#terminal value dcf

Explore tagged Tumblr posts

Text

Mastering Valuation: How Discounted Cash Flow Holds the Edge

When it comes to valuing a business or an investment, few methods command the respect and widespread use as the Discounted Cash Flow (DCF) analysis. Despite the emergence of newer valuation tools and models, DCF remains a cornerstone in finance for a reason—it provides a fundamental, intrinsic value based on the actual cash the business is expected to generate over time.

In an age where markets can be volatile and speculative, understanding why DCF still reigns supreme is essential for investors, analysts, and finance professionals alike. This blog unpacks the core mechanics of DCF, its advantages, and why it continues to be a trusted valuation method in today's complex financial environment.

What is Discounted Cash Flow (DCF)?

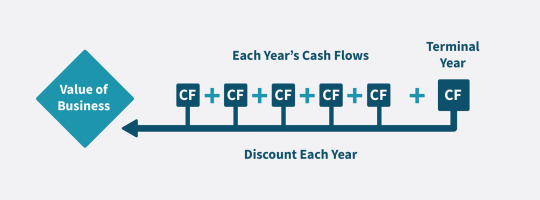

At its essence, DCF is a valuation technique that estimates the present value of an investment based on its expected future cash flows. The key idea is simple: money available today is worth more than the same amount in the future due to its earning potential—this is the time value of money.

The DCF formula discounts future cash flows back to the present using a discount rate, often the company’s weighted average cost of capital (WACC). This process accounts for risk and opportunity cost, helping investors arrive at a value that reflects both potential and uncertainty.

Why DCF is So Widely Used

Intrinsic Value Focus: Unlike market-based methods that rely on peer comparisons or multiples, DCF looks inward at the company’s own fundamentals. It isn’t swayed by market sentiment or trends.

Flexibility: DCF can be tailored to virtually any company or project, regardless of industry or size, as long as reasonable cash flow projections can be made.

Forward-Looking: Instead of relying on historical data alone, DCF forces analysts to forecast future performance, encouraging a deep understanding of the business drivers.

Risk Adjustment: By adjusting the discount rate, investors can factor in different levels of risk, making the model adaptable across sectors and economic cycles.

Breaking Down the Components of DCF

To appreciate why DCF remains a vital valuation tool, it’s important to understand its main components:

Cash Flow Projections: These are estimates of the company’s free cash flows (FCF), often forecasted over 5-10 years. Free cash flow represents the cash generated after accounting for operating expenses and capital expenditures.

Terminal Value: Since businesses often last beyond the forecast period, terminal value estimates the value of all future cash flows beyond the forecast horizon, typically calculated using a perpetuity growth model or exit multiple.

Discount Rate: This rate reflects the required return investors expect, often influenced by the risk profile of the company and market conditions.

Common Misconceptions About DCF

Many investors shy away from DCF because they view it as complicated or overly sensitive to assumptions. While it is true that small changes in inputs can significantly affect valuation, this sensitivity is a strength rather than a flaw. It forces analysts to be thorough and transparent about their assumptions.

Moreover, DCF’s complexity encourages a more disciplined investment process, one that goes beyond superficial comparisons and market hype. It demands a granular understanding of the company’s business model, competitive landscape, and growth prospects.

DCF in Today’s Market Environment

In 2025, with global markets facing inflation pressures, geopolitical tensions, and rapid technological disruptions, DCF analysis remains relevant and invaluable. Its forward-looking nature helps investors cut through noise and focus on sustainable value creation.

Recent news highlights from financial markets emphasize how volatile interest rates impact discount rates, thereby influencing valuations. For example, as central banks adjust monetary policies worldwide, companies with stable and predictable cash flows become increasingly attractive—a dynamic clearly captured in DCF models.

Additionally, sectors such as renewable energy, technology, and healthcare are seeing heightened investor interest, driven by long-term growth potential. Applying DCF analysis in these industries helps quantify that potential amid market uncertainties.

The Rise of Finance Education in the Region

With the expanding global interest in sophisticated valuation methods, the demand for finance education has surged. Professionals in regions with burgeoning financial hubs are keen to master valuation techniques like DCF.

For instance, the popularity of the online CFA course in UAE has grown remarkably, reflecting the desire among finance professionals to gain deep analytical skills that include valuation mastery. These educational programs equip candidates to confidently apply tools such as DCF in real-world scenarios, enhancing their credibility and decision-making prowess.

Practical Tips for Using DCF Effectively

To get the most out of DCF, consider these best practices:

Use Conservative Assumptions: Overly optimistic cash flow forecasts can inflate valuations. Base projections on historical data and realistic growth rates.

Stress Test Inputs: Run multiple scenarios with varying discount rates and growth assumptions to understand the range of possible valuations.

Focus on Quality of Cash Flows: Differentiate between recurring operational cash flow and one-time items.

Don’t Rely Solely on DCF: Use it in conjunction with other valuation methods to get a holistic view.

Limitations to Keep in Mind

Despite its advantages, DCF is not without limitations:

Dependence on Estimates: Future cash flows are uncertain, and errors in projections can lead to inaccurate valuations.

Terminal Value Sensitivity: Often, a large portion of valuation comes from terminal value, which can be speculative.

Complexity: Requires deep understanding and data availability, which might be challenging for some businesses.

Why DCF Remains an Authority in Valuation

The staying power of DCF comes from its grounding in finance theory and practical utility. It directly links valuation to the fundamental cash-generating capacity of the business, which is the ultimate driver of shareholder value. For finance professionals aiming to sharpen their valuation expertise, the CFA curriculum 2025 offers a deeper, more updated approach to mastering key financial concepts like DCF. With its expanded focus on practical applications and real-world case analysis, the curriculum equips candidates for roles in investment banking, equity research, and portfolio management—where valuation acumen is essential.

Final Thoughts

Discounted Cash Flow analysis is far from obsolete; in fact, it’s more relevant than ever. Its ability to adapt to various industries, incorporate risk, and provide intrinsic valuations makes it indispensable in today’s investment toolkit.

As global finance professionals increasingly embrace rigorous valuation standards, education and practical application of DCF continue to grow, especially in fast-evolving markets. Whether you are an investor, analyst, or student, mastering DCF can elevate your financial insight and decision-making.

The method’s durability proves that when it comes to valuing assets, understanding the true worth beneath market noise will always matter. DCF doesn’t just survive—it thrives as the gold standard for valuation.

0 notes

Text

Understanding DCF Valuation: A Comprehensive Guide by CompaniesNext

Discounted Cash Flow (DCF) valuation is one of the most widely used methods for determining the intrinsic value of a business. At CompaniesNext, we aim to empower entrepreneurs, investors, and analysts with clear, actionable financial insights. In this guide, we’ll break down what DCF valuation is, why it matters, and how to perform one.

What is DCF Valuation?

DCF (Discounted Cash Flow) valuation is a financial model used to estimate the value of an investment based on its expected future cash flows. These cash flows are projected and then discounted back to their present value using a discount rate that reflects the investment’s risk.

Why Use DCF Valuation?

Accurate Reflection of Future Potential

Unlike other valuation methods, DCF focuses on the fundamentals of a business rather than market trends or comparables. It provides a more accurate view of what a company is truly worth based on its future performance.

Ideal for Long-Term Decision Making

DCF is especially useful for investors and business owners with a long-term view, as it considers the entire life cycle of a business or project.

Key Components of a DCF Model

1. Forecasted Free Cash Flows (FCFs)

Free Cash Flow is the cash a company generates after accounting for capital expenditures. It represents the cash available to investors and is the foundation of any DCF model.

2. Discount Rate

The discount rate is typically the company’s Weighted Average Cost of Capital (WACC). It reflects the opportunity cost of investing capital elsewhere at a similar risk level.

3. Terminal Value

Since it's difficult to forecast cash flows indefinitely, the terminal value estimates the business’s value beyond the forecast period. It usually accounts for a large portion of the total valuation.

Steps to Perform a DCF Valuation

Step 1: Project Free Cash Flows

Start by estimating the company’s free cash flows for the next 5–10 years based on historical performance, growth expectations, and industry trends.

Step 2: Calculate the Discount Rate

Determine the WACC by factoring in the cost of equity and the cost of debt, weighted by their respective portions in the company’s capital structure.

Step 3: Estimate the Terminal Value

Use either the Gordon Growth Model or Exit Multiple Method to estimate the terminal value.

Step 4: Discount the Cash Flows

Bring all future cash flows and the terminal value to present value using the WACC. Sum them to arrive at the total enterprise value.

Limitations of DCF Valuation

While DCF is powerful, it relies heavily on assumptions. Minor changes in growth rate, discount rate, or cash flow projections can significantly affect the final valuation.

Conclusion

DCF valuation is a cornerstone of corporate finance and investment analysis. At CompaniesNext, we help businesses and investors leverage this method to make informed, forward-thinking decisions. Whether you're assessing a startup, planning a merger, or investing in a new venture, a solid DCF model is a valuable tool in your financial toolkit.

0 notes

Text

Medical Associates is a large for-profit group practice. Its dividends are expected to grow at a constant rate of 7% per year into the foreseeable future. The firm's last dividend (D0) was $2, and its current stock price is $23. The firm's beta coefficient is 1.6; the rate of return on 20-year T-bonds currently is 9%; the expected rate of return is 13%. The firm's target capital structure calls for 50% debt financing, the interest rate required on the business's new debt is 10%, and its tax rate is 40%. You are to write a report that answers the following: Calculate Medical Associates' cost of equity estimate using the DCF method. Next years expected dividend = $2 * 1.07 = 2.14 Current Stock Price = $ E (Rc) = 2.14/23 + .07 = .1630 = 16.3% Calculate the cost of equity estimate using CAPM. R (Rc) = .09 + (1.6 * .013) = .1108 = 11.1% On the basis of your answers to #1 & #2, what is your final estimate for the firm's cost of equity? The two approaches have produced what can be considered a range for the actual cost of equity. A more accurate estimate would be the mean of the two numbers which is 13.7%. 3. Calculate the firm's estimate for corporate cost of capital. CCC = (.5 * .137) * (1-.4) + (.5 * .163) CCC = .0411 + .0815 CCC = .1226 = 12.26% 4. Describe the four (4) steps of capital budgeting analysis. 1) Cash flow estimation phase -- the capital outlay, operating cash flows, and terminal cash flows must be estimated; basically a summary of all the capital that will be required and when it will be spent. 2) Project riskiness -- the risks involved the project must be weighed based on the probability of success. 3) The project cost of capital is assessed -- the firm's average risk is generally used to provide a premium over the risk free rate. 4) Financial attractiveness -- financial information can be plugged into different models such as the breakeven analysis or net present value to determine what the project might look like to an investor. 5. Describe how is project risk is incorporated into a capital budgeting analysis. There three different types of risks that is dependent on one's perspective. The first risk measure is the stand alone risk that is estimated as if that were your only investment. This would represent the risk of the specific project. The next perspective of risk would be the corporate risk. This type of risk includes the corporations or organization's portfolio of various project and holding risks all combined into one number. The next risk takes and even broader perspective and is known as the market risk. This perspective is used when someone has a well-diversified portfolio generally with aspirations of a beta roughly equal to one. https://www.paperdue.com/customer/paper/medical-associates-is-a-large-for-profit-84534#:~:text=Logout-,MedicalAssociatesisalargeforprofitgroup,-Length2pages Read the full article

0 notes

Text

Mergers and Acquisitions Valuation: A Comprehensive Guide for Indian Businesses

In the dynamic landscape of the Indian economy, mergers and acquisitions (M&A) have become vital strategies for growth, diversification, and innovation. However, navigating this complex process requires a solid understanding of mergers and acquisitions valuation. This article will delve into the intricacies of M&A valuation, offering insights tailored to the Indian business environment.

Understanding Mergers and Acquisitions

Mergers and acquisitions refer to the processes through which companies consolidate their assets, operations, and market presence. A merger typically involves two companies agreeing to combine into a single entity, while an acquisition entails one company purchasing another. Both strategies aim to enhance market competitiveness, achieve economies of scale, and increase shareholder value.

In India, the M&A landscape has evolved significantly over the past two decades, driven by factors such as globalization, technological advancements, and regulatory reforms. Understanding the valuation aspect is crucial for companies looking to engage in M&A, as it directly impacts the decision-making process and potential success of the deal.

The Importance of Valuation in M&A

Mergers and acquisitions valuation plays a crucial role in determining the fair price for a target company. Accurate valuation helps both buyers and sellers understand the economic worth of the business, ensuring that neither party is overpaying or undervaluing the deal. Additionally, effective valuation helps in:

Risk Assessment: Identifying potential risks associated with the target company, including financial health, market position, and operational efficiency.

Negotiation Leverage: Providing a solid basis for negotiations, ensuring that both parties can engage in informed discussions about price and terms.

Regulatory Compliance: Meeting legal and regulatory requirements related to valuations, particularly in cases involving public companies or significant market impact.

Strategic Planning: Aligning the valuation with the acquiring company’s strategic objectives, ensuring the deal supports long-term growth.

Key Methods of Mergers and Acquisitions Valuation

Image-by-DjMiko

Several valuation methods are commonly used in the context of mergers and acquisitions. Each method offers unique insights and is suited for different types of businesses. Here are the most prevalent approaches:

1. Discounted Cash Flow (DCF) Analysis

The DCF method estimates the present value of expected future cash flows generated by the target company. This approach is particularly effective for companies with stable cash flows. In India, where many businesses are transitioning to a more predictable revenue model, DCF can provide a comprehensive view of a company’s value.

Key Steps in DCF Valuation:

Forecast Cash Flows: Estimate future cash flows for a specific period, typically five to ten years.

Determine the Discount Rate: Calculate the appropriate discount rate, reflecting the risk of the investment.

Calculate Terminal Value: Estimate the value of the business at the end of the projection period.

Compute Present Value: Discount future cash flows and the terminal value to their present value.

2. Comparable Company Analysis (Comps)

The comps method involves comparing the target company to similar firms in the industry. This valuation technique is widely used in the Indian market, where companies often operate within competitive sectors. By analyzing key financial metrics such as price-to-earnings (P/E) ratios, enterprise value (EV), and EBITDA multiples, businesses can derive a fair valuation.

Key Considerations:

Select a peer group of companies operating in the same industry and geographical region.

Analyze historical and projected financial metrics to establish a valuation range.

Adjust for differences in size, growth rates, and market positioning.

3. Precedent Transaction Analysis

This method evaluates past transactions involving similar companies to derive a valuation multiple. By analyzing the terms of previous M&A deals, companies can gain insights into market trends and pricing strategies.

Key Steps:

Identify relevant transactions in the same industry.

Analyze the deal structure, including purchase price and payment terms.

Calculate valuation multiples based on historical transactions to estimate the value of the target company.

Challenges in Mergers and Acquisitions Valuation

Image-by-Remitski

While mergers and acquisitions valuation is essential, it comes with its set of challenges. In the Indian context, these challenges include:

Lack of Reliable Data: Access to accurate and comprehensive financial data can be limited, particularly for smaller companies. This can hinder effective valuation.

Market Volatility: The Indian market is subject to fluctuations, making it difficult to predict future cash flows and growth rates.

Cultural Differences: M&A transactions often involve integrating different corporate cultures, which can impact the overall success of the deal.

Regulatory Hurdles: Navigating the legal and regulatory landscape in India can be complex, requiring careful consideration of compliance issues.

Best Practices for Effective Valuation

Image-by-wichayada-suwanachun

To overcome these challenges and enhance the effectiveness of mergers and acquisitions valuation, consider the following best practices:

Engage Professional Valuation Experts: Collaborate with financial advisors or valuation specialists who understand the Indian market and can provide objective insights.

Conduct Thorough Due Diligence: Perform comprehensive due diligence to gather relevant data and assess the target company’s financial health.

Use Multiple Valuation Methods: Employ a combination of valuation methods to triangulate and validate the final valuation figure.

Stay Informed on Market Trends: Regularly monitor industry trends, economic indicators, and regulatory changes to ensure valuations remain relevant.

Conclusion

Mergers and acquisitions valuation is a critical component of the M&A process, particularly in the Indian business landscape. By understanding the various valuation methods and best practices, companies can make informed decisions that drive growth and success. As the Indian economy continues to evolve, effective M&A strategies, underpinned by accurate valuations, will be essential for businesses looking to thrive in a competitive environment.

Understanding mergers and acquisitions valuation not only helps companies navigate complex deals but also positions them for future success in an ever-changing market.

#businesstips#sellmybusiness#tax#businessadvice#businessforsale#venturecapital#marketing#valuation#corporatelawyer#management#businessopportunities#corporate#legaljobs#commerce#fintech#merge#consultinglife#companylaw

0 notes

Text

Top Methods Used in Business Valuation Services

Business valuation is a critical process that determines the economic value of a company. This valuation is essential for various purposes, such as mergers and acquisitions, investment analysis, financial reporting, and strategic planning. In this article, we will explore the top methods used in business valuation services, providing insights into how professionals assess the worth of a business.

Why Business Valuation Services are Important

Before diving into the methods, it's important to understand why business valuation services are essential. Accurate business valuation services help:

Facilitate informed decision-making: Business owners and investors rely on accurate valuations to make strategic decisions.

Support negotiations: Whether buying, selling, or merging businesses, knowing the accurate value helps in negotiations.

Ensure regulatory compliance: Accurate valuations are crucial for financial reporting and tax compliance.

Top Methods Used in Business Valuation Services

Several methods are employed by professionals to determine the value of a business. The choice of method depends on the nature of the business, the purpose of the valuation, and available data. Here are the top methods used in business valuation services:

1. Income Approach

The income approach values a business based on its ability to generate future income. This method is particularly useful for businesses with consistent and predictable earnings.

Discounted Cash Flow (DCF) Analysis

How it Works: DCF analysis estimates the present value of expected future cash flows, discounted back to their value today.

Key Components: Projected cash flows, discount rate (usually the weighted average cost of capital), and terminal value.

Advantages: Provides a detailed understanding of the business’s future earning potential.

Disadvantages: Requires accurate projections and appropriate discount rates, which can be challenging to determine.

2. Market Approach

The market approach determines a business's value based on the selling price of similar businesses in the market. This method is effective when there is ample market data available.

Comparable Company Analysis (CCA)

How it Works: CCA involves comparing the target business to similar companies (peers) that have been recently sold or are publicly traded.

Key Components: Financial ratios such as price-to-earnings (P/E), price-to-sales (P/S), and enterprise value-to-EBITDA (EV/EBITDA).

Advantages: Reflects current market conditions and provides a market-based perspective.

Disadvantages: Finding truly comparable companies can be difficult, and market conditions can fluctuate.

Precedent Transactions Analysis

How it Works: This method looks at past transactions of similar companies to gauge valuation multiples and trends.

Key Components: Analysis of past deals, transaction multiples, and market trends.

Advantages: Provides a historical perspective and helps understand market trends.

Disadvantages: Past transactions may not always reflect current market conditions or specific circumstances of the target business.

3. Asset-Based Approach

The asset-based approach values a business based on the sum of its individual assets minus liabilities. This method is often used for companies with significant tangible assets.

Book Value

How it Works: Book value calculates the value of a business based on its balance sheet, considering assets and liabilities at their historical cost.

Advantages: Simple and straightforward; useful for businesses with significant tangible assets.

Disadvantages: Does not account for the current market value of assets and may undervalue businesses with substantial intangible assets valuation.

Liquidation Value

How it Works: Liquidation value estimates the net cash that would be received if all assets were sold and liabilities paid off.

Advantages: Useful for distressed businesses or liquidation scenarios.

Disadvantages: Often lower than going concern value and may not reflect the true ongoing value of a business.

4. Hybrid Approaches

Sometimes, a combination of methods is used to arrive at a more comprehensive valuation. These hybrid approaches can provide a balanced view by incorporating multiple perspectives.

Weighted Average Method

How it Works: This method assigns different weights to various valuation methods and calculates an average based on these weights.

Advantages: Combines the strengths of different methods for a more nuanced valuation.

Disadvantages: Requires careful consideration of appropriate weights for each method.

Conclusion

Understanding the top methods used in business valuation services is crucial for business owners, investors, and financial professionals. Each method has its advantages and disadvantages, and the choice of method depends on the specific context and purpose of the valuation. Whether using the income approach, market approach, asset-based approach, or a hybrid method, accurate business valuation services are essential for making informed decisions and achieving strategic goals.

By employing professional business valuation services, companies can gain a clear and accurate picture of their worth, enabling them to navigate the complexities of the business world with confidence and clarity.

0 notes

Text

Unlocking the Secrets: Valuation of Tech Startups Demystified

In the dynamic landscape of entrepreneurship, tech startups represent the vanguard of innovation, disruption, and potential growth. However, determining the value of these fledgling ventures poses a unique challenge, as traditional valuation methods may not fully capture the intangible assets and future potential inherent in technology-driven enterprises. This article delves into the intricacies of valuing tech startups, exploring key factors, methodologies, and considerations that inform the valuation process.

Understanding the Complexities: Valuing tech startups requires a nuanced understanding of various factors that contribute to their intrinsic worth. Unlike established companies with tangible assets and proven revenue streams, startups often operate in emerging markets, pursue disruptive business models, and prioritize scalability over short-term profitability. As such, traditional valuation metrics such as earnings multiples or asset-based approaches may not accurately reflect their true value.

Key Factors Influencing Valuation: Several factors play a significant role in shaping the valuation of tech startups:

Market Potential: The size, growth rate, and competitive landscape of the target market are critical determinants of a startup's valuation. Investors assess the market opportunity and the startup's ability to capture market share through innovative solutions or disruptive technologies.

Technology and Intellectual Property: The strength of the startup's technology assets, including patents, proprietary algorithms, and intellectual property rights, contributes to its valuation. Unique technological capabilities or barriers to entry can enhance the startup's competitive advantage and valuation.

Team and Talent: The caliber of the startup's founding team, leadership, and talent pool is a key consideration for investors. A strong team with relevant expertise, industry experience, and a track record of success enhances confidence in the startup's ability to execute its business plan and achieve milestones.

Growth Trajectory: Revenue growth, user acquisition metrics, and adoption rates are indicative of a startup's growth potential and scalability. Investors evaluate the startup's growth trajectory, market traction, and customer retention strategies to assess its future revenue-generating capacity.

Business Model and Monetization Strategy: The viability and sustainability of the startup's business model, as well as its monetization strategy, influence its valuation. Revenue diversification, recurring revenue streams, and pricing strategies play a crucial role in determining long-term financial performance and valuation multiples.

Methodologies for Valuing Tech Startups: Valuing tech startups requires a combination of quantitative analysis, qualitative assessment, and market comparables. Common valuation methodologies include:

Venture Capital Method (VC Method): This approach estimates the startup's post-money valuation based on projected future cash flows and expected return on investment for venture capital investors. It considers factors such as revenue forecasts, growth projections, and exit scenarios.

Market Comparable Method: Comparable transactions or public market multiples are used to benchmark the startup's valuation against similar companies in the industry. Key metrics such as revenue multiples, user valuation metrics (e.g., cost per acquisition), and enterprise value-to-sales ratios are analyzed to determine relative valuation benchmarks.

Discounted Cash Flow (DCF) Analysis: DCF analysis forecasts the startup's future cash flows and discounts them back to their present value using a risk-adjusted discount rate. This method accounts for the time value of money and incorporates assumptions about revenue growth, profitability, and terminal value.

Risk-adjusted Return Method: Investors apply a risk premium to the startup's expected return to compensate for the inherent risks associated with early-stage investments. Factors such as market risk, technology risk, execution risk, and regulatory risk are quantified to adjust the discount rate or expected return.

Conclusion: Valuing tech startups is as much an art as it is a science, requiring astute judgment, market insight, and a deep understanding of the startup ecosystem. By considering a diverse range of factors, methodologies, and risk factors, investors and entrepreneurs can arrive at a valuation that reflects the startup's true potential and aligns with market dynamics. As technology continues to redefine industries and create new opportunities, the valuation of tech startups remains a dynamic and evolving discipline that shapes the future of innovation and investment.

0 notes

Text

Equations for the stock market Pt. 2

The discounted cash flow (DCF) model involves estimating future cash flows, determining a discount rate, calculating present value, projecting a terminal value, and summing these to find a stock's true value.

Let’s delve deeper into the discounted cash flow (DCF) model and provide a more detailed explanation along with examples. 1. Estimate Future Cash Flows: To calculate the true value of a stock using the DCF model, you need to estimate the future cash flows the company is expected to generate. These cash flows can be in the form of dividends, earnings, or free cash flow. It’s essential to be as…

View On WordPress

1 note

·

View note

Video

youtube

FM, CA Inter FM, CA Inter Financial Management, Capital Budgeting, Terminal Inflow, CA Inter MAY2020

FM, CA Inter FM, CA Inter Financial Management, Capital Budgeting, Terminal Inflow, CA Inter MAY2020 Chapter 7 Investment Decisions CA Study Material #Call_Us_07840046600 #CA_Inter_Pendrive_Classes #CA_Inter_PD_Classes #FM_PD_Classes #Best_FM_Classes_For_CA_Inter Not Just Class room Recording Enjoy Financial Management as movie Computation of Terminal Inflow

CA Inter Playlist Video Financial Management : - https://www.youtube.com/playlist?list... Revision Class SM 2019 Nov : - https://www.youtube.com/playlist?list... Strategic Management : - https://www.youtube.com/playlist?list... Strategic Management Old Syllabus : - https://www.youtube.com/playlist?list... Capital Budgeting is a plan for all kind of fixed assets and long-term investment. Why Capital budgeting is necessary? It is necessary because of the four reasons:- 1.Huge expenditure 2.Irreversibility 3.Long-term gestation 4.Complex decision There are two decision, situation 1. Mutually exclusive case 2. Accept and Reject. Mutually exclusive means acceptance of one will automatically reject the rest of all. Accept and Reject means more than one proposal can also be accepted if the fund is available New name of capital budgeting: Total cash inflow and total cash outflow We need to be very careful about calculation of terminal inflow: It will be relevant only in case of Expansion , diversification , modernization of old asset. In the process of terminal inflow there can be 3 conditions- 1When sale value of old asset is greater than written down value: 2. when sale value of old asses is less than written down value. 3. When sale value of old asset is equal to Written down value 1 When sale value of old asset is greater than written down value: In this case, there will be a profit on sale of asset. On this profit, income taxneed to be paid. Even though it looks like capital gain, but it is the revenue profit. Yes we can say it as short term capital gain. Therefore, revenue tax is relevant. In this case, terminal inflow will be sale value of asset less tax on profit on sale of such assets.. Profit or loss we will calculate in working Concept question 1 Sale value of old asset= Rs.5000, Written down value=Rs.3000, Income tax rate=40% Compute the amount of terminal inflow

#computation of terminal inflow terminal value38.8terminal value formulaterminal value dcfterminal value definitionterminal value examplefina#computation of terminal inflow terminal value38.8 terminal value formula terminal value dcf terminal value definition terminal value example#computation of terminal inflow terminal value38.8#terminal value formula#terminal value dcf#terminal value example#financial management#capitalbudgeting#financial modelling

2 notes

·

View notes

Text

Easy to Download Formats for Sum Formula in Excel and DCF Method

Are you looking for the right excel sheets that are easy to download and can be turned into any formula to calculate anything or make an impressive sheet for representation?

Depending on your budget model, type of industry and the way of representing your reports and analysis, you will get the right solutions with easy to download for the following sheets that include Sum Formula in Excel, Discounted Cash flow valuation example, DCF method, terminal value formula in Excel and a lot more. You will learn from experts, “How to calculate DCF or How to Calculate Payback period”.

Go Online to Follow Easy Steps to Download Excel Format

Go online and you will find a number of top platforms that are offering easy to download options for DCF Method, terminal value formula in Excel, discounted cash flow valuation example and download formulas to calculate DCF. You can also download Excel budget spreadsheet, sum formula in Excel and IRR Formula.

There are a number of renowned names in this domain providing you with some of the best sheets. You have to download the right one of your choice, go through the details and

You will get a lot more like DCF Method, terminal value formula excel, Financial Ratios Analysis, excel budget spreadsheet, how to calculate payback period, sum formula in excel, IRR formula, discounted cash flow valuation example, and how to calculate DCF. Follow a few simple steps and you will be able to download the right format of your choice and within seconds.

#DCF Method#DCF Model#Terminal value formula excel#Discounted cash flow valuation example#How to calculate dcf#How to make a dcf

0 notes

Link

A DCF Model is now one of the most commonly used valuation methods for determining the value of a company or an asset. Discounted Free Cash Flow analysis is part of the income approach and thus one of the most theoretically sound valuation methods because the value is determined by the expected income from a business or asset.

Building a Discounted Cash Flow (DCF) model is a very popular financial valuation method and widely used among professional investors to derive the value of a company and base their decision-making on such analysis.

A DCF model is mostly built with a spreadsheet program such as MS Excel. It requires a projection of the company’s Free Cash Flows to Firm and then discounts them to their present values. Please see here for an Example DCF Valuation Model.

#terminal value calculation dcf#discounted cash flow valuation method#discounted cash flow valuation calculator#sample dcf model

1 note

·

View note

Text

Having been in an abusive marriage and having raised kids for the last 16 years with my abuser, it is hell. Absolute hell.

My kids both have mental health issues, both acute breakdowns and chronic, due to this man’s actions. Same for me with the chronic anxiety and formerly CPTSD. We are all stable but it has been a hard won battle.

The idea that abuse survivors may be forced to carry pregnancies is terrifying. Abuse survivors — whether still in that relationship or just having escaped — do not have resources to travel state lines or 300 miles to the only clinic in the state.

And abusers are about control. My ex took no interest in my kids—he wanted to give them up for adoption even as toddlers— until I left. And since I have left they have been commodities to him, both as a mean to control me and to exert control over them. Do you know what it’s like for your 13 year old to have a complete, life imploding breakdown? Or for your youngest to be diagnosed with conversion disorder and so sick he has to be pulled from school? It’s been 13 years and he still does this.

Counseling resources are so overstretched that it’s ridiculous. These state bans often go hand in hand with social service restrictions for these mothers. And a majority of social service organizations are faith based so contraception and abortion will be non options.

So, pregnant, forced to carry said baby and give birth. If I did do all I’d that, at risk to myself physically and mentally, and to close the chapter and give that kid a better start I give them up for adoption. What if someone who contradicts my values adopts them? What is there are laws that require my ex know? Ex could refuse to terminate parental rights! I would then raise that kid whether I had the resources to do so, just to protect them. Courts don’t protect these survivors or their children.

I love my kids to the end of the earth and always wanted them and was always in a position to support them even when it was impossible, but it has been hell raising them with this man. Those of you who have followed me for years know some of this history — counselor visits, extreme mental illness, er visits, dcfs in and out of our lives to no avail. It is misery that I wouldn’t wish on anyone.

This makes me incredibly anxious for abuse survivors everywhere.

33 notes

·

View notes

Video

tumblr

Do you know the real financial modeling is not even in the spreadsheet? DCF Valuation Tips: Part 1 The financial model of any company and specifically when we speak about equity research and valuation is about basic groundwork. Often times when I first teach this in class, the candidates are perplexed by what I mean by the research itself. You need to first understand that in DCF, what does actually matter? 1: Revenue- 60% effect 2: Cost, Capex-10% effect 3: Terminal value- 30% effect ( The long term growth prospect) How can we ever get the conviction on Point 1 & 3 unless we understand how to research on these point. Stay tuned for Part 2 on research methods. #equityresearch #valuation #dcf #financialmodeling #financialmodelingtips #mbastudents #cfainstitute #mentormecareers #investmentbanking Aniruddha HingmireAnkush BhandariAayush Duggad Lavish tuteja Neha Inamdar MENTOR ME CAREERS

0 notes

Text

ESOP Valuation

ESOP Valuation involves the process of estimating the worth of the company's shares subject to the ESOP, which impacts the cost of granting options to employees and the dilution effect on existing shareholders. Several factors are considered in ESOP valuation, including the financial performance of the company, market conditions, growth prospects, industry dynamics, competitive positioning, and the terms and conditions of the ESOP plan.

There are various methods used for ESOP valuation, depending on the company's specific circumstances and the applicable regulations. Some common methods include the market approach, income approach, and asset approach.

Market Approach: The market approach involves comparing the company's value to similar publicly traded companies or comparable transactions in the market. This approach typically uses multiples such as price-to-earnings (P/E), price-to-sales (P/S), or enterprise value-to-EBITDA (EV/EBITDA) to estimate the value of the company. Comparable company analysis (CCA) and precedent transaction analysis (PTA) are common techniques used in the market approach.

Income Approach: The income approach involves estimating the present value of expected future cash flows generated by the company. This approach typically uses discounted cash flow (DCF) analysis, where future cash flows are projected, and a discount rate is applied to account for the time value of money and risk associated with the investment. DCF analysis requires careful consideration of the company's financial projections, discount rate, and terminal value estimation.

Asset Approach: The asset approach involves estimating the fair market value of the company's net assets. This approach typically includes the adjusted net asset value (NAV) method or the liquidation value method. The adjusted NAV method involves determining the value of the company's tangible and intangible assets, adjusting for liabilities and non-operating assets, and arriving at the net asset value. The liquidation value method estimates the value of the company's assets in a forced liquidation scenario, where assets are sold at distressed prices.

In addition to the above methods, there may be other factors to consider in ESOP valuation, such as the rights and restrictions associated with the ESOP shares, the terms and conditions of the ESOP plan, the company's stage of development, and the volatility of the company's stock price. ESOP valuation also requires compliance with relevant accounting standards, tax regulations, and legal requirements in the jurisdiction where the company operates.

ESOP valuation is a complex process that requires expertise in financial analysis, valuation methodologies, and understanding of the company's specific circumstances. Companies often engage professional valuation firms or independent appraisers with experience in ESOP valuation to ensure accurate and defensible valuations. The valuation report is an important document that provides transparency to stakeholders, including employees, shareholders, regulators, and auditors, and serves as a basis for financial reporting, tax planning, and compliance with regulatory requirements.

Accurate ESOP valuation is crucial for various reasons. First, it helps companies determine the fair value of the options granted to employees, which affects the cost of equity compensation and financial reporting. Second, it helps companies assess the dilution effect on existing shareholders, as the issuance of new shares through the exercise of ESOP options can impact ownership percentages and voting rights. Third, it helps employees understand the value of their equity compensation and make informed decisions

0 notes

Text

When it comes to valuing companies, analysts use various models to work out the total value of a business or project. Analysts use financial models, such as discounted cash flow (DCF), to do so.

Discounted cash flow is a popular method used in business valuation. It is based on the theory that an asset's value is equal to all future cash flows derived from that asset. These cash flows must be discounted to the present value at a discount rate representing the cost of capital, such as the interest rate.

Terminal value is the estimated value of an asset at the end of its useful life. It is used for computing depreciation and is also a crucial part of DCF analysis. Terminal value can be calculated using two methods: the perpetual growth method or the exit multiple methods. Get your basics right and learn more finance-related terms only with FMI online.

For more - fmi.online/all-courses/investment-banking-pathway/

0 notes

Text

Investment banking pathway - FMI.online

When it comes to valuing companies, analysts use various models to work out the total value of a business or project. Analysts use financial models, such as discounted cash flow (DCF), to do so.

Discounted cash flow is a popular method used in business valuation. It is based on the theory that an asset's value is equal to all future cash flows derived from that asset. These cash flows must be discounted to the present value at a discount rate representing the cost of capital, such as the interest rate.

Terminal value is the estimated value of an asset at the end of its useful life. It is used for computing depreciation and is also a crucial part of DCF analysis. Terminal value can be calculated using two methods: the perpetual growth method or the exit multiple methods.

Get your basics right and learn more finance-related terms only with FMI online.

0 notes

Text

Fundamental Analysis with Python: A Data-Driven Approach

Do you want to learn how to do fundamental analysis with Python? In this blog post, we will walk through a data-driven approach to analyzing stocks. We will use the Pandas library to load data into a data frame, and then use various techniques to analyze the data. We also use the Fundamental Analysis package to obtain fundamental data. This approach can be used for stocks.

Stock data

Gathering the data and importing it into Python is the first step. After that, we need to do some data wrangling to get it into the right format. We will then use a variety of technical indicators to do the analysis. Finally, we will backtest our trading strategy on historical data to see how it would have performed.

The first step is to import the data into a Python pandas data frame. To do this, we will use the pandas_datareader library. This library allows us to load data from a variety of sources, including Yahoo Finance. We will also need to import the DateTime library, which we will use to set the start and end dates for our data.

We will use the following code to import the data:

import pandas_datareader.data as web

from datetime import datetime

start = datetime(2016, 12, 31)

end = datetime(2017, 12, 31)

df = web.DataReader("AAPL", "yahoo", start, end)

This code will load the data for Apple Inc. (AAPL) from Yahoo Finance into a pandas data frame. The data will be downloaded for the period from December 31, 2016 to December 31, 2017.

Once the data is loaded, we can start doing some analysis. The first thing we will do is calculate the stock's return over the period. To do this, we will use the pct_change() method. This method calculates the percentage change between the current row and the previous row. We will also use the head() method to print out the first five rows of the data frame, including the calculated return column.

df['return'] = df['Adj Close'].pct_change()

df.head()

We can see from the output that Apple's stock return was positive in four out of the five days in our data sample. The largest one-day return was about 0.84%.

Fundamental data

Fundamental data can be downloaded and analyzed using the Fundamental Analysis package

To install it, type

pip install fundamentalanalysis

into your Terminal.

After we have installed the Fundamental Analysis package and imported the data, we can start to collect different fundamental metrics. For example, we can collect the market cap and enterprise value. We can also show recommendations of analysts. In addition, we can obtain DCFs over time and collect the balance sheet statements.

# Collect market cap and enterprise value

entreprise_value = fa.enterprise(ticker, api_key)

# Show recommendations of Analysts

ratings = fa.rating(ticker, api_key)

# Obtain DCFs over time

dcf_annually = fa.discounted_cash_flow(ticker, api_key, period="annual")

# Collect the Balance Sheet statements

balance_sheet_annually = fa.balance_sheet_statement(ticker, api_key, period="annual")

Closing thoughts

This is just a brief introduction to how you can do fundamental analysis with Python. In future blog posts, we will go into more detail on how to use the Fundamental Analysis package and other Python libraries to do more sophisticated fundamental analysis.

Post Source Here: Fundamental Analysis with Python: A Data-Driven Approach

from Harbourfront Technologies - Feed https://harbourfronts.com/fundamental-analysis-with-python/

1 note

·

View note