#Fair labor standards act

Text

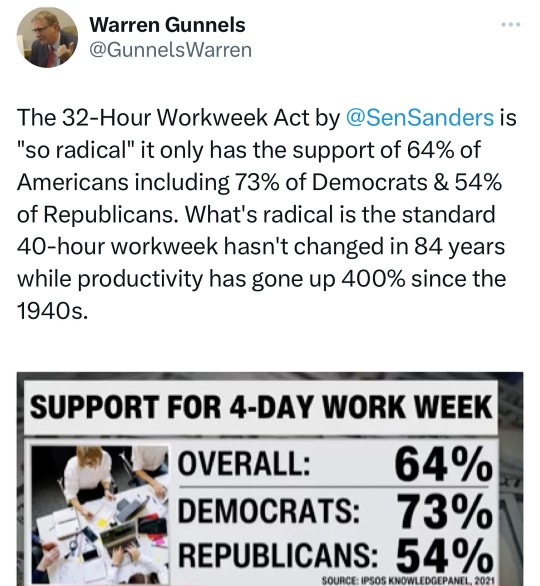

#bernie sanders#work week reduction#32-hour work week#overtime pay#productivity#technology#fair labor standards act#international examples#france#norway#denmark#germany#well-being#stress#fatigue#republican senator bill cassidy#small enterprises#job losses#consumer prices#japan#economic output#labor dynamics#artificial intelligence#automation#workforce composition

120 notes

·

View notes

Text

John Knefel at MMFA:

Project 2025, a sprawling right-wing plan to provide policy and staffing to a future Republican president, proposes an extreme anti-worker agenda that would severely curtail unions’ ability to collectively bargain on behalf of their members and reverse gains organized labor has made in recent years. It would also weaken overtime regulations, give corporations wider latitude in misclassifying workers as independent contractors, and dismantle safety regulations that prohibit young people from working dangerous jobs.

The initiative’s policy book, Mandate for Leadership, is an attempt to roll back New Deal-era, working class victories by allowing state-level exemptions from the National Labor Relations Act and the Fair Labor Standards Act, and by creating nonunion “employee involvement organizations” to undermine unions’ negotiating power. It additionally calls for sharp reductions in the budgets of the National Labor Relations Board and the Department of Labor and a freeze on new hires.

Project 2025 is organized by The Heritage Foundation and includes more than 100 conservative groups on its advisory board, which have collectively received more than $55 million from groups tied to conservative megadonors Leonard Leo and Charles Koch. Leo has been pushing the Supreme Court to further erode the power of organized labor, and the Koch family has waged a war on unions for more than 60 years.

[...]

Project 2025: Eviscerate overtime and dismantle pro-worker regulations

One central proposal in Mandate that illuminates Project 2025’s extreme anti-work posture is the suggestion that employers should be allowed to eviscerate overtime regulations and potentially withhold pay. The attacks on overtime take several forms, including a proposal to allow workers to accrue vacation instead of time-and-a-half compensation — but at least 40 percent of lower- and middle-income workers already don’t use their allotted paid time off. Under this policy employers could coerce workers into “voluntarily” selecting vacation that they’re either formally or informally prohibited from taking, thereby denying them overtime compensation.

Project 2025 further recommends that workers and bosses agree to extend the overtime threshold to a period of two weeks or one month. The policy would empower management to overload busy weeks with extra-long shifts and take advantage of slow periods through under-scheduling — effectively eliminating overtime altogether.

[...]

A return to company unionism

Project 2025 seeks to roll back New Deal-era labor victories by proposing that Congress “pass legislation allowing waivers from federal labor laws” — like the National Labor Relations Act and the Fair Labor Standards Act — “under certain conditions.” Allowing state-level exemptions to the NLRA and FLSA would almost certainly trigger a race-to-the-bottom dynamic, where firms relocate to states with the weakest (or nonexistent) labor protections at the expense of workers. That’s what happened in states that passed so-called “right-to-work” laws — which starve unions of resources by preventing them from collecting fees from all employees they represent, thereby creating a free-rider problem — where employers were able to depress wages and union membership.

Unions have made significant gains under the Biden administration’s National Labor Relations Board, which enforces labor law and investigates anti-union practices. That progress is largely thanks to NLRB general counsel Jennifer Abruzzo, who has taken an aggressive, pro-worker enforcement posture. Project 2025 promises to fire her on “Day One.” It also calls for reductions in the budgets of the NLRB and the Department of Labor to the “low end of the historical average,” as well as implementing a “hiring freeze for career officials.”

[...]

Project 2025 would further undermine unions by eliminating “card check” — where a majority of workers who have signed union authorization forms can ask their employer for voluntary recognition — and mandating “the secret ballot exclusively.” Although the idea of a secret ballot has the veneer of democracy, in practice it’s a power grab for management. By forcing organizers to go through the byzantine NLRB election process, an employer can buy itself time to wage an anti-union campaign and bog down the process, often through illegal means. A 2019 study found that employers violated labor laws in 41.5% of NLRB-supervised union elections in 2016 and 2017 and intimidated or coerced workers in nearly a third of all elections.

The radical right-wing Project 2025 spearheaded by The Heritage Foundation in association with over 100 organizations has an agenda attacking labor and unions.

#Workers' Rights#Project 2025#Overtime Pay#Unions#Donald Trump#The Heritage Foundation#Leonard Leo#Charles Koch#Fair Labor Standards Act#National Labor Relations Act#US Department of Labor#NLRB#Labor#Jonathan Berry#Mandate For Leadership#Card Check#Employee Involvement Organizations

22 notes

·

View notes

Photo

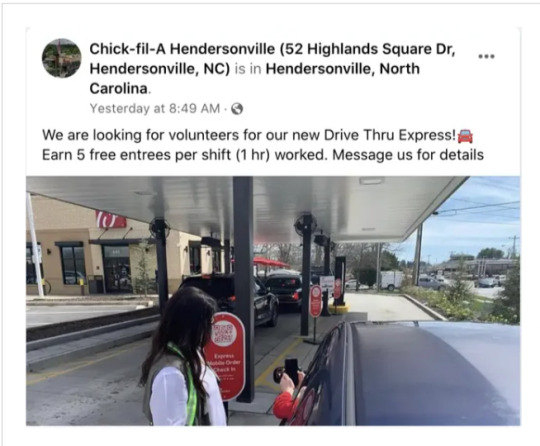

(via Chick-Fil-A Restaurant Required To Pay Workers In Legal Tender, Not Chicken Tenders - Wonkette)

In July of this year, a Chik-Fil-A franchisee in Hendersonville, South Carolina, tried to save some money by asking "volunteers" to come work at their store directing customers to their new Drive Thru Express in exchange for chicken dinners.

"We are looking for volunteers for our new Drive Thru Express! Earn 5 free entrees per shift (1 hr) worked," a Facebook post read, "Message us for details."

then

Now, instead of saving a few bucks, franchise owner Joel Benson will be required to pay all of his "volunteers" in actual, non-edible money. The Labor Department ordered him this week to pay $235 in back pay to seven workers — on top of, we can assume, the five chicken entrees they were given at the time — as paying them in chicken was a violation of the Fair Labor Standards Act. Imagine that!

and

In addition to the backpay, this particular Chick-Fil-A is also being fined $6,450 in civil penalties for violating child labor laws by allowing three minors to operate a trash compactor, which is also illegal. While people under 18 can work, there are laws regulating what kind of work they are allowed to do, and operating a trash compactor is not one of the things they are allowed to do.

don’t go there - this entire company sucks in every way

220 notes

·

View notes

Text

9 notes

·

View notes

Text

Sometimes I'll be reading through wage and employment law and it's blatantly obvious which lobbies Congress was listening to at the time

#I was going through the FLSA#Fair Labor Standards Act#because uhhh I wanted to doublecheck what bonuses that DO have to be included in overtime premium calculations are called#and it didn't answer my question but there were some additional exemptions in here I wasn't aware of

3 notes

·

View notes

Text

New DOL Salary Threshold for Most White-Collar Exemptions Is Now in Effect

Update July 1, 2024: The U.S. Department of Labor’s new rule on the required salary threshold for employees to qualify as exempt from overtime is now in effect as of July 1, 2024. Although the federal district court for the Eastern District of Texas issued an injunction blocking enforcement of the new rule against the State of Texas as an employer on Friday, June 28, 2024, that injunction does…

#business#Employment Law#Fair Labor Standards Act#government#labor and employment#legal#Overtime Eligibility#overtime salary threshold#U.S. Department of Labor

0 notes

Text

Fair labor standards act of 1938

On this page you will read detailed information about Fair Labor Standards Act 1938.

As an employer, you have a responsibility to understand the requirements of the Fair Labor Standards Act. This seminal labor law establishes standards for minimum wage, overtime pay, recordkeeping, and child labor. By educating yourself on the provisions of the FLSA, you can ensure your business complies with federal wage and hour regulations. Adherence demonstrates respect for your employees and reduces exposure to costly litigation. This article provides an overview of the key components of the law and practical guidance for implementation. With 100 words allotted, a concise and focused introduction sets the stage for an exploration of this essential employment statute. Understanding the intricacies of the FLSA allows you to create a compliant workplace that values your staff.

What Is the Fair Labor Standards Act?

The Fair Labor Standards Act (FLSA) is a federal law that establishes minimum wage, overtime pay, record-keeping, and youth employment standards for employees in the private sector and in federal, state, and local governments. It was enacted in 1938 to provide basic protections for workers.

Sets Minimum Wage and Overtime Standards

The FLSA establishes a federal minimum wage for covered employees and ensures that they receive overtime pay of at least one and one-half times their regular rate of pay for hours worked over 40 in a workweek. The minimum wage and overtime provisions apply to employees in the private sector as well as to most federal, state, and local government employees.

Requires Accurate Record Keeping

The FLSA requires employers to keep records on employees and their wages, hours, and other conditions of employment. Employers must keep records for certain periods of time and make them available for inspection by the U.S. Department of Labor’s Wage and Hour Division. Accurate record keeping is essential to determine compliance with the FLSA and to ensure employees receive proper payment for all hours worked.

Prohibits Oppressive Child Labor

The FLSA establishes restrictions on employment of minors to ensure that work does not jeopardize their health, well-being, and opportunities for education. It sets the minimum age for employment, limits the times of day and number of hours minors can work, and prohibits hazardous occupations for minors.FLSA’s child labor provisions are designed to protect the educational opportunities of youth and prohibit their employment in jobs that are detrimental to their health and safety.

Provides Enforcement Mechanisms

The FLSA authorizes the U.S. Department of Labor to investigate and enforce the law, including conducting compliance reviews and bringing court actions for unpaid minimum wages and/or overtime. The FLSA also allows employees to file private lawsuits to recover back wages.

In summary, the Fair Labor Standards Act establishes wage and hour protections for workers to ensure fair working conditions and adequate compensation in the U.S. labor market. It remains the principal federal law regulating wages and hours of employees in the private sector and in federal, state, and local governments.

Who Is Covered Under the FLSA?

The Fair Labor Standards Act (FLSA) applies to most employees in the United States. However, there are some exceptions. The FLSA covers both full-time and part-time workers, with some exemptions for seasonal employees, independent contractors, volunteers, and certain agricultural employees.

For complete information please visit :

0 notes

Text

JUST IN: US Dept. of Labor files complaint against North Central Health Care

North Central Health Care is accused of willfully, repeatedly violating the Fair Labor Standards Act by failing to pay employees overtime in its community treatment program, according to a May 14 federal complaint filed by the U.S. Department of Labor.

By Shereen Siewert | Wausau Pilot & Review

North Central Health Care is accused of willfully, repeatedly violating the Fair Labor Standards Act by failing to pay employees overtime in its community treatment program, according to a May 14 federal complaint filed by the U.S. Department of Labor.

Federal officials say a Wage and Hour Division investigation found NCHC failed to keep accurate and…

View On WordPress

0 notes

Text

Final Independent Contractor Rule: Implications for Health Care

This morning, the Department of Labor issued a final rule interpreting who is and who is not, an independent contractor v. an employee. Contract work in health care has boomed since the pandemic, though even pre-pandemic, the use of contractors (physicians, nurses, therapists, etc.) was on the increase. The final rule is available here: 2024-00067

The new rule makes it harder for companies to…

View On WordPress

#1099#Agency#Compliance#Contract Work#Department of Labor#DOL#Employee#employer#Fair Labor Standards Act#Final Rule#Independent Contractor#Industry Outlook#Labor#litigation#Locum Tenens#Management#Money#Nurses#Policy#Post-Acute#staffing#Staffing Agencies#Strategy#Trends#W-2#wage and hour#wages#Washington

0 notes

Text

A Depression-era law allowing employers to pay them less is widely seen as unfair. But that view isn’t unanimous in the disability community.

0 notes

Text

How Does the Fair Labor Standards Act Protect Employees?

In 1938, the Fair Labor Standards Act was passed which protects employees’ rights to fair wages. Also known as the FLSA, this law protects employees by placing regulations on interstate commerce employment. It oversees things like child labor, minimum wage, and overtime pay; and has standards for both salaried employees and those paid by the hour.

What is the Fair Labor Standards Act?

The FLSA is a federal law that oversees wage regulations for both full and part time employees whether they are employed by a private company or government employer. It regulates things such as the minimum wage, child labor, recordkeeping, and overtime. Federal minimum wage was increased to $7.25 in 2009 and has not been raised since. Generally, if employees work more than forty hours per workweek, they should be paid ‘time and a half’ which is 1.5 times their regular rate of pay.

Who is Protected By the FLSA?

The Fair Labor Standards Act protects employees of public agencies, interstate commerce, production of commercial goods, domestic service, hospitals, schools, and other education facilities. Independent contractors and volunteers are not legally considered employees, and as such, are not protected by the standards and regulations of the FLSA. Employees who are eligible for overtime compensation are required to complete a record of their attendance and times worked.

Primary Areas of Coverage in FLSA

Minimum Wage – The FLSA maintains the federal minimum wage. As of 2009, the minimum wage has been $7.25 per hour. While states are free to set their own minimum wage rates, the only states with a minimum wage lower than the federal rate are Georgia and Wyoming. Both states pay a minimum wage of $5.15 per hour, although employers who are subject to FLSA regulations are required to pay no less than the federal minimum.

Overtime – If an employee is sixteen or older, they may work as many hours as their employer allows. However, if an employee works more than forty hours in a workweek, they may be entitled to overtime pay. Overtime pay must be at least one and a half times the normal hourly rate of pay for the employee.

Hours Worked – The FLSA oversees all time that an employee is doing their job either on site, on duty, or at a designated location.

Recordkeeping – The FLSA requires that employers keep accurate records of employee timecards and payroll. They must also have an official poster of FLSA requirements displayed for employees.

Child Labor – The FLSA maintains regulations that ensure that work does not interfere with a child’s education or best interests. It also limits the types of jobs that children can work and the conditions they can work under.

FLSA Minimum Wage Protections

Though the FLSA maintains a federal minimum wage of $7.25 per hour, many states have instituted their own laws that set their own minimum wage. The FLSA does not govern state law outside of provisions that are in line with preexisting FLSA requirements.

California Minimum Wage

As of January 2023, the state imposed minimum wage in California is $15.50 per hour for all employers. In the past, employers with 26 or more employees were required to pay slightly more than employers with fewer employees. California minimum wage has been rising steadily for years now:

Minimum Wage by Year

FLSA Overtime Protections

The FLSA maintains that an employer must pay covered non-exempt employees time and a half for any time worked over forty hours in a given work week. This does not include paid time off. A work week might not line up with what is considered a calendar week but is a fixed increment of 168 hours. While the work week may vary for different employees, employers are prohibited from averaging hours beyond the confines of a given work week. Furthermore, overtime pay must generally be paid out on the pay period in which it was earned.

Classifying Employees Under FLSA

It is important to know whether a worker is an employee or an independent contractor. Not only are there differences in the rights and benefits, but employers may face fines and legal action if they are caught misclassifying their workers. There are many questions that can be asked to help determine if a worker is an employee or an independent contractor:

Does the employer or the worker determine when and how the work is done?

Does the employer or the worker determine what the worker’s responsibilities are?

Does the employer or the worker provide the supplies and equipment needed?

Does the employer or the worker pay the payroll taxes?

Does the employer or the worker set the rate of pay?

Who is Exempt from Minimum Wage & Overtime Wages?

If an employee is considered nonexempt, then their employer is required to pay them overtime. If an employee is considered exempt, then their employer is not required to pay them overtime. While there are some jobs that are considered exempt in of themselves, there are three conditions that must be met to determine if an employee is considered exempt, such as:

The amount the employee is paid – Generally $35,568 or more a year

The way they are paid – Generally salary

The type of work performed – As defined by FLSA regulations

Freelance workers and independent contractors are not covered by the FLSA. Employers with less than $500,000 a year in sales as well as small farms that do not engage in interstate commerce are also exempt. Other exempt workers also include:

Executives who manage at least two people and authorize job status of others

Administrators who directly work for management and control their own work duties

Outside salespeople who work primarily offsite and on commission

Computer workers paid at least $684 weekly by salary or fee basis

Workers employed by seasonal recreation establishments

Employees of small local newspapers including delivery workers

Sailors on foreign vessels

Personal caregivers such as homecare aides and babysitters

Employees working under an apprenticeship

Record Keeping That Meets FLSA Standards

When an employer is covered by the FLSA, they must keep detailed records for their non-exempt employees. While there is no uniform standard for how these records are kept, there are specific pieces of information that need to be recorded with complete accuracy for each employee:

Full Name

Social Security Number

Date of Birth (employees under 19)

Sex

Occupation

Start of Workweek Day and Time

Daily Hours Worked

Workweek Hours Worked

How wages are paid

Pay Rate by Hour

Total Straight-time Earnings

Workweek Overtime Earnings

Wage Deductions and Additions

Wages per Pay Period

Dates of Pay Period

Date of Payment

Different types of records must be kept on file for different lengths of time. Payroll, collective bargaining agreements, and sales or purchase records must be kept for at least three years. Things like timecards, work schedules, and other methods for computing wages must be kept for at least two years. These records should be kept on site or at a central record keeping office. Employers are required to make these records open and available for Division inspection.

How FLSA Defines and Regulates Hours Worked

The law defines the word ‘employ’ as “to suffer or permit to work”. The time that an employee spends on site or on duty is considered part of their workweek. The workday begins when the employee first starts working and ends when the employee completes their work. The workday often includes more than just hours worked. There are many different classifications of hours under the FLSA and variables that determine if they are considered working hours.

Waiting – There are two different kinds of waiting time. Being engaged to wait is considered work time such as short periods of down time between tasks. Waiting to be engaged is not considered work time such as free time between jobs.

On Call – An employee is considered working while on call if they are required to stay on site. Generally, if an employee is free to go about their day, they are not considered working while on call. The extent of that freedom may change whether or not the employee is considered working.

Breaks – Short breaks, often five to twenty minutes, are generally considered to be part of hours worked and are paid time. Employers may implement their own consequences for employees taking extended breaks and may be permitted to not count the extra time as time worked. Meal breaks, often thirty to sixty minutes, are usually not considered to be part of hours worked and are unpaid so long as the employee is completely free of their work responsibilities while on break.

Sleep – If an employee is on duty for shifts of twenty-four hours or longer, they may negotiate unpaid sleeping breaks with their employer. These breaks must be more than five and less than eight hours and the employer must provide a proper sleeping area. For shifts shorter than twenty-four hours, authorized sleeping breaks are considered time worked.

Training & Meetings – There are four factors that must apply in order for a meeting or training program to be unpaid: Outside of working hours, attendance is voluntary, unrelated to the employee’s job, and no work is required to be done.

Daily Commute – Regular travel time from home to work and back is not considered hours worked.

One Time Extended Commute – If an employee routinely works at one location and is required to go to another location in another city for a day, the additional commute time may be considered time worked. Employers are permitted to exclude the employee’s normal commute time from those hours.

Daily Travel – Some jobs may require travel as part of the employee’s duties such as deliveries or traveling between job sites. This travel time is considered hours worked.

Trips – If an employee is required to travel for work and is kept away overnight, this is considered travel away from home and is hours worked. Not only is working time counted, but also work hours on days off while away.

FLSA Regulations on Child Labor

There are many restrictions on the type of work that employees under eighteen years old may be permitted to perform as well as the conditions under which they are permitted to work. The FLSA does not allow minors to work jobs that they consider hazardous to the minor’s wellbeing or education. There are also restrictions governing the hours a minor is allowed to work and the breaks they must be provided. Each state also has their own laws regulating child labor that employers should be aware of.

Recent FLSA Updates

The 2018 amendments to FLSA regarding tipped employees were updated in 2020 and 2021. The new regulations forbid employers from taking any part of the employee’s tips and also updated the restrictions on when an employer can alter an employee’s pay based on earned tips.

The Joint Employer Rule was rescinded in July of 2021.

The United States Department of Labor recently began proposal of a new rule to update the regulations and guidelines for determining if a worker is an independent contractor or an employee in accordance with the FLSA. This rule was proposed in October of 2022, replacing the January 2021 rule with a more accurate and precise method for classification. The rule is considered mutually beneficial for both workers and employers, reducing the risk of employee misclassification, and increasing employer confidence and peace of mind when hiring independent contractors.

Common Violations of FLSA

Unfortunately, there are many ways in which employers can and do violate the Fair Labor Standards Act:

Misclassification – Employers may sometimes classify an employee as exempt based on their job title or type of pay rate even though the job duties and amount of pay indicate that the employee is nonexempt. It is important for employers to be mindful of all the variables of a situation and for employees to be well informed of their rights.

Not compensating off the clock work – When an employee works beyond their scheduled time, even if they are clocked out, that is still considered hours worked and the employee should be compensated. Even if the employer did not request or permit the off the clock work, they are still responsible for paying the employee.

Not compensating working breaks – When an employee is expected to be on call through their breaks, or works through their lunch, that time is considered hours worked and the employee must be compensated. In order for a break to be unpaid, the employee must not be performing any job-related duties such as cleaning, replying to emails, or interacting with clients.

Overtime waivers – If an employer has an employee sign a document waiving their right to overtime pay, that document is invalid and unenforceable.

Averaging workweeks – Sometimes, an employer may average out the number of hours an employee has worked over two or more weeks to avoid paying overtime. If an employee takes a day off one week and then works an extra eight hours the next week, the employer may average those hours out to say the employee worked forty hours each week. This may seem mathematically logical, but it is actually legally prohibited.

What to Do If Your Employer Violates the FLSA

Because there are employers who will violate FLSA, employees must be aware of the options available to them and the steps to take if they find themselves in such a situation. Complaints regarding FLSA violations can and should be filed with the Department of Labor’s Wage and Hour Division.

The WHD investigates violation claims by having a representative conduct interviews with the employer and various employees, research payroll and timecard documents, and gather any other information that may indicate if a violation has been committed.

The person who files the complaint does not need to be the person against whom the violation was committed. Anyone who witnesses their employer violating the FLSA may report that violation.

It is prohibited for an employer to retaliate against an employee who has filed a complaint or participated in an investigation against them.

How to File FLSA Complaint

When filing a complaint with the WHD, there are several details you will need to provide:

Your name

Your address

Your phone number

The company’s name, address, and number

Owner/employer/manager name

Your job duties

Your pay rate and method

It is good to be as detailed as possible when providing information. Your complaint is the starting point of their investigation. When filing a complaint as a third party, you may not have all of the information needed, but it is important to share as much as possible.

Contact Mesriani Law Group if You Have Experienced a FLSA Violation

The Fair Labor Standards Act exists to protect workers and their right to fair wages. All too often, employers try to circumvent the law and get away with cheating their employees out of the money they’ve earned. When these violations occur, employees have the right to file complaints against their employers. If you are facing retaliation for filing a claim with the Department of Labor or participating in an investigation against your employer, call Mesriani Law Group today for a free consultation.

Fair Labor Standards Act FAQs

What are the four main elements of the FLSA?

There are four primary areas established and enforced by the Fair Labor Standards Act. Establishing and enforcing minimum wage, overtime pay, regulations for recordkeeping, and regulations for child labor. While some jobs and employees may not be covered by the FLSA or exempt from overtime, the act generally applies to part time as well as full time workers of both private and government employers.

What are some common mistakes made under FLSA?

Whether intentional or accidental, there are employers who do not adhere to the regulations set forth by the FLSA. One of the most common mistakes employers make is misclassifying their employees. Not paying overtime properly and allowing employees to work off the clock or during their breaks without compensation are also violations that occur far too often. It is important for everyone on both sides of an employment relationship to be familiar with the law and how it applies to them.

What is not regulated under the Fair Labor Standards Act?

There are several aspects of employment that the Fair Labor Standards Act does not oversee. This includes but it not limited to things like the payment of wages in excess of FLSA requirements, lunch and rest breaks, termination letters, and final payments for terminated employees. The FLSA also does not regulate paid time off. It is important to also be aware of state laws and regulations pertaining to all employment matters.

#California Employment Law#Fair Labor Standards Act#FLSA#Employment Law#Employment Lawyers#California Attorneys

0 notes

Text

1 note

·

View note

Text

Who Needs School? Just Put 'Em To Work!

Much has been written about the history of children working and child labour laws in the United States. Federal child labor laws are broad in scope, and many states have state laws that are more restrictive, as is only right and fair. Children are children for the first 18 years of their lives, and then they are adults for the entire rest of their lives. The focus during their childhood should…

View On WordPress

0 notes

Text

DOL Issues Guidance on Handling Telework Under FLSA, FMLA

The U.S. Department of Labor (DOL) has issued guidance on the application of the Fair Labor Standards Act (FLSA) and Family and Medical Leave Act (FMLA) to employees who telework from home or from another location away from the employer’s facility.

The Field Assistance Bulletin (FAB) 2023-1, released on February 9, 2023, is directed to agency officials responsible for enforcement and provides…

View On WordPress

#business#department of labor#DOL#Employment Law#Fair Labor Standards Act#Family and Medical Leave Act#FLSA#FMLA#Labor Law#legal

1 note

·

View note

Text

Corporate Bullshit

I'm coming to BURNING MAN! On TUESDAY (Aug 27) at 1PM, I'm giving a talk called "DISENSHITTIFY OR DIE!" at PALENQUE NORTE (7&E). On WEDNESDAY (Aug 28) at NOON, I'm doing a "Talking Caterpillar" Q&A at LIMINAL LABS (830&C).

Corporate Bullshit: Exposing the Lies and Half-Truths That Protect Profit, Power, and Wealth in America is Nick Hanauer, Joan Walsh and Donald Cohen's 2023 book on the history of corporate apologetics; it's great:

https://thenewpress.com/books/corporate-bullsht

I found out about this book last fall when David Dayen reviewed it for the The American Prospect; Dayen did a great job of breaking down its thesis, and I picked it up for my newsletter, which prompted Hanauer to send me a copy, which I finally got around to reading yesterday (I have gigantic backlog of reading):

https://pluralistic.net/2023/10/27/six-sells/#youre-holding-it-wrong

The authors' thesis is that the business world has a well-worn playbook that they roll out whenever anything that might cause industry to behave even slightly less destructively is proposed. What's more, we keep falling for it. Every time we try to have nice things, our bosses – and their well-paid Renfields – dust off their talking points from the last go-round, do a little madlibs-style search and replace, and bust it out again.

It's a four-stage plan:

I. First, insist that there is no problem.

Enslaved people are actually happy. Smoking doesn't cause cancer. Higher CO2 levels are imaginary and they're caused by sunspots and they're good for crop yields. The hole in the ozone layer is only a problem if you foolishly decide to hang around outside (this is real!).

II. OK, there's a problem, but it's your fault.

An epidemic of on-the-job maimings is actually an epidemic of sloppy workers. A gigantic housing crash is really a gigantic cohort of greedy, feckless borrowers. Rampant price gouging is actually a problem of too much "spending power" (that is, "money") in the hands of working people.

III. Any attempt to fix this will make it worse.

Equal wages for equal work will cause bosses to fire women and people of color. Protecting people with disabilities will cause bosses to fire disable people. Minimum wages will cause bosses to buy machines and fire "unskilled" workers. Gun control will only increase underground gun sales. Banning carcinogenic pesticides will end agriculture as we know and we'll all starve to death.

IV. This is socialism.

Income tax is socialism. Estate tax is socialism. Medicare and Medicaid are socialism. Food stamps are socialism. Child labor laws are socialism. Public education is socialism. The National Labor Relations Act is socialism. Unions are socialism. Social security is socialism. The Fair Labor Standards Act is socialism. Obamacare is socialism. The Civil Rights Act is socialism. The Occupational Health and Safety Act is socialism. The Family Medical Leave Act is socialism. FDR is a socialist. JFK is a socialist. Lyndon Johnson is a socialist. Carter is a socialist. Clinton is a socialist. Obama is a socialist. Biden is a socialist (Biden: "I beat the socialist. That's how I got the nomination").

Though this playbook has been in existence since the nation's founding, the authors point out that from the New Deal until the Reagan era, it didn't get much traction. But starting in the Reagan years, the well-funded network of billionaire-backed think-tanks, endowed economics chairs, and latter-day propaganda vehicles like Prageru breathed new life into these tactics.

We can see this playing out right now as the corporate world scrambles for a response to the Harris campaign's proposal to address price-gouging. Reading Matt Stoller's dissection of this response, we can see the whole playbook on display:

https://www.thebignewsletter.com/p/monopoly-round-up-price-gouging-vs

First, corporate apologists insisted that greedflation didn't exist, despite the fact that CEOs kept getting on earnings calls and boasting to their investors about how they were using the excuse of inflation to jack up prices:

https://pluralistic.net/2023/03/11/price-over-volume/#pepsi-pricing-power

Or the oil CEOs who boasted that the Russian invasion of Ukraine gave them cover to just screw us at the pump:

https://pluralistic.net/2022/03/15/sanctions-financing/#soak-the-rich

There are all these out-in-the-open commercial entities whose sole purpose is to "advise" large corporations about their prices, which is just a barely disguised euphemism for price-fixing, from meat-packing:

https://pluralistic.net/2023/10/04/dont-let-your-meat-loaf/#meaty-beaty-big-and-bouncy

To rents:

https://pluralistic.net/2024/07/24/gouging-the-all-seeing-eye/#i-spy

That's stage one: "there's no problem." Stage two is "it's your fault." That's Larry Summers and co insisting that a couple of stimulus checks a couple years ago are responsible for inflation, because it gave you too much "buying power," and so the only possible fix is to jack up interest rates and trigger mass layoffs and sharp wage decreases across the economy:

https://pluralistic.net/2022/12/14/medieval-bloodletters/#its-the-stupid-economy

Stage three is "any attempt to fix this will make it worse." When Isabella Weber pointed out that there was a long history of price-controls being used to fight price-gouging, corporate apologists lost their minds and brigaded her, calling her all kinds of nasty names and insisting that her prescription didn't even warrant serious discussion, because any attempt to control prices would destroy the economy:

https://www.theglobeandmail.com/podcasts/lately/article-the-millennial-economist-who-took-on-the-world/

You may recognize this as cousin to the response to rent control proposals, which inevitably trigger a barrage of economists screaming that this will not work and will actually reduce the housing supply and drive up prices, which is true, provided that you ignore all evidence and history:

https://pluralistic.net/2023/05/16/mortgages-are-rent-control/#housing-is-a-human-right-not-an-asset

And stage four is "this is socialism." Look, I am a literal card-carrying member of the Democratic Socialists of America and I can assure you, Kamala Harris is not a socialist (and more's the pity). But that didn't stop the most eminently guillotineable members of the investor class from hair-on-fire, ALL-CAPS denunciations of the Harris proposal as SOCIALISM and Harris herself as a COMMUNIST:

https://twitter.com/Jason/status/1824580470052725055

The author's thesis is that by naming the playbook and giving examples of it – for example, showing how the "proof" that minimum wage increases will destroy jobs was also offered as "proof" not to abolish slavery, ban child labor, add fireproofing to textile factories, and pay women and Black people the same as white guys – we can vaccinate ourselves against it.

Certainly, we've reached a moment where the public is increasingly skeptical of claims that we can't fix anything because the economists say that this is the best of all possible worlds, and if that means that we're all going to boil to death in our own skin, so be it:

https://pluralistic.net/2022/10/27/economism/#what-would-i-do-if-i-were-a-horse

In other words, after 40 years of subordinating politics to economics, there's a resurgence of belief in politics – that is, doing stuff – rather than hunkering down and waiting for the technocrats to fix everything:

https://www.programmablemutter.com/p/seeing-like-a-matt

Corporate Bullshit is a brisk and bracing read – I got through it in about an hour in my hammock yesterday – and, in laying out the bullshit playbook's long history of nonsensical predictions and pronouncements, it does make a very good case that we should stop listening to people who quote from it.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/08/19/apologetics-spotters-guide/#narratives

#pluralistic#narratives#lakoff#joan walsh#david cohen#nick hanauer#apologetics#bullshit#history#books#reviews#gift guide

241 notes

·

View notes