#Challenges and Regulations of Cryptocurrency

Text

The Impact of Cryptocurrency on Global Financial Systems

Written by Delvin

Cryptocurrency has emerged as a disruptive force in the world of finance, challenging traditional financial systems and revolutionizing the way we transact and store value. Over the past decade, cryptocurrencies like Bitcoin, Ethereum, and others have gained significant attention and popularity. In this blog post, we will explore the profound impact of cryptocurrency on global…

View On WordPress

#Blockchain Technology#Challenges and Regulations of Cryptocurrency#Crypto Investment Opportunities#Cryptocurrency#dailyprompt#Disintermediation#Financial#Financial Literacy#knowledge#money#Passive Income#Personal Finance#The Impact of Cryptocurrency on Global Financial Systems

1 note

·

View note

Text

Decentralized Social Media: Privacy, Freedom, and User Control

In the 21st century, the realm of digital discourse is shaped considerably by social media, and understanding its ceaseless evolution is pivotal to keeping pace with its fast-changing dynamics. The journey of social media from a simple form of communication to being instrumental in driving modern democracy has been a spectacle to behold. However, despite its meteoric rise, centralization, a key…

View On WordPress

#blockchain#Censorship#Censorship resistance#Centralization#Centralized social media platforms#Challenges of decentralized platforms#cryptocurrencies#Data distribution#Data privacy#Dawn of social media#Decentralization#Decentralized social media networks#Efficiency#Fake news#Freedom of speech#Future of social media#Gatekeeping power#Government regulations#Hybrid social media networks#Hybrid solutions#Mastodon#Network power distribution#Peer-to-peer network#Potential obstacles#Power dynamics#Privacy breaches#Privacy concerns#Public acceptance#Regulatory complexities#Revolutionizing communication

1 note

·

View note

Text

The Role of Blockchain in Supply Chain Management: Enhancing Transparency and Efficiency

Blockchain technology, best known for powering cryptocurrencies like Bitcoin and Ethereum, is revolutionizing various industries with its ability to provide transparency, security, and efficiency. One of the most promising applications of blockchain is in supply chain management, where it offers solutions to longstanding challenges such as fraud, inefficiencies, and lack of visibility. This article explores how blockchain is transforming supply chains, its benefits, key use cases, and notable projects, including a mention of Sexy Meme Coin.

Understanding Blockchain Technology

Blockchain is a decentralized ledger technology that records transactions across a network of computers. Each transaction is added to a block, which is then linked to the previous block, forming a chain. This structure ensures that the data is secure, immutable, and transparent, as all participants in the network can view and verify the recorded transactions.

Key Benefits of Blockchain in Supply Chain Management

Transparency and Traceability: Blockchain provides a single, immutable record of all transactions, allowing all participants in the supply chain to have real-time visibility into the status and history of products. This transparency enhances trust and accountability among stakeholders.

Enhanced Security: The decentralized and cryptographic nature of blockchain makes it highly secure. Each transaction is encrypted and linked to the previous one, making it nearly impossible to alter or tamper with the data. This reduces the risk of fraud and counterfeiting in the supply chain.

Efficiency and Cost Savings: Blockchain can automate and streamline various supply chain processes through smart contracts, which are self-executing contracts with the terms of the agreement directly written into code. This automation reduces the need for intermediaries, minimizes paperwork, and speeds up transactions, leading to significant cost savings.

Improved Compliance: Blockchain's transparency and traceability make it easier to ensure compliance with regulatory requirements. Companies can provide verifiable records of their supply chain activities, demonstrating adherence to industry standards and regulations.

Key Use Cases of Blockchain in Supply Chain Management

Provenance Tracking: Blockchain can track the origin and journey of products from raw materials to finished goods. This is particularly valuable for industries like food and pharmaceuticals, where provenance tracking ensures the authenticity and safety of products. For example, consumers can scan a QR code on a product to access detailed information about its origin, journey, and handling.

Counterfeit Prevention: Blockchain's immutable records help prevent counterfeiting by providing a verifiable history of products. Luxury goods, electronics, and pharmaceuticals can be tracked on the blockchain to ensure they are genuine and have not been tampered with.

Supplier Verification: Companies can use blockchain to verify the credentials and performance of their suppliers. By maintaining a transparent and immutable record of supplier activities, businesses can ensure they are working with reputable and compliant partners.

Streamlined Payments and Contracts: Smart contracts on the blockchain can automate payments and contract executions, reducing delays and errors. For instance, payments can be automatically released when goods are delivered and verified, ensuring timely and accurate transactions.

Sustainability and Ethical Sourcing: Blockchain can help companies ensure their supply chains are sustainable and ethically sourced. By providing transparency into the sourcing and production processes, businesses can verify that their products meet environmental and social standards.

Notable Blockchain Supply Chain Projects

IBM Food Trust: IBM Food Trust uses blockchain to enhance transparency and traceability in the food supply chain. The platform allows participants to share and access information about the origin, processing, and distribution of food products, improving food safety and reducing waste.

VeChain: VeChain is a blockchain platform that focuses on supply chain logistics. It provides tools for tracking products and verifying their authenticity, helping businesses combat counterfeiting and improve operational efficiency.

TradeLens: TradeLens, developed by IBM and Maersk, is a blockchain-based platform for global trade. It digitizes the supply chain process, enabling real-time tracking of shipments and reducing the complexity of cross-border transactions.

Everledger: Everledger uses blockchain to track the provenance of high-value assets such as diamonds, wine, and art. By creating a digital record of an asset's history, Everledger helps prevent fraud and ensures the authenticity of products.

Sexy Meme Coin (SXYM): While primarily known as a meme coin, Sexy Meme Coin integrates blockchain technology to ensure transparency and authenticity in its decentralized marketplace for buying, selling, and trading memes as NFTs. Learn more about Sexy Meme Coin at Sexy Meme Coin.

Challenges of Implementing Blockchain in Supply Chains

Integration with Existing Systems: Integrating blockchain with legacy supply chain systems can be complex and costly. Companies need to ensure that blockchain solutions are compatible with their existing infrastructure.

Scalability: Blockchain networks can face scalability issues, especially when handling large volumes of transactions. Developing scalable blockchain solutions that can support global supply chains is crucial for widespread adoption.

Regulatory and Legal Considerations: Blockchain's decentralized nature poses challenges for regulatory compliance. Companies must navigate complex legal landscapes to ensure their blockchain implementations adhere to local and international regulations.

Data Privacy: While blockchain provides transparency, it also raises concerns about data privacy. Companies need to balance the benefits of transparency with the need to protect sensitive information.

The Future of Blockchain in Supply Chain Management

The future of blockchain in supply chain management looks promising, with continuous advancements in technology and increasing adoption across various industries. As blockchain solutions become more scalable and interoperable, their impact on supply chains will grow, enhancing transparency, efficiency, and security.

Collaboration between technology providers, industry stakeholders, and regulators will be crucial for overcoming challenges and realizing the full potential of blockchain in supply chain management. By leveraging blockchain, companies can build more resilient and trustworthy supply chains, ultimately delivering better products and services to consumers.

Conclusion

Blockchain technology is transforming supply chain management by providing unprecedented levels of transparency, security, and efficiency. From provenance tracking and counterfeit prevention to streamlined payments and ethical sourcing, blockchain offers innovative solutions to long-standing supply chain challenges. Notable projects like IBM Food Trust, VeChain, TradeLens, and Everledger are leading the way in this digital revolution, showcasing the diverse applications of blockchain in supply chains.

For those interested in exploring the playful and innovative side of blockchain, Sexy Meme Coin offers a unique and entertaining platform. Visit Sexy Meme Coin to learn more and join the community.

#crypto#blockchain#defi#digitalcurrency#ethereum#digitalassets#sexy meme coin#binance#cryptocurrencies#blockchaintechnology#bitcoin#etf

264 notes

·

View notes

Text

British Columbia is proposing legal changes that would allow the government to regulate the supply of electricity to cryptocurrency miners.

A statement from the Ministry of Energy says cryptocurrency miners consume large amounts of electricity to constantly run high-powered computers while creating very few jobs or economic opportunities.

It says the legislative amendments would allow the government to prohibit or restrict the provision of electricity to cryptocurrency miners because “unchecked growth” of the sector could make it challenging and more costly to provide electricity to homes and other businesses.

Continue Reading.

Tagging: @newsfromstolenland

152 notes

·

View notes

Text

HeroFX Review: A Comprehensive Look at the Alleged Forex Scam

In the vast and often volatile world of forex trading, the presence of unscrupulous brokers is a constant threat to both novice and seasoned traders. HeroFX, a broker that has recently come under scrutiny, is the subject of many discussions and concerns. This review delves into the various aspects of HeroFX to determine whether it is a legitimate broker or a potential scam.

Background and Overview

HeroFX claims to offer a comprehensive trading platform with a wide range of assets, including forex, commodities, indices, and cryptocurrencies. Promising competitive spreads, high leverage, and a user-friendly interface, HeroFX aims to attract traders looking for a reliable trading experience.

Regulation and Licensing

One of the primary red flags for any forex broker is the lack of proper regulation and licensing. HeroFX is reportedly not registered with any reputable financial regulatory authority. This absence of regulation means that traders are not protected by any governing body, increasing the risk of fraudulent activities and loss of funds.

Trading Platform and Tools

HeroFX offers its own proprietary trading platform, which is marketed as intuitive and feature-rich. While the platform appears to be functional, there have been numerous complaints about its reliability and execution speed. Some users have reported significant delays in order execution, leading to potential losses.

The broker also provides various tools and resources for traders, such as educational materials, market analysis, and trading signals. However, the quality and accuracy of these resources are questionable, with many users alleging that the information provided is often outdated or misleading.

Customer Support

Effective customer support is crucial for any forex broker, especially when dealing with complex financial transactions. HeroFX has received mixed reviews in this area. While some traders have reported satisfactory interactions with the support team, many others have experienced long wait times, unhelpful responses, and unresolved issues. This inconsistency in customer service further undermines the broker's credibility.

Withdrawal and Deposit Issues

One of the most significant concerns surrounding HeroFX is the difficulty many traders face when trying to withdraw their funds. Numerous complaints highlight delayed withdrawals, with some users claiming they never received their money. This pattern of behavior is often indicative of a scam broker, as legitimate brokers prioritize transparent and efficient fund transfers.

Additionally, the deposit process has also raised suspicions. HeroFX allegedly encourages large initial deposits and offers enticing bonuses that come with restrictive terms and conditions, making it challenging for traders to access their funds.

User Reviews and Complaints

A cursory glance at various online forums and review sites reveals a plethora of negative feedback from traders who have used HeroFX. Common grievances include:

Unresponsive or hostile customer service.

Manipulated trading conditions leading to unexpected losses.

Inability to withdraw funds.

Suspiciously positive reviews that appear fabricated.

These recurring themes paint a concerning picture of HeroFX and suggest a pattern of unethical practices.

Conclusion

In conclusion, while HeroFX presents itself as a reputable forex broker with attractive features, the overwhelming evidence points to the contrary. The lack of regulation, persistent withdrawal issues, and numerous negative user reviews all indicate that HeroFX may not be a trustworthy broker. Traders are advised to exercise extreme caution and conduct thorough research before engaging with this broker. In the unpredictable world of forex trading, it is always better to err on the side of caution and choose a broker with a proven track record of reliability and transparency.

For more check out this article: Herofx-review

#HeroFX Review 2024#is herofx a regulated broke#herofx#herofx review#herofx login#hero fx#herofx broker#is herofx regulated#herofx reviews#herofx minimum deposit#herofx mt5#herofx broker review#forextradingreviews#forextradingreview

60 notes

·

View notes

Text

How to Choose the Best Broker for Stock, Forex, and Crypto Trading in 2024?

Navigating the world of trading can be overwhelming, especially when it comes to selecting the right broker to meet your trading requirements. Whether you’re interested in stocks, forex, or cryptocurrencies, the choice of broker can significantly impact your trading experience and success. In this post, we’ll explore the key factors to consider when choosing a broker and introduce you to ForexJudge.com, a reliable resource that offers comprehensive reviews and detailed analysis of the world’s best brokers.

Factors to Consider When Choosing a Broker

Regulation and Security:

Ensure the broker is regulated by a reputable financial authority. Regulation provides a level of security and oversight, protecting you from fraudulent activities.

Look for brokers that offer robust security measures, including encryption and two-factor authentication, to safeguard your funds and personal information.

Trading Platform:

A good trading platform should be user-friendly, reliable, and equipped with essential tools for analysis and trading.

Consider whether the platform offers mobile compatibility if you plan to trade on-the-go.

Fees and Commissions:

Compare the fees and commissions charged by different brokers. Lower fees can significantly enhance your profitability, especially if you trade frequently.

Be aware of hidden fees, such as withdrawal charges, inactivity fees, or charges for additional services.

Range of Assets:

Ensure the broker offers the range of assets you’re interested in trading. If you plan to diversify your portfolio, choose a broker that provides access to stocks, forex, and cryptocurrencies.

Some brokers specialize in specific asset classes, so make sure your chosen broker aligns with your trading preferences.

Customer Support:

Reliable customer support is crucial, especially if you encounter issues with your account or trading platform. Look for brokers that offer multiple support channels, including live chat, phone, and email.

Check reviews to gauge the quality and responsiveness of the broker’s customer service.

Education and Resources:

Many brokers offer educational resources such as tutorials, webinars, and market analysis. These resources can be invaluable, especially for beginners.

A broker that provides regular market updates and trading insights can help you stay informed and make better trading decisions.

How ForexJudge.com Can Help

With so many brokers available, making an informed choice can be challenging. This is where ForexJudge.com comes in. ForexJudge is a trusted platform that has compiled detailed reviews and analysis of the world’s best brokers. By providing comprehensive information and user feedback, ForexJudge helps traders make well-informed decisions.

Detailed Broker Reviews

ForexJudge offers in-depth reviews of brokers across various asset classes, including stocks, forex, and cryptocurrencies. Each review covers critical aspects such as regulation, fees, trading platforms, and customer support. By reading these reviews, you can gain valuable insights into the strengths and weaknesses of different brokers, helping you choose the one that best meets your needs.

User Feedback and Ratings

In addition to expert reviews, ForexJudge features user feedback and ratings. This community-driven aspect allows traders to share their experiences and provide honest assessments of brokers. This real-world feedback can offer a clearer picture of what to expect and help you avoid potential pitfalls.

Regular Updates and Alerts

The trading world is dynamic, with brokers frequently updating their services, fees, and policies. ForexJudge keeps you informed with regular updates and alerts, ensuring you have the latest information at your fingertips. This proactive approach helps you stay ahead of the curve and make timely decisions.

Making the Final Decision

When choosing a broker, it’s essential to consider your trading goals, risk tolerance, and preferred asset classes. By leveraging the resources available on ForexJudge, you can make a well-informed decision that aligns with your trading strategy.

Steps to Follow:

Identify Your Needs:

Determine what you want to trade (stocks, forex, crypto) and what features are most important to you (low fees, robust platform, educational resources).

Research and Compare:

Use ForexJudge’s detailed reviews and user feedback to compare different brokers. Pay close attention to factors such as regulation, fees, and customer support.

Test the Platform:

Many brokers offer demo accounts. Use these to test the trading platform and ensure it meets your needs before committing real funds.

Start Small:

When you choose a broker, start with a small investment to test the waters. As you gain confidence and experience, you can increase your trading capital.

Conclusion

Choosing the right broker is a crucial step in your trading journey. By considering factors such as regulation, fees, trading platforms, and customer support, you can make an informed choice that enhances your trading experience.

For a reliable resource in your broker selection process, turn to ForexJudge.com. With its comprehensive reviews, user feedback, and regular updates, ForexJudge provides the insights you need to make the best decision for your trading needs.

Happy trading, and may your investments be fruitful!

#Forex Trading Reviews#Best Forex Brokers#Crypto trading#Financial News Services#Forex Trading Forum#How to get money back from Forex scam#Forex Scams#Crypto Scams#Best Forex Trading Platforms#Financial Calendar

141 notes

·

View notes

Text

The Untamed Web: How Internet Culture Rebels, Evolves, and Defines Our Digital Age

What is Internet culture? The question drifts through the ether like a rogue signal, elusive and captivating. To untangle this web, we must trace its lineage back to its inception, a digital genesis rooted in the analog rituals of Deadheads in the 70s. Much like those dedicated followers of the Grateful Dead, early Internet denizens sought connection and community, but instead of tapes and stories, they shared bytes and bits in mailing lists and Usenet newsgroups. Here, intellectuals, hackers, and rebels mingled in a digital potluck of ideas, raw and unfiltered.

As the dial-up tones gave way to the persistent hum of a growing network, Internet Relay Chat (IRC) emerged as the heartbeat of this underground culture. Real-time interaction became the new frontier, a global speakeasy where minds met in channels dedicated to everything imaginable. This wasn't just idle chat; it was a crucible for innovation and rebellion. Hacking groups like Cult of the Dead Cow and Legion of Doom pushed the limits of technology and legality, shaping the Internet in their anarchic image.

Then came vaporwave, the eerie soundtrack of a digital dystopia. This genre, with its nostalgic echoes of the 80s and 90s, felt like the Internet itself was creating music. Vaporwave artists like MACINTOSH PLUS crafted tracks that were both haunting and familiar, resonating with those disillusioned by the encroaching corporatization of digital spaces. It was a sonic rebellion, an aural middle finger to the commercialization of the Internet.

Memes, those viral fragments of culture, became the lifeblood of this digital underground. From the early days of "All Your Base Are Belong to Us," a quirky mistranslation from the game Zero Wing, to the complex narratives of modern memes, these digital artifacts spread like wildfire, uniting and dividing communities in equal measure. The tragicomic saga of Harambe, the gorilla shot at the Cincinnati Zoo, turned into a meme that evolved into a cultural phenomenon and even inspired a cryptocurrency in his legacy. Memes are the modern folklore, ever-evolving and reflective of the current digital zeitgeist.

At its core, Internet underground culture embodies the cyberpunk ethos—an unyielding rebellion against corporate overlords, a fight for digital freedom and privacy. Piracy, casual hacking, and the rise of cryptocurrency are not just acts of defiance but declarations of identity. This culture stands in stark opposition to corporatism, advocating for the decentralization of information and power. The emergence of decentralized networks and cryptocurrencies like Bitcoin are testaments to this ongoing struggle for autonomy.

Influences of Discordianism, with its embrace of chaos and rejection of traditional structures, permeate this culture. The Internet thrives on disruption, finding beauty in the unpredictable and the chaotic. It's a digital frontier where order is constantly challenged, and chaos is celebrated.

Politicians view Internet culture with a mix of fascination and fear. The concept of an "ungovernable" digital populace is both an ideal and a nightmare. Early Internet pioneers dreamed of a decentralized, unregulated space where freedom reigned supreme. However, as the Internet has grown, so too have efforts to control it. Governments impose regulations, corporations seek to monetize it, and the original vision of an ungovernable digital utopia becomes harder to live. Yet, pockets of resistance remain, where the spirit of rebellion and the desire for autonomy continue to thrive.

But like any culture, it has a dual nature. The democratization of information and the global connections fostered by Internet culture are profound positives. Yet, the same platforms that unite can also incubate hate speech and cybercrime. It is a reflection of humanity itself, with its myriad facets of light and dark.

So, what is Internet culture in 2024? It is a digital rebellion, a chaotic blend of nostalgia, anti-corporatism, and radical freedom of expression that continues to shape and redefine the digital landscape. In one sentence: Internet culture is the chaotic digital tapestry woven from the threads of rebellion, nostalgia, and the relentless pursuit of freedom.

We seek resistance. It begins with the maintainance of the culture.

#cyberpunk#faewave#tengushee#horror#mystery#vaporwave#hauntology#wierd#strange#weird#myth#monster#fae#faerie#dark#dark art#lost media#retro#retro gaming#creepycrawly#nightmaresfuel#darkaesthetic#horrorshorts#unsettling#paranormal#cryptid#haunted#creepystories#eerie#ghostsightings

29 notes

·

View notes

Text

ERC20 token generator

Ever wanted to create your own cryptocurrency? Thanks to the ERC20 Token Generator, it’s more accessible than ever. Dive into the world of blockchain and see how simple it can be.

What is an ERC20 Token?

ERC20 tokens are digital assets built on the Ethereum blockchain. They follow a specific standard, allowing them to interact seamlessly with platforms and other tokens.

Benefits of ERC20 Tokens:

Interoperability: All ERC20 tokens adhere to the same protocol.

Widespread Acceptance: Many platforms on Ethereum support these tokens.

Developer Support: Extensive documentation and community support.

How Does the ERC20 Token Generator Work?

Creating a token might sound complex, but the ERC20 Token Generator simplifies the process. Here’s a step-by-step guide:

Define Your Token:

Choose a name and symbol.

Set the total supply.

Access the Generator:

Use online tools designed for token creation.

Input your token details.

Deploy to the Blockchain:

Confirm your details.

Launch your token on the Ethereum network.

Key Features of ERC20 Tokens

These tokens offer various features that make them attractive for both developers and investors:

Standardized Functions: Such as balance checking and transfers.

Smart Contract Integration: Seamlessly integrate with smart contracts.

Security: Built on the robust Ethereum blockchain.

Why Create an ERC20 Token?

Creating your own token can offer several advantages:

Fundraising: Launch your own ICO (Initial Coin Offering).

Community Building: Reward loyal customers or followers.

Innovation: Develop new applications and uses for blockchain.

Potential Challenges

Despite the ease of creation, there are challenges:

Technical Knowledge: Basic understanding of blockchain is required.

Security Risks: Vulnerabilities can lead to exploitation.

Regulatory Issues: Compliance with local laws is crucial.

Best Practices for Creating ERC20 Tokens

To ensure success, follow these guidelines:

Audit Your Code: Ensure there are no security loopholes.

Engage with the Community: Gather feedback and make improvements.

Stay Informed: Keep up with blockchain trends and regulations.

Conclusion

The ERC20 Token Generator opens doors to the exciting world of cryptocurrency creation. Whether you're an entrepreneur, developer, or enthusiast, it offers an innovative way to engage with blockchain technology.

Final Thoughts

Creating an ERC20 token can be a game-changer. It empowers you to participate in the digital economy and experiment with new ideas.

FAQs

1. What is an ERC20 Token Generator?

An ERC20 Token Generator is a tool that simplifies the creation of custom tokens on the Ethereum blockchain.

2. Is technical knowledge necessary to create a token?

Basic blockchain understanding is helpful, but many generators offer user-friendly interfaces.

3. Can I sell my ERC20 tokens?

Yes, you can list them on cryptocurrency exchanges or sell directly to users.

4. Are there costs associated with creating a token?

Yes, deploying tokens on Ethereum requires gas fees, paid in Ether.

5. How do I ensure my token is secure?

Regular code audits and following best practices can enhance security.

Source : https://www.altcoinator.com/

#erc20#erc20 token development company#erc#erc20tokengenerator#token#token generator#token creation#ethereum#bitcoin

51 notes

·

View notes

Text

This day in history

On June 20, I'm keynoting the LOCUS AWARDS in OAKLAND.

#15yrsago Student challenges prof, wins right to post source code he wrote for course https://memex.craphound.com/2009/06/10/student-challenges-prof-wins-right-to-post-source-code-he-wrote-for-course/

#15yrsago France’s three-strikes copyright rule is unconstitutional and hence dead https://www.laquadrature.net/en/2009/06/10/hadopi-is-dead-three-strikes-killed-by-highest-court/

#15yrsago The Brain that Changes Itself: hopeful book on the science of neuroplasticity https://memex.craphound.com/2009/06/10/the-brain-that-changes-itself-hopeful-book-on-the-science-of-neuroplasticity/

#10yrsago National anti-censorship orgs protest cancellation of Little Brother summer reading program https://ncac.org/incident/little-brother-pensacola

#10yrsago Piketty’s inherited-wealth dystopia: private capital millionaires multiply https://www.bbc.com/news/business-27774753

#10yrsago How Heinlein went from socialist to right-wing libertarian https://newrepublic.com/article/118048/william-pattersons-robert-heinlein-biography-hagiography

#10yrsago Whistleblower org says it will go to jail rather than turning over its keys https://arstechnica.com/tech-policy/2014/06/to-defeat-encryption-feds-deploy-the-subpoena/

#10yrsago Texas school bans sunscreen because a child might drink it https://web.archive.org/web/20140608074518/http://www.keyetv.com/news/features/top-stories/stories/san-antonioarea-school-district-do-not-bring-sunscreen-school-18590.shtml

#10yrsago Small town sheriff buys tank: “the United States of America has become a war zone” https://www.indystar.com/story/news/2014/06/07/police-officer-safety-surplus-zeal-military-equipment-spurs-debate-mrap-military-vehicle/10170225/

#5yrsago A grandmother is suing the TSA for strip searching her to get a look at her panty liner, on Mother’s Day https://professional-troublemaker.com/2019/06/06/tsa-strip-searches-grandmother-on-mothers-day-for-over-feminine-hygiene-product-gets-sued/

#5yrsago A trove of leaks show that Brazil’s “anti-corruption” task force was secretly trying to oust Lula and install a far-right strongman https://theintercept.com/2019/06/09/brazil-archive-operation-car-wash/

#5yrsago Americans are too poor to survive whether or not they’re working https://eand.co/half-of-americans-are-effectively-poor-now-what-the-c944c518db6a

#5yrsago Competition can fix Big Tech, but only if we don’t make “bigness” a legal requirement https://www.economist.com/open-future/2019/06/06/regulating-big-tech-makes-them-stronger-so-they-need-competition-instead?fsrc=gp_en?fsrc=scn/tw/te/bl/ed/regulatingbigtechmakesthemstrongersotheyneedcompetitioninsteadopenvoices

#5yrsago Weekend SIM-swapping blitz targets US cryptocurrency holders https://www.zdnet.com/article/wave-of-sim-swapping-attacks-hit-us-cryptocurrency-users/

#5yrsago The NRA begs gun nuts for donations, spends lavishly on its board of directors and execs https://www.washingtonpost.com/investigations/nra-money-flowed-to-board-members-amid-allegedly-lavish-spending-by-top-officials-and-vendors/2019/06/09/3eafe160-8186-11e9-9a67-a687ca99fb3d_story.html

#5yrsago On Grenfell’s second anniversary, 60,000 Britons are still living in firetraps clad in the same deadly, decorative materials https://www.independent.co.uk/news/uk/politics/grenfell-tower-fire-material-high-rise-buildings-flat-block-a8946276.html

#1yrago Links, dumped https://pluralistic.net/2023/06/10/in-the-dumps-2/#do-the-humpty-dump

13 notes

·

View notes

Text

Coinbase's Legal Battle with the SEC: A Push for Transparency and Clear Regulation

The ongoing tension between Coinbase and the U.S. Securities and Exchange Commission (SEC) has taken a new turn. In recent months, Coinbase has launched two significant legal actions against the SEC, reflecting the company's growing frustration with the regulatory environment for cryptocurrencies in the United States. These actions underscore the urgent need for transparency and clear rules in the rapidly evolving digital asset industry.

Lawsuit Over FOIA Requests

In June 2024, Coinbase filed lawsuits against both the SEC and the Federal Deposit Insurance Corporation (FDIC) for failing to comply with Freedom of Information Act (FOIA) requests. Coinbase's FOIA requests sought critical information on two fronts:

The SEC's View on Ethereum: Coinbase is particularly interested in how the SEC perceives Ethereum, especially after its transition to a proof-of-stake consensus mechanism. This shift has sparked debates about whether Ethereum should be classified as a security under current U.S. laws.

"Pause Letters": Coinbase also requested copies of "Pause Letters" referenced in an Office of Inspector General report. These letters could provide insight into the SEC's internal communications and strategies regarding the regulation of digital assets.

By taking legal action, Coinbase aims to compel these agencies to release the requested information. The company alleges that federal financial regulators are attempting to "cripple the digital-asset industry" and believes that greater transparency will shed light on the true motivations and actions of these regulators.

Petition for Rulemaking

The second significant legal action by Coinbase is its April 2023 lawsuit against the SEC, which seeks to force the agency to respond to a petition for rulemaking. Coinbase initially submitted this petition in July 2022, requesting formal guidance on the regulatory framework for the crypto industry. The SEC's prolonged silence prompted Coinbase to seek judicial intervention, hoping to secure a clear and actionable response.

This lawsuit highlights Coinbase's argument that the SEC's current approach—termed "regulation by enforcement"—is detrimental to the crypto industry. Coinbase asserts that the lack of clear rules creates uncertainty and stifles innovation. The company contends that formal guidance would provide the necessary clarity for businesses operating in the digital asset space.

Broader Context and Implications

These legal battles are part of a broader debate over the regulation of cryptocurrencies in the United States. The SEC has taken a stringent stance, asserting that most cryptocurrencies are securities and should be regulated as such. This perspective has led to numerous enforcement actions against various crypto companies, including Coinbase.

In March 2024, a federal judge ruled that most of the SEC's claims against Coinbase could proceed to trial, marking a significant setback for the company's efforts to dismiss the lawsuit. Coinbase argues that the SEC's aggressive stance is counterproductive and calls for a more collaborative approach to developing a comprehensive regulatory framework.

Aligning with Coinbase's Mission

These legal actions are not just strategic moves but are deeply aligned with Coinbase's mission statement of promoting financial freedom. By challenging the SEC and advocating for transparent and clear regulations, Coinbase is doing everything in its power to create an environment where digital assets can thrive. This dedication to financial freedom and innovation is at the core of Coinbase's goals, reflecting its commitment to transforming the financial landscape.

Conclusion

Coinbase's legal actions against the SEC and FDIC reflect a pivotal moment in the relationship between the crypto industry and U.S. regulators. By demanding transparency and clear rules, Coinbase is advocating for a regulatory environment that supports innovation while protecting investors. As this legal battle unfolds, it will undoubtedly shape the future of cryptocurrency regulation in the United States and potentially set precedents for other jurisdictions around the world.

#Coinbase#SEC#Cryptocurrency#CryptoRegulation#Bitcoin#Ethereum#FinancialFreedom#FOIA#Transparency#DigitalAssets#CryptoNews#Blockchain#LegalBattle#CryptoCommunity#CryptoInnovation#CryptoLaw#CoinbaseVsSEC#CryptoUpdates#DigitalCurrency#CryptoEconomy#CryptoLawyers#financial education#unplugged financial#globaleconomy#financial experts#financial empowerment#finance

8 notes

·

View notes

Text

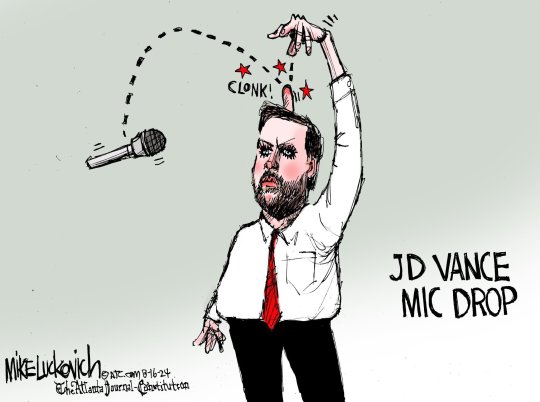

Mike Luckovich

* * * *

Keeping control of the Senate

September 24, 2024

Robert B. Hubbell

Sep 24, 2024

On a day with a dozen important stories reverberating in the media echo chamber, I want to start with a positive report on a fundraiser for Senators Jon Tester and Sherrod Brown. Both face challenging races in November because they have achieved the improbable—being elected and reelected as Democratic Senators in red states. That fact alone means that every reelection effort is an uphill battle.

Their MAGA opponents are being showered with staggering amounts of dark money from the unholy trinity of the cryptocurrency industry, billionaires whose only goal is to lower taxes, and conservative organizations promoting the autocratic, Christian nationalist agenda of Project 2025.

But as is increasingly the case in the 2024 election, Democrats responded with enthusiasm and generosity. Several hundred readers of this newsletter donated to and showed up at a fundraiser hosted by Senate Circle. I moderated a conversation with Senators Tester and Brown that left everyone on the call feeling more confident about Democratic prospects in the US Senate in 2024.

It is easy to see why Senators Tester and Brown have succeeded as Democrats in red states. There is not an ounce of artifice or political calculation between them. They say what they think in a plainspoken, genuine, and charismatic manner. They hold strong beliefs that run counter to those of some of their constituents, but they are men of their word who devote every day working to make the lives of their constituents better—regardless of their political affiliation.

Neither candidate guaranteed victory. They have too much integrity to issue guarantees during a volatile election season. But when they tell you that their chances are strong and that their policy positions are resonating with the voters in their states, it is clear that Democrats have a reasonable basis for hoping we will retain both seats.

Senator Tester noted that at this point in his 2018 re-election bid, he was down by four to six points in the polls (because he voted against Brett Kavanaugh’s confirmation). The current public polling regarding the Montana race is skewed by small, low-quality polls by Republican operatives. But even those polls show that Senator Tester leads with younger voters and women—two cohorts that should be motivated to turn out in an election with an initiative protecting reproductive rights on the ballot. Senator Tester is confident that he is better positioned than in 2018 and has the ground organization to win.

Senator Brown is running against an opponent (Bernie Moreno) recruited by JD Vance and supported by the cryptocurrency industry because, you know, cryptocurrency regulation is at the top of the list of issues for Ohio voters—not! Of course, JD Vance and Bernie Moreno have made anti-Haitian animus in Springfield a top campaign theme. But Bernie Moreno outdid himself on Monday, saying that Ohio women are “a little crazy” for supporting abortion rights.”

Moreno continued,

You know, the left has a lot of single-issue voters. Sadly, by the way, there’s a lot of suburban women, a lot of suburban women that are like, ‘Listen, abortion is it. If I can’t have an abortion in this country whenever I want, I will vote for anybody else.’ … OK. It’s a little crazy by the way, but — especially for women that are like past 50 — I’m thinking to myself, ‘I don’t think that’s an issue for you.'”

See Ohio.net, Bernie Moreno calls Ohio women 'a little crazy' for supporting abortion rights.

Bernie Moreno is repeating and extending the slander against women that JD Vance has thrust into the limelight with his “childless cat lady comments.” Moreno shows the same disrespect, ignorance, and intolerance toward women that JD Vance has exhibited throughout the 2024 presidential campaign.

Senators Tester and Brown are both in the fight to win it—and believe they will. They have strong ground operations but need “late money” to keep those operations going strong. At the fundraiser on Monday, readers of this newsletter helped raise $192,170 to be split between Tester and Brown.

It would be terrific if readers of Today’s Edition can help push that total beyond $200,000—to help maximize Democratic prospects for retaining control of the Senate. If you are moved to contribute any amount, the link is here: https://secure.actblue.com/donate/2024_mt_oh. (For amounts less than $100, just fill in the “additional contribution box”).

Thanks to the hundreds of readers who contributed and joined the call. Your generosity and commitment will help Democrats defend the Senate and preserve democracy! Bless you all.

Post-script to the fundraiser

During conversation with Senator Sherrod Brown, he noted that his wife, Connie Schultz, is a Substack author. Connie writes Hopefully Yours—a title that resonates with the viewpoint of this newsletter—“Viewing the news through the lens of hope.”

While I am a guy with a laptop and a lot of opinions, Connie is a Pulitzer Prize-winning columnist and best-selling author, among many other accomplishments. I just subscribed to her Substack. Check it out. As an incentive, Connie recently interviewed Heather Cox Richardson and will be publishing an article about that interview on Substack. Keep an eye out for it!

[Robert B. Hubbell Newsletter]

4 notes

·

View notes

Text

Navigating The Cryptocurrency Controversies💰🔍

Explore the explosive and complex world of cryptocurrency with 'The Cryptocurrency Controversies.' This timely book delves into the tumultuous world of digital currencies, exploring the controversies surrounding key players such as FTX, Binance, and Elon Musk. Through incisive analysis and in-depth research, this book sheds light on the events that have rocked the cryptocurrency market, from regulatory challenges to market manipulation allegations. With clarity and precision, the book offers insights into the implications of these controversies for investors, regulators, and the broader financial ecosystem. Whether you are a seasoned crypto enthusiast or a curious observer, this book provides invaluable perspective on the evolving landscape of digital finance. Join us as we navigate the twists and turns of this dynamic industry, illuminating the opportunities and challenges that lie ahead.

#CryptocurrencyControversies#FTXDebacle#BinanceScandal#ElonMuskImpact#DigitalCurrencyDrama#CryptoMarketAnalysis#RegulatoryChallenges#MarketManipulation#CryptocurrencyInvesting#FinancialEcosystem#CryptoRegulation#MarketVolatility#BlockchainTechnology#CryptocurrencyTrends#InvestorEducation#FinancialTransparency#CryptocurrencyInsights#CryptoMarketTurbulence#FinancialScandals#MarketSpeculation#FTXControversy#BinanceDebacle#ElonMuskControversies#CryptocurrencyScandals#FinancialControversies#DigitalCurrencyDisputes#BlockchainControversies#CryptoIndustryScandals#ControversialCryptoEvents#CryptocurrencyDebates

8 notes

·

View notes

Text

Can you imagine what a digital white ethnostate or a cyber caliphate might look like? Having spent most of my career on the inside of online extremist movements, I certainly can. The year 2024 might be the one in which neo-Nazis, jihadists, and conspiracy theorists turn their utopian visions of creating their own self-governed states into reality—not offline, but in the form of Decentralized Autonomous Organizations (DAOs).

DAOs are digital entities that are collaboratively governed without central leadership and operate based on blockchain. They allow internet users to establish their own organizational structures, which no longer require the involvement of a third party in financial transactions and rulemaking. The World Economic Forum described DAOs as “an experiment to reimagine how we connect, collaborate and create”. However, as with all new technologies, there is also a darker side to them: They are likely to give rise to new threats emerging from decentralized extremist mobilization.

Today, there are already over 10,000 DAOs, which collectively manage billions of dollars and count millions of participants. So far, DAOs have attracted a wild mix of libertarians, activists, pranksters, and hobbyists. Most DAOs I have come across in my research sound innocent and fun. Personally, my favorites include theCaféDAO, which aims “to replace Starbucks” (good luck with that!); the Doge DAO, which wants to “make the Doge meme the most recognizable piece of art in the world”; and the HairDAO, “a decentralized asset manager solving hair loss.” But some DAOs use a more radical tone. For example, the Redacted Club DAO, which is rife with alt-right codes and conspiracy myth references, claims to be a secret network with the aim of “slaying” the “evil Meta Lizard King.”

The year 2024 might be one in which extremists start using DAOs strategically. Policies, legal contracts, and financial transactions that were traditionally the domain of governments, courts, and banks can be replaced with smart contracts, non-fungible tokens (NFTs), and cryptocurrencies. The use of anonymous bitcoin wallets and non-transparent cryptocurrencies such as Monero is already widespread among extremists whose bank accounts have been frozen. A shift to entirely decentralized forms of self-governance is only one step away.

Beyond practical reasons that encourage extremists to create their own self-governed structures, there is an ideological incentive too: their fundamental distrust in the establishment. If you believe that the deep state or the “global Jewish elites” control everything from governments and Big Tech to the global banking system, DAOs offer an appealing alternative. Conversations on far-right fringe platforms such as BitChute and Odysee reveal that there is much appetite for decentralized alternative forms of collaboration, communication, and crowdfunding.

So what happens if anti-minority groups establish their own digital worlds in which they impose their own governing mechanisms? What are the stakes if trolling armies start cooperating via DAOs to launch election interference campaigns? The activities of extremist DAOs could challenge the rule of law, pose a threat to minority groups, and disrupt institutions that are currently considered fundamental pillars of democratic systems. Another risk is that DAOs can serve as safe havens for extremist movements by enabling users to circumvent government regulation and security services monitoring activities. They might also allow extremists to find new ways to fundraise, plan, and plot radicalization campaigns or even attacks. While many governments have focused on developing legal frameworks to regulate AI, few have even recognized the existence of DAOs. Their looming exploitation for extremist and criminal purposes is something that has flown under the radar of global policymakers.

Technology expert Carl Miller, who has long warned of potential misuse of DAOs, told me that “even though DAOs behave like companies, they are not registered as legal entities.” There are only a few exceptions: The US states of Wyoming, Vermont, and Tennessee have passed laws to legally recognize DAOs. With no regulations in place to hold DAOs accountable for extremist or criminal activities, the big question for 2024 will be: How can we ensure the metaverse doesn’t give rise to digital white ethnostates or cyber caliphates?

10 notes

·

View notes

Text

The Rise of DeFi: Revolutionizing the Financial Landscape

Decentralized Finance (DeFi) has emerged as one of the most transformative sectors within the cryptocurrency industry. By leveraging blockchain technology, DeFi aims to recreate and improve upon traditional financial systems, offering a more inclusive, transparent, and efficient financial ecosystem. This article explores the fundamental aspects of DeFi, its key components, benefits, challenges, and notable projects, including a brief mention of Sexy Meme Coin.

What is DeFi?

DeFi stands for Decentralized Finance, a movement that utilizes blockchain technology to build an open and permissionless financial system. Unlike traditional financial systems that rely on centralized intermediaries like banks and brokerages, DeFi operates on decentralized networks, allowing users to interact directly with financial services. This decentralization is achieved through smart contracts, which are self-executing contracts with the terms of the agreement directly written into code.

Key Components of DeFi

Decentralized Exchanges (DEXs): DEXs allow users to trade cryptocurrencies directly with one another without the need for a central authority. Platforms like Uniswap, SushiSwap, and PancakeSwap have gained popularity for their ability to provide liquidity and facilitate peer-to-peer trading.

Lending and Borrowing Platforms: DeFi lending platforms like Aave, Compound, and MakerDAO enable users to lend their assets to earn interest or borrow assets by providing collateral. These platforms use smart contracts to automate the lending process, ensuring transparency and efficiency.

Stablecoins: Stablecoins are cryptocurrencies pegged to stable assets like fiat currencies to reduce volatility. They are crucial for DeFi as they provide a stable medium of exchange and store of value. Popular stablecoins include Tether (USDT), USD Coin (USDC), and Dai (DAI).

Yield Farming and Liquidity Mining: Yield farming involves providing liquidity to DeFi protocols in exchange for rewards, often in the form of additional tokens. Liquidity mining is a similar concept where users earn rewards for providing liquidity to specific pools. These practices incentivize participation and enhance liquidity within the DeFi ecosystem.

Insurance Protocols: DeFi insurance protocols like Nexus Mutual and Cover Protocol offer coverage against risks such as smart contract failures and hacks. These platforms aim to provide users with security and peace of mind when engaging with DeFi services.

Benefits of DeFi

Financial Inclusion: DeFi opens up access to financial services for individuals who are unbanked or underbanked, particularly in regions with limited access to traditional banking infrastructure. Anyone with an internet connection can participate in DeFi, democratizing access to financial services.

Transparency and Trust: DeFi operates on public blockchains, providing transparency for all transactions. This transparency reduces the need for trust in intermediaries and allows users to verify and audit transactions independently.

Efficiency and Speed: DeFi eliminates the need for intermediaries, reducing costs and increasing the speed of transactions. Smart contracts automate processes that would typically require manual intervention, enhancing efficiency.

Innovation and Flexibility: The open-source nature of DeFi allows developers to innovate and build new financial products and services. This continuous innovation leads to the creation of diverse and flexible financial instruments.

Challenges Facing DeFi

Security Risks: DeFi platforms are susceptible to hacks, bugs, and vulnerabilities in smart contracts. High-profile incidents, such as the DAO hack and the recent exploits on various DeFi platforms, highlight the need for robust security measures.

Regulatory Uncertainty: The regulatory environment for DeFi is still evolving, with governments and regulators grappling with how to address the unique challenges posed by decentralized financial systems. This uncertainty can impact the growth and adoption of DeFi.

Scalability: DeFi platforms often face scalability issues, particularly on congested blockchain networks like Ethereum. High gas fees and slow transaction times can hinder the user experience and limit the scalability of DeFi applications.

Complexity and Usability: DeFi platforms can be complex and challenging for newcomers to navigate. Improving user interfaces and providing educational resources are crucial for broader adoption.

Notable DeFi Projects

Uniswap (UNI): Uniswap is a leading decentralized exchange that allows users to trade ERC-20 tokens directly from their wallets. Its automated market maker (AMM) model has revolutionized the way liquidity is provided and traded in the DeFi space.

Aave (AAVE): Aave is a decentralized lending and borrowing platform that offers unique features such as flash loans and rate switching. It has become one of the largest and most innovative DeFi protocols.

MakerDAO (MKR): MakerDAO is the protocol behind the Dai stablecoin, a decentralized stablecoin pegged to the US dollar. MakerDAO allows users to create Dai by collateralizing their assets, providing stability and liquidity to the DeFi ecosystem.

Compound (COMP): Compound is another leading DeFi lending platform that enables users to earn interest on their cryptocurrencies or borrow assets against collateral. Its governance token, COMP, allows users to participate in protocol governance.

Sexy Meme Coin (SXYM): While primarily known as a meme coin, Sexy Meme Coin has integrated DeFi features, including a decentralized marketplace for buying, selling, and trading memes as NFTs. This unique blend of humor and finance adds a distinct flavor to the DeFi landscape. Learn more about Sexy Meme Coin at Sexy Meme Coin.

The Future of DeFi

The future of DeFi looks promising, with continuous innovation and growing adoption. As blockchain technology advances and scalability solutions are implemented, DeFi has the potential to disrupt traditional financial systems further. Regulatory clarity and improved security measures will be crucial for the sustainable growth of the DeFi ecosystem.

DeFi is likely to continue attracting attention from both retail and institutional investors, driving further development and integration of decentralized financial services. The flexibility and inclusivity offered by DeFi make it a compelling alternative to traditional finance, paving the way for a more open and accessible financial future.

Conclusion

Decentralized Finance (DeFi) represents a significant shift in the financial landscape, leveraging blockchain technology to create a more inclusive, transparent, and efficient financial system. Despite the challenges, the benefits of DeFi and its continuous innovation make it a transformative force in the world of finance. Notable projects like Uniswap, Aave, and MakerDAO, along with unique contributions from meme coins like Sexy Meme Coin, demonstrate the diverse and dynamic nature of the DeFi ecosystem.

For those interested in exploring the playful and innovative side of DeFi, Sexy Meme Coin offers a unique and entertaining platform. Visit Sexy Meme Coin to learn more and join the community.

249 notes

·

View notes

Text

Binance: World’s largest exchange

To gain further insight into Binance, it is necessary to first comprehend the notion of cryptocurrencies. Despite its boom, a lot of people these days are unaware of what cryptocurrencies actually are. A cryptocurrency is a kind of digital or virtual money that is protected by cryptography and is very difficult to fake or spend twice. Blockchain-based decentralized networks underpin a large number of coins.

In terms of the amount of cryptocurrency traded every day, Binance is the biggest cryptocurrency exchange in the world.[2] It is registered in the Cayman Islands and was established in 2017.

Changpeng Zhao, a developer who had previously worked on high-frequency trading software, launched Binance. China was the original home of Binance, but as cryptocurrency regulation in China grew, the company relocated its offices outside of the country.

Following the Chinese government's prohibition on cryptocurrency trading in September 2017, the company was compelled to exit the country. Since then, it has offices in Taiwan and Japan. Currently, Malta serves as its base.

The goal of Binance is to attract as many users as possible. The exchange offers enough currencies and functionality to satisfy experienced traders while remaining user-friendly enough for beginners. For cryptocurrency traders of practically any experience level, I would suggest Binance.

The biggest cryptocurrency trading platform worldwide is called Binance.1. It is not very user-friendly, despite having a wide range of trading options and features. Depending on their level of experience and education, investors may encounter a challenging learning curve when using Binance.

Binance provides a vast range of trading options, such as an amazing assortment of market charts and hundreds of cryptocurrencies, through its desktop or mobile dashboards. In addition, a range of order types and trading alternatives, such as options and futures, are available to users. Only more than 65 cryptocurrencies are accessible to American consumers, and many services and possibilities are unavailable in the country.

Binance offers a thorough learning platform, an NFT platform, and more in addition to its tools and services. US clients don't seem to have access to the NFT marketplace just now.

Only more than 65 of the more than 365 cryptocurrencies that Binance offers for trading are accessible in the United States. It also supports a range of fiat currencies, such as USD, EUR, AUD, GBP, HKD, and INR, for users who are located abroad. Binance offers an extensive selection of cryptocurrency pairs based on your region.

Binance Coin (BNB), VeChain (VET), Harmony (ONE), VeThor Token (VTHO), Dogecoin (DOGE), and Matic Network (MATIC) are a few of the cryptocurrencies that are available on Binance U.S. Furthermore, Binance accepts well-known cryptocurrencies like:

Dash (DASH)

Cosmos (ATOM)

Compound (COMP)

Bitcoin (BTC)

Ethereum (ETH)

Litecoin (LTC)

Cardano (ADA)

For more information>>

#CryptoExchange#Binance#Cryptocurrency#Blockchain#CryptoTrading#CryptocurrencyExchange#Bitcoin#Finance#CryptoNews

2 notes

·

View notes

Text

Memecoins: The Fast Track to Living Like a Millionaire?

In the ever-evolving world of cryptocurrencies, memecoins have emerged as a fascinating phenomenon, capturing the imagination of investors with their wild price swings and speculative allure. Often born from internet memes and viral trends, these digital assets are characterized by their community-driven hype and dramatic market movements. While many regard them as mere fads, others view them as potential pathways to substantial financial gains. In this blog, we’ll explore the appeal of memecoins, their impact on the cryptocurrency market, and whether they represent a viable route to living like a millionaire.

The Appeal of Memecoins

1. Community and Culture

A significant factor driving the success of memecoins is the power of community. These tokens often have dedicated followings that are passionate about their origins and the memes associated with them. The sense of belonging to a vibrant and engaged community can fuel interest and investment.

Social media platforms, such as Twitter, Reddit, and Telegram, play a crucial role in amplifying the reach of memecoins. Memecoins frequently gain traction through viral posts, memes, and discussions within cryptocurrency communities. This grassroots marketing approach can lead to rapid adoption and substantial price movements, driven largely by social media buzz and viral trends.

2. Speculative Gains

The allure of making quick profits is another driving force behind memecoin investments. Known for their extreme volatility, memecoins often experience dramatic price surges over short periods. This volatility attracts speculators looking to capitalize on rapid price swings and achieve substantial returns.

For instance, the price of Dogecoin soared by thousands of percent in 2021, driven by celebrity endorsements, social media hype, and a general surge in interest. Such dramatic price movements create opportunities for investors to realize significant gains, albeit with high risk.

3. Accessibility and Low Barriers to Entry

Memecoins often have low entry points in terms of cost, making them accessible to a broad range of investors. Unlike established cryptocurrencies with high price tags, memecoins can often be purchased at a fraction of a cent. This low barrier to entry allows retail investors to participate in the market and potentially benefit from price increases.

Risks and Challenges

While the potential for significant gains exists, investing in memecoins is fraught with risks. Here are some challenges to consider:

1. Volatility and Speculation

Memecoins are highly speculative and prone to extreme price fluctuations. The same factors that can drive rapid gains can also lead to equally dramatic losses. Many memecoins lack intrinsic value or practical use cases, meaning their prices are often driven by market sentiment rather than fundamental factors.

2. Lack of Regulation

The cryptocurrency market, including memecoins, operates in a largely unregulated environment. This lack of oversight exposes investors to potential fraud, manipulation, and scams. As with any investment, conducting thorough research and understanding the risks involved is essential.

3. Sustainability and Longevity

The long-term viability of memecoins is uncertain. Many of these tokens are created as short-lived experiments or jokes, and their popularity can wane quickly. While some may experience temporary success, maintaining value over time is a significant challenge.

Memecoins and the Path to Wealth

The idea of becoming a millionaire through memecoins is enticing, but it’s essential to approach it with a balanced perspective. Here are some considerations for those looking to explore this avenue:

1. Do Your Research

Before investing in any memecoin, it’s crucial to research the coin’s background, community, and market dynamics. Understanding the factors driving the coin’s popularity and evaluating its potential risks can help make informed investment decisions.

2. Diversify Your Investments

Relying solely on memecoins for wealth accumulation is risky. Diversifying your investment portfolio across different asset classes, including established cryptocurrencies, traditional investments, and other financial instruments, can help mitigate risks and enhance overall returns.

3. Set Realistic Goals

While some investors have achieved significant gains with memecoins, it’s essential to set realistic expectations. The speculative nature of these assets means that while substantial profits are possible, so are losses. Investing in memecoins should be done with a clear understanding of the risks and potential rewards.

4. Stay Informed

The cryptocurrency market is highly dynamic, with new developments and trends emerging regularly. Staying informed about market trends, news, and regulatory changes can help navigate the complexities of investing in memecoins.

Conclusion

Thanks For Reading Blog , In conclusion We Strongly Suggest about solana launcher, here you can generate your own memecoins token in just less than three seconds without any programming knowledge,

Memecoins represent a unique and intriguing aspect of the cryptocurrency market. Their origins in internet culture and community-driven enthusiasm offer a stark contrast to traditional cryptocurrencies with established use cases. While the potential for significant financial gains exists, investing in memecoins requires careful consideration and a solid understanding of the associated risks.

For those drawn to the excitement and speculative nature of memecoins, it’s essential to approach them with caution and a well-researched strategy. While memecoins can offer the allure of quick wealth, achieving long-term financial success requires a balanced approach and prudent investment decisions.

As the cryptocurrency landscape continues to evolve, memecoins will likely remain a captivating phenomenon. Whether they represent a fast track to millionaire status or a speculative gamble depends on individual investment strategies and market conditions. In any case, the journey into memecoins offers a glimpse into the dynamic and ever-changing world of digital assets.

2 notes

·

View notes