#Banks of Sri Lanka

Text

Investigating the Beat Banks in Sri Lanka: Your Extreme Direct

Sri Lanka’s keeping money segment could be a crucial component of the country’s budgetary scene, advertising a run of administrations to people, businesses, and the economy as a entirety. With a steady and quickly developing economy, Sri Lanka brags a few legitimate banks that provide exceptional money related administrations. In this article, we’ll dive into the beat banks in Sri Lanka, highlighting their key highlights and offerings. These best banks in Sri Lanka prioritize client fulfillment and are committed to keeping up the most noteworthy measures of polished skill and moral hones. They too effectively contribute to the country’s financial advancement through activities such as supporting business enterprise, advancing money related proficiency, and contributing in economical advancement ventures. With their solid monetary establishments and unflinching commitment to fabulousness, these banks proceed to play a crucial part in forming Sri Lanka’s budgetary scene.

Bank of Ceylon:

Built up in 1939, the Bank of Ceylon (BOC) is the biggest state-owned bank in Sri Lanka. With an broad organize of branches and ATMs over the nation, BOC offers a wide run of budgetary items and administrations. Their offerings incorporate individual and corporate keeping money, advances, exchange back, outside money trade, and advanced keeping money arrangements. BOC’s commitment to mechanical development, customer-centric approach, and strong nearness in rustic zones make it one of the driving banks within the nation.

Commercial Bank of Ceylon PLC:

As one of the biggest private segment banks in Sri Lanka, the Commercial Bank of Ceylon PLC is famous for its comprehensive run of keeping money arrangements. With a center on client comfort and cutting-edge innovation, Commercial Bank offers administrations such as individual and trade keeping money, riches administration, credit cards, online keeping money, and versatile managing an account. The bank’s broad department organize, counting specialized branches for SMEs and Islamic managing an account, caters to diverse client needs.

Hatton National Bank:

Built up in 1888, Hatton National Bank (HNB) contains a wealthy history and could be a noticeable player in Sri Lanka’s managing an account segment. HNB gives a wide run of keeping money administrations, counting individual and commercial managing an account, exchange back, treasury administrations, and venture keeping money. With a solid accentuation on client fulfillment, HNB offers imaginative computerized keeping money arrangements, making managing an account more open and helpful for its clients.

Sampath Bank PLC:

Sampath Bank PLC is known for its customer-centric approach and inventive financial solutions. With a different portfolio of administrations, counting individual and corporate managing an account, credit cards, advances, and riches administration, Sampath Bank caters to wants of people and businesses alike. The bank is additionally recognized for its center on advanced change and has presented a few cutting-edge innovative arrangements to improve the managing an account encounter.

People’s Bank:

People’s Bank, a state-owned bank, is profoundly established in Sri Lanka’s rustic regions and plays a pivotal part in budgetary incorporation. The bank offers a wide extend of administrations, counting individual managing an account, SME managing an account, corporate managing an account, and agrarianmanaging an account. People’s Bank’s broad department organize guarantees that its administrations reach each corner of the nation, giving fundamental budgetary support to the rustic populace.

Conclusion:

Sri Lanka’s managing an account segment brags a few legitimate teach that cater to the assorted budgetary needs of people and businesses. The Bank of Ceylon, Commercial Bank of Ceylon PLC, Hatton National Bank, Sampath Bank PLC, and People’s Bank are among the beat players within the industry, advertising a comprehensive extend of administrations coupled with cutting-edge innovation and customer-centric approaches. Whether you look for individual keeping money arrangements, corporate monetary administrations, or inventive computerized stages, these banks are well-equipped to meet your necessities. It is prudent to completely evaluate your needs and inclinations some time recently choosing a bank, guaranteeing that you simply select the one that adjusts best along with your budgetary objectives and needs.

0 notes

Text

In their February paper, “US Dollar Primacy in an Age of Economic Warfare,” presented at the West Point Symposium on “Order, Counter-Order, Disorder” Michael Kao and Michael St. Pierre argue for using a stronger US dollar as geopolitical leverage:

Not only are the effects of interest rates hikes magnified in other countries due to a myriad of structural and idiosyncratic economic fragilities previously discussed, the confluence of wide USD adoption with cyclical USD strength … make the USD a potent geopolitical lever masquerading as a domestic fight against inflation. National Power lends the USD dominance in adoption, while an opportunistic fight against inflation lends the USD cyclical strength for geopolitical leverage.

The US and US-led institutions are already trying to sideline China in countries struggling to make debt payments. And these efforts are likely to continue as interest rates rise and more countries in the Global South are unable to repay loans. A recent UNDP paper stated that 52 developing countries are suffering from severe debt problems.

China is the world’s largest bilateral creditor, and this is especially true for countries that are part of Beijing’s Belt and Road Initiative and/or for countries that possess strategically important natural resources. Washington estimates that Chinese lending ranges from $350 billion to a trillion dollars.

In recent years, western officials and media have ratcheted up criticism of China’s lending practices, claiming Beijing is putting its boot on the neck of countries, holding back their development, and is seizing assets offered as collateral.

Deborah Bräutigam, the Director of the China Africa Research Initiative at the Paul H. Nitze School of Advanced International Studies, has written that this is “ a lie, and a powerful one.” She wrote, “our research shows that Chinese banks are willing to restructure the terms of existing loans and have never actually seized an asset from any country.”

Even researchers at Chatham House admit there’s nothing nefarious about China’s lending, explaining that it has instead created a debt trap for China. That is becoming more evident as nations are unable to repay, largely due to the economic fallout from the pandemic, the Nato proxy war against Russia in Ukraine, inflation, and rising interest rates.

These confluence of events hitting developing countries are entangling China in multilateral talks that include US-backed institutions like the IMF. Beijing’s preference has always been to try and tackle debt repayment issues at a bilateral level, typically by extending maturities rather than accepting write-downs on loans.

But US Treasury Secretary Janet Yellen and company continue to parrot the talking point that China’s lending is harming countries, and in countries unable to repay their international debts, the West and China are increasingly at odds.

Back in 2020, the G-20 countries created the Common Framework for Debt Treatments to provide relief to indebted countries, which included “fair burden sharing” among all creditors. Beijing’s reluctance to agree to such burden sharing is illustrated by the case of Zambia.

Zambia became the first African country to default on some of its dollar-denominated bonds during the Covid-19 pandemic when it failed to make a $42.5 million bond payment in November 2020.

More than a third of the country’s $17 billion in debt is owed to Chinese lenders. Zambia worked out a deal with the IMF for a $1.3 billion bailout package but can’t access the relief until its underlying debt is restructured – including Chinese debts. But the IMF prescription for Zambia is a blow to Beijing. Here are some details of the arrangement from The Diplomat:

Zambia will shift its spending priorities from investment in public infrastructure – typically financed by Chinese stakeholders – to recurrent expenditures. Specifically, Zambia has announced it will totally cancel 12 planned projects, half of which were due to be financed by China EXIM Bank, alongside one by ICBC for a university and another by Jiangxi Corporation for a dual highway from the capital. The government has also canceled 20 undistributed loan balances – some of which were for the new projects but others for existing projects. While such cancellations are not unusual on Zambia’s part, Chinese partners account for the main bulk of these loans…

While some of these cancellations may have been initiated by Chinese lenders themselves, especially those in arrears, Zambia may not have needed to cancel so many projects. Since 2000, China has canceled more of Zambia’s bilateral debt than any sovereign creditor, standing at $259 million to date.

Nevertheless, the IMF team justified the shift because they – and presumably Zambia’s government – believe that spending on public infrastructure in Zambia has not returned sufficient economic growth or fiscal revenues. However, no evidence is presented for this in the IMF’s report.

Zambia will also cut fuel and agriculture subsidies. So instead of infrastructure investment and social spending, the country gets austerity. The IMF deal also relegates China to the backseat, as it allows for 62 concessional loan projects to continue, only two of which will involve China. The vast majority of the projects will be administered by multilateral institutions and involve recurrent expenditure rather than infrastructure-focused projects.

Despite all the evidence to the contrary, Yellen on a trip to Zambia in February warned that Chinese lending “can leave countries with a legacy of debt, diverted resources, and environmental destruction” and called out Beijing for being a “barrier” to ending the major copper producer’s debt crisis and noted that it had “taken far too long already to resolve.”

The US effort to sideline China in Zambia comes at the same time that Washington is trying to tighten control over resources in the region. Note that back in December the US signed deals with the Democratic Republic of Congo and Zambia (the world’s sixth-largest copper producer and second-largest cobalt producer in Africa) that will see the US support the two countries in developing an electric vehicle value chain.

Beijing is insisting that multilateral lenders also accept haircuts on loans rather than just China being expected to do so. This is a position that most debtor nations agree with. On the other side, the IMF and its partners are worried that its bailout money would merely go to Chinese creditors – many of which are state banks that are increasingly troubled by bad debts.

Gong Chen, founder of Beijing-based think tank Anbound, says that if countries are unwilling or unable to repay their debts to China, it would be devastating:

Widespread debt evasion and avoidance would have a significant impact on China’s financial stability,” he said, “and we are concerned that some countries may try to avoid paying back their debt by utilizing geopolitics and the ideological competition between East and West.

Yellen and company tried to apply more pressure on Beijing at the recent G20 meeting of finance officials in India, but that fell flat on its face much like the West’s efforts to hijack the meeting and turn it into a roundtable on Russian sanctions.

Meanwhile, Zambia has halted work on several Chinese-funded infrastructure projects, including the Lusaka-Ndola road, and canceled undisbursed loans in line with the IMF prescription for its debt problem.

Chinese companies are now attempting to work around these roadblocks by shifting more toward public-private partnerships. For example, a Chinese consortium is now planning to build a $650 million toll road from the Zambian capital to the mineral-rich Copperbelt province and the border with the Democratic Republic of the Congo.

The situation in Zambia does not bode well for other nations needing debt relief, as the delays while the West and China clash mean more pressure on government finances, companies and populations.

And if the West’s primary goal in offering debt relief is to sideline Beijing, as it appeared in Zambia, then that will mean a drastic scaling back of infrastructure projects replaced by austerity. From Sovdebt Oddities:

More broadly, as noted by Mark Sobel, the current international financial architecture is ill-equiped to deal with a major recalcitrant creditor benefiting from outsized (geo)political leverage. While it remains illusional to insulate sovereign restructurings from geopolitical considerations, there is a risk that they would turn into a game of chicken between China on the one hand and the IMF and Paris Club on the other hand. The problem being that if none of the players yields, it will just mean more economic and social hardship for the debtor country stuck in the middle.

Sure enough, the same situation is playing out in two nations that are key points on China’s Belt and Road project: Pakistan and Sri Lanka.

Here is Islamabad’s debt situation, courtesy of Pakistani economist Murtaza Syed at The International News:

For each of the next five years, Pakistan owes the world $25 billion in principal repayments. It will also need at least $10 billion to finance the current account deficit, bringing total external financing needs to $35 billion a year between now and 2027. We have foreign exchange reserves of just $3 billion. For each of the next five years, the government needs to pay 5 percent of GDP to service the debt it owes to residents and foreigners. Our total tax take is only 10 percent of GDP.

Around fourth-fifths of this external debt is owed to the official sector, split roughly evenly between multilaterals (like the IMF, World Bank and ADB) and bilaterals (countries like China, Saudi Arabia and the United States). The remaining one-fifth is commercial, again roughly evenly split between Eurobond/Sukuk issuances and borrowing from Chinese and Middle Eastern banks. By region, we owe roughly one-third of our external debt to China and 10 percent to the old-boys network of the Paris Club, which includes Europe and the US.

Additionally, last year, the Pakistan rupee plunged nearly 30 percent compared to the US dollar. All indications are that the IMF is using bailout negotiations to pressure Pakistan to move away from China and revive its partnership with the US. Some background from WSWS:

Former prime minister Imran Khan’s government was promptly removed in April 2022 after he reversed IMF-demanded subsidy cuts in the face of country-wide protests. Khan had previously implemented two rounds of some of the toughest austerity in the country’s history. In the final year of his government, Khan shifted the country’s foreign policy towards a closer alliance with Russia and deepened ties with China, prompting concern and anger in Washington.

Sharif’s Muslim League (PML-N) and the People’s Party (PPP) assumed power in a coalition with the approval of the military, long the most powerful political actor in the country and the linchpin of the alliance between the Pakistani bourgeoisie and US imperialism. The express aim of the new government was to implement IMF austerity, which it has done.

The IMF-prescribed austerity imposed by Pakistani elites also targets Beijing. China is Pakistan’s largest single creditor as the country is perhaps the most important country in China’s Belt and Road plans because it would provide China with a potential corridor to the seaport at Gwadar on the Indian Ocean. The supply line would reduce the distance between China and the Middle East by thousands of miles via insecure sea lanes to a shorter and more secure distance by land. Beijing’s spending in Pakistan reflects this, as the $53 billion China has spent on the Belt and Road Initiative (BRI) in the country is tops of all BRI countries.

Yet many of the BRI plans are unrealized, and Pakistan’s current economic situation makes it unlikely they’ll be finished anytime soon. China has dramatically scaled back investment, which fits with its more cautious approach to BRI projects. Meanwhile, decades-high inflation, economic mismanagement, and last year’s biblical floods have led to Islamabad burning through its foreign exchange reserves in order to make debt payments. The US blames China.

“We have been very clear about our concerns not just here in Pakistan, but elsewhere all around the world about Chinese debt, or debt owed to China,” US State Department Counselor Derek Chollet told journalists at the US Embassy in Islamabad after he met with Pakistani officials in February.

Additionally, Cholett said Washington is warning Islamabad about the “perils” of a closer relationship with Beijing.

According to the Times of India, many Pakistani officials have come around to the US way of thinking and are also blaming the China-Pakistan Economic Corridor Project (CPEC), a $65 billion network of roads, railways, pipelines, and ports connecting China to the Arabian Sea, for worsening the country’s debt crisis. From Indian Express:

Pakistan expanded its electricity generation capacity under the China-Pakistan Economic Corridor Programme (CPEC) but the expansion came at a high cost both in terms of high returns guaranteed to the Chinese independent power producers (IPPs) and the expensive foreign currency debt. Pakistan has been unable to make the capacity payments to IPPs under the long-term power purchase agreements with the electricity sector debt rising to a staggering $ 8.5 billion.

Last December, the government agreed to repay this debt in installments. However, this may have displeased the IMF, which had expected the government, in August 2022, to renegotiate the purchase power agreements. Pakistan tried to renegotiate but the Chinese refused.

The IMF extended the current program on the condition that it would not go to the Chinese IPPs. More from Nikkei Asia:

Observers say Pakistan’s handling of the electricity issue is likely to irk China, noting that Sharif’s government committed to the IMF to reopen power contracts without taking the Chinese companies into confidence. Pakistan has also reneged on a promise to set up an escrow account to ensure smooth payments to Chinese IPPs.

The IMF is demanding that Pakistan rationalize payments to the Chinese IPPs in line with earlier concessions extracted from local private power producers…

The IMF now wants Pakistan to negotiate an increase in the duration of bank loans from 10 years to 20 years, or to reduce the markup on arrears owed to Chinese IPPs from 4.5% to 2%.

Notably, the IMF appears to have been less willing to make concessions than the previous 22 times Pakistan has sought its support since 1959. Oddly enough Beijing is pushing for a deal between Islamabad and the IMF, and China recently extended a $2 billion loan to Pakistan. From the Middle East Institute:

It is interesting to note, for example, that Chinese officials reportedly urged Islamabad to repair ties with the IMF — if true, an indication that Beijing regards resumption of the Fund’s lending program as key to mitigating Pakistan’s risk of default.

It is also revealing that Pakistan seems keener to take on new financing from China than China may be to furnish it. Even as the economy wobbles under a heavy debt burden and other acute challenges, Pakistani officials have sought support from China to upgrade the Main Line 1 (ML-1) railroad, a project which, if not undertaken, they claim could result in the breakdown of the entire railway system.Yet, the IMF wants Pakistan to rein in CPEC activity. And China’s own domestic economic challenges and priorities might make it hesitant to respond to Islamabad’s appeals. On the other hand, the ML-1 project might meet Beijing’s more exacting standards and increasing emphasis on “high quality” BRI infrastructure projects.

The recent rapprochement between Iran and Saudi Arabia could leave Pakistan out in the cold and even more reliant upon the US. From Andrew Korybko:

With the Kingdom likely to focus more on mutually beneficial Iranian investments than on dumping billions into seemingly never-ending Pakistani bailouts that haven’t ever brought it anything in return, Islamabad will predictably become more dependent on the US-controlled IMF. China will always provide the bare minimum required to keep Pakistan afloat in the worst-case scenario, but even it seems to be getting cold feet nowadays for a variety of reasons, thus meaning that US influence might further grow.

About that, last year’s post-modern coup restored American suzerainty over Pakistan to a large degree, which now makes that country a regional anomaly in the geopolitical sense considering the broader region’s drift away from that declining unipolar hegemon. The very fact that previously US-aligned Saudi Arabia patched up its seemingly irreconcilable problems with Iran as a result of Chinese mediation reinforces this factual observation. Pakistan now stands alone as the broader region’s only US vassal.

Pakistan is not only the most highly indebted to China of its BRI partners, but along with Sri Lanka, is also among the largest recipients of Chinese rescue lending. The ruling elite Pakistan is increasingly concerned that the social crisis could spiral out of control and result in something similar to what happened in Sri Lanka last year when a popular uprising toppled the government.

Due to haggling between the West and China, Sri Lanka has been waiting since September to finalize a bailout after a $2.9 billion September staff level IMF deal. And yet many of the recommendations in the agreement have already been implemented—to disastrous effect.

The country is dealing with its worst economic crisis since independence in 1948, including a shortage of reserves and essential items. In February, the IMF said Sri Lanka’s bailout package was set to be approved as soon as the country obtained adequate assurances from bilateral creditors, i.e., China.

Beijing now appears ready to meet more of the IMF’s demands, although details have yet to be released. In a letter in January, the Export-Import Bank of China offered a two-year debt moratorium, but the IMF said that wasn’t enough. According to Reuters, total Sri Lankan debt to Chinese lenders totals roughly 20 percent of the country’s total debt.

Sri Lanka is another focal point of the BRI due to its geographical position in the middle of the Indian Ocean. China’s goal was to transform the country into a transportation hub as much of its energy imports from the Middle East and mineral imports from Africa pass through Sri Lanka. Beijing has already achieved much of these goals. For example, in 2017 a 70 percent stake of the Hambantota port was leased to China Merchants Port Holdings Company Limited for 99 years for $1.12 billion.

The West blames China’s BRI initiative in Sri Lanka for saddling the country with unsustainable debt, but is that really the case? Political economists Devaka Gunawardena , Niyanthini Kadirgamar, and Ahilan Kadirgamar write at Phenomenal World:

The problems associated with the IMF’s policy package have been caught in geopolitical rhetoric. The US alleges that Sri Lanka is the victim of a Chinese debt trap. In fact, Sri Lanka is in an IMF trap. The structural consequences of over four decades of neoliberal policies have exploded into view with the receding welfare state, a ballooning import bill, and investment in infrastructure without returns, all of which relied on inflows of speculative capital. Framing Sri Lanka’s crisis within a narrative of geopolitical competition obscures the core dilemmas of the global economy. Will the evident breakdown force a reckoning with the present order, or will it be used as an excuse to inflict more suffering?

Thus far, it looks like the latter.

#economics#china#zambia#sri lanka#pakistan#international monetary fund#world bank#capitalism#belt and road initiative#new silk road#us imperialism#china-pakistan economic corridor program#chinese investment in africa

29 notes

·

View notes

Text

Apply for DFCC Bank job vacancies 2024 as a Relationship Officer in Batticaloa. Join us to foster growth and progress together.

#lanka career#job vacancies 2024#sri lanka job vacacnies#management assistant#jobsearch#job vacancies in sri lanka#srilanka#jobalert#hiringnow#jobhunt#dfcc bank

0 notes

Text

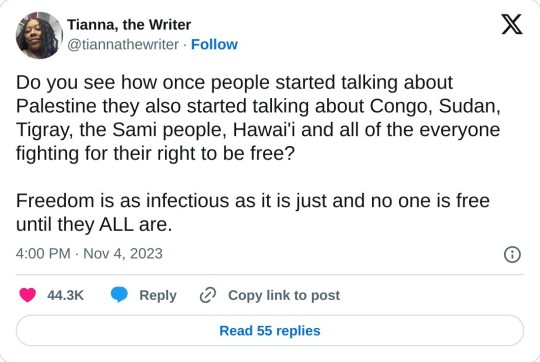

People & countries mentioned in the thread:

DR Congo - M23, Cobalt

Darfur, Sudan - International Criminal Court, CNN, BBC (Overview); Twitter Explanation on Sudan

Tigray - Human Rights Watch (Ethnic Cleansing Report)

the Sámi people - IWGIA, Euronews

Hawai'i - IWGIA

Syria - Amnesty International

Kashmir- Amnesty Summary (PDF), Wikipedia (Jammu and Kashmir), Human Rights Watch (2022)

Iran - Human Rights Watch, Morality Police (Mahsa/Jina Amini - Al Jazeera, Wikipedia)

Uyghurs - Uyghur Human Rights Project (UHRP) Q&A, Wikipedia, Al Jazeera, UN Report

Tibetans - SaveTibet.org, United Nations

Yazidi people - Wikipedia, United Nations

West Papua - Free West Papua, Genocide Watch

Yemen - Human Rights Watch (Saudi border guards kill migrants), Carrd

Sri Lanka (Tamils) - Amnesty International, Human Rights Watch

Afghans in Pakistan - Al Jazeera, NPR

Ongoing Edits: more from the notes / me

Armenians in Nagorno-Karabakh/Azerbaijan (Artsakh) - Global Conflict Tracker ("Nagorno-Karabakh Conflict"), Council on Foreign Relations, Human Rights Watch (Azerbaijan overview), Armenian Food Bank

Baháʼís in Iran - Bahá'í International Community, Amnesty, Wikipedia, Minority Rights Group International

Kafala System in the Middle East - Council on Foreign Relations, Migrant Rights

Rohingya - Human Rights Watch, UNHCR, Al Jazeera, UNICEF

Montagnards (Vietnam Highlands) - World Without Genocide, Montagnard Human Rights Organization (MHRO), VOA News

Ukraine - Human Rights Watch (April 2022), Support Ukraine Now (SUN), Ukraine Website, Schools & Education (HRW), Dnieper River advancement (Nov. 15, 2023 - Ap News)

Reblogs with Links / From Others

Indigenous Ppl of Canada, Cambodia, Mexico, Colombia

Libya

Armenia Reblog 1, Armenia Reblog 2

Armenia, Ukraine, Central African Republic, Indigenous Americans, Black ppl (US)

Rohingya (Myanmar)

More Hawai'i Links from @sageisnazty - Ka Lahui Hawaii, Nation of Hawai'i on Soverignty, Rejected Apology Resolution

From @rodeodeparis: Assyrian Policy Institute, Free Yezidi

From @is-this-a-cool-url: North American Manipur Tribal Association (NAMTA)

From @dougielombax & compiled by @azhdakha: Assyrians & Yazidis

West Sahara conflict

Last Updated: Feb. 19th, 2024 (If I missed smth before this, feel free to @ me to add it)

#resources#important#congo#sudan#tigray#sámi#hawai'i#syria#kashmir#iran#uyghurs#china#tibetans#yazidi#west papua#yemen#sri lanka#afghans in pakistan#pakistan#human rights#palestine#twitter#lmk if there's a better reource or I linked smth wrong. I am very tired#my posts#genocide#social justice#nagorno karabakh#Bahá'í#kafala system#qatar

45K notes

·

View notes

Text

What is the Current Loan Interest Rate in Sri Lanka?

Understanding the current bank loan interest rates in Sri Lanka is essential for anyone considering borrowing funds for personal, business, or investment purposes. The loan interest rate is the percentage charged on the total loan amount, impacting the overall cost of borrowing.

In Sri Lanka, loan interest rates are influenced by various factors, including the Central Bank's monetary policy, inflation rates, and the financial health of the lending institution. Typically, these rates can range significantly based on the type of loan, the borrower's creditworthiness, and the loan tenure.

Personal loans generally come with higher interest rates compared to secured loans like home or auto loans. This is due to the increased risk for the lender when offering unsecured credit. Business loans, on the other hand, might have varying rates based on the business's financial stability and the specific loan terms negotiated.

To find the best loan interest rate, it's crucial to compare offerings from different banks and financial institutions. Many institutions provide detailed information about their loan products online, making it easier for potential borrowers to make informed decisions. Additionally, consulting with financial advisors can provide insights into the most suitable loan options based on individual financial situations.

Prospective borrowers should also be aware of any additional fees and charges associated with loans, such as processing fees, early repayment penalties, and insurance costs. These can add to the overall cost of borrowing, making it important to read the fine print and understand all terms and conditions before committing to a loan.

Staying informed about the current loan interest rates in Sri Lanka helps borrowers make sound financial decisions. By comparing rates and understanding the various factors influencing these rates, individuals and businesses can secure loans that best meet their financial needs.

For competitive loan interest rates and reliable financial services, consider exploring the offerings from Siyapatha Finance.

Siyapatha Finance

0 notes

Text

Peoples Bank

Personal Banking

Savings Accounts: Wide variety to suit different financial goals. Learn more here.

Loans: Includes housing, personal, vehicle, and educational loans. Competitive interest rates and flexible repayment options. Details here.

Credit and Debit Cards: Offers various benefits and rewards. Explore options here.

Corporate Banking

Business Loans: Customized solutions for small to large businesses. More information here.

Trade Services: Facilitates international trade with import/export support. Details here.

Treasury Services: Efficient management of corporate finances, including cash management and forex services. More here.

Digital Banking

Online and Mobile Banking: Convenient access to banking services via the People's Wave app. Manage accounts, transfer funds, and pay bills online. More information here.

International Remittances

Secure and fast money transfer services, partnering with global providers to ensure reliable transactions. Details here.

Membership Programs

Elegance and Excelsior: Exclusive membership programs offering personalized banking services and additional benefits for high-net-worth individuals. Learn more here.

People’s Bank continues to enhance its offerings, ensuring customers receive comprehensive and efficient services. For more information, visit the People's Bank website.

1 note

·

View note

Text

Policy changes post-elections can deter the economic recovery: Central bank chief

The approaching official decisions in the not so distant future could obstruct Sri Lanka's conditional recuperation from its serious monetary emergency, advised the country's national bank boss on Tuesday (7).

Following a long time of deficiencies in fundamental products like food, fuel, and medication, Sri Lanka defaulted on its unfamiliar obligation in 2022, starting boundless fights that prompted the evacuation of then-president Gotabaya Rajapaksa.

Under his replacement, Ranil Wickremesinghe, grim measures have been executed, including huge duty increments, close by a firm crackdown on enemy government fights.

Nandalal Weerasinghe noticed that while the emergency stricken economy has settled somewhat because of severe changes provoked by a Global Financial Asset bailout, the nation actually faces difficulties ahead.

"Locally, what I see as the test is to proceed with similar arrangements going ahead regardless of the organization," Weerasinghe said. "That is a significant one."

Wickremesinghe's party has shown that he will look for a new term at the decisions due in September or October.

His two principal rivals have said they need to reconsider the particulars of the IMF bailout, decrease expenses and increment food and energy endowments.

Last month, the Asian Advancement Bank additionally cautioned that Sri Lanka's recuperation could be slowed down by unexpected arrangement changes after races assuming the result debilitated the public authority's obligation to sameness measures.

Unfamiliar loan specialists have likewise cautioned that any postpone in rebuilding Sri Lanka's unfamiliar obligation could affect the economy.

Sri Lanka had anticipated an arrangement with unfamiliar banks — including China, its single greatest respective loan boss — toward the finish of Spring, however up to this point no understanding has been declared.

#breaking news#international news#news#srilanka news#srilanka weekly#world news#sri lanka#india#Policy changes post-elections can deter the economic recovery: Central bank chief

0 notes

Text

Pan Asia Bank: Your Gateway to Progressive Banking in Sri Lanka

In the heart of Sri Lanka's bustling financial landscape stands Pan Asia Bank, a beacon of innovative and customer-focused banking. With a legacy of over two decades, the bank has consistently redefined the banking experience, merging tradition with technology to meet the evolving needs of its customers. This blog post delves into the journey, services, and unique aspects of Pan Asia Bank, spotlighting why it stands out in Sri Lanka's competitive banking sector.

1. A Rich Legacy of Service and Innovation:

The Journey of Pan Asia Bank: Founded with a vision to offer distinctive banking services, Pan Asia Bank has grown from a small financial institution to a significant player in Sri Lanka's banking industry. Its journey is marked by a commitment to innovation, customer satisfaction, and sustainable growth.

Innovation at Its Core: Pan Asia Bank has been at the forefront of introducing cutting-edge banking technologies. From online banking solutions to mobile platforms, it ensures that customers enjoy a seamless and secure banking experience.

2. Comprehensive Banking Solutions:

Personal Banking Perfection: Whether you're saving for a rainy day, seeking a loan for your dream home, or exploring investment options, Pan Asia Bank offers a suite of personal banking services tailored to your needs. With attractive interest rates, flexible terms, and a focus on customer convenience, your financial goals are within reach.

Corporate and SME Banking: Understanding the backbone of Sri Lanka's economy, Pan Asia Bank provides a range of products designed for corporate and SME clients. From working capital loans to trade financing and treasury services, it stands as a supportive partner for businesses of all sizes.

3. Digital Banking Revolution:

Embracing Technological Advancements: Pan Asia Bank's digital platforms exemplify convenience and security. Its online and mobile banking services allow customers to manage their finances effortlessly, anytime and anywhere.

Innovations for the Future: The bank continuously invests in technological advancements, ensuring it remains at the cutting edge of the digital banking revolution. From AI-driven customer service to advanced security protocols, Pan Asia Bank is shaping the future of banking in Sri Lanka.

4. Customer-Centric Approach:

Unmatched Customer Service: At Pan Asia Bank, every customer is a priority. The bank's commitment to providing personalized service ensures that each individual's banking experience is satisfactory and beyond.

Feedback and Improvement: Pan Asia Bank values customer feedback, using it as a cornerstone for continuous improvement and innovation. This responsive approach has earned it a loyal customer base and numerous accolades.

5. Commitment to Sustainability and Community:

Green Banking Initiatives: Pan Asia Bank takes its environmental responsibility seriously, implementing green banking initiatives that promote sustainability and reduce its carbon footprint.

Empowering Communities: Through various CSR activities, the bank invests in community development, education, and health projects, demonstrating its commitment to the well-being of the people of Sri Lanka.

Conclusion:

Pan Asia Bank isn't just a financial institution; it's a dynamic, progressive, and customer-oriented bank that puts the needs of its customers and the community first. With its blend of traditional values and modern innovation, it offers a banking experience that's not only satisfying but also secure and forward-looking. As Sri Lanka continues to grow and evolve, Pan Asia Bank remains a steadfast partner, ready to meet the changing needs of its customers and help them achieve their financial dreams.

1 note

·

View note

Text

#Daily Current Affairs Capsules 14th December 2023#UIDAI Imposes Rs.50#000 Penalty for Overcharging Aadhaar Services#Suspends Operator#Uttar Pradesh to Witness Aviation Boom: Nine New Airports in Two Years#Arvind Kejriwal and Punjab CM Mann Initiate Scheme For Doorstep Services#RBI Grants Authorization to Bandhan Bank for Pension Disbursement to Retired Railway Employees'#Moody’s Affirms Reliance Industries’ Baa2 Rating with a Stable Outlook#IMF Approves $337 Million Second Tranche Loan For Sri Lanka#Air India Unveils New Uniforms for Cabin#Cockpit Crew Designed by Fashion Designer Manish Malhotra#Defence Ministry Approves Rs 2800 Crore Rockets for Pinaka Weapon System#Telangana Introduces Free Bus Travel For Women And Transgender Individuals#Emmy-Winning Actor Andre Braugher Passes Away at 61

0 notes

Text

IMF Stresses Timely Debt Restructuring as Crucial for Sri Lanka's Economic Recovery

Timely debt restructuring is of utmost importance for Sri Lanka, as emphasized by the International Monetary Fund (IMF). The island nation is facing significant economic challenges, compounded by the ongoing COVID-19 pandemic. Sri Lanka's high debt burden and limited fiscal space necessitate swift action to restructure its debt in order to alleviate the financial strain and pave the way for sustainable economic recovery.

Sri Lanka's economy has been severely impacted by the pandemic, with declining revenues, reduced tourism, and disruptions in global trade. The country's external debt obligations have become increasingly burdensome, posing a threat to its long-term financial stability. The IMF recognizes the urgency of addressing this issue to prevent further deterioration of Sri Lanka's economic situation.

A timely debt restructuring plan would involve renegotiating terms with creditors, extending repayment periods, and possibly seeking debt relief. Such measures are essential to ease the immediate financial pressure on Sri Lanka, enabling the government to allocate resources towards crucial sectors such as healthcare, education, and infrastructure development. Additionally, debt restructuring would help restore investor confidence, attract foreign investment, and promote economic growth in the long run.

The IMF's support and guidance in navigating this challenging period are crucial for Sri Lanka. The international financial institution can provide valuable expertise and assistance in formulating an effective debt restructuring strategy. The IMF's involvement also signals to other global stakeholders that Sri Lanka is committed to implementing necessary reforms and regaining its economic stability.

However, debt restructuring alone is not a comprehensive solution. Sri Lanka must also address underlying structural issues within its economy to ensure sustained growth and stability. This includes implementing structural reforms to enhance competitiveness, promoting fiscal discipline, improving governance, and diversifying the economy to reduce reliance on a few sectors.

The government of Sri Lanka has taken steps towards fiscal consolidation and economic reforms, but further efforts are required to achieve long-term sustainability. It is imperative for policymakers to strike a balance between short-term measures to address the immediate crisis and long-term reforms that will lay the foundation for a resilient and robust economy.

The successful implementation of a debt restructuring plan will require strong political will, effective communication with creditors, and a commitment to transparency. It is crucial for all stakeholders, including the government, international financial institutions, and creditors, to work collaboratively and in good faith to find mutually beneficial solutions.

In conclusion, the IMF's recognition of the importance of timely debt restructuring for Sri Lanka highlights the critical nature of the country's economic challenges. Swift action is required to alleviate the burden of high debt and create a conducive environment for sustainable recovery. Through effective debt restructuring, coupled with comprehensive economic reforms, Sri Lanka can overcome its current difficulties and lay the foundation for a prosperous future. The cooperation and support of international financial institutions, along with the commitment of the Sri Lankan government, will be instrumental in achieving these goals and securing a brighter economic outlook for the nation.

0 notes

Text

The West is drowning the Global South in debt

“The world economy is already in the midst of a sovereign debt crisis. The United States Conference on Trade and Development (UNCTAD) has warned that the developing world faces a ‘lost decade’ as a result of the debt crisis, estimating that debt servicing alone will cost these states at least $800 billion ...

“Interest rate hikes won’t solve the inflationary crisis in the rich world. They will, however, make it much more expensive for poor countries to finance their debts. The monetary policy currently being pursued in the rich world has been designed to impoverish workers domestically, with the added bonus of impoverishing poor countries globally.

“We have been here before. In the 1980s, when the then Chair of the Federal Reserve, Paul Volker, sent US interest rates through the roof to discipline US workers, it led to dozens of defaults in the global South. The so-called Volker shock laid the foundations for neoliberalism in the US and, conveniently, it also provided the perfect pretext for imposing neoliberal policies on the global South.

“When poor countries were forced to appeal to international financial institutions for emergency lending, they received this assistance in exchange for introducing policies like privatisation, deregulation and tax cuts. The terms of these loans — referred to as structural adjustment programmes — decimated many economies and permanently increased inequality in others.”

#global debt crisis#debt crisis#global south#ghana#sri lanka#pakistan#federal reserve#usa#interest rate hikes#interest rates#imf#world bank#neoliberalism#global economic system#global capitalism#capitalism#world economy#economics#politics

0 notes

Text

People's Bank recognized at SAFA Awards for its 2020 Annual Report

People’s Bank recognized at SAFA Awards for its 2020 Annual Report

People’s Bank Annual Report 2020 was awarded the First Runner-up in the “Public Sector Banks” category at the South Asian Federation of Accountants (SAFA) Best Presented Annual Report Awards.

People’s Bank Annual Report 2020 is the sixth Integrated Annual Report of the Bank and was designed and created under the theme of “Pride of the Nation”. The Annual Report, presented in two books, covers…

View On WordPress

0 notes

Text

Join NDB Bank Vacancies as a Trainee Banking Assistant in 2024! Open to school leavers with GCE Advanced Level qualifications. Apply now!

#lanka career#job vacancies 2024#sri lanka job vacacnies#job vacancies in sri lanka#srilanka#ndb bank vacancies

0 notes

Text

Israel has thus fully embraced the “war on terror” and richly profited from it. One of the most successful though bloody counterinsurgency battles of the early twenty-first century was the Sri Lankan government’s destruction of the Tamil Tigers militant group. Israel played a key, though largely unpublicized, part in Colombo’s successful campaign in a civil war that killed and disappeared more than 200,000 people, mostly Tamils, over a quarter-century that ended in 2009. Israel sold Kfir fighter jets and trained the Special Task Force, a brutal unit of the Sri Lankan police. Sri Lanka borrowed the Israeli playbook during the last stages of the civil war and ignored calls by NGOs, human rights organizations, and foreign governments to cease violence. The military stopped when the Tamil Tigers were completely decimated and Velupillai Prabhakaran, its leader, killed.

Israel also helped generations of Sinhalese politicians build and maintain Sinhalese enclaves in the north and east of Sri Lanka, areas where most Tamils live. The aim was to create buffer zones around Tamil-majority areas and establish an unofficial occupation of Tamil territory. These plans continued after 2009 and Sinhala colonization has never stopped. These ideas were directly taken from Israel’s presence in the West Bank, where Palestinian sovereignty is denied with numerous fortified Jewish colonies. Israel signed a US$50 million deal with Sri Lanka in 2021 to upgrade the country’s Kfir jets.

Antony Loewenstein, The Palestine Laboratory: How Israel Exports the Technology of Occupation Around the World

630 notes

·

View notes

Text

The Dali - a 948ft (289m) container ship - was at the start of a 27-day journey from Baltimore to Sri Lanka when it struck the Francis Scott Key Bridge, sending thousands of tonnes of steel and cement into the Patapsco. It left the ship stranded under a massive expanse of shredded metal.

[...]

The crew, made up of 20 Indians and a Sri Lankan national, has been unable to disembark because of visa restrictions, a lack of required shore passes and parallel ongoing investigations by the National Transportation Safety Board (NTSB) and FBI.

On Monday, the crew remained on board even as authorities used small explosive charges to deliberately "cut" an expanse of the bridge lying on the ship's bow.

Ahead of the controlled demolition, US Coast Guard Admiral Shannon Gilreath said that the crew would remain below deck with a fire crew at the ready.

"They're part of the ship. They are necessary to keep the ship staffed and operational," Adm Gilreath said. "They're the best responders on board the ship themselves."

[...]

According to Mr Messick, the crew has been left largely without communication with the outside world for "a couple of weeks" after their mobile phones were confiscated by the FBI as part of the investigation.

"They can't do any online banking. They can't pay their bills at home. They don't have any of their data or anyone's contact information, so they're really isolated right now," Mr Messick said. "They just can't reach out to the folks they need to, or even look at pictures of their children before they go to sleep. It's really a sad situation."

The Beached Dutchman, stuck forever at a foreign port but never able to step off

102 notes

·

View notes

Text

State Mortgage Bank (1976-78) in Colombo, Sri Lanka, by Geoffrey Bawa

#1970s#office building#concrete#brutalism#brutalist#architecture#sri lanka#architektur#colombo#geoffrey bawa

164 notes

·

View notes