#yusho productions

Text

Weiss: You, with the ponytail bigger than mine!

Ilia: Huh?!

Weiss: Beacon Academy is a prestigious huntress education facility. You should know better than to show up, covered in zits and whatnot!

Ilia: Th-These are freckles...

Weiss: NO EXCUSES!

105 notes

·

View notes

Text

Xyz arc Duels:

Sawatari/Gongenzaka/Yuya vs. Academia Students

Kaito vs. Academia Students (Galaxy-Eyes Cipher Dragon debut, offscreen)

Sawatari/Gongenzaka vs. Kaito (Superheavy Samurai Ninja Sarutobi, and Abyss Actor - Wild Hope debuts)

Kaito vs. Yuya (N/A)

(Asuka vs. Juvenile Officers (Cyber Angel Vrash debut))

Edo vs. Yuya (Yuto intervenes) (Destiny HERO - Dystopia, and Dark Requiem Xyz Dragon debuts)

Kaito vs. Shun (N/A)

(Yuri vs. You Show Duel School - Fusion Dimension Branch Students (N/A))

Sayaka/Allen vs. Tyler Sisters (Amazoness Empress, Amazoness Pet Liger, and Heavy Armored Train Ironwolf debuts)

Sawatari/Gongenzaka vs. Tyler Sisters (offscreen)

Shun & Yuya (w/Yuto) vs. Tyler Sisters (N/A)

Shun & Yuya vs. Obelisk Force (Kaito takes over for Shun & Yuya)

Edo vs. Yuya (Brave-Eyes Pendulum Dragon, and Performapal Laugh Maker debuts)

(Dennis vs. Yusho (N/A))

****

We already discussed this arc's structure, so there isn't much to go over.

If we get some of the unprinted cards soon, or get new Kotori support, then there might be something to discuss new.

However, since about a third of this arc is spent with Yuzu in Fusion, this arc isn't really a some sort of isolate arc, written independently of rest of S3, it is really just the Fusion prologue, metanarratively, and in terms of actual episode production.

The abundance of Tag Duels, and 2-to-1 Duels is a reference to various 2-to-1, and Tag Duels in ZEXAL, particularly for the final Duels starting from Fake Barian Emperor arc. There are a few ZEXAL references in this arc, such as the Edo vs. Yuya's Wire Chain Field Spell being a reference to binding Kaito used against Yuma in their first Duel (which itself was referenced in Sawatari/Gongenzaka vs. Kaito previously), and many Duels involve victory at 100 LP, again like ZEXAL Duels. Going over all the references in this short arc would take too much time, and we already went over some of the more obscure stuff.

Emphasis on Edo-Sawatari, Yuri, and Shun-Yuto has more to do with Booster SP: Destiny Soldiers, Invasion of Venom (Invasion: Vengeance in TCG), and Booster SP: Wing Raiders, which were sets focused on them. Yuri will of course be more prominent in Fusion arc proper, tying in with Booster SP: Fusion Enforcers.

The only major new characters introduced in this arc, Tyler Sisters, got their support in OCG-only Duelists of Pyroxene, but since they never appeared in recent video games, they would need completely new sprites for Duel Links, but they will likely appear sooner than many other characters.

0 notes

Note

why is your display name Leo akabas menstrual cup? Curious

tldr some weird transphobic person was having a go at me for headcanoning yugioh dads as trans. I countered by asking what menstrual products Leo and yusho would use. Hence, Leo Akaba menstrual cup

0 notes

Text

'Tangent shelf' by Yusho Nishioka Studio.

#tangent shelf#yusho nishioka studio#canadian design#design#designer#greatdesigner#goodesign#good shape#design furniture#furniture#shelve#product design#minimal design#designisgoodforyou#welovedesign#freshdesignflow

97 notes

·

View notes

Photo

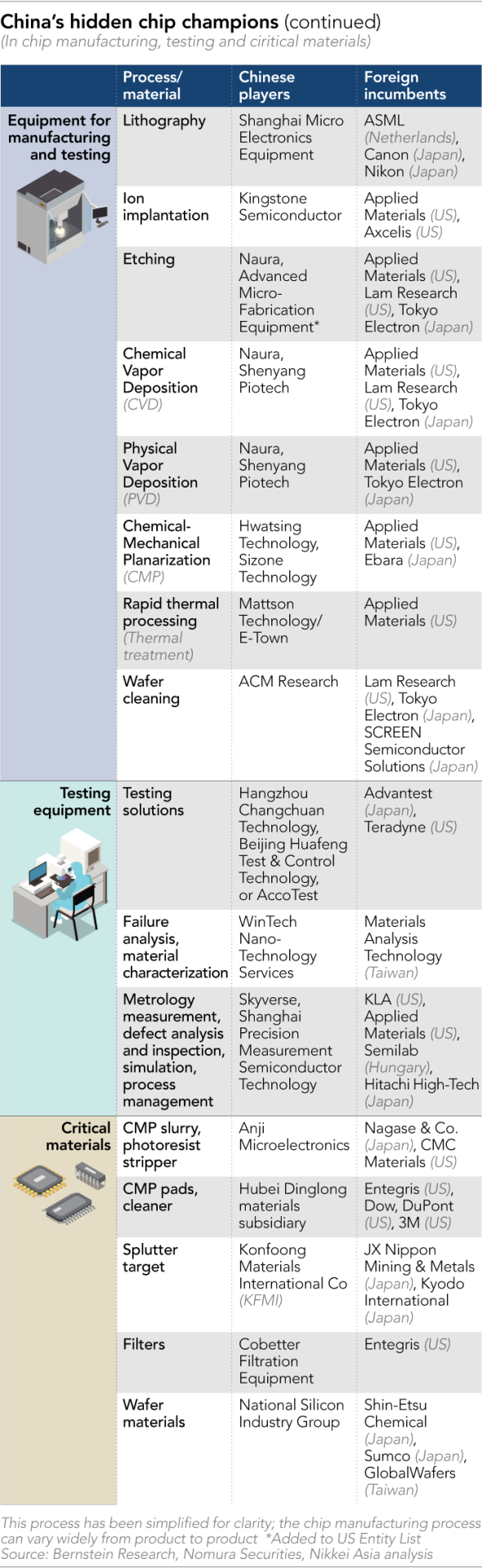

US-China tech war: Beijing’s secret chipmaking champions

Once a month, senior executives of Yangtze Memory Technologies Co fly to Beijing for a flurry of meetings with China’s top economic management bodies. They focus on the company’s efforts to build some of the world’s most advanced computer memory chips — and its progress on weaning itself off American technology.

Based in the central riverside city of Wuhan, Yangtze Memory is considered at the vanguard of the country’s efforts to create a domestic semiconductor industry, already mass-producing state of the art 64-layer and 128-layer Nand flash memory chips, used in most electronics from smartphones to servers to connected cars.

These marvels of nanoengineering stack tiny memory cells in ever-greater densities, rivalling industry leaders such as US-based Micron Technology and South Korea’s Samsung Electronics.

That would be hard enough for a company that only opened its doors in 2016. But added to the challenge is the ambitious, state-directed aim of weeding out the group’s American suppliers, along with those reliant on US technology. The equipment used to manufacture high-end computer chips is virtually an American global monopoly. Eighty per cent of the market in some chipmaking and design processes such as etching, ion implantation, electrochemical deposition, wafer inspection and design software is in the hands of US companies.

This article is from Nikkei Asia, a global publication with a uniquely Asian perspective on politics, the economy, business and international affairs. Our own correspondents and outside commentators from around the world share their views on Asia, while our Asia300 section provides in-depth coverage of 300 of the biggest and fastest-growing listed companies from 11 economies outside Japan.

Subscribe | Group subscriptions

It is a frustrating area of dependence for China, which imported $350bn worth of semiconductors last year, according to the China Semiconductor Industry Association. Removing this source of US leverage over its economy became a national priority two years ago, when Washington put sanctions on China’s biggest telecoms equipment maker, Huawei Technologies, amid spying allegations that the Chinese company has constantly denied.

This was followed by sanctions on several other big Chinese technology companies, from its top contract chipmaker, Semiconductor Manufacturing International Co, to Hikvision, the world’s biggest surveillance camera maker. More than 100 companies in total have been placed on a trade blacklist prohibiting most US technology to be sold to them without a licence. That has spurred an aggressive effort by Beijing to identify and replace risky parts and suppliers.

The result has been an unprecedented flourishing of chip-related companies within China. Dozens of Chinese groups, with specialisations mirroring US incumbents in key areas from ion implantation to etching, have sprung into prominence over the past few years, accelerating as the state realises the enormity of the self-sufficiency project.

“The clock is ticking because they still know that the US could hit the local industry hard,” said Roger Sheng, a chip analyst at consultancy Gartner. “New chip competition is evolving as all the major economies, not just China, now recognise the importance of semiconductors.”

Plan B

So far, Yangtze Memory, also known as YMTC, has remained under the radar of the US government. But the company is taking no chances. With the guidance of Beijing, it has launched a massive review of its supply chain in an effort to find local suppliers — or, at least, non-US ones — to replace the dependence on American technology.

The collective effort has occupied more than 800 people, full time, and including staff from its multiple local suppliers, for two years. And they have not finished yet.

YMTC is seeking to learn as much as it can about the origin of everything that goes into its products, from production equipment and chemicals to the tiny lenses, screws, nuts and bearings in chipmaking machinery and production lines, multiple sources familiar with the matter said. The audit extends not only to YMTC’s own production lines, but also to suppliers, suppliers’ suppliers, and so on.

“The review is as meticulous as knowing where the screws and nuts are coming from, the lead time, and if those parts have alternatives,” one person familiar with the matter told Nikkei Asia.

Yangtze Memory’s plant in Wuhan © Yusho Cho

Each supplier is assigned a score for geopolitical risk, identified in many pages of documents detailing the components they use in their machines. YMTC has sent engineers to audit local equipment suppliers’ production sites to verify that the origins of parts have been truthfully reported, one of the people told Nikkei.

American-made parts are scored highest for risk, followed by parts bought from Japan, Europe and those made locally, the person said. Meanwhile, suppliers are asked to provide corrective action reports to explain how they can together diversify procurement and find alternatives.

“Previously, when China talked about self-sufficiency, they were thinking about starting to cultivate some viable chip developers that could compete with foreign chipmakers,” a chip industry executive told Nikkei. “However, they did not expect that they would need to do all that, starting from fundamentals.

“It’s like when you want to drink milk — but you not only need to own a whole farm, and learn how to breed dairy cows, and you have to build barns, fences, as well as grow hay, all by yourselves.”

It’s like when you want to drink milk — but you not only need to own a whole farm . . . breed dairy cows . . . build barns, fences . . . all by yourselves

The purge of YMTC’s supply chain has been handled with the spirit of a national emergency. Based in the city of Wuhan, the effort did not pause even when the virus centre was ravaged by Covid-19 last spring.

While the rest of the city endured a brutal quarantine, high-speed trains remained in service to ferry YMTC employees to its $24bn 3D Nand flash memory plant that began producing chips in 2019. All the while, delivery trucks for critical chipmaking materials drove to and from the production campus.

After Wuhan reopened last April, YMTC mobilised hundreds of engineers, including many from little-known emerging local semiconductor equipment suppliers. They were stationed inside the production campus, labouring for three shifts a day with the aim of overhauling all of its production processes and replacing as many foreign tools as possible, sources said.

“Senior management is raising targets of using locally built chip production machines almost every month, and they hope we could at least know what kind of alternatives we have and have a Plan B of the production line that will be free from US control,” one of the people told Nikkei.

YMTC declined multiple requests by Nikkei to interview the company about its supply chain reviews, progress and capacity expansion plans, as well as its localisation efforts.

‘Secure and controllable’

This effort to localise production has been the opportunity of a lifetime for a new generation of Chinese chip champions such as YMTC and their suppliers, whose fortunes have risen sharply following the start of the US-China trade war.

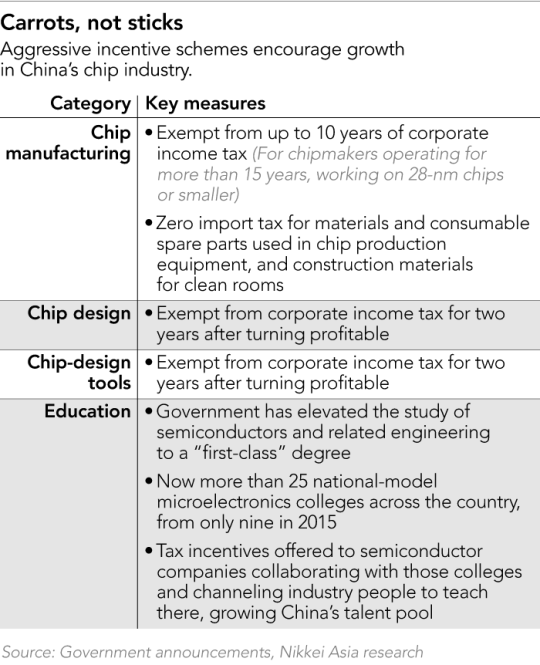

While the threat of sanctions hangs over them, so too does the largesse of state aid — subsidies and investment from local governments and the private sector have amounted to at least $170bn since 2014, according to the state-backed China Securities Journal. There are also guaranteed orders with other Chinese chipmakers and domestic tech giants such as Xiaomi, Oppo, Vivo and Lenovo.

“It’s not like it has been written down on a public posting or an official announcement,” another Chinese chip executive told Nikkei, “but everyone in the industry now has a mutual understanding that if anyone is building a new chip plant or expanding a semiconductor manufacturing line, at least 30 per cent of production tools must be from local vendors.”

Every US market leader in the computer chip industry now has a Chinese doppelgänger that is being positioned to take its place as a vendor to the Chinese chip industry. YMTC, for example, is strikingly similar in its approach and strategy to Boise, Idaho-based Micron, while Beijing-based Naura Technology Group represents China’s hope to later challenge Applied Materials, which is based in Santa Clara, California, and makes a wide range of chip production equipment.

Shanghai’s Advanced Micro-Fabrication Equipment (AMEC) is China’s version of Lam Research of the US, renowned for building essential etching machines. Tianjin-based Hwatsing Technology produces cutting-edge chemical-mechanical planarisation equipment and is set to break Applied Materials’ monopoly on the technology.

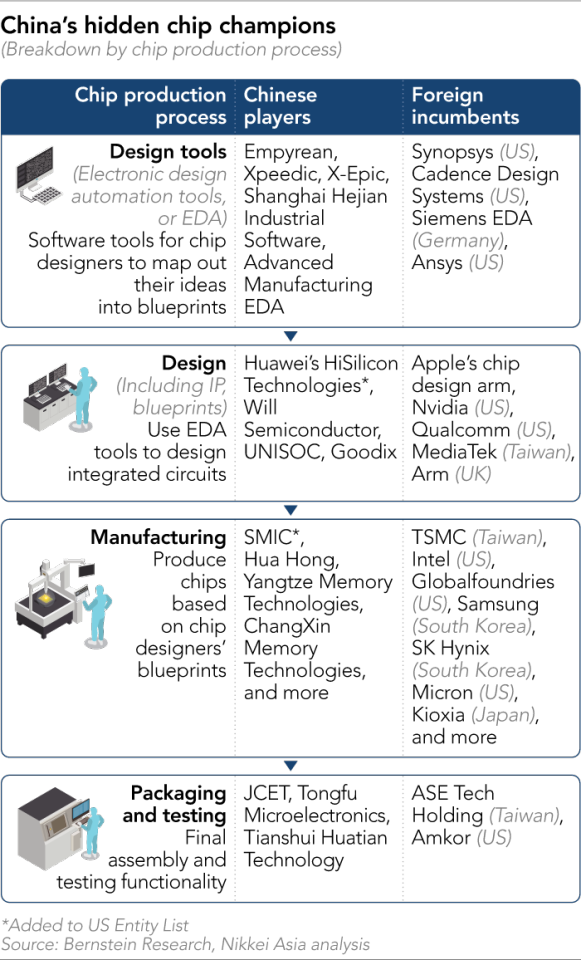

See the full graphic at the end of this article for more of China’s upcoming chipmakers.

These and dozens of other state and private companies have become the focus of an industrial policy known by the slogan “secure and controllable”, which has found its way on to posters and into speeches, backed up by immense state investment and guaranteed contracts.

“We have to strengthen self-innovation and to make breakthroughs in some core technologies as soon as possible,” China’s President Xi Jinping told a group of economic and social experts in remarks published in January.

YMTC, for one, is followed closely by China’s leadership, supervised by officials in the State Council — the country’s top administrative authority — as well as the China Integrated Circuit Industry Investment Fund, the nation’s premium seed fund for the semiconductor industry, which also owns a 24 per cent stake, two people with direct knowledge told Nikkei.

“We are not sure how fast and how well they could build their own independent semiconductor industry, but certainly they will try,” said Chad Bown, a senior fellow with Peterson Institute for International Economics.

‘The whole country is rooting for this.’

In fact, the US trade war and Huawei sanctions have arguably given China’s government the necessary cover for something it has long desired. Since the revelations by Edward Snowden in 2013 that detailed the participation of American tech companies in US government surveillance, Beijing has seen dependence on American technology as a national security threat.

But grand plans to end this dependency have been made in the past, and, despite massive injections of state investment, progress has been slow. For example, when China’s State Council set out its “Made in China 2025” industrial policy in 2015, aimed at promoting China’s high-tech exports, it set a goal of 70 per cent self-sufficiency in semiconductors by 2025.

But the industry has so far fallen short of this goal, according to US-based research firm IC Insights. In 2020, China-based chip production accounted for only 15.9 per cent of the domestic market, the firm estimated in January, predicting it would reach just 19.4 per cent in 2025. Of the 2020 total, China-based companies accounted for only 5.9 per cent of domestic sales, while foreign companies with their headquarters in China accounted for the rest of the China-based sales.

Under threat: cameras near the headquarters of Chinese video surveillance firm Hikvision in Hangzhou © Bloomberg

However, the US sanctions may have removed the main domestic obstacle to the goal of China’s chip self-sufficiency effort, which is the lack of co-operation by China’s own local buyers. They have always preferred buying from tried-and-tested foreign vendors rather than inexperienced local companies. But that, crucially, has now changed.

“Previously, domestic chip manufacturers only used leading production equipment that all the other top global chipmakers like Samsung and Intel also use in their production lines,” another manager with a China-based chipmaker told Nikkei, preferring not to be named. “Who would bother to use and try these local-made machines that could possibly affect production quality?”

As the threat of sanctions hits close to home, however, these same producers are increasingly exploring domestic-made alternatives to the top-end US-made technology, the manager said. “That also means these local players finally have a chance to practice and really upgrade their products in an atmosphere that the whole country is rooting for this,” he said.

Sheng of Gartner told Nikkei that US-China tensions have consolidated industry opinion around the necessity to localise production. “It’s the whole country’s consensus now that building a viable semiconductor industry and boosting self-reliance is the top priority . . . The top policymakers know, company executives know and even local people know,” said Sheng.

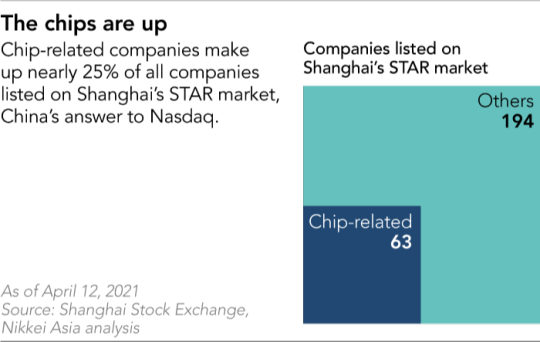

Chip related companies make up nearly 25% of all groups listed on Shanghai’s STAR market

For Chinese chipmaking tool and material makers — mostly little known, with limited presence in the industry — the trade disputes serve as the once-in-a-lifetime opportunity to expand business, a chip executive with Kingstone Semiconductor Joint Stock Co, a local ion implanter maker, told Nikkei.

“Not only is our production capacity fully booked for 2021 and needs to expand . . . but also many of our peers’ capacities are fully reserved,” the executive said.

Other domestic champions have done similarly well. Naura Technology Group, China’s largest chip equipment maker, generated a record profit in 2020, up more than 73 per cent from a year earlier. Meanwhile, despite being added to the US trade blacklist in late 2020, the earnings for AMEC, the etching machines maker, hit a record high last year.

Previously a third choice at best, Hwatsing Technology’s chemical-mechanical planarisation equipment has already been widely adopted by Chinese chipmakers such as SMIC, Hua Hong Semiconductor Group and YMTC, according to the prospectus it released late last year as it filed an application to list on Shanghai Star stock market, China’s version of the Nasdaq.

Shanghai Micro Electronics Equipment, under majority control by the Shanghai government, has been cemented as a key local participant that China’s government hopes to one day compete against global chip lithography machine builders of ASML, Nikon and Canon, several people with knowledge told Nikkei.

Employees of ASML working on the final assembly of semiconductor lithography tools in Veldhoven, Netherlands © Bloomberg

For now, China’s global market share in the advanced chip fabrication equipment sector is 2 per cent at most. Bernstein Research estimated, while its self-sufficiency rate is about 10 per cent — a very low figure, but one that suggests massive room for future growth.

Crashing the market?

This new push by China has already begun to make waves in the global semiconductor industry, threatening to disrupt the delicate equilibrium between supply and demand. A global chip shortage has swept many industries partly due to “panic buying” by Chinese companies, spooked by the risk of US sanctions, said Eric Xu, the current rotating chair of Huawei, in remarks last month.

One example is that YMTC and other domestic chip companies, such as China’s top contract chipmaker, Semiconductor Manufacturing International Co, have begun to stockpile “at-risk” parts in a jointly owned warehouse that just went into operation this year, sources told Nikkei Asia.

At the same time as they are braced for shortages, however, the global chip industry is simultaneously making preparations for a massive glut of chips as Chinese companies such as YMTC hit their stride.

The Wuhan-based national champion, for example, plans to double its monthly output of memory chips to 100,000 wafers by the second half of 2021, giving it 7 per cent of the global Nand flash memory market measured in wafers, two people with knowledge of the matter told Nikkei.

Measured in gigabit equivalent terms, Taipei-based consultancy Trendforce predicted YMTC would take 3.8 per cent of the global market share in Nand flash memory for 2021 and likely expand its share to 6.7 per cent in 2022 — a precipitous climb, considering it was close to zero two years ago. Samsung, the leader, has a 34 per cent share.

“We expect YMTC will start to affect the overall Nand flash market price by next year and the market may also face some oversupply issues,” said Avril Wu, an analyst with Trendforce.

Yangtze’s chief executive Simon Yang has tried to allay fears of a massive glut of chips. “We want to tell everyone that we are not here to crash the market, and we hope that the industry could be sustainable and healthy,” he told a business forum in 2018, when the company started producing 64-layer Nand flash memory chips.

Despite shortages, the global chip industry is preparing for a massive glut as companies like Yangtze Memory hit their stride

Anticipating just such an oversupply, however, Intel — the world’s biggest microprocessor maker and sixth-largest Nand flash maker — sold its Dalian-based Nand flash memory plant to SK Hynix last year, bowing out in the face of future competition.

The vertiginous rise of YMTC has shown just what China is capable of in the chip industry. It started operations in 2016 and within four years was mass producing some of the most advanced 3D Nand flash memory chips in the world. Memory chips used to be flat wafers with one layer of memory cells, but recently “3D stacking” chips have become the cutting-edge standard for almost all electronics from computers and smartphones to servers and connected cars, with memory cells layered on top of each other in ever-higher stacks.

In 2017, chipmaker Western Digital introduced the “skyscraper,” a 64-layer chip, while Micron last year announced the 176-layer chip, the proportions of which it compared to the Burj Khalifa in Dubai.

YMTC has been mass-producing 64-layer chips for two years and has just started mass-producing 128-layer chips at its Nand flash memory factory in Wuhan. It is said to be in the process of developing a 192-layer chip that one industry analyst referred to as the “Himalaya”. The company declined to comment.

‘Neck-choking’ technology

In reality, though, the massive growth scenarios for YMTC and the rest of China’s semiconductor industry remain predicated on continued access to western chips and other key equipment. For all the patriotism and rhetoric surrounding self-sufficiency, few believe 100 per cent “de-Americanisation” is a genuinely realistic goal in the near future.

“If Yangtze Memory could continue to buy from US suppliers, they will definitely do that,” Mark Li, a veteran chip analyst with Bernstein Research, told Nikkei. “We all know that it’s an irreversible trend that China is keen to have their own version of everything,” Li said. “However, in reality, it will take a lot of time and great execution and we don’t expect to see them cut significantly from the amount of chipmaking equipment procurement from the US very soon.”

YMTC’s own supply chain audit, for example, found that many vital processes were not immediately replaceable with domestic vendors: high-end lenses, precision bearings, quality vacuum chambers, and motors, radio frequency components and programmable chips all still come from foreign manufacturers in the US, Japan and Europe, people briefed on the matter told Nikkei.

Meanwhile, the entire industry is still reliant on foreign equipment for lithography, ion implantation, etching, and chemical and physical vapour deposition and chemical-mechanical planarisation — all indispensable in manufacturing chips, experts say.

The Chinese government refers to such technologies as “neck-choking,” referring to potential points of US pressure. To build advanced semiconductors, there is presently no way around the leading American participants. Applied Materials, for example, leads the world in chip production technology such as ion implantation, physical and chemical vapour deposition, and chemical-mechanical polishing; Lam Research makes etching, chemical vapour deposition and wafer-cleaning equipment.

California-based KLA and Boston-based Teradyne specialise in providing testing and measuring equipment for defect analysis and failure inspection. Aside from tools, materials suppliers Dow, DuPont and 3M and other US companies also dominate the supplies of special chemical formulas used in advanced chip production.

They collectively control the global market share of more than 80 per cent in equipment and materials for some vital steps in building advanced semiconductors, said Li of Bernstein. In some specialised segments such as electrochemical deposition and gate stack tools, the US share could be almost 100 per cent.

Another key vulnerability in China’s ecosystem was exposed when Huawei’s chip-designing arm HiSilicon — China’s number one chip developer — lost access to technical support and software updates for electronic design automation tools owing to sanctions. That restricted the software used by HiSilicon to lay out blueprints for integrated circuits as well as printed circuit boards and other electronic systems. These tools are 90 per cent-dominated by US companies such as Synopsys, Cadence Design Systems, Ansys and Siemens EDA (which, before its acquisition, was known as Mentor Graphics and is still located in America).

On China’s part, it has been gearing up to cultivate its own participants by luring many talented former employees of Synopsys and Cadence. But Chinese efforts remain far short of the required standard.

“We have gained some business because of China’s de-Americanisation campaign,” a manager of Empyrean Technology, China’s biggest local chip design toolmaker, told Nikkei. “However, asking us to fully replace Synopsys and Cadence is like coming to carmakers and asking to build rockets.”

In some crucial areas, such as the field-programmable gate array — a type of programmable semiconductor component essential for satellites and advanced jet fighters — the market leaders are Xilinx or Intel’s Altera, while for China, this space is largely still blank. In central processing units, the US maintains a tight grip, with leaders including Intel and Advanced Micro Devices that dominate more than 90 per cent of the global market.

This virtual monopoly on chip design and chipmaking equipment sectors has given the US vast powers to control the flow of technology to China, even from non-US companies. Industry leaders such as Samsung Electronics, Taiwan Semiconductor Manufacturing Co, Infineon Technologies, SK Hynix and Sony, all still use massive amounts of American technologies on their production lines and in their development processes, giving Washington a veto over their product sales.

“Once the US names anyone on a trade blacklist, most of the Asian suppliers will see it as a serious warning, and even if legally they could continue to ship to the blacklisted entities, they will self-censor to stop shipping due to political pressure, or consider stopping,” a chip industry legal director told Nikkei. “No one wants to openly and publicly violate Washington’s will . . . That could be dangerous, and your own company could become a target too.”

Europe’s biggest chipmaking tool maker, ASML of the Netherlands, is the exclusive supplier of extreme ultraviolet (EUV) lithography machines — the world’s most costly but top-notch tool essential to producing the world’s most advanced chips, including Apple’s latest iPhone core processors.

ASML has a production plant in the US, and about one-fifth of the components that ASML needs to build its machines are also made at its US plant in Connecticut, Nikkei has learned. The Netherlands has halted shipments of China’s first orders of the EUV machine amid US pressure since 2019, Nikkei Asia first reported in November of that year.

For Chinese companies, therefore, localisation efforts must be carried out quietly. By far the most preferred course of action is not to fall into Washington’s crosshairs.

“We have to recognise and realise that we are still far lagging behind instead of thinking that we could quickly rock the world . . . The best way, under the geopolitical climate, is to keep our head low and do our work and grow silently,” said a chip executive with ChangXin Memory Technologies, another of China’s key memory chipmakers, based in Hefei, Anhui Province.

Localisation efforts must be carried out quietly. By far the most preferred course of action is not to fall into Washington’s crosshairs

While it pursues its Plan B of self-sufficiency, YMTC still sees it as extremely unrealistic to strip all foreign equipment from its production site. It still hopes to maintain good relationships with American, Japanese and European suppliers, according to people familiar with the company’s thinking. In parallel to its localisation efforts, YMTC keeps building production lines that use American equipment and parts to facilitate its expansion.

“It’s really an irreversible trend that China wants to switch to local suppliers,” said Li of Bernstein, “but in reality and in real practices, there are still hurdles and [it] could still take a lot of time. If they want to grow faster and quickly gain more business, it’s more practical that they still use the tools and equipment that all of the foreign market leaders also use.”

In an effort to fend off future sanctions, meanwhile, the Chinese company has also boosted its legal compliance team since 2019, citing the “highly challenging, complex and changing environment in the chip industry” — a step aimed at giving the US no excuses to make it a target.

Martijn Rasser, a senior fellow of the technology and national security programme at the Center for a New American Security, told Nikkei: “China’s goal of total self-sufficiency in semiconductors is unrealistic. It is unaffordable to create a China-only supply chain, and there will almost certainly be some reliance on foreign technology and expertise. What it can do is build a globally competitive industry, and that is something that US policymakers are eyeing closely.”

Decoupling do’s and don’ts

Despite China’s considerable efforts, few experts believe that its chip sector will ever be genuinely free of US parts. However, most also believe that the doomsday scenario — a complete blockade of China’s tech and semiconductor industries — is not realistic, either.

The world’s two largest economies are still interconnected, and they are also the two biggest semiconductor markets: China accounts for at least 25 per cent of the sales of most US chip companies, according to a January report by the Brookings Institution, and few want to see that market disappear.

Bown of the Peterson Institute, said the Biden administration’s approach on China is not yet clear. On the one hand, the US expects China to buy more chips as promised in recent trade talks but has also continued restricting its use of American technologies.

“It’s likely that we are looking at more precisely confined export controls at some areas such as military uses and areas that are really linked to national security,” Bown said. “After all, it’s a trade-off. China is a massive consumer market, and if you restrict a lot of semiconductor shipment, many US companies will be hurt too.”

‘Neck choking’ technology: US president Joe Biden holds a chip before signing an executive order aimed at addressing a global semiconductor shortage in February © AFP via Getty Images

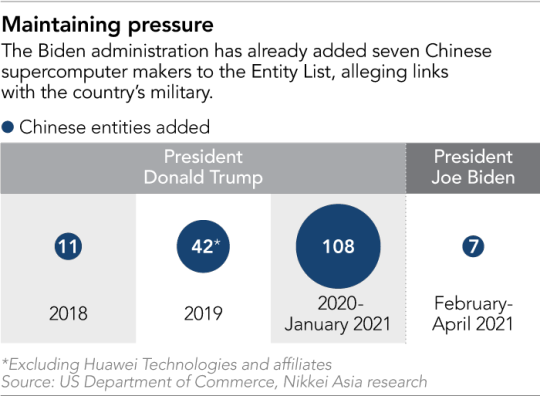

So far, the Biden administration has not yet softened on China’s technological advancement. A total of 162 Chinese entities had been sanctioned by the Trump administration since 2018, while in April, the US Department of Commerce added a further seven Chinese supercomputer makers to the so-called Entity List to restrict their use of American technologies, citing alleged links with the Chinese military.

On April 12, the White House hosted a virtual CEO summit on semiconductor and supply chain resilience, which included the world’s top three chip producers — Intel, Samsung and TSMC — as well as executives from carmakers, including Ford Motor and General Motors, to discuss how to maintain US leadership in the global semiconductor industry.

The Chinese Communist party “aggressively plans to reorient and dominate the semiconductor supply chain,” President Joe Biden said in opening remarks to the summit, quoting a bipartisan letter from 23 senators. “China and the rest of the world is not waiting, and there’s no reason why Americans should wait,” he said.

The administration has also proposed a $50bn funding programme for chip manufacturing, and research and development, mirroring China’s efforts.

The Committee on Foreign Investment in the United States, or Cfius, last year tightened the rules for examining the national security risks posed by foreign deals, followed by the Taiwanese government’s Investment Commission announcing a new set of rules to intensify screening of Chinese investments in Taiwanese tech companies. Meanwhile, the Italian government rejected a takeover bid for a Milan-based semiconductor equipment provider by a Shenzhen-based Chinese investment company.

South Korea and Taiwan — two leading Asian chipmaking economies — all face growing pressure to help the US boost local chip manufacturing. TSMC, the world’s largest contract chipmaker, based in Taiwan, and South Korea’s Samsung, the world’s biggest memory chipmaker, were both forced to cut off supplies to once-big customer Huawei after the US sanctions.

TSMC’s share of revenue from China plunged to 6 per cent in the January-March period from 22 per cent the same time a year earlier. Samsung also saw its revenue from China trending down in the past three quarters.

Most of the global chip developers and manufacturers will still have to side with the US, as American technologies still prevail in their products or services, said Su Tzu-yun, senior analyst at the Institute for National Defense and Security Research. “They have to choose what are their best interests if they get caught between the world’s two biggest economies.”

However, it is still hard to fully decouple the semiconductor supply, involving thousands of suppliers from around the world that have been tightly intertwined for decades. China can try to reduce its reliance on the US, but without American technology sources, it can hardly speed up its technological advancement.

Neither is it practical for the US to exclude China from all of its supply chains, as the country is still a big source of critical raw materials and rare-earth elements used in semiconductors and electronic components, according to a recent report by the Semiconductor Industry Association, an American industry organisation.

“In the short term, due to geopolitical uncertainties, China’s tech development could be slowed a bit,” said Miin Wu, founder and chair of Macronix International, a leading memory chipmaker in Taiwan that serves Apple, Sony and Nintendo. “However, in the longer run, from China’s perspective, it will definitely hope to build a competitive industry. It’s a trend that is hard to resist, and there is no turning back.”

A version of this article was first published by Nikkei Asia on May 5 2021. ©2021 Nikkei Inc. All rights reserved

Related stories

0 notes

Text

Arc V Discussion Prompt Day 15: Headcanons

I haven’t been participating, but I have been reading and checking out other people’s posts. I have random HCs, so...why not!??!?! I’m sure there’s more...I just can’t think of everything right now. I had more for Ruri/Yuto than I thought...and not nearly enough for Yuzu/Yuya O.o But it’s still a hell of a lot....

Sorry...

Ruri/Yuto:

1) She loves animals, especially birds. She has some birds as pets, and she will donate money to many animal rescue organizations.

2) She likes to make her own clothes when she can. If she doesn't make them, she will rummage through thrift stores to find cute, stylish pieces.

3) She takes such good care of her hair. It's so soft and so thick and healthy. The bathroom at her home is covered in 99% of her hair care products.

4) She's very gentle and kind, but she can bite your head off if provoked. Shun smothers her due to being the overprotective big brother, and while their friends have heard her get a little testy in public, only Shun and Yuto have seen her actually blow up before. She has not blown up at Yuto (yet), but he's seen her get truly angry at Shun and it was still enough to make him cower in fear. He doesn't like to talk about it...

5) She's mostly a vegetarian. She seldomly eats meat.

6) Yuto still remains on edge even after the war is over. A small sound can cause him to tense and spring into survival mode.

7) He's very polite.

8) Ruri initiated the relationship officially, and Yuto usually lets her make the first move.

9) He gets nervous while he's with Ruri if Shun is nearby.

10) Where Yuya is fairly spontaneous and outgoing, Yuto is fairly reserved and introverted.

Yugo/Rin:

1) He's afraid of thunder. If it even rains, he'll probably run to Rin's room just in case it turns into a thunderstorm.

2) Rin always likes to have a plan. If things don't go according to plan, she feels very unstable and uncomfortable.

3) Yugo likes to rest his head on Rin's stomach and let her play with his hair. They both find it soothing.

4) Rin's plans for the future are to be the queen of riding duels in the Synchro Dimension, marry Yugo, and have "lots of little babies", but her plans derail when she gets pregnant so young...

5) Yugo, for whatever reason, seems to get the worst of the trauma from the war. He gets PTSD, nightmares, and night terrors almost every single day/night.

6) Yugo always gets Rin a gift for their birthday or Christmas, even when Rin says they don’t have the money to spend on each other that year. And even though it happens almost every year, Rin is still angrily surprised, yet flattered, that Yugo gets her a gift anyway.

7) Yugo always wants to be touching Rin in some way. Whether it be holding hands, or leaning against her, or hugging her, or snuggling her, leaning his head against hers, what have you.

Serena/Yuri:

1) She has nightmares about being put into the arc v reactor. They happen frequently. She'll wake up screaming and have to run outside in order to see the moon, which is the only thing that can calm her down.

2) Serena is slow to warm up to Yuri, but an eventually, if not reluctantly, enjoys his company. Oddly enough, she has no nightmares if he's sleeping beside her.

3) Yuri is actually fairly prim and proper. He'll keep to himself a lot, and loves to read. He likes dropping "fancy" words while arguing with Serena, mostly because he gets the greatest satisfaction out of her confused looks because she doesn't know what the word means.

4) Serena swears like a sailor.

5) Yuri loves arguing with Serena. He thinks making her mad is the greatest game in the world.

6) Yuri can't swim.

7) Yuri gardens. The Professor even granted him his own little greenhouse at Duel Academy where Yuri could tend to his plants. It kept him out of trouble while he was younger. It relaxes him.

8) Serena and Yuri knew each other when they were younger. They were very close until the Professor interfered. The two were inseparable, but the Professor only saw his daughter and the monster that took her away. So in order to keep the two apart, he erased their memories of one another and kept them far away from each other, thus turning them into who they became.

9) Yuri is toned down a lot now that Serena is by his side, but Serena's counterparts (mainly Rin and Ruri) still distrust him. Yuzu is willing to give him a second chance only because Serena is with him and she trusts her judgement.

10) Yuri and Serena are not outright affectionate with each other, but if they’re watching a movie, Serena will rest her head on Yuri’s shoulder or chest.

11) Serena constantly complains about Yuri and how much she hates him and how annoying he is, and when her sisters ask why she’s still with him, Serena looks at them with genuine confusion and says, “Because I love him...”

Yuzu/Yuya:

1) Yuzu loves to sing.

2) Yuya also loves to sing, but he'd rather listen to Yuzu.

3)En is Yuya's favorite pet (but he would never admit that just in case any of his other pets are listening).

4)Yuzu's dad becomes a little overprotective of her when she initially returns after the war.

5) Once Yuzu becomes a pro, she and Yuya start performing a lot of tag duels together. They always ham it up together.

6) The two of them love snuggling.

7) They are known to randomly break out in dance and have dance offs with each other (and anyone else who would want to join them).

Yoko/Yusho:

1) They adopt the other boys.

2) They are embarrassingly lovey dovey with each other. They don't even do it on purpose. It's just how they are.

3) They treat all of Yuya's/Yuzu's/their counterparts' friends like family. Sora is unofficially adopted into the family. Gongenzaka has always practically been a part of their family, Sylvio, Shun, anybody.

4) Once all the kids are grown up, Yoko and Yusho set up an official day for all of them to get back together for a big family dinner. Usually Saturdays. Of course, all the kids are welcome any time they want to drop by.

3 notes

·

View notes

Photo

文豪ストレイドッグス 迷ヰ犬怪奇譚

文豪ストレイドッグス 迷ヰ犬怪奇譚

Game 文豪ストレイドッグス 迷ヰ犬怪奇譚 là dòng game Puzzle

Giới thiệu 文豪ストレイドッグス 迷ヰ犬怪奇譚

大人気アニメ『文豪ストレイドッグス』から、初のスマートフォン向けゲームが登場!

奇怪千万の文豪異能力バトル、ここに開幕!!

▼TVアニメの名シーンをスマートフォンで追体験!▼

「メインストーリー」ではアニメ『文豪ストレイドッグス』のストーリーを追体験できる!

あのアニメの名シーンやキャラクター同士の掛け合いをアプリで体感しよう!

「イベントストーリー」ではアプリ完全オリジナルのストーリーや、

アニメでは語られなかったサイドストーリーも楽しめる!

▼かんたん操作で異能バトル!▼

引っ張って飛ばすだけのかんたんな操作で楽しめる「爽快異能スリングパズル」!

異能力発動でド派手なカットイン!

「月下獣」「人間失格」「羅生門」……

様々な異能力を駆使して敵に立ち向かおう!

魅力的なSDキャラクターのバトルアニメーションも必見!

▼夢の共闘も実現!自分だけのオリジナルチームを編成しよう!▼

アニメでのキャラクター達はもちろん、ゲームオリジナルの衣装を来たキャラクターや、

個性的な動きをするSDキャラクターも登場!

「武装探偵社」のメンバーをはじめ、「ポートマフィア」のメンバーも編成が可能!

自分だけのオリジナルチームで文豪ストレイドッグスの世界を体験しよう!

▼豪華声優陣録り下ろしのキャラクターボイスも多数収録!▼

中島 敦 (CV:上村祐翔)

太宰 治 (CV:宮野真守)

国木田独歩 (CV:細谷佳正)

江戸川乱歩 (CV:神谷浩史)

泉鏡花 (CV:諸星すみれ)

芥川龍之介 (CV:小野賢章)

中原中也 (CV:谷山紀章)

▼公式Twitter▼

公式Twitterでは迷ヰ犬怪奇譚の最新情報を随時配信しております。

https://twitter.com/bungomayoi

【タイトル】

文豪ストレイドッグス 迷ヰ犬怪奇譚 (まよいいぬかいきたん)

【対応OS】

Android 4.4以上

※対応OS以外でご利用頂いた場合はサポートや補償等のご対応は致しかねますのでご了承下さい。

※一部端末では動作しない端末がございます。予めご了承下さい。

【価格】

アプリ本体:無料

※一部有料アイテムがございます。

(C)2016 朝霧カフカ・春河35/ KADOKAWA /文豪ストレイドッグス製作委員会

(C)2017 Ambition Co., Ltd.

このアプリケーションには、(株)CRI・ミドルウェアの「CRIWARE (TM)」が使用されています。 Popular from the anime "great writer Stray Dogs", appeared first smartphone game!

Of bizarre ten million literary master different ability battle, opening here! !

▼ relive the scenes of the TV animation in your smartphone! ▼

You can relive the story of the "main story" in the anime "great writer Stray Dogs"!

Trying to feel the negotiations of scenes and characters to each other of that animation in the app!

And "Event Story" in app completely original story,

Also enjoy side story that was not told in the anime!

▼ exceptionally talented battle with easy operation! ▼

Enjoy only a simple operation of the fly by pulling "exhilarating exceptionally talented sling puzzle"!

Flashy cut-in at different ability triggered!

"Moonlight Beast," "No Longer Human", "Rashomon" ......

We will confront the enemy by making full use of a variety of different capacity!

A must-see also attractive SD character of the battle animation!

▼ dream of a united front also be realized! Trying to organize the only original team of your own! ▼

Characters have in animation, of course, and the character came the game original costumes,

Also appeared SD character to the unique movement!

Including the members of the "armed Detective Agency", it can be members also organized a "port mafia"!

Let's experience the world of the great writer Stray Dogs in only the original team of your own!

▼ also many recording character voice of down gorgeous actors-recording! ▼

Atsushi Nakajima (CV: Uemura YuSho)

Osamu Dazai (CV: Miyano Mamoru)

Doppo Kunikida (CV: Yoshimasa Hosoya)

Ranpo Edogawa (CV: Hiroshi Kamiya)

Kyoka Izumi (CV: Sumire Moroboshi)

Ryunosuke Akutagawa (CV: Kenshō Ono)

Chuya Nakahara (CV: Kisho Taniyama)

▼ official Twitter ▼

We deliver at any time the official 迷Wi dog horror latest information of Tan at Twitter.

https://twitter.com/bungomayoi

【title】

Great writer Stray Dogs 迷Wi dog horror Tan (delusion Inukai Kitan)

[Supported OS]

Android 4.4 or higher

※ Please note that If we receive your use in the corresponding non-OS support your support and compensation, etc. I am afraid that I can not.

※ There is a terminal that does not work on some devices. Please note.

[Price]

Apps body: Free

※ There is some paid items.

(C) 2016 morning mist Kafka-Spring River 35 / KADOKAWA / writer Stray Dogs Production Committee

(C) 2017 Ambition Co., Ltd.

This application, has been used "CRIWARE (TM)" in the (stock) CRI · middleware. ・機能改善

・不具合の修正

Download APK

Tải APK ([app_filesize]) #gamehayapk #gameandroid #gameapk #gameupdate

0 notes

Text

Taiyang: Those two will make a great team! Jaune and Yang, the best dynamic duo since The Joker and Harley Quinn! Or Hank Pym and Janet! Or... My wife and me.

Mama Arc: Oh my- Oh my lord...

74 notes

·

View notes

Text

Before Episode 99, we will talk about OP5.

Opening starts with a homage to Heartland shots in ZEXAL, of course this time around, it is completely destroyed.

We get the extended version of Yuya-Yuto shot from OP2.

Yugo vs. Yurii features Starving Venom vs. Crystal Wing, not Clear Wing. Again, showcasing Starving Venom is stronger than base forms.

Sayaka, and Allen are somewhere with Chaos Ancient Gear Giants attacking.

Girls thrown into the ARC-V reactor. Yuzu is in Asuka's old clothes, which she will wear for the rest of the show.

We get a shot of Xyz arc characters, and Asuka with Yusho.

Yuya is riding with wheels attached to his shoes. There is the egao shot of the girls, implying Yuya is fighting for their smiles (he doesn't actually know half these people).

Yugo is riding towards the tower, with Rin being in the shot.

Shun has a shot with Ruri, and Sayaka, with the background from Ruri duel present.

Final shot is Yuya and Performapals.

Emphasis on Allen, and Sayaka make sense, but is also completely unimportant ultimately. The duels with brainwashed Rin/Ruri is obviously teased, so is the death of the Bracelet Girls. So we are off to a good start.

Though this episode is formally part of Season 2, because it aired with Episode 100, and has the new opening, it was clearly part of the same production cycle as the early half of Season 3, so it can be considered the first episode of Season 3 for meta analysis. I won't be doing that, though. Not yet.

0 notes

Text

Experiment Log 02

What? Did you thought I had forgotten about this? That my cousin had opted out? I would lie if I say she wasn’t tempted (“But nothing is happening!”) But she resisted and here is the result:

Watching Status: Episode 106 - 109

Episode 106

Cousin: *sigh of relief* Thank god we’re back to Yuzu!

*After the episode*

Cousin: Wow! So much happened… first: Yusho was the one with the “make people smile with your dueling” motto?

Me: Yep.

Cousin: Then what the heck was the Xyz people contribution to all of this? Ok, ok I’ll calm down… And Asuka! Damn that was intense! Love her already!

Me: Nice, anything else?

Cousin: Well, Yuri is fun and all but he behaved just the same as before… I assume he’s not done much right? And Yugo seems to be quite fond of Yuzu now! When did that happened!

Me: ehhh… you know back then.

Cousin: …damn it.

__________

Episode 107

Cousin: Oh they look cool *referring to Grace and Gloria* are they gonna capture the Pokemon kids?

Me: *Chokes*

After the episode

Cousin: Nice duel, they were using Mai’s monsters right?

Me: more or less, any thought on the kids?

Cousin: Is there anything to say? He has a Transformer deck and she has a… cheerleader deck? I wish to say they put on a good fight but I would be lying.

———

Episode 108

Cousin: Come on! We don’t even get to see Sawatari and Gon-chan defeating turn? I feel bad for them now.

After the episode

Cousin: Have I ever told you how much I love Yuya?

Me: yep, almost as many as you say you love Yuzu, and about Grace…

Cousin: I think it was nicely done! Like they had never seen a duel like Yuya’s and she was taken by it.

Me: And Shun?

Cousin:… It’s official I have no idea what he’s supposed to be, like bounce back and forth all the time… I … ugh don’t ruin this episode for me ok?

-----------------

Episode 109

Cousin: *Read the title of the ep* Ugh I’m done with this arc raising my hopes up for the Angry Bird, I mean nothing is going to happen to him he’s like the darling of the fandom or something.

*After the episode*

Cousin: I stand correct, the writers have my respect for sorta putting the darling out of service... for a while anyway.

Me: Anything else?

Cousin: Kaito is... adequate at least he’s stay consistent, unlike the Darling and the Emo, i would have prefered that the twins got to duel though.

Subject Status: Not angry anymore, slightly less moody probably product of her skepticism.

7 notes

·

View notes

Text

ARC-V-hetypes

With ARC-V drawing to a close, wanted to do something to commemorate my absolute favorite Yugioh series. But seeing as I can’t draw, write stories, or do anything that would be beneficial or productive, I thought I could at least do something that I really like: deckbuilding.

This series brought us so many insane, memorable, fun, and well-designed archetypes. From the OTK power of Performapals and Odd-Eyes, to the careful planning of D/D/Ds, to the KOI KOI KOI of Flower Cardians, Arc-V has it all. I already made a few decks based on these cards, so why not go all the way and make all the decks?

So I’ve been slowly creating all the decks I haven’t finished, but I plan to keep adding to the list.

Yu Boys

Yuya Sakaki

Yuto

Yugo: Speedroid

Yuri: Predaplant

Bracelet Girls

Yuzu Hiragii: Melodious

Serena: Lunalight

Rin: Windwitch

Ruri Kurosaki: Lyrical Luscinia

Lancers

Reiji Akaba

Noboru Gongenzaka

Shingo Sawatari

Shun Kurosaki

Tsukikage

Sora Shiun’in

Standard Dimension

Yuu Sakuragi

Mieru Hochun

Hokuto Shijima

Masumi Kotsu

Yaiba Todo

Ayu Ayukawa

Tatsuya Yamashiro

Synchro Dimension

Chojiro Tokumatsu: ENJOOOOOY

Crow Hogan

Jack Atlas: Resonator

Security

Xyz Dimension

Kaito Tenjo

Allen Kozuki

Sayaka Sasayama

Fusion Dimension

Dennis Macfield

Asuka Tenjoin: Cyber Angel

Edo Phoenix

Obelisk Force, etc.: Ancient Gear

Battle Beast

Characters who don’t have printed archetypes (Reira, Yoko, Kachidoki), or don’t have enough cards to make a good, full deck (Yusho, Teppei) will usually be skipped over, unless people are just dying to see me try and make something for them.

5 notes

·

View notes

Text

Selfish/Selfless

Rating: PG

Summary: Somehow, Gongenzaka feels like he both knows much and not that much about Dennis. He knows Dennis has a flair for the dramatic and used to be a student of Yusho’s, but he doesn’t know why he always tries to force a smile on his face. He knows Dennis was revealed to be a spy while he was underground, but he doesn’t know why then he would give them the location of the other bracelet girls. He knows Dennis cares more about saving his own skin than anything else, but he doesn’t know why then he’d card himself.

For not the first time, Dennis reminds of him of a cat.

Gongenzaka has neither a favorable or unfavorable connection with them, but whenever he goes over to the Sakaki’s residence, he notices just how they sneak up on you without even realizing it, walking around like they own the place without a care in the world. They can be finicky with when and how they give and receive affection, and for the life of him, Gongenzaka can never feel sure if he is interacting with them in the right way.

Considering that Dennis has been staying at the Sakaki’s like any other stray, the description only grows more and more appropriate. The metaphor’s biggest shortcoming is that thankfully he doesn’t leave his hair everywhere.

Somehow, he feels like he both knows much and not that much about Dennis. He knows Dennis has a flair for the dramatic and used to be a student of Yusho’s, but he doesn’t know why he always tries to force a smile on his face. He knows Dennis was revealed to be a spy while he was underground, but he doesn’t know why then he would give them the location of the other bracelet girls. He knows Dennis cares more about saving his own skin than anything else, but he doesn’t know why then he’d card himself.

All of these thoughts come to a confusing collision when Dennis starts walking around the family dojo like he owns the place. He’s perfectly polite, always smiling, always friendly with the other students, but Gongnezka hardly knows what he actually does while here. He’ll be training others in the Steadfast Dueling style or lecturing those who lack the faith and discipline it takes to fully commit to the style, when out of the corner of his eye he’ll spot a familiar mess of red curls. He’ll find Dennis chatting with other students after they rest from a long workout. It’s just maddening how he slowly creeps his way into their daily life without speaking a word to Gongenzaka.

Dennis is never intrusive or disruptive, but it gets under him skin like nothing else. It’s always been a policy to open the dojo to whoever needs it, as long as they come with pure intentions and cause no harm, but Gongenzaka can’t help but feel uneasy with him around. Dennis is nothing like Steadfast Dueling. He’s a mystery wrapped in secrets that’s about as straightforward as a winding mountain trail. For the life of him, he can’t understand Dennis, no matter how hard he tries.

He attempts to keep this to himself though. There’s a need to be professional and a an example to the others. Still when he tries to get some private practice and finds that familiar red head peeking through, he can’t help but snap.

“Why are you here?” His words are as sharp as steel.

“I was just curious, if you want privacy then I’ll go-”

“No,” Gongenzaka finds himself closing the distance between them. “Why are you here in Standard and lurking around my dojo?”

“Like I said, curiosity,” He twirls a curl around his finger, a flippant action, but the atmosphere suggests otherwise. “I’m not causing any harm am I?”

Gongenzaka grunts in response. “Steadfast Dueling doesn’t suit you.”

“Never thought it did. I’m more interested in figuring out why it suits you.”

“Why it suits me?” He can’t help but raise an eyebrow in confusion.

“You’re practically a perfect candidate. Always going out of your way to defend everyone. You’re always in hero mode, can’t pretend for a second you aren’t,” He gives him a sly look as memories of their sideshow duel come back, “The entire dojo looks up to you. Everyone wants to be like you. The only flaw I can see in you being the poster boy for Steadfast Dueling is that for all your protecting, you can’t protect yourself.”

“Stop with the mind games,” Gongenzaka growls, “If you don’t have anything productive to say then get out.”

“I’m being serious,” Dennis’ voice grows surprisingly firm. Green eyes bear into him with an unexpected determination. “Even now when you could be getting some alone time, you still decide that I’m worth it. I hear you’re the first one up and the last one to sleep. Yuya told me a story where you ruined your entire deck just to save him. You’re always saving others, but you’re never saving yourself.”

Gongenzaka finds himself speechless. There’s something about someone else showing you your reflection. No matter how comfortable you are with your identity, it seems more flaws and beauty marks spring up from nowhere. And while he can pinpoint pearls of truth in his statement, he isn’t sure what just to do with the information.

“Why are you here?”

“I already answered your question, to figuring out why-”

“Why does that matter to you though? For someone who never cares to protect others, it hardly makes sense.”

“For someone so straightforward, I have trouble understanding you.” Dennis runs a hand through his curls sheepishly, and something between a scoff and laughter catches in Gongenzaka’s throat.

“You’re hardly the only one.”

Strange enough he finds himself becoming more and more at peace with that.

#sideshowshipping#arc v#gongenzaka noboru#dennis macfield#arc v fanfic#my lame writing#otp: i'm not calling you a liar#fruit clones dual#the man#sad clown#ah it feels good to write and independent piece

8 notes

·

View notes

Text

Goodwitch: First to fight each other will be... Jaune Arc and Yang Xiao Long!

Jaune: (Thinking) I can't fight Yang!.

Yang: (Thinking) This is it! Oh my god! Okay, be cool! Be cool, be cool, be cool. You're finally gonna kill Jaune.

Jaune: She's my bestie.

58 notes

·

View notes

Text

Goodwitch: Prepare yourselves, students! Today's training... is combat training!

Yang: Oh god yes!

Jaune: Oh god no!

54 notes

·

View notes

Text

Ruby: Yang is really acting like a bad guy to Jaune. And by bad guy, I mean dick. ...She's being a dick.

Blake: Are we sure she isn't one?

Ruby: A bad guy or a dick?

Blake: ...Yes.

35 notes

·

View notes

Text

Winter: Wow, Jaune, that was... the worst throw I have ever seen. Like, in the history of every. You even used your semblance and it sucked. May used her semblance to help her throw, too, and she still did better than you. And her semblance is invisibility!

May: Suck it, Jaune!

49 notes

·

View notes