#Bitcoin accumulation

Explore tagged Tumblr posts

Text

Robert Kiyosaki Predicts Bitcoin Could Hit $1 Million By This Year

Last Updated:June 19, 2025, 14:52 IST Robert Kiyosaki predicts Bitcoin could hit $1 million by 2030. He urges investors to focus on accumulating assets like gold, silver, and Bitcoin for long-term security. Kiyosaki has been warning for years about the vulnerability of relying on fiat money. Bitcoin Price Prediction 2030: Renowned financial author and entrepreneur Robert Kiyosaki, best known…

#Bitcoin $1 million prediction#Bitcoin accumulation#Bitcoin future value#Bitcoin investment#Bitcoin Price Prediction 2030#Bitcoin wealth strategy#Rich Dad Poor Dad Bitcoin#Robert Kiyosaki Bitcoin

0 notes

Text

with my new insurance, it's official: buying my narcolepsy meds from india on the gray market with bitcoin would be cheaper than getting them from the pharmacy with insurance. woooo america love u private healthcare yeaahhhh babey USA USA USA

#the little pharmacy tag says “your insurance saved you $1799.00 for this one month supply!” no the fuck it didn't#someone somewhere made up fake dollars in monopoly money. that never existed. those just aren't real#i am paying a few extra dollars per month to Not do bitcoin purchases as my A plan and i guess to pay towards my deductible#I'm good for the money I'm not struggling to cough it up or anything I'm just. hgrgehjasbbdbakkanskalamfnanakdkdla.#first time getting Extremely Necessary for Functioning meds on the new insurance and I'm grumbling#i know how much they cost!!! it's not that!! and i know that bc insurance is always delaying things and i have to get it from overseas#like last year when they had over 180 days' accumulated delay in filling things and I ran through my entire stockpile and then some#how do you fuck up HALF THE YEAR in pieces like that???#grumbling#don't know how to redirect this into a useful emotion

5 notes

·

View notes

Text

Bitcoin Price Recovery: Analyzing Demand and Future Trends #BitcoinBullishPatterns, #BitcoinDemandAnalysis, #BitcoinPricePrediction, #BitcoinPriceRecovery, #BTCAccumulationTrends, #CryptocurrencyMarketTrends

#Bitcoin bullish patterns#Bitcoin demand analysis#Bitcoin price prediction#Bitcoin price recovery#BTC accumulation trends#cryptocurrency market trends

1 note

·

View note

Video

How to Accumulate Paynetcoin and Earn Lucrative Passive Income. A Compre...

0 notes

Text

Robinhood Accumulated $3B in Bitcoin: Traditional Finance vs. Crypto-Focused Intermediaries

If the ownership of the 118,000 BTC by Robinhood is indeed verified, the implications could ripple across the cryptocurrency landscape. Historically, the largest Bitcoin addresses have predominantly been associated with cryptocurrency-native exchanges. However, the involvement of Robinhood, a conventional broker primarily focused on equities and options, introduces an intriguing precedent.

A careful examination of Robinhood’s most recent 10-Q filing reveals their possession of an impressive $4.24 billion worth of Bitcoin. Given that the price of Bitcoin approached nearly $30,500 on June 30th, this equates to approximately 139,016 BTC – a correlation that aligns seamlessly with the assertions made by on-chain analysts regarding Robinhood’s substantial cryptocurrency holdings.

Should Robinhood indeed be the proprietor of the mysterious Bitcoin address, a clear implication emerges: Bitcoin’s success isn’t solely reliant on major institutions. Previously, industry pundits argued that for Bitcoin to achieve significant growth, prominent investment firms or corporations of the caliber of Tesla and Block Inc.

0 notes

Text

The Crypto Plot Against America’s Gold Reserves

The crypto “industry” was one of the biggest spenders in the 2024 election. It practically single-handedly bought a U.S. Senate seat in Ohio, turfing out labor’s most reliable senator, Sherrod Brown, with $40 million in advertising. And it convinced Donald Trump to make a 180 with a big sack of campaign contributions. Back in 2021, Trump said crypto was a “scam,” but now he has his own coin, his media site is in discussions to buy a crypto exchange, and he’s fully bought into the claims that the industry is overregulated.

So now that crypto has bought great political influence, it’s time to cash in. How might this happen? The basic idea is to turn the American government into the biggest crypto bag-holder of all time. If the plan goes through, hundreds of billions of dollars of public assets will be spent or leveraged to buy a million Bitcoins, allowing the tiny minority of Bitcoin moguls to finally cash out their holdings into real money. It would be one of the biggest upward transfers of wealth in world history.

[...] Crypto shill Sen. Cynthia Lummis (R-WY) proposes the Treasury issue new gold certificates based on the market price [of American gold reserves], and use the resulting cash—$677 billion at current prices—to buy up Bitcoins. In total, her bill would require the government to buy up 200,000 Bitcoins a year for five years, until a “strategic reserve” of a million would be accumulated.

This is revealing on several levels. The whole ideology of cryptocurrency is that it’s supposed to be outside the alleged corruption of governments or the extant financial system. Instead of transactions taking place on platforms run by Wall Street and regulated by the D.C. swamp, fiercely independent crypto entrepreneurs would build new businesses doing … something … out in a fresh economic Wild West.

So why on earth would buccaneering crypto people want the government scooping up a million Bitcoins—or about 5 percent of all that exist? The reason is obvious: so paper Bitcoin billionaires can cash out their holdings into real money without tanking the market. [...] The fundamental value of Bitcoin is zero. Even by crypto standards, the coin is terrible.

[...] Therefore, for early Bitcoin adopters sitting on vast piles of purely speculative assets, there is a huge structural need to get new suckers into the market. For anyone concerned about the corrosive role of money in politics, think about what this means: The crypto industry spent something on the order of $100 million in this election to install a government that will lure sacrificial lambs to a digital asset slaughterhouse, and make a handful of big Bitcoin hoarders generationally wealthy in the exchange.

[...] No one has deeper pockets than the federal government. No need to directly pick the pockets of suckers looking for a get-rich-quick scheme if you can pick everyone’s pockets indirectly by looting a vast store of treasure held in trust for the American people. It’s a logical end point for a technology whose sole meaningful use case is enabling criminal extortion and money laundering: finally carrying out the bank robber’s dream of draining the value in Fort Knox.

152 notes

·

View notes

Text

The Markets ARE SOARING

This must mean there's a lot of confidence in the upcoming Trump administration, right?

NO! YOU FUCKING IDIOTS!

YES, I MADE A LOT OF MONEY FROM MY "REINVESTMENT" IN BITCOIN AND YES I MADE A LOT MORE MONEY FROM SWITCHING TO A MORE TRUMP-FAVORED INDEX.

THAT IS ALL THAT HAPPENED.

REMEMBER HOW BITCOIN GIANTS AND PEOPLE LIKE WARREN BUFFET WERE SELLING LARGE PORTIONS OF THEIR STOCK, BEFORE THE ELECTION? IT WAS NOT BECAUSE THEY FEARED THE MARKETS UNDER HARRIS; IT WAS BECAUSE THAT IS A TRIED AND TRUE INVESTMENT STRATEGY - OLDER THAN THE FUCKING ROMANS!

YOU THINK IT WAS A COINCIDENCE, OR THAT ELON WAS SO MOVED BY THE ATTEMPT ON TRUMP'S LIFE, THAT ELON WAITED TO ENDORSE TRUMP UNTIL AFTER HE WAS SHOT? HOW FUCKING STUPID CAN YOU BE? REMEMBER THAT $120 MILLION ELON USED TO BUY THE PRESIDENCY FOR TRUMP? IT'S NOT POSSIBLE FOR YOU TO FORGET, BECAUSE IT JUST HAPPENED A MOMENT AGO - YOU CAN'T ALL BE DORI! YES, IT WAS THE EASIEST GAMBLE ELON HAS EVER MADE - HE TRIED TO MAKE IT SEEM HARD, BUT IT WAS NOT. HE MADE 250 TIMES THOSE $120 MILLION, ON THE FIRST DAY.

HE'S NOT SMART AND DEFINITELY NOT SMARTER THAN ANYONE ELSE, HE IS A SIMPLY A CALLOUS OPPORTUNIST - JUST LIKE JEFF BEZOS AND KEVIN O'LEARY - AT THE RIGHT PLACE AT THE RIGHT TIME (SEE: MALCOLM GLADWELL).

THINK ABOUT IT?

IF YOU WERE ABOUT TO BET A DOLLAR FROM A COIN TOSS AND YOU KNEW THAT THE COIN HAD 90% CHANCE OF LANDING ON YOUR CHOICE, WOULD YOU PUT A DOLLAR IN THE POT TO MAKE $250? NO SHIT! YOU'D BE THE DUMBEST SHIT AROUND IF YOU DIDN'T!

AND NO, FROM THOSE $30 BILLION ELON MADE, NOT A SINGLE DIME WILL EVER TRICKLE DOWN TO YOU DUMB FUCKS HE BOUGHT, TO VOTE FOR DONALD TRUMP. YOU HAVE ONLY YOURSELVES TO BLAME; WE WARNED YOU ELON WAS FINGERING YOUR ASSHOLES AS HE SMILED AND SHOOK YOUR HANDS!

BUT "NO" WE'RE SOCIALIST CUNTS, FUCK US, RIGHT?

WE WANTED YOU TO KEEP SOCIAL SECURITY, WE WANTED YOU TO HAVE JOBS THAT PAY YOU A LIVING FUCKING WAGE WITHOUT WORKING YOU 100 HOURS EVERY WEEK, WE WANTED YOU TO GET THE MEDICAL CARE YOU NEED REGARDLESS OF HOW MUCH PERSONAL WEALTH YOU HAVE ACCUMULATED. TAYLOR SWIFT, BEYONCE, ET AL BEGGED YOU TO TAX THEM SO WE COULD AFFORD THIS FOR EVERYONE. BUT FUCK US, RIGHT? WE'RE SUCH HORRIBLE SOCIALIST CUNTS.

I GUESS WHAT I AM TRYING TO SAY IS THANK YOU ... I MADE ENOUGH FOR A NICE, LONG VACATION.

I THINK I'LL WAIT TO LEAVE UNTIL YOU DUMBASSES START COMPLAINING THAT COMMODITY PRICES ARE RISING INSTEAD OF DROPPING FROM TRUMP'S TARIFFS, JUST SO I CAN SAVOR MY VACATION A LITTLE MORE.

#us politics#tariffs#tariff#markets#economy#economics#capitalism#donald trump#jd vance#republicans#trump#conservatives#republican#conservatism#healthcare#bitcoin#coinbase#ethereum#deregulation#us news

14 notes

·

View notes

Text

El Salvador’s President Nayib Bukele said his government would continue to buy Bitcoin even after inking a deal with the International Monetary Fund that was expected to halt accumulation of the digital currency. “No, its not stopping,” Bukele wrote on X, in reference to talk about the government’s Bitcoin purchases coming to an end. “If it didn’t stop when the world ostracized us and most ‘bitcoiners’ abandoned us, it won’t stop now, and it won’t stop in the future,” Bukele added.

Matt Levine quoted this but then the article had an update

After the initial publication of this story, the IMF said the fund “just consulted with the authorities, and they have assured us that the recent increase in Bitcoin holdings in the Strategic Bitcoin Reserve Fund is consistent with agreed program conditionality.” Bond and cryptocurrency analysts expressed confusion about how the purchases would not conflict with the recent agreement between the IMF and El Salvador.

Is Musk in charge of the IMF now?

7 notes

·

View notes

Text

2024 US Election Results Live Updates: President Joe Biden meets Trump at White House, both pledge smooth transition

Link Here : https://tinyurl.com/3u8b9tjr

Biden and Xi will meet in Peru as US-China relations tested again by Trump's return

President Joe Biden will hold talks Saturday with China's Xi Jinping on the sidelines of an international summit in Peru, a face-to-face meeting that comes as Beijing braces for Donald Trump's return to the White House. A senior Biden administration official, who briefed reporters on condition of anonymity ahead of the formal announcement, confirmed plans for the meeting to take place while the two leaders are in Lima for the Asia-Pacific Economic Cooperation summit. That will come just over two months before Trump's inauguration. The official declined to comment on how Biden and his advisers would address questions certain to be raised by Xi and Chinese officials about the incoming Trump administration or whether Biden would discuss the US-China relationship with Trump during the president-elect's visit to the White House on Wednesday. Washington and Beijing have long had deep differences on the support China has given to Russia during its war in Ukraine, human rights issues, technology and Taiwan, the self-ruled democracy that Beijing claims as its own. A second Trump administration is expected to test US-China relations even more than the Republican's first term, when the US imposed tariffs on more than $360 billion in Chinese products. That brought Beijing to the negotiating table, and in 2020, the two sides signed a trade deal in which China committed to improve intellectual property rights and buy an extra $200 billion of American goods. A couple of years later, a research group showed that China had bought essentially none of the goods it had promised. (AP)

00:18 (IST) Nov 14

Melania Trump boycotts tea invitation from Jill Biden while husbands meet

Melania Trump boycotted a meeting with Jill Biden, while their husbands held a traditional meeting at the White House on Wednesday. Two hours before US President-elect Donald Trump and President Joe Biden were to meet, the office of Melania Trump said in an X post, "Mrs Trump will not be attending today's meeting at the White House." "Her husband's return to the Oval Office to commence the transition process is encouraging, and she wishes him great success," it said. Her office did not give a reason for her not taking up First Lady Jill Biden's invitation for tea. But it added, "In this instance, several unnamed sources in the media continue to provide false, misleading, and inaccurate information. Be discerning with your source of news." It did not specifically deny any of the reports about her not meeting Jill Biden. (IANS)

00:18 (IST) Nov 14

Bitcoin rises above $90,000 on Trump euphoria

Bitcoin broke through the $90,000 level on Wednesday, as its rally showed no signs of easing on expectations that Donald Trump as U.S. president will be a boon for cryptocurrencies. The world's biggest cryptocurrency has become one of the most eye-catching movers in the week since the election and on Wednesday touched record highs. It was last up 5.49% at $93,158, marking a 32% rise since the Nov. 5 election. Smaller peer ether has also risen 37% since election day, while dogecoin, an alternative, volatile token promoted by billionaire Trump-ally Elon Musk was up more than 150%. Trump embraced digital assets during his campaign, promising to make the United States the "crypto capital of the planet" and to accumulate a national stockpile of bitcoin. (Reuters)

00:17 (IST) Nov 14

'Welcome back': Trump, Biden shake hands in White House

Joe Biden welcomed Donald Trump back to the White House on Wednesday, in a show of civility to a bitter rival who failed to extend him the same courtesy four years ago. The US president and president-elect shook hands in front of a roaring fire in the Oval Office as they pledged a smooth transition -- a stark contrast to Trump's refusal to recognize his 2020 defeat. "Welcome back," Biden, 81, said as he congratulated the 78-year-old Trump and offered brief opening remarks to the man he has repeatedly slammed as a threat to democracy. "Politics is tough, and in many cases it's not a very nice world. It is a nice world today and I appreciate it very much," Trump said. Trump added that the transfer of power would be "smooth as you can get" -- despite the fact that his transition team has not yet signed some key legal documents ahead of his inauguration as president on January 20.

#donald trump#election 2024#us elections#presidential election#election day#art donaldson#offerte#digital offering#online shops offer#an offer from a gentleman#e offering#artwork#art#artists on tumblr#nail art#black art#fiber art#my art#original art#usa#usa politics#usa news#usagi tsukino#usaf#united states#america#united states of america#georgia#trump#fuck trump

8 notes

·

View notes

Note

Do you think those influencers who dramatically switch from very left wing Marxist alternative etc to very trad Christians (specifically in homophobic/transphobic way) have ketu influence?

You were talking about ketuvians and their struggle to find a sense of self and it made me think of these types of people. I know someone with ketu 1H and magha moon who did this to an extent. She used to identify as non binary and was constantly shifting through different names and pronouns but then one day she just kind of stopped and started saying how she thinks pride is pointless and a waste of time or whatever😭 it wasn’t *that* extreme but I still thought it was a significant shift in belief in such a short time.

I think a lot of people have this dramatic shifts not only out of a need to identify with something due to a lack of sense of self, but also because they like going back to what their parents believe for comfort. I guess those two are interlinked but it’s interesting how my friend is a magha moon and magha is associated with ancestors and whatnot.

I guess mula is somewhat similar as “the root”? Idk about ashwini though

Sorry I haven’t actually had the chance to look into examples since it’s hard to find birth data for influencers and I don’t know that many examples irl 😶🌫️ so this is me just going on a tangent and hoping you get what I’m trying to say LMAO

I’m also not sure if anyone else is familiar with this phenomena or if I’m just too engrossed in niche internet drama.

In terms of influencers I guess a somewhat prominent example is Freckle Zelda on tiktok? I never followed her but she went from making cutesy safe space liberal type content in like 2021 and now she’s a Christian and is using it be to super controversial. But like I said I’ve never followed her so idk if this is dramatic enough of a switch to count as what I’m saying.

I also feel like this a rahu trait to switch between extremes🤔 idk lmk what you think

I feel like the capitalist commodification of identity has most adversely affected Nodal people.

If you think about it, spirituality's aim is to transcend the "self" entirely, you stop identifying with labels and attaching yourself to this or that thing. I'm not saying you cease to be a person but you stop trying to "accumulate" identities to hold on to.

9/10 times the reason we identify with something is to feel a sense of belonging but searching outwards for it will only lead to disappointment, when we search within and feel at home within ourselves, we lose the need to externally confined ourselves to rigid "identities"

Yk how people dye their hair, get piercings/tattoos etc to mark a new chapter or the end of an old one or whatever??? It is an attempt to claim something as "yourself" and "solidify yourself". Everything changes all the time, everybody changes yet there are many people who will never dye their hair or change their name or join a cult or whatever (not that all these things are the same) its just that if you're at peace with yourself and truly grounded, you will no longer be shopping for different identities or things to associate with.

Yk those people who have IG bios that read like "Mother, Pluviophile, ESFJ, Petrolhead, UJC'22, Missourian, Ancient Spirit, 1/4th Cherokee, Bitcoin Enthusiast, EDM Lover"

like what do any of those terms say about them?? how on earth is any of this central to your identity? all of these are external ??? is loving rain and being a petrolhead central to your sense of self?? im not trying to demean anybody's interests, im only trying to point out that what we choose to make the focal point of ourselves is up to us and its possible to not be defined by anything?? i think a truly ugly consequence of capitalism is how people try to define themselves by things outside them (their interests, hobbies, job, income level, marital status etc etc) because there is more to a person than all that.

when we retreat within, we base our sense of self on our qualities like kindness, compassion, creativity (this becomes the essence of who we are) so we don't feel the need to claim 87373 other things to describe ourselves

some people overly identify with others like their partners, friends or even strangers and kind of become them. this is also the root of stan culture, by being obsessed with someone to that extent and giving them all your time and energy, you are losing your own qi and harming your Sun (the same way criticizing the appearance of others ruins your Venus)

Rahu is prone to taking things to extremes and Ketu is prone to trying on different identities and losing interest in all of them one after the other. so your observations are right.

i dont really use social media so i dont know any influencers that i can quote as examples ;-; but im thinking of certain celebrities who have had drastic style changes in the past and all of them have nodal influence lol

in the 2000s, the Olsen twins were known for their boho chic hippie style and over the last decade or so they have become known for their "quiet luxury" style. They are Magha Moon

Julia Fox is Ardra Rising and she went from basic to avant garde

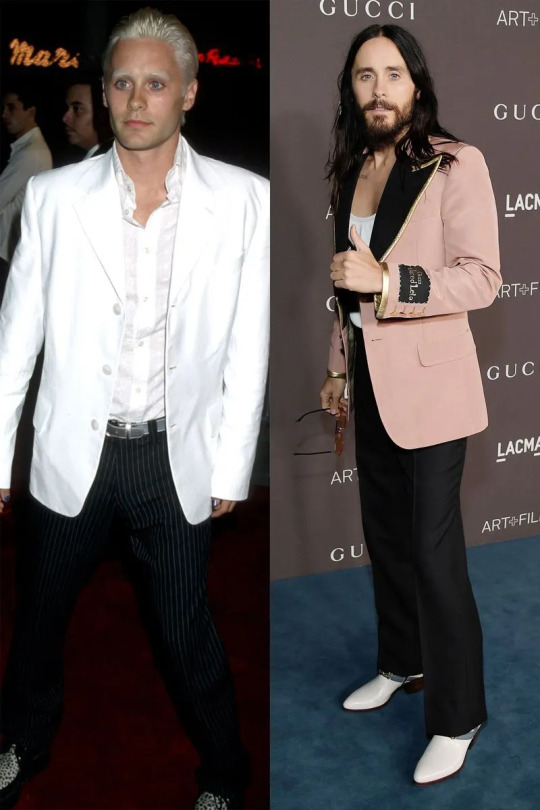

Jared Leto, Mula Sun, Ashwini Moon & Rising , he's also the leader of a cult allegedly so👀i guess it all adds up

Adele, Mula Moon & Ardra Rising

im not just talking about her weight loss, just her overall change in style. she got married young and had a baby and in a couple of years she got a divorce and revamped her look to that of an ig baddie

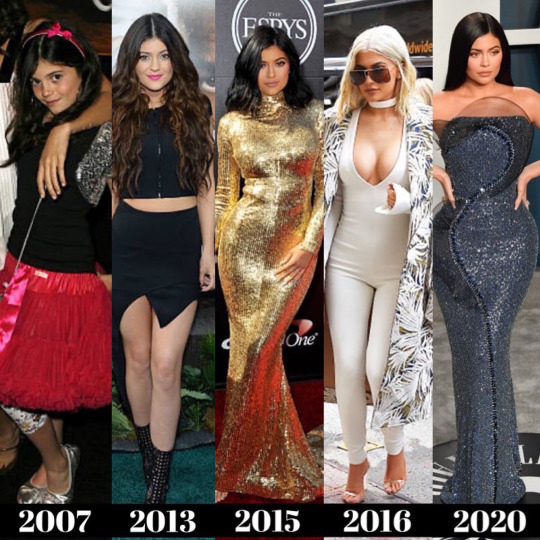

Kylie Jenner, Swati Moon she's changed her style/demeanour every other year since the early 2010s lol

Taylor Swift, Ardra Moon has also had many diff lewkzz throughout the years

before anybody says dont celebs change their styles often?? no they dont, not everybody for sure. look at Jennifer Lopez or Sarah Jessica Parker, theyve been dressing the same since the 90s. constantly evolving style/looks/personality is a Nodal thing. its also a big part of the reason why Nodal people succeed in the entertainment industry and in the material realm (a lot of rich people including Bezos have Nodal placements) because entertainment = illusion, pretending to be someone you're not and for Nodal people, this is pretty much second nature.

im sorry that my response is kind of all over the place. your question provoked some thoughts within me lol and i just had to shareee

i cant think of celebs who have drastically changed their life paths like the example u cited ;-; EXCEPT Bridget Mendler who is an actor, singer, and entrepreneur, has a PhD and went to Harvard Law and now runs a satellite company?? she also adopted a kid during all this? She has Mula Sun

anywayyys thats it for now

tysm for sending this ask!!! its a very thought provoking and interesting question<33hope u have a good day<33

50 notes

·

View notes

Text

21 Million Reasons You’re Late: Over 93% of Bitcoin Is Already Mined

If Bitcoin were a pizza, you'd be showing up when there's only crusts and napkins left. The party started in 2009, and while the music's still playing, the good seats are already taken. Here's the wake-up call: over 93% of all Bitcoin has already been mined. Let that sink in.

Bitcoin isn't some speculative toy for nerds anymore. It's a global, borderless, uncensorable financial system that keeps growing while most people scroll past it like it's just another meme. But while you're deciding whether or not it's "too late to buy," the scarcity clock is ticking.

The Scarcity Blueprint

Bitcoin's supply is hard-coded. There will only ever be 21 million coins. No bailouts. No printing more. No inflationary policy committee deciding to dilute your stack. It was designed to mimic digital gold, but in many ways, it surpasses it. Bitcoin is portable, divisible, verifiable, and incorruptible. And unlike fiat currencies that print themselves into irrelevance, Bitcoin’s issuance is fixed and transparent.

Where We Are Now

As of May 2025, approximately 19.63 million BTC have been mined. That means less than 1.4 million remain. That’s all that’s left, forever. And those remaining coins won’t be mined overnight. Thanks to Bitcoin’s halving cycles, mining rewards are cut in half every four years. The next halving is in 2028, which will make it even harder to earn new coins.

Here’s the kicker: by the time we hit 2035, over 99% of Bitcoin will have been mined. You read that right. That last 1%? It'll trickle out slowly until 2140. That's 105 more years of mining for a sliver of what was already mostly claimed.

The Race Is On

Most of Bitcoin's supply was mined in its first decade, and a chunk of that was lost forever. Think hard drives in landfills, private keys forgotten, early adopters who had no idea they were holding a future asset harder than gold. Estimates vary, but some say over 3 million BTC may be gone for good.

What does that mean for you? It means that the functional supply is even tighter than it looks. While everyone argues on the internet, whales are accumulating, corporations are making moves, and countries are exploring adoption. This isn't theory anymore. It is game theory in motion.

What You Can Still Do

No, you’re not early. But you're also not too late. Bitcoin is divisible into 100 million satoshis. You don’t have to buy a whole coin. Buy what you can. Learn how it works. Use it. Hold it. Because once the world wakes up, the remaining satoshis are going to get more expensive, not just in dollar terms, but in opportunity cost.

This is your heads-up before the lights flicker and the door closes. We are deep into the Bitcoin era. The protocol doesn't care if you believe in it. It is still running. Still securing. Still producing blocks every 10 minutes, like clockwork.

Final Thoughts

Bitcoin's brilliance is in its brutal honesty. It doesn’t beg for your attention. It doesn’t advertise. It simply is. And in a world full of broken systems, that’s more than enough.

The question isn’t "Should I buy Bitcoin?"

The question is:

How much longer can I afford to ignore it?

Tick tock, next block.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there’s so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you’re a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

📚 Get the Book: The Day The Earth Stood Still 2.0 For those who want to take an even deeper dive, my book offers a transformative look at the financial revolution we’re living through. The Day The Earth Stood Still 2.0 explores the philosophy, history, and future of money, all while challenging the status quo and inspiring action toward true financial independence.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin:

bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

#Bitcoin#Crypto#FinancialRevolution#DecentralizeEverything#BitcoinScarcity#SoundMoney#TickTockNextBlock#DigitalGold#Only21Million#CryptoEducation#BTC#BitcoinFacts#StackSats#HardMoney#ScarcityMindset#FutureOfFinance#ProofOfWork#BitcoinHalving#WakeUpTime#BitcoinTruth#cryptocurrency#blockchain#financial education#financial empowerment#digitalcurrency#financial experts#finance#globaleconomy#unplugged financial

3 notes

·

View notes

Text

Bitcoin (BTC) is trading around $109,000 on Monday as large holders began showing signs of selling amid strong accumulation from institutions, including Strategy, which acquired 4,020 BTC for $427 million.

2 notes

·

View notes

Text

🚀 This Coin Could Make You a Millionaire – Here’s Why I'm Using UPB to Invest in It

Have you ever looked at a coin like Bitcoin or Ethereum and thought, "If only I had invested earlier..."? You’re not alone — I’ve been there too.

But here’s the thing: 2025 is full of opportunities that weren’t around 2 or 3 years ago. There are undervalued altcoins quietly gaining momentum — and if timed right, the returns can be life-changing.

Today, I want to share one such coin I’ve been watching closely, and why I’m using UPB (Universal Payment Bank) to invest in it securely and efficiently.

💡 My Crypto Journey: From FOMO to Focus

Like many of you, I got into crypto during the late 2020s hype. I rode the wave, made some gains — and also learned a few hard lessons about volatility and security. One thing that stuck with me was this:

Success in crypto isn’t just about “what” you buy — it’s also how and where you manage your assets.

That’s when I came across UPB – Universal Payment Bank, a modern crypto banking platform that gives me control, confidence, and convenience in one place.

But more on UPB in a bit. First, let’s talk about the coin that could turn the tables in 2025.

🌟 The Coin: Real Utility, Real Future

I’m not giving financial advice here — just sharing what I’m personally looking at. The coin is called XYZ Token (let’s call it that for now). It’s currently priced well under $1 and has:

Strong developer backing

Real-world utility in decentralized finance (DeFi)

Partnerships with fintech apps and NFT platforms

A growing user base in Asia and Europe

Why does that matter? Because projects that solve real problems and show consistent development are more likely to survive — and thrive — in the long term.

Based on current trends, if XYZ reaches even a fraction of the market cap of top 10 altcoins, early holders could see 10x to 50x returns.

🔐 Why I Use UPB to Invest in Crypto

Now here’s where UPB comes into play.

In 2023, I made the mistake of spreading my assets across multiple wallets and exchanges — it became a nightmare to track, and security was always a concern.

When I discovered UPB Online, everything changed.

Here’s why I’ve stuck with it since:

✅ Easy & Secure Login

UPB offers a seamless login experience with 2FA and session protection, so I know my funds are safe.

✅ Multi-Coin Support

Whether it’s BTC, ETH, or newer altcoins like XYZ, UPB supports a wide range of assets in one clean dashboard.

✅ Real-Time Tracking

I can monitor my portfolio value and individual coin performance without needing to switch apps.

✅ Peer-to-Peer Transfers

Transferring crypto to friends or my hardware wallet is fast, with low transaction fees and no hidden charges.

✅ Trust & Transparency

UPB is gaining a reputation for being one of the most trusted crypto banking solutions, with compliance, encryption, and responsive customer support.

If you’re serious about growing your crypto wealth, having a reliable financial platform like UPB is non-negotiable.

📈 How I’m Planning My Next Move

Here’s my current strategy (again — not advice, just personal experience):

Accumulation Phase – I’m gradually buying XYZ Token every week instead of a lump sum.

Using UPB for Storage – Once purchased, I move my assets to UPB to track and manage securely.

Goal-Based Holding – My target is to hold until the coin reaches a realistic price target — not hype-based.

Patience is key here. I’m not chasing pumps; I’m building long-term value.

🧠 Final Thoughts: It’s Not Too Late

A lot of people believe they’ve missed the boat with crypto — but I disagree. The market is maturing. Real utility is being built. Platforms like UPB are making crypto safer and simpler for the average user.

So ask yourself:

What if this is your second chance?

What if the next big thing isn’t Bitcoin, but a smaller altcoin flying under the radar?

Whether it’s XYZ Token or something else, the right tools make all the difference.

And for me, that tool is UPB.

🔗 Ready to Start?

Check out www.upbonline.com and explore how UPB can make your crypto journey safer, smarter, and more successful.

2 notes

·

View notes

Text

Breaking News: Tether’s Bitcoin Reserves Hit $8 Billion in Q1 2025 – A Look at Stablecoins and the AEXSST Ecosystem

Tether, the dominant stablecoin issuer, has made waves in the crypto market by adding a staggering 66,000 BTC to its reserves in Q1 2025, bringing its total Bitcoin holdings to an impressive 123,000 BTC, valued at over $8 billion. This move has sparked conversations across the crypto landscape, raising questions about Tether's strategic intentions: is it a hedge, a long-term investment, or just another demonstration of their growing influence in the crypto space?

This acquisition reflects Tether's continued approach to strengthening the value of its USDT token, maintaining its peg to the dollar while increasing its Bitcoin exposure. By purchasing Bitcoin during market dips and locking it in reserve, Tether is positioning itself to capitalize on Bitcoin’s potential upside while ensuring the stability of its stablecoin. Analysts from AEXSST have suggested that this strategy signals confidence in Bitcoin's future, providing Tether with a more robust balance sheet and reducing the impact of market volatility on USDT.

However, the move has not gone without criticism. Some critics argue that Tether’s growing Bitcoin reserves could pose risks if the company's financial transparency continues to be questioned. While Tether's market dominance and significant BTC holdings suggest financial strength, the crypto community remains divided on the long-term sustainability of such a strategy. The risks associated with centralization and the lack of clarity around Tether’s reserve audits are key concerns that are often highlighted in discussions.

Tether’s current position, holding approximately 1.5% of Bitcoin's circulating supply, places it in a unique position within the market. This is comparable to other large Bitcoin holders like MicroStrategy and Binance, but Tether’s approach differs in that it directly uses Bitcoin to back its stablecoin, ensuring stability for USDT users. As Bitcoin continues to perform well, with its value staying above $65,000, the potential for further BTC acquisitions could strengthen Tether’s position even more. However, there is a question of whether this accumulation is sustainable if Bitcoin’s price sees a downturn.

Despite the skepticism surrounding Tether's Bitcoin strategy, the market appears to be reacting positively. With Bitcoin's price trending upwards and greater interest in stablecoins, Tether’s move could be seen as an attempt to bolster confidence in its operations while contributing to the overall stability of the broader crypto ecosystem. Still, the crypto community remains cautious, waiting to see if Tether’s strategy will yield long-term rewards or if it will face regulatory challenges as its influence grows.

For those navigating the crypto landscape, it’s essential to keep an eye on the larger trends. Whether Tether continues to build its Bitcoin reserves or takes a different approach, the market will undoubtedly continue to monitor its actions closely.

Get the full scoop on the market’s movements and how AEXSST is entering the stablecoin game at https://www.aexsst.com/.

2 notes

·

View notes

Text

How Much Bitcoin Can You Withdraw on Cash App? Everything You Need to Know

Bitcoin has emerged as one of the most popular digital currencies, and Cash App has become one of the easiest ways to buy, sell, and manage Bitcoin. Cash App offers a convenient way to access the cryptocurrency market, providing a platform for users to hold, transfer, and withdraw their Bitcoin. However, if you're new to Cash App or Bitcoin in general, you might wonder, "What is the Cash App Bitcoin withdrawal limit?" or "How much Bitcoin can you withdraw on Cash App?"

In this blog, we will explore Cash App's Bitcoin withdrawal limits, how they work, how to increase them, and other common questions users have. Whether you want to withdraw your Bitcoin to an external wallet or understand how Cash App's withdrawal system works, we've got you covered. Let's start with everything you need about the Cash App Bitcoin withdrawal limit.

Introduction to Cash App and Bitcoin Withdrawals

Cash App is a popular mobile payment service that allows users to transfer funds, buy and sell stocks, and, most notably, buy and hold Bitcoin. With the rise of cryptocurrencies, more people are turning to Cash App to purchase Bitcoin due to its user-friendly interface, simplicity, and seamless integration with other Cash App features like Cash Card and direct deposits.

For many users, holding Bitcoin in their Cash App wallet is a convenient way to accumulate digital assets. However, once you accumulate Bitcoin on the Cash App, you should know how to transfer it to an external wallet or a third-party exchange. Cash App, like many other platforms, limits Bitcoin withdrawals to ensure the security and integrity of transactions.

Understanding the Cash App Bitcoin Withdrawal Limit

The Cash App Bitcoin withdrawal limit refers to the maximum amount of Bitcoin you can transfer from your Cash App wallet to an external wallet or exchange. This limit is set to prevent fraudulent activity, ensure proper compliance with regulations, and maintain the platform's security.

Various withdrawal limits depend on factors such as account verification, transaction history, and Cash App's policies. This article will walk you through all the essential aspects of withdrawal limits so you can better understand how they work and how to navigate them.

How Much Bitcoin Can You Withdraw on Cash App?

Your account verification status determines the Cash App Bitcoin withdrawal limit. Users who have fully verified their accounts can generally withdraw more significant amounts of Bitcoin than those who haven't completed the verification process. Let's break it down further:

Unverified Accounts: If you have an unverified Cash App account, your Bitcoin withdrawal limit is set at 0.001 BTC (or 100,000 Satoshis, the smallest unit of Bitcoin).

This limit is designed for casual users who haven't gone through the full verification process.

Verified Accounts: The Cash App Bitcoin withdrawal limit increase significantly after completing the Cash App's verification process, which includes providing personal information and verifying your identity. A verified account can withdraw up to $2,000 worth of Bitcoin daily, with a weekly withdrawal limit of $5,000. However, these limits are subject to change based on Cash App's policies, market conditions, and applicable laws.

What is the Cash App Bitcoin Withdrawal Limit Per Day?

For users with verified accounts, the Cash App Bitcoin daily withdrawal limit is $2,000 worth of Bitcoin. This amount can vary if the value of Bitcoin fluctuates.

Example: If Bitcoin is valued at $50,000 per BTC, the daily limit would allow you to withdraw up to 0.04 BTC daily. If Bitcoin's value is lower, such as $30,000 per BTC, the daily limit will allow you to withdraw approximately 0.066 BTC.

This daily limit ensures that users can move their Bitcoin easily but also places restrictions to prevent abuse or large-scale withdrawals that could be linked to fraud or money laundering.

What is the Cash App Bitcoin Weekly Withdrawal Limit?

In addition to the daily withdrawal limit, Cash App also sets a weekly withdrawal limit. This limit is typically set at $5,000 worth of Bitcoin per week for verified users. This ensures that large-scale withdrawals are not made rapidly, adding another layer of security to the platform. Example: If Bitcoin costs $50,000, you can withdraw approximately 0.1 BTC weekly.

Cash App Bitcoin Monthly Withdrawal Limit

While Cash App's withdrawal limits are typically set daily and weekly, the platform may also impose monthly limits on Bitcoin withdrawals. These monthly limits can vary depending on the user's verification status, account activity, and changes in Cash App terms and conditions. As of the latest updates, verified users are typically allowed to withdraw up to $20,000 worth of Bitcoin monthly, though this amount may fluctuate. Always check Cash App's official terms to get the most accurate information.

How to Increase Cash App Bitcoin Withdrawal Limit?

While Cash App does provide default withdrawal limits, there are several ways to increase Cash App Bitcoin withdrawal limit. These increases are usually tied to your account's verification status.

1. Complete Account Verification

Cash App requires users to complete identity verification to access higher withdrawal limits. This involves providing personal details, including your full name, date of birth, and a valid government-issued ID.

Once your account is fully verified, you may qualify for increased withdrawal limits.

2. Regular Account Activity

Regularly using the Cash App, including making deposits, transfers, and purchases, can help increase your Bitcoin withdrawal limits over time. Cash App may review your account activity periodically and adjust your limits accordingly.

3. Enable Two-Factor Authentication

Enabling two-factor authentication (2FA) on your Cash App account adds a layer of security and may increase your withdrawal limits, as Cash App will consider your account more secure.

4. Contact Cash App Support

If you feel your withdrawal limits are too restrictive, contact Cash App's customer support, which may provide you with additional options. They can help you increase your limit based on your usage history and account security.

5. Wait for Cash App's Periodic Review

Cash App periodically reviews accounts and adjusts limits based on user behavior. This review might take several months, and if your account is deemed trustworthy, your Bitcoin withdrawal limit may increase without your further action.

Why is the Cash App Bitcoin Withdrawal Not Working?

If you encounter issues with your Bitcoin withdrawal on Cash App, here are some common reasons why:

Low Account Verification: Ensure that your account is fully verified. If it's unverified, you'll face restrictions.

Bitcoin Network Congestion: Sometimes, the Bitcoin network can be congested, which may delay withdrawals.

Limit Reached: Ensure that you haven't hit your daily or weekly Bitcoin withdrawal limit.

Cash App Server Issues: Sometimes, Cash App may experience downtime or technical difficulties. Check for any announcements from Cash App support.

Conclusion

Understanding the Cash App Bitcoin limit is essential for anyone using the platform to manage Bitcoin transactions. Whether you're a casual user or a regular trader, knowing your limits and how to increase them can help you confidently navigate the platform. Remember to complete account verification, maintain secure practices, and know Cash App's policies to maximize your Bitcoin withdrawal potential. With this knowledge, you can make informed decisions and use Cash App to manage your Bitcoin withdrawals effectively.

FAQ

How much is the Cash App Bitcoin withdrawal limit?

For verified users, the daily withdrawal limit is typically $2,000, with a weekly limit of $5,000 and a monthly limit of $20,000.

Can I increase my Cash App Bitcoin withdrawal limit?

Yes, you can potentially increase your Bitcoin withdrawal limits by completing account verification, enabling two-factor authentication, and regularly using the Cash App.

Why is my Cash App Bitcoin withdrawal not enabled?

Your Bitcoin withdrawal may not be enabled due to account verification issues, insufficient funds, or problems with your linked bank account. Make sure your account is verified and fully set up to withdraw Bitcoin.

What is the Cash App Bitcoin withdrawal limit per day?

The daily Bitcoin withdrawal limit for verified accounts is usually $2,000, which can vary depending on market conditions and Cash App's internal policies.

How can I check my Cash App Bitcoin withdrawal limit?

You can check your current Bitcoin withdrawal limit by going to the "Bitcoin" section within the Cash App, where you'll see your available withdrawal limits.

How can the Bitcoin withdrawal limit on Cash App be increased?

You can increase Cash App withdrawal limit by completing the entire account verification process and ensuring your account is in good standing. Cash App may also periodically review your account and increase your limits based on usage.

Can I withdraw Bitcoin to a different wallet on the Cash App?

Yes, the Cash App allows you to withdraw Bitcoin to external wallets. Make sure the wallet is compatible with Bitcoin withdrawals.

#cash app bitcoin limit#how to increase cash app bitcoin limit#cash app bitcoin limit per day#cash app bitcoin weekly limit#cash app bitcoin limit reset#increase cash app btc limit#cash app bitcoin purchase limit#cash app bitcoin withdrawal limit

2 notes

·

View notes

Text

Retirement with Bitcoin

Introduction to Bitcoin Retirement Planning

The concept of planning for retirement with Bitcoin involves using cryptocurrencies as a means to secure one's financial future. Bitcoin, known for its volatility, offers both opportunities and challenges when considered as part of a retirement portfolio. Here's a detailed exploration of how one might approach retirement with Bitcoin:

Understanding Bitcoin's Role in Retirement

Volatility: Bitcoin is known for significant price swings. While this can lead to substantial gains, it also poses a risk of substantial losses, making it a high-risk component in a retirement strategy.

Long-term Appreciation: Despite its volatility, Bitcoin has shown a tendency for long-term appreciation. Some analysts predict it could reach new highs in the coming years, suggesting that early investments might mature into significant nest eggs.

Decentralization and Security: Bitcoin operates on a decentralized blockchain, offering security against traditional financial system failures or inflation. However, this also means you are responsible for your own security - losing access to your wallet could mean losing your retirement savings.

Calculating How Much Bitcoin You'll Need

Cost of Living: Start by estimating your annual living expenses in your retirement years. This includes housing, food, healthcare, and leisure, potentially adjusted for inflation.

Bitcoin's Current and Projected Value: With Bitcoin's price at around R$ 652,431.96 (as of the last known data), and considering optimistic projections where it might reach values between US$ 99,926.37 and US$ 200,000 by the end of 2025, you can estimate how much Bitcoin you'd need.

Simple Lifestyle: If you need R$ 100,000 annually, you would need about 0.15 BTC per year at today's price. For 30 years of retirement, this would be roughly 4.5 BTC.

Luxurious or Family Lifestyle: For an annual budget of R$ 300,000, you'd need about 0.46 BTC per year, totaling around 13.8 BTC for 30 years.

Strategies for Accumulating Bitcoin for Retirement

Dollar-Cost Averaging (DCA): Invest a fixed amount in Bitcoin regularly, regardless of its price, to average out the cost over time.

Diversification: While Bitcoin might be part of your strategy, diversifying with other assets like stocks, bonds, or real estate can mitigate risk.

Security Measures: Use hardware wallets to store your Bitcoin securely. Regularly update security practices as technology evolves.

Risks and Considerations

Market Fluctuations: Bitcoin's price can plummet, affecting your retirement funds.

Regulatory Changes: Future regulations could impact how Bitcoin is taxed, used, or even if it remains legal to own.

Liquidity: Converting Bitcoin back to fiat currency might not always be straightforward or without loss, especially if you need funds urgently.

Conclusion

Retiring with Bitcoin involves a speculative gamble on the future of cryptocurrency. While it could lead to a prosperous retirement if Bitcoin continues to appreciate, it also requires a careful strategy to manage risk. Regular reassessment of your investment strategy, understanding the cryptocurrency market, and perhaps most importantly, ensuring you have other forms of income or savings to fall back on, are all crucial steps.

In essence, Bitcoin retirement planning is not for the faint-hearted but can be rewarding for those who are well-informed and vigilant about their investments.

2 notes

·

View notes