#IPO LIST 2023

Text

Initial Public Offering (IPO): Is Investing in IPOs Advantageous?

A stock market is the most favoured way to build wealth. IPO is one of the various segments of the stock market which offers several advantages in both the short and long term if invested appropriately. This blog covers the top four benefits of investing in IPOs. Read further to gain more insights about the topic.

What are IPOs?

An Initial Public Offering (IPO) or stock launch is an initial public offering in which company shares are sold to institutional investors. Along with institutional investors, it also includes retail (individual) investors.

An IPO is usually underwritten by one or more investment banks, who also make arrangements for the shares to be listed on one or more stock exchanges. Through this process, generally known as floating, a privately held company is converted into a public company.

Top 4 Advantages of Investing in IPOs

• Listing Gains

To step into the stock market, the companies value their stocks and mention the offer price in the prospectus. An investor can apply to a particular number of shares at that specific price. If the share price on a listing day is trading higher than the price paid at the time of IPO application, it is called the listing gain. Thus, investors can leverage the benefit from the listing gains if invested at the right time.

• Economical

ASX, or the Australian Securities Exchange, has developed various guidelines regarding the block amounts for Latest ASX IPO . These guidelines ensure that the money is debited only after the allotment of shares and continues to earn interest in your account till the allotment day. However, it is not applicable in the secondary marketplace, where the amount is debited immediately after the share purchasing.

Even IPOs are often offered at low prices, which is difficult once the company goes public. Hence, you can get the advantage of investing in a small company within a limited budget that has the potential to grow big.

• Shareholder Ownership Authority

Whenever an investor invests money in a company, he procures voting rights in the company general meetings. It gives them the power and ownership authority in the company's decision-making. For example, the company you invested in announces in their Annual General Meetings that it will expand its operations to increase profitability. As an equity shareholder, you carried the right to participate or vote for that decision.

• Transparency

Anyone investing in IPOs and receiving shares allotment becomes a company shareholder. The company ensures the sharing of all the required information with its shareholders in order to keep them invested in the company. In addition, the company will substantially emphasise on and work hard towards achieving all the promised goals at the deadline. It keeps transparency between owners and company shareholders, giving them reasons to keep investing in the organisation.

Final Words

IPO can be tricky for some due to its long and complicated process. However, investing in a company at the beginning which has a great potential to grow can yield good returns over a period. However, the performance of an IPO entirely depends on the market dynamics of that particular day. Though investing in IPOs is beneficial, it is essential to conduct proper research before putting money in any company shares. You can even hire expert stock market research services for the same.

Stay in touch to learn more about the ASX IPOs, Australian Securities Exchange and the stock market.

1 note

·

View note

Text

#upcoming ipo#new ipo#ipo investm#investment#share market#new ipo listed companies#best investment 2023

0 notes

Text

Unlock Profit Potential with Upcoming IPOs 2023 Analysis

Best Stocks Broker offer comprehensive insights on Upcoming IPOs in 2023, empowering investors with early access to potential market movers, enabling smart investment decisions for the future. So, HURRY UP! Contact now for more details: 9953155122

#upcoming ipos 2023#upcoming ipo listing date#latest ipo list#new ipo coming#upcoming ipo 2023#new ipo launch#new ipo listing today#upcoming ipo list#grey market upcoming ipo

0 notes

Text

IPO Fever: The 2023 Upcoming IPO Listing Date You Can't Afford To Miss

INTRODUCTION

upcoming IPO listing date

INTRODUCTIONUpcoming IPO List :FAQs :What Are The Upcoming Ipo This Week ?What Are The Upcoming IPO In September 2023 ?What Is An IPO ?

An Initial Public Offering (IPO) is a significant financial event where a privately-held company goes public by selling its shares on a stock exchange. This transition allows the company to raise funds from a wide range…

View On WordPress

#list of upcoming ipo in 2023#upcoming ipo in september 2023#upcoming ipo listing date#upcoming ipo this week

0 notes

Text

Basilic Fly Studio IPO 2023: Your Gateway to the World of Visual Effects

Basilic Fly Studio Announces IPO for 2023: Opening on September 01Chennai-based visual effects (VFX) powerhouse, Basilic Fly Studio Private Limited, is set to embark on a new phase of growth with its upcoming Initial Public Offering (IPO). The IPO is scheduled to open on September 01, 2023, and will conclude on September 05, 2023. The company, known for its exceptional expertise in creating…

View On WordPress

#Basilic fly studio India#Basilic fly studio IPO#best company#best vfx studio#Chennai#gateway to vfx now#India top companies#IPO 2023#IPO india#IPO list companies 2023#now Basilic fly in stock market#Sipo mumbai#stock list#stock market#vfx studio

0 notes

Text

70+ Upcoming Latest IPO 2023 List!

Are you finding the Upcoming Latest IPO 2023 List? We provide all details and Many unicorn companies listed. Bajaj energy, byju's, ola, oyo rooms, swiggy, SAMHI Hotels, Fincare Small Finance Bank, Go Airlines, and Utkarsh Small Finance Bank is the latest upcoming IPO. If you want to know more about the IPO list for 2023, visit our blog!

#bajaj energy#byju's#fusion microfinance#gemini foods and fats#go airlines#hdb financial#ipo list#latest ipo#latest ipo 2023#muthoot microfin#ola#oyo rooms#snapdeal#swiggy#upcoming ipo list#upcoming ipo list for 2023#utkarsh small finance bank#vlcc health care

1 note

·

View note

Text

Favors

Book: Open Heart, Book 1

Pairing: Dr. Ethan Ramsey x F!MC (Dr. Sawyer Brooks)

Rating: General

Category: Angsty Fluff, Christmas

Word count: 2.5K

Summary: Sawyer is worried that her crush is getting the wrong impression and is later hurt when she thinks he has taken advantage of a situation.

A/N: This takes place during intern year (pre-Miami) shortly before the events in Merry Christmas, Rookie.

Events/Prompts:

• Photo prompt from @jerzwriter

• Participating in CFWC Holidays 2023

• Participating in Choices Flashfics Holiday Prompts

🎄12: “The tree isn’t the only thing getting lit this year.”

🎅21: “It looks like Santa threw up in here.”

🎁67: “What’s wrong? Do you not like your gift?”

• Participating in Choices Flashfics Week #64 Prompts

👨🏻⚕️2: “I’m not in the mood for a lecture.”

• Participating in Choices Holidays Winter 2023

While waiting in the lunch rush lines in the cafeteria, Sienna reminded her roommates of their party assignments. “...I’ve got the treats covered, Elijah is handling the music, Jackie is making jingle juice-”

“Hell yeah!” Elijah exclaimed, giving Jackie a high-five.

“The tree isn’t the only thing getting lit this year,” she said coolly.

“Oh, and don’t forget your white elephant gifts!” Sienna also reminded them.

“Shit, I forgot about that. What are the rules again?” Jackie asked.

“The only rule is you can’t buy anything,” Sienna answered.

“I’ll go shop the lost and found when we’re done here.”

“Or, I saw some pharma reps in the atrium earlier. You could try to hit them up for some swag,” Sawyer chimed in.

When the group reached the front of the line, a heavy arm slipped around Sawyer’s shoulders. “Thanks for saving my spot, Brooks,” Bryce winked, cutting in line.

“Do you meatheads have to cut into everything?” Jackie barked.

Bryce chomped into the apple he hadn’t yet paid for. “Yep,” he nodded with a big toothy grin. “I’m just trying to get on the naughty list. If you all want to join me, we could save Santa a trip this year,” he joked.

“You’re already looking at Santa’s favorite ho,” Jackie quipped.

“Brooksie, I actually am in a hurry. I need to scrub in for a lymphadenectomy. Do you mind?” he asked seriously.

Sawyer tilted her head to the register, gesturing for him to go ahead.

“Thanks.” When the cashier asked if they were together, Bryce said yes.

“Bryce, you don’t have to-”

He placed a hand on the small of her back. "I've got you, Ipo. I'll see you later," he promised before hurrying away.

“Girl, what are you holding out for? He's hot and he's totally into you,” Sienna teased, once Bryce was out of earshot.

Sawyer lifted her tray and turned to her friend. She opened her mouth to say something, but froze when she spotted a six-foot-four-inch, blue-eyed attending at the adjacent register. Not knowing how much he saw or heard, a blush of embarrassment colored her cheeks. Feeling like a shy teenager at a school dance, Sawyer hoped the interaction with Bryce hadn’t given her crush the wrong impression.

As Ethan raised his eyes to her, he gave no indication. Pocketing his wallet, he stoically turned and exited the cafeteria.

As their shift ended, Sawyer approached her roommates who were walking in the opposite direction down the hall.

“Locker room is that way, Brooks,” Jackie pointed.

“I know, I just need to run and check on one more patient before I clock out.”

“Do you want us to wait for you?” Sienna asked.

“No, don’t wait up. I’ll be right behind you.”

After making sure the coast was clear, Sawyer slipped behind the plastic curtain that sealed off the construction wing. Naveen spiked a fever earlier in the day, and she wanted to check on him before going home. She found him fast asleep, and after checking his monitors and medications, she quietly tidied the room. When she finished, she softly closed the door behind her, whispering, “Goodnight, Dr. B.”

On her way to dispose of some trash, Sawyer’s phone buzzed in her pocket.

Bryce knocked and let himself in, making a beeline to the kitchen to find Sienna. “Help?” he asked, lifting a roll of wrapping paper and tape.

She looked at him puzzled. “Where’s your gift?”

“You're looking at it.” He beckoned her to the living room, where he laid down on the floor.

“You’re ridiculous, you know that?” she laughed, kneeling next to him.

A few minutes later, Sienna placed the last piece of tape, securing the wrapping around Bryce’s torso. Using all of her body weight, she rolled him to his back and slid him under the Christmas tree.

“Si?” he called, his voice muffled. “Do me a favor and start the game sooner than later. I already have to pee.”

In the locker room, Sawyer traded her white coat for her winter one. As she gathered her things, her phone buzzed with an incoming call.

“Hi,” she answered.

“Hi. By any chance, are you still at the hospital?” Ethan asked.

“I am.”

“Could I ask you for a favor? I’ve had something come up at the last minute. Would you be able to stay with Naveen for a few hours?”

By now, Sawyer had come to know Ethan Ramsey well enough to know that he would not ask for help unless he was desperate. “Sure. Is everything okay?”

“Yes. I’m pressed for time right now, but I’ll explain later. I’ll relieve you as soon as I can.”

“No problem.”

“Thanks, Rookie.”

Sawyer was about to text Sienna when Danny entered the room.

“Hey, Sawyer,” he waved. “I thought you’d be at home getting ready for the party. I’m heading there now if you want a ride.”

“Danny, I’m so glad you’re here! Could you take something to Sienna for me? I’m not going to make it home for a while.”

“How come?”

She made sure they were alone and lowered her voice. “Dr. Ramsey got tied up with something and asked if I would look after Patient X for a few hours.”

“You should go and have fun with your roommates, Sawyer. I can stay,” he insisted, having been recruited by Ethan shortly after Naveen agreed to be treated.

“That’s really sweet of you, Danny, but I know you traded shifts so you could be off tonight. Besides, Sienna baked a batch of peppermint chocolate chip cookies just for you.”

“She did?” he smiled.

“Yeah. Go. Have fun. I’ll be there as soon as Dr. R gets here.”

After Danny left with what appeared to be a wrapped bedpan, she updated her roommate.

Later, Sawyer was in Naveen’s room, scrolling through Pictagram when her phone vibrated with a new text notification.

Several hours had passed when Sawyer felt a hand on her shoulder.

“Rookie?”

“Hiiiii,” she managed through a yawn.

“I’m so sorry,” Ethan apologized.

“Huh? What time is it?” Sawyer reached for her phone, noticing several missed calls from Sienna and Bryce.

“It’s almost four in the morning. I would have been here sooner, but I accidentally dozed off,” he explained, helping her to her feet.

“It’s okay. There's no doubt you probably needed it. And it’s been quiet here. His fever finally broke a little while ago.”

“Good. Go home and get some sleep,” he instructed, “I’ll tell Ines that you’ll be in this afternoon.”

“Okay.” Sawyer shouldered her bag and headed for the door. “Good night."

“Sawyer?”

“Yeah?”

“Thank you.”

With a shake of the snow from her coat, Sawyer entered her apartment and found Landry eating breakfast at the kitchen table. “Oh boy. It looks like Santa threw up in here.”

“Smells like it too,” he grumbled.

“I’m surprised you’re still going in early after…,” she circled her hand in the air, “all of this.”

“Yeah, well, not all of us are lucky enough to get preferential treatment from Dr. Ramsey.”

“Excuse me?”

“What? This is the second time he’s personally assigned you a case. To my knowledge, he hasn’t assigned cases to any of the other interns in the competition.”

“Wow. Well, maybe if you ever crack the top five, he will.” She let him chew on that as she hung her coat and walked to her room.

Bryce turned from the surgical board and spotted Sawyer approaching. “Finally coming to collect your prize, Brooksie?”

Sawyer rolled her eyes.

“What’s wrong? Do you not like your gift?”

“You’re ridiculous,” she shook her head with an amused smile.

“So I’ve been told. By the way, this gift comes with a night on the town.”

Unbeknownst to her, Dr. Ramsey inconveniently emerged from a nearby patient’s room, catching the tail end of their conversation.

“Bryce-”

But before she could protest, he backed his way down the hall. “I’ve gotta run. Check your schedule and let me know when to pick you up. And you should know, I have a strict ‘no rejections’ policy.”

She sighed deeply once his back was to her, then turned to find Ethan standing a couple feet away, his eyes focused on the tablet in his hand.

“Dr. Ramsey,” she acknowledged sheepishly.

Ethan glanced at her with a side eye. “Brooks.”

“Rrrrr! Of course he is here right now!” As they moved on to their next tasks, Sawyer told herself it was time for a heart to heart with Bryce.

"Excuse me, would you please page Dr. Ramsey?"

A few minutes later, Ethan met an attractive woman at the nurses’ station and led her away from the busybodies seated at the circular desk. As they walked down the hall, she handed him a small box. “Thank you, Jen. I really appreciate this. I’ll send you the outcome report as soon as the trial period ends.”

Stepping in front of him, Jen pulled him to the side until their shoulders hugged the wall. "It was great to see you again." She paused as a couple nurses walked past. "We had a good time last night, didn’t we?"

“It was nice to catch up.”

She didn’t mean to eavesdrop, but when Sawyer heard the familiar voice, she wondered if her ears were deceiving her.

“Listen, I would love to see you again tonight,” Jen continued, reaching for the end of his tie and running it through her fingers. “I’m staying at The Langham. Come have drinks with me and…,” she shrugged, "we can see where things go from there.”

“I-”

Stepping out from the vending machine alcove, Sawyer turned her head in their direction.

Ethan’s surprised eyes met hers, finding only hurt. He moved Jen’s hand back to her side as Sawyer spun and walked briskly in the opposite direction.

“Jen, you’ll have to excuse me. I need to go,” he apologized, watching the woman he longed for retreat and disappear from sight. “I appreciate your assistance. I will speak with you later.”

“Later tonight?”

“I’ll text you,” he said as he sidestepped her.

Ethan’s long strides carried him down the hall quickly. He nearly collided with a visitor as he rounded the corner. “I’m sorry. Excuse me.”

In the far corner of the cafeteria, Sawyer watched the snow fall in the empty courtyard. The sound of metal chair legs scraping against the tiled floor jarred her from her thoughts.

“I’ve been looking all over for you.”

“Why? Need another favor?” she said, words laced with disdain.

“Rookie, that-”

“Dr. Ramsey, I haven’t been helping you to win favor or get a leg up in the competition. If you want an intern to run errands and cover for your ass, then let me suggest Dr. Olsen. He'd be more than happy to fill that role.”

She lowered her voice, hurt replacing anger. “I canceled plans with my roommates last night, because I believed that if you were asking for help, it must have been important. If I had known I was only covering so that you could go on a date and get…” She let the rest of the sentence die on her tongue. “Sorry. I know it’s none of my business how you spend your free time, but I won’t let you take advantage of mine.”

Visibly disappointed, she avoided eye contact. Ethan keenly observed that her disappointment went beyond merely thinking he would take advantage of her kindness. If he was reading the situation correctly, it was the same disappointment he had felt seeing her with the surgical intern.

“Sawyer, let me explain. Jen works for Phlaum Pharmaceuticals. They are currently conducting a trial on a new antibiotic for sepsis. I reached out to her when I heard about it. Her team is in the area promoting a new product this week. You may have noticed her reps in the lobby. She made herself available to meet with me last night. And after some convincing, she agreed to pull some strings to get Naveen into the trial. She was here this afternoon to drop off the treatment.” Ethan pulled a small vial from his pocket and placed it on the table.

“It sounded like you convinced her all right,” she muttered.

“Rookie. I know we haven’t known each other long, but do you honestly believe I’m the type of person who would trade sexual favors? I agreed to a testimonial and a couple expo appearances. That’s all.”

“What? Can you blame me for going there? She said she had a ‘good time,’ and you told me you were late because you ‘accidentally dozed off,’ then she asked you to meet her again tonight…At. A. Hotel.”

He shook his head and pinched the bridge of his nose at her teasing dramatization, failing to hide the crack of a smile.

“So, how’d you get out of it?” she wondered.

“I told her I would text her later.”

“You don’t text.”

“Exactly.” His knee touched hers, but neither one attempted to move away. “I need to get back upstairs. Can you meet me later to review the trial protocols?”

“I have a few patients to check on. I’ll page you after?” she answered.

Ethan scooted back in his chair, but before standing, he covered Sawyer’s hand with his own.

“Sawyer, your contributions and the sacrifice of your time have not gone unnoticed. And as far as I’m concerned, you are my partner on this case. I should have filled you in on the drug trial. I just didn’t want either of us to get our hopes up.”

“Thank you, Dr. Ramsey.” When he moved to stand, she followed. “I’m finished here. I’ll head back up with you.”

The elevator doors were halfway closed when a fellow intern squeezed his way through.

“Hi, Brad,” Sawyer greeted.

“Sooo, who’s the lucky guy?” he quizzed, embarrassingly indiscreet.

“Pardon?”

“Come on, girl. Why else would you ditch us last night? Your roommates say you’re never home. You rarely come out for drinks anymore. And, you’ve parked Bryce in the friend zone.” Brad nudged her shoulder with his. “Spill the tea.”

“Sorry to disappoint, TMZ, but I’m not dating anyone. I got stuck here with a last minute case.” She made her eyes big and subtly tipped her head toward Dr. Ramsey as a warning. Luckily, Brad picked up on the cue, sparing her from having to tell any more white lies.

Ethan hid a smile, pretending not to notice the act.

“Any chance you guys will host again for New Years? You’re the only ones with an apartment big enough,” Brad asked as they exited the elevator together.

“Talk to Elijah. He’s the party planner of the group.”

Once Brad was on his way, Ethan reached for Sawyer's elbow drawing her back. “You skipped your own party?”

She shrugged. “You needed my help, and our patient wasn’t in any condition to be left alone.”

“You should have told me. I would have figured something else out…” He looked into her eyes with a sense of wonder. “Thank you. I owe you one.”

She smiled up at him. “You’re welcome.”

“So, what excuse did you give your roommates?” he asked as they walked side by side down the hall.

“About that…” she said with a tense grin, “I’m gonna need you to assign some of your cases to the other interns in the top five.”

“Come again?”

Tag List: @choicesficwriterscreations @openheartfanfics @peonierose @potionsprefect @trappedinfanfiction @jerzwriter @queencarb @coffeeheartaddict2 @quixoticdreamer16 @jamespotterthefirst @liaromancewriter @zealouscanonindeer @tveitertotwrites @tessa-liam @youlookappropriate @kyra75 @socalwriterbee @txemrn @choicesflashfics

#open heart#open heart choices#open heart fanfic#ethan ramsey#ethan ramsey x mc#ethan x mc#ethan x sawyer#choices stories you play#choices open heart#playchoices#choices fic writers creations#cfwc fics of the week#cfwc holidays 2023#choicesflashfics

54 notes

·

View notes

Text

When you look up the definition of greedy in the dictionary, there's a picture of this man

Aaack! That's terrifying.

Okay, I've been meaning to write this post for eons but it seems especially important now given all the crap that's going down at HYBE. We need to talk about BSH and his obscene wealth.

This April, Forbes published the list of South Korea's 50 richest people. Coming in at number 17 was the hitman himself, Bang Si-Hyuk, estimated to be worth 2.1 BILLION US DOLLARS. I believe that figure has likely gone down a bit thanks to HYBE's falling stock price, but that's still an absolutely crazy number.

Now let's talk about Scooter Braun. According to Wikipedia, he is estimated to be worth approximately $1 billion, however, most other outlets list him at being worth about $500 million. Either way, he's not buying generic cereal when he goes grocery shopping.

Bang PD paid approximately $1 billion dollars to Scooter when he acquired Ithaca Holdings in April, 2021. Scooter was given over $100 million in HYBE stock as well as an undisclosed cash payment.

Justin Bieber and Ariana Grande were each given $12 million worth of stock, while J Balvin received $4.8 million and Demi Lovato received $1.2 million. I would describe these "gifts" as glorified bribes to prevent each of them from bolting the minute the buyout was announced.

Now compare that to what the members of BTS received. For all their blood, sweat, and tears, starvation diets, no time off, worked to exhaustion, they each received 68,385 shares prior to the IPO, which were initially valued at $8 million per person. It's important to note Bang Si-Hyuk maintained their voting rights and votes on their behalf. So, they have shares, but no voting rights, i.e. no say in the direction of the company at the board of directors level.

It's worth noting that JB, AG, JB, and DL did absolutely nothing to earn those shares. They contributed nothing to the success of Big Hit and the eventual creation of HYBE Corporation. It's also worth noting that all four of them are no longer Scooter's clients.

HYBE America was the worst performing subsidiary under HYBE Corp in 2023, posting a loss of about $100 million (I'll dig up the financials for a future post). I think we all know where that went, but we can talk about that later. However poorly SB's business line performed, he will still continue to make profits off of his legacy clients thanks to sunset clauses in their original contracts. You can read about that here:

Scooter Braun sits on HYBE's Board of Directors. He is also 5th largest shareholder, with 0.8698% ownership. The members of BTS each have 0.1642% ownership (assuming they haven't sold their initial shares). I believe they will receive more ownership and voting rights when their new contract goes into effect, though. Meanwhile...

Bang Si-Hyuk is the Chairman of HYBE Corporation and the majority shareholder, with 31.57% ownership. He owns the place. When you add up all seven members' shares together, they still own less than 2% of the total shares of the company.

So please, for the love of GOD, understand that the members of BTS are not in charge. They are just employees. And frankly, they aren't well compensated when you compare them to other artists in the industry. Most sources say the members are each worth somewhere between $25 million to $40 million. Let's go with the low end of $25 million since that's the number I see most often. If Bang PD is worth $2.1 billion, that means each member is worth less than 1.2% of what Bang is worth.

ONE POINT TWO PERCENT!!!!

And you think Min Hee Jin is greedy???

Okay, back to the boys. Let's take a look at Simon Cowell's net worth. You know that guy? The one who formed One Direction and is a music and TV producer and personality? Do you want to guess how much he's worth? Well, its' not $2.1 billion. He's estimated to be worth a measly $600 million. And what about the former One Direction members themselves? (FYI all of these are estimates based upon online media sources).

Harry Styles - $120 million

Zayn Malik - $75 million

Niall Horan - $70 million

Louis Tomlinson - $70 million

Liam Payne - $70 million.

So, let's just pretend they each have $70 million. That means each member of One Direction is worth just under 12% of what Simon Cowell is worth.

One last thing. This is Bang PD's house in Bel Air, California. He bought it from Trevor Noah for $26 million. Mind you, that's potentially more than what the members of BTS are each worth. Just for one house in a country the man doesn't even live in.

Benevolent father figure my ass. But BTS are shareowners!!

Disclaimer: these numbers are all estimated based upon information available on the world wide web.

P.S. the 2024 Q1 earnings call is in a few hours. Prepare yourself for the media play.

18 notes

·

View notes

Text

Well, many of those users don’t seem very happy about the IPO and are expecting Huffman to run the site into the ground. “I don’t really see any good that can come from Reddit going public,” Dan M. told me. “Not to sound dramatic but it kinda feels like the final nail in Reddit’s coffin after years of degrading quality.”

Kevon, who told me he was thinking of investing, says he thinks Huffman was overpaid. (In the filing, Huffman is listed as making $193 million in 2023.) He was surprised Huffman made so much while the company was operating at a loss.

u/itsreallyreallytrue was more succinct. “Tech narcissist CEO vibes,” he said of Huffman. “Fuck Spez, Fuck Elon, Fuck Sam Altman.”

How embarassing if reddit dies before tumblr

22 notes

·

View notes

Text

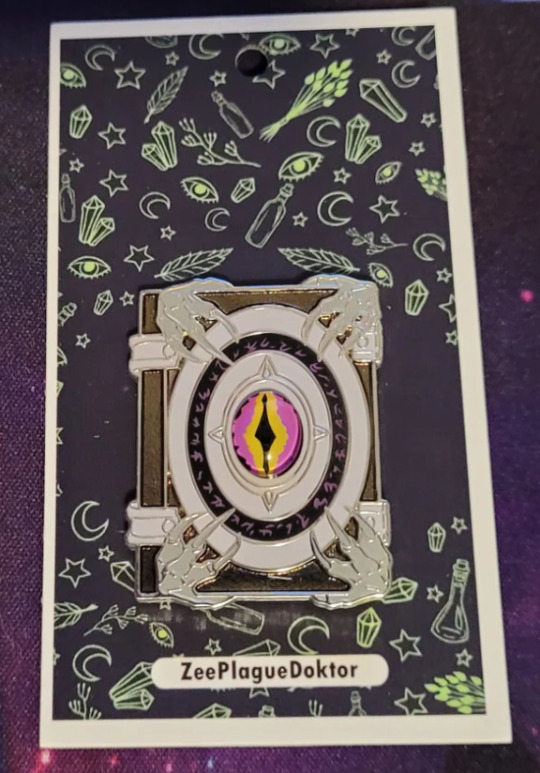

Hello folks! Ive reduced the price of my binding of Ipos pins, if anyone's interested please check out my etsy~

7 notes

·

View notes

Text

My media this week (10-16 Dec 2023)

📚 STUFF I READ 📚

🥰 Second Chances in New Port Stephen (TJ Alexander, author; Aden Hakimi & Feodor Chin, narrator) - 2nd chance romance between 2 former HS sweethearts after Eli comes back home to his small FL home town (post-transition & unemployed due to proximity to an industry scandal) and reconnects with Nick (who left for college, came back, got married & divorced and became a (hot) dad). Also there is a fat ginger cat named Sweet Potato. I kind of love what a mess Eli is. Nick is also a bit of a mess but masking it better. I loved them both.

💖💖 +120K of shorter fic so shout out to these I really loved 💖💖

The First Rule of Book Club series (Deisderium) - MCU: stucky, 28K - reread for stucky bookclub; a forever fave where recovering Bucky joins a book club - just a warm hug of a series, with a fantastic OC (unfortunately does have period-typical reading of HP but I was able to just focus on everything else)

tattoo your last bruise (ftmsteverogers) - MCU: stucky, 9K - great post-WS recover fic

Blood, Sweat, Ambrosia (AidaRonan) - Stranger Things: steddie, 4K - amazing gift of a monsterfucking fic. aida has truly blessed us this holiday season

📺 STUFF I WATCHED 📺

Doctor Who: The Giggle (2023 special #3)

D20: Fantasy High: Sophomore Year - e8-15

🎧 PODCASTS 🎧

The Sporkful - How Do Michelin Stars Actually Work?

Pop Culture Happy Hour - Diddy, Hip-Hop, and #MeToo

The Atlas Obscura Podcast - Ol Pejeta Rhino Cemetery

Our Opinions Are Correct - What Makes Us Quit Reading a Book in the Middle?

Today, Explained - A concrete solution to climate change

Wiser Than Me with Julia Louis-Dreyfus - Julia Gets Wise with Darlene Love

NPR's Book of the Day - Jordan Peele curates a new Black horror story collection 'Out There Screaming'

The Atlas Obscura Podcast - Knoxville Weather Kiosk

Pop Culture Happy Hour - 2023 Pop Culture Favorites [love that D20's Dungeons & Drag Queens made this list!]

Switched on Pop - Nicki Minaj's Roman Empire

The Allusionist - 186. Ravels

It's Been a Minute - Music trends that took us by surprise in 2023

Shedunnit - The Murderless Christmas Mystery

Vibe Check - It’s Like an Inspirational Relay Race

⭐ 99% Invisible #563 - Empire of the Sum

The Atlas Obscura Podcast - New Bedford Whaling Museum

⭐ Off Menu - Ep 216: Dawn French (Christmas Special)

Twenty Thousand Hertz+ - Tournament of Champions

Ologies with Alie Ward - Quasithanatology (NEAR-DEATH EXPERIENCES) with Bruce Greyson

The Atlas Obscura Podcast - Gourdlandia

One Year - 1990: Art on Trial

Sara & Cariad's Weirdos Book Club - Persuasion by Jane Austen with Andrew Hunter Murray

Not Another D&D Podcast - D&D Court: Sneaky Snowmen, Horny Dogs, and The PC vs The People’s Champion

Wiser Than Me with Julia Louis-Dreyfus - Julia Gets Wise with Rhea Perlman

Up First - Gaza Post-War Plans, Ohio Prosecutor Misconduct, Comer Shell Company

What Next: TBD - Shein’s Newest Offering? An IPO

Pop Culture Happy Hour - Wonka And What's Making Us Happy

Dear Prudence - I Rejected A Friend’s Sexual Advance—Now He’s Being Weird. Help!

Endless Thread - This song wants you to stick out your what!?

⭐ Welcome to Night Vale #240 - He Is Holding a Knife

Today, Explained - Why millennials dread motherhood

🎶 MUSIC 🎶

Classic Rock Instrumentals

Presenting Stevie Ray Vaughan

Presenting Santana

Dropkick Murphys Radio • Familiar

New Blue Sun [André 3000] {2023}

Throwback Workout

my christmas playlist

#sunday reading recap#bookgeekgrrl's reading habits#bookgeekgrrl's soundtracks#fanfic ftw#second chances in new port stephen#tj alexander#d20#dimension 20#fantasy high#fantasy high: sophmore year#my christmas playlist is over 600 songs‚ basically every holiday song i like#i just put it on shuffle and let it go#stevie ray vaughan#carlos santana#andré 3000#welcome to night vale#99% invisible podcast#off menu podcast#npr's pop culture happy hour podcast#the sporkful podcast#20k hz podcast#one year podcast#switched on pop podcast#shedunnit podcast#the atlas obscura podcast#vibe check podcast#what next: tbd podcast#ologies podcast#endless thread podcast#it's been a minute podcast

3 notes

·

View notes

Text

Upcoming IPOs in India 2023

The IPO is an Initial Public Offer in which companies offer their privately held shares to the public for the first time, i.e, they sell their shares to the public. Companies that wish to change their company status from Private Limited to Limited must draft a DRHP with SEBI. Here is the list of upcoming IPOs in the year 2023:

S.No

Company

Issue Size (in Rs. Crores)

Sector

1.

Infinion Biopharma

Yet to be updated

Health Care

2.

Go Airlines India Ltd.

3,600

Aviation

3.

Snapdeal Ltd.

1,250 + OFS

E-commerce

4.

Skanray Technologies Ltd.

400

Healthcare technology

5.

One Mobikwik Systems Ltd

1,900

Technology

6.

Ixigo

1,600

Travel & Hospitality

7.

Sterlite Power Transmissions Ltd.

1,250

Industrials

8.

Gemini Edibles and Fats

2,500

Consumer Staples

9.

Bajaj Energy

5,450

Electric utilities

10.

Arohan Financial Services Pvt Ltd.

1,800

Financials

11.

Capillary Technologies India Ltd.

850

Technology

12.

Uma Converter Limited

Yet to be updated

Packaging

13.

Emcure pharmaceuticals

Around 4,500-5,000

Health Care

Here are some factors you should consider before investing in an IPO:

Company’s background: Before investing in any IPO, look for the company’s past background, and understand its business model and how it is operated. Also, look for their financials. It would be a good investment if revenues and profits are increasing consistently.

Valuation: Another factor is to check the company’s valuation. The best way to assess a company's valuation is to compare its price to that of its listed peers. Look for various ratios like price-to-earnings ratio, return on equity, etc.

Future prospects: Now try to understand the reason behind the IPO. And also understand the industry and business in detail to make sure it will sustain itself in the future. Also, the reason behind bringing the IPO can be many, so try to understand whether the money will be used for expansion, paying off loans or anything else.

Conclusion IPOs have rarely seen such strong investor demand as they have in recent years. According to data, the total collection for IPOs has well surpassed the INR 100 lakh crore mark this year. With less than a month until the end of the year, investors may see similar investor participation in upcoming IPOs.

Source - https://justpaste.it/2q3cc

#Upcoming IPOs in India#Upcoming IPOs in India 2023#Upcoming IPOs in India2022#Upcoming IPOs in India 2021#Upcoming IPOs#stocktrading#stock markerting#stock broker in india

2 notes

·

View notes

Text

Top Upcoming IPOs to Watch in 2024: Latest Grey Market Premium Updates

Top Upcoming IPOs to Watch in 2024: Latest Grey Market Premium Updates

As we venture into 2024, the IPO market is brimming with anticipation. For investors, this year promises a wealth of opportunities, with several high-profile companies preparing to go public. Whether you're a seasoned investor or just beginning to dip your toes into the market, staying informed about upcoming IPOs and their Grey Market Premiums (GMP) is crucial for making sound investment decisions.

In this blog, we'll explore some of the top upcoming IPOs to watch in 2024 and provide insights into their GMP trends. These metrics can offer valuable clues about investor sentiment and the potential success of these public offerings.

KRN Heat Exchanger IPO

IPO Details:

IPO Date: September 25–27, 2024

Industry: Engineering & Manufacturing

Price Band: ₹202-₹220 per share

GMP (as of last update): ₹225

Why It’s Worth Watching: KRN Heat Exchanger has gained a strong market position by offering innovative and sustainable solutions in the industrial engineering sector. The company’s consistent financial performance and recent expansion into advanced heat exchange technologies have made this IPO one to watch. With a Grey Market Premium (GMP) of ₹225, there is a strong indicator of investor confidence, suggesting a significant oversubscription is likely.

Investor Tip: As the GMP remains high, keep track of any fluctuations that could provide insight into investor sentiment before the listing date. Strong market interest could result in a profitable listing.

Manba Finance IPO

IPO Details:

Expected IPO Date: September 23–25, 2024

Industry: Financial Services

Price Band: ₹114-₹120 per share

GMP (as of last update): ₹60

Why It’s Worth Watching: Manba Finance has established itself as a leader in consumer and vehicle financing, with a growing portfolio and expanding client base. The company’s robust revenue growth in 2024 and a strong return on equity (ROE) make this IPO attractive to investors. With a current GMP of ₹60, Manba Finance is poised for moderate listing gains, appealing to both retail and institutional investors.

Investor Tip: Monitor any significant changes in the GMP and consider how this IPO fits within broader market trends in the financial sector. Given its stable growth and strong fundamentals, this IPO could offer long-term returns.

TechEra Engineering IPO

IPO Details:

Expected IPO Date: September 25–27, 2024

Industry: Aerospace & Defense Manufacturing

Price Band: ₹75-₹82 per share

GMP (as of last update): ₹10

Why It’s Worth Watching: TechEra Engineering has carved out a niche in the aerospace and defense sectors, with its cutting-edge manufacturing processes. The company has shown impressive growth, with revenue jumping from ₹26.59 crore in 2023 to ₹39.08 crore in 2024. Although the current GMP is a modest ₹10, the company’s long-term prospects and growing order book in the defense sector make it a worthwhile investment for those looking at long-term gains.

Investor Tip: TechEra’s focus on high-precision components and increasing global market share could yield substantial future growth. While the short-term gains may be limited, this IPO could offer strong potential for long-term investors.

Understanding Grey Market Premium (GMP) and Its Importance

Grey Market Premium (GMP) is an indicator of the premium at which IPO shares are being traded in the unofficial market before they are listed on the stock exchanges. A high GMP typically signals strong investor interest and the likelihood of the IPO being oversubscribed, potentially leading to higher listing gains.

How to Use GMP in Your Investment Strategy:

Gauging Demand: A rising GMP often indicates increasing demand for the IPO shares, which could translate into a successful listing.

Risk Assessment: While a high GMP can be a positive sign, it’s important to consider the overall market conditions and the company’s fundamentals before investing.

Timing Your Investment: Monitoring GMP trends can help you decide whether to invest in the IPO or wait until the shares are listed and trading begins on the exchange.

Final Thoughts

2024 is shaping up to be an exciting year for IPOs, with several companies poised to make a significant impact on the market. By keeping track of upcoming IPOs and their Grey Market Premiums, you can better navigate the investment landscape and identify opportunities for potential gains.

As always, while GMP can offer valuable insights, it should be just one of many factors considered when making investment decisions. Thorough research and a clear understanding of your financial goals will help you make the most of the opportunities that 2024 has to offer.

Stay tuned to our platform for the latest updates on upcoming IPOs and GMP trends. Whether you’re looking to capitalize on short-term gains or seeking long-term investment opportunities, staying informed is key to success in the dynamic world of IPO investing.

1 note

·

View note

Text

TechEra Engineering IPO Date, Review, Price, Allotment Details

TechEra Engineering IPO is opening for subscription on September 25, 2024, and closing on September 27, 2024. This NSE SME IPO aims to raise ₹35.90 Crores, with a 100% Fresh Issue of TBA equity shares, each with a face value of ₹10. The price band for the TechEra Engineering IPO is fixed at ₹75 - ₹82 Per Share, with a market lot of 1600 share. The allocation for this IPO is as follows: 35% for retail investors, 50% for QIBs, and 15% for high-net-worth individuals (HNI). TechEra Engineering IPO Allotment will done on September 30, 2024, and TechEra Engineering IPO listing date is October 3, 2024.

TechEra Engineering Company Profile

TechEra Engineering Limited was established with a focus on delivering high-quality engineering and technology solutions. The company operates in the industrial engineering sector, providing a wide range of services, including fabrication, installation, and the design of engineering systems for industrial clients. Over the years, TechEra has developed a strong foothold in the industry, driven by its commitment to innovation and excellence.

Sector and Services: TechEra Engineering specializes in industrial engineering, particularly catering to sectors such as construction, heavy engineering, and industrial machinery. The company’s services include:

- Engineering design and consultancy

- Fabrication and installation of industrial systems

- Equipment maintenance and technical support

- Solutions for large-scale industrial projects

Strengths and Competitive Advantages:

- Strong Growth Track Record: TechEra Engineering has demonstrated a steady increase in revenue and profitability over recent years, which reflects its ability to successfully execute large-scale projects.

- Experienced Leadership: The management team brings decades of experience in industrial engineering and project execution, which has played a crucial role in building the company’s reputation.

- Client-Centric Approach: TechEra focuses on delivering customized solutions to meet the specific needs of its clients, ensuring long-term partnerships and repeat business.

TechEra Engineering IPO GMP

TechEra Engineering IPO Objectives

The funds raised through the IPO will be utilized for:

- Funding capital expenditure for new machinery

- Meeting working capital requirements

- Repayment of certain outstanding borrowings

- General corporate purposes

- Issue expenses

TechEra Engineering IPO Key Details

- TechEra Engineering IPO Open Date: September 25, 2024

- TechEra Engineering IPO Close Date: September 27, 2024

- TechEra Engineering IPO Size: Approximately ₹35.90 Crores, Equity Shares

- Face Value: ₹10 Per Equity Share

- TechEra Engineering IPO Price Band: ₹75 - ₹82 Per Equity Share

- TechEra Engineering IPO Listing on: NSE SME IPO

- Retail Quota: 35% of the net offer

- QIB Quota: 50% of the net offer

- HNI Quota: 15% of the net offer

TechEra Engineering IPO Timeline

- TechEra Engineering IPO Open Date: September 25, 2024

- TechEra Engineering IPO Close Date: September 27, 2024

- Basis of Allotment: September 30, 2024

- Refunds: October 1, 2024

- Credit to Demat Account: October 1, 2024

- TechEra Engineering IPO Listing Date: October 3, 2024

How to Apply for TechEra Engineering IPO

Investors can apply for the TechEra Engineering IPO through ASBA (Applications Supported by Blocked Amount) online via their bank accounts or by using the offline IPO forms, which can be downloaded from the NSE website.

TechEra Engineering Financial Performance (in Crores)

- Year 2024: Assets: ₹37.24 Cr, Revenue: ₹39.08 Cr, Expenses: ₹34.26 Cr, PAT: ₹4.82 Cr

- Year 2023: Assets: ₹39.21 Cr, Revenue: ₹26.59 Cr, Expenses: ₹25.28 Cr, PAT: ₹1.31 Cr

- Year 2022: Assets: ₹21.36 Cr, Revenue: ₹7.37 Cr, Expenses: ₹13.66 Cr, PAT: ₹-6.29 Cr

TechEra Engineering Valuation FY2024

- Return on Equity (ROE): 30.33%

- Return on Capital Employed (ROCE): 23.47%

- EBITDA Margin: 23.26%

- PAT Margin: 12.45%

- Debt-to-Equity Ratio: 0.90

- Earnings Per Share (EPS): ₹4.14 (Basic)

- Price/Earnings (P/E) Ratio: N/A

- Return on Net Worth (RoNW): 30.33%

- Net Asset Value (NAV): ₹13.09

TechEra Engineering Peer Group

Paras Defence and Space Technologies Ltd: EPS: ₹8.22, PE Ratio: 140.51, RoNW: 6.75%, NAV: ₹114.01, Income: ₹261.77 Cr

Azad Engineering Ltd: EPS: ₹11.20, PE Ratio: 141.25, RoNW: 9.08%, NAV: ₹109.12, Income: ₹372.76 Cr

TechEra Engineering Company Promoters

- Nimesh Rameshchandra Desai

- Meet Nimesh Desai

- Kalpana Nimesh Desai

TechEra Engineering IPO Registrar

Kfin Technologies Limited

KFintech, Tower-B, Plot No 31 & 32,

Financial District, Nanakramguda, Gachibowli,

Hyderabad, Telangana India - 500 032.

Website: https://kosmic.kfintech.com/ipostatus/

Phone: 04067162222, 04079611000

Email: [email protected]

TechEra Engineering IPO Allotment Status Check

- Check the TechEra Engineering IPO allotment status on the Kfin Technologies website.

TechEra Engineering IPO Allotment Link

- Check the TechEra Engineering IPO allotment on the Check Ipo Allotment website.

TechEra Engineering IPO Lead Managers (Merchant Bankers)

- SKI Capital Services Limited

TechEra Engineering Company Address

Gat No. 565~

Behind Namo Marble & Timbers At Post Velu

Tal. Bhor~ Pune-412205

,Maharashtra- India

Website: https://techera.co.in/

Phone: +91 8605016251

Email: [email protected]

TechEra Engineering IPO FAQs

What is TechEra Engineering IPO?

TechEra Engineering IPO is an NSE SME IPO. They are going to raise ₹35.90 Crores via IPO. The issue is priced at ₹75 - ₹82 Per equity share. The IPO is to be listed on NSE.

When will the TechEra Engineering IPO open?

The IPO is to open on September 25, 2024, for NII, and Retail Investors.

What is TechEra Engineering IPO Investors Portion?

The investors’ portion for QIB is 50%, HNI is 15%, and Retail is 35%.

How to Apply for the TechEra Engineering IPO?

You can apply for Shelter Finance IPO via ASBA online via your bank account. You can also apply for ASBA online via UPI through your stock brokers. You can also apply via your stock brokers by filling up the offline form.

How to Apply Gala Precision Engineering IPO through M-Stock?

For those using M-Stock, the application process involves logging into the M-Stock Account, selecting the IPO under the Product Tab, and then filling in the necessary details. Approval through a UPI app is also required. Opening a Demat Account with M-Stock may be necessary for some applicants. Open Demat Account with M-Stock.

How to Apply the TechEra Engineering IPO through Alice Blue?

Alice Blue users can apply by logging into the Alice Blue application, selecting the IPO, and confirming their application. Similar to other methods, approval via a UPI app is required. Opening a Demat Account with Alice Blue may also be necessary. Open a Demat Account with Alice Blue.

How to Apply for the TechEra Engineering IPO through Motilal Oswal?

Log in to Motilal Oswal Application with your credentials. Select the IPO. You will see the IPO Name. Click on the Bid Button. Confirm your application. Now go to your UPI App on Net Banking or BHIM App to Approve the mandate. Open Demat Account with Motilal Oswal.

What is TechEra Engineering IPO Size?

TechEra Engineering IPO size is ₹35.90 Crores.

What is TechEra Engineering IPO Price Band?

TechEra Engineering IPO Price Band is ₹75 - ₹82 Per equity share.

What is TechEra Engineering IPO Minimum and Maximum Lot Size?

The IPO bid is 1600 share with ₹131,200.

What is TechEra Engineering IPO Allotment Date?

TechEra Engineering IPO allotment date is September 30, 2024.

What is TechEra Engineering IPO Listing Date?

TechEra Engineering IPO listing date is October 3, 2024. The IPO to list on NSE SME IPO.

Read the full article

#DetailsipoTechEraEngineering#ipo#ipoTechEraEngineering#ipoTechEraEngineeringopen#ShareTechEraEngineeringopen#TechEraEngineeringdetailsipo#TechEraEngineeringipo#TechEraEngineeringipobandprice#TechEraEngineeringipodate#TechEraEngineeringipogmp#TechEraEngineeringipogmptoday#TechEraEngineeringipolotsize#TechEraEngineeringiponews#TechEraEngineeringipopricebar#TechEraEngineeringiposize#TechEraEngineeringiposubscriptionstatus#TechEraEngineeringlimitedipo#TechEraEngineeringlimitedipodetails#TechEraEngineeringlimitedipogmp#TechEraEngineeringnsesmeipo

0 notes

Text

How NSE Unlisted Shares Have Performed Over the Years

NSE unlisted shares have had remarkable growth over the years, as it has been marked by high demand from retail and institutional investors alike. The performance has been influenced by multiple factors such as strong financial results, strategic developments and market dynamics occurring within the company.

Overview of Performance

Finance

In the year 2023, NSE had reported a revenue of Rs 12650 Crore, growing to Rs 14793 Crore in 2024. The year-on-year growth was 16.95% approximately. PAT or Profit After tax also increased from Rs 7501 Crore to Rs 8406 Crores during this period, thereby showing a growth rate of 12.02% approximately.

Share Price

In May 2023, the share price was around Rs 3,600 for each share, rising to Rs 4,200 by January 2024, and further reaching approximately Rs 4,800 per share by May 2024, marking a significant increase of 33.33% over the year. NSE unlisted shares’ current price in 2024 is about Rs 6,000 per share, with the market cap standing at Rs 14.85 lakh crore.

Comparison of Market

As compared to BSE, NSE shares show commendable growth. However they have been slightly outperformed by BSE in terms of growth of percentage in the last year. Irrespective of this, NSE’s valuation metrics and market capitalization remains stronger for its dominant position in the financial ecosystem of India.

Valuation and Returns

NSE unlisted shares trade at a P/E ratio of around 36.51. The return on equity for NSE is at 35.06%, highlighting strong profitability relative to its shareholders' equity. The valuation metrics indicate the attractive returns that NSE shares have offered investors.

Bonus and Dividend

NSE has announced a 4:1 bonus issue and a substantial dividend of Rs 90 each share in recent developments, showing how it’s committed to rewarding shareholders. These moves enhance shareholder value and also demonstrate confidence in the future growth trajectory of the company.

Buy NSE Unlisted Shares from Altius Investech.

Factors Driving the Growth

Strategic Initiatives

NSE has continued to develop innovative solutions for trading, such as options trading platforms, that have boosted its market position. This, in conjunction with an increasing number of investors is a major factor in the growth of share price.

Learn More About NSE:-

NSE Gets Closer to an IPO with Potential Settlement with MSEI

Key Highlights from NSE India’s 4QFY24 Conference Call

NSE’s Fiscal Triumph: Crossing the $1 Billion Profit Milestone

National Stock Exchange (NSE) Announces Bonus Issue

Greater Accessibility

The unlisted shares market, which was previously accessible only by institutional investors, is now opened for retail investors, offering an unique opportunity to be part of the growth of large corporations such as NSE prior to when they go public. The increase in demand by retail investors is a major factor in driving share prices up.

Regulation Changes

Reforms to the regulatory system including cutting down the lock-in time for shares that are not listed and the tax benefits that come to holding times, make unlisted shares more appealing to investors, further increasing the market's interest.

Final Thoughts

Unlisted NSE shares have been performing exceptionally well and consistently over time due to solid financial performance, innovative strategies, as well as growing investor accessibility through platforms like Altius Investech. While investing in unlisted shares is risky, it actually has the potential for huge yields, as evident by NSE's rapid growth, which continues to draw investors who want to diversify their portfolios by investing in high-growth assets.

The option of investing in unlisted shares like NSE through platforms such as Altius Investech provides a means to get early exposure to companies with promising growth trajectories, making it a popular choice for retail and institutional investors. However, proper diligence and an in-depth analysis of market conditions are essential to make the most of an evolving investment market.

0 notes

Text

Bajaj Housing Finance IPO Listing Date and Time की बहुत प्रतीक्षित debut जल्द ही होने वाली है, और इसे लेकर बाजार में काफी उत्साह है।

Bajaj Housing Finance IPO Listing Date and Time: A Highly Anticipated Debut

Bajaj Housing Finance shares की लंबे समय से प्रतीक्षित listing अगले हफ्ते की शुरुआत में stock exchanges पर होने जा रही है, जिससे markets में उत्साह का माहौल है। Investors विशेष रूप से आशावादी हैं, क्योंकि Initial Public Offering (IPO) ने primary market में प्रभावशाली प्रदर्शन किया है। ये shares Monday, 16 September 2024 को सुबह 10 बजे, National Stock Exchange (NSE) और Bombay Stock Exchange (BSE) दोनों पर debut करेंगे। Stellar Performance in the Primary MarketBajaj Housing Finance ने सुर्खियां बटोरीं जब इसके IPO को investors से अभूतपूर्व प्रतिक्रिया मिली। Public issue ने कुल ₹3.23 लाख करोड़ की record-breaking subscriptions प्राप्त कीं, जो पिछले benchmarks को पार कर एक नया milestone सेट कर चुकी हैं। विशेष रूप से retail investors से massive demand ने इस subscriptions में वृद्धि को प्रेरित किया। यह ऐतिहासिक राशि, जो ₹3 लाख करोड़ से अधिक है, India's fiscal year 2023-24 के लिए nominal GDP का 1 प्रतिशत से अधिक है, जिसका अनुमान ₹295.36 लाख करोड़ है। यह तथ्य IPO की असाधारण magnitude को दर्शाता है, जो न केवल कंपनी के लिए बल्कि देश की financial landscape के लिए भी महत्वपूर्ण है। Grey Market Premium Signals Strong Gains for InvestorsOfficial listing से पहले, Bajaj Housing Finance shares का Grey Market Premium (GMP) ₹79 per share पर report किया गया है, जो issue price की तुलना में 113 प्रतिशत से अधिक का premium दिखाता है। इसका मतलब है कि शुरुआती investors अपने निवेश को listing के समय दोगुना कर सकते हैं। Grey market की मजबूत sentiment यह दर्शाती है कि कंपनी का stock exchanges पर debut महत्वपूर्ण returns दे सकता है। Breaking Records: Largest IPO in India's HistoryBajaj Housing Finance का ₹6,560 करोड़ का IPO, जो 11 September 2024 को समाप्त हुआ, ने record books को फिर से लिखा है, ₹2.36 लाख करोड़ की previous highest subscription, जो Coal India ने 2008 में स्थापित की थी, को पार कर लिया। यह नया benchmark इस बात का संकेत है कि कंपनी मौजूदा market environment में कितनी मजबूत और आकर्षक है। साल की शुरुआत में, Premier Energies और Tata Technologies के IPO bids ने क्रमशः ₹1.48 लाख करोड़ और ₹1.56 लाख करोड़ आकर्षित किए थे। हालांकि, Bajaj Housing Finance ने बढ़त बना ली है, और financial market में एक मजबूत खिलाड़ी के रूप में अपनी जगह पक्की कर ली है। Factors Driving Investor InterestBajaj Housing Finance ने कई कारणों से निवेशकों का ध्यान आकर्षित किया है। India के housing finance sector में second-largest player होने के नाते, कंपनी ने diversified product range पेश की है और इसे इसके parent company, Bajaj Finance का मजबूत समर्थन प्राप्त है। इस समर्थन ने आने वाले वर्षों में महत्वपूर्ण growth की उम्मीदों को बढ़ावा दिया है।कंपनी की ताकत इसके high-quality asset base में निहित है, जिसमें risky segments का कम exposure है और stable profitability है। यह home loans, loans against property, lease rental discounting और developer financing जैसे mortgage solutions की एक विस्तृत श्रृंखला प्रदान करती है, जिससे यह housing finance industry में एक flexible और dynamic player बनती है। Compliance with RBI Regulations and Strategic Capital Strengtheningयह IPO, Bajaj Housing Finance की Reserve Bank of India (RBI) के नियमों के साथ compliance का हिस्सा भी है। केंद्रीय बैंक की आवश्यकता है कि शीर्ष-स्तरीय non-banking finance companies (NBFCs) को September 2025 तक stock exchanges पर listed किया जाए। इस mandate का पालन करके, Bajaj Housing Finance खुद को भविष्य में सफलता के लिए तैयार कर रही है। इस IPO से जुटाई गई funds का उपयोग कंपनी की capital base को मजबूत करने के लिए किया जाएगा, ताकि यह सुनिश्चित किया जा सके कि उसके पास growth targets को पूरा करने और अपने product offerings को विस्तारित करने के लिए वित्तीय संसाधन हों। A Growing Force in India’s Housing Finance SectorSeptember 2015 से National Housing Bank के साथ registered, Bajaj Housing Finance India के housing finance sector में एक महत्वपूर्ण खिलाड़ी बन गई है। कंपनी की diversified financial solutions की range, residential और commercial property buyers दोनों के लिए है, जो purchasing और renovation purposes दोनों के लिए products प्रदान करती है। RBI ने इस firm को "upper layer" NBFC के रूप में वर्गीकृत किया है, जो financial sector में इसकी प्रमुखता को मान्यता देता है। housing finance की मजबूत demand और इसकी parent company, Bajaj Finance के समर्थन के साथ, कंपनी अपने growth trajectory को जारी रखने के लिए अच्छी स्थिति में है। ConclusionBajaj Housing Finance shares की listing Monday, 16 September को Indian stock market में एक ऐतिहासिक घटना बनने जा रही है। Grey market premium से संकेत मिल रहे हैं कि significant gains की संभावना है, और कंपनी के मजबूत fundamentals के साथ, निवेशक इस debut का बेसब्री से इंतजार कर रहे हैं। IPO पहले ही एक record स्थापित कर चुका है, और कंपनी की मजबूत market position यह दर्शाती है कि यह housing finance sector में sustained success के लिए तैयार है।Also Read:Bajaj Housing Finance IPO आज हुआ लॉन्च – क्या यह अगला Multibagger हो सकता है?

Read the full article

0 notes