#IIot Sensors

Text

#IndustrialInternetofThings#smarter#sensors#IIoT#data#and#automated#Consegic Business Intelligence#electronicsnews#technologynews

0 notes

Text

IoT in Manufacturing Market is Estimated to Witness High Growth Owing to Need for Streamlining Operations

The IoT in manufacturing market involves connecting and integrating physical devices, sensors, and other smart objects into the manufacturing operations through the use of networking and cloud technologies. It enables the collection of information from various manufacturing equipment and assets and utilizes analytics tools to analyze the collected data to optimize operations. IoT allows manufacturers to drive improvements in equipment performance, reduce downtime, improve quality control, and optimize logistics and inventory management. The advantages of IoT in manufacturing include increased productivity, predictive maintenance, asset monitoring, inventory management, and energy management. The need for streamlined operations, improved asset utilization, and reduced maintenance costs through advanced monitoring and predictive analytics is fueling the demand for IoT in manufacturing.

The global IoT in manufacturing market size was valued at US$ 198.8 billion in 2022 and is anticipated to witness a compound annual growth rate (CAGR) of 18.4% from 2023 to 2030.

Key Takeaways

Key players operating in the IoT in Manufacturing are EnableX.io (VCLOUDX PTE. LTD), Twilio Inc., Infobip Ltd., Vonage Holdings Corp, M800 Limited, MessageBird BV, Iotum Inc., Plivo Inc., Voxbone SA, Snich AB, Telestax, Voximplant (Zingaya Inc.), Mitel Networks Corporation, 8x8 Inc., AT&T Inc., Voxvalley Technologies, Avaya Inc., Bandwidth Inc. (Bandwidth.com), Wazo Communication Inc., and IntelePeer Cloud Communications. These players are focusing on developing advanced IoT solutions and services for manufacturing applications.

The key opportunities in the Iot In Manufacturing Market Forecast include predictive maintenance through condition monitoring of equipment, remote asset management through sensors and connectivity, improving supply chain visibility, and optimizing energy consumption. Adoption of advanced analytics is also opening up new revenue streams through data monetization.

North America is expected to continue dominating the global IoT in manufacturing market during the forecast period owing to the presence of many global players and early adoption. However, Asia Pacific is expected to witness the highest growth attributed to increasing investments by governments and manufacturers in smart factory initiatives to drive industry 4.0. Countries like China, India, Japan, and South Korea are emerging as global manufacturing hubs and rapidly adopting IoT technologies.

Market drivers

The key driver fueling the growth of IoT in manufacturing is the need for streamlining operations through real-time data collection, monitoring, and analytics. IoT allows connecting all manufacturing assets and enables data-driven decision making for predictive maintenance, quality control, inventory management, and production planning. This helps reduce downtime, save costs, improve overall equipment effectiveness, and enhance operational efficiency. IoT also enables remote asset management and driving energy efficiency initiatives through connected smart systems and remote asset performance monitoring.

PEST Analysis

Political: IoT in manufacturing market is affected by government regulations around data privacy and security. Stricter privacy laws make it challenging for businesses to collect and use customer data. On the other hand, regulations supporting industry digitization creates opportunities for IoT solutions.

Economic: Factors like global economic growth, industrial production levels, and investment in automation impact demand for IoT systems in manufacturing. During recessionary periods, organizations may delay IoT deployments to control costs.

Social: Younger workforce is more receptive to new technologies. Skill gaps challenge wider IoT adoption. Awareness programs help promote social acceptance of advanced manufacturing technologies.

Technological: Emerging technologies like AI, 5G, edge computing, and blockchain offer new possibilities for optimizing manufacturing processes. However, integrating legacy systems with advanced IoT platforms poses technological challenges. Security also remains a key concern with expanding network connectivity.

The geographical regions where the IoT in manufacturing market is concentrated in terms of value are North America and Europe. North America accounts for the largest share mainly due to early adoption of Industry 4.0 technologies by US factories.

The Asia Pacific region is projected to be the fastest growing market during the forecast period. This is because key developing economies like China and India are making heavy investments to automate their manufacturing industries using industrial IoT solutions. China's "Made in China 2025" initiative advocates implementation of IoT, robotics, and other innovative technologies across manufacturing sectors.

Get more insights on Iot In Manufacturing Market

About Author:

Money Singh is a seasoned content writer with over four years of experience in the market research sector. Her expertise spans various industries, including food and beverages, biotechnology, chemical and materials, defense and aerospace, consumer goods, etc. (https://www.linkedin.com/in/money-singh-590844163)

#Coherent Market Insights#Iot In Manufacturing Market#Iot In Manufacturing#Smart Manufacturing#Industry 4.0#Digital Transformation#Automation#Industrial Iot#Iiot#Connected Devices#Sensors

0 notes

Text

Innovating the connected future with our IoT application development services. From prototypes to production, our experts deliver smart, scalable IoT solutions. Let's discuss your project!

🛠️ Services We Offer:

✅ Prototyping

✅ Custom Development

✅ Data Analytics

✅ Security & Privacy

✅ Full-scale Production

Ready to embark on your IoT journey? Let's discuss your project and shape the future together! 💬

👉 Visit Us-: www.digitalbrain.co.in

👉 Email Us-: [email protected]

#IoT#InternetOfThings#ConnectedDevices#Sensors#Wearables#IIoT#IndustrialIoT#MachineLearning#AI#SmartCity#SmartHome#Tech#Innovation#Engineering#IoTDevelopment#SmartTechnology#IoTSolutions#TechExperts

0 notes

Text

Unleash the Power of Automation with SIRUS ELECTRONET! 💡

From AC Motors to HMI, we've got you covered.

Let's boost productivity and cut downtime together! 🚀

Consult us now:

📱 +917995080634

📧 [email protected]

🌐 sirus.in

#IndustrialAutomationExperts#industrialautomation#industry40#automation#manufacturing#smartfactory#digitaltransformation#IIoT#iot#automationexperts#concepttoimplementation#partner#acmotors#servodrives#motorisedgearunits#sensors#vfds#hmi#plcs

0 notes

Photo

Temperature and humidity sensors are one of the most commonly used environmental sensors. They are used to provide actual humidity and temperature condition within the air or of any required place. Measuring humidity within the environment can be critical due to the fact that the higher the humidity, the warmer it may seem. In industries, humidity measurement is often important because it can affect the health and safety of personnel as well as the cost of the product. As a result, temperature and humidity sensors are often quite important in which air conditions may be extreme or where air conditions need to be controlled due to varying reasons.

UniConverge Technologies offers Wireless Temperature and humidity sensors to reduce the complication of laying down the wire and monitoring the required product or environment. It can provide monitoring for a long range and at a low cost.

Learn more-https://www.uniconvergetech.in/wireless-devices

#iot#iiot#temperature#temperature and humidity sensor#humidity#sensor#energymonitoring#startupindia#atmanirbharbharat#madeinindia#uniconvergetechnologies

1 note

·

View note

Text

Types and 5 Most Popular for 2023

Types of IoT

Networking, communication, and connectivity systems depend on the specific IoT application being deployed. Just as there are many different IoT devices, there are many types of IoT applications depending on their use. Here are some of the more common ones:

• IoT client – intended for everyday use. Examples: home appliances, voice assistants and lighting.

• Business IoT – commonly used in the healthcare and travel industries. Examples: smart pacemakers and monitoring systems.

• Military Matters (IoMT) - Commonly used for the application of IoT technology in the military sector. Examples: surveillance robots and attack-capable objects.

• Industrial Internet of Things (IIoT) - commonly used in industrial applications, such as in manufacturing and the energy sector. Ex: Digital control systems, smart agriculture and big data industries.

• IoT Infrastructure – It is widely used for connectivity in smart cities. Example: equipment sensors and control systems.

Why is IoT important? IoT has enabled the physical world to meet the digital world in collaboration. It provides benefits to organizations by allowing them to work and simplify their work. As IoT grows exponentially year on year, businesses are taking advantage of the incredible business benefits it can deliver. Here are some of the most important benefits of IoT:

• Create new business models and revenue streams

• Improve business decisions and insights based on IoT data.

• To increase productivity and efficiency of business operations

• To improve customer experience

Although global IoT spending has been affected by the economic impact of the COVID-19 pandemic, IDC's analysis shows that it will reach a CAGR of 11.3% over the forecast period 2020-2024.

What are IoT devices?

IoT devices are hardware devices, such as sensors, appliances, devices and other machines that collect and exchange data over the Internet. They are designed for certain applications that can be connected to other IoT devices. For example, an IoT device in your car can detect oncoming traffic and send an instant message to the person you're about to see about an upcoming delay.click amazon market place.

How do IoT devices work?

Different IoT devices have different functions, but they all have similarities in terms of how they work. First, IoT devices are physical objects that see what is happening in the physical world. They have integrated processors, network cards, and hardware, and are often connected to Dynamic Host Configuration Protocol servers. It also requires an IP address to work on the network.

Many IoT devices are programmed and controlled through software. For example, an app on your smartphone to control the lights in your home. Some tools are also built into the web server, eliminating the need for external applications. For example, the light turns on immediately when you enter the room.

1 note

·

View note

Text

Smart Manufacturing Market: Key Drivers and Trends Projected to Fuel $733.4 Billion by 2031

The global smart manufacturing market is set to undergo substantial growth, expected to reach $733.4 billion by 2031, expanding at an impressive compound annual growth rate (CAGR) of 24.6% from 2024 to 2031, according to a recent report from Meticulous Research®. The market's rapid growth is primarily fueled by several key factors, including the rising demand to reduce operational costs through predictive maintenance, the integration of AI and machine learning (ML) technologies, and the increased utilization of 3D printing for additive manufacturing. However, while the market presents significant opportunities, it also faces challenges such as high capital and operational costs, alongside a shortage of skilled personnel and concerns over privacy and data protection. Despite these hurdles, advancements in 5G connectivity and growing smart manufacturing adoption in developing countries are anticipated to open up new growth avenues for industry players.

Download Sample Report Here @ https://www.meticulousresearch.com/download-sample-report/cp_id=5265?utm_source=article&utm_medium=social&utm_campaign=product&utm_content=23-09-2024

Driving Forces of Growth in Smart Manufacturing

The global push toward operational efficiency and cost reduction stands at the forefront of smart manufacturing’s growth. Predictive maintenance, which helps minimize equipment downtime and repair costs, is a significant contributor to this trend. Additionally, the integration of AI and ML into manufacturing processes allows for enhanced decision-making and operational flexibility, enabling manufacturers to optimize resource allocation and productivity.

Another pivotal factor propelling this market is the expanded use of 3D printing, or additive manufacturing, which has revolutionized the production process. By allowing for the precise creation of complex components and reducing material waste, additive manufacturing offers significant cost-saving potential, especially in industries such as aerospace, automotive, and healthcare.

However, the market does not come without its challenges. The high initial capital investment required to deploy smart manufacturing solutions, coupled with significant ongoing operational expenses, has been a barrier to entry for some companies. Moreover, the shortage of skilled labor to operate and manage these advanced systems presents a continuous obstacle. In addition, privacy concerns and the need to protect sensitive manufacturing data from cyber threats have raised further concerns among industry leaders.

Emerging Opportunities

Amid these challenges, the introduction of 5G technology is expected to unlock significant growth opportunities. 5G's high-speed, low-latency capabilities are poised to enhance communication between machines, sensors, and cloud systems, thereby enabling real-time monitoring and decision-making. The ability to remotely control and automate production processes with unprecedented precision will likely accelerate the adoption of smart manufacturing technologies.

Moreover, developing nations are increasingly adopting smart manufacturing technologies as they seek to modernize their industrial capabilities. Countries such as India, Brazil, and Vietnam have made significant strides in integrating advanced technologies into their manufacturing processes, contributing to the overall growth of the global market.

Key Technological Segments in the Smart Manufacturing Market

The smart manufacturing market can be segmented by technology into various categories, including the Industrial Internet of Things (IIoT), cloud computing and storage, robotics and automation, industrial cybersecurity, additive manufacturing, augmented reality (AR) and virtual reality (VR), digital twin, artificial intelligence (AI), and blockchain technology.

Among these, IIoT is expected to dominate the market in 2024, accounting for over 33.4% of the total market share. The increasing deployment of IIoT in manufacturing enables businesses to achieve end-to-end operational visibility, streamline processes, and reduce manual input, thus minimizing the risks associated with human error. With growing investments in smart manufacturing technologies, many companies are working to improve logistics operations and productivity through the enhanced use of IIoT.

An example of this development is the partnership between Nexans S.A. (France) and Schneider Electric SE (France), established in February 2021. The collaboration focuses on digital transformation, aiming to enhance factory digitalization, improve production line efficiency, enable predictive maintenance, and reduce carbon emissions.

Application-Based Market Segmentation

By application, the market is further segmented into areas such as surveillance and safety, quality management, resource optimization, inventory and warehouse management, machine inspection and maintenance, production planning, energy management, and more. In 2024, the surveillance and safety segment is expected to lead, commanding over 21.1% of the market share. This growth can be attributed to rising investments in 5G networks and the integration of smart cameras that monitor worker behavior, ensure machinery compliance, and detect safety anomalies.

Manufacturers are increasingly leveraging advanced technologies such as motion detection, facial recognition, geofencing violation detection, and fire recognition to boost workplace safety and productivity. These technologies also enhance employees' awareness of their surroundings, further reducing the risk of accidents.

Smart Manufacturing Across End-Use Industries

Smart manufacturing technologies are being adopted across a broad range of industries, including automotive, aerospace and defense, electronics, healthcare, and pharmaceuticals, among others. In 2024, the automotive sector is expected to capture the largest market share, representing over 14.3% of the smart manufacturing market. This growth is driven by the increasing adoption of automation, AI, and IoT solutions in automotive production facilities, which help reduce costs, improve decision-making processes, and minimize downtime.

In January 2022, ABB Ltd (Switzerland) partnered with HASCO Hasenclever GmbH + Co KG (Germany) to accelerate smart manufacturing in China’s automotive industry. The partnership aims to enhance automation and sustainability in auto parts production, showcasing the potential for further innovation in this sector.

Regional Analysis: Asia-Pacific to Lead the Market

From a geographical perspective, Asia-Pacific is expected to dominate the smart manufacturing market in 2024, with a market share exceeding 37.3%. This region's significant market share is attributed to the increasing adoption of cloud-based smart manufacturing solutions across industries such as automotive, healthcare, and pharmaceuticals. Moreover, the expansion of manufacturing hubs in countries such as China, South Korea, and Japan further supports the growth of the market in this region.

For instance, in October 2021, Japan’s Robot Revolution & Industrial IoT Initiative (RRI) partnered with the U.S.-based Clean Energy Smart Manufacturing Innovation Institute (CESMII) to promote the development of smart manufacturing and robotics in Japan. This collaboration focuses on developing pre-competitive concepts, recommendations, and practical use cases for the industry, further driving growth in the region.

Competitive Landscape

The smart manufacturing market is highly competitive, with numerous prominent players striving to expand their market presence through strategic partnerships, innovations, and acquisitions. Key players in the global smart manufacturing market include International Business Machines Corporation (U.S.), Siemens AG (Germany), Microsoft Corporation (U.S.), SAP SE (Germany), Capgemini SE (France), ABB Ltd (Switzerland), Deutsche Telekom AG (Germany), Telefónica, S.A. (Spain), Accenture plc (Ireland), TE Connectivity Ltd. (Switzerland), NXP Semiconductors N.V. (Netherlands), Telefonaktiebolaget LM Ericsson (Sweden), Intel Corporation (U.S.), Tata Consultancy Services Limited (India), Cisco Systems, Inc. (U.S.), Honeywell International, Inc. (U.S.), Mitsubishi Electric Corporation (Japan), Robert Bosch GmbH (Germany), Rockwell Automation, Inc (U.S.), and Schneider Electric SE (France).

As companies continue to focus on improving efficiency, reducing costs, and embracing digital transformation, the global smart manufacturing market is poised for tremendous growth over the coming years. With rapid advancements in technology, emerging economies adopting smart manufacturing solutions, and increasing investments in research and development, the market is set to revolutionize the future of manufacturing on a global scale.

Read Full Report :- https://www.meticulousresearch.com/product/smart-manufacturing-market-5265?utm_source=article&utm_medium=social&utm_campaign=product&utm_content=23-09-2024

Contact Us:

Meticulous Research®

Email- [email protected]

Contact Sales- +1-646-781-8004

Connect with us on LinkedIn- https://www.linkedin.com/company/meticulous-research

#Smart Manufacturing Market#Industrial Internet of Things#Cloud Computing & Storage#Robotics & Automation#Industrial Cybersecurity#Augmented Reality (AR)/Virtual Reality (VR)#Digital Twin#Surveillance & Safety#Inventory & Warehouse Management#Machine Inspection & Maintenance#Production Planning#Resource Optimization

0 notes

Text

Industry 4.0 Market Share, Supply, Sales, Manufacturers, Competitor and Consumption 2023 to 2030

Industry 4.0 Industry Overview

The global Industry 4.0 market size was estimated at USD 146.14 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 19.9% from 2023 to 2030.

The factors driving the market growth include increasing adoption of automated equipment & tools on factory floors, warehouses, and manufacturing; rising investment toward addictive manufacturing units; and growing digitalization trends globally. Moreover, the emergence of cutting-edge digital technologies like Machine Learning (ML), Artificial Intelligence (AI), Internet of Things (IoT), 5G connectivity, and cloud-based services, among others contribute to the thriving landscape of the market. These converging factors are projected to create lucrative growth opportunities for the market.

Gather more insights about the market drivers, restrains and growth of the Industry 4.0 Market

Industries are increasingly subject to stringent regulations related to product safety, quality standards, environmental impact, and data privacy. These technologies enable end-users to effectively comply with these regulations by providing real-time monitoring, traceability, and quality control mechanisms. The end-use compliance issues are categorized into process and product compliance. Industry 4.0 practices are ideal for companies aiming to achieve time and quality metrics at reduced costs. Digitization of production aids in numerous tasks, such as engineering changes, risk assessment, process improvement, improving process visibility, and providing data on demand. Therefore, the need for compliance to gain a competitive edge is expected to act as a significant growth driver for the market.

The adoption of IIoT technologies is a significant opportunity in the market. By connecting industrial equipment, sensors, and devices, companies can gather real-time data and enable machine-to-machine communication. This data can be used to optimize production processes, reduce downtime, and improve overall operational efficiency. As the systems become more connected, ensuring the security of industrial networks and data becomes crucial. The increasing complexity of the industrial ecosystem creates opportunities for cybersecurity solutions and services. Companies can develop robust cybersecurity frameworks, implement secure communication protocols, and offer solutions to protect against cyber threats, thereby addressing the growing demand for secure systems.

The combination of robotics & automation with the IoT results in IoT-enabled robotics, enabling remote monitoring and predictive maintenance, driving efficiency through data-driven insights. Innovations in fleet management and robot swarms are shaping industries, such as logistics and warehousing, by orchestrating coordinated robot actions. Simultaneous localization and mapping (SLAM) technology empowers robots to navigate complex environments autonomously, underpinning applications like autonomous vehicles and drones. Wearable robotics boost human capabilities, particularly in sectors where physical assistance is pivotal, like healthcare and manufacturing. Leveraging digital twins for robot design and optimization expedites development while refining performance.

Enhanced human-robot interaction and user interfaces underscore the seamless integration of robots into various industries. These concepts work together to illustrate the development of industrial robots and automation, revolutionizing manufacturing efficiency, enhancing human skills, and spurring innovation across industries. The market landscape is significantly influenced by AI and ML technology trends. Within this trend, several key developments stand out. Predictive analytics and maintenance leverage AI and ML to foresee and prevent equipment breakdowns, optimizing maintenance schedules. Anomaly detection and quality control utilize these technologies to identify irregularities in manufacturing, ensuring product excellence swiftly. In addition, supply chain and inventory optimization benefit from AI-driven algorithms that enhance efficiency by refining inventory management and logistics.

In August 2023, Telefonaktiebolaget LM Ericsson and RMIT University collaborated to establish the RMIT & Ericsson AI Lab at RMIT's Hanoi campus in Vietnam. This initiative builds upon their existing 5G education partnership, to educate Vietnamese students about 5G and emerging technologies including AI, machine learning, and blockchain. The use of artificial intelligence in Industry 4.0 projects is becoming increasingly prevalent in Vietnam. The deployment of 5G, Ericsson, and RMIT are now able to assist business, academic, and neighborhood partners in developing and implementing AI solutions that will help drive the adoption of Industry 4.0 across a range of sectors. This will benefit industries, such as energy, manufacturing, agriculture, transport, and logistics.

Browse through Grand View Research's Next Generation Technologies Industry Research Reports.

The global AI in aerospace and defense market size was valued at USD 22.45 billion in 2023 and is projected to grow at a CAGR of 9.8% from 2024 to 2030.

The global aviation software market size was estimated at USD 10.68 billion in 2023 and is expected to grow at a CAGR of 7.2% from 2024 to 2030.

Key Companies & Market Share Insights

The key players in the market often include technology innovators, solution providers, and research institutions. These players contribute to the development of advanced manufacturing, automation, IoT, AI, and data analytics solutions. Their efforts drive the transformation of industries through digitization and smart technologies, impacting supply chains, production processes, and customer experiences. They also encompass software developers, hardware manufacturers, etc. as these entities collaborate to create integrated solutions that optimize production efficiency, enhance predictive maintenance capabilities, enable real-time monitoring, etc.

In addition, regulatory bodies and standardization organizations play a crucial role in shaping the framework and guidelines for the ecosystem. For instance, In August 2023, Denso Corporation acquired a full stake in Certhon Group, a horticultural facility operator. The aim of this acquisition is to further accelerate their efforts to solve global food challenges by leveraging the strengths of both companies and the results of their past collaboration. Some prominent players in the global Industry 4.0 market include:

ABB LTD.

Cisco Systems Inc.

Cognex Corporation

Denso Corporation

Emerson Electric

Fanuc Corporation

General Electric Company

Honeywell International Inc.

Intel Corporation

Johnson Controls International

Kuka Group

Robert Bosch GmbH

Rockwell Automation Inc.

Schneider Electric SE

Siemens AG

Order a free sample PDF of the Industry 4.0 Market Intelligence Study, published by Grand View Research.

0 notes

Text

Industrial Gas Sensors Ensure Safety and Efficiency in Critical Environments

Industrial gas sensors are critical for monitoring and detecting the presence of gases in various environments such as manufacturing plants, oil refineries, and chemical processing facilities. These sensors play a key role in ensuring the safety of personnel by providing early warnings of hazardous gas leaks, while also optimizing production processes by monitoring gas levels to ensure efficient operations.

Gas sensors come in various types, including electrochemical, infrared, and catalytic sensors, each designed to detect specific gases like carbon monoxide, methane, or ammonia. These devices are vital for industries that handle volatile or toxic substances, as they enable real-time monitoring of gas concentrations and trigger alarms if dangerous levels are detected.

Industrial Gas Sensors Market size was valued at USD 1054 million in 2022 and is expected to grow to USD 1757.2 million by 2030 and grow at a CAGR of 6.6 % over the forecast period of 2023-2030.

Future Scope

The future of industrial gas sensors lies in the development of smarter and more efficient sensors with enhanced sensitivity and faster response times. The integration of industrial gas sensors with the Industrial Internet of Things (IIoT) will enable remote monitoring and real-time data analysis, improving safety and operational efficiency.

Advancements in sensor miniaturization and wireless technology will also enable the deployment of gas sensors in more compact and hard-to-reach spaces, enhancing their versatility in various industrial applications. Furthermore, the focus on environmental regulations will drive the demand for sensors that can detect and monitor greenhouse gases, contributing to sustainability efforts.

Trends

Key trends in the industrial gas sensor market include the adoption of wireless and IoT-enabled sensors that provide real-time data and remote monitoring capabilities. Another trend is the increasing focus on environmental monitoring, where gas sensors are used to track emissions and ensure compliance with environmental standards.

There is also a trend toward developing more durable and reliable sensors that can operate in extreme industrial environments, ensuring long-term performance without frequent maintenance or calibration.

Applications

Industrial gas sensors are used across a variety of sectors, including oil and gas, chemical processing, mining, and manufacturing. In oil and gas operations, these sensors monitor for combustible gases to prevent explosions. In chemical plants, gas sensors detect toxic gases to protect workers from exposure.

In the manufacturing industry, gas sensors are used for emissions monitoring, ensuring that production processes comply with environmental regulations. Additionally, in mining operations, gas sensors are critical for detecting methane and other dangerous gases to ensure worker safety.

Solutions and Services

Companies offering industrial gas sensors provide a range of solutions, including wireless monitoring systems, portable gas detectors, and fixed gas detection units. These solutions are tailored to meet the specific needs of different industries, ensuring both safety and regulatory compliance. Maintenance and calibration services are also available to ensure that sensors remain accurate and operational over time.

Key Points:

Critical Safety Role: Industrial gas sensors provide real-time monitoring of hazardous gases to ensure worker safety.

Wireless and IoT-Enabled: The integration of wireless technology enhances the remote monitoring capabilities of gas sensors.

Environmental Monitoring: Gas sensors are increasingly used to track emissions and ensure regulatory compliance.

Extreme Durability: Industrial gas sensors are built to operate reliably in harsh and hazardous environments.

0 notes

Text

Industrial IoT System Integration: Enhancing Connectivity and Efficiency

The Industrial Internet of Things (IIoT) is revolutionizing the manufacturing industry by connecting machines, devices, and sensors to collect and analyze data for improved decision-making. However, integrating IIoT solutions into existing systems can present challenges, requiring careful planning, collaboration, and technical expertise.

Understanding Industrial IoT System Integration

IIoT system integration involves connecting disparate systems, devices, and sensors to collect, analyze, and act on data for improved operations.

The process requires assessing current infrastructure, identifying areas for improvement, and designing a customized IIoT integration solution.

Key considerations for Industrial IoT System Integration

Data Interoperability: Ensure that data collected by IIoT devices and sensors can be read and analyzed by all relevant systems to enable key insights.

Software Compatibility: Ensure that software systems are compatible with your IIoT solution, and that they can effectively process/stream data and manage communications between devices and systems.

Quality of Service: Prioritize data reliability, real-time processing, and continuity when designing an industrial IoT solution, to ensure uninterrupted communication.

Security and Privacy: Implement robust security measures to protect data and ensure privacy when collecting and sharing data across the systems and devices.

Scalability and Future-proofing: It is important to select an industrial IoT solution that can grow and scale with your business to support future innovation and new technologies.

Benefits of Industrial IoT Integration

Increased Operational Efficiency: IIoT integration can streamline processes, reduce waste, and optimize operations to enhance efficiency, productivity, and resource utilization.

Real-time Data Tracking: Industrial IoT platform provides real-time data monitoring and analytics, enabling organizations to proactively identify issues and opportunities.

Improved Quality Management: Using IIoT solutions helps measure and analyze quality measures to maintain quality standards and improve customer satisfaction.

Remote Monitoring: Real-time data tracking through IIoT solutions enables remote monitoring of facilities and production lines, improving troubleshooting, and reducing downtime.

The Importance of Hiring an Experienced IIoT Integration Solution Provider

IIoT system integration is a complex process and requires the expertise of experienced professionals to ensure a seamless integration of various systems and devices.

It is vital to choose an IIoT solution provider who understands the unique requirements of your business and can design a customized solution that meets your specific needs.

Conclusion

Through industrial IoT system integration, organizations can harness the power of real-time data for improved decision-making, increased efficiency, and reduced downtime. By prioritizing key considerations such as data interoperability, scalability, security, and software compatibility, businesses can realize the full potential of disruptive technologies to revolutionize their operations.

Partnering with an experienced IIoT integration solution provider can ensure seamless integration and effective optimization, enabling organizations to gain a competitive edge and meet the fast-paced demands of the market.

0 notes

Text

Industrial IoT Gateway Devices: Powering the Future of Connected Industries with CMSGP

The Industrial Internet of Things (IIoT) is revolutionizing the manufacturing landscape by enabling smarter, more connected operations. At the core of this transformation are Industrial IoT Gateway Devices, which serve as the bridge between legacy machines, sensors, and modern cloud-based platforms. CMSGP, a leader in IoT solutions, offers advanced Industrial IoT Gateway Devices designed to help industries harness the power of data, optimize processes, and drive digital transformation.

What are Industrial IoT Gateway Devices?

An Industrial IoT Gateway Device acts as a mediator between different industrial equipment and the cloud or central data centers. It collects data from various sensors, machines, and devices in real-time, processes it locally (edge computing), and then transmits it to cloud platforms for further analysis. This enables seamless data flow, real-time analytics, and actionable insights, thereby improving decision-making and operational efficiency.

Key Features of CMSGP's Industrial IoT Gateway Devices

CMSGP’s Industrial IoT Gateway Devices are built to meet the complex needs of modern industrial environments. Here are some key features that distinguish them from others:

Multi-Protocol Support: Industrial environments often involve a mix of legacy systems and modern devices, each using different communication protocols. CMSGP’s gateways support a wide range of protocols, such as MQTT, Modbus, OPC UA, HTTP, and more, enabling seamless integration and communication between heterogeneous systems.

Edge Computing Capabilities: With edge computing, CMSGP's gateways process data at the source, significantly reducing latency and bandwidth usage. This capability ensures faster decision-making by providing real-time analytics, even in remote or bandwidth-constrained environments.

Robust Security Features: Security is a critical concern in IoT deployments. CMSGP’s gateways are equipped with advanced security features, including secure boot, encrypted data transmission, firewall protection, and intrusion detection systems, ensuring data integrity and protecting against cyber threats.

Industrial-Grade Durability: Designed for harsh industrial conditions, CMSGP’s gateways are built to withstand extreme temperatures, humidity, dust, and vibration, making them reliable for continuous operation in demanding environments.

Remote Management and Monitoring: CMSGP’s IoT gateways support remote management, enabling administrators to configure, update, and troubleshoot devices from a centralized location. This reduces the need for on-site interventions, saving time and operational costs.

Scalable and Flexible Architecture: Whether a small-scale factory setup or a large industrial complex, CMSGP’s gateways are designed to be scalable and flexible, supporting thousands of devices and a massive volume of data.

Real-Time Data Visualization and Analytics: Equipped with powerful data processing and analytics capabilities, CMSGP’s gateways provide real-time data visualization and actionable insights that help industries optimize operations, improve efficiency, and reduce costs.

Seamless Integration with Cloud Platforms: CMSGP’s Industrial IoT Gateway Devices seamlessly integrate with popular cloud platforms such as AWS, Microsoft Azure, and Google Cloud, as well as on-premises systems, providing a unified view of the entire operation.

Applications of CMSGP's Industrial IoT Gateway Devices

CMSGP’s Industrial IoT Gateway Devices are versatile and can be applied across various industrial sectors. Here are some key applications:

Predictive Maintenance: By continuously monitoring the condition of machinery and equipment through connected sensors, CMSGP’s gateways help predict potential failures before they occur. This reduces downtime, minimizes maintenance costs, and enhances asset reliability.

Energy Management: In energy-intensive industries, managing and optimizing energy usage is crucial. CMSGP’s gateways provide real-time monitoring and analytics of energy consumption, helping industries reduce energy wastage, lower costs, and achieve sustainability goals.

Process Automation: By enabling real-time monitoring and control of industrial processes, CMSGP’s gateways facilitate process automation, resulting in increased productivity, reduced errors, and optimized resource utilization.

Remote Asset Monitoring: For industries with geographically dispersed assets, such as oil and gas or utilities, CMSGP’s gateways offer remote monitoring capabilities, ensuring efficient asset management and reducing operational risks.

Smart Factory Implementation: CMSGP’s gateways are at the heart of smart factory initiatives, enabling data-driven decision-making, process optimization, and continuous improvement in manufacturing operations.

Supply Chain Optimization: By providing end-to-end visibility into the supply chain, CMSGP’s IoT solutions help industries optimize inventory management, reduce lead times, and enhance customer satisfaction.

Benefits of Choosing CMSGP for Industrial IoT Gateway Devices

High Performance and Reliability: CMSGP’s gateways are built to deliver high performance and reliability, ensuring seamless data flow and processing even in challenging industrial environments.

Enhanced Security and Compliance: With robust security features and compliance with industrial standards, CMSGP’s gateways ensure data integrity and protection against potential threats.

Cost-Effective Solutions: By offering scalable and flexible solutions, CMSGP helps industries achieve significant cost savings in terms of reduced downtime, optimized maintenance, and efficient operations.

Expert Support and Services: CMSGP provides expert support and services to assist with the deployment, configuration, and management of IoT gateway devices, ensuring a smooth transition to Industry 4.0.

Future-Proof Technology: With a commitment to continuous innovation, CMSGP’s IoT gateways are designed to adapt to future technological advancements, ensuring a future-proof investment for industries.

Why Choose CMSGP for Your Industrial IoT Gateway Needs?

CMSGP is a trusted name among Industrial IoT Gateway Providers in India, offering reliable, secure, and high-performance devices tailored to meet the unique needs of industrial environments. With a deep understanding of industry requirements and a focus on quality, CMSGP empowers businesses to unlock the full potential of IoT technology, drive digital transformation, and stay competitive in today’s rapidly evolving market.

Transform your industrial operations with CMSGP’s advanced Industrial IoT Gateway Devices. Contact us today to learn more about how we can help you achieve operational excellence and digital innovation.

0 notes

Text

Predictive Maintenance Best Practices For Manufacturers

In today's rapidly evolving industrial landscape, manufacturers are constantly seeking ways to improve operational efficiency and reduce downtime. One approach that has gained significant traction is predictive maintenance. By leveraging data-driven insights, predictive maintenance helps manufacturers address potential equipment failures before they happen, ensuring smooth production processes and minimizing unplanned disruptions. Let’s explore the best practices to optimize predictive maintenance strategies and maximize efficiency.

1. Utilize Real-Time Data Monitoring

One of the core principles of predictive maintenance for manufacturers is continuous monitoring of equipment. Sensors placed on machinery collect real-time data such as vibration levels, temperature, and motor current. This data is then analyzed to detect anomalies and predict when a machine might fail. Implementing an Industrial Internet of Things (IIoT) platform enables manufacturers to centralize this data and gain instant insights, enhancing the effectiveness of predictive maintenance.

2. Prioritize Critical Equipment

Not all machinery in a manufacturing facility needs to be monitored at the same level. To maximize efficiency with predictive maintenance, manufacturers should identify the most critical equipment—those that, if they fail, could cause significant operational or financial losses. By focusing predictive maintenance efforts on high-priority assets, companies can prevent costly downtimes while optimizing resource allocation.

3. Leverage Historical Data and Machine Learning

Predictive maintenance becomes more powerful when manufacturers combine real-time data with historical data. Machine learning algorithms can analyze years of machine performance data to identify patterns that precede equipment failures. By doing so, manufacturers can build more accurate predictive models, helping to foresee issues well in advance and make more informed maintenance decisions.

4. Establish a Proactive Maintenance Schedule

Once the predictive algorithms identify potential failures, it's essential to implement a proactive maintenance schedule. This strategy allows manufacturers to service or replace components at the most convenient time, ensuring production continues without interruption. Setting a regular cadence of maintenance activities based on predictive insights is one of the predictive maintenance best practices that ensures equipment reliability and operational consistency.

5. Train Personnel on Predictive Tools and Techniques

For a predictive maintenance strategy to be effective, the workforce must be adequately trained. Maintenance teams need to understand how to use predictive tools, interpret the data, and execute preventive actions. Investing in training programs ensures that personnel can maximize the benefits of predictive technologies, leading to better outcomes in both equipment uptime and cost savings.

6. Integrate Predictive Maintenance with Enterprise Systems

Integrating predictive maintenance data with broader enterprise systems, such as enterprise resource planning (ERP) or computerized maintenance management systems (CMMS), can significantly enhance decision-making processes. Manufacturers can automate maintenance workflows, track performance metrics, and optimize inventory management for spare parts. This integration streamlines the maintenance process and ensures that resources are available when needed.

7. Measure and Adjust Based on KPIs

Measuring the success of a predictive maintenance program is crucial. Key performance indicators (KPIs) like mean time between failures (MTBF), mean time to repair (MTTR), and overall equipment effectiveness (OEE) should be tracked regularly. Analyzing these metrics helps manufacturers adjust their strategies to continuously improve the performance and reliability of their equipment.

Conclusion

By adopting predictive maintenance best practices, manufacturers can significantly reduce downtime, improve equipment lifespan, and increase overall efficiency. Through real-time monitoring, machine learning, proactive scheduling, and skilled personnel, predictive maintenance empowers companies to stay ahead of equipment failures, ensuring uninterrupted production and optimized resources. As the industry continues to evolve, embracing these strategies will be key to maximizing efficiency with predictive maintenance.

0 notes

Text

IIoT Platform Market Share, Key Market Players, Trends & Forecast, 2024–2030

The IIoT Platform Market was valued at USD 9.0 billion in 2023 and will surpass USD 21.7 billion by 2030; growing at a CAGR of 13.4% during 2024 - 2030. IIoT platforms act as the backbone of this revolution, offering the essential infrastructure for integrating diverse devices, systems, and processes within industrial environments. The IIoT platform market is experiencing rapid growth, driven by the need for increased efficiency, predictive maintenance, and smarter manufacturing processes. In this blog, we explore the current state of the IIoT platform market, key trends shaping its development, and the challenges and opportunities that lie ahead.

IIoT platforms are comprehensive software solutions designed to manage and analyze data from industrial devices and systems. These platforms enable real-time monitoring, predictive maintenance, and data-driven decision-making, which are critical in industries such as manufacturing, energy, and transportation. By providing a unified interface for integrating sensors, machines, and IT systems, IIoT platforms help businesses optimize operations, reduce downtime, and enhance overall productivity.

Get a Sample Report: https://intentmarketresearch.com/request-sample/iiot-platform-market-3652.html

Key Trends Driving the IIoT Platform Market

Edge Computing and Analytics: One of the most significant trends in the IIoT market is the shift towards edge computing. By processing data closer to the source—at the edge of the network—businesses can reduce latency, enhance data security, and improve real-time decision-making. Edge analytics allows companies to analyze data locally, providing immediate insights without the need for constant cloud connectivity.

Artificial Intelligence and Machine Learning Integration: AI and ML are becoming integral components of IIoT platforms, enabling predictive maintenance, anomaly detection, and automated decision-making. These technologies allow platforms to learn from historical data, identify patterns, and predict potential issues before they lead to costly downtime.

Interoperability and Open Standards: As the IIoT ecosystem expands, the need for interoperability between different devices, systems, and platforms has become crucial. Open standards and protocols, such as OPC UA and MQTT, are gaining traction, allowing seamless communication and data exchange across diverse industrial environments.

Cybersecurity Focus: With the increasing connectivity of industrial systems, cybersecurity has become a paramount concern. IIoT platforms are evolving to include robust security features, such as encryption, identity management, and anomaly detection, to protect against cyber threats and ensure the integrity of industrial operations.

Cloud-Native Platforms: The adoption of cloud-native architectures is accelerating in the IIoT space. Cloud-native platforms offer scalability, flexibility, and ease of integration, making it easier for businesses to deploy and manage IIoT solutions. The combination of cloud computing and IIoT enables enterprises to leverage vast amounts of data for advanced analytics and decision-making.

Challenges in the IIoT Platform Market

Despite the promising growth, the IIoT platform market faces several challenges:

Complexity of Integration: Integrating IIoT platforms with existing legacy systems and infrastructure can be complex and costly. Companies often need to invest in new hardware, software, and training to ensure a smooth transition.

Data Management and Privacy: The vast amount of data generated by IIoT devices raises concerns about data management, privacy, and ownership. Companies need to establish clear policies for data governance to ensure compliance with regulations and protect sensitive information.

Scalability Issues: As IIoT deployments scale, managing and processing data from thousands of devices becomes increasingly challenging. Ensuring that IIoT platforms can handle large-scale deployments without compromising performance is a key concern for businesses.

Vendor Lock-In: With a multitude of IIoT platforms available, companies may face the risk of vendor lock-in, where they become dependent on a single vendor's ecosystem. This can limit flexibility and increase long-term costs. Companies must carefully evaluate platforms to avoid being tied to proprietary solutions.

Get an insights of Customization: https://intentmarketresearch.com/ask-for-customization/iiot-platform-market-3652.html

Opportunities Ahead

The IIoT platform market presents significant opportunities for innovation and growth:

Vertical-Specific Solutions: Developing IIoT platforms tailored to specific industries—such as automotive, healthcare, or agriculture—can offer more targeted functionalities and improve adoption rates.

Partnerships and Ecosystem Development: Collaborations between IIoT platform providers, hardware manufacturers, and industry players can foster innovation and create more comprehensive solutions. Building a robust ecosystem around IIoT platforms can drive market growth and provide added value to customers.

Sustainability and Energy Efficiency: As industries increasingly focus on sustainability, IIoT platforms can play a crucial role in optimizing energy use and reducing carbon footprints. Platforms that offer energy management and environmental monitoring features will be in high demand.

Expansion into Emerging Markets: The adoption of IIoT platforms in emerging markets offers significant growth potential. As industries in these regions modernize, there will be a growing demand for IIoT solutions that can enhance productivity and competitiveness.

Conclusion

The IIoT platform market is poised for continued expansion as industries embrace digital transformation and seek to optimize their operations. While challenges such as integration complexity and data management persist, the opportunities for innovation and growth are vast.

#Industrial IoT platform#Smart manufacturing platform#Industrial Internet platform#Industry 4.0#IoT for manufacturing

0 notes

Text

PLC Modbus RTU TCP to MQTT Modbus OPC UA SCADA AWS Ignition DCS IoT Gateway 2/6 RS485 4G/WIFI/GPS

An IIoT gateway, or Industrial IoT gateway, serves as a bridge between industrial devices, sensors, and equipment and the broader Internet or cloud-based services.

BL110 is an IIoT gateway that converts Modbus RTU, Modbus TCP, PLC to Modbus, OPC UA, MQTT protocol. The gateway supports Ethernet, WiFi, or cellular networks(4G) transmission, ensuring that data is transmitted to AWS, ThingsBoard, IgnitionSCADA, and other cloud platforms stably and reliably.

BLIIoT IIoT gateway supports PLC remote monitoring, PLC remote programming, PLC remote debugging, PLC remote upload and download, PLC remote control, PLC data acquisition, PLC remote communication.

By incorporating TLS/SSL encryption, the protocol conversion gateway can provide a secure, reliable, and trustworthy communication channel, protecting industrial data from eavesdropping, tampering, and unauthorized access.

0 notes

Text

Industry 4.0 Market Leading Players Updates and Growth Analysis, 2030

The global Industry 4.0 market size was estimated at USD 146.14 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 19.9% from 2023 to 2030.

The factors driving the market growth include increasing adoption of automated equipment & tools on factory floors, warehouses, and manufacturing; rising investment toward addictive manufacturing units; and growing digitalization trends globally. Moreover, the emergence of cutting-edge digital technologies like Machine Learning (ML), Artificial Intelligence (AI), Internet of Things (IoT), 5G connectivity, and cloud-based services, among others contribute to the thriving landscape of the market. These converging factors are projected to create lucrative growth opportunities for the market.

Gather more insights about the market drivers, restrains and growth of the Industry 4.0 Market

Industries are increasingly subject to stringent regulations related to product safety, quality standards, environmental impact, and data privacy. These technologies enable end-users to effectively comply with these regulations by providing real-time monitoring, traceability, and quality control mechanisms. The end-use compliance issues are categorized into process and product compliance. Industry 4.0 practices are ideal for companies aiming to achieve time and quality metrics at reduced costs. Digitization of production aids in numerous tasks, such as engineering changes, risk assessment, process improvement, improving process visibility, and providing data on demand. Therefore, the need for compliance to gain a competitive edge is expected to act as a significant growth driver for the market.

The adoption of IIoT technologies is a significant opportunity in the market. By connecting industrial equipment, sensors, and devices, companies can gather real-time data and enable machine-to-machine communication. This data can be used to optimize production processes, reduce downtime, and improve overall operational efficiency. As the systems become more connected, ensuring the security of industrial networks and data becomes crucial. The increasing complexity of the industrial ecosystem creates opportunities for cybersecurity solutions and services. Companies can develop robust cybersecurity frameworks, implement secure communication protocols, and offer solutions to protect against cyber threats, thereby addressing the growing demand for secure systems.

The combination of robotics & automation with the IoT results in IoT-enabled robotics, enabling remote monitoring and predictive maintenance, driving efficiency through data-driven insights. Innovations in fleet management and robot swarms are shaping industries, such as logistics and warehousing, by orchestrating coordinated robot actions. Simultaneous localization and mapping (SLAM) technology empowers robots to navigate complex environments autonomously, underpinning applications like autonomous vehicles and drones. Wearable robotics boost human capabilities, particularly in sectors where physical assistance is pivotal, like healthcare and manufacturing. Leveraging digital twins for robot design and optimization expedites development while refining performance.

Enhanced human-robot interaction and user interfaces underscore the seamless integration of robots into various industries. These concepts work together to illustrate the development of industrial robots and automation, revolutionizing manufacturing efficiency, enhancing human skills, and spurring innovation across industries. The market landscape is significantly influenced by AI and ML technology trends. Within this trend, several key developments stand out. Predictive analytics and maintenance leverage AI and ML to foresee and prevent equipment breakdowns, optimizing maintenance schedules. Anomaly detection and quality control utilize these technologies to identify irregularities in manufacturing, ensuring product excellence swiftly. In addition, supply chain and inventory optimization benefit from AI-driven algorithms that enhance efficiency by refining inventory management and logistics.

In August 2023, Telefonaktiebolaget LM Ericsson and RMIT University collaborated to establish the RMIT & Ericsson AI Lab at RMIT's Hanoi campus in Vietnam. This initiative builds upon their existing 5G education partnership, to educate Vietnamese students about 5G and emerging technologies including AI, machine learning, and blockchain. The use of artificial intelligence in Industry 4.0 projects is becoming increasingly prevalent in Vietnam. The deployment of 5G, Ericsson, and RMIT are now able to assist business, academic, and neighborhood partners in developing and implementing AI solutions that will help drive the adoption of Industry 4.0 across a range of sectors. This will benefit industries, such as energy, manufacturing, agriculture, transport, and logistics.

Industry 4.0 Market Segmentation

Grand View Research has segmented the Industry 4.0 market report based on component, technology, Industry vertical, and region:

Component Outlook (Revenue, USD Billion, 2018 - 2030)

• Hardware

• Software

• Services

Technology Outlook (Revenue, USD Billion, 2018 - 2030)

• Industrial Internet of Things (IIoT)

• Robotics & Automation

• Artificial Intelligence & Machine Learning (AI & ML)

• Big Data & Advanced Analytics

• Additive Manufacturing

• Augmented Reality & Virtual Reality (AR & VR)

• Digital Twin & Simulation

• Blockchain & Secure Data Exchange

• Others

Industry Vertical Outlook (Revenue, USD Billion, 2018 - 2030)

• Manufacturing

• Petrochemicals

• Automotive

• Energy & Utilities

• Oil & Gas

• Food & Beverage

• Aerospace & Defense

• Others

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

• North America

o U.S.

o Canada

• Europe

o Germany

o UK

o France

o Italy

o Spain

• Asia Pacific

o China

o Japan

o India

o South Korea

• Latin America

o Brazil

o Mexico

• Middle East and Africa

o UAE

o Saudi Arabia

Browse through Grand View Research's Next Generation Technologies Industry Research Reports.

• The global AI in aerospace and defense market size was valued at USD 22.45 billion in 2023 and is projected to grow at a CAGR of 9.8% from 2024 to 2030.

• The global aviation software market size was estimated at USD 10.68 billion in 2023 and is expected to grow at a CAGR of 7.2% from 2024 to 2030.

Key Companies & Market Share Insights

The key players in the market often include technology innovators, solution providers, and research institutions. These players contribute to the development of advanced manufacturing, automation, IoT, AI, and data analytics solutions. Their efforts drive the transformation of industries through digitization and smart technologies, impacting supply chains, production processes, and customer experiences. They also encompass software developers, hardware manufacturers, etc. as these entities collaborate to create integrated solutions that optimize production efficiency, enhance predictive maintenance capabilities, enable real-time monitoring, etc.

In addition, regulatory bodies and standardization organizations play a crucial role in shaping the framework and guidelines for the ecosystem. For instance, In August 2023, Denso Corporation acquired a full stake in Certhon Group, a horticultural facility operator. The aim of this acquisition is to further accelerate their efforts to solve global food challenges by leveraging the strengths of both companies and the results of their past collaboration. Some prominent players in the global Industry 4.0 market include:

• ABB LTD.

• Cisco Systems Inc.

• Cognex Corporation

• Denso Corporation

• Emerson Electric

• Fanuc Corporation

• General Electric Company

• Honeywell International Inc.

• Intel Corporation

• Johnson Controls International

• Kuka Group

• Robert Bosch GmbH

• Rockwell Automation Inc.

• Schneider Electric SE

• Siemens AG

Order a free sample PDF of the Industry 4.0 Market Intelligence Study, published by Grand View Research.

#Industry 4.0 Market#Industry 4.0 Market size#Industry 4.0 Market share#Industry 4.0 Market analysis

0 notes

Text

Usine intelligente, Prévisions de la Taille du Marché Mondial, Classement et Part de Marché des 15 Premières Entreprises

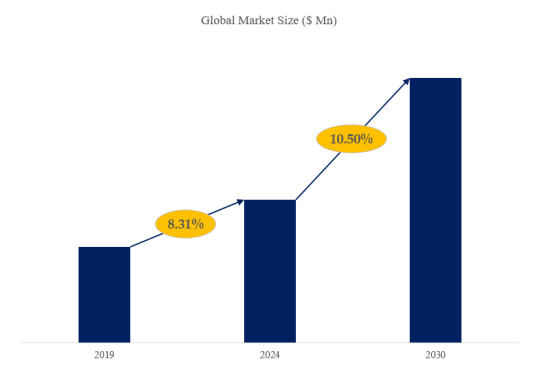

Selon le nouveau rapport d'étude de marché “Rapport sur le marché mondial de Usine intelligente 2024-2030”, publié par QYResearch, la taille du marché mondial de Usine intelligente devrait atteindre 182100 millions de dollars d'ici 2030, à un TCAC de 10.5% au cours de la période de prévision.

Figure 1. Taille du marché mondial de Usine intelligente (en millions de dollars américains), 2019-2030

Selon QYResearch, les principaux fabricants mondiaux de Usine intelligente comprennent Siemens, ABB, Atos SE, Cisco Systems Inc., General Electric, Emerson, Bosch, Honeywell, Microsoft Corporation, IBM, etc. En 2023, les cinq premiers acteurs mondiaux détenaient une part d'environ 17.0% en termes de chiffre d'affaires.

Figure 2. Classement et part de marché des 15 premiers acteurs mondiaux de Usine intelligente (Le classement est basé sur le chiffre d'affaires de 2023, continuellement mis à jour)

The key market drivers for the Smart Factory market:

1. Increasing Demand for Automation and Optimization of Manufacturing Processes: The need to improve productivity, efficiency, and quality in manufacturing has driven the adoption of smart factory technologies.

2. Growing Focus on Reducing Operating Costs and Improving Profitability: The desire to minimize production costs, waste, and downtime through the implementation of smart factory solutions has been a significant market driver.

3. Advancements in Industrial Internet of Things (IIoT) and Connectivity: The rapid development and integration of IIoT technologies, such as sensors, cloud computing, and data analytics, have enabled the transformation of traditional factories into smart factories.

4. Shortage of Skilled Labor and Workforce Challenges: The difficulty in finding and retaining skilled manufacturing workers has led companies to invest in smart factory technologies to improve operational efficiency and productivity.

5. Stringent Regulatory Requirements and Environmental Sustainability Concerns: The increasing focus on compliance with environmental regulations and the need to reduce the carbon footprint of manufacturing operations have driven the adoption of smart factory solutions.

6. Demand for Flexible and Reconfigurable Manufacturing Systems: The need for agile and adaptable manufacturing systems that can quickly respond to changing market demands and product variations has fueled the growth of the smart factory market.

7. Increasing Adoption of Predictive and Preventive Maintenance Strategies: The recognition of the benefits of predictive and preventive maintenance, enabled by smart factory technologies, has driven their adoption to reduce downtime and maintenance costs.

8. Rising Emphasis on Product Quality, Traceability, and Supply Chain Optimization: The demand for improved product quality, enhanced traceability, and optimized supply chain operations has been a key driver for smart factory implementations.

9. Government Initiatives and Policies Supporting Industrial Digitalization: Government programs and policies aimed at promoting the adoption of Industry 4.0 and smart manufacturing technologies have contributed to the growth of the smart factory market.

10. Increasing Competitive Pressures and the Need for Operational Excellence: The competitive pressures faced by manufacturing companies to maintain a competitive edge and improve operational excellence have driven the implementation of smart factory solutions.

À propos de QYResearch

QYResearch a été fondée en 2007 en Californie aux États-Unis. C'est une société de conseil et d'étude de marché de premier plan à l'échelle mondiale. Avec plus de 17 ans d'expérience et une équipe de recherche professionnelle dans différentes villes du monde, QYResearch se concentre sur le conseil en gestion, les services de base de données et de séminaires, le conseil en IPO, la recherche de la chaîne industrielle et la recherche personnalisée. Nous société a pour objectif d’aider nos clients à réussir en leur fournissant un modèle de revenus non linéaire. Nous sommes mondialement reconnus pour notre vaste portefeuille de services, notre bonne citoyenneté d'entreprise et notre fort engagement envers la durabilité. Jusqu'à présent, nous avons coopéré avec plus de 60 000 clients sur les cinq continents. Coopérons et bâtissons ensemble un avenir prometteur et meilleur.

QYResearch est une société de conseil de grande envergure de renommée mondiale. Elle couvre divers segments de marché de la chaîne industrielle de haute technologie, notamment la chaîne industrielle des semi-conducteurs (équipements et pièces de semi-conducteurs, matériaux semi-conducteurs, circuits intégrés, fonderie, emballage et test, dispositifs discrets, capteurs, dispositifs optoélectroniques), la chaîne industrielle photovoltaïque (équipements, cellules, modules, supports de matériaux auxiliaires, onduleurs, terminaux de centrales électriques), la chaîne industrielle des véhicules électriques à énergie nouvelle (batteries et matériaux, pièces automobiles, batteries, moteurs, commande électronique, semi-conducteurs automobiles, etc.), la chaîne industrielle des communications (équipements de système de communication, équipements terminaux, composants électroniques, frontaux RF, modules optiques, 4G/5G/6G, large bande, IoT, économie numérique, IA), la chaîne industrielle des matériaux avancés (matériaux métalliques, polymères, céramiques, nano matériaux, etc.), la chaîne industrielle de fabrication de machines (machines-outils CNC, machines de construction, machines électriques, automatisation 3C, robots industriels, lasers, contrôle industriel, drones), l'alimentation, les boissons et les produits pharmaceutiques, l'équipement médical, l'agriculture, etc.

0 notes