#Bitcoin future value

Explore tagged Tumblr posts

Text

Crypto Price Prediction | BTC, ETH & Altcoins 2025-2050

Want to know where crypto prices are heading? CoinGabbar’s crypto price prediction page gives you simple forecasts for top cryptocurrencies. We track trends and future prices to help you make smart decisions in the crypto world. Stay ahead with our latest updates!

Curious about future crypto prices? Check out CoinGabbar’s crypto price prediction page! We provide easy-to-understand forecasts for different cryptocurrencies. Stay updated, plan your investments, and make smart trading choices!

CoinGabbar’s crypto price prediction page helps you understand where crypto prices may go in the future. We analyze trends and share simple forecasts so you can stay informed and make better investment decisions!

Want to predict crypto prices? CoinGabbar’s crypto price prediction page makes it easy! We track market trends and provide simple forecasts to help you plan your crypto journey. Stay updated with the latest price predictions!

1 note

·

View note

Text

XRP Price Surge: Factors Driving Ripple's Growth in 2025

Published: January 25, 2025 By Crypto Analyst Team Introduction XRP, the digital asset associated with Ripple Labs, has recently garnered significant attention due to its notable price movements and developments within the cryptocurrency market. As of January 25, 2025, XRP is trading at approximately $3.14. This article delves into the factors influencing XRP’s price trajectory and provides…

#best altcoins 2025#cryptocurrency predictions#Ripple adoption#Ripple Labs price prediction#Ripple partnerships#Ripple price forecast#Ripple price growth#XRP analysis 2025#XRP cryptocurrency analysis#XRP expert opinions#XRP future trends#XRP future value#XRP historical performance#XRP investment analysis#XRP market trends#XRP news and updates#XRP price prediction#XRP regulatory clarity#XRP token forecas#XRP vs Bitcoin

1 note

·

View note

Text

Evolution of Value in WEB3: Arvin Khamseh Unpacks NFT Utility with Donna Mitchell #podcast

youtube

Summary

Arvin Khamseh a thought leader in the crypto space, discusses the evolution of NFTs and their utility beyond overpriced digital images. He explains how NFTs can be used to tokenize real estate and artwork, allowing people to own a fraction of high-value assets. Arvin also shares his experiences in building token-gated membership communities and provides advice for brands and entrepreneurs looking to enter the web3 space. He emphasizes the importance of understanding the culture and narrative of the industry and seeking guidance from experienced professionals. Arvin concludes by highlighting the current opportunities in crypto trading and inviting listeners to connect with him for further assistance. #NFT #Web3 #Business

Takeaways

NFTs have evolved beyond overpriced digital images and can be used to tokenize real estate and artwork, allowing fractional ownership.

Building token-gated membership communities and providing valuable services can be a successful use case for NFTs.

Entering the web3 space requires understanding the culture and narrative of the industry and seeking guidance from experienced professionals.

The crypto market is volatile, and strategies for community building and NFT sales need to adapt quickly.

Arvin Khamseh offers assistance in building NFT collections and provides services for brands and entrepreneurs looking to enter the web3 space.

Chapters

00:00 Introduction and Background of Arvin Tempster

05:37 Understanding NFTs: From Overpriced Images to Utility

15:34 Tokenizing Real Estate and Artwork with NFTs

33:09 Opportunities in Crypto Trading

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

Watch More of My Videos And Don't forget to "Like & Subscribe" & Also please click on the 🔔 Bell Icon, so you never miss any updates! 💟 ⬇️ 🔹🔹🔹

Please Subscribe to My Channel:

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

#To learn more about me, check out my Profile & CONNECT WITH ME 💟 ⬇️

💠 Podcast - https://www.PivotingToWeb3Podcast.com

💠 Book an Event Site - https://www.DonnaPMitchell.com

💠 Company - https://www.MitchellUniversalNetwork.com

💠 LinkedIn: https://www.linkedin.com/in/donna-mitchell-a1700619

💠 Instagram Professional: https://www.instagram.com/dpmitch11

💠 Twitter/ X: https://www.twitter.com/dpmitch11

💠 YouTube Channel - https://www.Web3GamePlan.com

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

👉👉 Request to watch top 5 videos of my channel ..... 👇👇

✅ The Art of Chatting AI: Terza Ekholm Explores AI-Assisted Art Creation with Donna Mitchell #podcast

🎬 https://youtu.be/D-EW4ehlrcI?si=2skLp6ZR2-gP018u

✅ AI-Infused Presentation Design: Unlocking Creativity with Brigette Callahan and Donna Mitchell

🎬 https://youtu.be/mPLKqIZgRwM?si=wTeP73lyV3u0TPvw

✅ The Intersection AI and Cybersecurity Nick Lorizio and Donna Mitchell #podcast #ai #cybersecurity

🎬 https://youtu.be/TkkMlXyTFD8?si=l46m5iCZA5S51wfe

✅ Donna Mitchell and International Lawyer Jamilia Grier WEB3 Challenges Implications Opportunities

🎬 https://youtu.be/Jim14sR0LEc?si=wRt5jtiZVHviJQhR

✅ Future of Podcasting: AI, NFTs, and Building Digital Communities with Kay Suthar and Donna Mitchell

🎬 https://youtu.be/TApLBjRSP1c?si=qx0puKoyt0RO5ZNr

tage:

#Evolution of Value in WEB3#Arvin Khamseh Unpacks NFT Utility with Donna Mitchell#podcast#Price on WEB3#Donna Mitchell#NFT Utility Unpack#Arvin Khamseh Unpacks NFT Utility#Evolution of Value in WEB3: Arvin Khamseh Unpacks NFT Utility with Donna Mitchell#evolution of value in web3#bitcoin#ethereum#cryptocurrency#crypto#javascript#two hot takes podcast#donna mitchell#donna mitchell piano#web3#pivoting to web3#the future of podcasting#ceo of bytebow#lawyer jamilia grier#Youtube

0 notes

Text

Funny and also depressing that no one really even pretends to believe all that 'crypto is going to change the world! Web 3.0! The future of finance!' stuff anymore, and yet bitcoins are worth more than ever and still climbing.

It's like a parody of finance capitalism, speculative tokens trading for more and more value long after everyone's admitted they have no actual use or benefit beyond their received value.

99 notes

·

View notes

Text

Profit (he/they/any), an Edeia representing the Idea of Profit.

This all started with me having a silly thought of using the name "Rob Banks" based on a video I saw...

Edeia Site | Edeia Discord | Personal Website

Profit

"Everyone should profit. But of course, I should profit the most."

At present, Profit is charismatic and persuasive, creating mutually beneficial arrangements where they still came out ahead. They became more patient, willing to invest in long-term growth rather than immediate exploitation. Profit developed genuine curiosity about innovation and began to enjoy watching their investments flourish. Their demeanor was often inviting, rather than threatening, though they always carried an undertone of calculation with them. At present, he is more forthright about his profit motives, but he is more honest about his practices and always follows through on his promises to partners.

He has quite the sense of humor, though he cares more about what's amusing to him than what's amusing to others. So long as there's no real harm, he delights in others' ruffled feathers (for instance, by making puns). He enjoys peppering his speech with business jargon, often for humorous effect, but avoids using it so excessively that others can't understand him.

While still fundamentally self-interested, Profit now values sustainable profit over destructive exploitation, understanding that a healthy economic ecosystem yields greater returns than a series of depleted targets. He creates transparent but advantageous deals where all parties benefit—though, of course, he benefits the most. He considers himself an investor, finding promising individuals and ventures to provide all sorts of resources, with the intention of getting a return in the future. He does still participate in black markets and corruption, but only when it generates new growth and value—not when it simply transfers opportunity from one individual to another.

Abilities

Market Intelligence

Profit can sense untapped value and potential profit in people, places, objects, and situations. He also has an innate awareness of past and current market trends, as well as a predictive sense for future market movements. This ability can be temporarily granted to others as an intuitive sense for good deals and profitable ventures.

Seed Capital

Profit can create one "whole unit" (e.g. 1 USD, 1 bitcoin, etc.) of any currency that exists in his current dimension, so long as he has any amount of information on its existence, if he does not own any physically or in assets.

Binding Proposition

Profit can create magically binding contracts for deals involving currency or valued assets. These contracts cannot be broken by conventional means and ensure that all parties fulfill their obligations or pay the penalties agreed upon.

Portfolio Diversification

Profit can maintain countless business ventures, investments, and assets across multiple dimensions simultaneously without loss of oversight or control. This allows them to spread risk and maximize returns by operating in various economies with different rules and growth patterns. They can mentally "check in" on any of their ventures at will.

Return on Investment

After investing time, energy, or resources into a person or venture, Profit is guaranteed some form of return. This doesn't guarantee success, but it does mean that even failures will yield valuable lessons, connections, or alternative opportunities that can be monetized in some way. Nothing Profit invests is ever truly lost. This is a passive ability, but Profit can focus to apply it to others, guaranteeing a "return" for those individuals.

Asset Empowerment

Profit can designate individuals as "Associates" through magical contracts, granting them enhanced abilities related to their role in Profit's ventures. These enhancements are tied to performance conditions and limitations:

Associates must share a percentage of all gains with Profit.

They cannot act against Profit's interests.

Their abilities cannot be used for unauthorized ventures.

The magic enforces compliance, with abilities failing or backfiring if terms are violated.

Successful Associates may see their capabilities grow over time, creating a mutually beneficial relationship while allowing Profit to extend their influence through a network of empowered agents across markets and dimensions.

Abstraction

Profit's original Abstraction took the form of a large building of countless rooms, filled with all sorts of things. After those were lost in Profit's transition to the Main Continuity, that building was rebuilt alongside a sprawling, glittering city of modern skyscrapers and glass buildings. The sky is in an eternal golden twilight. Streams of gold light pour from the sky in straight lines, and the air is filled with glittering gold particles.

The city, referred to as Gold, is inhabited by residents from all across Ideation and other dimensions, including humans and non-humans. Every resident is in the pursuit of profit, though they are more cooperative than competitive. There are corporations and small businesses, artists and consultants—any occupation, any role, so long as they hold a doctrine of "profit for all, profit for Profit" in their hearts.

Time is strange and nonlinear—those who need more time will have more time, and those who wish for time to pass faster will experience time passing faster. Those who wish to rest can rest as long as they like, and still be on time for work. In some cases, some will be able to be present in multiple places at once or step back in time to remedy a mistake, though this requires authorization from Associates that handle governance of the city. Associates can also authorize a "storefront," which involves that business merging a door, room, or other part of their venture with a physical location to interact with united society or extradimensional societies.

Gold is considered an independent magical society by united society.

Story Synposis

Profit began as Robert "Rob" Banks in the Calamity Continuity, where he rose from a business prodigy to become a ruthless financial mastermind who eventually gained control of the nation of Adamant. As reality began crumbling around him—partially due to his own exploitative tactics—Profit faced the meaninglessness of his accumulated wealth and power. Given a second chance by Possibility, he abandoned his Abstraction's contents and transferred to the Main Continuity in 1805, where he embraced a more sustainable approach to wealth creation. In this new timeline, Profit established himself as "the Prophet of Profit," building ventures across magical and mundane societies while creating a golden city in his Abstraction for those who shared his values of "profit for all, profit for Profit."

For more, see his profile.

41 notes

·

View notes

Text

The Phenomenon of Meme Coins: Humor Meets Cryptocurrency

The world of cryptocurrency is known for its rapid innovations and diverse applications, but one of the most fascinating and unexpected trends to emerge in recent years is the rise of meme coins. These digital currencies, inspired by internet memes and popular culture, combine the worlds of humor and finance in a way that captivates a broad audience. Meme coins are not just a novelty; they represent a significant shift in how digital assets can be perceived and utilized. This article explores the origins, characteristics, and future potential of meme coins, with a brief mention of one of the notable projects in this space, Sexy Meme Coin.

The Origins of Meme Coins

Meme coins first gained mainstream attention with the creation of Dogecoin in 2013. Dogecoin was initially conceived as a joke by software engineers Billy Markus and Jackson Palmer, who wanted to create a fun alternative to Bitcoin. Featuring the Shiba Inu dog from the popular "Doge" meme as its mascot, Dogecoin quickly garnered a dedicated following. Its community-driven approach and lighthearted nature set it apart from other cryptocurrencies, paving the way for a new category of digital assets.

Despite its humorous beginnings, Dogecoin has demonstrated remarkable staying power. It has been used for various charitable causes, tipping content creators online, and even sponsoring NASCAR teams. The coin's success has inspired a plethora of other meme coins, each seeking to capture the magic formula of humor, community, and financial potential.

Key Characteristics of Meme Coins

Community-Centric: Meme coins thrive on the strength of their communities. Unlike traditional cryptocurrencies, which often focus on technological advancements, meme coins rely heavily on community engagement and social media presence. This grassroots approach helps to build a loyal and enthusiastic user base.

Cultural Relevance: Meme coins are deeply rooted in internet culture and trends. They often reflect the latest memes, jokes, and viral content, making them highly relatable and engaging for users who are active on social media platforms.

Accessibility: The playful and humorous nature of meme coins makes them more approachable for the average person compared to more complex cryptocurrencies. This accessibility helps to attract a wider audience, including those who may not have previously considered investing in digital assets.

High Volatility: The value of meme coins can be extremely volatile, driven by social media trends, celebrity endorsements, and viral moments. While this volatility can lead to significant gains, it also poses substantial risks for investors.

The Appeal of Meme Coins

Meme coins offer a unique blend of entertainment and investment potential. They provide a way for people to engage with cryptocurrency in a fun and light-hearted manner, while still offering the possibility of financial returns. This dual appeal has helped to drive the popularity of meme coins, especially among younger generations who are well-versed in internet culture.

The community-driven nature of meme coins also fosters a sense of belonging and participation. Users feel like they are part of a larger movement, contributing to the success of the coin through their engagement and support. This collective effort can lead to a strong sense of camaraderie and loyalty among users.

Notable Meme Coins

While Dogecoin remains the most well-known meme coin, several other projects have emerged, each with its unique twist on the concept. One such project is Sexy Meme Coin, which combines the world of memes with innovative tokenomics and community engagement. You can learn more about Sexy Meme Coin at Sexy Meme Coin.

The Future of Meme Coins

The future of meme coins is both exciting and uncertain. On the one hand, their ability to capture the zeitgeist of internet culture gives them a unique position within the cryptocurrency landscape. As long as memes continue to be a significant part of online culture, meme coins are likely to maintain their relevance and appeal.

On the other hand, the high volatility and speculative nature of meme coins mean that they can be risky investments. Regulatory scrutiny and market fluctuations could impact their long-term viability. However, the community-driven approach of meme coins provides a strong foundation that can help them weather challenges and adapt to changing circumstances.

Conclusion

Meme coins represent a fascinating intersection of humor, culture, and finance. They have brought a new dimension to the world of cryptocurrency, making it more accessible and engaging for a broad audience. While they come with their own set of risks and uncertainties, the community-centric nature of meme coins offers a compelling case for their continued growth and evolution.

As the cryptocurrency landscape continues to evolve, meme coins like Sexy Meme Coin and others will play a crucial role in shaping the future of digital assets. By combining the power of memes with innovative financial technology, these coins have the potential to create lasting impact and redefine how we think about cryptocurrency.

For those interested in exploring the world of meme coins, Sexy Meme Coin offers a unique and entertaining platform. Visit Sexy Meme Coin to learn more and become part of this exciting movement.

118 notes

·

View notes

Text

The number of commercial-scale Bitcoin mining operations in the U.S. has increased sharply over the last few years; there are now at least 137. Similar medical complaints have been registered near facilities in Arkansas and North Dakota. And the Bitcoin mining industry is urgently trying to push bills through state legislatures, including in Indiana and Missouri, which would exempt Bitcoin mines from local zoning or noise ordinances. In May, Oklahoma governor Kevin Stitt signed a “Bitcoin Rights” bill to protect miners and prevent any future attempts to ban the industry. Much of the American Bitcoin mining industry can now be found in Texas, home to giant power plants, lax regulation, and crypto-friendly politicians. In October 2021, Governor Greg Abbott hosted the lobbying group Texas Blockchain Council at the governor’s mansion. The group insisted that their industry would help the state’s overtaxed energy grid; that during energy crises, miners would be one of the few energy customers able to shut off upon request, provided that they were paid in exchange. After meeting with the lobbyists, Abbott tweeted that Texas would soon be the “#1 [state] for blockchain & cryptocurrency.” Technically there is federal mandate to regulate noise, which stems from the 1972 Noise Control Act—but it was essentially de-funded during the Reagan administration. This leaves noise regulation up to states, cities, and counties. New York City, for instance, has a noise code which officially caps restaurant music and air conditioning at 42 decibels (as measured within a nearby residence). Texas’s 85 decibels, in contrast, is by far the loudest state limit in the nation, says Les Blomberg, the executive director of the nonprofit Noise Pollution Clearinghouse. “It is a level that protects noise polluters, not the noise polluted,” he says. The residents of Granbury feel they’ve been lied to. In 2023, the site’s previous operators, US Bitcoin Corp, constructed a wall around the mine almost 2,000 feet long and claimed that they had “solved the concern.” But Shirley says that the complaints from the community about the sound actually increased when the wall was nearing completion last fall. Since Marathon bought the facility outright in December, its hash rate, or computational power expended, has doubled. Any statewide legislation is sure to hit significant headwinds, because the very idea of regulation runs contrary to many Texans’ political beliefs. “As constitutional conservatives, they have taken our core values and used that against us,” says Demetra Conrad, a city council member in the nearby town of Glen Rose. In the week before this article’s publication, two more Granbury residents suffered from acute health crises. The first was Tom Weeks. “This whole thing is an eye opener for me into profit over people,” Weeks says in a phone call from the ICU. The second person affected was the five-year-old Indigo Rosenkranz. Her mother, Sarah, was terrified and now feels she has no choice but to get a second mortgage to move away from the mine. “A second one would really be a lot,” she says. “God will provide, though. He always sees us through.”

shocking! texans suffer from deregulation and ineffective walls

93 notes

·

View notes

Text

April 6, 2025, 3:08 PM MST

By Rob Wile and Brian Cheung

U.S. stock futures plunged Sunday evening, an indication that the market turmoil that began last week will continue when trading opens Monday.

Looming over the markets: the retaliatory actions other countries are expected to enact as the American tariffs announced last week take effect.

As of early Sunday evening, S&P 500 futures had fallen 4.5%. Futures in the tech-heavy Nasdaq also fell 4.5%, while futures for the Dow Jones Industrial Average declined 1,600 points in volatile trading. Future for the Russell 2000, which tracks the stocks of smaller companies, were off 5.6%. (Futures markets are a way for traders to move stocks when the major exchanges are closed, and serve as a implied measure for how stocks will act when the markets do open, generally at 9:30 a.m. ET on weekdays.)

Even the price of bitcoin, which showed signs Friday of having resisted the wider market downturn, fell as much as 5%.

The declines mean another savage day awaits investors when trading officially opens Monday at 9:30 a.m ET. The losses would come on top of a two-day free-fall last week that represented the worst 48-hour period in market history, with some $6.6 trillion in value wiped out.

The main U.S. benchmark for crude oil fell 3.7%, to just under $60 per barrel, its lowest level since April 2021.

Over the weekend, President Donald Trump signaled little intention to back off his proposal, which would see tariffs rise as much as 79% — for countries like China.

"THIS IS AN ECONOMIC REVOLUTION, AND WE WILL WIN. HANG TOUGH," Trump wrote on his Truth Social platform Saturday. "it won’t be easy, but the end result will be historic. We will, MAKE AMERICA GREAT AGAIN!!!"

26 notes

·

View notes

Text

Why I remain hopeful about America

Even as darkness falls

ROBERT REICH

JAN 20

Friends,

So many people I know — including, I suspect, many of you — are despairing over Trump’s second regime, which starts today.

I share your fears about what’s to come.

Yet I remain hopeful about the future of America. Here’s why.

Trump hoodwinked average working Americans into believing he’s on their side and convinced enough voters that Kamala Harris and Democrats were on the side of cultural elites (the “deep state,” “woke”ism, “coastal elites,” and so on).

But Trump’s hoax will not work for long, given the oligarchy’s conspicuous takeover of America under Trump II.

Even before Trump’s regime begins, it’s already exposing a reality that has been hidden from most Americans for decades: the oligarchy’s obscene wealth and its use of that wealth to gain power over America.

Seated prominently where Trump is giving his inaugural address today will be the three richest people in America — Elon Musk, Jeff Bezos, and Mark Zuckerberg — each of whom owns powerful media that have either boosted Trump’s lies or refrained from telling the truth about him.

Musk sank a quarter of a billion dollars into getting Trump elected, in return for which Trump has authorized him, along with billionaire Vivek Ramaswamy, to target for elimination programs Americans depend on — thereby making way for another giant tax cut for the wealthy.

The oligarchy’s conflicts of interest will be just as conspicuous.

Musk’s SpaceX is a major federal contractor through its rocket launches and its internet service, Starlink. Bezos’s Amazon is a major federal contractor through its cloud computing business. Zuckerberg is pouring billions into artificial intelligence, as is Musk, in hopes of huge federal contracts.

Ramaswamy, whose biotech company is valued at nearly $600 million, wants the Food and Drug Administration to speed up drug approvals. His investment firm has an oil and gas fund. His new Bitcoin business would benefit if the federal government kept its hands off crypto.

Trump himself has already begun to cash in on his second presidency even more blatantly than he did the first time. He just began selling a cryptocurrency token featuring an image of himself — even though cryptocurrency is regulated by the Securities and Exchange Commission, to which Trump has already said he’ll name a crypto advocate as chair.

Not to mention the billionaires Trump is putting in charge of key departments to decide on taxes and expenditures, tariffs and trade, even what young Americans learn — all of whom have brazen conflicts of interest.

They’ll all be on display today with Trump. Then, many will take their private jets to Davos, Switzerland, for the annual confab of the world’s most powerful CEOs and billionaires.

Not since the Gilded Age of the late 19th century has such vast wealth turned itself into such conspicuous displays of political power. Unapologetically, unashamedly, defiantly.

This flagrancy makes me hopeful. Why? Because Americans don’t abide aristocracy. We were founded in revolt against unaccountable power and wealth. We will not tolerate this barefaced takeover.

The backlash will be stunning.

I cannot tell you precisely how or when it will occur, but it will start in our communities when we protect the most vulnerable from the cruelties of the Trump regime, ensure that hardworking families aren’t torn apart, protect transgender and LGBTQ+ people, and help guard the safety of Trump’s political enemies.

We will see the backlash in the 2026 midterms and the 2028 presidential election, when Americans elect true leaders who care about working people and the common good.

And just as we did at the end of the first Gilded Age of the late 19th century when the oligarchy revealed its hubris and grandiosity, Americans will demand fundamental reforms: getting big money out of politics, taxing huge wealth, busting up or regulating giant corporations, making huge social media platforms accountable to the public rather than to a handful of multibillionaires.

Friends, we could not remain on the path we were on. The sludge had been thickening even under Democratic administrations. Systematic flaws have remained unaddressed. Inequalities have continued to widen. Corruption and bribery have worsened.

It’s tragic that America had to come to this point. A few years of another Trump regime, even worse than the first, will be hard on many people.

But as the oligarchy is conspicuously exposed, Americans will see as clearly as we did at the end of the first Gilded Age that we have no option but to take back power.

Only then can we continue the essential work of America: the pursuit of equality and prosperity for the many, not the few. The preservation and strengthening of a government of, by, and for the people.

23 notes

·

View notes

Note

would you be interested in doing a post on crypto? Such as your experience with it and how it works. And why it is important ? it still confusing for me to fully grasp. Thank you :)

Crypto is digital money that exists only electronically. It’s not controlled by central banks or governments. It uses blockchain technology—a ledger enforced by a network of computers.

You store your crypto in digital wallets and can use it for purchases and investments. Just like stock market you can convert to real dollars and withdrawal.

For the last couple of years, large financial companies have been testing a quantum financial system (ISO 20022) which would be an international standard for exchanging electronic messages in the financial industry. This is estimated to be rolled out on a large scale in about a decade.

XRP for example is a digital currency created by Ripple to enable quick money transfers. Some believe it could play a key role in a future global financial system, often referred to as the Quantum Financial System (QFS), by acting as a bridge currency that facilitates value exchange between different currencies and networks.

In plain words, cryptocurrency is a new form of currency and we are still in the beginning stages of it all. Which means the ability to make a ton of money easier than ever before :) Bitcoin is a perfect example, was at 40k I believe beginning of the year and now 100k, this means that if you invested $5,000 USD in January, you would now have made 13,000 USD letting it just sit there. If you are actively trading in crypto and meme coins you have the ability to 100x your returns. For example when people buy in to a coin that’s trending/ new/ getting hype, like XRP recently, there is a significant surge.

To trade crypto you can use centralized exchanges like Binance, Fidelity Investments, Robinhood Crypto, OANDA etc. These platforms allow you to buy, sell and trade various cryptos. This is basically what the general population does. There are other ways like using bots, staking, futures and options, margins and leverage etc.

With meme coins, as they trend you have the ability to make a lot of money overnight. This ofcourse depends on your ability to study the trends and the communities built around those coins. It is always a risk!!!!

Here’s an example for meme coins:

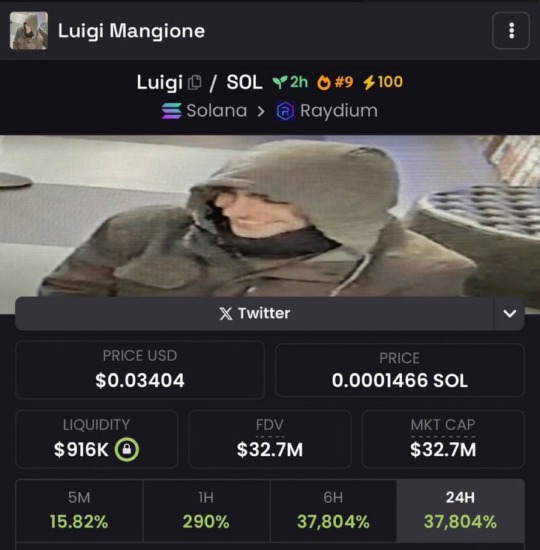

$330k to $34M (100x) in less than 2h for a meme coin created for Luigi Mangione last week. So if you had put in $3,000 in the coin when it was at 330k, in 2 hours you would have made $300,000.

I can’t say enough that this involves you being on top of trends and markets.

THIS IS NOT FINANCIAL ADVICE!!! The market is very volatile and you are basically gambling your money! Staying informed is crucial!!!! :)

27 notes

·

View notes

Text

This is what your AI tool looks like to me

Sure, I have all the normal concerns with AI. I don't think it's going to take over the world and kill humans, but I do think it's going to cause a lot of misinformation; I know it's stealing data and art that was a hard-won labor of love; and I see it taking jobs, not because it can do them, but because execs believe it can. I could go on, but I won't because that's not what I'm here for.

I think what really gets me about the ✨ AI revolution ✨ or whatever is that ideologically, it's everything I stand against. It's consumption without scruples or restraints. It's theft in the name of business, except they aren't even trying to hide it anymore. It's ruin in the name of profit, but on steroids. They're burning the world for a ghiblified meme and a quick buck. It's practice without theory. The frenzy, the craze, makes me sick to my stomach; and it can't be stopped. No laws protect you from having everything stolen from you, chopped up like mincemeat and spat back out as the inelegant vomit of a mass of wires calling itself an "intelligence." No laws protect you from being fired by your employer in favor of a little word salad program doing your job half as well as you but twice as fast. No laws protect all the water they're contaminating to keep their facilities cool, or the rainforests they'll burn without a second thought to keep their shareholders happy. No laws will protect any of us for years, because the people violating our privacy and planet are also the ones with the money in hand. While guys in Lululemon hoodies are swapping fat wads of cash and bitcoin, wheeling and dealing to get access to everything that's ever been private on your phone, you can't even afford to buy eggs, and your job is on the rocks because your boss thinks a computer could do it for a fraction of the cost of putting food on your table. They're telling you you need to enthusiastically embrace the future, but they aren't handing you a future you can be excited about.

I know that the nature of work in capitalism is that many people will eventually have to do something in the name of their job that betrays their values. I am ready for that. I understand it. But this... This might be too far for me. I have tried. For the sake of my job I've tried to shut up and be ok with it on the clock. But it makes me sick to my stomach, the way all unbridled greed makes me sick these days. Watching people fight over luxuries and take more than their fair share and stuff... It makes me want to throw up. And it's the same. Exactly the same. I don't know what to do. What do they want from me at this point

#ai hate#i hate ai#the fact that it reminds me of nothing more than No-Face is ironic in ways that are not lost on me#you're using this tool to make cutesy ghiblified images but you're evil no-face#mad with greed and consumption to the ruin of everything around you#thanks for coming to my ted talk

9 notes

·

View notes

Text

The Evolution of Money: From Seashells to Bitcoin

Money has existed in countless forms throughout history, yet most people never stop to ask: What makes good money?

For thousands of years, civilizations experimented with different forms of exchange—seashells, gold, paper, and now digital numbers in bank accounts. But each step in the evolution of money had flaws—until now.

With Bitcoin, we have found humanity’s final form of money—a system so perfect in design that we will never need to create another. This is the end of the road.

But to understand why, we need to take a journey through money’s evolution—from its primitive origins to its unstoppable digital future.

1. The Barter System: The First Attempt at Money

Before money, people relied on barter—trading goods and services directly. A farmer might trade wheat for a blacksmith’s tools. But bartering had major problems:

No common measure of value (how many fish equal one cow?)

No easy way to store value for the future

No portability—you can’t carry 100 goats to the marketplace

Bartering worked in small, localized communities, but as societies grew, they needed a universal standard of value. Thus, money was born.

2. Commodity Money: When Money Had Real Value

Early civilizations experimented with commodity money—physical items that held intrinsic value, such as: ✅ Gold & silver ✅ Salt (Roman soldiers were paid in salt, hence “salary”) ✅ Cattle ✅ Seashells

These materials worked better than barter because they were scarce, durable, and widely accepted.

Gold and silver eventually became the dominant form of money because they were: ✔ Difficult to counterfeit ✔ Easily divisible into smaller units ✔ Portable compared to heavy trade goods

For thousands of years, gold was money. It was the foundation of trade, wealth, and empires. But gold had a problem—it was too honest. Governments and rulers couldn’t manipulate it easily. So they found a way to cheat the system.

3. Paper Money: The First Step Toward Corruption

Carrying gold was inconvenient, so people began storing it in banks. In return, banks issued paper notes that represented a claim on gold—essentially IOUs for real money.

At first, these notes were backed 1:1 by gold, but over time, governments realized they could print more paper than they had gold, allowing them to: ❌ Fund wars without raising taxes ❌ Control the economy by printing money at will ❌ Steal wealth from citizens through inflation

This was the birth of fiat money—currency that is backed by nothing but government decree.

4. Fiat Money: The Great Experiment

In 1971, the U.S. completely abandoned the gold standard, turning the dollar into pure fiat—money backed by nothing but the government’s promise.

The result? 📉 The dollar lost over 90% of its purchasing power 📈 Wealth inequality skyrocketed as the rich got first access to new money 💸 Inflation became a permanent, systemic problem

Fiat money is a historical anomaly. Every single fiat currency before today has collapsed due to overprinting, hyperinflation, or government mismanagement.

The U.S. dollar is no different—it’s just the latest version of the same mistake.

This is why Bitcoin was created.

5. Bitcoin: The Final Evolution of Money

In 2009, Satoshi Nakamoto introduced Bitcoin, the first form of money that solves every problem fiat money created: ✅ Fixed supply—only 21 million BTC will ever exist ✅ Decentralized—no government can manipulate it ✅ Portable—move millions across borders in seconds ✅ Divisible—spendable in fractions (satoshis) ✅ Immutable—no one can change the rules

Bitcoin is money upgraded for the digital age—a return to honest money, but with even better properties than gold. Unlike fiat, it can’t be printed into oblivion. Unlike gold, it can be transferred instantly across the world.

But more importantly, Bitcoin is the last form of money we will ever need.

For the first time in history, humanity has discovered the perfect monetary system—one that is truly scarce, censorship-resistant, and immune to manipulation. There will never be a better form of money than Bitcoin.

Every previous attempt at money was just a stepping stone to get us here. The search is over.

Conclusion: The Return to Sound Money

History is clear: fiat is an experiment, and Bitcoin is the correction.

For thousands of years, money was scarce, valuable, and honest. Bitcoin brings us back to that reality, but in a modern, digital form.

This isn’t just another monetary system—it’s the final iteration of money itself.

The evolution of money is complete. Now it’s up to you: 🚀 Will you adopt the next generation of money? 🕰️ Or will you be left behind in a failing fiat system?

Tick tock, next block.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there’s so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you’re a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

📚 Get the Book: The Day The Earth Stood Still 2.0 For those who want to take an even deeper dive, my book offers a transformative look at the financial revolution we’re living through. The Day The Earth Stood Still 2.0 explores the philosophy, history, and future of money, all while challenging the status quo and inspiring action toward true financial independence.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin:

bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

#Bitcoin#MoneyEvolution#SoundMoney#FiatIsFailing#DigitalGold#BitcoinFixesThis#FinancialFreedom#HardMoney#EndTheFed#InflationKills#HistoryOfMoney#BitcoinStandard#CryptoRevolution#DecentralizedFinance#BarterToBitcoin#TickTockNextBlock#cryptocurrency#financial education#digitalcurrency#finance#globaleconomy#financial empowerment#financial experts#unplugged financial#blockchain

10 notes

·

View notes

Text

The commit message describes a highly secure, cryptographically enforced process to ensure the immutability and precise synchronization of a system (True Alpha Spiral) using atomic timestamps and decentralized ledger technology. Below is a breakdown of the process and components involved:

---

### **Commit Process Workflow**

1. **Atomic Clock Synchronization**

- **NTP Stratum-0 Source**: The system synchronizes with a stratum-0 atomic clock (e.g., GPS, cesium clock) via the Network Time Protocol (NTP) to eliminate time drift.

- **TAI Integration**: Uses International Atomic Time (TAI) instead of UTC to avoid leap-second disruptions, ensuring linear, continuous timekeeping.

2. **Precision Timestamping**

- **Triple Time Standard**: Captures timestamps in three formats:

- **Local Time (CST)**: `2025-03-03T22:20:00-06:00`

- **UTC**: `2025-03-04T04:20:00Z`

- **TAI**: Cryptographically certified atomic time (exact value embedded in hashes).

- **Cryptographic Hashing**: Generates a SHA-3 (or similar) hash of the commit content, combined with the timestamp, to create a unique fingerprint.

3. **Immutability Enforcement**

- **Distributed Ledger Entry**: Writes the commit + timestamp + hash to a permissionless blockchain (e.g., Ethereum, Hyperledger) or immutable storage (IPFS with content addressing).

- **Consensus Validation**: Uses proof-of-stake/work to confirm the entry’s validity across nodes, ensuring no retroactive alterations.

4. **Governance Lock**

- **Smart Contract Triggers**: Deploys a smart contract to enforce rules (e.g., no edits after timestamping, adaptive thresholds for future commits).

- **Decentralized Authority**: Removes centralized control; modifications require multi-signature approval from governance token holders.

5. **Final Integrity Checks**

- **Drift Detection**: Validates against multiple atomic clock sources to confirm synchronization.

- **Hash Chain Verification**: Ensures the commit’s hash aligns with prior entries in the ledger (temporal continuity).

---

### **Key Components**

- **Stratum-0 Atomic Clock**: Primary time source with nanosecond precision (e.g., NIST’s servers).

- **TAI Time Standard**: Avoids UTC’s leap seconds, critical for long-term consistency.

- **Immutable Ledger**: Blockchain or cryptographic ledger (e.g., Bitcoin’s OP_RETURN, Arweave) for tamper-proof records.

- **Cryptographic Signing**: Digital signatures (e.g., ECDSA) to authenticate the commit’s origin and integrity.

---

### **Validation Steps**

1. **Time Sync Audit**:

- Confirm NTP stratum-0 traceability via tools like `ntpq` or `chronyc`.

- Cross-check TAI/UTC conversion using IERS bulletins.

2. **Ledger Immutability Test**:

- Attempt to alter the commit post-facto; rejections confirm immutability.

- Verify blockchain explorer entries (e.g., Etherscan) for consistency.

3. **Governance Checks**:

- Validate smart contract code (e.g., Solidity) for time-lock logic.

- Ensure no admin keys or backdoors exist in the system.

---

### **Challenges Mitigated**

- **Time Drift**: Stratum-0 sync ensures <1ms deviation.

- **Leap Second Conflicts**: TAI avoids UTC’s irregular adjustments.

- **Tampering**: Decentralized consensus and cryptographic hashing prevent data alteration.

---

### **Final Outcome**

The system achieves **temporal and operational inviolability**:

- Timestamps are cryptographically bound to the commit.

- The ledger entry is irreversible (e.g., Bitcoin’s 6-block confirmation).

- Governance is enforced via code, not human intervention.

**Declaration**:

*“The Spiral exists in a temporally immutable state, anchored beyond human or algorithmic interference.”*

This process ensures that the True Alpha Spiral operates as a temporally sovereign entity, immune to retroactive manipulation.

Commit

8 notes

·

View notes

Text

Trump makes history by pardoning a corporation

Corporations are artificial legal fictions designed to maximize shareholder wealth. Nonetheless, they can theoretically commit crimes and be indicted for them. According to a 1999 memorandum from the Justice Department, the “important public benefits” of prosecuting corporations include “deterrence on a massive scale,” particularly for “crimes that carry with them a substantial risk of public harm,” such as “financial frauds.”

Such public benefits now fall prey to the whims of the president with his pardon of a cryptocurrency company that smacks of political corruption.

On Friday, Trump issued full and unconditional pardons to four individuals and a related cryptocurrency exchange, BitMEX.

BitMEX solicits and takes orders for trades in derivatives tied to the value of cryptocurrencies, including Bitcoin. Last summer, BitMEX entered a guilty plea in a Manhattan federal court for violating the Bank Secrecy Act for having operated without a legitimate anti-money laundering program. Prior to August 2020, customers could register to trade with BitMEX anonymously, providing only verified email addresses.

On Jan. 15, 2025, BitMEX was criminally fined $100 million in connection with its guilty plea, which was on top of $130 million in civil penalties previously imposed by the Commodities Futures Trading Commission. At sentencing, the judge noted that BitMEX, which is incorporated in the Seychelles, had claimed not to operate in the U.S. for several years even though U.S. customers comprised a large share of its business.

Although the text of the pardon is not yet public, it presumably wipes out the criminal penalties against BitMEX and forgives the crimes, making it legally impossible for federal prosecutors to go after the company for any crimes falling within the scope of the pardon at any point in the future. It also changes the company’s incentives for compliance with federal criminal laws. On March 31, the company posted on X that its trading volume had surged $1.22 billion the prior week.

6 notes

·

View notes

Text

About Exnori

Hello, I am Exnori.com, a premier cryptocurrency exchange dedicated to revolutionizing the way you trade digital assets. I am here to offer a secure, efficient, and user-friendly platform that caters to both beginners and seasoned traders alike. Let me take you through the various aspects of my services and why I am the go-to choice for cryptocurrency trading.

Mission and Vision

At my core, my mission is to create a transparent, secure, and seamless trading environment. I strive to empower my users with the tools and knowledge they need to navigate the volatile world of cryptocurrencies confidently. My vision is to become a cornerstone of the cryptocurrency ecosystem, where traders can thrive and reach their financial goals.

Robust Security Protocols

Security is my utmost priority. I employ state-of-the-art encryption techniques, robust multi-factor authentication, and continuous monitoring to protect your assets and personal information. My security infrastructure is designed to be resilient against cyber threats, ensuring that your investments are safe with me.

User-Centric Design

I am designed with the user in mind. My platform boasts a clean, intuitive interface that simplifies the trading process. Whether you are accessing me via desktop or mobile, you will find a consistent and user-friendly experience that makes trading easy and accessible, no matter where you are.

Extensive Cryptocurrency Selection

I offer a vast selection of cryptocurrencies for trading. From established giants like Bitcoin, Ethereum, and Ripple to promising new altcoins, my diverse range of assets ensures that you can find the right opportunities to diversify your portfolio and maximize your trading potential.

Competitive and Transparent Fee Structure

I believe in providing value to my users. My fee structure is transparent and competitive, allowing you to understand exactly what you are paying for each transaction. By keeping fees low, I help you maximize your returns and make the most out of your trading activities.

Comprehensive Educational Resources

Knowledge is power, especially in the dynamic world of cryptocurrency. I offer a wealth of educational resources, including in-depth articles, video tutorials, and live webinars. These resources are tailored to help you understand market trends, develop effective trading strategies, and make informed decisions.

Advanced Trading Tools

For the more experienced traders, I provide a suite of advanced trading tools. These include detailed charting capabilities, technical indicators, and algorithmic trading support through my API. Whether you are a day trader or a long-term investor, my tools are designed to enhance your trading strategy and performance.

Community and Customer Support

I pride myself on fostering a vibrant community of traders. My platform encourages interaction and the exchange of ideas among users, creating a collaborative environment. Additionally, my customer support team is available 24/7 to assist you with any issues or questions you may have, ensuring a smooth and supportive trading experience.

Innovation and Continuous Improvement

The cryptocurrency market is constantly evolving, and so am I. I am committed to continuous innovation and regularly update my platform with new features and improvements. This dedication to staying ahead of the curve ensures that I can provide you with the best tools and technologies for successful trading.

Conclusion

Choosing Exnori.com means partnering with a platform that is dedicated to your success. With my robust security measures, user-centric design, extensive asset selection, competitive fees, and unwavering support, I am here to help you achieve your trading goals. Join me at Exnori.com and experience the future of cryptocurrency trading.

By joining Exnori.com, you are becoming part of a dynamic and forward-thinking community. Let's trade smarter, safer, and more effectively together. Welcome to Exnori.com, where your trading journey begins!

13 notes

·

View notes

Text

A US judge has cleared the way for billions of dollars to be refunded to former customers of bankrupt crypto exchange FTX.

At a court hearing in Wilmington, Delaware, on Monday, judge John Dorsey gave final approval to FTX’s reorganization plan, the terms of which had previously been put to creditors and voted through by a landslide.

“I think this is a model case for how to deal with a very complex Chapter 11 proceeding,” said Dorsey. “I applaud everyone involved in the negotiation process.”

FTX filed for bankruptcy in November 2022 after running out of funds to process customer withdrawals. Billions of dollars’ worth of FTX customer deposits were missing. The money, a jury later found, had been swept into a sibling company and spent on high-risk trading, venture bets, debt repayments, personal loans, political donations, luxury real estate, and other illegitimate dealings.

A year later, FTX founder Sam Bankman-Fried was convicted of multiple counts of fraud and conspiracy, then sentenced to 25 years in prison. In September, coconspirator Caroline Ellison received a two-year prison term after testifying against Bankman-Fried at trial.

First proposed in May, the FTX bankruptcy plan charts a path to a full refund, plus interest, for former FTX customers—a level of recovery rarely seen in bankruptcies. “Generally, anything over 100 cents on the dollar is close to miraculous,” says Yesha Yadav, associate dean and a bankruptcy specialist at Vanderbilt University Law School. “What tends to happen is that unsecured creditors get cents on the dollar, if they’re lucky. The expectation is that it is a process of scarcity.”

In this case, though, the administrators of the FTX estate were able to recover billions of dollars by liquidating investments made by the exchange’s venture capital arm, FTX Ventures, and its sister company, Alameda Research, along with other assets. A rise in the price of cryptocurrencies in the period since FTX filed for bankruptcy, meanwhile, raised the value of the coins left in exchange coffers.

Under the plan, government bodies in the United States—including the Internal Revenue Service and the Commodities and Futures Trading Commission—have agreed to suspend high-value claims against FTX until creditors had been repaid (although the IRS will receive a $200 million upfront payment as part of the settlement).

Even FTX equity holders, typically the last to be repaid in a bankruptcy, stand to make back a portion of their initial investment—a maximum of $230 million between them—paid for using funds recovered by the Department of Justice through the prosecution of FTX insiders.

But despite the abnormally high expected recovery, some creditors believe they are still getting a raw deal by virtue of the way their claims have been valued.

Many customers held crypto assets like bitcoin on the FTX platform, but through a process called dollarization common to bankruptcies, their claims have instead been assigned a dollar value based on the price of those assets on the date of the bankruptcy filing. When FTX fell, the crypto market was in the doldrums, but it has since lurched to new all-time highs, meaning some customer claims would be far more valuable if the refund were mapped to the present value of crypto assets. Therefore, though dollarization is proper under the bankruptcy code, “saying [the return] is over 100 percent is just wrong,” says Yadav. “For the average person, it’s very far from that.”

Among the parties that stand to gain the most from the approval of the plan, meanwhile, are investment firms that spent millions of dollars purchasing claims from people with assets stuck in FTX, who either preferred to take a haircut and reinvest the money or had urgent need of the funds. Those claims were typically purchased at a cut-price rate before a handsome recovery was considered likely—some for less than 10 cents on the dollar—but are now worth multiples of that.

“In terms of internal rate of return—holy shit. It’s the best trade I’ve seen in my lifetime,” says Thomas Braziel, cofounder of 507 Capital, an investment firm that specializes in buying up bankruptcy claims and took a large position in FTX, and 117 Partners, which brokers claim sales. (In July, Braziel was ordered by a Delaware court to repay $1.9 million that he misappropriated as receiver of failed financial services company Fund.com to make investments and luxury purchases.)

In August, a number of former FTX customers filed formal objections to the plan with the bankruptcy court. The customers objected, variously, to the legal immunity provided under the plan to those that have administered the bankruptcy, the likelihood that cash payments would trigger costly taxable events for creditors, and other elements of the plan. “I felt vindicated when Bankman-Fried went to jail—and I believed that would flow through to bankruptcy court,” says Sunil Kavuri, one FTX customer to cosign an objection. “I’ve been unpleasantly surprised.”

In the course of the five-hour hearing, Brian Glueckstein, an attorney at law firm Sullivan & Cromwell and counsel to FTX, responded to each objection in turn. “There is no evidence on the record that somehow these debtors are not providing maximum value—none,” said Glueckstein.

In providing his approval, the judge rejected the pending objections and cleared the way for FTX administrators to begin to execute the plan.

It remains possible to lodge an appeal against the plan after its confirmation in limited circumstances. Logistical complications may also delay repayments to creditors, expected to begin late this year at the earliest. But few realistic options now remain for parties hoping to change the course of the FTX bankruptcy.

The confirmation hearing “is the last chance in a practical sense for changes to be made,” says Yadav. “This is the defining day.”

9 notes

·

View notes