#I’m part time and was not offered healthcare but they took a healthcare payment out of my paycheck. for healthcare they Are Not providing

Text

I feel like I should be making a list of all the violations I’m seeing at work

#it’s not wheelchair accessable#there are no disabled stalls in the bathrooms#corporate refuses to buy a cleaner for some. compactor thing and it’s resulting in Fly Infestations Every Year#I know for a FACT there is expired product currently in the dairy section that won’t be removed till a customer finds it#we had. milk. sitting in the back. unrefridgerated. for A FULL WEEK AT LEAST. BEFORE SOMEONE TOOK IT OUT. IT WAS SOLID.#I’m part time and was not offered healthcare but they took a healthcare payment out of my paycheck. for healthcare they Are Not providing#we require a managers signature on Almost Everything. the manager is only here for about three hours three days of the week#I’m fully aware some of these ain’t violations anymore but like ???#I Am Not payed enough for this#it smells rancid#it’s 90 degrees upstairs and under 60 downstairs#I just get assigned random ass tasks when I finish with My job because it means they don’t have to hire another worker in that section#I am part time and scheduled for 37 hours. the manager wants me to schedule for More.#the manager is also Very Insistent that I transfer to the location near my college when I move back there. for a minimum of 37 hours a week.#I am taking 18 credit hours. my shifts start at eight and end at three. my classes start at eight and end at three.#he does not seem to understand I Cannot work what is practically full time. during the school year.#half the tech is broke#we have a freezer that’s broken. we call it the snowglobe cause it’s frozen over half the time.#the roof leaks. they got it fixed two days ago. it’s leaking again today.#help

1 note

·

View note

Text

psa about book piracy

the publishing industry does not work like the film/tv industry or whatever other industries you’ve decided make piracy a victimless crime. it does actively and directly hurt authors

many authors are paid an “advance”. this is occasionally large, but more frequently is small (~£2k) and even more frequently is somewhere in the middle (~£10k). this may be the only payment they receive for what is frequently years of work. in order to earn any royalties, they need to sell enough books to “earn out” (make the publisher back the money they spent on the advance). if they don’t earn out, they will never get royalties. also, the advance for their next book will probably be smaller.

if their book is part of a series, later books in the series may be cancelled because the first book didn’t sell well enough

even if a book isn’t cancelled, the print run may be reduced (=how many copies are printed) which means the book will be in fewer bookshops which mean there are fewer opportunities for it to sell copies

all of that conspires to mean... the author’s next advance is smaller, a series gets cancelled before it’s finished, and generally you have fucked over the person whose work you were stealing

(if they have earned out already, it may not directly fuck over their future books as much, but you are directly taking royalties out of their pocket, so)

if you’ve ever been mad because the 3rd book in a trilogy you were reading never got published, it’ll be because the first two didn’t sell enough. maybe the market was wrong at the time, maybe they took a while to take off, or maybe -- and increasingly frequently -- it’s because too many people pirated them instead of buying them.

(this is also why waiting until a series is complete to buy any of them is more likely to result in the series never being complete. the publishers need to know it’s a good investment. better to buy the books and wait to read them, if you’re concerned about cliffhangers, than to refrain from buying them entirely.)

“but the book is still there after i download it so i haven’t technically stolen anything” read the above bullet points again and understand that what you have stolen is not the book per se, it’s the sale, and therefore the goodwill with the publisher that makes them buy that author’s future books and pay that author money

do not @ me about “but what if it’s the only way to access english-language books in your country” because that is not the situation i’m talking about or the majority situation in the general scheme of things. 90% of people who pirate books do so either because they don’t realise it hurts authors or they don’t give a shit

also if your justification is that authors are “rich” i would like to point out that a recent report showed average earnings for an author in the uk to be £10.5k/yr in 2018. that is substantially below minimum wage (for full-time work), so genuinely, fuck off with that

you have no idea what somebody else’s financial situation is, and i know several authors who have been told to their faces that it was okay to pirate from them because they were rich when those people were in fact struggling to make ends meet

(not to mention that authors are technically self employed which means no benefits; this is particularly challenging in countries without universal healthcare)

whatever bullshit “net worth” estimate you’ve found online or whatever bears absolutely no resemblance to most people’s financial reality

so if you think you’re being clever by only targeting authors you’ve decided are wealthy, consider that there’s a high chance you’re wrong

yes books are expensive and yes big publishing companies are the ones seeing most of the benefit of that. but it’s not the big publishing companies that get hurt when you steal them, because they just squeeze that money out of the authors instead to make up their bottom line. does it suck as a system? obviously! does that make piracy a good way to resist it? no, because it only hurts the people on the bottom

some people think that piracy doesn’t affect sales. it does. it has been demonstrated over and over again that piracy impacts sales (see maggie stiefvater’s experiment with the raven king for an example). “it’s helping people discover the books” doesn’t hold up to scrutiny. all an author gains from this is more people who will steal from them. exposure doesn’t pay the bills. exposure just kills ya.

many places have libraries. libraries benefit authors, because they buy books. in some countries, like the UK, authors receive money based on how many times their books are borrowed. libraries frequently offer ebooks, so if you’re not able to access them in-person you can still get books. libraries are good! if you can use your local library, you should. free books for you, without fucking over the creators. you can often request books that they don’t carry, which then means that other people also get to read that book.

(“my library doesn’t carry queer books” i sympathise and i realise it can be challenging to request those in a conservative area but also consider that books by marginalised authors are exactly the ones that publishers will yeet if they think they’re not making a return on their investment, so unfortunately, pirating those is extra bad. publishers will drop “risky” shit like a hot potato if it’s not making them money. those are exactly the books we need to show up for.)

obviously in an ideal world we would have UBI or whatever and therefore people’s ability to put food on the table would not be dependent on monetising creative pursuits but that’s not the world we live in. in the world we live in, writing is work and work deserves to be paid for. stealing people’s labour because you feel entitled to it is not more justifiable just because that labour is creative.

the fact that people write as a hobby does not negate the challenges of writing as a profession. the two are actually pretty different. writing as a hobby isn’t easy, but writing as a profession has a whole heap of extra behind-the-scenes work that you don’t see, in case you’re tempted to take the “but it’s not real work” argument. besides which, “but people do it for free on the internet” is a shitty reason not to pay people for their work.

if you can’t afford a particular book, that sucks, i often cannot afford a book i would like. the solution: read other books that you can afford / which your library does carry / which are out of copyright. not: steal the book because obviously you should have whatever you want whenever you want it.

don’t be a dick

stealing screws authors over

in conclusion: stop trying to justify piracy in my notes or in the replies to authors who complain about it. stop telling authors to their face that you don’t value their work and their time. it’s not cool, it’s not clever, it’s not revolutionary. it’s just fucking over people who are already underpaid and living precariously.

#also while we're here stop telling people to pirate music#spotify is shit for artists but piracy is worse#buy their music on bandcamp if you want to avoid ads and big corps#but unless they're like world-famous musicians#piracy also fucks them over#source: my brother is a musician#meanwhile source for this post: i literally work in the publishing industry#and a bunch of my friends are authors#in a bunch of different genres and age groups#so i have a reasonable grasp of what goes on behind the scenes#book piracy#books#anyway i've had this rant in my drafts for a while but i saw people being dicks about this on twitter so i guess we're posting it now

69 notes

·

View notes

Text

i am not reblogging this post from OP (posted 2 days ago, with 4,400 notes and counting) because i know that often people are just making their own vent posts on their blogs and maybe don’t expect them to circulate widely outside of their small tumblr circle! and i don’t mean to like, jump on someone who is just commenting on something and then going on with their life. but i feel like i keep seeing versions of this sentiment on leftist twitter too and i really think it is a gross misrepresentation of the bill that passed earlier this month - which is due in part to social media’s intense focus on the “stimulus check” part of the bill. but the bill was not called “the stimulus check” act! it was called “The American Rescue Plan” and it was specifically geared towards providing desperately-needed relief to the American middle & working classes. the $1400 direct payments to individuals was just one small portion of the bill. here are the far more important parts:

in addition to receiving a $1400 direct payment themselves, individuals with children receive an additional $1400 check for each dependent

college students who are still listed as dependents on their parents’ tax forms (typically so they can retain health insurance benefits under the ACA) can more easily claim stimulus money - which is huge for college kids who may be helping to financially support immediate or extended family members

unemployment benefits have been extended from March 31, 2021 (their original expiration date) to September 6, 2021

unemployment benefits will be supplemented with a $300 weekly payment (ie $300 on top of what people are receiving from their state government)

unemployment benefits received in 2020-21 are tax-exempt (a retroactive change that means people who are unemployed won’t receive a surprise tax bill counting their unemployment money as “income”)

a substantial tax credit for employers who offer paid sick leave and paid family leave benefits (ie creating a direct incentive for employers to authorize emergency paid leave)

15% increase in food stamp benefits and extension of eligibility

child and family tax credit benefits!!!! this is the part that people are describing as one of the most significant anti-poverty initiatives in American history. families are eligible for a tax credit of $3600 for each child under the age of 6 and $3000 for each child between 6-18. people can also claim a child and dependent care credit with a maximum benefit of $4000 for one eligible dependent and up to $8000 for two or more. it also expands the earned income tax credit and lowers the age limit to 19. dems also pushed to get at least 50% of the tax credit money to people this year instead of making them wait for their 2021 tax return. this calculator allows you to calculate how much families will receive. if you make $50,000 a year and have four children, you will receive $13,200 through the child tax credit alone, paid out in monthly payments of $1,100 from July to December 2021 + an additional $6,600 lump-sum payment when you file your 2021 tax return early next year. there are also some additional dependent-related tax credits things that I don’t fully understand but that seem to indicate people are eligible for even more money.

forgiven student loan debt is made tax-free (a necessary prerequisite for future efforts to cancel/forgive student loan debt)

huge expansion of grant benefits to small businesses, including $28.6 billion specifically for bars and restaurants; $15 billion for low-interest, long-term replayment emergency disaster loans; and $7 billion more for the paycheck protection program (which can only be used on payroll expenses and makes it possible for small businesses to keep workers on payroll even if they are operating at lower capacity). you can describe this as “for the economy only” if you want, but I sure feel like it will alleviate a whole lot of human suffering by allowing people to keep their jobs & paychecks even if their workplaces remain partially shut down. my dad is a small business owner and has been able to keep his entire staff on payroll through the entire pandemic. the bill also includes billions for airlines and concert venues, which will again! means people won’t lose their jobs!! plus it allocates $175 million to fund a Community Navigator Program that reaches out to eligible businesses and helps guide them through the application process—ie making it possible for small businesses to actually take receive these benefits.

$350 billion to state, local, and tribal governments

$130 billion for K-12 schools to improve ventilation, reduce class sizes, purchase PPE for employees and students, and hire support staff; of this money, 20% must be dedicated to programs designed to counteract “learning loss” from students who missed school during the pandemic

$40 billion for colleges and universities, at least $20 billion of which must go to emergency grants to students (our university has been giving regular emergency grants throughout the pandemic to students to help cover rent, unexpected medical expenses, costs related to family emergencies or lost family income, tuition bills that they suddenly can’t pay, fees associated with wifi or purchasing tech equipment so they can learn virtually)

a HUGE amount of money four housing benefits!!!! i keep seeing people yelling about how $1400 won’t cover their rent but THAT’S WHAT THE RENTAL ASSISTANCE PROGRAMS ARE FOR. $21.6 billion in rent and utility assistance, paid directly to states and local governments so they can disburse it to eligible households!!! plus $5 billion to Section 8 housing (which “must go to those who are or were recently homeless, as well as individuals who are escaping from domestic violence, sexual assualt, or human trafficking”).

$5 billion to support state and local programs for homeless and at-risk individuals (can be used for rental assistance, homelessness prevention services, and counseling; can also be used to purchase properties that will be turned into permanent shelters or affordable housing for people who are homeless). plus an additional $120 for housing counseling.

$4.5 billion earmarked for a special assistance program that helps low-income households cover costs of heating and cooling and $500 million to cover water costs

$750 million in housing assistance for tribes and native Hawaiians (who are also eligible for other benefits through the rental assistance and direct tribal government grants described above)

and then BILLIONS of dollars to support FEMA, the Veterans Affairs’ healthcare system, the CDC, and state, local, and territorial public health departments for all things related to: COVID testing, contact tracing, vaccine production and distribution, vaccine outreach, PPE, and public health education. this includes (among many, MANY other things), $5.4 billion to the Indian Health Services (division of the Department of Health and Human Services that specifically provides health services to Native people and tribal territories), $200 million for nursing loan repayment programs, $80 million for mental health training, $3.5 billion in block grants specifically geared towards community mental health programs and substance abuse/prevention/treatment programs

$86 billion for a rescue package for pension funds (esp union-sponsored pension funds) that are on the verge of collapse - collectively covering 10.7 million workers.

billions of dollars for public transit programs (and sure, public transit is important to the economy, but access to regular, reliable, affordable, and safe public transit is HUGELY important to human health and well-being! it is how many people esp in urban areas access grocery stores, health care, their jobs, childcare facilities, etc.

$10.4 billion for agriculture, of which $5 billion is specifically earmarked for socially disadvantaged farmworkers. to quote wikipedia: “Experts identified the relief bill as the single most important piece of legislation for African-American framers since the Civil Rights Act of 1964.”

tons of money to fund 100% of premiums for COBRA (health insurance for people who have unexpectedly lost or had to leave their jobs) through October 2021. COBRA is hella expensive and experts estimate that 2.2 million people will need to enroll for COBRA benefits in 2021. there are also various provisions that expand Medicaid and the Children’s Health Insurance Program (a program targeted at uninsured children in families who don’t qualify for Medicaid but may not be able to afford adequate healthcare coverage. it also fixes some things with the ACA that could’ve led to people getting surprise bills due to fluctuating income or unexpected changes in employment status.

i am SO OVER the so-called ‘progressive’ rhetoric that no good can ever come from the government, or that all politicians (dems or republicans) are basically the same level of evil and incompetent, or that ~mutual aid~ (ie small payments made between individuals in a community) is the only thing we can count on or should count on in times of crisis. no!!!! fuck no!!!! like mutual aid is great but America is an INSANELY WEALTHY country and it is such bullshit to act like we can’t or shouldn’t expect our government to take care of the people who live here. and i am also just GRAHARRGHGHH at people who are completely disengaged from politics offering their jaded and hyper-cynical hot takes on things they don’t! actually! know! anything! about!!!!!!! and in the process making other people increasingly jaded and cynical about the possibility of electing a government that actually prioritizes the needs & well-being of its citizenry!!!

ugh i’m just TIRED of leftist political cynicism y’all especially when it comes from people who have absolutely no understanding of how much WORK it takes to make huge things like the American Rescue Act happen (work that includes not just the immediate negotiation of the bill but also the years of organizing & voter recruitment work it took to get a narrow democratic majority in the senate so that we could pass things like this!!!!). I’M DONE WITH BEING CYNICAL!!!! i feel, in a totally earnest and unjaded way, that it’s absolutely incredible that dems were able to write, negotiate, and pass this bill, and i feel so so so relieved to be currently living under an administration that is flawed in many ways but is at least actually and earnestly TRYING to reckon with unprecedented “suffering in an actual human scale” (to quote OP) and is even using this crisis as an opportunity to advance major anti-poverty initiatives that will have a LASTING IMPACT on actual human lives. as opposed to our previous administration, which was made up of thousands of people who woke up every single day and asked themselves “what can I do today to further dehumanize & inflict needless suffering upon millions of people?”

PHEW!!!! SORRY!!!! JUST HAVE A LOT OF FEELINGS I GUESS!!!!!!!!

#i went into this thinking i was going to be very measured and calm#but actually i'm pretty pissed off#people fire off their hot takes and thousands of people read them and it's so! fucking! infuriating!!!#no government is ever gonna be perfect! certainly ours still has a shit-ton of problems!!!!!#but i hate the 'only option is to fully disengage & say fuck it' attitude#esp when then thousands of people read it and accept it as truth#long post

30 notes

·

View notes

Text

There is NO Capitalism.

There is just Socialism. mainly four types...

1. Socialism Only for Banks (USA, post-Brexit UK),

2. Socialism Only for Party Bosses (Communism: Vietnam, China. Plus the Old USSR and the Warsaw Pact)

3. Socialism Only for the State (Fascism: Turkey, Brazil, Philippines, North Korea. In the past Mussolini Italy, Hitler Germany, Tojo Japan, Franco Spain, Salazar Portugal)

4. Socialism for Organized Worker Resistance and, incidentally, everyone else(E.U.,Japan, Korea, Singapore, Cuba. The USA 1946 to 1973, UK 1926 to 1960)

[This is a LONG post]

US Socialism Only for Banks - a History

US Bank failures prior to 1913 & the Federal reserve:

When checks from one bank are cashed in another bank, unfortunately, actual printed paper money does not relocate from bank to bank.

Nor do the banks handle accounting for liabilities as must any other business.

The Originating bank issues a check and sets up an account for the bank that cashed the check; an IOU has been issued to the 2nd bank.

The check cashing 2nd Bank books as “Income-available-for-loaning-out” the IOU from the originating bank. That IOU becomes, through the miracle of accountancy, “available” money. A current “asset”. Not a future “receivable “ as it would be in any other business.

When the second bank uses the money for one of its depositors’ checking accounts which issues a new check to pay a third party - that 2nd IOU becomes through “deposit” in the 3rd bank magically transformed into 2x the money available. Because “it”now exists in 2 banks as “an asset”.

And so on 3x) and so on (4x) an so on (5x) and...

The originating bank may be making the IOU based on a deposit or a loan

If the Originating bank makes a loan, it books as “Available-for-loan-today” both the principal and anticipated interest not due in full for many years in the future.

Any, any, any hickcup in cash flow in any bank in line creates a domino affect with the IOUs. Sufficiently sized hickups and bank failures and the various multiple Panics, five “Great Depressions” and 40+ Recessions 1782 to 1912.

(See Fed Reserve article at end of post)

Socialism Only for Banks post-1913 from the Establishment of the Federal Reserve until 1935.

Same as above (what? You thought...)

PLUS Socialism Only for the 1/3 of Banks that had joined the Reserve.

The Reserve bailed out its members after the 1929 Crash and the stronger non-member Banks at the taxpayers expense.

The taxpayer depositors lost whatever they had in the non-bailed out banks.

The St. Louis Fed Reserve in 1930 declined to bail out non-members. Triggered catastrophic failure. That failure which in turn gave rise to bank robber folk heroes Bonnie & Clyde, Ma Parker, Dillinger, Nelson, etc in the mid-west.

Continued over-extension by Banks led to continual bank failures even with Bailouts 1929 to 1934

Socialism Only for Banks 1935 to 1980

Same as above except...

FDR establishes the FDIC in which the ordinary taxpayers get to replace their own bank-lost deposits in banks to a preset imited amount - of course at the taxpayers’ expense, not the Banks’.

FDR Administration took over 1 million mortgages from failed banks at lower rates. The other million who families who applied...well...

The tax payers through the magic of doubletalk borrowed from their future tax payments to pay through the FDIC to the Bank to put back the taxpayer’s own money the over-extended bank had lost.

Anything not covered by FDIC was lost.

All banks are part of the FDIC and the Federal Reserve. Both of which essentially do the same thing without “reserves” or actual “insurance deposits”.

Regan screws us all: Socialism for Banks Only 1981 to 2007

Same as above except...

In the 1980s Speculators paid Congress to loosen banking regulations and anti-trust laws.

Massive Ponzi scheme involving Speculators purchasing Savings and Loans or “junk bonds”, making loans on wildly inflated property values, losing everything, then declaring bankruptcy 1984-1994.

The ordinary tax payers got to bail out the S&Ls through a couple of new federal agencies. The taxpayers once more borrowing from their future taxes to bailout their own current mortgages.

With Savings and Loans the 25 national commercial banks were “forced” to take over mortgages. By 2008 we were down to 6 national commercial banks.

Couple of 1990-era debacles. Building the cell phone network but somehow lost the investors money. Then overinvestment in early dial-up internet startups which lost the Investors money.

Important gibberish: “... the Gramm-Leach-Bliley Act of 1999 repealed significant aspects of the Glass-Steagall Act as well as the Bank Holding Act of 1956, both of which had served to sever investment banking and insurance services from commercial banking. From 1999 onwards, a bank could now offer commercial banking, securities, and insurance services under one roof.” (Investopedia)

Oh goodie! No more cumbersome “guberment reg-jew-laysions”!

In next to no time Commercial Banks came up with a dictionary full of gibberish (derivatives, tranches, MBS,negative amortization ) to cover bundling and selling mortgages for up to 3x any possible future payments or conceivable property value (just like S&L debacle above - see, business as usual)

In 2004 the Bush Administration “relaxed” the net capitalization requirements at the behest of five Wall Street Banks. (Less than four years later three of these experienced financial geniuses went under while two were saved by brillant...just kidding, two had “friends” in high places and were bailed out)

In 2006 the bottom fell out of the real estate market.

In 2007 no Economist saw the Iceberg ahead.

Socialism Only for Banks 2008 to Present

Same as above except...

In October, 2008 the largest single Ponzi scheme in galactic history collapsed taking down most of the world economy.

I hate to be the bearer of bad news but when we were told about the $700 billion “bailout” of 2008...no one mentioned that - according to Forbes (see link at bottom) - it was just the first installment on the $4.6 TRILLION paid out as of 2014 of the...are you sitting down?...$16.8 TRILLION the Geo W Bush Administration committed.

As I’m sure you remember, when the Banks got their Special Socialism Bailout they humbly awarded themselves Multi-Million$$ bonuses. ($132 Million$$ in 2010 when they weren’t loaning)

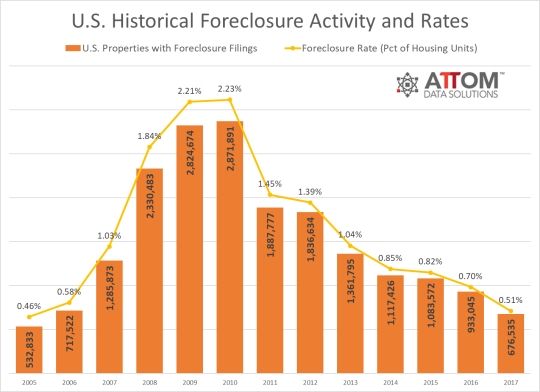

Then the Banks foreclosed on 16 MILLION HOMEOWNERS who were victims of Predatory loans(see graph below) Over 10% of all households.

I forget, who bailed out the self-bankrupted Banks? Oh, yeah, the US taxpayer. But at $17 Trillion also we taxpayers’ children, grand children, great grand children, etc, etc, etc, etc to sometime in the 22nd Century.

It’s not just the Banks...

Did I mention that when the Banks obtain the money to pay interest on our savings by “investing” in that Great-Ongoing-Ponzi-Institution we call the Stock Market? That 80% of all stocks are owned by the Banks - not the Super-Rich?

The Super-Rich only own about 5% of Stocks The Super-Rich own voting stocks however, unlike the stocks owned by the Banks. So the voting stocks give the Super-Rich “control” with minimal investment.

That of the $700 Billion$$ per year Congress insists the Pentagon spends, $100 Billion is for all service personnel here and abroad living in aging decrepited bases. The Lion’s share of the Budget the Pentagon doesn’t want goes to military contractors (who are, coincidentally, BIG Congressional campaign donors) for obsolete armaments no other country has or wants. Such as sitting duck’ Nuclear aircraft carriers Russia can hit from 300 miles away ; nuclear attack subs with no enemy fleets to attack; $400,000,000 temperamental fighter jets that required a week of maintenance after an hour in the air; etc, etc, etc. ( You didn’t really think we spent trillions and trillion$ fighting Iraq oilfield workers or Afghanistan farmers did you?)

When the Super-Rich screw up as they do with appalling frequency, they pay Congress to take our future tax payments to pay for today’s bailout. Or Subsidy, Or Taxcut. Or...

Of course, thanks to the Bank bailouts, Corporate bailouts/subsidies, and tax cuts for the One-Percent, we are told by their bribed stooges in Congress that “we” have to “do something about Entitlements”. By which “they” mean “gut everyone’s Social Security and Medicare”.

Also “we” “can’t afford Universal Healthcare”. Even though EVERY COUNTY with Universal Healthcare pays HALF or less than the $11,000 per person Private Insurance “Choices” costs the US Insured ($11,000 which doesn’t include “co-pays”, “not covered”, “covered, but denied”, “deductibles”)

Every country pays less. Every country in Europe including Russia. Every country in the world receiving US military aid including Israel. Small Island Nations like Grenada and Fiji with populations of 100,000 (I’ve been there and spoken to the ordinary people).

Same goes for Veteran Care, the Homeless, the Hungry, Education, etc.

What about the Future?

Idk about you, but at $17 Trillion for last decade’s imbecility I don’t think we can afford Banks, Stock Markets, Military Contractors, Big Insurance, Big Pharma, the Fossil Fuel Industry and the Super-Rich anymore.

In the near future when the Predators’ Ponzis fail, we could use the 22nd or 23rd Century’s taxpayers’ money to bail out ONLY our own 21st Century asses.

This next time let the banks fail. Break up the Mega-Corporations. And tax-like-its-theft whatever the Super-Rich have.

At this point it’s ALL been paid for with our great grandparents tax money. Our grand parents tax money. Our parents tax money. Our current and future tax money. Our children’s , their children’s. Their children’s children’s, and, of course, etc.

Otherwise...the same as above.

The Fall of World Capitalism:

Lenin was apparently correct when he predicted in 1912 the imminent collapse of late-stage Capitalism which Marx earlier predicted would be in the form of Imperalism. The First World War errupted as countries chose up “teams” to steal the other “team’s” overseas empires.

The losing side’s colonies were redistributed to the “winners” who had bankrupted themselves to achieve “Victory”. The British Empire, the French Empire, the Dutch Empire, the Belgian Empire had entered their Twilight Years.

The true winners of WW1 were the US and the USSR which took no new territories. Russia exited the ‘War to Steal Colonies’ as the USSR to save what was left of its population. That exit threatened Billion$$ the US had loaned the Allies if the Allies lost. As a result, and not for the first or last time, the US came up with a pretext to enter the war the very next month. (Google “Zimmerman Telegram”. 200,000 US casualties resulted).

“Loser” Turkey came out better as well. Their post-war nationalist revolution was evidently happy to be out from under the burden of maintaining the Ottoman Empire.

WW2 or (the Death of Late-Stage Capitalism part 2) grew out of the disaffection of number of “Victorious”countries and independence movements that felt cheated in the redistribute or in remaining colonies: Italy, Japan, China, India/Pakistan, Indonesia, Vietnam, China.

Of course, Germany and Austria had fought to a stalemate - not a defeat. So the anger of over being blockaded during the supposed 1919 Peace Negotiations with subsequent starvation of friends and families created the Nationalists who helped fuel Part 2.

Part 2 might have been avoided had the Czar spent more on transportation infrastructure for moving food. Then the October 1917 Revolution might have gone on to inflame half or all of Continental Europe and a large part of Asia. As it was, the Soviets couldn’t move food fast enough. So Lenin accepted the British bribe of food to feed the starving. In exchange for continued food supply he backed off on international revolution. (“BS”you say having not read of Revolutionary uprisings n the 1920s in Germany and England).

For a time in the US when labor had strengthened through the war years, the White working class enjoyed a “Socialism for Organized Resistance.” era 1946 to 1973. The rise of Civil Rights to join the Resistance split the White working class organized labor. Thus the downward spiral back into “Socialism Only for the Banks”.

Qualifications:

I have not researched the developing nations such as India and Africa. They may be experimenting with macroeconomic organizations different from anything above.

The Basque region of Spain continues the Anarchic economy that began in the mid-1930s. Evidently very successfully. But I regret I’ve not researched or traveled there - yet.

I have classified Cuba based on the apparent (to an outsider) Social stability and healthcare as something separate from ‘Socialism Only for Party Bosses.’ Perhaps more like Leninism before Dzerzhinsky, Stalin & the Terror?

I fear that Japan and perhaps Korea are closer to the US/UK.

I wanted this Post to be about matters I believe most of the readers don’t know about. So...

I’ve left out tax cuts. I’ve written extensively about tax cuts elsewhere as have many smarter than me. . It’s unlikely anyone who believes in Tax Cuts for the Rich will read much or any of this post.

I’ve left out how our post-Regan Oligarchical Economic System allows the suppression of wages and supplier prices while allowing price-fixing inflation. Others have written whole books. Suffice to say it is the lower half of our countriy’s economic strata who have suffered the greatest loss - about a third to a half of their comparative buying power. The same US Mega-Corporations pay Australians or Germans half again as much per hour than they pay their US workers for the exact same job.

I have left out how specifically Cartels can stagnant wages. In the decade 2008 to 2017, wages generally did not increase while we experienced 16% inflation. A few corporations in each economic sector at the top of the supply chain are in a position to fix wages and supplier prices which fix wages and supplier prices down each tier of the supply chain

I’ve left out Inflation. As has the Media for 20 or 30 years while Inflation has made us poorer but the Rich wealthier. The affect of the Banks multiplying the money supply is in economic gibberish “inflationary”. But the effect is not expansive. “Inflation” decreases the buying power of any money. As buying power decreases, the worker must work more hours to pay the same rent, buy the same food, buy the same utilities, buy the same gasoline. And/Or cut out some purchases. An argument can be made that it is the Banks and Corporate Oligarchies that are driving inflation and not the Governments generally. But I’m not up to the task.

++++++++++++++++++++++++++++++++

LINKS

Clarity from the Federal Reserve about “business as usual” and “fictitious reserves”: “One cause was the practice of counting checks in the process of collection as part of banks’ cash reserves. These ‘floating’ checks were counted in the reserves of two banks, the one in which the check was deposited and the one on which the check was drawn.2 In reality, however, the cash resided in only one bank. Bankers at the time referred to the reserves composed of float as fictitious reserves. The quantity of fictitious reserves rose throughout the 1920s and peaked just before the financial crisis in 1930. This meant that the banking system as a whole had fewer cash (or real) reserves available in emergencies (Richardson 2007).”

https://www.federalreservehistory.org/essays/banking_panics_1930_31

The COST of the bailout of 2008:

https://www.google.com/amp/s/www.forbes.com/sites/mikecollins/2015/07/14/the-big-bank-bailout/amp/

Foreclosures after 2008:

http://static.realtytrac.com/images/reportimages/foreclosure_activity_historical.png

5 notes

·

View notes

Text

My Money Snapshot

[Inspired by Corporette]

Location: Ohio, small college town

Age: 29

Occupation: PhD candidate (English)/half-time instructor

Income: $16,000 before deductions

Net worth: $588 (I’m crying)

Current Debt: $12,844

Living situation: Renting with a roommate

Money Philosophy:

I grew up in the “working poor” category. My parents are divorced and my father never contributed much financially. Mom made around $21,000 per year at work and she cleaned houses “under the table” to supplement that. Somehow, we never went hungry, what we ate was relatively fresh and healthy, and she managed to put two of us through Catholic schools for a total of 14 years. I know now that mom is still paying some of those loans and credit card debts and that part of her strategy included not contributing more than the 3% that her employer matched in her 401k. Every time I complain about the financial stress I feel at my salary level, I have to remind myself how comparatively unstressful my financial life is.

I’ve always been poor and I always knew that graduate school/academia is not a lucrative career. I tell myself that if I can make things work at this pay grade, then I’m ready for just about anything. My main strategy is to have a budget, stay in the budget, and save every bit that I can.

Monthly budget

$1000-1100 for the necessities each month. Monthly spending on eating out, entertainment, shopping and other categories varies widely. I also won’t lie... dating someone who makes 4x more money than me helps... I’m fairly frugal on all of these fronts: I buy most of my clothes second hand and I tend to shop seasonally. Spikes in spending occur around the winter holidays when I’m buying gifts and when I am doing traveling. And I also have totally weak, impulsive moments - like the $3 soap sales at Bath & Body works, or that time I spent $110 on bras and underwear on a whim. Anyway:

Rent: $272.50/month

Other living expenses: $130-170/month (electric, internet, phone, renter’s insurance - lower in summer, higher in winter)

Transportation: $332/month (gas, insurance, car payment)

Healthcare: $162/month (health+dental insurance, no vision coverage)

Groceries: $120-150/month ($30/week)

Debt Picture

Student loan: $2000

Car loan: $10,488

I’m a career student & my motto for all the years I’ve been in school has been “follow the money.” I went to college on very hefty scholarships and I only had to take out the $2000 loan to cover housing costs during my first year. For the subsequent three years, I was an RA, so I never had to take loans again. I applied to graduate programs based on the research fit, and when I got my offers, money weighed heavily in the decision. I would have loved to live in Boston as a wee 22-year old, but I wasn’t about to take out loans for a year’s worth of tuition and the living expenses. And to get a PhD while living in Minneapolis, my very favorite city in the US? It would have been such a dream, but for the quite steep difference in stipends and the significant disparity in cost of living compared with Ohio. My only regret on this front is that I haven’t started paying back my tiny student loan. I’ve been able to defer it since I’m in graduate school, which was a great idea when I was a master’s student who didn’t know the first thing about budgeting. But if I had just paid $25/month from the start of grad school the balance would be $0 about the same time I graduate from this PhD program this August. Instead, I’ll be scrambling to pay off the whole balance before my 6 month grace period ends.

The car loan is less than a year old. I finally broke down and bought a new (by which I mean used) car last summer after really pushing it with the car my parents had bought me in high school. Repairing that car put me into credit card debt more than once and I was getting so stressed about it. It was time. I have a very good credit score, so I qualified for a nice loan rate with my credit union, and to get a better rate I got my mom to co-sign my loan. It’s a popular rental fleet model so there were tons of them on the market, but average miles were high - so when I saw one that was two years old with only a years worth of miles on it at $1000 less than the average price for that make, model, and year, I jumped on it. My payments are $231/month on the 5-year plan. Currently, I’m paying that minimum, but I plan to escalate my payments as my income goes up (I’m on the academic job market now, pray for me). I folded this car payment into my existing budget by giving up solo-living and finding a roommate. When I had my own apartment, very spacious with a huge kitchen and tons of windows/natural light, I was paying about $585 for monthly rent. I hate living with people, but I hated the idea of being trapped in this college town without a car even more - one of my other mantras is “you can do anything for a year.”

A note on credit cards: I love them. I’m one of those responsible people that charges everything and pays the balance like clockwork every month. This is the only way to make sure you’re actually taking advantage of the cash back/reward perks! Currently, I’m using Capital One’s Venture card and stockpiling airline miles for travel (it has a 40,000 mile sign-on bonus). If you’re good for it, I also recommend one card with a great balance transfer program. For me, when I get into an emergency situation, it makes me feel like I have options. It’s been about 4 years since I’ve had to use my balance transfer card to cover costs ($1400 in car repairs, summer 2015), but at my level, I can’t afford to not have back up plans.

Savings and Investments

$5,517 Cash

$7,861 Roth IRA + employer mandated retirement account

Retirement: The biggest financial mistake I've made in grad school is that I did not opt into the retirement account offered by the university when I started my M.A. in 2012. When they ask me that “what I wish I had known before I went to grad school” question, this is near the top of the list. I did, eventually, open a Roth IRA and slowly I started to build something. This year, when my graduate funding dried up and they made me a “half-time instructor” the retirement account for public school teachers was mandatory and the contributions are high: 14% of every pay check (annoying, yes, but on the flipside, there is an equally high employer match). While I’m contributing to this, I’ve paused my contributions to the IRA. I’ll roll this money over, either into the IRA or into another state/employer retirement fund when I move on from here.

Personal savings: I strive for a minimum of $100 per month and frequently do a little more, but each month is different and I consider it a win if I break even. Through most of grad school, I’ve taken on “second jobs” to bolster what I can save (and boost my resume). Both jobs have been through the university, so they limit me to five hours a week. When I max them out, this can be an extra $200-250 each month.

I took up a new savings challenge this academic year to build on my “play money” savings account (a high yield savings account which my bank labels a “goal setter” account). The challenge involves tallying the “total savings” printed on my receipts each month (i.e. when the grocery store is like “you saved $6″ because of sales and coupons). So, At the end of the month, I put that running total into my goal setter account. Sometimes the total savings are like $26, but others its as much as $171. It’s an interesting challenge because it encourages me to do tedious things, like scroll through all the digital coupons on the grocery store app; but at the same time, I know that the higher that number is usually coincides with a lot of shopping which encourages some self-regulation.

I initially set my goal at $2500 when I opened the goal setter account in 2014. When I had to dip into the account in April 2018 to pay $930 in car repairs, I finally set plans in motion to buy my car. Since I bought used, I only put 10% down on the car (just over $1200). When I sold my old car for $1000, I put that money right back into the account to start saving for new things...

What I’m saving for now:

travel: to celebrate finally finishing this PhD, I’m hoping to pull off a trip to Europe. Later this year, I’m also turning 30 around the same time that one of my regular professional conferences is meeting in Hawaii. If I can do one or both in the next year, that’d be grand. (As I mentioned, I'm saving up airline miles with my credit card program, too!)

a multicooker: think InstantPot...but more expensive because my dreams all revolve around small appliances that match my stand mixer.

What I do to be frugal...

I’ve been frugal my whole life, but a couple of major habits I’ve formed include:

Meal planning and home cooking (read my guide to meal prep here). The money part of that means planning what I eat around maximizing the ingredients I have to buy. I plan meals that use the same ingredients so I’m not spending on an entire bunch of celery and then throwing out 75% of it. Routinization also helps, so my grocery lists stay about the same week to week and the bill relatively predictable - for example, I eat avocado egg salad almost every day for lunch. I know, avocados are not cheap, but I also believe in spending on the things that nourish you––literally and “spiritually.” Roxane Gay once said that she never bought avocados or blueberries when she was a “poor grad student.” Once she started making money, she realized she would buy them because she could afford them, but she also threw them out all the time because she didn’t plan her meals right to actually eat them. The point is, buy the foods that you like/feel good about and build habits around them. It’s not wasted money. That said, I won’t pay more than $1.25 for an avocado!

Second hand clothes shopping, especially for my business casual (it’s amazing what people donate to the Goodwill, barely worn!)

31 notes

·

View notes

Text

Wintersend’s Exchange

A gift for @dovabunny in the Fenders Wintersend Exchange! They requested:

Homeless Fen and doctor/nurse Anders who always tries to feed and dress warmly his elf. Fenris doesnt want or trust charity, he wants to be seen as a man - not a project.

also available on my AO3

It started in the winter. A winter’s night, precisely, when Anders is locking the clinic’s door after a day of treating injuries, maladies, and general complaining from late stragglers. Luckily, his Maker-sent secretary was more than happy to handle the last part (read: forcibly showing them the door by social convention or force) and when the patient line dwindled to none, he sent her home. That had been hours ago. Now, it was late, and Anders was more than ready to flip the sign from open to closed and head upstairs for some well-deserved rest.

No sooner than his fingers brushed against the card than someone rapped against the door. Anders sighed, debated turning the sign over fully like the asshole he was, then decided against it since the person technically did come before the clinic was truly closed. He opened the door with a heavy heart. “Can I help you with-” He started, then stopped.

“Yes.” Fenris replied, arms wrapped around himself and his threadbare clothing, the very picture of a shivering wreck. “You can help me out of this cold.”

Anders was too stunned to do more than step back and let Fenris inside. Fenris made a beeline for one of the waiting chairs and collapsed onto it. It was only then that Anders noticed the goosebumps rippling on his skin, the shaking in Fenris’ body, the way his fingers trembled even as he tried to hide them underneath his armpits. Anders sighed again, pinching the space between his brows. “What made you think in here would be better than out there? Or anywhere else for that matter?”

“Hawke is...indisposed.” Fenris answered carefully. “And it’s too late for anyone else.”

“But apparently, not late enough for the hard-working doctor, who’s spent all day holed up in a clinic treating people as their last line of healthcare. What, the walk back home not good enough for you?”

At least Fenris had the decency to look ashamed. Well, as ashamed as a prickly elf could look. “I don’t trust home at the moment.”

Anders’ long face grew longer. For all of his bad blood with Fenris, even he saw the cruelty in shutting the door in a runaway’s face. “Fine.” He relented. “Stay for the night, but I expect you to be out first thing in the morning.”

Fenris nodded mutely and curled up on himself – almost like a cat. As soon as the comparison made its way into his head, it took root and refused to move from Anders’ mind, following him all the way to the supplies closet, where he grabbed the least threadbare blanket and pillow, and back to where Fenris was huddling. “Here.” Anders said, tossing the items at him. “At least crash here properly, for Maker’s sake.”

A person with less than perfect reflexes might have been slapped face-first with bedding, but Fenris only caught the items with a raised eyebrow. Anders had already turned away to finally prepare for sleep, he heard a quiet-

“Thank you.”

He paused, glancing over his shoulder. Fenris had already wrapped himself up in the blanket and curled into the pillow, stuffing his head under the cover until only the tips of his ears were peeking out. In that moment, he looked like any other elf refugee trying to stay warm in a none-too comfortable chair (and Anders can attest to that uncomfortable thing after an ill-advised nap during a quiet hour in the clinic). That image was a real, tangible proof of his care - even if it took form of a ball of blanket and silvery hair - and it reminded Anders why he treated people, or ran a clinic, or let in mage-hating runways.

He didn’t smile, but his steps going up the back staircase were much lighter than before.

His next time off was spent at the Hanged Man with Hawke and (proclaimed) merry band of misfits. It was certainly fitting considering the company currently present at their usual table – a set of twins, a police officer, the co-manager of the Hanged Man, a doctor (Anders), a runaway actor, an internet pirate, and a Dalish student.

And of course, Hawke himself, who was guffawing about something Varric said. Anders wouldn’t know since he was too busy losing at Wicked Grace badly.

“Well...at least all the cards are different this time. I really like how unique all of them are.” Merrill said as she peered over his hand.

“That’s not a good thing sweetness.” Isabela pointed out, laying out her completed set of suits, then appraised Anders with a smile playing at the corner of her lips. “You really do have the worst luck. Can’t be helped really.” On his right, Bethany patted his arm sympathetically as she laid down her own modest hand.

Anders frowned at Isabela. “As opposed to cheating?”

Isabela shrugged, not-so-coincidentally jostling a naughty card nesting in her cleavage (much to the poorly hidden delight of Carver). “It’s not cheating if you don’t get caught.”

Hawke chose that moment to tune into the conversation and gasped. “Isabela would never cheat!” He exclaimed indignantly. Knowing him, he was 100% serious. Varric and Isabela exchanged smiles, then Varric patted Hawke’s bicep.

“We believe you Hawke.”

“It’s not the matter of believing me, but believing in Isabela.” He turned to her. “I believe in you.”

Isabela’s face contorted in a strange mix between amused and touched, which ended up making her look extremely seasick. Fenris stifled a laugh behind his hand, turning his expression to the closest person next to him, and found himself looking at an equally humorous Anders. There was a moment when their eyes met, a moment when Fenris wasn’t feeling the usual hostility and it was just him and Anders sharing a common laugh.

Then Anders turned his head, breaking the connection. Fenris returned his gaze to the table as the conversation moved on. It seemed only minutes before Aveline said regretfully, “Well, I have the morning shift tomorrow, so I should get going.”

Isabela took one look at Merrill covering her yawn with a hand and stood. “I better get kitten home too. Don’t get into too much trouble boys. At least, not without me.”

With Hawke’s innocent, “We won’t Isabela!” sent her way, Isabela put an arm around Merrill’s shoulders, dropped money onto the table, and left with her. Following their example, Varric and Hawke put their heads together to figure out how to pay for their night in the bar (“Put it on my tab.” Was Varric’s usual reply, to Hawke trio’s indignation, which then started a one-versus-three of who would get to pay it back).

As Fenris reached into his own pocket to draw out the lone bills he had, Anders’ hand slapped in front of him, startling him. Anders withdrew his hand without another word and stalked out, leaving behind a few bills where his hand had been. It was more than enough to cover his own split bill.

“Anders-” Fenris started, but the mage was already gone. He frowned. Despite his feelings on Anders’ ideals, he recognises altruism when he sees it, in the man who chooses to sleep in his own clinic. It’s not cheap to run the service that Anders does, and for as long as Fenris has known him, he not the type to spend frivolously when he’s saving for the endless costs of the clinic.

And yet. Fenris would not deny that Anders was not the only one who had been counting pennies, so to speak. His had pride dictated that he would not accept any of the charity money offered by his friends, but there was clearly enough money for both his and Anders’ meals. How did the mage know that would he would be short for the evening?

No matter. Varric was already grudgingly accepting the Hawkes’ payment, as well as sweeping the bills off the table and into his hand. There was nothing else he could do about it, in terms of paying.

It still left an unsettling pit in his stomach.

It was only more ‘kindness’ since then, disguised as inconveniences for Anders and often riding along the coattails of excuses. ‘I needed to get rid of some of the older blankets, take this one. There’s no holes in it, at least.’ ‘A patient made a pie as a thankyou, but what do you know, I’m allergic to blueberries!’ ‘Someone kindly donated a hand-made beanie and scarf. Unfortunately, grey’s just not my colour.’

Not that Fenris hasn’t been trying to refuse them, with the keyword being ‘trying’. Being in the middle of an unusually harsh winter and dry season for jobs, it would make sense to accept the help. But just because it was logical didn’t mean that Fenris liked it very much. It felt too close to the small acts of mercy Danarius would give to him, akin to throwing a bone to a very beaten dog after a whole day of posing and remembering lines and pushing himself to exhaustion, which Fenris was ashamed to admit to have lapped up as a sign of favouritism. Delicious meals, fine clothes. He might as well have been a glorified pet with a lyrium collar back then.

When Anders dumped a pair of earmuffs on him – elongated for long tipped elven ears – Fenris finally confronted him. “Why all of this?”

Anders fixed him a confused look. “I’m very sure elven biology is enough similar to humans that they both feel the cold somewhat similarly. Unless your prickly sensibilities chose not to feel cold in the air?”

“I mean why all these...gifts.”

“...I needed someone to dump them off? Lirene only accepts cash donations and there’s only so many mismatched scarves and beanies I can own before I would have to give them away as well. Not to mention I’m trying to watch my weight, so food’s the least of my problems-”

Fenris knew stalling when he heard it. “Then cease it. I’m not a charity case, nor a project. If you feel nothing more than pity for me, then I would prefer how we were at the start.”

Hurt flashed across Anders’ face, for a moment, then it was wiped away with a frown. “This wasn’t- this isn’t a- I wasn’t doing it to try to, Maker forbid, change you Fenris. Are you a prickly bastard? Yes. Do I think that you should be a little more sympathetic to the plight of mages because they’re so similar to your own problems? Also yes. Do I still think of you as a friend? Well, I do, unless it’s not been mutual this entire time, which I guess makes me an idiot.”

Fenris knew stalling when he heard it. “Get on with it, Anders.”

“I was, I was. Look. If I was trying to change you – which I’m not! - I would put a lot more effort into shaping you into a specific person, don’t you think?”

Logic warred with suspicion. “And what if you are only bribing me?”

“That’s assuming there’s anything you can give me.”

That stung more than it should. Fenris shook his head. “Then there is no sense to keep giving me things when I have nothing to give back. I do not want to be indebted to you, and I am not yours to shape as you see fit.”

“For the last time, I’m not trying to lord this over you. But I’ll stop it if that’s what you, honest-to-Andraste, believe is the logical thing to do.”

Yes. Fenris was convinced it was.

So the gifts stopped, and with it, so did whatever little camadrie there had been. The next time they met as a group, Anders barely acknowledged him. But Fenris had meant what he said, so he forced himself to swallow the bitter taste of seeing Anders’ eyes pass over him with a neutral glance. At the one after that, Anders chose not to turn up at all, citing a busy clinic as his excuse. Fenris didn’t know if he was relieved or disappointed.

A few days of this apathy passed without fanfare, only for Hawke to pull Fenris and quietly asked if he had a fight with Anders.

“We had a discussion and cleared the air. Nothing else happened.” Fenris answered, if a bit testily.

Hawke levelled a stare at him. “Anders has been throwing himself into his work. He hasn’t been coming to the last three Wicked Grace nights, and he loves Wicked Grace. Either flu season was terrible, or you two are trying to avoid each other.”

“I am not avoiding him.”

“Yes you are. You two seemed to getting along so well with all the presents Anders was giving you.”

Fenris scowled, reminded of the reason why he was in a bad mood in the first place. Hawke continued, oblivious. “When I asked Anders, all he said was that he was giving you space. Did he do something Fenris? Should I be more worried? Were the presents themselves really that bad?”

...the meals may have been warm, but not the creations of a gourmet kitchen, and the clothes, clearly hand-me-downs despite their well-cared for appearance. “No.” Fenris said. “They were passable.”

“They must’ve sure been something if you didn’t want them anymore.”

They were hardly the rewards Danarius would shower him during the sponsorship, especially the ones Danarius gave when he was feeling more whimsical than demanding. But Danarius always had the ulterior motive of keeping Fenris docile and controlled. Anders just did it because he felt like it.

“Thank you, I suppose, for giving me something to think about it.”

Hawke clapped his shoulder, taking that as a sign that the problem was solved. “Not a problem. I’m always here if you need me.”

People to depend on. Those were rare. Maybe Fenris could do with one more.

This time, it was Fenris who was pacing in front of Anders clinic just before closing time. His earlier resolve had crumbled, and he tried in vain to gather its remains. He jumped when the front door opened, but it was only a lone dwarven couple ferrying a sleepy child out. He held the door open respectfully and stepped inside before the door swung shut.

As Fenris’ eyes adjusted to the dark, he could make out the surprise in Ander’s face from behind the receptionist desk. “Fenris?” Anders rose out of his chair, eyebrows raised in surprise.

“I wanted to talk to you.”

“Really? I was under the impression that you didn’t want anything to do with me.”

“I opposed your pity gifts. The company was…less than terrible, truth be told.”

Anders narrowed his eyes at him. “Why do I feel like you’re lying.”

Anders, as much as Fenris would hate to admit, had a point – here he was, after weeks of avoiding Anders like he had the Blight, and now, trying to make contact like he wasn’t the one who cut off Anders in the first place. The mage deserved honesty.

“I am not. I needed time to make sense of what I was feeling. I am not the best at words.”

Anders tipped his head at Fenris’ statement. At least he wasn’t making a smart remark. The fact that Fenris could predict a good Anders sentence and an irritated Anders sentence was an indicator that he probably knew Anders more than he had originally thought.

“What I said back then is still true. I do not like being in the debt of others. When I was. underneath Danarius’ contract, everything I received was something that could be used against me later. I cannot just shake this suspicion for it has saved me often. But one day, I would like to know what it would be like to walk freely, without distrust in every interaction. All I ask for is time and a chance to try existing outside that sponsorship.”

Anders stared at him for a long moment. Fenris willed himself to stare back, not defiantly, but in hope that his look would convey his sincerity. Finally, Anders spoke. “I will admit, it stung when you didn’t my goodwill. But that makes sense. I may be an advocate for mage rights, but even I can admit that bastard belongs in the Deep Roads, so it’s no wonder you don’t want anything to do with him.”

That’s all Fenris wanted and hoped for. He had nothing else to mention, so he nodded and turned to the door.”

“Wait.” Anders called out. “Do you somewhere to sleep tonight?”

Fenris faltered. He hadn’t been planning very far apart from hoping Hawke would answer his door. “I was thinking of asking Hawke, if he is awake at this time.”

“It’s very, very late so he’s probably not. Do you want to stay for the night? I promise, no doing this for bragging rights.”

Just as he reasoned on the first night, there could be worst places than an undocumented doctor’s clinic to sleep in. When Fenris nodded, Anders disappeared in the back, just as he did before, however, he returned with seemingly more items in his hand than the last time – another pillow, a fuzzier blanket, and something dangling off a lanyard on his wrist. Anders dumped them on the chair nearby chair, but held onto the lanyard.

“So I went through a few days of thinking in the span of a few minutes while I was getting these – I can think fast if I have to, don’t look at me like that – and I can’t blame you for thinking like you have to be suspicious of everything. Considering what you just told me, it would be like getting mad at pounce-a-lot for taking down the Wintersend tree.

“So this time, I’m going to give you something else: a choice. Happy Wintersend.”

He held out the lanyard, finally showing the small key hanging on the end. Fenris stared at it. “I don’t understand what this is Anders.”

“It’s one of the spare keys for the clinic – one of the only three in the world, I might add. The only people who have this is me and Lirene. So know that I’m not offering this lightly. This is a...job offer, I guess? I can’t pay you anything other than food, maybe a bit of the stipend if I beg Lirene enough to spare some of the weekly change. I’m sure I can convert one of the rooms upstairs to another bedroom if you want somewhere to board as well. There’s also a contract to read over, but we can do that together. Probably with someone else if you like. Hawke?”

It was good that Fenris was already sitting on the chair. It gave him a measure of support as the full implication hit him. This was Ander’s life, the home of his hopes and dreams, a sanctuary for those who had no-where else – or those without insurance. The previous gifts did not carry the weight of that disarmingly small key, but Fenris could feel its weight off the lanyard.

“I...would need some time. Maybe. I can’t promise anything now.” Fenris said, relishing the way maybe rolled off his tongue. The choice to say so. The feeling only flared when Anders nodded his head.

“I understand. Well, the waiting room is yours until morning.” Anders disappeared to staircase, his steps echoing in the stairwell, until they too faded away. The chairs were just as uncomfortable as they had been the first time Fenris had slept in them, but as Fenris buried himself deeper in them, his mind became cotton-heavy with the incoming sleep.

The last though Fenris had before he drifted off was the speculation of working in a place like the clinic. He had no skills has a medical professional, but there had to be just as honest work there. Fenris smiled to himself. He would let Anders know his answer in the morning.

#fendersassoc#fenders#fenders dragon age#charwriting#fender modern au#fenris ( dragon age )#anders ( dragon age )#secondary:#the kirwall crew ( dragon age )#im too lazy to tag everyone#dragon age#dovabunny#modern au#i already published this ages ago on ao3 i just wanted to do it here as well

27 notes

·

View notes

Text

Mortgage, Groupon and card debt: how the bottom half bolsters U.S. economy

Jonathan Spicer, Reuters, July 23, 2018

PHILADELPHIA (Reuters)--By almost every measure, the U.S. economy is booming. But a look behind the headlines of roaring job growth and consumer spending reveals how the boom continues in large part by the poorer half of Americans fleecing their savings and piling up debt.

A Reuters analysis of U.S. household data shows that the bottom 60 percent of income-earners have accounted for most of the rise in spending over the past two years even as the their finances worsened--a break with a decades-old trend where the top 40 percent had primarily fueled consumption growth.

With borrowing costs on the rise, inflation picking up and the effects of President Donald Trump’s tax cuts set to wear off, a negative shock--a further rise in gasoline prices or a jump in the cost of goods due to tariffs--could push those most vulnerable over the edge, some economists warn.

That in turn could threaten the second-longest U.S. expansion given consumption makes up 70 percent of the U.S. economy’s output.

To be sure, the housing market is far from the dangerous leverage reached in 2007 before the crash. With unemployment near its lowest since 2000 and job openings at record highs, people may also choose to work even more hours or take extra jobs rather than cut back on spending if the money gets tight.

In fact, a growing majority of Americans says they are comfortable financially, according to the Federal Reserve’s report on the economic well-being of U.S. households published in May and based on a 2017 survey.

Yet by filtering data on household finances and wages by income brackets, the Reuters analysis reveals growing financial stress among lower-income households even as their contribution to consumption and the broad economy grows.

The data shows the rise in median expenditures has outpaced before-tax income for the lower 40 percent of earners in the five years to mid-2017 while the upper half has increased its financial cushion, deepening income disparities.

It is this recovery’s paradox. A hot job market and other signs of economic health encourage rich and poor alike to spend more, but tepid wage growth for many middle-class and lower-income Americans means they need to dip into their savings and borrow more to do that.

As a result, over the past year signs of financial fragility have been multiplying, with credit card and auto loan delinquencies on the rise and savings plumbing their lowest since 2005.

Myna Whitney, 27, a certified medical assistant at Drexel University’s gastroenterology unit in Philadelphia, experienced that firsthand.

Three years ago, confident that a steady full-time job offered enough financial security, she took out loans to buy a Honda Odyssey and a $119,000 house, where she lives with her mother and aunt.

Since then she has learned that making $16.47 an hour--more than about 40 percent of U.S. workers--was not enough.

“I was dipping into my savings account every month to just make all of the payments.” Whitney says. With her savings now down to $900 from $10,000 she budgets down to toilet paper and electricity.

“God forbid I get a ticket, or something breaks on the car. Then it’s just more to recover from.”

Stephen Gallagher, economist at Societe Generale, says stretched finances of those in the middle dimmed the economy’s otherwise positive outlook.

“They are taking on debt that they can’t repay. A drop in savings and rise in delinquencies means you can’t support the (overall) spending,” he said. An oil or trade shock could lead to “a rather dramatic scaling back of consumption,” he added.

In the past, rising incomes of the upper 40 percent of earners have driven most of the consumption growth, but since 2016 consumer spending has been primarily fueled by a run-down in savings, mainly by the bottom 60 percent of earners, according to Oxford Economics.

This reflects in part better access to credit for low-income borrowers late in the economic cycle.

Yet it is the first time in two decades that lower earners made a greater contribution to spending growth for two years in a row.

“It’s generally really hard for people to cut back on expenses, or on a certain lifestyle, especially when the context of the economy is actually really positive,” said Gregory Daco, Oxford’s chief U.S. economist. “It’s essentially a weak core that makes the back of the economy a bit more susceptible to strains and potentially to breaking.”

While the Fed expects the labor market to get even hotter this year and next, policymakers have been perplexed that wages do not reflect that.

With inflation factored in, average hourly earnings dropped by a penny in May from a year ago for 80 percent of the country’s private sector workers, including those in the vast healthcare, fast food and manufacturing industries, Bureau of Labor Statistics figures show.

“It stinks,” says Jennifer Delauder, 44, who runs a medical lab at Huttonsville Correctional Center in West Virginia. In seven years her hourly wage has risen by about $2 to $14.

She took on two part-time jobs to help pay rent, utilities and a student loan. But she still sometimes trims her weekly $15 grocery budget to make ends meet, or even gathers broken fans, car parts, and lanterns to sell as scrap metal. A $2,000 hospital bill early this year wiped out her savings.

Even so, Delauder, a grandmother, recently signed papers for a mortgage of up to $150,000 on a house. “I’m paying rent for a house. I might as well pay for a house that I own,” she said.

Hourly wages for lower- and middle-income workers rose just over 2 percent in the year to March 2017, compared with about 4 percent for those near the top and bottom, while spending jumped by roughly 8 percent.

That reflects both higher costs of essentials such as rent, prescription drugs and college tuition but also some increased discretionary spending, for example at restaurants.

Economists say one symptom of financial strain was last year’s spike in serious delinquencies on U.S. credit card debt, which many poorer households use as a stop-gap measure. The $815-billion market is not big enough to rattle Wall Street, but could be an early sign of stress that might spread to other debt as the Fed continues its gradual policy tightening.

More borrowers have also been falling behind on auto loans, which helped bring leverage on non-mortgage household debt to a record high in the first quarter of this year.

While painting a broadly positive picture, the Fed’s well-being survey also noted that one in four adults feared they could not cover an emergency $400 expense and one in five struggled with monthly bills. This month the central bank reported to Congress that rising delinquencies among riskier borrowers represented “pockets of stress.”

That many Americans lack any financial safety net remains a concern, New York Fed President John Williams told Reuters in an interview last month. “Even though the overall picture is pretty good, pretty solid, or strong,” he said, “this is a problem that continues to hang over half of our country.”

8 notes

·

View notes

Text

Two Years Without Health Insurance (and What I’m Doing Now)

Two years ago, I was unsatisfied with my options for health insurance. The premiums were rising even as the quality dropped in the form of an ever-increasing deductible. I am guessing that you might feel the same way these days – most of us Americans are in the same boat.

I felt like I was being squeezed from both ends and it was starting to piss me off. So I decided to take some action, by doing the math for myself using a spreadsheet. I needed to answer the question, “Is this insurance really as bad a deal as I think it is?”

Sure enough, the risks and rewards of the coverage did not justify the premiums, so I decided to try an experiment and simply drop out of the market and insure myself. In other words, just rolling the dice and going through life with no form of health insurance at all.

Doubling down on the bikes, barbells and salads, I did my best to eliminate any risk factors that are in my control, while accepting that there are still much less likely but more random factors that are not.

Figure 1 – DIY Health Care

Almost two years and $10,000 in premium savings later, I have found the experiment to be a success: I have slept well and not worried about the fact that I could be on the hook for a big bill if I did ever need major care. And as luck would have it, I also enjoyed the same good health as always over this time period – probably the best in my life so far because the extra healthy living has been working its magic.

But.

This situation has not been quite ideal, because my life is not a very useful model for everyone to follow. Most people don’t have the luck of perfect health, many have a larger family than I do, and very few people are in a financial position to self-insure for all possible medical bills.

Also, I found myself wishing I had a doctor that actually knew me, who I could call or visit on short notice if I ever did need help.

Finally, I wanted to switch back to having some form of insurance so that I could learn about it and write about it as time goes on. But was I really willing to be part of that unsatisfying and broken insurance model?

Then something magical happened: I learned about the new and vastly improved world of Direct Primary Care physicians.

What is DPC?

DPC is a fairly new trend in the US, but it is also a return to a very old tradition: a direct relationship between you and your doctor, with no insurance company in the way.

As a customer, you pay for a monthly subscription (somewhere around $100), and in exchange you get unlimited access to super elite, personalized medicine for the vast majority of your medical needs. Diagnoses, prescriptions, skin conditions, stitches, even fixing a broken bone if you don’t need surgery. All covered, with no co-pay and in an environment that feels to me like Presidential-level health care, in striking contrast to some of my past experiences where I felt like an anonymous numbered ticket in a sloshing sea of bureaucratic institutional medicine.

Oh, and direct email, phone and text message contact with your doctor, prescriptions over phone or video call, and in some cases even house calls depending on the practice and the situation.

Through some sort of magic, the Direct Primary Care model offers much better medical care and much lower prices, at the same time.

How could it be? It’s because of the incentives.

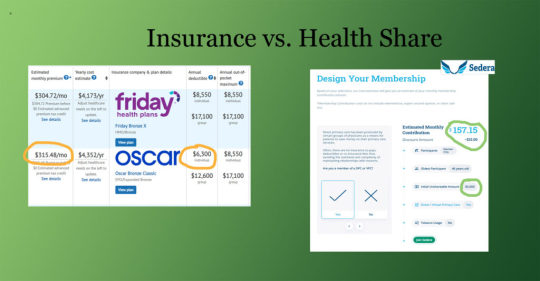

Figure 2: The Insurance Model for Health Care

In our famously broken US healthcare model, an insurance company is wedged in between you and your doctors, and it has different objectives than you do.

You just want the best overall health for yourself, and when the shit does hit the fan and you need medical care, you want it to be quick, effective, and at minimum cost. And you don’t want to be hounded with years of stressful stray bills after an expensive medical procedure.

Your Doctor wants to help as many people as possible and make a good living, without having to wade through a sea of paperwork or stress or lawsuits.

Your Insurance company wants to make as much profit as possible, which means maximizing the amount they collect from you, and minimizing the amount they pay to your doctor. In theory, they benefit from helping you to stay healthy. But they have also developed elaborate contracts (putting in as many loopholes as possible to allow them to drop your coverage or deny claims), become masters of delaying payments, limiting which procedures and tests they will authorize doctors to do, and just generally throwing the biggest monkey wrench into the system that they can.