#Best e-Invoice software in India

Explore tagged Tumblr posts

Text

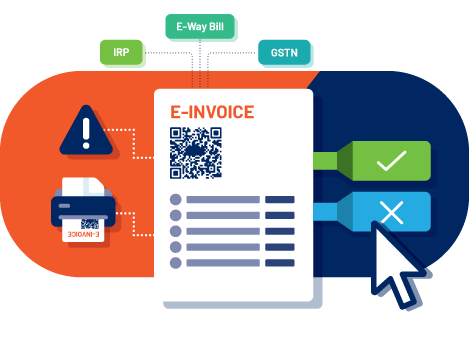

Opt for the Best e-Invoice software in India

Looking for the best e-invoice software in India? Your search ends at Meon Technologies! We offer an impeccable, highly responsive billing tool that enables users to generate paperless invoices according to industry norms. Incorporating such convenient software solutions facilitates the companies to track the invoices at their fingertips and mitigates the chance of any fraud and duplicacy.

For more detail :- https://meontechnologie.wixsite.com/meon-technologies/post/opt-for-the-best-e-invoice-software-in-india

0 notes

Text

5 Tips to Streamline Your Billing Process

Efficient billing is the backbone of successful business operations. The streamlined process not only saves time but also improves customer satisfaction and ensures steady cash flow. Here are five actionable tips to simplify and enhance your billing process using TRIRID Accounting and Billing Software:

Automate Repetitive Tasks

Manual invoicing is time-consuming and prone to errors. With TRIRID, you can automate recurring invoices, set reminders for payments, and generate GST-compliant bills with ease. This automation eliminates delays and reduces human errors.

Leverage Real-Time Reporting

Keep yourself updated with the real-time reporting feature of TRIRID. Track pending invoices, payment statuses, and overall financial health with a click. This transparency helps in taking timely actions to manage receivables.

Cloud-Based Solution

TRIRID's cloud-based platform provides you with access to your billing data at any time and from anywhere. Whether in the office or on the go, you can securely manage invoices, payments, and customer records from any device.

Simplify GST Compliance

Managing taxes can be challenging, but TRIRID makes it easy. Generate GST-ready invoices, calculate tax rates automatically, and stay compliant with the latest regulations—all within the software.

Integrate Billing with ERP Systems

Make your billing software integrate with other business tools such as ERP or inventory management systems to ensure seamless workflow. TRIRID compatibility ensures smooth data flow and enhances efficiency.

Why Choose TRIRID Accounting and Billing Software?

You get a robust solution designed to simplify complex billing processes with TRIRID. The user-friendly interface, customization options, and advanced features make it the go-to choice for businesses of all sizes.

Ready to transform your billing process? Contact us today!

Call @ +91 8980010210 / +91 9023134246

Visit @ https://tririd.com/tririd-biz-gst-billing-accounting-software

#TRIRID Biz Accounting and Billing Software#Best Accounting & Billing Software In India#Best GST e-Invoicing Software for Business#Top 10 Easy To Use Billing and Invoicing Software in India#Best e-Invoicing Software for SMBs in India

0 notes

Text

https://jabitsoft.com/10-key-signs-for-introducing-an-erp-solution-to-your-business/

#Website and Mobile App Development Company#Android and iOS App Development company#mobile app development company#iOS app development services#Android app development services#App Development Company#Mobile App Development Company in Noida#Android App Development Company#Android App Development Company in Noida#iOS App Development Company in Noida#iOS App Development Company#iOS App Development Company India#Mobile Application Development company#Invoicing Software development company in Noida#eCommerce Application Development Company#eCommerce app development services#eCommerce App Development Company#Custom E-Commerce App Development#Custom Software Development Services#Best Website Development Services in Noida#Best Website Development Services in India#Best Website Development Company in Noida#Web Development Services in Noida#software development company in india#Best software development company in india#Best Software Development Companies in India

0 notes

Text

What is the best web-based enterprise accounting software?

In the fast-paced and ever-evolving landscape of business, staying on top of your finances is crucial. As enterprises expand their operations, managing accounts efficiently becomes a daunting task. Thankfully, with the advent of technology, businesses now have access to a plethora of web-based enterprise accounting software options to streamline their financial processes. In this comprehensive guide, we will explore the ins and outs of web-based enterprise accounting software, helping you make an informed decision on the best solution for your business needs.

Understanding Web-Based Enterprise Accounting Software

Web-based enterprise accounting software, often referred to as cloud accounting software, is a digital solution that allows businesses to manage their financial activities online. Unlike traditional accounting systems that rely on on-premise software, web-based accounting tools operate in the cloud, offering users the flexibility to access their financial data from anywhere with an internet connection.

Advantages of Web-Based Enterprise Accounting Software

1. Accessibility

One of the primary advantages of web-based accounting software is accessibility. With data stored securely in the cloud, users can access their financial information anytime, anywhere. This proves especially beneficial for enterprises with multiple locations or remote teams, fostering collaboration and efficiency.

2. Cost Efficiency

Web-based accounting solutions often follow a subscription-based model, eliminating the need for costly upfront investments in software and hardware. This cost-effective approach makes it easier for businesses to scale their accounting infrastructure according to their needs without breaking the bank.

3. Real-Time Updates

In the dynamic world of business, real-time data is invaluable. Web-based accounting software provides instant updates, ensuring that users have access to the most recent financial information. This feature is crucial for making informed decisions and adapting to market changes promptly.

4. Automatic Updates and Maintenance

Gone are the days of manual software updates and maintenance. With web-based accounting solutions, updates are automatic, and maintenance is handled by the service provider. This frees up valuable time for businesses to focus on core operations rather than managing software updates.

Features to Look for in Web-Based Enterprise Accounting Software

1. User-Friendly Interface

A user-friendly interface is essential for ensuring that your team can navigate the software seamlessly. Look for solutions with intuitive dashboards and easy-to-understand features to minimize the learning curve for your staff.

2. Scalability

As your enterprise grows, so do your accounting needs. Choose a web-based accounting solution that can scale with your business, accommodating increased transaction volumes and additional users without compromising performance.

3. Integration Capabilities

Efficient accounting doesn't happen in isolation. Ensure that the web-based accounting software you choose integrates seamlessly with other essential business tools, such as CRM systems, project management software, and e-commerce platforms.

4. Security

The security of your financial data should be a top priority. Opt for web-based accounting software that employs robust encryption protocols and follows industry best practices for data protection. Additionally, check for features such as multi-factor authentication to add an extra layer of security.

Top Contenders in the Web-Based Enterprise Accounting Software Market

1. MargBooks

MargBooks Online is a India's popular online accounting solution known for its user-friendly interface and robust features. It offers a range of plans to suit businesses of all sizes and provides tools for invoicing, expense tracking, and financial reporting.

2. Xero

Xero is another cloud accounting software that caters to small and medium-sized enterprises. With features like bank reconciliation, inventory management, and payroll integration, Xero is a comprehensive solution for businesses looking to streamline their financial processes.

3. NetSuite

NetSuite, owned by Oracle, is a cloud-based ERP (Enterprise Resource Planning) solution that includes robust accounting functionalities. It is suitable for larger enterprises with complex financial needs and offers features such as financial planning, revenue recognition, and multi-currency support.

4. Zoho Books

Zoho Books is part of the Zoho suite of business applications and is designed for small and medium-sized enterprises. It provides features such as automated workflows, project billing, and collaborative client portals, making it a versatile choice for businesses with diverse needs.

Making the Right Choice for Your Business

Choosing the best web-based enterprise accounting software for your business requires careful consideration of your specific needs and objectives. Here are some steps to guide you through the decision-making process:

1. Assess Your Business Requirements

Start by identifying your business's specific accounting requirements. Consider factors such as the number of users, the complexity of your financial transactions, and the need for integration with other business applications.

2. Set a Budget

Determine a realistic budget for your accounting software. While web-based solutions often offer cost savings compared to traditional software, it's essential to choose a solution that aligns with your financial resources.

3. Explore Free Trials

Many web-based accounting software providers offer free trials of their platforms. Take advantage of these trials to explore the features and functionalities of different solutions before making a commitment.

4. Seek Recommendations and Reviews

Consult with other businesses in your industry or network to gather recommendations and insights. Additionally, read reviews from reputable sources to gain a better understanding of the user experiences with different accounting software options.

The Evolution of Web-Based Enterprise Accounting Software

As technology continues to advance, so does the landscape of web-based enterprise accounting software. The evolution of these platforms is driven by the ever-changing needs of businesses and the ongoing developments in cloud technology. Let's delve deeper into the evolving trends shaping the future of web-based accounting solutions.

1. Artificial Intelligence (AI) and Automation

The integration of artificial intelligence and automation is revolutionizing how businesses handle their financial processes. Modern web-based accounting software is incorporating AI algorithms to automate repetitive tasks, such as data entry and invoice categorization. This not only increases efficiency but also minimizes the risk of human error.

2. Enhanced Data Analytics

In the age of big data, the ability to derive meaningful insights from financial data is paramount. Advanced web-based accounting solutions are now equipped with powerful data analytics tools. These tools help businesses analyze trends, forecast future financial scenarios, and make data-driven decisions.

3. Mobile Accessibility

The shift towards mobile accessibility is a notable trend in web-based enterprise accounting software. Businesses are increasingly relying on mobile devices for day-to-day operations, and accounting software providers are responding by offering mobile-friendly applications. This allows users to manage their finances on the go, providing unparalleled flexibility.

4. Integration with E-Commerce Platforms

As e-commerce continues to thrive, businesses are looking for accounting solutions that seamlessly integrate with their online sales platforms. Modern web-based accounting software often includes features tailored for e-commerce, such as automated transaction reconciliation with online sales channels and inventory management.

5. Blockchain Technology

Blockchain technology is making waves in various industries, and accounting is no exception. Some web-based accounting solutions are exploring the integration of blockchain for enhanced security and transparency in financial transactions. This could revolutionize how businesses handle aspects like auditing and transaction verification.

Common Challenges and How to Overcome Them

While web-based enterprise accounting software offers numerous benefits, it's important to be aware of potential challenges and how to overcome them. Here are some common issues businesses may face:

1. Security Concerns

The sensitive nature of financial data raises concerns about security in the cloud. To address this, choose a web-based accounting solution that employs robust encryption protocols and complies with industry security standards. Additionally, educate your team about best practices for secure online behavior.

2. Connectivity Issues

Reliable internet connectivity is crucial for accessing web-based accounting software. In regions with unstable internet connections, businesses may face challenges in real-time collaboration and data accessibility. Consider implementing backup solutions for offline access or explore accounting software with offline capabilities.

3. Customization Needs

Every business has unique accounting requirements. Some businesses may find that certain web-based accounting solutions lack the level of customization they need. In such cases, explore platforms that offer extensive customization options or consider integrating additional specialized accounting tools.

4. Data Ownership and Control

Understanding the terms of service and data ownership is essential when using web-based accounting software. Ensure that the chosen platform allows you to retain control over your financial data and provides mechanisms for data export in case of migration to a different system.

Conclusion: Making the Right Choice for Long-Term Success

In the fast-paced world of business, the right web-based enterprise accounting software can be a game-changer. Whether you're a small startup or a large enterprise, the key is to stay informed about the latest advancements in accounting technology and align your choice with the long-term goals of your business.

As you navigate the vast landscape of web-based accounting solutions, remember that the best choice is the one that seamlessly integrates with your business processes, enhances efficiency, and adapts to the evolving needs of your enterprise. If you have any specific questions or need further guidance on a particular aspect of web-based accounting software, feel free to ask for more information!

Also read- Online billing and accounting software to manage your business

#Web-based accounting#Cloud software#Financial management#Enterprise solutions#accounting#software#billing#online billing software#technology#programming#erp#tech#drawings#illlustration#artwork#art style#sketchy#art#aspec#aromantic asexual#arospec#acespec#aroace#aro#bg3#astarion#shadowheart#gale dekarios#gale of waterdeep#karlach

2 notes

·

View notes

Text

Simplifying Tax Filing: The Best Accounting Software Solutions for Indian Companies

Tax filing can be a complex and time-consuming process for Indian companies. However, with the right accounting software, this task can be simplified and streamlined. In this article, we will explore the best accounting software solutions for Indian companies that can assist in simplifying tax filing.

1. Tally ERP 9: Tally ERP 9 is a leading accounting software widely used in India. It offers comprehensive features for managing financial transactions, generating accurate financial reports, and ensuring GST compliance. With built-in tax filing capabilities, Tally ERP 9 simplifies the process of tax computation and e-filing, saving time and reducing errors.

2. QuickBooks: QuickBooks is a popular accounting software that caters to small and medium-sized businesses in India. It provides features like expense tracking, invoicing, and financial reporting. QuickBooks simplifies tax filing by automatically categorizing transactions, generating GST-compliant reports, and facilitating seamless integration with tax filing portals.

3. Zoho Books: Zoho Books is a cloud-based accounting software that offers Indian businesses an efficient way to manage their finances. It provides GST-compliant invoicing, expense tracking, and bank reconciliation features. Zoho Books streamlines tax filing by generating accurate tax reports, providing support for e-way bill generation, and enabling integration with GSTN for seamless filing.

By leveraging these top accounting software solutions, Indian companies can simplify tax filing processes and ensure compliance with GST regulations. These software options automate various aspects of tax computation, generate GST-compliant reports, and facilitate easy e-filing. They minimize manual effort, reduce the chances of errors, and provide businesses with a clear overview of their tax obligations.

In conclusion, choosing the right accounting software is essential for Indian companies looking to simplify tax filing. Tally ERP 9, QuickBooks, and Zoho Books are among the top accounting software solutions that can streamline the tax filing process, saving businesses valuable time and effort while ensuring accuracy and compliance.

2 notes

·

View notes

Text

Start Your Career in Finance with BUSY Software Training

INTRODUCTION

In today’s competitive job market, having just a degree is often not enough. If you're a commerce student or aspiring finance professional, gaining practical software skills is the key to unlocking career opportunities. One of the most in-demand tools in accounting today is BUSY Accounting Software. It’s widely used by businesses for managing inventory, GST, invoicing, and financial reporting—making it a must-have skill for those looking to step confidently into the finance world.

Why BUSY Accounting Software?

BUSY is an integrated business accounting and management software used across multiple industries, especially in small and medium enterprises. Its simplicity and power make it a favorite for accountants and business owners. Whether it’s day-to-day accounting, GST returns, or inventory control—BUSY does it all. That’s why enrolling in BUSY Software Classes in Yamuna Vihar or BUSY Software Classes in Uttam Nagar is a smart investment in your future.

Learn by Doing: The Importance of Practical Training

Theory alone won’t prepare you for real-world accounting tasks. Practical exposure to tools like BUSY helps you understand how actual business transactions are recorded and managed. That’s where Advanced BUSY Software Training with Practical in Yamuna Vihar or Practical BUSY Software and Accounting Course in Uttam Nagar comes into play. These programs offer hands-on experience so you can confidently work with ledgers, GST reports, TDS entries, and more.

What You Will Learn in BUSY Software Courses

Enrolling in a Complete BUSY Accounting and GST Course in Yamuna Vihar or Uttam Nagar will help you build strong fundamentals and job-ready skills. Here's a glimpse of what you’ll learn:

Core Accounting Principles using BUSY

GST Setup and Invoicing

Voucher and Journal Entry Creation

Inventory Management

Financial Reporting and Analysis

TDS, TCS, and Taxation Handling

Payroll Processing

E-Way Bill and Return Filing

This is especially beneficial for students taking up the BUSY Accounting and Taxation Course in Uttam Nagar or BUSY Accounting Software with GST Training in Yamuna Vihar, where GST modules are integrated for complete job readiness.

Certified Training Means Better Job Prospects

A course from a Certified BUSY Accounting Software Institute in Uttam Nagar or Yamuna Vihar adds weight to your resume. It proves that you not only understand accounting principles but can also implement them using one of India’s most popular accounting platforms. Employers often give preference to candidates who have completed BUSY ERP Software Training Classes in Yamuna Vihar or similar certification-based training.

Career Opportunities After BUSY Software Training

Learning BUSY isn’t just for accountants. The skills you gain are useful in multiple roles across industries:

Junior Accountant

GST Executive

Billing Executive

Accounts Assistant

Data Entry Operator

Inventory Manager

Freelance Accountant for SMEs

Thanks to the rising demand for skilled professionals, students from Top Institutes for BUSY Software Training in Uttam Nagar are being placed in good companies, often with better starting salaries than peers who lack software experience.

Who Should Enroll?

B.Com, M.Com, BBA students

Job seekers in accounting or finance

Working professionals looking to upgrade skills

Entrepreneurs managing their own books

Freelancers offering accounting services

Final Thoughts

Starting your career in finance with BUSY Software Training is not just about learning software—it’s about becoming job-ready. The knowledge you gain from BUSY Accounting Software Training in Uttam Nagar can bridge the gap between classroom learning and workplace requirements. It gives you the confidence to apply for jobs, handle interviews, and perform efficiently in real-world accounting roles.

If you’re serious about building a future in accounting, now is the time to take that next step. Explore the BUSY ERP Software Training Classes near you and set your career in motion with skills that matter.

Suggested Links:

TallyPrime With GST

BUSY Accounting Software

e Accounting

GST Course with e-Filing

#busy accounting software course.#busy accounting#busy accounting training#busy accounting classes#busy accounting off#line course

0 notes

Text

GST Portal Use Course Complete Walkthrough

GST Course: एक ज़रूरी स्किल हर Accountant के लिए

GST Course आज के समय में हर finance और accounting student के लिए जरूरी हो चुका ह��। अगर आप finance field में career बनाना चाहते हैं, तो ये course आपके लिए बहुत फायदेमंद रहेगा।

📌 Introduction: GST क्या है और Course क्यों ज़रूरी है?

GST यानी Goods and Services Tax, एक indirect tax system है। इसे 1 जुलाई 2017 में लागू किया गया था।

इसका मकसद था – tax structure को simplify करना और सारे indirect taxes को एक umbrella में लाना।

आज के time में हर business को GST filing करनी होती है। इसलिए, GST course करना एक job-ready skill बन चुका है।

🎓 GST Course क्या सिखाता है?

GST course में students को GST की theory aur practical दोनों सिखाई जाती है।

आप सीखते हैं:

GST Registration कैसे करें

GST Returns कैसे file करें

ITC (Input Tax Credit) क्या होता है

E-invoicing और GST portal का use कैसे करें

हर student को real-time software जैसे Tally, Busy, Zoho Books पर भी training दी जाती है।

🏫 Course Duration और Eligibility: कितना समय लगेगा?

✅ Duration of GST Course:

Course का duration institute पर depend करता है।

कुछ institutes इसे 1 month में complete कराते हैं, वहीं कुछ places में ये 3 महीने तक चलता है।

Short-term course होने के कारण इसे college-going students और working professionals दोनों कर सकते हैं।

🎓 Eligibility Criteria:

आपने अगर 12th या graduation complete कर लिया है, तो आप ये course join कर सकते हैं।

Commerce background वालों के लिए ये course ज़्यादा beneficial होता है।

लेकिन अगर आप non-commerce stream से भी हैं और interest है, तो भी course easily किया जा सकता है।

💸 Course Fee: कितना खर्च आएगा?

GST course की fee काफी affordable होती है।

Generally, fee structure ₹5,000 से ₹15,000 के बीच होता है।

कुछ reputed institutes में ये ₹20,000 तक भी जा सकता है, खासकर अगर certification government-recognized हो।

🧑🏫 Best Institutes for GST Course in India

अगर आप Delhi, Mumbai, या Bangalore जैसे cities में रहते हैं, तो आपको बहुत सारे अच्छे institutes मिल जाएंगे।

कुछ popular institutes हैं:

IPA (Institute of Professional Accountants), Delhi

ICA Edu Skills

NIIT

IITC

इनमें से कई institutes online classes भी offer करते हैं, जिससे आप घर बैठे सीख सकते हैं।

📃 Certification & Recognition: Course Complete करने के बाद क्या मिलेगा?

GST course करने के बाद आपको certificate मिलता है।

अगर आप किसी recognized institute से course करते हैं, तो उसका certificate काफी valuable होता है।

Certification आपके resume को strong बनाता है और job chances बढ़ाता है।

💼 Career Opportunities after GST Course

GST course करने के बाद आपके लिए कई job opportunities खुल जाती हैं।

आप apply कर सकते हैं:

GST Executive

Tax Consultant

Accounts Assistant

GST Practitioner (with Govt registration)

अगर आप already accounting field में हैं, तो ये course आपकी salary बढ़ाने में help कर सकता है।

🔧 Practical Knowledge: सिर्फ Theory नहीं, Hands-on Training भी

Good GST courses सिर्फ theory पर focus नहीं करते।

आपको GST return filing, portal use करना, challan बनाना, और invoice verification जैसी चीज़ें practically सिखाई जाती हैं।

यही skill आपको market में दूसरे candidates से अलग बनाता है।

📲 Online GST Course: घर बैठे सीखें Professional Skills

आजकल कई reputed institutes और platforms जैसे:

Udemy,

Coursera,

IPA Online,

इनसे आप online GST course कर सकते हैं।

ये courses flexible होते हैं और working professionals के लिए perfect रहते हैं।

💡 Why GST Course is Trending?

हर small और big business को GST compliance करनी होती है।

इसलिए हर company को एक skilled GST professional की जरूरत होती है।

GST system में frequent updates आते हैं। इस वजह से GST expert की demand कभी कम नहीं होती।

🔍 What Makes a Good GST Course?

अगर आप GST course join करने जा रहे हैं, तो इन बातों का ध्यान ज़रूर रखें:

Course syllabus updated हो

Practical assignments और software training हो

Industry expert faculty पढ़ाएं

Placement assistance available हो

Certificate recognized हो

एक अच्छा GST course वही है जो आपको market-ready बनाए।

🧾 GST Course के Benefits: क्यों करना चाहिए ये Course?

✔️ Skill-Based Learning:

GST एक technical और जरूरी skill है। इससे आपकी employability बढ़ती है।

✔️ Extra Earning:

आप freelance GST filing भी कर सकते हैं। इससे आप part-time भी income generate कर सकते हैं।

✔️ Business के लिए Helpful:

अगर आप खुद का business चलाना चाहते हैं, तो GST knowledge से आपको बड़ा फायदा होगा।

🤝 Final Words: GST Course – A Smart Career Investment

अगर आप accounting, finance या business में career बनाना चाहते हैं, तो GST course एक must-have skill है।

ये आपको ना सिर्फ job-ready बनाता है, बल्कि self-employment के भी रास्ते खोलता है।

तो इंतज़ार मत कीजिए, आज ही admission लें और अपने career को एक नया मोड़ दें।

✅ FAQs: आपके सवाल, हमारे जवाब

Q1. क्या commerce background ज़रूरी है GST course के लिए? नहीं, interest और dedication हो तो कोई भी student course कर सकता है।

Q2. क्या GST certification government recognized होता है? अगर आप reputed और authorized institute से करते हैं तो हां।

Q3. क्या online course भी job में मदद करता है? अगर course practical और updated है, तो online certification भी valuable होता है।

Accounting interview Question Answers

Tax Income Tax Practitioner Course

How to become an income tax officer

Learn Tally free online

Best Accounting Training Institute

journal entries questions with answers

What is B Com full form

Highest Paying Jobs in India

ICWA Course

Short Cut keys in tally

Tally Prime free download

Tally Prime Features

Meaning of sundry debtor creditor

Income Tax Return Filing services

Education Business ideas

Accounting Entry

Income Tax

Accounting

Tally

Career

0 notes

Text

Clinics Operate More Smoothly: 10 Firmly Proven Ways Clinthora Could Trill Your Practice

Time is at a premium in the hectic world of healthcare, with each patient interaction being crucial in forming care. Be it trying to manage a multi-location clinic that seems to be growing in Dubai, the tools chosen determine the kind of care rendered.

Enter Clinthora — an all-in-one clinic management software designed for today’s fast-moving healthcare world, placing compliance at the center.

Here are 10 tested tips for your clinic productivity — real things that bring results — they are just there in Clinthora for you.

1. Bring About 30% Fewer No-shows With an Automated Appointment Reminder

No-shows are lost revenue opportunities and disruptions to care.

Manual calls and messages, a no-show rate of anywhere between 20 and 30% is reported.

Automated reminders with Clinthora pop up seamlessly in your workflow — SMS, email, and even WhatsApp. No separate apps, no staff overhead.

Clinics in India reported a 28% drop in no-shows within 2 weeks of switching on auto-reminders.

2. Go Digital Since Paper Charts Don’t Get a Search Bar

Paper charts misfiled? Files destroyed by humidity or fire threat?

Clinthora EMR boasts:

Cloud-based access with encryption

Search using symptoms, diagnosis, or patient ID with ease

Access from anywhere — be it in Hyderabad or Sharjah

Better records equal faster decisions and safer care.

Especially in busy metros where appointment slots matter.

3. Half the Time for Billing—Auto-Magically

10–15 minutes for one patient to complete billing?

Clinthora speeds it up to under 2 minutes by offering

Auto-fill insurance codes

Compile service charges automatically

GST/VAT invoices instantly (India & UAE-compliant)

Automation in billing has resulted in 22% faster discharges for patients in Dubai multi-specialty clinics.

4. Never Skip a Follow-Up

When a follow-up appointment is missed, there’s not just a loss of money; the continuity of care is compromised.

Clinthora sends smart, personalized follow-up reminders, depending on whichever channel the patient wishes.

Whether WhatsApp in Delhi or email in Dubai Marina, it ensures that

💬 Consistent communication leads to better retention and better outcomes.

5. See Your Practice in Action

Who is the best doctor in your clinic? Peak-Patient-Hour Revenue Tracks?

With the live dashboard from Clinthora, monitor:

Appointment-hour-quality

Staff performance

Collection-wise category or analysis according to department or clinic

Her data drives fast growth.

6. Telehealth = Real Retention

Telehealth is no longer a “nice-to-have” but one of the major convenience factors that enhance satisfaction among patients.

Clinthora provides seamless video consultations along with digital notes and remote e-prescriptions to be synced with regular scheduling.

Telehealth clinics in the UAE have enjoyed a 25-percent higher retention rate within six months.

7. Multiple Clinics With One Dashboard

If you have branches in Kochi, Chennai, and Dubai, wouldn’t you have five tools (one for each location) to work with?

Clinthora enables you to

See all locations from a single login

Assign roles per branch

Perform consolidated billing & reporting

The scalable clinic management starts with unified control.

8. Built-In Compliance for Indian and Dubai Healthcare Laws

📋 From NABH in India to DHA compliance in Dubai — laws apply with no exceptions.

Clinthora keeps you ahead by providing

Mapping and catch-up alerts

Proper formatting and storage of records

Consent form logs and digital signatures

The peace of mind without the additional administration.

9. Unblock That Front Desk with Smart Queueing & Task Automation

🚦Long check-ins. Billing backlogs. Waiting room chaos.

Clinthora’s automated queue clearing and task assignment set the front desk clear.

Receptionists now attend to three times more patients with fewer clicks.

Patients get faster and smoother service — with no crowding, no confusion.

10. Patients Expect Digitization—Are You Providing It?

📱 Online booking. Instant confirmation. WhatsApp updates. E-prescriptions. Video consults.

Patients today expect everything to be just one tap away.

With Clinthora, it actually is.

🎯 Give your clinic the edge — modernize care, digitize communication, and meet your patients where they are.

Clinthora: Trusted by Smart Clinics in India & UAE

From family clinics in Cochin to specialized wellness centers in Jumeirah, Clinthora is assisting healthcare providers to:

Reduce admin costs

Improve care continuity

Increase patient satisfaction

Ensure region-specific compliance

Ready to transform your clinic into a smart, efficient, patient-first practice?

Prepare Clinthora.com or go ahead and request a demo.

Because the future of care is digital — and it is here now.

0 notes

Text

Transform Manufacturing with Udyog Best ERP — India’s Smartest ERP Solution

In an era where digital transformation is reshaping industries, manufacturers need a technology partner that understands their unique challenges and delivers intelligent, scalable solutions. Udyog Software, a pioneer in business automation since 1993, offers exactly that with Udyog Best ERP — a smart, India-first Best erp in india manufacturing ERP Software india designed to revolutionize how manufacturing businesses operate.

Built for Indian Manufacturers, Backed by Global Standards

Udyog Best erp in india manufacturing ERP Software india is not just another ERP system. It is a product born out of decades of industry experience, specifically crafted for Indian enterprises. It goes beyond basic automation to deliver deep process integration, tax compliance, and real-time insights — all in a single platform

Key Features That Drive Transformation:

End-to-End Manufacturing Management

From the bill of materials to the final delivery of finished goods, Udyog Best erp in india manufacturing ERP Software india provides complete transparency and control across the entire production cycle. With powerful features like job work management, shop floor tracking, and process-wise costing, it empowers manufacturers to streamline operations, increase productivity, and minimize waste.

GST- Ready and Tax Compliant

Udyog Best ERP comes equipped with built-in support for GST, e-Invoicing, e-Way Bills, and TDS. This significantly reduces the compliance workload, ensures data accuracy, speeds up return filings, and keeps your business always prepared for audits.

Powerful Inventory & Asset Control

Real-time inventory tracking helps manufacturers stay updated on stock levels at all times. Reorder alerts ensure materials are always available when needed, reducing downtime. Expiry management adds another layer of control for perishable or time-sensitive items. In addition, Udyog Best erp in india manufacturing ERP Software india simplifies capital asset and CWIP project management. Automated depreciation, scheduled maintenance, and full asset lifecycle tracking keep operations smooth and compliant.

Modular & Scalable Design

Whether you’re a fast-growing startup or a large enterprise with multiple branches, Udyog Best erp in india manufacturing ERP Software india scales seamlessly with your business. Its modular design lets you start with what you need — like accounting, HR, production, or supply chain — and easily add more features as your operations grow.

In the fast-paced world of manufacturing, success is determined by how well a business adapts, automates, and innovates. With Udyog Best erp in india manufacturing ERP Software india Indian manufacturers now have a powerful tool to simplify operations, enhance productivity, and drive profitability. Visit www.udyogsoftware.com to book a free demo today.

0 notes

Text

Opt for the Best e Invoice software in India

Looking for the best e-invoice software in India? Your search ends at Meon Technologies! We offer an impeccable, highly responsive billing tool that enables users to generate paperless invoices according to industry norms. Incorporating such convenient software solutions facilitates the companies to track the invoices at their fingertips and mitigates the chance of any fraud and duplicacy. So, what are you waiting for? Embrace the advanced e-invoicing technologies and stay ahead in the tough competition.

Find the Best auto mailer software.

Significance of Customer Service Tools

Customer service tools are not a new concept, but these are indispensable for organisations to handle their customer issues and enhance their experience. These software solutions are based on ticketing systems and allow customer support representatives to track, manage, and set priorities based on client preferences. In this system, the customers get a notification regarding their raised tickets, and they can complete and upload the documents related to the bug issues they are facing. For more details, visit the website!

Enhance your Customer Trip Plans with Itinerary Creator

An itinerary creator tool is specially designed for the travel industry, which reduces the burden of travel agents as well as travel enthusiasts. This software empowers users to create beautiful itineraries with the help of advanced artificial intelligence algorithms and saves time and energy. It enables users to make travel plans quickly and efficiently under their budgets. If you're interested in getting a free demo, don't hesitate to fix a schedule right now!

source

#best e-invoice software in India#best auto mailer software#Customer service tools#itinerary creator

0 notes

Text

Top Benefits of Using e-Procurement Software for Enterprises

In a competitive and digitally driven market, procurement is no longer a back-office function—it’s a strategic business enabler. As enterprises strive for efficiency, visibility, and cost savings, the demand for the best e-procurement software in India is growing rapidly. Leveraging advanced digital tools like e-Procurement software in India can significantly optimize procurement operations for large and small enterprises alike.

In this blog, we explore the top benefits of using e-procurement software and why Indian enterprises are increasingly turning to leading procurement software companies in India to stay ahead in 2025.

What Is e-Procurement Software?

e-Procurement software automates the entire procurement lifecycle, including vendor management, requisition, purchase orders, invoicing, and payment processes. A powerful procurement software system in India allows companies to digitize their sourcing and buying processes, ensuring faster, safer, and more strategic procurement.

Key Benefits of e-Procurement Software for Enterprises

1. Streamlined Procurement Process

Manual procurement processes often lead to delays, human errors, and compliance risks. With a robust e-procurement software company in India, enterprises can automate workflows, eliminate redundant steps, and streamline the purchase cycle from start to finish.

This not only accelerates approvals but also improves communication between departments, vendors, and procurement managers.

2. Cost Savings and Budget Control

Using the best procurement software in India allows enterprises to manage budgets more effectively. By automating the sourcing and purchasing process, companies can:

Reduce maverick spending

Access competitive vendor pricing

Negotiate better contracts

Gain real-time visibility into expenditures

Enterprises can allocate funds wisely and avoid overspending with a top-rated procurement software in India.

3. Enhanced Vendor Management

Effective supplier relationships are crucial for procurement success. A top procurement software company in India offers features like:

Vendor registration and onboarding

Performance tracking

Risk management

Compliance monitoring

With centralized supplier data, enterprises can make smarter decisions and reduce procurement risks.

4. Data-Driven Decision Making

A modern eProcurement software in India provides real-time data and analytics that empower procurement teams to:

Monitor KPIs

Analyze spend patterns

Identify cost-saving opportunities

Forecast procurement needs

These insights drive strategic decisions and help in optimizing supply chain operations.

5. Improved Transparency and Compliance

Regulatory compliance is a major concern for large enterprises. With features like audit trails, digital records, and automated alerts, order procurement software in India ensures full transparency. Companies can maintain compliance with local and international procurement standards.

6. Better Collaboration Across Departments

An integrated procurement software system in India connects finance, legal, operations, and procurement departments seamlessly. This cross-functional collaboration enhances productivity and eliminates miscommunication or process delays.

7. Scalability and Customization

Whether you're a mid-sized company or a multinational enterprise, the best e procurement software India can be scaled and customized according to your specific business needs. From configurable approval workflows to multilingual and multi-currency support, the system grows with your business.

Why Indian Enterprises Are Choosing mjPRO

mjPRO stands out as a trusted e-procurement software company in India. Designed to address local and global procurement needs, mjPRO offers a unified, cloud-based platform that brings together:

Supplier discovery

Automated sourcing

Smart negotiations

Contract and spend management

Post-activation support

As one of the top procurement software in India, mjPRO is tailored to meet the dynamic needs of growing Indian enterprises.

The Digital Procurement Revolution in India

India's enterprise sector is undergoing a digital transformation. Government initiatives like Digital India and Make in India are accelerating tech adoption across industries. As businesses embrace automation, partnering with the best procurement software company in India becomes a strategic move.

Organizations that invest in reliable e procurement software in India today are positioning themselves for long-term growth, agility, and resilience.

Final Thoughts

The benefits of using e-procurement software go beyond operational efficiency. It empowers enterprises to take control of spending, improve supplier collaboration, and make faster, smarter decisions. In 2025, businesses looking to lead their industry must choose the best e procurement software company in India that aligns with their growth vision.

Whether you're exploring procurement transformation or scaling operations, mjPRO is your trusted partner—a reliable procurement software company in India offering advanced, AI-powered solutions for modern enterprises.

#top procurement software in India#best e procurement software in India#best e procurement software company in India

0 notes

Text

The Best Accounting Software for Indian Businesses in 2025

In today’s competitive landscape, Indian businesses are under increasing pressure to manage finances accurately while staying compliant with tax regulations like GST and e-invoicing. The good news is that modern accounting software makes it easier than ever to handle your books, automate tasks, and ensure you're always in line with government mandates. Whether you're a startup, a small trader, or a growing enterprise, selecting the right accounting software is a key investment decision. In this article, we’ll explore the Best Accounting Software for Indian Businesses in 2025, covering options for every business type and budget.

What Makes Accounting Software Ideal for Indian Businesses?

The best accounting software for Indian users goes beyond just bookkeeping—it must support GST billing, handle e-invoicing, generate accurate tax reports, manage inventory, and integrate easily with banks and payment systems. Cloud access, user-friendly interfaces, mobile apps, and data security are also critical in a digital-first economy.

TallyPrime:

TallyPrime continues to be one of the most popular accounting solutions for Indian SMEs. Known for its offline strength and flexibility, Tally is fully GST-ready, supports e-invoicing, and now offers cloud backup options. It also includes features like inventory tracking, payroll processing, and the Tally Prime Edit Log, which helps with auditing. Tally does have a learning curve and isn’t fully cloud-based out of the box, but it's a solid option for businesses with a traditional setup.

Zoho Books:

For startups and tech-savvy businesses, Zoho Books stands out with its modern interface and powerful automation features. It’s fully cloud-based, supports real-time GST filing, integrates with India’s IRP portal for e-invoicing, and even has a free version for small businesses with annual turnover under ₹25 lakh. From bank feeds to client portals and mobile apps, Zoho Books is built for today’s fast-paced digital businesses.

Busy Accounting Software:

Busy is another strong contender, especially for wholesalers, traders, and manufacturing companies. It offers detailed inventory control, GST compliance, multi-location management, and strong reporting capabilities. While its interface isn’t as modern as some cloud-based competitors, Busy’s functionality and affordability make it a favorite among traditional business sectors.

Marg ERP:

If you're in retail, distribution, or pharmaceuticals, Marg ERP may be your best bet. This software is tailored for industries that need barcode scanning, batch tracking, and real-time stock management. Marg ERP also supports e-invoicing and is GST-ready, making it highly relevant for Indian retailers. While it’s primarily desktop-based and requires training, its industry-specific modules offer real value.

Vyapar App:

Vyapar is a mobile-friendly solution aimed at micro and small businesses. It offers GST billing, expense tracking, inventory management, and even WhatsApp invoice sharing. What makes Vyapar stand out is its ease of use and low price point—ideal for shopkeepers, freelancers, and small traders. It doesn’t offer advanced analytics or deep integrations but delivers exactly what a small business needs to stay organized and compliant.

Saral Accounts:

Saral Accounts is especially popular with CA firms and tax practitioners. It includes modules for GST, TDS, e-invoicing, and payroll, all aligned with Indian tax laws. It’s not the flashiest in terms of design, but it offers a comprehensive suite for businesses that need to manage complex compliance tasks with precision.

Smaket Billing Software :

Smaket Billing Software is an emerging solution designed to meet the needs of small and mid-sized Indian businesses seeking a smart yet simple billing system. It offers fast and professional GST-compliant invoicing, inventory tracking, e-invoicing capabilities, and detailed reporting—all through an easy-to-use interface. What sets Smaket apart is its focus on usability without sacrificing power. It’s cloud-ready, mobile-accessible, and ideal for businesses that want modern features without a steep learning curve. Smaket also offers real-time tax calculations, data backups, and customer support that makes it appealing to businesses looking to get started quickly and stay compliant with minimal effort.

Final Thoughts

Selecting the right Accounting Software for your business in 2025 depends on your size, industry, and workflow. If you value offline access and robust features, TallyPrime and Busy are excellent choices. For startups or tech-forward companies, Zoho Books delivers powerful cloud-based automation and simplicity. If you're in retail or distribution, Marg ERP covers your industry-specific needs. For freelancers and small shop owners, Vyapar is an affordable and intuitive solution, while Saral is well-suited for finance professionals and firms handling multiple clients.

1 note

·

View note

Text

Meeting Deadlines: How to Select the Best GST Return Filing Consultants for Your Business

Tax season doesn’t knock politely — it bangs on the door with penalties, late fees, and stress. For businesses navigating the complex Indian tax landscape, GST return filing is one of the most critical yet commonly mismanaged tasks. It isn’t just about submitting numbers on a portal; it’s about compliance, accuracy, and protecting your financial standing.

So, how do you ensure your returns are not just filed, but filed right? That’s where experienced GST return filing consultants step in.

Demystifying GST Return Filing: Beyond Just a Routine Process

The Goods and Services Tax (GST) was created to make India's indirect taxes easier to understand. But for many businesses — especially MSMEs and startups — the filing process often feels anything but simple. Various forms must be addressed, such as GSTR-1, GSTR-3B, GSTR-9, and GSTR-9C, each having distinct filing frequencies and requirements.

A single mismatch in invoices, failure to reconcile Input Tax Credit (ITC), or a missed deadline can lead to interest charges, audit scrutiny, or even loss of compliance rating.

That’s why GST return filing is not a task to be handled casually or internally unless there’s a dedicated tax expert on the team.

What Do GST Return Filing Consultants Actually Do?

Qualified GST return filing consultants go far beyond just data entry. They ensure your filings are:

Accurate: Matching purchase and sales data with GSTN

Timely: Avoiding late fees and interest penalties

Compliant: Complying with the most recent GST regulations and updates.

Reconciled: Cross-verifying ITC claims with vendor filings

Ready for audit: Maintaining appropriate digital records and trail

They act as both advisors and executors, bridging the gap between tax laws and your day-to-day business operations.

Why Businesses Are Moving Away from DIY GST Filing

While online GST portals are designed for accessibility, most business owners are overwhelmed. Here’s why:

Constant changes in rules: GST compliance is dynamic. Notifications and clarifications are released frequently.

High error probability: Manual entries or spreadsheet management can lead to costly mistakes.

Lack of expertise: Understanding the impact of reverse charges, exemptions, or HSN/SAC codes is not always straightforward.

Multi-state complications: Businesses operating across India deal with different registration numbers, adding to the complexity.

By engaging professional GST return filing consultants, businesses can reduce errors, stay updated, and focus on growth rather than grappling with tax portals.

Key Traits to Look for in a Consultant

Choosing a consultant isn’t just about outsourcing paperwork. You’re entrusting them with legal and financial responsibility. Look for:

Domain expertise in indirect taxation and finance

Technology integration to streamline documentation and e-filing

Regular updates and reminders on upcoming due dates

Tailored services based on your business size, type, and industry.��

Post-filing support, including handling notices or clarifications from GST authorities

Some firms also offer integrated services that link GST compliance with accounting software and audit support, reducing duplication and increasing accuracy.

Technology Is Changing the Game

Today’s consultants don’t just operate through spreadsheets. Many offer cloud-based dashboards where clients can:

Upload invoices and purchase records

Track filing status

View reconciliation summaries

Receive automated due date alerts

This combination of tech and tax expertise has redefined what businesses expect from GST return filing consultants in 2025.

Penalties Are Expensive – Non-Compliance Isn’t Worth the Risk

Filing GST returns late or incorrectly may result in:

Penalties starting at ₹50 to ₹200 per day

Blocking of Input Tax Credit

Departmental audits and notices

Deterioration of business reputation and GST compliance rating.

Consistent failure to comply may result in the suspension or cancellation of GST registration, a consequence that can be detrimental for any business.

The Bigger Picture: GST Filing as a Business Function

Forward-thinking businesses have begun treating GST compliance not just as a statutory necessity, but as a strategic function. Proper filing offers:

Better cash flow through timely ITC

Stronger vendor relationships through accurate reconciliations

Risk mitigation from tax scrutiny

Improved business valuation in case of investment or exit

Whether you're a small trader, a mid-sized manufacturer, or a rapidly scaling tech startup, accurate and timely GST return filing is essential to stay compliant and stress-free. Given the growing complexity of tax structures and increasing use of data analytics by authorities, businesses are now prioritising qualified, tech-enabled guidance.

Firms like Shah Doshi are playing a pivotal role in offering reliable GST return compliance services across industries. With a combination of domain knowledge, process rigour, and client-focused support, they help Indian businesses navigate GST regulations with confidence and clarity.

0 notes

Text

GST & Compliance Made Easy with Udyog ERP

Running a manufacturing business in India requires a keen understanding of the ever-changing regulatory landscape. From GST compliance to e-way bills and tax filings, staying on top of these tasks can often feel overwhelming. But with Udyog ERP, the complexity of managing GST compliance is simplified, making life easier for your accounting team and allowing you to focus on growth.

In this blog, we’ll explore how Udyog ERP helps businesses streamline their GST and compliance requirements while ensuring that the entire process is automated, efficient, and foolproof.

Navigating GST Compliance in India

For manufacturers, GST compliance is not just a formality — it’s a critical part of doing business. The nuances of India’s GST system, along with the need to file returns on time and generate e-way bills, can be tricky without the right tools. That’s where best ERP software in India, like Udyog ERP, becomes a game-changer.

Udyog ERP takes the complexity out of GST compliance, automating tasks such as:

Generating GST-compliant invoices

Calculating tax liabilities automatically

Managing GST returns for different states

Simplifying the creation and management of e-way bills

With Udyog ERP, you’ll always stay ahead of the game when it comes to tax compliance.

Automating GST Returns with Udyog ERP

One of the biggest challenges businesses face is the manual process of filing GST returns. It can be time-consuming, error-prone, and often stressful. Udyog ERP streamlines this process, making it easier than ever to file returns.

Here’s how it works:

Automatically consolidates data from your purchase and sales invoices

Prepares the required GST returns in the correct format

Sends timely reminders so you never miss a deadline

Provides real-time validation for discrepancies

By integrating best ERP software in India like Udyog ERP, manufacturers can reduce the chances of errors and avoid penalties for late or incorrect filings.

E-Way Bill Management Simplified

Transporting goods across India? You’re familiar with the challenges of creating and managing e-way bills. This process can be time-consuming and tedious without automation. Udyog ERP simplifies this task by automatically generating e-way bills based on the shipment details entered in the system.

With features such as:

E-way bill creation from within the system

Automatic validation to prevent errors

Seamless integration with GSTN (Goods and Services Tax Network)

You’ll never have to worry about compliance issues during transit.

Real-Life Example: A Manufacturer’s Compliance Transformation

A Pune-based textile manufacturer was struggling to keep up with GST compliance and e-way bill requirements. Their manual processes led to delays, fines, and frustration. Once they integrated Udyog ERP into their system, things turned around quickly.

GST return filing time reduced by 50%

E-way bill generation became fully automated

Tax-related penalties and discrepancies dropped to zero

With Udyog ERP, they not only streamlined compliance but also improved operational efficiency. This is what best ERP software in India can do for you.

Why Choose Udyog ERP for GST Compliance?

Udyog ERP isn’t just another software tool; it’s an end-to-end solution that helps businesses stay compliant with minimal effort. Here’s why manufacturers trust Udyog ERP for their compliance needs:

Automated GST return filing

E-way bill management

Comprehensive tax calculations

Customizable for different industries

It’s the best ERP software in India for businesses that want to future-proof their operations while keeping compliance at the forefront.

Conclusion

Udyog ERP’s GST and compliance features aren’t just about meeting legal requirements — they’re about giving you peace of mind. With automated processes, real-time tax updates, and seamless integration, you can focus on growing your business while Udyog ERP handles the rest.

Stay compliant, stay efficient, and stay ahead. Udyog ERP is the key to unlocking smoother operations and a stress-free GST experience.

0 notes

Text

BAT Course with 100% Job Assistance

Business Accounting and Taxation Course BAT – बिज़नेस अकाउंटिंग और टैक्सेशन कोर्स

Introduction – व्यवसायिक लेखांकन और कर प्रणाली का सही ज्ञान

Business Accounting and Taxation Course BAT आज के समय में बेहद ज़रूरी बन गया है. Yeh course accounting और tax से जुड़े essential practical skills सिखाता है.

हर business को accounting aur taxation में skilled professionals की जरूरत होती है. इसलिए BAT course career growth के लिए perfect choice माना जाता है.

What is BAT Course? – BAT कोर्स क्या होता है?

Business Accounting and Taxation Course ek short-term professional course है. Yeh आपको GST, TDS, payroll aur income tax जैसे topics सिखाता है.

Course में real-world accounting software जैसे Tally, Excel aur SAP का use भी कराया जाता है. Practical training से students को actual business scenarios से familiar कराया जाता है.

Why Choose BAT Course? – इस कोर्स को क्यों करें?

अगर aap job-ready बनना चाहते हैं without a long degree, तो ये course perfect है. Practical skills aur real-time case studies आपको edge देती हैं job market में.

Accounting aur taxation knowledge हर sector में काम आता है. Yeh course उन students के लिए best है जो accounting background से हैं.

Course Duration & Eligibility – अवधि और योग्यता

BAT course ki duration आमतौर पर 3 से 6 months होती है. Kuch institutes fast-track batches bhi offer करते हैं weekends पर.

Eligibility simple है – Graduation in Commerce या किसी भी relevant stream से होनी चाहिए. Non-commerce background वाले students को भी कुछ institutes allow करते हैं.

Modules Covered in BAT Course – कोर्स में क्या-क्या सिखाया जाता है?

1. Accounting Principles – लेखांकन के सिद्धांत

Basics of accounting, journal entries, ledger aur balance sheet prepare करना सिखाया जाता है.

2. GST (Goods and Services Tax) – वस्तु एवं सेवा कर

GST returns भरना, GST portal पर काम करना aur e-invoicing ka तरीका सिखाया जाता है.

3. Income Tax – आयकर

Form 16, TDS calculation, aur income tax return file करने की प्रक्रिया explained की जाती है.

4. Payroll Processing – वेतन प्रक्रिया

Salary structure, PF, ESI aur payslip बनाना सिखाया जाता है real software के ज़रिए.

5. Tally ERP & Excel – टैली और एक्सेल

Tally ERP 9, Excel formulas aur MIS reports banाना भी included होता है syllabus में.

Benefits of Business Accounting & Taxation Course – फायदे जो बना दें करियर

Yeh course practical exposure देता है, jo theoretical degrees नहीं देतीं. Hands-on training आपको confident बनाती है interviews के लिए.

Job opportunities मिलती हैं accounting firms, CA offices aur MNCs में. Freelancing aur खुद का consultancy business start करना भी आसान होता है.

Job Roles After BAT – कोर्स के बाद मिलने वाली नौकरियां

BAT course complete करने के बाद आप कई roles में काम कर सकते हैं:

Accounts Executive – एकाउंट्स एग्जीक्यूटिव

Tax Assistant – टैक्स असिस्टेंट

Payroll Executive – वेतन प्रक्रिया अधिकारी

GST Practitioner – जीएसटी प्रैक्टिशनर

Finance Analyst – वित्त विश्लेषक

Audit Assistant – ऑडिट सहायक

Companies like KPMG, Deloitte, TCS, और Infosys BAT professionals hire करती हैं.

Salary Expectations – सैलरी कितनी मिलती है?

Fresher BAT course complete करने के बाद ₹15,000 से ₹25,000 per month earn कर सकते हैं. Experience बढ़ने पर ये figure ₹50,000 तक भी जा सकती है.

MNCs aur Big 4 firms में salary packages काफी अच्छे होते हैं. Freelancers bhi per project ₹5,000 – ₹50,000 तक earn कर सकते हैं.

Online platforms जैसे Udemy और Coursera पर भी इस course के affordable versions available हैं.

Online vs Offline Learning – क्या है बेहतर तरीका?

Online learning flexible aur cost-effective होती है. Self-paced learning busy professionals के लिए ideal होती है.

Offline mode में better interaction, guidance aur live projects का फायदा मिलता है. Hybrid courses दोनों का best combination देते हैं.

Scope in India & Abroad – देश और विदेश में अवसर

BAT certified professionals की demand सिर्फ India में ही नहीं, foreign countries में भी है. Especially countries with GST or VAT system, जैसे UAE, Canada aur Australia में.

Global companies remote काम के लिए भी BAT qualified individuals hire करती हैं.

How to Choose the Right BAT Course? – सही कोर्स कैसे चुनें?

Course चुनते समय नीचे दिए गए factors पर ध्यान दें:

Updated syllabus aur software training

Institute की credibility और recognition

Placement assistance

Trainers का industry experience

Course fee और EMI options

A सही decision ही आपके future को secure कर सकता है.

Conclusion – निष्कर्ष

Business Accounting and Taxation Course BAT एक career-transforming विकल्प है. Commerce graduates aur job seekers के लिए ये एक smart और practical decision हो सकता है.

Yeh course आपको practical tools, software aur market-ready knowledge देता है. तो अगर आप fast-track career चाहते हैं, तो BAT course आपके लिए best choice है.

#diploma in taxation#payroll management course#business accounting and taxation (bat) course#gst course#finance

0 notes

Text

Top 5 Digital Payment Solutions for Seamless Business Transactions

In the digital era, how your business handles payments is as important as the products or services you offer. Customers today expect quick, secure, and flexible payment options—whether online, in-store, or on mobile. Businesses that embrace modern digital payment systems are not just keeping up—they’re staying ahead.

At Payomatix, we believe the right digital payment solution can completely transform how a business operates. From reducing friction at checkout to enabling global expansion, the right tools matter.

Here’s our curated list of five top-performing payment processing software platforms in 2025—and why they’re trusted by thousands of businesses worldwide.

1. PayPal – Global Reach and Trusted Security

PayPal continues to dominate the global payment space. With an easy setup process, broad international compatibility, and buyer-seller protection, it’s a reliable choice for businesses of all sizes.

Highlights:

Accepts credit/debit cards, PayPal balance, and bank transfers

Used in over 200 countries

Integrated invoicing and refund tools

Seamless integration with e-commerce platforms

Best for: Freelancers, small businesses, and cross-border e-commerce.

2. Stripe – Developer-Friendly and Fully Customizable

Stripe offers robust features for businesses looking to customize their payment experience. With powerful APIs and developer tools, Stripe stands out for its flexibility and scalability.

Highlights:

Accepts payments via cards, digital wallets, BNPL, and more

Supports recurring billing and subscription models

Real-time fraud prevention

Deep integration with mobile and web platforms

Best for: SaaS companies, tech startups, and app-based businesses.

3. Square – Ideal for Retail and In-Person Transactions

Square is a leader in combining hardware and software to offer a seamless retail payment experience. It’s perfect for small businesses and physical stores looking to simplify sales and inventory tracking.

Highlights:

All-in-one POS and payment processing

Portable card readers and mobile integration

Contactless payments (NFC) and QR support

Built-in sales and inventory reporting

Best for: Retail stores, cafés, salons, and pop-up shops.

4. Paytm – Driving Digital Payments in India

Paytm is a cornerstone of India’s digital payment ecosystem. Its QR-based system, mobile wallet, and UPI integration make it a go-to for millions of merchants and customers across the country.

Highlights:

Accepts UPI, Paytm Wallet, credit/debit cards, and net banking

One QR code for all payment methods

Built-in customer engagement tools like cashback and loyalty programs

Merchant-friendly dashboard for transaction tracking

Best for: Indian SMEs, local retailers, and service providers.

5. Razorpay – A Full-Suite Payment Solution for Growing Businesses

Razorpay offers comprehensive payment infrastructure tailored to Indian startups and digital-first businesses. Its smart automation tools and wide support for alternative payment methods make it a future-ready choice.

Highlights:

Accepts cards, UPI, wallets, net banking, BNPL, and EMI

Payment links, invoices, and smart checkout

Advanced routing and settlement options

Subscription billing and recurring payments

Best for: Startups, high-growth e-commerce brands, and online service providers.

Why Alternative Payment Methods Are the Future

Consumer habits are shifting fast. Traditional card payments are now just one part of the picture. Customers expect alternative payment methods like mobile wallets, UPI, BNPL (Buy Now, Pay Later), and subscription billing.

By offering a range of payment options, businesses can:

Improve customer satisfaction and retention

Reduce payment failures and cart abandonment

Increase conversion rates

Gain valuable customer insights

Today’s digital-first customer values convenience, speed, and trust. Meeting them where they are isn’t optional—it’s essential.

How Payomatix Supports Seamless Payment Integration

At Payomatix, we simplify the complex world of digital transactions. Our unified platform enables businesses to accept payments through cards, UPI, mobile wallets, net banking, and more—all from a single dashboard.

Our platform is designed for flexibility, compliance, and performance—whether you're a startup or a large enterprise. With fast onboarding, powerful APIs, and detailed analytics, Payomatix helps businesses of all sizes create frictionless, secure payment experiences.

Final Thoughts

Choosing the right payment processing software is about more than just processing transactions—it’s about future-proofing your business. Whether you’re accepting payments from across the world or managing daily sales in a local market, the tools you use can enhance customer experience, streamline operations, and drive growth.

The five platforms we highlighted—PayPal, Stripe, Square, Paytm, and Razorpay—each offer unique benefits. The best choice depends on your industry, location, and customer expectations.

For businesses looking for a complete, scalable solution, Payomatix is here to help you build smarter, more seamless payment flows.

Explore our platform at payomatix.com Stay connected for more fintech updates and insights.

#Payomatix #DigitalPayments #PaymentSoftware #BusinessGrowth #TechForBusiness #TumblrBusiness

0 notes