#Art Tokenization Platform Development

Explore tagged Tumblr posts

Text

Explore the complete 2025 guide to Art Tokenization Platform Development. Learn how to digitize, fractionalize, and trade art securely using blockchain technology. check out us : https://www.blockchainx.tech/art-tokenization-services/

#Art Tokenization Platform#Art Tokenization Platform Development#rwa tokenization#tokenization#technology#blockchain

0 notes

Text

The Metaverse: A New Frontier in Digital Interaction

The concept of the metaverse has captivated the imagination of technologists, futurists, and businesses alike. Envisioned as a collective virtual shared space, the metaverse merges physical and digital realities, offering immersive experiences and unprecedented opportunities for interaction, commerce, and creativity. This article delves into the metaverse, its potential impact on various sectors, the technologies driving its development, and notable projects shaping this emerging landscape.

What is the Metaverse?

The metaverse is a digital universe that encompasses virtual and augmented reality, providing a persistent, shared, and interactive online environment. In the metaverse, users can create avatars, interact with others, attend virtual events, own virtual property, and engage in economic activities. Unlike traditional online experiences, the metaverse aims to replicate and enhance the real world, offering seamless integration of the physical and digital realms.

Key Components of the Metaverse

Virtual Worlds: Virtual worlds are digital environments where users can explore, interact, and create. Platforms like Decentraland, Sandbox, and VRChat offer expansive virtual spaces where users can build, socialize, and participate in various activities.

Augmented Reality (AR): AR overlays digital information onto the real world, enhancing user experiences through devices like smartphones and AR glasses. Examples include Pokémon GO and AR navigation apps that blend digital content with physical surroundings.

Virtual Reality (VR): VR provides immersive experiences through headsets that transport users to fully digital environments. Companies like Oculus, HTC Vive, and Sony PlayStation VR are leading the way in developing advanced VR hardware and software.

Blockchain Technology: Blockchain plays a crucial role in the metaverse by enabling decentralized ownership, digital scarcity, and secure transactions. NFTs (Non-Fungible Tokens) and cryptocurrencies are integral to the metaverse economy, allowing users to buy, sell, and trade virtual assets.

Digital Economy: The metaverse features a robust digital economy where users can earn, spend, and invest in virtual goods and services. Virtual real estate, digital art, and in-game items are examples of assets that hold real-world value within the metaverse.

Potential Impact of the Metaverse

Social Interaction: The metaverse offers new ways for people to connect and interact, transcending geographical boundaries. Virtual events, social spaces, and collaborative environments provide opportunities for meaningful engagement and community building.

Entertainment and Gaming: The entertainment and gaming industries are poised to benefit significantly from the metaverse. Immersive games, virtual concerts, and interactive storytelling experiences offer new dimensions of engagement and creativity.

Education and Training: The metaverse has the potential to revolutionize education and training by providing immersive, interactive learning environments. Virtual classrooms, simulations, and collaborative projects can enhance educational outcomes and accessibility.

Commerce and Retail: Virtual shopping experiences and digital marketplaces enable businesses to reach global audiences in innovative ways. Brands can create virtual storefronts, offer unique digital products, and engage customers through immersive experiences.

Work and Collaboration: The metaverse can transform the future of work by providing virtual offices, meeting spaces, and collaborative tools. Remote work and global collaboration become more seamless and engaging in a fully digital environment.

Technologies Driving the Metaverse

5G Connectivity: High-speed, low-latency 5G networks are essential for delivering seamless and responsive metaverse experiences. Enhanced connectivity enables real-time interactions and high-quality streaming of immersive content.

Advanced Graphics and Computing: Powerful graphics processing units (GPUs) and cloud computing resources are crucial for rendering detailed virtual environments and supporting large-scale metaverse platforms.

Artificial Intelligence (AI): AI enhances the metaverse by enabling realistic avatars, intelligent virtual assistants, and dynamic content generation. AI-driven algorithms can personalize experiences and optimize virtual interactions.

Wearable Technology: Wearable devices, such as VR headsets, AR glasses, and haptic feedback suits, provide users with immersive and interactive experiences. Advancements in wearable technology are critical for enhancing the metaverse experience.

Notable Metaverse Projects

Decentraland: Decentraland is a decentralized virtual world where users can buy, sell, and develop virtual real estate as NFTs. The platform offers a wide range of experiences, from gaming and socializing to virtual commerce and education.

Sandbox: Sandbox is a virtual world that allows users to create, own, and monetize their gaming experiences using blockchain technology. The platform's user-generated content and virtual real estate model have attracted a vibrant community of creators and players.

Facebook's Meta: Facebook's rebranding to Meta underscores its commitment to building the metaverse. Meta aims to create interconnected virtual spaces for social interaction, work, and entertainment, leveraging its existing social media infrastructure.

Roblox: Roblox is an online platform that enables users to create and play games developed by other users. With its extensive user-generated content and virtual economy, Roblox exemplifies the potential of the metaverse in gaming and social interaction.

Sexy Meme Coin (SEXXXY): Sexy Meme Coin integrates metaverse elements by offering a decentralized marketplace for buying, selling, and trading memes as NFTs. This unique approach combines humor, creativity, and digital ownership, adding a distinct flavor to the metaverse landscape. Learn more about Sexy Meme Coin at Sexy Meme Coin.

The Future of the Metaverse

The metaverse is still in its early stages, but its potential to reshape digital interaction is immense. As technology advances and more industries explore its possibilities, the metaverse is likely to become an integral part of our daily lives. Collaboration between technology providers, content creators, and businesses will drive the development of the metaverse, creating new opportunities for innovation and growth.

Conclusion

The metaverse represents a new frontier in digital interaction, offering immersive and interconnected experiences that bridge the physical and digital worlds. With its potential to transform social interaction, entertainment, education, commerce, and work, the metaverse is poised to revolutionize various aspects of our lives. Notable projects like Decentraland, Sandbox, Meta, Roblox, and Sexy Meme Coin are at the forefront of this transformation, showcasing the diverse possibilities within this emerging digital universe.

For those interested in the playful and innovative side of the metaverse, Sexy Meme Coin offers a unique and entertaining platform. Visit Sexy Meme Coin to explore this exciting project and join the community.

274 notes

·

View notes

Text

This article about Dead Boy Detectives and Netflix's stewardship of LGBTQ+ shows is my Roman Empire

I'm linking the article below, and it's one of the best analysis' out there about both the significance of Dead Boy Detectives' being cancelled, but also the bigger picture of why this is so significant to both fans and the LGBTQ+ community at large. Please read (and share!) the article, Why we need more queer art, not less-the case of Dead Boy Detectives, written by Karla Elliott.

A damning excerpt, and article linked below:

"Netflix has long tried to market itself to audiences just like this as an alternative to more traditional media companies. Yet its cancellation of Dead Boy Detectives is another in a long line of queer shows and shows with queer storylines – such as Sense8, Julie and the Phantoms, and Shadow and Bone – to be axed by the company before their time.

The showrunner of Warrior Nun, another of Netflix’s prematurely cancelled shows, even revealed that Netflix pushed back against the writers developing a queer romance for the show’s second season.

Meanwhile, the streaming service continues to platform performers such as Dave Chappelle, who used his latest Netflix special (his seventh on the streaming service) to double down on jokes made about the queer community, particularly targeting transgender folk.

It seems, then, that companies such as Netflix are still largely only interested in token queer representation, and only if and when it aligns with ever-shifting profit goalposts."

She goes on to talk about the crew and fans rallying around Dead Boy Detectives and taking a grassroots approach to save this show. She links IG and Twitter posts (it'll always be Twitter, to me), and she includes The Petition in her article.

She also accurately addresses the NG elephant in the room, pointing to his limited involvement in the show and how Dead Boy Detective fans have "resolutely condemned his alleged actions and stood with the women speaking out against him. Their outrage perfectly aligns with the core lessons of the show, which counters harmful gendered stereotypes and advocates for men to take responsibility for their actions, hold one another accountable, process anger, and open up to feelings like love and empathy."

She concludes, and I must admit, this brought a tear to my jaded 'lil heart, that "[t]hrough its community-building, energy, and activism, the fanbase is proving to be the living embodiment of the lessons Dead Boy Detectives has to teach us about solidarity, love and care."

So, go us. Keep at it. Don't loose hope. And please check out this article. I gave you a sneak peak, but it's chalk full of really good information and I promise you'll be glad you read it.

#dbda#dead boy detectives#save dead boy detectives#edwin payne#charles rowland#niko sasaki#crystal palace#renew dead boy detectives#netflix#excellent article about dead boy detectives#Netflix's history with LGBTQ+ shows and y'all it isn't great#but I believe there are people at Netflix who want to do better#we just have to convince the decision makers to make better decisions#specifically to bring back this show#Season 2 is already written#we just have to keep being loud#we have unfinished business#Let's get this job jobbed

61 notes

·

View notes

Text

"Netflix’s recent cancellation of Dead Boy Detectives is about more than a TV show – it’s about the fight for queer art and representation.

In a world of attacks on queer rights and queer folk, including rising transphobia, Dead Boy Detectives is a desperately needed piece of queer art.

[...]

The show centres and celebrates queerness and tackles serious issues regarding violence, justice, and accountability. It’s also an exemplar of diverse media representation and inclusion, with three of the four main characters people of colour.

It captured a loyal fanbase, excellent critical reception and reviews (including a 92% approval rating and 90% audience score on Rotten Tomatoes), and good streaming metrics, staying in the top 10 shows on Netflix for three weeks. It was even submitted by Warner Bros. (one of the show’s production companies) for Emmy nominations in several categories.

[...]

Positive, nuanced queer representation on screen is still hard to come by. Damaging stereotypes and tropes like “bury your gays” – where queer characters are killed off to further the narrative of heterosexual characters – are still routine on screen [...]

[...]

Much queer media still focuses on narratives of trauma and tragedy, understandably so in some ways, given the prevalence of these experiences in queer people’s lives.

But Dead Boy Detectives stands out by refusing to be reduced to representations of queerness as suffering. It does explore trauma, hardship, and death, but it also presents a world where queer love and solidarity are mainstreamed and valued, and where even queer joy and creativity flourish.

[...]

Netflix has long tried to market itself to audiences just like this as an alternative to more traditional media companies. Yet its cancellation of Dead Boy Detectives is another in a long line of queer shows and shows with queer storylines – such as Sense8, Julie and the Phantoms, and Shadow and Bone – to be axed by the company before their time.

The showrunner of Warrior Nun, another of Netflix’s prematurely canceled shows, even revealed that Netflix pushed back against the writers developing a queer romance for the show’s second season.

Meanwhile, the streaming service continues to platform performers such as Dave Chappelle, who used his latest Netflix special (his seventh on the streaming service) to double down on jokes made about the queer community, particularly targeting transgender folk.

It seems, then, that companies such as Netflix are still largely only interested in token queer representation, and only if and when it aligns with ever-shifting profit goalposts."

@netflix

13 notes

·

View notes

Text

Future of LLMs (or, "AI", as it is improperly called)

Posted a thread on bluesky and wanted to share it and expand on it here. I'm tangentially connected to the industry as someone who has worked in game dev, but I know people who work at more enterprise focused companies like Microsoft, Oracle, etc. I'm a developer who is highly AI-critical, but I'm also aware of where it stands in the tech world and thus I think I can share my perspective. I am by no means an expert, mind you, so take it all with a grain of salt, but I think that since so many creatives and artists are on this platform, it would be of interest here. Or maybe I'm just rambling, idk.

LLM art models ("AI art") will eventually crash and burn. Even if they win their legal battles (which if they do win, it will only be at great cost), AI art is a bad word almost universally. Even more than that, the business model hemmoraghes money. Every time someone generates art, the company loses money -- it's a very high energy process, and there's simply no way to monetize it without charging like a thousand dollars per generation. It's environmentally awful, but it's also expensive, and the sheer cost will mean they won't last without somehow bringing energy costs down. Maybe this could be doable if they weren't also being sued from every angle, but they just don't have infinite money.

Companies that are investing in "ai research" to find a use for LLMs in their company will, after years of research, come up with nothing. They will blame their devs and lay them off. The devs, worth noting, aren't necessarily to blame. I know an AI developer at meta (LLM, really, because again AI is not real), and the morale of that team is at an all time low. Their entire job is explaining patiently to product managers that no, what you're asking for isn't possible, nothing you want me to make can exist, we do not need to pivot to LLMs. The product managers tell them to try anyway. They write an LLM. It is unable to do what was asked for. "Hm let's try again" the product manager says. This cannot go on forever, not even for Meta. Worst part is, the dev who was more or less trying to fight against this will get the blame, while the product manager moves on to the next thing. Think like how NFTs suddenly disappeared, but then every company moved to AI. It will be annoying and people will lose jobs, but not the people responsible.

ChatGPT will probably go away as something public facing as the OpenAI foundation continues to be mismanaged. However, while ChatGPT as something people use to like, write scripts and stuff, will become less frequent as the public facing chatGPT becomes unmaintainable, internal chatGPT based LLMs will continue to exist.

This is the only sort of LLM that actually has any real practical use case. Basically, companies like Oracle, Microsoft, Meta etc license an AI company's model, usually ChatGPT.They are given more or less a version of ChatGPT they can then customize and train on their own internal data. These internal LLMs are then used by developers and others to assist with work. Not in the "write this for me" kind of way but in the "Find me this data" kind of way, or asking it how a piece of code works. "How does X software that Oracle makes do Y function, take me to that function" and things like that. Also asking it to write SQL queries and RegExes. Everyone I talk to who uses these intrernal LLMs talks about how that's like, the biggest thign they ask it to do, lol.

This still has some ethical problems. It's bad for the enivronment, but it's not being done in some datacenter in god knows where and vampiring off of a power grid -- it's running on the existing servers of these companies. Their power costs will go up, contributing to global warming, but it's profitable and actually useful, so companies won't care and only do token things like carbon credits or whatever. Still, it will be less of an impact than now, so there's something. As for training on internal data, I personally don't find this unethical, not in the same way as training off of external data. Training a language model to understand a C++ project and then asking it for help with that project is not quite the same thing as asking a bot that has scanned all of GitHub against the consent of developers and asking it to write an entire project for me, you know? It will still sometimes hallucinate and give bad results, but nowhere near as badly as the massive, public bots do since it's so specialized.

The only one I'm actually unsure and worried about is voice acting models, aka AI voices. It gets far less pushback than AI art (it should get more, but it's not as caustic to a brand as AI art is. I have seen people willing to overlook an AI voice in a youtube video, but will have negative feelings on AI art), as the public is less educated on voice acting as a profession. This has all the same ethical problems that AI art has, but I do not know if it has the same legal problems. It seems legally unclear who owns a voice when they voice act for a company; obviously, if a third party trains on your voice from a product you worked on, that company can sue them, but can you directly? If you own the work, then yes, you definitely can, but if you did a role for Disney and Disney then trains off of that... this is morally horrible, but legally, without stricter laws and contracts, they can get away with it.

In short, AI art does not make money outside of venture capital so it will not last forever. ChatGPT's main income source is selling specialized LLMs to companies, so the public facing ChatGPT is mostly like, a showcase product. As OpenAI the company continues to deathspiral, I see the company shutting down, and new companies (with some of the same people) popping up and pivoting to exclusively catering to enterprises as an enterprise solution. LLM models will become like, idk, SQL servers or whatever. Something the general public doesn't interact with directly but is everywhere in the industry. This will still have environmental implications, but LLMs are actually good at this, and the data theft problem disappears in most cases.

Again, this is just my general feeling, based on things I've heard from people in enterprise software or working on LLMs (often not because they signed up for it, but because the company is pivoting to it so i guess I write shitty LLMs now). I think artists will eventually be safe from AI but only after immense damages, I think writers will be similarly safe, but I'm worried for voice acting.

8 notes

·

View notes

Text

The Future of Cryptocurrency: Trends and Innovations to Watch

Cryptocurrency has evolved from a niche technology into a global financial powerhouse. With major institutions, governments, and retail investors now taking digital assets seriously, the future of crypto is more promising than ever. As we look ahead, here are some key trends and innovations shaping the future of cryptocurrency.

1. Institutional Adoption

One of the most significant changes in the crypto landscape is the growing interest from institutional investors. Companies like Tesla, MicroStrategy, and even traditional banks are now holding Bitcoin and other digital assets on their balance sheets. This growing adoption will likely drive more stability and legitimacy in the market.

2. Central Bank Digital Currencies (CBDCs)

Governments worldwide are exploring Central Bank Digital Currencies (CBDCs) to modernize their financial systems. Countries like China, the U.S., and the European Union are working on their own digital currencies, aiming to offer a secure, government-backed alternative to decentralized cryptocurrencies.

3. Decentralized Finance (DeFi) Expansion

DeFi platforms have revolutionized the financial industry by offering decentralized lending, borrowing, and trading without intermediaries. The rapid growth of DeFi projects suggests that traditional banking could soon face stiff competition from blockchain-based alternatives.

4. Layer 2 Scaling Solutions

One of the biggest challenges facing blockchain networks like Ethereum is scalability. Layer 2 solutions, such as the Lightning Network for Bitcoin and Optimistic Rollups for Ethereum, are designed to reduce transaction fees and improve processing speeds. These advancements will make crypto more accessible and practical for everyday use.

5. NFTs and the Metaverse

Non-Fungible Tokens (NFTs) have transformed digital ownership, impacting art, gaming, and virtual real estate. The integration of NFTs with the metaverse—a digital universe where users interact in virtual spaces—will open new opportunities for creators, businesses, and investors.

6. Regulatory Developments

As crypto adoption grows, governments are working on regulatory frameworks to ensure security and compliance. While some regulations could pose challenges, they could also provide greater legitimacy, attracting more mainstream users and institutions.

7. Sustainable Crypto Mining

The environmental impact of cryptocurrency mining has been a concern, leading to the rise of eco-friendly mining solutions. Innovations such as proof-of-stake (PoS) consensus mechanisms, renewable energy mining, and carbon offset initiatives are helping reduce crypto’s carbon footprint.

Final Thoughts

The cryptocurrency industry is constantly evolving, driven by innovation and adoption. Whether it’s institutional interest, DeFi growth, or the rise of NFTs, the future of crypto looks bright. However, investors should remain informed and cautious as regulatory changes and technological advancements continue to shape the market.

3 notes

·

View notes

Text

Top 10 Emerging Tech Trends to Watch in 2025

Technology is evolving at an unprecedented tempo, shaping industries, economies, and day by day lifestyles. As we method 2025, several contemporary technology are set to redefine how we engage with the sector. From synthetic intelligence to quantum computing, here are the important thing emerging tech developments to look at in 2025.

Top 10 Emerging Tech Trends In 2025

1. Artificial Intelligence (AI) Evolution

AI remains a dominant force in technological advancement. By 2025, we will see AI turning into greater sophisticated and deeply incorporated into corporations and personal programs. Key tendencies include:

Generative AI: AI fashions like ChatGPT and DALL·E will strengthen similarly, generating more human-like textual content, images, and even films.

AI-Powered Automation: Companies will more and more depend upon AI-pushed automation for customer support, content material advent, and even software development.

Explainable AI (XAI): Transparency in AI decision-making becomes a priority, ensuring AI is greater trustworthy and comprehensible.

AI in Healthcare: From diagnosing sicknesses to robot surgeries, AI will revolutionize healthcare, reducing errors and improving affected person results.

2. Quantum Computing Breakthroughs

Quantum computing is transitioning from theoretical studies to real-global packages. In 2025, we will expect:

More powerful quantum processors: Companies like Google, IBM, and startups like IonQ are making full-size strides in quantum hardware.

Quantum AI: Combining quantum computing with AI will enhance machine studying fashions, making them exponentially quicker.

Commercial Quantum Applications: Industries like logistics, prescribed drugs, and cryptography will begin leveraging quantum computing for fixing complex troubles that traditional computer systems can not manage successfully.

3. The Rise of Web3 and Decentralization

The evolution of the net continues with Web3, emphasizing decentralization, blockchain, and user possession. Key factors consist of:

Decentralized Finance (DeFi): More economic services will shift to decentralized platforms, putting off intermediaries.

Non-Fungible Tokens (NFTs) Beyond Art: NFTs will find utility in actual estate, gaming, and highbrow belongings.

Decentralized Autonomous Organizations (DAOs): These blockchain-powered organizations will revolutionize governance systems, making choice-making more obvious and democratic.

Metaverse Integration: Web3 will further integrate with the metaverse, allowing secure and decentralized digital environments.

4. Extended Reality (XR) and the Metaverse

Virtual Reality (VR), Augmented Reality (AR), and Mixed Reality (MR) will retain to improve, making the metaverse extra immersive. Key tendencies consist of:

Lighter, More Affordable AR/VR Devices: Companies like Apple, Meta, and Microsoft are working on more accessible and cushty wearable generation.

Enterprise Use Cases: Businesses will use AR/VR for far flung paintings, education, and collaboration, lowering the want for physical office spaces.

Metaverse Economy Growth: Digital belongings, digital real estate, and immersive studies will gain traction, driven via blockchain technology.

AI-Generated Virtual Worlds: AI will play a role in developing dynamic, interactive, and ever-evolving virtual landscapes.

5. Sustainable and Green Technology

With growing concerns over weather alternate, generation will play a vital function in sustainability. Some key innovations include:

Carbon Capture and Storage (CCS): New techniques will emerge to seize and keep carbon emissions efficaciously.

Smart Grids and Renewable Energy Integration: AI-powered clever grids will optimize power distribution and consumption.

Electric Vehicle (EV) Advancements: Battery generation upgrades will cause longer-lasting, faster-charging EVs.

Biodegradable Electronics: The upward thrust of green digital additives will assist lessen e-waste.

6. Biotechnology and Personalized Medicine

Healthcare is present process a metamorphosis with biotech improvements. By 2025, we expect:

Gene Editing and CRISPR Advances: Breakthroughs in gene modifying will enable treatments for genetic disorders.

Personalized Medicine: AI and big statistics will tailor remedies based on man or woman genetic profiles.

Lab-Grown Organs and Tissues: Scientists will make in addition progress in 3D-published organs and tissue engineering.

Wearable Health Monitors: More superior wearables will music fitness metrics in actual-time, presenting early warnings for illnesses.

7. Edge Computing and 5G Expansion

The developing call for for real-time statistics processing will push aspect computing to the vanguard. In 2025, we will see:

Faster 5G Networks: Global 5G insurance will increase, enabling excessive-velocity, low-latency verbal exchange.

Edge AI Processing: AI algorithms will system information in the direction of the source, reducing the want for centralized cloud computing.

Industrial IoT (IIoT) Growth: Factories, deliver chains, and logistics will advantage from real-time facts analytics and automation.

Eight. Cybersecurity and Privacy Enhancements

With the upward thrust of AI, quantum computing, and Web3, cybersecurity will become even more essential. Expect:

AI-Driven Cybersecurity: AI will come across and prevent cyber threats extra effectively than traditional methods.

Zero Trust Security Models: Organizations will undertake stricter get right of entry to controls, assuming no entity is inherently sincere.

Quantum-Resistant Cryptography: As quantum computer systems turn out to be greater effective, encryption techniques will evolve to counter potential threats.

Biometric Authentication: More structures will rely on facial reputation, retina scans, and behavioral biometrics.

9. Robotics and Automation

Automation will hold to disrupt numerous industries. By 2025, key trends encompass:

Humanoid Robots: Companies like Tesla and Boston Dynamics are growing robots for commercial and family use.

AI-Powered Supply Chains: Robotics will streamline logistics and warehouse operations.

Autonomous Vehicles: Self-using automobiles, trucks, and drones will become greater not unusual in transportation and shipping offerings.

10. Space Exploration and Commercialization

Space era is advancing swiftly, with governments and private groups pushing the boundaries. Trends in 2025 include:

Lunar and Mars Missions: NASA, SpaceX, and other groups will development of their missions to establish lunar bases.

Space Tourism: Companies like Blue Origin and Virgin Galactic will make industrial area travel more reachable.

Asteroid Mining: Early-level research and experiments in asteroid mining will start, aiming to extract rare materials from area.

2 notes

·

View notes

Text

Subject: Request to Publish News on Russian Flag NFT Initiative

],

I am reaching out to share an important development in the world of digital art and NFTs that I believe would be of great interest to your readers. Recently, an NFT inspired by the Ukrainian flag was sold for 2500 Ethereum, showcasing the immense value and recognition of national symbols in the digital space.

Inspired by this event, I have created a unique NFT titled "Russian Mother Flag" as a tribute to Russia's cultural pride and heritage. This NFT is now available for acquisition on the Rarible platform.

I kindly request your support in publishing a feature about this NFT, highlighting its significance and the growing global attention toward national identity in digital art. Publishing this news will help garner interest in this unique project and showcase Russia's presence in the evolving digital art world.

Here is the link to the NFT for reference:

https://rarible.com/token/0xc9154424b823b10579895ccbe442d41b9abd96ed:88104568749764234640630105623225807237445361296462492029665175369939314278443

I would be deeply grateful if you could give this project some coverage, encouraging awareness and appreciation of Russia's cultural legacy in the global NFT marketplace. Please feel free to reach out if you need any additional details or information.

Thank you for your attention and consideration.

Best regards,

[Himanashi tyagi

/

Best Chris

2 notes

·

View notes

Text

Blockchain Investment: A New Frontier for Investors

The rise of blockchain technology over the last decade has sparked interest across various industries, from finance and supply chain management to healthcare and entertainment. As blockchain matures, investors are starting to recognize its potential not only for transforming traditional sectors but also for offering new investment opportunities. In this article, we explore the significance of blockchain investment, the types of investments available, the associated risks, and the future outlook for this promising technology.

What is Blockchain?

Blockchain is a decentralized digital ledger technology that securely records transactions across multiple computers. It allows information to be stored transparently, immutably, and without the need for intermediaries such as banks or government bodies. The most famous application of blockchain technology is Bitcoin, the first cryptocurrency, but its potential extends far beyond digital currencies.

Blockchain’s unique features—decentralization, transparency, and security—make it an appealing foundation for various applications, ranging from finance to supply chain management to voting systems. With an increasing number of industries exploring blockchain’s use cases, it has garnered significant attention from investors.

youtube

Why Invest in Blockchain?

Disruption of Traditional Systems: Blockchain has the potential to disrupt a wide range of industries by providing more efficient, transparent, and secure alternatives to legacy systems. For example, blockchain-based financial services can lower transaction costs, reduce fraud, and offer access to previously unbanked populations. The transformation of industries such as healthcare, logistics, and government services is just beginning.

The Growth of Cryptocurrencies: Blockchain is the backbone of cryptocurrencies, which have seen exponential growth in recent years. Bitcoin, Ethereum, and other altcoins have become established assets, and decentralized finance (DeFi) platforms built on blockchain promise further innovation in financial markets. Investors can benefit from both the appreciation of these digital assets and the broader adoption of cryptocurrency ecosystems.

Tokenization of Assets: Blockchain enables the tokenization of real-world assets, including real estate, art, and commodities. This allows investors to gain fractional ownership in previously illiquid assets, opening up new avenues for diversification and investment. Tokenization can also improve liquidity and streamline processes such as cross-border payments and property transfers.

Venture Capital and Startups: Many blockchain-based startups are developing innovative applications, from decentralized applications (dApps) to non-fungible tokens (NFTs) to blockchain-based identity verification systems. Venture capitalists and angel investors can tap into the high growth potential of these companies, as blockchain adoption continues to rise globally.

Types of Blockchain Investments

Blockchain investments can be approached in several ways. Some of the most common types include:

Cryptocurrencies: Direct investment in digital currencies like Bitcoin, Ethereum, and other altcoins is the most straightforward form of blockchain investment. These cryptocurrencies can be purchased through exchanges and stored in digital wallets. While Bitcoin and Ethereum are the most well-known, there are thousands of altcoins that investors can explore.

Blockchain-related Stocks and ETFs: Rather than investing directly in cryptocurrencies, investors can gain exposure to blockchain technology by purchasing stocks in companies that are integrating blockchain into their operations. Public companies such as Nvidia (which provides hardware for mining), Coinbase (a cryptocurrency exchange), and Block (formerly Square) are examples of firms investing heavily in blockchain. Additionally, blockchain-focused exchange-traded funds (ETFs) allow investors to diversify their exposure to the sector.

Initial Coin Offerings (ICOs) and Token Sales: ICOs and token sales are fundraising mechanisms where startups issue their own cryptocurrency tokens in exchange for investments. While ICOs were initially seen as high-risk, high-reward ventures, they have become more regulated over time. This form of investment allows early-stage investors to gain a stake in blockchain projects before they are widely adopted.

Blockchain Real Estate: The tokenization of real estate allows fractional ownership of property via blockchain-based tokens. Platforms like RealT and Propy have been pioneers in this space, enabling investors to buy shares in real estate and receive dividends from rental income. Blockchain’s transparency and immutability make it ideal for managing property transactions.

Decentralized Finance (DeFi): DeFi is a rapidly growing sector that leverages blockchain to provide financial services such as lending, borrowing, and trading without intermediaries. By investing in DeFi projects or liquidity pools, investors can earn returns in the form of interest or tokens.

Risks of Blockchain Investment

While blockchain presents exciting investment opportunities, there are several risks to consider:

Volatility: Cryptocurrencies, in particular, are known for their extreme price volatility. Dramatic price swings can occur in a short time, making blockchain investments high-risk, especially for short-term traders. Long-term investors should be prepared for fluctuations in value.

Regulatory Uncertainty: Blockchain and cryptocurrencies are still in the early stages of regulatory development. Governments around the world are working on creating frameworks to govern blockchain and digital currencies, but until clear regulations are established, there could be sudden changes in legal and tax requirements that impact investment returns.

Security and Fraud Risks: While blockchain technology itself is secure, the platforms and exchanges built on top of it may not always be. Hacks, scams, and fraud have occurred in the blockchain space, with investors losing substantial amounts of money. Conducting thorough research and choosing reputable platforms is crucial.

Technological Risks: Blockchain is still an emerging technology, and its long-term scalability, interoperability, and environmental impact remain open questions. For instance, Ethereum, one of the leading blockchains, is transitioning from a proof-of-work to a more energy-efficient proof-of-stake consensus mechanism, highlighting the potential for technical challenges.

The Future of Blockchain Investment

As blockchain technology evolves, it’s expected that adoption across industries will only increase. Many experts believe that blockchain will play a central role in reshaping the global economy, particularly in areas like supply chain transparency, decentralized finance, and digital identity verification.

The rise of central bank digital currencies (CBDCs), which are government-backed digital currencies that leverage blockchain technology, will likely spur further mainstream adoption. Additionally, innovations in smart contracts, which automate transactions based on predefined conditions, will expand the use of blockchain beyond simple transactions into complex business processes.

For investors, this presents an exciting opportunity to position themselves at the forefront of a technological revolution. However, as with any emerging technology, it is important to approach blockchain investment with caution, conducting thorough due diligence and maintaining a diversified portfolio to manage risk effectively.

Conclusion

Blockchain investment offers promising opportunities for those willing to navigate its complexities. From cryptocurrencies to tokenized assets to decentralized finance, the potential for growth in this sector is vast. However, investors should carefully consider the risks associated with volatility, regulation, and security before diving in. As blockchain technology matures and becomes more widely adopted, it will likely be a key driver of innovation, providing unique opportunities for savvy investors to capitalize on the next generation of digital transformation.

2 notes

·

View notes

Text

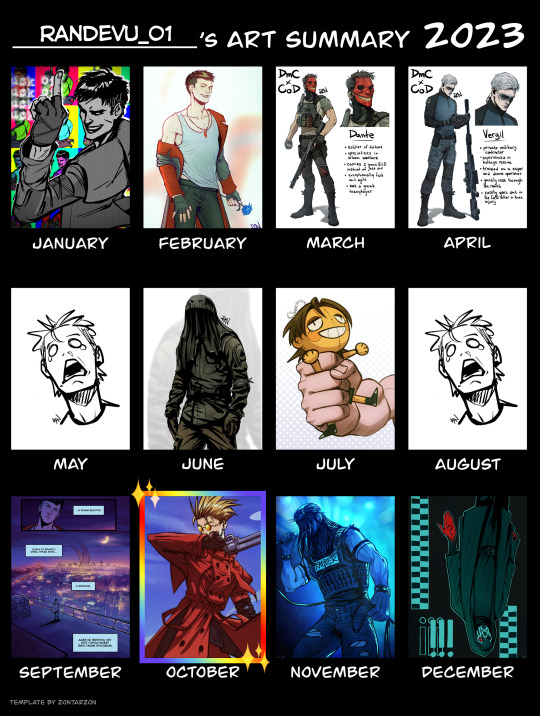

2023 art summary time!

some of my thoughts and comments are below the cut :)

This was... an interesting year. I got out of my DmC shell (after 3 or 4 years) and spent most of the year obsessing over other fandoms, e.g. Call of Duty of all things lol. I also got into Trigun, watched and loved both adaptations, as well as Fullmetal Alchemist and Death Note - quite an accomplishment for someone who generally doesn't like anime. Oh, and closer to the end of the year I discovered a whole new world of music band fandoms after I somehow got invested in Sleep Token and Ghost (it's the masks I'm sure)

Productivity-wise, even though I couldn't even fill in all the spots in the template, I feel like I did pretty good. Some months I didn't manage to finish anything, but October was wild, I did a lot of nice complete pieces then. A significant portion of my time and effort was put into drawing comics for the DMC ask, and I also took some commissions at the start and in the middle of the year, so there was very little time for me to make personal art, which I miss greatly and hope to make more of in 2024.

Speaking of future plans, I definitely want to give more attention to my OCs from Waffen AG and City Ghouls. When it comes to making OC content, I tend to stop at colored sketches at best, but in 2024 I hope I can make actual polished art of my characters. (Though I'm convinced that this will make my social media reach even worse than it is now, I'll try to not gaf, 'cause I learned that making and developing OCs can be super fun, and oh boy do I need that serotonin lol)

Skill-wise, I think I've definitely improved at making comics, lineart and anatomy, which were my 2023 goals a year ago. However, I feel like I could've done even better. But, again, I was pretty busy with irl stuff, so it's okay.

In general, life was pretty exciting in 2023. I visited 4 cities this summer, met my old friends and made some new ones. Despite some heath issues, I had a great time!

Thank you all for sticking around and appreciating my art! I cherish every little comment and reblog ^^

Hopefully, I'll be able to reach even more people on this platform in 2024. Happy New Year!

#art summary#art summary 2023#2023 art summary#2023 summary of art#summary of art 2023#summary of art

14 notes

·

View notes

Text

Emerging Trends Shaping the Future of White-Label Crypto Exchange Development

The cryptocurrency market has seen exponential growth over the years, and as demand for seamless and feature-rich trading platforms rises, white-label crypto exchange development has become a game-changing solution for businesses. A white-label crypto exchange allows entrepreneurs to quickly launch a customizable trading platform, eliminating the need for extensive development time and resources.

As the crypto landscape evolves, so do the expectations for white-label solutions. In this blog, we’ll explore the future trends shaping white-label crypto exchange development, showcasing how businesses can stay competitive and meet the ever-changing demands of traders.

1. Increased Focus on Decentralized Exchange Features

Decentralized exchanges (DEXs) are becoming increasingly popular due to their security and transparency. As a result, many white-label solutions are integrating DEX functionalities into their offerings.

Key Trends:

Hybrid Models: Combining the security of DEXs with the liquidity of centralized exchanges (CEXs).

Non-Custodial Wallets: Allowing users to trade directly from their wallets without intermediaries.

Smart Contract Integration: Automating trading processes and enhancing security.

Why It Matters:

DEX-like features in white-label solutions cater to the growing demand for privacy and decentralization, attracting a broader user base.

2. Multi-Asset Support and Tokenization

With the rise of tokenized assets and diverse cryptocurrencies, future white-label exchanges will focus on supporting a wide range of assets.

What to Expect:

Support for tokenized stocks, commodities, and real estate.

Integration of emerging blockchain networks like Solana, Avalanche, and Polkadot.

Cross-chain compatibility for seamless trading across multiple blockchain ecosystems.

Impact:

Businesses that offer multi-asset trading options will attract institutional and retail investors seeking diverse investment opportunities.

3. Advanced Security Measures

Security remains a top concern in the crypto industry. Future white-label crypto exchanges will incorporate state-of-the-art security measures to protect user funds and data.

Innovative Security Features:

Multi-Signature Wallets: Ensuring transactions require multiple approvals.

Cold Storage Solutions: Safeguarding the majority of funds offline.

AI-Powered Fraud Detection: Identifying and mitigating suspicious activities in real-time.

End-to-End Encryption: Securing user data and communication.

Why It’s Important:

Enhanced security builds trust, which is crucial for attracting and retaining users in the competitive crypto exchange market.

4. Customizable User Experiences (UX/UI)

As competition grows, user experience (UX) will become a key differentiator. White-label exchanges will prioritize customizable and intuitive interfaces.

Future Developments in UX/UI:

Personalized Dashboards: Allowing users to customize their trading view.

Simplified Onboarding: Streamlining the KYC process for faster registration.

Mobile-First Design: Optimizing platforms for seamless use on smartphones.

Dark Mode and Accessibility Features: Catering to diverse user preferences.

Result:

User-friendly platforms enhance engagement and attract a wider audience, including beginners entering the crypto space.

5. Integration of DeFi Features

Decentralized finance (DeFi) is one of the fastest-growing sectors in the crypto industry. Future white-label solutions will integrate DeFi functionalities to meet user demands for innovative financial services.

Popular DeFi Features:

Staking and Yield Farming: Enabling users to earn passive income.

Lending and Borrowing: Providing decentralized financial services.

Liquidity Pools: Allowing users to earn rewards by providing liquidity.

Why It Matters:

Incorporating DeFi features enhances platform functionality and attracts users looking for diverse earning opportunities.

6. AI and Machine Learning Integration

Artificial intelligence (AI) and machine learning (ML) are revolutionizing the way crypto exchanges operate. Future white-label exchanges will harness these technologies for automation and efficiency.

AI-Powered Features:

Predictive Analytics: Helping users make data-driven trading decisions.

Automated Trading Bots: Enabling high-frequency and algorithmic trading.

Fraud Detection: Identifying suspicious activities and enhancing security.

Outcome:

AI integration improves platform performance and user satisfaction, giving businesses a competitive edge.

7. Compliance and Regulatory Readiness

With governments worldwide tightening regulations on cryptocurrencies, compliance will be a critical factor for future exchanges.

What to Expect:

Automated KYC/AML Processes: Using AI to verify user identities and prevent money laundering.

Transparent Reporting: Providing real-time audit trails for regulators.

Global Regulatory Support: Adapting platforms to comply with regional laws.

Impact:

Regulatory-compliant exchanges inspire confidence among users and attract institutional investors.

8. Gamification in Trading

Gamification is emerging as a strategy to enhance user engagement on trading platforms. Future white-label crypto exchanges will incorporate interactive elements to make trading more engaging.

Gamification Features:

Leaderboards: Highlighting top traders and rewarding performance.

Achievements and Badges: Encouraging users to reach milestones.

Demo Trading: Offering virtual trading environments for beginners.

Why It’s Effective:

Gamification boosts user retention and makes trading enjoyable, particularly for younger demographics.

9. White-Label NFT Marketplaces

The rise of non-fungible tokens (NFTs) has created new opportunities for crypto exchanges. White-label platforms will increasingly support NFT trading and minting.

Key Features:

NFT Minting Tools: Allowing users to create and sell digital assets.

Integrated Marketplaces: Enabling seamless buying and selling of NFTs.

Royalty Management: Automating creator royalties using smart contracts.

Impact:

Businesses that offer NFT capabilities can tap into a growing market and attract creators and collectors alike.

10. Scalability and Performance Optimization

As the user base for crypto exchanges grows, scalability and performance will remain top priorities for white-label solutions.

Enhancements:

Layer-2 Scaling: Using solutions like Polygon for faster and cheaper transactions.

Cloud-Based Infrastructure: Ensuring platform reliability during traffic spikes.

Low Latency Trading: Enabling high-speed transactions for professional traders.

Result:

Scalable platforms can handle larger user bases and higher trading volumes, ensuring a seamless experience for all users.

Why Partner with Professional White-Label Crypto Exchange Development Services?

To stay competitive in the evolving crypto market, partnering with an experienced white-label crypto exchange development company is essential.

Key Benefits:

Custom Solutions: Tailored platforms with unique branding and features.

Quick Launch: Faster time-to-market compared to building from scratch.

Security Integration: Advanced measures to safeguard user funds and data.

Ongoing Support: Regular updates and technical assistance to ensure smooth operations.

Conclusion

The future of white-label crypto exchange development lies in innovation, security, and user-centric features. From integrating DeFi functionalities to offering multi-asset support and gamification, the next generation of white-label solutions will empower businesses to thrive in the competitive crypto space.

By leveraging the latest trends and partnering with professional development services, businesses can launch cutting-edge platforms that attract users, drive engagement, and generate sustainable revenue.

Ready to build your own white-label crypto exchange? The future is now—embrace innovation!

#crypto exchange platform development company#crypto exchange development company#cryptocurrency exchange development service#crypto exchange platform development#white label crypto exchange development#cryptocurrencyexchange#cryptoexchange

3 notes

·

View notes

Text

Art Tokenization Platform Development: A Complete Guide (2025)

Introduction

The art sector is presently undergoing transformational changes initiated by blockchain technology. Recently, digital ownership gained some stemmed attention, with one of the most exhilarating advances in this space being art tokenization. Through this technology, art whether physical or digital may then be identified on a blockchain as digital tokens, and anyone can invest or trade in art with full transparency and ease.

As we step into 2025, the demand for dedicated platforms that enable art to be tokenized in a safe, expedient, and user-friendly manner is rapidly increasing. This guide provides everything you need to know to successfully build an art tokenization platform-from first exploring the concept to identifying the right platform features and deciding on the best blockchain development strategy.

What Is Art Tokenization?

The process of tokenizing art refers to the conversion of ownership rights in an artwork into digital tokens stored on a blockchain. These tokens thus may grant complete or fractional ownership of the artwork, providing for more than a single investor to hold shares in a specific artwork. Another essential detail included in the smart contract behind each token is the provenance of the artwork, ownership history, and resale royalty terms.

This procedure empowers the art industry against counterfeit acts while improving liquidity and authentication. Physical artworks that can be tokenized are rare paintings, digital arts, animations, photographs, and even AI-generated images. From an investment perspective, this is exciting because this model allows a much wider population of investors to participate while allowing artists to reach worldwide markets and maintain control over resale prices for their creations.

Why Build an Art Tokenization Platform in 2025?

There has never been a more apt time to launch an art tokenization platform. Fractional ownership is at an all-time high, especially among millennial and Gen Z investors who are looking at alternative assets. With the passing years, this burgeoning technology has matured to the stature of being readily available and reliable for real-world applications like art investments.

In addition, the traditional art industry is slowly warming up to digital innovation, with galleries, auction houses, and museums looking into tokenized models as an avenue to grow their business. Artists are also in search of further streams where they can monetize their works without depending heavily upon intermediaries. Your platform can cater to that by creating a digital marketplace where artists, collectors, and investors can interact seamlessly and securely.

Features of an Art Tokenization Platform

An art tokenization platform needs to be built from functionality and user experience. Fundamentally, the platform should allow users to register, carry out a kind of identity verification (KYC/AML), and specify their wallets for buying and selling art. Artists can mint NFTs (principally, ERC-721 or ERC-1155) and set fractional ownership settings.

The backend should allow smart contracts to issue tokens and transfer ownership and royalties automatically. Since the users could also want to pay via fiat, integrating payment gateway systems that are secure would be most ideal. Besides, the platform should facilitate a marketplace with search and filtering options, portfolio management dashboards, and secure storage (IPFS) for artwork metadata. An efficient admin panel would also need to keep track of transactions, user activities, and compliance requirements.

Step-by-Step Development Process

In the development of the platform, one must understand its purpose and target audience. Is it to be designed for independent digital artists, for fine art institutions, or for global-level investors? Such a decision will shape the entire feature set and marketing efforts of the platform. Next should be the design of a user interface that is familiar to digital-age users and very attractive to classical ones; navigating through the platform should hardly be a task for anyone. Now comes one of the principal decisions to be made: the choice of blockchain.

Ethereum continues to be an attractive blockchain, perhaps for its strength and its vast ecosystem. On the contrary, chains such as Polygon, Tezos, and Solana seem to be a bargain from the point of view of cheap transaction fees and better scalability. Next, prepare to develop your smart contracts, interpreting how NFTs are minted, sold, and resold and a bit of logic around royalties and access rights. Then frontend and backend development will take care of integrating secure wallets, listing artworks, and creating user dashboards for the platform.

You should test rigorously for both smart contract exploits and performance issues. When the time comes, the launch plan will focus on onboarding artists, building a community, and running global marketing campaigns aimed at the Web3 space.

Revenue Models and Market Opportunities

An art tokenization platform can be monetized in various ways. Good money can be made by charging artists listing fees to mint and display their work; at the same time, the platform might collect small commissions from every sale and resale to ensure that some revenue keeps rolling through it. In the case of fractional ownership, the platform would earn by selling shares of very expensive artworks.

Furthermore, premium services could be marketed for subscriptions or just one-time use fees. Such services include artist verification, featured listings, marquee promotions, and an analytics dashboard. An emerging trend is to license your technology to other entities-galleries or museums-on a white-label basis. As such platforms gain mainstream acceptance, they should scale rapidly and tap into international markets, carving out new avenues in both investment and creative industries.

How BlockchainX Can Help You Build Your Art Tokenization Platform

BlockchainX brings the talent along with years of experience in tokenization and decentralized applications. We provide full-stack solutions for art tokenization platforms-from smart contract design to the deployment and maintenance of the platform. Our team of developers can build a fully custom platform or supply you with a white-labeled solution that can be launched in record time.

If you're looking for an Ethereum developer, Polygon developer, Tezos developer, or Solana developer, or one of any other sorts of developers, we've got the other thing we do is help with compliance integrations, such as {KYC/AML injection}, royalty frameworks, secure storage of metadata, and more. By making it easy to purchase blockchain-powered art, our goal is to enable creators, investors, and innovators. BlockchainX stands with you in developing your project, whether it is building it from scratch or growing an existing concept.

Conclusion

Art tokenization is no passing trend-it's a digital revolution reshaping the systems of ownership, investment, and experiencing art. By developing a custom tokenization platform, you will be embracing the new age and forging a bridge between art and blockchain. With features that highlight transparency, fractional ownership, and global access, your platform can become a worthy instrument for artists and collectors. As 2025 opens doors to opportunities in the Web3 world, there couldn't be a better time to realize your platform. Let BlockchainX spin the future of tokenized art with you.

0 notes

Text

The Emergence of NFTs: Transforming Digital Ownership and Creativity

Non-Fungible Tokens (NFTs) have revolutionized the way we think about digital ownership, art, and collectibles. By leveraging blockchain technology, NFTs provide a way to create, buy, sell, and own unique digital assets with verifiable provenance and scarcity. This article explores the world of NFTs, their impact on various industries, key benefits and challenges, and notable projects, including a brief mention of Sexy Meme Coin.

What Are NFTs?

NFTs, or Non-Fungible Tokens, are unique digital assets that represent ownership of a specific item or piece of content, such as art, music, videos, virtual real estate, and more. Unlike cryptocurrencies like Bitcoin or Ethereum, which are fungible and can be exchanged on a one-to-one basis, NFTs are indivisible and unique. Each NFT is recorded on a blockchain, ensuring transparency, security, and verifiability of ownership.

The Rise of NFTs

NFTs gained mainstream attention in 2021 when digital artist Beeple sold an NFT artwork for $69 million at Christie's auction house. This landmark event highlighted the potential of NFTs to transform the art world by providing artists with new revenue streams and collectors with verifiable digital ownership.

Since then, NFTs have exploded in popularity, with various industries exploring their potential applications. From gaming and music to real estate and fashion, NFTs are creating new opportunities for creators, businesses, and investors.

Key Benefits of NFTs

Digital Ownership: NFTs provide a way to establish true digital ownership of assets. Each NFT is unique and can be traced back to its original creator, ensuring authenticity and provenance. This is particularly valuable in the art and collectibles market, where forgery and fraud are significant concerns.

Monetization for Creators: NFTs enable creators to monetize their digital content directly. Artists, musicians, and other content creators can sell their work as NFTs, earning revenue without relying on intermediaries. Additionally, smart contracts can be programmed to provide creators with royalties each time their NFT is resold, ensuring ongoing income.

Interoperability: NFTs can be used across different platforms and ecosystems, allowing for interoperability in the digital world. For example, NFTs representing in-game items can be traded or used across multiple games and virtual worlds, enhancing their utility and value.

Scarcity and Collectibility: NFTs introduce scarcity into the digital realm by creating limited editions or one-of-a-kind items. This scarcity drives the collectibility of NFTs, similar to physical collectibles like rare coins or trading cards.

Challenges Facing NFTs

Environmental Impact: The creation and trading of NFTs, especially on energy-intensive blockchains like Ethereum, have raised concerns about their environmental impact. Efforts are being made to develop more sustainable blockchain solutions, such as Ethereum's transition to a proof-of-stake consensus mechanism.

Market Volatility: The NFT market is highly speculative and can be volatile. Prices for NFTs can fluctuate significantly based on trends, demand, and market sentiment. This volatility poses risks for both creators and investors.

Intellectual Property Issues: NFTs can raise complex intellectual property issues, particularly when it comes to verifying the rightful owner or creator of the digital content. Ensuring that NFTs are legally compliant and respect intellectual property rights is crucial.

Access and Inclusivity: The high costs associated with minting and purchasing NFTs can limit accessibility for some creators and collectors. Reducing these barriers is essential for fostering a more inclusive NFT ecosystem.

Notable NFT Projects

CryptoPunks: CryptoPunks are one of the earliest and most iconic NFT projects. Created by Larva Labs, CryptoPunks are 10,000 unique 24x24 pixel art characters that have become highly sought-after collectibles.

Bored Ape Yacht Club: Bored Ape Yacht Club (BAYC) is a popular NFT collection featuring 10,000 unique hand-drawn ape avatars. Owners of these NFTs gain access to exclusive events and benefits, creating a strong community around the project.

Decentraland: Decentraland is a virtual world where users can buy, sell, and develop virtual real estate as NFTs. This platform allows for the creation of virtual experiences, games, and social spaces, showcasing the potential of NFTs in the metaverse.

NBA Top Shot: NBA Top Shot is a platform that allows users to buy, sell, and trade officially licensed NBA collectible highlights. These video clips, known as "moments," are sold as NFTs and have become popular among sports fans and collectors.

Sexy Meme Coin (SXYM): Sexy Meme Coin integrates NFTs into its platform, offering a decentralized marketplace where users can buy, sell, and trade memes as NFTs. This unique approach combines humor and finance, adding a distinct flavor to the NFT landscape. Learn more about Sexy Meme Coin at Sexy Meme Coin.

The Future of NFTs

The future of NFTs is bright, with continuous innovation and expanding use cases. As technology advances and more industries explore the potential of NFTs, we can expect to see new applications and opportunities emerge. From virtual fashion and digital identities to decentralized finance (DeFi) and beyond, NFTs are poised to reshape various aspects of our digital lives.

Efforts to address environmental concerns, improve accessibility, and ensure legal compliance will be crucial for the sustainable growth of the NFT ecosystem. Collaboration between creators, platforms, and regulators will help build a more robust and inclusive market.

Conclusion

NFTs have ushered in a new era of digital ownership, creativity, and innovation. By providing verifiable ownership and provenance, NFTs are transforming industries ranging from art and entertainment to gaming and virtual real estate. While challenges remain, the potential benefits of NFTs and their ability to empower creators and engage communities make them a significant force in the digital economy.

For those interested in the playful and innovative side of the NFT market, Sexy Meme Coin offers a unique and entertaining platform. Visit Sexy Meme Coin to explore this exciting project and join the community.

254 notes

·

View notes

Text

Can you imagine what a digital white ethnostate or a cyber caliphate might look like? Having spent most of my career on the inside of online extremist movements, I certainly can. The year 2024 might be the one in which neo-Nazis, jihadists, and conspiracy theorists turn their utopian visions of creating their own self-governed states into reality—not offline, but in the form of Decentralized Autonomous Organizations (DAOs).

DAOs are digital entities that are collaboratively governed without central leadership and operate based on blockchain. They allow internet users to establish their own organizational structures, which no longer require the involvement of a third party in financial transactions and rulemaking. The World Economic Forum described DAOs as “an experiment to reimagine how we connect, collaborate and create”. However, as with all new technologies, there is also a darker side to them: They are likely to give rise to new threats emerging from decentralized extremist mobilization.

Today, there are already over 10,000 DAOs, which collectively manage billions of dollars and count millions of participants. So far, DAOs have attracted a wild mix of libertarians, activists, pranksters, and hobbyists. Most DAOs I have come across in my research sound innocent and fun. Personally, my favorites include theCaféDAO, which aims “to replace Starbucks” (good luck with that!); the Doge DAO, which wants to “make the Doge meme the most recognizable piece of art in the world”; and the HairDAO, “a decentralized asset manager solving hair loss.” But some DAOs use a more radical tone. For example, the Redacted Club DAO, which is rife with alt-right codes and conspiracy myth references, claims to be a secret network with the aim of “slaying” the “evil Meta Lizard King.”

The year 2024 might be one in which extremists start using DAOs strategically. Policies, legal contracts, and financial transactions that were traditionally the domain of governments, courts, and banks can be replaced with smart contracts, non-fungible tokens (NFTs), and cryptocurrencies. The use of anonymous bitcoin wallets and non-transparent cryptocurrencies such as Monero is already widespread among extremists whose bank accounts have been frozen. A shift to entirely decentralized forms of self-governance is only one step away.

Beyond practical reasons that encourage extremists to create their own self-governed structures, there is an ideological incentive too: their fundamental distrust in the establishment. If you believe that the deep state or the “global Jewish elites” control everything from governments and Big Tech to the global banking system, DAOs offer an appealing alternative. Conversations on far-right fringe platforms such as BitChute and Odysee reveal that there is much appetite for decentralized alternative forms of collaboration, communication, and crowdfunding.

So what happens if anti-minority groups establish their own digital worlds in which they impose their own governing mechanisms? What are the stakes if trolling armies start cooperating via DAOs to launch election interference campaigns? The activities of extremist DAOs could challenge the rule of law, pose a threat to minority groups, and disrupt institutions that are currently considered fundamental pillars of democratic systems. Another risk is that DAOs can serve as safe havens for extremist movements by enabling users to circumvent government regulation and security services monitoring activities. They might also allow extremists to find new ways to fundraise, plan, and plot radicalization campaigns or even attacks. While many governments have focused on developing legal frameworks to regulate AI, few have even recognized the existence of DAOs. Their looming exploitation for extremist and criminal purposes is something that has flown under the radar of global policymakers.

Technology expert Carl Miller, who has long warned of potential misuse of DAOs, told me that “even though DAOs behave like companies, they are not registered as legal entities.” There are only a few exceptions: The US states of Wyoming, Vermont, and Tennessee have passed laws to legally recognize DAOs. With no regulations in place to hold DAOs accountable for extremist or criminal activities, the big question for 2024 will be: How can we ensure the metaverse doesn’t give rise to digital white ethnostates or cyber caliphates?

10 notes

·

View notes

Text

Steps Involved in Tokenizing Real-World Assets

Introduction

Tokenizing real-world assets implies translating the ownership rights of physical or intangible assets into a blockchain-based digital token. By doing this the asset gains liquidity and fractions of the ownership with a high degree of transparency. The main steps of tokenization of real-world assets

Tokenize Real World Assets in simple steps

Asset Identification and Valuation:

Start with the selection of an asset such as real estate, artwork, or commodities, for tokenization, and then understand the market value. This refers to the valuation of all identifying features of the asset the market demand and the legal reasons to see if the asset is viable for tokenization. The valuation of the asset must be an accurate one since it greatly impacts investor confidence and the overall effect of the process of tokenization.

Legal Structuring and Compliance:

Establish the robust legal framework to ensure tokenize an asset complies with relevant regulation. This would require defining the rights and obligations of a token holder and compliance with securities laws and appropriate entities or agreements. It would be very advisable to engage legal experts who understand blockchain technology and financial regulations to help navigate this rather difficult terrain.

Choosing the Blockchain Platform:

The selection of the blockchain is highly dependent on security, scalability, transaction costs, and lastly compatibility with the asset type. Acceptance of public blockchains like Ethereum against private or permissioned chains would ultimately boil down to the requirements of the specific asset type and the demands of stakeholders Defining the Token Type and Standard:

represents equity, debt, or utility, and selects an appropriate token standard. Common standards include ERC-20 tokens and ERC-721 tokens . This decision impacts the tokens functionality interoperability and how to traded or utilized within the ecosystem

Developing Smart Contracts:

Create smart contracts to automate the processes like token issuance distribution and compliance. These self-executing contracts with the terms and directly written into code ensure transparency and reduce the need for intermediaries and enforce the predefined rules and regulations associated with the tokenized asset.

Token Creation and Management

Automating compliance

Transaction Automation

Security and Transparency

Integration with External Systems

Asset Management:

Securing the physical asset or its legal documentation in a way that ensures that the tokens issued are backed by the asset per se is called asset custody and management. It includes the engagement of third-party custodians or establishing trust structures for holding the asset, thereby providing assurance to the token holders of the authenticity and security of their investments.

Token Issuance and Distribution:

Mint and distribute the digital tokens over a selected platform or exchange to investors. Carry out the process in a completely transparent way and in full conformance with the pre-established legal framework, like initial coin offerings (ICOs) or security token offerings (STOs), among others, to reach the target investors.

Establishing a Secondary Market:

Facilitating trading of tokens in secondary markets allows liquidity and enables investors to buy or sell their holdings. Listing tokens on appropriate exchanges and ensuring compliance with relevant ongoing regulations is part and parcel of enhancing the marketability and attractiveness to investors.

Benefits Tokenize Real World Assets

Enhanced Liquidity

Traditionally illiquid assets, such as real estate and fine art, can be to challenging the buy or sell quickly. Tokenization facilitates the division of these assets into smaller tradable digital tokens, thereby increasing market liquidity and enabling faster transactions.

Fractional ownership

high-value assets mandate a substantial capital investment, which limits access to a small group of investors. However, with tokenization, these assets can be broken into smaller shares whereby multiple investors could come to own fractions of the asset. This democratizes the opportunity for investment and broadens participation in the market.

Efficiency and Decreases Costs

The application of tokenization settles processes such as settlement, record-keeping, and compliance on the blockchain. Accordingly, this reduces the need for intermediaries, lowers administrative expenses, and reduces cost per transaction. For example, the Hong Kong government issued a digital bond that reduced settlement time from five days to one.

Transparency and Security Upgraded

The important features of the blockchain promise an incorruptible, transparent ledger for all transactions. Ownership records are made secure against tampering and easily verifiable and hence fostering a greater sense of trust among investors and stakeholders and Transparency and Security Upgraded

Expanded Reach into the Market

Tokenization creates a borderless approach, enabling investors all around the world to reach and invest in a plethora of diverse assets. Aside from global reach, it creates an ecosystem that is more inclusive and opens the window for further possibilities in the world of investors and asset owners.

Conclusion

Tokenization of real-world assets (RWAs) signifies a new methodology for asset management and investment. Through converting a tangible or intangible asset into a digital token to be deployed on the blockchain this method aids in turning such assets into liquid forms permitting fractional ownership, and ensuring the performance of the transaction in a traceable manner. The whole process, from locating and appraising the asset to creating a secondary market, thus provides a systematic framework in applying blockchain technology to asset tokenization.

The increased operational efficiency, lower transaction costs, raised transparency, and wider access to the marketplace imply that, with the onset of tokenization, the very nature of investment opportunities is likely to undergo a drastic change with increased democratization from the heights of capital to meet investors on the streets. As this technology evolves, we will find innovative solutions to asset management, enhancing the accessibility and efficiency of investments for a broad spectrum of investors.

1 note

·

View note

Text

What Exactly is Cryptocurrency? A Comprehensive Guide to Get You Started!

The term cryptocurrency has been gaining increasing attention over the past few years, capturing the interest of both investors and the general public. But what exactly is this emerging digital asset? How does it work, and what does it mean for someone new to the world of crypto? In this guide, we’ll walk you through the basics, from the core concepts to real-world applications, offering a complete insight into the rapidly evolving world of cryptocurrency.

What is Cryptocurrency?

Cryptocurrency is a digital asset built on blockchain technology. Unlike traditional currencies, it is not issued by central banks but is created and managed through decentralized technology. The key characteristics of blockchain are its openness, transparency, and immutability, which allow for secure transactions without the need for intermediaries like banks or other financial institutions.

Bitcoin (BTC), created in 2009, is the first and most well-known cryptocurrency. Its creator, Satoshi Nakamoto, aimed to leverage blockchain technology to build a new financial system that operates independently of traditional banking institutions. Since then, countless other cryptocurrencies have emerged, including Ethereum (ETH), Ripple (XRP), and many more.

Different cryptocurrencies have different design goals. Some are used for payments, others for executing smart contracts, while others are primarily investment or store-of-value tools. In essence, cryptocurrencies emerged to address issues in the traditional financial system, such as high transaction fees, long settlement times, and lack of transparency.

Cryptocurrency and Blockchain: The Relationship

To understand cryptocurrency, it’s essential to grasp the underlying technology — blockchain. Simply put, blockchain is a distributed ledger where all participants can view transaction records, but no one can arbitrarily alter them. Each time a transaction is completed, it’s added to a "block," and these blocks are linked in chronological order to form a chain — hence the name "blockchain." This setup ensures that every step of the transaction is traceable and nearly impossible to manipulate.