#Backtested

Explore tagged Tumblr posts

Text

UNIFIED OVERNIGHT STRATEGY PORTFOLIO KEY INSIGHTS

The unified overnight strategy portfolio delivers robust performance with a 14.6% CAGR, a 62% win ratio, and a max drawdown of 15%. Over 1373 trades, the average gain per trade is 0.3%, proving consistent returns since 2017. Automated execution is recommended for practicality. Explore more details in our Amibroker course.

#tradingstrategies#OvernightTrading#AutomatedTrading#SharpeRatio#Backtested#StockMarketSuccess#QuantTrading#AmibrokerStrategies

1 note

·

View note

Text

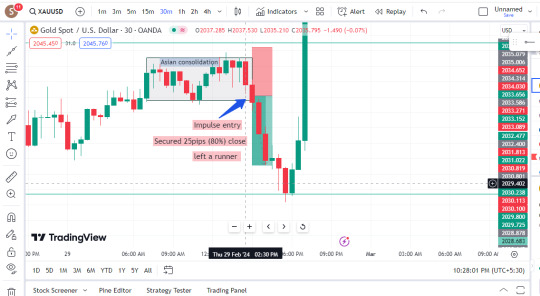

Consolidation

Stocks rallied for 5.85% last week to close above the 50 day MA on Friday. Stocks backtested the 50 day MA on Monday but still closed higher on the day. Stocks are now quite stretched above the 10 day MA. Stocks are beginning to consolidate above the 50 day MA, which will help to allow the 10 day MA to catch up to price. Stocks are currently in a daily uptrend. A bullish break out of…

View On WordPress

0 notes

Text

Gold! Remember to backtest and journal your trades. Simplify your charts for clearer opportunities. Keep it straightforward, folks! Clean charts enhance opportunity visibility.

2 notes

·

View notes

Text

🚀Project Title: Real-Time Cryptocurrency Price Action Modeling and Algorithmic Trading Strategy Backtesting Engine. ⚽

ai-ml-ds-finance-crypto-trading-backtesting-022 Filename: crypto_trading_backtester.py Timestamp: Mon Jun 02 2025 19:45:14 GMT+0000 (Coordinated Universal Time) Problem Domain:Algorithmic Trading, Quantitative Finance, Cryptocurrency Markets, Time Series Analysis, Financial Engineering, Risk Management, High-Frequency Data Analysis. Project Description:This project develops a comprehensive…

#AlgorithmicTrading#Backtesting#CCXT#CryptoTrading#DeFi#NumPy#pandas#python#QuantitativeFinance#TechnicalAnalysis#TradingBot

0 notes

Text

🚀Project Title: Real-Time Cryptocurrency Price Action Modeling and Algorithmic Trading Strategy Backtesting Engine. ⚽

ai-ml-ds-finance-crypto-trading-backtesting-022 Filename: crypto_trading_backtester.py Timestamp: Mon Jun 02 2025 19:45:14 GMT+0000 (Coordinated Universal Time) Problem Domain:Algorithmic Trading, Quantitative Finance, Cryptocurrency Markets, Time Series Analysis, Financial Engineering, Risk Management, High-Frequency Data Analysis. Project Description:This project develops a comprehensive…

#AlgorithmicTrading#Backtesting#CCXT#CryptoTrading#DeFi#NumPy#pandas#python#QuantitativeFinance#TechnicalAnalysis#TradingBot

0 notes

Text

🚀Project Title: Real-Time Cryptocurrency Price Action Modeling and Algorithmic Trading Strategy Backtesting Engine. ⚽

ai-ml-ds-finance-crypto-trading-backtesting-022 Filename: crypto_trading_backtester.py Timestamp: Mon Jun 02 2025 19:45:14 GMT+0000 (Coordinated Universal Time) Problem Domain:Algorithmic Trading, Quantitative Finance, Cryptocurrency Markets, Time Series Analysis, Financial Engineering, Risk Management, High-Frequency Data Analysis. Project Description:This project develops a comprehensive…

#AlgorithmicTrading#Backtesting#CCXT#CryptoTrading#DeFi#NumPy#pandas#python#QuantitativeFinance#TechnicalAnalysis#TradingBot

0 notes

Text

🚀Project Title: Real-Time Cryptocurrency Price Action Modeling and Algorithmic Trading Strategy Backtesting Engine. ⚽

ai-ml-ds-finance-crypto-trading-backtesting-022 Filename: crypto_trading_backtester.py Timestamp: Mon Jun 02 2025 19:45:14 GMT+0000 (Coordinated Universal Time) Problem Domain:Algorithmic Trading, Quantitative Finance, Cryptocurrency Markets, Time Series Analysis, Financial Engineering, Risk Management, High-Frequency Data Analysis. Project Description:This project develops a comprehensive…

#AlgorithmicTrading#Backtesting#CCXT#CryptoTrading#DeFi#NumPy#pandas#python#QuantitativeFinance#TechnicalAnalysis#TradingBot

0 notes

Text

🚀Project Title: Real-Time Cryptocurrency Price Action Modeling and Algorithmic Trading Strategy Backtesting Engine. ⚽

ai-ml-ds-finance-crypto-trading-backtesting-022 Filename: crypto_trading_backtester.py Timestamp: Mon Jun 02 2025 19:45:14 GMT+0000 (Coordinated Universal Time) Problem Domain:Algorithmic Trading, Quantitative Finance, Cryptocurrency Markets, Time Series Analysis, Financial Engineering, Risk Management, High-Frequency Data Analysis. Project Description:This project develops a comprehensive…

#AlgorithmicTrading#Backtesting#CCXT#CryptoTrading#DeFi#NumPy#pandas#python#QuantitativeFinance#TechnicalAnalysis#TradingBot

0 notes

Text

Miner Change Of Perspective

The Miners backtested the 50 day MA on Monday. As discussed in the Weekend Report, the Miners are in the 1st daily cycle of a new intermediate cycle. The expectation is for the 1st daily cycle to right translate. That aligns with the Miners are currently in a daily uptrend. If the Miners form a swing low above the upper daily cycle band that will indicate a continuation of the daily uptrend and…

View On WordPress

0 notes

Text

youtube

🔧 Comment utiliser vos indicateurs perso en backtest ProRealTime

Vous avez développé vos propres indicateurs sur ProRealTime ? Parfait. Mais les avez-vous testés dans de vraies conditions historiques avant de les utiliser en live ? Dans cette vidéo, découvrez comment intégrer et tester vos indicateurs personnalisés dans le moteur de backtest de ProRealTime, pour valider vos stratégies avant de les mettre en pratique.

📌 Dans cette vidéo, vous apprendrez : ✅ Comment insérer vos indicateurs perso dans une stratégie Prorealtime ✅ Comment écrire un code simple pour déclencher un backtest ✅ Comment utiliser des indicateurs importés dans une backtest

#stock market#ProRealTime#backtest ProRealTime#indicateur personnel ProRealTime#stratégie ProRealTime#indicateur trading#tester ses indicateurs#ProRealTime tutoriel#backtest trading#indicateur personnalisé#trading algorithmique#ProRealCode#coder stratégie trading#valider stratégie trading#stratégie automatique#comment backtester#tutoriel PRT#optimiser stratégie trading#créer indicateur trading#ProRealTime code#apprendre ProRealTime#Youtube

0 notes

Text

https://www.storeboard.com/sachinjoshi1/images/how-to-customise-algorithmic-trading-software-to-suit-your-trading-style/1136694

Algorithmic trading, or algo-trading, has revolutionised the financial markets. It involves using computer programs to execute trading strategies automatically based on predefined rules and parameters.

#Algorithmic Trading Software#Customise Algorithmic Trading Software#pre-built algorithmic trading#robust backtesting

0 notes

Text

4/9-Weekly EMA Crossover Strategy

I recently came across a reddit post from some random guy in Brazil. He mentioned the 4/9 EMA cross was pretty successfull so I wanted to try it.

Period = Weekly Initial Size = $1000 Stop Loss = -$50 Opening Condition = 4 period EMA > 9 period EMA Closing Conditions = Close < 20EMA

0 notes

Text

nifty and bank nifty movers 23 jan 2024

#nifty50#nifty prediction#nifty fifty#bank nifty#nifty today#niftytrading#nifty index#backtesting#backtestmojo#Backtest#free Backtest

1 note

·

View note

Text

Value At Risk Indicated By Aberrant Stock Market Volatility and Expected Shortfalls for January 2025

Value at Risk, and VAR Normalized Returns Patterns, which are risk management indicators, and an early indicator of expected shortfalls for a given month of stock returns, are all turning in patterns which exceed expectations for the previous 100-Day...

#Backtesting#Broad Money#Federal Reserve#FOMC#Jerome Powell#M1#M2#M3#M4#M5#M6#Monetary Authority#Monetary Base#President Donald Trump#Standardized Normal Returns#United States#Value-At-Risk#VAR

0 notes

Text

Free Backtesting

#freebackktesting#backtest#backtesting#freebacktest#niftybacktesting#optionbacktesting#freeoptionbackteting#bankniftybacktesting

1 note

·

View note

Text

Algorithmic Trading

Trade automatically with speed and precision. Code your strategy, backtest it, and execute emotion-free trades in real time.

#tradingstrategies#AlgorithmicTrading#AlgoTrader#Backtesting#TradingBots#QuantTrading#AutomationInFinance#tradingtips#tradingstrategy#algotrading

1 note

·

View note