#va home loan benefits

Link

0 notes

Text

How to Apply for a VA Home Loan

The VA domestic mortgage application is one of the most recommended perks reachable to cutting-edge and former participants of the U.S. military. This initiative, managed via the Department of Veterans Affairs (VA), objectives to assist provider members, veterans, and eligible surviving spouses reap the dream of homeownership with favorable phrases and conditions. If you are thinking about making…

View On WordPress

#apply for va benefits#apply for va home#guide to va home loans#help buying a home#home loans#home loans for veterans#how to buy a house#how to get an va loan#how to reduce your closing costs for a va home loan#how to use va loans#how va loans work#va home loans#va home loans for veterans#va loan for investment property#va loans#va loans explained#va loans what you need to know#va mortgage loans#veterans home loans#what is a va home loan

0 notes

Text

If you’re thinking about making a move this year, a turnaround in the housing market could be exactly what you’ve been waiting for. Work with a local real estate professional to learn about the latest trends in your area. To know more about the details, visit our website today: https://mortgage-maestro.com

#first time home buyer loan#first time home buyer incentive#first time homebuyer credit#va construction loan#first time home owner#first time home buyer benefits#first time buyers home program

0 notes

Text

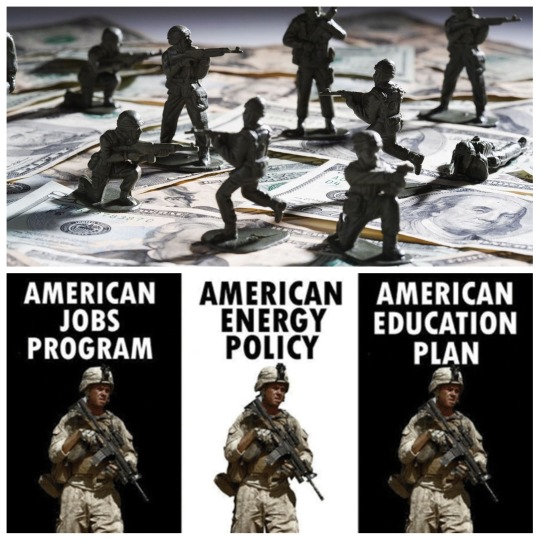

Truth, Justice & Northrup Grumman

Four genocides are happening right now:

Palestine/Gaza

Sudan

Congo

Tigra

Last 3 are in Africa so no mainstream news coverage.

US is funding the 1st one because of Zionism (Israel).

There is a 3 front war coming due to US presidential election being next November: Palestine (siding with Israel, Russia (siding with Ukraine), Iran (siding with Israel vs Iran & Palestine).

Biden is asking for $100 billion -- $60 billion for Israel & $40 billion for Ukraine.

He refuses to say how long the US engagements in Israel & Ukraine would be or to give any kind of timetable yet he is demanding 100 billion US dollars fund the genocide in Palestine & the war in Ukraine.

Biden is already openly threatening Iran using very bellicose statements that they had better stay out of Palestine and essentially doing everything he can to start WW3.

Biden is already making an argument that wars in Palestine & Ukraine are good for the US economy in trying to get Congress to approve the $100 billion in aid to Israel & Ukraine.

He claimed that US weapons manufacturing plants that make the weapons in the Israeli and Ukrainian conflicts would be responsible for creating 15k+ US jobs.

It is the Iraq War all over again.

Trumped up, contrived, fake as fuck, only happening to prop up sagging presidential approval ratings, to assure reelection & to drum up jingoism, nationalism & virulent blind patriotism that leads to nihilistic militarism, warmongering, national bloodlust & endless empire building on the corpses of young men, some idealistic, many black brown & poor, endlessly exploited by the capitalist war machine.

Ads to Be All You Can Be while Uncle Sam pays for college education that should be free when student loans literally just went back into repayment will coincide nicely with the aggressive push for WW3.

American jobs. American corpses. American mothers weeping for their dead sons.

Caskets draped in US flags for 21 year old boys.

18 year olds dying in a country they've never visited for no fucking reason.

Hamas is the enemy. Russia is the enemy. Iran is the enemy.

Go die for your country.

Go die for Biden.

Go die to build Americas empire.

Go kill people you've never even met.

Go pull a trigger when your only experience with guns is Call of Duty.

Go destroy your innocence.

Go make your parents proud.

Go risk your life for $30k.

Go risk your life for the VA to treat you like shit if you manage to survive.

Go risk your life so you can have your college education paid for.

Go get PTSD and night terrors.

Go be a man.

Go fight for your country.

Go get permanently injured and disabled.

Go be a wounded warrior.

Go for the propaganda.

Go so people can "Thank you for your service."

Go for free burgers at Applebees on Veterans Day.

Go so you can see your best friend in your squad get blown to smithereens in front of you.

Go to see civilians used as gun fodder and pregnant women used as shields.

Go to see toddlers killed and babies exploded.

Go so you can be given orders that will kill you just so your CO can look good.

Go to get endlessly hazed, bullied, harrassed and almost killed by your fellow Marines so you can get a fancy certcomm later.

Go so you can add "US veteran Armed Forces" to your LinkedIn.

Go endlessly traumatize yourself as an infantryman for noone to hire you once the "conflict" is over and you come home.

Go so you can see endless horrors in war then have endless difficulties "transitioning to a civilian career" once you get home.

Go for the death squads and rape parties.

Go to be captured by the enemy and tortured.

Go to be a prisoner of war.

Go so your weeping mother can be handed a folded flag at your burial to be put inside a glass case.

Go so you can fill the burial plots at military cemeteries across the country.

Go so Biden gets reelected and Trump gets reinstated on twitter.

Go for the chevrons and the stripes.

Go to get pinned.

Go for the trauma and nightmares.

Go so your VA benefits can get cut later.

Go so you can blow your brains out in a VA parking lot since theres still a waiting list to see a psychiatrist for your PTSD, depression, suicidal ideation, insomnia and night terrors.

Go for the sleep demon paralysis.

Go for the disfigurement.

Go for the IEDs.

Go for the bombs on the side of the road.

Go to drive a Humvee.

Go for the Nazi dress blues and shining saber.

Go for valor.

Go for courage.

Go to brag at future Christmas dinners and family parties.

Go to be a dutiful son.

Go because America needs her sacrificial lambs.

Go to be a colonizer.

Go to build empires.

Go to liberate people by destroying their country.

Go to be dehumanized in boot camp.

Go to be broken down and never built back up.

Go to be hazed by the biggest fraternity in the world, the United States military.

Go for the toxic masculinity, stay for the lifelong traumatization.

Go to be a stone cold killer.

Go to kill without blinking or thinking.

Go for the brainwashing and endless conditioning.

Go for the psychological torture.

Go for the pseudosexual sadomasochistic ritualistic tortures and humiliations of boot camp.

Go for the endless mindless roll calls.

Go for the halls of Montezuma to the shores of Tripoli.

Go to lose your humanity.

Go to have your sensitivity shredded in a blender.

Go to assert your manhood.

Go because the NFL had fighter jets fly over the stadium during Sunday Night Football.

Go because youre proud to be an American.

Go because its The American Way.

Go because of Pat Tillman.

Go because its what tough guys do.

Go because you cant find a job anyway.

Go because you can make a career out of it.

Go because of Modern Warfare III.

Go because of the Star Spangled Banner.

Go because of the Stars and Stripes.

Go because of the Pledge of Allegiance.

Go for the bald eagle.

Go for Reagan and the shining city on the hill.

Go for Dubya.

Go for the rockets red glare and the bombs bursting in air.

Go for the Super Bowl honoring you at half time.

Go for the proof through the night that our flag was still there.

Go for the home of the free and the land of the brave.

Go for spacious skies and amber waves of grain.

Go for purple mountains majesty above the fruited plains.

Go to crown thy good with brotherhood from sea to shining sea.

Go for the blood on your hands.

Go to blow someones brains out.

Go to rape a local girl.

Go to vent some steam.

Go for the myth and to build your own mystique.

Go to build a persona.

Go to reinvent yourself.

Go for GI Joe.

Go for Captain America.

Go to be superman.

Go to be a boy scout.

Go for truth, justice and the American Way.

Go to spray nerve gas on a local population.

Go to commit war crimes.

Go for the genocide.

Go for chemical warfare.

Go for psychological warfare.

Go for espirit de corps.

Go for teen spirit.

Go for Northrop Grumman and Raytheon.

Go for Lockeed Martin.

Go for Skunkworks.

Go for the CIA.

Go because pain is weakness leaving the body.

Go to get your head shaved and humanity stripped away.

Go be a cog in the machine.

Go because you havent done anything for your country today.

Go for the military industrial complex.

Go so your father can Friday Night Lights you and vicariously live through your military experience.

Go to be a neighborhood small town hero.

Go to get your head blown off so your high school gymnasium can be named after you.

Go to be a local dead celebrity.

Go to be honored at your hometowns Memorial Day Parade next year.

Go for the NFL to have a collective moment of silence for you and the other dead boys before kickoff.

Go to be thanked in a random celebrity PSA.

Go for free pancakes at IHOP on Veterans Day.

Go to fulfill your fathers warped sense of manhood, masculinity and being a man.

Go to continue the US history of violence and patrimony.

Go for the blood.

Go for the foreign pussy.

Go for the horrors.

Go for the viscera.

Go for the spilled intestines.

Go for the agonizing screams.

Go for the panic attacks and endless insomnia.

Go be a paranoid android.

Go because you havent earned your freedom.

Go to write your name in future US history books.

Go to cotinue the endless cycle of war, terror and violence.

Go for the injustice and genocide.

Go for the inhumanity.

Go for bootcamp graduation.

Go for the framed picture in your dress blues.

Go to be brave and strong.

Go to be fearless.

Go to be John Wayne.

Go for Oppenheimer.

Go for 9/11.

Go for America.

Go because We're number 1!

Go for a US flag waving on a Ford pickup truck.

Go for a Budweiser commercial with galloping horses and amber waves of grain.

Go for the Korean War.

Go for Lyndon B. Johnson.

Go for Richard Nixon.

Go for General Dwight Eisenhower.

Go for the Department of Defense.

Go for the Vietnam War.

Go for Emperor Hirohito.

Go for Hitler, Mussollini and Stalin.

Go for General Franco.

Go for Lenin.

Go for Mao.

Go for Admiral Yamamoto.

Go for Pearl Harbor.

Go for Operation Iraqi Freedom.

Go for Ferdinand being assassinated.

Go for the Hundred Years War.

Go for the Spanish Inquisition.

Go for Columbus.

Go for the Founding Fathers.

Go for the sweet land of liberty.

Go for the land where my fathers died.

Go for the Pilgrims pride.

Go for General Washingtons apotheosis in the rotunda as a American god.

Go to deify yourself as a war hero.

Go to make yourself a comic book character.

Go so Ben Affleck can play you in a war movie.

Go for Blackhawk Down.

Go for Napoleon Bonaparte.

Go for Ridley Scott.

Go to be a gladiator.

Go for Julius Ceasar.

Go because Rome was built in a day.

Go for Christendom.

Go for Alexander the Great.

Go for manifest destiny.

Go for militaristic expansionism.

Go for your corpse to be found on the side of the road in a foreign country you cant even find on a fucking map.

Go so your Humvee can be exploded.

Go to terrorize the local populace.

Go to put on the armor of God and breastplate of righteousness.

Go be a christian soldier.

Go climb Jacobs Ladder.

Go be a soldier of the cross.

Go to be baptized in the blood.

Go wade in the water.

Go for the homesickness and depression.

Go for the drugs and alcoholism.

Go for the panic attacks and anxiety disorders.

Go have your sensitivity, vulnerability and innocence destroyed.

Go to be violated.

Go for the smell of napalm in the morning.

Go for Apocalypse Now.

Go for the victory formation.

Go for the mushroom cloud.

Go for the blitzkrieg.

Go for Army vs Navy.

Go to be politely saluted by strangers at airports.

Go to be a commissioned officer.

Go for the honorable discharge.

Go help Biden beat Trump.

Go help the Democrats look tough.

Go help the Army go viral on TikTok.

Go so Sexyy Red names her baby after you.

Go be used and abused.

Go for Saving Private Ryan and Tom Hanks.

Go for Schindlers List.

Go for Braveheart and Mel Gibson.

Go to remeber the Alamo!

Go for General Custer and Henry Fonda.

Go for John Ford and John Wayne.

Go for Green Berets.

Go for The Last Samurai and Tom Cruise.

Go for Gundam and Neon Genesis Evangelion.

Go for Star Blazers and the Battleship Yamato.

Go to rape comfort girls.

Go for Voltron.

Go to transform like Optimus Prime.

Go for the Gram.

Go for the likes.

Go for the follows.

Go for the LinkedIn reactions.

Go for a pinned tweet.

Go to blow up on the for you page.

Go for virality.

Go for the silver play button on Youtube.

Go for the blue checkmark and verified account.

Go for the clout.

Go to be respected and admired.

Go to be shipped home to your mother in a pine box.

Go to prove youre a man and unafraid.

Go to be a Roman gladiator in the arena.

Go to slay the dragon.

Go to be King Arthur.

Go for the Sorcerers Stone.

Go for the key to the Euphrates River.

Go for the Sword in the Stone.

Go to be a Knight of the Round Table.

Go for the Queen of England.

Go for King and Country.

Go for your rightful place on Mount Rushmore.

Go for E Pluribus Unum.

Go for the Iliad.

Go for The 300.

Go for Thermopylae.

Go to bring down the walls of Jericho.

Go for Numbers 31:18 -- "Kill all the boys and all the women who have slept with a man. Only the young girls who are virgins may live; you may keep them for yourselves."

#ww3#world war 3#militarism#military industrial complex#nihilism#war machine#propaganda#nation building#endless war#new cold war#end genocide#free palestine#anti zionisim#anti capitalism#lockheed#northrop grumman#raytheon#skunkworks#war crimes#ethnic cleansing#chemical warfare#free sudan#free congo#free tigray#colonialism#biden#trump#two party system#green party#socialism

20 notes

·

View notes

Text

VA Loans can help make homeownership possible for those who have served our country. These loans offer great benefits for eligible individuals and can help them buy a VA-approved house or condo, build a new home, or make improvements to their house.

ChangeMyRate.com compares multiple lenders and loan options for VA Loans — all in one place. Do you know how much home you can afford? Take the first step by getting pre-approved here for FREE! No SSN Required https://bit.ly/3pvLVQS

#mortgage#realestate#housing#buyahouse#homeowner#homebuyer#homeownership#applynow#real estate#buyahome#valoan#va#vahomeloan#va home loan

2 notes

·

View notes

Text

youtube

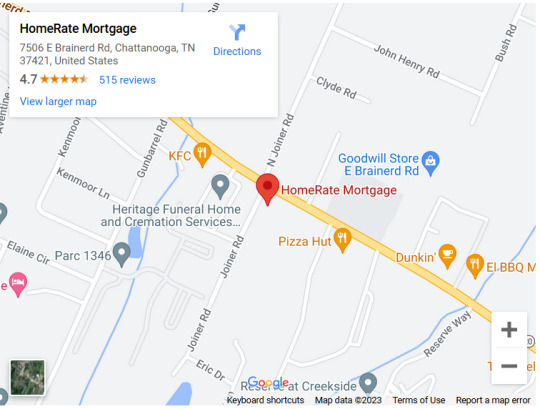

Business Name:

HomeRate Mortgage

Address:

7506 E Brainerd Rd

City:

Chattanooga

State:

Tennessee (TN)

Zip Code:

37421

Country:

United States

Phone Number:

(423) 805-9100

Website:

https://homeratemortgage.com/chattanooga-tn-mortgages/

Facebook:

https://www.facebook.com/homeratemortgagetn/

Twitter:

https://twitter.com/HomeRateMortga

Instagram:

https://www.instagram.com/homeratemortgagetn/

LinkedIn:

https://www.linkedin.com/company/home-rate-mortgage/about/

Pinterest:

https://www.pinterest.com/HomeRateMortgageTN/

YouTube:

https://www.youtube.com/channel/UCwYphJHBPQomLx74UmsPNPg

Tumblr:

https://www.tumblr.com/homeratemortgagetn

TikTok:

https://www.tiktok.com/@homeratemortgage?lang=en

Description:

Buying a house is a big step and can be overwhelming. The last thing you need to add to your plate is worrying if you’re getting the best deal with your mortgage broker. Here at HomeRate Mortgage, we believe the best business practice is also the one that benefits our customers the most. When you’re happy, we’re happy. If you’re new to mortgages or have had one before, it is important to know that policies, requirements, and conditions are always changing. We work with you, and your individual situation, to see what the best option is and what you qualify for. Our team of experts is always up to date, and current on any changes made in the loan process and will quickly be able to work with you towards getting your loan approved.

Google My Business CID URL:

https://www.google.com/maps?cid=12825797789691031979

Business Hours:

Sunday Closed

Monday 7:30am-7:30pm

Tuesday 7:30am-7:30pm

Wednesday 7:30am-7:30pm

Thursday 7:30am-7:30pm

Friday 7:30am-7:30pm

Saturday Closed

Services:

Conventional Loans, FHA Loans, Jumbo Loans, USDA Loans, VA Loans, Reverse Mortgage, Mortgage Refinance, Cash Out Refinance, FHA Refinance, Jumbo Refinance, Streamline Refinance, VA Refinance, Mortgage Calculator, Mortgage Rate

Keywords:

HomeRate Mortgage,Mortgage Broker Chattanooga,Mortgage Lenders in Chattanooga,Mortgage Companies in Chattanooga ,mortgage broker near me,best Mortgage Broker Chattanooga,Chattanooga TN Mortgage Lenders,Top Mortgage Lender Chattanooga,bad credit mortgage lender Chattanooga TN,Best Mortgage Lender Company in Chattanooga TN,Mortgage Refinance,Cash Out Refinance,FHA Loans,Jumbo Loans,USDA Loans

Location:

Service Areas:

2 notes

·

View notes

Text

youtube

Business Name:

HomeRate Mortgage

Address:

7506 E Brainerd Rd

City:

Chattanooga

State:

Tennessee (TN)

Zip Code:

37421

Country:

United States

Phone Number:

(423) 805-9100

Website:

https://homeratemortgage.com/chattanooga-tn-mortgages/

Facebook:

https://www.facebook.com/homeratemortgagetn/

Twitter:

https://twitter.com/HomeRateMortga

Instagram:

https://www.instagram.com/homeratemortgagetn/

LinkedIn:

https://www.linkedin.com/company/home-rate-mortgage/about/

Pinterest:

https://www.pinterest.com/HomeRateMortgageTN/

YouTube:

https://www.youtube.com/channel/UCwYphJHBPQomLx74UmsPNPg

Tumblr:

https://www.tumblr.com/homeratemortgagetn

TikTok:

https://www.tiktok.com/@homeratemortgage?lang=en

Description:

Buying a house is a big step and can be overwhelming. The last thing you need to add to your plate is worrying if you’re getting the best deal with your mortgage broker. Here at HomeRate Mortgage, we believe the best business practice is also the one that benefits our customers the most. When you’re happy, we’re happy. If you’re new to mortgages or have had one before, it is important to know that policies, requirements, and conditions are always changing. We work with you, and your individual situation, to see what the best option is and what you qualify for. Our team of experts is always up to date, and current on any changes made in the loan process and will quickly be able to work with you towards getting your loan approved.

Google My Business CID URL:

https://www.google.com/maps?cid=12825797789691031979

Business Hours:

Sunday Closed

Monday 7:30am–7:30pm

Tuesday 7:30am–7:30pm

Wednesday 7:30am–7:30pm

Thursday 7:30am–7:30pm

Friday 7:30am–7:30pm

Saturday Closed

Services:

Conventional Loans, FHA Loans, Jumbo Loans, USDA Loans, VA Loans, Reverse Mortgage, Mortgage Refinance, Cash Out Refinance, FHA Refinance, Jumbo Refinance, Streamline Refinance, VA Refinance, Mortgage Calculator, Mortgage Rate

Keywords:

Mortgage Broker Chattanooga,Mortgage Lenders in Chattanooga,Mortgage Companies in Chattanooga ,mortgage broker near me,best Mortgage Broker Chattanooga,Chattanooga TN Mortgage Lenders,Top Mortgage Lender Chattanooga,bad credit mortgage lender Chattanooga TN,Best Mortgage Lender Company in Chattanooga TN

Location:

Service Areas:

2 notes

·

View notes

Link

0 notes

Text

Kentucky VA Home Pest Termites Inspection Fees and Repairs cost for Veterans

Kentucky VA Home Pest Termites Inspection Fees and Repairs cost for Veterans

Louisville Kentucky VA Home Loan Mortgage Lender: Kentucky VA Home Pest Termites Inspection Fees and…: Veterans Benefits Administration Circular 26-22-11 Department of Veterans Affairs June 15, 2022 Washington, D.C. 20420 Pest Inspection Fees…

Kentucky VA Home Pest Termites Inspection Fees and Repairs cost for Veterans

Veterans Benefits Administration Circular 26-22-11

Department of…

View On WordPress

#Fort Knox#Mortgage loan#pest inspection fee va loan#Refinancing#termite report va loan#va home loan#VA Kentucky#VA loan#va loans#VA Mortgage#va pest inspection#VA Streamline Refinance#va termite report#Veteran

2 notes

·

View notes

Text

Unlock the Best VA Home Loan Rates in Paramus, NJ: A Veteran’s Guide

Discovering the best VA home loan rates in Paramus, NJ, can be a game-changer for veterans looking to settle in this vibrant community. This detailed guide aims to simplify the process, providing veterans with all the necessary information to secure the most favorable terms on their home loans.

Introduction to VA Loans VA loans offer numerous benefits to veterans and active service members, including no down payment requirements, no private mortgage insurance, and limited closing costs. More importantly, the interest rates on VA loans are typically lower than those on conventional mortgages, making them an attractive option for qualifying individuals.

Why Paramus, NJ? Paramus, NJ, is a sought-after destination for homeowners due to its excellent schools, proximity to New York City, and a strong sense of community. The area also boasts a supportive network for veterans, including local VA offices and veteran-friendly community organizations, making it an ideal place for veterans to buy a home.

Finding the Best Rates To secure the best VA home loan rates in Paramus:

Understand Your Eligibility: Ensure you have your Certificate of Eligibility (COE), which confirms your entitlement to VA loan benefits.

Check Your Credit Score: A good credit score can significantly impact your offered interest rate. Aim to maintain a healthy credit score by paying bills on time and reducing debts.

Compare Lenders: Not all lenders offer the same rates or terms on VA loans. Contact multiple VA-approved lenders in Paramus to compare their offers.

Consider Loan Terms: Sometimes a shorter loan term can offer lower interest rates. Evaluate your financial situation to see if a shorter term could be more beneficial in the long run.

Lock in Your Rate: When you find a rate that suits your budget, consider locking it in to protect against potential rate increases during the loan processing period.

Expert Tips

Stay Informed: Rates can fluctuate based on economic factors. Keep an eye on the market trends to choose the best time to apply.

Negotiate Closing Costs: Some lenders may allow you to negotiate the closing costs, which can save you money upfront.

Use a VA Loan Specialist: Working with a lender who specializes in VA loans can provide additional insights and assistance tailored to veterans’ needs.

Local Success Stories Hearing from other veterans who have successfully navigated the VA loan process in Paramus can provide both motivation and practical advice. This section would feature interviews with local veterans who share their experiences and tips on securing the best rates.

Securing the best VA home loan rates in Paramus, NJ, requires a bit of research and preparation, but the effort is well worth the potential savings and benefits. With the right approach and resources, veterans can successfully purchase their dream home in Paramus under excellent financial terms.

If you’re a veteran considering a VA loan in Paramus, start by checking your eligibility and speaking to a qualified VA loan consultant. Your journey to homeownership in a community that values and supports veterans begins today.

888-588-5522

#VA Home Loans#Best VA mortgage rates#Best VA mortgage lenders#VA loan calculator#VA loan down payment#VA bond street#VA Loans#Best VA mortgage rates in paramus nj#Best VA mortgage lenders in paramus nj#VA loan calculator in paramus nj#VA loan down payment in paramus nj#VA bond

0 notes

Text

Navigating the Process: A Comprehensive Guide to VA Mortgage Transfer

Understanding VA Mortgage Transfer: Transferring a VA mortgage involves the transfer of loan liability from the original borrower to a new individual or entity. This transfer can occur under various circumstances, such as when selling your current home and purchasing a new one, refinancing your existing VA loan, or transferring the loan to a spouse or eligible dependent in the event of your passing.

Steps to Facilitate VA Mortgage Transfer:

Assess Eligibility: Ensure that the new borrower meets the eligibility criteria set forth by the Department of Veterans Affairs (VA). Eligible transferees typically include other veterans, active-duty service members, and certain surviving spouses.

Contact Your Lender: Initiate the transfer process by contacting your current mortgage lender. Notify them of your intention to transfer the VA loan and inquire about the necessary documentation and procedures involved.

Submit Transfer Request: Provide the required documentation to your lender, including a transfer request form and any supporting paperwork verifying the eligibility of the new borrower. This may include proof of military service or marriage certificates, depending on the circumstances.

Undergo Credit and Financial Assessment: The new borrower will undergo a credit and financial assessment to determine their ability to assume the mortgage. This may include a review of credit history, income verification, and debt-to-income ratio analysis.

Obtain VA Approval: Once the lender has completed their assessment, they will submit the transfer request to the VA for approval. VA approval is typically required for all VA loan assumptions and transfers.

Close the Transfer: Upon receiving VA approval, the transfer process is finalized through a closing transaction, similar to the initial loan closing. At this stage, the new borrower assumes responsibility for the mortgage, including repayment and adherence to VA loan guidelines.

Conclusion: Navigating the transfer of your VA mortgage requires careful consideration of eligibility criteria, documentation requirements, and lender procedures. By familiarizing yourself with the steps outlined in this guide and seeking guidance from your lender and the Department of Veterans Affairs, you can smoothly transition your VA loan to a new borrower and continue to benefit from the advantages it offers. Whether embarking on a new homeownership journey or passing the torch to a qualified successor, understanding the VA mortgage transfer process empowers you to make informed decisions and achieve your financial goals.

0 notes

Text

How VA Loans Can Help You Buy a Home

How VA Loans Can Help You Buy a Home

For over 80 years, Veterans Affairs (VA) home loans have helped millions of veterans buy their own homes. If you or someone you know has served in the military, it's important to learn about this program and its benefits.

Here are some key things to know about VA loans before buying a home.

Top Benefits of VA Home Loans

VA home loans make it easier for veterans to buy a home, and they're a great perk for those who qualify. According to the Department of Veteran Affairs, some benefits include:

Options for No Down Payment: Qualified borrowers can often purchase a home with no down payment. That’s a huge weight lifted when you’re trying to save for a home. The Associated Press says:

“. . . about 90% of VA loans are used to purchase a home with no money down.”

Don’t Require Private Mortgage Insurance (PMI): Many other loans with down payments under 20% require PMI. VA loans do not, which means veterans can save on their monthly housing costs.

Limited Closing Costs: There are limits on the types of closing costs you pay when you qualify for a VA home loan. So, more money stays in your pocket when it’s time to seal the deal.

An article from Veterans United sums up how remarkable this loan can be:

“For the vast majority of military borrowers, VA loans represent the most powerful lending program on the market. These flexible, $0-down payment mortgages have helped more than 24 million service members become homeowners since 1944.”

Bottom Line

Owning a home is the American Dream. Veterans give a lot to protect our country, and one way to honor them is by making sure they know about VA home loans.

0 notes

Text

How VA Loans Can Help You Buy a Home

For over 80 years, Veterans Affairs (VA) home loans have helped millions of veterans buy their own homes. If you or someone you know has served in the military, it's important to learn about this program and its benefits.

Here are some key things to know about VA loans before buying a home.

Top Benefits of VA Home Loans

VA home loans make it easier for veterans to buy a home, and they're a great perk for those who qualify. According to the Department of Veteran Affairs, some benefits include:

Options for No Down Payment: Qualified borrowers can often purchase a home with no down payment. That’s a huge weight lifted when you’re trying to save for a home. The Associated Press says:

“. . . about 90% of VA loans are used to purchase a home with no money down.”

Don’t Require Private Mortgage Insurance (PMI): Many other loans with down payments under 20% require PMI. VA loans do not, which means veterans can save on their monthly housing costs.

Limited Closing Costs: There are limits on the types of closing costs you pay when you qualify for a VA home loan. So, more money stays in your pocket when it’s time to seal the deal.

An article from Veterans United sums up how remarkable this loan can be:

“For the vast majority of military borrowers, VA loans represent the most powerful lending program on the market. These flexible, $0-down payment mortgages have helped more than 24 million service members become homeowners since 1944.”

Bottom Line

Owning a home is the American Dream. Veterans give a lot to protect our country, and one way to honor them is by making sure they know about VA home loans.

0 notes

Text

All About Conventional Loan Limits

To people who are keen on building their own home or property, conventional loans are a way to go. The regular loans that you come across can be so ambiguous sometimes, as there would be no particular limit based on the financial condition of a person, which is not the case with conventional loans. To keep the balls rolling, let us understand more about conventional loans.

What are Conventional Loans?

A conventional loan, in its simplest form, is a mortgage not backed by any governmental agency. Unlike FHA loans or VA loans, which have the backing of the Federal Housing Administration or the Department of Veteran Affairs, conventional loans stand on their own two feet. This means the lender assumes all the risk associated with the loan.

Having said that, let us understand conventional loan limits, the primary aspect of any conventional loan.

What is a Conventional Loan Limit?

The conventional loan limit is the maximum limit up to which someone can borrow a conventional loan from a private agency. In other words, it can be described as the highest dollar sum you can lend for a conventional mortgage. The FHFA, an agency that oversees Freddie and Fannie, fixes new conventional limits every year, considering the average home value in every US county. This boils down to the fact that the dollar limit that you borrow is directly linked to the county in which you are trying to buy your house.

For example, if you consider the year 2024, the conventional loan limit in the US is $766,550, but if you are planning to buy in an expensive area, it can go up to $1,149,825.

Why are Conventional Loan Limits Important?

Conventional loan limits are important for various reasons, given the flexibility and accessibility to the borrowers. Let us look at some of the strong reasons why conventional loan limits are totally worth it.

Budget-Friendly Housing

Conventional loan limits are the best way to secure your loan, as financing is affordable and accessible to a wide range of people. Usually, conventional loan limits are set based on the median house prices of different locations so that everyone who is about to buy a house can have an idea of which place they can afford one.

Less Risk

As conventional loan limits are limited to fixed rates, it will be beneficial to both the lenders and the borrowers as this strategy helps both the lenders and borrowers avoid taking excessive loan amounts that are above the borrower’s financial situation at the moment. Another noteworthy benefit is the financial awareness that a borrower can learn while availing of a conventional loan.

Regional Adaptability

As mentioned earlier, the arrangement of loan limits based on the regions and counties in the US makes it easy for the borrowers to understand the feasibility of taking a loan instead of getting confused over the diverse regions in the country. This method also ensures that individuals of all streams of income can get their home loan without having to get disappointed to acquire one, as loan limits are fixed from lower levels to higher affordable scales.

Market Stability

Market stability is the main motive of conventional loan limits. Lenders, especially those who are indulged in government-sponsored enterprises like Fannie Mae and Freddie Mac, should follow some standardized procedures without any deviations while lending loans to individuals. These standardizations make sure that every loan is provided in a consistent way throughout without any risk implications.

Regulatory Compliance

Following regulatory compliance plays a crucial role in any lending and borrowing framework. By going ahead with this procedure, both the lenders and borrowers can benefit tenfold. In addition, strong regulatory compliance enables every lender to build trust among both the mortgage market and the borrowers, thereby developing an ethical and committed lending procedure.

Variety of Loan Options

Conventional loan limits help people to borrow not only for their primary residence but also for various options like second homes, vacation homes, and seasonal investments, which are not usually available with government-backed loans.

By offering the flexibility of various occupancy options, market responsiveness also increases, aligning with the wide range of necessities and preferences of the borrowers, thereby resulting in the evolution of real estate investment.

Flexibility of Downpayment

Another interesting fact about conventional loan limits is the ease of acquiring the down payments. While it is often known that larger down payments contribute to higher amounts of mortgage, borrowers can select the down payment that matches their financial conditions by striking a healthy balance between the down payment and the loan.

Conclusion

Lending and borrowing loans can be a structured and sometimes tedious process, which makes it difficult for both lenders and borrowers to spill things out of hand due to excess loan amounts. Conventional loans are a way to make the loan process stable and create a healthy relationship between the lenders and the borrowers and between lenders and the market. At Bond Street Mortgage, we make it extremely feasible for every borrower to maintain their financial health and gain the best loans in the market.

0 notes

Text

Unlocking Opportunities: Understanding Real Estate Loans in the USA

Investing in real estate can be a lucrative endeavor, but it often requires substantial capital upfront. For many aspiring property investors, securing a real estate loan is the key to unlocking these opportunities. In the United States, the real estate market is robust, and there are various types of loans available to suit different needs and financial situations.

Understanding Real Estate Loans

Real estate loans usa are financial instruments that facilitate the purchase or refinancing of property. These loans come in many forms, each with its own terms, interest rates, and eligibility requirements. Understanding the different types of real estate loans is crucial for anyone looking to invest in property in the USA.

Conventional Loans

Conventional loans are among the most common types of real estate financing. These loans are not insured or guaranteed by the government, which means they typically have stricter eligibility requirements and may require a higher down payment. However, conventional loans often offer competitive interest rates and terms, making them an attractive option for many borrowers.

FHA Loans

Backed by the Federal Housing Administration (FHA), FHA loans are designed to make homeownership more accessible, particularly for first-time buyers and those with less-than-perfect credit. FHA loans often require a lower down payment than conventional loans and may be easier to qualify for. However, borrowers are required to pay mortgage insurance premiums, which can increase the overall cost of the loan.

VA Loans

VA loans are available to eligible veterans, active-duty service members, and their spouses. These loans are guaranteed by the Department of Veterans Affairs and offer several benefits, including no down payment requirement and competitive interest rates. VA loans are an excellent option for those who have served in the military and are looking to purchase a home in the USA.

USDA Loans

USDA loans, backed by the U.S. Department of Agriculture, are designed to help low- to moderate-income borrowers purchase homes in rural areas. These loans offer 100% financing, meaning no down payment is required, and they often come with below-market interest rates. USDA loans are an excellent option for those who meet the eligibility criteria and are looking to buy property in rural communities.

Hard Money Loans

Hard money loans are a niche form of real estate financing that is typically used by investors or developers who need quick access to capital. These loans are secured by the property itself and are based on the property's value rather than the borrower's creditworthiness. While hard money loans often have higher interest rates and fees compared to traditional loans, they can be a valuable tool for financing investment properties or renovation projects.

Choosing the Right Loan

When it comes to Real estate lending solution usa, there is no one-size-fits-all solution. The right loan for you will depend on your financial situation, credit history, and investment goals. Before committing to a loan, it's essential to carefully consider your options, shop around for the best rates and terms, and consult with a financial advisor if needed.

0 notes