Welcome to Knowledge Tree, my very own passion project filled with unique and engaging content. Explore my site and all that I have to offer; perhaps Knowledge Tree will ignite your own passions of reading great new content as well.

Don't wanna be here? Send us removal request.

Text

Tools for Social Media Marketing

Are you equipped to stage up your social sport? If you need your social media advertising and marketing to be effective, you’ll need to invest in the right gear for the job. Tools that help you manage and optimize your posts. We’re sharing 5 exceptional equipment that’ll rework your social media advertising and marketing skills.

1. IFTTT So you’ve were given your social media posts scheduled and maybe you even crossed off the content material curation mission. What’s the following step? To automate the whole thing that comes before and after (and in among). That’s what IFTTT is for. The name of this automation device stands for If This, Then That. It links all sorts of apps and offerings collectively to automate multi-step responsibilities in anything manner you need. So for example, in case you put up a weblog, you can create an IFTTT “recipe” so that it will see the brand new publish and create a tweet as well as an Instagram put up approximately it.

2. Buffer Buffer began off as a scheduling device for Twitter. Today, it supports all of the predominant social media platforms, along with Facebook, Instagram, Pinterest, LinkedIn, and Google + (for the only man or woman who nonetheless makes use of it.) Let’s take a look.

3. PostPlanner Postplanner was once the device for scheduling Facebook updates. Now, this is a far extra widespread function, so Postplanner has developed pretty loads to encompass extra cool functions. Its principal awareness is now on helping marketers growth their engagement on Facebook, Twitter and Pinterest. With Postplanner, you may easily become aware of the top performing content material for any hashtag, topic or social media account, ranked by their virality. With this statistics, you could extra easily provide you with updates in order to growth your engagement, attain and in the long run your visitors.

4. Tagboard Tagboard allows users to combination records from essential social media web sites into impactful shows that can be embedded and re-displayed on diverse channels. Their Tagboard Live device lets in you to look your posts live on a display and gives layouts and gear to personalize the display. It’s one of the pleasant social media control tools available.

5. Socialbakers Socialbakers is a suite of gear for making decisions based totally on your fans’ statistics. You can degree your overall performance as opposed to competitors, then use the ones insights to enhance your content. This data is precious when monetizing your campaigns. You can use it to finances greater efficaciously, while additionally boosting patron acquisition, retention, and boom.

0 notes

Text

Things you need to know about Covid-19

Few days ago, the World Health Organization (WHO) upgraded the status of the COVID-19 outbreak from epidemic to pandemic.

Here are some important pieces of information on what this means for you and your community.

What’s the difference between an epidemic and a pandemic?

Before Wednesday’s WHO announcement, the COVID-19 outbreak was described by the UN health agency as an epidemic, meaning that it has been spreading to many people, and many communities, at the same time.

Labelling the spread a pandemic, indicates that it has officially spread around the world, and is also a reflection of the WHO's concern at what it calls the “alarming levels of the coronavirus spread, severity and inaction”, and the expectation that the number of cases, deaths and affected countries will continue to climb.

Should I be now be more worried about COVID-19?

Calling COVID-19 a pandemic does not mean that it has become more deadly, it is an acknowledgement of its global spread.

Tedros Adhananon Ghebreyesus, the head of WHO, said as much at a media briefing on Wednesday, when he insisted that the pandemic label does not change WHO’s assessment of the threat posed by the virus: “It doesn’t change what WHO is doing, and it doesn’t change what countries should do”.

Tedros also called on the world not to fixate on the word “pandemic”, but to focus instead on five other words or phrases, beginning with “p”: Prevention, Preparedness, Public health, Political leadership and People.

The WHO chief acknowledged that the COVID-19 spread is the first pandemic to be caused by a coronavirus (i.e. any of the large variety of viruses that cause illnesses ranging from the common cold to more severe diseases).

However, he also pointed out that all countries can still change the course of this pandemic, and that it is the first ever, that can actually be controlled.

What should countries do?

WHO reiterated its call for countries to detect, test, treat, isolate, trace, and mobilize their citizens, to ensure that those with just a handful of cases can prevent wider spread throughout the community.

Although some 118,000 cases have been reported, in 114 countries, more than 90 per cent of those cases are clustered in just four countries: China, Italy, South Korea and Iran.

In two of those countries (China and South Korea) the numbers of new cases are, in the words of WHO, “significantly declining”. 81 countries have yet to report any COVID-19 cases and, in 57 countries, there have been only 10 or fewer cases reported.

However, there is still considerable concern that many countries are not acting quickly enough, or taking the urgent and aggressive action that the health agency says is required.

Even before the pandemic announcement, WHO was advocating a whole-of-government approach to dealing with the crisis, on the basis that every sector, not just the health sector, is affected.

Even countries in which the virus has spread throughout the community, or within large population clusters, can still turn the tide of the pandemic, said Tedros, adding that several nations have shown that the virus can be suppressed and controlled.

What should I do?

Whilst it is understandable to feel anxious about the outbreak, WHO emphasizes the fact that, if you are not in an area where COVID-19 is spreading, or have not travelled from an area where the virus is spreading, or have not been in contact with an infected patient, your risk of infection is low.

Nevertheless, we all have a responsibility to protect ourselves, and others.

Everyone should frequently wash their hands (and wash them thoroughly, with soap); maintain at least one metre distance from anyone coughing or sneezing, and avoid physical contact when greeting; avoid touching our eyes, nose and mouth; cover the mouth and nose with a bent elbow or disposable tissue when coughing or sneezing; and stay home and seek medical attention from local health providers, if feeling unwell.

Whilst the virus infects people of all ages, there is evidence that older people (60 and over), and those with underlying health conditions (such as cardiovascular disease, diabetes, chronic respiratory disease, and cancer), are at a higher risk.

People in these categories are being advised to take further measures, including ensuring that any visitors wash their hands, regularly cleaning and disinfecting home surfaces, and making a plan in preparation for an outbreak in their community.

WHO and other UN agencies have underlined the importance of solidarity, and avoiding stigmatizing community members in the face of the pandemic. “We’re in this together”, said Tedros on Wednesday, urging everyone to “do the right things with calm and protect the citizens of the world. It’s doable."

Where can I get reliable information?

The best place to get reliable information is the WHO Website, www.who.int. Here you can find comprehensive advice, including more on how to minimise the risk of spreading, or catching COVID-19.

The site is currently being updates on a daily basis, so check in regularly.

It is also advisable to check the official Website of your local and regional municipality, which may have specific health information, as well as news concerning your community, such as travel guidance, and outbreak hotspots.

WHO warns that a number of myths and scams are circulating online. Criminals have been advantage of the spread of the virus to steal money or sensitive information and, says WHO, if anyone is contacted by a person or organization claiming to be from the Organization, they should take steps to verify their authenticity.

The WHO site includes a “myth-buster” section, debunking some unsubstantiated theories that have been circulating online. For example, it is a myth that cold weather can kill the virus, that taking a hot bath or eating garlic can prevent infection, or that mosquitos can spread the virus. There is no evidence for any of these claims.

#covid-19#covidquarantine#covid_19#covidー19#covid virus#coronapocalypse#coronavirus#coronavid19#what is covid-19#bewaspish#epidemic#pandemic#pandemi virus corona#health#world health organisation disinfectant#world health organisation (who)

0 notes

Text

What is Covid-19? Corona Virus

The COVID-19 pandemic, also known as the coronavirus pandemic, is an ongoing pandemic of coronavirus disease 2019 (COVID‑19), caused by severe acute respiratory syndrome coronavirus 2 (SARS‑CoV‑2). The outbreak was first identified in Wuhan, China, in December 2019. The World Health Organization declared the outbreak a Public Health Emergency of International Concern on 30 January, and a pandemic on 11 March. As of 17 May 2020, more than 4.71 million cases of COVID-19 have been reported in more than 188 countries and territories, resulting in more than 315,000 deaths. More than 1.73 million people have recovered from the virus. The virus is primarily spread between people during close contact, most often via small droplets produced by coughing, sneezing, and talking. The droplets usually fall to the ground or onto surfaces rather than travelling through air over long distances. Less commonly, people may become infected by touching a contaminated surface and then touching their face. It is most contagious during the first three days after the onset of symptoms, although spread is possible before symptoms appear, and from people who do not show symptoms. Common symptoms include fever, cough, fatigue, shortness of breath, and loss of smell. Complications may include pneumonia and acute respiratory distress syndrome. The time from exposure to onset of symptoms is typically around five days but may range from two to fourteen days. There is no known vaccine or specific antiviral treatment. Primary treatment is symptomatic and supportive therapy. Recommended preventive measures include hand washing, covering one's mouth when coughing, maintaining distance from other people, wearing a face mask in public settings, and monitoring and self-isolation for people who suspect they are infected. Authorities worldwide have responded by implementing travel restrictions, lockdowns, workplace hazard controls, and facility closures. Many places have also worked to increase testing capacity and trace contacts of infected persons. The pandemic has caused severe global economic disruption, including the largest global recession since the Great Depression. It has led to the postponement or cancellation of sporting, religious, political, and cultural events, widespread supply shortages exacerbated by panic buying, and decreased emissions of pollutants and greenhouse gases. Schools, universities, and colleges have closed either on a nationwide or local basis in 186 countries, affecting approximately 98.5 percent of the world's student population. Misinformation about the virus has spread online, and there have been incidents of xenophobia and discrimination against Chinese people and against those perceived as being Chinese or as being from areas with high infection rates.

The coronavirus COVID-19 pandemic is the defining global health crisis of our time and the greatest challenge we have faced since World War Two. Since its emergence in Asia late last year, the virus has spread to every continent except Antarctica. Cases are rising daily in Africa the Americas, and Europe.

Countries are racing to slow the spread of the virus by testing and treating patients, carrying out contact tracing, limiting travel, quarantining citizens, and cancelling large gatherings such as sporting events, concerts, and schools. The pandemic is moving like a wave—one that may yet crash on those least able to cope.

But COVID-19 is much more than a health crisis. By stressing every one of the countries it touches, it has the potential to create devastating social, economic and political crises that will leave deep scars. As the UN’s lead agency on socio-economic impact and recovery, UNDP will provide the technical lead in the UN’s socio-economic recovery, supporting the role of the Resident Coordinators, with UN teams working as one across all aspects of the response.

We are in uncharted territory. Many of our communities are now unrecognizable. Dozens of the world’s greatest cities are deserted as people stay indoors, either by choice or by government order. Across the world, shops, theatres, restaurants and bars are closing.

Every day, people are losing jobs and income, with no way of knowing when normality will return. Small island nations, heavily dependent on tourism, have empty hotels and deserted beaches. The International Labour Organization estimates that 195 million jobs could be lost.

#covid-19#covidquarantine#covid_19#covidー19#covid virus#coronapocalypse#coronavirus#coronavid19#world#health#home organization#what is covid-19#effective#death metal

0 notes

Text

Get Clean Copy of Windows 10, But How?

Downloading a clean Win10 version 1909 is remarkably easy, doesn’t take very long (if you have a fast internet connection anyway), and may well save your keister at some point. You can even download it from your phone or iPad.

Don’t worry, it’s 100% legal and, at worst, will occupy about 8GB on a USB drive for a while. Nothin’ to it.

Step 1. If you’re running Win10, use the Media Creation Tool

If you have a license for Windows 10, the easiest way to get version 1909 involves Microsoft’s Media Creation Tool. Go to the Download Windows 10 site and, under "Create Windows 10 installation media," click the link marked "Download tool now."

You'll see a notice that you’re opening MediaCreationTool1909.exe (screenshot). It may take a second, but when the Save File button goes live, click on it. Give approval for the Media Creation Tool to make changes to your PC, and you'll see the Windows 10 Setup dialog. Click to accept Microsoft’s multi-page Software License Terms.

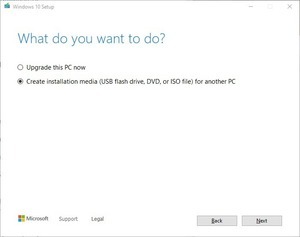

The Windows 10 Setup routine asks if you want to upgrade this PC now, or if you want to create installation media (screenshot).

Choose "Create installation media (USB flash drive, DVD, or ISO file) for another PC." Yes, you should choose that even if you never intend to use the clean copy of Win10 1909 on any other PC. Click Next. Choose the language, architecture and edition — all of which should match what you’re currently running.

When you’re asked to "Choose which media to use," choose "ISO file." Ignore the part about “You’ll need to burn the ISO file to a DVD later” — old advice, rarely necessary these days. Click Next.

When you get to the point where you choose a place to put the file, give it a name that you’ll be able to identify in the future — say, Win10 1909.iso or something similar — and stick the file someplace you’ll be able to find it.

Hit Save, wait a few minutes, and you’ll have a brand-new, clean copy of Win10 version 1909 downloaded and ready for the inevitable disaster.

When you’re told to burn the ISO file to a DVD, just ignore it and click "Finish." OK, boomer.

Step 2. If you aren’t running Windows 10, grab a different machine

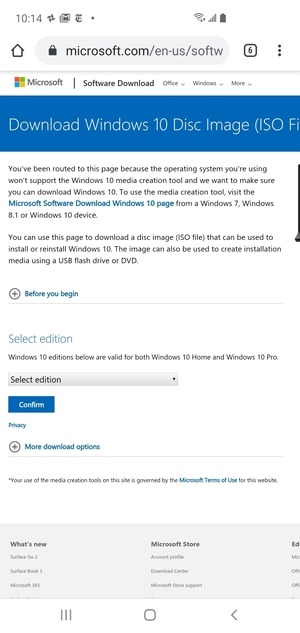

If you go to the Download Windows 10 site using anything other than a fully ordained Windows machine, you’ll see something like the screenshot, which was taken on my Android phone.

That’s good news. Really. Downloading Win10 is as simple as choosing an edition (“Windows 10 November 2019 Update” is version 1909) and clicking Confirm. You’ll need about 8GB of free space — which may or may not present a problem on your device. Moving the file from your phone, tablet, Mac, Linux machine, or Raspberry Pi is almost always a simple task.

Step 3. Save it someplace handy

No matter which path you choose, you’ll end up with a copy of the official Win10 version 1909 ISO file, which can be easily used to install 1909. At least, “easily” in a Windows kind of way. If you download right now, you’ll get the Jan. 14 flavor, known as build 18363.592.

Stow it away someplace handy. You may need it someday.

#Windows#windows 10#microsoft#bill gates#clean copy#but how#download#free#operating system#10#free windows download

0 notes

Text

9 Ways to do When Bad Things Happen

“We all have problems. The way we solve them is what makes us different.” ~Unknown

Have you ever experienced times when you go through just one bad thing after another? When it seems like the world is out to get you? When things go wrong no matter what you do?

You are not alone. Bad things happen to all of us too, including me. I experienced a small set back recently which I want to share with you.

Not too long ago, I was working on my upcoming eBook. It was my #1 priority project at that time and I had been working on it tirelessly, day and night. After lots of hard work, I was 90 percent done. At that time, it was 630 pages. (The final book was almost 800 pages.)

I was happy with the progress. Cover done, foreword written, articles in place, right order, formatting done, layout completed—it was on track to launch in a week’s time.

Unfortunate Turn of Events

One evening after I got home, I sat at my computer and opened my document, ready to start work. Imagine my horrified look when I looked at the document and saw the cover design was an older version.

Bewildered, I checked the page count. It was 430 pages, 200 pages lesser than my latest version! This was an old version I was working on a few days ago. I was flabbergasted.

I couldn’t believe what was happening. I had always been careful with my documents, especially having experienced painful reworks before from document crashes and what not. It seemed there was a software error which caused an older version of my file to save over the new version, even though I had saved the latest version.

I was almost done with the book, ready to launch and my latest file disappeared. It was disheartening and honestly, somewhat depressing.

After fiddling around for fifteen minutes, I came to terms that the latest version was gone. Two hundred pages of material and endless hours of hard work—all gone.

Focusing on What Could Be Done

Interestingly, while I felt bummed, I wasn’t hung up about it. Almost immediately after I realized the document was really gone, I got right to work.

I listed down what changes were lost in the old version so I could redo them. I added them on my to-do list and mapped out my schedule so I could still meet the original launch date. I was determined to meet my launch timing and I was not about to let this hiccup throw me off.

Was I frustrated? Sure I was. There were thoughts of “Aw shucks, I should have backed it up manually” and “How did this even happen?” but those thoughts were fleeting. They didn’t bog me down. If anything, I felt more charged up than anything.

While a good chunk of work was gone, I was focused on how I could get back on track, since lamenting what happened wouldn’t accomplish anything.

Our Negative Coping Behaviors

There are many possible negative things that can happen to us in a day—from the little things like coffee spilling, being caught in a traffic jam, losing our keys, having people criticize you, to the bigger mishaps like getting into a car accident, losing our valuables, breaking up from relationships, or losing our jobs.

Whenever something bad happens to us, it’s easy for us to slip into one of the following behaviors:

Self-victimization. We ask ourselves “Why is this happening to me? Why am I so unlucky? Why doesn’t this happen to anyone else? It’s not fair!”

Reacting in anger. We lash back at the situation, or even people around us, for what’s happening.

Self-blame. We make self-depreciating comments like “Why am I so stupid to have done that?” “Only someone like myself can make such a dumb mistake.”

Slipping into depression. For those of us who have faced cases of depression before, we might fall back if we’re not careful at managing our emotions.

Dejection or giving up. We lose hope, or worse still, we give up. We decide it’s not worth it, that life is out to get us, and we should just stop trying altogether.

9 Tips to Cope With Negative Situations

The thing is, as long as you live in this world, you are subjected to the same chaos, the ups and downs, the good and bad, the positives and the negatives of life. You are not the only person facing this.

What sets you apart from others though, is how you choose to deal with this situation. Here are my personal steps to cope with bad situations and create something good out of them:

1. Release your frustrations.

Don’t bottle them up because you might just implode. Talk to a friend about it. A listening ear does wonders. Go exercise and release the tension. Journal it out.

2. Realize you are not alone.

No matter what you may think, you’re not alone in this. Somewhere around the world, someone else is thinking the exact same thing as you. Someone out there is feeling down and out too, wondering why she is experiencing this. Knowing it’s not just you helps you to get out of a self-victimizing mindset.

3. Being frustrated isn’t going to solve anything.

The problem will still remain whether you go berserk at it or whether you think about it calmly. The former will create more problems as your agitation prevents you from making good decisions. I knew remaining frustrated was not going to help me get my 200 pages back, so I focused on what could be done instead (#6).

4. Know you always have a choice.

Realize no matter what happens, you always have a choice in how you react. While you may not be able to control what happens to you, you can most certainly control your behaviors. You can face the worst things in the world, but if you make the choice not to let yourself be affected by them, you won’t be.

5. Objectify it.

An incident is an incident; we’re responsible for the feelings attached. Remove the feelings and look at the situation objectively. This will help us cope a lot better.

6. Focus on what you can do.

Action creates empowerment. It brings possibilities. It creates results. By taking action, you are no longer a passive recipient. You are a conscious creator.

7. Ask for help if you need to.

It’s okay to ask for help if it makes the situation easier. Remember, you are not alone in this (#2).

8. See it as an obstacle to be overcome.

Life is a journey of learning and growth, and everything happens for a reason. Obstacles are the things stopping you from getting your goals, and if you keep overcoming these obstacles, you’ll eventually get what you want.

9. Identify the lesson learned.

There are always things to be learned from every situation. For me, I learned to rigorously back-up everything I’m doing now—even saving files in different versions so I can still recover the last version if the latest version ever gets destroyed.

No matter what bad stuff life throws your way, as long as you cope with it constructively, nothing can get you down.

0 notes

Text

Top 5 Android Launchers (Best & Fastest)

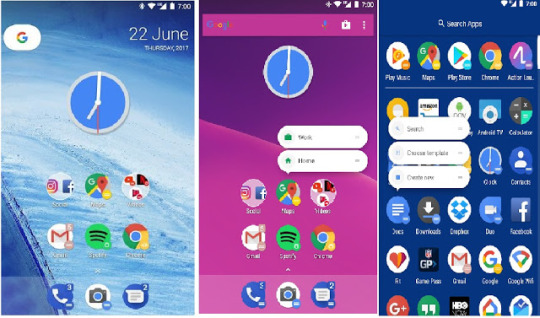

Want to make your Android phone more beautiful? If yes, then you have landed on the correct page as we are here today with some of the best and fastest Android Launcher that will make your simple smart phone look more stylish and customizable. Well, Android launchers are basically all about making your Android phone look more customized and user friendly. They allow you to enjoy the excess of impressive themes and icons that you will get after installing a launcher. You can then have a complete control on your mobile device and its performance. So in case you are looking for installing an Android Launcher I am sure you want it to be quick loading, fast and with awesome UI. Geeks, be with me, I will be telling you some of the coolest and fastest Android Launchers 2017.

So let’s check out fastest lightweight android launchers.

Action Launcher - Oreo + Pixel on your phone

Action Launcher brings all the features of Pixel Launcher and Android Oreo to your device, then adds a wealth of color, customizations and unique features so you can quickly and easily make your home screen shine! Standout features include:

All Pixel Launcher features: swipe up from your dock to reveal the new full screen All Apps mode, tint the dock, use the new circular folder style, place the Google Pill and Date widgets and more. Enabled by default, and available for free!

App Shortcuts: Use Android 8's App Shortcuts, on devices running Android 5.1 or later!

Adaptive Icon support: Devices running Oreo can use native Adaptive Icon support. Devices not yet on Oreo can also use Adaptive Icons by installing Action Launcher's official companion app, Adaptive Pack!

An inbuilt weather widget!

Google Now integration for all!

Full Notification Dots support.

Quick theme: marvel as your home screen is customized with the colors from your wallpaper.

Shutters: swipe a shortcut to reveal an app's widget. Useful for previewing your inbox or Facebook feed without opening the app.

Quick bar: customize the Google search bar with shortcuts and apps of your choosing.

Quick edit: have alternative icon suggestions instantly presented to you, without having to dig through icon packs.

Smart size icons (Beta): icons are automatically resized to match Material Design's recommended icon size.

Covers: an innovative take on traditional folders. Tapping a Cover loads an app, swiping a Cover opens a hidden folder which you have customized.

Use icon packs, scale icons, hide and rename apps and much more.

Full phone, phablet and tablet support.

Action Launcher allows you to import from your existing layout from other launchers such as Apex, Nova, Google Now Launcher, HTC Sense, Samsung/Galaxy TouchWiz and the stock Android launcher, so you'll instantly feel right at home.

2- Apex Launcher – Most Iconic launcher

Well, second in the list comes another innovative launcher called as Apex launcher that has remained favorite of many for very long time. Almost similar to Android in looks but some extra ordinary features makes it iconic. You can get it for free unlike Action Launcher though its Pro Version is also available. You can use plenty of icons on home screen with smooth scrolling,making it work fast and can even use transition animations making it stylish. It comes with many icon packs and themes to select from.

its pros and cons include-

Arrange home screen according to grid size which is easily customizable. You can hide your apps with its Drawer option in the setting Scroll docks smoothly with transition effects and even works with tabets. Easily back up with its Launcher settings to restore your previous options Map actions like Show Notifications, go to default screen with easy swiping to top and bottom If you do not upgrade to its Pro Version, certain features might not be available for you, like unlimited drawer tabs and Apex Notifier extension and to buy it from in app purchase you need to pay $4.49 to access its other features.

Apex Launcher Pro (Paid Version) Features:

• Powerful drawer customizations (sort apps in drawer, folders in drawer)

• Unread count notifications (provided by the free Apex Notifier extension)

• Convenient icon gestures 🙌 (swipe up and down actions)

• More gesture options (two-finger gestures)

• Additional transition effects (accordion, cross, etc.)

• Enhanced folder support (bulk add, merge folders)

• Advanced widget options (widgets in dock, overlapping widgets)

• More features on the way!

3-CM Launcher 3D Theme, wallpaper, Secure, Efficient

More Personalized——10,000+ free 3D themes, 2D icon packs, live wallpapers, lock screen themes and contacts themes to personalize your phone interface. 3D transition effects to redefine your stylish launcher. ★ More Secure——Lock screen, applock, hide apps & snap intruder all-round protect your privacy security. Anti-theft & Anti-virus secure your phone.★ More Efficient——Instant reply, smart card, quick search, intelligent apps sorting and phone & Wi-Fi booster makes your life more efficient.

This launcher is new in the market and can be considered as a launcher that you must try to customize your Android device. Its best part is that it will go very well with the storage capacity of your phone making it a light weight launcher but with great features of interest. Its highlighting specs is its anti virus protection that is built in it, that secures your device making it fast and safe.

its pros & cons includes:

Gets downloaded within 2 MB of storage hence is light, fast as well as stable.Its most important feature is its Direct Integration with CM Security against threats. Easy to use as it comes with basic designs and themes. Has smart folders to maintain your apps at one place with innovative icons. Though it is used by large number of users, it lacks in its battery saving mode as using this launcher, the battery of our device drains misleadingly.

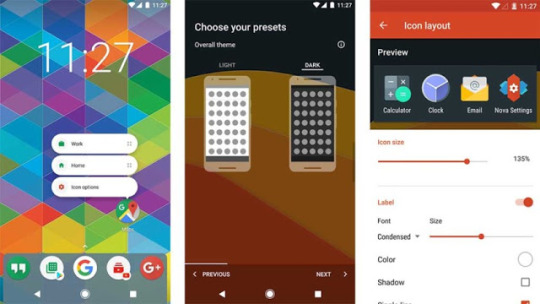

4- Smart Launcher 3

Simple, Light, Fast is the slogan of Smart Launcher, the innovative custom launcher that has been selected by Google as one of the best app on Play Store during January 2016. Smart Launcher automatically organizes your apps in different categories allowing you to intuitively find any app in few taps. Smart Launcher upgrades the interface of your device providing it a clean home screen powered by an efficient and styleable app launch center. Customization is a very important part of SL, any part of the app is personalizable and tons of free themes are available for free, providing icon pack, widgets and launcher skins. Almost any icon pack supported by Nova Launcher, Apex Launcher or Adw Launcher is supported in Smart Launcher too.

Some of the most notable features in SL are:

Exclusive app launch center layouts: try out the flower and the honeycomb layouts;

global, AI powered search bar: search in apps, contacts and web.

smart turn off: your screen automatically turns off when lay down your phone;

Many customization options and hundreds of free themes

on screen notifications: see which app needs attention (requires plugin);

knock off: turn off the screen with a double tap (requires plugin);

gestures support: up to 10 different gestures!

hide apps: remove any app from your app grid (works also with system apps)

security: select the apps you want to hide and protect them with a PIN.

popup widgets: double tap on an icon to show the widget you chose;

low resources usage: Smart Launcher is optimized to work greatly even on older devices and to use as less memory and battery as possible in any situation.

great wallpaper selection: new wallpaper proposed every day.

custom lock screens: personalize and add features to your lock screen;

interface optimized both for portrait and landscape mode

This Smart Launcher for Android users is the simplest styling launcher that is easy and fast in its use. It is commonly known for its Spin Style recent app menu, the feature that makes it rising in the list of launchers. If you have a small screen size then this launcher is at its best as this contains single home screen with certain short cuts arranged in stylish flower pattern. This arrangement allows you to swipe your different icons quickly.

5- Nova Launcher

The highly customizable, performance driven, home screen . Accept no substitutes! Nova Launcher is the top launcher for modern Android, embracing full Material Design throughout. Nova Launcher replaces your home screen with one you control and can customize. Change icons, layouts, animations and more. For my money, Nova Launcher is the best of the AOSP-style launchers available in Android. --Android Police

It doesn’t get too much better than Nova Launcher. Like Apex Launcher, Nova has been around since the good old days. It remains not only relevant, but one of the best Android launcher app options available. It has a laundry list of customization features that include gesture support, the ability to customize the look and feel of the app, icon pack support, themes, and much, much more. The app also gets updated at a breakneck pace which means bugs generally get squished quickly and new features are added consistently. It also comes with the ability to backup and restore your home screen layouts for when you eventually switch to a new phone. It's the one we'd recommend you try first. Nova Launcher has some very capable hands behind it --Phandroid

Our favorite is Nova Launcher, which strikes a great perfect balance between incredible performance and high customizability without getting too gimmicky and difficult to use --Lifehacker

Chock full of features you won't find in the stock launcher, and comes highly recommended --Android Central

Icon Themes - Find thousands of icon themes for Nova Launcher on the Play Store

Subgrid positioning - Much greater control than standard launchers, Nova Launcher allows you to snap icons or widgets half way through the desktop grid cells

Color controls - for labels, folders, unread badges, drawer tabs and backgrounds

Customize App Drawer - Custom tabs, Vertical or Horizontal scrolling, Custom effects

Improved Widget Drawer - Widgets grouped by app makes it much faster to use

Infinite scroll - Never far from your favorite page, loop through the desktop or drawer continuously

Backup/Restore - Sophisticated backup/restore system allowing you to backup your desktop layout and launcher settings

Scrollable Dock - Create multiple docks and scroll between them

Widgets in dock - Place any widget in your dock, such as a 4x1 music player widget

Import Layout - No need to rebuild your desktop from scratch, Nova Launcher can import from most popular launchers. Including the one that came with your phone.

Fast - Nova Launcher is highly optimized to do it's work quickly and quietly, keeping the animations smooth and letting you use your phone as fast as you can move your fingers.

Nova Launcher Prime

Unlock the following extras by purchasing Nova Launcher Prime

Gestures - Swipe, pinch, double tap and more on the home screen to open your favorite apps. Unread Counts - Never miss a message. Unread count badges for Hangouts, SMS, Gmail and more using the TeslaUnread plugin

Custom Drawer Groups - Create new tabs or folders in the app drawer

Hide Apps - Keep a clean app drawer by hiding never used apps

Icon Swipes - Set custom actions for swiping on app shortcuts or folders More scroll effects - Such as Wipe, Accordion, and Throw

#andriod#smartphone#mobile#tablet#apex#cm#smart#nova#action#launcher#google#education#knowledge#tree#purpose

0 notes

Text

How to Un-root Android Smartphones? (Only for Educational Purpose)

Rooting is useful on Android, but if you're looking to sell your device, or simply want to revoke your root privileges, it's useful to know how to unroot. Read our guide on how to unroot your Android phone or tablet.

Having root privileges is the equivalent of administrator privileges on a desktop PC. It just enables you to fully access and change things on your Android phone. However, some find the extra functionalities dangerous or want it disabled due to certain functions and apps not working. Niantic, the creators of the vastly popular Pokemon GO app disabled the use of rooted Android phones and jailbroken iOS devices.

You might also want remove root in order to receive official software updates, where some phone manufacturers prevent OTA updates if you're rooted - understandably you might want to permanently unroot your Android phone or tablet, so here's our guide. To check if you've got root, we recommend downloading Root Checker for free on the Play Store.

SuperSU unrooting

The SuperSU app is a must-have if you've rooted. Often you'll find the app installed after you've rooted, so look for it in your app drawer. If it's not installed you can download it for free on the Play Store. When you've launched the app and ironically granted it root access, you'll see a few tabs, more specifically Settings. If you scroll down within the Settings tab, you'll see a Full unroot option. Tap it and you'll be prompted to completely unroot your device - when you continue, SuperSU will close. Reboot your device and you should now be unrooted. Make sure to delete the app (among other root apps) after you've finished. Check with the Root Checker app to confirm a successful unroot.

Universal Unroot app

Another app that allows you to fully unroot your Android device is, Universal Unroot. The app is paid-for, where it costs £0.78 on the Play Store. The app works in the same way as SuperSU, but where some have had problems with SuperSU, Universal Unroot has had the ability to fully unroot an Android device. Once you launch the app, it will be self explanatory as you'll have the option to unroot your device. It should be noted that some phone manfacturers make it hard for apps to work, such as Samsung (with KNOX) and LG (with LG eFuse) that make it very hard to unroot. If you have a device with these features, we would suggest navigating to XDA Developers' forums and asking (search before asking!) about your specific device. Check the Root Checker app to confirm a successful unroot.

ES File Explorer (manual unroot)

ES File Explorer is a free file manager app on the Play Store that allows you to use root functionalities to delete system apps.

This method involves a more manual approach and might to guarantee you a full unroot, as it's only used to delete system apps (including root-apps), but this won't necessarily remove root from your file system. Nevertheless, it's worth trying if the prior two solutions haven't worked. Open ES File Explorer and scroll down to Tools and turn on Root Explorer. You'll be prompted to enable root, accept and go back to the main menu by tapping '/'. From your main directory, go into 'system' > 'bin' and find the 'busybox' and 'su' folders. Sometimes these folders might not exists on a device, but if they do, delete them. Go back using '/' and open the 'app' folder. Delete 'superuser.apk' and then reboot your Android device. You should now be unrooted, but if you're not read on. Also check the Root Checker app to confirm a successful unroot.

Flash stock firmware

If you still have root, the best option would be to flash stock firmware. There are many guides per device on the XDA Developers forums - as each device is specific. You can also find many YouTube guides, such as this one from TotallydubbedHD that guide you on how to unroot and flash a stock ROM.

Remember, every device is different, so be sure to download the right stock ROM (including region) and follow written guides for your specific device. If you're unsure, be sure to ask before flashing, or else you might end up with a very expensive brick!

It should also be noted that you can sometimes unroot by simply installing an OTA update. Unfortunately, this isn't always the case with all phone manufacturers, where some won't allow you to update while rooted and others simply don't push out many OTA updates. You can always check the Root Checker app to confirm if you've successfully unrooted.

#andriod#smartphone#mobile#tablet#root#access#education#educational#purpose#unrootable#google#operating#operating system

0 notes

Text

How to install Custom ROMs to Android? (Just for Educational Purpose)

One of the main reasons many people root their phones is to install custom ROMs. These are replacements for the operating system on the devices, and are often updated versions of Android that the manufacturers haven’t made available. The most famous ROMs are Cyanogenmod and Paranoid Android, both of which offer excellent alternatives to the bloat heavy offerings of many mainstream Android flavors. Installing a custom ROM is another risky venture, which should again only be undertaken with the knowledge that problems could occur. Non optimized ROMs could cause hardware issues, drain the battery quicker, and mean some apps don’t work properly anymore. Then of course there’s that old ‘brick’ issue.

Usually before you install a custom ROM you’ll need to create a Custom Recovery. This will allow the device to make a backup of your system, install ROMs, and provide a way to get going again if things go wrong. The most common types are Standard Recovery (this is a part of every Android phone), ClockworkMod (CWM) and Team Win Recovery Project (TWRP).

Apps such as TWRP Manager, ROM Installer and ROM Manager have the ability to create these Custom Recovery features, and they also provide a way of downloading ROMs and installing them on your device. As flashing a custom ROM can be a fairly tricky business, you will certainly need to visit sites like XDA Developers or the excellent Cyanogenmod, where you can search for the detailed steps that you will need to follow in order to flash the Custom ROM. It’s extremely important that you follow the steps to the letter, and read them several times before you begin. Otherwise you can quickly end up with an expensive paperweight on your desk.

We used TWRP Manager to install a dedicated ROM on our LG G3 that we downloaded from the CyanogenMod site.

The sequence for installing custom ROMs is essentially this

Root your phone

Find the version of the ROM for your specific device and download it to your phone

Download TWRP Manager or another ROM manager app

Use the ROM manager to create a Custom Recovery

Backup your existing ROM and data

Use the ROM manager to boot into recovery mode

Wipe the existing ROM

Flash the new ROM

Reboot your device

Creating a backup of your existing ROM means that if you don’t like the new one you install, or you want to put your phone back to its original state, you can use a ROM manager to restore the backup.

One thing to consider is that CyanogenMod and other ROMs don’t come with the Google Play Store as standard, and you’ll need to visit the CyanogenMod or relevant ROM builder’s site to find instructions for installing the service. It isn't difficult, certainly not now that you've gotten this far, but it still involves downloading software and using the Recovery mode to install it on your system.

Return to factory settings

If you’ve finished experimenting with ROMs and Root access, then there is a simple was to take your phone back to the way it was when you began. Open up the SuperSU app, go to Settings and then select the Full Unroot option. Hopefully now your device will return to its unrooted status.

If this doesn’t work then you can still unroot your phone, but it will involve researching your particular handset and maybe asking a few questions on the XDA Developers forums. They’re a friendly bunch though, so it’s not a bad way to spend some time

0 notes

Text

How to root Android Smartphones, tablet? (Just for Educational purpose)

Android is a wonderfully open platform, with Marshmallow and Lollipop being excellent examples of how far the OS has developed. There's even more potential under the hood though, and our beginner's guide to rooting your phone or tablet shows you how to get the most from your Android device. To root Android you'll need to enable Developer Mode and USB debugging on your device, then connect it to your PC. Free third-party software such as OneClickRoot can simplify rooting your Android phone or tablet, but alternatives are available. You can also root your phone or tablet without a PC using Stump Root. We'll explain all this in our guide to rooting Android below.

In-depth guide

One of the biggest advantages of the Android platform over its rivals is how users can customize devices to their personal tastes and requirements. The ultimate expression of this is rooting a phone. While Android is customizable, the layers of software that manufacturers often put on top of the OS can be limiting. Rooting is a way to get rid of this barrier, gain access to every aspect of the device, and take total control of your system. In this feature we’ll show you the basic principles of how to root a device running Marshmallow, Lollipop, or an older version of Android, and some of the pitfalls you need to avoid. This is a beginner’s guide, so you don’t need to be a seasoned technician to achieve a rooted phone. There are some risks involved though, including the potential to make your phone totally unusable, so we recommend you read through the article in full before you consider heading down this path, and if possible practice on an old phone first. That being said, rooting a phone is actually quite straightforward and the benefits easily outweigh the risks for careful users.

What does rooting mean?

Rooting an Android device is the process of gaining privileged or full control of the operating system, and even the software that runs the operating system. The idea is to get root access hence why it is known as 'rooting'. It's a bit like having a VIP pass at a gig, you can go anywhere you like and do anything you want (within reason). Rooting an Android smart phone or tablet is effectively the same as 'jail breaking' an iPhone.

Why should I root my Android phone or tablet?

Android is a mature platform now, and the arguments for rooting that made sense a couple of years ago hold a little less water these days. Google has worked hard to refine the user experience, and the current iteration – 6.0 Marshmallow – is a clutter-free work of art that feels a long way from the dark days of Froyo and Gingerbread.(We've largely blanked those from our collective memory.)

The problems occur when phone manufacturers lay their own interfaces on top of it. Far from improving Android, they often make things slower, uglier and more confusing. Then there’s the mortal sin of pre-loaded apps, often duplicating the functionality of stock Google versions, and being impossible to remove. Not only does this take valuable storage space away from the user, but it seems to suggest that this expensive device you’ve paid for doesn't actually belong to you. If you want that kind of experience then a trip to the Apple Store is probably a good idea, and at least you’ll be able to sell the device for a decent amount of money when you decide to upgrade. The good news is it doesn't have to be this way. If you want to control every aspect of your device, choosing the access apps have to the web and the very interface itself, then rooting remains a solid option. The process is free, shouldn't take too long, and in many cases is reversible. Of course if you don’t want cumbersome pre-loaded software suites, then there is the more capitalistic approach of not buying a phone from a manufacturer that employs such tactics. Instead you can pick up one of the Nexus range from Google, which includes the Nexus 5X and its larger brother the Nexus 6P, or a Moto G, Moto X Play, or Moto X Style from Motorola, all of which arrive with a minimum of bloat. But if you already have a different Android phone, or have your eye on one in particular, and just don’t aren't keen on the software, then rooting could let you build the device of your dreams.

Is rooting Android dangerous?

Rooting isn't a five-minute job. The decision needs a bit of thought. First, rooting your phone will absolutely void your warranty. Manufacturers don’t want you to do it, Google doesn't want you to do it, and you won’t get any customer support if you run into problems…and you are likely to run into problems. The worst case scenario is you will brick your phone. This doesn't mean you grow so frustrated that you'll throw it against the wall - it simply describes the technological abilities your phone will possess if rooting goes wrong. Which is nothing at all. Hence, a brick.Security becomes a more serious concern. Many of the reports you read about malicious attacks on Android users will most likely involve rooted devices, or certainly those running software not found on the Google Play Store. So it’s more risky than a standard setup. But, and this is very important, if you do your research, are not afraid to learn how things work, and don’t mind spending time fixing software problems, rooting can be hugely liberating and give you a device that is truly your own. Just remember, backup anything important before you begin, preferably to a PC or cloud service.

Can anyone root Android?

Considering the risks involved with rooting our advice is that you should only do it on your device if you can survive if something goes wrong. If you already have doubts then it's probably best to leave things well alone. We said this was a beginner's guide - which it is - but that doesn't mean rooting is suitable for everyone. If you're keen to learn about rooting, use - or buy - an old, cheap phone to practice on before moving up to your main device.

Rooting a device running Android 6.0 Marshmallow

Since its release in October 2015, the Android 6.0 Marshmallow update has been slowly making its way out into the Android community. As it remains a relatively new version of Android, the number of phones actually running the software is still quite small. At the time of writing only a handful of the major manufacturers have released the Marshmallow update for their handsets so far, although we expect to see this increase rapidly throughout the next few months.

This absence means that there are very few options available for those who want to root their brand new devices. Our investigations only found solutions for Google’s own Nexus range of handsets and the LG G4. All of these routes involve unlocking the bootloader, wiping devices, installing a new kernel, then installing a custom ROM, all of which is simpler than it sounds but would still be a challenge for many beginners. For the moment we’d recommend holding off for a few months, as the hacking community is bound to produce tools that automate parts of the process, which would make it a little less intimidating. As so much of rooting involves fixing issues by talking with others that have already worked through them, it’s a good idea to let more experienced hackers go before you and weed out any potential nasty bugs that could cause your phone problems. Remember, being one step ahead makes you a pioneer, being two steps ahead makes you a martyr.

How do I root Android? Step-by-step guide to rooting Android Lollipop or earlier versions

The first thing to know is that there isn't a ‘root my phone’ button on your device. It’s also not entirely clear whether your particular handset can be rooted easily. So before you begin thinking about custom ROMs or root-enabled apps, you’ll need to research your specific Android phone or tablet. A good search term is ‘[model name] how to root’. More often than not you’ll probably find a link to a website called XDA Developers, which is undoubtedly the best resource for this sort of thing. Here you may well discover that there are many variants of your handset, each with different identifying numbers and codes. European models tend to vary from their North American cousins, as do the ones from other parts of the world. To find your exact unit go to Settings on your phone and navigate through General>About Phone, then check the Model number. On some Android variants you might find this in the Hardware Information option on the About Phone menu. You’ll also want to know which flavor of Android you’re running, so visit Settings>General>About Phone, and check the Android version. Again some phone will have this under Software Information. Another thing you’ll need to do before you can root your phone, no matter which method you use, it to turn on Developer mode. To do this go to Settings>General>About Phone, then tap on the Build number several times until you see a message saying that you are now a developer. Then when you return to Settings>General you’ll see that Developer Options has appeared on your menu, tap this and ensure that USB debugging is turned on.

Armed with your handset model information you should be able to track down the method that exists to root your phone. While we were writing this guide we used an old LG G3 that we had in the office, and found a couple of different tools that were recommended. The most appealing was OneClickRoot, which is a website that promises a simple process for rooting a number of Android phones. You visit the site, find your phone, download the free software, then connect your phone to your PC and run the root process. There are a number of other downloadable Root tools to choose from, such as SuperOneClick, Unlock Root, Z4Root and Universal AndRoot, but you'll need to check if your device is supported.

The potential hazards of trying to root a phone showed up straight away for us, as the OneClickRoot method didn't actually work. Our phone appeared on the list, it matched the model number, but when we tried to root a message appeared saying our device wasn't eligible yet, but would hopefully be added in the future. There was a chat option, but we decided to carry on our search. We tried another piece of software that was recommended on several sites, but this time the program wouldn't actually run on our PC, even after several attempts and multiple copies being downloaded.

We mention this because the path to rootedness can be filled with this sort of frustration. It’s very much a community effort, run by enthusiasts, and therefore you can expect to spend lots of time on forums if things don’t turn out as you’d hoped. Of course, you might try any of the above and find it works first time, which would have been our experience if we’d started with Stump Root.

Is my phone rooted? How do I know if my phone is rooted?

When you first turn on a rooted phone there isn't much to differentiate it from an unrooted one. A quick way to make sure is to download the free Root Checker app from the Google Play Store. Just tap the Check button in the top right hand corner of the installed app, and it will do a short scan of your system and confirm whether you have Root Access or not.

Why do people root Android?

One of the first apps to download from the Google Play Store is SuperSU, which allows you to control the permissions that root apps have, alongside a variety of other settings. Depending on how you rooted your device, SuperSU might already have been installed, or you might find an alternative called KingRoot on your system which does many of the same things. There are some very useful apps that require root access, and now you can use any of these on your phone. If you really want to gain complete governance over your system then Device Control is an excellent app that has options for a whole manner of deep settings such as speed limits on your CPU, internal temperature controls, and the Tasker which allows you to create rules for how your phone behaves in different circumstances. This last one is incredibly useful, but can be intimidating to make sense of at first. We recommend searching for a few tutorials online, and before you know it you’ll be whizzing around the interface. Device Control requires another app, Busybox, to work properly, but you’ll be taken to the right place to install it when needed.

Backing up your phone is another very handy feature, and this can be achieved by downloading Titanium Backup app from the Google Play Store. Once installed you can use Titanium to make backups of your user data, applications, or both. To do your first full backup tap on the Backup/Restore tab at the top of the app, then tap Menu>Batch action>Backup all user apps + system data, then tap the green tick.

If you want to fine tune your system and customise its behaviour even further, but don’t fancy heading down the more nuclear Custom ROM route, then the Xposed Framework offers many of the advantages of custom ROMs, but without the hassle. It’s not a standard app you’ll find in the Google Play Store, so you’ll need to search for it online - just go to the XDA Developers site - then install it, and download some of the many tweak packs that actually do the adjusting. Popular options include Tweakbox, and the MoDaCo Toolkit.

0 notes

Text

How to remove sponsored ads in uTorrent

uTorrent displays sponsored advertisements in the free version of its torrent application. These ads help keep uTorrent free, but can bog down slower computers. While you may know that you can pay to upgrade uTorrent to an ad-free version, you may not realize that ads can easily be disabled in your preferences. Learn how to disable ads in uTorrent by adjusting some settings, as well as how to upgrade to the uTorrent Ad-Free.

Open the uTorrent application. While the free version of uTorrent displays ads by default, you can disable these ads in the Preferences menu.

uTorrent ads ensure that the developer can provide a free version of the program without losing money. If you like uTorrent and want to thank the developers, you may consider paying $4.95 USD to upgrade to the ad-free version. (By Clicking Here)

Click "Options" and then select "Preferences" from the menu bar.

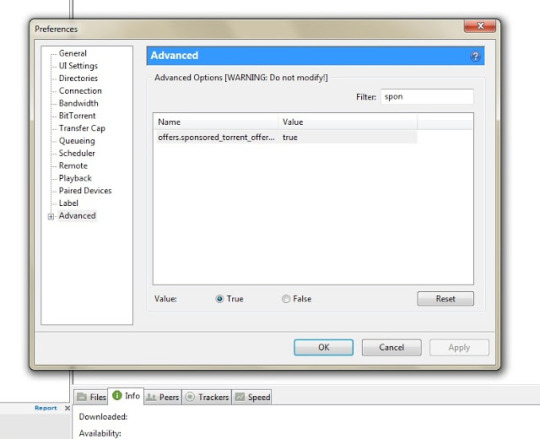

Select "Advanced” from the list on the left side of the Preferences window. “Advanced” is at the bottom of the list.

Now in "Advanced" option find all three options by writing the same (as shown in Pictures) in Top Right "Filter" Box. After finding all three options (Name Listed Below):

gui.show_plus_upsell

offers.sponsored_torrent_offer_enabled

offers.left_rail_offer_enabled

Now set All these three options to "False" and Click "OK" to save your changes.

Note that if you did not find one (or more) of the above options in Advanced Options, don’t panic—uTorrent sometimes changes the names of these options. Return to the Advanced Options screen and type “offer” into the “Filter” box. Now, change all of those currently set to “True” to “False”.

Click “File” and then “Exit” to close uTorrent. To make sure all of your changes take effect, restart uTorrent.

Open uTorrent and enjoy your ad-free experience.

0 notes

Text

What is the Difference between a 32 bit and 64 bit Smartphones?

Whenever you look at a phone you go for the specifications of the phone that it how much RAM and storage of this particular phone has. One thing you may have spotted is the point at which a smart phone is either "32-bit" or "64-bit" which isn't plain as day with reference to what it implies precisely. Usually, what does it mean? We should investigate the distinction between 32-bit and 64-bit for Android Smart phones, what it implies for you as a client, and which one is the better decision.

What Does 32-and 64-bit Mean?

Given how greater numbers on PC equipment typically mean better things, it's anything but difficult to assume that a 64-bit smart phone is a change over a 32-bit smart phone. In any case, what does 32-and 64-bit mean precisely?

This specification identifies to the type of processor inside the device being referred to. At the point when a processor is named as 32-or 64-bit, it's alluding to the amount of values that can be put away on that specific processor's register. Processors utilize their register to store information as they play out their job, so more space means more values can be reserved. A 32-bit processor has space for 2^32 vales (around 4 billion, adjusted down), while a 64-bit processor can store 2^64 of them (18 quintillion, adjusted down). This implies 64-bit processors have four billion more addresses at their disposal than 32-bit processors – an unmistakable change!

What Difference Does It Make?

So now we've discovered that a 64-bit processor has significantly more handling space than a 32-bit processor, which certainly sounds amazing on paper. What does it mean when we think about 32-bit and 64-bit for Android smart phone? What would we be able to see on a 64-bit smart phone that we won't see on a 32-bit one?

Processor

With the additional space that 64-bit processors have, they can get through a greater number of information every second than 32-bit processors. All things considered, they have a great deal more space to store more information, which implies they can chip away at bigger volumes of information without going back to memory as regularly as 32-bit processors do. Therefore, 64-bit processors can take in and prepare information speedier than their 32-bit partners – dependably an or more!

RAM

One fascinating advantage of 32-bit versus 64-bit for Android smart phone is that 64-bit processors increment the amount of RAM that can be basically utilized as a part of a device. The size of a 32-bit register implies that product is confined to utilizing 4 GB of memory at an absolute best. This implies that if we use more than 4 GB of RAM in a smart phone with a 32-bit processor, the additional RAM can't be utilized by software and "goes to waste" subsequently.

There are ways we can bypass this farthest point; however, by just installing a 64-bit processor, the size of its register permits us to utilize around 16 exabytes (17 billion GB) of RAM in a device. Obviously, it'll be quite a while (if at any time!) before we utilize that much RAM, which implies we can have more than 4 GB of RAM in our smart phones. More RAM means more space to place applications in memory which implies multitasking between applications gets a considerable measure smoother.

APP

One thing that won't generally accelerate when moving to 64-bit are the applications and the working framework installed on the smart phone. The issue here is that the developers may have coded these for 32-bit frameworks, so they didn't take advantage of the additional equipment a 64-bit smart phone brings to the table. All things considered, if the developer was going for a 32-bit smart phone, why might they try attempting to utilize equipment that isn't there? Nonetheless, if the operating system or application was coded in light of 64-bit, there will be remarkable contrasts in speed compared with 32-bit variations.

How to find if your Device is 64-bit?

If you want to check that if your own smart phone is 32-or 64-bit, you can do as such effortlessly with the app name AnTuTu Benchmark. Once you've downloaded and installed the app, then on the bottom right of the app press Info and check under the CPU class for the Type field. It will disclose to you what sort of processor does your smart phone has.

Conclusion

Unlike something like disk space, the topic of 32-bit versus 64-bit for Android smart phone isn't generally clear as crystal. Ideally you'll now comprehend what the particular is, the thing that it implies for android smart phones, and regardless of the possibility that your own smart phone is 64-bit or not.

Did you make the jump to 64-bit smart phone? Provided that this is true, did you see a distinction in performance, or did it feel the same as some time recently?

Let me know if you feel any distinction in performance in the comments down below.

0 notes

Text

Concept of Musharakah in Islam (Islamic Banking)

Musharakah meaning partnership, is an Islamic mode of finance in which capital is provided by two or more parties for project development. Banks can provide financing to a project with equity rather than a fixed-interest loan, which most pious Muslim consider haram (forbidden). The profits of the project are shared among the investing parties on the basis of their participation or on a pre-agreed ratio and the losses are shared on the basis of equity participation. The difference between Musharakah and mudarbah is that in Musharakah, all involved parties provide capital to share in the profit or loss of the project. In mudarbah, one party provides the capital and the other acts as an agent to invest it. The agent in a mudarbah does not share in the losses.

Equity finance is considered the backbone of Islamic banking. Yet, in the last two decades, debt finance, i.e., short-term Murabaha, has been the most popular mode of financing for Islamic banks. With the growing demand for long-term financing, some Islamic banks are beginning to get involved in providing Musharakah financing for projects. In 1997, the Saudi British Bank provided a U.S.$72 million Musharakah facility to the Abdul Lateef Jameel Group, Saudi Arabia, which provided financing to individual clients for the purchase of Toyota cars. The Musharakah is essentially unsecured funding and exposes banks to a higher risk than that faced through Murabaha or Ijarah, where the funding is secured by the asset. However, the risk in the Musharakah can be mitigated by choosing an appropriate security structure.

Areas of Application

Musharakah financing is very flexible and can be used to finance domestic industry, working capital finance and trade financing - imports and exports. Musharakah is good substitute for short term corporate facilities as provided by conventional banking in addition to overdrafts or running finance, short-term financing, bridge financing and/or project financing.

Difference B/W Islamic & Conventional Banking

We selected two banks first is Faysal banks taken as the conventional banks representative

Second one is Meezan bank as representative of Islamic banks,

Meezan Bank

MEEZAN was established as an Islamic Investment Bank in 1997 as “AL MEEZAN INVESTMENT BANK LTD”. First Islamic Commercial Bank’s license was awarded to Al Meezan Investment Bank in year 2002, They bought the local operations of “Society General” (French Bank) 03 branches. In 2009, Branch network of six dedicated Islamic banks increases to 480 branches (including sub-branches) Meezan Bank having a 42% share of the Islamic Banking branch network in the country. 201 branches in 54 cities across the country. Over 5.5% of the total Banking industry.

Similarities

Conventional banking practices are concerned with "elimination of risk" whereas Islamic banks "bear the risk" when involve in any transaction.

When Conventional banks involve in transaction with consumer they do not take the liability only get the benefit from consumer in form of interest whereas Islamic banks bear all the liability when involve in transaction with consumer. Getting out any benefit without bearing its liability is declared Haram in Islam.

Faysal Bank

Faysal Bank Limited was incorporated in Pakistan on October 3, 1994, as a public limited company under the Companies Ordinance, 1984. Currently, the Bank's shares are listed on the Karachi, Lahore and Islamabad Stock Exchanges. Faysal Bank is engaged in Commercial, Consumer, Corporate and Islamic Banking activities. The bank is principally engaged in providing consumer, corporate and investment banking services to its customers. The bank offers a wide range of consumer banking products and services which include deposit accounts, car loans, home loans and other consumer loans. It also provides treasury and capital market services and cash management services to its customers.

Balance Sheet of Bank

#application#concept#conventionlife#conventional#islam#islamic banking#bank#musharkah#riba#interest#private#public#balance#sheer

0 notes

Text

Awareness about Islamic Banking in Pakistan

Banking sector has immense important for the growth and economic development of a country. Pakistan has a growing economy and banking sector is playing a vital role in it. Being a Muslim nation our first priority should be Islamic Banking. Efforts for economy wide elimination of Riba started during 1970s and most of the significant and practical steps were taken in 1980. In 1980 initial steps were taken by the State Bank of Pakistan by changing the rules and regulation of the Banking sector. After that in 2001 first certificate had been issued to Meezan bank of Pakistan as a full fledge Islamic Bank. And present there are six full fledge Islamic Bank in Pakistan. (Meezan Bank, Albarka Islamic Bank, Dai Islamic Bank, Dawood Islamic Bank, burj Bank, Bank Islamic Pakistan). More efforts are needed to increase the share of Islamic bank in Pakistan.

Question is how much people are aware about the Islamic banking in our country?

The demand for Islamic banking in Pakistan is strong. Industry is growing rapidly since 2002. The potential for further expansion is vast in Islamic Banking. However it requires awareness about Islamic banking. For this purpose steps should be taken to educate the people. According to a research majority of the people know about the Islamic banking but they do not know about the product offered by the Islamic Banks, such as Musharaka, Mudarbah etc. Most of the people think that Islamic banking is such like conventional Banking. Here need arises of aware to the people about the benefits of Islamic banking. For the purpose of growth, Islamic Banks should start public awareness programs. Islamic Bank is an institution of conducting business according to Islamic values and for the welfare of the society. To promote this slogan Islamic bank should conduct social welfare programs, launch development projects and play their role to eliminate poverty from the society. These are the steps towards success which can motivate people towards Islamic banking. An important issue arises here that, most of the customers are using both banking system Islamic as well as conventional. The reason is IBS do not provide the efficient product to their customers as the conventional banks provide. So Islamic banks have to consider this issue and offer the products to their customers and expand their networks and the products. Awareness should be created that the product offered by the Islamic banks is different from the conventional banks.

The Role of education is crucial in every aspect of life. Education gives us knowledge and enhances our perception and our point of view about things in the right way. Education makes a person capable to do things right. It is quoted that “Education is that whole system of human training within and without the school house walls, which molds and develops men”. The lack of education and unawareness creates ignorance and uncertainty in our choices. Islamic finance industry is facing the challenges of ignorance about the Islamic banking system. People have different point of view about Islamic banking, some says Islamic bank is just like the conventional bank, whereas few do not agree with the concept of Islamic banking and finance system. People do not consider their religious obligation while entering into banking system. They are not well aware about how harmful riba is for the society as well as for the Day of Judgment.

According to a Hadith of Holy prophet (PBUH) trading with riba is a much graver sin than eating pork.

However majority of the Muslims do not consider it as much. These all challenges are due to lack of awareness about Islamic financial system and education. In fact promoting Islamic financial system is not only fulfilling the religious obligation but good for the economy of the country. Many of the Muslims as well as the non-Muslims country adopted the Riba free banking system and benefiting their economies such as Malaysia, Indonesia, Qatar, Saudi Arabia, Kuwait, Bahrain and UAE. These countries are fully benefiting their economies from Islamic financial system. Pakistan as a Muslim country should takes steps to promote the Islamic financial system in country by educating the people. This all can be done by the proper education and awareness of the people. Although it not an easy task to educate the people easily in a country where the literacy rate is 56 %( according to World Bank), but steps can be taken to educate the people. In this sense Islamic bank can play vital role by expanding their operations in every locality and involve with the local communities. They should Offer the benefits to the customers which they can be offered by the conventional banks. State should offer the syllabus in which Islamic banking should be taught to students. Prohibition of the Riba should be emphasized in the syllabus which will improve awareness about Islamic banking since childhood. As we have discussed earlier that most of the people think that there is no concept of Banking in Islam.

Let’s agree that concept of Banking is not prescribed in Quran and Hadith but the other comprehensive source which lay out the foundation of Islamic banking is there. Shariah provides the guide line about conducting business in fair way. Awareness of Shariah roles and their compliance is necessary to promote Islamic banking in Pakistan. People should be educated that Islam emphases both Ibadat as well as mamlat. Most probably 75% teaching of Islam is about mamlat. It is well said “It's all to do with the training: you can do a lot if you're properly trained (Queen Elizabeth II). A well-educated and trained person can persuade people easily. The staff of Islamic banks should be properly trained and well educated. They must know about the Islamic financial practices properly. They just not only know about practices of banks but also having proper knowledge of Shariah. Proper trained staff can guide the customer easily and they can very well explain the products of Islamic banking. It should be mandatory for the banks to hire the staff which possesses at least basic knowledge of Shariah as well as the banking practices.

Evidences have shown that the staff of the Islamic bank lacks the basic knowledge about the products of Islamic banks. Thus the staff should be qualified and trained in their field. A well trained staff leads to increase in product selling. So Islamic banks should focus on the training of their staff. Training session should be conducted with a regular interval. Shariah advisers can play their vital rule in the training and development of the staff. Advisers have to make sure that bank is running in compliance with the Shariah regulation and SPB laws. It is also noticed that mostly the management of the Islamic banking has started career with conventional banking. They have concern with attractive salaries and better opportunities so they moved to Islamic banking. Such people cannot represent the Islamic banks ideology. However, there were a few who had a more faith driven agenda in moving to the Islamic banking sector. So the selection and the training of staff do matter in the awareness of Islamic Banking to public.

Ulema can play their important role in the development of Islamic banking. They can create awareness in people about Islamic banking. They can take steps in the elimination of riba, and this is their religious obligation as well to tell the people how strictly riba is prohibited in Islam. Ulema should give the reference to the Quran and Hadith to people.

Allah says in Quran.” O ye who believe! Fear Allah and give up what remains of interest, if you are truly believers. But if you do it not, then beware of war from Allah and His Messenger; and if you repent, then you shall have your principal; thus you shall not wrong nor shall you be wronged”

Islamic banks with the help of their Shariah advisers promote role of Ulema in eliminating riba from the society and gives the alternative financial system to the people which is according to the role of Shariah. Shariah advisers which are working in Islamic banks and check their transaction must make it sure that any of the dealing is not against the principle of Shariah. Because it is said that Islamic banking is also involved in such dealings which deviate from the Shariah, obviously this is impossible without the permission of their advisers. Board of Shariah advisers should have to check this issue and build the trust of public that Islamic banking system is different from the conventional banks.

Awareness of Islamic banks can be created with the help of media campaign. People can be encouraged to deposit their savings in the banks. Most of the people have spare money and they could not deposit their money in the banks. Such saving remains idol unless it would be invested in productive purpose. If people deposit their saving in the banks it creates capital formation which leads to employment opportunity in the country. So such people should be motivated and offered incentives on their investments in banks. Sometimes people think that they can suffer the loss as well profit if they invest in Islamic banks. Bank guides them, if there would be no chances of loss or the investment is fixed it will be riba which is not allowed in Islam. State bank is the pioneer which took step in 1980 first time to implement Islamic banking in Pakistan. And in 2002 a full fledge Islamic bank was open in this regard.