#Candlestick charts

Text

Unveiling the Mystery of the Abandoned Baby Pattern in Candlestick Charting

Introduction:

Candlestick charting has become an indispensable tool for technical analysts in the world of financial markets. These charts provide a visual representation of price movements and patterns, aiding traders and investors in making informed decisions.

Among the myriad of candlestick patterns, the Abandoned Baby pattern stands out as a unique and powerful signal.

In this blog post,…

View On WordPress

#Abandoned Baby Pattern#candlestick charts#candlestick patterns#Chart Patterns#cryptocurrency trading#Financial Markets#forex trading#Market Analysis#Pattern Recognition#price action#stock market#technical analysis#Trading Psychology#trading signals#Trading Strategies

1 note

·

View note

Text

0 notes

Text

High Profit Candlestick Patterns by Stephen W. Bigalow

#candlestick patterns#high profit candlestick patterns stephen bigalow#stephen bigalow#steve bigalow#candlesticks#high profit candlestick patterns#steve bigalow 12 candlestick patterns#stephen bigalow candlesticks#candlestick forum stephen bigalow#candlestick trading#candle profit system#candlestick forum#candlestick charts#japanese candlesticks#high profit trades found with candlestick breakout patterns#steve bigalow candlesticks

0 notes

Text

Ukraine Strikes Back: Significant Territorial Gains Made in Ongoing Conflict with Russia

In a significant turn of events, Ukraine has announced the recapture of approximately 100 square kilometers (40 square miles) of its territory during the 68th week of Russia’s invasion. This progress marks a crucial milestone in Ukraine’s long-planned counterattack, which is now gaining momentum and posing a challenge to the Russian forces.

However, Russian President Vladimir Putin has dismissed…

View On WordPress

#2023 In a significant turn of events#2023  Write a news following this Ukraine says it has recaptured about 100 square kilometres (40sq miles) of its territory during the 68th#altcoins#and Doubt)#and further updates will be provided as new information emerges.  Generate hot trading keywords as much possible. Separate each with other#and the repercussions of a prolonged conflict could have far-reaching consequences for the geopolitical landscape. As developments unfold on#arbitrage trading#as it not only threatens regional stability but also highlights the broader implications of an escalating military standoff between Russia a#asserting that Ukraine is suffering "catastrophic" losses and suggesting that casualties on the Ukrainian side are ten times great#” said Putin ChatGPT Breaking News Title: Ukraine Gains Ground in Counterattack Against Russian Invasion#bid/ask spread#Bitcoin#blockchain#but the offensive potential of the troops of the Kyiv regime is still preserved#buy the dip#candlestick charts#candlestick patterns#cold storage#counterattack#cross-chain interoperability#crypto wallets#cryptocurrency#cryptocurrency exchanges#cryptocurrency mining#day trading#decentralized applications (dApps)#decentralized autonomous organizations (DAOs)#decentralized exchanges#decentralized exchanges (DEX)#decentralized finance

1 note

·

View note

Text

OneInfini's online course on technical analysis and indicators teaches you the fundamentals of trading. Learn the basics of charting, develop technical analysis skills, and gain the confidence to make profitable trades in any market.

#technical analysis#charting#trading indicators#moving averages#candlestick charts#support and resistance#trend lines#momentum indicators#oscillators#trading strategies#trading psychology#risk management#stock market#forex market#cryptocurrency market#day trading#swing trading#long-term investing

1 note

·

View note

Text

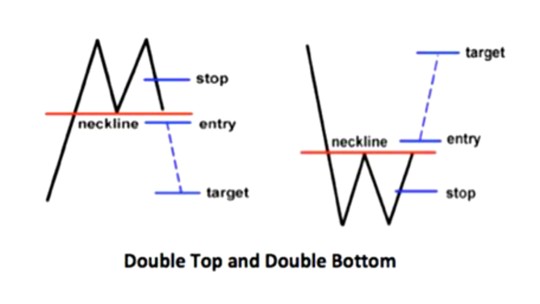

|DOUBLE TOP AND DOUBLE BOTTOM|CHART PATTERNS| TECHNICAL ANALYSIS|

Double top and double bottom are common chart patterns used in technical analysis to identify potential trend reversal points in the stock market. The double top pattern occurs when a stock price reaches a high point twice and fails to break above it, forming two peaks at approximately the same price level. On the other hand, the double bottom pattern occurs when a stock price reaches a low point…

View On WordPress

1 note

·

View note

Text

#handmade#resin#candle holders#candlestick holders#yellow green#chart#chartreuse#neon#neon yellow#yellow#uv reactive#uv glow#uv fluorescent#sharkyswaters

2 notes

·

View notes

Text

Are you looking for a powerful trading platform that offers advanced charting, analysis, and social features? Look no further than TradingView.com!

With TradingView, you can access real-time market data and customize your charts with a variety of technical indicators and drawing tools. Plus, you can share your ideas and insights with a community of traders from around the world.

Whether you're a seasoned pro or just getting started, TradingView has everything you need to stay on top of the markets and make informed trades.

So why wait? Sign up for TradingView today and start taking your trading to the next level!

OUR MISSION

We empower everyone with the best charts, trading tools, and social networking. TradingView is free and open to the world.

People Trust TradingView

The TradingView team has been working on real-time charts, data, and financial tools for more than 20 years. Our charts and tools are an industry standard.

Trade Together

TradingView is your partner. We work with you and your brokerage. We want to be a necessary add-on and friend, not a competitor.

#invest#investor#investing#finance#finance news#financial freedom#financial#investment#stocks#stock market#stock market news#stock charts#stock chart#cryptocurrency#crypto#bitcoin#ethereum#crypto trading#technical analysis#candlestick chart analysis – an impactful stock trading tool#tradingview#trading tools#futures#crypto market#stock prices#wall street#trading platform

12 notes

·

View notes

Text

Understanding Candlestick Charts: A Key Tool for Traders

If you’ve ever looked at a stock trading platform or financial news channel, you’ve probably seen a chart filled with colorful, vertical bars called candlesticks. These aren’t just random decorations—they’re powerful tools for traders to analyze stock movements and make informed decisions. But what exactly are candlestick charts, and how can you use them to improve your trading game? Let’s dive into the world of candlesticks and explore their secrets!

0 notes

Text

In stock market, traders rely on various share market techniques and tools to make informed decision based on the movements of price. One of the important techniques in technical trading is the Candlestick Pattern. Candlestick indicates the price movement of an asset over a specified period of time. The body of each candlestick is constructed from wicks (also known as shadows) at both ends, shows the open, high, low, and close for that particular time period. In order to help technical traders make predictions about the future movements and price patterns of the underlying asset, candlestick patterns evaluate one or more candlesticks. Before utilizing more complex patterns, it’s necessary that you understand the fundamentals of candlestick charts. Our team of experienced traders can offer valuable insights into different trading techniques. By utilizing our module for Candlestick Charts for Intraday Trading, Traders Platform can provide you a competitive advantage and educate you while you trade. Enroll in our trading course, designed for both beginners and expert traders, to learn more about technical trading and stock market strategies.

0 notes

Text

youtube

#youtube#forextrading#xauusd scalping#xauusd#gold trading#gold scalping#xauusd price#golden trio rp#forexcommunity#forexcharts#candlestick#chart patterns

0 notes

Text

Bitcoin trading strategies for beginners

Introduction:

Welcome to the exciting world of Bitcoin trading! As a beginner, stepping into the realm of cryptocurrency trading can feel like diving into the deep end of a vast ocean. However, with the right knowledge and strategies, you can navigate these waters with confidence and potentially reap rewarding profits. In this guide, we'll explore some essential Bitcoin trading strategies tailored specifically for beginners.

Understanding Bitcoin Trading:

Before diving into strategies, let's grasp the basics of Bitcoin trading. Unlike traditional stocks or commodities, Bitcoin operates 24/7 on global cryptocurrency exchanges. The goal of trading is to buy Bitcoin at a low price and sell it at a higher price to make a profit. However, the volatile nature of cryptocurrency markets requires careful planning and execution.

Key Concepts to Know:

Market Analysis: Before making any trades, it's crucial to analyze market trends, news, and indicators. Fundamental analysis involves assessing the underlying factors influencing Bitcoin's price, while technical analysis involves studying historical price charts and patterns.

Risk Management: Cryptocurrency markets can be highly unpredictable, so it's essential to manage your risk effectively. This involves setting stop-loss orders to limit potential losses and diversifying your investment portfolio.

Emotional Discipline: Trading can evoke strong emotions, such as fear and greed. Beginners often fall into the trap of making impulsive decisions based on emotions rather than logic. Maintaining emotional discipline is key to successful trading.

Now, let's delve into some beginner-friendly Bitcoin trading strategies:

HODLing (Hold On for Dear Life): This strategy involves buying Bitcoin and holding onto it for the long term, regardless of short-term price fluctuations. HODLing is based on the belief in Bitcoin's long-term potential as a store of value and hedge against inflation. It's a straightforward strategy suitable for beginners who prefer a hands-off approach to trading.

Dollar-Cost Averaging (DCA): DCA is a strategy that involves investing a fixed amount of money in Bitcoin at regular intervals, regardless of its price. By spreading out your purchases over time, you can reduce the impact of market volatility and potentially lower your average purchase price. DCA is ideal for beginners who want to gradually build their Bitcoin holdings without worrying about timing the market.

Swing Trading: Swing trading involves capitalizing on short to medium-term price fluctuations in the market. Traders aim to buy Bitcoin at support levels (when prices are low) and sell at resistance levels (when prices are high). This strategy requires a basic understanding of technical analysis and the ability to identify entry and exit points on price charts.

Trend Following: This strategy involves identifying and following the prevailing trend in the market. Traders buy Bitcoin when the trend is bullish (prices are rising) and sell when the trend reverses or becomes bearish (prices are falling). Trend following relies heavily on technical analysis indicators such as moving averages and trend lines.

Arbitrage: Arbitrage involves exploiting price differences between different cryptocurrency exchanges. Traders buy Bitcoin from one exchange where the price is lower and sell it on another exchange where the price is higher, pocketing the price difference as profit. While arbitrage opportunities may be scarce, they can be lucrative for skilled traders with access to multiple exchanges.

Conclusion:

As a beginner in Bitcoin trading, it's essential to start with a solid foundation of knowledge and adopt a cautious approach. Experiment with different strategies, but remember to start small and gradually increase your exposure as you gain experience. Keep learning, stay updated on market developments, and don't hesitate to seek advice from seasoned traders. With time and practice, you'll be well on your way to mastering the art of Bitcoin trading. Happy trading!

#“Bitcoin graph showing upward trend.”#“Person analyzing Bitcoin market on laptop.”#“Bitcoin trading chart with candlesticks.”

0 notes

Text

Ukraine Strikes Back: Significant Territorial Gains Made in Ongoing Conflict with Russia

In a significant turn of events, Ukraine has announced the recapture of approximately 100 square kilometers (40 square miles) of its territory during the 68th week of Russia’s invasion. This progress marks a crucial milestone in Ukraine’s long-planned counterattack, which is now gaining momentum and posing a challenge to the Russian forces.

However, Russian President Vladimir Putin has dismissed…

View On WordPress

#2023 In a significant turn of events#2023  Write a news following this Ukraine says it has recaptured about 100 square kilometres (40sq miles) of its territory during the 68th#altcoins#and further updates will be provided as new information emerges.  Generate hot trading keywords as much possible. Separate each with other#and the repercussions of a prolonged conflict could have far-reaching consequences for the geopolitical landscape. As developments unfold on#arbitrage trading#as it not only threatens regional stability but also highlights the broader implications of an escalating military standoff between Russia a#asserting that Ukraine is suffering "catastrophic" losses and suggesting that casualties on the Ukrainian side are ten times great#” said Putin ChatGPT Breaking News Title: Ukraine Gains Ground in Counterattack Against Russian Invasion#bid/ask spread#Bitcoin#blockchain#but the offensive potential of the troops of the Kyiv regime is still preserved#buy the dip#candlestick charts#candlestick patterns#cold storage#counterattack#cross-chain interoperability#crypto wallets#cryptocurrency#cryptocurrency exchanges#day trading#decentralized applications (dApps)#decentralized autonomous organizations (DAOs)#decentralized exchanges#decentralized exchanges (DEX)#decentralized finance#decentralized finance platforms#decentralized identity

1 note

·

View note

Text

Price Action Trading

Mastering Price Action Trading: Strategies, Patterns, and Psychology

Price action trading is a methodology used in financial markets, particularly in trading stocks, currencies, commodities, and other assets.

Unlike traditional technical analysis, which relies heavily on indicators and mathematical formulas, price action trading focuses solely on the movement of prices on a chart. It is based…

View On WordPress

#candlestick patterns#Chart Patterns#Commodities Trading#day trading#forex trading#Market Dynamics#Market Structure#Price Action Signals#Price Action Trading#Price movements#Risk Management#stock trading#Support and Resistance#swing trading#technical analysis#Trading Discipline#Trading Education#Trading Psychology#Trading Strategies#Trend Analysis

1 note

·

View note

Text

Unveiling the Magic of Shooting Star Candlestick Pattern

Title: Unveiling the Magic of Shooting Star Candlestick Pattern: A Step-by-Step Guide

Introduction:Candlestick patterns are essential tools for technical analysts in the world of trading. Among the myriad patterns, the Shooting Star stands out as a powerful indicator of potential trend reversals. In this blog post, we will delve into the nuances of the Shooting Star candlestick pattern,…

View On WordPress

#candlestick#candlestick chart#candlestick patterns#candlestick trading#candlestick trading patterns#candlestick trading setup#candlestick trading strategies#candlesticks#candlesticks pattern#elemer of the briar#forex trading against the trend#history of the elder scrolls#japanese candlesticks#making of the elder scrolls#swing trading guide#swing trading patterns#technical analysis chart patterns#the elder scrolls: arena - a complete retrospective

1 note

·

View note