#world bank

Text

End of the line for corporate sovereignty

I'm on tour with my new, nationally bestselling novel The Bezzle! Catch me next weekend (Mar 30/31) in ANAHEIM at WONDERCON, then in Boston with Randall "XKCD" Munroe (Apr 11), then Providence (Apr 12), and beyond!

Back in the 1950s, a new, democratically elected Iranian government nationalized foreign oil interests. The UK and the US then backed a coup, deposing the progressive government with one more hospitable to foreign corporations:

https://en.wikipedia.org/wiki/Nationalization_of_the_Iranian_oil_industry

This nasty piece of geopolitical skullduggery led to the mother-of-all-blowbacks: the Anglo-American puppet regime was toppled by the Ayatollah and his cronies, who have led Iran ever since.

For the US and the UK, the lesson was clear: they needed a less kinetic way to ensure that sovereign countries around the world steered clear of policies that undermined the profits of their oil companies and other commercial giants. Thus, the "investor-state dispute settlement" (ISDS) was born.

The modern ISDS was perfected in the 1990s with the Energy Charter Treaty (ECT). The ECT was meant to foam the runway for western corporations seeking to take over ex-Soviet energy facilities, by making those new post-Glasnost governments promise to never pass laws that would undermine foreign companies' profits.

But as Nick Dearden writes for Jacobin, the western companies that pushed the east into the ECT failed to anticipate that ISDSes have their own form of blowback:

https://jacobin.com/2024/03/energy-charter-treaty-climate-change/

When the 2000s rolled around and countries like the Netherlands and Denmark started to pass rules to limit fossil fuels and promote renewables, German coal companies sued the shit out of these governments and forced them to either back off on their democratically negotiated policies, or to pay gigantic settlements to German corporations.

ISDS settlements are truly grotesque: they're not just a matter of buying out existing investments made by foreign companies and refunding them money spent on them. ISDS tribunals routinely order governments to pay foreign corporations all the profits they might have made from those investments.

For example, the UK company Rockhopper went after Italy for limiting offshore drilling in response to mass protests, and took $350m out of the Italian government. Now, Rockhopper only spent $50m on Adriatic oil exploration – the other $300m was to compensate Rockhopper for the profits it might have made if it actually got to pump oil off the Italian coast.

Governments, both left and right, grew steadily more outraged that ISDSes tied the hands of democratically elected lawmakers and subordinated their national sovereignty to corporate sovereignty. By 2023, nine EU countries were ready to pull out of the ECT.

But the ECT had another trick up its sleeve: a 20-year "sunset" clause that bound countries to go on enforcing the ECT's provisions – including ISDS rulings – for two decades after pulling out of the treaty. This prompted European governments to hit on the strategy of a simultaneous, mass withdrawal from the ECT, which would prevent companies registered in any of the ex-ECT countries from suing under the ECT.

It will not surprise you to learn that the UK did not join this pan-European coalition to wriggle out of the ECT. On the one hand, there's the Tories' commitment to markets above all else (as the Trashfuture podcast often points out, the UK government is the only neoliberal state so committed to austerity that it's actually dismantling its own police force). On the other hand, there's Rishi Sunak's planet-immolating promise to "max out North Sea oil."

But as the rest of the world transitions to renewables, different blocs in the UK – from unions to Tory MPs – are realizing that the country's membership in ECT and its fossil fuel commitment is going to make it a world leader in an increasingly irrelevant boondoggle – and so now the UK is also planning to pull out of the ECT.

As Dearden writes, the oil-loving, market-worshipping UK's departure from the ECT means that the whole idea of ISDSes is in danger. After all, some of the world's poorest countries are also fed up to the eyeballs with ISDSes and threatening to leave treaties that impose them.

One country has already pulled out: Honduras. Honduras is home to Prospera, a libertarian autonomous zone on the island of Roatan. Prospera was born after a US-backed drug kingpin named Porfirio Lobo Sosa overthrew the democratic government of Manuel Zelaya in 2009.

The Lobo Sosa regime established a system of special economic zones (known by their Spanish acronym, "ZEDEs"). Foreign investors who established a ZEDE would be exempted from Honduran law, allowing them to create "charter cities" with their own private criminal and civil code and tax system.

This was so extreme that the Honduran supreme court rejected the plan, so Lobo Sosa fired the court and replaced them with cronies who'd back his play.

A group of crypto bros capitalized on this development, using various ruses to establish a ZEDE on the island of Roatan, a largely English-speaking, Afro-Carribean island known for its marine reserve, its SCUBA diving, and its cruise ship port. This "charter city" included every bizarre idea from the long history of doomed "libertarian exit" projects, so ably recounted in Raymond Craib's excellent 2022 book Adventure Capitalism:

https://pluralistic.net/2022/06/14/this-way-to-the-egress/#terra-nullius

Right from the start, Prospera was ill starred. Paul Romer, the Nobel-winning economist most closely associated with the idea of charter cities, disavowed the project. Locals hated it – the tourist shops and restaurants on Roatan all may sport dusty "Bitcoin accepted here" signs, but not one of those shops takes cryptocurrency.

But the real danger to Prospera came from democracy itself. When Xiomara Castro – wife of Manuel Zelaya – was elected president in 2021, she announced an end to the ZEDE program. Prospera countered by suing Honduras under the ISDS provisions of the Central America Free Trade Agreements, seeking $10b, a third of the country's GDP.

In response, President Castro announced her country's departure from CAFTA, and the World Bank's International Centre for Settlement of Investment Disputes:

https://theintercept.com/2024/03/19/honduras-crypto-investors-world-bank-prospera/

An open letter by progressive economists in support of President Castro condemns ISDSes for costing latinamerican countries $30b in corporate compensation, triggered by laws protecting labor rights, vulnerable ecosystems and the climate:

https://progressive.international/wire/2024-03-18-economists-the-era-of-corporate-supremacy-in-the-international-trade-system-is-coming-to-an-end/en

As Ryan Grim writes for The Intercept, the ZEDE law is wildly unpopular with the Honduran people, and Merrick Garland called the Lobo Sosa regime that created it "a narco-state where violent drug traffickers were allowed to operate with virtual impunity":

https://theintercept.com/2024/03/19/honduras-crypto-investors-world-bank-prospera/

The world's worst people are furious and terrified about Honduras's withdrawal from its ISDS. After 60+ years of wrapping democracy in chains to protect corporate profits, the collapse of the corporate kangaroo courts that override democratic laws represents a serious threat to oligarchy.

As Dearden writes, "elsewhere in the world, ISDS cases have been brought specifically on the basis that governments have not done enough to suppress protest movements in the interests of foreign capital."

It's not just poor countries in the global south, either. When Australia passed a plain-packaging law for tobacco, Philip Morris relocated offshore in order to bring an ISDS case against the Australian government in a bid to remove impediments to tobacco sales:

https://isds.bilaterals.org/?philip-morris-vs-australia-isds

And in 2015, the WTO sanctioned the US government for its "dolphin-safe" tuna labeling, arguing that this eroded the profits of corporations that fished for tuna in ways that killed a lot of dolphins:

https://theintercept.com/2015/11/24/wto-ruling-on-dolphin-safe-tuna-labeling-illustrates-supremacy-of-trade-agreements/

In Canada, the Conservative hero Steven Harper entered into the Canada-China Foreign Investment Promotion and Protection Agreement, which banned Canada from passing laws that undermined the profits of Chinese corporations for 31 years (the rule expires in 2045):

https://www.vancouverobserver.com/news/harper-oks-potentially-unconstitutional-china-canada-fipa-deal-coming-force-october-1

Harper's successor, Justin Trudeau, went on to sign the Canada-EU Trade Agreement that Harper negotiated, including its ISDS provisions that let EU corporations override Canadian laws:

https://www.cbc.ca/news/politics/trudeau-eu-parliament-schulz-ceta-1.3415689

There was a time when any challenge to ISDS was a political third rail. Back in 2015, even hinting that ISDSes should be slightly modified would send corporate thinktanks into a frenzy:

https://www.techdirt.com/2015/07/20/eu-proposes-to-reform-corporate-sovereignty-slightly-us-think-tank-goes-into-panic-mode/

But over the years, there's been a growing consensus that nations can only be sovereign if corporations aren't. It's one thing to treat corporations as "persons," but another thing altogether to elevate them above personhood and subordinate entire nations to their whims.

With the world's richest countries pulling out of ISDSes alongside the world's poorest ones, it's feeling like the end of the road for this particularly nasty form of corporate corruption.

And not a moment too soon.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/03/27/korporate-kangaroo-kourts/#corporate-sovereignty

Image:

ChrisErbach (modified)

https://commons.wikimedia.org/wiki/File:UnitedNations_GeneralAssemblyChamber.jpg

CC BY-SA 3.0

https://creativecommons.org/licenses/by-sa/3.0/deed.en

#pluralistic#isds#investor state dispute settlement#steven harper#canada#canpoli#ukpoli#honduras#prospera#roatan#Energy Charter Treaty#ect#eu#rockhopper#world bank#charter cities#cryptocurrency#libertarian exit#Xiomara Castro

220 notes

·

View notes

Photo

World bank's country classification.

by mapsbyme

144 notes

·

View notes

Text

When William Ruto was sworn in as Kenya’s fifth president in September 2022, he used his inauguration speech to demand an end to humanity’s “addiction to fossil fuels” and reaffirmed Kenya’s commitment to reach 100% clean energy by 2030. Kenya is not far off this target today.

In 2021, 81% of Kenya’s electricity generation came from the low carbon sources of geothermal, hydro, wind, and solar power. Over half of this low carbon electricity came from geothermal energy, which Kenya has in abundance. So much in fact, that excess geothermal energy is released during the night when electricity demand is low. Installed geothermal capacity in Kenya could be increased by at least eightfold, which could open opportunities for scaling up green manufacturing capacity or exporting excess electricity to neighbouring countries.

Renewable rollouts have substantially improved energy access. In 2013, around 28% of Kenyans had access to electricity. By 2020, this had risen to over 71%. This was achieved as the population grew by over seven million over the same period, while the rate of urbanisation continued to gather pace. According to the World Bank, barely one million Kenyans had electricity in 1990 [which, back then, was approximately just 5% of the population].

Ruto’s words, and Kenya’s actions, are timely due to the backdrop they are made against. Amid Russia’s invasion of Ukraine, and the vacuum created in global energy markets, European leaders and multinational fossil fuel firms have launched a ‘dash for gas’ across Africa, where a raft of new oil and gas projects, as well as old ones, are being given the green light. At COP27, Ruto kicked back against the dash for gas, stating that “we [Kenya] have taken a position that as a country we are going green and we are well on course.”

-via Rapid Transition Alliance, November 17, 2022

#kenya#green energy#sustainability#carbon emissions#air pollution#africa#world bank#developing nations#electrification#wind power#solar#solar power#geothermal#geothermalpower#fossil fuels#clean energy#good news#hope

224 notes

·

View notes

Text

Hey guys maybe if the West gets money-scared they'll stop the genocide

#free gaza#free palestine#gaza strip#irish solidarity with palestine#palestine#gaza#news on gaza#al jazeera#boycott israel#israel#Capitalism#Global economy#world bank#Ajay Banga

89 notes

·

View notes

Text

BE ALERT!!! 👇👇👇💯💯

Imagine a future where the central bank holds all the power and control over our financial transactions.

This is the reality that could come with the introduction of a Central Bank Digital Currency (CBDC). Unlike traditional forms of money, a CBDC would give the central bank absolute authority over the rules and regulations that dictate its use. This means that the government would have unprecedented control over our financial activity, which could have dire consequences for our freedom.

One of the biggest concerns with a CBDC is its potential threat to privacy. With the ability to track every transaction and gather vast amounts of data, the government would have endless opportunities to monitor and control citizen's financial activity. This level of surveillance could be used to target political opponents and suppress dissent. The mere thought of a government having such power should raise alarm bells for anyone who values their freedom and privacy.

Furthermore, a CBDC could be easily weaponized against those who oppose the government’s agenda. By controlling access to funds and monitoring transactions, the government could effectively silence dissenting voices and stifle any opposition. This would create a chilling effect on free speech and undermine the very foundations of FREEDOM

It is crucial that we carefully consider the implications it could have on our freedom and privacy. The power that a central bank would wield with a CBDC is unprecedented, and we must ensure that safeguards are in place to protect our rights and liberties. The future of CBDC should not come at the expense of our fundamental freedoms. Congress should prohibit the Fed and Treasury from issuing such. CBDCs have no place in the American economy.

Move your funds into the Quantum Ledger Account and be safe from government agendist. We can be reached via email (check bio for email) or a DM away.

# EyesOpenAmerica

#bad government#bad omens#breaking news#donald trump#bank of america#wells fargo#world news#bank clash#chase bank#bank crash#world bank#new york#currency#decentralisation#decentralised finance#education#educate yourself#reeducate yourself#rebel#carbal#biden#joe biden#democrats#democracy#washington dc#white house#stay woke#qfs#quantum financial system#socialist revolution

31 notes

·

View notes

Text

The private sector arm of the World Bank is facing claims that it contributes to global heating and the undermining of animal welfare by providing financial support for factory farming, including the building of pig farming tower blocks in China.

A coalition of environmental and animal welfare groups is calling on the World Bank to phase out financial support for large-scale “industrial” livestock operations. More than $1.6bn was provided for industrial farming projects between 2017 and 2023, according to an analysis by campaigners.

23 notes

·

View notes

Text

🇮🇱⚔️🇵🇸 🚀🏘️💥 🚨

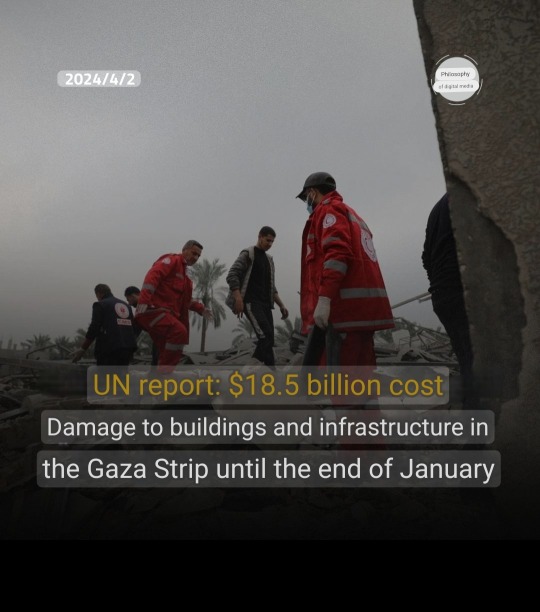

U.N. REPORT: DAMAGE TO PALESTINIAN HOMES AND INFRASTRUCTURE IN GAZA TOTALS OVER $18.5B

✍️ A Report published today by the United Nations and the World Bank assessed to total dollar amount of damage the Zionist entity has inflicted on the homes, buildings and infrastructure belonging to the Palestinians in the Gaza Strip at over $18.5b.

The report mentions that this is equivalent to 97% of the combined GDP of the West Bank and Gaza in 2022, with 72% of the cost coming from residential housing, while healthcare and education accounts for 19% of damages. Commercial and industrial buildings accounted for 9% of damages.

According to the U.N. report, the Israeli occupation army has created an estimated 26 million tons of debris and rubble covering nearly every corner of the Gaza Strip.

Over 1 million Palestinians are now without homes, with 75% of the population of Gaza displaced by Zionist aggression, the U.N. says.

The report also states that 84% of all health facilities in Gaza have been damaged or destroyed, while the water and sewage systems have "nearly collapsed," and are now delivering less than 5% of their pre-war output.

Among the most insidious harm inflicted on the Palestinian population of the Gaza Strip has been the complete and utter destruction of the education system, with 100% of children out of school. This inflicts harm, not only on parents who must care for their children full-time, but also deeply harms the future of Gaza, typically lowering economic and healthcare indicators.

The report also points out that 92% of primary roads have been destroyed, making delivery of humanitarian aid incredibly difficult, even without the occupation bombing aid workers.

As a result of Israel's ongoing war of genocide in the Gaza Strip, the death toll among Palestinians now exceeds over 32'916 citizens killed, mostly women and children, while another 75'494 others have been wounded since the start of the latest round of Zionist aggression beginning on October 7th, 2023.

#source1

#source2

#graphicsource

@WorkerSolidarityNews

#united nations#world bank#un news#palestine#palestinians#palestine news#gaza news#gaza#gaza strip#gaza genocide#genocide in gaza#genocide of palestinians#genocide#free palestine#israeli occupation forces#occupation#israel#israeli war crimes#war crimes#crimes against humanity#genocide in palestine#israeli genocide#politics#news#geopolitics#world news#global news#international news#breaking news#current events

28 notes

·

View notes

Text

By Julia Conley

Common Dreams

April 16, 2024

"The institutions of world finance have lost their muscle," wrote more than 100 activists, celebrities, and political leaders. "You can be the leaders who bring them into the 21st century."

Quoting the economist John Maynard Keynes at the time of the founding of the modern global finance system in 1944, more than 100 signatories on Tuesday called on the world's largest economies to allow the world "to taste hope again" by pouring resources into solving the global debt and climate crises.

Keynes remarked after the historic Bretton Woods meeting in New Hampshire that the summit offered new hope to everyone from "our businessmen and our manufacturers and our unemployed" as world leaders established the World Bank and the International Monetary Fund (IMF).

But with the world now "rocked by conflict, food insecurity, biodiversity loss, and spiraling inflation," said the signers of an open letter organized by communications and campaign group Project Everyone, the global community needs "another Bretton Woods moment"—one that would correct the "imperfect" system hammered out 80 years ago and live up to the ideals that were centered at the original meeting, including "prosperity as a means of peace" and wealth as a means of serving "the common good."

The letter states that global inequality is "compounded by the devastation wrought by climate change," which is disproportionately likely to impact the Global South even as developing countries contribute a mere fraction of the planet-heating emissions of wealthy nations.

The signatories—including International Rescue Committee CEO David Miliband, philanthropist Abigail Disney, and singer and activist Annie Lennox—called on G20 countries to take steps including tripling their investment in the World Bank and IMF, canceling developing countries' debt to the institutions, and reforming tax codes to ensure big polluters and the wealthiest people contribute to efforts to mitigate inequality.

"This is your chance," reads the letter, which was released as world leaders met in Washington, D.C. for the World Bank and IMF's Spring Meetings. "The institutions of world finance have lost their muscle. You can be the leaders who bring them into the 21st century. You can unlock the colossal public and private investment potential of renewable energy, sustainable agriculture, and climate adaptation."

Under the status quo, the signatories noted, the United Nations Sustainable Development Goals are "way off track," with $3 trillion still needed achieve the objective of a "greener, fairer, better world by 2030," as agreed to by 193 U.N. member states.

Project Everyone and its supporters reiterated a demand made by Oxfam International Monday to cancel debts owed by countries in the Global South that are facing rising inequality, as their debt obligations to the IMF and the World Bank have left them unable to invest in education, climate adaptation, housing, and other public services.

"Removing burdensome debt allows countries to invest in their people and their future: in resilience, education, health, and nutrition," wrote the signatories. "This drives growth and creates string partners to trade with... Each of us stands to gain from stability, lower food and energy costs, and nature protection."

The wealthiest countries in the world, said Project Everyone, must look to the leaders who met at Bretton Woods and "fulfill their promise: to transform these instruments for peace and prosperity and truly set them to work in our common interest."

18 notes

·

View notes

Text

#imf#world bank#bretton woods#economic enslavement#debt trap#african countries#independence#marshall plan#economic imperialism

11 notes

·

View notes

Text

The purchasing power parity (PPP) exchange rates that undergird the WBPL [World Bank’s poverty line] are calculated on the basis of prices across the entire economy – including commercial airfares, sports cars, and meals at high-end restaurants – rather than the prices of goods that people need in order to meet basic needs, such as food and shelter. When it comes to measuring poverty, what matters is not income as such but rather what that income can buy in terms of access to essential goods; in other words, what matters is the welfare purchasing power of income. Allen (2017) analyses commodity prices around the world in 2011 and finds that the cost of meeting basic needs, measured in PPP terms, changes depending upon the price of food and shelter relative to prices across the rest of the economy. In Zimbabwe a person’s subsistence needs can be met with $1.74, PPP. But purchasing a similar basket would cost $3.19 in Egypt, and $4.02 in France. Because the WBPL does not account for the variable cost of meeting basic needs in different countries, it cannot be used to establish meaningful estimates of poverty.

The problems with the WBPL become particularly acute when comparing socialist states like pre-reform China to capitalist states such as India or Brazil. Socialist states tend to invest in public provisioning systems to provide people with access to essential goods . In such cases, the cost of meeting basic needs is generally quite low. In capitalist states, with high levels of commodification or privatisation, the same goods may be significantly more expensive. Therefore, a dollar of income (in broad-gauge PPPs) is likely to have a stronger welfare purchasing power in socialist states than in capitalist states.

Capitalist reforms and extreme poverty in China: unprecedented progress or income deflation?

29 notes

·

View notes

Text

Governments of wealthy countries must pledge hundreds of billions more in overseas aid payments channelled through the World Bank to avert the worst effects of the climate crisis, civil society experts and economists have said.

The International Development Association fund, the arm of the World Bank that disburses loans and grants to poor countries, is worth about $93bn (£75bn) but that figure must be roughly tripled by 2030, according to economic experts.

Governments are expected to discuss new aid pledges this week at the World Bank’s annual spring meetings in Washington DC. The World Bank, its fellow publicly funded development banks around the world and the International Monetary Fund are under pressure to show they can lead the world to the low-carbon transition needed.

Ajay Banga, the president of the World Bank, told journalists the climate crisis would be a priority. “The world is facing a set of intertwined challenges: the climate crisis, debt, food insecurity, pandemics, fragility, and there is clearly a need to accelerate access to clean air, water and energy,” he said.

“The [World Bank] needs a fit-for-purpose mission and vision, and that is to create a world free from poverty on a liveable planet.”

continue reading

Hundreds of billions. I'll not hold my breath. The rich countries were at least 3 years late with their first $100bn, and I'm not sure if they met that in full. There will be a lot of humming and hawing about the costs but had they heeded the warnings and started phasing out fossil fuels sooner, in the '80s or '90s the costs would have been far, far lower.

3 notes

·

View notes

Text

In their February paper, “US Dollar Primacy in an Age of Economic Warfare,” presented at the West Point Symposium on “Order, Counter-Order, Disorder” Michael Kao and Michael St. Pierre argue for using a stronger US dollar as geopolitical leverage:

Not only are the effects of interest rates hikes magnified in other countries due to a myriad of structural and idiosyncratic economic fragilities previously discussed, the confluence of wide USD adoption with cyclical USD strength … make the USD a potent geopolitical lever masquerading as a domestic fight against inflation. National Power lends the USD dominance in adoption, while an opportunistic fight against inflation lends the USD cyclical strength for geopolitical leverage.

The US and US-led institutions are already trying to sideline China in countries struggling to make debt payments. And these efforts are likely to continue as interest rates rise and more countries in the Global South are unable to repay loans. A recent UNDP paper stated that 52 developing countries are suffering from severe debt problems.

China is the world’s largest bilateral creditor, and this is especially true for countries that are part of Beijing’s Belt and Road Initiative and/or for countries that possess strategically important natural resources. Washington estimates that Chinese lending ranges from $350 billion to a trillion dollars.

In recent years, western officials and media have ratcheted up criticism of China’s lending practices, claiming Beijing is putting its boot on the neck of countries, holding back their development, and is seizing assets offered as collateral.

Deborah Bräutigam, the Director of the China Africa Research Initiative at the Paul H. Nitze School of Advanced International Studies, has written that this is “ a lie, and a powerful one.” She wrote, “our research shows that Chinese banks are willing to restructure the terms of existing loans and have never actually seized an asset from any country.”

Even researchers at Chatham House admit there’s nothing nefarious about China’s lending, explaining that it has instead created a debt trap for China. That is becoming more evident as nations are unable to repay, largely due to the economic fallout from the pandemic, the Nato proxy war against Russia in Ukraine, inflation, and rising interest rates.

These confluence of events hitting developing countries are entangling China in multilateral talks that include US-backed institutions like the IMF. Beijing’s preference has always been to try and tackle debt repayment issues at a bilateral level, typically by extending maturities rather than accepting write-downs on loans.

But US Treasury Secretary Janet Yellen and company continue to parrot the talking point that China’s lending is harming countries, and in countries unable to repay their international debts, the West and China are increasingly at odds.

Back in 2020, the G-20 countries created the Common Framework for Debt Treatments to provide relief to indebted countries, which included “fair burden sharing” among all creditors. Beijing’s reluctance to agree to such burden sharing is illustrated by the case of Zambia.

Zambia became the first African country to default on some of its dollar-denominated bonds during the Covid-19 pandemic when it failed to make a $42.5 million bond payment in November 2020.

More than a third of the country’s $17 billion in debt is owed to Chinese lenders. Zambia worked out a deal with the IMF for a $1.3 billion bailout package but can’t access the relief until its underlying debt is restructured – including Chinese debts. But the IMF prescription for Zambia is a blow to Beijing. Here are some details of the arrangement from The Diplomat:

Zambia will shift its spending priorities from investment in public infrastructure – typically financed by Chinese stakeholders – to recurrent expenditures. Specifically, Zambia has announced it will totally cancel 12 planned projects, half of which were due to be financed by China EXIM Bank, alongside one by ICBC for a university and another by Jiangxi Corporation for a dual highway from the capital. The government has also canceled 20 undistributed loan balances – some of which were for the new projects but others for existing projects. While such cancellations are not unusual on Zambia’s part, Chinese partners account for the main bulk of these loans…

While some of these cancellations may have been initiated by Chinese lenders themselves, especially those in arrears, Zambia may not have needed to cancel so many projects. Since 2000, China has canceled more of Zambia’s bilateral debt than any sovereign creditor, standing at $259 million to date.

Nevertheless, the IMF team justified the shift because they – and presumably Zambia’s government – believe that spending on public infrastructure in Zambia has not returned sufficient economic growth or fiscal revenues. However, no evidence is presented for this in the IMF’s report.

Zambia will also cut fuel and agriculture subsidies. So instead of infrastructure investment and social spending, the country gets austerity. The IMF deal also relegates China to the backseat, as it allows for 62 concessional loan projects to continue, only two of which will involve China. The vast majority of the projects will be administered by multilateral institutions and involve recurrent expenditure rather than infrastructure-focused projects.

Despite all the evidence to the contrary, Yellen on a trip to Zambia in February warned that Chinese lending “can leave countries with a legacy of debt, diverted resources, and environmental destruction” and called out Beijing for being a “barrier” to ending the major copper producer’s debt crisis and noted that it had “taken far too long already to resolve.”

The US effort to sideline China in Zambia comes at the same time that Washington is trying to tighten control over resources in the region. Note that back in December the US signed deals with the Democratic Republic of Congo and Zambia (the world’s sixth-largest copper producer and second-largest cobalt producer in Africa) that will see the US support the two countries in developing an electric vehicle value chain.

Beijing is insisting that multilateral lenders also accept haircuts on loans rather than just China being expected to do so. This is a position that most debtor nations agree with. On the other side, the IMF and its partners are worried that its bailout money would merely go to Chinese creditors – many of which are state banks that are increasingly troubled by bad debts.

Gong Chen, founder of Beijing-based think tank Anbound, says that if countries are unwilling or unable to repay their debts to China, it would be devastating:

Widespread debt evasion and avoidance would have a significant impact on China’s financial stability,” he said, “and we are concerned that some countries may try to avoid paying back their debt by utilizing geopolitics and the ideological competition between East and West.

Yellen and company tried to apply more pressure on Beijing at the recent G20 meeting of finance officials in India, but that fell flat on its face much like the West’s efforts to hijack the meeting and turn it into a roundtable on Russian sanctions.

Meanwhile, Zambia has halted work on several Chinese-funded infrastructure projects, including the Lusaka-Ndola road, and canceled undisbursed loans in line with the IMF prescription for its debt problem.

Chinese companies are now attempting to work around these roadblocks by shifting more toward public-private partnerships. For example, a Chinese consortium is now planning to build a $650 million toll road from the Zambian capital to the mineral-rich Copperbelt province and the border with the Democratic Republic of the Congo.

The situation in Zambia does not bode well for other nations needing debt relief, as the delays while the West and China clash mean more pressure on government finances, companies and populations.

And if the West’s primary goal in offering debt relief is to sideline Beijing, as it appeared in Zambia, then that will mean a drastic scaling back of infrastructure projects replaced by austerity. From Sovdebt Oddities:

More broadly, as noted by Mark Sobel, the current international financial architecture is ill-equiped to deal with a major recalcitrant creditor benefiting from outsized (geo)political leverage. While it remains illusional to insulate sovereign restructurings from geopolitical considerations, there is a risk that they would turn into a game of chicken between China on the one hand and the IMF and Paris Club on the other hand. The problem being that if none of the players yields, it will just mean more economic and social hardship for the debtor country stuck in the middle.

Sure enough, the same situation is playing out in two nations that are key points on China’s Belt and Road project: Pakistan and Sri Lanka.

Here is Islamabad’s debt situation, courtesy of Pakistani economist Murtaza Syed at The International News:

For each of the next five years, Pakistan owes the world $25 billion in principal repayments. It will also need at least $10 billion to finance the current account deficit, bringing total external financing needs to $35 billion a year between now and 2027. We have foreign exchange reserves of just $3 billion. For each of the next five years, the government needs to pay 5 percent of GDP to service the debt it owes to residents and foreigners. Our total tax take is only 10 percent of GDP.

Around fourth-fifths of this external debt is owed to the official sector, split roughly evenly between multilaterals (like the IMF, World Bank and ADB) and bilaterals (countries like China, Saudi Arabia and the United States). The remaining one-fifth is commercial, again roughly evenly split between Eurobond/Sukuk issuances and borrowing from Chinese and Middle Eastern banks. By region, we owe roughly one-third of our external debt to China and 10 percent to the old-boys network of the Paris Club, which includes Europe and the US.

Additionally, last year, the Pakistan rupee plunged nearly 30 percent compared to the US dollar. All indications are that the IMF is using bailout negotiations to pressure Pakistan to move away from China and revive its partnership with the US. Some background from WSWS:

Former prime minister Imran Khan’s government was promptly removed in April 2022 after he reversed IMF-demanded subsidy cuts in the face of country-wide protests. Khan had previously implemented two rounds of some of the toughest austerity in the country’s history. In the final year of his government, Khan shifted the country’s foreign policy towards a closer alliance with Russia and deepened ties with China, prompting concern and anger in Washington.

Sharif’s Muslim League (PML-N) and the People’s Party (PPP) assumed power in a coalition with the approval of the military, long the most powerful political actor in the country and the linchpin of the alliance between the Pakistani bourgeoisie and US imperialism. The express aim of the new government was to implement IMF austerity, which it has done.

The IMF-prescribed austerity imposed by Pakistani elites also targets Beijing. China is Pakistan’s largest single creditor as the country is perhaps the most important country in China’s Belt and Road plans because it would provide China with a potential corridor to the seaport at Gwadar on the Indian Ocean. The supply line would reduce the distance between China and the Middle East by thousands of miles via insecure sea lanes to a shorter and more secure distance by land. Beijing’s spending in Pakistan reflects this, as the $53 billion China has spent on the Belt and Road Initiative (BRI) in the country is tops of all BRI countries.

Yet many of the BRI plans are unrealized, and Pakistan’s current economic situation makes it unlikely they’ll be finished anytime soon. China has dramatically scaled back investment, which fits with its more cautious approach to BRI projects. Meanwhile, decades-high inflation, economic mismanagement, and last year’s biblical floods have led to Islamabad burning through its foreign exchange reserves in order to make debt payments. The US blames China.

“We have been very clear about our concerns not just here in Pakistan, but elsewhere all around the world about Chinese debt, or debt owed to China,” US State Department Counselor Derek Chollet told journalists at the US Embassy in Islamabad after he met with Pakistani officials in February.

Additionally, Cholett said Washington is warning Islamabad about the “perils” of a closer relationship with Beijing.

According to the Times of India, many Pakistani officials have come around to the US way of thinking and are also blaming the China-Pakistan Economic Corridor Project (CPEC), a $65 billion network of roads, railways, pipelines, and ports connecting China to the Arabian Sea, for worsening the country’s debt crisis. From Indian Express:

Pakistan expanded its electricity generation capacity under the China-Pakistan Economic Corridor Programme (CPEC) but the expansion came at a high cost both in terms of high returns guaranteed to the Chinese independent power producers (IPPs) and the expensive foreign currency debt. Pakistan has been unable to make the capacity payments to IPPs under the long-term power purchase agreements with the electricity sector debt rising to a staggering $ 8.5 billion.

Last December, the government agreed to repay this debt in installments. However, this may have displeased the IMF, which had expected the government, in August 2022, to renegotiate the purchase power agreements. Pakistan tried to renegotiate but the Chinese refused.

The IMF extended the current program on the condition that it would not go to the Chinese IPPs. More from Nikkei Asia:

Observers say Pakistan’s handling of the electricity issue is likely to irk China, noting that Sharif’s government committed to the IMF to reopen power contracts without taking the Chinese companies into confidence. Pakistan has also reneged on a promise to set up an escrow account to ensure smooth payments to Chinese IPPs.

The IMF is demanding that Pakistan rationalize payments to the Chinese IPPs in line with earlier concessions extracted from local private power producers…

The IMF now wants Pakistan to negotiate an increase in the duration of bank loans from 10 years to 20 years, or to reduce the markup on arrears owed to Chinese IPPs from 4.5% to 2%.

Notably, the IMF appears to have been less willing to make concessions than the previous 22 times Pakistan has sought its support since 1959. Oddly enough Beijing is pushing for a deal between Islamabad and the IMF, and China recently extended a $2 billion loan to Pakistan. From the Middle East Institute:

It is interesting to note, for example, that Chinese officials reportedly urged Islamabad to repair ties with the IMF — if true, an indication that Beijing regards resumption of the Fund’s lending program as key to mitigating Pakistan’s risk of default.

It is also revealing that Pakistan seems keener to take on new financing from China than China may be to furnish it. Even as the economy wobbles under a heavy debt burden and other acute challenges, Pakistani officials have sought support from China to upgrade the Main Line 1 (ML-1) railroad, a project which, if not undertaken, they claim could result in the breakdown of the entire railway system.Yet, the IMF wants Pakistan to rein in CPEC activity. And China’s own domestic economic challenges and priorities might make it hesitant to respond to Islamabad’s appeals. On the other hand, the ML-1 project might meet Beijing’s more exacting standards and increasing emphasis on “high quality” BRI infrastructure projects.

The recent rapprochement between Iran and Saudi Arabia could leave Pakistan out in the cold and even more reliant upon the US. From Andrew Korybko:

With the Kingdom likely to focus more on mutually beneficial Iranian investments than on dumping billions into seemingly never-ending Pakistani bailouts that haven’t ever brought it anything in return, Islamabad will predictably become more dependent on the US-controlled IMF. China will always provide the bare minimum required to keep Pakistan afloat in the worst-case scenario, but even it seems to be getting cold feet nowadays for a variety of reasons, thus meaning that US influence might further grow.

About that, last year’s post-modern coup restored American suzerainty over Pakistan to a large degree, which now makes that country a regional anomaly in the geopolitical sense considering the broader region’s drift away from that declining unipolar hegemon. The very fact that previously US-aligned Saudi Arabia patched up its seemingly irreconcilable problems with Iran as a result of Chinese mediation reinforces this factual observation. Pakistan now stands alone as the broader region’s only US vassal.

Pakistan is not only the most highly indebted to China of its BRI partners, but along with Sri Lanka, is also among the largest recipients of Chinese rescue lending. The ruling elite Pakistan is increasingly concerned that the social crisis could spiral out of control and result in something similar to what happened in Sri Lanka last year when a popular uprising toppled the government.

Due to haggling between the West and China, Sri Lanka has been waiting since September to finalize a bailout after a $2.9 billion September staff level IMF deal. And yet many of the recommendations in the agreement have already been implemented—to disastrous effect.

The country is dealing with its worst economic crisis since independence in 1948, including a shortage of reserves and essential items. In February, the IMF said Sri Lanka’s bailout package was set to be approved as soon as the country obtained adequate assurances from bilateral creditors, i.e., China.

Beijing now appears ready to meet more of the IMF’s demands, although details have yet to be released. In a letter in January, the Export-Import Bank of China offered a two-year debt moratorium, but the IMF said that wasn’t enough. According to Reuters, total Sri Lankan debt to Chinese lenders totals roughly 20 percent of the country’s total debt.

Sri Lanka is another focal point of the BRI due to its geographical position in the middle of the Indian Ocean. China’s goal was to transform the country into a transportation hub as much of its energy imports from the Middle East and mineral imports from Africa pass through Sri Lanka. Beijing has already achieved much of these goals. For example, in 2017 a 70 percent stake of the Hambantota port was leased to China Merchants Port Holdings Company Limited for 99 years for $1.12 billion.

The West blames China’s BRI initiative in Sri Lanka for saddling the country with unsustainable debt, but is that really the case? Political economists Devaka Gunawardena , Niyanthini Kadirgamar, and Ahilan Kadirgamar write at Phenomenal World:

The problems associated with the IMF’s policy package have been caught in geopolitical rhetoric. The US alleges that Sri Lanka is the victim of a Chinese debt trap. In fact, Sri Lanka is in an IMF trap. The structural consequences of over four decades of neoliberal policies have exploded into view with the receding welfare state, a ballooning import bill, and investment in infrastructure without returns, all of which relied on inflows of speculative capital. Framing Sri Lanka’s crisis within a narrative of geopolitical competition obscures the core dilemmas of the global economy. Will the evident breakdown force a reckoning with the present order, or will it be used as an excuse to inflict more suffering?

Thus far, it looks like the latter.

#economics#china#zambia#sri lanka#pakistan#international monetary fund#world bank#capitalism#belt and road initiative#new silk road#us imperialism#china-pakistan economic corridor program#chinese investment in africa

29 notes

·

View notes

Text

Meeting the target of limiting heating to 1.5C

At Cop26 in Glasgow, countries agreed to limit global heating to 1.5C above pre-industrial levels. The pledges on emissions cuts they came forward with were not enough to meet this goal, however, so they agreed to return this year with strengthened commitments. Few have done so – only 24 submitted new national plans on emissions to the UN in advance of Cop27.

Likelihood: 0/5

Verdict: There will not be enough progress here to meet the 1.5C goal, but there is a baby step forward – the UN estimates that the improved plans that have been submitted will bring down temperatures by about 0.1C. But we are still heading for a disastrous 2.5C of heating on current policies.

Fulfilling promise of $100bn a year on climate finance

Since 2009, poor countries have been promised $100bn (£87bn) a year from 2020 to help them cut greenhouse gas emissions and adapt to the impacts of extreme weather. This target has not been met, and will not be met before next year.

Likelihood: 0/5

Verdict: The rich world has caused the climate crisis, but the poor world – with tiny emissions in comparison – is bearing the brunt. The longer rich countries fail to fulfil their promises, the less trust there is in them among developed nations.

Adaptation funding

Most of the money that does go to the developed world in climate finance is destined to help middle income countries with projects to cut emissions, such as wind and solar farms. But what the poorest countries most need is help with ways to adapt to the extreme weather they are already seeing, such as regrowing forests, building flood barriers and putting in place early warning systems. Only about a fifth of climate finance is currently for adaptation, and nations promised last year to double that.

Likelihood: 1/5

Verdict: The Egyptian Cop27 presidency launched an action plan for adaptation as a key focus of its first week, so there will be progress but the target of doubling adaptation finance will not be met yet this year.

Loss and damage

One of the biggest issues at Cop27 is loss and damage. This refers to the most devastating impacts of the climate crisis, so extreme that countries could not adapt to them. Examples include the record droughts threatening nearly 150 million people with severe hunger in Africa, and the record floods that hit Pakistan this September. Poor countries say they need funding for rescue and reconstruction when such disasters strike, but rich countries have so far been reluctant to come up with any way of funding this.

Likelihood: 2.5/5

Verdict: Loss and damage is firmly on the official agenda for this conference – that was assured after a late night of negotiations at the start – but it will not be settled here. Countries have only embarked on the process of setting out what loss and damage means and how help for poor countries can be structured. While a few countries have come up with funding, discussions on how to find the hundreds of billions needed will carry on long after delegates leave Egypt.

World Bank reform

The World Bank is not on the agenda of the UN climate summit – it’s a completely separate institution to the UN. But many world leaders here have called for reform of the bank, which they said had failed to focus on the climate crisis and was not fit for the 21st century. Beleaguered World Bank president David Malpass is attending Sharm el-Sheikh, but his job will be looking a lot more shaky by the end of this fortnight.

Likelihood: 4/5

Verdict: If the World Bank is reformed, which is looking more and more necessary and likely, the pressure brought to bear at Cop27 will be a important factor in achieving it.

Movement on African gas

Many African countries are sitting on large reserves of fossil fuels, and with soaring gas prices around the world would like to exploit those reserves. Oil and gas companies would like to invest in them too, but rich countries and climate experts warn that doing so will just add to the climate crisis that is already having disastrous impacts on the poorest on the continent. African countries scent hypocrisy, pointing out that the rich have already burned their supplies.

Likelihood: 5/5

Verdict: There will certainly be movement on African gas at this Cop, but in which direction? Oil and gas investors are lurking in every corner of the conference centre, and they will be looking to go home with climate-busting deals.

#cop27#odds#world politics#climate change#climate action#world bank#loss and damage#fossil fuels#1.5c#finally moving this from my drafts 8 days after it was published

36 notes

·

View notes

Text

BE ALERT!!!

It's becoming more serious , and it's high time everyone on here needs to be Awake!!

Dollar Crash is already taken it's course and our only savior is to Switch to the QFS, Xrp and Xlm backed by gold and silver.

I will no longer be assisting Dms or messages that contain doubts, if you need assistance In switching to the QFS system I will be here for assistance. Serious minded persons only

#EyesOpenAmerica

#donald trump#bank of america#breaking news#bank crash#bad government#world news#qfs#bank clash#wells fargo#new york#republicans#decentralisation#decentralised finance#stay woke#world bank#quantum financial system#carbal#reeducate yourself#rebel#educate yourself#education#be aware#be alert#veterans#marine life#patriotic#white house#trump 2024#nesara#bad omens

6 notes

·

View notes

Text

🇵🇸 🌏🏦 🚨

WORLD BANK ANNOUNCES $20 MILLION IN NEW FINANCING FOR EMERGENCY RELIEF AND AID TO GAZA

The World Bank today approved $20 million in new financing for emergency relief and aid to Gaza as part of an overall $35 million package for the besieged territory.

The package includes $10 million in new financing for food vouchers and parcels, which was approved by the World Bank's Board of Directors. It is estimated the new funding will effect 377'000 Palestinians living in the Gaza Strip.

The assistance is badly needed as Gaza teters on the edge of catastrophe, according to a multitude of sources and aid organizations on the ground in Gaza, and is expected to be delivered through the World Food Programme.

The additional financing will come from the Emergency Social Protection and Jobs Covid-19 Response Project.

In addition to this new source of funding, the World Bank's Health Emergency & Preparedness Trust Fund Program has also allocated an additional $10 million, to be provided by Japan and Germany, for medical care and humanitarian supplies.

The additional $10 million in aid will be delivered through UNICEF and the World Health Organization through the Gaza Health Emergency Response Project, and is expected to provide 10% of Gaza's population with emergency medical care.

The approvals are part of a $35 million aid package being allocated by the World Bank through grant programs on an emergency basis to provide relief to the affected Palestinian population in Gaza.

$15 million in aid for emergency relief has already been delivered, according to reporting.

#source

@WorkerSolidarityNews

#world bank#gaza#gaza strip#gaza news#gaza war#palestine#palestine news#occupied palestine#palestinians#world food programme#politics#geopolitics#news#world news#war#wars#war news#global news#global politics#international news#international affairs#politics news#conflict#israel palestine conflict#israeli occupation#occupation#international organizations#humanitarian aid#humanitarian relief#medical care

7 notes

·

View notes