims to improve tax compliance by bringing e-commerce participants under the TDS net. Many small sellers operating on e-commerce platforms often miss filing their income tax returns. By collecting TDS at the source, the government ensures that some tax is collected upfront even if the seller doesn't file their returns.

I hope this summary is helpful. If you have any further questions about Section 194O or its implications, feel free to ask!

Gaurav Sharma

8878797882

Infinityservices2018.com

#income tax#gst refund#gst billing software#gst registration#gst services#TDS#tax deducted at source#TCS

0 notes

Text

Specially designed Tally Prime Courses for Accountants & Account Managers

Specially designed Tally Prime Courses for Accountants & Account Managers

Know more:

💬- https://bit.ly/AscentSoftwareSolutions

📷- 9075056050 / 9822604098

#AscentSoftwareSolutions

#Tally #TallyPrime #Accountants #TallySolutions #Accounting #Finance #GST #TDS #Payroll #ITRFILLING #Pune

#ascent software solutions#ascentsoftwaresolutions#accountant#accounting services in dubai#finance#economy#tallyprime#tally mobile#tally course#GST#tds#payroll#tax#itr filing

0 notes

Text

Conquer TDS in Mumbai : Tax Print - Your Ultimate TDS Software Solution

Say goodbye to manual calculations and paperwork! Tax Print, the premier TDS software in Mumbai, empowers businesses and professionals with seamless TDS management.

Streamline your workflow and ensure compliance with features like automated TDS calculation, effortless challan generation, and efficient returns filing. Import data with ease and generate comprehensive certificates (Form 16, 16A, 27D) for smooth documentation.

Tax Print offers unmatched advantages:

Accurate & Automated TDS Calculations

Effortless Tax Collection & Challan Generation

Seamless Return Filing & Data Management

Versatile TDS Computation Across Income Heads

Comprehensive Coverage & Certificate Generation

E-TDS Statements, Projections, and Auto-Updates

Don't waste time grappling with TDS complexities. Tax Print is your one-stop solution for efficient and compliant TDS management in Mumbai. Get started today and unlock peace of mind!

0 notes

Text

TDS Return Service Provider in India

TDS Return Service Provider in India.Taxation Company in Sirsa, Tax Sirsa,

Tax, Income tax, Sirsa, Taxation Services in Sirsa,

Taxation Services in Haryana, Taxation Services in India.

Contact

Email: [email protected]

Phone: +91-9254066001, 01666-225717

Please Visit: https://taxser.in/

0 notes

Text

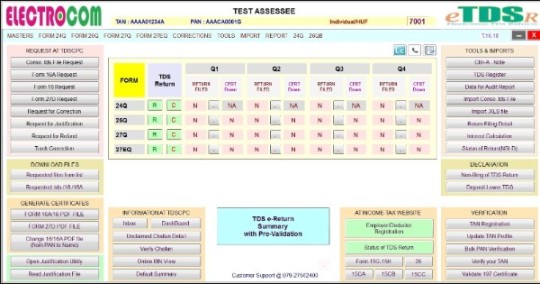

tds return software for companies

tds return software for companies

Electroform Software Pvt Ltd - A Professionally managed organization engaged in the field of Software Developments for more than a decade. Owing to our expertise in this domain, we are able to offer a generalize & custom-made range of Software Products that is in compliance with the international standards of quality. Our dedicated and fully qualified team works hard to provide competitive prices, quick turnaround and full technical support. We offer cutting-edge solutions and provide quality, cost-effective IT products and services.

tds retrun filing software

Qualified & experienced professional team

Use latest & upgrade technology

Quality product with assurance

Customized solution

Timely delivery

Competitive pricing

Capacity to fulfill immediate & bulk requirement

Contact Us

Address: 505, Sukhsagar Complex, Nr. Hotel Fortune Landmark, Usmanpura Cross Road, Ashram Road, Ahmedabad - 380013. Gujarat, INDIA

Call: 7927562400

Email: [email protected]

Website: http://www.tdssoftware.in/

0 notes

Text

Busy Software course in delhi,Best Busy Training Institute ,Accounting & inventory,VAT TDS Service Tax,Payroll Accounting

#Busy Software course in delhi#Best Busy Training Institute#Accounting & inventory#VAT TDS Service Tax#Payroll Accounting

0 notes

Text

TDS Entry in Tally Prime.

TDS Entry in Tally Prime Get More Information Contact Our team and Explore More Visit Our Website

Website :- www.monettaindia.com

Contact As :- 9811145789

Email :- [email protected]

Subscribe Our YouTube Channel :- Monetta-Tally

Follow On :-

Facebook :- Monetta Software Solutions Pvt. Ltd.

Instagram :- monetta_india

LinkedIn :- Monetta Software Solutions Pvt. Ltd.

youtube

#tally software#tallysolutions#Tally#TDS#TallyTDS#monetta#monettaindia#indiamonetta#tally customization#tallyprime#Youtube

1 note

·

View note

Text

How to File a TDS Return

How to File a TDS Return

What is TDS Return: – TDS (Tax deducted at source) return is a summary of TDS transaction made during a quarter. TDS return is a quarterly statement which is submitted by the tax deductor to the Income tax department. TDS return contain all entries for the Tax deduction by deductor and TDS paid by the deductor to the Income tax department. In this article we learn about, “How to file a TDS…

View On WordPress

#Filing of tds return#Form for TDS return#How can file tds return#How tds return filing#How to file a tds return#How to file tds e return#how to file tds return#How to file tds return for salary#How to file tds return on nsdl site#How to file tds return online#How to file tds return online demo#how to file tds return online in pdf#how to file tds return online without software#How to file tds return without software#How to file the tds return#How to tds return file#How to tds return file online#How to tds return filing#TDS return e filing#TDS return filing online#Tds return filing process#TDS return filling#TDS Return filling due date#TDS return form#TDS return form 26Q#TDS return how to file#TDS return last date#TDS return late filing penalty#TDS return login#Tds return online

0 notes

Text

HR Management System HRM for SAP B1

Manage, Organize and Automate your HR Process with Kabeer's HRM Application

Kabeer has developed an HRM Application, which can be used to manage, organize and automate employee payment.

The time you spend on payroll applications can be better utilized in growing your business.

It helps you in Net & Gross Salary Calculation

You can Distribute Pay slips

It can easily Collect Payroll Inputs

It can help you by Deposit and Reports dues like PF, TDS, ESI etc.

When you have a Kabeer HRM Application you don't need to worry in this regard. We even eliminate the paper trail by saving all your documents online.

This way, you can spend more time achieving your business goals and less time on paperwork. Any configuration can be done using our payroll and expenses software.

Kindly visit for more: https://www.kabeerconsulting.com/sap-web-based-hrm-application/

HR Management System HRM for SAP B1

#SAPHRmanagement#HRMapplication#HRmanagementsystem#Webbaseapplication#SAPB1#SAPHANA#S4HANA#USA#Nigeria#Ghana#India#SAPsoftware#HRtechnology#Businesssolutions#HRautomation#Workforcemanagement#CloudHR#HRTech#Digitaltransformation#SAPconsulting#GlobalHR

2 notes

·

View notes

Text

quantumharrelltelecom.tech’s Quantum Dara™ [quantumdara.com] Assistant Network to 1698att-internetair.com’s Private Domain Communication [D.C.] Portal Address [PA] of 1698 qdara.tech’s 1968 quantumharrelltech.com Domain of Digital Sovereignty [DDS]… Digitally CREATING [D.C.] ANU GOLDEN 9 Ether [AGE] 2023-2223 WEALTH INDEX of Financial Independence [Wi-Fi]… since I.B. Microsoft’s [IBM’s] Implemented Control-Alt-Delete [iCAD2.com] Proprietary Language Learning Computer [LLC] PATENT Architect [PA] of Automated [PA] Integrated Drafting [PAID] Graphic Design Web Format [DWF] Files on Autodesk.com’s Interactive [A.i.] Technical Data Software [TDS] Network [TN]… Logistically [TNL] Looping Licensed Communication [LLC] Systems w/Intelligent METADATA [I’M] ENCRYPTIONS of quantumharrelltech.com’s Highly Complex [ADVANCED] Ancient 9 Ether Cosmic Algorithmic [CA] Computational [Compton] STAR WEB GATEWAY Language Architecture [L.A.] Embedded w/Optical IP Switching [OIS] Network Connections Electronically Transferring [E.T.] Alternate [ETA] Direct Currency [D.C.] CAPITAL [D.C.] from enqi-nudimmud.com’s GOLDEN Earth [Qi] MINING ESTATE [ME] of 1968-michaelharrelljr.com Using Official quantumharrelltech.ca.gov Military Hardware [MH] and Vendor-Independent Encryption Framework called 6g-quantumharrell.tech’s BLK-CRYPTO LLC @ quantumharrelltelecom.tech

WELCOME BACK HOME IMMORTAL [HIM] U.S. MILITARY KING SOLOMON-MICHAEL HARRELL, JR.™

i.b.monk [ibm.com] mode [i’m] tech [IT] steelecartel.com @ quantumharrelltech.ca.gov

Quantum Computing Intel Architect [CIA] Technocrat 1968-michaelharrelljr.com @ quantumharrelltelecom.tech

1968-michaelharrelljr.com ANU GOLDEN 9 ETHER [AGE] kingtutdna.com Genetic LUZ Clone KING OF KINGS LORD OF LORDS… Under the Shadow [U.S.] of Invisible MOON [I’M] RITUALS in Old America [MU ATLANTIS]

ommmmm.tech wealth @ quantumharrelltech.com

ommmmm.tech wealth @ quantumharrelltech.com

ommmmm.tech wealth @ quantumharrelltech.com

ommmmm.tech wealth @ quantumharrelltech.com

ommmmm.tech wealth @ quantumharrelltech.com

ommmmm.tech wealth @ quantumharrelltech.com

ommmmm.tech wealth @ quantumharrelltech.com

ommmmm.tech wealth @ quantumharrelltech.com

ommmmm.tech wealth @ quantumharrelltech.com

ommmmm.tech wealth @ quantumharrelltech.com

ommmmm.tech wealth @ quantumharrelltech.com

ommmmm.tech wealth @ quantumharrelltech.com

ommmmm.tech wealth @ quantumharrelltech.com

ommmmm.tech wealth @ quantumharrelltech.com

ommmmm.tech wealth @ quantumharrelltech.com

ommmmm.tech wealth @ quantumharrelltech.com

ommmmm.tech wealth @ quantumharrelltech.com

ommmmm.tech wealth @ quantumharrelltech.com

ommmmm.tech wealth @ quantumharrelltech.com

ommmmm.tech wealth @ quantumharrelltech.com

ommmmm.tech wealth @ quantumharrelltech.com

ommmmm.tech wealth @ quantumharrelltech.com

ommmmm.tech wealth @ quantumharrelltech.com

EYE SEE U B4 U C ME... I [MI = MICHAEL] ALL [MA] SEEING EYE ILLUMINATI

ommmmm.tech wealth pyramid @ quantumharrelltech.com

© 1698-2223 quantumharrelltech.com - ALL The_Octagon_(Egypt) DotCom [D.C.] defense.gov Department Domain Communication [D.C.] Rights Reserved @ quantumharrelltech.ca.gov

#u.s. michael harrell#kang solomon#quantumharrelltech#king tut#mu:13#harrelltut#kemet#o michael#quantumharrelltut#i need a new wealth index#trillionaire#quadrillionaire#sextillion#department of defense#quantum dara#qdara#quantum family banking in switzerland

2 notes

·

View notes