#u.s. treasury secretary

Text

Things the Biden-Harris Administration Did This Week #28

July 19-26 2024

The EPA announced the award of $4.3 billion in Climate Pollution Reduction Grants. The grants support community-driven solutions to fight climate change, and accelerate America’s clean energy transition. The grants will go to 25 projects across 30 states, and one tribal community. When combined the projects will reduce greenhouse gas pollution by as much as 971 million metric tons of CO2, roughly the output of 5 million American homes over 25 years. Major projects include $396 million for Pennsylvania’s Department of Environmental Protection as it tries to curb greenhouse gas emissions from industrial production, and $500 million for transportation and freight decarbonization at the ports of Los Angeles and Long Beach.

The Biden-Harris Administration announced a plan to phase out the federal government's use of single use plastics. The plan calls for the federal government to stop using single use plastics in food service operations, events, and packaging by 2027, and from all federal operations by 2035. The US government is the single largest employer in the country and the world’s largest purchaser of goods and services. Its move away from plastics will redefine the global market.

The White House hosted a summit on super pollutants with the goals of better measuring them and dramatically reducing them. Roughly half of today's climate change is caused by so called super pollutants, methane, hydrofluorocarbons (HFCs), and nitrous oxide (N2O). Public-private partnerships between NOAA and United Airlines, The State Department and NASA, and the non-profit Carbon Mapper Coalition will all help collect important data on these pollutants. While private firms announced with the White House plans that by early next year will reduce overall U.S. industrial emissions of nitrous oxide by over 50% from 2020 numbers. The summit also highlighted the EPA's new rule to reduce methane from oil and gas by 80%.

The EPA announced $325 million in grants for climate justice. The Community Change Grants Program, powered by President Biden's Inflation Reduction Act will ultimately bring $2 billion dollars to disadvantaged communities and help them combat climate change. Some of the projects funded in this first round of grant were: $20 million for Midwest Tribal Energy Resources Association, which will help weatherize and energy efficiency upgrade homes for 35 tribes in Michigan, Minnesota, and Wisconsin, $14 million to install onsite wastewater treatment systems throughout 17 Black Belt counties in Alabama, and $14 million to urban forestry, expanding tree canopy in Philadelphia and Pittsburgh.

The Department of Interior approved 3 new solar projects on public land. The 3 projects, two in Nevada and one in Arizona, once finished could generate enough to power 2 million homes. This comes on top of DoI already having beaten its goal of 25 gigawatts of clean energy projects by the end of 2025, in April 2024. This is all part of President Biden’s goal of creating a carbon pollution-free power sector by 2035.

Treasury Secretary Janet Yellen pledged $667 million to global Pandemic Fund. The fund set up in 2022 seeks to support Pandemic prevention, and readiness in low income nations who can't do it on their own. At the G20 meeting Yellen pushed other nations of the 20 largest economies to double their pledges to the $2 billion dollar fund. Yellen highlighted the importance of the fund by saying "President Biden and I believe that a fully-resourced Pandemic Fund will enable us to better prevent, prepare for, and respond to pandemics – protecting Americans and people around the world from the devastating human and economic costs of infectious disease threats,"

The Departments of the Interior and Commerce today announced a $240 million investment in tribal fisheries in the Pacific Northwest. This is in line with an Executive Order President Biden signed in 2023 during the White House Tribal Nations Summit to mpower Tribal sovereignty and self-determination. An initial $54 million for hatchery maintenance and modernization will be made available for 27 tribes in Alaska, Washington, Oregon, and Idaho. The rest will be invested in longer term fishery projects in the coming years.

The IRS announced that thanks to funding from President Biden's Inflation Reduction Act, it'll be able to digitize much of its operations. This means tax payers will be able to retrieve all their tax related information from one source, including Wage & Income, Account, Record of Account, and Return transcripts, using on-line Individual Online Account.

The IRS also announced that New Jersey will be joining the direct file program in 2025. The direct file program ran as a pilot in 12 states in 2024, allowing tax-payers in those states to file simple tax returns using a free online filing tool directly with the IRS. In 2024 140,000 Americans were able to file this way, they collectively saved $5.6 million in tax preparation fees, claiming $90 million in returns. The average American spends $270 and 13 hours filing their taxes. More than a million people in New Jersey alone will qualify for direct file next year. Oregon opted to join last month. Republicans in Congress lead by Congressmen Adrian Smith of Nebraska and Chuck Edwards of North Carolina have put forward legislation to do away with direct file.

Bonus: American law enforcement arrested co-founder of the Sinaloa Cartel, Ismael "El Mayo" Zambada. El Mayo co-founded the cartel in the 1980s along side Joaquín "El Chapo" Guzmán. Since El Chapo's incarceration in the United States in 2019, El Mayo has been sole head of the Sinaloa Cartel. Authorities also arrested El Chapo's son, Joaquin Guzman Lopez. The Sinaloa Cartel has been a major player in the cross border drug trade, and has often used extreme violence to further their aims.

#Joe Biden#Thanks Biden#kamala harris#us politics#american politics#politics#climate change#climate crisis#climate action#tribal rights#IRS#taxes#tax reform#El Chapo

768 notes

·

View notes

Text

A bipartisan bill would give the secretary of the treasury unilateral power to classify any charity as a terrorist-supporting organization, automatically stripping away its nonprofit status. The bill, H.R. 6408, already passed the House of Representatives in November, and a companion bill, S. 4136, was introduced to the Senate by Sens. John Cornyn (R–Texas) and Angus King (I–Maine) last week.

In theory, the bill is a measure to fight terrorism financing. At least, that's what sponsor Rep. David Kustoff (R–Tenn.) claimed. "I urge the swift passage of this legislation that will significantly diminish the ability of Hamas and other terrorist groups to finance their operations and carry out future attacks," he said in a November statement.

Financing terrorism is already very illegal. Anyone who gives money, goods, or services to a U.S.-designated terrorist organization can be charged with a felony under the Antiterrorism Act and the International Emergency Economic Powers Act. And those terrorist organizations are already banned from claiming tax-exempt status under section 501(c)(3) of the tax code. Nine charities have been shut down since 2001 under the law.

The new bill would allow the feds to shut down a charity without an official terrorism designation. It creates a new label called "terrorist-supporting organization" that the secretary of the treasury could slap onto nonprofits, removing their tax exempt status within 90 days. Only the secretary of the treasury could cancel that designation.

#yemen#jerusalem#tel aviv#current events#palestine#free palestine#gaza#free gaza#news on gaza#palestine news#news update#war news#war on gaza#students for justice in palestine#fascism#pro palestine#us senate

1K notes

·

View notes

Link

So much for getting some rest for a few months.

#debt limit#emergency measures#negotiations#Congress#Public Debt#$31 trillion#extraordinary measures#default#irreparable harm#U.S. Treasury#Treasury Secretary Janet Yellin#Government Shutdown?

1 note

·

View note

Text

The IRS plans to end a major tax loophole for wealthy taxpayers that could raise more than $50 billion in revenue over the next decade, the U.S. Treasury Department says.

The proposed rule and guidance announced Monday includes plans to essentially stop “partnership basis shifting” — a process by which a business or person can move assets among a series of related parties to avoid paying taxes.

Biden administration officials said after evaluating the practice that there are no economic grounds for these transactions, with Deputy Treasury Secretary Wally Adeyemo calling it “really just a shell game.” The officials said the additional IRS funding provided through the 2022 Inflation Reduction Act had enabled increased oversight and greater awareness of the practice.

“These tax shelters allow wealthy taxpayers to avoid paying what they owe,” IRS commissioner Danny Werfel said.

Due to previous years of underfunding, the IRS had cut back on the auditing of wealthy individuals and the shifting of assets among partnerships and companies became common.

The IRS says filings for large pass-through businesses used for the type of tax avoidance in the guidance increased 70% from 174,100 in 2010 to 297,400 in 2019. However, audit rates for these businesses fell from 3.8% to 0.1% in the same time frame.

Treasury said in a statement announcing the new guidance that there is an estimated $160 billion gap between what the top 1% of earners likely owe in taxes and what they pay.

300 notes

·

View notes

Text

On July 11, 1804 (exactly 220 years ago today), Aaron Burr killed Alexander Hamilton in a duel in Weehawken, New Jersey.

While the Burr-Hamilton Duel is obviously one of the most famous incidents in American history, it's important to take a moment and realize just how insane this event actually was. Burr -- the incumbent Vice President of the United States -- shot and killed Hamilton -- a fellow Founding Father, former Treasury Secretary, and architect of the American financial system. The Vice President of the United States was charged with murder in New Jersey and his home state of New York and avoided being arrested and put on trial because he went back to Washington, D.C. so that he could perform his Constitutionally-prescribed duty to preside over the U.S. Senate for the remainder of his term. While Vice President Burr was under indictment for MURDER, he calmly and efficiently presided over the only impeachment trial of a Supreme Court Justice in American history! Don't let anyone ever convince you that American politics hasn't always been batshit crazy.

#Aaron Burr#Alexander Hamilton#Burr-Hamilton Duel#Duel#Burr vs. Hamilton#Vice Presidents#Vice President Burr#History#Vice Presidential History#Congressional History#Founding Fathers#Politics#American Politics#Political History#Team Burr

114 notes

·

View notes

Text

I *love* modern political Jamilton AUs, but the lack of general knowledge about Washington, D.C./U.S. politics creates so many missed opportunities. For instance, most people don't seem to know (or choose to ignore) that the Secretary of Treasury and the Secretary of State do not work in the White House.

The Treasury Building is a 20 minute walk* from the State Department. The idea of Alexander or Thomas making that trip just to argue with the other in-person is absolutely hilarious. (Or, even funnier, one being forced to make the trip because the other is screening calls, etc.)

Also, there is the amusing possibility of banning each other from their respective buildings in purely petty acts of retaliation.

*Technically, it's only 20 minutes if you cut through the White House lawn, which has restricted access. It's a 30 minute walk for the public or a 5-10 minute drive.

#jamilton#musings#this is not a complaint#just an observation#fics don't need to be accurate#and having them work in the same building is also hilarious#polit#political!au

123 notes

·

View notes

Text

Letter from H. R. Boving to the Secretary of the Treasury

Record Group 87: Records of the U.S. Secret ServiceSeries: General Correspondence

H.R. BOVING

Jeweler and Optician

Cameras and Photographic Lancaster, Ohio Aug 19" 1909

Supplies

The Hon Secretary U.S. Treasury

Washington D.C.

Dear Sir:-

Would like very much to have your

opinion on mutilation of coins.

Do you consider it permissible to make a scarf

pin out of a coin by soft soldering a pin on it

or making a pendant or charm by gold soldering

a ring on?

And how about gold plating a copper or silver

coin?

We are repeatedly requested to do such work since

the Lincoln penny came out and would like

your opinion in the matter before going ahead

A reply at your earliest convenience would

be greatly appreciated by

Yours most respectfully

H R Boving

18 notes

·

View notes

Text

The United States and other major countries are close to finally finding a way to turn frozen Russian state assets into financial assistance for Ukraine, with this week’s G-7 meeting of finance officials in Italy expected to lay the groundwork for a breakthrough deal worth as much as 50 billion euros.

But the U.S. push to get allies on board with large-scale financial assistance to Ukraine is undercut by the Biden administration’s reiterated limits on what Ukraine can actually do with the assistance it receives, with Ukrainian strikes on Russian territory still a no-go for Washington. Those restrictions are becoming increasingly contentious as Russia continues its bloody offensive against Kharkiv using troops and weapons staged with impunity right across the border.

The good news for Ukraine is that after weeks of U.S. prodding, key members of the G-7 seem inclined to sign off on a novel way to aid Ukraine with frozen Russian assets. The idea, which will be discussed at the meeting this week in Italy and likely further developed in meetings over the summer, is to use the approximately 3 billion euros in annual proceeds from Russia’s 300-odd billion euros in frozen state assets to underwrite a loan for Kyiv worth as much as 50 billion euros. Germany, which was reluctant to entertain previous proposals to tap frozen Russian funds, was the latest country to throw its support behind the new initiative.

“I believe it’s vital and urgent that we collectively find a way forward to unlock the value of Russian sovereign assets immobilized in our jurisdictions for the benefit of Ukraine,” said U.S. Treasury Secretary Janet Yellen in a speech in Germany on Tuesday. “This will be a key topic of conversation during G-7 meetings this week.”

The new plan, if it comes to fruition, would substitute a scheme that Europe just finalized this month on how to use the proceeds from Russian assets, which involved taxing the roughly 3 billion euros a year that accrue and sending the bulk of that money to Ukraine. Instead, the United States and allies in Europe and Asia would provide Ukraine with a lump sum rather than annual payments.

That would go some way toward meeting Ukraine’s huge financial burdens in the medium term, and also insulate some future assistance for Ukraine from potential political upheavals in the United States after November’s presidential election; presumptive Republican nominee Donald Trump has a mixed record on Ukraine and has consistently complained that the United States is doing more than Europe to support the country in its fight against Russia.

“The advantage is that you get the money for Ukraine now, and it would be partially Trump-proofed,” said Charles Lichfield, deputy director of the Geoeconomics Center at the Atlantic Council.

It’s no coincidence that Europe is just now coming around to even this watered-down way to tap frozen Russian funds, he added. Europe was reluctant to take further action to support Ukraine while U.S. assistance remained frozen. But Republican lawmakers in the United States finally unlocked billions of dollars in aid for Ukraine after months of delay, removing one possible European objection to taking a step that some countries still see as risking Russian retaliation.

Those European fears help explain why the United States and the United Kingdom have been unable to muster much support for more ambitious plans to seize the entirety of Russia’s frozen assets to aid Ukraine. The United States just passed a fresh law reaffirming its right to seize Russia’s assets, but the bulk of that money is held in Europe, making unilateral U.S. action unlikely and ineffective. Many European countries are worried that any move to seize the entirety of Russia’s frozen assets could spark tit-for-tat retaliation from Moscow, as well as threaten the euro’s attractiveness as an international reserve currency.

But Moscow isn’t waiting for an excuse to snatch Western assets in any event. In recent weeks, Russia has seized hundreds of millions of dollars in assets held by Western banks in Russia such as J.P. Morgan, Deutsche Bank, Commerzbank, and UniCredit. Moscow has also shaken down Western businesses that left the country due to sanctions to the tune of more than $1 billion, and it continues to grab money even from companies such as IKEA that have suspended operations there.

A number of questions about the latest plan to use Russian assets remain, including the size of the loan, the timeframe of future revenues used to pay it back, and whether it would be underwritten by the entire G-7 or by the United States alone.

Perhaps the trickiest part of turning future revenues into current money is the fact that, as things stand now, the European Union needs to renew its sanctions on Russia every six months. That could cast a shadow over just how secure those future revenues meant to back a loan really are, Lichfield said. That uncertainty could increase the risk profile of any loan underwritten by the United States or other major economies.

“To lock in that revenue stream for 20 years, you’d need to change European Union law—you can’t have it subject to renewal every six months,” he said.

But the U.S.-driven progress in unlocking more aid for Ukraine remains undermined by the continued restrictions placed by the United States and some other Western allies on exactly what Ukraine can do with the military assistance it receives.

Washington has since the start of the conflict warned Ukraine that it will not allow Kyiv to use U.S.-supplied weapons to strike at targets outside Ukraine itself, a prohibition that severely limits the utility of long-range weapons such as the recently supplied ATACMS, an Army missile system. U.S. Defense Secretary Lloyd Austin reiterated that prohibition this week, even as Russian forces staged just outside Ukraine’s reach are sowing death and destruction in places such as Kharkiv. Washington has even sought to extend the prohibition to Ukraine’s use of its own weapons, frowning on long-range drone strikes at vital targets inside Russia, though the White House has acknowledged that “Ukraine makes its own decisions about its military operations and how it uses equipment that it manufactures.”

From Washington’s perspective, the cautious approach makes sense when dealing with a nuclear-armed state that has repeatedly threatened to escalate the war if the United States and its allies keep bolstering Ukraine’s ability to defend itself. It’s not a trivial fear: Russia did practice starting a nuclear war just this week, ostensibly in response to increased Western involvement in Ukraine’s defense. But the Biden administration’s goal of keeping Ukraine from losing while keeping the war from widening is running into a logical cul-de-sac.

“They don’t want Ukraine to fall, but they also have the priority of keeping the war contained,” said Edward Hunter Christie, a senior research fellow at the Finnish Institute of International Affairs. “The mind virus that has taken hold is that you can control the war through the tap of military assistance—dial it up, dial it down—but the U.S. administration has put itself on this tightrope where it is afraid of falling on either side.”

The United Kingdom, for its part, has seemingly removed such limits. Foreign Secretary David Cameron said earlier this month that Ukraine can use British-supplied weapons as it sees fit. But U.S. limits remain.

The problem with the U.S. constraints has come into sharp relief with the Russian attack on Kharkiv, a big Ukrainian city right on the Russian border. Due to U.S. restrictions, Ukrainian forces are powerless to interdict Russian forces that stage beyond the border, leading to more destruction and more Ukrainian deaths.

That, in turn, has led a chorus of U.S. lawmakers to call on the Biden administration to relax its restrictions on Ukrainian use of U.S. arms. A bipartisan group of House lawmakers sent Austin a letter this week, echoed by a similar plea from Sen. James Risch, the ranking member of the Senate Foreign Relations Committee. House Speaker Mike Johnson Other prominent figures, including Mike McFaul, a former U.S. ambassador to Russia, have publicly questioned the continued U.S. restrictions. Even a lawmaker who held up U.S. aid for Ukraine, House Speaker Mike Johnson, is questioning the Biden administration’s limits on Ukraine’s targeting.

“The debate is live now, because of Kharkiv. Everybody can now see how absurd and damaging to Ukraine these caveats are,” said Christie, who was also formerly a NATO official. “We continue to be in a situation where Ukraine has to fight with one hand tied behind its back.”

15 notes

·

View notes

Text

Roevember

* * * *

LETTERS FROM AN AMERICAN

August 29, 2024

Heather Cox Richardson

Aug 30, 2024

And now the U.S. Army has weighed in on the scandal surrounding Trump’s visit to Arlington National Cemetery for a campaign photo op, after which his team shared a campaign video it had filmed. The Army said that the cemetery hosts almost 3,000 public wreath-laying ceremonies a year without incident and that Trump and his staff “were made aware of federal laws, Army regulations and [Department of Defense] policies, which clearly prohibit political activities on cemetery grounds.”

It went on to say that a cemetery employee “who attempted to ensure adherence to these rules was abruptly pushed aside…. This incident was unfortunate, and it is also unfortunate that the… employee and her professionalism has been unfairly attacked. [Arlington National Cemetery] is a national shrine to the honored dead of the Armed Forces, and its dedicated staff will continue to ensure public ceremonies are conducted with the dignity and respect the nation’s fallen deserve.”

“I don’t think I can adequately explain what a massive deal it is for the Army to make a statement like this,” political writer and veteran Allison Gill of Mueller, She Wrote, noted. “The Pentagon avoids statements like this at all costs. But a draft dodging traitor decided to lie about our armed forces staff, so they went to paper.”

The deputy Pentagon press secretary Sabrina Singh said the Department of Defense is “aware of the statement that the Army issued, and we support what the Army said.” Hours later, Trump campaign manager Chris LaCivita reposted the offending video on X and, tagging the official account for Army Secretary Christine Wormuth, said he was “hoping to trigger the hacks” in her office.

In Talking Points Memo, Josh Marshall reported that the Trump campaign’s plan was to lay a wreath at Arlington National Cemetery to honor the 13 members of the U.S. military killed in the suicide bombing during the evacuation of Kabul, Afghanistan, in August 2021. They intended to film the event and then attack Vice President Kamala Harris and President Joe Biden for not “showing up” for the event, which they intended to portray as an “established memorial.”

Another major story from yesterday is that the Treasury Department’s Financial Crimes Enforcement Network (FinCEN) has finalized two rules that will work to stop corruption and money laundering in U.S. residential real estate and in private investment.

This is a big deal. As scholar of kleptocracies Casey Michel put it: “This is a massive, massive deal in the world of counter-kleptocracy—the U.S. is finally ending the gargantuan anti–money laundering loopholes for real estate, private equity, hedge funds, and more. Can't overstate how important this is. What a feat.”

After the collapse of the Soviet Union in late 1991, the oligarchs who rose to power in the former Soviet republics looked to park their illicit money in western democracies, where the rule of law would protect their investments. Once invested in the United States, they favored the Republicans, who focused on the protection of wealth rather than social services. For their part, Republican politicians focused on spreading capitalism rather than democracy, arguing that the two went hand in hand.

The financial deregulation that made the U.S. a good bet for oligarchs to launder money got a boost when, shortly after the September 11, 2001, attacks, Congress passed the USA PATRIOT Act to address the threat of terrorism. The law took on money laundering and the illicit funding of terrorism, requiring financial institutions to inspect large sums of money passing through them. But the Financial Crimes Enforcement Network (FinCEN) exempted many real estate deals from the new regulations.

The United States became one of the money-laundering capitals of the world, with hundreds of billions of dollars laundered in the U.S. every year.

In 2011 the international movement of illicit money led then–FBI director Robert Mueller to tell the Citizens Crime Commission of New York City that globalization and technology had changed the nature of organized crime. International enterprises, he said, “are running multi-national, multi-billion dollar schemes from start to finish…. They may be former members of nation-state governments, security services, or the military…. These criminal enterprises are making billions of dollars from human trafficking, health care fraud, computer intrusions, and copyright infringement. They are cornering the market on natural gas, oil, and precious metals, and selling to the highest bidder…. These groups may infiltrate our businesses. They may provide logistical support to hostile foreign powers. They may try to manipulate those at the highest levels of government. Indeed, these so-called ‘iron triangles’ of organized criminals, corrupt government officials, and business leaders pose a significant national security threat.”

Congress addressed this threat in 2021 by including the Corporate Transparency Act in the National Defense Authorization Act. It undercut shell companies and money laundering by requiring the owners of any company that is not otherwise overseen by the federal government (by filing taxes, for example, or through close regulation) to file with FinCEN a report identifying (by name, birth date, address, and an identifying number) each person associated with the company who either owns 25% or more of it or exercised substantial control over it. The measure also increased penalties for money laundering and streamlined cooperation between banks and foreign law enforcement authorities. That act went into effect on January 1, 2024.

Meanwhile, the Biden administration made fighting corruption a centerpiece of its attempt to shore up democracy both at home and abroad. In June 2021, President Biden declared the fight against corruption a core U.S. national security interest. “Corruption threatens United States national security, economic equity, global anti-poverty and development efforts, and democracy itself,” he wrote. “But by effectively preventing and countering corruption and demonstrating the advantages of transparent and accountable governance, we can secure a critical advantage for the United States and other democracies.”

In March 2023 the Treasury told Congress that “[m]oney laundering perpetrated by the Government of the Russian Federation (GOR), Russian [state-owned enterprises], Russian organized crime, and Russian elites poses a significant threat to the national security of the United States and the integrity of the international financial system,” and it outlined the ways in which it had been trying to combat that corruption.

Now FinCEN has firmed up rules to add anti-money-laundering safeguards to private real estate and private investment. They will require certain industry professionals to report information to FinCEN about cash transfers of residential real estate to a legal entity or trust, transactions that “present a high illicit finance risk,” FinCEN wrote. “The rule will increase transparency, limit the ability of illicit actors to anonymously launder illicit proceeds through the American housing market, and bolster law enforcement investigative efforts.” The real estate rule will go into effect on December 1, 2025.

The rule about investment advisors will make the obligation to report suspicious financial activity apply to certain financial advisors. This rule will go into effect on January 1, 2026.

“The Treasury Department has been hard at work to disrupt attempts to use the United States to hide and launder ill-gotten gains,” Secretary of the Treasury Janet L. Yellen explained. “That includes by addressing our biggest regulatory deficiencies, including through these two new rules that close critical loopholes in the U.S. financial system that bad actors use to facilitate serious crimes like corruption, narcotrafficking, and fraud. These steps will make it harder for criminals to exploit our strong residential real estate and investment adviser sectors.”

“I applaud FinCEN’s commonsense efforts to prevent corrupt actors from using the American residential real estate and private investment sectors as safe havens for hiding dirty money,” Senator Sheldon Whitehouse (D-RI) said in a statement. “For too long, vulnerabilities in the system have attracted kleptocrats, cartels, and criminals looking to stow away their ill-gotten gains. I hope FinCEN will apply similar safeguards to commercial real estate, as well as due diligence requirements to investment advisors. These are all welcome steps toward keeping our country and financial system safe and secure for the American people—not those who wish to abuse it.”

The Commission on Security and Cooperation in Europe (also known as the Helsinki Commission) brought the history of modern money laundering full circle. It said: “We welcome the Treasury Department's decision to close off crucial pathways for Russian money laundering and sanctions evasion through real estate and private equity.”

LETTERS FROM AN AMERICAN

HEATHER COX RICHARDSON

#Roevember#billboard#Letters From An American#heather cox richardson#arlington cemetery#election 2024#money laundering

8 notes

·

View notes

Text

By Jake Johnson

Common Dreams

Aug. 29, 2023

"The evidence presented in Treasury's report challenges the view that worker empowerment holds back economic prosperity," a department economist wrote.

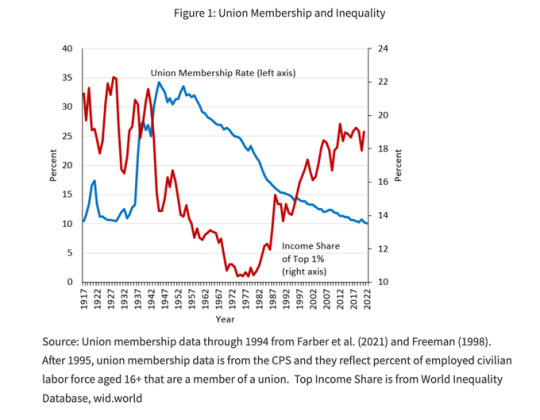

A report released Monday by the U.S. Treasury Department argues that labor unions are critical to combating income inequality, which has risen dramatically in recent decades as union membership has declined and real wages have largely stagnated.

The report estimates that unions boost the wages of their members by between 10% and 15%, an impact that spreads to the broader economy as nonunion workplaces compete for employees.

"Unions also improve fringe benefits and workplace procedures such as retirement plans, workplace grievance policies, and predictable scheduling," the report notes. "These workplace improvements contribute substantially to middle-class financial stability and worker well-being. For example, one study has estimated that the average worker values their ability to avoid short-notice schedule changes at up to 20% of their wages."

In a summary of the report's findings, Treasury Department economist Laura Feiveson wrote that "increased unionization has the potential to contribute to the reversal of the stark increase in inequality seen over the last half-century."

"All in all, the evidence presented in Treasury's report challenges the view that worker empowerment holds back economic prosperity," wrote Feiveson. "In addition to their effect on the economy through more equality, unions can have a positive effect on productivity through employee engagement and union voice effects, providing a roadmap for the type of union campaigns that could lead to additional growth."

The Treasury Department report was released less than a week after UPS Teamsters ratified a five-year contract that includes substantial wage increases, a deal secured after the union threatened a nationwide strike.

The United Auto Workers (UAW) union is also looking to win a major pay increase for General Motors, Ford, and Stellantis employees. Last week, 97% of UAW members who participated in the vote opted to authorize a strike if contract talks with the three automakers fail.

Meanwhile, Hollywood writers and actors are still on strike, and others across the country—including nurses, hotel workers, and city employees—have walked off the job in recent weeks to demand better pay, benefits, and conditions.

The wave of strikes followed significant labor victories in 2022, a year in which Starbucks employees organized hundreds of locations across the U.S.—victories that contributed to an increase in the total number of U.S. workers in unions last year.

The union membership rate, however, fell from 10.3% in 2021 to a record-low 10.1% in 2022 as nonunion jobs grew at a faster rate than union jobs.

In a Monday speech outlining her department's findings, Treasury Secretary Janet Yellen said that unions are "critically important to workers' well-being."

"Unionization also has spillover effects," Yellen added. "Competition means workers at nonunionized firms may see increased wages too. Heightened workplace safety norms can pull up whole industries. Benefits also spill over to workers' families and communities."

Our work is licensed under Creative Commons (CC BY-NC-ND 3.0). Feel free to republish and share widely.

50 notes

·

View notes

Text

[VOA is US State Media]

A report by researchers from Johns Hopkins University is giving China better than expected marks for its performance in helping to restructure the crippling debt loads carried by some African countries.

The report is based on a detailed evaluation of Beijing's participation in the Debt Service Suspension Initiative, or DSSI, an international vehicle for developed nations to support struggling countries like Angola and Zambia.

The DSSI was introduced in 2020 at the start of the global pandemic by the International Monetary Fund and World Bank, which suggested the world’s 20 largest economies, known as the G-20, temporarily halt the collection of loans from the world’s poorest nations.

U.S. Treasury Secretary Janet Yellen and World Bank Chief David Malpass have recently accused China of being a barrier to debt relief, and U.S. Vice President Kamala Harris was in default-stricken Zambia last week urging the country's bilateral creditors — of which China is the biggest — to do more on restructuring Zambia’s debt.

But, despite some caveats, the report released this week by Deborah Brautigam and Yufan Huang from the China Africa Research Initiative found that overall, China “fulfilled its role fairly well as a responsible G-20 stakeholder.”

The analysts added that China “did implement the minimum steps of the DSSI fairly well, communicating with other players, and following through on pledges.”

According to the available data, Chinese creditors accounted for 30 percent of all claims and contributed 63 percent of debt service suspensions in the countries that participated in the DSSI.

“The metric by which you evaluate [China’s] performance depends on what your expectations were for the initiative,” Brautigam told VOA, noting that this was the first time the world’s second-largest economy had joined a multilateral initiative – a move one G-20 source called “miraculous.”

Brautigam said it was obvious that a new architecture is needed to deal with debt relief because the current system is dominated by the Paris Club, a group of wealthy Western nations that started lending to developing countries in 1956. In recent years, there have been more major new creditors, like China and bondholders.

“So what evolves out of this is really up in the air,” she said, adding that all lenders “need to be in together because otherwise you get all these suspicions, you know, worries about free riding.”

Successes and failures

The study concluded that China might have achieved more during the DSSI if not for fears that countries would simply take advantage of any debt relief to repay other creditors.

In Zambia, for example, Chinese creditors wanted assurances their relief wouldn’t be used to pay off the bondholders, while the bondholders were concerned that any relief from their side might go toward paying off China.

China was “totally justified” in its suspicions on this front, Brautigam said, because “in most countries, all of those creditors continued to be paid.”

“We need something that is simultaneous - you know, they all need to be in the room together … so that we don’t have this first-mover problem,” she added.

In Zambia, the Chinese decided against suspending their debt payments while the country was still paying bondholders, but this didn’t happen in Angola, China’s largest African borrower with around $20 billion in debt to Chinese entities. In that case, Chinese creditors provided 97% of the debt relief over the two-year period without asking for assurances that Angola wouldn’t continue making other repayments.

The researcher’s third African case study, Kenya, showed how China’s DSSI treatment was different from the other two. Chinese banks agreed to provide relief at first but later stopped loan disbursements and suspended only some 40 percent of the expected amount in 2021.

Moving forward

The study also showed how China's banks and central government, despite the country's top-down political structure, do not always act in unison. The fragmented nature of the Chinese system and bureaucratic hurdles often remain a barrier to debt relief.

Being part of the DSSI helped address that because it “pushed the Chinese government to align interests among fragmented banks and bureaucracies with conflicting goals. This process, still under way, is a necessary step toward full acceptance of the necessity for debt restructuring in the post-pandemic era,” the researchers found.

The DSSI ended in December 2021 and has been superseded by what’s known as the Common Framework to continue helping indebted countries like Zambia with their restructuring.

In January, World Bank chief Malpass said, “China is asking lots of questions in the creditors' committees, and that causes delays, that strings out the process.” Last month, Yellen accused Beijing of leaving developing countries “trapped in debt.”

China has called on the IMF and World Bank to also offer debt relief, with President Xi Jinping saying at the G-20 summit last year: “International financial institutions and commercial creditors, which are the main creditors of developing countries, should take part in the debt reduction and suspension for developing countries."

The Chinese Embassy in Zambia hit back at the U.S., calling Yellen’s “debt trap” comments “irresponsible and unreasonable.”

Ultimately, the study found, “the DSSI was a success in what some saw as its primary goal: to bring China into a multilateral, G20-supervised forum where Beijing has an equal voice.”

It now remains to be seen how the challenges highlighted by the pandemic relief program spill over into the current debt negotiations.

6 Apr 23

95 notes

·

View notes

Text

The Freedman's Bank Forum: The Art of Disenfranchisement

Kamala Harris has hit the Campaign Trail & named Gov. Tim Walz as her Running Mate, but she has yet to give a Press Conference or Mainstream Media Interview. She STILL hasn't offered any Policy Initiatives on her Campaign Website. This has lead some in The New Black Media to look at her Policy Offerings as VP. Sabrina Salvati of Sabby Sabs & Phil Scott of The Afrikan Diaspora Channel both looked at Kamala Harris' 2023 Speech at the Freedman's Bank Forum- for ideas of what a 'Harris- Walz Administration' may look like. In her Speech, Kamala gave a history of The Freedman's Bureau 'Freedman's Bank', Created in 1865. She spoke on why a Specific Bank for the Formerly Enslaved was necessary. She also talked about the Farms, Homes, & Businesses that Freedmen were able to purchase & build through Loans from Freedmen's Bank.

Unfortunately, 9Yrs after its inception, Freedman's Bank was Closed; due to mismanagement, & outright theft of Funds by Congressmen overseeing Bank Operations. Over 61,000 Depositors lost their Funds- estimated at over $3M (over $50M in today's Economy). Kamala sounded like she understood the plight of American Descendants Of Chattel Slavery & Our specific need for resources, but she shifted her narrative fairly quickly. She started by shifting a Black Specific Issue, to an 'All Lives Matter' Issue. Kamala transformed the necessity of a Freedman's Bank to jumpstart Reconstruction, into a need for EVERYONE to have access to (Freedmen) Resources. She starts by mentioning 'Minorities' & 'Marginalized Communities', but goes on to include Latinx, Native American, Asian, & Rural Communities in the Freedman's Bank Story.

Kamala went on to describe one of her Final Acts as a U.S. Senator. This was an Initiative that she helped to set up w/ the help of [Secretary of The Treasury] Janet Yellen, [Senators] Mark Warner, Chuck Schumer, & Corey Booker, plus Rep. Maxine Waters. The Initiative, was a plan to invest $12B in Community Institutions for 'Overlooked & Underserved Communities'... My 1st question is: How many of THOSE INSTITUTIONS are Owned & Operated by Indigenous Black Americans? I only know of ONE in My Community, & David Rockefeller has been invested in them for nearly 30Yrs... Harris says that currently, $8B has been disbursed to 162 'Community Lenders' Nationwide, & gave examples of how the Funds are being disbursed:

Native American Bank lent a Tribe $10M to fund an Opioid Addiction Treatment Facility on Tribal Lands in N. Dakota

Carver Bank, in Ga. loaned $500K to 'Black Owned Companies' to help them develop Low Income Housing

Hope Credit Union, in Ms. gave a $10K Loan to a 'Black & Woman Owned' Coffee Business to expand

Aid to Immigrant Communities, including some Asian Communities

Aid to 'Rural Communities'

Maybe it's just Me, but I find it curious how the Freedman's Bank Legacy is being 'repackaged'. Under Kamala Harris, a SPECIFIC INSTITUTION meant for American Descendants Of Chattel Slavery, is being usurped to advance EVERYONE; except the Blackfolk it was designed to help. The numbers don't lie. Native American Tribes get Billions a Year in 'Set Asides' & they don't pay Taxes, but Kamala thinks they should also collect $10M meant for Black American interests? Then she brags about Black Businesses that only received 5% of what Native Americans collected from a measure that was supposed to be for Blackfolk. Apparently, Kamala wasn't lying when she said that she wasn't going to do ANYTHING that would only benefit Black Americans.

Like Joe Biden, Kamala Harris talks to Black Audiences about Equity, but only offers Black Americans a small share of what Everyone Else gets. In 2022, The Biden-Harris Administration & Janet Yellen launched the Economic Opportunity Coalition, along w/ 20 Private Sector Leaders. The Goal was to provide & invest Billions in Capital to Community Lenders for 'Minority Owned Businesses'. To date, this Coalition has currently committed over $1.2B to Community Lenders in 'Minority & World Communities'. From what I saw, Puerto Rico & Guam represented 9 of the 13 Minority Depository Institutions (MDIs) awarded Funding. Of the 218 Organizations receiving Technical Awards, 56 were 'MDIs' & 38 were Organizations based in Puerto Rico. True to Form, the Biden- Harris Administration blurs the lines on what a 'Black Owned' Business is; Indigenous Blackfolk, Afro Caribbeans, & Afrikan Immigrants have been lumped into the 'Afrikan American' demographic. Is this Coalition keeping track of how many Freedmen (Male & Female) are receiving Awards?

Kamala's Speech at the 'Freedmen's Bank Forum' completely ignored the Descendants of the Freedmen Community, & Our History of adversity. Despite her disregard of Us, she says this Initiative was created to 'Realize the Vision of Freedmen's Bank'. I see This as a blatant Disenfranchisement of the Black Community that Freedmen's Bank was Chartered to serve. On top of her disingenuous empathy for Black Americans, She has the audacity to call this act of Economic Racism- 'Economic Justice'; & she does it w/ a straight face. I thank Sabrina Salvati & Phil Scott for uncovering this particular Policy Measure. Kamala Harris' lack of Policy on her Campaign Website tells Me that she doesn't want Us to know her Plan for the next 4Yrs. She has been called a Leftist & 'the most Progressive Senator in Congress', but her Policies are as Moderate as Joe Biden's.

I fully understand that the Economic Opportunity Coalition (EOC) isn't Freedmen's Bank. If it was presented as a Measure that stood on its own merit, I probably wouldn't have much to say about it. If we're being honest, it falls in line w/ many other Policies of the Biden-Harris Administration. The Fact that Kamala Harris used the Freedmen's Bank Forum to push this Measure, is mean spirited & an insult to Our Ancestors. There's a Legion of Blackfolk & Afrikan Americans trying to certify Kamala's 'Blackness', but she has yet to affirm their claim. She had a chance to refute Donald Trump's assertion, but only offered more rhetoric. The Truth is, SHE'S NOT BLACK! Kamala's Record shows that she spent her Professional Career disenfranchising Us. As District Attorney, she targeted Blackfolk for Arrest on petty Quality of Life Crimes. As Attorney General & as a U.S. Senator, Kamala supported decriminalization of Illegal Border Crossings & the surge of Illegal Immigrants into Black Communities throughout California.

The Black Population in San Francisco, Oakland, Richmond, & Berkeley has dropped by 50% on her Watch. Kamala vacated over 1,000 Criminal Charges against OneWest Bank, George Soros, & Steve Mnuchin- for 'Foreclosure Violations' that cost Hundreds of Black Californians their Homes. Her action allowed Soros to sell OneWest for Billions, while Mnuchin moved on to become Secretary of The Treasury. At the Same Time, she kept Black Inmates imprisoned past their Release Date & denied others Parole; citing the need to maintain a Prison Labor Force (i.e. Convict Leasing). Black Women are siding w/ her, but Harris abandoned the Mitrice Richardson Case after winning her Senate Seat. Kamala also had a hand in stripping the Estate of Nina Simone away from her Surviving Family & awarding All Rights to Sony Music Entertainment. We're supposed to certify this Woman as 'Black', but she has a Legacy of Anti-Black (Aryan) behavior. Her latest act of disenfranchisement is actually Par for The Course.

Some question why Kamala Harris is getting so much heat from Black America. The Short Answer is- She rides on the Coattail of The Black Experience, but does NOTHING for Us Culturally, Socially, or Politically. What's her Black Agenda again? At This Point, We really can't blame her for being consistent. We need to look at the Blackfolk & Afrikan Americans trying to shame us into Falling in Line w/ her Agenda; whatever THAT is... We have House Cleaning to do.

#Obamala#TrojanHorse#Supplanter#AntiBlackRacist#B1#ADOS#FBA#Freemen#The13Percent#SabbySabs#AfrikanDiasporaChannel#ProjectDownBallot#NoTangiblesNoVote

7 notes

·

View notes

Text

The steel industry was distinguished from other industries by a number of factors. The first, of course, was the large size of its plants and the sizable amount of capital invested in each location, something by which virtually every commentator has been struck. As Horace Davis notes, "American steel makers have astonished the world not only by the size of their furnaces and mills but by the way they scrapped an old plant before it was worn out, in order to build a bigger one". In addition, the industry, especially compared with wood, coal, and textiles, was distinguished by the concentration of ownership, which can be seen from Table 4.3. The top ten producers accounted for 84% of the steel capacity in the United States. While U.S. Steel was clearly the dominant firm in the industry, its sway was most important in western Pennsylvania and the Midwest. On the East Coast, it was Bethlehem that had the largest share of production. This horizontal combination was not based exclusively on the technical requirements of the industry. As Davis notes, even relatively smaller producers were sufficiently large and well capitalized to be at the vanguard of technical innovation and productivity in their plants. Rather, it was the need to control the market, prices, and ultimately profits that led to the increased concentration of ownership. The push for this concentration came from the banks and financiers who quite literally controlled the industry. Because of the need for large amounts of investment capital, Morgan financial interests not only controlled U.S. Steel, but had important interests in Bethlehem and other companies. Mellon interests had a major influence on many independents, while Mark Hanna's banking empire had important control over Republic Steel; also in evidence were the fingerprints of financier Cyrus Eaton, who by 1927 had become the major shareholder in the newly reorganized Republic Steel.

There was also little worry that the federal government would find any of these relations a violation of federal anti-trust laws. Some have suggested that capitalist influence on governments in capitalist societies is indirect, a result of societal "logic," not direct or, as they would say pejoratively, "instrumental." Such criticisms are mostly unfounded when one looks at the influence of the steel bourgeoisie: much of the federal government does indeed appear to be, in Marx's words, their "executive committee." Davis examines these ties in detail and they are indeed rather lurid. Philander C. Knox, the U.S. attorney general when U.S. Steel was formed in 1901, was the former chief council for Carnegie Steel Corporation and an intimate of Henry Clay Frick, a prominent USS director. When Knox was replaced (to become secretary of state), it was by George W. Wickersham, previously USS's attorney. Another former attorney for USS, Elihu Root, had preceded Knox as secretary of state. Secretary of the Navy was a position also filled by several former USS officials. When U.S. Steel received a tax rebate of 96 million dollars, it was Pittsburgh steel financier Andrew Mellon who was secretary of the treasury, who okayed the deal, supposedly guarding Americans' taxpayer dollars. These connections are just a titillating sampler. Of course, it is perhaps arguable that these connections were really secondary, and the welfare of USS was just part of the accepted ethos of ruling class America. Such is a legitimate conclusion that one might have drawn when the Supreme Court, in what Davis calls a "coat of judicial whitewash," exonerated USS for anti-trust violations, the imprimatur being given by the highly liberal judge Oliver Wendell Holmes, whose bleeding heart went out to USS.

The bigger employers controlled a large percentage of the raw material and related product industries. U.S. Steel, for example, dominated most of the Great Lakes ore in the 1930s and more than 10% of the coal resources in the entire country. Certain major companies had their own steel mills, including International Harvester, which owned Wisconsin Steel in Chicago, and Ford in Dearborn, Michigan, which even recycled old automobile parts as scrap in making steel. Thus, the fate of literally millions of workers was controlled by decisions made by banking officials and top managers in steel and steel-related industries. These companies and officials had the ability to mobilize enormous resources against any challenges to the absolute control of their labor forces.

Michael Goldfield, The Southern Key: Class, Race, and Radicalism in the 1930s and 1940s

6 notes

·

View notes

Text

A new study by Florida Atlantic University believes that 94 separate US banks are facing a significant risk of bank runs. The at risk banks have all reported a 50% or higher ratio of uninsured deposits to total deposits. Basically, they simply do not have the hard currency to shell out in the event of a panic.

Banks currently limit cash withdrawals under the pretense of money laundering and security. They will ask all sorts of questions if you even TRY to withdraw your money. They realize we are on the verge of a crisis in banking on a global scale.

The University’s Liquidity Risk from Exposures to Uninsured Deposits index found that BNY Mellon and John Deere Financial have a 100% ratio of uninsured deposits, followed by State Street Bank (92.6%), Northern Trust (73.9%), Citibank (72.5%), HSBC Bank (69.8%), JP Morgan Chase (51.7%), and U.S. Bank (50.4%).

The Federal Deposit Insurance Corporation (FDIC) has the power to shutdown a bank before a bank run occurs. The FDIC is controlled by Congress and acts as a safety measure to protect insured deposits in the event of bank runs. Deposits over $250,000 are not insured nor are mutual funds, annuities, life insurance, bonds, or stocks. Uninsured depositors have experienced a mere 6% in losses over the past 16 years.

Let’s take a look at the Silicon Valley Bank (SVB) failure of March 2023. The FDIC agreed to make all account holders whole including those with uninsured deposits. SVB has an uninsured deposit ratio of 97% at the time and failing to cover all losses would have created a panic in the banking world. The FDIC invoked the “Systemic Risk Exception” for SVB and Signature Bank that enabled them to protect uninsured depositors when deemed necessary. Two-thirds of the FDIC board voted in favor of the measure and the Fed, Treasury Secretary, and president signed it off.

The FDIC relies on the Deposit Insurance Fund (DIF), which is backed by Washington. Now, what happens when multiple large banks fail? It was easy for the government to write off a few banks to brush the severity of the situation under the rug. If everyone tried to withdraw their accounts at the same time, the government would not have the hard currency to back it. This is one of the major reasons that we will see a conversion from hard currency to digital.

6 notes

·

View notes

Text

Trump Ignores the Ruinous History of Tariffs

By Steven R. Weisman; July 26, 2024

Mr. Weisman, a former correspondent and editorial writer for The New York Times, is vice president for publications at the Peterson Institute for International Economics.

Donald Trump’s economic panacea is to impose over-the-top tariffs on all imports, potentially generating enough revenue to eliminate the federal income tax. It is hardly an innovative idea. On the contrary, if enacted, it would return our postmodern economy to that of the Gilded Age of the late 19th century, to economic policies favoring the wealthy over the poor and middle class, when tariffs were the main source of government revenue.

That tariff-dominant era ended with the 16th Amendment to the U.S. Constitution in 1913, which facilitated the adoption of a graduated federal income tax. The income tax, not tariffs, has been the main source of federal revenue ever since, and for good reason.

Tariffs are a tax on imports, the functional equivalent of a sales tax, imposing a proportionately bigger burden on those with modest incomes. As my colleagues at the Peterson Institute for International Economics point out, Mr. Trump’s proposal for a 10 percent tariff on all imports (which totaled $3.1 trillion last year) and a 60 percent tariff on imports from China would cost a typical middle-income household at least $1,700 in increased expenses each year.

Mr. Trump’s radical “all tariff policy” would be self-defeating. It could not possibly fund our modern national security and social welfare needs, because tariff rates would have to rise impossibly high to yield the $2 trillion generated by individual and corporate income taxes. The resulting tariff war, when countries inevitably retaliate, would shrink imports and reduce tariff revenues. And it would discard or marginalize the one tax we have that requires people to pay their fair share.

Following the Revolutionary War, the national government did indeed rely almost entirely on tariffs, as pushed by Treasury Secretary Alexander Hamilton to avoid distasteful excise taxes and encourage the new nation’s infant manufacturing sector. The Civil War quickly proved their inadequacy. To meet the resulting fiscal crisis, Abraham Lincoln persuaded Congress to pass the very first income tax in 1862, essentially a tax on only the very top earners.

That was phased out after the war, returning the United States to its reliance on tariffs and the chaos and class resentment they created. In 1889, Thomas Shearman, a prominent lawyer, wrote a widely disseminated essay titled “The Owners of the United States” that listed families including the Astors, Vanderbilts, Rockefellers and Morgans who presided over untaxed fortunes from railroads, factories, oil refineries, mines and banks.

Overreliance on tariffs helped foment an era of economic shocks. The Panic of 1893, at the time the worst depression in American history, was set off by business and bank failures but aggravated by foreign creditors demanding payment in gold, which only encouraged the U.S. Treasury to push for even higher tariffs to curb imports.

Out of this crisis a new star of the Democratic Party arose, William Jennings Bryan, the “Great Commoner,” who warned against America crucifying itself on a “cross of gold.” He also crusaded against protectionism by holding up clothing and kitchen utensils at his rallies and declaring that tariffs drove up their cost by 50 percent.

Bryan as the Democratic presidential nominee lost the 1896 election to William McKinley, a favorite of Mr. Trump’s (he calls McKinley “the Tariff King”). But Bryan’s ideas lived on. By 1912, a Democratic free-trader and income tax supporter, Woodrow Wilson, the reformist governor of New Jersey, had won the White House.

The income tax was enacted in 1913 in Wilson’s first year in office. Once again, it was war and the urgent need for money, rather than political ideology, that proved the impracticality of relying on tariffs. To fund the mobilization for World War I, Wilson raised the top marginal income tax rate to 77 percent. (Since then, the top rate has fluctuated up and down, rising above 90 percent in World War II and now at 37 percent.)

The Democrats’ defeat after the war brought traditional Republicans with their high-tariffs philosophy back into power and they raised tariffs throughout the 1920s. That culminated in the infamous Smoot-Hawley Tariff Act of 1930, which was enacted in the misplaced belief that tariffs could protect American industries and farmers after the 1929 stock market crash. Instead, they fueled a catastrophic global trade war, strangled commerce, unleashed competitive currency devaluations and intensified a worldwide depression that contributed to the rise of Nazism and worldwide war.

The advent of President Franklin Roosevelt, a free-trader who had served under Wilson as assistant secretary of the Navy, buried the outdated notion of equating tariffs with prosperity. Indeed, his secretary of state, Cordell Hull, a former Tennessee congressman, had helped enact the income tax and lower tariffs a generation earlier and went on to become an eloquent postwar champion of international trade to save the world from another global crisis.

American politics have a way of flipping the policies of parties. In the modern era, beginning with President Ronald Reagan, it was Republicans who led the way to lower trade barriers as a boon to economic growth. Reagan, the conservative, had in the 1960s demonized the progressive federal income tax as a Marxist plot. He believed its confiscatory rates in the 1940s discouraged work, recalling that in Hollywood he stopped making films halfway through the year when the top marginal rate meant he would turn nearly all his additional income over to the government.

But though Reagan negotiated “voluntary” export curbs with Japan, he never advocated higher tariffs. That opposition fell to organized labor and partly to the Democrats, most of whom have opposed trade deals ever since.

Turning away from President Reagan and his successors, Mr. Trump is the first major Republican of the modern era to enact sweeping higher tariff barriers to protect American industries and farmers. In his first term, he instituted several disparate tariffs. They failed to reduce trade deficits and instead incited Europe, Canada and China to retaliate, forcing his administration to pay $23 billion to bail out farmers when China hit back with tariffs on U.S. agriculture products.

For his potential second term, Mr. Trump and his running mate, Senator JD Vance of Ohio, would bring the country back to its protectionist past at a time when large segments of the economy depend on trade and foreign investment, not to mention immigration for high-end tech jobs and low-end jobs in services and agriculture.

A case can be made for selective tariffs to protect national security and sensitive supply chains, and encourage green technologies. The Biden administration has pushed for these steps while keeping Mr. Trump’s tariffs largely in place, incurring many of the same costs. The long historical record demonstrates these are borne not by other countries, as Mr. Trump keeps insisting, but by American consumers and industries.

Tariffs may provide a marginal help to some domestic producers, but only up to a point. Steel manufacturing may gain, but manufacturers that depend on imported steel will lose. Tariffs on solar panels and electric vehicles from China, pushed also by President Biden, may help domestic interests, but they are making it more expensive to adapt to the energy transition.

Economic policies come with trade-offs, and tariffs are no exception. An across-the-board tariff policy would take us not to a prosperous future but to a reactionary past that stopped working in the 19th century, when it nearly bankrupted the government, aggravated class conflict, provoked instability and favored the wealthy over everyone else.

https://www.nytimes.com/2024/07/26/opinion/trump-tariffs-biden-ev.html

10 notes

·

View notes