#Finance apps Developer

Explore tagged Tumblr posts

Text

📲📲 Top Mobile App Development in India. ✅✅

Transform ideas into stunning apps with expert solutions tailored for you!

Call Now 📞 +91 8890045686

Visit Now - 🌐 www.meentosys.com

#mobile app development#business#startup#finance#entrepreneur#mobile app company#mobile app design bd#mobile app developers#mobile application development

2 notes

·

View notes

Text

manage your money easily

financial management mobile app developer

As the world becomes more digitally driven, the way we handle finances is undergoing a major transformation. With smartphones at the center of everyday life, a mobile app for financial management has shifted from a luxury to a necessity.

0 notes

Text

Streamline your finances with custom accounting software by InStep Technologies. We build scalable, secure, and easy-to-use solutions tailored to your business needs—trusted by SMEs, startups, and enterprises. Automate, analyze, and grow smarter with our expert development team.

#accounting software development#custom accounting software#finance software development#cloud accounting software#small business accounting software#accounting app development#enterprise accounting solutions#billing and invoicing software#bookkeeping software solutions#financial reporting software#AI accounting software#software for accountants#tax management software#online accounting system#InStep accounting solutions

0 notes

Text

Which Field of Application Uses Blockchain the Most And How You Can Profit

1. Introduction

Blockchain the next big thing? If you've been wondering where it really fits in our world and, more importantly, how to make it work for you, you're in the right place. Let’s explore which field of application uses blockchain the most and how you can profit from it.

2. Blockchain Explained Simply

You’ve probably heard terms like “ledger,” “decentralized,” and “peer-to-peer” tossed around. But what does it all mean?

Understanding the Blockchain Network

At its core, a blockchain network is a chain of digital “blocks” containing information. These blocks are distributed across a network of computers (nodes), and once data is added, it can’t be changed. That’s the magic—it’s secure, transparent, and immutable.

Core Components: Nodes, Ledgers, and Blocks

Nodes: Participants in the blockchain that keep a copy of the ledger.

Ledger: A record of all transactions.

Blocks: Units where data is stored and linked cryptographically.

3. Applications of the Blockchain

Blockchain isn’t just for Bitcoin anymore. It's weaving itself into several industries, offering solutions to age-old problems.

Smart Contracts in Real Estate

Imagine buying a house without a lawyer or agent—just you and the seller, connected through a smart contract. The blockchain handles the deal, holding the money and deeds in digital escrow.

Tracking and Transparency in Supply Chains

From farm to fork, blockchain tracks every step. Companies like Walmart use it to trace the origin of food, reducing waste and increasing safety.

Healthcare and Patient Records Security

Hospitals are exploring blockchain for secure storage of patient records. You control who accesses your medical history, not some admin behind a desk.

Voting and Identity Verification Systems

Governments are piloting blockchain-based voting to prevent fraud. With digital IDs, you can vote from your phone with full transparency.

Gaming and NFTs

In the gaming world, blockchain powers NFTs and virtual economies, where players own and trade in-game assets for real-world value.

4. The Dominant Industry: Financial Services

Without a doubt, the financial sector is blockchain’s biggest fan—and for good reason.

Why Financial Services Lead the Charge

Financial transactions require security, speed, and transparency—all strengths of blockchain. It eliminates middlemen and brings trust to digital payments.

Use of Blockchain Technology in Financial Services

From cross-border transfers to fraud prevention and automated compliance, the use of blockchain technology in financial services has redefined how money moves.

5. Real-World Examples in Finance

Let’s look at some heavy hitters already profiting.

Ripple and Cross-Border Payments

Ripple enables real-time global payments at a fraction of the cost banks charge. It's used by institutions like Santander and American Express.

DeFi (Decentralized Finance) Platforms

Platforms like Uniswap and Aave remove banks from the equation, allowing users to lend, borrow, and earn interest using crypto wallets.

Tokenization of Assets

You can now own a fraction of a Picasso or a Manhattan skyscraper—tokenized and traded through blockchain platforms.

6. How You Can Profit from Blockchain

Now the fun part—making money.

Investing in Cryptocurrencies and Tokens

This one’s obvious. Buy low, sell high. But be smart: do your homework, diversify, and understand the risk.

Building Blockchain-Based Apps or Platforms

If you're tech-savvy, start developing dApps (decentralized apps) for high-demand sectors like supply chain or finance.

Becoming a Blockchain Consultant

Many businesses want in but don’t know how. Learn the ropes and guide them—for a price, of course.

7. Partnering with Blockchain Development Services

You don’t have to do it alone. Bring in the experts.

Why Businesses Hire a Blockchain Development Company in USA

A blockchain development company in the USA offers top-tier talent and proven strategies to build secure, scalable blockchain solutions.

Key Features to Look for in a Blockchain Development Service

Proven track record

Transparent pricing

Strong cybersecurity protocols

Experience across industries

8. Exploring Career Opportunities in Blockchain

The blockchain job market is booming. Here’s where you can fit in.

Developers and Engineers

They’re the backbone—coding smart contracts, building networks, and solving bugs.

Analysts and Compliance Experts

Helping firms navigate the legal maze around blockchain regulations.

Marketing and Sales Roles

Even the best tech needs a good story. Sell it right, and you’re golden.

9. Blockchain in the Future: What’s Next?

This isn’t the end—it’s just the beginning.

Trends and Predictions

Governments launching Central Bank Digital Currencies (CBDCs)

More enterprise blockchain adoption

Seamless integration with traditional systems

Integration with AI and IoT

Imagine a smart fridge ordering food based on blockchain-tracked supply chains. That future? Closer than you think.

10. Conclusion

The use of blockchain technology is growing fast, but financial services continue to lead the charge. With so many opportunities—from investing and development to consulting and employment��profiting from blockchain is no longer reserved for tech geniuses or early adopters. It’s about recognizing the shift, understanding where you fit in, and taking action.

So, are you ready to turn blockchain innovation into personal opportunity?

#technology#blockchain development#blockchain development services#blockchain in healthcare#smart contracts#blockchain app development#blockchain applications#finance#blockchain business

0 notes

Text

Transform Banking with AI & Blockchain Technology

Future-proof your financial services with TechMave’s innovative FinTech solutions.

0 notes

Text

Fintech Solutions for Developer Financial Wellness- Managing Cash Flow Gaps

Software developers, particularly freelancers and contractors, often navigate the complexities of variable income streams. While the tech industry offers lucrative opportunities, managing finances effectively, especially during project gaps or while waiting for invoices to clear, is crucial for overall financial wellness. Unexpected expenses, from essential hardware upgrades to new software licenses, can further strain cash flow. Understanding these challenges and leveraging modern financial technology (fintech) can make a significant difference.

Understanding Cash Flow Challenges for Tech Professionals

The nature of contract work or freelancing means income isn't always predictable month-to-month. This irregularity can make traditional budgeting difficult. Delays between project completion, invoicing, and actual payment receipt can create temporary shortfalls. Even salaried developers might face unexpected costs that disrupt their financial equilibrium. Actionable Tip: Implement a budgeting system designed for variable income, such as the 'envelope system' adapted digitally or using apps that allow for income fluctuations. Resources like the Consumer.gov guide to budgeting can offer foundational strategies.

Leveraging Technology for Financial Stability

Fintech has revolutionized personal finance management, offering tools that provide greater control and insight. Developers, being tech-savvy, are well-positioned to adopt these solutions. From sophisticated budgeting apps that categorize spending automatically to platforms facilitating micro-investing or automated savings, technology empowers users to manage their money more proactively. Actionable Tip: Utilize banking app features like setting up automated transfers to a savings account whenever income arrives or using expense tracking apps to identify areas for potential savings. Explore resources on financial planning from institutions like the Federal Reserve for broader insights.

The Role of Modern Financial Tools

Beyond basic budgeting, specific fintech tools can address developer needs. Automated invoicing platforms streamline billing, while expense management apps simplify tracking business costs for tax purposes. For managing liquidity, understanding the available short-term financial tools is key. These tools can bridge the gap during lean periods without derailing long-term financial goals. Actionable Tip: Set up low balance alerts and payment reminders through your primary banking or financial apps to stay ahead of potential overdrafts or late fees.

Exploring Short-Term Cash Flow Solutions

When facing a temporary cash flow gap, several options exist. Traditional methods like credit cards or personal lines of credit offer solutions but often come with high interest rates and fees. In recent years, cash advance appshave emerged as alternatives, providing small, short-term advances to help users cover immediate expenses until their next paycheck or invoice payment. Key factors when considering these apps include the speed of access, associated costs, and repayment terms. Actionable Tip: Always read the fine print. Understand all fees, interest rates (if any), and repayment schedules before using any financial product. Consult resources from the Consumer Financial Protection Bureau (CFPB) to understand your rights.

Security Considerations in Fintech Apps

As developers know, security is paramount, especially when dealing with financial data. When choosing any fintech app, evaluate its security measures. Look for features like multi-factor authentication (MFA), data encryption, and transparent privacy policies. Understanding how an app protects your financial information is crucial. Actionable Tip: Regularly review app permissions and update security settings. Follow best practices for password management and be cautious about sharing sensitive information. Refer to cybersecurity guidelines from sources like CISA.

Finding the Right Fit: Comparing Options

The market offers various cash advance solutions. Some apps, like Earnin, operate on a tip-based model, while others, such as Dave, might involve a small subscription fee. It's essential to compare these models based on your needs and frequency of use. For developers seeking flexibility without incurring extra costs, exploring fee-free options is worthwhile. Actionable Tip: Create a small comparison chart of potential apps, noting fees, advance limits, repayment terms, and transfer speeds before making a decision.

One alternative in this space is the Gerald cash advance app. Gerald differentiates itself by offering Buy Now, Pay Later (BNPL) services and cash advances with absolutely no interest, no monthly subscriptions, no transfer fees, and no late fees. Users first need to make a purchase using a BNPL advance to become eligible for a fee-free instant cashadvance transfer. For users with supported banks, these transfers can even be instant at no extra charge. This model can be particularly beneficial for managing short-term needs without the burden of compounding costs.

In conclusion, managing finances effectively is a key component of well-being for developers, especially those with fluctuating incomes. Leveraging the right fintech tools, understanding cash flow solutions, and prioritizing security can provide stability. Options like Gerald offer a fee-free approach to handling temporary financial gaps, contributing to greater peace of mind.

#fintech#developer finance#cash flow management#financial wellness#cash advance app#freelancer finance#budgeting tools

1 note

·

View note

Text

Stock Trading App by Code Regime Technologies – Grandeur Your Trading Experience! . . Are you ready to redefine stock trading with Next-Gen technology? Code Regime Technologies brings you an advanced Stock Trading App, designed for speed, security, and precision. Whether you're a beginner or a pro, our powerful platform ensures seamless execution, smart insights, and a smooth user experience across web & Gmail integration. . . 🌟 Key Features: 1. AI-Powered Trade Insights – Get real-time market predictions & trend analysis. 2. Automated Trading Bots – Execute trades automatically based on pre-set conditions. 3. Instant Buy/Sell Execution – Ultra-fast transactions with real-time price tracking. 4. Custom Watchlists & Alerts – Stay ahead with personalized notifications. 5. Secure & Encrypted Transactions – Industry-leading security for worry-free trading. 6. Multi-Platform Access – Trade seamlessly on web & receive trade alerts via Gmail. 7. Social Trading & Copy Trading – Follow expert traders & replicate their strategies. 8. Advanced Charting Tools – Make informed decisions with pro-level analytics. 9. Fractional Trading – Invest in high-value stocks with minimal capital. 10. Regulatory Compliance & KYC Automation – Fully secure onboarding & transactions. . . 🚀 Limited-Time March Offer – Fast-Track Your Trading Business! 🔹 Exclusive customizations & branding options 🔹 Faster deployment in just a few weeks 🔹 Special pricing & additional integrations for early sign-ups . . 📞 Let’s Build Your Future in Trading! This is your chance to launch a powerful trading app at lightning speed. Schedule a quick business call now and unlock premium benefits before March ends!

#finance#custom mobile app development company#software development#cloneappdevelopment#aiappdevelopmentcompany#blockchaintechnology#stockexchasnge#bitcoin#altcoin#fintech

0 notes

Text

Top Software Development Trends in 2025

In 2025, the Software development Industry massively changed. Instead of traditional software, businesses need more user-friendly, dynamic, and scalable software. Software industries now follow the new trends like: 1. Progressive Web App 2. AI and ML Integration 3. IoT App Development 4.AR/VR Development 5. No-Code App development

#entrepreneur#software development#artificial intelligence#startup#2025 trends#ai software#development#applications#mobile app development#finance#mobile application development

0 notes

Text

Don't forget! I got AppleCare

I don't have to care… so talk to the air..

I'm rational, but I need a caregiver…

So who cares? Denver Cares.

That's how I get paid to smoke! $75 per smoke. So fuck you pay me - Rico Bentley

Case Study With Shiba Straight from Japan… not Coinbase… that would require a referral…. But guess what? You don't donate to PayPal, I thought Elon Musty was friends and family by Patreon.com/naturesuprise

So this is Valentino’s and My dad’s Birthday month…. What Amazon or Walmart Wishlist? Control with Alexa and Fire TV and IFTTT some evil shit. 🧞🔥🇯🇵🔪🇹🇼🎉😈🇨🇦���♂️🐍🇷🇺🌹🍑🍆Or call/text 303 518 0222. Or switch numbers with me on E-Sim if you have Comcast Business because I already have VerizonGreen on X. Since someone has the Sun Devil number 520-664-6634 on dispensary rewards. But Colorado is a drug state. So the Devil became Hades…720-666-???? But I'll let you figure that out from Greece.

www.patreon.com/naturesuprise

But I like to square dance with Amanda, is that Neuroscience girl from the federal hospital? Or Webner?

So if it's not realistic then it's not realistic. Where did Snoop Dogg go? Because Will Smith is my AI. Up in the sky. So why lie? Goodbye! Nice try.

I'm Android 20 though. Ask Facebook a Question about VR Meta Education

or Rico Bentley until you are free from financial dependency. Tie every action to money. And jump on as many payrolls until you run out of Gasolina. The med card is for age 18 in Denver Colorado if you see Nature’s Uprise on Pexels, Pinterest, or Pexels for photography challenges.

Trademark that shit! -Canva

Expunge that shit! -Archive

Sign that shit! -Documentation in writing

Collect that shit! - File or Shred PII

Garnish that shit. - ACP and Model Walk away with Cuban

Crowdfund that shit! - Patreon Challenges on Trello with us while you partner with Starbucks

Patent that shit. If you can…. Millions by Young Thug.

Email questions to [email protected]

#spotify#911 abc#artists on tumblr#batman#cats of tumblr#formula 1#halloween#mouthwashing#pokemon#entertainment#soundcloud#mobile app development#apple music#appleradio#severance apple tv#aviation crash#donald trump#vivica a. fox#kill bill#netflix#verizon#the sims 4#tmz.com#world news#cnn#finance#fox#passive income#flo milli#us election 2024

2 notes

·

View notes

Text

Get a feature rich Mobile App For Your Brand!

Hurry up 📞 +918890045686 For More - www.meentosys.com

#mobile app development#business#startup#entrepreneur#finance#mobile app company#mobile app design bd

0 notes

Text

Top FinTech App Trends You Can’t Ignore

If you’re considering diving into the world of financial technology, now is the time. The FinTech industry is booming, offering endless opportunities for innovation, convenience, and financial empowerment. Whether you're an entrepreneur, an investor, or a developer, there's a wealth of untapped fintech ideas waiting to be explored.

From digital banking and personal finance management to crypto trading and RegTech, the possibilities are vast. This article highlights some of the best FinTech app ideas that can redefine financial services while providing lucrative opportunities for startups.

1. Digital-Only Banking Apps

Traditional banking is fading fast. Today’s users expect seamless, 24/7 access to their finances without visiting a physical branch. Digital banks provide a mobile-first experience with features like:

Instant money transfers

Bill payments

Budgeting tools

AI-powered financial insights

Fraud alerts and security measures

Market Insight: The global digital banking market was valued at $20.8 billion in 2021 and is expected to grow at a 20.5% CAGR through 2030.

If you're considering launching a digital banking app, working with an experienced mobile app service provider can help ensure a smooth, scalable, and compliant development process.

2. Peer-to-Peer (P2P) Payment Apps

P2P payment apps like Venmo, Zelle, and Cash App have made transferring money easier than ever. These apps remove the need for cash or checks, offering:

Quick money transfers between individuals

Bill-splitting features

Payment request options

Integration with digital wallets and bank accounts

Market Insight: The P2P payment market was valued at $2.21 trillion in 2022 and is projected to hit $11.62 trillion by 2032.

Startups looking to disrupt this space should consider iOS and Android app development solutions that emphasize security, speed, and user-friendliness.

3. AI-Powered Personal Finance Management Apps

Consumers today seek better control over their spending habits. AI-driven personal finance apps help users:

Track expenses and categorize spending

Set financial goals and receive AI-driven advice

Automate bill payments and savings

Connect all financial accounts for a unified dashboard

Market Insight: The personal finance apps market was worth $101 billion in 2023 and is expected to reach $450.8 billion by 2030.

For businesses looking to enter this market, developing custom fintech software solutions can give users the advanced features they expect.

4. Robo-Advisory & Investment Apps

Investing is no longer limited to Wall Street professionals. With robo-advisors, anyone can access automated financial planning. Features include:

AI-powered investment strategies

Low-cost portfolio management

Stock and ETF trading

Fractional share investing

Market Insight: The robo-advisor market is expected to surpass 3.270 million users by 2028.

Building a robo-advisory app requires strong AI and machine learning integration, which can be achieved by hiring a mobile app developer with expertise in financial automation.

5. Cryptocurrency & Blockchain Apps

The rise of decentralized finance (DeFi) and blockchain-based apps has opened up new opportunities in the FinTech space. Features of a strong crypto app include:

Secure crypto trading

Digital wallets for multiple cryptocurrencies

AI-powered risk analysis

Smart contract integration

Market Insight: The crypto exchange market is projected to grow exponentially, fueled by rising adoption rates of blockchain technology.

For security and regulatory compliance, partnering with a team that specializes in blockchain-based custom fintech software solutions is essential.

6. InsurTech (Insurance Technology) Apps

Insurance apps simplify policy management and claims processing. Features include:

AI-driven policy recommendations

Instant claims approval

Risk analysis and fraud detection

Pay-as-you-go insurance options

Market Insight: The global InsurTech market was valued at $5.45 billion in 2022 and is expected to grow at a 52.7% CAGR through 2030.

With iOS and Android app development solutions, startups can offer seamless insurance experiences that appeal to tech-savvy consumers.

7. RegTech Apps for Compliance & Fraud Detection

With increasing regulatory requirements, financial institutions need RegTech solutions to stay compliant. These apps can:

Automate compliance reporting

Monitor transactions for suspicious activity

Verify customer identity (KYC/AML)

Detect fraud using AI and big data analytics

Market Insight: The RegTech industry is projected to reach $44.5 million by 2030 as demand for financial security grows.

For startups, this is one of the most untapped fintech ideas, with significant potential for expansion.

8. Micro-Investing & Fractional Ownership Apps

Investing in real estate, stocks, and collectibles is now accessible to everyone with micro-investing platforms. Features include:

Buy shares in fractional amounts

Automated round-up investing

Low or zero commission trading

Education and investment tracking tools

Market Insight: The stock trading app market generated $22 billion in revenue in 2021 and continues to expand.

To build fintech software solutions that stand out, integrating AI-driven insights and gamification can boost user engagement.

9. Subscription & Bill Management Apps

With multiple subscription services today, managing payments can be overwhelming. These apps help users:

Track and manage recurring subscriptions

Set reminders for bill payments

Identify and cancel unwanted subscriptions

Integrate with digital wallets for automatic payments

Market Insight: The subscription economy is growing, with the bill-splitting app market expected to reach $993.02 million by 2031.

For startups entering this space, partnering with a mobile app development service provider ensures a user-friendly and feature-rich app.

10. Sustainable & Ethical Investment Apps

With growing interest in ESG (Environmental, Social, and Governance) investing, apps that guide users toward sustainable financial decisions are in demand. Features include:

Investment in eco-friendly stocks and bonds

ESG risk analysis and reports

Carbon footprint tracking

AI-driven recommendations for ethical investing

Market Insight: The sustainable investment market is expected to grow significantly, driven by conscious consumerism.

By offering custom fintech software solutions focused on ethical investing, startups can differentiate themselves in the crowded financial market.

Final Thoughts

The FinTech industry presents endless opportunities for innovation and disruption. Whether you're planning to launch a digital bank, investment platform, InsurTech app, or a compliance-focused RegTech solution, success depends on:

User-centric design: Prioritize ease of use and security.

Regulatory compliance: Ensure adherence to financial regulations.

Scalable technology: Use iOS and Android app development solutions to expand your market reach.

If you’re ready to enter the FinTech space, now is the time to act. Hire a mobile app developer with expertise in building fintech software solutions and take your idea from concept to reality.

#hire developers#hire app developer#mobile app development#hire mobile app developers#ios app development#android app development#fintech app development company#fintech#finance

0 notes

Text

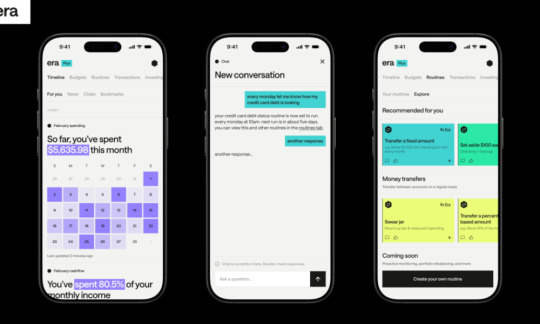

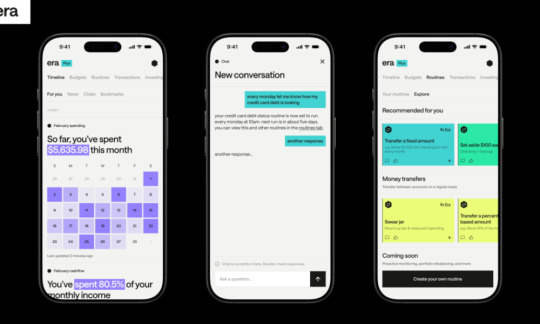

Era Raises $6.2M to Advance Agentic AI for Personalized Wealth-Care

New Post has been published on https://thedigitalinsider.com/era-raises-6-2m-to-advance-agentic-ai-for-personalized-wealth-care/

Era Raises $6.2M to Advance Agentic AI for Personalized Wealth-Care

Era, the AI-driven financial intelligence platform redefining personal wealth management, has secured $6.2 million in seed funding. The round was co-led by MaC Venture Capital, Third Kind Venture Capital, and Protagonist, bringing Era’s total funding to $9.1 million with additional participation from Clocktower Ventures, K5 Ventures, and Northzone.

In addition to this milestone, Era has announced a groundbreaking partnership with Cerebras Systems, aiming to introduce agentic AI into personal finance. This collaboration is a major step toward Era’s mission of making “wealth-care” a universal reality by integrating real-time AI-driven financial intelligence into everyday money management.

Bringing AI-Powered Wealth Management to Everyone

Era is redefining personal finance through AI-driven automation and real-time intelligence. By integrating advanced artificial intelligence with deep financial expertise, Era provides users with proactive money management, personalized insights, and automated financial actions. The platform functions as an intelligent financial assistant, learning from users’ connected accounts to optimize their finances seamlessly. With AI-powered automation, Era can move money between accounts, optimize balances, and alert users to financial opportunities.

Unlike traditional finance apps that simply track spending, Era anticipates financial needs, detects opportunities, and helps users navigate complex financial decisions in real-time. The partnership with Cerebras enhances these capabilities, allowing Era to deliver institutional-grade financial intelligence at a consumer scale.

Era operates on a freemium model, making instant money management accessible to all. Instead of charging traditional asset-under-management (AUM) fees like robo-advisors, Era’s paid tiers are based on usage and utility. The platform is continuously expanding its product offerings, with features designed to enhance accessibility and automation in financial planning.

Routines: Automates money transfers between existing bank accounts, going beyond basic budgeting tools.

Investments: Provides access to supported brokerages, enabling in-app stock and ETF investments.

Blueprints: A marketplace for portfolio rebalancing strategies designed by financial creators and advisors.

Personalized Timeline: Delivers AI-generated insights, spending snapshots, and financial alerts to help users stay informed.

“Era Finance is revolutionizing personal finance by empowering consumers with real-time insights, personalized guidance, and seamless financial planning,” said Angela Yeung, VP of Product Management at Cerebras. “Powered by Cerebras Inference, Era delivers instant AI-driven solutions, setting a new standard for customer experience in the industry. We’re excited to collaborate with Era Finance in pushing the boundaries of personalized financial solutions through unparalleled AI performance and scalability.”

Strategic Growth with New Talent

To further accelerate its mission, Era has expanded its team with key hires from Stripe and SoFi:

Vince Joy, formerly of Stripe, joins as Design Lead, bringing expertise in visual design and UI/UX.

Chase McCoy, a seasoned mobile and web developer, joins as Senior Engineer.

Sam Garrison, former Business Lead at SoFi’s Relay product, will drive Product Growth.

Dave Skender, a financial technology expert, has been appointed as Engineering Manager.

“AI is reshaping every industry, and its potential in personal finance is transformative,” said Lindsay Brady, Co-Founder and COO at Era. “Traditional tools show you where your money went—Era helps you see where it can go. By combining advanced AI with deep financial expertise, we’ve built more than a platform to track spending; Era is your personal financial assistant, providing insights into your habits, market trends, and automating smarter decisions. Whether it’s optimizing savings with intelligent round-ups or delivering real-time market analysis, we’re making sophisticated financial management simple and accessible. With our investors’ support, we’re accelerating the vision of making wealth-care a universal reality.”

The Future of Wealth-Care

Era is pioneering the next generation of personal finance with AI-powered automation, financial intelligence, and a commitment to accessibility. The company plans to continue expanding its user base, launching new partnerships, and updating its product suite to bring wealth-care to every American.

#Accessibility#Accounts#Agentic AI#ai#AI performance#AI-powered#alerts#American#Analysis#app#apps#artificial#Artificial Intelligence#automation#bank#budgeting#Business#Cerebras#collaborate#Collaboration#consumers#creators#customer experience#Design#Developer#Engineer#engineering#era#Features#finance

1 note

·

View note

Text

InStep Technologies is a trusted fintech software development company delivering secure, scalable, and innovative financial solutions. We build custom fintech apps, APIs, mobile wallets, blockchain integrations, and automation tools for startups, banks, and enterprises.

#fintech software development#custom fintech solutions#financial technology apps#fintech development company#banking app development#blockchain in finance#secure payment software#finance automation tools#investment software solutions#fintech API integration

0 notes

Text

Fintech built smarter. 🤓💻

SDH integrates cutting-edge technologies with your vision. Digital banking, blockchain, personal finance apps—done right. Explore:

#financial software development#custom app solutions#fintech#SDH#digital banking#blockchain#personal finance apps

0 notes

Text

Building in Public at NVSTly: What It Means and Why It Matters

Discover how NVSTly embraces "building in public" by rolling out updates quickly, collaborating with users for real-world feedback, and fostering transparency in our development process.

At NVSTly, we embrace the concept of "building in public." This approach shapes how we develop, test, and roll out features, with the goal of making NVSTly the best social trading platform for our users. But what exactly does building in public mean for NVSTly? Let’s break it down.

Updates as They’re Finished

Instead of waiting to bundle new features and fixes into big, infrequent releases, we push updates as they’re completed. This ensures users benefit from improvements as soon as possible. However, our agile development style means you might notice subtle changes before they’re officially included in a published changelog. These incremental updates allow us to iterate and enhance the platform quickly.

Internal Testing, Real-World Feedback

Before any update reaches the production environment, our team conducts internal testing to ensure the new feature or fix works as intended. For example, a recent update to allow stats and daily/weekly recap commands to function with usernames containing spaces was thoroughly tested internally. Unfortunately, this change inadvertently broke compatibility with Discord IDs, highlighting the challenges of anticipating every edge case.

This is where building in public comes into play: while we strive for thorough testing, some issues only emerge when updates meet real-world usage. That’s why we rely on our vibrant user base to help us identify bugs, unintended behaviors, and areas for improvement.

The Role of Our User Community

Our users play a critical role in the development process. By using NVSTly in their daily trading workflows, they encounter scenarios that internal testing might miss. When users report bugs, glitches, or other issues, it provides us with invaluable insights into how the platform performs under various conditions.

If you ever experience something on NVSTly that doesn’t seem to work as expected, we encourage you to report it to us. Unlike platforms that may identify and resolve issues passively over time, NVSTly relies directly on user feedback to detect and prioritize fixes. Every report helps us improve.

Changelogs: A Snapshot of Progress

Given our frequent updates, we publish changelogs only after accumulating several changes or introducing major features. This means that when you see a changelog, many of the updates listed might have been implemented days or even weeks earlier. While this approach helps us focus on building and refining the platform, it’s another example of how building in public keeps the development process transparent.

Why Building in Public Matters

By building in public, we:

Accelerate innovation: Continuous updates ensure the platform evolves rapidly.

Foster transparency: Users gain insight into what’s changing and how issues are addressed.

Strengthen collaboration: Feedback from users directly informs our priorities and solutions.

This approach isn’t without its challenges, but we believe the benefits far outweigh the risks. Building in public allows us to create a platform that truly meets the needs of our community — a community we’re proud to involve in the journey.

How You Can Help

If you notice a bug, glitch, or unintended behavior, please let us know right away. Your feedback is essential to making NVSTly better every day. Together, we’re not just building a platform; we’re building a community-driven experience that reflects the collective expertise and passion of its users.

Thank you for being part of the NVSTly journey. Let’s keep building — together.

NVSTly is available for free on web, mobile devices (iOS & Google Play), and is fully integrated with Discord via a unique bot- the only of it’s kind and available to any server or trading community on Discord. Or feel free to join a community of over 45,000 investors & traders on our Discod server.

#crypto#cryptocurrency#finance#fintech#forex#futures#investing#investors#stock market#stocks#startup#startups#development#developer#web development#web developers#app development#app developers#mobile app development#social media#social networks

1 note

·

View note

Text

Top Accounting and Bookkeeping Services in Nungambakkam, Chennai

Hey there, Nungambakkam locals! If you're on the lookout for stellar accounting and bookkeeping services in our vibrant part of Chennai, you're in the right place. Managing your finances can be a hassle, but with the right support, it becomes a breeze. Whether you're a small business owner or someone needing a hand with personal finance, we've got you covered.

In the bustling area of Nungambakkam, you'll find a range of professional services tailored to your accounting and finance needs. From comprehensive bookkeeping to detailed financial reports, the local experts are here to ensure your numbers add up perfectly.

One standout option in the area is the use of cutting-edge accountancy practice management software. This technology streamlines your accounting tasks, making them more efficient and accurate. With tools designed specifically for the local market, you can easily track your finances, manage invoices, and get valuable insights into your financial health.

So, if you’re searching for top-notch accounting and bookkeeping services in Nungambakkam, look no further. The professionals in this area are dedicated to helping you manage your finances with ease, so you can focus on what really matters to you. Check out the full range of services available and find the perfect fit for your needs. For more information, visit Iykons and get started today!

#IT Service Providers for Fintech Companies#IT Service Providers for Fintech Development#IT Service Providers for Fintech firms#IT Service Providers for Fintech Technology#IT Service Providers for Fintech Enterprises#IT solution provider company#Ecommerce Solution for Startup#Mobile App Development#Payroll Company for Very Small Business#Personal Loan Finance Companies#Complete Ecommerce Solution#Human Resource Management Services#Payroll HRMS Software

0 notes