#Accurate Data Entry in Finance

Explore tagged Tumblr posts

Text

How to Ensure Accurate Ledger Management in High-Volume Businesses

As a growing number of businesses in India scale their operations, one critical area that often becomes increasingly difficult to manage is the ledger management. At Pillaiyar.in, we understand that effective ledger management is foundational to financial accuracy, especially for high-volume businesses handling thousands of transactions each month. From streamlined data entry to precise bookkeeping, accurate ledger tracking can mean the difference between smooth audits and compliance headaches.

Why Ledger Management Matters in High-Volume Environments

In a high-volume business—be it eCommerce, logistics, retail chains, or SaaS—transactions move fast and in bulk. This leads to vast amounts of financial data being generated every day. Without structured and consistent ledger management, errors creep in, reconciliation becomes difficult, and business insights become unreliable.

Ledger errors are not just accounting problems—they can:

Misstate profits or losses

Compromise cash flow projections

Affect tax calculations and compliance

Lead to potential fraud or data manipulation

That’s why it’s essential to implement a robust system that ensures accuracy, consistency, and compliance.

Best Practices for Accurate Ledger Management

1. Maintain Real-Time Data Entry

One of the biggest causes of ledger discrepancies is delayed or inconsistent data entry. In high-volume businesses, transactions should be logged in real-time or at scheduled intervals during the same day. Relying on weekly data entry increases the chance of missed or duplicated entries.

At Pillaiyar.in, our team ensures daily ledger updates through automated imports and double-verification workflows to maintain up-to-the-minute accuracy.

2. Reconcile Bank Statements Regularly

Reconciliation is a non-negotiable task. All cash, credit, and bank transactions must be reconciled with your ledger at least weekly—and preferably daily for businesses with hundreds of transactions.

Automated reconciliation tools can match entries across statements, invoices, and receipts, flagging inconsistencies instantly.

3. Use Segregated Ledgers

To avoid confusion in high-volume entries, we recommend segmenting ledgers by category:

Revenue ledgers (by product or service line)

Expense ledgers (by department)

Vendor and customer ledgers

Asset and liability ledgers

Segregation not only simplifies audit trails but also improves the quality of bookkeeping and financial reporting.

4. Automate Repetitive Tasks

Manual entry is time-consuming and prone to error. Wherever possible, automate:

Recurring expenses

Invoice posting

Journal entry creation

Tax deductions and GST classifications

Tools like Zoho Books, Tally Prime, and QuickBooks Online integrate well with automation plugins. Our clients benefit from customized automation workflows we set up during onboarding.

Types of Reports in Ledger Management

At Pillaiyar.in, accurate ledger management translates directly into meaningful and actionable reports. Here are some of the key financial reports we generate from well-managed ledgers:

1. General Ledger Report

A master report that shows all debit and credit transactions over a period, essential for audits and annual filings.

2. Trial Balance

Summarizes all ledger balances to check if debits equal credits. A must-have monthly report to catch errors early.

3. Accounts Payable and Receivable Reports

Help businesses track who they owe money to and who owes them, ensuring timely settlements.

4. Journal Summary

Gives a snapshot of all journal entries made, aiding in backtracking and correction of errors.

5. Audit Trail Report

Shows all edits, additions, and deletions in ledger entries for compliance and internal control.

Frequency: How Often Should You Update and Review Ledgers?

For high-volume businesses, frequency is key. Here's a basic guideline we follow for our clients:

Daily: Data entry, reconciliation of sales and purchases, tracking cash/bank transactions

Weekly: Expense categorization, accounts receivable/payable reports

Monthly: Trial balance, general ledger summary, tax summaries, financial statement drafts

Quarterly: Review for internal audits, strategy planning, budget realignments

Staying consistent with this schedule helps prevent end-of-month overload and ensures business owners always have a pulse on their finances.

Standard Templates We Use for Ledger Reporting

Templates bring structure to your financial data, making it easier to interpret. At Pillaiyar.in, we use industry-standard and customizable templates tailored to high-volume businesses:

Multi-column ledger formats for segmented financial views

Pivot-ready trial balances for real-time analytics

Expense summary dashboards for visual representation

Automated Excel or Google Sheet integrations for client transparency

These templates help us deliver reports faster while maintaining accuracy and clarity.

Tools That Make Ledger Management Efficient

With the right technology stack, ledger management can be streamlined significantly. Here are some of the tools we implement or recommend to our clients:

1. Tally Prime

Ideal for Indian businesses; highly customizable with strong ledger and tax management modules.

2. Zoho Books

Great for automation, cloud access, and easy integration with banks, payment gateways, and eCommerce platforms.

3. QuickBooks Online

User-friendly and ideal for those who want real-time collaboration with their bookkeeping service provider.

4. Hubdoc and Receipt Bank

Capture and auto-post bills and receipts to ledgers, reducing human error in data entry.

5. Customized Dashboards

We also build custom dashboards using Google Data Studio and Zoho Analytics to visualize ledger data for better decision-making.

Automation: The Secret to Accuracy in Ledger Management

One of the most impactful shifts we encourage is embracing automation in financial operations. Automation not only reduces errors but also frees up your time to focus on growth.

Here’s how we leverage automation at Pillaiyar.in:

Auto-import of bank feeds

Rule-based categorization of entries

Scheduled reconciliation checks

Alerts for ledger anomalies

Auto-backup and log tracking

Even our bookkeeping and review processes are semi-automated, with final verification done by experts to combine the best of both worlds—speed and accuracy.

How We Help at Pillaiyar.in

As a trusted partner in ledger management, we serve fast-growing businesses with a hands-on, tech-enabled approach. Here’s what we offer:

End-to-end data entry, categorization, and reconciliation

Custom bookkeeping and ledger tracking workflows

Monthly and quarterly reporting with clean audit trails

Integration with ERP, CRM, and eCommerce systems

Strategic financial planning backed by real-time ledger insights

Whether you're a retail chain processing thousands of daily sales or a services firm with complex receivables, we tailor our solutions to fit your exact needs.

Final Thoughts

For high-volume businesses, managing ledgers is not just a routine accounting task—it’s a critical backbone of financial stability and growth. Inaccurate ledgers can distort financial reports, delay tax filings, and erode profitability. That’s why you need structured processes, reliable templates, timely reporting, and intelligent automation.

At Pillaiyar.in, we take pride in delivering precise, tech-powered ledger management solutions. From real-time data entry to expert-led bookkeeping, we empower businesses across India to stay financially sound and audit-ready—no matter how fast they scale.

Want to bring structure and accuracy to your ledger management? 👉 Partner with Pillaiyar.in today and let us streamline your financial operations.

#edger Management Best Practices#High-Volume Business Accounting#Bookkeeping Automation Tools#Accurate Data Entry in Finance#Financial Reporting for Businesses

0 notes

Text

COCO'S REVIEW: LACKADAISY INGENUE (Ft. @thesilliestofallqueers)

Welcome to Coco’s Review! Where I review and breakdown episodes, movies and etc and overthink every tiny detail and/or give my thoughts and opinions :D

Today I'm discussing Lackadaiy Ingenue (ft.Robin)

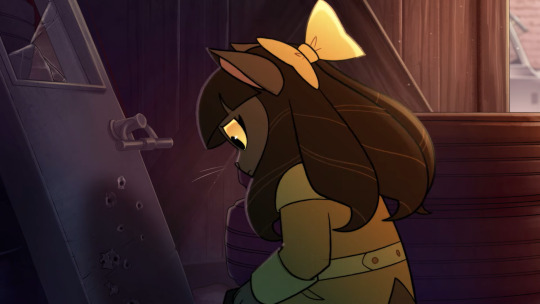

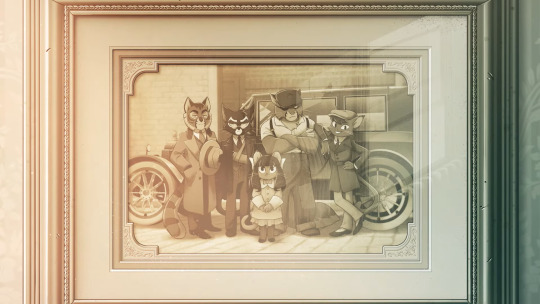

Yes I’m a fan of Lackadaisy! I haven’t been there since the start BUT I have been following the series ever since the animated pilot- I’ve also read a handful of the comics but I wasn’t able to read everything. But I have a good idea of the characters and their lore. I’m very happy to revisit this series through Lackadaisy Ingenue! So to start things off I want to define what ‘Ingenue’ means for those who don’t know (like I did). According to google, “An Ingenue is an innocent or unsophisticated young woman, especially in a play or film.” which makes a lot of sense since this short focuses on Ivy when she was a little kitten (I’m assuming she’s around 6-9 here), and I guess this short technically counts as a film. New word to add to your vocabulary ✨ So the short opens with Ivy’s father, Reuben Peppers showing off a car to Atlas (who is confirmed to be Ivy’s godfather in the description). Btw Reuben sounds INCREDIBLY young in my opinion, I didn’t even think he was her father- I thought he was her older brother or something but nope, that’s her dad. Confirmed in the description!

We aren’t even a minute in and I’m already asking questions- mostly with how close Ivy and Reuben are. With “I like it when it’s just you and me”, it got me confused since it IS just them traveling. I’m going to assume maybe she prefers private trips with her father over using public transportation where others can hear their conversations. Which really shows how close they probably are if Ivy really enjoys one-on-one time with him.

So as Reuben greets Mitzi, Atlas, Viktor and “Joe”. Reuben and Mitzi have an interesting conversation… “What happened to New Years?” “It’s Effie, she's uh.. We’ll talk later” The look Reuben gives Ivy might imply that “Effie” is Ivy’s mother or just a relative of the Pepper family since Reuben doesn’t want to talk about it with Ivy listening. But that's just me- So that’s totally not suspicious :D

I also just want to mention the nice hug Atlas and Reuben have- it really does seem like they’re very close. Which is probably why Atlas is Ivy’s godfather- Atlas seems pretty comfortable around Reuben too! From what I can tell Atlas was more of a “show more, talk less” kinda guy but that’s maybe because this is my first real introduction to him before he died (lmk if he appears in a flashback in the comics). He doesn’t have any lines in this episode too so I just thought that’d be interesting to point out. And that's why I came to that conclusion.

Upnext is Ivy meeting Mordecai for the first time I’m assuming. So this seems to take place when Mordecai used to work with Lackadaisy before switching to Marigold. This also confirms that he was the bookkeeper for the daisy cafe to which if you don’t know- a bookkeeper oversees a company's financial data and compliance by maintaining accurate books on accounts payable and receivable, payroll, and daily financial entries and reconciliations. They basically take care of the finances of the cafe. This scene also highlights the gun Mordecai was trying to hide, which I guess adds more evidence for Ivy to what these people actually do for a living. In the description it seems that Ivy is not very aware of what her father does for work. At least at the time. Mordecai having a gun despite being “just” a bookkeeper gives her an idea of what they might actually do other than running a cafe.

Also the “I subtract numbers too” line is fucking hilarious I’m sorry 😭 Now we have the scene where Ivy and Viktor’s bond seems to have started! I would eat up their interactions in the comics istg I LOVE THEM<33 Victor becoming that one chill uncle

Viktor lying about how Mordecai broke his arm is fucking hilarious too- I’m now requesting a short comic of Mordecai trying to rollerskate but failing miserably! ANYONE PLEASE- TAG ME IF YOU DO THAT (Rob ik youre an artist pls /j)

I don’t have a lot to say about this scene- I just love Ivy and Viktor’s dynamic smm! I gotta talk abt them in one of my Dynamic Duos episodes! (getting ready to go through so many comics) After their interaction Ivy notices a broken car door with bullet holes on it. It looks very similar to the door Viktor was replacing while he and Ivy were talking. That’s when Ivy pieced it together, Mordecai’s gun and the bullet holes? Yeah it became obvious to her that these guys are criminals-

You can tell that was her conclusion with her asking Viktor directly if they were robbers or gangsters while also assuring that the secret is safe with her!

I’d just end my breakdown here BUT YOU SAW THE TITLE! I would like to welcome my first guest ROBIN!!! Aka TheSilliestofallQueers :D I wanted to bring them in because they know more about the extensive lore of Lackadaisy so I feel like this’d be a perfect time to have them featured! SO I GIVE THE FLOOR TO ROBIN!!

HELLO YES THIS IS ROBIN!! (@thesilliestofallqueers)

I’m not as obsessed with Lackadaisy as I used to be back when the animated pilot was just released (I had a friend who got me into it, thank you for that Breezy) but I still know quite a bit so I’ll be putting a few footnotes to this already extensive deep dive into the animated short

Apologies in advance but this is just going to be me analyzing / ranting about Viktor and Ivy’s interactions since Coco didn’t!! (ITS SPELLED WITH A K?? -Coco fixing her typos) (YEAH ITS VIKTOR LMFAOOAOAOAO -Rob) Now first of all, I found it so endearing that Viktor almost immediately warms up to Ivy and starts joking with her / trying to cover up what they actually do with lighthearted / white lies.

As someone who has read the comics I always knew Viktor was fiercely protective of Ivy (He beat up her exes because he thought they were no good lol) but Ivy almost always responded to this by being annoyed with Viktor (specifically in the instance of the ex boyfriends, she got mad at Viktor for it)

So seeing her as a kid getting along with Viktor so well was refreshing and sweet (Also this short implies that these mfs are OLD AS HELL -Coco) (YEAH IT DO DUNNIT LMFAOAOAO -Robbobin)

Now they keep getting along until Viktor suddenly tells Ivy that she shouldn’t be there in the middle of her telling a joke, and you can SEE his expression shift from fond to worried as I guess he realizes that if he keeps being nice to her, she’ll want to stick around. Therefore putting her in more danger than if she was kept away

He slams the car door as he yells at her to go, and she does, but not before giving him one last angry look because dude WHAT THE FUCKK WE WERE SO CHILL LIKE 5 SECONDS AGO

And then Coco details the rest of what happened

SORRY IF MY PORTION WAS SHORT I JUST WANTED TO EXPAND ON WHAT COCO DIDNT LMFAOOAOA (also there wasn’t much to go off of since it was short + coco covered most of it in detail already) THANK YOU ROB FOR YOUR INPUT!! Tbh I was struggling with finding words for Viktor and Ivy’s scene so thankfully Rob did the job! Please go follow Rob on their page! And that concludes our breakdown of Lackadaisy Ingenue :D Huge respect to Tracy Butler and her team for their amazing work on this because the animation is GORGEOUS and the storytelling is super clever! I’m so excited to cover the future episodes of the series when it eventually comes out !!

This is Coco and Robin typing... thank you for reading!

#lackadaisy#lackadaisy ivy#lackadaisy viktor#lackadaisy mitzi#lackadaisy atlas#lackadaisy mordecai#lackadaisy ingenue#tracy j butler#iron circus animation

30 notes

·

View notes

Text

Accounting Firms in India: Enabling Financial Growth for Modern Businesses

The Essential Role of Accounting Firms in India

In today’s competitive business environment, accounting firms in India have become indispensable to companies aiming for financial transparency, legal compliance, and sustained growth. These firms are not only handling traditional tasks like bookkeeping and tax filing but are also offering strategic support in areas such as auditing, payroll management, and financial consulting. As India’s economy continues to evolve, the role of accounting professionals is becoming more crucial than ever.

With the increasing complexity of tax laws and financial regulations, businesses are turning to professional accounting firms to manage their financial responsibilities accurately and efficiently. The right firm can help reduce financial risks, ensure compliance with Indian accounting standards, and support the overall decision-making process.

Why Businesses Choose Professional Accounting Firms

Managing finances internally can be overwhelming, especially for small and mid-sized businesses. That’s why many organizations choose to outsource accounting functions to expert firms. Here’s why this trend is growing:

Regulatory Compliance: Accounting firms keep up with evolving tax laws, ensuring that businesses remain compliant with GST, income tax, and MCA regulations.

Cost Savings: Outsourcing is often more affordable than hiring an in-house accounting team, reducing operational costs.

Efficiency and Accuracy: Professional firms use advanced software and tools to ensure accurate record-keeping and timely financial reporting.

Scalable Solutions: Services can be adjusted to meet the needs of growing businesses, from startups to established enterprises.

Services Offered by Accounting Firms in India

Accounting firms in India offer a wide range of services tailored to different types of businesses. These include:

1. Bookkeeping and Financial Reporting

Maintaining organized financial records is the foundation of sound business practices. Firms handle daily transaction tracking, journal entries, ledger management, and monthly financial statement preparation.

2. Tax Planning and Filing

Navigating India’s tax system can be challenging. Accounting firms assist with GST returns, income tax filings, TDS calculations, and tax audits, while also advising on effective tax-saving strategies.

3. Audit and Assurance Services

Internal audits, statutory audits, and compliance audits help identify risks and inefficiencies. These services enhance transparency and build trust with stakeholders and investors.

4. Payroll and Compliance Management

From salary processing to PF, ESI, and professional tax deductions, accounting firms handle every aspect of payroll while ensuring compliance with labor laws and statutory requirements.

5. Business Advisory and Financial Consulting

Many firms also provide financial planning, budgeting, and forecasting services. This helps business owners make informed decisions based on data-driven insights.

Qualities to Look for in an Accounting Firm

Choosing the right accounting partner is a strategic business decision. When evaluating potential firms, consider the following:

Certification and Experience: Ensure the firm is registered with the Institute of Chartered Accountants of India (ICAI) and has experience in your industry.

Technological Capability: Look for firms that use modern accounting tools such as Tally, Zoho Books, QuickBooks, or Xero.

Transparent Communication: A reliable firm provides regular updates, clear reports, and prompt support.

Customizable Services: Every business has unique needs. Choose a firm that offers tailored solutions instead of one-size-fits-all packages.

The Advantages of Hiring Indian Accounting Firms

India’s accounting sector is recognized for its high standards of professionalism and affordability. Some of the key benefits include:

Skilled Workforce: India produces thousands of qualified CAs and finance professionals each year.

Language Proficiency: English-speaking professionals make communication seamless for both domestic and international clients.

Competitive Pricing: Indian firms offer world-class services at cost-effective rates, making them attractive for global outsourcing.

The Evolving Future of Accounting in India

The accounting industry in India is rapidly adapting to technological innovation. Automation, artificial intelligence (AI), and cloud computing are transforming how firms deliver services. Clients now benefit from real-time financial data, predictive analytics, and paperless operations.

Additionally, government initiatives such as faceless assessments, e-invoicing, and digital compliance are pushing accounting firms to adopt smarter workflows and enhance client service quality.

As businesses continue to embrace digital transformation, accounting firms are expected to play an even bigger role—not just as compliance experts, but as strategic financial advisors.

Conclusion

In a fast-changing economic landscape, accounting firms in India have emerged as trusted partners for businesses that want to operate with confidence and clarity. Their expertise, combined with advanced technology and deep regulatory knowledge, allows companies to focus on their core activities while leaving the complexities of finance and compliance to the professionals.

Whether you're launching a startup, managing a growing enterprise, or expanding internationally, working with a reliable accounting firm can drive efficiency, reduce risk, and support long-term success.

2 notes

·

View notes

Text

Outsourcing Data Entry: Healthcare, Legal and Finance Sectors

Data entry services for various sectors bring a plethora of benefits by organizing high volumes of data in a structured format. This brings outsourcing data entry services for accurate results by reliable firms. Uniquesdata is a best data entry service provider and brings holistic solutions to several industries.

#data entry services#data entry company#data entry services companies#online data entry services#data digitization services#outsourcing data digitization#outsource data entry services#medical data entry#best data entry services#top data entry company

2 notes

·

View notes

Text

**From PCI DSS to HIPAA: Ensuring Compliance with Robust IT Support in New York City**

Introduction

In contemporary digital world, organisations are a growing number of reliant on science for their operations. This dependence has caused a heightened focus on cybersecurity and compliance specifications, specifically in regulated industries like healthcare and finance. For services working in New York City, wisdom the nuances of compliance frameworks—specifically the Payment Card Industry Data Security Standard (PCI DSS) and the Health Insurance Portability and Accountability Act (HIPAA)—is quintessential. Navigating those policies requires potent IT give a boost to, which encompasses everything from community infrastructure to documents management.

With the rapid advancement of technological know-how, organizations ought to additionally remain abreast of high-quality practices in details technologies (IT) give a boost to. This article delves into how organizations can ensure that compliance with PCI DSS and HIPAA thru triumphant IT processes whilst leveraging materials from accurate providers like Microsoft, Google, Amazon, and others.

Understanding PCI DSS What is PCI DSS?

The https://brooksxaoj631.over.blog/2025/04/navigating-cybersecurity-in-the-big-apple-essential-it-support-solutions-for-new-york-businesses.html Payment Card Industry Data Security Standard (PCI DSS) is a group of safety principles designed to look after card tips all the way through and after a economic transaction. It was once proven by using significant credit card enterprises to fight growing times of fee fraud.

Why is PCI DSS Important?

Compliance with PCI DSS enables groups defend touchy economic recordsdata, thereby modifying visitor trust and slicing the possibility of info breaches. Non-compliance can bring about intense consequences, such as hefty fines or maybe being banned from processing credit score card transactions.

youtube

Key Requirements of PCI DSS Build and Maintain a Secure Network: This carries fitting a firewall to preserve cardholder knowledge. Protect Cardholder Data: Encrypt kept files and transmit it securely. Maintain a Vulnerability Management Program: Use antivirus utility and develop protect structures. Implement Strong Access Control Measures: Restrict entry to in basic terms people that want it. Regularly Monitor and Test Networks: Keep observe of all get admission to to networks and aas a rule look at various protection tactics. Maintain an Information Security Policy: Create insurance policies that cope with defense necessities. Exploring HIPAA Compliance What is HIPAA?

The Health Insurance Portability and Accountability Act (HIPAA) sets the ordinary for conserving sensitive sufferer know-how in the healthcare trade. Any entity that offers with blanketed well being know-how (PHI) have got to adjust to HIPAA regulations.

Importance of HIPAA Compliance

HIPAA compliance no longer handiest protects affected person privateness however also guarantees more suitable healthcare outcome with the aid of permitting maintain sharing of affected person data between permitted entities. Violations can cause titanic fines, prison results, and wreck to popularity.

" style="max-width:500px;height:auto;">

Core Components of HIPAA Compliance Privacy Rule: Establishes countr

2 notes

·

View notes

Text

AI’s Role in Business Process Automation

Automation has come a long way from simply replacing manual tasks with machines. With AI stepping into the scene, business process automation is no longer just about cutting costs or speeding up workflows—it’s about making smarter, more adaptive decisions that continuously evolve. AI isn't just doing what we tell it; it’s learning, predicting, and innovating in ways that redefine how businesses operate.

From hyperautomation to AI-powered chatbots and intelligent document processing, the world of automation is rapidly expanding. But what does the future hold?

What is Business Process Automation?

Business Process Automation (BPA) refers to the use of technology to streamline and automate repetitive, rule-based tasks within an organization. The goal is to improve efficiency, reduce errors, cut costs, and free up human workers for higher-value activities. BPA covers a wide range of functions, from automating simple data entry tasks to orchestrating complex workflows across multiple departments.

Traditional BPA solutions rely on predefined rules and scripts to automate tasks such as invoicing, payroll processing, customer service inquiries, and supply chain management. However, as businesses deal with increasing amounts of data and more complex decision-making requirements, AI is playing an increasingly critical role in enhancing BPA capabilities.

AI’s Role in Business Process Automation

AI is revolutionizing business process automation by introducing cognitive capabilities that allow systems to learn, adapt, and make intelligent decisions. Unlike traditional automation, which follows a strict set of rules, AI-driven BPA leverages machine learning, natural language processing (NLP), and computer vision to understand patterns, process unstructured data, and provide predictive insights.

Here are some of the key ways AI is enhancing BPA:

Self-Learning Systems: AI-powered BPA can analyze past workflows and optimize them dynamically without human intervention.

Advanced Data Processing: AI-driven tools can extract information from documents, emails, and customer interactions, enabling businesses to process data faster and more accurately.

Predictive Analytics: AI helps businesses forecast trends, detect anomalies, and make proactive decisions based on real-time insights.

Enhanced Customer Interactions: AI-powered chatbots and virtual assistants provide 24/7 support, improving customer service efficiency and satisfaction.

Automation of Complex Workflows: AI enables the automation of multi-step, decision-heavy processes, such as fraud detection, regulatory compliance, and personalized marketing campaigns.

As organizations seek more efficient ways to handle increasing data volumes and complex processes, AI-driven BPA is becoming a strategic priority. The ability of AI to analyze patterns, predict outcomes, and make intelligent decisions is transforming industries such as finance, healthcare, retail, and manufacturing.

“At the leading edge of automation, AI transforms routine workflows into smart, adaptive systems that think ahead. It’s not about merely accelerating tasks—it’s about creating an evolving framework that continuously optimizes operations for future challenges.”

— Emma Reynolds, CTO of QuantumOps

Trends in AI-Driven Business Process Automation

1. Hyperautomation

Hyperautomation, a term coined by Gartner, refers to the combination of AI, robotic process automation (RPA), and other advanced technologies to automate as many business processes as possible. By leveraging AI-powered bots and predictive analytics, companies can automate end-to-end processes, reducing operational costs and improving decision-making.

Hyperautomation enables organizations to move beyond simple task automation to more complex workflows, incorporating AI-driven insights to optimize efficiency continuously. This trend is expected to accelerate as businesses adopt AI-first strategies to stay competitive.

2. AI-Powered Chatbots and Virtual Assistants

Chatbots and virtual assistants are becoming increasingly sophisticated, enabling seamless interactions with customers and employees. AI-driven conversational interfaces are revolutionizing customer service, HR operations, and IT support by providing real-time assistance, answering queries, and resolving issues without human intervention.

The integration of AI with natural language processing (NLP) and sentiment analysis allows chatbots to understand context, emotions, and intent, providing more personalized responses. Future advancements in AI will enhance their capabilities, making them more intuitive and capable of handling complex tasks.

3. Process Mining and AI-Driven Insights

Process mining leverages AI to analyze business workflows, identify bottlenecks, and suggest improvements. By collecting data from enterprise systems, AI can provide actionable insights into process inefficiencies, allowing companies to optimize operations dynamically.

AI-powered process mining tools help businesses understand workflow deviations, uncover hidden inefficiencies, and implement data-driven solutions. This trend is expected to grow as organizations seek more visibility and control over their automated processes.

4. AI and Predictive Analytics for Decision-Making

AI-driven predictive analytics plays a crucial role in business process automation by forecasting trends, detecting anomalies, and making data-backed decisions. Companies are increasingly using AI to analyze customer behaviour, market trends, and operational risks, enabling them to make proactive decisions.

For example, in supply chain management, AI can predict demand fluctuations, optimize inventory levels, and prevent disruptions. In finance, AI-powered fraud detection systems analyze transaction patterns in real-time to prevent fraudulent activities. The future of BPA will heavily rely on AI-driven predictive capabilities to drive smarter business decisions.

5. AI-Enabled Document Processing and Intelligent OCR

Document-heavy industries such as legal, healthcare, and banking are benefiting from AI-powered Optical Character Recognition (OCR) and document processing solutions. AI can extract, classify, and process unstructured data from invoices, contracts, and forms, reducing manual effort and improving accuracy.

Intelligent document processing (IDP) combines AI, machine learning, and NLP to understand the context of documents, automate data entry, and integrate with existing enterprise systems. As AI models continue to improve, document processing automation will become more accurate and efficient.

Going Beyond Automation

The future of AI-driven BPA will go beyond automation—it will redefine how businesses function at their core. Here are some key predictions for the next decade:

Autonomous Decision-Making: AI systems will move beyond assisting human decisions to making autonomous decisions in areas such as finance, supply chain logistics, and healthcare management.

AI-Driven Creativity: AI will not just automate processes but also assist in creative and strategic business decisions, helping companies design products, create marketing strategies, and personalize customer experiences.

Human-AI Collaboration: AI will become an integral part of the workforce, working alongside employees as an intelligent assistant, boosting productivity and innovation.

Decentralized AI Systems: AI will become more distributed, with businesses using edge AI and blockchain-based automation to improve security, efficiency, and transparency in operations.

Industry-Specific AI Solutions: We will see more tailored AI automation solutions designed for specific industries, such as AI-driven legal research tools, medical diagnostics automation, and AI-powered financial advisory services.

AI is no longer a futuristic concept—it’s here, and it’s already transforming the way businesses operate. What’s exciting is that we’re still just scratching the surface. As AI continues to evolve, businesses will find new ways to automate, innovate, and create efficiencies that we can’t yet fully imagine.

But while AI is streamlining processes and making work more efficient, it’s also reshaping what it means to be human in the workplace. As automation takes over repetitive tasks, employees will have more opportunities to focus on creativity, strategy, and problem-solving. The future of AI in business process automation isn’t just about doing things faster—it’s about rethinking how we work all together.

Learn more about DataPeak:

#datapeak#factr#technology#agentic ai#saas#artificial intelligence#machine learning#ai#ai-driven business solutions#machine learning for workflow#ai solutions for data driven decision making#ai business tools#aiinnovation#digitaltools#digital technology#digital trends#dataanalytics#data driven decision making#data analytics#cloudmigration#cloudcomputing#cybersecurity#cloud computing#smbs#chatbots

2 notes

·

View notes

Text

In today’s fast-paced business environment, enhancing productivity is more crucial than ever to successfully accomplish this, one can rely on the power of automation. By automating routine tasks, businesses can save time, reduce errors, and focus on more strategic activities. In this blog post, we will explore essential automation strategies that can help boost productivity in your organization.

Boost productivity with these essential automation strategies. Automation is transforming the way businesses operate, making processes more efficient and streamlined. Implementing the right automation strategies can lead to significant improvements in productivity and overall business performance. In this article, we will discuss several key automation strategies that can help you achieve these goals.

1. Automate Repetitive Tasks

One of the most effective ways to boost productivity is by automating repetitive tasks. These tasks often consume a significant amount of time and can be easily automated using the right tools. For example, you can automate data entry, email responses, and appointment scheduling. By doing so, you free up valuable time for more critical activities.

2. Utilize Workflow Automation

Workflow automation involves creating a series of automated actions that complete a process. This strategy is particularly useful for complex processes that involve multiple steps and departments. Tools like Zapier and Microsoft Power Automate can help you set up automated workflows, ensuring that tasks are completed efficiently and accurately.

3. Implement Marketing Automation

Marketing automation can significantly enhance your marketing efforts by automating tasks such as email marketing, social media posting, and lead nurturing. Platforms like HubSpot and Mail chimp offer comprehensive automation features that can help you reach your target audience more effectively and improve your marketing ROI.

4. Enhance Customer Service with Chatbots

Integrating chatbots into your customer service strategy can greatly improve efficiency and customer satisfaction. Chabot’s can handle a wide range of customer queries, provide instant responses, and escalate issues to human agents when necessary. This not only saves time but also ensures that customers receive timely and accurate support.

5. Streamline Financial Processes

Automation can also be applied to financial processes such as invoicing, expense tracking, and payroll management. Tools like QuickBooks and Xero offer robust automation features that can help you manage your finances more efficiently and reduce the risk of errors.

Boost Productivity with These Essential Automation Strategies. Automation is a powerful tool that can help businesses enhance productivity and efficiency. By implementing the strategies discussed in this article, you can streamline your processes, reduce manual workload, and focus on more strategic activities. Have you tried any of these automation strategies?

#Automation#Productivity#BusinessEfficiency#TechTrends#WorkflowAutomation#DigitalTransformation#AutomationTools#SmartBusiness#Innovation#Accomation#BusinessAutomation#InvoiceManagement#EfficiencyTools#AutomationSolutions#SmallBusinessTools#StreamlineOperations#BusinessGrowth#FinancialAutomation

2 notes

·

View notes

Text

🔍 Elevate your document analysis with AlgoDocs' state-of-the-art automated table extraction.

In today's digital era, where information is abundant, efficiency is paramount. AlgoDocs seamlessly identifies and extracts structured data from tables, eliminating manual entry and cumbersome processes.

🚀 Why AlgoDocs?

✅ Harness advanced OCR algorithms and AI techniques.

✅ Achieve accurate identification of tables in various document formats.

✅ Streamline operations, enhance decision-making, and gain a competitive edge.

📈 Unlock the true potential of your data-rich documents across industries such as finance, healthcare, research, and legal entities. AlgoDocs empowers you to extract valuable insights, automate processes, and make informed decisions.

💼 Embrace efficiency. Subscribe now for a forever-free plan with 50 pages per month. Tailored pricing plans are available for higher processing needs. Contact us for custom solutions.

#TableExtraction#DocumentAnalysis#DataInsights#AlgoDocs#BusinessAutomation#OCRAlgorithms#AITechnology#StructuredDataExtraction#DocumentProcessing#PDFConversion

3 notes

·

View notes

Text

AI in Finance: Automating Processes and Enhancing Decision-Making in the Financial Sector

Introduction:

In today’s rapidly evolving world, technology continues to reshape various industries, and the financial sector is no exception. Artificial Intelligence (AI) has emerged as a game-changer, revolutionizing the way financial institutions operate and make critical decisions. By automating processes and providing valuable insights, AI is transforming the financial landscape, enabling greater efficiency, accuracy, and customer satisfaction.

AI Applications in Finance:

Automation of Routine Tasks: Financial institutions deal with massive amounts of data on a daily basis. AI-driven automation tools can streamline tasks such as data entry, processing, and reconciliation, reducing manual errors and increasing operational efficiency. Additionally, AI-powered bots can handle customer inquiries and support, freeing up human agents to focus on more complex issues.

Fraud Detection and Security: Cybersecurity is a top priority for financial institutions. AI algorithms can analyze vast datasets in real-time to detect unusual patterns and anomalies, flagging potential fraudulent activities before they escalate. This proactive approach enhances security measures and safeguards customer assets.

Personalized Customer Experience: AI-powered chatbots and virtual assistants offer personalized interactions with customers, providing quick responses to queries and offering tailored financial solutions based on individual preferences and behavior. This level of personalization enhances customer satisfaction and loyalty.

AI for Risk Assessment and Management:

Credit Scoring and Underwriting: AI-powered credit risk models can assess an individual’s creditworthiness more accurately, incorporating a wide range of factors to make data-driven decisions. This expedites loan underwriting processes, allowing financial institutions to serve customers faster while managing risk effectively.

Market Analysis and Predictions: AI algorithms can analyze market trends, historical data, and other influencing factors to predict market fluctuations with higher accuracy. By leveraging AI-driven insights, investment professionals can make more informed decisions, optimizing investment strategies and portfolios.

Improving Financial Decision-Making:

Algorithmic Trading: AI-driven algorithmic trading systems can execute trades based on predefined criteria, eliminating emotional biases and executing trades with greater precision and speed. This technology has the potential to outperform traditional trading methods, benefiting both investors and institutions.

Portfolio Management: AI can optimize portfolio performance by considering various risk factors, asset correlations, and individual investment goals. Through data-driven portfolio management, investors can achieve a balanced risk-return profile, aligning with their specific financial objectives.

Ethical and Regulatory Considerations:

As AI becomes more prevalent in the financial sector, it’s crucial to address ethical concerns and ensure compliance with regulatory requirements. Financial institutions must be vigilant in identifying and mitigating biases present in AI algorithms to maintain fairness and transparency in decision-making processes. Additionally, adhering to data privacy laws is essential to protect customer information and build trust with clients.

Real-world Examples of AI Adoption in Finance:

JPMorgan Chase: The multinational bank utilizes AI to streamline customer interactions through their virtual assistant, providing personalized financial advice and support.

BlackRock: The investment management firm employs AI-powered algorithms to enhance its portfolio management and make data-driven investment decisions.

Challenges and Future Outlook:

While AI offers tremendous benefits to the financial sector, challenges remain, including data privacy concerns, algorithmic biases, and potential job displacement. Addressing these challenges is vital to maximizing the potential of AI in finance. Looking ahead, the future of AI in finance is promising, with advancements in Natural Language Processing (NLP), predictive analytics, and machine learning expected to reshape the industry further.

Conclusion:

AI is revolutionizing the financial sector by automating processes, improving decision-making, and enhancing customer experiences. Financial institutions embracing AI can gain a competitive edge, providing better services, reducing operational costs, and managing risks more effectively. However, ethical considerations and regulatory compliance must remain at the forefront of AI adoption to ensure a sustainable and equitable financial landscape for the future. With responsible implementation, AI is set to continue transforming finance, empowering institutions to thrive in the digital age.

6 notes

·

View notes

Text

AP management services

Streamline Your Finances with Masllp's AP Management Services: Say Goodbye to Paper Chase and Hello to Efficiency Introducing Masllp's AP Management Services: your one-stop shop for transforming your AP process from a tedious chore into a smooth, efficient operation.

Here's how we can help:

Ditch the Paper: We say goodbye to mountains of paper invoices and hello to paperless processing. No more manual data entry, lost documents, or chasing down approvals. Our secure, cloud-based platform handles everything electronically, streamlining your workflow and saving you valuable time. Boost Accuracy: Say goodbye to human error and hello to automatic data capture and verification. Our system eliminates typos, duplicates, and miscalculations, ensuring your payments are accurate and on time, every time. Optimize Workflows: We customize your AP process to fit your specific needs. From two-way PO matching to automated approvals, we help you move invoices from receipt to payment faster, improving your cash flow and vendor relationships. Gain Valuable Insights: Forget sifting through spreadsheets to find buried treasure. Our insightful reporting tools provide real-time visibility into your AP performance, allowing you to identify areas for improvement and make data-driven decisions. Free Up Your Team: Let our dedicated AP experts handle the heavy lifting. Our experienced team takes care of everything from data entry and invoice verification to vendor communication and payment processing, freeing up your internal staff to focus on more strategic tasks. But the benefits go beyond just efficiency:

Reduced Costs: Our automated processes and paperless platform save you money on printing, postage, and storage. Plus, our expertise helps you avoid late fees and payment errors, further shrinking your bottom line. Improved Vendor Relationships: Timely payments and clear communication keep your vendors happy, potentially leading to better discounts and terms. Enhanced Security: Our robust security measures protect your financial data, giving you peace of mind and ensuring compliance with industry regulations. In short, Masllp's AP Management Services are your key to achieving financial peace of mind. We take the pain out of AP, allowing you to focus on what matters most: growing your business.

Ready to ditch the paper chase and embrace the future of AP? Contact Masllp today for a free consultation and discover how we can help you streamline your finances and unlock the full potential of your business. Call to action: Visit our website, download our free ebook, or schedule a demo to learn more about how Masllp's AP Management Services can transform your business.

#audit#accounting & bookkeeping services in india#ajsh#income tax#auditor#businessregistration#chartered accountant#foreign companies registration in india#taxation#AP management services

4 notes

·

View notes

Text

What is Quick Payable?

Quick Payable is a user-friendly application available on Salesforce's app exchange platform. It is designed to simplify and streamline the accounts payable process for businesses. Here are the key features and benefits of Quick Payable:

1. Efficient Bill Management:

- Quick Payable allows businesses to easily manage bills from multiple vendors.

- The intuitive interface makes it easy to organize and track invoices.

- Businesses can ensure timely payments and avoid penalties or late fees.

2. Automated Invoice Data Capture:

- Quick Payable leverages advanced software to automate invoice data capture.

- This eliminates the need for manual data entry, saving time and reducing errors.

- The system intelligently extracts relevant information from invoices, such as invoice numbers, due dates, and amounts.

3. Streamlined Approval Process:

- With Quick Payable, businesses can customize their approval workflow.

- Approvers can be assigned based on vendor configurations, ensuring the right people review and authorize invoices.

- This streamlines the approval process, reducing bottlenecks and delays in the payment cycle.

4. Complete Expense Visibility:

- Quick Payable provides rich dashboards and reports, offering complete visibility of expenses.

- Businesses can track and analyze spending patterns, identify unnecessary costs, and optimize their spending.

- This level of insight empowers businesses to make informed financial decisions and improve overall financial management.

5. Effortless Data Export:

- Quick Payable allows for seamless data export to third-party ERP systems.

- Businesses can integrate their accounts payable information with existing financial software.

- This eliminates the need for manual transfers and ensures data consistency across different platforms.

6. Enhanced Efficiency and Error Reduction:

- By utilizing Quick Payable, businesses can improve the efficiency of their accounts payable processes.

- The app automates repetitive tasks, freeing up valuable time for the finance team.

- With fewer errors and delays, businesses can focus on strategic financial planning and ensure accurate financial records.

In summary, Quick Payable is a powerful tool that simplifies and streamlines the accounts payable process for businesses. With features like efficient bill management, automated invoice data capture, and streamlined approval processes, businesses can improve their financial management capabilities. The complete expense visibility and effortless data export features further enhance efficiency and reduce errors. Embrace Quick Payable to optimize your accounts payable processes and take control of your financial management.

2 notes

·

View notes

Text

How GST Billing Software Simplifies Tax Compliance for Small Businesses

In today's fast-paced digital economy, small businesses face increasing pressure to comply with regulatory requirements while maintaining efficient operations. One such critical obligation is the Goods and Services Tax (GST) compliance. For many small business owners, staying on top of tax filings, generating accurate invoices, and ensuring timely payments can be overwhelming. This is where GST billing software steps in as a game-changer.

What is GST Billing Software?

GST billing software is a specialized tool designed to help businesses create GST-compliant invoices, manage sales and purchases, file tax returns, and maintain accurate financial records. These platforms are typically equipped with features that automate tax calculations, track GST rates, and generate reports required for filing returns with tax authorities.

Key Ways GST Billing Software Simplifies Tax Compliance

1. Automated GST Calculations

Manually calculating GST for every invoice can lead to errors and inconsistencies, especially when dealing with multiple tax slabs. GST billing software automatically applies the correct tax rate based on the product or service category and location of sale, ensuring accuracy in every transaction.

2. Easy GST-Compliant Invoicing

The software enables businesses to generate professional, GST-compliant invoices within seconds. These invoices typically include HSN/SAC codes, GSTINs, invoice numbers, and breakdowns of CGST, SGST, or IGST – all formatted according to government regulations.

3. Effortless Filing of GST Returns

GST billing software simplifies return filing by maintaining organized records of all transactions. Most platforms integrate directly with the GST portal or allow easy export of return-ready data, minimizing the need for manual data entry and reducing the chances of errors.

4. Real-Time Data Tracking

With cloud-based solutions, business owners can monitor their financial and tax data in real-time from any device. This visibility helps in tracking outstanding payments, managing cash flow, and preparing for audits.

5. Improved Record-Keeping and Audit Readiness

Proper documentation is crucial during audits. GST software automatically stores and categorizes invoices, credit notes, debit notes, and returns, ensuring that all records are easily accessible and audit-ready.

6. Inventory and Expense Management

Many GST billing tools come with built-in inventory and expense tracking. This helps businesses keep tabs on stock levels and analyze financial performance while ensuring accurate tax reporting on all purchases and sales.

7. Reduced Dependence on Accountants

While accountants remain valuable, GST software reduces the day-to-day burden by automating routine tasks. This lowers operating costs for small businesses and empowers owners to handle more of their financial management independently.

Benefits Beyond Compliance

Aside from easing the compliance burden, GST billing software offers a competitive edge through improved operational efficiency. With faster invoicing, integrated reporting, and better control over finances, small businesses can focus more on growth and customer satisfaction.

Conclusion

For small businesses navigating the complex world of GST, adopting GST billing software is not just a convenience — it's a necessity. It streamlines tax compliance, reduces manual workload, ensures accuracy, and provides peace of mind. As regulations evolve and the digital economy grows, having the right tools in place can make all the difference in staying compliant and competitive.

0 notes

Text

Outsourcing Data Entry: Healthcare, Legal and Finance Sectors

Data entry outsourcing has become common practice for key sectors of the economy such healthcare, legal and finances. The rising demand for accurate data management and informed decision making, outsourcing is beneficial solutions. Here's how outsourcing data entry makes a significant impact on various sectors.

#data entry services#data entry company#data entry services companies#online data entry services#data digitization services#outsourcing data digitization#outsource data entry services#medical data entry#best data entry services#top data entry company

3 notes

·

View notes

Text

Elevate Your Finance with Rightpath Global Services

Transforming Finance with Intelligent BPM Solutions

In the fast-paced world of finance, staying ahead requires more than just traditional methods. It demands intelligent innovation that can help businesses thrive in an ever-changing landscape. As a leading BPM service provider, Right Path Global Services Pvt. Ltd. has witnessed firsthand the power of AI in revolutionizing financial operations. The traditional approach to finance was often slow, error-prone, and heavily reliant on manual processes. Teams worked tirelessly to process data, chase invoices, and ensure compliance – leaving little time for strategic decision-making, Right Path Financial Process Management: Streamline, Automate, and Thrive

But today, we’re here to change that. With the integration of AI into BPM, financial operations are no longer weighed down by outdated methods. Our AI-powered BPM solutions offer businesses a way to streamline their finance functions – automating routine tasks, improving accuracy, and unlocking real-time insights that drive growth.

The Evolution of Financial Processes: From Manual to Intelligent

Let’s think about the way finance used to work. In the past, managing financial tasks required a lot of human effort – manual data entry, complex reconciliations, and reporting processes that took hours or even days. Companies would rely on outdated software and disconnected systems, which often led to inefficiencies, delays, and missed opportunities for improvement.

Fast forward to today, businesses are embracing intelligent BPM solutions powered by AI to automate these repetitive tasks. At Right Path, we guide our clients through this exciting transformation by integrating AI and automation into their finance processes. Now, routine tasks like invoice processing, account reconciliation, fraud detection, and compliance checks are automated, ensuring that your team can focus on more high-value work – like analyzing trends, forecasting growth, and driving business decisions with confidence.

AI-Powered BPM Services: Unlocking Efficiency, Accuracy, and Agility

In our experience at Right Path, we’ve seen how AI-powered BPM services can completely transform a company’s financial processes. With automation at the heart of it, financial teams can process data faster, reduce the chance of human error, and improve decision-making accuracy. AI solutions, such as predictive analytics, machine learning, and robotic process automation (RPA), enable businesses to streamline operations and improve their overall financial health.

But what makes AI so powerful is its ability to continuously learn and adapt. By using historical data, AI can predict trends, flag potential risks, and help companies stay on top of compliance requirements in real-time. Right Path’s BPM solutions provide businesses with cutting-edge technology to ensure that financial tasks are handled quickly, efficiently, and accurately – empowering teams to make informed decisions without waiting for reports or chasing down information.

Partnering for Success: Right Path’s Approach to AI-Driven BPM Solutions

At Right Path, we believe that the true potential of AI lies in its ability to enhance the human element of business. As a BPM service provider, our goal is not only to introduce innovative technologies into your finance processes but to do so in a way that empowers your team to thrive. We help businesses integrate AI and automation without disrupting their workflow. Instead, we enhance it – making everything faster, more accurate, and easier to manage.

We work closely with our clients to ensure that AI-driven BPM solutions are tailored to meet their specific needs. Whether you’re automating accounts payable, improving reporting accuracy, or strengthening compliance monitoring, our solutions are designed to create tangible, measurable improvements in your business operations. With Right Path as your partner, you can transform your finance function into a strategic asset that drives growth and efficiency.

Start Your Journey Towards Smarter Financial Operations

The future of finance is intelligent—and with the right BPM solutions, your business can lead the way.

At Right Path Global Services Pvt. Ltd., we specialize in delivering AI-powered BPM services that optimize financial processes, enhance decision-making, and drive meaningful business outcomes. Our solutions are designed to help you transition to smarter, more agile finance operations that support sustainable growth and long-term success.

To help you take the first step, we’re offering a free Procure-to-Pay (P2P) assessment. This expert-led review will uncover inefficiencies, highlight key improvement areas, and provide actionable insights to optimize your end-to-end Accounts Payable workflow.

Explore our website to learn more and claim your free P2P assessment today.

Let our experts show you how to turn AP complexity into a competitive advantage.

Are you ready to embrace the power of AI and elevate your finance function? Connect with Right Path Global today—and let’s shape the future of finance, together.

For more information click here: - https://rightpathgs.com/blogs/

0 notes

Text

Front Office Vs Back Office BPO: Differences

Hey, business enthusiasts! Ever wondered if your company uses third-party help for tasks? That’s BPO—Business Process Outsourcing—and it’s booming! From $92.5 billion in 2019 to $232.32 billion in 2020, the BPO market is thriving, especially in our gig-economy, remote-work world. With 80% of global execs planning to keep or boost outsourcing spend, it’s time to explore BPO’s two stars: Front Office and Back Office.

Front Office BPO

Deloitte’s 2024 survey reveals 50% of execs outsource front office tasks—think customer-facing roles. This BPO covers marketing, sales, tech support, and customer service, directly impacting revenue and reputation. Companies save costs by hiring vendors like marketing agencies or help desks.

What It Does

Customer Service: Handles calls, emails, and texts to solve issues.

Sales & Lead Gen: Converts leads into loyal customers.

Tech Support: Fixes client tech glitches.

Telemarketing: Closes deals via calls.

Social Media: Engages customers online.

Skills Needed

Great communication

Language skills

Problem-solving

Sales talent

Emotional intelligence

Back Office BPO

Back office BPO tackles internal ops like accounting, IT, HR, and supply chain—non-customer-facing tasks. It’s evolving into niches like legal or knowledge outsourcing. Small businesses, per Clutch’s 2023 report, use it to cut costs and tap expertise without full-time hires.

What It Does

Data Entry: Keeps data accurate and accessible.

Accounting: Manages finances and invoices.

HR: Recruits and onboards staff.

Research: Offers market insights.

IT Support: Maintains tech systems.

Supply Chain: Moves goods efficiently.

Skills Needed

Technical know-how

Attention to detail

Process optimization

Analytical skills

Compliance knowledge

Front Office Vs Back Office BPO

Customer Interaction

Front office BPO chats with clients (e.g., support agents), while back office stays behind the scenes (e.g., accountants).

Revenue Impact

Front office boosts sales and revenue; back office ensures smooth operations without direct profit gains.

Time Sensitivity

Front office reacts instantly to customer needs; back office follows flexible, accuracy-focused timelines.

Performance Metrics

Front office tracks satisfaction and conversion rates; back office measures task accuracy and cost savings.

Conclusion

BPO—whether front or back office—saves money and enhances efficiency. Front office shines in customer engagement, while back office keeps the engine running. Assess your needs and team to decide what to outsource!

0 notes

Text

What Are the 10 Benefits of Artificial Intelligence?

Artificial Intelligence (AI) is no longer a futuristic concept — it’s already reshaping our lives, industries, and the way we solve problems. Whether it’s the recommendations on Netflix, voice assistants like Alexa, or advanced robotics in factories, AI is powering smarter and faster decisions everywhere.

In this blog, we’ll explore the 10 Benefits of Artificial Intelligence and how it is becoming a game-changer in 2025 and beyond.

1. Automation of Repetitive Tasks

One of the key benefits of AI is automation. It reduces human effort by handling repetitive tasks like data entry, email sorting, and customer support chats. Businesses can save time and focus on more creative or strategic work. Among the 10 Benefits of Artificial Intelligence, this one helps cut costs and improve productivity significantly.

2. Faster Decision-Making

AI systems analyze massive amounts of data in seconds. From finance to healthcare, AI assists in making faster and more accurate decisions. For example, AI tools help doctors diagnose diseases quickly by analyzing X-rays or scans. This is one of the most practical 10 Benefits of Artificial Intelligence in critical sectors.

3. 24/7 Availability

Unlike humans, AI systems don’t need sleep or breaks. Chatbots and virtual assistants powered by AI can provide uninterrupted customer service 24/7. This feature improves customer satisfaction and response time. When listing the 10 Benefits of Artificial Intelligence, round-the-clock support is a big advantage.

4. Reduction in Human Error

Humans are prone to errors, especially in data-heavy or repetitive jobs. AI algorithms follow patterns and logic, minimizing the chances of mistakes. Industries like aviation, banking, and healthcare are using AI to improve safety and accuracy. This makes error reduction one of the most important 10 Benefits of Artificial Intelligence.

5. Personalization at Scale

Have you noticed how YouTube or Spotify knows exactly what you might like next? AI personalizes content based on your behavior. Businesses use AI to deliver personalized emails, offers, and product suggestions, creating a better user experience. This benefit stands out among the 10 Benefits of Artificial Intelligence for marketers.

6. Enhanced Security and Surveillance

AI-powered surveillance systems can identify threats, monitor crowds, and detect suspicious activity in real-time. In cybersecurity, AI tools scan for abnormal patterns that could signal a hack or data breach. Improved security is a top mention in the 10 Benefits of Artificial Intelligence today.

7. Smarter Healthcare Solutions

AI is transforming healthcare. From drug discovery to robotic surgeries, it offers faster and more precise treatment options. Virtual health assistants and remote monitoring tools are making healthcare more accessible. This is undoubtedly one of the most life-changing 10 Benefits of Artificial Intelligence.

8. Boost in Business Efficiency

AI-driven insights help companies optimize supply chains, predict market trends, and improve customer engagement. Automation tools also streamline business operations, saving time and resources. When you look at the 10 Benefits of Artificial Intelligence, boosting efficiency and profits is high on the list.

9. Support for the Differently-Abled

AI is improving lives by creating tools for those with disabilities. Voice recognition, text-to-speech apps, and AI-powered prosthetics help individuals perform daily tasks with more independence. Empowering accessibility is a meaningful part of the 10 Benefits of Artificial Intelligence.

10. Environmental Monitoring and Sustainability

AI is also helping fight climate change. It’s used to predict natural disasters, monitor pollution levels, and optimize energy usage. Smart sensors and AI systems help cities become greener and more sustainable. Environmental impact definitely deserves a spot among the 10 Benefits of Artificial Intelligence.

Final Thoughts

As we’ve explored, the 10 Benefits of Artificial Intelligence are changing the way we live and work. From simplifying everyday tasks to solving global challenges, AI continues to grow in importance. However, with great power comes great responsibility — ethical use of AI is just as important as its development.

In the years ahead, AI will likely become even more embedded in our lives. Whether you’re a business owner, student, or consumer, understanding the 10 Benefits of Artificial Intelligence gives you a clearer picture of where the future is headed.

0 notes