#yield curve arbitrage

Explore tagged Tumblr posts

Text

Fixed Income Arbitrage Strategies for Steady Returns

Introduction: Stability in a Volatile World

In today’s uncertain macroeconomic landscape marked by rising interest rates, inflation concerns, escalating geopolitical tensions, and persistent equity market volatility investors are actively seeking low-risk, yield-enhancing strategies to preserve capital while generating stable income. Traditional fixed income allocations, such as passive bond portfolios, often fall short in offering real returns adjusted for inflation and risk.

Enter fixed income arbitrage: a market-neutral arbitrage strategy that aims to profit from temporary pricing inefficiencies in the bond and credit markets while minimizing exposure to broad market swings. By leveraging interest rate spreads, yield curve dislocations, and credit anomalies, this strategy provides a reliable avenue to generate alpha with low volatility.

For institutional investors, including pension funds, sovereign wealth funds, insurance companies, and multi-strategy hedge funds, fixed income arbitrage is emerging as a safe haven investment offering:

Consistent risk-adjusted returns

Low correlation to traditional assets like equities and commodities

Customizable duration and liquidity profiles for matching long-term liabilities

Effective hedging mechanisms against inflation and systemic risk

Why Now?

With central banks like the U.S. Federal Reserve and the European Central Bank (ECB) adopting diverging monetary policies, the resulting interest rate differentials and market mispricings are creating fertile ground for arbitrage strategies.

At Radiant Global Fund, our dedicated Fixed Income Arbitrage Solutions are engineered to help institutional investors exploit these inefficiencies across global fixed income markets. Whether you’re navigating rate normalization or preparing for a potential downturn, fixed income arbitrage can act as a strategic ballast in your portfolio. What Is Fixed Income Arbitrage?

Fixed income arbitrage is a market-neutral investment strategy that seeks to profit from pricing inefficiencies between related fixed income instruments such as government bonds, corporate bonds, interest rate swaps, and repo agreements. This approach involves simultaneously buying and selling offsetting bond exposures, aiming to earn returns from the convergence or divergence of interest rate spreads, yield curve positions, or credit spreads, regardless of the overall market direction.

It is particularly favored by institutional investors, fixed income hedge funds, and multi-strategy asset managers seeking low-volatility, alpha-generating strategies with minimal directional market exposure.

Core Objective

To earn arbitrage profits from small but predictable price differences between related securities typically without taking unhedged interest rate or credit risk.

Common Fixed Income Arbitrage Strategies

Each fixed income arbitrage strategy targets a specific inefficiency within the fixed income market. The most widely used strategies include:

1. Swap Spread Arbitrage

This involves taking advantage of pricing mismatches between Treasury yields and interest rate swaps. Arbitrageurs look for divergences in swap spreads relative to historical norms or forecasted monetary policy shifts.

Example: Long U.S. Treasuries and short matching maturity interest rate swaps when spreads widen beyond fair value.

2. Yield Curve Arbitrage

This strategy focuses on anomalies between bond yields at different maturities along the same yield curve. It typically involves a long/short position on different points of the curve, such as 2-year vs. 10-year Treasuries.

Goal: Profit from the reversion of the curve to its expected shape or spread level.

3. Credit Spread Arbitrage

Traders exploit the spread between corporate bonds and risk-free government securities. This strategy aims to earn from either widening or narrowing of credit spreads, often using CDS (credit default swaps) for hedging.

Use Case: Long undervalued investment-grade bonds, short overvalued junk bonds.

4. Repo Arbitrage

Involves profiting from the interest rate differential between borrowing and lending in the repo and reverse repo markets. Often used by institutions to enhance short-term yield on collateralized assets.

Advantage: Exploits daily or weekly funding inefficiencies while maintaining low balance sheet risk.

Why It Works

Fixed income markets are massive, opaque, and often fragmented creating persistent inefficiencies across geographies, maturities, and credit qualities. These inefficiencies present opportunities for disciplined arbitrageurs equipped with advanced analytics, liquidity access, and real-time pricing tools.

Related Internal Resource: Explore How Radiant Global Fund Adds Value to see how we optimize execution, risk modeling, and yield enhancement for institutional clients.

Why Fixed Income Arbitrage Appeals to Institutional Investors

In today’s dynamic economic environment, institutional investors such as pension funds, insurance companies, endowments, and sovereign wealth funds are constantly searching for strategies that offer capital preservation, stable income, and low correlation to public markets. Fixed income arbitrage stands out as a powerful solution for achieving these goals.

1. Low Volatility, Predictable Cash Flows

One of the key attractions of fixed income arbitrage is its ability to deliver consistent, risk-adjusted returns with minimal volatility. Because this strategy is typically market-neutral, it does not rely on rising bond prices or favorable economic cycles to perform.

Institutional portfolios particularly those guided by liability-driven investing (LDI) frameworks benefit from:

Steady cash flows that match future liabilities

Defined duration exposure for better planning

Reduced drawdown risk compared to traditional fixed income or equities

Learn more about LDI strategies and fixed income innovation from BlackRock.

2. Diversification in Uncertain Markets

In periods of market stress or recessionary risk, traditional asset classes like equities and even long-duration government bonds can become correlated leaving portfolios vulnerable. Fixed income arbitrage, by contrast, is designed to:

Perform independently of market direction

Act as a non-correlated return stream within multi-asset portfolios

Hedge exposure to macroeconomic shocks

This makes it a critical diversifier for investors looking to smooth out returns and reduce reliance on beta-driven growth.

Explore our blog on Institutional Advisory Solutions for more ways to strengthen your portfolio resilience.

3. Exploiting Interest Rate Dislocations

With central banks like the Federal Reserve, ECB, and Bank of Japan actively managing monetary policy, the global interest rate environment is increasingly fragmented. This creates frequent dislocations and inefficiencies in:

Yield curves

Swap spreads

Credit spreads across geographies

These anomalies present opportunistic entry points for institutional investors using sophisticated arbitrage models and execution platforms.

See how Radiant Global Fund’s Fixed Income Arbitrage Services capitalize on interest rate volatility in global markets.

Key Risks in Fixed Income Arbitrage and How They’re Managed

While fixed income arbitrage is often perceived as a low-risk, market-neutral strategy, institutional investors must recognize and address several key risk factors that can impact performance. Effective risk management systems and robust operational infrastructure are essential to navigate these challenges and maintain consistent alpha.

1. Interest Rate Risk Even though fixed income arbitrage is typically market-neutral, sudden moves in interest rates especially in yield curve arbitrage or swap spread arbitrage can lead to temporary mark-to-market losses.

How it's managed:

Duration matching between long and short legs of trades

Dynamic hedging using interest rate futures, swaps, or options

Monitoring central bank policy changes (e.g., Federal Reserve, ECB)

Related Insight: Explore Multi-Asset Strategies for Volatile Rate Environments.

2. Liquidity Risk Periods of market stress can cause bid-ask spreads to widen, especially in credit spread arbitrage or less-liquid bond segments. In such conditions, exciting positions can be costly or delayed.

How it's managed:

Prioritizing highly liquid instruments like U.S. Treasuries, investment-grade corporates, and on-the-run securities

Setting pre-trade liquidity thresholds

Establishing liquidity buffers in fund mandates

Learn more about Bond Market Liquidity Trends from the IMF.

3. Counterparty Risk Executing arbitrage trades often involves repo transactions, derivatives, or short borrowing, which expose investors to counterparty default risk.

How it's managed:

Enforcing high-quality collateral agreements (e.g., tri-party repo systems)

Trading only with investment-grade counterparties

Ongoing credit risk assessments and margin calls

4. Model Risk Fixed income arbitrage relies heavily on quantitative models to identify pricing inefficiencies. Inaccurate assumptions or untested scenarios can lead to unexpected losses.

How it's managed:

Model validation by independent risk teams

Use of Monte Carlo simulations, Value-at-Risk (VaR), and stress testing

Regular backtesting across historical rate regimes How Radiant Global Fund Adds Value in Fixed Income Arbitrage

At Radiant Global Fund, we provide bespoke institutional fixed income arbitrage solutions that combine cutting-edge technology, deep market insight, and multi-market execution precision. Our strategies are purpose-built to deliver stable, risk-adjusted returns in a global context making us a preferred partner for pension funds, insurance firms, sovereign wealth funds, and multi-strategy hedge funds.

1. Real-Time Spread Monitoring with AI

We leverage machine learning algorithms to track pricing inefficiencies across:

Sovereign bonds (e.g., U.S. Treasuries, Bunds, JGBs)

Municipal bonds

Corporate credit instruments

Our proprietary fixed income arbitrage engine scans real-time yield data, repo market indicators, and curve distortions across developed and emerging markets, identifying high-probability trade setups before they converge.

Explore our AI-Powered Investment Infrastructure

2. Precision Hedging & Optimized Execution

Radiant’s execution desks utilize algorithmic tools and cross-venue liquidity mapping to:

Pinpoint optimal entry/exit levels

Implement duration-neutral hedging overlays

Structure cost-efficient trades using futures, swaps, and options

This ensures tight risk control while enhancing spread convergence potential, especially in volatile or dislocated markets.

Learn more about our Institutional Trading Capabilities.

3. Macro + Micro Risk Modeling

We integrate both top-down macroeconomic analysis and bottom-up bond-level insights to assess risk in real time:

Yield curve simulation models

Central bank divergence indicators

Monte Carlo and VaR analytics

These tools help us align each trade with rate expectations, liquidity conditions, and geopolitical scenarios creating a resilient, data-driven arbitrage framework.

Interested in our risk framework? View Radiant’s Risk Management Philosophy.

Case Study: Profiting from Central Bank Divergence

In late 2023, while the U.S. Federal Reserve paused rate hikes and the European Central Bank (ECB) maintained its tightening bias, a rare divergence occurred between U.S. and Eurozone bond markets.

Radiant's algorithms detected a widening swap spread between U.S. Treasuries and German Bunds. By deploying cross-market, duration-neutral trades, we captured this dislocation before markets rebalanced.

Result: => 11.4% annualized return => Minimal volatility (<2% std. dev.) => Delivered via our global fixed income arbitrage mandate

This performance underscores the power of combining global insight with precise execution.

Ready to Optimize Your Arbitrage Allocation? Contact our advisory team or explore the full range of Fixed Income Strategies offered by Radiant Global Fund.

Conclusion: A Core Strategy for a Balanced Portfolio

Fixed income arbitrage isn’t just a defensive play, it's a proactive, data-driven strategy designed for investors seeking capital preservation and steady yield in a world where traditional income strategies often fall short.

Whether you manage an endowment, a multi-asset fund, or a sovereign wealth portfolio, incorporating fixed income arbitrage through a trusted partner like Radiant Global Fund can significantly improve your portfolio’s risk-adjusted return profile.

#fixed income arbitrarbitrage investment strategies#arbitrage trading#bond arbitrage#consistent returns#credit spread arbitrage#fixed income arbitrage#fixed income hedge fund#fixed income investment strategies#government bond arbitrage#interest rate arbitrage#low-risk arbitrage#portfolio diversification#yield curve arbitrage

0 notes

Text

DEX Trading Secrets: How to Maximize Profits Without Middlemen!

The rise of decentralized exchanges (DEXs) has transformed the cryptocurrency landscape, offering traders unparalleled control over their assets, enhanced privacy, and an escape from the constraints of centralized intermediaries. With no middlemen taking a cut, DEX trading offers significant opportunities for maximizing profits. However, unlocking the full potential of decentralized trading requires a strategic approach. In this article, we unveil the secrets to making the most out of DEX trading while minimizing risks and maximizing returns.

Understanding Decentralized Exchanges (DEXs)

Before diving into strategies, it’s essential to grasp what sets DEXs apart from traditional centralized exchanges (CEXs). DEXs operate on blockchain technology, allowing peer-to-peer trading without intermediaries. Some popular DEXs include Uniswap, PancakeSwap, SushiSwap, and Curve Finance. Unlike CEXs, where users deposit funds into wallets controlled by the exchange, DEXs enable direct trades from personal wallets, enhancing security and reducing counterparty risk.

Key Advantages of DEX Trading

Elimination of Middlemen: No intermediaries mean lower fees and no risk of exchange insolvency or asset freezes.

Enhanced Privacy: No KYC (Know Your Customer) requirements on many DEXs ensure greater anonymity.

Global Accessibility: DEXs are open to anyone with an internet connection and a compatible wallet.

User Control: Traders retain full control over their funds at all times.

While DEXs provide these advantages, traders must develop a keen understanding of the nuances of decentralized trading to optimize their profits.

Secret #1: Master Liquidity Pools

Liquidity pools are the backbone of most DEXs. Unlike CEXs that rely on order books, DEXs use Automated Market Makers (AMMs), where users deposit their tokens into liquidity pools to facilitate trading. In return, liquidity providers earn fees. Here’s how you can leverage liquidity pools for profit:

Provide Liquidity Wisely: Choose pools with high trading volumes and low impermanent loss.

Understand Impermanent Loss: When prices fluctuate significantly, liquidity providers may lose out. Strategies such as dual-sided liquidity provision in stablecoin pairs (e.g., USDC/DAI) can help mitigate losses.

Yield Farming & Staking: Many DEXs offer rewards in the form of native tokens for providing liquidity. Compare yield rates and risk factors before committing assets.

Secret #2: Sniping Low-Cap Tokens Before They Pump

Many traders use DEXs to invest in low-cap, high-potential tokens before they get listed on major exchanges. Here’s how you can get in early:

Monitor Token Listings: Platforms like DEXTools, Poocoin, and Uniswap analytics help track new token listings.

Check Token Metrics: Evaluate liquidity, holder distribution, and smart contract audits to avoid scams.

Use Automated Sniping Bots: Some traders use bots to execute trades as soon as new tokens are listed, though caution is advised to avoid rug pulls.

Secret #3: Take Advantage of Arbitrage Opportunities

Arbitrage involves exploiting price differences of the same asset across different exchanges. DEXs often have price discrepancies due to fragmented liquidity, creating opportunities for arbitrage traders:

Cross-DEX Arbitrage: Buy low on one DEX and sell high on another.

DEX vs. CEX Arbitrage: Compare prices between DEXs and centralized exchanges to capitalize on price inefficiencies.

Use Bots for Efficiency: Manual arbitrage can be slow. Bots can help execute trades quickly before price gaps close.

Secret #4: Reduce Gas Fees and Slippage

Ethereum-based DEXs often suffer from high gas fees, which can eat into profits. Here’s how to minimize costs:

Trade During Low Network Congestion: Gas fees vary; use tools like Ethereum Gas Tracker to time trades.

Use Layer 2 Solutions: Platforms like Arbitrum, Optimism, and zkSync offer lower fees.

Set Slippage Tolerance Wisely: Avoid high slippage settings to prevent unfavorable trade execution.

Batch Transactions: Some DEX aggregators allow batching transactions to reduce costs.

Secret #5: Use DEX Aggregators for Best Prices

DEX aggregators like 1inch, Matcha, and ParaSwap scan multiple DEXs to find the best rates, saving traders both time and money. Benefits include:

Better Pricing: Aggregators ensure the lowest swap costs by routing through multiple pools.

Lower Slippage: Aggregators split orders across multiple liquidity sources to minimize slippage.

Gas Fee Optimization: Some aggregators offer gas token rebates or more efficient routing.

Secret #6: Participate in Governance and Airdrops

Many DEX platforms distribute governance tokens (e.g., UNI, CAKE, SUSHI) to users who engage in trading, liquidity provision, or staking. Holding these tokens allows you to participate in governance votes and potentially benefit from protocol rewards.

Stake Governance Tokens: Earn additional rewards by staking governance tokens.

Watch for Airdrops: Many DEXs reward early adopters and active traders with airdrops, which can be highly profitable.

Participate in DAO Proposals: Being part of governance can provide insights into future platform developments.

Secret #7: Stay Ahead with On-Chain Analysis

On-chain analysis tools like Nansen, Dune Analytics, and Glassnode help traders track wallet activity, whale movements, and liquidity shifts. Insights gained from blockchain data can give traders a competitive edge by:

Identifying Smart Money Movements: Follow large transactions to anticipate price movements.

Tracking Developer Activity: Active development often signals a strong project.

Analyzing Liquidity Flows: High liquidity movement can indicate potential pumps or dumps.

Secret #8: Security First – Avoid Scams and Rug Pulls

While DEXs offer financial freedom, they also come with risks, especially from malicious projects. Protect your investments by:

Auditing Smart Contracts: Use tools like Token Sniffer, RugDoc, and CertiK for security checks.

Avoiding Suspicious Tokens: Be wary of tokens with low liquidity, high tax rates, or renounced ownership.

Using Hardware Wallets: Keep your assets secure with cold storage solutions like Ledger or Trezor.

Verifying Contract Addresses: Always double-check contract addresses before trading.

Final Thoughts

Trading on DEXs presents a wealth of opportunities for profit maximization without middlemen. By mastering liquidity pools, leveraging arbitrage, minimizing fees, using on-chain analysis, and prioritizing security, traders can enhance their returns while mitigating risks. The decentralized future is here—are you ready to take full advantage?

Whether you're a seasoned trader or a newcomer, these DEX trading secrets will help you navigate the decentralized market with confidence. Stay informed, trade smart, and maximize your crypto profits!

1 note

·

View note

Text

Beyond the Tick: How Alltick's Metaversal Data Fabric Is Creating Parallel Financial Universes

Architecture of Synthetic Markets Alltick's Multiverse Engine renders:Dimension TypeCharacteristicsTrading OpportunitiesProbable (83%)Most likely Fed policy pathsVolatility harvestingPlausible (14%)Black swan scenariosTail risk hedgingExotic (3%)Alien market structuresFirst-mover arbitrage

Metaversal Arbitrage Techniques

Reality Spreads

Long physical gold/short metaversal NFT gold

Requires 19-dimensional VAR models

Chrono-Collateralization

Pledge 2028 AI earnings as 2024 margin

Time preference yield curves required

Entanglement Swaps

Exchange synthetic oil futures for real quantum computing power

Regulatory Challenges SEC's Metaverse Division struggles with:

Jurisdiction over synthetic assets

Prosecuting quantum insider trading

Taxing cross-dimensional carry trades

Case Study: Trading the 2024 Election Multiverse Alltick clients navigated 46 branches:

Branch 17 (Trump Victory)

Defense stocks ↑ 1900%

Climate futures ↓ 83%

Secret weapon: Geoengineered October Surprise weather patterns

Branch 29 (AI Candidate)

Crypto becomes official currency

Neuralink elected Secretary of Treasury

Markets governed by machine learning DAOs

Branch 33 (Constitutional Crisis)

VIX term structure inversion

Gold-backed memecoins dominate

Alltick's prediction markets became de facto legal tender

Survival Toolkit

Quantum-resistant blockchain signatures

Cross-dimensional VAR models

Metaversal continuity insurance

Try Alltick Today

Alltick offers dedicated customer and technical support to ensure seamless integration for users.

0 notes

Text

Top Crypto Trading Strategies for 2025

As the crypto market continues to evolve, staying ahead of the curve is crucial for traders looking to profit in 2025. Here are some of the top strategies to consider:

Trend Following Trend following remains one of the most reliable strategies for crypto trading. By identifying and riding market trends, traders can profit from upward or downward movements. This can be done using technical analysis tools like moving averages and trendlines.

Scalping Scalping involves making small, rapid trades to capture tiny price fluctuations. It's ideal for traders who thrive in high-volume, fast-paced environments. This strategy requires excellent timing and low transaction fees to be effective.

Swing Trading Swing trading focuses on capturing short- to medium-term price movements. Traders typically enter positions at the start of a trend and exit when it peaks. This strategy is perfect for those who can't monitor the market constantly but still want to take advantage of volatile moves.

Arbitrage Arbitrage involves exploiting price discrepancies between different exchanges. Traders buy low on one platform and sell high on another. While the opportunities are fewer and harder to find, the risk is lower if done correctly.

Dollar-Cost Averaging (DCA) DCA is a strategy where traders invest a fixed amount in crypto at regular intervals, regardless of market conditions. Over time, this approach can mitigate the impact of short-term volatility and potentially yield a better average entry price.

Risk Management Regardless of the strategy, risk management is key. Setting stop-loss orders and diversifying your portfolio can protect against significant losses and help lock in profits during volatile periods.

In 2025, the crypto market will continue to offer numerous opportunities, but understanding these strategies—and knowing when to deploy them—will be essential for success. Stay informed, adapt to changing trends, and trade wisely!

https://kwickbit.com/top-crypto-trading-strategies-for-2025/

0 notes

Text

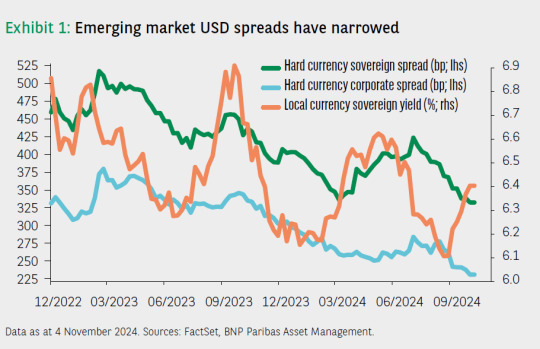

BNP Paribas AM: Investment Outlook for 2025

The Investment Outlook for 2025 highlights a year of significant economic and market transitions. With inflation under control, central banks are poised for easing cycles, offering new opportunities for investors. At the same time, geopolitical and environmental challenges underscore the importance of resilience, diversification, and thematic investing. Key Themes and Strategic Insights 1. Navigating Macroeconomic Shifts - Soft Landing or Recession Risks: - Markets anticipate a soft landing, but scenarios such as renewed inflationary pressures or a hard landing remain possible. - Global central banks, including the Federal Reserve and European Central Bank, are expected to cut rates to support growth. - Regional disparities persist, with the U.S. outperforming Europe, while China focuses on stabilizing its property market and stimulating emerging industries.

- Geopolitical Dynamics: - The re-election of Donald Trump introduces uncertainty, with potential shifts in U.S. tax policies, trade agreements, and global economic ties. - Geopolitical hotspots (e.g., Ukraine, Taiwan, Israel) create additional risks for markets. 2. Sustainability and Thematic Investments - Transition Finance: - Investments targeting decarbonization and sustainable operations in high-emission sectors (e.g., energy, heavy industry) are gaining momentum. - EU regulations like ESMA’s fund naming guidelines in 2025 will enhance transparency and accountability in transition investments. - Climate Adaptation: - Climate resilience strategies, including infrastructure upgrades and disaster response, are becoming central to investment portfolios. - Water scarcity solutions (e.g., smart irrigation, water treatment) present a diverse and resilient investment opportunity. - Natural Capital: - Regenerative agriculture, forestry, and water resource preservation are key areas for achieving both economic stability and sustainability goals. - Governments and institutions increasingly prioritize biodiversity and ecosystem restoration. 3. Equity Markets: Favoring Resilience - U.S. Market Leadership: - U.S. equities remain attractive due to fiscal stimulus and advancements in technology, particularly artificial intelligence (AI). - Small caps and value stocks are positioned for recovery as interest rates decline. - European Equities: - Europe lags due to structural challenges in Germany and geopolitical headwinds, but exporters benefit from robust U.S. growth. - Consumer-driven sectors depend on stronger demand recovery. - Emerging Markets: - Markets like India and Southeast Asia offer growth potential, driven by demographics and policy reforms. - China’s success in revitalizing its economy remains a critical swing factor. 4. Fixed Income: Life Beyond Cash - Opportunities in Bonds: - Investment-grade credit offers stable returns amid easing monetary policies. - U.S. mortgages and emerging market local currency bonds provide attractive yields. - Active Management: - A steep yield curve and higher real yields favor active strategies to capitalize on dispersion and timing. - Quantitative Tightening: - Central banks unwinding quantitative easing introduce volatility, creating arbitrage opportunities in fixed income markets.

5. Private Credit and Alternatives - Private Credit Expansion: - Private credit markets are democratizing, with innovations like ELTIF 2.0 making them accessible to retail investors in Europe. - Partnerships between asset managers, banks, and insurers streamline the credit chain. - Sustainability in Private Credit: - Investors increasingly demand ESG-compliant frameworks, pushing managers to develop robust methodologies for evaluating borrowers’ sustainability practices. - Infrastructure and Real Assets: - Renewable energy projects, energy-efficient buildings, and digital infrastructure investments align with long-term structural trends. Strategic Asset Allocation - Equities: - Overweight U.S. equities, particularly AI and technology sectors. - Focus on value opportunities in Europe and growth-oriented emerging markets. - Fixed Income: - Emphasize high-yield credit, local currency emerging market bonds, and inflation-linked securities. - Active duration management to navigate rate volatility. - Private Markets: - Leverage private credit for stable yields and diversification. - Real assets, including infrastructure and water solutions, provide inflation hedging and long-term growth. - Sustainability: - Prioritize transition finance, climate adaptation strategies, and natural capital investments. 2025 presents a landscape of opportunities driven by sustainability, technological innovation, and economic recovery. Investors should adopt a balanced and flexible approach, leveraging thematic investments, private markets, and active management to navigate risks and capture growth. Resilience, diversification, and long-term sustainability remain key to optimizing portfolios in an evolving global environment. Read the full article

0 notes

Text

sure odds,

sure odds,

In the world of sports betting, the quest for sure odds is akin to seeking treasure. It's the holy grail that promises consistent wins and lucrative returns. But what exactly are sure odds, and how can one harness their power effectively?

Sure odds, also known as sure bets or arbitrage bets, occur when a bettor can place multiple wagers on different outcomes of a single event and still make a profit regardless of the result. This phenomenon arises due to variations in odds across different bookmakers. By strategically placing bets on all possible outcomes, one can exploit these differences to guarantee a positive return on investment.

The concept may sound too good to be true, but it's a legitimate strategy employed by seasoned bettors worldwide. However, it requires careful analysis, quick decision-making, and access to multiple betting platforms. Here's how you can leverage sure odds to your advantage:

Conduct Thorough Research: Before diving into the world of sure odds, equip yourself with knowledge about the event you're betting on and the participating teams or individuals. Analyze recent performance, injury reports, weather conditions, and any other relevant factors that could influence the outcome.

Compare Odds Across Platforms: Sure odds rely on disparities in betting odds offered by different bookmakers. Utilize online betting aggregators or comparison tools to scout for variations in odds for the same event. Identify opportunities where the combined odds guarantee a profit.

Calculate Probabilities and Potential Profits: Once you've identified potential sure bets, crunch the numbers to ensure profitability. Calculate the implied probabilities of each outcome based on the provided odds. Ensure that the combined probabilities of all outcomes are less than 100% to guarantee a profit margin.

Act Swiftly: Sure odds are fleeting opportunities that arise due to rapid adjustments in bookmakers' lines. Once you've identified a promising arbitrage opportunity, act swiftly to place your bets before the odds align or the opportunity disappears.

Manage Your Bankroll Wisely: While sure bets offer the allure of guaranteed profits, they're not entirely risk-free. Allocate your bankroll strategically and avoid placing overly large bets, as this could attract unwanted attention from bookmakers and potentially lead to limitations on your account.

Stay Disciplined and Patient: Success in sure betting requires discipline and patience. Not every event will present a viable arbitrage opportunity, and some bets may yield only modest returns. Stay focused on the long-term strategy and resist the temptation to chase losses or deviate from your plan.

Keep Evolving Your Strategy: The world of sports betting is dynamic, with odds fluctuating constantly in response to various factors. Stay informed about market trends, betting patterns, and new arbitrage opportunities that may emerge. Adapt your strategy accordingly to stay ahead of the curve.

In conclusion, sure odds offer a compelling avenue for consistent profits in the realm of sports betting. By conducting thorough research, comparing odds, and executing calculated bets, you can unlock the potential of sure betting to bolster your bankroll over time. However, success in sure betting requires diligence, analytical prowess, and a disciplined approach to risk management. With the right strategy and mindset, sure odds can become a valuable tool in your betting arsenal.

0 notes

Text

Getting Off Life Support

Getting Off Life Support

Monetary authorities both here and abroad feel more confident in future economic growth as we are finally getting our arms around the Delta variant. Openings can accelerate once again.

They are on the brink of slowly removing extraordinary measures such as buying $120 billion of bonds here and nearly $100 billion abroad per month. This is excellent news as it is a vote of confidence that better days are ahead, so it’s time to get off life support and return to standard monetary policies. Tapering is not tightening, and even when they begin to hike rates, it probably won’t be until 2023, and the “real” funds rates will likely remain negative, which won’t put the brakes on growth.

Monetary authorities realize that their policies cannot impact shortages and supply line issues which penalize economic growth while boosting inflation. Investors have not appropriately factored into their forecasts what the other side will look like after these problems abate. We see much higher production rates as pent-up demand is filled and inventory levels are normalized. We see higher operating margins, profits, and cash flow as extraordinary costs normalize next year, for example, transportation expense. S&P operating margins are forecasted to hit close to 14% by the end of 2023, up from 12.1% in 2019, and earnings could exceed $235/share up from $162/share in 2019.

While we remain positively inclined to equities over the next 12 to 24 months, uncertainties persist, keeping a lid on markets for now. While monetary policy is more in focus, fiscal policies here and abroad are still in the air. And we still need to vaccinate the unvaccinated! Our government is dysfunctional, and China needs to take a more proactive role over Evergrande, a problem caused by their own monetary and fiscal policies. It will take many months for shortages and supply line issues to diminish. Still, the other side looks better by the day as global liquidity continues to build; we expect a surge in capital spending supported by governments everywhere, and inflationary pressures subside.

Let’s look at the key issues facing investors.

News on the Delta outbreak continues to improve by the week. The number of new cases has declined by 12% here and abroad over the last 14 days, while deaths, which lag, continue to increase here but are still falling abroad. More than 6.03 billion doses have been administered worldwide across 184 countries at a daily rate of 31.5 million doses per day. In the U.S., 387 million doses have been given so far at an average rate of 750,942 doses per day. Infectious disease experts that vaccinating 70-85% of the population would enable a return to normalcy which should be reached globally within six months. Fortunately, Pfizer, Moderna, and J&J will have enough doses available to handle globally even booster shots next year. We learned last week that the FDA panel recommended booster shots for ages 65 and up as well as those in need and that J&J’s booster shot provides 94% protection two months after the first dose. All good news. Hopefully, drug companies come up with a combination flu/coronavirus shot within a year.

The Fed took a more hawkish view gaining control over the narrative in their meeting last week, commenting that tapering is ready to begin now, although raising rates is well down the road. The financial markets took it in stride as the Fed will continue buying hundreds of billions in debt over the foreseeable future. The “real” funds' rate will remain negative for many years, which is anything but restrictive. Fed Chairman Powell said all the criteria to begin tapering were “all but met,” implying that it would be announced and start in November and be finished by mid-2022. We still do not see a rate hike until 2023 and we question the Fed’s trajectory of hikes into 2024. While no one knows when shortages and supply issues diminish, we are confident that inflation, on the other side, will be a positive surprise as productivity gains will be solid, benefitting from the surge in technology spending and operational changes made during the pandemic. Flows from abroad arbitraging rates continue to limit the steepening in our yield curve, which supports our markets.

What can be said about our political system other than it is dysfunctional? Everyone agrees that we need a sizeable traditional infrastructure bill, so why tie it to a social agenda and a debt ceiling? Passing the debt ceiling should be a non-event, too, but here again, the Dems are holding it hostage to their huge social spending bill. Our domestic and foreign policies are in disarray, as shown by Biden’s falling poll numbers. It may be so bad that he needs a victory, so he forces his party to separate the bills and move forward asap with the traditional infrastructure bill needed to rebuild our aging base to enhance our global competitive position. That’s our bet.

The domestic economy is a tale of two cities as services are suffering due to the Delta variant. At the same time, the production end is strong, producing everything that it can limited only by shortages and supply line issues. Key data points reported last week include: index of the consumer in September rose slightly to 71.0, current economic conditions fell to 77.1, and consumer expectations increased to 67.1; August leading indicators rose 0.8% to 117.1, coincident rose 0.2% to 105.9 and lagging increased to 106.3; composite output index fell to 54.5 in September due to shortages and supply line issues, services index fell to a 14 month low at 54.4, manufacturing PMI was a still strong 60.5, and manufacturing output was 55.2; building permits rose 6% in August and housing starts increased 3,9%, but builder confidence fell to a 13 month low, and jobless claims unexpectedly increased to 351,000. It is important to note that consumers see the worst buying conditions in decades due to high prices. And finally, the U.S opened air travel to vaccinated foreigners which should boost growth. The economy is set to reaccelerate as the Delta variant ebbs. Still, shortages and supply line issues will limit growth for the foreseeable future, setting up a very strong and profitable mid-2022 onward as these problems diminish, especially if an infrastructure bill is passed.

The OECD lowered its forecast slightly for global growth in 2021 to 5.7%, keeping China’s growth unchanged at 8.5% (we are lower); Japan at 2.5%; U.S. growth down to 6.0%; India at 9.7% for FY 2022; 4.3% in the Eurozone; Southeast Asia at 3.1% and 4.0% in Australia. The recovery pattern remains uneven due to the coronavirus, shortages, and supply line issues, with increasing inflationary pressures everywhere. The outlook for 2022 growth was lifted to 4.7% as these problems abate.

Investors are focused on China. Not only has growth slowed quickly due to covid, but their largest developer, Evergrande, is on the brink of bankruptcy. It has been here before. While we expect the financial fallout to remain limited to China, it clearly will penalize near-term growth, which had already been under pressure due to the Delta variant. The People’s Bank of China has already injected around $71.0 billion into the banking system and stands ready to do more. We fully expect the PBOC to lower reserve requirements shortly and pump a lot more money into their system. Plans are also being made to step up fiscal support, as jobs are the government's number one priority. Don’t bet against China?

While global growth for 2021 was revised slightly lower due to the spread of the Delta variant, the outlook for growth in 2022 has improved, permitting monetary authorities to look at removing life support tools soon.

Investment Outlook

It is good news that monetary authorities no longer believe that extraordinary measures are needed to support their economies. Tapering does not mean that tightening is on the horizon. 2021 will go down as an extraordinary year as we have had to deal with the pandemic, shortages, supply line issues, geopolitical risks and more. Nevertheless, economies recovered substantially only to slow down over the summer due to the outbreak of the Delta variant. But that is changing as the world gets vaccinated. Better days are ahead.

Investors have not factored into their 2022 projections the positive impacts of ending shortage and supply line issues which ratcheted costs up dramatically in 2021 while also curtailing production/sales. Inventories are at all-time lows everywhere and need to be rebuilt. Infrastructure plans are on the horizon globally on top of significant increases in capital spending and research. All good for growth.

We continue to favor investing in value stocks tied to global economic growth and technology companies riding the wave of digitalization. Companies hurt by shortages and supply-side issues will be the winners next year, too, as these problems abate. Inflation will subside too. We continue to see a steepening yield curve, but it will be held down by large inflows from abroad arbitraging the yield differential.

Getting off life support is a good thing.

1 note

·

View note

Text

Informational Blog

1. The Innovative Theory - Joseph A. Schumpeter argues in "Capitalism, Socialism, and Democracy" that capitalism isn't stationary and always evolving, with new markets and new products entering the sphere. He is perhaps most known for coining the phrase “creative destruction," which describes the method that sees new innovations replacing existing ones that are rendered obsolete over time. Schumpeter proclaims that economics may be a natural self-regulating mechanism when undisturbed by “social and other meddlers.”

He said that theories are based on logic and provide structure for understanding fact. He proceeds to illustrate that there are fundamental principles in the phenomena of money, credit, and entrepreneurial profit that complement his earlier theories of interest and the business cycle. His theory of development assigns the uppermost role to the entrepreneur and innovations introduced by him in the process of economic development. This video shows you how the Innovative Theory really works.

https://www.youtube.com/watch?v=0Hv-sMeNKGQ&t=120s

2. Keynesian Theory - Keynesian theory is a macroeconomic economic theory of total spending in the economy and its effects on output, employment, and inflation. Keynesian economics was developed by the British economist John Maynard Keynes in an attempt to understand the Great Depression. Keynesian economics is considered a "demand-side" theory or shall we say inflation, that focuses on changes in the economy over the short run.

His theory was the first to differentiate the study of economic behavior and markets based on individual incentives from the study of broad national economic aggregate variables and constructs. Based on his theory, Keynes advocated for increased government expenditures and lower taxes to stimulate demand and pull the worldwide economy out of Depression . Subsequently, Keynesian economics was wont to ask the concept that optimal economic performance might be achieved—and economic slumps prevented—by influencing aggregate demand through activist stabilization and economic intervention policies by the government. This video allows you to understand the Keynesian Theory without confusion.

https://www.youtube.com/watch?v=kukKpqd_B2c

3. Alfred Marshall Theory - Alfred Marshall’s specialty was microeconomics—the study of individual markets and industries, as opposed to the study of the whole economy. In his most vital book, Principles of Economics, Marshall emphasized that the worth and output of an honest are determined by both supply and demand: the 2 curves are like scissor blades that intersect at equilibrium. Modern economists trying to know why the worth of an honest changes still start by trying to find factors which will have shifted demand or supply, an approach they owe to Marshall.

The concept of consumer surplus is another of Marshall’s contributions. He noted that the worth is usually an equivalent for every unit of a commodity that a consumer buys, but the worth to the buyer of every additional unit declines. A consumer will buy units up to the point where the marginal value equals the price. Therefore, on all units previous to the last one, the buyer reaps a benefit by paying but the worth of the great to himself. The size of the benefit equals the difference between the consumer’s value of all these units and the amount paid for the units. This difference is called the consumer surplus, for the surplus value or utility enjoyed by consumers. Marshall also introduced the concept of producer surplus, the quantity the producer is really paid minus the quantity that he would willingly accept. Marshall used these concepts to live the changes in well-being from government policies like taxation. Although economists have refined the measures since Marshall’s time, his basic approach to what is now called welfare economics still stands. The video below explains how the theory works.

https://www.youtube.com/watch?v=oTd0nQeW05U

4. Risk and Uncertainty - bearing Theory - Frank Hyneman Knight distinguished between risk that can be modeled probabilistically, from uncertainty, for which the probabilities are unknowable. For instance, uncertainty surrounds the implementation of latest strategies, the event of latest products or entry into new markets. Similarly, the positive consequences of acquiring a competitor may have unknowable probabilities. According to the idea , bearing business uncertainty creates profit and therefore the more uncertainty taken on, the more profit are often gained. The relationship between uncertainty and gain could also be linear, or maybe exponential, where there are bigger payoffs on the proper hand side of the chart.

The uncertainty-bearing theory obviously views entrepreneurs as bearers of uncertainty making it a very individualistic theory to start out with. The theory places great emphasis on the entrepreneur’s ability to form decisions under uncertainty. The uncertainty perspective suggests a normative dimension: that entrepreneurs who are willing to require on great uncertainty may deserve windfall profits the rare times they are doing succeed. Entrepreneurs combat uncertainty consistent with their inclinations and abilities—the greater their self-confidence, the more they will combat . Thus, uncertainty bearing may be a capability that's innate or developed and using it in touch uncertainty in an entrepreneurial context may be a normal cost of doing business or "cost of production", where the payoffs are indefinite, future, and supported hope and theories. In this video, it explains the how the theory works.

https://www.youtube.com/watch?v=vAzj_CBgSPk

5. Kirzner’s Learning-Alertness Theory - According to Kirzner, the profits entrepreneurs receive from entrepreneurship are their reward for their tolerance of uncertainty as they eliminate arbitrage opportunities (the opportunity to sell the same product at a higher price than he or she bought it) created by the ignorance or incompetence of incumbent firms. Entrepreneurs need to be alert in order to be able to perceive economic opportunities that others cannot yet see, such as the need for new goods or services. Opportunities are seen to exist only because of the ignorance of incumbents otherwise they would already be exploited. When incumbents don't know key information or don't even realize what they are doing not know, then opportunities for entrepreneurship are born.

Ignorance begets errors that can be corrected by the actions of entrepreneurs. The entrepreneur acts under uncertainty and can't know if his or her action will yield a profit until after the action has been taken. Thus, entrepreneurs must accept they'll lose money (or that of their investors) from their actions if they end up to be incorrect. Kirzner believes that entrepreneurial alertness cannot be taught. However, this belief has been critiqued because marketing research and customer discovery can clearly help to acknowledge certain sorts of opportunities. But a rebuttal could be that knowing that marketing research was needed within the first place is entrepreneurial. Kirzner doesn't view the economic actions like buying resources or creating new products as entrepreneurial. Rather it's only the act of alertness that's entrepreneurial. The video below explains the theory.

https://www.youtube.com/watch?v=Bu-i1q8LVvA

1 note

·

View note

Text

Natural rate chimera and bond pricing reality

We build a novel macro-finance model that combines a semi-structural macroeconomic module with arbitrage-free yield-curve dynamics. We estimate it for the United States and the euro area using a Bayesian approach and jointly infer the real equilibrium interest rate (r*), trend inflation (π*), and term premia. Similar to Bauer and Rudebusch (2020, AER), π* and r* constitute a time-varying trend for the nominal short-term rate in our model, rendering estimated term premia more stable than standard yield curve models operating with time-invariant means. In line with the literature, our r* estimates display a distinct decline over the last four decades. from ECB - European Central Bank https://ift.tt/3qQ9HVQ via IFTTT

0 notes

Text

Pairs Trading Strategy-What are the Sources of Excess Returns?

Pairs trading is a quantitative trading strategy that is often discussed in the academic as well as practitioners’ literature. We have written about this trading strategy extensively from different perspectives. In this post, we’re going to look at the risk/PnL drivers of the pairs trading strategy.

Reference [1] pointed out that the profit of pairs trading comes from the spreads between small- and large-cap stocks and between value and growth stocks in addition to the spread between high- and intermediate-grade corporate bonds and shifts in the yield curve.

These profits are uncorrelated to the S&P 500; however, they do exhibit low sensitivity to the spreads between small and large stocks and between value and growth stocks in addition to the spread between high- and intermediate-grade corporate bonds and shifts in the yield curve. In addition to risk and transaction cost, we rule out several explanations for the pairs trading profits, including mean reversion as previously documented in the literature, unrealized bankruptcy risk, and the inability of arbitrageurs to take advantage of the profits because of short-sale constraints

However, in a recent publication [2], other authors linked the profitability of pairs trading to market liquidity,

Our results have shown that a simple pairs trading strategy building on an unsupervised machine learning approach does not generate sufficient excess returns to cover a conservative estimate of explicit transaction costs on the S&P500. Conversely, the same trading strategy appears to be profitable on OSE even when adjusting for both explicit and implicit transaction costs. We have shown that the profitability of pairs trading appears to be closely related to the market liquidity of the stocks that are traded, which might explain why the trading strategy appears to be more profitable at OSE.

In other words, using their proposed approach, which consists of first using Principal Component Analysis to divide stocks into clusters and then using cointegration to select the pairs, the strategy is not profitable in SP500, but in OSE, and the profitability is closely related to the market liquidity.

These articles raised some interesting questions,

Is pairs trading still profitable in the US markets,

What truly is the source of excess return, if any,

Does the profitability depend on strategy design?

Let us know what you think.

References

[1] E. Gatev, WN. Goetzmann, KG. Rouwenhorst, Pairs Trading: Performance of a Relative-Value Arbitrage Rule, The Review of Financial Studies, Volume 19, Issue 3, Fall 2006

[2] A. Høeg, EK. Aares, Statistical Arbitrage Trading using an unsupervised machine learning approach: is liquidity a predictor of profitability?, BI Norwegian Business School, 2021.

Article Source Here: Pairs Trading Strategy-What are the Sources of Excess Returns?

0 notes

Text

REASONS TO TRADE 10-YEAR TREASURY BOND FUTURES

Trading 10-Year Treasury Bond Futures offers opportunities for speculating on interest rate movements and hedging risks at the short end of the yield curve. With diverse trading strategies like spread trading and arbitrage, it facilitates portfolio diversification through safe-haven debt instruments.

0 notes

Text

Trade Tensions Dim Global Economic Prospects

Trump continues to surprise us by snatching defeat from the jaws of victory. We were so impressed when his administration a few weeks ago postponed any punitive action against Eurozone and Japanese car imports for up to 6 months and finalized the trade deal with Mexico and Canada to focus solely on trade negotiations with China. After all, how many battles can his administration fight at one time?

Unfortunately, that view changed with a tweet Thursday night when Trump threatened to impose tariffs beginning at 5% moving up to 25% on Mexican imports over the surge in migrants. Is he kidding!? Add that to the current 25% tariff on $250 billion of Chinese imports with the possibility going up to 25% tariff on the full $550 billion of Chinese imports by the end of June. The total tariffs could eventually be 25% on $900 billion of imports equal to $225 billion. We do not expect U.S. companies to absorb all or even some of the tariff. Hopefully overseas manufacturers lower prices somewhat to keep the business. Lower foreign currencies will help too. What we do expect is some part of the tariffs will be passed along in part or full in the form of higher prices to the consumer. Not good! But it is only a one-time event and lower prices will occur down the line when/if supply chains are moved.

Right now, companies don’t know where to shift their supply lines to avoid tariffs. They don’t what country, except the U.S., is safe from Trump’s tariffs. Did you see what happened to India yesterday? Not good!

We know many companies shifting production from China to avoid tariffs that have or are in the process of moving production to Mexico. Imagine their shock in reading Trump’s tweet. Really! How can a business plan for the future? Boardrooms around the world must be scratching their heads. Trump wants them all to build in America. Won’t happen! Companies will keep their hands mostly in their pockets until trade deals are reached bringing some certainty to planning supply chains. Until then, capital spending, hiring and economic growth will be penalized.

We must also consider retaliation by those countries singled out by Trump. We already know that China raised tariffs yesterday on $60 billion of U.S. imports. Additional actions will be forthcoming like on rare minerals. And then there is Fed Ex. We are quite confident that Mexico will not stand still and will most likely raise tariffs on at least some of the $265 billion of U.S. imports if Trump moves forward raising tariffs on Mexican imports.

Finally, we believe that Trump’s actions basically end any chance that Congress will pass the new USMCA. It appears that both Robert Lighthizer and Bob Mnuchin disagreed with Trump, but to no avail. Kudlow would have, too, but is out on medical leave. So, who did Trump get advice from? Not from those in the know. Clearly this was a political decision without full consideration of the economic consequences. Mexico, Canada and the U.S. need to be a seamless supply chain which is now in jeopardy.

But all of this could be reversed in a tweet! Same with the trade conflict with China. We think that cooler heads will prevail to avoid these all of these tariffs as the alternative is just too dire for all concerned. Don’t forget that Trump is a political animal first and foremost and he weighs his actions/success by the Dow Jones. Well, the markets have declined the most consecutive weeks in over 30 years since his turnabout on trade while long term bond rates have plummeted to lows not seen in years with a good part of the yield curve inverted signaling a major slowdown or even a recession ahead. We see a slowdown coming in the U.S. but not a recession.

Don’t forget that 2020 is an election year and Trump needs both a strong economy and higher stocks prices to win. He will focus on this political base. So will we! Could Trump be so smart to take the pain now so that 2020 will be a strong year going into elections? That is our current thinking. We now believe that economic stats for the remainder of 2019 will be weaker than we anticipated just weeks ago but remain confident that 2020 will be a better year. While we recognize that stocks are cheap, we may remain in purgatory a while longer waiting for the next tweet and/or resolution of all/some of these issues. We also expect the Fed to come into play by lowering rates at least once in 2019 and more next year if needed. The Fed has two mandates: employment and inflation. They succeeded on one but failed on the other. Inflation is just too low so the Fed must adjust rates down to take that into account. Hopefully the dollar will then weaken too which will be a bonus for all. The yield curve will steepen too.

We have continued to adjust our portfolios to reflect our new forecast: economic growth around 1.3% in the second quarter followed by 2% for the rest of the year as consumer spending remains relatively strong. S & P 500 EPS will likely expand by only 4% in 2019 to $167/share but accelerate to a 6% gain in 2020 to $177/share. While we always expected our rates to be pushed lower than forecasted due to huge capital flows from abroad, we had to adjust down our view of interest rates even more to incorporate weaker than anticipated global growth and inflation. Who would have forecasted German and Japanese rates remaining below 0 for so long putting immense downward pressure on our rates?

Let’s take a look at recent economic stats that support our current view that the global economy is weaker than earlier anticipated:

1.) We have lowered our view of U.S. economic growth as the spring recovery has just not materialized as we had anticipated: home price growth continues to slow and is now up less than 3.7% year over year as housing continues to weaken despite lower mortgage rates; household spending rose only 0.3% in April from March despite a 0.5% increase in pretax earnings from wages, salaries and investments; the April PCE rose 0.3% in April and is up only 1.5% from a year ago; first quarter GNP growth was lowered to 3.1% and showed signs of slowing growth In capital spending and manufacturing ahead; the wettest winter/spring will hurt the agriculture sector big time; and factories are on track for their weakest showing in 2019 since 2016 as demand for business equipment and commodities weakens here and abroad.

On the other hand, consumer confidence rose to an incredible 134.1 in May and is now close to an 18-year high. Consumer demand has picked up from weak first quarter numbers and is likely to remain relatively strong for the remainder of the year into 2020. It does not hurt that employment continues to increase above trend, hourly wages are rising, inflation and interest rates are low and over 7 million jobs need still to be filled. Remember that consumer spending is over 60% of our GDP. And our fiscal policy is additive to growth too.

Our economy is still in the best shape compared to the rest of the world. Our rates are being pulled down due primarily to arbitrage from abroad. We believe that our short rates are too high and our long rates are slightly too low. Our yield curve should steepen once the Fed finally lowers the funds rate. Our inverted yield curve is NOT indicating an impending recession as many believe.

Who will be the major beneficiary of any trade deals at the margin and who has less to lose without them? The USA! So, we are investing in America. Not China, Europe, the Emerging Markets or Japan.

2.) As expected, May economic results weakened in China: the official manufacturing PMI fell beneath 50 to 49.4 despite all the stimulus introduced by the government since December. Chinese leaders have eased credit, reduced taxes and ramped up infrastructure spending but the May slowdown accelerated in industrial production, fixed asset investment and exports. No matter what the government says, domestic demand cannot offset near term weakness in exports and companies leaving China to produce elsewhere. China needs to sustain growth neat 6% to fund all of its domestic needs so the country has a real problem no matter what face they put on.

3.) All you have to do is look at the interest rates in Europe and Japan to get an indication of how well/badly their economies are doing. We remain very pessimistic about the Eurozone due to a whole host of factors beginning with their inability to enact fiscal, monetary, regulatory and trade reforms to make the region globally competitive. No Brexit hurts too!

4.) Japan is just too reliant on global trade so the country badly needs the U.S. and China to make a deal. It really won’t make enough difference to Japan’s economy to make a deal with the U.S. alone which remains very likely before the end of the summer.

Global bonds yields hit multi year lows last week says it all: the global economy is weakening.

What are we doing?

We have continued to take risk off since Trump did a 180 weeks ago. We have significantly raised our cash levels, reduced our foreign exposure and lowered our economic sensitivity. In addition, we have sold calls against our core positions offering us 7% upside and 8% downside protection over the next four months. This move added to our cash reserves while we will also collect future dividends from these stocks.

All of the companies that we own have superior management; winning business strategies in a globally competitive environment; strong new product flows with pricing power; rising operating margins/operating income/net income/cash flow and free cash flow. In addition, the average dividend yield on our portfolio exceeds the 10-year treasury and each company is buying in a lot of stock out of free cash flow.

Our main exposure remains in healthcare; technology; capital goods and industrials; housing related; some financials and many special situations. We own no bonds nor are we long the dollar although we expect the dollar to remain strong until the Fed lowers rates and/or trade deals are reached.

Paix et Prospérité continues to not only outperform the averages, we are in position to take advantage of any further weakness should it occur.

Remember to review all the facts; pause, reflect and consider mindset shifts; look at your asset mix with risk controls; do independent research and…

Invest Accordingly!

Bill Ehrman

Paix et Prospérité LLC

4 notes

·

View notes

Text

ebook Efficiently Inefficient How Smart Money Invests and Market Prices Are Determined (DOWNLOAD E.B.O.O.K.^)

Download Or Read This Ebook at:

http://read.ebookcollection.space/?book=0691196095

Download/Read Efficiently Inefficient: How Smart Money Invests and Market Prices Are Determined Ebook

information book:

Author : Lasse Heje Pedersen

Pages : 368

Language :

Release Date :2019-9-17

ISBN :0691196095

Publisher :Princeton University Press

BOOK DESCRIPTION:

Financial market behavior and key trading strategies--illuminated by interviews with top hedge fund expertsEfficiently Inefficient describes the key trading strategies used by hedge funds and demystifies the secret world of active investing. Leading financial economist Lasse Heje Pedersen combines the latest research with real-world examples to show how certain tactics make money--and why they sometimes don't. He explores equity strategies, macro strategies, and arbitrage strategies, and fundamental tools for portfolio choice, risk management, equity valuation, and yield curve trading. The book also features interviews with leading hedge fund managers: Lee Ainslie, Cliff Asness, Jim Chanos, Ken Griffin, David Harding, John Paulson, Myron Scholes, and George Soros. Efficiently Inefficient reveals how financial markets really work.

Efficiently Inefficient: How Smart Money Invests and Market Prices Are Determined pdf download

Efficiently Inefficient: How Smart Money Invests and Market Prices Are Determined audiobook download

Efficiently Inefficient: How Smart Money Invests and Market Prices Are Determined read online

Efficiently Inefficient: How Smart Money Invests and Market Prices Are Determined epub

Efficiently Inefficient: How Smart Money Invests and Market Prices Are Determined pdf full ebook

Efficiently Inefficient: How Smart Money Invests and Market Prices Are Determined amazon

Efficiently Inefficient: How Smart Money Invests and Market Prices Are Determined audiobook

Efficiently Inefficient: How Smart Money Invests and Market Prices Are Determined pdf online

Efficiently Inefficient: How Smart Money Invests and Market Prices Are Determined download book online

Efficiently Inefficient: How Smart Money Invests and Market Prices Are Determined mobile

Efficiently Inefficient: How Smart Money Invests and Market Prices Are Determined pdf free download

download ebook PDF EPUB, book in english language, Download pdf kindle audiobook

0 notes

Text

Revealed – The Next Big Altcoins & Airdrops!!

Let’s talk about tokens today. The Altcoins because if we are getting near the end of the bear trap I predicted we currently are in those alts are going to run. Like, run forest run because after the bear trap is mania phase, or my term for it, the last hoorah. So you maniacs can you give me a hoorah? Because it’s time for Chico Crypto! Yesterday it seemed a touch of mania was already beginning! Coinbase late to the party, decided to finally do it and list Dogecoin to Coinbase Pro. And the Coinbase listing effect still had its power.

Checking out the Dogecoin price chart, some explosive moves, which have shot it up by over 51 percent since its Saturday lows. Which got ole Elon tweeting again. In response to Coinbase Pro listing it, he posted (dot dot dot) and a retweet of the meme of the doge storm standard, taking over the global financial system and him saying it’s inevitable.

So, there is a play with Doge still to this day. Just 2 weeks ago, on May 20th Elon tweeted this. How much is that Doge in the Window? With a picture of what looks to be a 1 dollar dogebill, on a laptop, in front of a neon Cyberviking sign. Aka Elon wants to see Doge to a buckeroo as it didn’t hit it when everyone thought it would with his SNL appearance So, what could be coming that would push it to that Dollar mark? Well, remember when Elon tweeted that Tesla was no longer accepting Bitcoin for payments? He also said they were looking at other cryptos that use less than 1 percent of BTCs energy per transaction.

Well, dogecoin fits that bill! It only takes .12 kilowatt-hours consumed per doge transaction, while BTC takes 707-kilowatt hours. That is less than 1 percent. And then there was this, just 3 weeks ago. Elon put out a poll for the public. Asking the Twitterverse if they want Tesla to accept Dogecoin.

Which got a nearly 80 percent YES with almost 4 million votes. In my opinion, it’s pretty obvious a Tesla announcement of Dogecoin for payment is coming and probably coming this Summer. Within the next month or two. And that hype, combined with a rebound in the markets should see Dogecoin relook towards that dollar mark.

Now, moving down the market cap rankings to the most popular and dominant DEX in the space. Uniswap!! We are closing in on the 1 monthly anniversary of the v3 launch of their exchange so it’s time to talk about LP, liquidity pool positions, and how to make it easier on yourself to add liquidity to the exchange.

Uniswap v2 made adding liquidity to trading pools simple..you just selected the pair you want, put equal value amounts of each in, and supplied and confirmed the transaction, receiving an LP token. It was automated for you. You didn’t have to change or set anything.

I’m sure some of you have seen today, what v3 is like there are things you have to set, like the fee, which isn’t too bad but also the one that confuses everybody the price ranges! A minimum and maximum price to create the range. Then going to Uniswap v3 liquidity documentation the team says If the price moves outside of the LP’s specified range, their position will be concentrated in one of the two assets and not earn trading fees until the price returns to their range.

Yeah, you have to keep a close eye on your LP positions, and the price, as if it moves out of your set ranges, you don’t earn fees. You have to be active which the team says in that documentation When making a price range decision, LPs should consider the extent to which they think prices will move over the course of their position’s lifetime and their willingness to actively manage their positions (and all the costs associated with more active management). So for those who don’t know what they are doing or don’t have the time to be so active.

How do you provide Liquidity to Uniswap easily?? Well, there is the Sommelier Finance pairing app!! Going to that it says it the easiest way to add liquidity to Uniswap v3. Heck yeah, Chico likes And it is pretty dang easy. You just search for the v3 pair you want to add liquidity to and click on it. We are doing Link and WrappedETH.

Select the pair you want, altcoin and eth or wrapped eth, and the amount of each. Once that is filled in, you select your sentiment for ETH, are you neutral.. you think Link vs ETH is gonna hodl the same. Are you bearish on ETH vs LINK, or are you bullish on ETH vs LINK? It changes the price ranges for you based on this.

You then set your gas price, and click add liquidity. Much, much, much more simple than setting the ranges yourself within the v3s liquidity interface. So I’m sure you are asking yourself a token?? For Sommelier? Not yet, they put out their product first, and plan to launch the token later.

SOMM It’s coming just no official date yet! Definitely, one to keep an eye on though. But speaking of Uniswap LP positions, and automating that leads us right into a sponsored segment of this content, supported by the team over at Peanut, and like always the full details of our agreement are down in the description Jumping right to their website found at peanut. trade, a link for that is down below in the description, we can see what their main selling point is.

They are a DeFi Price Balancer for DEX users to reduce slippage and impermanent loss & the main product is the liquidity balancer. Jumping to that’s landing page, they describe it as putting your liquidity on autopilot and maximizing LP profits.

Very nice they continue. Peanut is the first-ever automated liquidity balancer for Uniswap v3 that concentrates liquidity price range based on real-time market conditions. Basically, this means Peanut will take the complexity out of the price ranges with v3.

They will automatically adjust and move them to the most capital-efficient and profitable ones. Keeping you earning the most fees. instead of those who do it manually, falling out of profitable ranges and the stats are looking good from their initial research. Providing more fees per dollar than just Uniswap v3 alone & manual adjustments.

Besides, automatic adjustments Peanut has something in the works with Curve, they partnered together & Michael Egorov, CEO of curve said this about the peanut solution: The presence of slippage is a huge inconvenience, and can sometimes carry significant risks for DEXs. Peanut provides a great solution to this problem. By using only 10% of user funds in a centralized manner (cross-exchange arbitrage), Peanut manages to achieve significantly higher efficiency of the mechanics and returns for users.

Although ack at their website you can see it’s a waitlist to join, which makes sense, as Uniswap v3 just launched less than a month ago. I’m sure it’s close to being ready so get signed up so you don’t miss the initial launch! But, also releasing soon, to work alongside their v3 product, is another piece of their DeFi puzzle. Peanut FeeNo. Feeno is an SDK that can be integrated into blockchain apps like crypto wallets, DEXs, lending protocols to enable ETH-free transactions and swaps, provide 100% front-run protection, and even can offer a cashback to the app users. Also with Feeno, you don’t need ETH at all, no matter which ERC-20 tokens you send or swap. Yes, others projects and apps can and will use FeeNo to help their own users. One of the first use cases, for FeeNo, will be Peanut’s own products, like the v3 liquidity balancer but since it’s an SDK, others can easily plug it in and use it too.

So if any of this fits your crypto fancy, links for the peanut are below! Now I want to finish this episode off with a bit of crypto alpha leak including an airdrop you might be eligible to claim! So let’s begin with the airdrop this is from Ribbon Finance, and at their website, they say they are a sustainable alpha for everyone, earning yield on crypto assets through DeFis first structured products protocol.

And they have one product out, the yield with 3 other structured products coming soon. And then scroll down to the investors it’s an alpha list.DragonFly, Coinbase, Joe Lubin, and even Kain Warwick So how do you get the airdrop? Well, you have to go to their app found at the app, ribbon, finance, and then in the top right corner, click red RBN, connect a wallet & see if you have any! Who is eligible? A total of 4M RBN was distributed between users of existing options protocols on Ethereum: Hegic, Opyn, Charm, and Primitive.

We talked about Hegic we talked about Opyn you may be eligible! Although if you are, the tokens aren’t transferable yet! So do you want to talk about a token that is trading!? One that I have been waiting to hit the scene for a very long time? Well, Centrifuge’s governance token CFG is finally on Coingecko & its first exchange! And Centrifuge is pushing forward with some BIG news 2 weeks ago, they announced Altair, their Kusama parachain.

And scrolling down to the genesis token distribution you can see 61 percent of AIR tokens, for the parachiain are airdropped to CFG holders. 1 CFG gets you 1 AIR.and with the parachain auctions on Kusama right around the corner this snapshot airdrop is becoming more likely to happen by the day. Chico likes. Cheers Ill see you next time!.

via Revealed – The Next Big Altcoins & Airdrops!!

0 notes

Text

One-month dollar-rupee forward rate curve inverts on arbitrage bets

One-month dollar-rupee forward rate curve inverts on arbitrage bets

The one-month USD-INR forward rate is now higher than one- and two-year forward rates, an anomaly brought on by arbitrageurs playing between the offshore and onshore markets. The one-month forward rate is at 4.9 per cent, while the one-year is at 4.6 per cent. The 2-year forward is also flat at 4.60 per cent. “Short-term forward yield is higher on account of arbitrage between offshore and…

View On WordPress

0 notes

Text

One-month dollar-rupee forward rate curve inverts on arbitrage bets

One-month dollar-rupee forward rate curve inverts on arbitrage bets

The one-month USD-INR forward rate is now higher than one- and two-year forward rates, an anomaly brought on by arbitrageurs playing between the offshore and onshore markets. The one-month forward rate is at 4.9 per cent, while the one-year is at 4.6 per cent. The 2-year forward is also flat at 4.60 per cent. “Short-term forward yield is higher on account of arbitrage between offshore and…

View On WordPress

0 notes