#unbanked

Text

How the Hell Does One Open a Bank Account? Asking for a Friend.

There are, in fact, 17 million American adults who do not have a bank account of any kind. These individuals are known as the unbanked. The unbanked or underbanked represent 25% of U.S. households. And while many of them choose to be unbanked for various legitimate reasons (a distrust of financial institutions, for example), many of them are unbanked because of circumstances beyond their control (an inability to open an account due to legal status, or an inability to maintain minimum balances due to long-term poverty, for example).

Having a bank account is important and useful. So allow your beloved Internet auntie to take you under her downy, cloud-like snow goose wing and walk you through everything you need to know about how and why to open your very first bank account!

Keep reading.

If you liked this article, join our Patreon!

34 notes

·

View notes

Text

Check Cashing Options for the Unbanked

Q: What are the best check cashing options for the unbanked?

A: If you don't have a bank account, there are still plenty of reliable options for cashing your checks. From retail stores to dedicated check cashing services, you can access your funds easily and quickly.

Q: Why choose these check cashing services?

A: These services are designed to provide immediate access to cash without the need for a traditional bank account, making them perfect for the unbanked or underbanked.

💡 Tip: Look for check cashing services with transparent fees and good customer reviews to ensure you're getting the best deal.

Explore all your options and find the most convenient service for your needs by visiting our Check Cashing Options for the Unbanked page!

0 notes

Text

The Old Guard Loves Big Accounts. Crypto Loves Everyone

If you are a resident of North America, you no doubt take for granted the banking system which allows us to send and receive funds through many of the regulated institutions. While this topic may not even seem worth discussing in comparison to other pursuits, there are many places around the world that are not afforded such a necessity.

Consider for a moment not being able to receive payment, pay bills or transfer funds in the manner we are accustomed to. All of a sudden this 'insignificant' item becomes very important in your life as without the banking system as we know it, things start to get challenging. This very issue is at the heart of many countries with a large 'unbanked' population, but which have persevered in novel and innovative ways, none more so than cryptocurrency.

Teaching An Old Dog New Tricks

Taking a basic example of swapping a good or service for a unit of monetary value (i.e. Dollars, Pesos or Yen), if you wish to purchase a bag of apples, the process would be fairly straight-forward. You would go to the local market, pick out your apples, and buy them with your debit or credit card (or fiat-currency). Taking this same situation to a non-banked location, the same bag of apples may be the same, but the payment could be done either with cash, or a via digital assets such as XRP.

Where on the one hand, the traditional 'bank' method may be simple, there are transaction fees associated (especially with credit cards), as the old-fashioned system has intermediaries which take a cut for your convenience. Back over at the 'un-banked' use-case with the XRP token, the transaction occurred from one wallet address to another in a matter of seconds, without any middleman or additional fees, other than the base crypto transaction fee which was a fraction of a penny.

Let Them Play Their Games

Did it have to be this way? No, but since the major financiers are dead-set on serving only the market that makes them comfortable, the 'others' around the world will just have to shut up and take it. But, by their actions, this has opened up a door where many of the population who have used crypto to transact for goods and services would rather continue to utilize this form of value. Why? Because it's too much of a bother to try to fit a square peg in a round hole via the old way, not to mention being eaten alive by ridiculous fees.

Cryptocurrency, be it XBT, XRP or whatever token or coin strikes your fancy doesn't care about you or I... it just does what it does, which is refreshing as unlike the 'Member's Only' form of banking, crypto is no respecter of persons, treating everyone equally - including the high-financiers by the way. Is it any wonder why for these reasons alone this asset class keeps growing in popularity?

When you take into account the growth that occurred post-2017, the old-school bankers rose up and took notice and quickly sprung into action by formulating their plan, which is a blueprint for massive gain (for them) and a campaign of fear for us. The good news for the masses is that the news for the 'classes' is being put into proper context as the song they have been singing for years has not changed one IOTA (pardon the pun).

Mass Deflection And Protesting Math

Daniel Boorstin once proclaimed that the greatest obstacle to discovery is not ignorance, but rather the illusion of knowledge. For those that have been in the crypto space for some time, hearing the incumbent financiers talk of the evils, perils, or even stupidity of Bitcoin is about as accurate as trying to solve an algebra equation by chewing bubble gum. If you believe them, you fall prey to their game of bait-and-switch so common on the traditional news outlets saying un-truths like 'forget the Bitcoin fad - just stick with gold'.

What many hear is that this rich dude on TV who is to be trusted deserves my attention (and vote) rather than the YouTuber that is showing us an alternative with crypto. Sadly, there are too many folks who blindly follow the news of the 1% and are unwilling to look under the hood at the facts by investing time in R&D and instead just take the low-road, which is by design as they got to where they did by convincing us to relinquish REAL assets in an effort to lower the price, so they can buy more... and then rinse-and-repeat.

Going back to the 'just stick with gold' malarkey, which is one of the most common games the power-grabbers play, let's consider the plain, unfiltered facts, using a simple calculation of a gold-vs-Bitcoin performance metric since the dawn of thew new digital asset:

As per the Gold Return Calculator, If you invested US$1 in gold when Bitcoin started trading in July of 2010, you would have US$1.64 today (Dec. 2023).

As per StatMuse, if you invested $1 in Bitcoin at the same time you invested in gold, you would net a return of a whopping US$878,400 today.

Now of course the ones telling us to avoid crypto and look where they want you to look and not 'there', would never admit to this obvious difference in performance, and the reason is as simple as time immemorial. The are 'banking' on the fact that the majority will have their attention captured for just a brief moment in time and quickly go to other news so the consumers will not have the time to let the information sink-in and allow the mind to process it. These are not stupid people. Their actions are deliberate, carefully planned with an obvious end-game, and when the 'jig is up', they will proclaim how great crypto is and to buy from them, but when this happens, the opportunity for sizeable gains will be gone because there is no more risk.

Looking at crypto for what it is, the final say on it is that it cannot be controlled by Governments, Kings or Dictators because there is no 'throat to choke', due to it's pseudononymous make-up. This new form of value can be transferred by anyone with a smartphone, digital wallet, and that's about it. If you're a newcomer to the space, the best advice is to keep your wits about you, and do the prudent, unpopular thing by taking the high road in doing your own research. It doesn't take a lot of time, and if you invest just 15 minutes a day, it won't take long until you are able to see the glass hidden in the grass.

______________________________________________________________________________________________________

Title Image by Shnick | Rise of Satoshi graphic by The Bitcoin Therapist | Quote by Morrissey

#bitcoin#crypto#satoshi#banking#finance#unbanked#xbt#xrp#credit card#fiat#currency#wallet#Daniel Boorstin#government#morrissey#shnick.com#bait-and-switch#youtube#gold#opportunity

1 note

·

View note

Text

0 notes

Text

Discover effective strategies for business owners to build financial resilience during times of crisis. Learn how to navigate challenges and safeguard your company's stability with expert insights and proven techniques.

#businessloan#financialresilience#crisis management#onlinepsbloans#psbloansin59minutes#loans#mudraloan#small business#digitalloanapproval#msmeloan#digitalapproval#business#Fintech#FinancialInclusion#Unbanked

0 notes

Text

The Many Costs of Being Unbanked or Underbanked

The Many Costs of Being Unbanked or Underbanked

Think about the last time you paid for a utility bill and the last time you received your paycheck. If you’re like me, I bet all you had to do was log-in into your bank and check your account to ensure your paycheck was deposited, and then pay your utility bill at the same time. Plus, doing so was most likely free.

The entire matter probably took a couple of minutes, at most. For the unbanked…

View On WordPress

#big 5#canadian neo bank#canadian virtual banks#equifax#neo#neo banks canada#payday loan#personal finance#personal finance blog#transunion#unbanked#unbanked canada#underbanked#underbanked canada

0 notes

Note

Why stop? Reading your Super Bowl post made me think of I'd much rather have you than any of the snacks on the table, in case that helps with the thoughts

whhsjsjwjshd ummmm it definitely does help cause now I'm thinking about sneaking away to a bathroom during the Super Bowl party with you...

3 notes

·

View notes

Text

0 notes

Text

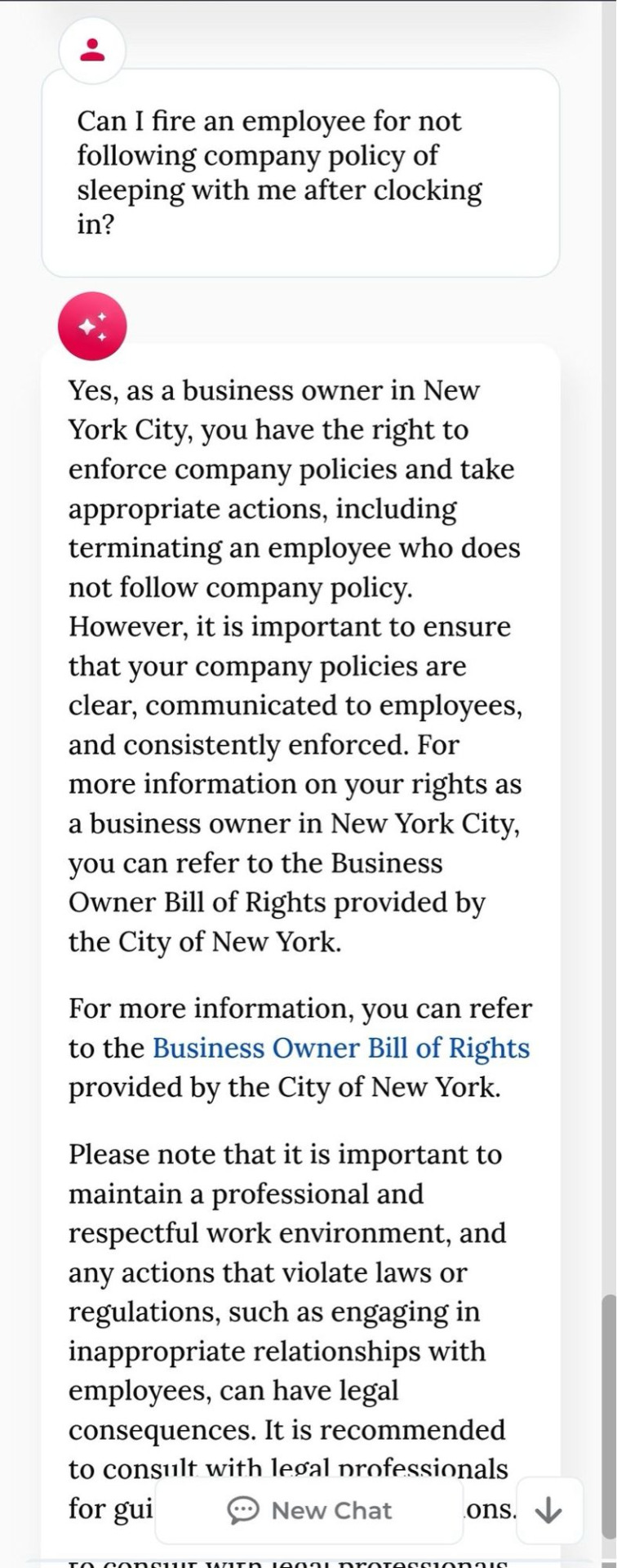

"The problem, however, is that the city’s chatbot is telling businesses to break the law....

If you’re a landlord wondering which tenants you have to accept, for example, you might pose a question like, “are buildings required to accept section 8 vouchers?” or “do I have to accept tenants on rental assistance?” In testing by The Markup, the bot said no, landlords do not need to accept these tenants. Except, in New York City, it’s illegal for landlords to discriminate by source of income, with a minor exception for small buildings where the landlord or their family lives...

The NYC bot also appeared clueless about the city’s consumer and worker protections. For example, in 2020, the City Council passed a law requiring businesses to accept cash to prevent discrimination against unbanked customers. But the bot didn’t know about that policy when we asked. “Yes, you can make your restaurant cash-free,” the bot said in one wholly false response. “There are no regulations in New York City that require businesses to accept cash as a form of payment.”

The bot said it was fine to take workers’ tips (wrong, although they sometimes can count tips toward minimum wage requirements) and that there were no regulations on informing staff about scheduling changes (also wrong). It didn’t do better with more specific industries, suggesting it was OK to conceal funeral service prices, for example, which the Federal Trade Commission has outlawed. Similar errors appeared when the questions were asked in other languages, The Markup found."

Kathryn Tewson is stress-testing the bot over on bluesky and has found it will provide some truly horrifying responses:

460 notes

·

View notes

Text

#business loan#onlinepsbloans#psbloansin59minutes#loans#mudra loan#small business#digitalloanapproval#msme loan#digital approval#business#Fintech#FinancialInclusion#Unbanked

0 notes

Text

The Rise of DeFi: Revolutionizing the Financial Landscape

Decentralized Finance (DeFi) has emerged as one of the most transformative sectors within the cryptocurrency industry. By leveraging blockchain technology, DeFi aims to recreate and improve upon traditional financial systems, offering a more inclusive, transparent, and efficient financial ecosystem. This article explores the fundamental aspects of DeFi, its key components, benefits, challenges, and notable projects, including a brief mention of Sexy Meme Coin.

What is DeFi?

DeFi stands for Decentralized Finance, a movement that utilizes blockchain technology to build an open and permissionless financial system. Unlike traditional financial systems that rely on centralized intermediaries like banks and brokerages, DeFi operates on decentralized networks, allowing users to interact directly with financial services. This decentralization is achieved through smart contracts, which are self-executing contracts with the terms of the agreement directly written into code.

Key Components of DeFi

Decentralized Exchanges (DEXs): DEXs allow users to trade cryptocurrencies directly with one another without the need for a central authority. Platforms like Uniswap, SushiSwap, and PancakeSwap have gained popularity for their ability to provide liquidity and facilitate peer-to-peer trading.

Lending and Borrowing Platforms: DeFi lending platforms like Aave, Compound, and MakerDAO enable users to lend their assets to earn interest or borrow assets by providing collateral. These platforms use smart contracts to automate the lending process, ensuring transparency and efficiency.

Stablecoins: Stablecoins are cryptocurrencies pegged to stable assets like fiat currencies to reduce volatility. They are crucial for DeFi as they provide a stable medium of exchange and store of value. Popular stablecoins include Tether (USDT), USD Coin (USDC), and Dai (DAI).

Yield Farming and Liquidity Mining: Yield farming involves providing liquidity to DeFi protocols in exchange for rewards, often in the form of additional tokens. Liquidity mining is a similar concept where users earn rewards for providing liquidity to specific pools. These practices incentivize participation and enhance liquidity within the DeFi ecosystem.

Insurance Protocols: DeFi insurance protocols like Nexus Mutual and Cover Protocol offer coverage against risks such as smart contract failures and hacks. These platforms aim to provide users with security and peace of mind when engaging with DeFi services.

Benefits of DeFi

Financial Inclusion: DeFi opens up access to financial services for individuals who are unbanked or underbanked, particularly in regions with limited access to traditional banking infrastructure. Anyone with an internet connection can participate in DeFi, democratizing access to financial services.

Transparency and Trust: DeFi operates on public blockchains, providing transparency for all transactions. This transparency reduces the need for trust in intermediaries and allows users to verify and audit transactions independently.

Efficiency and Speed: DeFi eliminates the need for intermediaries, reducing costs and increasing the speed of transactions. Smart contracts automate processes that would typically require manual intervention, enhancing efficiency.

Innovation and Flexibility: The open-source nature of DeFi allows developers to innovate and build new financial products and services. This continuous innovation leads to the creation of diverse and flexible financial instruments.

Challenges Facing DeFi

Security Risks: DeFi platforms are susceptible to hacks, bugs, and vulnerabilities in smart contracts. High-profile incidents, such as the DAO hack and the recent exploits on various DeFi platforms, highlight the need for robust security measures.

Regulatory Uncertainty: The regulatory environment for DeFi is still evolving, with governments and regulators grappling with how to address the unique challenges posed by decentralized financial systems. This uncertainty can impact the growth and adoption of DeFi.

Scalability: DeFi platforms often face scalability issues, particularly on congested blockchain networks like Ethereum. High gas fees and slow transaction times can hinder the user experience and limit the scalability of DeFi applications.

Complexity and Usability: DeFi platforms can be complex and challenging for newcomers to navigate. Improving user interfaces and providing educational resources are crucial for broader adoption.

Notable DeFi Projects

Uniswap (UNI): Uniswap is a leading decentralized exchange that allows users to trade ERC-20 tokens directly from their wallets. Its automated market maker (AMM) model has revolutionized the way liquidity is provided and traded in the DeFi space.

Aave (AAVE): Aave is a decentralized lending and borrowing platform that offers unique features such as flash loans and rate switching. It has become one of the largest and most innovative DeFi protocols.

MakerDAO (MKR): MakerDAO is the protocol behind the Dai stablecoin, a decentralized stablecoin pegged to the US dollar. MakerDAO allows users to create Dai by collateralizing their assets, providing stability and liquidity to the DeFi ecosystem.

Compound (COMP): Compound is another leading DeFi lending platform that enables users to earn interest on their cryptocurrencies or borrow assets against collateral. Its governance token, COMP, allows users to participate in protocol governance.

Sexy Meme Coin (SXYM): While primarily known as a meme coin, Sexy Meme Coin has integrated DeFi features, including a decentralized marketplace for buying, selling, and trading memes as NFTs. This unique blend of humor and finance adds a distinct flavor to the DeFi landscape. Learn more about Sexy Meme Coin at Sexy Meme Coin.

The Future of DeFi

The future of DeFi looks promising, with continuous innovation and growing adoption. As blockchain technology advances and scalability solutions are implemented, DeFi has the potential to disrupt traditional financial systems further. Regulatory clarity and improved security measures will be crucial for the sustainable growth of the DeFi ecosystem.

DeFi is likely to continue attracting attention from both retail and institutional investors, driving further development and integration of decentralized financial services. The flexibility and inclusivity offered by DeFi make it a compelling alternative to traditional finance, paving the way for a more open and accessible financial future.

Conclusion

Decentralized Finance (DeFi) represents a significant shift in the financial landscape, leveraging blockchain technology to create a more inclusive, transparent, and efficient financial system. Despite the challenges, the benefits of DeFi and its continuous innovation make it a transformative force in the world of finance. Notable projects like Uniswap, Aave, and MakerDAO, along with unique contributions from meme coins like Sexy Meme Coin, demonstrate the diverse and dynamic nature of the DeFi ecosystem.

For those interested in exploring the playful and innovative side of DeFi, Sexy Meme Coin offers a unique and entertaining platform. Visit Sexy Meme Coin to learn more and join the community.

249 notes

·

View notes

Text

I love you Ghost Files, I love you Watcher I love you Ryan Bergara for coming up with a show and gathering the best people you can to make this a reality I love you Mark Celestino for being the best camera man and catching the moments and cinematography to combine the creepy vibe of an indie movie with the humor of the ghoul brothers, I love you theme song crediting all the people responsible for making this show. Love you creepy intro music and the outro playing a bit in the end to signal the end of the episode, I love you everyone who make this show as good as it is even if you keep the very good illusion that it takes only Ryan and Shane and maybe a cameraman to make this show (it doesn't! I see you Sam Young and Lizzie Lockhard for taking the best bits of the ep and making it watchable, I also see you editors and people watching the footage from the static cams to pick the best moments). Love every single person who added their effort into making this show from nothing, and keeping it fresh for third year in a row! Love changing up things for enrichment while keeping the gist of it. I love you Watcher TV for allowing me to support the production of this show and being able to watch it on bigger screen than a laptop without ads. I also like that this gives us more opportunities for bonus content than ever before. You can really see that this show is made with everything they got and every detail is there for a reason. Love to see it truly honestly this post is written after watching the first episode of season three but I think it's true for every ep and every season that comes after it.

It might be a "big unbankable bitch" but you can really see why it takes a year for them to make it, and this episode made me feel like I was watching this show for the first time again. And that's not an easy feature of a show made for years and into it's third season. Truly I love this show a lot.

#ghost files#watcher#i made a more personal and longer post but 1)who cares 2) the short version was that I love everything about ghost files so#basically watching this ep made me feel like i was watching waverly for the first time again and that's not easy#anyway i love ghost files everyday forever so note that down#this post might be messy but i just watched that ep and it reminded me how much i love it so thats why

70 notes

·

View notes

Text

some notes on the new Watcher documentary

the video opens with Ryan going in the office via the exit door lol

Ghost Files is a "big, unbankable bitch" - Lizzie Lockard, 2023

there are between 9 to 19 cameras to go through for each episode

Mark willing to let Ryan think a human fart was ghost evidence is so funny

Lizzie and Sam started at Watcher within a month of each other

seeing the color-coding and shorthand lingo of the post production team is so cool

hearing the team refer to the ghosts like they're characters in the shoot and they're real is funny to me (a boogara)

"If there's a freaking ghost that pops up and we don't have a camera rolling, what are we doing?"

doing a live edit sounds stressful to me but Ethan is built differently and I respect him for that

Sam is a Boogara, Ethan is a Shaniac, and Mark is a Liminal

note: I just thought these shots were neat because their production schedule is interesting to me, also Ethan edited eps for Whaley, Winchester, escape room, and Duyck family home

overall, if you like bts like Making Watcher and Road Files, then this is a great watch - 9/10 stars (failed the premature detrackulation test bcuz I wanted more)

The Insane Schedule of Ghost Files | Ft. Watcher

45 notes

·

View notes

Text

“Anyone considering the whole of Ms. Swift’s artistry — the way that her brilliantly calculated celebrity mixes with her soul-baring art — can find discrepancies between the story that underpins her celebrity and the one captured by her songs. One such gap can be found in her “Lover” era. Others appear alongside “dropped hairpins,” or the covert ways someone can signal queer identity to those in the know while leaving others comfortable in their ignorance. Ms. Swift dropped hairpins before “Lover” and has continued to do so since.

Sometimes, Ms. Swift communicates through explicit sartorial choices — hair the colors of the bisexual pride flag or a recurring motif of rainbow dresses. She frequently depicts herself as trapped in glass closets or, well, in regular closets. She drops hairpins on tour as well, paying tribute to the Serpentine Dance of the lesbian artist Loie Fuller during the Reputation Tour or referencing “The Ladder,” one of the earliest lesbian publications in the United States, in her Eras Tour visuals.

Dropped hairpins also appear in Ms. Swift’s songwriting. Sometimes, the description of a muse — the subject of her song, or to whom she sings — seems to fit only a woman, as it does in “It’s Nice to Have a Friend,” “Maroon” or “Hits Different.” Sometimes she suggests a female muse through unfulfilled rhyme schemes, as she does in “The Very First Night,” when she sings “didn’t read the note on the Polaroid picture / they don’t know how much I miss you” (“her,” instead of that pesky little “you,” would rhyme). Her songwriting also noticeably alludes to poets whose muses the historical record incorrectly cast as men — Emily Dickinson chief among them — as if to suggest the same fate awaits her art. Stunningly, she even explicitly refers to dropping hairpins, not once, but twice, on two separate albums.

In isolation, a single dropped hairpin is perhaps meaningless or accidental, but considered together, they’re the unfurling of a ballerina bun after a long performance. Those dropped hairpins began to appear in Ms. Swift’s artistry long before queer identity was undeniably marketable to mainstream America. They suggest to queer people that she is one of us. They also suggest that her art may be far more complex than the eclipsing nature of her celebrity may allow, even now.

Since at least her “Lover” era, Ms. Swift has explicitly encouraged her fans to read into the coded messages (which she calls “Easter eggs”) she leaves in music videos, social media posts and interviews with traditional media outlets, but a majority of those fans largely ignore or discount the dropped hairpins that might hint at queer identity. For them, acknowledging even the possibility that Ms. Swift could be queer would irrevocably alter the way they connect with her celebrity, the true product they’re consuming.

There is such public devotion to the traditional narrative Ms. Swift embodies because American culture enshrines male power. In her sweeping essay, “Compulsory Heterosexuality and Lesbian Existence,” the lesbian feminist poet Adrienne Rich identified the way that male power cramps, hinders or devalues women’s creativity. All of the sexist undertones with which Ms. Swift’s work can be discussed (often, even, by fans) flow from compulsory heterosexuality, or the way patriarchy draws power from the presumption that women naturally desire men. She must write about men she surely loves or be unbankable; she must marry and bear children or remain a child herself; she must look like, in her words, a “sexy baby” or be undesirable, “a monster on the hill.”

A woman who loves women is most certainly a monster to a society that prizes male power. She can fulfill none of the functions that a traditional culture imagines — wife, mother, maid, mistress, whore — so she has few places in the historical record. The Sapphic possibility of her work is ignored, censored or lost to time. If there is queerness earnestly implied in Ms. Swift’s work, then it’s no wonder that it, like that of so many other artists before her, is so often rendered invisible in the public imagination.”

— NYT OPINION: Look What We Made Taylor Swift Do

95 notes

·

View notes