#Business Finance Assignment Help Service

Explore tagged Tumblr posts

Text

Empowering Students to Excel: Strategies for Mastering Business Finance Assignments

Navigating the intricacies of business finance assignments can be a challenging task for students pursuing courses in finance. The intricate concepts, mathematical complexities, and real-world applications often leave students grappling for assistance. Recognizing this need, platforms like FinanceAssignmentHelp.com step in to provide invaluable support, ensuring that students not only complete their assignments but also master the subject matter. Whether it's comprehending assignment requirements, mastering key concepts, or seeking clarification on complex topics, FinanceAssignmentHelp.com is dedicated to offering Help With Business Finance Assignment. In this blog, we'll explore effective strategies for excelling in business finance assignments and highlight the features of FinanceAssignmentHelp.com that make it a go-to resource for students seeking academic support.

Understanding the Assignment Requirements:

One of the initial challenges students face is comprehending the assignment requirements. It's crucial to carefully read and understand what is expected. Break down the instructions, identify key concepts, and create a roadmap for your work. If uncertainties persist, seeking clarification from professors or utilizing online resources like FinanceAssignmentHelp.com can provide the necessary clarity.

Mastering Key Concepts:

Business finance assignments often involve intricate concepts and formulas. Mastering these is essential for producing high-quality assignments. Make use of textbooks, lecture notes, and supplementary materials to reinforce your understanding. Online platforms like FinanceAssignmentHelp.com offer comprehensive resources, including explanatory videos, case studies, and practice problems, facilitating a deeper understanding of complex topics.

Utilizing Online Resources:

The internet has become a treasure trove of information for students. Websites like FinanceAssignmentHelp.com offer specialized assistance tailored to business finance assignments. These platforms provide not only solutions but also explanations, ensuring that students grasp the underlying principles. FinanceAssignmentHelp.com stands out with its user-friendly interface, making navigation seamless for students seeking specific help with business finance assignments.

Features of FinanceAssignmentHelp.com:

a. Expert Tutors: FinanceAssignmentHelp.com boasts a team of experienced tutors with profound knowledge of business finance. These experts are well-versed in academic requirements and industry practices, providing students with the guidance needed to excel in their assignments.

b. 24/7 Availability: Recognizing the unpredictable nature of student schedules, FinanceAssignmentHelp.com ensures round-the-clock availability. This feature allows students to seek help whenever they encounter challenges, promoting a stress-free and efficient learning experience.

c. Customized Solutions: Each student is unique, and their learning needs vary. FinanceAssignmentHelp.com understands this diversity and offers customized solutions to address individual requirements. This tailored approach enhances the effectiveness of the assistance provided.

d. Plagiarism-Free Content: Academic integrity is paramount. FinanceAssignmentHelp.com prioritizes the delivery of original content, ensuring that students receive solutions that are free from plagiarism. This commitment to authenticity strengthens the educational value of the provided assistance.

e. Timely Delivery: Meeting deadlines is crucial in the academic realm. FinanceAssignmentHelp.com emphasizes the importance of timely delivery, allowing students to submit their assignments punctually without compromising on quality.

Practice, Practice, Practice:

Mastery comes with practice. Once the theoretical concepts are understood, it's imperative to apply them through practical problem-solving. Platforms like FinanceAssignmentHelp.com offer a plethora of practice problems and case studies that enable students to reinforce their learning by tackling real-world scenarios.

Collaborative Learning:

Engage in collaborative learning by forming study groups or participating in online forums. Discussing concepts with peers not only provides different perspectives but also reinforces your understanding. FinanceAssignmentHelp.com encourages collaborative learning through discussion forums where students can interact with tutors and peers, fostering a supportive academic community.

Feedback and Revision:

Submitting assignments is not the end; it's a step in an ongoing learning process. Pay attention to feedback provided by professors or online tutors. Use this feedback constructively to identify areas of improvement and revise your approach accordingly. FinanceAssignmentHelp.com facilitates this process by offering feedback on submitted assignments, guiding students toward continuous improvement.

Conclusion:

Mastering business finance assignments is a journey that demands dedication, understanding, and strategic utilization of available resources. FinanceAssignmentHelp.com stands as a beacon for students navigating this journey, offering expert guidance, customized solutions, and a commitment to academic excellence. By implementing the strategies discussed and leveraging the features of platforms like FinanceAssignmentHelp.com, students can empower themselves to not only excel in their assignments but also develop a profound understanding of the fascinating world of business finance.

#Business Finance Assignment Help#Help With Business Finance Assignment#Online Business Finance Assignment Help#Business Finance Assignment Help Service

8 notes

·

View notes

Text

GAAP vs IFRS

Decoding US Accounting Rules: GAAP vs IFRS | Expert Insights in 2024

Navigate the GAAP vs IFRS debate in US Accounting effortlessly. Gain expert insights, make sense of regulations. Your guide to financial clarity.

The evolving landscape of accounting standards unfolds a nuanced debate between the Generally Accepted Accounting Principles and the International Financial Reporting Standards. These two frameworks, while sharing a common goal of transparent financial reporting, diverge in their approaches, giving rise to a multifaceted discourse with far-reaching implications for the financial world.

1. Introduction

The evolution of accounting standards has witnessed the crystallization of two dominant frameworks – General Accounting Accepted Principles and International Financial Reporting Standards. In the labyrinth of financial reporting, companies grapple with choosing between these standards, each with its unique history, principles, and global relevance. The debate surrounding GAAP vs IFRS is not a mere academic exercise but a pivotal consideration with implications for investment decisions, legal compliance, and the global financial landscape.

1.1. Evolution of Accounting Standards

The journey of accounting standards traces back to the aftermath of the 1929 stock market crash when the need for standardized, transparent financial reporting became glaringly apparent. What emerged were the General Accounting Accepted Principles, designed to restore investor confidence by providing a reliable framework for financial statements. Over time, GAAP has become deeply embedded in the U.S. financial system, shaping the way companies communicate their financial health.

On the global stage, the International Financial Reporting Standards evolved as a response to the growing interconnectedness of economies. The International Accounting Standards Board (IASB) took the reins in developing IFRS, aiming for a standardized global language of financial reporting. This set the stage for a two-pronged approach to financial reporting standards – General Accounting Accepted Principles dominating in the U.S. and International Financial Reporting Standards gaining traction internationally.

1.2. The Crucial Role of GAAP and IFRS

GAAP stands as the bedrock of accounting standards in the United States, overseen by the Financial Accounting Standards Board (FASB). Its principles, rooted in historical cost, revenue recognition, and matching, provide stability and a familiar structure for U.S. businesses. On the other hand, IFRS, under the stewardship of the IASB, operates as a global player, emphasizing fair value, substance over form, and materiality.

The significance of General Accounting Accepted Principles lies in its historical context and its alignment with the unique needs of the U.S. business environment. Its principles have served as a guiding light for American companies, offering a consistent framework for financial reporting. International Financial Reporting Standards, with its global perspective, caters to the interconnectedness of today’s businesses, providing a common language for multinational corporations.

1.3. Navigating the GAAP vs IFRS Dilemma

The choice between General Accounting Accepted Principles and International Financial Reporting Standards is not a one-size-fits-all decision. Companies grapple with a complex decision-making process, considering factors such as their geographical reach, industry nuances, and investor preferences. This debate is not isolated to boardrooms; it resonates in financial markets, legal proceedings, and regulatory landscapes, shaping the very fabric of financial reporting practices.

2. Understanding GAAP

2.1. The Foundation of GAAP

a. Historical Roots and Evolution

GAAP’s roots delve deep into the need for a standardized accounting framework post the 1929 stock market crash. FASB emerged as a response to the chaos that ensued, charged with the responsibility of establishing and improving financial accounting and reporting standards. The journey of GAAP has been one of continuous evolution, adapting to the changing business landscape and regulatory requirements.

b. FASB’s Ongoing Influence

The Financial Accounting Standards Board (FASB) stands as the guardian of GAAP, playing a pivotal role in setting and refining accounting standards. FASB’s mission goes beyond rule-making; it seeks to improve financial reporting, providing transparency and relevance in financial statements. The ongoing influence of FASB ensures that GAAP remains adaptive and responsive to the dynamic nature of business transactions.

2.2. Core Principles Anchoring GAAP

a. Embracing the Historical Cost Principle

One of the cornerstones of GAAP is the historical cost principle, dictating that assets should be recorded at their original cost. This principle provides stability and reliability in financial statements, allowing users to assess the financial health of a company based on the actual cost of its assets at the time of acquisition. While critics argue that this approach may not reflect current market values, proponents emphasize the prudence and consistency it offers.

b. Revenue Recognition as a Cornerstone

GAAP’s approach to revenue recognition centers on the realization and earned criteria. Revenue is recognized when it is realized or realizable and earned. This conservative approach ensures that revenue is not prematurely recognized, aligning with the matching principle. While this method may defer recognizing revenue until later stages in the sales cycle, it safeguards against potential overstatement and presents a cautious picture to investors.

c. The Significance of the Matching Principle

The matching principle is a guiding force in GAAP, emphasizing the alignment of expenses with the revenue they generate. This principle ensures that the costs associated with generating revenue are recognized in the same period as the revenue itself, presenting a more accurate portrayal of a company’s profitability. While adhering to the matching principle might result in lower reported profits during high-revenue periods, it provides a more realistic long-term view.

2.3. Scrutinizing Criticisms and Recognizing Limitations

a. Rigidity vs. Stability

One common criticism leveled against GAAP is its perceived rigidity, particularly regarding the historical cost principle. Critics argue that this approach may not capture the true economic value of assets, especially in industries with rapidly changing market conditions. However, proponents assert that this rigidity provides stability and consistency, allowing for easier comparison across periods and industries.

b. The Balancing Act of Revenue Recognition

The conservative approach to revenue recognition in GAAP has faced scrutiny for potentially understating a company’s immediate financial performance. Critics argue that this caution may not be reflective of a company’s true economic position, especially in industries where revenue realization is instantaneous. However, the balancing act lies in mitigating the risk of premature revenue recognition, ensuring financial statements maintain integrity and accuracy.

c. Challenges in Adhering to the Matching Principle

While the matching principle aligns expenses with revenue, critics contend that it introduces complexities in determining the direct association between costs and specific revenue streams. This challenge becomes more pronounced in industries with diverse revenue sources. Despite these challenges, adhering to the matching principle remains integral in presenting a holistic view of a company’s financial health, helping investors make informed decisions.

3. Embracing IFRS

3.1. IFRS: A Global Framework

a. The Rise of International Financial Reporting Standards

The emergence of IFRS marks a significant shift towards a globalized approach to financial reporting. As businesses expanded internationally, the need for a common accounting language became evident. IFRS, under the stewardship of the International Accounting Standards Board (IASB), rose to prominence as a framework that transcends borders, providing a standardized set of principles for companies operating on the world stage.

b. IASB’s Pivotal Role in Shaping IFRS

The International Accounting Standards Board (IASB) shoulders the responsibility of developing and maintaining IFRS. Unlike GAAP, IFRS operates under a principles-based approach, focusing on broad principles rather than detailed rules. This flexibility allows for easier adaptation to diverse business environments, making IFRS an attractive choice for multinational corporations seeking a harmonized approach to financial reporting.

3.2. Unpacking Core Principles of IFRS

a. Fair Value Measurement: A Paradigm Shift

One of the fundamental differences between GAAP and IFRS lies in the approach to asset valuation. While GAAP predominantly adheres to the historical cost principle, IFRS leans towards fair value measurement. Fair value reflects the current market value of assets, providing a more dynamic and responsive perspective. Critics argue that fair value introduces volatility, but proponents emphasize its relevance in capturing real-time economic conditions.

b. Substance Over Form: Emphasizing Economic Reality

In IFRS, the substance of transactions takes precedence over their legal form. This principle ensures that financial statements reflect the economic reality of transactions, promoting transparency and accuracy. While this approach aligns with the overarching goal of providing relevant information to users, it requires careful judgment and interpretation, potentially introducing subjectivity in financial reporting.

c. Materiality’s Role in Flexibility

IFRS introduces greater flexibility in materiality judgments compared to GAAP. Materiality refers to the threshold at which information becomes relevant to users. The more flexible stance in IFRS allows entities to exercise judgment in determining what information is material, considering both quantitative and qualitative factors. This flexibility, while enhancing the adaptability of IFRS, also raises concerns about potential inconsistencies in financial reporting.

3.3. Weighing Advantages and Drawbacks

a. IFRS Flexibility: A Double-Edged Sword

The flexibility embedded in IFRS is both its strength and weakness. Proponents argue that this adaptability makes IFRS suitable for diverse business environments, allowing for easier integration with various industries and legal systems. However, critics contend that this very flexibility can lead to inconsistencies and a lack of comparability, challenging the reliability of financial statements for investors and stakeholders.

b. Global Appeal vs. Application Challenges

The global nature of IFRS makes it an attractive choice for multinational companies aiming for consistency in financial reporting across borders. The common language of IFRS facilitates international transactions and fosters a seamless global financial landscape. However, the application of IFRS can pose challenges in jurisdictions with varying legal and regulatory frameworks, potentially leading to complexities in implementation and interpretation.

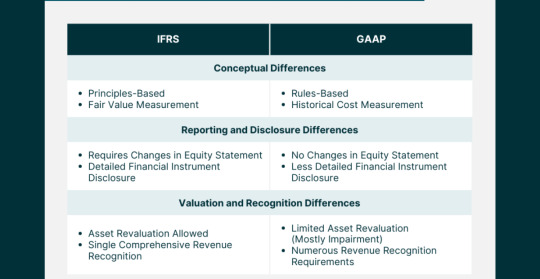

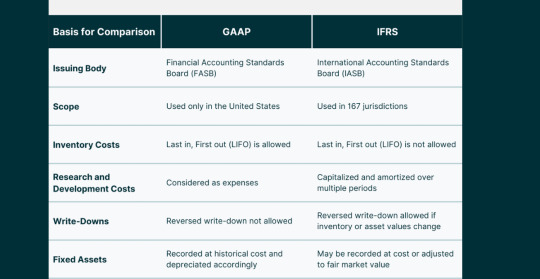

4. Key Differences Between GAAP and IFRS

4.1. Delving into Variances

a. Revenue Recognition: The GAAP-IFRS Divergence

One of the pivotal differences between GAAP and IFRS lies in the recognition of revenue. While both frameworks aim to depict the economic reality of transactions, their approaches diverge in certain key aspects. GAAP tends to be more prescriptive, providing specific guidelines for various industries, whereas IFRS adopts a broader principles-based approach, allowing entities more room for interpretation.

b. Inventory Valuation: Differing Approaches

The treatment of inventory valuation varies significantly between GAAP and IFRS. GAAP typically follows a specific set of rules for valuing inventory, such as the Last In, First Out (LIFO) or First In, First Out (FIFO) methods. In contrast, IFRS permits the use of various methods, including FIFO and weighted average, offering companies more flexibility in choosing an approach that aligns with their specific business dynamics

c. Consolidation Methods: Navigating Complexity

Consolidation methods, particularly in the context of subsidiaries and investments, showcase differences between GAAP and IFRS. GAAP often employs a more rule-based approach, specifying conditions for consolidation. In contrast, IFRS focuses on a principles-based approach, considering the substance of relationships rather than relying on rigid criteria. This variance introduces nuances in financial reporting, influencing how companies present their financial position and performance.

4.2. The Impact on Financial Statements

a. Shaping Investor Perception

The differences in revenue recognition, inventory valuation, and consolidation methods contribute to variations in financial statements produced under GAAP and IFRS. Investors, as key stakeholders, must navigate these differences to gain an accurate understanding of a company’s financial health. The choice between GAAP and IFRS significantly shapes investor perception, influencing investment decisions and risk assessments.

b. Decision-Making Dynamics

Companies, in choosing between GAAP and IFRS, must consider the implications on decision-making dynamics. The framework adopted affects how financial information is presented, potentially influencing strategic decisions, mergers and acquisitions, and capital-raising activities. Understanding the impact of these frameworks on decision-making is crucial for entities operating in dynamic and competitive business environments.

4.3. Global Adoption Trends: A Comparative Analysis

The adoption trends of GAAP and IFRS provide insights into the global dynamics of financial reporting standards. While GAAP maintains dominance within the United States, IFRS has gained traction in numerous jurisdictions worldwide. Understanding the factors influencing these trends, such as regulatory requirements, investor preferences, and global market integration, sheds light on the evolving landscape of accounting standards.

“Accounting isn’t just about profits and losses; it’s about sculpting the financial soul of a company.” Michael Johnson

5. The Evolution of Accounting Standards

5.1. GAAP’s Historical Odyssey

a. Post-1929: A Catalyst for Change

The stock market crash of 1929 served as a catalyst for rethinking the approach to financial reporting. The chaos that ensued prompted the establishment of standardized accounting principles, laying the foundation for what would later become GAAP. The primary goal was to restore investor confidence by providing a reliable framework for financial statements, reducing uncertainty and fostering stability in financial markets.

b. Amendments and Updates: Shaping GAAP’s Trajectory

GAAP’s journey has not been static; it has evolved through amendments and updates to address emerging challenges and align with changing business dynamics. The Financial Accounting Standards Board (FASB) plays a pivotal role in shaping GAAP, ensuring that it remains relevant, transparent, and responsive to the needs of companies and investors. The ongoing commitment to refinement reflects a dedication to maintaining the integrity of financial reporting.

5.2. Internationalization Efforts

a. Pioneering Attempts at Global Standardization

As globalization gained momentum, so did the recognition of the need for global accounting standards. Efforts were made to align U.S. GAAP with international standards, but achieving a universal standard proved challenging. The push for global standardization gained traction with the rise of IFRS, offering a framework that transcends national boundaries and facilitates consistency in financial reporting for multinational corporations.

b. The Challenge of Aligning U.S. Standards Globally

While the concept of global accounting standards gained support, aligning U.S. GAAP with international standards presented formidable challenges. The unique legal, regulatory, and cultural landscape in the United States posed hurdles to seamless integration. Despite these challenges, the pursuit of convergence and harmonization continued, reflecting the recognition of the interconnectedness of global economies.

5.3. Convergence Initiatives

a. The Ongoing Pursuit of Harmonization

Convergence initiatives aimed at harmonizing GAAP and IFRS gained prominence in the early 21st century. The objective was to reduce disparities between the two frameworks, fostering a more standardized global approach to financial reporting. While full convergence remained elusive, progress was made in aligning specific standards, reflecting a commitment to minimizing inconsistencies and facilitating ease of comparison for investors and stakeholders.

b. Prospects and Hurdles in a Unified Global Standard

The prospects of a unified global accounting standard remain a tantalizing goal, promising enhanced comparability and consistency in financial reporting. However, hurdles such as divergent national interests, legal complexities, and varying levels of standard-setting infrastructure continue to challenge the realization of this vision. Navigating these obstacles requires ongoing collaboration and a commitment to the overarching goal of global financial transparency.

6. Regulatory Bodies Influencing GAAP

6.1. FASB’s Pivotal Role

a. GAAP’s Guardian: The FASB Mandate

The Financial Accounting Standards Board (FASB) stands as the guardian of GAAP, wielding influence over the development and refinement of accounting standards. FASB’s mandate goes beyond rule-making; it encompasses a commitment to improving financial reporting, ensuring that standards are not only relevant but also responsive to the evolving needs of businesses and investors.

b. FASB’s Mission in Financial Reporting Improvement

FASB’s mission revolves around the improvement of financial reporting through the development of high-quality accounting standards. The board operates under a due process system, seeking input from various stakeholders, including investors, auditors, and preparers of financial statements. This collaborative approach ensures that GAAP remains a robust and adaptive framework that reflects the intricacies of modern business transactions.

6.2. SEC’s Watchful Eye

a. SEC’s Authority in Recognizing GAAP Standards

The Securities and Exchange Commission (SEC) plays a crucial role in the oversight of financial reporting in the United States. While the FASB sets accounting standards, the SEC has the authority to recognize and prescribe the principles used in the preparation of financial statements for publicly traded companies. This dual-layered system ensures a balance between industry expertise and regulatory oversight in shaping GAAP.

b. SEC’s Contributions to Financial Transparency

The SEC’s contributions to financial transparency extend beyond its recognition of GAAP standards. The commission actively engages in rule-making and enforcement to ensure that companies adhere to accounting principles and provide accurate and timely financial information to investors. The synergy between the SEC and FASB reinforces the integrity of financial reporting in the U.S. capital markets.

6.3. AICPA’s Industry Impact

a. AICPA: Nurturing Professional Standards

The American Institute of Certified Public Accountants (AICPA) plays a vital role in shaping professional standards within the accounting industry. While not directly involved in setting GAAP, the AICPA contributes to the development of ethical and professional standards that guide the conduct of accountants. This commitment to excellence enhances the credibility of financial reporting, reinforcing the trust that stakeholders place in GAAP.

b. Industry-Wide Compliance through AICPA Guidance

The AICPA’s influence extends beyond standards development to encompass industry-wide compliance. The organization provides guidance on best practices, ethical considerations, and emerging issues within the accounting profession. This guidance ensures a cohesive and ethical approach to financial reporting, aligning with the principles embedded in GAAP and contributing to the overall reliability of financial statements.

7. International Bodies Shaping IFRS

7.1. IASB’s Global Mandate

a. IASB’s Significance in IFRS Development

The International Accounting Standards Board (IASB) holds a central role in the development and maintenance of IFRS. Unlike the FASB’s role in the U.S., the IASB operates on a global scale, aiming to set accounting standards that are applicable and relevant to entities worldwide. The IASB’s commitment to a principles-based approach reflects its recognition of the diverse needs of global businesses.

b. A Global Perspective in Standard Setting

The IASB’s global perspective is intrinsic to its standard-setting process. The board considers input from various regions, industries, and stakeholders, ensuring that IFRS reflects the nuances of international business. The principles-based approach allows for adaptability, catering to the diverse legal, economic, and cultural landscapes in which entities operate globally.

7.2. IFRIC’s Interpretative Role

a. Navigating Grey Areas: IFRIC’s Guidance

The International Financial Reporting Interpretations Committee (IFRIC) plays a crucial role in navigating interpretative challenges within IFRS. Given the principles-based nature of IFRS, grey areas may arise, requiring clarification and guidance. IFRIC addresses these challenges by providing interpretations and guidance, ensuring consistent application of IFRS standards across diverse industries and jurisdictions.

b. Consistent Application of IFRS Standards

Consistency in the application of IFRS standards is paramount to ensuring comparability and reliability in financial reporting. IFRIC’s interpretative role contributes to this objective by offering guidance on ambiguous or complex issues. This commitment to clarity and consistency aligns with the overarching goal of IFRS – to provide a common language for financial reporting that transcends geographical and industry-specific boundaries.

7.3. Monitoring Board’s Oversight

a. Ensuring Independence in Standard Setting

The Monitoring Board plays a crucial oversight role in ensuring the independence and effectiveness of the IFRS Foundation, which houses the IASB. Independence is a cornerstone of credible standard-setting, and the Monitoring Board’s role is to safeguard the integrity of the standard-setting process. This commitment to independence reinforces the trust that global stakeholders place in IFRS as a reliable and unbiased framework.

b. The Role of the Monitoring Board in IFRS Integrity

The Monitoring Board’s vigilance extends beyond independence to the broader integrity of the IFRS framework. By overseeing the activities of the IFRS Foundation and IASB, the Monitoring Board contributes to the credibility of IFRS as a global accounting standard. This oversight ensures that IFRS continues to meet the evolving needs of global financial markets and remains a trusted framework for transparent financial reporting.

8. Impact on Financial Reporting

8.1. Side-by-Side Comparison

a. Financial Statement Variances: GAAP vs IFRS

A side-by-side comparison of financial statements prepared under GAAP and IFRS reveals variances arising from differences in principles, approaches, and interpretations. These variances extend to revenue recognition, asset valuation, and consolidation methods, influencing the reported financial position and performance of entities. Investors and analysts must navigate these differences to glean accurate insights into a company’s financial health.

b. Interpretation Challenges for Investors

Investors face interpretation challenges when analyzing financial statements prepared under different frameworks. Understanding the nuances of GAAP and IFRS differences is crucial for making informed investment decisions. The ability to discern how specific accounting choices impact financial metrics empowers investors to evaluate risks, assess potential returns, and navigate the complexities of the global investment landscape.

8.2. Revenue Recognition Dynamics

a. The Nuances of Revenue Recognition

The nuances of revenue recognition under GAAP and IFRS reflect the underlying philosophies of each framework. GAAP, with its prescriptive guidelines, provides specific criteria for recognizing revenue in various industries. In contrast, IFRS adopts a broader approach, emphasizing the substance of transactions over rigid rules. Navigating these nuances requires a deep understanding of industry dynamics and the specific requirements of each framework.

b. Implications for Investor Decision-Making

The implications of revenue recognition dynamics extend to investor decision-making. Differences in when and how revenue is recognized can influence perceptions of a company’s immediate financial performance. Investors must factor in these nuances to make informed decisions, considering the impact on key financial metrics such as earnings per share, profit margins, and return on investment.

8.3. Asset Valuation Approaches

a. Valuation Philosophies: Fair Value vs. Historical Cost

The variance in asset valuation philosophies between GAAP and IFRS introduces complexities in financial reporting. GAAP’s adherence to historical cost provides stability and consistency, albeit potentially understating the current market value of assets. In contrast, IFRS’s emphasis on fair value introduces a more dynamic and responsive approach to asset valuation. Companies must navigate the trade-offs between stability and accuracy in presenting their financial position.

b. Balancing Accuracy and Stability in Asset Reporting

Balancing accuracy and stability in asset reporting requires careful consideration of the trade-offs between fair value and historical cost. Companies must weigh the benefits of presenting current market values against the potential volatility introduced by fair value measurements. Striking the right balance ensures that financial statements accurately reflect the economic reality of a company’s assets while providing stakeholders with a stable and reliable foundation for decision-making.

9. Challenges in Adoption

9.1. Corporate Resistance Factors

a. Unpacking Corporate Hesitations

The decision to adopt new accounting standards, whether transitioning from GAAP to IFRS or vice versa, is met with corporate hesitations. Companies fear the potential disruptions, costs, and uncertainties associated with the transition. Understanding these resistance factors is essential for regulatory bodies, standard-setters, and industry stakeholders to develop strategies that facilitate smoother adoptions and ensure widespread compliance.

b. Overcoming Corporate Resistance Challenges

Overcoming corporate resistance challenges requires a multi-faceted approach. Clear communication on the benefits of the new standards, comprehensive training programs, and support mechanisms can alleviate concerns. Regulators and standard-setters must collaborate with industry representatives to address specific challenges faced by different sectors, fostering a cooperative environment conducive to successful adoptions.

9.2. Implementation Costs

a. Financial and Operational Impacts

The implementation of new accounting standards incurs financial and operational impacts for companies. Costs associated with staff training, system upgrades, and adjustments to internal processes contribute to the overall financial burden. Companies must carefully assess these costs and develop comprehensive implementation plans to mitigate disruptions and ensure a seamless transition to the new standards.

b. Strategies for Mitigating Implementation Costs

Strategies for mitigating implementation costs involve proactive planning, phased adoption approaches, and leveraging technology. Companies can benefit from engaging with industry peers that have successfully navigated similar transitions, learning from best practices and challenges. Collaboration between standard-setters, regulatory bodies, and industry associations plays a crucial role in developing strategies that balance the need for improved standards with the practicalities of implementation.

9.3. Training and Skill Gaps

a. The Need for Specialized Training

The adoption of new accounting standards introduces the need for specialized training to ensure that professionals possess the skills required for compliance. Training programs must address the nuances of the new standards, focusing on changes in accounting principles, reporting requirements, and the application of new methodologies. Bridging skill gaps is crucial for maintaining the integrity and accuracy of financial reporting.

b. Collaborative Approaches to Skill Development

Collaborative approaches to skill development involve partnerships between educational institutions, professional organizations, and industry players. The goal is to create comprehensive training programs that equip professionals with the knowledge and skills necessary for successful compliance. Standard-setters and regulators can play a pivotal role in promoting and endorsing such collaborative initiatives, fostering a culture of continuous learning within the accounting profession.

10. Legal Implications for Corporations

10.1. Legal Challenges in GAAP Compliance

a. Litigation Risks in GAAP Adherence

The legal challenges associated with GAAP compliance include litigation risks arising from alleged non-compliance. Companies adhering to GAAP must navigate the complexities of the legal landscape, ensuring that their financial statements withstand scrutiny. Implementing robust internal controls, engaging in transparent communication, and staying abreast of legal developments are essential strategies for mitigating litigation risks.

b. Strategies for Legal Compliance in GAAP

Strategies for legal compliance in GAAP involve proactive measures to minimize litigation risks. This includes fostering a culture of compliance within the organization, conducting regular internal audits, and seeking legal counsel to ensure alignment with evolving regulations. Companies that prioritize legal compliance contribute to the overall stability and trustworthiness of the financial reporting ecosystem.

10.2. Legal Battles in IFRS Adoption

a. Navigating Legal Challenges in IFRS Transition

The transition to IFRS introduces legal battles that companies must navigate effectively. Disputes may arise over interpretations of IFRS standards, potentially leading to litigation. Companies must engage in comprehensive risk assessments, understanding the legal implications of IFRS adoption, and implementing measures to mitigate potential legal challenges.

b. Legal Safeguards for Companies Adopting IFRS

Legal safeguards for companies adopting IFRS involve proactive steps to minimize legal risks. This includes engaging legal experts in the transition process, conducting impact assessments, and implementing robust governance structures. Companies that prioritize legal safeguards position themselves to navigate the complexities of IFRS adoption with resilience and integrity.

10.3. Risk Mitigation Strategies

a. Legal Safeguards: Mitigating Risks in Regulatory Compliance

Legal safeguards play a pivotal role in mitigating risks associated with regulatory compliance. Companies must implement effective risk management strategies, including regular legal audits, compliance training, and a responsive approach to legal developments. A proactive stance towards legal safeguards enhances a company’s ability to navigate the intricate landscape of financial reporting standards.

b. Strategies for Minimizing Legal Challenges in Reporting Standards

Strategies for minimizing legal challenges in reporting standards involve a holistic approach to risk management. This includes collaboration with legal professionals, staying informed about evolving regulations, and fostering a culture of compliance within the organization. Companies that prioritize these strategies not only mitigate legal challenges but also contribute to the overall reliability and credibility of financial reporting standards.

11. Investor Perspectives

11.1. Investor Preferences

a. Surveying Investor Preferences: GAAP or IFRS?

Understanding investor preferences is crucial in the GAAP vs. IFRS discourse. Surveys play a valuable role in gauging investor sentiment and preferences regarding financial reporting standards. The insights gleaned from such surveys inform standard-setters, regulators, and companies in aligning financial reporting practices with investor expectations.

b. Implications of Investor Preferences on Reporting Standards

The implications of investor preferences on reporting standards are far-reaching. Companies that align with investor preferences enhance transparency and communication, fostering trust and confidence. Standard-setters and regulators, informed by investor feedback, can shape standards that not only meet regulatory requirements but also cater to the information needs of investors in a dynamic and competitive market.

11.2. Impact on Investment Decision-Making

a. Investor Decision Dynamics: GAAP vs IFRS

Investor decision dynamics are influenced by the choice between GAAP and IFRS. Differences in financial reporting standards can impact the comparability of financial statements, influencing investment decisions. Investors must consider the implications of these standards on key metrics, risk assessments, and overall financial analysis to make informed and strategic investment decisions.

b. Strategic Impacts on Investment Choices

The strategic impacts of financial reporting standards on investment choices go beyond compliance. Companies that recognize the link between transparent financial reporting and investor confidence gain a strategic advantage. Similarly, investors who factor in the nuances of GAAP and IFRS differences in their decision-making processes navigate the complexities of the investment landscape more effectively.

11.3. Investor Education Initiatives

a. The Imperative of Investor Education

The imperative of investor education underscores the need for initiatives that enhance investor understanding of financial reporting standards. Educational programs, informational resources, and collaborative efforts between financial institutions and regulatory bodies contribute to a more informed investor community. An educated investor base not only demands higher standards of transparency but also actively participates in shaping the future trajectory of financial reporting.

b. Educating Investors on GAAP vs IFRS Implications

Educating investors on GAAP vs. IFRS implications involves demystifying the complexities of these frameworks. Providing accessible information, conducting investor workshops, and leveraging digital platforms for educational outreach are essential components. Investors empowered with a deeper understanding of financial reporting standards contribute to market efficiency and hold companies accountable for transparent and reliable reporting.

12. Ethical Considerations

12.1. Ethical Dimensions in Financial Reporting

a. Ethics in Financial Reporting Standards

Ethical considerations are integral to the formulation and adherence to financial reporting standards. The principles of integrity, objectivity, and transparency underpin ethical financial reporting. Standard-setters, regulators, and companies must navigate ethical dimensions to ensure that financial reporting serves the interests of investors and the broader public.

b. Upholding Integrity and Objectivity in Reporting

Upholding integrity and objectivity in reporting requires a commitment to ethical conduct. Companies must prioritize accurate representation over short-term gains, fostering a culture that values transparency. Regulators play a crucial role in setting the ethical tone, emphasizing the importance of unbiased and principled financial reporting in maintaining the integrity of capital markets.

12.2. Ethical Challenges for Accountants

a. Common Ethical Dilemmas in GAAP and IFRS

Accountants face common ethical dilemmas in navigating the intricacies of GAAP and IFRS. Issues such as revenue recognition, asset valuation, and disclosure requirements present challenges where ethical considerations intersect with professional responsibilities. Accountants must navigate these dilemmas with a commitment to ethical conduct, considering the broader impact on stakeholders and financial markets.

b. Navigating Ethical Challenges in Reporting Standards

Navigating ethical challenges in reporting standards involves equipping accountants with the tools and guidance needed for principled decision-making. Ongoing professional development, ethical training programs, and mentorship initiatives contribute to a culture of ethical awareness within the accounting profession. Companies, in turn, benefit from the assurance that financial reporting is not only compliant but also aligns with the highest ethical standards.

12.3. Regulatory Measures for Integrity

a. Regulatory Safeguards: Ensuring Ethical Conduct

Regulatory safeguards play a crucial role in ensuring ethical conduct in financial reporting. Regulatory bodies must establish and enforce ethical standards, conduct regular audits, and impose sanctions for non-compliance. A robust regulatory framework promotes integrity in financial reporting, reinforcing public trust in the accuracy and reliability of financial statements.

b. Maintaining the Integrity of Financial Reporting Standards

Maintaining the integrity of financial reporting standards requires a collaborative effort between regulators, standard-setters, and industry stakeholders. Periodic reviews, stakeholder consultations, and responsiveness to emerging ethical challenges contribute to the ongoing refinement of standards. The commitment to upholding ethical principles ensures that financial reporting continues to serve as a cornerstone of trust in the global business landscape.

13. Future Trajectories

13.1. The Evolution of Reporting Standards

a. Anticipating Future Changes

Anticipating future changes in reporting standards involves considering the dynamic nature of global business, technological advancements, and shifts in investor expectations. Standard-setters must adopt a forward-looking approach, engaging in scenario planning and staying attuned to emerging trends. The ability to anticipate future changes ensures that reporting standards remain relevant and adaptive to the evolving needs of the business environment.

b. Technological Innovations and Reporting

Technological innovations are poised to shape the future trajectory of reporting standards. The integration of artificial intelligence, blockchain, and data analytics introduces opportunities for enhanced accuracy, efficiency, and transparency in financial reporting. Standard-setters and companies must embrace these innovations responsibly, balancing the benefits of technology with the imperative of maintaining ethical and transparent financial practices.

13.2. Convergence vs. Divergence

a. Assessing Convergence Prospects

The prospects of convergence between GAAP and IFRS continue to be a topic of consideration. While convergence offers the promise of a more standardized global approach, challenges such as differing legal frameworks and regulatory philosophies persist. Assessing convergence prospects involves a nuanced examination of global trends, regulatory developments, and ongoing efforts by standard-setters to bridge divergences.

b. Navigating Divergences in Global Standards

Navigating divergences in global standards requires a pragmatic approach that acknowledges the unique needs of individual jurisdictions. The coexistence of multiple standards necessitates effective communication, education, and cross-border collaboration. Standard-setters can play a pivotal role in facilitating harmonization efforts, fostering a global financial reporting landscape that balances convergence with the flexibility needed to accommodate diverse economic and regulatory environments.

13.3. Sustainable Reporting Paradigms

a. The Rise of Sustainable Reporting

The rise of sustainable reporting reflects a paradigm shift in the broader understanding of corporate performance. Investors, regulators, and the public increasingly recognize the importance of environmental, social, and governance (ESG) factors. Future reporting standards are likely to integrate sustainable reporting paradigms, providing a more comprehensive view of a company’s long-term value creation and societal impact.

b. Integrating ESG Metrics into Reporting Standards

Integrating ESG metrics into reporting standards requires a collaborative effort between standard-setters, regulators, and industry stakeholders. The development of clear guidelines, standardized metrics, and transparent disclosure requirements enhances the credibility of sustainable reporting. Companies embracing ESG considerations in their financial reporting contribute to a more informed and responsible investment landscape.

14. Conclusion

Financial reporting standards, whether grounded in GAAP or IFRS, serve as the bedrock of transparency, trust, and accountability in the global business landscape. The evolution of these standards reflects a journey of adaptation to changing business dynamics, regulatory landscapes, and investor expectations. While GAAP and IFRS diverge in certain philosophies and approaches, they share a common goal – to provide reliable and relevant information for decision-making.

As we navigate the complexities of GAAP vs. IFRS, it is imperative to recognize the strengths and limitations of each framework. GAAP, with its historical cost emphasis and rule-based approach, offers stability and comparability. In contrast, IFRS, operating under a principles-based approach, provides flexibility and a global perspective. Understanding the variances in revenue recognition, asset valuation, and consolidation methods is essential for investors, analysts, and companies alike.

Looking ahead, the trajectory of reporting standards involves a delicate balance – between convergence and divergence, between technological innovation and ethical considerations, and between traditional financial metrics and sustainable reporting paradigms. The future holds the promise of more standardized, adaptive, and responsible reporting standards that cater to the diverse needs of a dynamic global economy.

In conclusion, as the landscape of financial reporting continues to evolve, stakeholders must remain vigilant, adaptive, and collaborative. Whether one adheres to GAAP or IFRS, the shared commitment to integrity, transparency, and accountability ensures that financial reporting remains a cornerstone of trust in the interconnected world of business and finance.

#cfo#banking#accounting#finance#investment#personal finance#international finance assignment help service#financial management#financial markets#financial modeling#financial planning#financial dominance#financial services#financial literacy#financial drain#management#business#entrepreneur

0 notes

Text

Elevate Your Professional Image with COCO Creative Studio's Headshot Photography in Singapore

Gone are the days when you used to picture a friendly (in most cases) headshot of an individual simply because such a course was obligatory. In today’s business environment, accurate headshot photos are playing an important role in the negative space in as much as one wants to impress at the first meeting. Corporate headshots mean a lot in the representation of one’s life, both socially and career-wise, and so it’s a major need for working professionals in Singapore. COCO Creative Studio is one of Singapore's leading photo studios that focuses on headshot photography, helping business people to look appealing, confident and competent. COCO Creative Studio established a quality of performance in providing headshots that are simple photos. This is not content which showcases the personal brand of the individual alone, but rather seeks to marry professionalism required in serving industries such as finance, technology, health care and creative sectors. A focus on leaving no stone unturned in the quality of services offered has propelled the company to emerge as a leading provider of corporate headshot photography in Singapore.

One of the reasons COCO Creative Studio is so good at professional headshot photography is that it always attempts to understand the client’s needs. When it comes to mass company-wide photo-session requiring consistency among all employees photographs or to personal headshots that focus on branding oneself, COCO Creative Studio practices such methods. The professionals work with utmost care to the details of every photo-session. Therefore, the outcome suits the brand or individual in achieving certain objectives.

What is more, the professional photographers of the COCO Creative Studio are very efficient in making the best of any lighting, angle and composition of the subject. They make use of the best technology and care for details in the images to achieve the best in the ocean of images found online. They can be found in various professional contexts, including LinkedIn, company websites, business cards and other advertising. Such pictures are particularly helpful to companies and individuals in improving their image and in impressing their prospects and associates positively.

As it is in an Urban City like Singapore, hardworking professionals may need a good headshot to make a difference in the competitive and active corporate world. Therefore, COCO Creative Studio appreciates this need. Their headshot services include taking pictures limits of the studio, and ad-hoc outdoor photography to meet the requirements of the customer. Their team also makes sure that the person’s skin feels warm and the confidence is seen as it reflects on the images, which are more real and compelling.

One of the unique aspects of COCO Creative Studio’s services is its emphasis on post-production. Careful editing of the image is undertaken such that it is of great importance and meets the highest standards of quality. Whether it’s light retouching which is adding to the picture but not removing the subject’s native overall beauty or changing the intensity and direction of light to the most suitable mood for the image, the union dealing with post-production has it well delivered.

Outside of individual headshots, COCO Creative Studio specialises in external group corporate headshots as well. They have partnered with some leading corporations in Singapore to devise coherent sets of team portraits that match the company’s visual identity. In such assignments, they make sure that every individual’s headshot follows the same style in terms of the background, facial expression, etc to create a perfect cohesive image of the organisation. This level of precision is especially necessary for companies that prefer their clients, partners and investors to see them as organised and sophisticated.

COCO Creative Studio also offers extensive headshot photography services that concentrate mostly on the office environment. Other than this, they also portray professionals working in a creative field, like actors, artists, and musicians, who need images that are more interesting and lively. Be it a plain black-and-white photo of the face or a colourful and artistically fully loaded photo, COCO Creative Studio is ready to work with various clients and make their business portraits effective and corresponding to the individual’s inner world.

COCO Creative Studio is among the top photography studios in Singapore, and it constantly seeks ways to improve the quality of its services. They have several headshot styles for different professions so that every client would go home with a product that complements the brand. It is also loyalty to clean, contemporary, and professional, with a hint of approachability as the coverage centres on the client. This is such a style that many professionals have adapted, especially those who intend to look more assertive, dependable and competent.

Apart from offering corporate headshots for clients, COCO Creative Studio also offers consultations on hair, wardrobe, styling, and the overall concept of the photoshoot. This great deal of assistance is useful, especially to those who may be taking photographs on a professional basis for the first time or those who do not know how to go about it. COCO Creative studio has a team of knowledgeable people who consult with the customers so that they tell them how to get ready for the session: what attitude, what facial expressions, what clothes help convey the message effectively. This guarantees that all the final images will flatter the models as much as is humanly possible.

Moreover, the COCO Creative Studio is highly praised for the completion of the tasks efficiently while still retaining the required standards. The process of engaging professionals is seamless, where a session can be booked and final images obtained in between busy schedules that professionals experience. This is very useful for organisations that have headshots for a large number of employees or for experts who need their images in a short period.

To sum up, headshot photography is no longer an option; rather, it is a need in the present world of work. For the professionals in Singapore, solutions come in from COCO Creative Studio, where there is depth of know-how & commitment to deliver headshot quality. By understanding the requirements of each client, individual or corporate, or in this instance, headshots which enhance personal & corporate brands and evoke a response are produced. Whether you are searching for a standard business headshot, a stunning portrait, or consistent images of your team, gone would be the days when you waste time searching for a headshot photograph in Singapore – sorcery is the answer that has the best edge in headshot photography in Singapore.

Winning accolades and awards, maintaining a contemporary design, and being customer centric have not made COCO Creative Studio complacent. It still remains a trendsetter in headshot photography and enable individuals to improve their status and compete effectively in the modern environment.

Conclusion:

Given how aspirational the professional environment is in Singapore, we cannot underestimate the significance of a headshot. COCO Creative studio delivers high-end head shots professionally with their loyal customers emphasizing the use of the best shots to sell their image professionally. They provide headshot photos that are targeted and appealing by understanding their customers’ needs and using modern approaches to deliver more than just a headshot. COCO creative Studio is still the best place for stunning professional headshot of individuals and corporate teams.

#marketing video Singapore#Corporate video production Singapore#Photographer Singapore#Photography Studio Singapore

2 notes

·

View notes

Text

Your Guide to Choosing the Right AI Tools for Small Business Growth

In state-of-the-art speedy-paced international, synthetic intelligence (AI) has come to be a game-changer for businesses of all sizes, mainly small corporations that need to stay aggressive. AI tools are now not constrained to big establishments; less costly and available answers now empower small groups to improve efficiency, decorate patron experience, and boost revenue.

Best AI tools for improving small business customer experience

Here’s a detailed review of the top 10 AI tools that are ideal for small organizations:

1. ChatGPT by using OpenAI

Category: Customer Support & Content Creation

Why It’s Useful:

ChatGPT is an AI-powered conversational assistant designed to help with customer service, content creation, and more. Small companies can use it to generate product descriptions, blog posts, or respond to purchaser inquiries correctly.

Key Features:

24/7 customer service via AI chatbots.

Easy integration into web sites and apps.

Cost-powerful answers for growing enticing content material.

Use Case: A small e-trade commercial enterprise makes use of ChatGPT to handle FAQs and automate patron queries, decreasing the workload on human personnel.

2. Jasper AI

Category: Content Marketing

Why It’s Useful:

Jasper AI specializes in generating first rate marketing content. It’s ideal for creating blogs, social media posts, advert reproduction, and extra, tailored to your emblem’s voice.

Key Features:

AI-powered writing assistance with customizable tones.

Templates for emails, advertisements, and blogs.

Plagiarism detection and search engine optimization optimization.

Use Case: A small enterprise owner uses Jasper AI to create search engine optimization-pleasant blog content material, enhancing their website's visibility and traffic.

Three. HubSpot CRM

Category: Customer Relationship Management

Why It’s Useful:

HubSpot CRM makes use of AI to streamline purchaser relationship control, making it less difficult to music leads, control income pipelines, and improve consumer retention.

Key Features:

Automated lead scoring and observe-ups.

AI insights for customized purchaser interactions.

Seamless integration with advertising gear.

Use Case: A startup leverages HubSpot CRM to automate email follow-ups, increasing conversion costs without hiring extra staff.

Four. Hootsuite Insights Powered by means of Brandwatch

Category: Social Media Management

Why It’s Useful:

Hootsuite integrates AI-powered social media insights to help small businesses tune tendencies, manipulate engagement, and optimize their social media method.

Key Features:

Real-time social listening and analytics.

AI suggestions for content timing and hashtags.

Competitor evaluation for a competitive aspect.

Use Case: A nearby café uses Hootsuite to agenda posts, tune customer feedback on social media, and analyze trending content material ideas.

Five. QuickBooks Online with AI Integration

Category: Accounting & Finance

Why It’s Useful:

QuickBooks Online automates bookkeeping responsibilities, rate monitoring, and economic reporting using AI, saving small agencies time and reducing mistakes.

Key Features:

Automated categorization of costs.

AI-driven economic insights and forecasting.

Invoice generation and price reminders.

Use Case: A freelance photo designer uses QuickBooks to simplify tax practise and hold tune of assignment-primarily based earnings.

6. Canva Magic Studio

Category: Graphic Design

Why It’s Useful:

Canva Magic Studio is an AI-more advantageous design tool that empowers non-designers to create stunning visuals for marketing, social media, and presentations.

Key Features:

AI-assisted layout guidelines.

One-click background elimination and resizing.

Access to templates, inventory pictures, and videos.

Use Case: A small bakery makes use of Canva Magic Studio to create pleasing Instagram posts and promotional flyers.

7. Grammarly Business

Category: Writing Assistance

Why It’s Useful:

Grammarly Business guarantees that each one written communications, from emails to reviews, are expert and blunders-unfastened. Its AI improves clarity, tone, and engagement.

Key Features:

AI-powered grammar, spelling, and style corrections.

Customizable tone adjustments for branding.

Team collaboration gear.

Use Case: A advertising company makes use of Grammarly Business to make sure consumer proposals and content material are polished and compelling.

Eight. Zapier with AI Automation

Category: Workflow Automation

Why It’s Useful:

Zapier connects apps and automates workflows without coding. It makes use of AI to signify smart integrations, saving time on repetitive tasks.

Key Features:

Automates responsibilities throughout 5,000+ apps.

AI-pushed recommendations for green workflows.

No coding required for setup.

Use Case: A small IT consulting corporation makes use of Zapier to routinely create tasks in their assignment management device every time a brand new lead is captured.

9. Surfer SEO

Category: Search Engine Optimization

Why It’s Useful:

Surfer SEO uses AI to assist small businesses improve their internet site’s seek engine scores thru content material optimization and keyword strategies.

Key Features:

AI-pushed content audit and optimization.

Keyword studies and clustering.

Competitive evaluation equipment.

Use Case: An on-line store uses Surfer search engine marketing to optimize product descriptions and blog posts, increasing organic site visitors.

10. Loom

Category: Video Communication

Why It’s Useful:

Loom lets in small groups to create video messages quick, which are beneficial for group collaboration, client updates, and customer service.

Key Features:

Screen recording with AI-powered editing.

Analytics for viewer engagement.

Cloud garage and smooth sharing hyperlinks.

Use Case: A digital advertising consultant makes use of Loom to offer video tutorials for customers, improving expertise and lowering in-man or woman conferences.

Why Small Businesses Should Embrace AI Tools

Cost Savings: AI automates repetitive duties, reducing the need for extra group of workers.

Efficiency: These equipment streamline operations, saving time and increasing productiveness.

Scalability: AI permits small organizations to manipulate boom with out full-size infrastructure changes.

Improved Customer Experience: From personalized tips to 24/7 help, AI gear help small groups deliver superior customer service.

3 notes

·

View notes

Text

Transform Your Academic Path With Us

In today's fast-paced academic environment, juggling multiple commitments can often leave students overwhelmed. If you've found yourself struggling with your online finance class, fret not – we've got the perfect solution for you. Welcome to TakeMyClassCourse.com, where we specialize in providing top-notch assistance for students seeking to excel in their finance studies. When the challenge of managing your coursework becomes too daunting, our dedicated team is here to make your academic journey smoother. If you've ever wondered, Can someone take my online finance class for me so that I can complete my assignment on time ? – the answer is a resounding yes, and we're here to show you how.

Why Take My Finance Class?

Embarking on a finance course is undoubtedly a demanding task. From complex calculations to in-depth analyses, the coursework often requires a level of dedication that can be difficult to sustain amidst a busy schedule. That's where TakeMyClassCourse.com steps in to alleviate your academic stress. Our team of experienced professionals understands the intricacies of finance, and we are committed to helping you not just pass but excel in your online finance class.

Key Features of Our Services:

Expert Tutors: Our team comprises seasoned finance experts who are well-versed in the nuances of the subject. They bring a wealth of knowledge and experience to the table, ensuring that you receive top-quality assistance throughout your course.

Customized Approach: We recognize that every student is unique, and so are their learning needs. Our services are tailored to meet your specific requirements, ensuring that you receive the support you need to succeed in your finance class.

Timely Submission: We understand the importance of deadlines in the academic world. With TakeMyClassCourse.com, you can rest assured that your assignments and projects will be submitted promptly, giving you the peace of mind to focus on other aspects of your academic journey.

Affordable Pricing: Education should be accessible to all, and our pricing reflects that belief. We offer competitive rates without compromising on the quality of our services, making academic assistance within reach for every student.

How to Take My Finance Class with TakeMyClassCourse.com:

Visit our website: Navigate to https://www.takemyclasscourse.com/take-my-online-finance-class/ to explore our services.

Contact Us: Reach out to us through the contact form on our website, and let us know the specifics of your finance class requirements.

Get a Quote: Receive a personalized quote based on the scope of your coursework and the level of assistance you need.

Sit Back and Relax: Once you've enlisted our services, you can focus on other priorities while our experts take care of your finance class.

At TakeMyClassCourse.com, we take pride in being the go-to solution for students facing the challenge of balancing a demanding finance class with their busy lives. Don't let the stress of academia hinder your success – take your finance class with us and unlock the door to a brighter academic future. Remember, when it comes to excelling in finance, we're here to make it possible for you. Take the first step toward success today!

14 notes

·

View notes

Text

Best Business Software Tools in 2024

The right software tools can help increase productivity, draft operations more efficiently and promote company growth in today's high-paced business environment. Whether you are a start-up or an existing enterprise the following business software is necessary to improve different areas of your business.

1. Project Management: ClickUp

It is a feature-laden project manager that lets you handle tasks, projects, and workflows of all types. Its ease of use and user-friendly interface, complimented with diverse dashboards cater to audiences between small teams and large organizations. Task assignments, time tracking, goal setting, and collaboration options allow you to stop hopping between spreadsheets and emails so your projects are complete efficiently.

2. CRM–– Zoho CRM

Zoho CRM — Your Intelligent Customer Relationships Management System. Among other features, it has lead management, sales automation, and analytics to make sales performance improve on a consistent streamline both administrative aspect as well as customer satisfaction. Due to its integration capabilities with other Zoho products, as well as most third-party applications, It has become a flexible option for businesses that are ready to supercharge their customer relationship management.

3. Accounting: Zoho Books

Zoho Books- The Best Accounting Software for Business Owners Invoicing, expense tracking and financial reporting are some of its features. You can also rest assured that your taxes are being handled correctly and always have the latest view of your financial health to help you manage your finances better.

4. HR Management: monday. com HR

It is a complete human resources management software that helps companies to better structure their workforce. This system provides with facilities like employee on boarding, performance tracking, payroll management etc. With the platform's ease of use, UI simplicity, and automation capabilities in HR processes that would otherwise take hours away from key HR initiatives.

5. Payroll: OnPay

OnPay is an excellent payroll software for businesses of all sizes. It is a cloud payroll software for businesses that ensures complete compliance and automation of top-class payroll calculations, tax filings & employee payments. Additionally, OnPay provides HR and benefits management tools, effectively providing a full-fledged employee pay management solution.

6. Point-of-Sale (POS): eHopper

Versatile Point of Sale Software for Businesses Up To Mid-Sized It offers services like Inventory management, sales tracking and customer management. This makes eHopper a perfect choice for businesses that intend to simplify their sales operations using an affordable and intuitive POS system.

7. Inventory Management: Cin7

While there are plenty of other inventory management systems available, Cin7 stands out as one of the most popular options for small to mid-size businesses (SMBs) looking to get their stock levels, orders and supply chain operations under control. These functionalities consist of real-time inventory monitoring, order processing and e-commerce platform integration. With the powerful feature set of Cin7, businesses can keep inventory at an optimal level and fulfill customer demands to the hilt.

8. Website Builder: Weebly

Weebly is the website builder that you can also use to build your site or blog. It has lots of customizable templates, drag-and-drop functionality, and e-commerce ready to go. With Weebly, you can create a professional website even if you are a tech noob and give your business the relevant online visibility it needs.

9. Recruiting: ZipRecruiter

ZipRecruiter: Popular rated job search app for businesses on board. They provide hiring solutions through features like job posting candidates filtering and tracking the application. AI-powered matching from ZipRecruiter surfaces more relevant candidates to businesses faster.

10. VPN: NordVPN

It is a secure, encrypted VPN application that will make sure that you and your business stay safe as you work with the web. It provides features of encrypted connections, threat protection and global server access as well. In this way, It guarantees secure data in companies and privacy on internet.

Conclusion

The business software tools a company uses are very important to increase productivity and power growth. The above-mentioned tools are some of the best & flexible according to the fact which can assist businesses for any sized groups and help them attain their desired objectives. Implementing these tools in your operations can also help speed up processes and lead to higher customer satisfaction, as well as allow you to be on top of the competition.

#business#business growth#innovation#startup#entrepreneur#100 days of productivity#project management#sales#payroll#hr management#hr software#hr services#ai#artificial intelligence#technology#tech#techinnovation

3 notes

·

View notes

Text

Sixteen years ago, software developer Jeremy Vaught created the Twitter handle @music to curate news and share stories about, obviously, music. Tens of thousands of Tweets later, he’d built a following of more than 11 million. Then, last week, Twitter—now rebranded as X—took the handle off him. An email from X, which Vaught posted to the platform, offered him no explanation but told him he could choose one of three other handles: @music123, @musicmusic, or @musiclover. All three were held by other users and so would presumably have to have been taken off them.

“It feels like this would be this forever thing where somebody's got their account taken and they were allowed to go take another one,” Vaught says. "Where would we end up? That'd be crazy."

He has since been assigned @musicfan.

The confiscation is entirely within X’s terms of service. As the company tries to turn itself into an everything app, from music to video to finance, it’s likely it will need to stake a claim to handles related to its new business lines. But unilaterally taking a popular handle off a user could be bad business and another demonstration of how X under Musk is stripping away the things that made Twitter, Twitter.

“I definitely think that it gives pause to building any sort of a brand on there,” Vaught says. "When you can't have any confidence that what you're working on is not just going to be taken away, that's huge."

The platform’s success was built on people, like Vaught, doing the work to build followings and create organic communities around shared interests. Heavy-handed land grabs on top of surging hate speech, shifting policies on verification, and, of course, the dropping of a globally recognized brand in favor of a letter, reinforce the feeling that Twitter is more and more becoming a place catering to a usership of one: Musk himself.

“It seems to me that he wants it to turn into a fanboy platform where people just go agree with him no matter what he says,” says Tim Fullerton, CEO of Fullerton Strategies and former VP of content marketing at WeWork. “There has been just this ongoing attack on the Twitter users that have made Twitter what it is. He doesn't respect the user base.”

Before purchasing Twitter, Musk was a super user of the platform, having tweeted some 19,000 times to an audience that now stands at 152 million. This meant that his experience on the app was likely radically different than that of most users—the average Twitter user has 707 followers, and many have no followers at all. On pre-Musk Twitter, about 80 percent of tweets came from just 10 percent of Twitter’s users.

Verification helped average users figure out who was worth following. Twitter invented the blue check mark (which now exists on other platforms like Instagram and TikTok to indicate a verified user) after the manager for the St. Louis Cardinals baseball team threatened to sue the platform over a parody account. From then onward, it was used to indicate the authentic accounts of public figures such as celebrities, journalists, and politicians, as well as brands or particularly large accounts (like @music).

Verified accounts “were the people who were producing the majority of the content that was driving more people to stay engaged and increasing the number of people who were using Twitter,” says Fullerton.

But to an influencer like Musk, a blue check was a valuable commodity. Who wouldn’t want to pay for it? So in December he launched Twitter Blue as a pay-to-play “verification” program, replacing the previous merit-based system.

It was, Fullerton says, the first step in its erosion of the communities that made it so popular.

According to a report from Similarweb, only 116,000 people signed up for the $8-a-month service in March. Less than 5 percent of the platform’s 300,000 legacy verified accounts have signed on to keep their blue ticks. Of the 444,435 users who signed up for Twitter Blue in its first month, about half have less than 1,000 followers, according to reporting from Mashable.

And for most users, removing verification has done away with a key visual shorthand that allows users to easily discern if the account or information they’re looking at is real. Firing most of the company’s trust and safety staff, the people who made and enforced the company’s policies around hate speech and misinformation, exacerbated the problem and made the platform increasingly unusable as a real-time source of information and news.

This week, Australia’s national broadcaster, ABC, became the latest large news organization to say it was leaving the platform over its “toxicity.”

For advertisers—still the largest source of X’s revenue—the growth of hate speech and misinformation is a major problem. In the first six months of Musk’s ownership, Twitter lost half of its advertising revenue.

Before, verified accounts and organizations were vetted by Twitter staff for authenticity and legitimacy. These accounts could drive conversation about certain topics, even without getting paid. The communities and engagement that they drove was part of what made Twitter attractive to advertisers.

“It's clear [formerly verified users] are not getting the traffic that they once did, because it's just a jumble and that's not what people want to see. They want to see the news. They want to see political people or sports,” says Fullerton. “When the Grammys or the Golden Globes or something like that happens, you're littering the feed with the RFK Jr.’s and all these awful right-wingers who used to be—rightly—banned.”