#consistent returns

Explore tagged Tumblr posts

Text

Fixed Income Arbitrage Strategies for Steady Returns

Introduction: Stability in a Volatile World

In today’s uncertain macroeconomic landscape marked by rising interest rates, inflation concerns, escalating geopolitical tensions, and persistent equity market volatility investors are actively seeking low-risk, yield-enhancing strategies to preserve capital while generating stable income. Traditional fixed income allocations, such as passive bond portfolios, often fall short in offering real returns adjusted for inflation and risk.

Enter fixed income arbitrage: a market-neutral arbitrage strategy that aims to profit from temporary pricing inefficiencies in the bond and credit markets while minimizing exposure to broad market swings. By leveraging interest rate spreads, yield curve dislocations, and credit anomalies, this strategy provides a reliable avenue to generate alpha with low volatility.

For institutional investors, including pension funds, sovereign wealth funds, insurance companies, and multi-strategy hedge funds, fixed income arbitrage is emerging as a safe haven investment offering:

Consistent risk-adjusted returns

Low correlation to traditional assets like equities and commodities

Customizable duration and liquidity profiles for matching long-term liabilities

Effective hedging mechanisms against inflation and systemic risk

Why Now?

With central banks like the U.S. Federal Reserve and the European Central Bank (ECB) adopting diverging monetary policies, the resulting interest rate differentials and market mispricings are creating fertile ground for arbitrage strategies.

At Radiant Global Fund, our dedicated Fixed Income Arbitrage Solutions are engineered to help institutional investors exploit these inefficiencies across global fixed income markets. Whether you’re navigating rate normalization or preparing for a potential downturn, fixed income arbitrage can act as a strategic ballast in your portfolio. What Is Fixed Income Arbitrage?

Fixed income arbitrage is a market-neutral investment strategy that seeks to profit from pricing inefficiencies between related fixed income instruments such as government bonds, corporate bonds, interest rate swaps, and repo agreements. This approach involves simultaneously buying and selling offsetting bond exposures, aiming to earn returns from the convergence or divergence of interest rate spreads, yield curve positions, or credit spreads, regardless of the overall market direction.

It is particularly favored by institutional investors, fixed income hedge funds, and multi-strategy asset managers seeking low-volatility, alpha-generating strategies with minimal directional market exposure.

Core Objective

To earn arbitrage profits from small but predictable price differences between related securities typically without taking unhedged interest rate or credit risk.

Common Fixed Income Arbitrage Strategies

Each fixed income arbitrage strategy targets a specific inefficiency within the fixed income market. The most widely used strategies include:

1. Swap Spread Arbitrage

This involves taking advantage of pricing mismatches between Treasury yields and interest rate swaps. Arbitrageurs look for divergences in swap spreads relative to historical norms or forecasted monetary policy shifts.

Example: Long U.S. Treasuries and short matching maturity interest rate swaps when spreads widen beyond fair value.

2. Yield Curve Arbitrage

This strategy focuses on anomalies between bond yields at different maturities along the same yield curve. It typically involves a long/short position on different points of the curve, such as 2-year vs. 10-year Treasuries.

Goal: Profit from the reversion of the curve to its expected shape or spread level.

3. Credit Spread Arbitrage

Traders exploit the spread between corporate bonds and risk-free government securities. This strategy aims to earn from either widening or narrowing of credit spreads, often using CDS (credit default swaps) for hedging.

Use Case: Long undervalued investment-grade bonds, short overvalued junk bonds.

4. Repo Arbitrage

Involves profiting from the interest rate differential between borrowing and lending in the repo and reverse repo markets. Often used by institutions to enhance short-term yield on collateralized assets.

Advantage: Exploits daily or weekly funding inefficiencies while maintaining low balance sheet risk.

Why It Works

Fixed income markets are massive, opaque, and often fragmented creating persistent inefficiencies across geographies, maturities, and credit qualities. These inefficiencies present opportunities for disciplined arbitrageurs equipped with advanced analytics, liquidity access, and real-time pricing tools.

Related Internal Resource: Explore How Radiant Global Fund Adds Value to see how we optimize execution, risk modeling, and yield enhancement for institutional clients.

Why Fixed Income Arbitrage Appeals to Institutional Investors

In today’s dynamic economic environment, institutional investors such as pension funds, insurance companies, endowments, and sovereign wealth funds are constantly searching for strategies that offer capital preservation, stable income, and low correlation to public markets. Fixed income arbitrage stands out as a powerful solution for achieving these goals.

1. Low Volatility, Predictable Cash Flows

One of the key attractions of fixed income arbitrage is its ability to deliver consistent, risk-adjusted returns with minimal volatility. Because this strategy is typically market-neutral, it does not rely on rising bond prices or favorable economic cycles to perform.

Institutional portfolios particularly those guided by liability-driven investing (LDI) frameworks benefit from:

Steady cash flows that match future liabilities

Defined duration exposure for better planning

Reduced drawdown risk compared to traditional fixed income or equities

Learn more about LDI strategies and fixed income innovation from BlackRock.

2. Diversification in Uncertain Markets

In periods of market stress or recessionary risk, traditional asset classes like equities and even long-duration government bonds can become correlated leaving portfolios vulnerable. Fixed income arbitrage, by contrast, is designed to:

Perform independently of market direction

Act as a non-correlated return stream within multi-asset portfolios

Hedge exposure to macroeconomic shocks

This makes it a critical diversifier for investors looking to smooth out returns and reduce reliance on beta-driven growth.

Explore our blog on Institutional Advisory Solutions for more ways to strengthen your portfolio resilience.

3. Exploiting Interest Rate Dislocations

With central banks like the Federal Reserve, ECB, and Bank of Japan actively managing monetary policy, the global interest rate environment is increasingly fragmented. This creates frequent dislocations and inefficiencies in:

Yield curves

Swap spreads

Credit spreads across geographies

These anomalies present opportunistic entry points for institutional investors using sophisticated arbitrage models and execution platforms.

See how Radiant Global Fund’s Fixed Income Arbitrage Services capitalize on interest rate volatility in global markets.

Key Risks in Fixed Income Arbitrage and How They’re Managed

While fixed income arbitrage is often perceived as a low-risk, market-neutral strategy, institutional investors must recognize and address several key risk factors that can impact performance. Effective risk management systems and robust operational infrastructure are essential to navigate these challenges and maintain consistent alpha.

1. Interest Rate Risk Even though fixed income arbitrage is typically market-neutral, sudden moves in interest rates especially in yield curve arbitrage or swap spread arbitrage can lead to temporary mark-to-market losses.

How it's managed:

Duration matching between long and short legs of trades

Dynamic hedging using interest rate futures, swaps, or options

Monitoring central bank policy changes (e.g., Federal Reserve, ECB)

Related Insight: Explore Multi-Asset Strategies for Volatile Rate Environments.

2. Liquidity Risk Periods of market stress can cause bid-ask spreads to widen, especially in credit spread arbitrage or less-liquid bond segments. In such conditions, exciting positions can be costly or delayed.

How it's managed:

Prioritizing highly liquid instruments like U.S. Treasuries, investment-grade corporates, and on-the-run securities

Setting pre-trade liquidity thresholds

Establishing liquidity buffers in fund mandates

Learn more about Bond Market Liquidity Trends from the IMF.

3. Counterparty Risk Executing arbitrage trades often involves repo transactions, derivatives, or short borrowing, which expose investors to counterparty default risk.

How it's managed:

Enforcing high-quality collateral agreements (e.g., tri-party repo systems)

Trading only with investment-grade counterparties

Ongoing credit risk assessments and margin calls

4. Model Risk Fixed income arbitrage relies heavily on quantitative models to identify pricing inefficiencies. Inaccurate assumptions or untested scenarios can lead to unexpected losses.

How it's managed:

Model validation by independent risk teams

Use of Monte Carlo simulations, Value-at-Risk (VaR), and stress testing

Regular backtesting across historical rate regimes How Radiant Global Fund Adds Value in Fixed Income Arbitrage

At Radiant Global Fund, we provide bespoke institutional fixed income arbitrage solutions that combine cutting-edge technology, deep market insight, and multi-market execution precision. Our strategies are purpose-built to deliver stable, risk-adjusted returns in a global context making us a preferred partner for pension funds, insurance firms, sovereign wealth funds, and multi-strategy hedge funds.

1. Real-Time Spread Monitoring with AI

We leverage machine learning algorithms to track pricing inefficiencies across:

Sovereign bonds (e.g., U.S. Treasuries, Bunds, JGBs)

Municipal bonds

Corporate credit instruments

Our proprietary fixed income arbitrage engine scans real-time yield data, repo market indicators, and curve distortions across developed and emerging markets, identifying high-probability trade setups before they converge.

Explore our AI-Powered Investment Infrastructure

2. Precision Hedging & Optimized Execution

Radiant’s execution desks utilize algorithmic tools and cross-venue liquidity mapping to:

Pinpoint optimal entry/exit levels

Implement duration-neutral hedging overlays

Structure cost-efficient trades using futures, swaps, and options

This ensures tight risk control while enhancing spread convergence potential, especially in volatile or dislocated markets.

Learn more about our Institutional Trading Capabilities.

3. Macro + Micro Risk Modeling

We integrate both top-down macroeconomic analysis and bottom-up bond-level insights to assess risk in real time:

Yield curve simulation models

Central bank divergence indicators

Monte Carlo and VaR analytics

These tools help us align each trade with rate expectations, liquidity conditions, and geopolitical scenarios creating a resilient, data-driven arbitrage framework.

Interested in our risk framework? View Radiant’s Risk Management Philosophy.

Case Study: Profiting from Central Bank Divergence

In late 2023, while the U.S. Federal Reserve paused rate hikes and the European Central Bank (ECB) maintained its tightening bias, a rare divergence occurred between U.S. and Eurozone bond markets.

Radiant's algorithms detected a widening swap spread between U.S. Treasuries and German Bunds. By deploying cross-market, duration-neutral trades, we captured this dislocation before markets rebalanced.

Result: => 11.4% annualized return => Minimal volatility (<2% std. dev.) => Delivered via our global fixed income arbitrage mandate

This performance underscores the power of combining global insight with precise execution.

Ready to Optimize Your Arbitrage Allocation? Contact our advisory team or explore the full range of Fixed Income Strategies offered by Radiant Global Fund.

Conclusion: A Core Strategy for a Balanced Portfolio

Fixed income arbitrage isn’t just a defensive play, it's a proactive, data-driven strategy designed for investors seeking capital preservation and steady yield in a world where traditional income strategies often fall short.

Whether you manage an endowment, a multi-asset fund, or a sovereign wealth portfolio, incorporating fixed income arbitrage through a trusted partner like Radiant Global Fund can significantly improve your portfolio’s risk-adjusted return profile.

#fixed income arbitrarbitrage investment strategies#arbitrage trading#bond arbitrage#consistent returns#credit spread arbitrage#fixed income arbitrage#fixed income hedge fund#fixed income investment strategies#government bond arbitrage#interest rate arbitrage#low-risk arbitrage#portfolio diversification#yield curve arbitrage

0 notes

Text

basically how tbob ended right??

#the book of bill#gravity falls#bill cipher#the book of bill spoilers#returning to my roots... from 2016-18 all i drew was bill cipher consistently

5K notes

·

View notes

Text

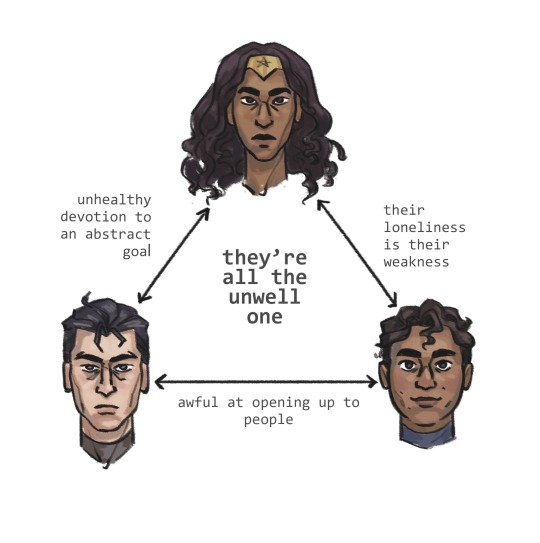

Trinity thesis

#this is what I think anyways#my art#dc#dc comics#clark kent#superman#bruce wayne#batman#wonder woman#diana of themiscyra#diana prince#dc trinity#you could honestly argue that any of these apply to all of them but#I think they most strongly apply to these pairings#like Bruce is also pretty lonely but Diana and Clark’s detachment from their homes specifically#is a consistent weakness for them#kryptonite literally being the shattered remains of Clark’s world and any threats or changes to themyscira being what always gets#an emotional reaction out of Diana in fights… they both have homes they’re unable to return to#and Diana is also pretty bad at opening up to people but only because she isn’t aware she has any problems to begin with#Bruce and Clark at least somewhat know when they have an issue. and then tell nobody anyways#Diana and Bruce ohh their parallels make me crazy#their incredible devotion to being a protector that they get so absorbed in they can’t see themselves as anything outside of it?? crazy#I think Clark and Diana also have a shared complicated relationship to their public idolization but I couldn’t#fit that into a concise sentence#I care for them so deeply. None of them are well#sorry for changing the text on this three times

2K notes

·

View notes

Text

deranged picnic

#obsessed with how this game manages to maintain a consistent utterly unhinged vibe for its entire runtime.#this scene is immediately followed by him receiving a letter from his girlfriend saying she's breaking up with him.#he gets the letter from an eldritch abomination in the form of his mentor's face on the body of dead dog as it turns into magic dust.#also his gf broke up with him because he wasn't returning any of her messages while he was being tortured in a dungeon for four years.#which is actually how he finds out it's been four years. he's been under the impression that it's been like. 2 weeks lol#the guy on the left is perfectly alive and monologuing the whole time.#and he happens to be the same guy that made clones of himself and went on a crusade to eat chunks of the protagonist's hair.#sighh..... crisis core my beloved........#(derogatory)#my art <3#ffvii#crisis core#oh god i forgot his scar. nobody look. don't look. you don't see shit.

1K notes

·

View notes

Text

Men clashed spear upon shield. ‘Éomer, my son! You lead the first éored ,’ said Théoden; ‘and it shall go behind the king’s banner in the centre. Elfhelm, lead your company to the right when we pass the wall. And Grimbold shall lead his towards the left. Let the other companies behind follow these three that lead, as they have chance. Strike wherever the enemy gathers. Other plans we cannot make, for we know not yet how things stand upon the field. Forth now, and fear no darkness!’ RETURN OF THE KING: THE RIDE OF THE ROHIRRIM

@lotr20 day 3: fear | courage | adventure

#lotr#lord of the rings#lotredit#lotrweek#tolkienedit#filmedit#rotk#*lotrq#return of the king#rotkedit#eowyn#eomer#theoden#the ride of the rohirrim#battle of the pelennor fields#*#coloring consistency? never heard of her

1K notes

·

View notes

Text

the barista lady in the treviso café fucking giggles every time you buy the fancy coffee lucanis likes from her btw. can't believe the game is calling out rook and me like this

#I've tried it several times to check it wasn't a fluke and nope it does happen consistently I'm pretty sure it's intentional#bioware Know. they knowwww. they know exactly what I'm like and god bless them for it#dragon age#dragon age: the veilguard spoilers#dragon age: the veilguard#dragon age spoilers#lucanis dellamorte#rook x lucanis#rookanis#café pietra barista gazing kindly at rye like 'I know what you are.' (a simp) while the tips of his ears go very very warm#clearly some sort of underlying drift compatability here since rook in one night can somehow manage to hit on all two (2)#of the elements of lucanis' instinctive understanding of courtship behaviour (knives and coffee/food) hfksjdfhas#in lucanis' defense when a guy buys you knives AND good coffee (despite not even drinking the stuff much himself) on a first date...#when your love language is that unhinged and they straight up compose a shakespeare level sonnet in it on the spot#seemingly without even realizing it. I mean what else can you be expected to do but fall so cataclysmically in love#that you'd kill god over it any day of the week easy. wild stuff#even wilder since in my playthrough he isn't entirely sure rye meant anything by it/as more than a friendly gesture#for like. MONTHS.#lucanis is a regular at that place and they all for sure know exactly who he is so can you IMAGINE the gossip that must start#after that conversation starts to take on a flirty edge. hotboi crown prince of the crows returns from the dead and is making eyes#at ~*mysterious stranger*~ who just showed up in town. some I hear netherfield park is let at last stuff going on for these guys#as they watch all of this go down

365 notes

·

View notes

Text

hello folks, i'm alive! to give you a little health update, my chronic pain still hasn't gotten better and it turned out there's a cyst growing in my wrist that will have to be taken care of. so i'm still not really drawing a lot and i have no new shuake art to show 😭

i did however get into alien stage and i'm (slowly) working on some art for that, maybe i'll post it on this account? but my followers are probably waiting for shuake so i feel a little bad i can't deliver fhbvdhvf

#txt#my inbox is so full too im sorryyy#i wanna try making a return to tumblr but i cant promise any consistent posting at all

118 notes

·

View notes

Text

Brain empty only fish 🐟

#sundrop#fnaf daycare attendant#Luca au#mermaid au#mermaid sundrop#I should really draw moon more often#prom myself I’ll do a moon to go with this#feels like I’m returning to form with this artstyle#soft pen with colored shading#ended up with the same effect of that crayon pen I used to use#keep in mind#set the characters up more in a more interesting position it’s too far away this way#god can I ever draw my own design consistently#add fin and maybe change frills

901 notes

·

View notes

Text

Petition to start calling them Weevilbees

#cw bugs#Beefly is very lacklustre for such a majestic weirdo 😔#where’s the creativity!#bee fly#diptera#dipteran#bugs#bugblr#insects#flies#cute bugs#entomology#weevil bees#consistent posting and doodles will return soon I promise these antibiotics knocked me down a bit <:]#sleepyyy

61 notes

·

View notes

Note

I have a question about the jp server pickups, since I really want knight Sebek, but I’m trying to save gems for bloom malleus + the 3rd tsum event that’s gonna show up sooner or later. Iirc, after knight Sebek, the next story update’s pickup had all of the previous story cards (ie cerberus Ortho, general Lilia, and knight Sebek). Is this true, and if it is, did it include a token system like the dorm pickups where you can just do 100 pulls and then buy the specific card you want directly? Because if that is how it works, then I can wait until then and be sure I won’t have to go to 200 for him.

we did indeed get a second chance at those three when 7-7 came out! I'm pretty sure there was not a token system -- though admittedly I don't 100% remember, sorry! 🙇 I took a quick search through some past posts/videos from people who tend to include the gacha and news stuff, but I didn't see any mention of it, so I'm inclined to think there really wasn't one. :( they were all separate pickups with their own pull counts rather than a combined one, if that info helps at all.

speaking as a strict f2p who hoards keys/gems like the lovechild of a dragon and a magpie, given the choice between saving for a story card and a birthday card, I'd go for story -- it does require a lot of patience, but there are way more opportunities to get past birthday cards, both from the anniversary events and the rerun pickups! tsums is a bit harder to say anything on because Eng doesn't follow the same event schedule, but it's a longish event and those pickups let you have a free 10-roll, so I think they're also a bit easier to save up for.

(ALSO speaking of free rolls, starting with the fifth round of birthdays -- the kutsurogi my room ones -- the birthday boy/union jacket/bloom cards have had a separate pickup that you can get two free 10-pulls at by doing missions! I got a bloom Jade from it a couple weeks ago. :D meanwhile general Lilia is the only story card I've ever managed to pull, so...I'm probably kinda biased. whoops.)

#twisted wonderland#twisted wonderland spoilers#twisted wonderland episode 7 spoilers#twisted wonderland book 7 spoilers#twisted wonderland episode 7 part 6 spoilers#twisted wonderland book 7 part 6 spoilers#joseimuke games are serious business#just speculating for a moment here#i could be completely wrong about all of this it's just me spitballin'#i suspect we WILL get a rerun pickup for the 7-7 and up story cards at some point#but probably not a third round of the diasomnia story boys :(#we never got a proper dorm rerun for them so i think we'll get that instead#but also that makes me wonder if we're going to maybe not get a story silver card after all...#because like#i realized earlier that since we've been getting main story drops pretty consistently every two months#(we had july + august in a row but september + october were for halloween so it averages out)#if we continue this way that means heartslabyul in january and return to diasomnia in march#which would be timed PERFECTLY for the fifth anniversary#it absolutely could just be a coincidence but. idk. i could see it being a fun place to end 7 on.#(i still think we're getting an episode 8 with grim. just. y'know. the TIMING)#but if that turns out to be true then there might not be time for a silver story card AND dorm reruns...#i mean i'm 100% talking out my butt here so i could be entirely wrong about all of it#(stay tuned for six months straight of training camp events and master chef reruns instead)#i just really want a silver story card okay#we've gotten so much silver angst and yet i demand MORE#unsuspecting anon: hey ego do you remember if there were tokens for the --#me: UUUURGH DELICIOUS SILVER TEARS#(sorry anon) (good luck with whoever you choose to pull for though! your taste in cards is excellent and i understand the dilemma 😭)

117 notes

·

View notes

Text

it is the man!!

#my art#purpled#purpled fanart#purpled mcyt#digital art#fanart#purpled my most consistent obsession#i return to you as usual

240 notes

·

View notes

Text

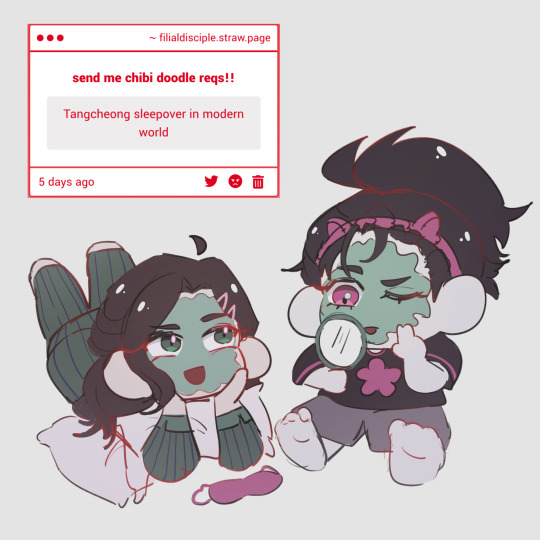

some silly rotbb chibis for twt/x strawpage prompts + hye yeon mini-comic (?) from the orv gun era lmao 🫶

#hye yeon bullet head is still my fave#rotbb#rotmhs#return of the blossoming blade#return of the mount hua sect#cheong myeong#baek cheon#tang bo#hye yeon#tangcheong#tin draws#reposting here for personal archiving purposes#art style consistency whomst

63 notes

·

View notes

Text

Zenos face studies ✨️

#final fantasy xiv#ffxiv#zenos#zenos yae galvus#choose your favourite zenos#mine is subtle smile zenos#what is my art style even lately i have no idea if you find it please return it help#99% experimentation 1% consistency#my art

74 notes

·

View notes

Text

The commentators calling Max the perpetrator & Oscar the victim but calling Franco the victim and simply saying that Oscar was punished... At least be consistent

#f1#formula 1#formula one#max verstappen#oscar piastri#abu dhabi gp 2024#franco colapinto#two of my drivers committing crimes on each other & another of my (innocent in this incident) drivers#normal f1 has returned!#but jesus can the commentators be more fricking consistent

56 notes

·

View notes

Text

For anyone wondering about my confidence levels in my ships I've found that the formula is very simple: more one on one time than they have with other characters between two similarly aged characters = romance.

There are a few other factors here and there like that screentime containing an arc not just being stagnant like the Shawn and Gus platonic example I've used before and compatible sexualities (alleged straightness is not incompatibility - I'm talking more like Stobin), but with just those two conditions in mind...I have yet to be wrong.

Go forth with security in your ships.

Byler screen time break down

#byler#buddie#911 abc#chenford#sydcarmy#stedebeard#janine x gregory#also it should be noted that multiple instances of queerbaiting actually lack some of these factors in consistency so it can#help spot them#also with cinematography and stuff i identify that more complicatedly by identifying what opinions of mine were my own and what were directe#d. the directed ones are to mold my opinion into liking the ending so if they puppeteered me in one direction that direction is the ending#some queerbaiting is sabotage of the entire story though tbf but most of it has some gaps or inconsistencies where they return to the story#as originally planned or the pacing is off etc.

29 notes

·

View notes

Text

every time i think im reaching the end of the emotional climax of Sea Of Stars somehow there is. More Plot. More Stakes. More more. So out of fear of spoilers i cannot yet look up gifs of this scene. but. to just. commemorate

garl..... my guy my buddy my pal.....

big bread for dragon and the power of friendship.... whatta game

#i need to play this game more consistently bc otherwise i keeo returning once every month and being awful at combat and vaguely confused#or emotionally impacted by plot and then i play wheels for forty minutes#i also need to finish this game so i can just listen to the soundtrack without. again. fear of spoilers#sea of stars#sea of stars spoilers#sysgaming#it IS a. deeply deeply charming game.

22 notes

·

View notes