#Digital Payments fraud

Text

Indian Banks See Higher Number of Frauds in Digital Payments in Fy23

According to the RBI annual report, Indian banks witnessed the maximum number of frauds in digital payments in FY23. Read our blog to know in detail.

https://financedesks.com/indian-banks-see-higher-number-of-frauds-in-digital-payments-in-fy23/

#bank fraud#Digital Payment#Digital Payments#Digital bank fraud#Digital Payments in Fy23#Digital Payments fraud

1 note

·

View note

Text

#Echecks#Electronic checks#Merchant services#Payment processing#Digital payments#ACH (Automated Clearing House)#Online payments#Payment gateways#Payment solutions#E-commerce payments#Payment processors#Secure transactions#Electronic funds transfer#Payment technology#Payment verification#Payment acceptance#Digital banking#Transaction fees#Fraud prevention#Payment authorization

2 notes

·

View notes

Text

In the current rapidly evolving digital currency market, decentralized finance (DeFi) platforms are redefining the shape of financial services with their unique advantages. Bit Loop, as a leading decentralized lending platform, not only provides a safe and transparent lending environment, but also opens up new passive income channels for users through its innovative sharing reward system.

Personal links and permanent ties: Create a stable revenue stream

One of the core parts of Bit Loop is its recommendation system, which allows any user to generate a unique sharing link when they join the platform. This link is not only a “key” for users to join the Bit Loop, but also a tool for them to establish an offline network. It is worth noting that offline partners who join through this link are permanently tied to the recommender, ensuring that the sharer can continue to receive rewards from the offline partner’s activities.

Unalterable referral relationships: Ensure fairness and transparency

A significant advantage of blockchain technology is the immutability of its data. In Bit Loop, this means that once a referral link and live partnership is established, the relationship is fixed and cannot be changed. This design not only protects the interests of recommenders, but also brings a stable user base and activity to the platform, while ensuring the fairness and transparency of transactions.

Automatically distribute rewards: Simplify the revenue process

Another highlight of the Bit Loop platform is the ability for smart contracts to automatically distribute rewards. When the partner completes the circulation cycle, such as investment returns or loan payments, the smart contract automatically calculates and sends the corresponding percentage of rewards directly to the recommender’s wallet. This automatic reward distribution mechanism not only simplifies the process of receiving benefits, but also greatly improves the efficiency of capital circulation.

Privacy protection and security: A security barrier for funds

All transactions and money flows are carried out on the blockchain, guaranteeing transparency and traceability of every operation. In addition, the use of smart contracts significantly reduces the risk of fraud and misoperation, providing a solid security barrier for user funds. Users can confidently invest and promote boldly, and enjoy the various conveniences brought by decentralized finance.

conclusion

As decentralized finance continues to evolve, Bit Loop offers a new economic model through its unique recommendation system that enables users to enjoy highly secure and transparent financial services while also earning passive income by building and maintaining a personal network. Whether for investors seeking stable passive income or innovators looking to explore new financial possibilities through blockchain technology, Bit Loop provides a platform not to be missed.

#In the current rapidly evolving digital currency market#decentralized finance (DeFi) platforms are redefining the shape of financial services with their unique advantages. Bit Loop#as a leading decentralized lending platform#not only provides a safe and transparent lending environment#but also opens up new passive income channels for users through its innovative sharing reward system.#Personal links and permanent ties: Create a stable revenue stream#One of the core parts of Bit Loop is its recommendation system#which allows any user to generate a unique sharing link when they join the platform. This link is not only a “key” for users to join the Bi#but also a tool for them to establish an offline network. It is worth noting that offline partners who join through this link are permanent#ensuring that the sharer can continue to receive rewards from the offline partner’s activities.#Unalterable referral relationships: Ensure fairness and transparency#A significant advantage of blockchain technology is the immutability of its data. In Bit Loop#this means that once a referral link and live partnership is established#the relationship is fixed and cannot be changed. This design not only protects the interests of recommenders#but also brings a stable user base and activity to the platform#while ensuring the fairness and transparency of transactions.#Automatically distribute rewards: Simplify the revenue process#Another highlight of the Bit Loop platform is the ability for smart contracts to automatically distribute rewards. When the partner complet#such as investment returns or loan payments#the smart contract automatically calculates and sends the corresponding percentage of rewards directly to the recommender’s wallet. This au#but also greatly improves the efficiency of capital circulation.#Privacy protection and security: A security barrier for funds#All transactions and money flows are carried out on the blockchain#guaranteeing transparency and traceability of every operation. In addition#the use of smart contracts significantly reduces the risk of fraud and misoperation#providing a solid security barrier for user funds. Users can confidently invest and promote boldly#and enjoy the various conveniences brought by decentralized finance.#conclusion#As decentralized finance continues to evolve#Bit Loop offers a new economic model through its unique recommendation system that enables users to enjoy highly secure and transparent fin

1 note

·

View note

Text

ATMs & CRMs – Unveiling Their Benefits in India’s Evolving Payment Landscape | AGS India

Both ATMs and CRMs facilitate various banking transactions, CRMs offer the additional functionality of cash recycling, making them more advanced and sophisticated machines.

#Billing software#Billing Machine#Fintech company#Digital payments#cash payment#cash management services#online payment systems#Cash transit#QR code payment#cashless transaction in India#Digital payment solutions#payment company#RFID solutions#Payment solutions#fuel management system#cashless payment#fraud prevention#Banking automation#retail automation#Banking outsourcing

0 notes

Text

Empowering High-Risk Merchants for Unstoppable Growth

Introduction:

In the fast-paced world of high-risk industries, payment processing can be a challenging endeavor. High-risk merchants often face unique obstacles, including elevated fraud risks, chargeback disputes, and compliance complexities. In this in-depth article, we explore how EpsilonPayments emerges as the ultimate solution, empowering high-risk businesses with tailored, robust, and innovative payment processing services. Let's delve into the unparalleled benefits that EpsilonPayments brings to high-risk merchants.

Understanding High-Risk Business Payment Challenges

To truly appreciate the significance of EpsilonPayments, we first delve into the payment challenges that high-risk businesses confront. From online gambling to adult entertainment and CBD products, each industry has its distinctive risks and regulatory hurdles. High-risk merchants require a payment partner that can effectively mitigate these challenges while providing a seamless and secure payment experience for customers.

EpsilonPayments: The Fortified Security and Robust Fraud Prevention

One of the critical reasons high-risk merchants flock to EpsilonPayments is its robust security and advanced fraud prevention measures. EpsilonPayments leverages cutting-edge technologies and machine learning algorithms to detect fraudulent activities in real-time. With its comprehensive chargeback protection, high-risk businesses can safeguard their revenue and reputation, instilling confidence in customers and stakeholders alike.

Tailored Solutions for Unique Business Needs

No two high-risk businesses are identical, and EpsilonPayments fully understands this reality. In this section, we explore how EpsilonPayments collaborates closely with each merchant to design personalized payment strategies. From tailored payment gateways to currency and language support, EpsilonPayments ensures seamless integration that optimizes operations and drives revenue growth.

Global Reach: Tapping into New Markets with Ease

For high-risk businesses looking to expand globally, EpsilonPayments is the ultimate partner. Its international high-risk payment gateway allows merchants to accept payments from customers worldwide, transcending geographical boundaries and unlocking new markets. We delve into how EpsilonPayments' global reach empowers high-risk merchants to seize untapped opportunities and fuel exponential growth.

Adherence: Navigating Regulatory Complexities with Confidence

Compliance is of utmost importance in high-risk industries, and EpsilonPayments takes this responsibility seriously. In this section, we explore EpsilonPayments' commitment to staying updated with industry standards, including PCI-DSS and KYC requirements. High-risk merchants can operate with peace of mind, knowing that EpsilonPayments ensures adherence to ever-changing regulations.

Dedicated Support: Partnering for Success

Beyond just providing services, EpsilonPayments takes pride in forging lasting partnerships with high-risk merchants. In this section, we shed light on EpsilonPayments' dedicated account managers, who offer expert guidance and support, assisting high-risk merchants in navigating the complexities of payment processing.

Conclusion:

EpsilonPayments has emerged as the undisputed leader in high-risk payment processing, providing tailored solutions, fortified security, global reach, compliance adherence, and dedicated support. For high-risk merchants, EpsilonPayments is more than just a payment partner; it is a catalyst for unstoppable growth and success.

Choose EpsilonPayments, and propel your high-risk business to unprecedented heights, transcending limitations and seizing limitless possibilities. Embrace the power of tailored solutions and fortified security, and let EpsilonPayments be your driving force towards prosperity in the dynamic high-risk landscape.

#payments#fraud#high risk merchant account#high risk payment gateway#digital payment solution#partner

0 notes

Photo

The future of FinTech is in blockchain technology and job seekers should be preparing themselves for mass adoption. The path to mass adoption lies in the hands of the FinTech community and their ability to create innovative applications that make blockchain technology more accessible to everyone.Job seekers need to stay ahead of the curve and learn about this new technology so they can find work in this growing industry. There are many opportunities for those who are willing to learn and be innovative. The future is bright for those who are willing to take the challenge.

#Banking#Blockchain#CBDC#Clearing & Settlement#Cryptocurrency#Data & Analytics#Digital#Digital Asset#Financial Crime & Fraud#Financial Services/Finserv#Innovation#Payments#Regulation#Blockchain.com#EY#FinTech Futures Jobs#Jobbio#Jobs#Wirex#fault

0 notes

Photo

See Fintech Nexus USA at NY Javits Center – 2023 in our World Liberty TV Technology Channel @ https://www.worldlibertytv.org/fintech-nexus-usa-at-ny-javits-center-2023/

0 notes

Text

#cashless payments#Japan#credit card fraud#financial systems#security#financial transactions#digital finance#financial crime.

0 notes

Text

Many eCommerce companies add every single payment option to their website to accommodate customers’ needs. Hey, someone out there is using Bitcoin… right?

However, having too many payment options can be counterintuitive. You need to offer the payment methods your customers want, but avoid adding payment methods your shoppers won’t use and that increase the risk of fraud. Think global, but adapt for local.

At the turn of the 21st century, two psychologists, Sheena Iyengar and Mark Lepper, set up an experiment at a food market. On day one, shoppers were shown a table with 24 different samples of jam. On the second day, only six samples were available.

The table with the larger number of samples attracted the most people, but did this interest convert to sales?

Interestingly, it didn’t.

#resources-our-work#digital marketing#digitalmarketing#ecommerce#digital#social media#digital transformation#marketing#Many eCommerce companies add every single payment option to their website to accommodate customers’ needs. Hey#someone out there is using Bitcoin… right?#However#having too many payment options can be counterintuitive. You need to offer the payment methods your customers want#but avoid adding payment methods your shoppers won’t use and that increase the risk of fraud. Think global#but adapt for local.#At the turn of the 21st century#two psychologists#Sheena Iyengar and Mark Lepper#set up an experiment at a food market. On day one#shoppers were shown a table with 24 different samples of jam. On the second day#only six samples were available.#The table with the larger number of samples attracted the most people#but did this interest convert to sales?#Interestingly#it didn’t.#webdesign

0 notes

Text

#fintech#digital banking#embedded finance#financial services#open banking#decentralisation#digital transformation#customer onboarding#fraud prevention#compliance#risk management#cashless payment

0 notes

Text

Intuit: “Our fraud fights racism”

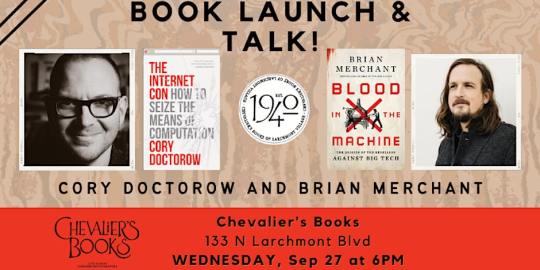

Tonight (September 27), I'll be at Chevalier's Books in Los Angeles with Brian Merchant for a joint launch for my new book The Internet Con and his new book, Blood in the Machine. On October 2, I'll be in Boise to host an event with VE Schwab.

Today's key concept is "predatory inclusion": "a process wherein lenders and financial actors offer needed services to Black households but on exploitative terms that limit or eliminate their long-term benefits":

https://journals.sagepub.com/doi/10.1177/2329496516686620

Perhaps you recall predatory inclusion from the Great Financial Crisis, when predatory subprime mortgages with deceptive teaser rates were foisted on Black homeowners (who were eligible for better mortgages), resulting in a wave of Black home theft in the foreclosure crisis:

https://prospect.org/justice/staggering-loss-black-wealth-due-subprime-scandal-continues-unabated/

Before these loans blew up, they were styled as a means of creating Black intergenerational wealth through housing speculation. They turned out to be a way to suck up Black families' savings before rendering them homeless and forcing them into houses owned by the Wall Street slumlords who bought all the housing stock the Great Financial Crisis put on the market:

https://pluralistic.net/2022/02/08/wall-street-landlords/#the-new-slumlords

That was just an update on an old con: the "home sale contract," invented by loan-sharks who capitalized on redlining to rip off Black families. Back when banks and the US government colluded to deny mortgages to Black households, sleazy lenders created the "contract loan," which worked like a mortgage, but if you were late on a single payment, the lender could seize and sell your home and not pay you a dime – even if the house was 99% paid for:

https://socialequity.duke.edu/wp-content/uploads/2019/10/Plunder-of-Black-Wealth-in-Chicago.pdf

Usurers and con-artists love to style themselves as anti-racists, seeking to "close the racial wealth gap." The payday lending industry – whose triple-digit interest rates trap poor people in revolving debt that they can never pay off – styles itself as a force for racial justice:

https://pluralistic.net/2022/01/29/planned-obsolescence/#academic-fraud

Payday lenders prey on poor people, and in America, "poor" is often a euphemism for "Black." Payday lenders disproportionately harm Black families:

https://ung.edu/student-money-management-center/money-minute/racial-wealth-gap-payday-loans.php

Payday lenders are just unlicensed banks, who deploy a layer of bullshit to claim that they don't have to play by the rules that bind the rest of the finance sector. This scam is so juicy that it spawned the fintech industry, in which a bunch of unregulated banks sprung up to claim that they were too "innovative" to be regulated:

https://pluralistic.net/2023/05/01/usury/#tech-exceptionalism

When you hear "Fintech," think "unlicensed bank." Fintech turned predatory inclusion into a booming business, recruiting Black spokespeople to claim that being the sucker at the table in the cryptocurrency casino was actually a form of racial justice:

https://www.nytimes.com/2021/07/07/business/media/cryptocurrency-seeks-the-spotlight-with-spike-lees-help.html

But not all predatory inclusion is financial. Take Facebook Basics, Meta's "poor internet for poor people" program. Facebook partnered with telcos in the Global South to rig their internet access. These "zero rating" programs charged subscribers by the byte to reach any service except Facebook and its partners. Facebook claimed that this would "bridge the digital divide," by corralling "the next billion internet users" into using its services.

The fact that this would make "Facebook" synonymous with "the internet" was just an accidental, regrettable side-effect. Naturally, this was bullshit from top to bottom, and the countries where zero-rating was permitted ended up having more expensive wireless broadband than the countries that banned it:

https://www.eff.org/deeplinks/2019/02/countries-zero-rating-have-more-expensive-wireless-broadband-countries-without-it

The predatory inclusion gambit is insultingly transparent, but that doesn't stop desperate scammers from trying it. The latest chancer is Intuit, who claim that the end of its decade-long, wildly profitable "free tax prep" scam is bad for Black people:

https://www.propublica.org/article/turbotax-intuit-black-taxpayers-irs-free-file-marketing

Some background. In nearly every rich country on Earth, the tax authorities send every taxpayer a pre-filled tax return, based on the information submitted by employers, banks, financial planners, etc. If that looks good to you, you just sign it and send it back. Otherwise, you can amend it, or just toss it in the trash and pay a tax-prep specialist to produce your own return.

But in America, taxpayers spend billions every year to send forms to the IRS that tell it things it already knows. To make this ripoff seem fair, the hyper-concentrated tax-prep industry, led by the Intuit, creators of Turbotax, pretended to create a program to provide free tax-prep to working people.

This program was called Free File, and it was a scam. The tax-prep cartel each took a different segment of Americans who were eligible for Freefile and then created an online house of mirrors that would trick those people into spending hours working on their tax-returns until they were hit with an error message falsely claiming they were ineligible for the free service and demanding hundreds of dollars to file their returns.

Intuit were world champions at this scam. They blocked their Freefile offering from search-engine crawlers and then bought ads that showed up when searchers typed "freefile" into the query box that led them to deceptively named programs that had "free" in their names but cost a fortune to use – more than you'd pay for a local CPA to file on your behalf.

The Attorneys General of nearly every US state and territory eventually sued Intuit over this, settling for $141m:

https://www.agturbotaxsettlement.com/Home/portalid/0

The FTC is still suing them over it:

https://www.ftc.gov/legal-library/browse/cases-proceedings/192-3119-intuit-inc-matter-turbotax

We have to rely on state AGs and the FTC to bring Intuit to justice because every Intuit user clicks through an agreement in which we permanently surrender our right to sue the company, no matter how many laws it breaks. For corporate criminals, binding arbitration waivers are the gift that keeps on giving:

https://pluralistic.net/2022/02/24/uber-for-arbitration/#nibbled-to-death-by-ducks

Even as the scam was running out, Intuit spent millions lobby-blitzing Congress, desperate for action that would let it continue to privately tax the nation for filling in forms that – once again – told the IRS things it already knew. They really love the idea of paying taxes on paying your taxes:

https://pluralistic.net/2023/02/20/turbotaxed/#counter-intuit

But they failed. The IRS has taken Freefile in-house, will send you a pre-completed tax return if you want it. This should be the end of the line for Intuit and other tax-prep profiteers:

https://pluralistic.net/2023/05/17/free-as-in-freefile/#tell-me-something-i-dont-know

Now we're at the end of the line for the scam, Intuit is playing the predatory inclusion card. They're conning Black newspapers like the Chicago Defender into running headlines like "IRS Free Tax Service Could Further Harm Blacks,"

https://defendernetwork.com/news/opinion/irs-free-tax-service-could-further-harm-blacks/

The only named source in that article? Intuit spokesperson Derrick Plummer. The article went out on the country's Black newswire Trice Edney, whose editor-in-chief did not respond to Propublica's Paul Kiel's questions.

Then Black Enterprise got in on the game, publishing "Critics Claim The IRS Free Tax Prep Service Could Hurt Black Americans." Once again, the only named source for the article was Plummer, who was "quoted at length." Black Enterprise declined to tell Kiel where that article came from:

https://www.blackenterprise.com/critics-claim-the-irs-free-tax-prep-service-could-hurt-black-americans/

For Intuit, placing op-eds is a tried-and-true tactic for laundering its ripoffs into respectability. Leaked internal Intuit memos detail the company's strategy of "pushing back through op-eds" to neutralize critics:

https://www.documentcloud.org/documents/6483061-Intuit-TurboTax-2014-15-Encroachment-Strategy.html

Intuit spox Derrick Plummer did respond to Kiel's queries, denying that Intuit was paying for these op-eds, saying "with an idea as bad as the Direct File scheme we don’t have to pay anyone to talk about how terrible it is."

Meanwhile, ex-NAACP director (and No Labels co-chair) Benjamin Chavis has used his position atop the National Newspaper Publishers Association to publish op-eds against the IRS Direct File program, citing the Progressive Policy Institute, a pro-business thinktank that Intuit's internal documents describe as part of its "coalition":

https://www.documentcloud.org/documents/6483061-Intuit-TurboTax-2014-15-Encroachment-Strategy.html

Chavis's Chicago Tribune editorial claimed that Direct File could cause Black filers to miss out on tax-credits they are entitled to. This is a particularly ironic claim given Intuit's prominent role in sabotaging the Child Tax Credit, a program that lifted more Americans out of poverty than any other in history:

https://pluralistic.net/2021/06/29/three-times-is-enemy-action/#ctc

It's also an argument that can be found in Intuit's own anti-Direct File blog posts:

https://www.intuit.com/blog/innovative-thinking/taxpayer-empowerment/intuit-reinforces-its-commitment-to-fighting-for-taxpayers-rights/

The claim is that because the IRS disproportionately audits Black filers (this is true), they will screw them over in other ways. But Evelyn Smith, co-author of the study that documented the bias in auditing says this is bullshit:

https://siepr.stanford.edu/publications/working-paper/measuring-and-mitigating-racial-disparities-tax-audits

That's because these audits of Black households are triggered by the IRS's focus on Earned Income Tax Credits, a needlessly complicated program available to low-income (and hence disproportionately Black) workers. The paperwork burden that the IRS heaps on EITC recipients means that their returns contain errors that trigger audits.

As Smith told Propublica, "With free, assisted filing, we might expect EITC claimants to make fewer mistakes and face less intense audit scrutiny, which could help reduce disparities in audit rates between Black and non-Black taxpayers."

Meanwhile, the predatory inclusion talking points continue to proliferate. Nevada accountants and the state's former controller somehow coincidentally managed to publish op-eds with nearly identical wording. Phillip Austin, vice-chair of Arizon's East Valley Hispanic Chamber of Commerce, claims that free IRS tax prep "would disproportionately hurt the Hispanic community." Austin declined to tell Propublica how he came to that conclusion.

Right-wing think-tanks are pumping out a torrent of anti-Direct File disinfo. This surely has nothing to do with the fact that, for example, Center Forward has HR Block's chief lobbyist on its board:

https://thehill.com/opinion/finance/4125481-direct-e-file-wont-make-filing-taxes-any-easier-but-it-could-make-things-worse/

The whole thing reeks of bullshit and desperation. That doesn't mean that it won't succeed in killing Direct File. If there's one thing America loves, it's letting businesses charge us a tax just for dealing with our own government, from paying our taxes to camping in our national parks:

https://pluralistic.net/2022/11/30/military-industrial-park-service/#booz-allen

Interestingly, there's a MAGA version of predatory inclusion, in which corporations convince low-information right-wingers that efforts to protect them from ripoffs are "woke." These campaigns are, incredibly, even stupider than the predatory inclusion tale.

For example, there's a well-coordianted campaign to block the junk fees that the credit card cartel extracts from merchants, who then pass those charges onto us. This campaign claims that killing junk fees is woke:

https://pluralistic.net/2023/08/04/owning-the-libs/#swiper-no-swiping

How does that work? Here's the logic: Target sells Pride merch. That makes them woke. Target processes a lot of credit-card transactions, so anything that reduces card-processing fees will help Target. Therefore, paying junk fees is a way to own the libs.

No, seriously.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/09/27/predatory-inclusion/#equal-opportunity-scammers

299 notes

·

View notes

Text

#Echecks#Electronic checks#Merchant services#Payment processing#Digital payments#ACH (Automated Clearing House)#Online payments#Payment gateways#Payment solutions#E-commerce payments#Payment processors#Secure transactions#Electronic funds transfer#Payment technology#Payment verification#Payment acceptance#Digital banking#Transaction fees#Fraud prevention#Payment authorization

2 notes

·

View notes

Text

Secure Credit Card Payment Systems for Global E-Commerce Expansion

Article by Jonathan Bomser | CEO | Accept-Credit-Cards-Now.com

In today's swiftly evolving digital realm, the e-commerce industry is experiencing unprecedented growth. As businesses venture into the global market, the importance of secure credit card payment systems becomes increasingly evident. This comprehensive guide delves into the realm of payment processing for high-risk industries, emphasizing the secure acceptance of credit cards, particularly in sectors like credit repair, CBD sales, and e-commerce. The goal is to provide valuable insights and strategies to ensure transaction safety and foster business growth.

DOWNLOAD THE SECURE CREDIT CARD INFOGRAPHIC HERE

Understanding High-Risk Merchant Processing

To truly comprehend the significance of secure credit card payment systems, it's essential to grasp the concept of high-risk merchant processing. Businesses labeled as high-risk often encounter obstacles in traditional payment processing due to factors like high chargeback rates, regulatory challenges, or operating in industries prone to fraud. High-risk merchant processing, a specialized service, addresses these challenges using advanced technologies and risk mitigation strategies. Whether in credit repair, CBD, or e-commerce, finding a reliable high-risk payment gateway is crucial.

The Role of Credit Card Payment Solutions

In the e-commerce realm, trust is a valuable currency. Customers navigating online stores seek assurance that their credit and debit card information is secure. This is where credit card payment solutions play a pivotal role. Reputable credit card payment processors offer robust encryption and fraud detection tools, ensuring the protection of sensitive data. Access to a vast network of financial institutions facilitates international transactions, while user-friendly interfaces enable seamless integration with online payment gateways. Partnering with the right credit card payment service provides businesses with a competitive edge and enhances the overall shopping experience.

Tailoring Payment Processing for Your Industry

Certain industries demand secure credit card payment systems. Credit repair businesses, often met with skepticism, can instill confidence in customers through a reliable Credit Repair Payment Gateway. The CBD industry, grappling with regulatory complexities, can navigate challenges seamlessly with a specialized CBD Merchant Account. E-commerce businesses, irrespective of their niche, heavily rely on secure payment systems. Fast and secure e-commerce payment processing is vital for both customer trust and operational efficiency.

Benefits of Accepting Credit Cards for Your Business

Exploring the significance of secure credit card payment systems reveals numerous advantages. Credit cards, a preferred payment mode for many customers, contribute to higher conversion rates. Accepting credit cards facilitates entry into international markets, expanding business reach. Businesses that accept credit cards are often perceived as more established and trustworthy by customers.

Online Payment Gateway - The Backbone of E-Commerce

At the core of secure credit card payment systems lies the online payment gateway. This virtual bridge connects customers to businesses, enabling seamless and secure transactions. Online payment gateways serve as intermediaries between e-commerce stores and financial institutions responsible for authorizing credit card transactions. They play a crucial role in ensuring swift and secure payments, benefiting both businesses and customers.

Modern payment gateways utilize state-of-the-art encryption techniques to protect sensitive customer data during transmission. Designed for easy integration into e-commerce websites, they facilitate a smooth checkout process. Payment gateways offer diverse payment options, including credit and debit cards, digital wallets, catering to a broader customer base. Advanced fraud detection tools identify and prevent fraudulent transactions, safeguarding businesses and customers.

youtube

Benefits of Using Online Payment Gateways

By accepting various payment methods, online payment gateways empower e-commerce stores to cater to a global customer base. A secure and hassle-free payment experience builds trust, encouraging repeat business. Automated payment processing reduces manual work, streamlining operations and minimizing the risk of errors. Integrating a reliable online payment gateway is a critical step for providing a secure and efficient credit card payment system in e-commerce setups.

Embracing secure credit card payment systems is not just a choice; it's a necessity. Whether operating in high-risk industries like credit repair or CBD sales or managing a thriving e-commerce store, the right payment processing solution can fuel growth. Explore the significance of high-risk merchant processing, the role of credit card payment services, and tailored solutions for various industries. By accepting credit cards, businesses ensure transaction security and pave the way for long-term success. Trust and security are the pillars on which businesses thrive. Embrace the power of secure credit card payment systems and unlock the potential for global e-commerce expansion.

#high risk merchant account#merchant processing#payment processing#credit card processing#high risk payment processing#high risk payment gateway#accept credit cards#credit card payment#payment#youtube#Youtube

21 notes

·

View notes

Text

Prepaid Cards – Empowering Secure Transactions in India’s Digital Payment Landscape | AGS India

Prepaid card market in India is projected to witness a CAGR of 31.5% during 2021-2025, reaching USD 89.8 billion by 2025, up from USD 30 billion in 2020.

#Billing software#Billing Machine#Fintech company#Digital payments#cash payment#cash management services#online payment systems#Cash transit#QR code payment#cashless transaction in India#Digital payment solutions#payment company#RFID solutions#Payment solutions#fuel management system#cashless payment#fraud prevention#Banking automation#retail automation#Banking outsourcing

0 notes

Note

i read the wiki on the jstor / aaron case and i’m still confused i don’t quite understand what happened? he was being criminally charged for … downloading academic files ???

yes.

what you need to understand for context is that most academic papers are kept behind a paywall. the authors of those papers are most commonly folks like university professors who performed the research under grants from various places including the government and large corporations.

from there, there are only a limited number of options to publish the findings. once upon a time, it used to all be in print but now obviously everything is digital.

thus, the only way to access these scientific publications is through specific journals and their digital collections, all of which require payment to access. when you shell out $25, $50, or even $100 to download an article, none of that money goes to the researchers. they've already been compensated through their grants and have shared their findings with the public at no cost. the entire fee ends up with, in Aaron Swartz's case, JSTOR.

so all of the research and work was funded by some group. the work was actually performed by another group. the work was given to the public to further the collective knowledge of humanity. but in order for any of us to access the knowledge we have to pay for it. Aaron Swartz believed that was wrong. he believed that JSTOR was profiting off of an unnecessary middle man position that it created itself to enrich individuals.

so he used a Python script running on a laptop hidden in a maintenance closet at MIT to bulk download a large amount of publicly available academic papers from the JSTOR database with the intention of hosting them for free elsewhere on the web. JSTOR realized it and sent the feds after him.

here is JSTOR, on a site that exists today, in 2013 describing what Aaron Swartz did as "extremely serious."

despite JSTOR later dropping its case after backlash and despite Aaron having access rights to the database, he was later indicted on federal charges under the Computer Fraud and Abuse Act.

faced with up to 35 years of jail time and quickly-draining legal funds, Aaron committed suicide in his Brooklyn apartment, shortly after being denied further negotiation on his plea bargain by Assistant US Attorney Stephen Heymann.

more from maia on this topic from just a few months ago can be found here.

13 notes

·

View notes

Text

When it comes to Australia’s national regulators, women rule.

Women now dominate the leadership of federal regulatory and oversight agencies that enforce rules for business and the economy, with 33 women holding chief executive or chair roles. This signals a profound shift for the nation’s top watchdogs, once almost solely the domain of male enforcers.

Rapid digitisation and rising globalisation are making traditional black letter enforcement approaches less effective, leading to women with so-called solid soft skills, such as influence, collaboration and communication, winning top-tier regulatory roles.

Women are now at the front line of the battles against scams, identity and data theft, cyber ransomware attacks, electronic espionage, digital surveillance, misinformation, social media abuse and dark web criminality.

“It’s very different to the skills base you needed a decade or two ago where it was just about telling people what to do, and they would toe the line,” says Ann Sherry, a former head of the Office of Status of Women in the Hawke and Keating governments.

“Those jobs were filled by a particular sort of person cast as a regulator. So, in a way, it was almost an enforcement role, whereas the jobs have changed.”

The leadership of the federal public service reached gender equilibrium last year.

Sherry, who is now QUT chancellor and chairs Queensland Airports, digital marketing firm Enero and UNICEF Australia, says that the public sector has been better at promoting women through the ranks but that many women have also built relevant skills in the private sector.

“Many women have had to broaden their careers and build a broad set of skills to be successful. There is now a body of capability to draw up. The talent pool has changed, and the jobs require broader skills. It is a confluence of events,” she says.

The surge in women leading federal regulators compares with 19 women (10 per cent) chairing ASX200 companies and 26 women (9 per cent) who are CEOs across the ASX300, as at the end of 2023.

Competition chief Gina Cass-Gottlieb and Reserve Bank of Australia governor Michele Bullock (who also chairs the Payments System Board) are the first women to lead their institutions. Others, such as media watchdog Nerida O’Loughlin and energy regulator Clare Savage, have won second appointments.

A push to bring in new blood from outside the Australian public service helped veteran NSW regulator Elizabeth Tydd win an appointment as head of the Australian Information Commission. Carly Kind was tapped from a London think tank to be the new privacy commissioner.

They join a swag of women now overseeing vast swaths of the economy, including infrastructure (Gabrielle Trainor), aviation (Pip Spence), food (Sandra Cuthbert), petroleum (Sue McCarrey) and fisheries (Helen Kroger).

Others such as Rachel Noble (espionage), Julie Inman Grant (e-safety), Jayde Richmond (anti-scams centre) and Michelle McGuinness (cyber co-ordinator) are focused on rapidly emerging harms, including national security threats, identity and data theft, consumer abuse, online scams and fraud.

Workplace and safety regulators are now dominated by women too, including Anna Booth (Fair Work Ombudsman), Joanne Farrell (Safe Work Australia), Jeanine Drummond (maritime safety), Natalie Pelham (rail safety) and Janet Anderson (aged care).

The dominant role female regulators play has been part of a profound shift in the number of women in leadership roles in the Australian government. This has risen from a quarter of executive roles being held by women 20 years ago to over 50 per cent last year.

Battle ready

Australian Competition and Consumer Commission chair Gina Cass-Gottlieb, who rose through the ranks as a competition lawyer at law firm Gilbert and Tobin, says her generation of leaders had battled their way through male-dominated workplaces.

“In those workplaces, to get ahead, we needed to target the areas we thought were most important to make an intervention and where we could most effectively make an impact.

“We actually had to build skills to succeed, which are beneficial skills in these roles.”

Ms Cass-Gottlieb says women have also had to differentiate themselves. “You needed to point to other ways of working, including creative and different solutions that drew from experience in various areas rather than a pure step-by-step standard career path.”

Australian Information Commissioner Tydd points to Columbia University research that measured creativity by analysing songs, finding that women created more songs than men.

“Digital government requires a creative use of proactive tools to identify and mitigate future harm. It’s the unforeseen or latent harms that are the most refractory and so we’ve got to look at diagnosis and predictive tools, and that’s where you start to get a bit creative.”

Tydd says she was attracted to regulatory work because of the value of promoting open government, transparency and accountability.

“I think that seeking service and purpose orientation are factors that drive people into this work and I do think seeking service is a very comfortable and well-established motivation within women.”

Demand for new approaches

According to ANU Crawford School of Public Policy director Professor Janine O’Flynn, the data on the importance of public motivation for women is mixed. However, she suggests that women’s more attuned risk and relationship skills help them to be more effective regulators.

“We certainly know that the most effective models of regulation are around how you can think about risk and how you build relationships with the parties that have been regulated.

“I don’t mean that in a sort of dodgy way. The higher the trust relationships you can get between regulators and those who are regulated, the more likely you are to get the outcomes that you’re looking for.”

Read the full article in the link above!

3 notes

·

View notes