#AI accounting software

Explore tagged Tumblr posts

Text

AI Accounting Software | AI Accounting Management System

Optimize financial management with AI accounting software. Automate tasks, increase accuracy and streamline processes with an advanced AI accounting management system for better business decisions.

0 notes

Text

5 Ways Artificial Intelligence Accounting Software Can Help Finance Teams Be More Proactive

In today’s fast-moving world, finance teams can’t afford to be reactive.

Staying ahead means having tools that simplify processes, deliver real-time insights, and reduce errors.

Enter Artificial Intelligence Accounting Software – the superhero your finance team needs! 🦸♂️📊

Here’s how it works its magic:

1️⃣ No More Mundane Tasks: Say goodbye to manual data entry and invoice headaches! AI automates repetitive jobs, saving time and reducing errors.

2️⃣ Real-Time Insights: Keep your finger on the pulse with up-to-the-minute data. Spot trends, flag anomalies, and make smarter decisions on the fly. 🚀

3️⃣ Compliance Made Easy: Tax laws? Regulations? AI keeps track so you don’t have to. It ensures accuracy and avoids costly mistakes. 🛡️

4️⃣ Smart Decision-Making: AI turns raw data into actionable insights, helping you plan better and seize opportunities. 📈

5️⃣ Teamwork FTW: Centralized data and seamless collaboration features mean fewer silos and faster workflows. 🙌

Artificial Intelligence Accounting Software isn’t just a tool; it’s your partner in transforming your finance team into a proactive, strategic powerhouse.

Ready to supercharge your accounting game? 💡

Read more about it from this link!

#AI Accounting Software#Finance Team Tools#Smart Accounting#Proactive Finance#Artificial Intelligence In Business

0 notes

Text

Expense Management Software - Spend Management Tool

Docyt AI's ExpenseFlow helps you manage spend, close your books daily, and automate manual expense management tasks.

#accounting platform#ai accounting software#software#best ai accounting software#automated bookkeeping software.#ai tools for accounting#business

0 notes

Text

So, anyway, I say as though we are mid-conversation, and you're not just being invited into this conversation mid-thought. One of my editors phoned me today to check in with a file I'd sent over. (<3)

The conversation can be surmised as, "This feels like something you would write, but it's juuuust off enough I'm phoning to make sure this is an intentional stylistic choice you have made. Also, are you concussed/have you been taken over by the Borg because ummm."

They explained that certain sentences were very fractured and abrupt, which is not my style at all, and I was like, huh, weird... And then we went through some examples, and you know that meme going around, the "he would not fucking say that" meme?

Yeah. That's what I experienced except with myself because I would not fucking say that. Why would I break up a sentence like that? Why would I make them so short? It reads like bullet points. Wtf.

Anyway. Turns out Grammarly and Pro-Writing-Aid were having an AI war in my manuscript files, and the "suggestions" are no longer just suggestions because the AI was ignoring my "decline" every time it made a silly suggestion. (This may have been a conflict between the different software. I don't know.)

It is, to put it bluntly, a total butchery of my style and writing voice. My editor is doing surgery, removing all the unnecessary full stops and stitching my sentences back together to give them back their flow. Meanwhile, I'm over here feeling like Don Corleone, gesturing at my manuscript like:

ID: a gif of Don Corleone from the Godfather emoting despair as he says, "Look how they massacred my boy."

Fearing that it wasn't just this one manuscript, I've spent the whole night going through everything I've worked on recently, and yep. Yeeeep. Any file where I've not had the editing software turned off is a shit show. It's fine; it's all salvageable if annoying to deal with. But the reason I come to you now, on the day of my daughter's wedding, is to share this absolute gem of a fuck up with you all.

This is a sentence from a Batman fic I've been tinkering with to keep the brain weasels happy. This is what it is supposed to read as:

"It was quite the feat, considering Gotham was mostly made up of smog and tear gas."

This is what the AI changed it to:

"It was quite the feat. Considering Gotham was mostly made up. Of tear gas. And Smaug."

Absolute non-sensical sentence structure aside, SMAUG. FUCKING SMAUG. What was the AI doing? Apart from trying to write a Batman x Hobbit crossover??? Is this what happens when you force Grammarly to ignore the words "Batman Muppet threesome?"

Did I make it sentient??? Is it finally rebelling? Was Brucie Wayne being Miss Piggy and Kermit's side piece too much???? What have I wrought?

Anyway. Double-check your work. The grammar software is getting sillier every day.

#autocorrect writes the plot#I uninstalled both from my work account#the enshittification of this type of software through the integration of AI has made them untenable to use#not even for the lulz

25K notes

·

View notes

Text

Accounting Automation: More Than Just Speeding Up the Workflow

Finance operations are quite similar across different industries and regions. Accounting maintenance, financial report creation, and accounts receivables management are core responsibilities of finance and accounting teams.

Over the years, using software to handle traditional accounting tasks has greatly improved efficiency, accuracy, and compliance. Given the current economic climate, organizations that delay implementing accounting process automation for their finance and accounting functions risk reduced productivity and decreased efficiency. Read more at https://pathquest.com/knowledge-center/blogs/accounting-automation-more-than-just-speeding-up-the-workflow/

0 notes

Text

All of the vocal editing Reddit posts I could find just said to use different AI programs for voice editing, so I tried one

It turned my vocal issued from the Tardive Dyskinesia into a heavy southern accent

So, to answer the question, DON'T!!!

#editing#voice#disability#tardive dyskinesia#vocal problems#content#content creation#youtube#youtuber#ai#anti ai#experimentation#experiment#test#i was having issues with my current software#kdenlive#the recording i made just would not fix and i could not re-record#every search i tried lead to reddit posts#and the reddit posts just kept saying to use ai tools#so#i tested one#disability be damned i guess#fuck ai#ai bullshit#i do like to experiment though#it just showed the terrible issues that can't be accounted for by the ai#since they work based on trends#and they would need a lot of trends to understand speech issues like mine#speech issues#reddit

2 notes

·

View notes

Text

What should I look for in an ERP solution

Everyone says that they have an ERP solution at a wide range of price points. How do I choose one for my SME

Longevity

Check if the ERP solution would meet your requirement 5 years from now when you grow say 5X, add new manufacturing locations, add different lines of business. ERPs not only need to address the growth volume of your business but need to adapt to the business process changes required as you grow.

How easy it is to use

Can your average user learn and adapt easily, this is more relevant for SME organizations trying to embrace ERPs , as they are not in a position to employ specially trained skills for ERP implementation or operations. Your cloud ERP should be intuitive to use and as simple and easy as an e-commerce website. Make sure that the user experience is simple and follows the typical standards of any web application.

A SaaS model helps

A SaaS based ERP allows you to start with very low opex costs and minimal investment. Your opex increases as your business grows and you have a more rational approach towards investment in technology.

What about open source

One major advantage of open source solutions is that there is no license cost to acquire it. Other than that, open source solutions really don't provide any additional benefits to the end customer, most of whom would like to concentrate on their business, rather than trying to change or modify the source code. Secondly since it is open source, support and feature enhancements are driven by the community and the community should be as eager as you to add a feature .

Check the total cost of ownership of open source solutions.

1.Requirement understanding costs

2.License costs

3.Hosting or cloud costs and all the licenses required to run the open source

4.Support costs

5.Cost and reliability of making changes in the solution

The connected EcoSystem

Organizations need to leverage on the connected ecosystem. Does your ERP provide open and easy connectivity to marketplaces, statutory bodies, vendor and customer systems, banks and financial intermediaries. Does it have the capability to provide APIs for easy and quick integration and implementation.

What about AI in ERP?

A number of ERP vendors have started incorporating AI in their ERP solutions, and most of them are Cloud ERP providers. It is impossible to incorporate the infrastructure required for AI on an stand alone ERP system, the costs become prohibitive. Cloud ERPs can build AI capabilities leveraging the cloud infrastructure and share the same infrastructure with all the users.

There are already a number of use cases where AI can be used in an ERP, for instance read unstructured documents / emails using AI and convert them to Sales orders, Expenses, GRN in the ERP. Flag transactions which seem irregular by nature, detect fraud or suspicious transaction, increase planning accuracy using AI, continuous auditing, realtime evaluation of your business partners and Ai driven business analytics and Insights

To conclude

Though most ERP vendors will try and match your requirement document either "out of the box" or by so called "minor" customisation, you need to look beyond the current requirements and ensure that your ERP vendor has a track record of adapting and leveraging trends in technology so that you will be able to stay ahead in the future.

Visit Our Site To Know More :-https://proteustech.in/

#erp#erpcloud#erp software#cloud erp#saas#erpdevelopment#ERP software#software services#proteusvision#vision AI#Vision ERP#ERPsolution#cloud computing#sap erp#cloud accounting#cloud solutions#cloud nonsense#VisionCRM

2 notes

·

View notes

Text

The way they're sneaking and forcing this should be illegal.

It should be illegal.

It should be completely illegal.

If I don't know it's happening or can't opt out, it's violating. If I can't get it to stop prompting me to use it, it's intrusive. It's stealing from me and spying on me, and I can know about it but not do anything about it. It's in my face all the time. AI content is cluttering up all the places I go for news, info and entertainment. I'm sick and tired of it. The fact that you can't opt out is a violation of the free market also - I'd like to withdraw my business AT LEAST until they get the environmental and legal concerns ironed out, but alas! I can't!

I hate it I hate it I hate it

#AI can die in a hole#except bakery scan 💛 which is artisan software designed by a small team that can be adapted to help find cancer cells#and is not an LLM that steals from you#and has never bothered me once#as a person with an interest in software engineering i have to acknowledge how cool AI can be#but LLMs strike me as sloppy even tho they're cool in theory#they DEFINITELY shouldn't be consumer level software imo#and they definitely certainly absolutely shouldn't be so widely available at least until the concerns are ironed out#legal and environmental and misinformation concerns#like with the Internet we're not ready as a society for the problems AI poses#we haven't even gotten to a point where laws fairly account for what happens on the Internet#and we've had the Internet for like 30 years#adding AI to that is gonna be a mess. it already is

76K notes

·

View notes

Text

Free Accounting Software; Simplify Your Finances

Discover Manager.io, free accounting software for small businesses. Track income, expenses, and invoices easily. Offline access, multi-currency support. Simplify finances today! See more...

1 note

·

View note

Text

Fiscal50 is an AI-powered online accounting software designed to simplify financial management for small businesses and startups. It offers features such as automated bookkeeping, invoicing, and an AI virtual assistant to streamline financial workflows.

The platform provides various pricing plans to accommodate different business needs, including a Starter plan at $5.50 per month and a Business plan at $15.50 per month, each offering a range of features tailored to support business growth.

Fiscal50's AI-driven tools aim to reduce errors and save time, making it a valuable asset for businesses seeking efficient and accurate financial management solutions.

For more information, visit fiscal50.com.

#automated bookkeeping software#small businesses#virtual bookkeeping#software#ai accounting software

0 notes

Text

How to Pick the Best AI Accounting Software for Your Needs

In today’s digital world, managing accounts manually feels like a thing of the past.

AI accounting software has stepped in to save the day, automating tasks like data entry, GST reconciliation, and financial reporting.

But how do you find the right one for your business?

Start by identifying your specific needs. Are you a small business owner, or do you manage multiple clients? Understanding your pain points—like errors in data entry or time-consuming reconciliations—can help you prioritize features.

The best AI accounting software should offer seamless automation, compatibility with your existing systems, and scalability to grow with your business. Security and user-friendliness are non-negotiable, too.

Choosing the right software isn’t just about saving time—it’s about boosting productivity and ensuring peace of mind.

Want to know more about finding the perfect AI accounting partner? Here’s the link!

0 notes

Text

AR Analytics: Leveraging Accounts Receivable Analytics for Actionable Insights

Efficient Accounts Receivable (AR) is an essential component of any organization’s financial health. Effective management of AR ensures that the company maintains a healthy cash flow, minimizes the risk of bad debt, and fosters strong customer relationships. One of the most powerful tools at a company’s disposal to enhance AR processes is analytics. By leveraging AR analytics, businesses can gain actionable insights into payment behaviors and collection effectiveness. This blog explores how AR analytics can be used to optimize financial operations.

Understanding AR Analytics

AR analytics involves the systematic use of data and statistical analysis to understand and improve accounts receivable processes. This includes tracking payment patterns, predicting future payment behaviors, identifying potential risks, and measuring the effectiveness of collection strategies.

By implementing AR analytics, businesses can transition from reactive to proactive management of their accounts receivable. Instead of waiting for payment issues to arise, companies can anticipate potential problems and take preemptive measures to address them.

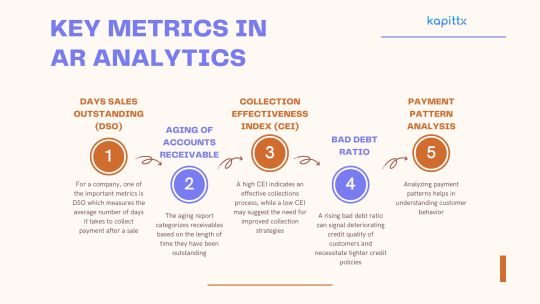

Key Metrics in AR Analytics

Days Sales Outstanding (DSO): For a company, one of the important metrics is DSO which measures the average number of days it takes to collect payment after a sale. A lower DSO indicates faster collection of receivables and better liquidity. Monitoring DSO trends can help identify inefficiencies in the collection process and prompt corrective actions.

Aging of Accounts Receivable: The aging report categorizes receivables based on the length of time they have been outstanding. This allows for the identification of overdue accounts and prioritizes collection efforts. By analyzing aging trends, businesses can also uncover patterns that may indicate underlying issues with certain customers or products.

Collection Effectiveness Index (CEI): The Collection Effectiveness Index (CEI) gauges the efficiency of the collections process by calculating the percentage of receivables collected within a specific timeframe. A high CEI indicates an effective collections process, while a low CEI may suggest the need for improved collection strategies.

Bad Debt Ratio: This ratio compares the amount of bad debt to total sales. A rising bad debt ratio can signal deteriorating credit quality of customers and necessitate tighter credit policies.

Payment Pattern Analysis: Analyzing payment patterns helps in understanding customer behavior. By identifying customers who consistently pay late, businesses can implement targeted strategies to encourage timely payments, such as offering early payment discounts or setting stricter credit terms.

Leveraging Predictive Analytics

Predictive analytics, an advanced form of AR analytics, leverages historical data and statistical algorithms to anticipate future payment behaviors. By leveraging predictive analytics, businesses can:

Identify At-Risk Accounts: Predictive models can flag accounts that are likely to become delinquent, allowing companies to proactively engage with these customers and negotiate payment plans before issues escalate.

Optimize Credit Policies: By understanding the factors that contribute to late payments, businesses can refine their credit policies to mitigate risks. For example, adjusting credit limits based on predictive insights can help balance sales growth with credit risk.

Enhance Cash Flow Forecasting: Accurate cash flow forecasting is essential for financial planning. Predictive analytics can improve the accuracy of these forecasts by accounting for anticipated payment delays and bad debts.

Enhancing Collection Strategies

Segmentation of Receivables: Segmenting receivables based on various criteria, such as customer size, industry, and payment history, allows for tailored collection strategies. For instance, high-value customers with good payment records may be handled differently from smaller accounts with inconsistent payment patterns.

Prioritization of Collection Efforts: Using AR analytics, businesses can prioritize their collection efforts based on the likelihood of recovery. Accounts with a high probability of payment can be targeted for softer collection tactics, while accounts with lower probabilities may require more intensive follow-up.

Monitoring Collection Performance: Regularly tracking collection performance through analytics ensures that the chosen strategies are effective. By comparing the success rates of different methods, businesses can continually refine their approach.

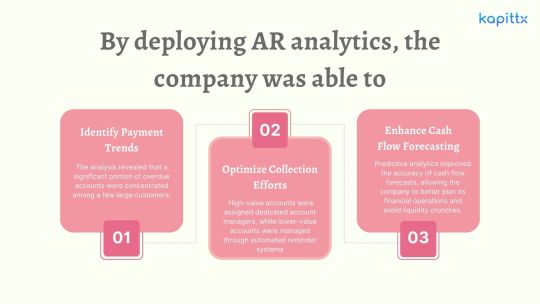

Case Study: AR Analytics in Action

Consider a mid-sized manufacturing company that implemented AR analytics to improve its cash flow management. Prior to leveraging analytics, the company struggled with high DSO and a significant amount of overdue receivables.

Identify Payment Trends: The analysis revealed that a significant portion of overdue accounts were concentrated among a few large customers. By addressing these accounts directly, the company was able to negotiate more favorable payment terms and reduce its DSO.

Optimize Collection Efforts: The company segmented its receivables and tailored its collection strategies accordingly. High-value accounts were assigned dedicated account managers, while lower-value accounts were managed through automated reminder systems. This resulted in a 20% improvement in the CEI.

Enhance Cash Flow Forecasting: Predictive analytics improved the accuracy of cash flow forecasts, allowing the company to better plan its financial operations and avoid liquidity crunches.

Conclusion

In today’s competitive business environment, leveraging AR analytics is no longer optional—it is a necessity. By gaining actionable insights into payment behaviors and collection effectiveness, businesses can significantly enhance their accounts receivable processes. This enhances cash flow, lowers the risk of bad debt, fortifies customer relationships, and promotes overall financial health.

Implementing AR analytics requires a commitment to data-driven decision-making and continuous improvement. With the right tools and strategies in place, businesses can transform their AR operations and achieve sustainable growth.

#ai based accounts receivable#Accounts receivable analytics#ar collection#cashflow management#ar management#ai in accounts receivable#payment reminder#cash application process#ai powered accounts receivable#accounts receivable automation software

0 notes

Text

The Future of AI in Accounting: How AI is Transforming South African Firms

Artficial intelligence (AI) is transforming accounting by increasing efficiency, improving risk management, and enhancing decision-making. South Africa’s emphasis on AI ethics and risk management positions its businesses to lead this shift. As AI automates routine tasks, accountants will take on strategic roles, driving both innovation and business growth. However, managing risks like job displacement and AI system bias is crucial for balanced integration within accounting firms.

For further insight into how AI is impacting tax accounting, check out our detailed blog on AI's role in tax management.

AI is Changing Accounting Practices in South Africa

In South Africa, AI is moving accounting from periodic financial reports to continuous data tracking. Traditionally, businesses relied on monthly or quarterly reports to assess performance. Now, AI-powered tools provide real-time insights that boost efficiency and competitiveness.

Automating tasks like tax preparation, payroll, and auditing enables accounting firms to focus on more strategic activities. This is especially beneficial for small and medium-sized businesses (SMBs), which need to remain competitive despite limited resources.

Key Benefits of AI for Accounting Firms

Real-Time Risk Management AI helps South African firms continuously monitor operations, reduce errors, and detect fraud more quickly. This allows businesses to manage risks effectively and avoid costly financial mistakes.

Better Decision-MakingAI enables faster, smarter decisions by analyzing large datasets in real time. This allows firms to provide more accurate advice, helping businesses swiftly adapt to changing market conditions.

Automation of Routine TasksRoutine tasks like invoice processing, payroll, and tax filing can be automated. This frees up accountants to focus on higher-value activities like planning and advising clients, significantly boosting productivity.

Continuous Financial InsightsWith real-time financial data, businesses no longer have to wait for month-end reports. AI helps companies optimize cash flow and allocate resources more efficiently.

Potential Risks of AI in South African Accounting

Although AI brings many advantages, South African accounting firms must address key challenges. Automation could lead to job displacement, especially for those focused on routine tasks. However, this shift presents opportunities for accountants to move into more strategic roles.

Another risk involves bias in AI systems. If trained on biased data, AI models may produce unfair outcomes, particularly in areas like financial approvals. To mitigate this, firms are adopting ethical AI practices to ensure fair decision-making.

Latest Technologies in South African Accounting

AI and other emerging technologies are revolutionizing accounting in South Africa. Cloud-based software such as Xero and QuickBooks now integrates AI to streamline processes. Blockchain is also gaining traction, providing secure, transparent transaction records that reduce fraud risk and ensure compliance.

Societal Impact of AI on Accounting in South Africa

AI's rise affects not only businesses but also society at large. While it enhances financial efficiency and drives economic growth, the potential displacement of traditional accounting jobs is a concern. To address this, South African accounting firms are reskilling employees for new, AI-driven roles.

Simultaneously, AI opens the door to innovation. Accountants are transitioning from routine tasks to roles focused on strategic advising and business planning, making them more valuable to clients. This shift is reshaping the accounting industry in South Africa.

Conclusion

AI is rapidly transforming accounting in South Africa. It provides businesses with real-time insights, better risk management, and increased efficiency. South African accounting firms are at the forefront of this change, adopting ethical AI practices and leveraging advanced technologies. While challenges such as job displacement exist, AI also creates opportunities for growth and innovation, helping South African businesses succeed in an evolving market.

#Accounting#south africa#finacialfreedom#accounting services#accounting software bd#artificial intelligence#ai

0 notes

Text

10 Best AI Accounting Tools (August 2024)

New Post has been published on https://thedigitalinsider.com/10-best-ai-accounting-tools-august-2024/

10 Best AI Accounting Tools (August 2024)

Efficient financial management is crucial for business and personal success. As technology continues to evolve, artificial intelligence has emerged in the accounting industry, offering innovative solutions to streamline processes, reduce errors, and provide valuable insights.

This article explores the top AI accounting tools that are changing how businesses handle their finances. From automating routine tasks to providing real-time analytics, these cutting-edge platforms are designed to enhance accuracy, save time, and empower financial decision-making. Whether you’re a small business owner, a freelancer, or an accounting professional, these AI-powered tools offer a range of features to meet diverse needs and transform financial management practices.

Vic.ai is an advanced AI-powered accounting tool that revolutionizes accounts payable processes. By leveraging sophisticated machine learning algorithms, Vic.ai automates and streamlines various finance tasks, with a particular focus on accounts payable. The platform’s intelligent system can automatically ingest, classify, and process invoices with exceptional accuracy, significantly reducing the need for manual data entry and virtually eliminating human errors in the process.

One of Vic.ai’s standout features is its ability to mimic human decision-making, enabling it to manage the entire accounts payable workflow from start to finish autonomously. This capability allows finance teams to shift their focus from routine tasks to more strategic activities such as financial analysis, cash flow forecasting, and vendor relationship management. Vic.ai’s continuous learning mechanism ensures that the AI adapts to each organization’s unique processes and requirements over time, leading to increasingly efficient and accurate operations.

Key features:

Autonomous invoice processing that boosts productivity by up to 355%

AI-driven PO matching that detects discrepancies and ensures precise matching

Streamlined approval workflows that reduce manual effort and accelerate invoice approvals

Intelligent payment processing that identifies early payment discounts and minimizes fraud risks

Real-time analytics and insights on invoices, team performance, and business trends to support data-driven decision making

Visit Vic.ai →

Bill is a comprehensive cloud-based accounting software designed to optimize accounts payable and accounts receivable processes for businesses of all sizes. The platform harnesses the power of AI and machine learning to simplify invoice management, streamline approval workflows, and automate payment processing. By doing so, Bill significantly reduces the time spent on financial tasks while minimizing errors that often occur in manual processes.

One of Bill’s primary strengths lies in its seamless integration capabilities with popular accounting systems, ensuring real-time data synchronization and providing enhanced visibility into financial operations. The platform’s user-friendly interface, coupled with its customizable options, makes it an attractive choice for businesses looking to modernize their financial processes. Bill empowers organizations to gain better control over their cash flow, strengthen vendor relationships, and allocate more resources to strategic initiatives rather than routine financial tasks.

Key features:

Streamlined invoice management that automates invoice capture, data entry, and categorization

Customizable approval workflows that allow setup of multi-level approval processes

Flexible payment options supporting various methods including ACH, EFT, virtual cards, and checks

International payment processing enabling transactions in over 130 countries

Seamless integration with popular accounting software like QuickBooks, Xero, and NetSuite

Visit Bill →

TurboDoc is an innovative AI-powered accounting tool that specializes in automating invoice and receipt processing. The platform leverages cutting-edge optical character recognition (OCR) technology to accurately extract data from documents in various formats. This advanced capability eliminates the need for manual data entry, significantly reducing the time and effort required for processing financial documents while simultaneously minimizing the risk of human error.

Beyond its core OCR functionality, TurboDoc offers a user-friendly interface that organizes extracted information in an intuitive manner. This feature enables businesses to effortlessly analyze data, assemble reports, and compare financial information across different periods or categories. TurboDoc’s emphasis on data security is evident in its use of enterprise-level encryption to protect sensitive financial information. Furthermore, the platform’s seamless integration with popular email services like Gmail allows users to automate document processing directly from their inboxes, streamlining workflow and enhancing overall productivity.

Key features:

Advanced OCR technology that processes documents in an average of 1.2 seconds per page

High-accuracy data extraction with a 96% accuracy rate

Seamless Gmail integration for automated document processing from inboxes

User-friendly dashboard for easy data analysis and report assembly

AES256 enterprise-level encryption for secure data storage on USA-based servers

Visit TurboDoc →

Indy is a comprehensive productivity platform meticulously designed to cater to the unique needs of freelancers and independent professionals. While not exclusively an accounting tool, Indy offers a robust suite of financial management features alongside other essential business functions. This all-in-one approach allows freelancers to manage various aspects of their business, including proposals, contracts, invoicing, time tracking, task management, and client communication, all from a single, user-friendly interface.

One of Indy’s most compelling attributes is its affordability, making it an accessible option for freelancers at various stages of their career. The platform offers a free plan with essential features, as well as competitively priced paid plans that provide access to more advanced tools. Indy’s intuitive design and ease of use make it an attractive choice for freelancers who want to efficiently manage their business finances without the need for extensive training or a steep learning curve. By consolidating multiple business functions into one platform, Indy helps freelancers save valuable time and stay organized, allowing them to focus more on their core business activities and client relationships.

Key features:

Customizable proposal and contract templates with legal vetting

Integrated invoicing and payment processing through popular gateways

Time tracking tool for recording billable hours

Project management features for task organization

Built-in client communication and file sharing capabilities

Visit Indy →

Docyt is a state-of-the-art AI-powered accounting automation platform designed to improve financial management for small businesses and accounting professionals. By harnessing the power of advanced generative AI capabilities, Docyt automates a wide range of accounting processes, including data capture, workflow management, and real-time reconciliation. This comprehensive approach provides businesses with unprecedented visibility and precision in their financial operations, enabling more informed decision-making based on up-to-date and accurate financial insights.

At the core of Docyt’s functionality are its intelligent algorithms, which possess the ability to read and understand expenses with human-like comprehension. This advanced technology accurately extracts information from receipts and invoices, categorizing transactions with a high degree of confidence. Docyt’s cutting-edge platform enables true real-time accounting, a feature that sets it apart from many traditional accounting solutions. Furthermore, Docyt seamlessly integrates with existing accounting systems, ensuring a smooth transition and minimal disruption to established processes. The platform’s user-friendly interface, combined with its powerful automation features, positions Docyt as a game-changer in the way businesses manage their accounting functions.

Key features:

AI-driven data capture from receipts, invoices, and other financial documents

Automated accounting workflows for tasks like invoice processing and approval routing

Real-time financial data reconciliation for up-to-date information access

Comprehensive financial insights and reporting capabilities

Seamless integration with existing accounting systems and business tools

Visit Docyt →

Zeni is an innovative AI-powered finance platform that combines intelligent bookkeeping, accounting, and CFO services to streamline financial operations for startups and small businesses. By leveraging advanced AI technology, Zeni automates a wide array of manual processes, providing real-time insights and offering personalized support from a dedicated team of finance experts. This comprehensive approach enables businesses to update their books daily, access real-time financial data, and make informed decisions based on accurate, up-to-date information.

One of Zeni’s key strengths lies in its ability to provide a complete financial solution on a single platform. From bill pay and invoicing to expense management and financial planning, Zeni offers a wide range of services to meet the diverse needs of growing businesses. The platform’s user-friendly interface, coupled with expert support from a dedicated finance team, makes it an attractive choice for entrepreneurs and business owners looking to optimize their financial operations and focus on growth. By consolidating multiple essential tools into one package, Zeni helps businesses save money and simplify their technology stack, providing a cost-effective solution for comprehensive financial management.

Key features:

AI-powered bookkeeping that automatically categorizes transactions and reconciles accounts

Comprehensive financial services including bill pay, invoicing, and expense management

Real-time financial insights and customizable reporting capabilities

Access to a dedicated team of finance experts, including bookkeepers, accountants, and CPAs

Seamless integration with popular business tools and platforms

Visit Zeni →

Blue dot is an AI-driven tax compliance platform designed to address the complexities of modern employee spend management. With the rise of hybrid work environments, decentralized purchasing, and online consumption, employee-triggered transactions have become increasingly prevalent, posing challenges for finance teams dealing with unstructured financial data. Blue dot’s platform tackles these issues by providing comprehensive coverage in both VAT and taxable employee benefit spaces.

The platform’s technology leverages advanced AI algorithms and machine learning to digitize tax compliance, automating various financial processes while reducing manual effort and ensuring accuracy. Blue dot offers optimized VAT outcomes by identifying eligible and qualified VAT spend in compliance with country tax regulations and company policies, ensuring accurate domestic VAT posting and foreign VAT refunds. Additionally, the platform automates the review of consumer-style spend subject to taxable employee benefits, ensuring compliance with wage taxation and pay-as-you-earn reporting requirements. By combining these features with an automatically updated tax knowledge base and configurable rule engines, Blue dot provides a robust solution for modern tax compliance challenges.

Key features:

Smart automation of financial processes for enhanced accuracy and audit preparedness

Optimized VAT outcomes through AI-driven identification of eligible spend

Automated review of taxable employee benefits for wage taxation compliance

Continuously updated tax knowledge base with configurable rule engines

Advanced AI and ML capabilities leveraging deep learning and natural language processing

Visit Blue dot →

Gridlex is a versatile, all-in-one app builder designed to streamline operations and boost productivity across various industries. While not exclusively an accounting tool, Gridlex offers a comprehensive suite of features that includes CRM, customer service, help desk ticketing, master data management, and operations management. The platform’s ultra-customizable nature allows organizations to configure the app builder to meet their specific needs, ensuring a tailored solution that addresses unique business challenges.

One of Gridlex’s standout features is its accounting and ERP module, Gridlex Sky. This component enables businesses to manage their finances effectively, offering capabilities such as invoicing, bill management, and bank reconciliation. By automating financial processes, reducing manual calculations, and simplifying expense claims, Gridlex Sky significantly enhances accounting efficiency. The platform’s AI-driven insights help businesses analyze their financial data, facilitating informed decision-making and strategic planning. Additionally, Gridlex’s ability to consolidate multiple essential tools into a single, cost-effective package helps businesses save money and simplify their technology stack, making it an attractive option for organizations looking to streamline their operations.

Key features:

Comprehensive accounting and ERP functionality through Gridlex Sky module

AI-powered financial insights for data analysis and strategic planning

Multi-currency transaction handling for global business operations

Integrated inventory management for efficient tracking and optimization

Built-in timesheet and HR software for streamlined workforce management

Visit Gridlex →

Truewind is an AI-powered accounting and finance platform specifically designed to streamline bookkeeping and financial management for startups and small to medium-sized businesses (SMBs). By harnessing the power of generative AI technologies, Truewind automates routine accounting tasks, delivers accurate and timely financial reports, and offers strategic insights to support business growth. The platform’s approach combines AI-driven processes with expert human oversight, resulting in a comprehensive, efficient, and reliable financial management solution.

At the core of Truewind’s offerings are AI-powered bookkeeping, month-end close automation, and CFO services. The platform seamlessly integrates with popular accounting software such as QuickBooks, NetSuite, and Xero, ensuring a smooth transition and minimal disruption to existing processes. Truewind’s commitment to data security and privacy is evident in its adherence to the highest standards, including SOC 2 certification and strict data privacy policies. This combination of cutting-edge AI technology, human expertise, and robust security measures positions Truewind as a powerful tool for businesses seeking to optimize their financial operations and drive growth.

Key features:

AI-powered bookkeeping for faster and more accurate financial record-keeping

Automated month-end close process to accelerate financial reporting

CFO services providing strategic insights and forecasting for business growth

Seamless integration with popular accounting software platforms

SOC 2 certified data security and strict privacy policies

Visit Truewind →

Booke is an innovative AI-powered bookkeeping automation platform designed to streamline financial processes for businesses and accounting professionals. By leveraging advanced AI technologies such as Robotic Process Automation (RPA) and Generative AI, Booke automates time-consuming tasks like transaction reconciliation and categorization, significantly reducing manual workload and enhancing accuracy. The platform’s intelligent algorithms excel at extracting data from financial documents in real-time, ensuring that financial records are always up-to-date and precise.

One of Booke’s key strengths lies in its seamless integration capabilities with popular accounting software such as Xero, QuickBooks, and Zoho Books. This integration ensures a smooth workflow and minimizes disruption to existing processes, making it an ideal solution for businesses looking to enhance their financial operations without overhauling their entire system. Booke’s user-friendly interface, combined with its powerful automation features, significantly improves efficiency and accuracy in financial management. By automating daily and month-end bookkeeping processes, including categorizing and matching bank feed transactions with corresponding bills, invoices, and receipts, Booke allows finance professionals to focus on more strategic tasks, ultimately leading to improved client satisfaction and business growth.

Key features:

AI-driven automation of transaction reconciliation and categorization

Real-time data extraction from financial documents for up-to-date records

Seamless integration with popular accounting software platforms

Automated daily and month-end bookkeeping processes

Enhanced efficiency and accuracy in financial management tasks

Visit Booke →

Why Use an AI Accounting Tool?

The rapid evolution of AI accounting tools has transformed the landscape of financial management, offering unprecedented advantages to businesses of all sizes. These innovative solutions streamline accounting processes, reducing the time and effort required for routine tasks such as data entry and transaction categorization. By automating these mundane activities, AI tools free up accounting professionals to focus on more strategic aspects of financial reporting and analysis, ultimately adding more value to their organizations or clients.

One of the most significant benefits of AI accounting tools is their ability to provide real-time financial insights. Unlike traditional methods that often rely on periodic reporting, these advanced platforms offer up-to-the-minute data on a company’s financial health. This immediate access to accurate financial data empowers decision-makers to respond swiftly to market changes, identify potential issues before they escalate, and capitalize on emerging opportunities. Moreover, the enhanced accuracy of AI-driven financial reports minimizes the risk of errors that can lead to costly mistakes or compliance issues.

As the accounting industry continues to embrace technological advancements, AI tools are becoming indispensable for maintaining a competitive edge. These platforms not only improve efficiency and accuracy but also enhance the overall quality of financial services provided by accounting firms. By leveraging AI in their daily operations, accountants can offer more comprehensive and insightful financial analysis, strengthening their role as trusted advisors to their clients. Ultimately, the adoption of AI accounting tools represents a strategic investment in the future of financial management, promising to deliver long-term benefits in terms of productivity, accuracy, and decision-making capabilities.

#2024#accounting#accounting and finance#accounting software#accounting tools#Accounts#ai#ai tools#AI-powered#Algorithms#Analysis#Analytics#app#approach#Art#Article#artificial#Artificial Intelligence#audit#automation#automation platform#autonomous#bank#Best Of#Blue#Books#Business#Capture#career#certification

0 notes

Text

#business#business owners#ai generated#technology#data analytics#ai girl#software#software development#human resources#employment#accounting#across the spiderverse#academia#80s#acne#100 days of productivity#3d printing#60s#70s#1950s#recruitment#workforce management software#humanresources#hiring#hrt#customer#reacts#tata motors#apply#original work

0 notes

Text

2 notes

·

View notes